Retail or conventional sales taxes are imposed on end users of services and goods. Most countries, states, and municipalities charge different sales taxes based on jurisdictions. It is also related to the Use tax means tax applied to citizens who bought items outside their jurisdictions. Each state of the United States(US) applies various sales taxes for business. Some companies face complications in managing these taxes for goods/services. You can avoid all your worries by running ERP software into your system. Odoo 16 Accounting module is suitable for controlling several tax rates for your firm.

This blog spotlighted the Indiana(US) Sales Tax calculation in Odoo 16 Accounting.

Top industrial use case and warning/alert function are the new features of the Odoo 16 Accounting module. Users can also configure payments, journals, invoices, customers, reports, and more in the specific application. Let's examine the process of calculating Indiana(US) sales tax in Odoo 16 Accounting.

Analysis of Indiana(US) Sales Tax

Indiana's sales tax rate is 7% with no local tax. It is easy to collect sales tax in Indiana in contrast to further states. Most tangible products are taxable in the state, with exemptions for grocery items, construction machines, and goods sold to farmers. Saas and some services are non-taxable in particular states. One of the taxes complimentary to Indiana Sales tax is the Use tax. It is due on the acquired property for consumption and storage if Indiana sales tax is unpaid to the seller at the purchase time. A purchaser still has a use tax responsibility if they did not pay a sales tax to the seller.

Use tax acts as a mirror of sales tax. Both tax rates are considered as 7% in Indiana(US). For example, you do not owe use tax if you paid 7% sales tax at the purchase time. However, you must owe use tax if you unpaid at least 7% sales tax. Sales tax permit registration is made easy through the Indiana Tax Centre. An estimated monthly taxable sales information is necessary to register the sales tax.

Indiana(US) Company Setup in Odoo 16

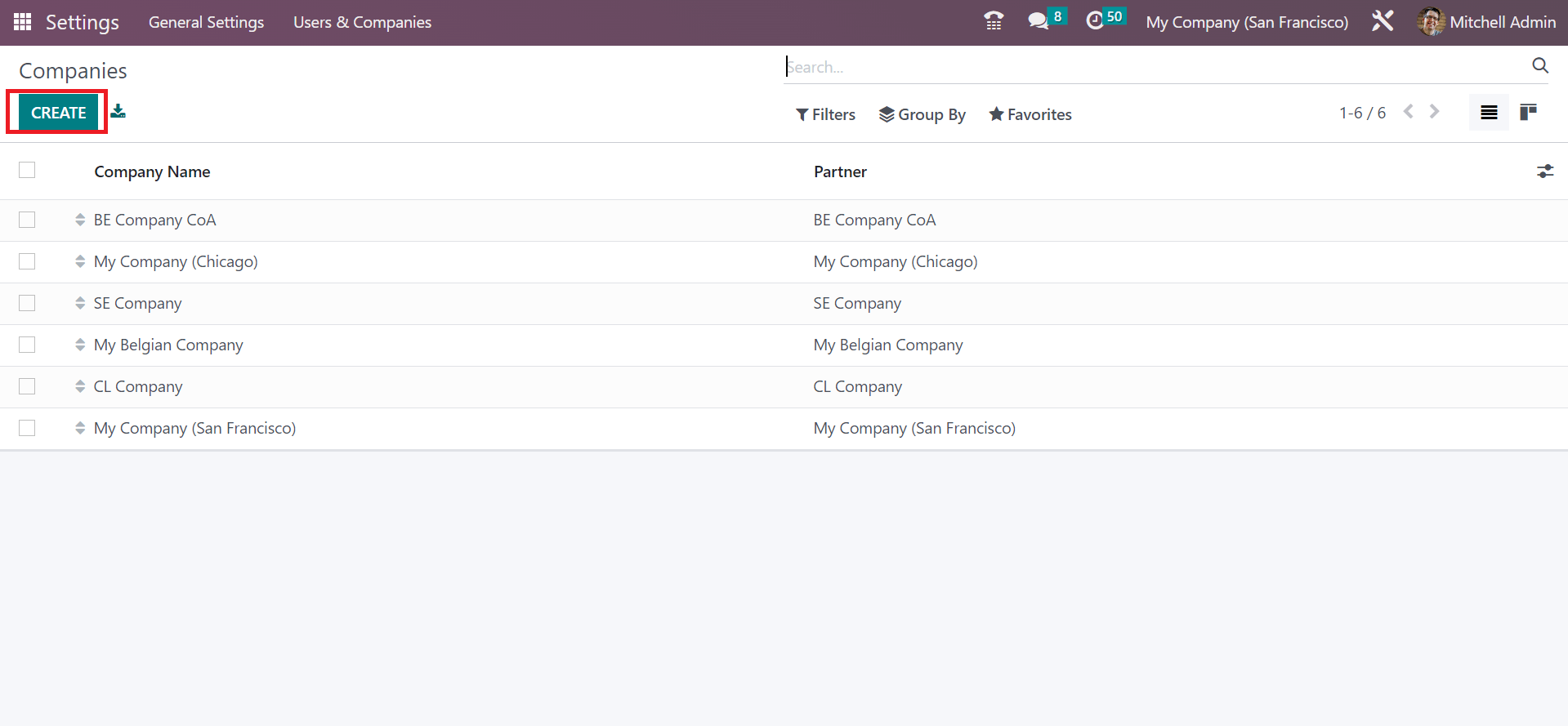

Before generating a sales tax, the user must develop company details in Odoo. You can obtain the Companies menu from the Odoo 16 Settings. Information such as each Company Name and Partner are visible in the Companies window. To formulate new company data, press the CREATE icon in the Companies window, as shown in the screenshot below.

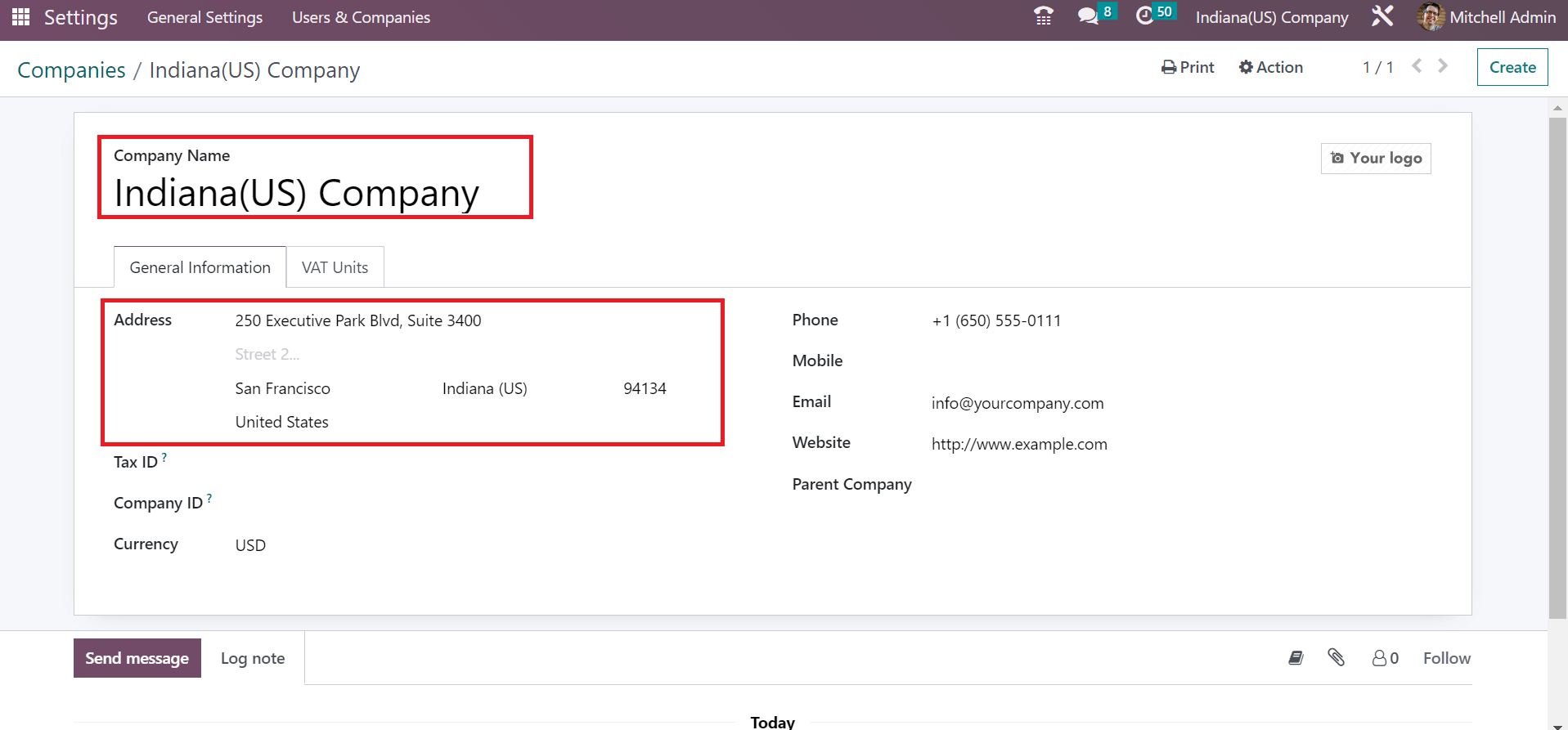

On the open page, apply Indiana(US) Company in the Company Name option. Later, enter the company address below the General Infromation tab, as denoted in the screenshot below.

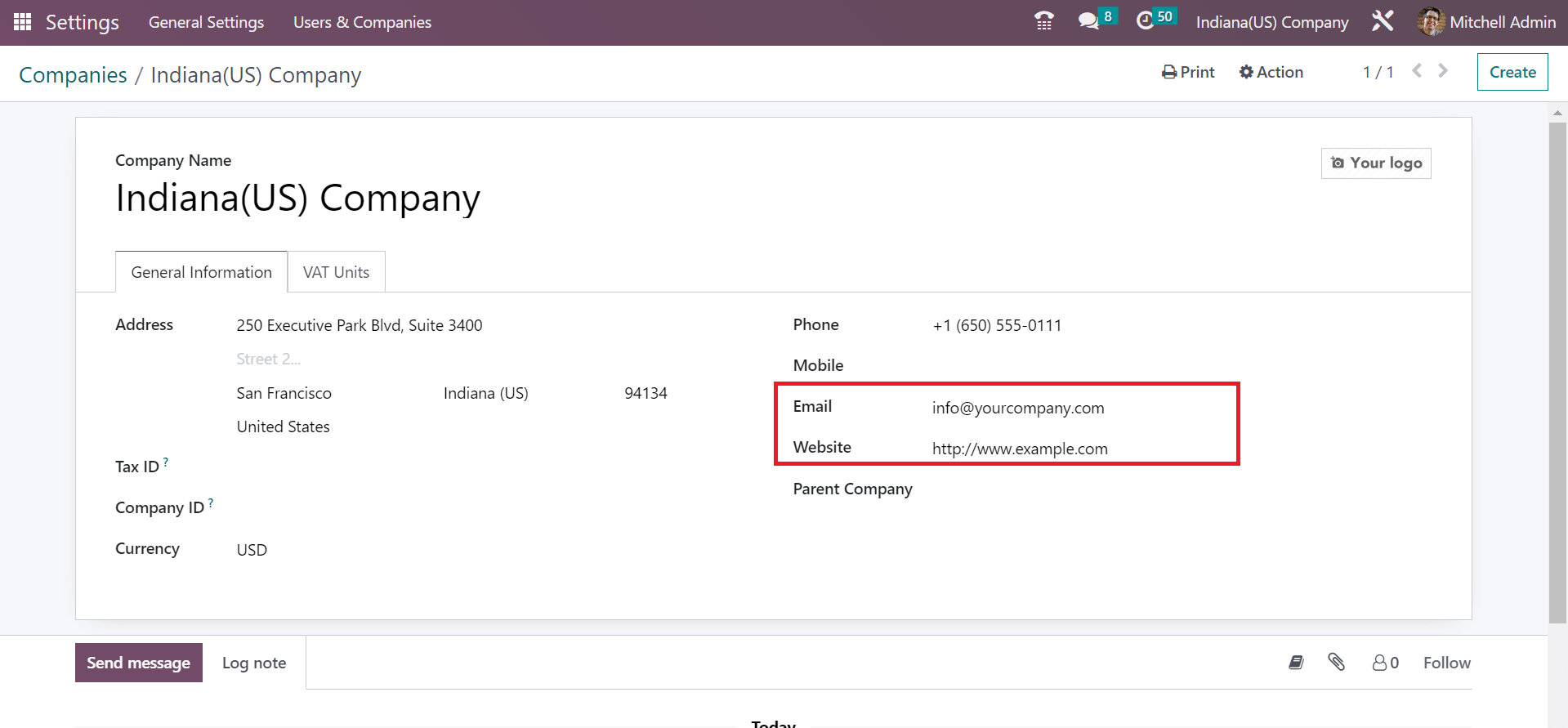

Here, we can see that Indiana(US) entered the State field and the United States as the Country, as mentioned in the above screenshot. Additionally, you can add a street name, Pincode, and city data. You must enter your company's email and website address, as represented in the screenshot

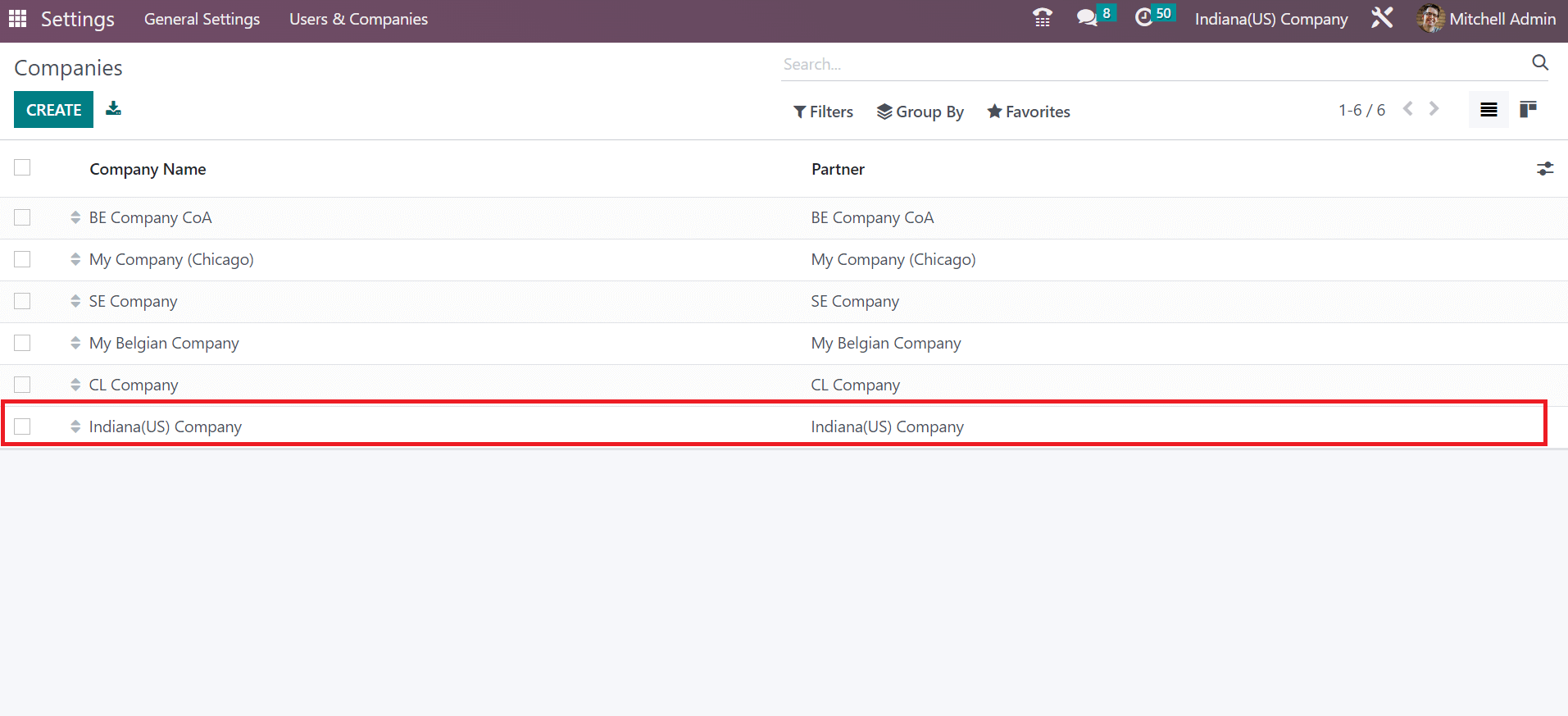

Each piece of information about the company is automatically saved in Odoo 16. We can access the created firm details in the main Companies window.

Now, let's move to the Odoo 16 Accounting module and create a sales tax for Indiana(US) Company.

How to Compute Indiana(US) Sales Tax in Odoo 16 Accounting?

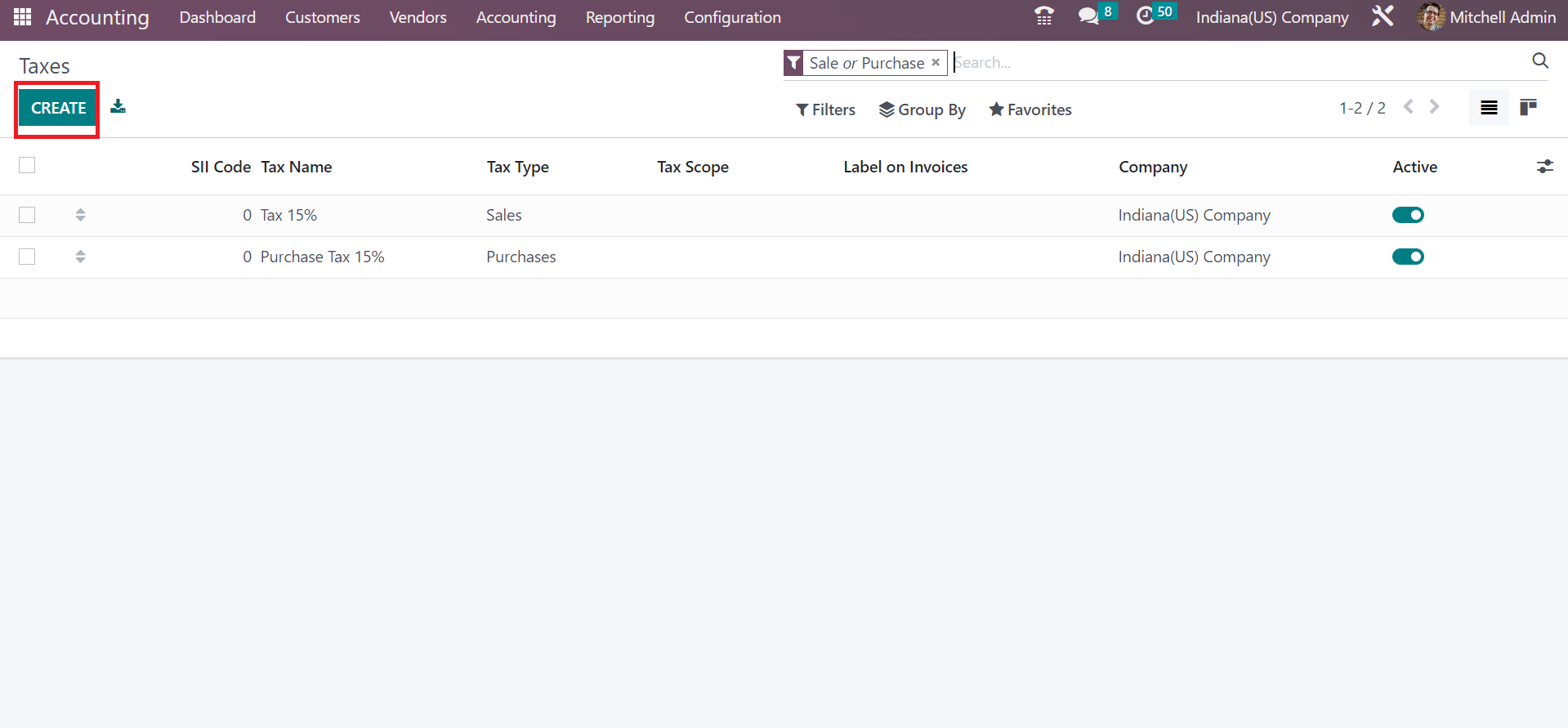

The history of all created taxes is viewable to a user after choosing the Taxes menu in Configuration of Odoo 16 Accounting. In the List view, the user can view the details of each tax, including SII Code, Company, Tax Type, etc. Select the CREATE icon for generating sale tax for Indiana(US) companies as specified in the screenshot below.

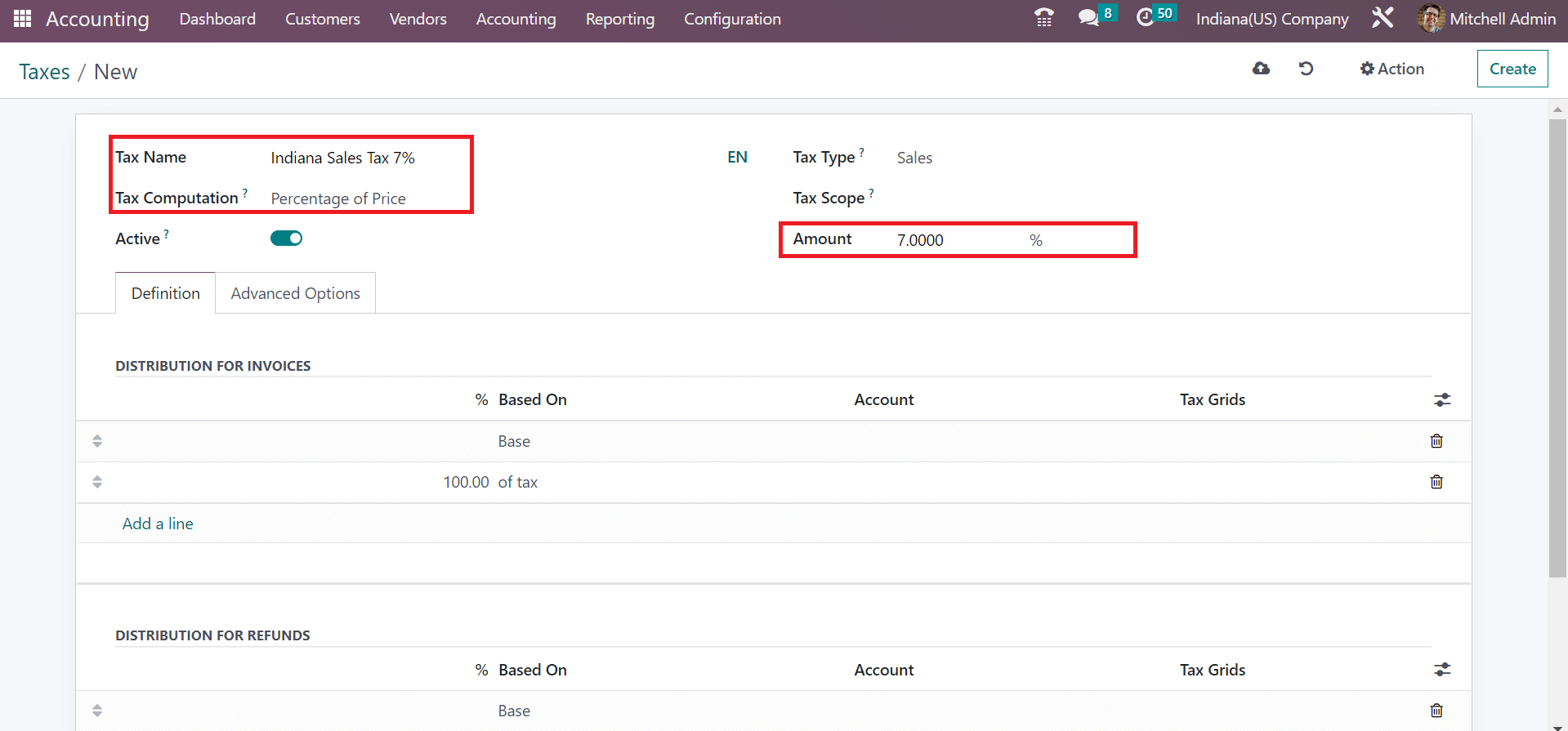

In the draft screen, apply the Tax Name as Indiana Sales Tax 7%. Afterward, the user can select the calculation method for tax in the Tax Computation field. Click the Percentage of Price option for your Indiana Sales Tax 7% computation, as cited in the screenshot below

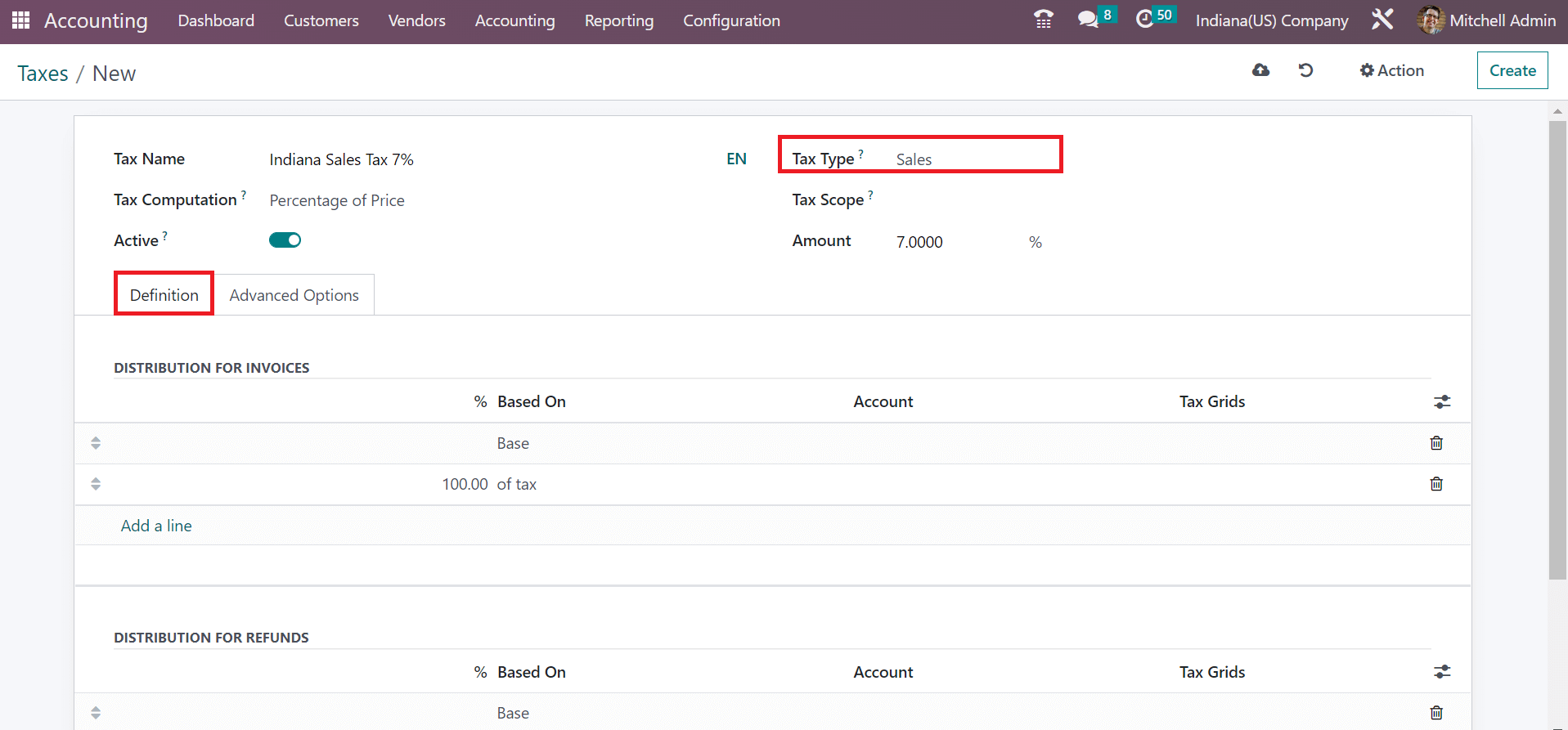

. Enter the percentage as 7% in the Amount option after setting your computation method. Later, the user can choose the category of tax as Sales or Purchase in the Tax Type field. We pick the Sales option as the Tax Type because of the Indiana Sales Tax 7% configuration. Moreover, it is possible to apply more distribution of taxes under the Definition tab.

Your tax details are manually saved in Odoo 16. Next, we can develop a customer invoice for Indiana Sales Tax of 7%.

Customer Invoice for Indiana Sales Tax 7% in Odoo 16 Accounting

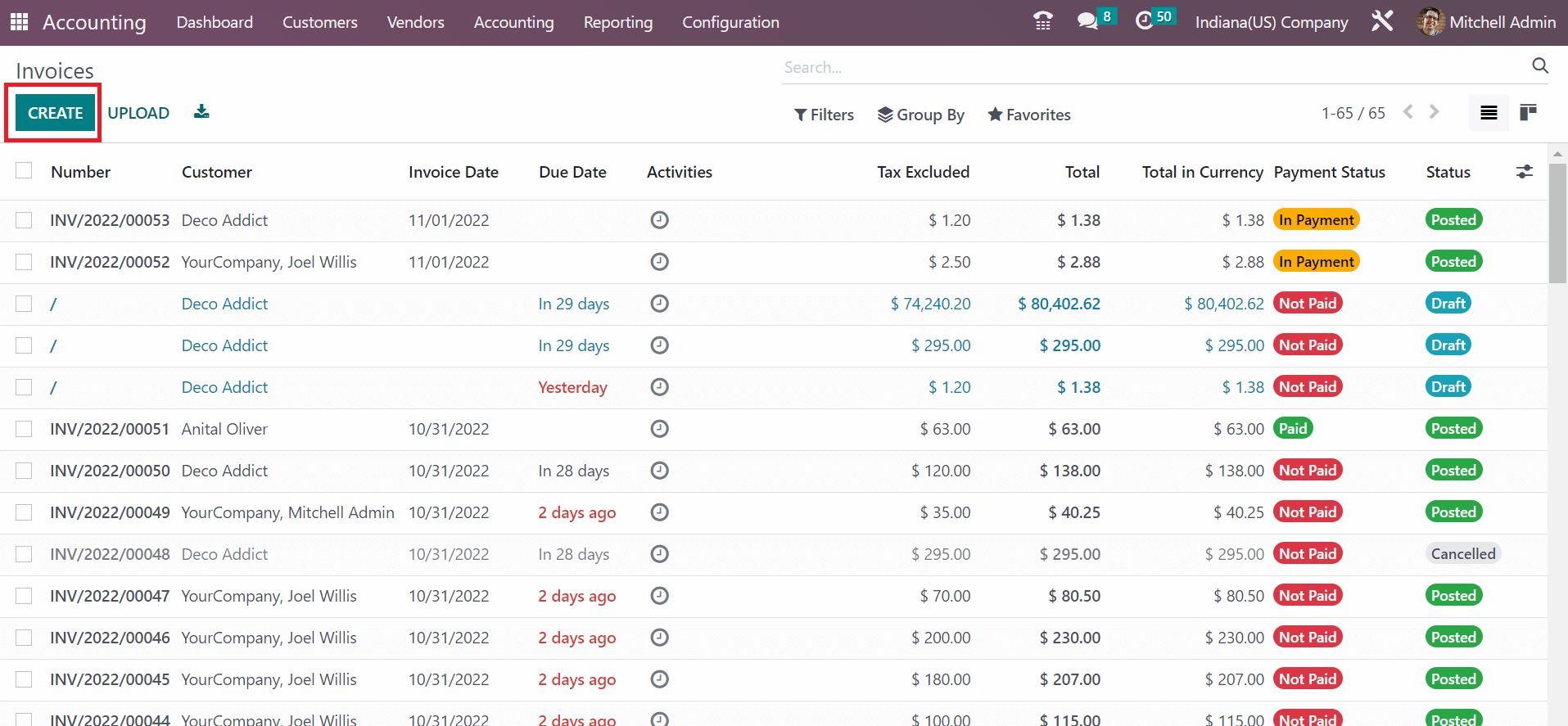

We can efficiently create several invoices after choosing the Invoices menu from Odoo 16 Accounting. In the Invoices window, the user can see a detailed view of each invoice, including Status, Invoice Date, Number, Activities, etc. To form a new invoice, click the CREATE button in the Invoices window, as indicated in the screenshot below.

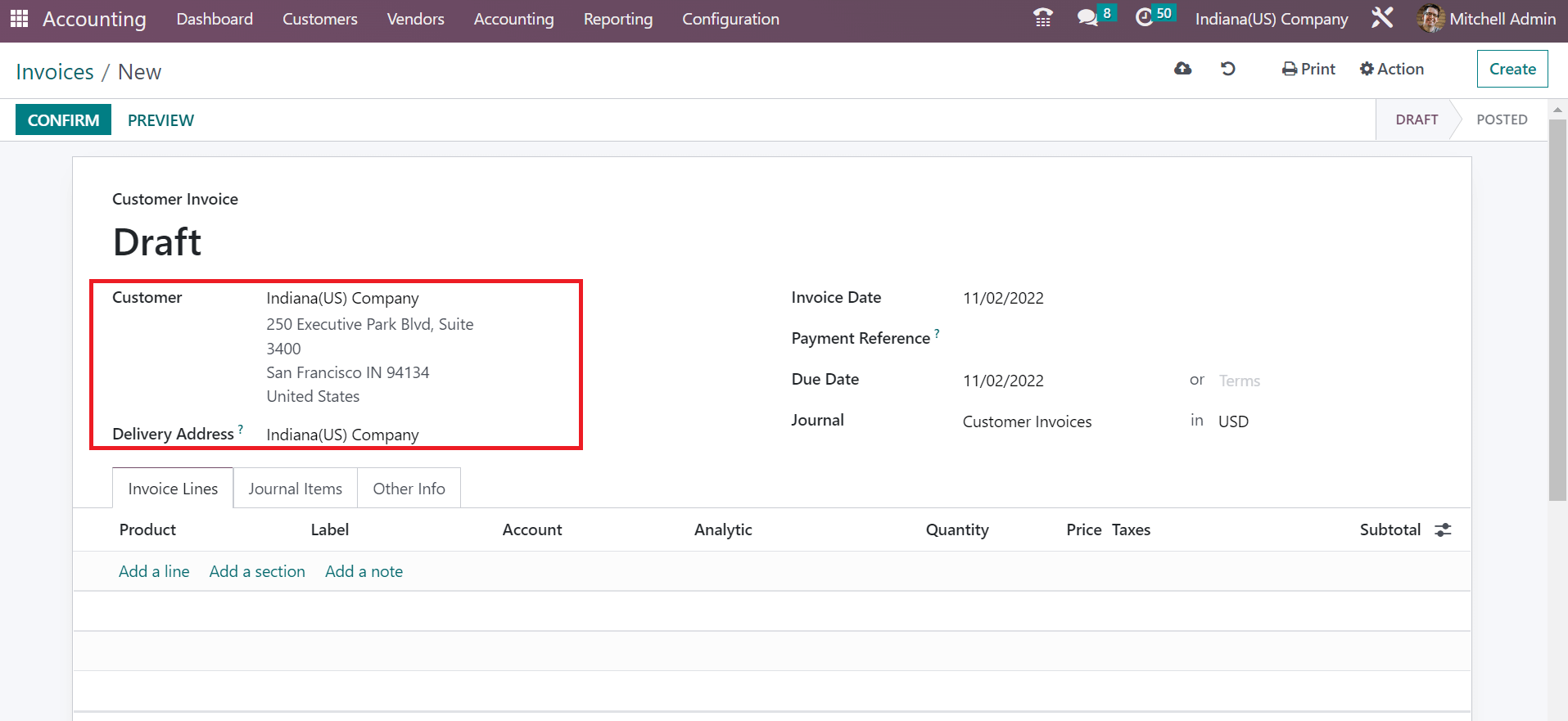

Select the Customer as Indiana(US) Company in the New invoice window. Users can automatically see the invoice address for their selected customer in the Customer Address field.

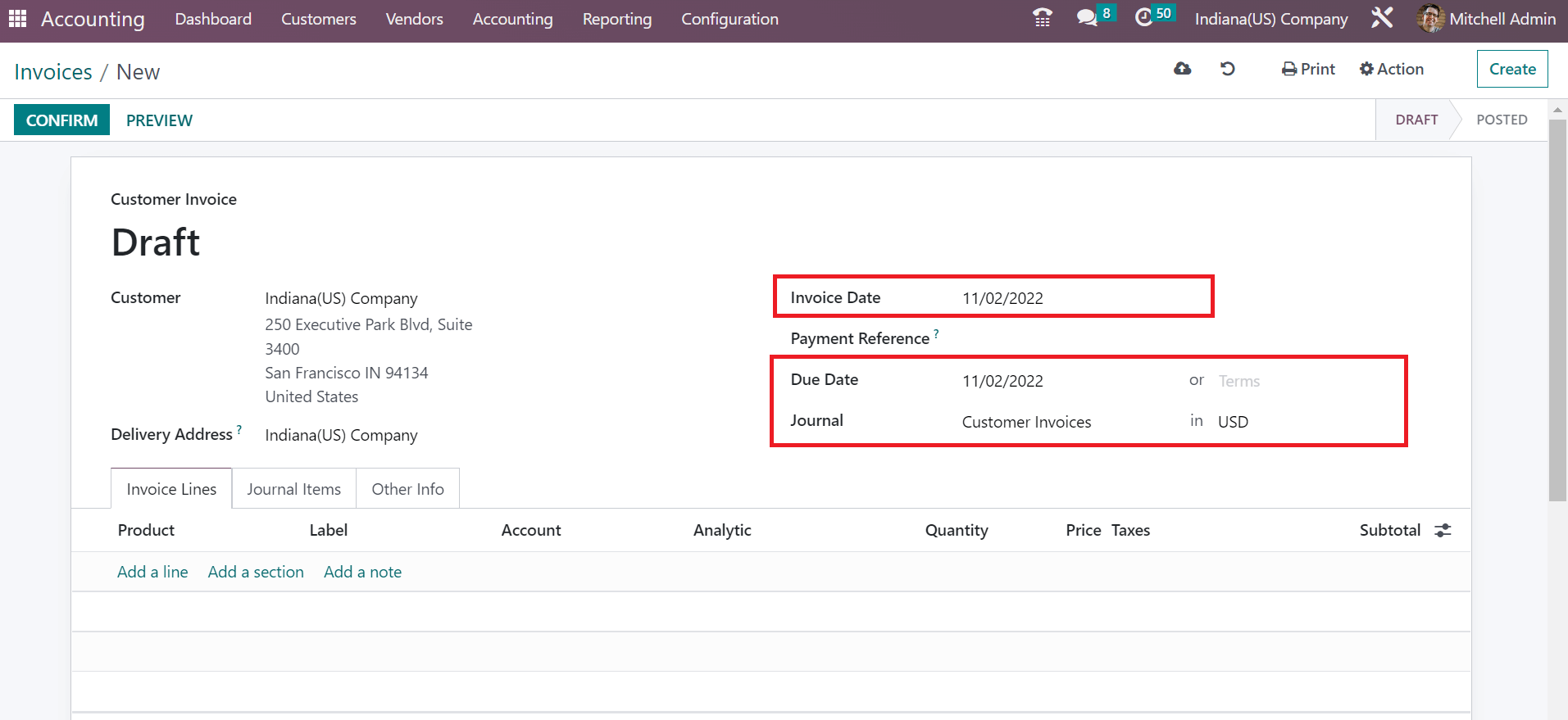

It is possible to mention the start date in the Invoice Date option and the last day in the Due Date field. Afterward, choosing the journal for your customer invoice would be best. Furthermore, the user can specify product details after clicking the Add a line button under the Invoice Lines section.

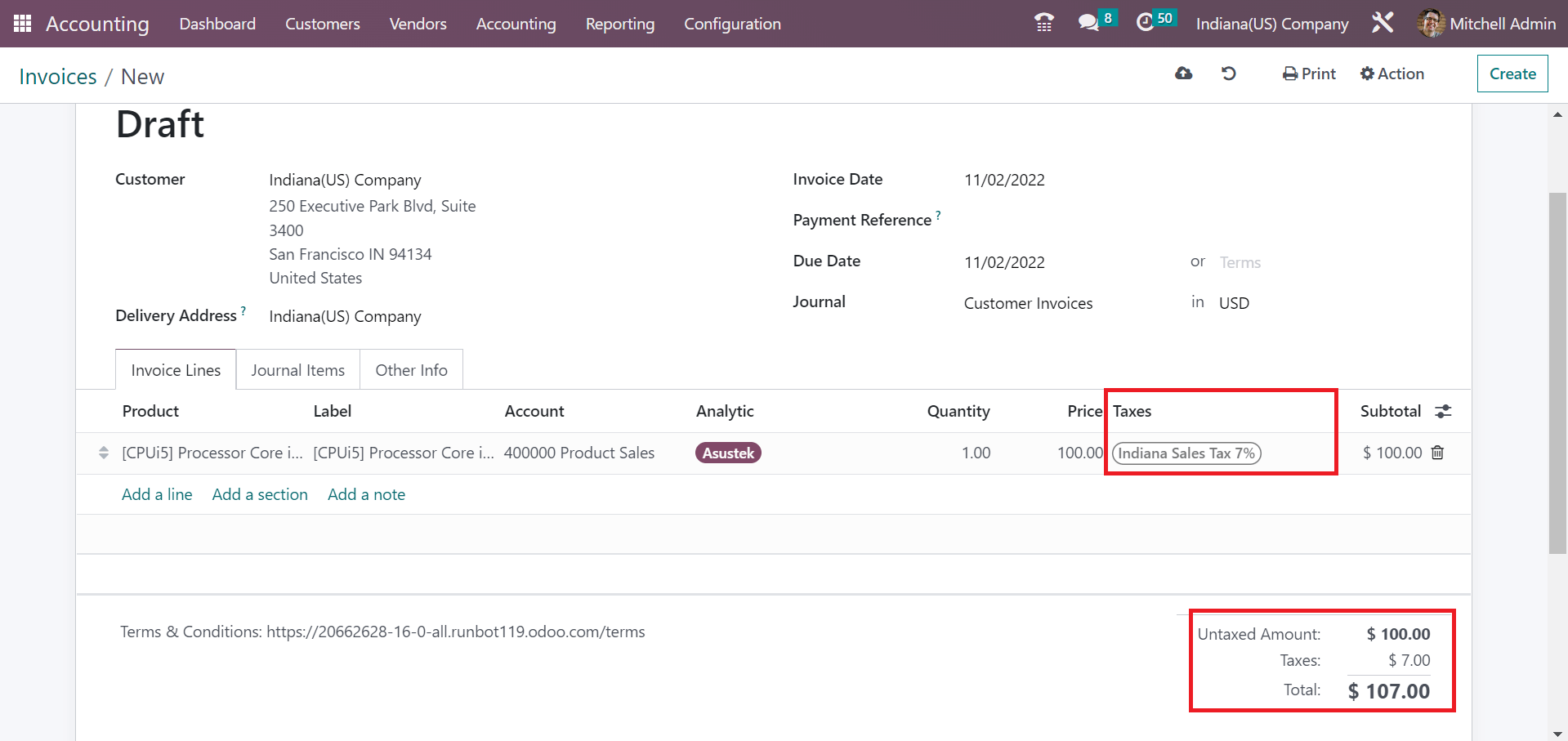

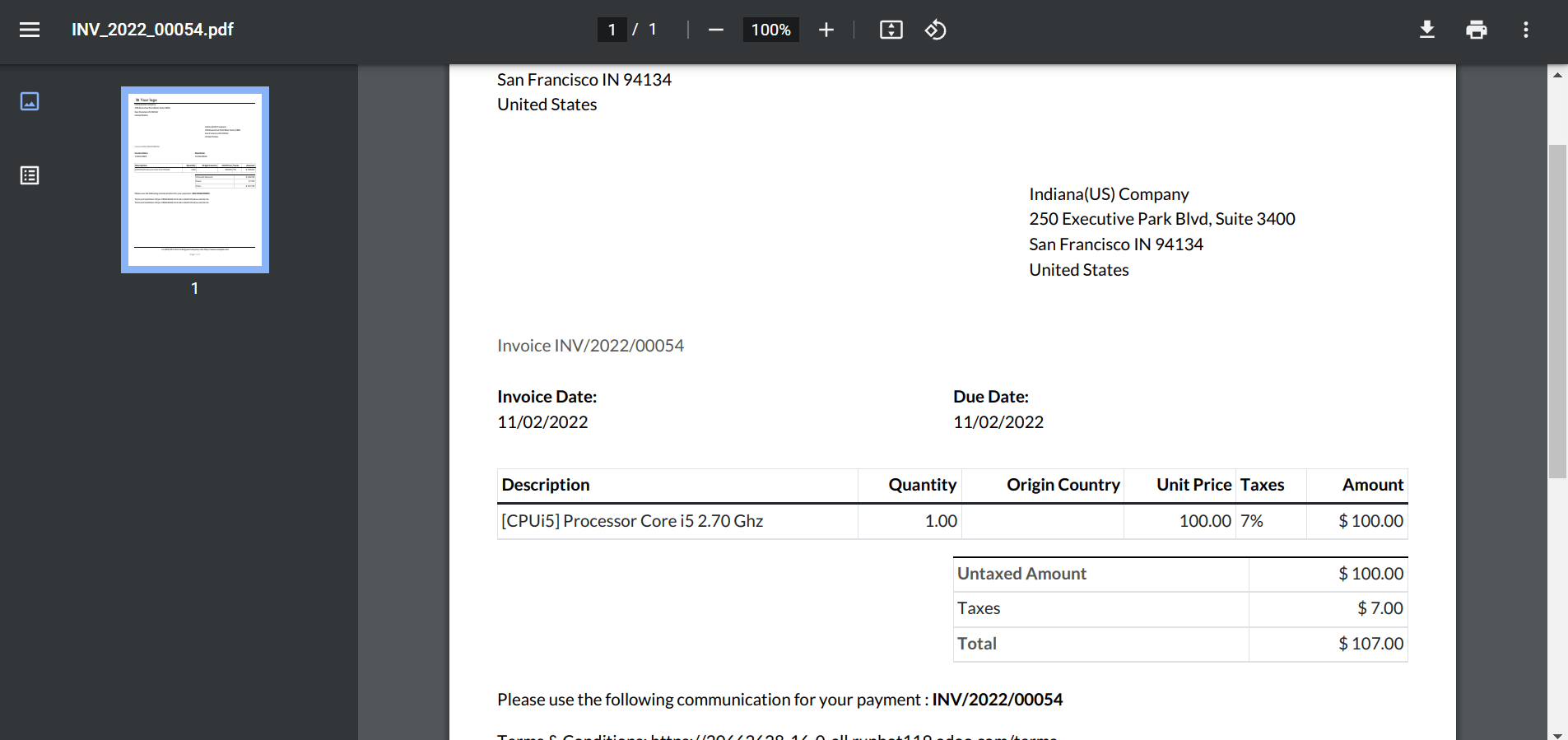

We pick one quantity of Processor core i5 with a price of 100. Choose the Indiana Sales Tax 7% under the Taxes section below Invoice Lines. After selecting your product data, we can acquire the total cost, including applied taxes, at the end.

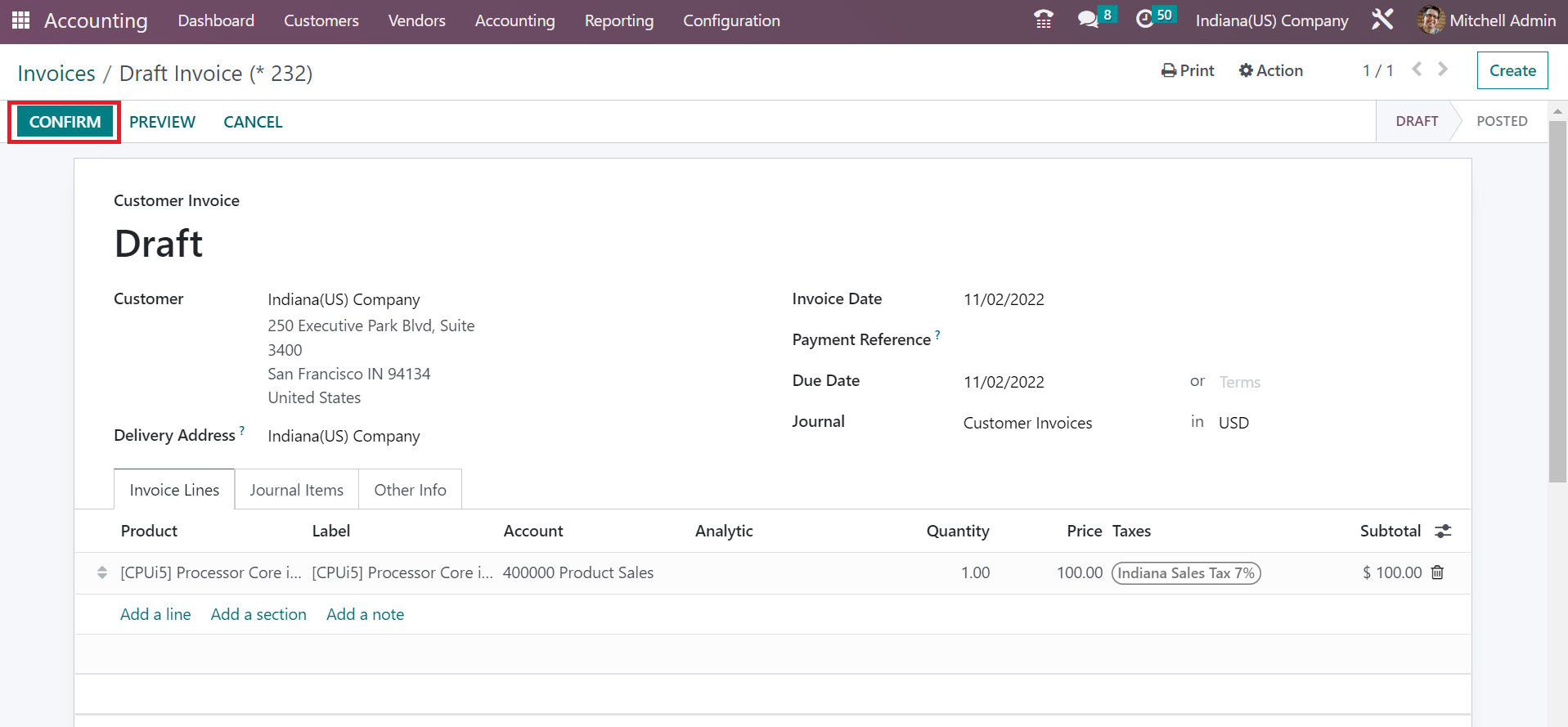

After saving the invoice details, you can validate it by pressing the CONFIRM icon.

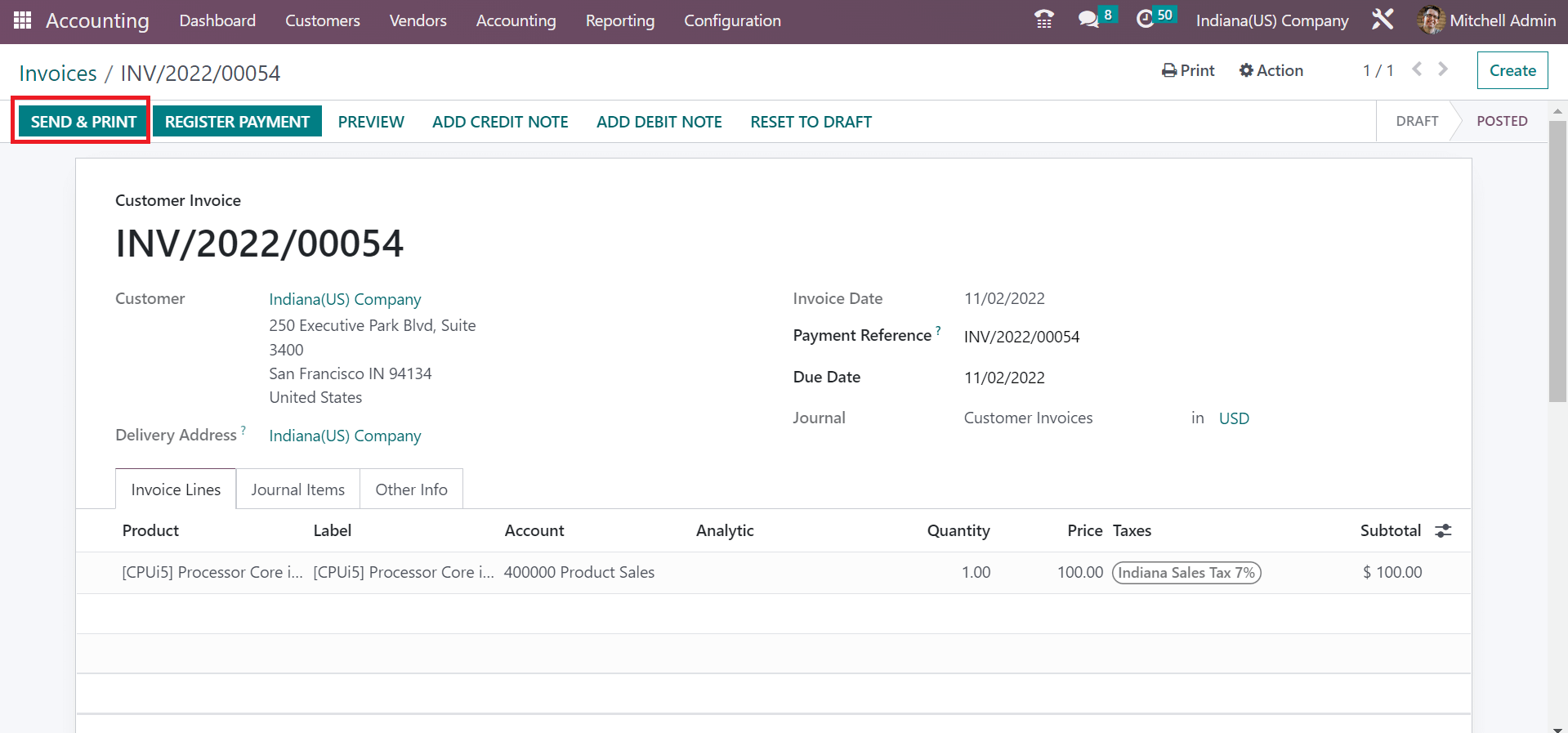

After posting the invoice, it is possible to take a printout of the document. Select the SEND & PRINT icon in the Invoices window as defined in the screenshot below.

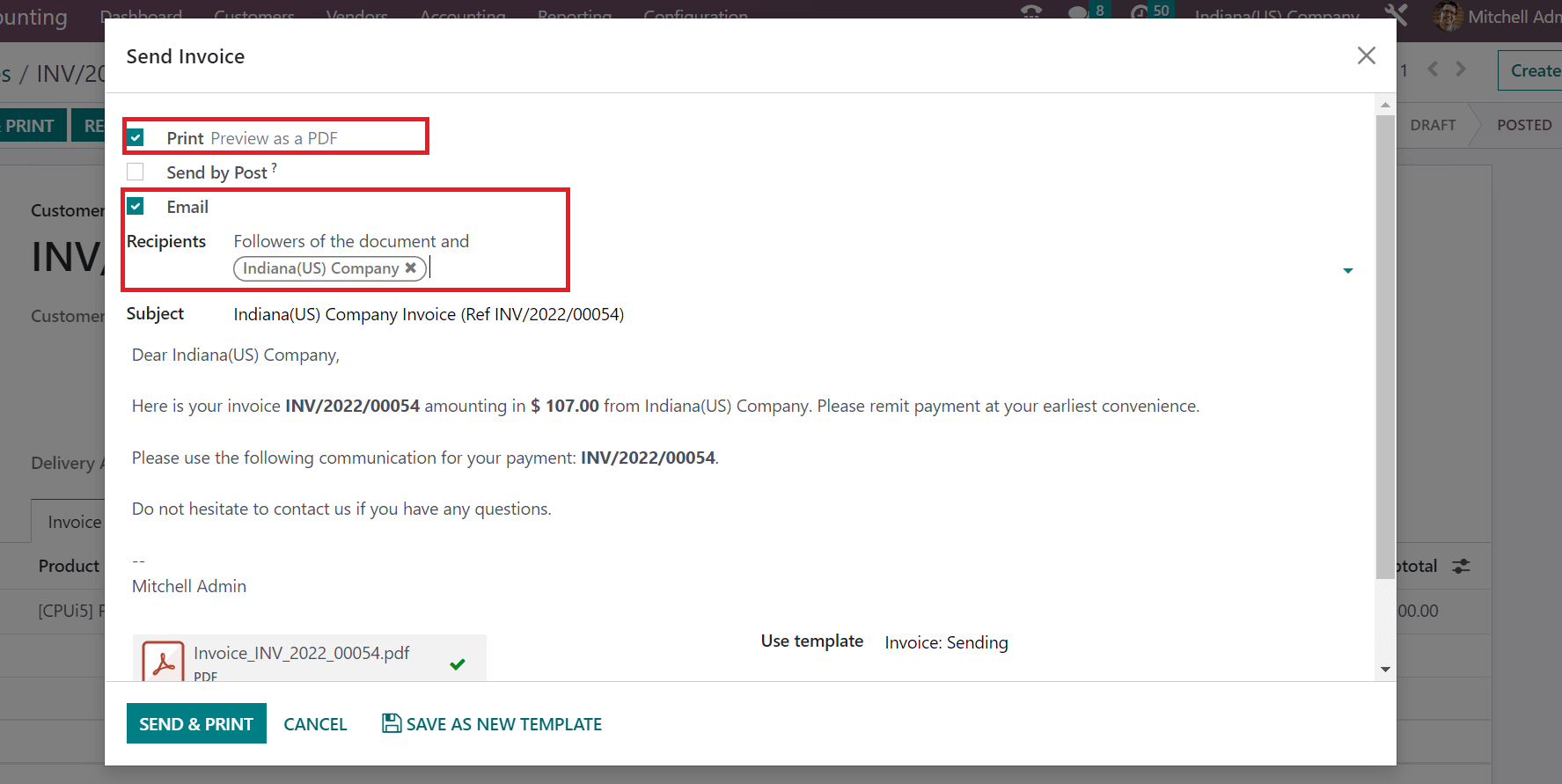

A Send Invoice window opens before the user and activates the Print or Email option. We can get the preview of the document as a pdf after enabling the Print option. By activating the Email option, sending the invoice document to other members is easy. You can add the followers of your record in the Recipients field.

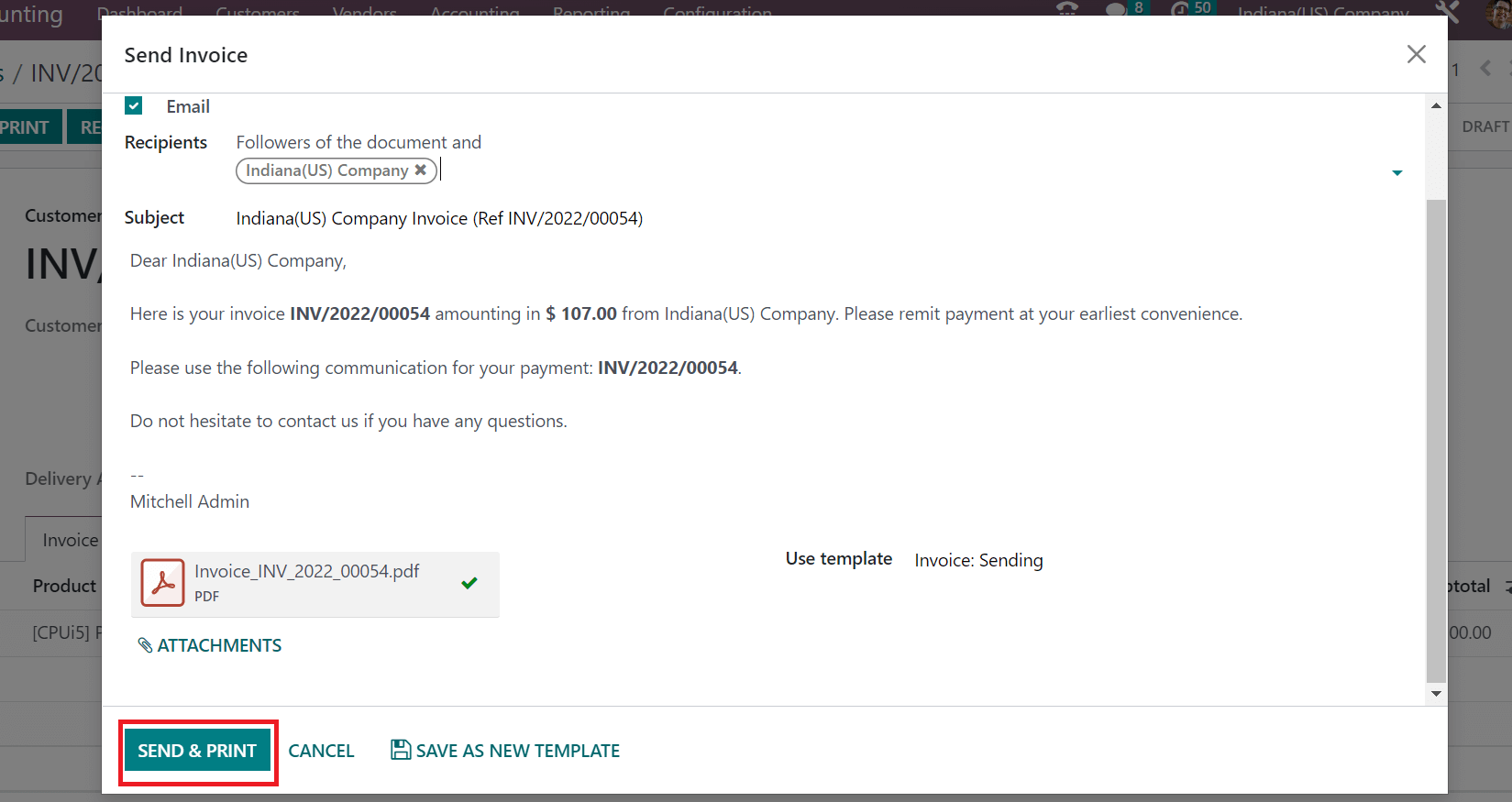

The subject and details of the invoice are manually visible to the user. After specifying all your followers, click the SEND & PRINT button in Send Invoice window.

Users can access the printout of customer invoice documents in your system.

Management of Indiana sales tax rate for your business is made simple through Odoo ERP support. Sales tax computation is automated easily and applied to an invoice using Odoo 16 Accounting module. Refer to the following link to learn about Arizona(US) Sales Tax calculation in Odoo 16.