The third-party application that helps business to configure sales tax on invoices based on a particular location is defined as AvaTax. It ensures a company to calculate rates as per shipping, product-specific taxes, and more. The automation of calculating taxes is made easy through the AvaTax application. Business development enhances quickly by implementing ERP software. Odoo 16 aids in managing the AvaTax function in your company efficiently. The AvaTax feature is available in the Odoo 16 Accounting module to configure sales tax for users.

This blog gives an idea about computing taxes automatically using the AvaTax feature in Odoo 16 Accounting.

Benefits of AvaTax for Users

Businesses that need to focus on sales automation and tax complaint depend on AvaTax for assistance. The software enables users to get an update about tax data and calculate it accurately. Let's view some features of using AvaTax in entrepreneurship.

Excellent Customer Support

We can contact experts of AvaTax through phone or website and clarify doubts. Users get the guidance to use products in the best possible manner with the help of a customer community. Customer support is available at any time within the AvaTax application.

Error-free Calculations

AvaTax clears the errors accurately for each transaction of taxes in a company. The accessibility and visibility of data formulate through an address verification system support. It is possible to summarize payments in a single schedule, and taxation is less complicated.

Access Precise Taxation Rules

Tax jurisdiction is made by identifying the business location and offers more precision. The final rate calculates automatically once the software validates an address. A detailed summary of transaction activities is available to users during a specific period.

Integrated with various applications

AvaTax is integrated with several applications such as Microsoft Dynamics, Intacct, Netsuite, Magento, and more. It is also linked with POS and ERP systems to manage tax rates in a company.

To Configure AvaTax in Odoo 16 Accounting

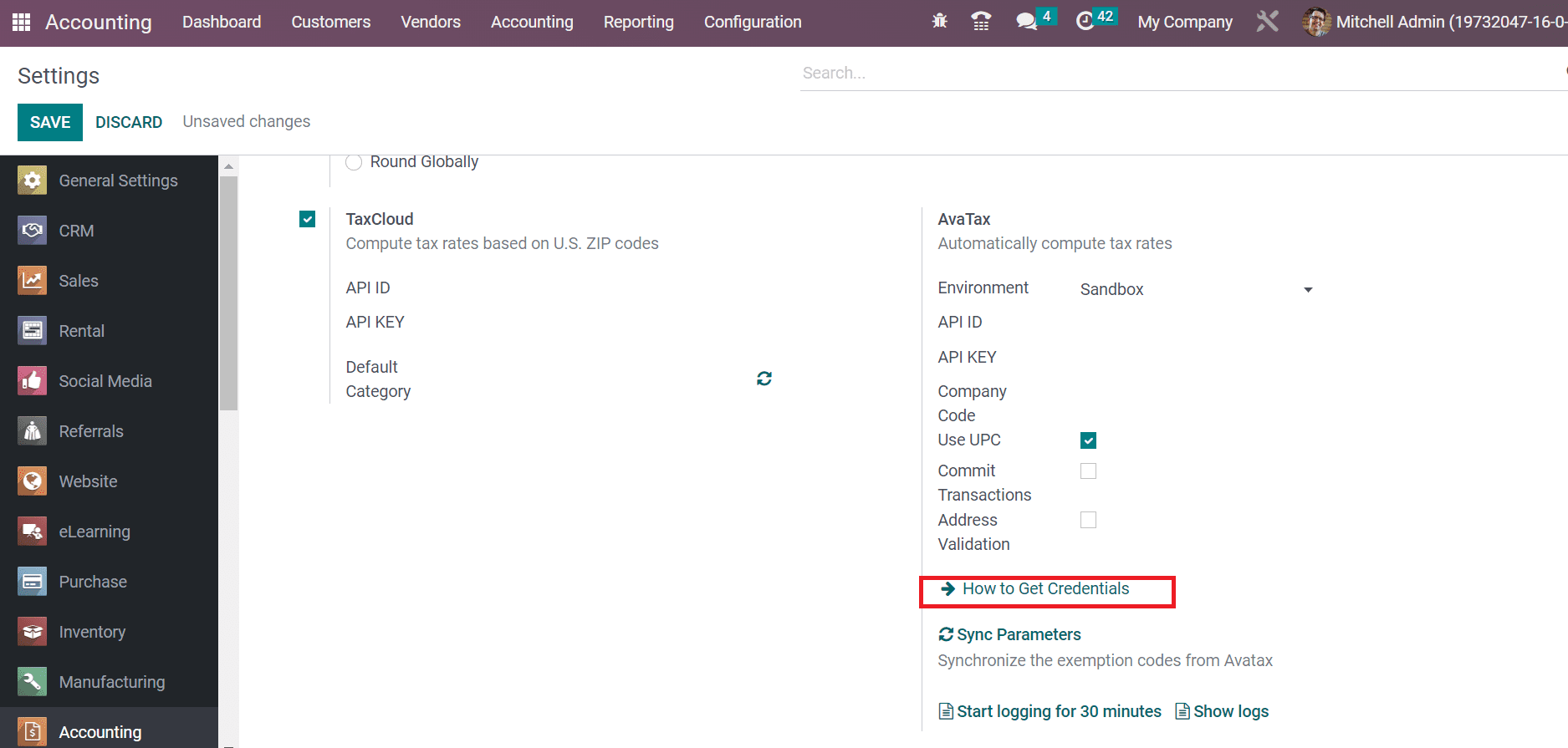

The tax calculation provider integrated with Odoo 16 is AvaTax. Users must set the credentials to compute taxes automatically. To manage AvaTax in Odoo 16, select the Settings menu in the Configuration tab, and you can see the AvaTax option below the Taxes section. Users can create new credentials by selecting the How to Get Credentials? Option as denoted in the screenshot below.

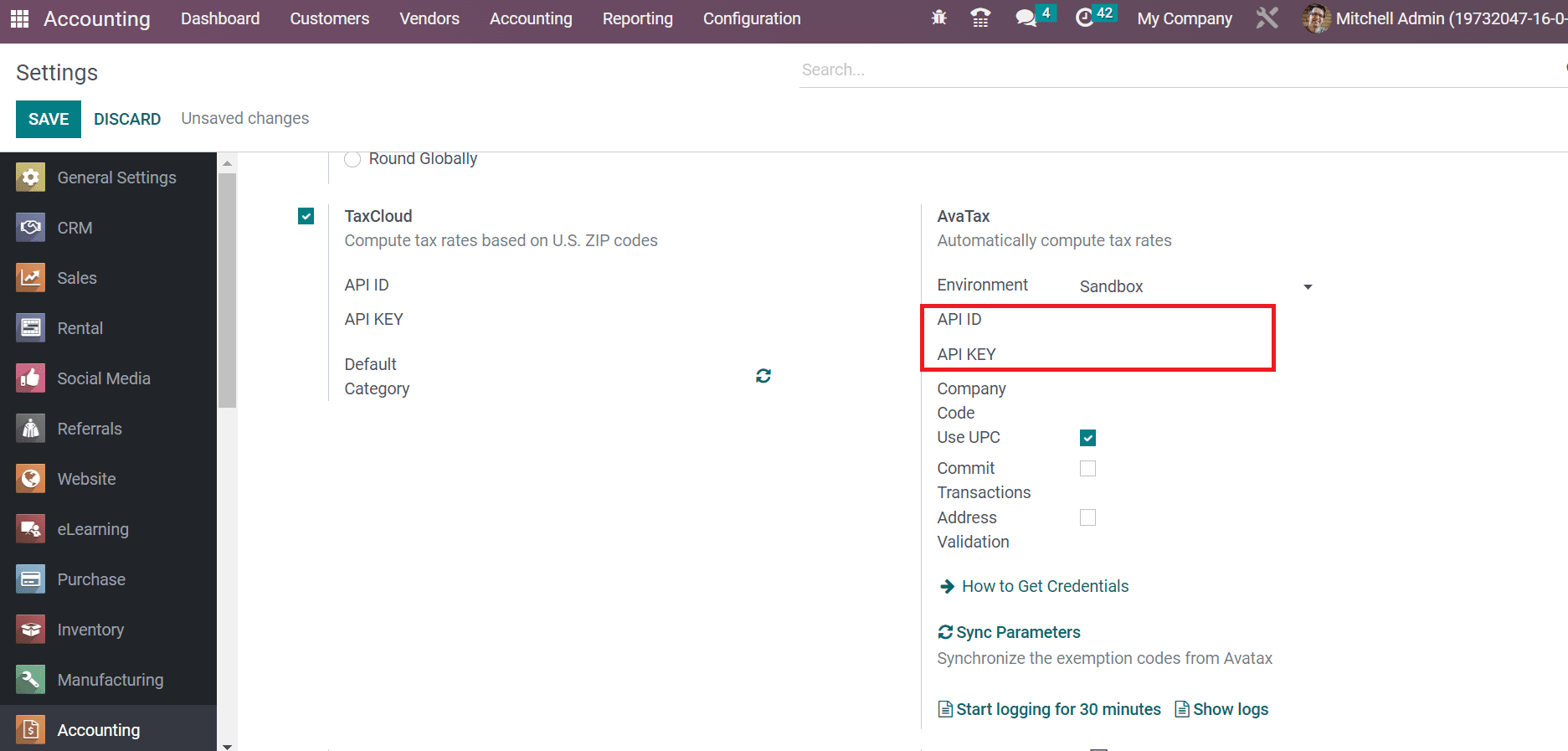

After pressing the How to Get Credentials option, you will be directed to Avalara's official page. The user must create a new account in AvaTax and get the necessary credentials. After accessing the credentials, apply them to the API ID and API Key below the AvaTax field, as displayed in the screenshot below.

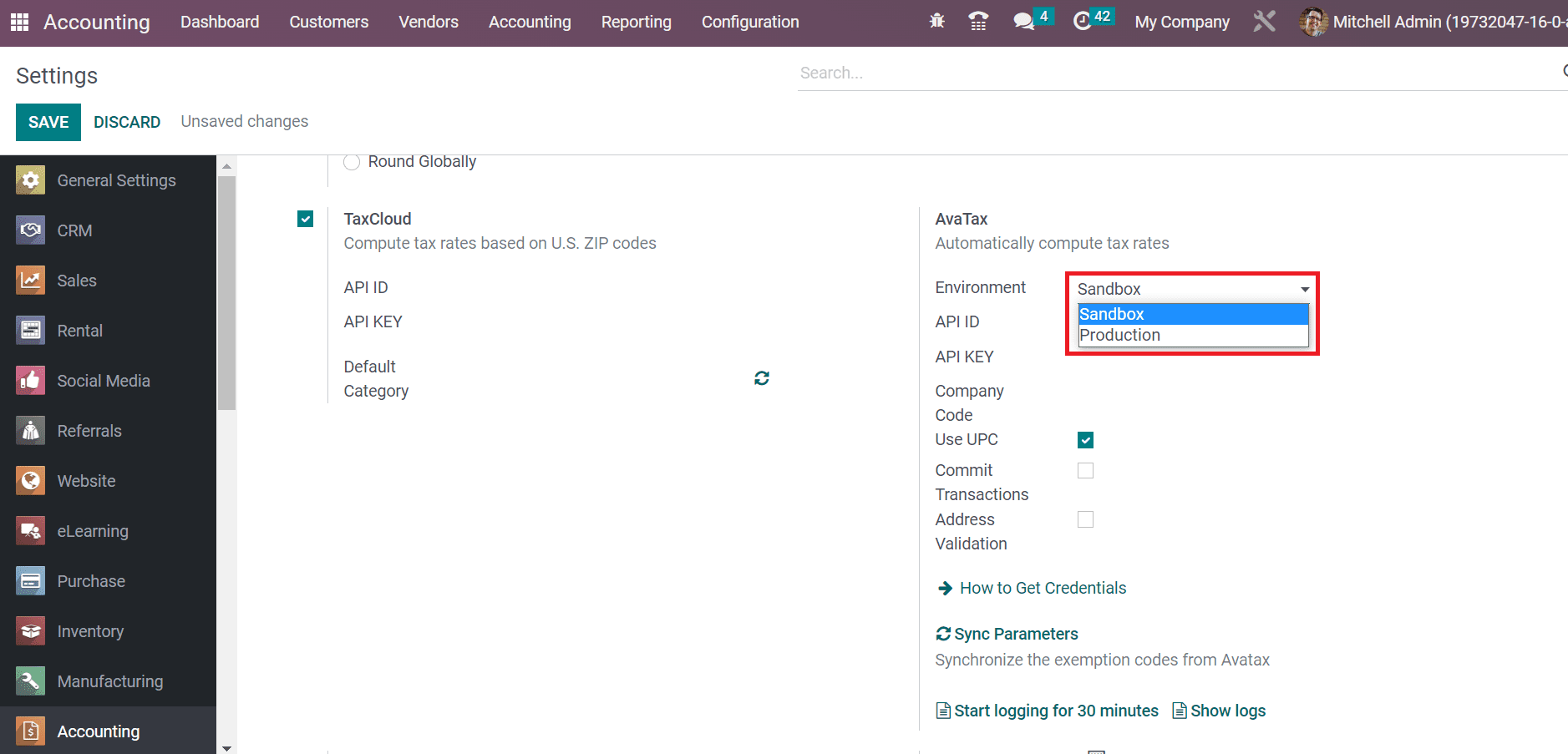

After entering the credentials, we can activate the AvaTax feature in Odoo 16. Users can compute tax automatically using the AvaTax feature. Additionally, we can set the Environment for AvaTax as Sandbox and Production, as marked in the screenshot below.

Hence, it is eays to formulate credentials and activate for AvaTax feature.

Automatic Tax Mapping for AvaTax in Odoo 16

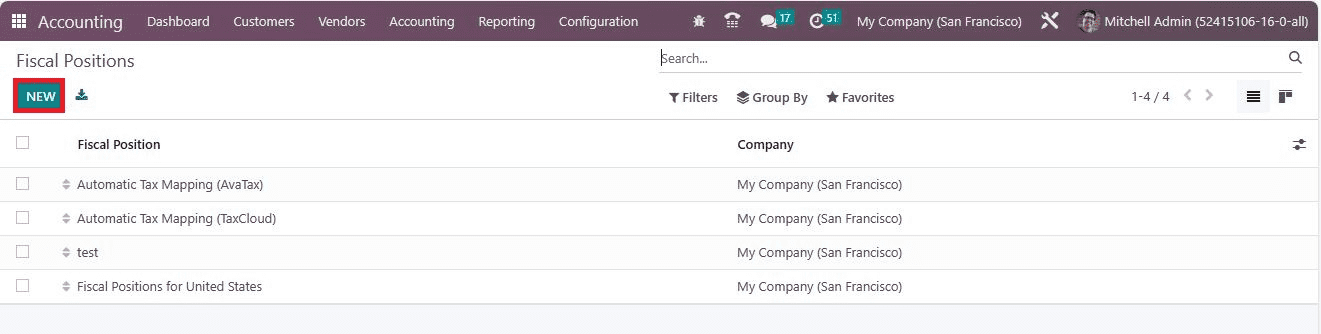

Users can set tax mapping for AvaTax in the Fiscal Positions. Choose the Fiscal Positions below the Accounting section in the Configuration tab. The Fiscal Position window shows the information about each fiscal position and company. To generate a new fiscal position, click the CREATE icon in the Fiscal Position window, as illustrated in the screenshot below.

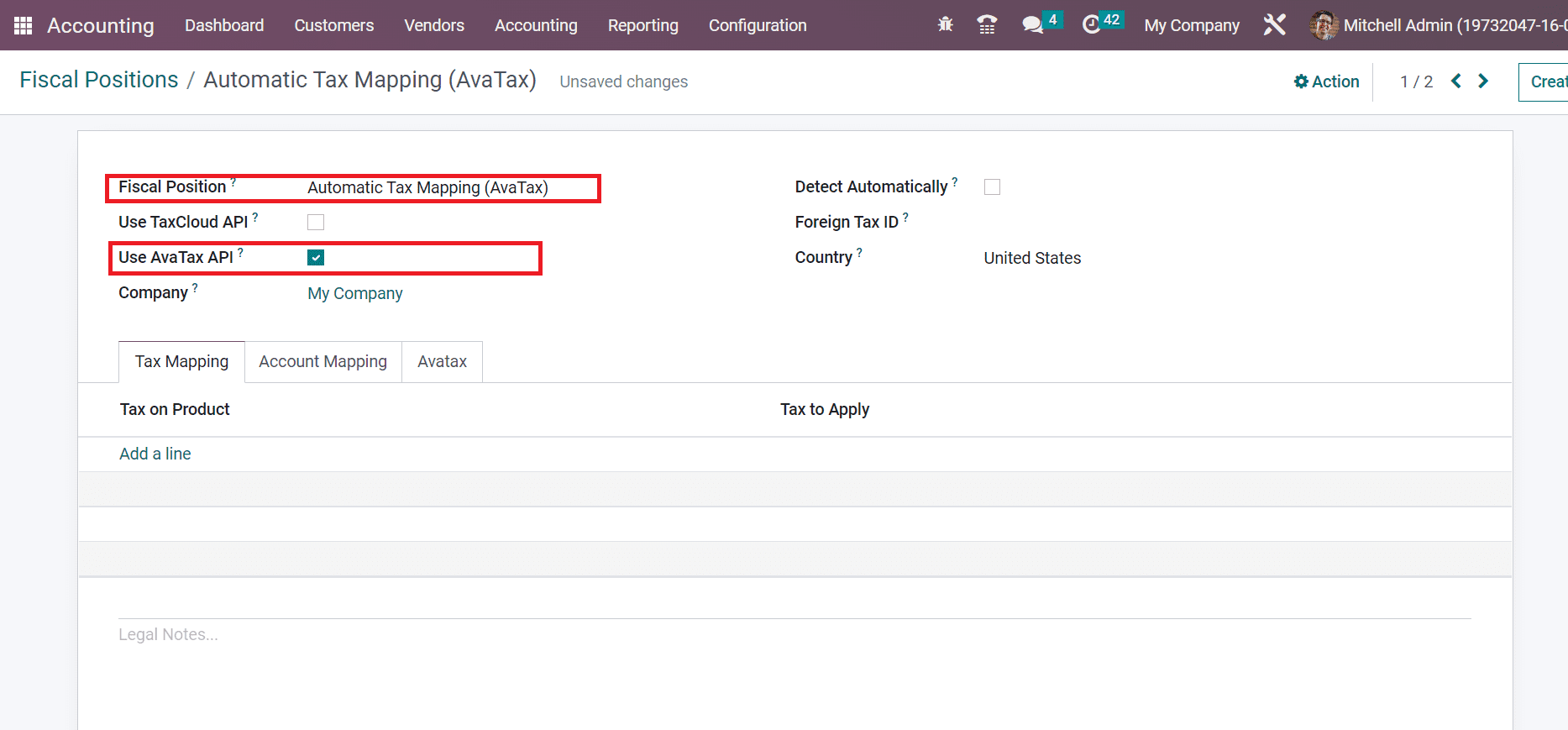

In the new window, apply the Fiscal Position name as Automatic Tax Mapping (AvaTax). We can run AvaTax API by activating the Use Avatax API field in the Fiscal Positions window, as demonstrated in the screenshot below.

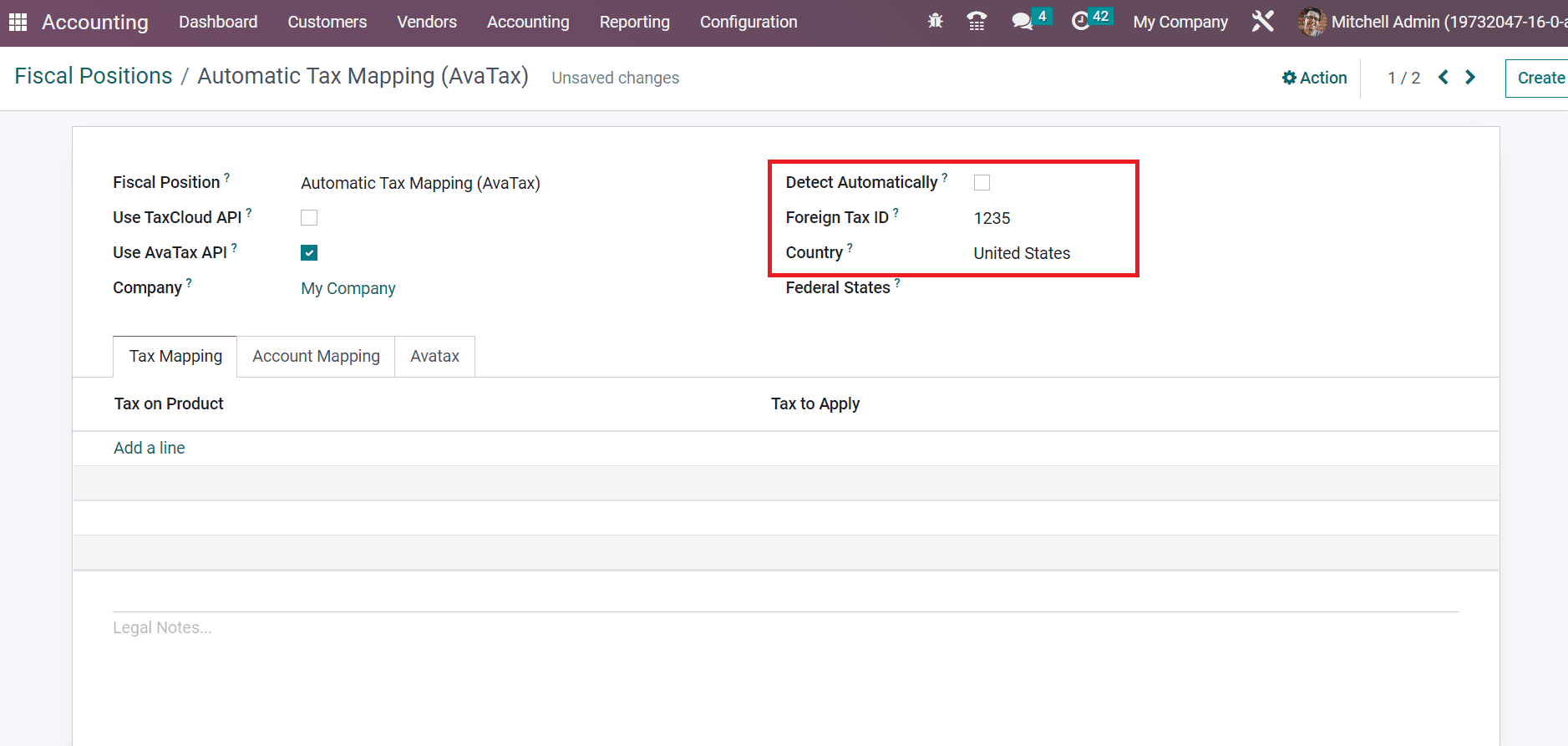

To detect the fiscal position automatically, enable the Detect Automatically field. Also, the user can specify the Foreign TAX ID and Country concerning the fiscal position.

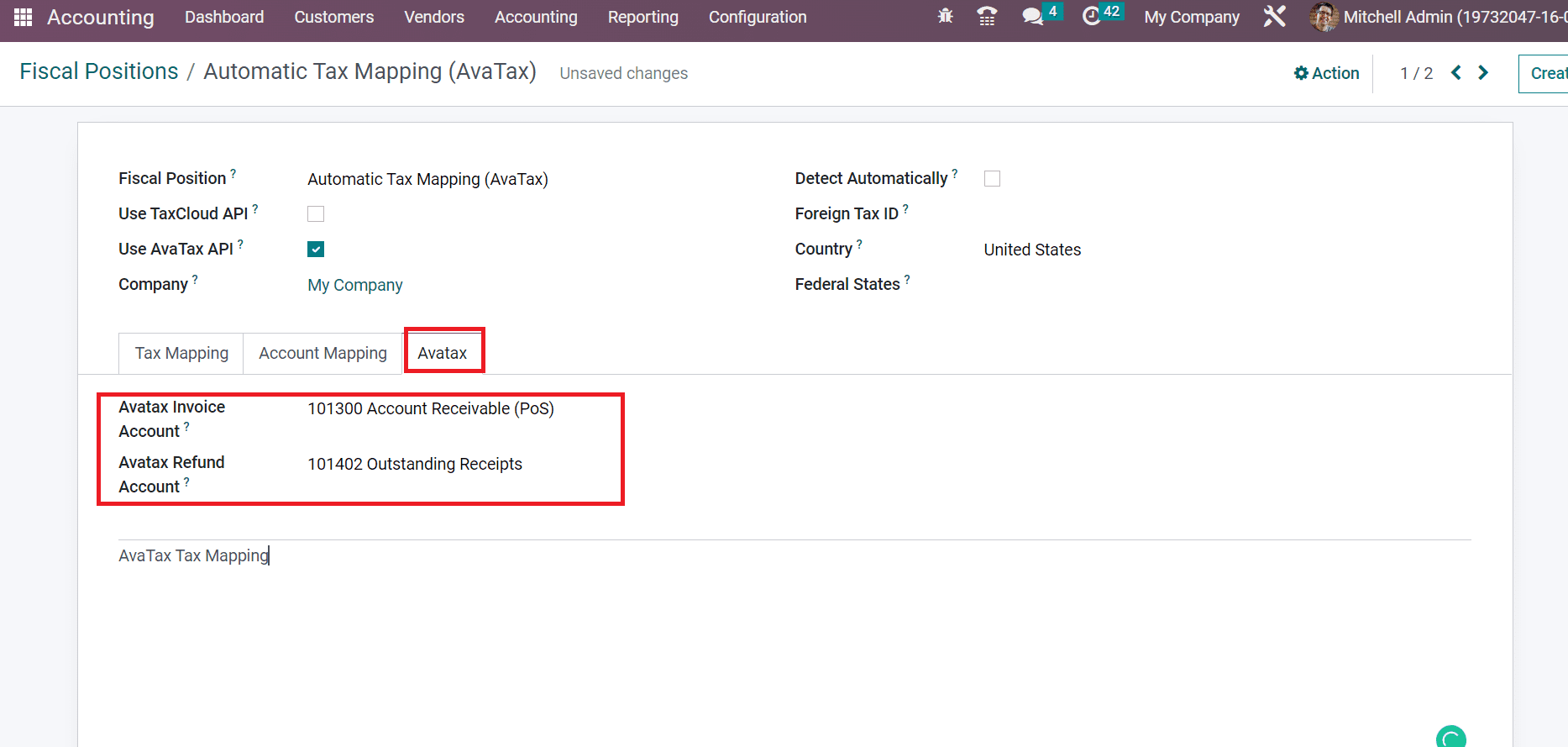

In the Fiscal Positions window, we can manage the AvaTax details below the AvaTax tab. Choose the account used for AvaTax Taxes in the AvaTax Invoice Account field. Moreover, pick the account for a refund to AvaTax taxes in the AvaTax Refund Account field as specified in the screenshot below.

At the end of the AvaTax tab, the user can mention the legal notes concerning AvaTax. These legal notes are printed on invoices, as cited in the screenshot below.

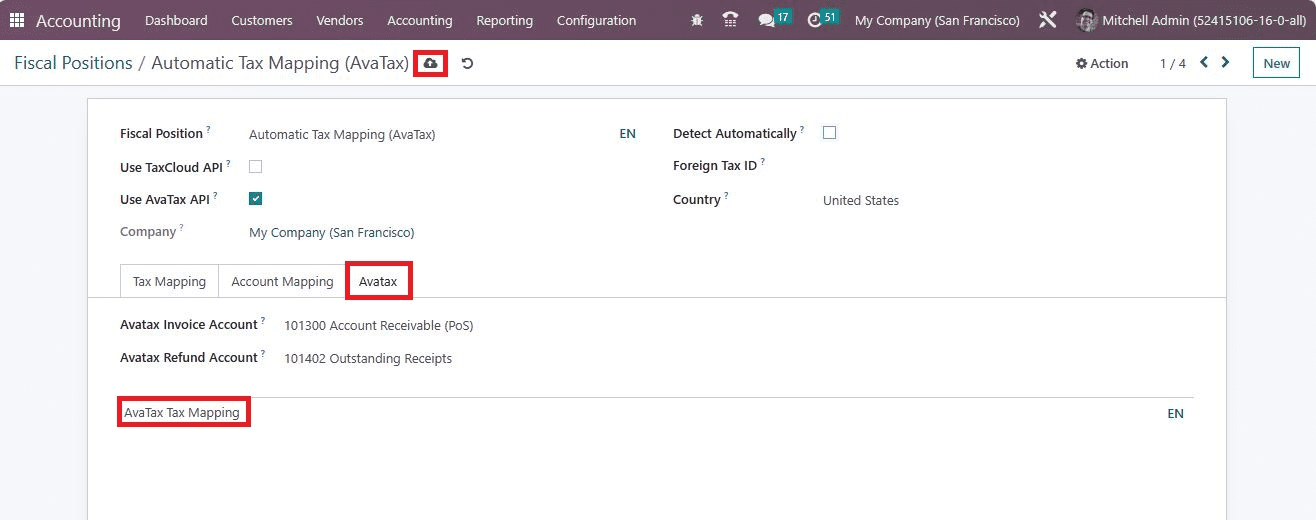

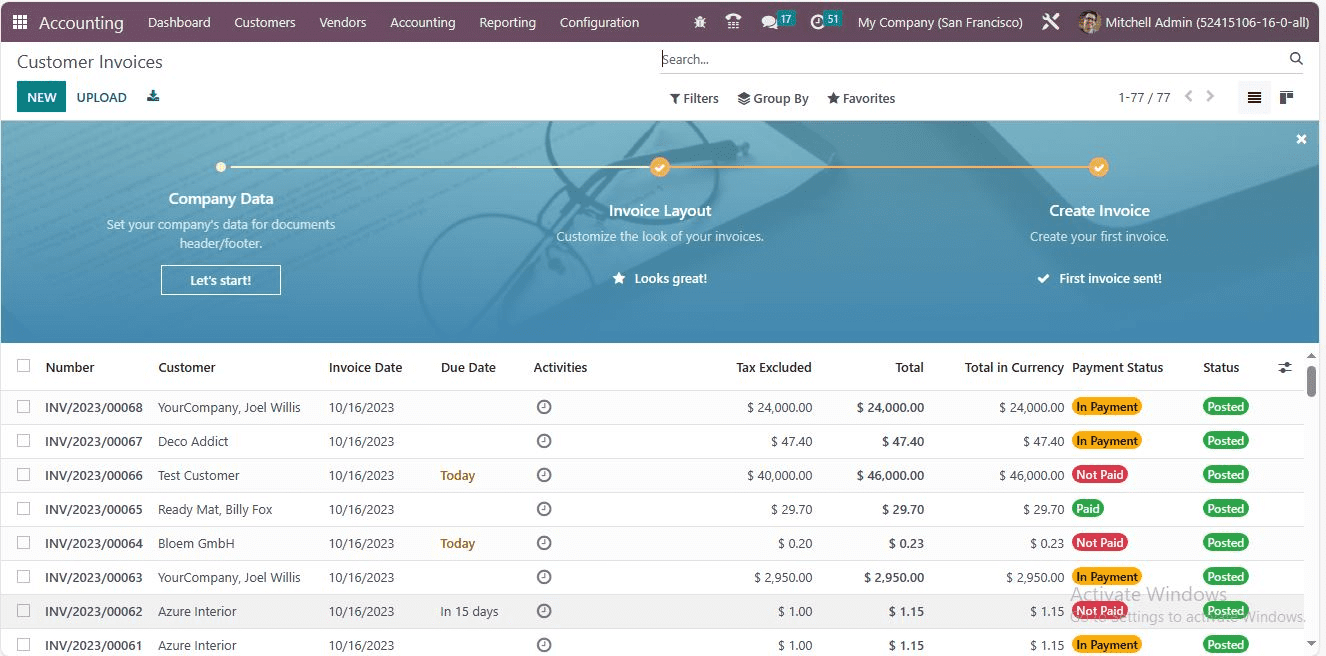

Select the Save manually icon after applying necessary data about Automatic Tax Mapping for AvaTax. Now, let's see the tax calculation after creating an invoice in Odoo 16 Accounting. Click the Invoices menu in the Customers tab, and a list of all created invoices is accessible to a user. Select the NEW icon in the Invoices window to start a new invoice, as illustrated in the screenshot below.

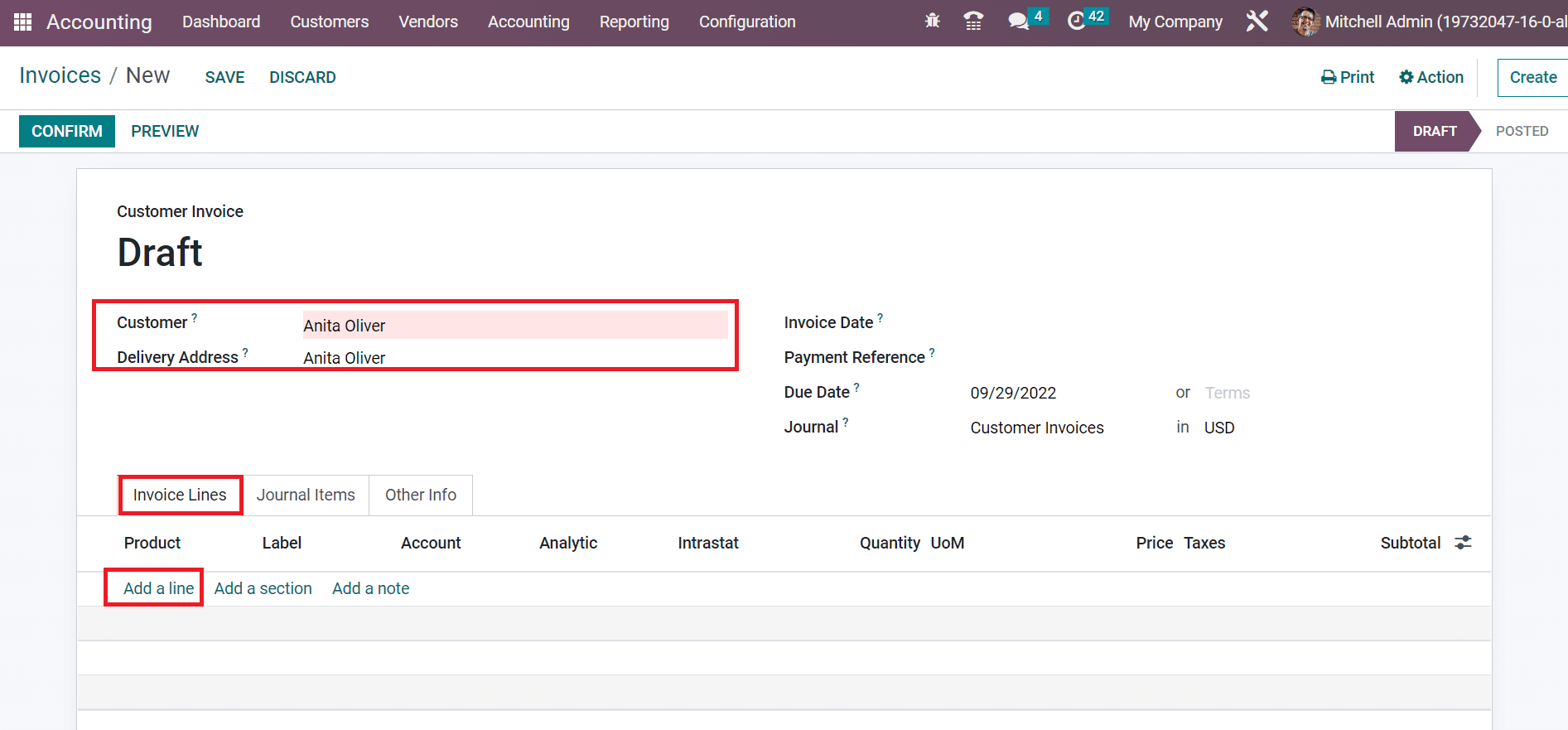

In the new window, apply the Customer and Delivery Address as Anita Oliver. Later, you can choose the product by clicking on Add a line option below the Invoices tab, as illustrated in the screenshot below.

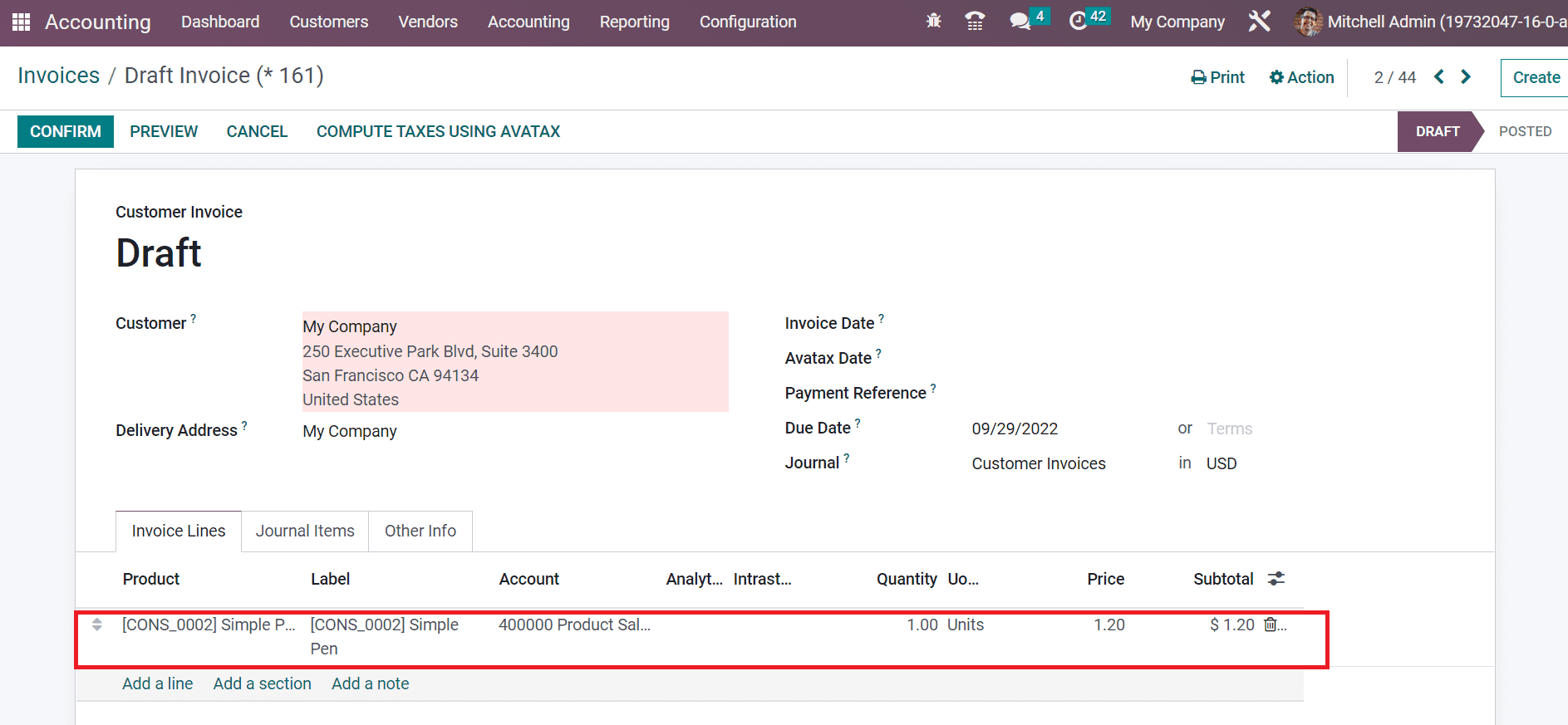

After clicking on Add a line, choose your product below the Invoice Lines tab. We selected the Simple product Pen inside Invoice Lines as presented in the screenshot below.

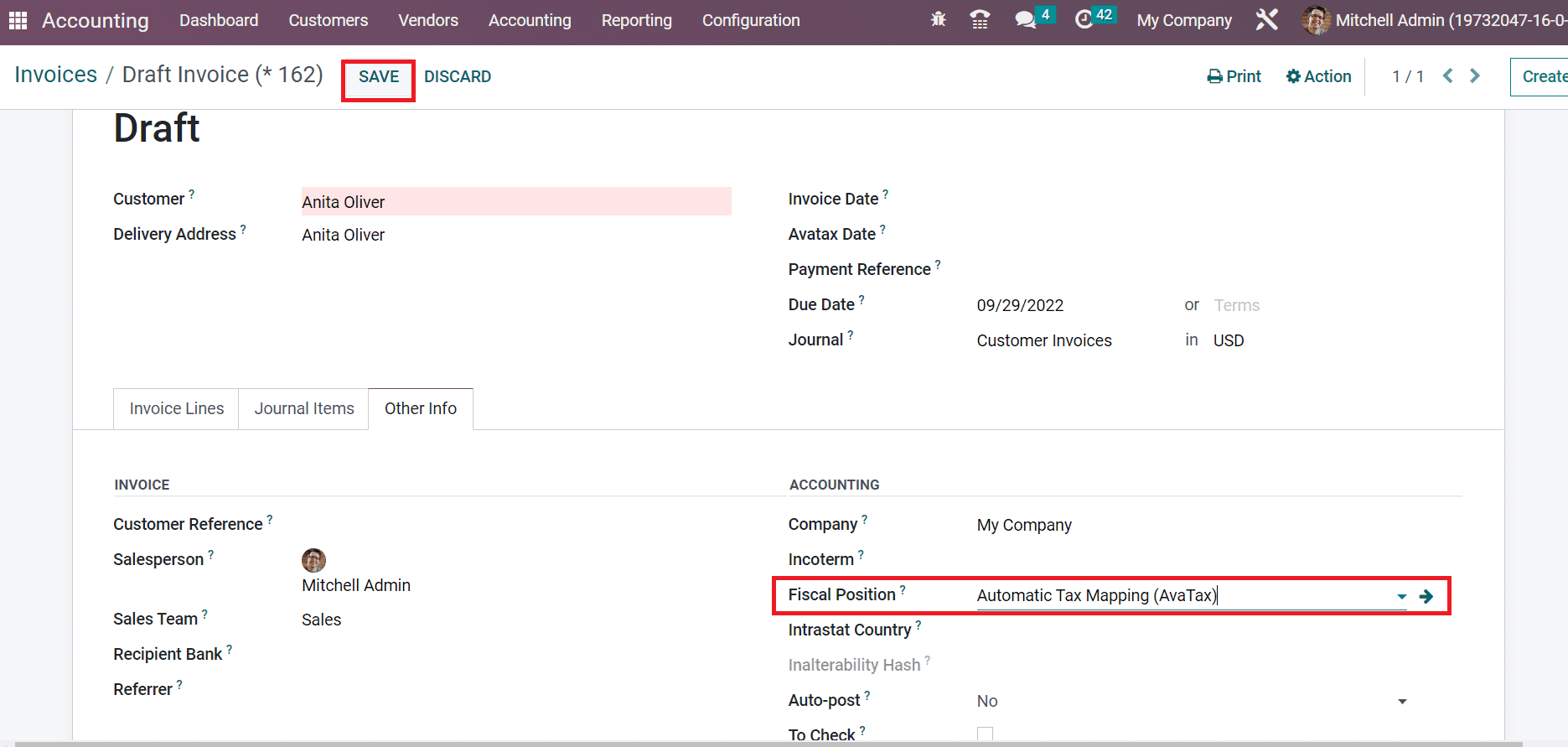

Below the Other Info tab, you can manage the fiscal position. It uses to adapt accounts and taxes for specific customers or invoice orders. Choose your created Fiscal Position Automatic Tax Mapping (AvaTax) below the Other info tab, as represented in the screenshot below.

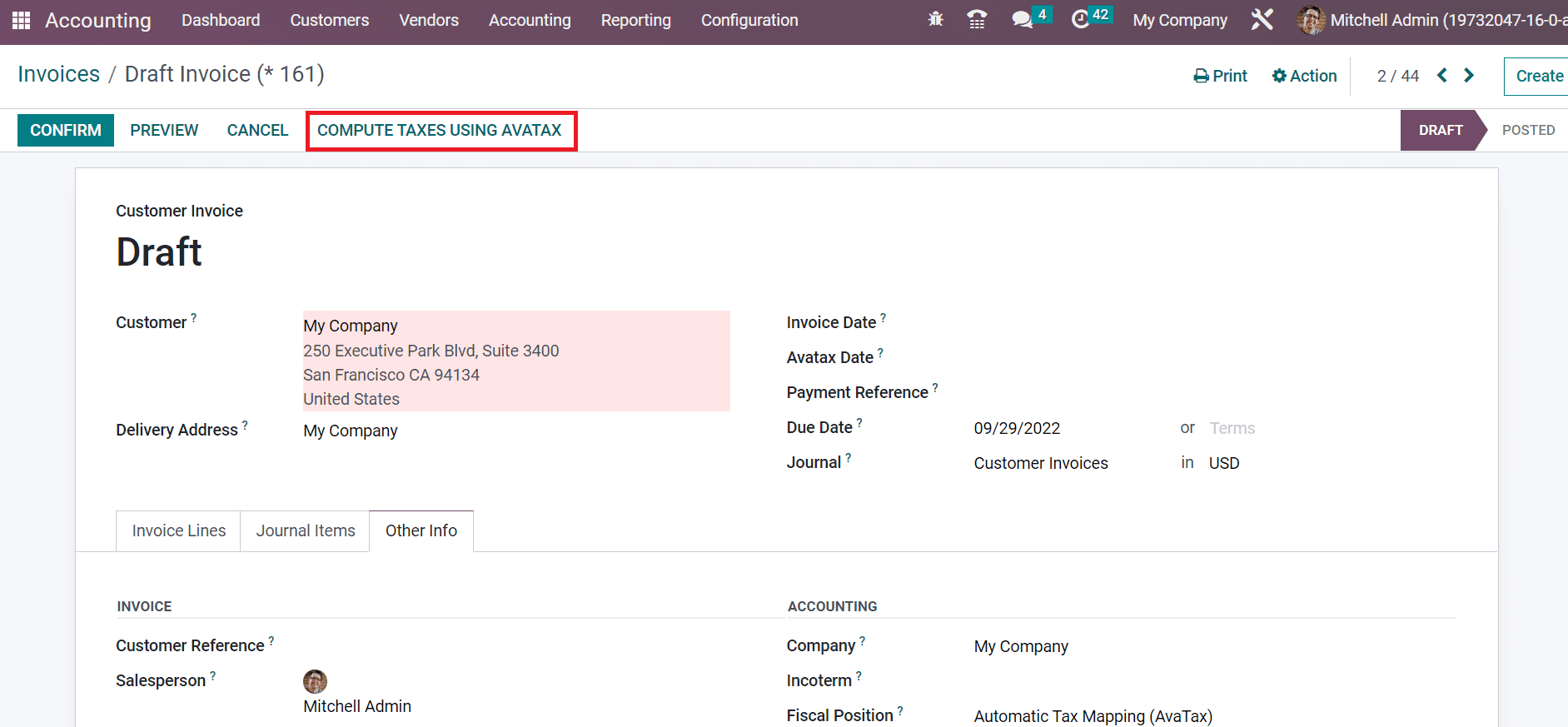

After making the necessary details, press the SAVE icon in the Invoices window in the screenshot above. We can calculate taxes automatically by pressing the COMPUTE TAXES USING AVATAX option in the Draft Invoice window.

Afterward, taxes are calculated inside an invoice manually using the AvaTax application.

How to Set AvaTax Category on Product Data in Odoo 16 Accounting?

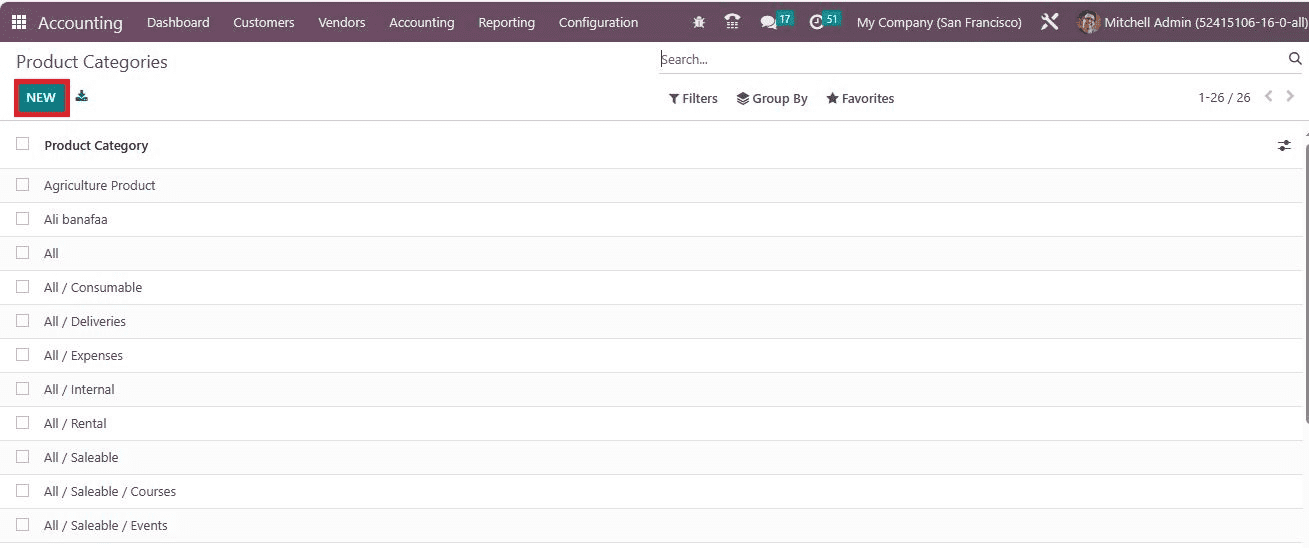

Avatax integration is possible on both Invoice and Sales orders within the Odoo 16, including AvaTax Fiscal position. A specific sort of item or service is termed a Product Category. Users can specify AvaTax Category within the Product Category. For that, choose Product Categories below the Management section of the Configuration tab. You can see the list of all created Product Categories in the new window, as portrayed in the screenshot below.

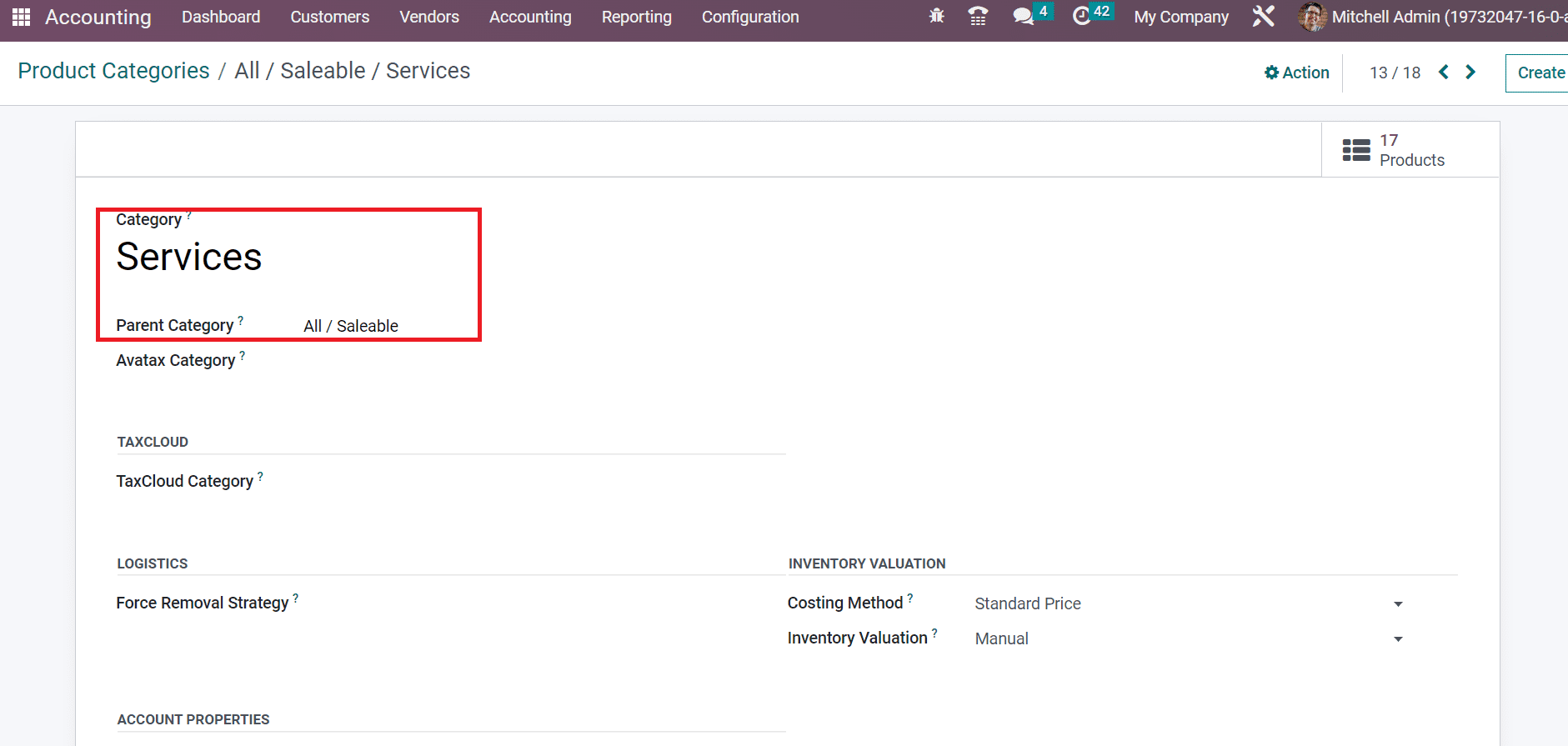

Select the NEW button in the Product Categories to develop a new category. In the new window, apply the Category name as Services and choose your Parent Category as defined in the screenshot below.

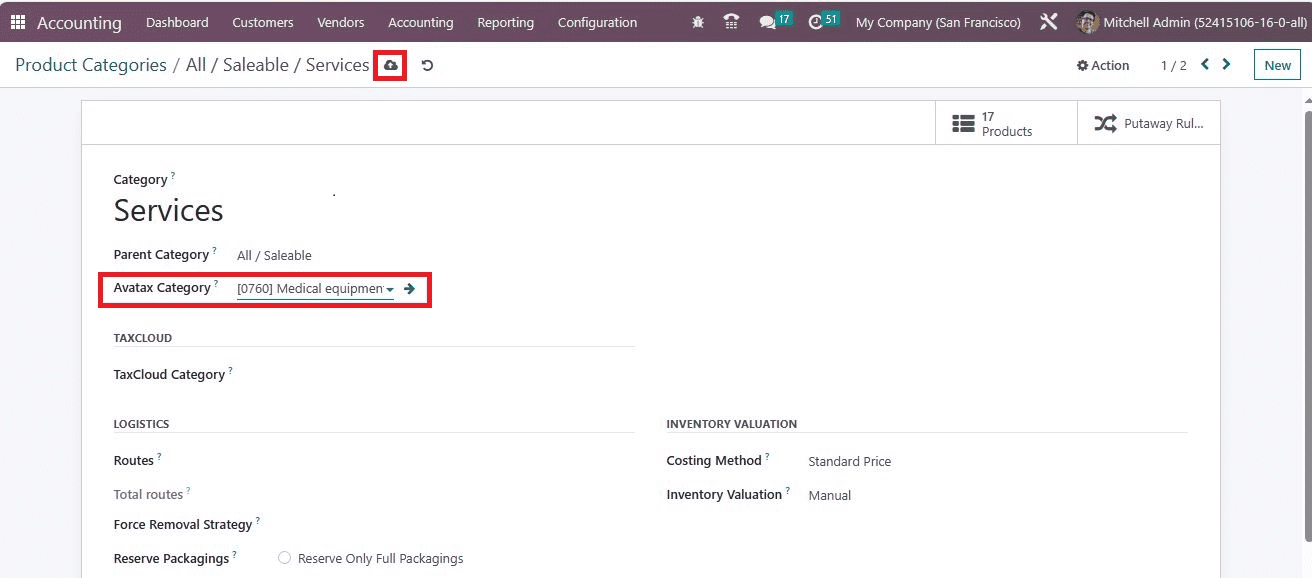

Pick your necessary category for AvaTax within the Avatax Category field and press the Save manually icon, as indicated in the screenshot below.

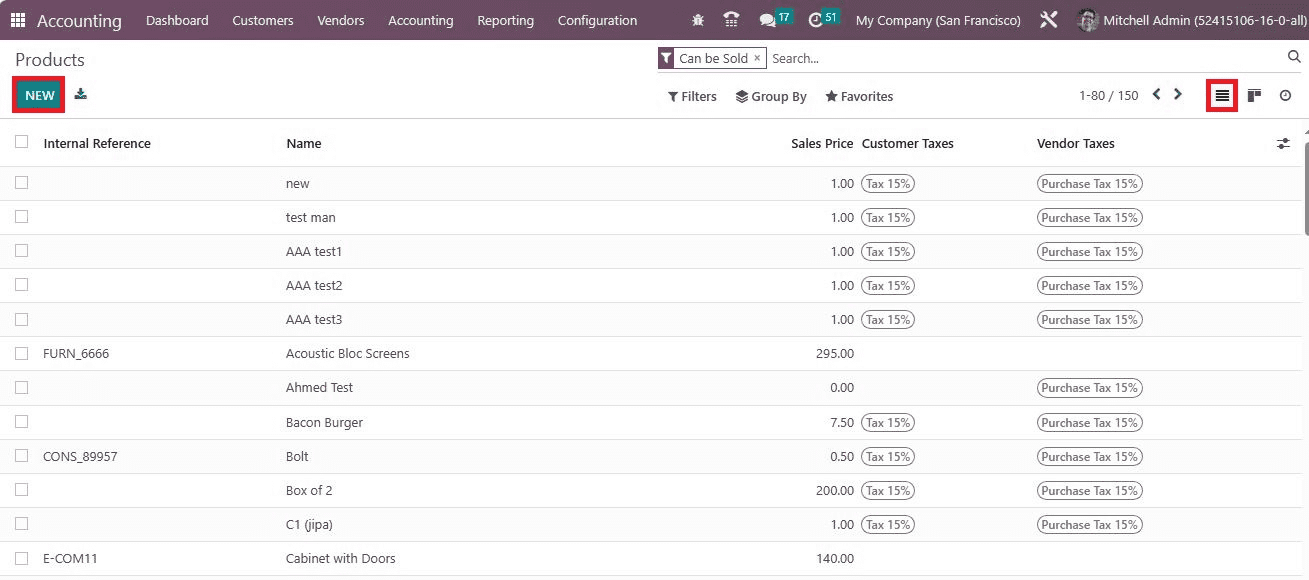

Hence, setting an AvaTax Category on a Product Category in the Odoo 16 Accounting is easy. Similarly, the user can specify the AvaTax Category on a specific product within the Odoo 16. Choose the Products menu from the Customers tab, and all product records are visible to the user. You can access details of each item such as Name, Vendor Taxes, Internal reference, Sales Price, and more. To generate a new product, click the CREATE button in the Products window, as noted in the screenshot below.

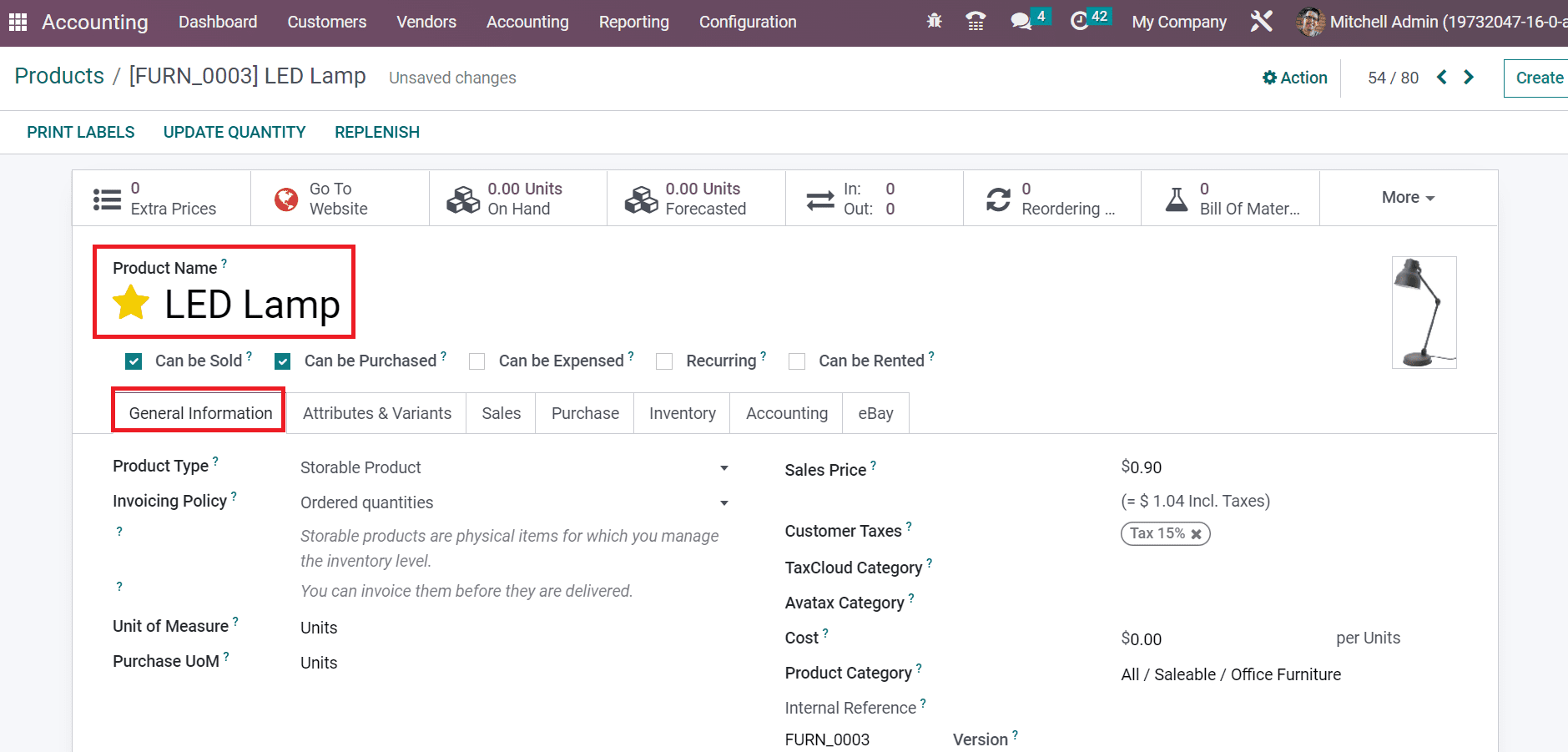

Add Product Name as LED Lamp on the new page and mark it as the prior one by clicking on the star icon. Users can manage basic information about a product below the General Information tab.

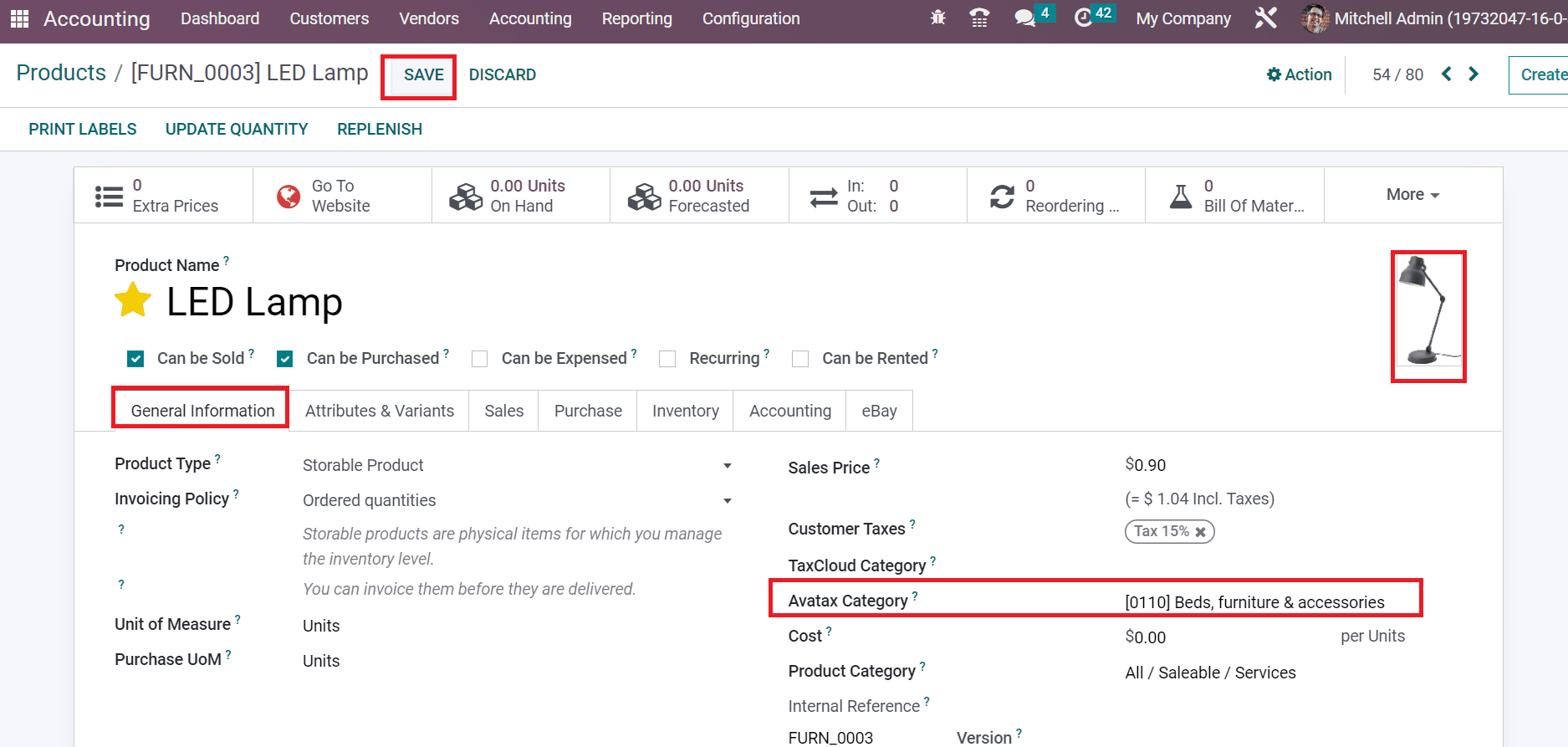

Later, upload the product image on the right end of the product window. Users can set the category of Avatax inside the AvaTax Category field below the General Information tab, as described in the screenshot below.

So, adding Avatax Category inside a product data is accessible in Odoo 16 Accounting module.

The tax calculation in an automatic manner is made easy using the AvaTax application in Odoo 16 Accounting module. Tax configuration in a business occurs quickly by implementing Odoo EP software.

To read more about configuring taxes with Odoo 16 accounting app, refer to our blog How to Configure Taxes With Odoo 16 Accounting App