- Asset Category Creation

- Purchasing an asset that belongs to this category

- Managing periodic Depreciation of the asset

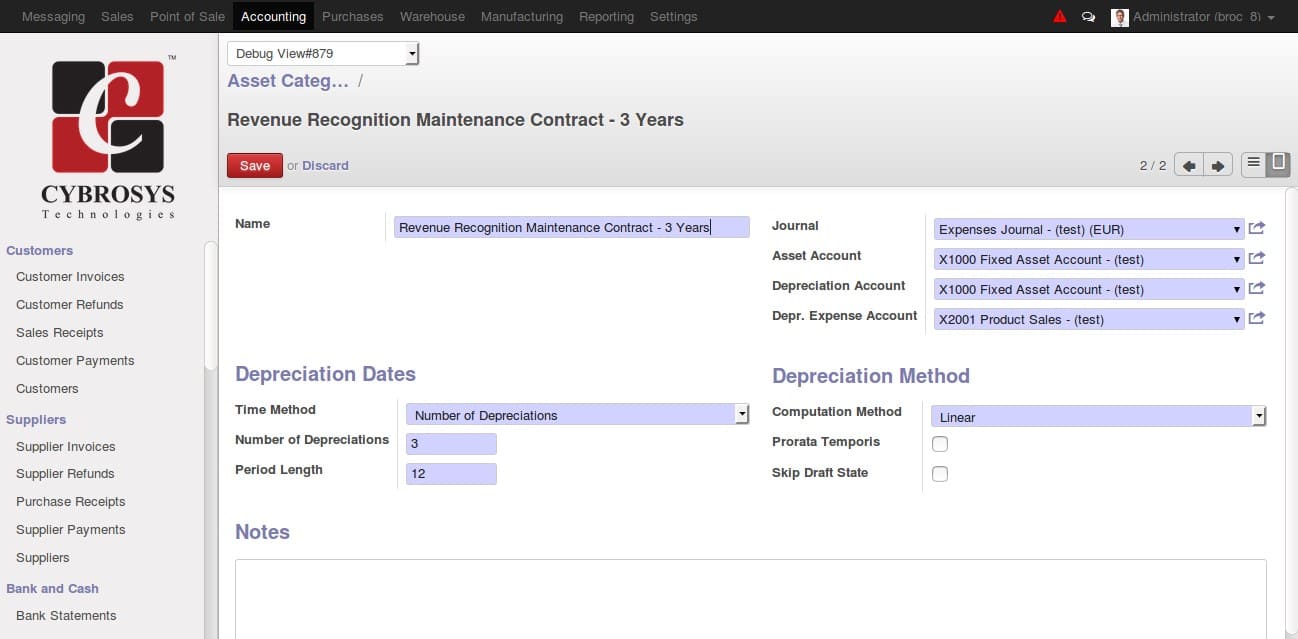

Asset Category Creation

step1: Accounting>Configuration>Assets>Asset Categories

In the form specify the name of asset category company name, provide the Journal, Asset acc.

Depreciation account, Depr.Expense account

- The Provided asset account gets debited while we purchase the asset

- On validating a supplier invoice this provided Depreciation account gets credited

and Depr Expense account gets debited

Under depreciation method computation methods you have two options

1) Linear

2) Degressive

If Degressive selected a field for giving depressive factor gets enabled, in that provide the factor so that each line gets computed with the depressive factor.

If Linear is selected each line will have same degressive value

Under Depreciation Date, you have Time method which has two options

1) Number of Depreciations – if selected a field to input the number of depreciation line required gets displayed. Provide the No

2) End Date – If selected it displays the end date field. Provide the date you need on which depreciation should end in that field

Period Length field we provide the length of the period (ie period gap between each line of depreciation) and save

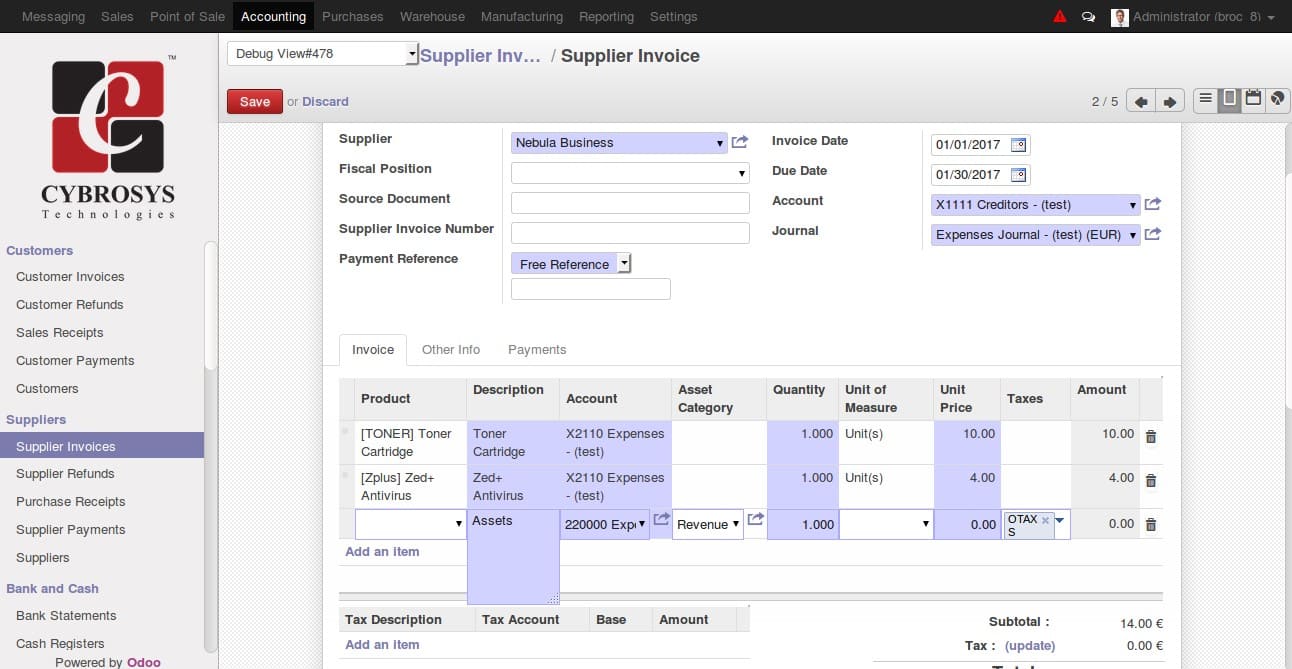

Purchasing an asset

step1: Make a supplier invoice for purchasing the asset

Accounting>Supplier>Supplier Invoice

In the invoice form select the supplier and in the invoice line don't provide any product. Instead in description field just type the asset name and account to be selected is the asset account for the asset that is to purchase(field next to description > Account) in asset category provide the category created for this asset and provide the quantity and unit price for the asset as shown in the screenshot no 2. Save and validate.

Step2: Once you validate the invoice, you can find the purchased asset in

Accounting>Assets>Assets

In the asset form, you could see the gross value as the purchase amount and all depreciation configuration options as selected in the asset category. The Depreciation lines could be viewed from

depreciation board tab, as shown in the screenshot 4