Government charges Sales tax for services and goods in a company or shops. The rate of sales tax varies based on the regulations of each state in a country. In the United States, sales tax for each state is different, and computation is a little bit difficult. California cities contain various sales tax rates and tax collections administered by the California Department of Tax and Fee Administration. You can manage the sales tax configuration by using ERP software in your system. Odoo 16 version is beneficial to maintain sales tax according to each country branch of your company. The Accounting application assists users in supervising tax records and securing them for future reference.

This blog depicts configuring California Sales Tax within the Odoo 16 Accounting.

It is easy to set up company data in California and compute sales tax in Odoo 16. Tax Report of a firm in a year-end accessed easily using the Reporting feature of Odoo 16 Accounting module. Let's view the steps to configure California Sales Tax in Odoo 16.

California(US) Sales Tax Information

At the beginning of 2022, 55 cities in California charged at least 10.25% as sales tax. The lowest California Sales Tax is 7.25% is not similar for all the states. The original sales tax in California is 6%, and an additional surcharge of 1.25% pays for city funds and country. So, individuals must pay a sales tax of 7.25% in California, which is one of the US maxima. Additionally, cities and individual countries also apply a sales tax. The total tax rate reaches 10.25%, depending on the local sales tax jurisdictions.

Sales tax is assessed on most goods and services in California, such as clothing, restaurant meals, etc. Certain things, including groceries, prescription drugs, and seeds/plants used in food, are exempted from the sales tax. It is essential to check local and state laws if you have to pay sales tax on specific items. California Department of Tax and Fee Administration helps to register sales tax permits for a business. You must need social security number, SEIN, FEIN, bank information, driver's license number, and more for sales tax registration in California(US).

Manage Your Company Data in Odoo 16

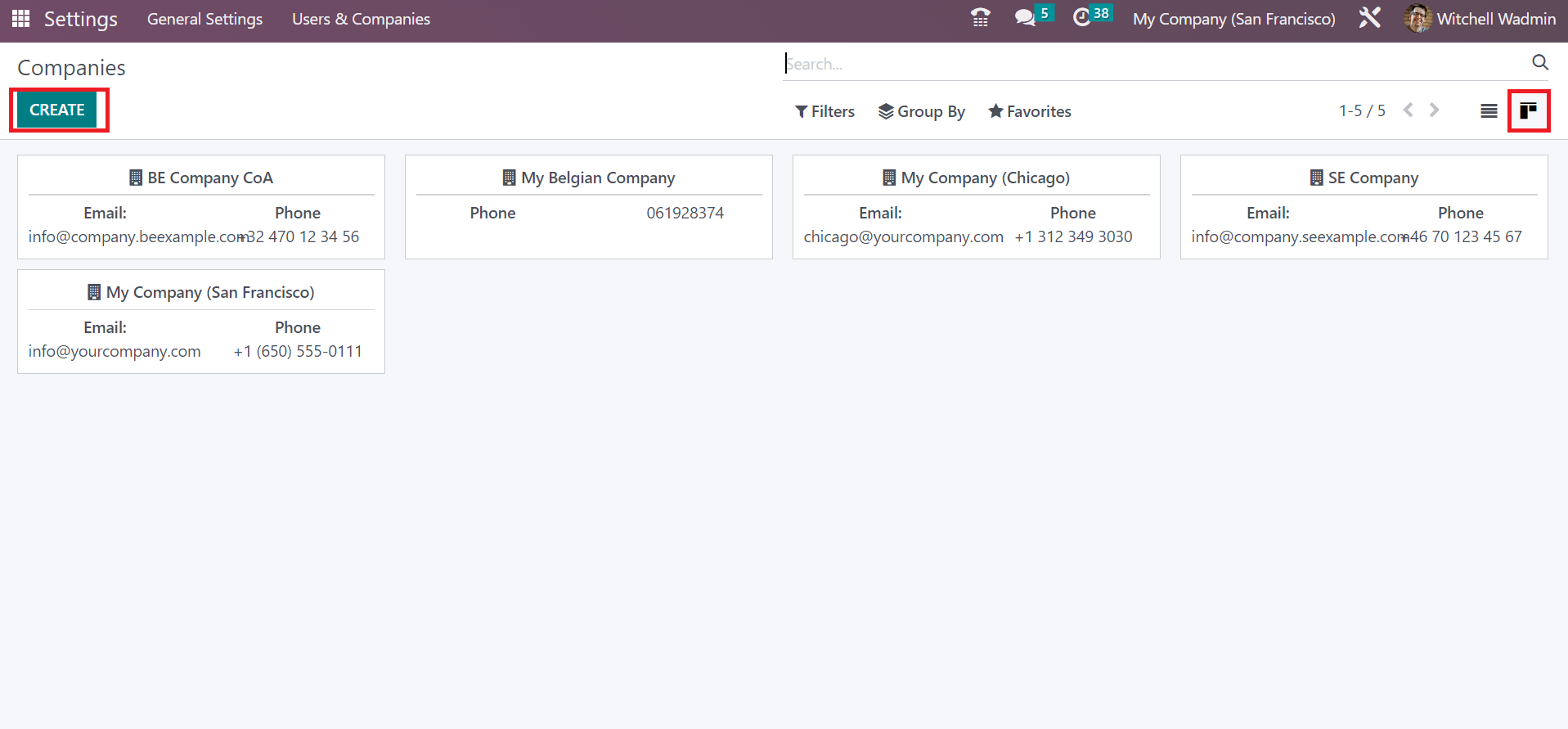

Before developing sales tax for California, we must mention the company data in Odoo 16. You can acquire the Companies menu within the Users & Companies tab in Settings. In the Kanban view, the user can see the information about each company, including company name, phone number, email id, and more. To add California company details, press the CREATE icon on the Companies screen, as mentioned in the screenshot below.

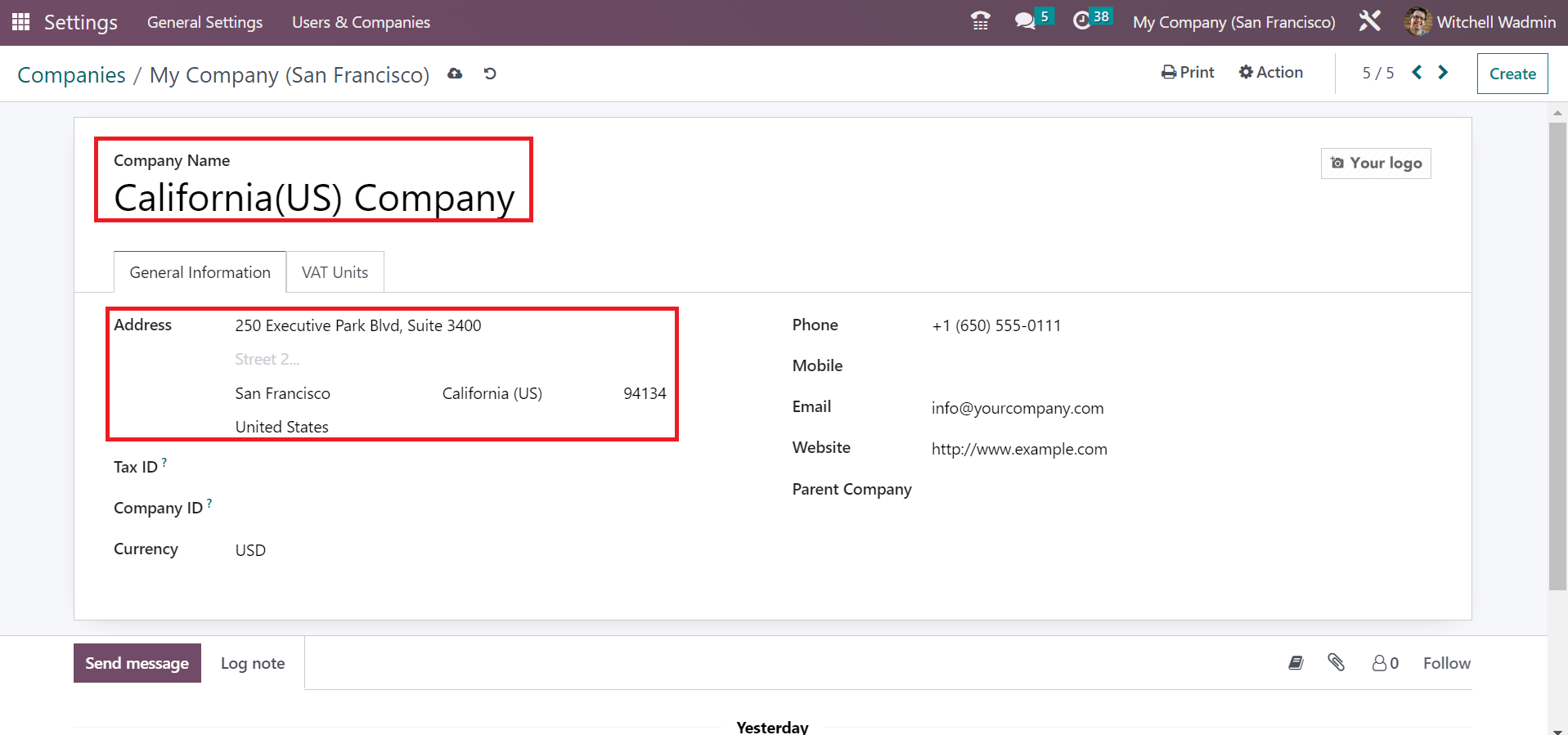

In the open window, enter the Company Name as California(US) Company. Users can specify other information about the company inside the General Information tab. Inside the Address field, you can enter the details of California(US) Company, including street name, pin code, state, country, and more. Apply the state name as California and the Country as United States in the Address option below the General Information tab, as described in the screenshot below.

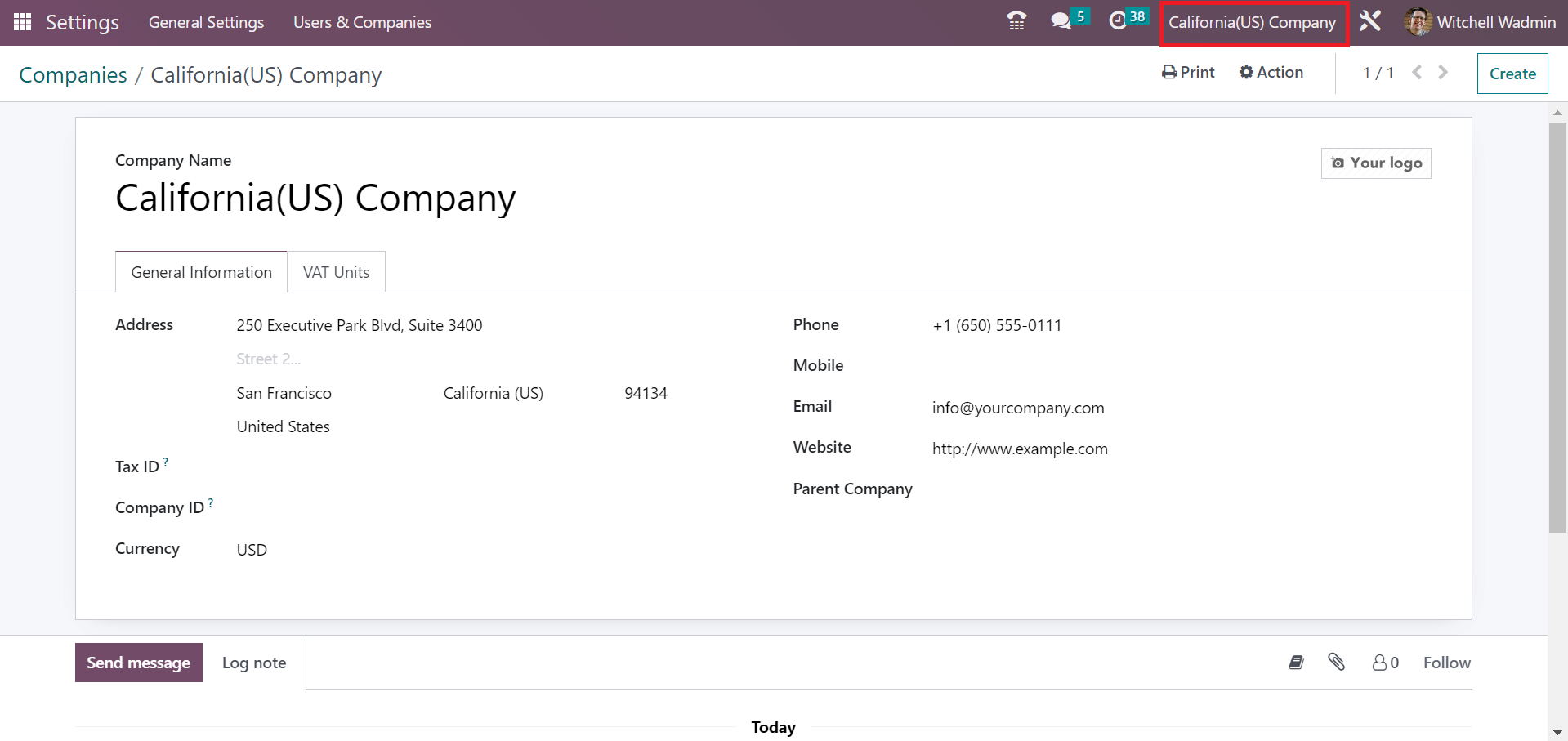

Later, enter the Phone number, Email, and Website address of the California(US) Company. Every data related to the company is automatically saved in the Odoo 16. After saving the data, the user can perceive the company name at the top bar of Odoo ERP, as depicted in the screenshot below.

To Set Up Sales Tax for California(US) in the Odoo 16 Accounting

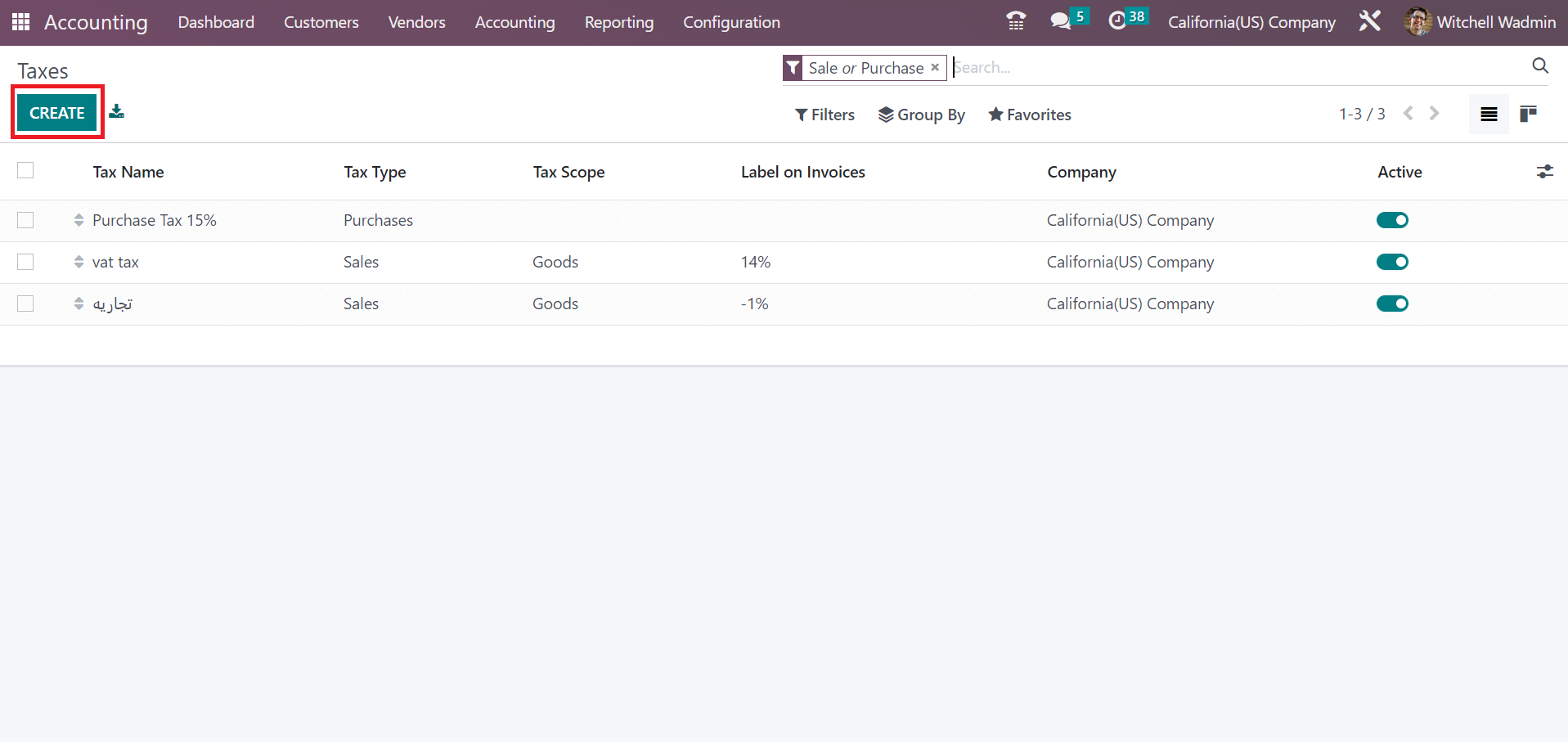

We can formulate sales tax per each state in a country with the help of the Odoo 16 Accounting module. Users can obtain the Taxes menu in the Configuration tab, and the history of each created tax is visible to the user in the Taxes window. Facts about each tax, such as Company, Tax Name, Tax Scope, and more, are available to users on the Taxes page. Press the CREATE icon to initiate a new tax for California(US) company, as pointed out in the screenshot below.

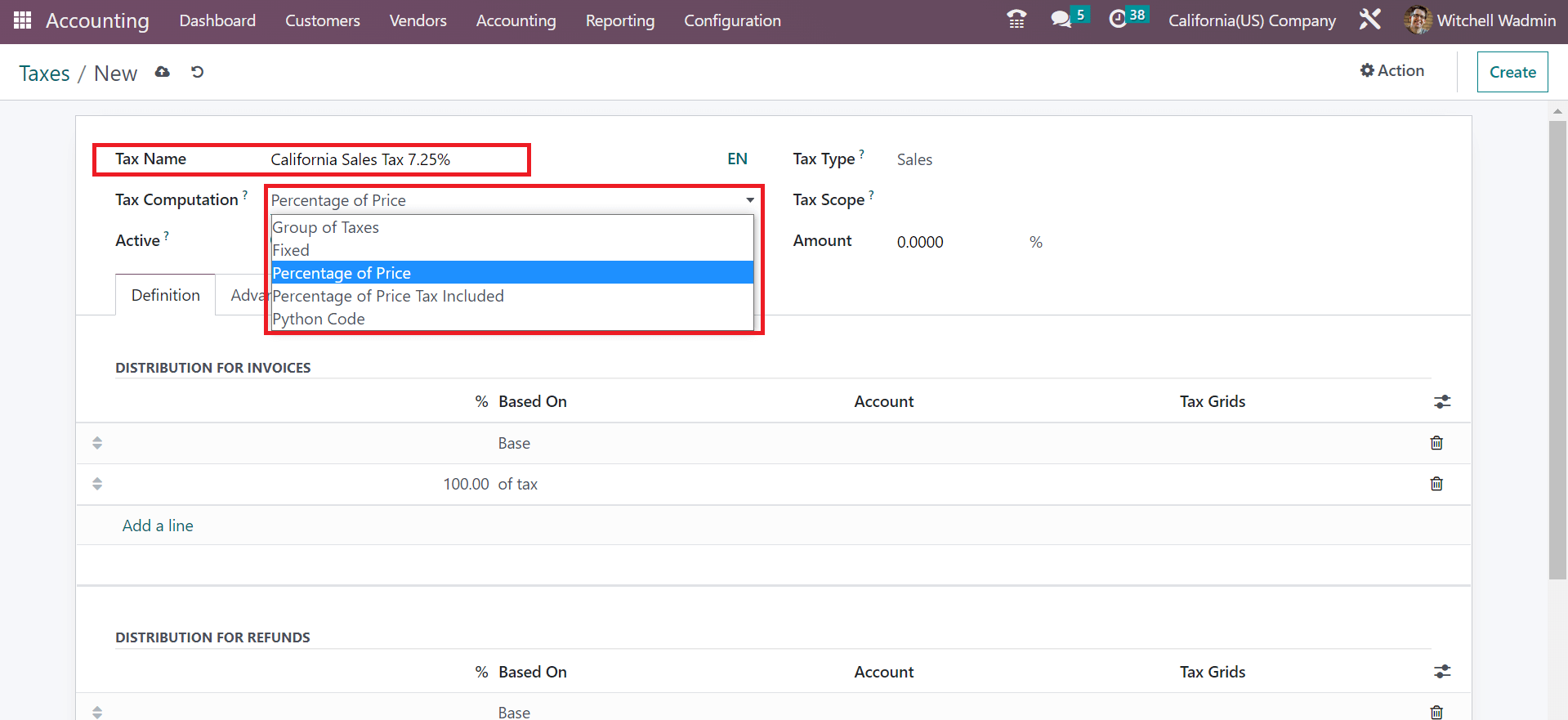

On the new page, put the name of the tax as California Sales Tax 7.25% in the Tax Name field. Next, a user must add the tax figuring method in the Tax Computation field. As defined in the screenshot below, you can obtain various tax computation methods, such as Fixed, Python code, etc.

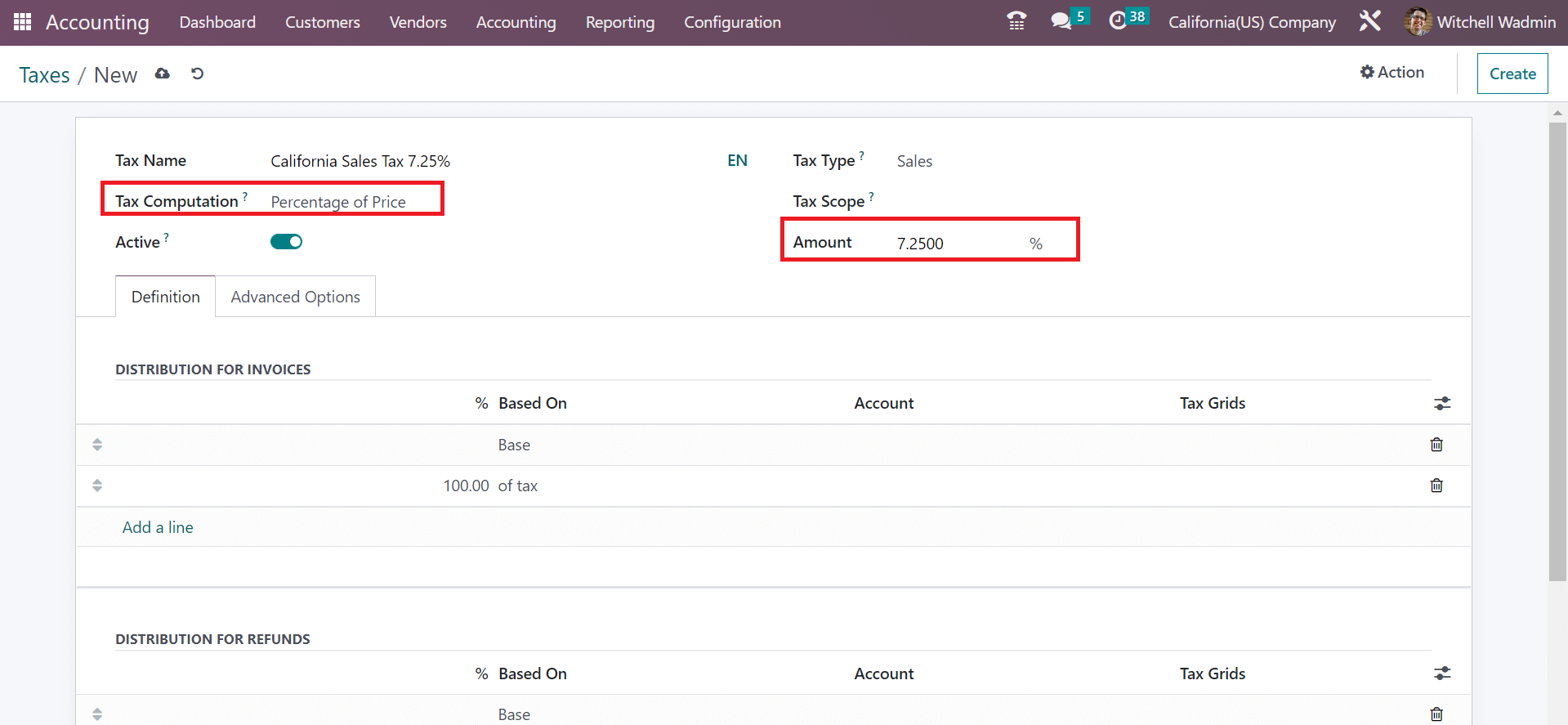

Select the Percentage of Price option inside the Tax Computation field to configure the tax amount as a price percentage. Afterward, you can mention the amount of tax computation in the Amount field. If you want 7.25% tax, you must choose Percentage of Price as Tax Computation and enter 7.25% for the amount. So, we applied 7.25% in the Amount field, as represented in the screenshot below.

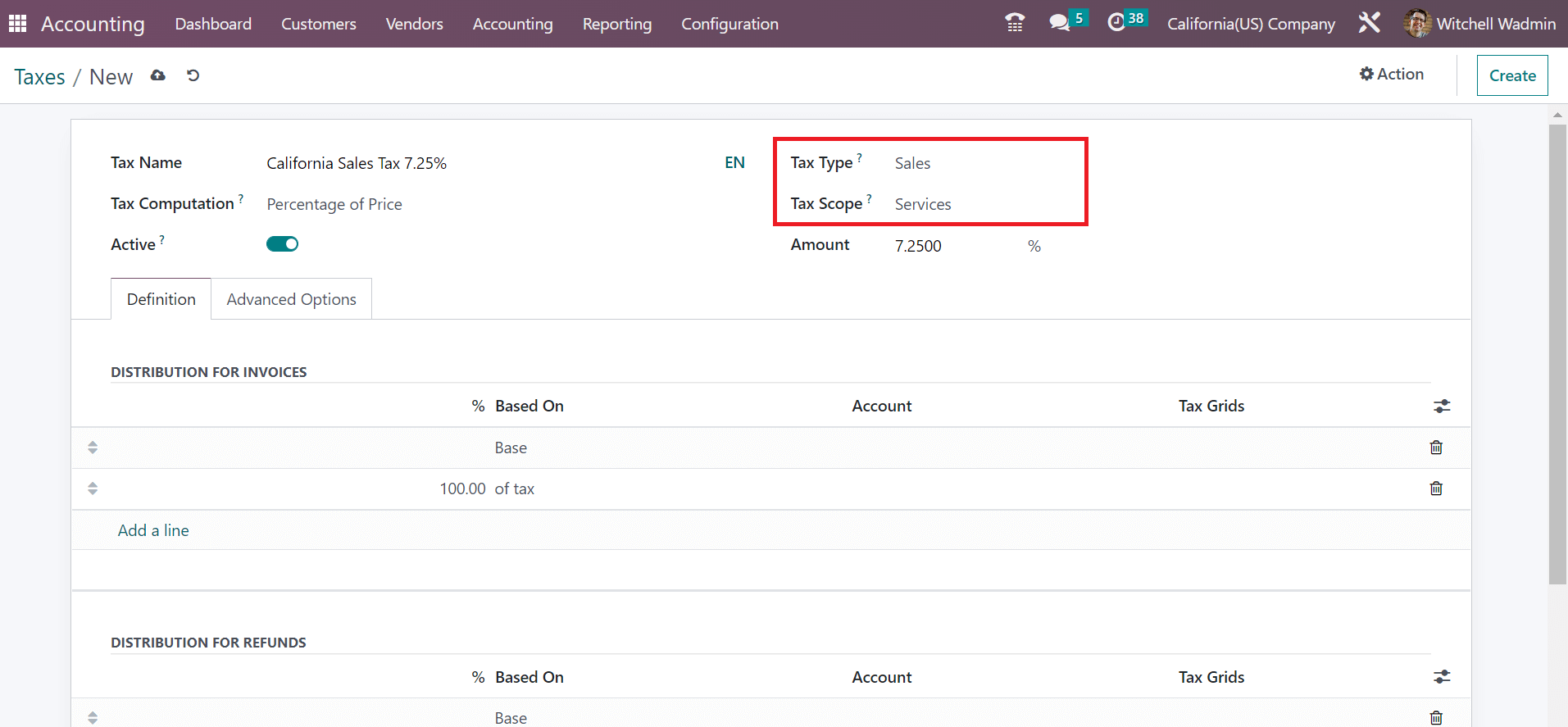

The user must set the type of tax within the Tax Type field, which will be for Purchase, Sales, or None. It would help if you chose the Sales option in the Tax Type field for the Sales tax computation. Moreover, it is possible to remove tax for goods/services using the Tax Scope field. Users can allow for both by leaving the space empty. So, we pick the Services option in the Tax Scope field to avoid specific service tax usage.

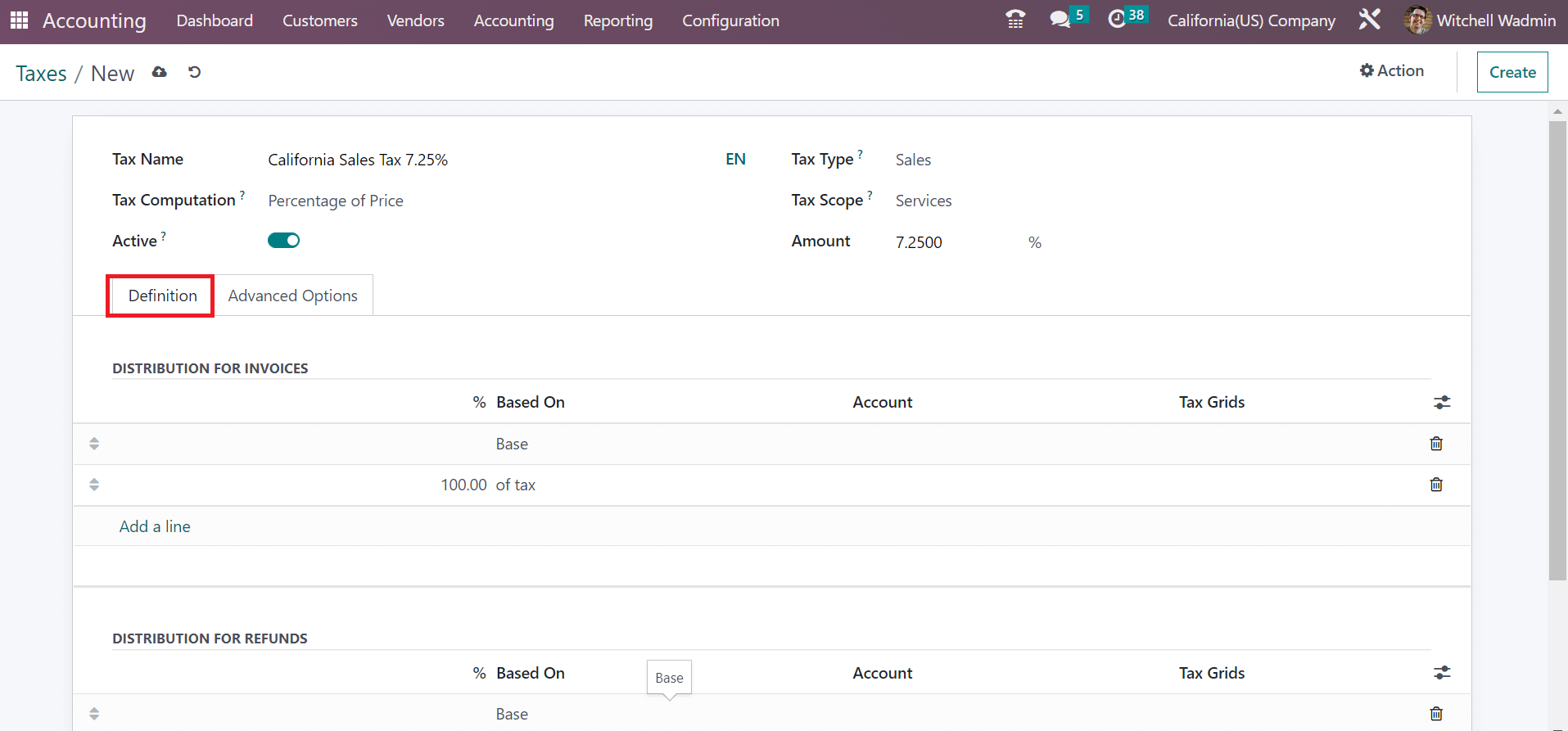

Below the Definition section, the user can distribute the specific tax for invoices and refunds as specified in the screenshot below.

Each detail of tax is automatically secured in the Odoo 16. Next, we can generate a customer invoice for California(US) sales tax in Odoo ERP.

To Define Customer Invoices for California Sales Tax in the Odoo 16 Accounting

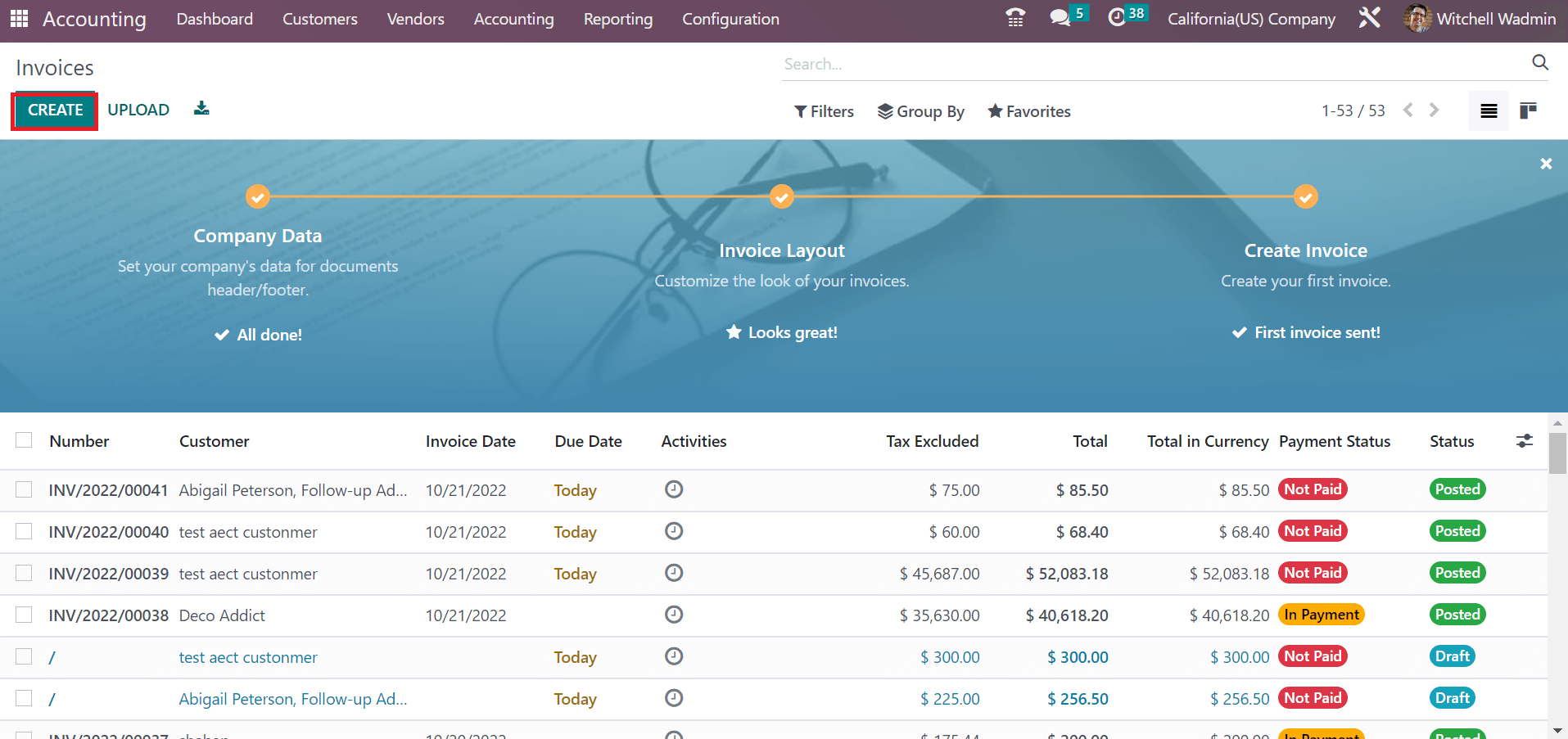

For creating a new invoice for a customer, the user can choose the Invoices menu in the Customers tab or the invoice journal from the Accounting dashboard. The history of all developed invoices is attainable within the Invoices window. To prepare a new invoice, click the CREATE icon on the Invoices page, as indicated in the screenshot below.

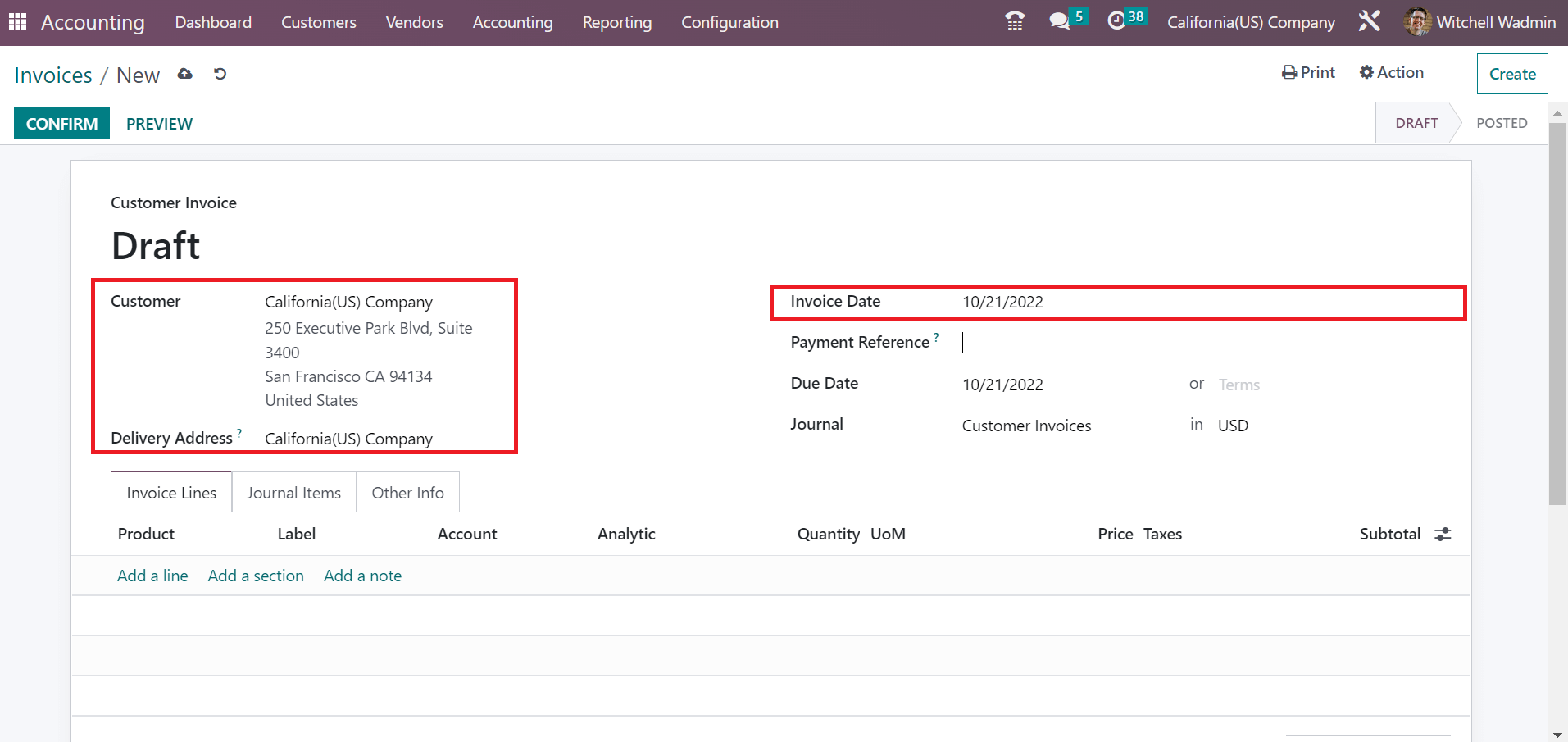

Choose your Customer details on the new screen, and the Address concerning your partner is viewable automatically. We pick the Customer as California(US) Company for the invoice. Later, add the start date of the invoice in the Invoice Date field, as illustrated in the screenshot below.

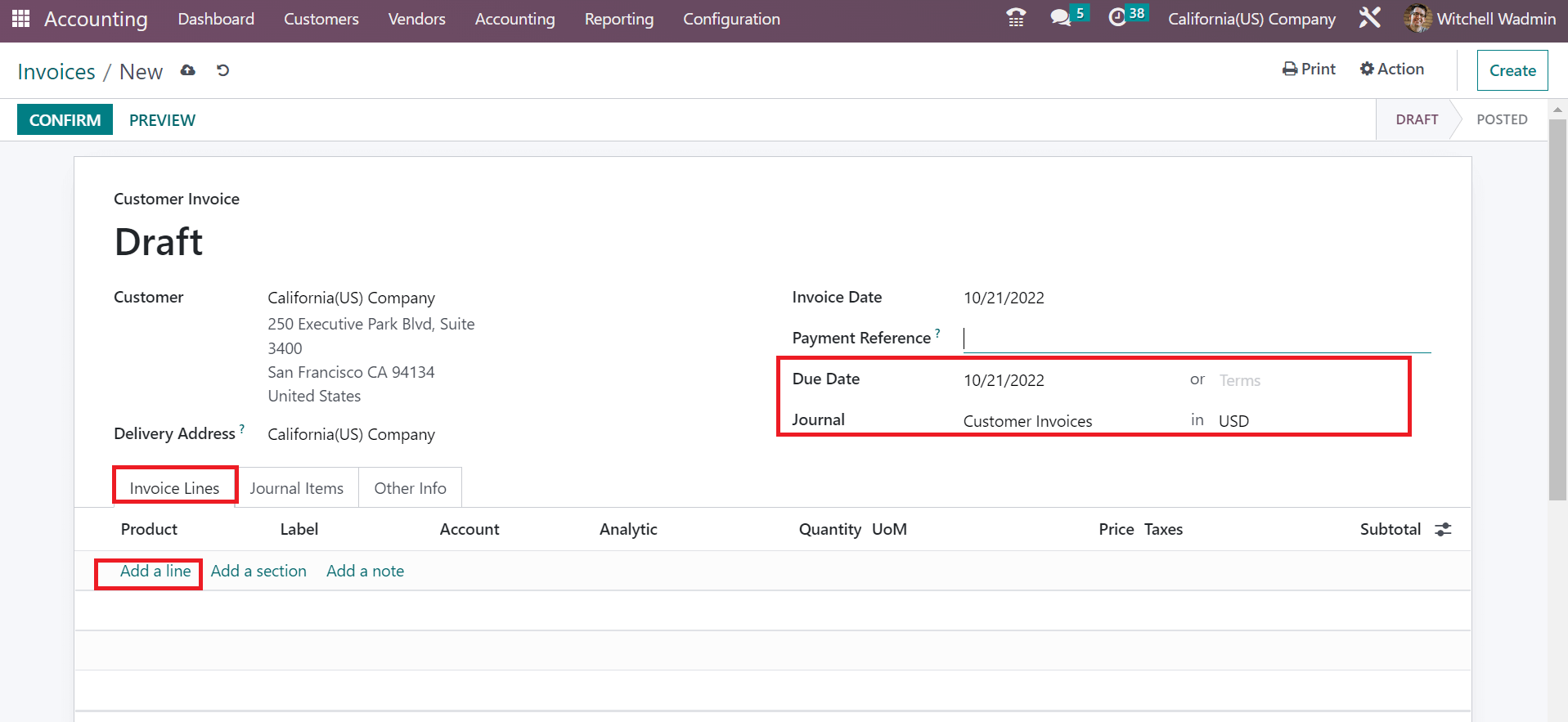

Enter the expected close date of the invoice in the Due date option. Furthermore, you must select the Journal corresponding to Customer Invoice in the Journal field. Select the Add a line option inside the Invoice Lines tab to apply a new commodity feature.

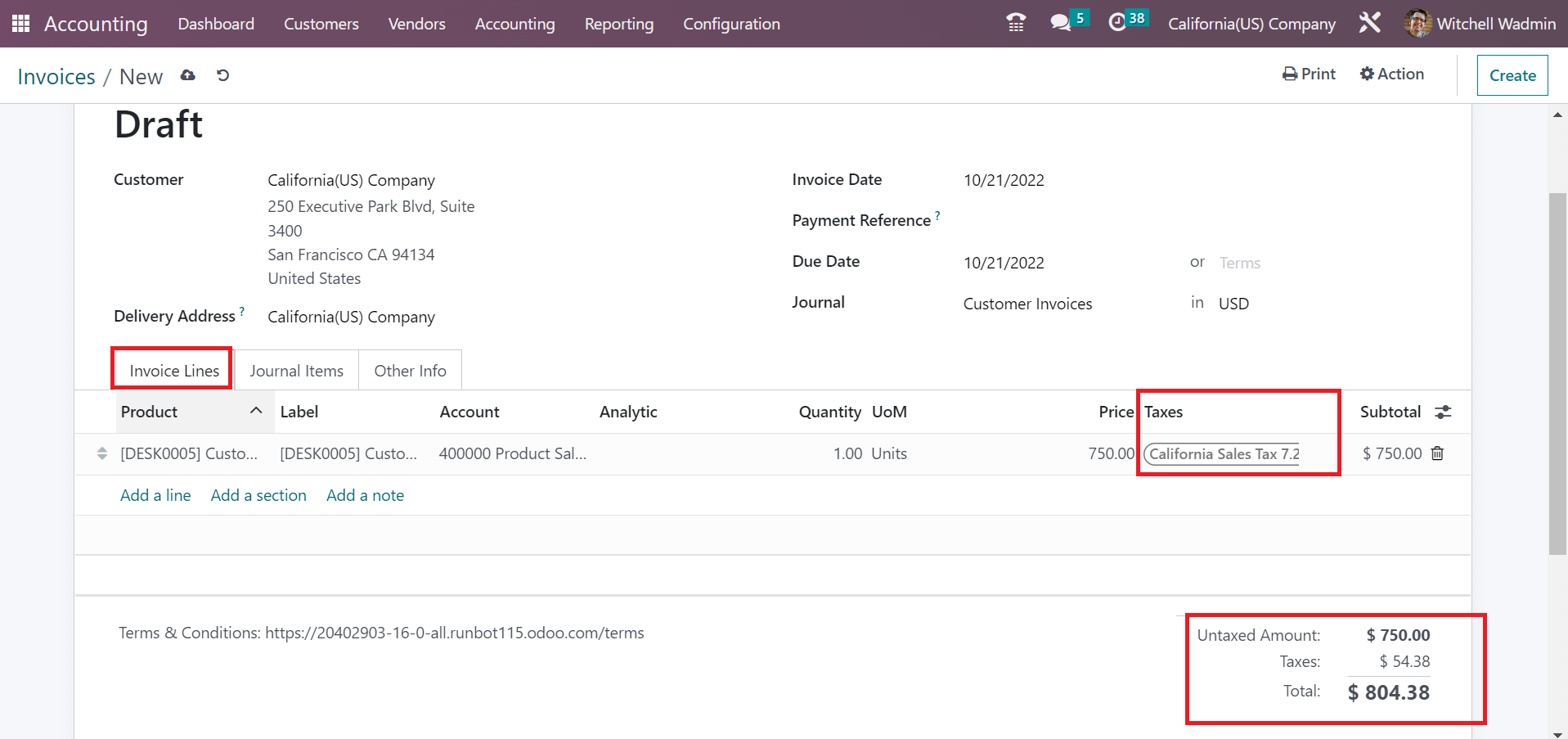

In the open space, choose one quantity of Customizable Desk with a price of 750. You can select California Sales Tax 7.5% below the Taxes section, as cited in the screenshot below.

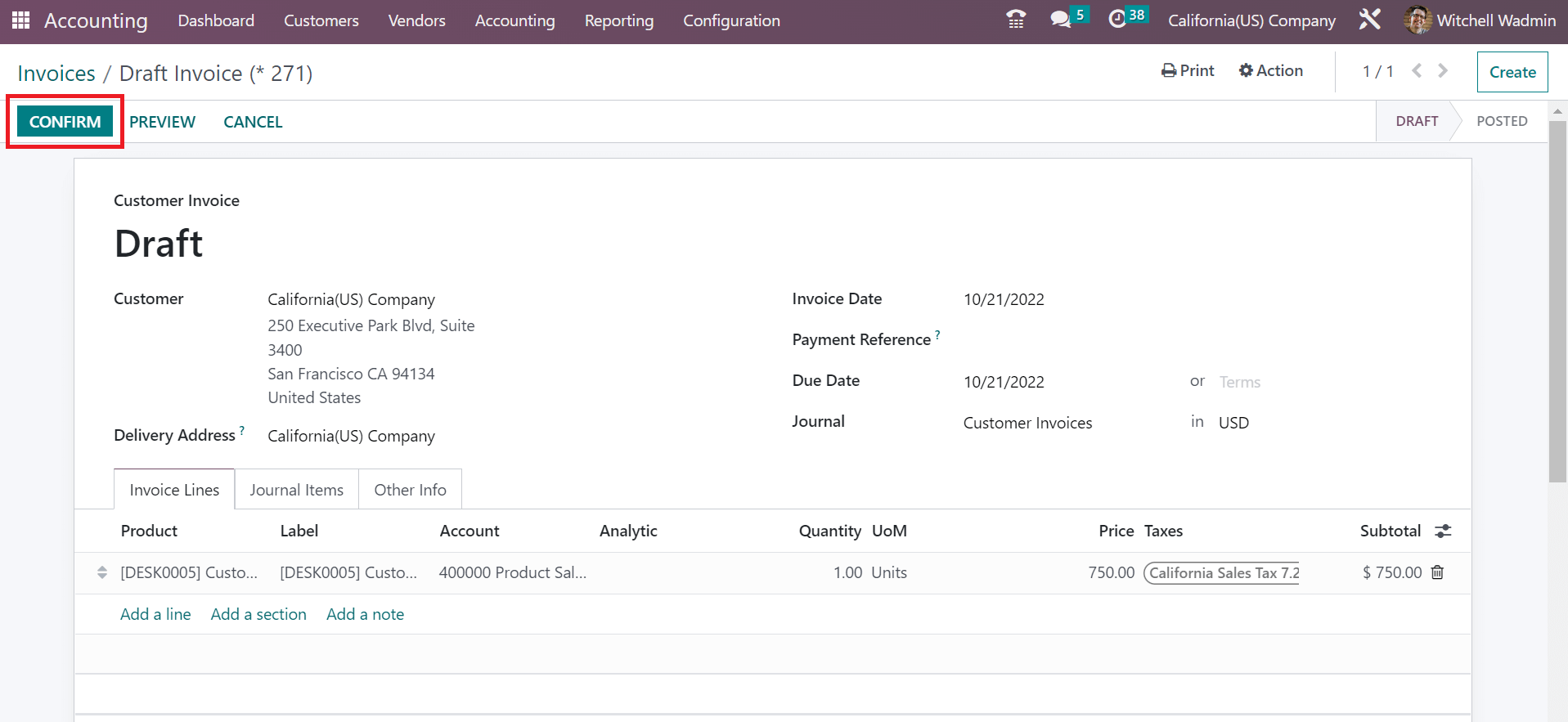

Here, you can get the total amount of the product after applying the taxes in the right-end corner. All the info about the customer invoice is saved manually in Odoo 16. You can post the invoice after clicking on the CONFIRM button, as demonstrated in the screenshot below.

Hence, we can quickly post a customer invoice and specific state tax within Odoo.

Tax configuration based on specific localization of a country in your business occurs easily using Odoo ERP support. We can maintain sales tax computation according to each country's state once the Odoo 16 Accounting module is imparted.