Cash Rounding happens when the base unit of an account is smaller than the most reduced denomination category of the currency. The payable sum for money exchange is adjusted to the closest various of cash unit accessible, through exchanges paid in different ways (eg: cheques, credit cards) are not adjusted.

In any business, cash rounding is an important feature. This feature enables the vendor to round off the cost of any request, while installment is made.

Cash rounding denotes in Odoo, it is used to round the total amount of a bill to the nearest 5 cents. This helps the vendor in creating a bill with a rounded total amount.

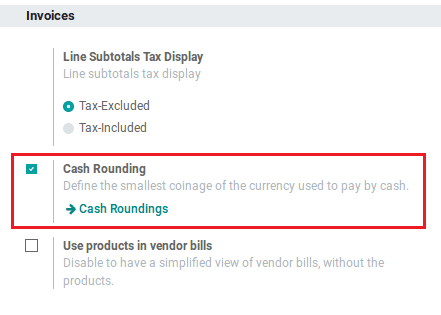

To enable the rounding function, Go to Accounting module -> Configuration -> Settings -> Invoices -> check Cash Rounding.

One can see a Cash Rounding menu, and can select it from either here or can go to Accounting module -> Configuration -> Management -> Cash Roundings.

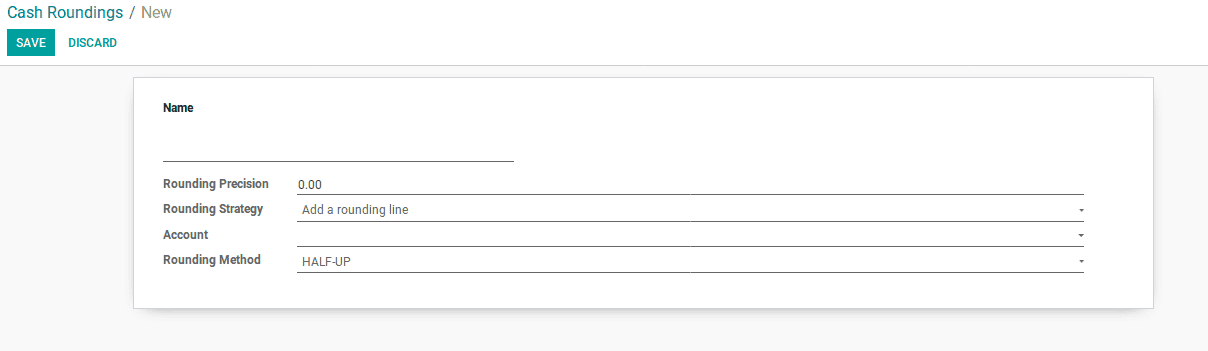

Now, one can create a new cash rounding method by clicking the “Create” button.

Here are some important parameters that you need to understand before creating a rounding method.

Name: Name of rounding.

Rounding Precision: Precision of a numeric value describes the number of digits that are used to express that value, including digits to both the left and right of any decimal point. The rounding precision will affect the rounding of the computed value.

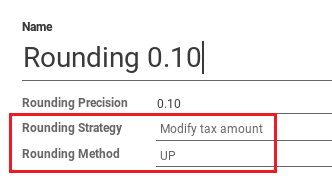

Rounding Strategy: You can do cash rounding by using two strategies.

1. Modify tax amount: Add the rounding to the highest amount of tax.

2. Add a rounding line: Add the rounding in a new line.

Account: It defines an account, where the rounding will go.

Rounding Method: You can do 3 types of rounding methods in Odoo.

1. UP: Value round towards plus infinity based on the rounding precision.

2. DOWN: Value round towards minus infinity based on the rounding precision.

3. HALF-UP: When the fraction part of a value is greater than or equal to 0.5, then round half towards plus infinity otherwise round half towards minus infinity.

Example: Rounding 0.10

one can create a new cash rounding method by clicking the “Create” button.

How to apply roundings.

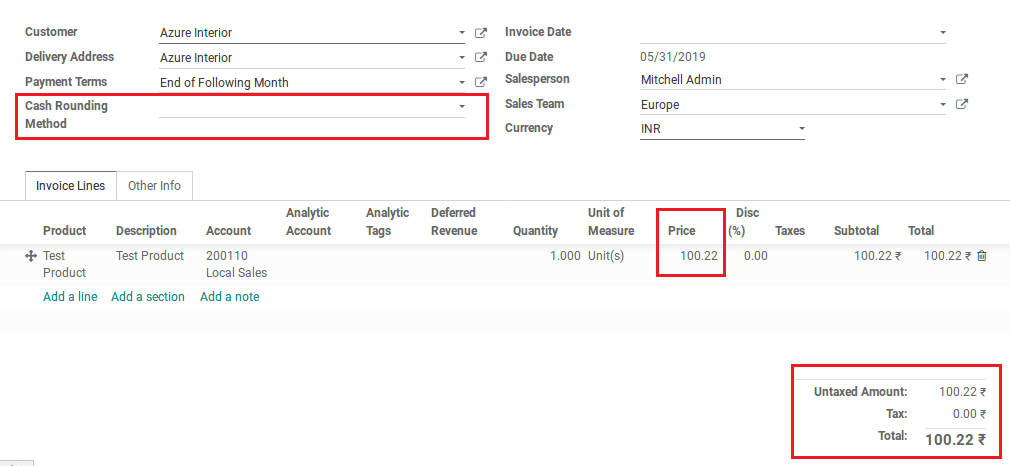

We can apply different rounding methods in customer invoices. While creating customer invoices you can see a field named as ‘Cash Rounding Method’, here we can create and use cash rounding methods.

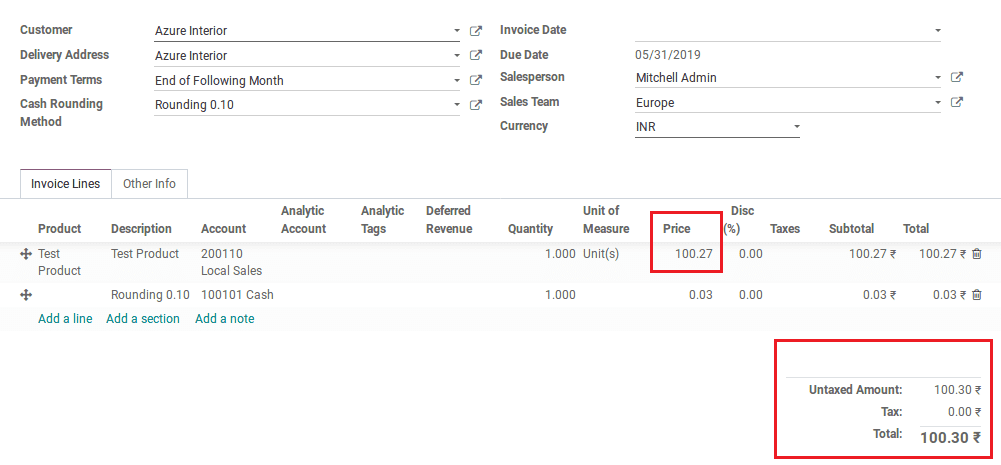

1. Add a rounding line

Create an invoice from Accounting module -> Customers -> Invoices.

Now, apply the previously created rounding method,

After that, choose the UP rounding method, then the total amount 100.22 will be changed to 100.30 ie, the total amount will be rounded up.

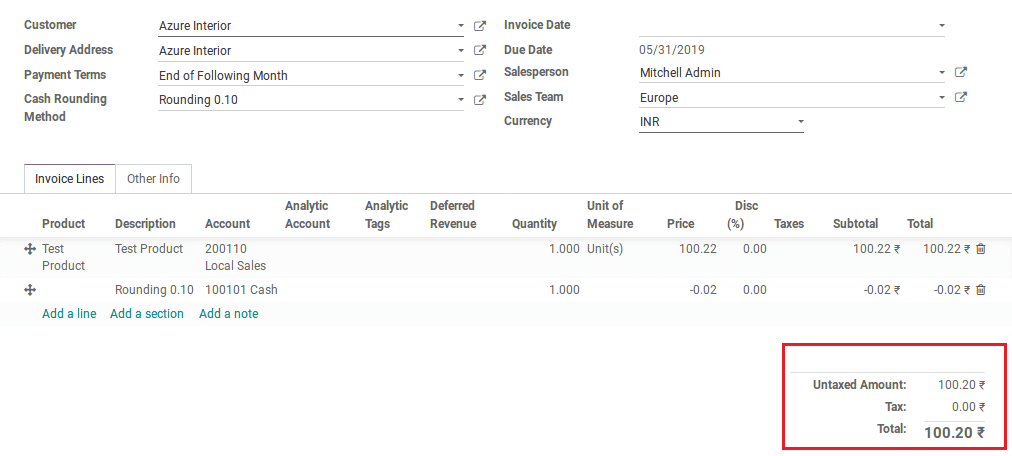

To see the difference, change the rounding method of the existing Cash Rounding Method as DOWN.

Then, check the invoice form.

The total amount will be rounded down from 100.22 to 100.20.

Now again, change the rounding method of Cash Rounding, and select HALF-UP method.

Again check the invoice form,

Here the unit price of the product is 100.22, so when you apply the HALF-UP rounding method, the total amount becomes 100.20 (ie, rounded down). If the same product having unit price 100.27 (ie, >100.25), then the total amount becomes 100.30 (ie, rounded up).

By analyzing the above example, you can see the total amount in invoice getting rounded based on the selected rounding method. This is a very common use case of any business industry. And most of the time, one couldn’t be able to provide the balance amount for decimal currency subunits. So the only possible solution here is the up rounding or down rounding.

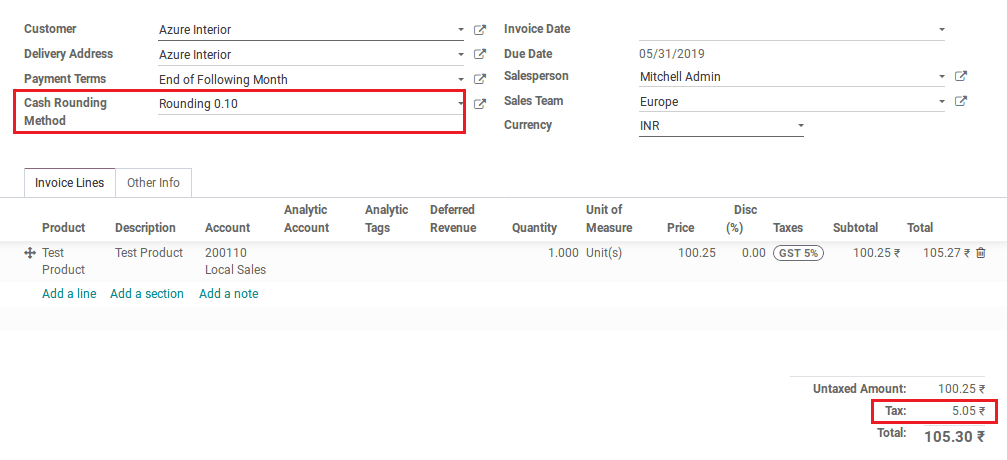

2. Modify the tax amount

Create an invoice with a tax. For example, here GST 5% is used as tax.

Create a rounding with below details.

Now one can apply the created cash rounding method on the invoice,

After that, choose UP rounding method. Upon the action, the tax amount of 5.02 gets changed to 5.05 ie, the tax amount will be rounded up to the amount of the highest tax.

To see the difference, change the rounding method of the existing Cash Rounding Method as DOWN.

Then check in invoice form.

The tax amount will be rounded down from 5.02 to 4.95.

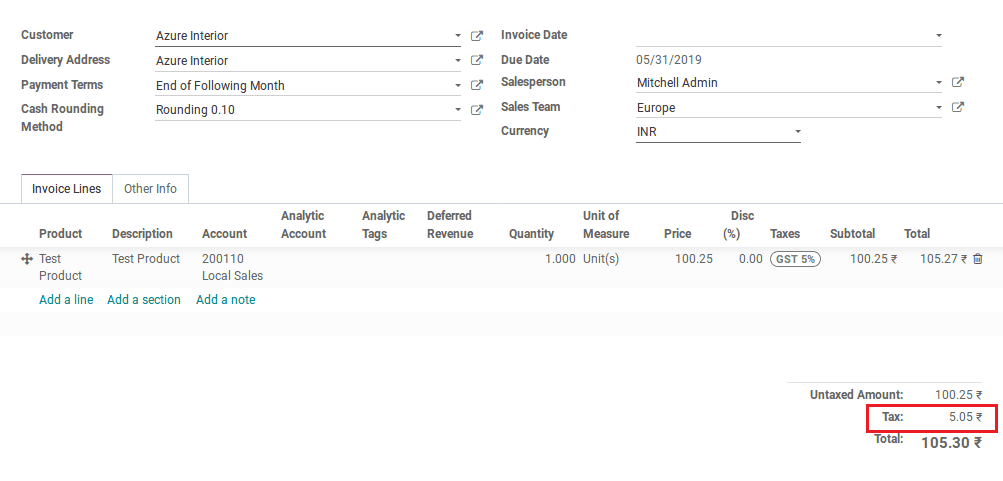

Now again change the rounding method of Cash Rounding Method, select HALF-UP method.

Again check the invoice form,

When applying the rounding method as HALF-UP, the tax amount becomes rounded up.

By analyzing the above example, you can see the tax amount in the invoice, rounded up to the amount of the highest tax based on the selected rounding method.

This is how the Cash Rounding in Odoo 12 is carried out.