It is not easy to match your Bank statement with your Account records. In the process the room for error is high along with loss of major data or records on transactions. Even a speck of data error can cause huge confusions and huddles on a smooth workflow of business.

This blog will help you to understand the bank reconciliation process in Odoo 14

Every step in the process is intricate and prone to error. This is why you need the support of an advanced system like Odoo to efficiently carry out the entire process for you. With Odoo you can easily match your invoices or any other payment document with your bank statement. Odoo allows you to have two major ways or options for the bank reconciliation process; you can either specify the payment on the invoice directly or you can reconcile open invoices with bank statements.

The feature doesn't require any configurations, all you have to do is install the Accounting module and the feature will be available in the module.

Using the feature

It is easy to use the feature and as most of the functions are automated in the Odoo you can easily manage intricate business data effortlessly. This is why with Odoo you can easily compare and contrast with intricate business data. You have to connect your Odoo account with your bank account to avail this feature. Most of the important features and functionalities of the Accounting module depend on your bank account and it is imperative that you connect your bank account with the Odoo system. This allows you to have direct access to your bank with Odoo and enables you to have a birds eye view on the bank transferred for business purposes.

For more information on setting up bank account in Odoo

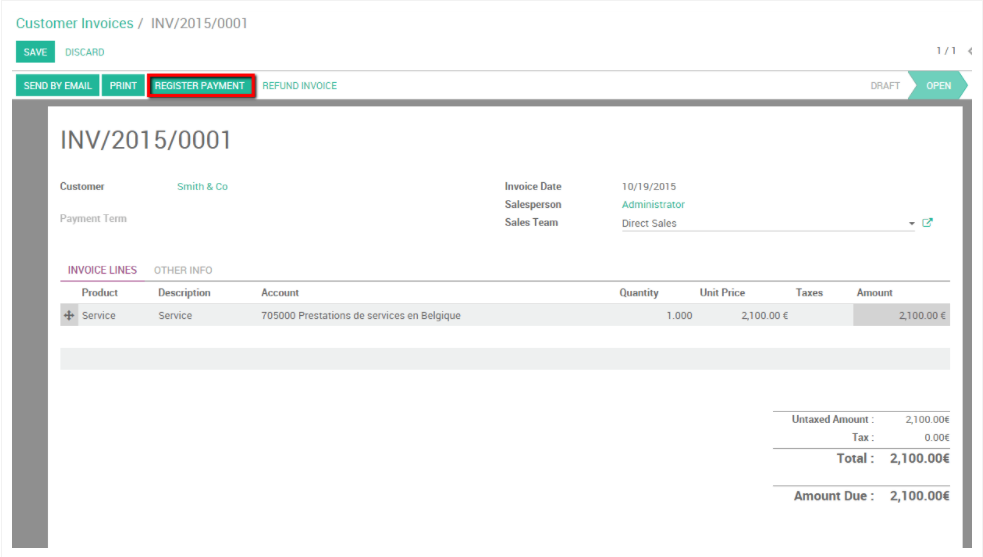

As mentioned earlier, using the feature easy after the initial Bank setup and configurations Odoo system with its advanced and automated nature will take care of the job for you efficiently. So registering payments and other such procedures are easy with Odoo. Explaining this with the help of an example will let you know how easy the procedure is. So consider that you received a proof of invoice in the amount of 2100 euros issued to Smith and Company. As you require the payment to be made as quickly as possible by the customer we start our issued invoice of 2100 euros for Smith and Company.

After the immediate receival of the customer payment confirmation you can just mark the invoice as paid and from the screenshot given below you can find the details of the invoice.

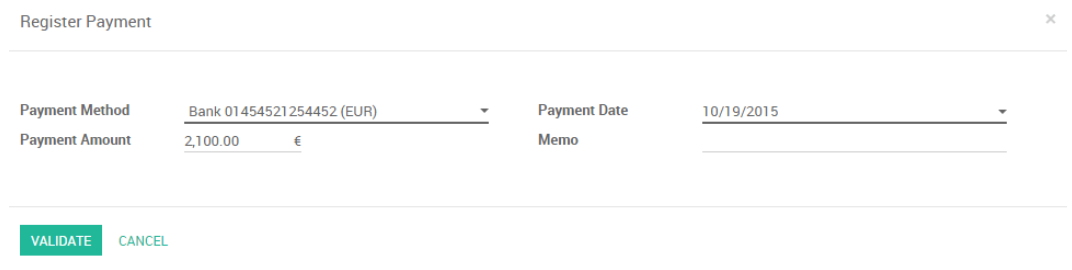

Click on Register payment as shown in the screenshot given above to inform your Odoo system that the customer has paid the Invoice and in the next step you have to specify the amount and the payment details as shown in the screenshot given below.

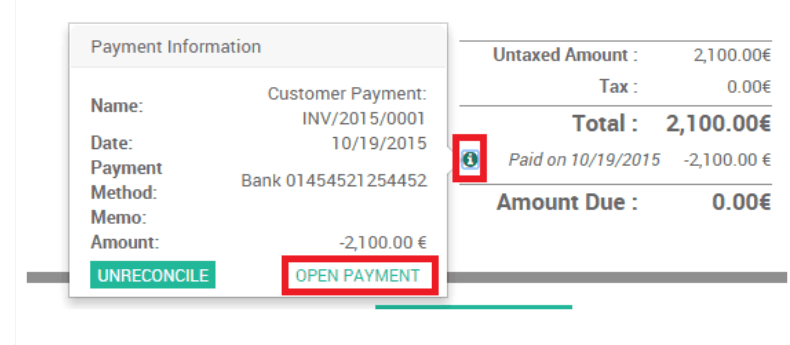

And click on the validate button on the left corner of the configuration tab shown in the screenshot given above to validate. After this you will be able to find the payment details by going to the Open payment form Info and it will show you the payment details as shown in the screenshot given below of the Accounting module of Odoo.

You can find the Info button click on it to view the details as shown in the screenshot given above. After Odoo has confirmed the payment, the reconciliation is done automatically.

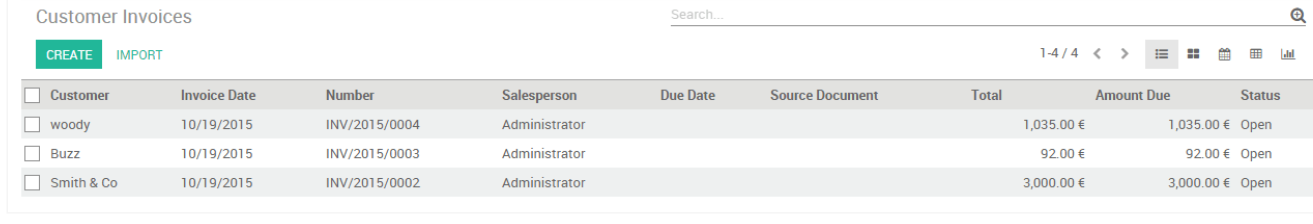

In another case assume that you have multiple invoices open for different customers and also assume that you start at the issued invoice of 3000 euros for Smith and Company. You can view your customer invoices from Invoices under the customers tab in your Accounting module and you list will be shown as in the screenshot given below.

You can create Bank or statements or import them to your Oodoo system by clicking on the Create or the Import buttons shown in the screenshot given above. This feature works on the basis of whether you have synchronised your bank with the Odoo system or not and if not the feature won’t be available to you.

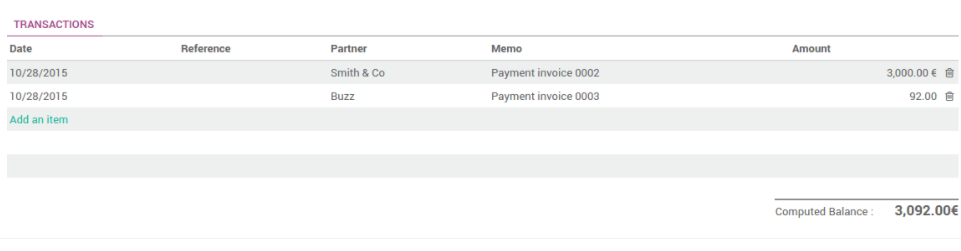

If you click on create Odoo will send you to a configuration space where you can create the bank statements or enter them into Odoo. Click on the Import button if you want to upload the bank statement to the system and Odoo. After completing the process you can find the invoice details on transactions with respect to the example given earlier as shown in the screenshot given below.

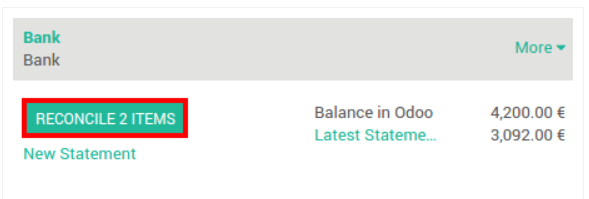

Here you can find two items and go to your Accounting module dashboard and under Bank you can find the two items with a reconcile button as shown in the screenshot given below.

Odoo will verify that all of the information is correct and up to the point. If the system finds the details are error free the reconciliations will be done automatically. The process is simple and easy to understand.

With the advanced support of Odoo system you can easily carry out intricate business Account management effortlessly and efficiently. With the synchronization of the Accounting module or the entire Odoo system with your Bank account, you can have access to more advanced business tools and features that can help you in running your business more smoothly.

You can have direct access to your bank account to have a detailed and in depth view of your business transactions and have a detailed view over your business procedures. Odoo will provide you with up to date information regarding the procedures of your bank account so that you can have direct control over your money. With the advanced security features of your Odoo system your information will be safe. Odoo system has the ability to track and report you about suspicious activities in your account helping you in making sure that you are in the right path of business data interpretation and is devoid of any possible internal scams.