Accounting transactions are essential for organizations to manage their income and costs effectively. They support budgetary, purchasing, and sales evaluation. Errors or typos in accounting papers, however, might need to be corrected. For the sake of future reference, all data must be secured. The accounting operations of Odoo 17 are automated, the accounting procedures of Odoo ERP software are streamlined, and corporate workflows are tracked. Productivity is increased, and work hours are decreased by managing all accounting duties through software support system integration. You can utilize the updated package of the Odoo 17 Accounting module, which has features that allow users to manage payments, journal entries, taxes, bank accounts, and more.

See the overview of the Odoo 16 platform's Accounting Dashboard inside this blog post.

Accounting Dashboard

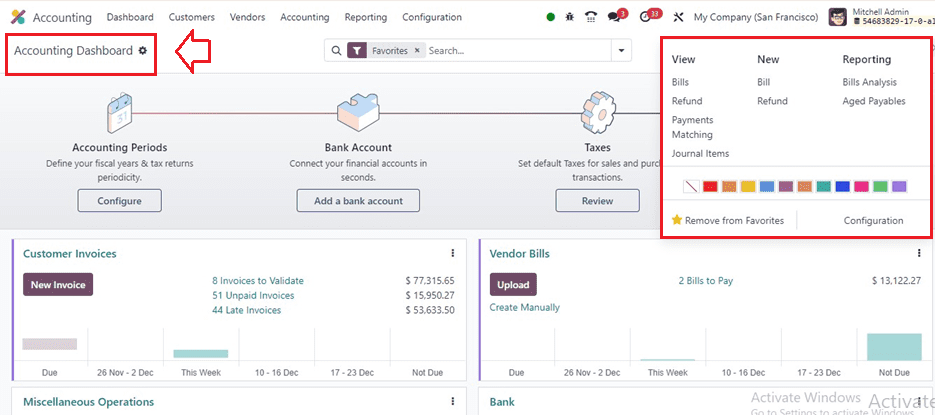

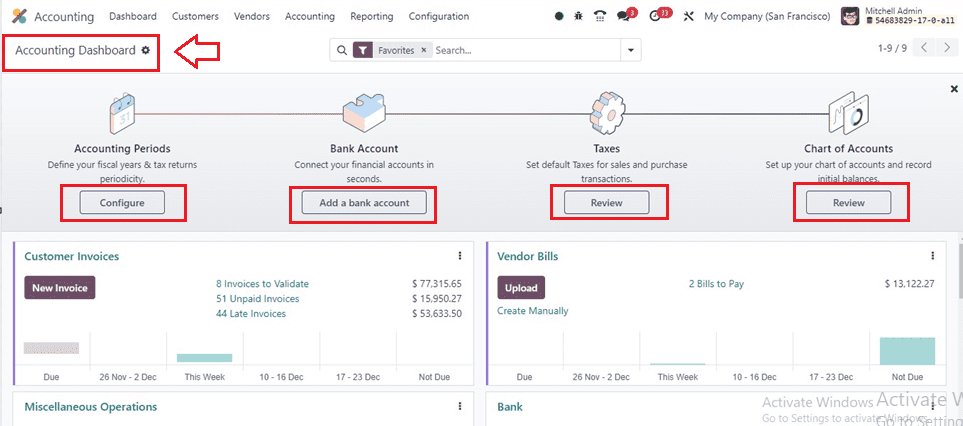

In a business that is readily controlled with the use of the Odoo 17 Accounting dashboard, the Dashboard menu homepage includes Bank Accounts, Taxes, Accounting Periods, and a Chart of Accounts. Users are given an overview of all pre-figured journals, which include cash, vendor bills, bank accounts, customer invoices, miscellaneous operations, and more. As seen in the picture below, each journal has information on validated bills as well as late and unpaid invoices.

In the Accounting Dashboard window, click the "New Invoice" icon to create an invoice in the Customer Invoices journal. There is a graphical analysis of the journal that includes residual quantities. To view further information, click the three dots located in the upper right corner of each column. There are three parts to the journal: Reports, View, and New. Each has a number of options. Users have the option to open a new window and mark the journal with numerous colors. To eliminate a journal from your list of favorites, use the Remove from Favourites menu item. The Accounting dashboard provides detailed features for each onboarding panel.

Various operations, including customer invoices, vendor bills, bank operations, miscellaneous operations, new transactions, point of sale entries, salaries, and expenses, may be created by users via the dashboard. Additional tabs allow for further operations, with graphical representations for a quick overview. Options menus allow users to view related aspects, create new operations, and view associated reports.

Accounting Periods

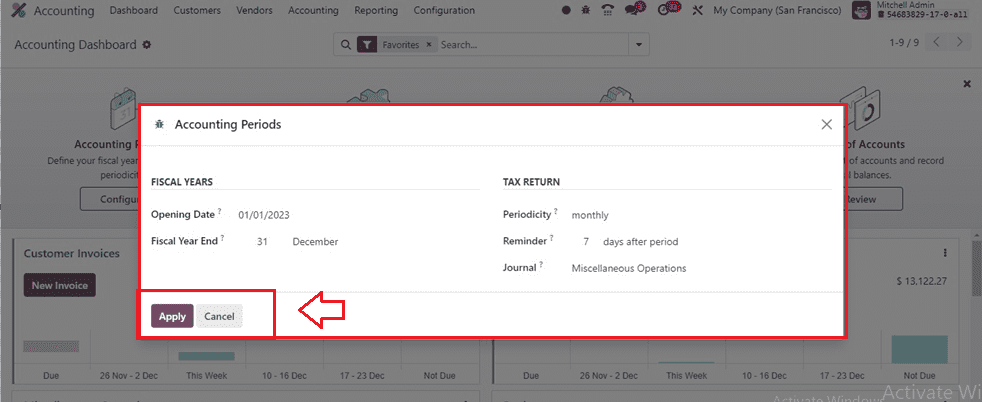

The main purpose of the Accounting dashboard is to show tax returns and the periodicity of fiscal years. By selecting the “Configure” button, users may create a new accounting period. The “Accounting Periods” box allows you to handle tax returns and fiscal year data. The Fiscal year-end option allows you to choose the start and finish dates of the accounting period.

Clicking on the “Configure” button will open a wizard, where you can configure FISCAL YEARS and TAX RETURN as shown below. Inside the FISCAL YEARS area, set the Opening Date and Fiscal Year End.

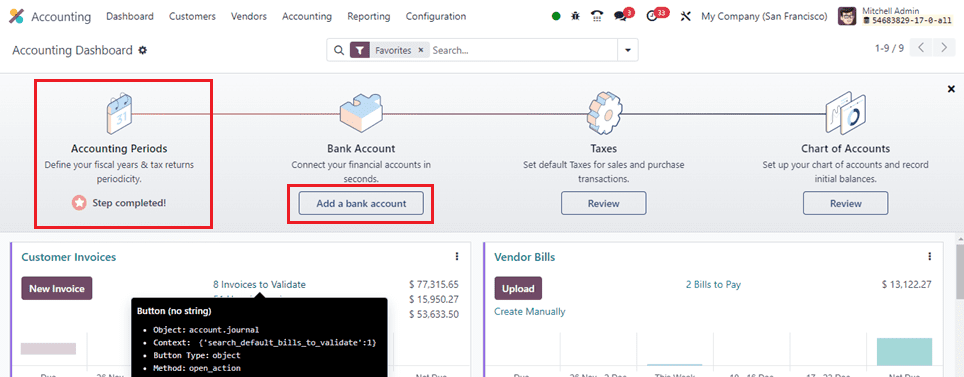

Inside the TAX RETURN area, set the Periodicity, Reminder, and Journal details and click the “Apply” button once the appropriate details have been completed in the Accounting Periods box. You can see a label named “Step completed” after configuring the Accounting Periods as depicted below.

Bank Account

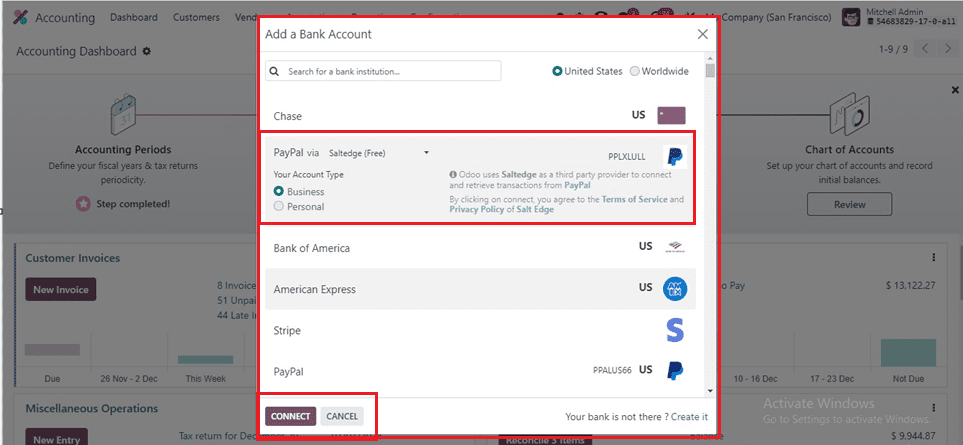

Bank Account, the second section of the Accounting Dashboard panel, links bank accounts rapidly. In order to create a new account, go to the "Bank Account" area and choose the "Add a Bank Account" option. Users may use the search box to look for certain financial organizations from the United States and Worldwide Banks.

You can see a list of various payment providers such as Chase, Paypal, Bank of America, American Express, Stripe, Wells Fargo, etc. Customers, clients, and other participants will find this procedure to be simple and quick.

After selecting a Bank Account, you can choose your “Account Type” and click on the “CONNECT” button to select the bank account for your accounting purposes inside the Odoo Accounting Module.

Taxes

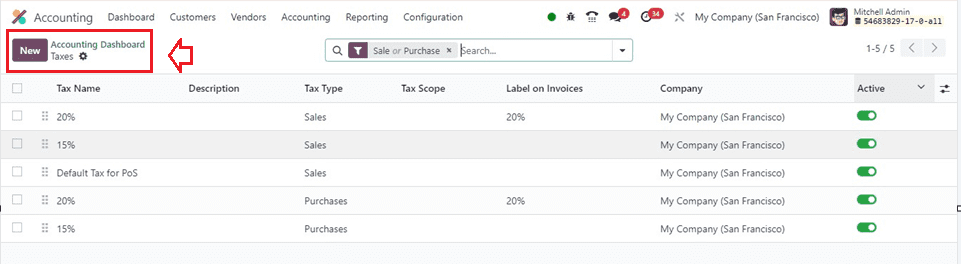

The government contributes taxes to worker income, corporate profit, and other commodities. You can use the “Review” button from the “Taxes” section. Companies can establish their taxes more quickly thanks to the Accounting Dashboard, which makes default taxes for sales and buying processes easily available. As seen in a screenshot, users have access to a record of all produced taxes, along with information about Tax Name, Scope, Active, Company, and Tax Type.

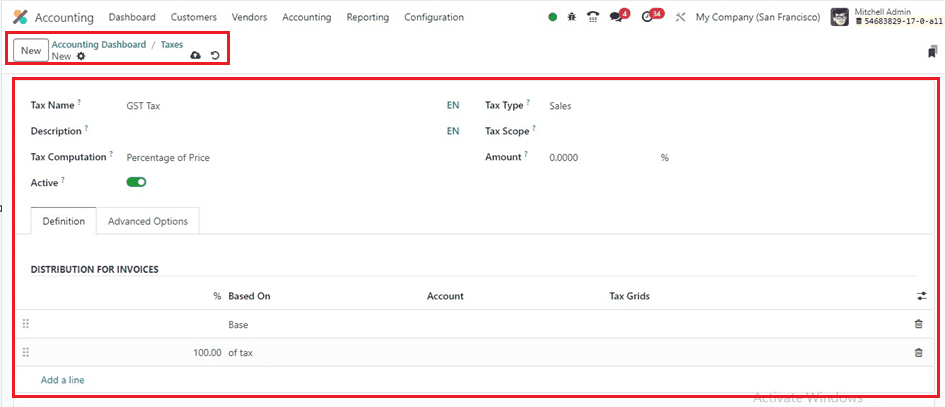

In the Taxes dashboard, click the "New" button to create a new tax for each item. Thus, we can use the Odoo 17 Accounting module to swiftly establish the taxes for any firm goods or services using the configuration form as shown below.

Now, Let's create an accounts chart using the Accounting Dashboard using the Chart Of Accounts Section.

Chart of Accounts

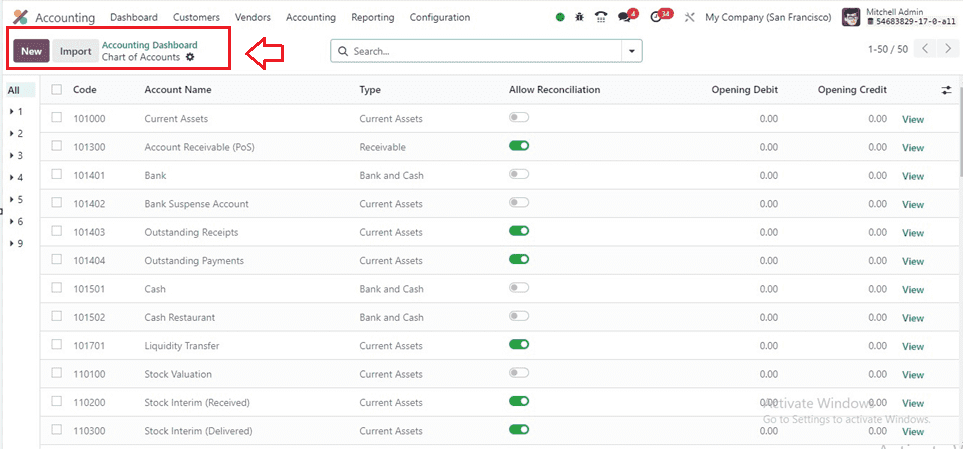

The Chart of Accounts feature in the onboarding panel manages records and initial balances, allowing companies to organize different charts based on specific operation areas. To create a new chart, click the “Review” button. A list of all created accounts is displayed in the Chart of Accounts box, which displays prior to hitting the Review button. The screenshot below illustrates the contents of the chart, which contains Code, Type, and Opening Credit.

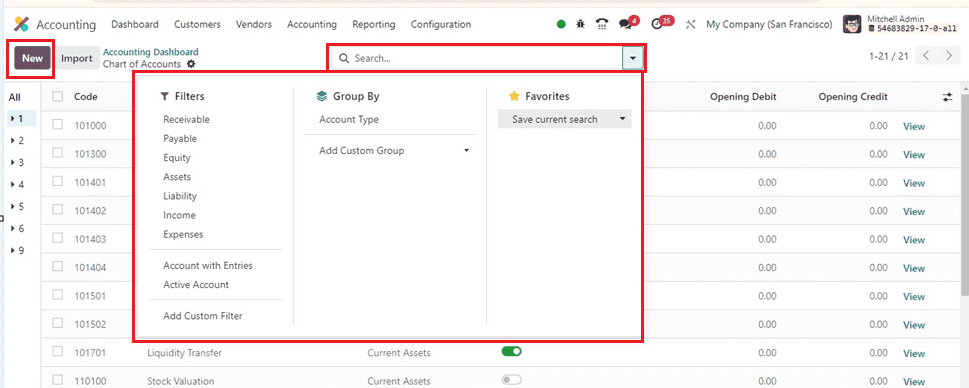

The advanced search bar provides us the facility to filter journals using the “Filters” tab in the Odoo 17 Accounting application based on Receivable, Payable, Equity, Assets, Liability, Income, and many more. Also, you can group the data and add records into the favorite records section using the “Group By,” and “Favorites” sections inside the search bar.

Users may now rapidly construct a new chart of accounts using the “New” button. We can import certain statements more quickly using the “Import” button. You can use the Chart of Accounts action menu to make articles, Dashboards, and Spreadsheets using the dashboard data and access them for future records and references.

These are the features offered by the Accounting Dashboard inside the Accounting Module. With the help of an organized framework and ERP software, Odoo 17 Accounting effectively handles a range of accounting tasks, improving organizational effectiveness and streamlining accounting procedures.