The goal of Odoo 17's accounting localization is to modify the platform's financial and accounting capabilities to satisfy the unique operational and regulatory requirements of enterprises across borders. Odoo 17 is a flexible option for international businesses since this localization guarantees that it complies with numerous national accounting standards, tax laws, and reporting criteria.

Odoo 17's accounting localization for the UK has been carefully developed to satisfy the unique demands of financial reporting standards, tax laws, and British accounting principles. Localization ensures that companies in the UK can follow local rules and requirements and manage their financial operations effectively.

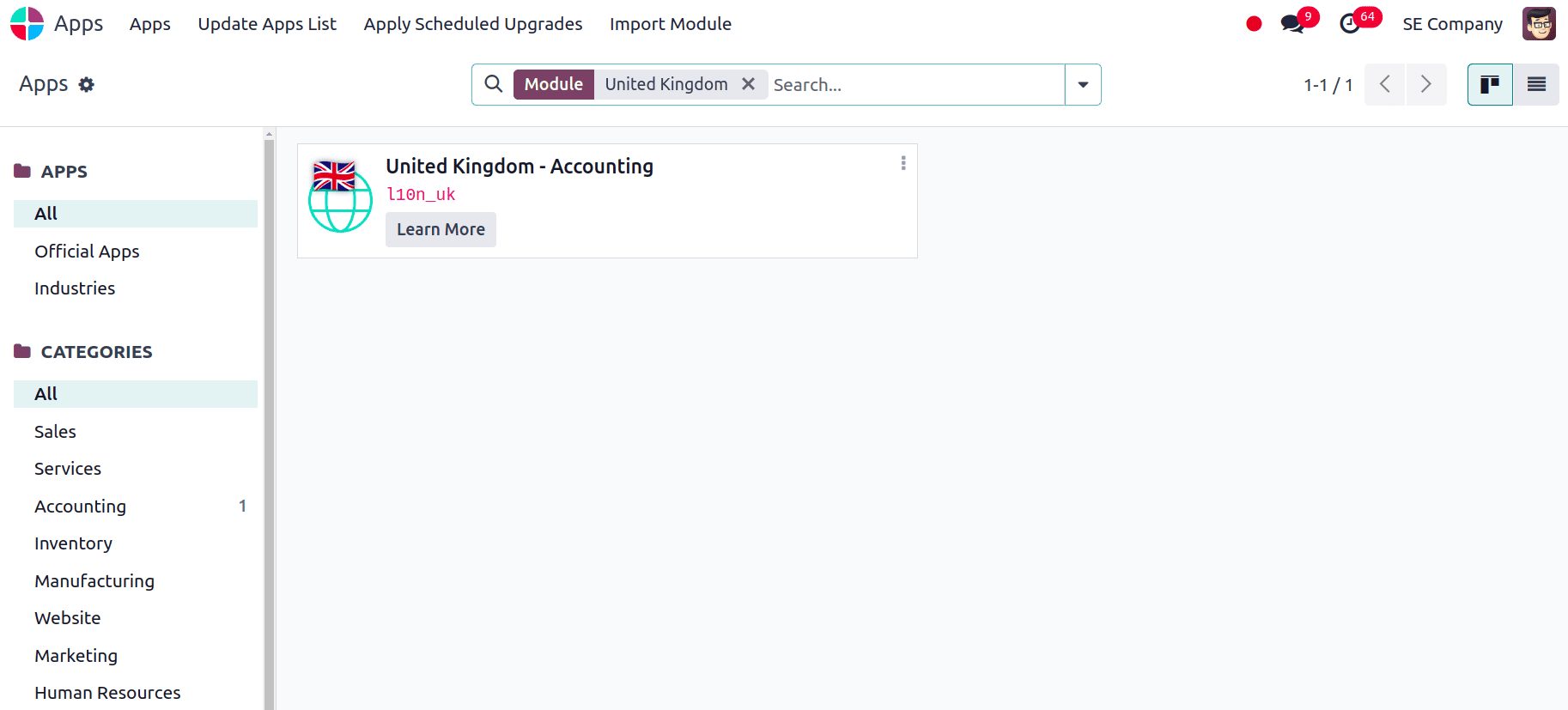

In order to use Odoo's accounting localization for the United Kingdom, you must first install a few specific modules. You may find these modules in Odoo's "Apps". Go to Apps and install the necessary modules.

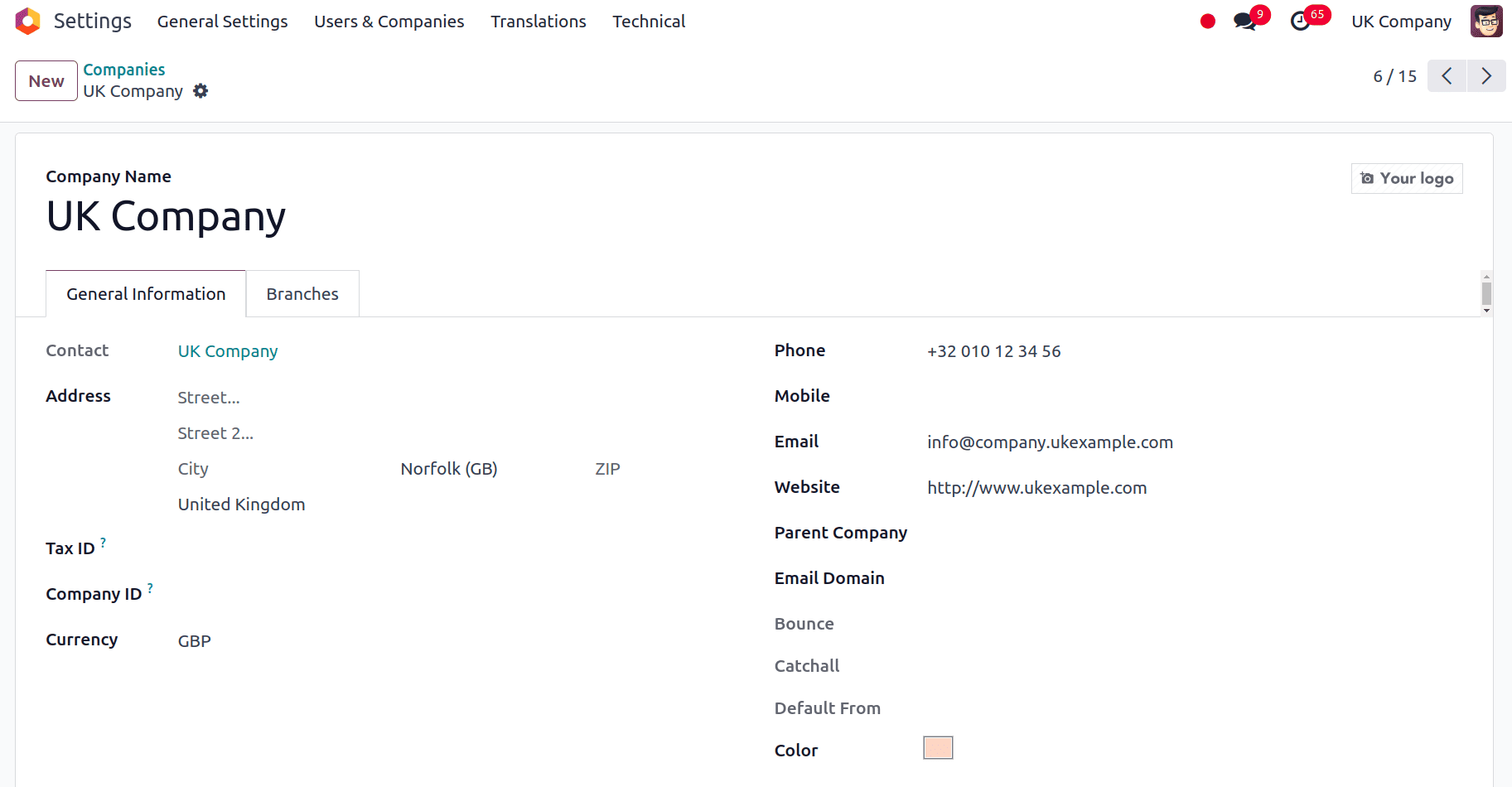

Next, it's critical to confirm that the company information entered is accurate. Odoo will be able to accurately use the United Kingdom accounting regulations in this way. If necessary, you can review the company information that already exists or start a new company profile with accurate details. Navigate to Users and Companies > Companies under Settings. This will display a list of the companies you have created in Odoo. Next, select a business and review its details, or establish a new business using the accurate national data for the United Kingdom's accounting functions.

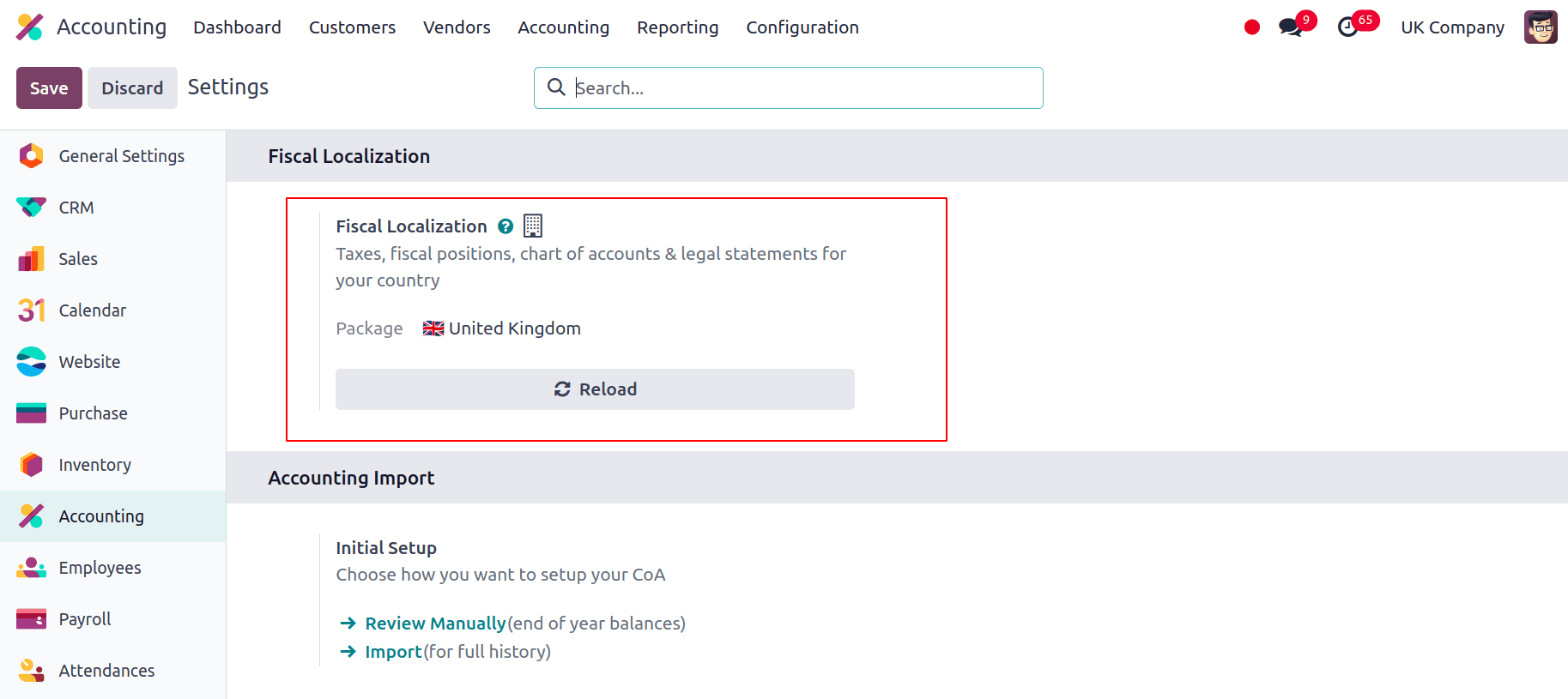

Lastly, you can verify that the Accounting module's Fiscal Localization feature in the configuration settings will be set to the United Kingdom.

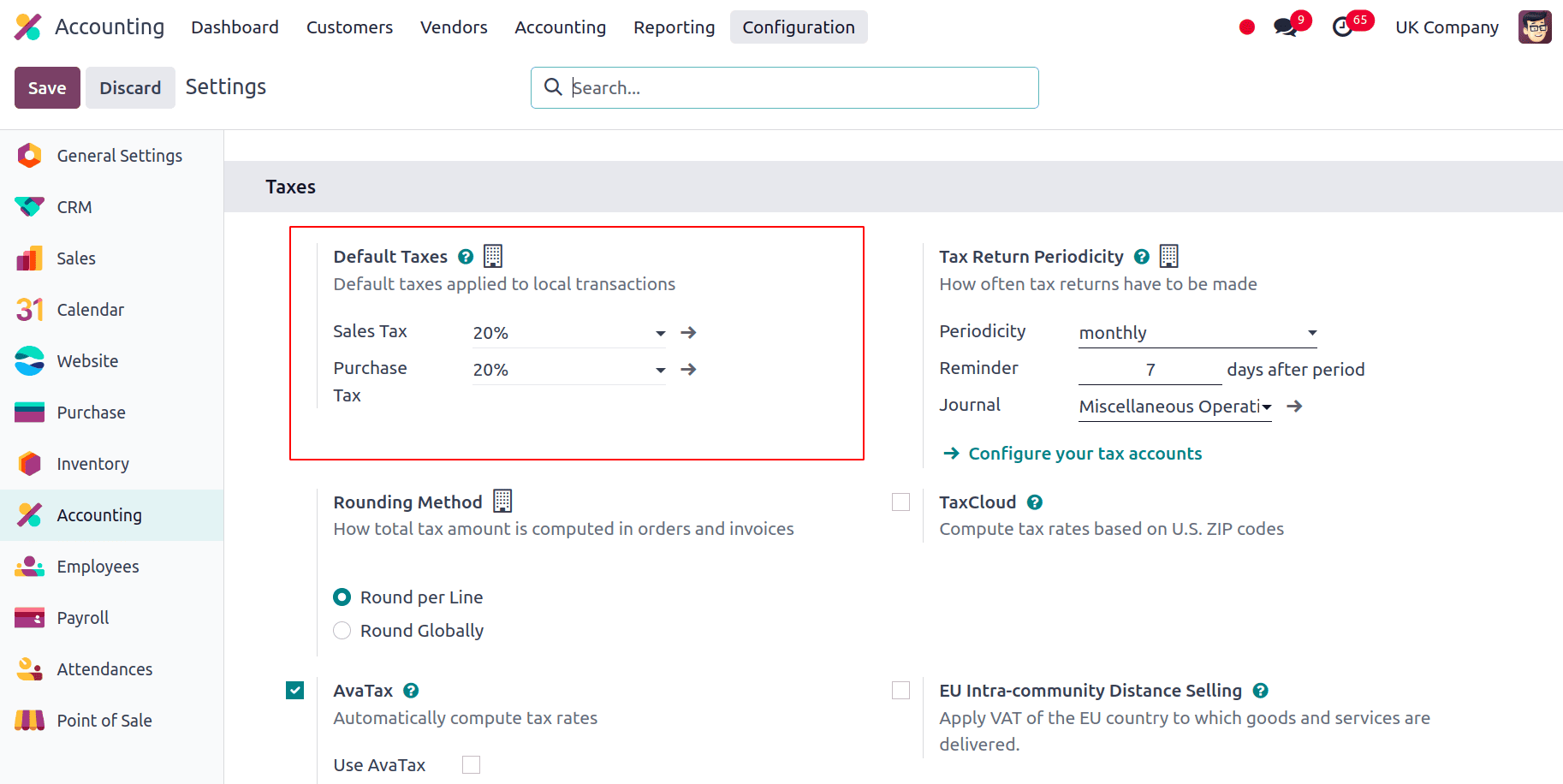

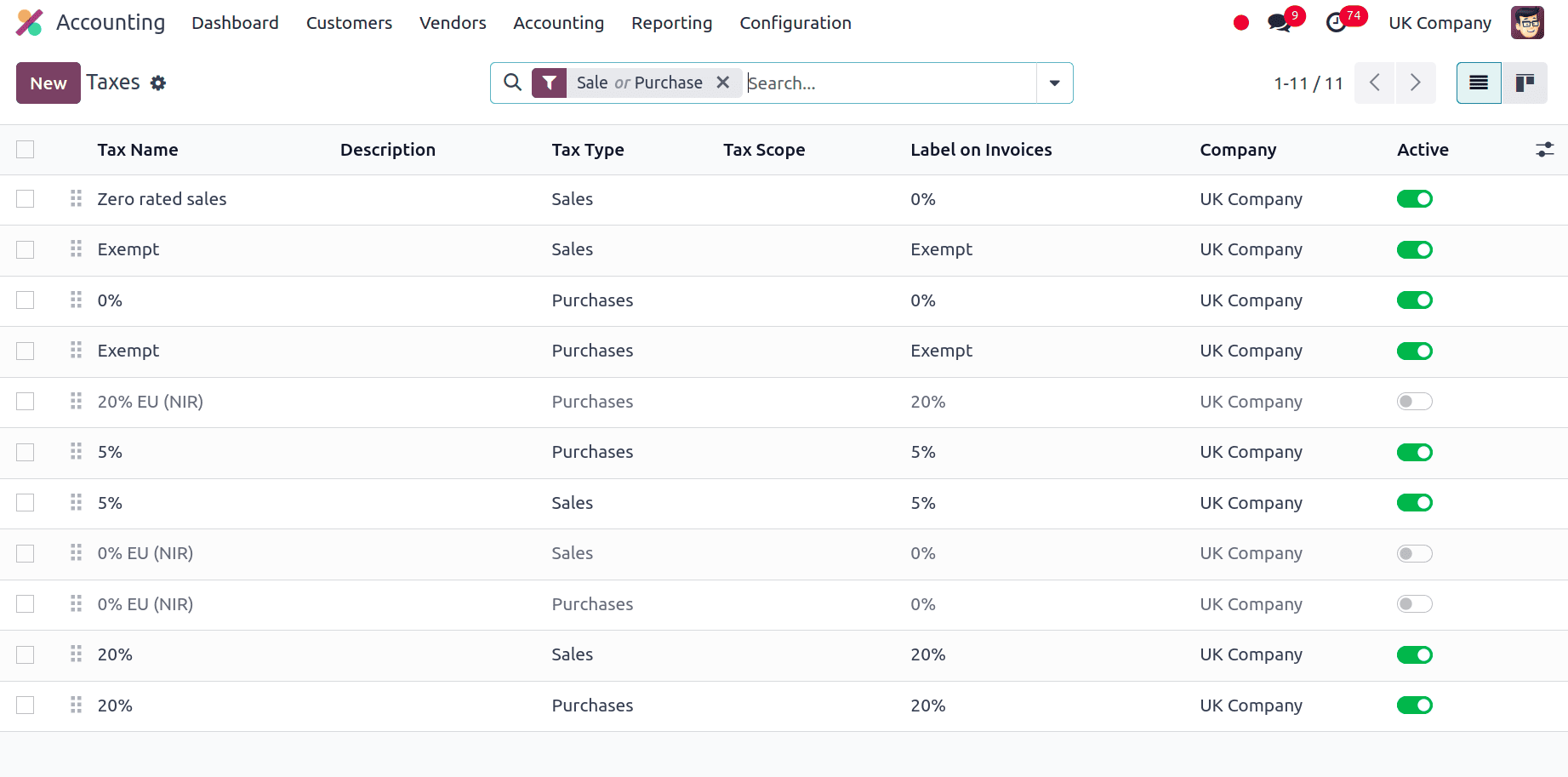

The Sales Tax and the Purchase Tax under the Default Taxes will be set to 20%, and it will be used for all Sales and Purchase transactions that take place in the Company.

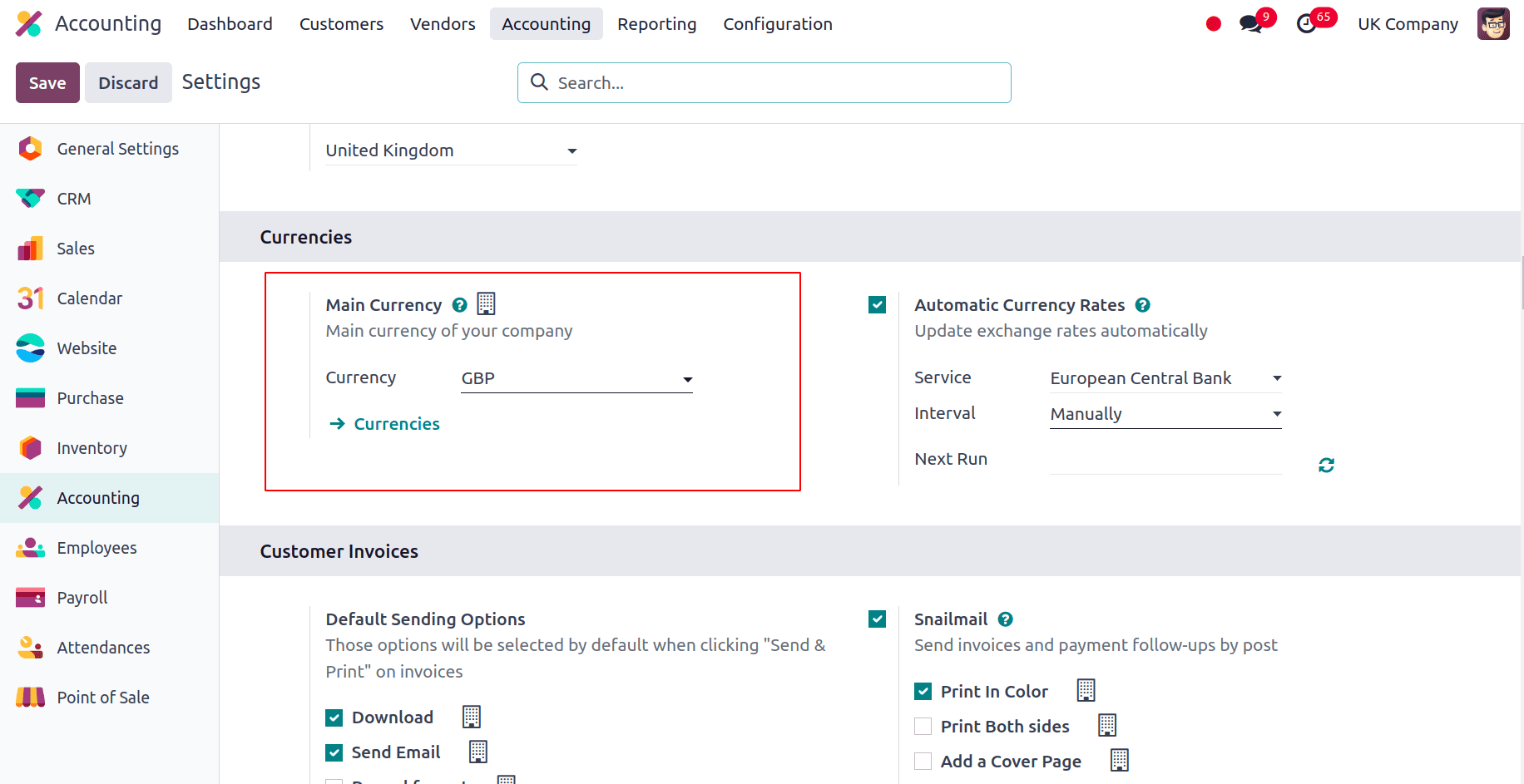

There will also be changes to the main currency. It will be set to the pound sterling (GBP), which is the national currency of the United Kingdom.

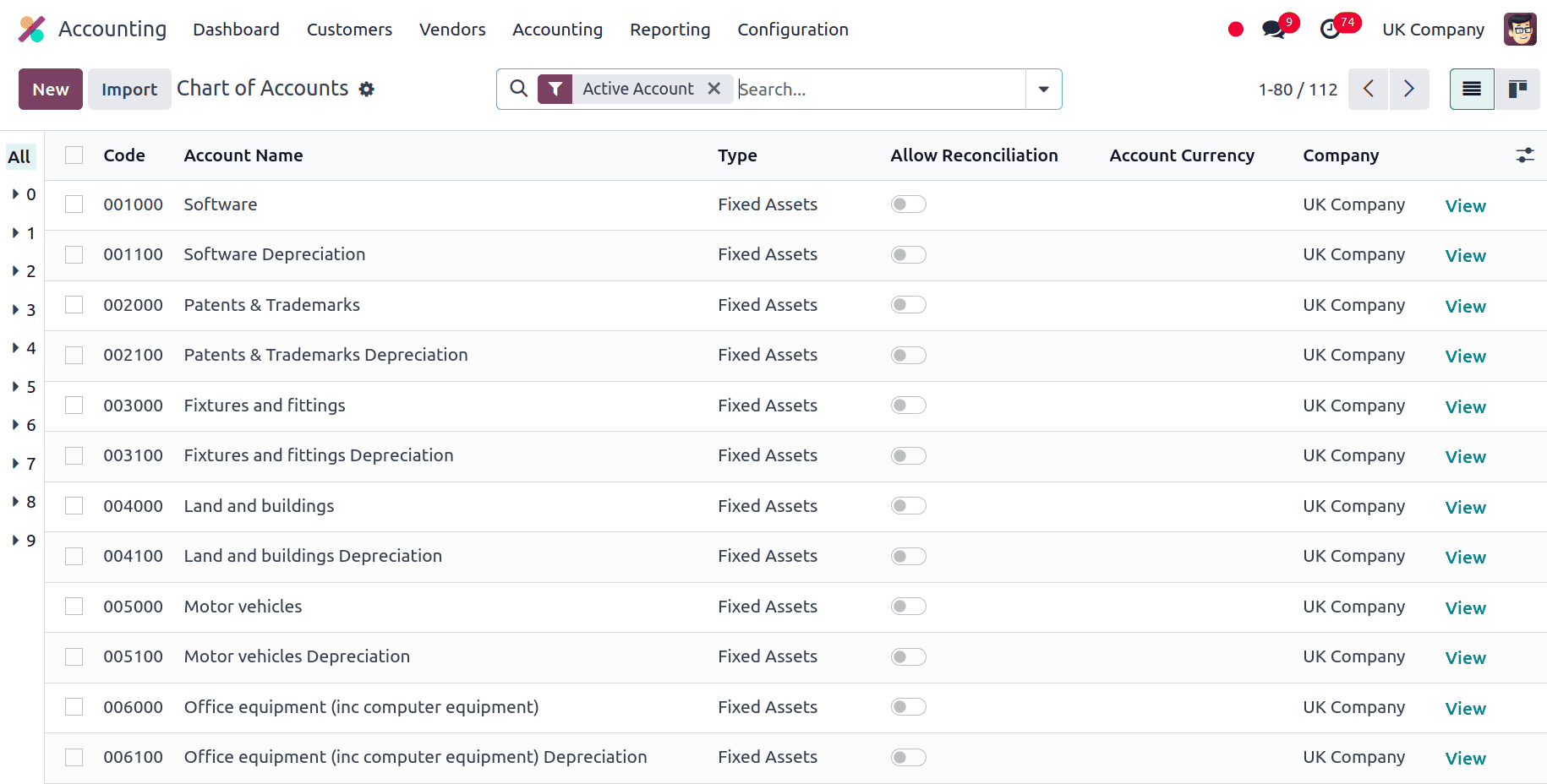

When the localization is installed, the required Chart of Accounts will be pre-defined. The Chart of Accounts in Odoo is a structured list that includes every account that a business uses to document financial activities. It offers an organized method of classifying and organizing financial data, guaranteeing correct financial reporting in accordance with regional laws. The Chart of Accounts is modified in the context of the UK localization to adhere to certain accounting norms and procedures.

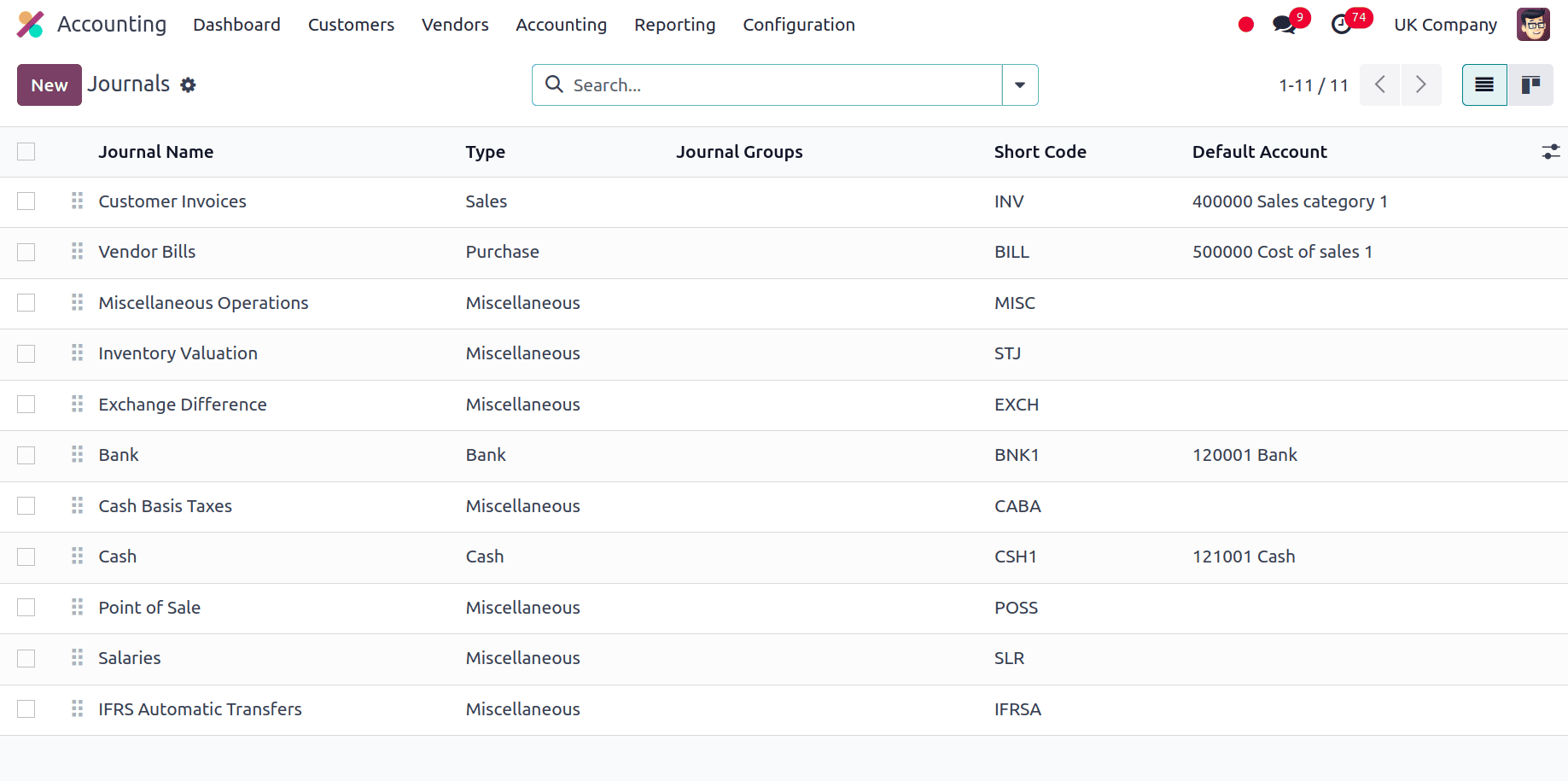

Next, we can look into journals, which are pre-installed as a feature of the UK localization package in Odoo. Journals are designed to specifically address the accounting requirements of firms that operate in the United Kingdom and are indispensable for documenting various forms of financial transactions.

Odoo journals localized for the United Kingdom include:

* Sales Journal: All sales transactions, including invoices and customer credit notes, are documented in this diary. It offers a thorough picture of sales activities and aids in revenue tracking.

* Purchase Journal: All purchase transactions, including credit notes and supplier invoices, are recorded in this journal. It keeps account of costs associated with purchasing products and services.

* Bank Journal: Transactions of bank accounts are documented in this journal. It contains information about deposits, withdrawals, bank statements, and other bank-related operations.

* Cash Journal: Transactions involving cash are documented in this diary. Petty cash expenses, payments, and cash revenues are all included.

* Expenses Journal: This is where you keep track of all the different transactions related to expenses, like staff reimbursements and other running expenditures.

A range of Taxes, such as purchases and sales, are managed in Odoo. Businesses may guarantee precise calculations on purchase orders and invoices by setting up tax rates, rules, and accounts accordingly. In order to guarantee compliance with regional laws and streamline the administration of tax-related activities, the Taxes function was created. Pre-configured tax settings that are customized to meet specific area requirements are included for a variety of taxes, including sales tax, VAT, and other taxes.

Making Tax Digital

The UK government's Making Tax Digital (MTD) initiative requires firms to retain digital records and submit tax information electronically in an effort to modernize the tax system. Introduced by HM Revenue and Customs (HMRC), MTD aims to improve accuracy, efficiency, and transparency in tax reporting.

Key Aspects of MTD in UK Accounting Localization:

1. Digital Record-Keeping:

* Companies are required to maintain digital records of all of their transactions, including VAT, income, and spending reports. This ensures that all tax information is readily available and up-to-date.

2. Electronic Submissions:

* Under MTD, businesses are required to submit their VAT returns and other tax information electronically. Manual submissions or paper filings are no longer accepted.

3. Quarterly Updates:

* Businesses must submit quarterly updates of their financial data to HMRC, allowing for more timely and accurate reporting.

4. Integration with Software:

* MTD mandates that businesses use accounting software or digital tools that are MTD-compliant. This ensures that data is automatically transmitted to HMRC in the required format.

5. VAT Compliance:

* MTD first concentrated on companies registered with the VAT which had taxable revenue beyond the threshold. However, the scope is expanding to include more businesses and other types of taxes over time.

6. Penalties for Non-Compliance:

* MTD rules must be followed; otherwise, penalties and fines may be applied. Therefore, businesses must ensure their accounting systems and processes meet the MTD standards.

Odoo’s UK localization includes features to support MTD compliance. This includes:

* Integration with HMRC: We can connect with HMRC for electronic VAT submissions in Odoo 17.

* Digital Record-Keeping: Facilitates the maintenance of digital records of financial transactions.

* Quarterly VAT Reporting: We can prepare and submit VAT returns in the format required by MTD.

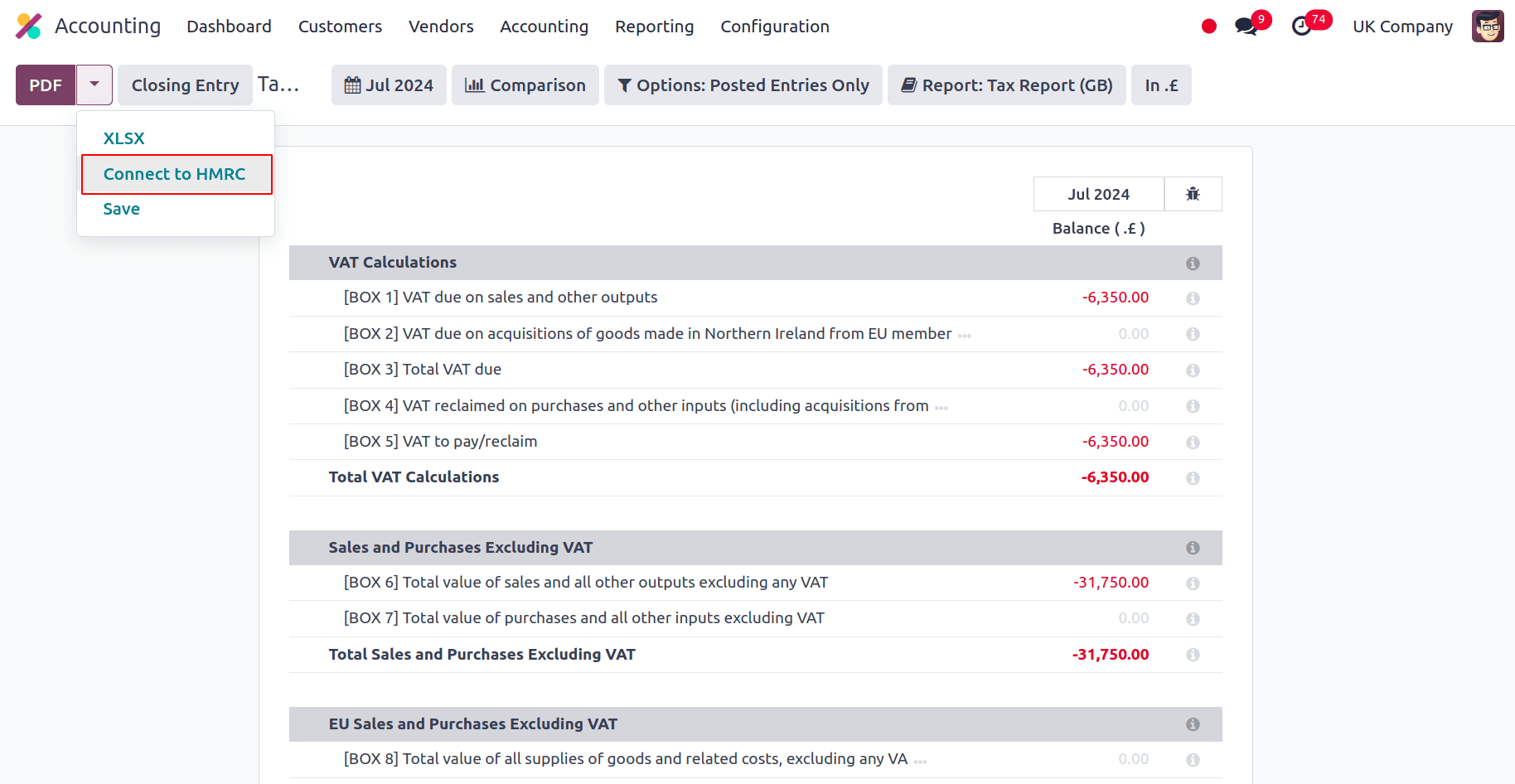

First, we have to register the company; for that, we have to select the "Connect to HMRC" option after going to Accounting > Reporting > Tax report. On the HMRC platform, enter the company details. It just needs to be done once.

Users and companies cannot connect to HMRC at the same time. Click transmit to HMRC to transmit your tax report after importing your requirements from HMRC and filtering on the period you wish to submit. Before submitting any HMRC report, the user submitting the report must adhere to the following guidelines if multiple UK-based entities are included in the same database:

Enter the company's website to complete the submission. Navigate to General Settings and select Manage Users under the Users section. Choose the person who has a connection to HMRC. Click the Reset Authentication Credentials or Remove Authentication Credentials button after selecting the UK HMRC Integration tab. At this point, you can file the company's tax return and register it with HMRC.

To submit HMRC forms for other firms, follow the same procedure.

* Log into the company for which the submission has to be done.

* Navigate to General Settings and select Manage Users under the Users section. Choose the person who has a connection to HMRC.

* Go to the UK HMRC Integration tab and click the Reset Authentication Credentials or Remove Authentication Credentials button.

* You can now register your company with HMRC and submit the tax report for this company.

Bacs Files

In the UK, computerized files called "bacs files" are used to handle payments and account transfers.

Once the UK BACS Payment Files module is installed, follow these steps to enable the use of Bacs files:

Set up the user number for the Bacs service:

* Navigate to Accounting > Configuration > Settings, then select the Customer Payments area by scrolling down.

* In BACS, type in your Service User Number and manually save.

* Now, choose the bank journal by going to Accounting ? Configuration ? Journals. Set the Account Number and Bank fields under the Journal Entries tab. Ensure that the BACS Direct Debit payment option is selected in the Incoming Payments and Outgoing Payments tabs.

* Set up the contacts for which you want to utilize Bacs files: Open the contact form, select the Accounting tab, and then click Add a line. Complete the fields for the account number and bank.

Balance Sheet

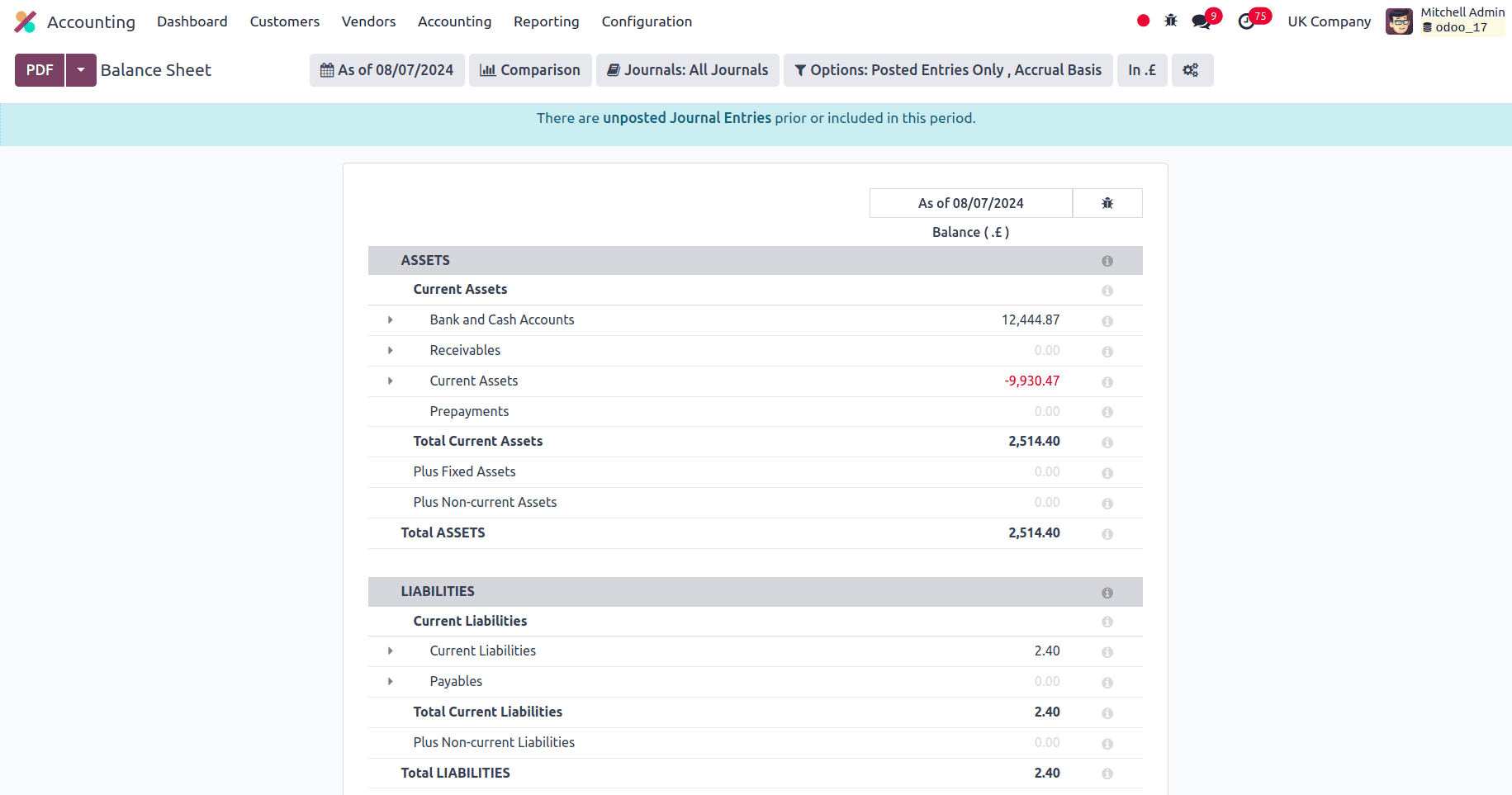

The balance sheet, which is an essential financial statement in Odoo's accounting system, provides a summary of a company's financial status at a specific point in time. Adapted to the accounting localization needs in the United Kingdom, this report is made to meet local financial reporting standards and compliance requirements. The UK localization of Odoo makes sure that the Balance Sheet complies with Financial Reporting Standard (FRS) 102, which sets forth the rules for UK organizations' accounting procedures. This involves adhering to the classifications and forms mandated by UK legislation.

Profit and Loss Report

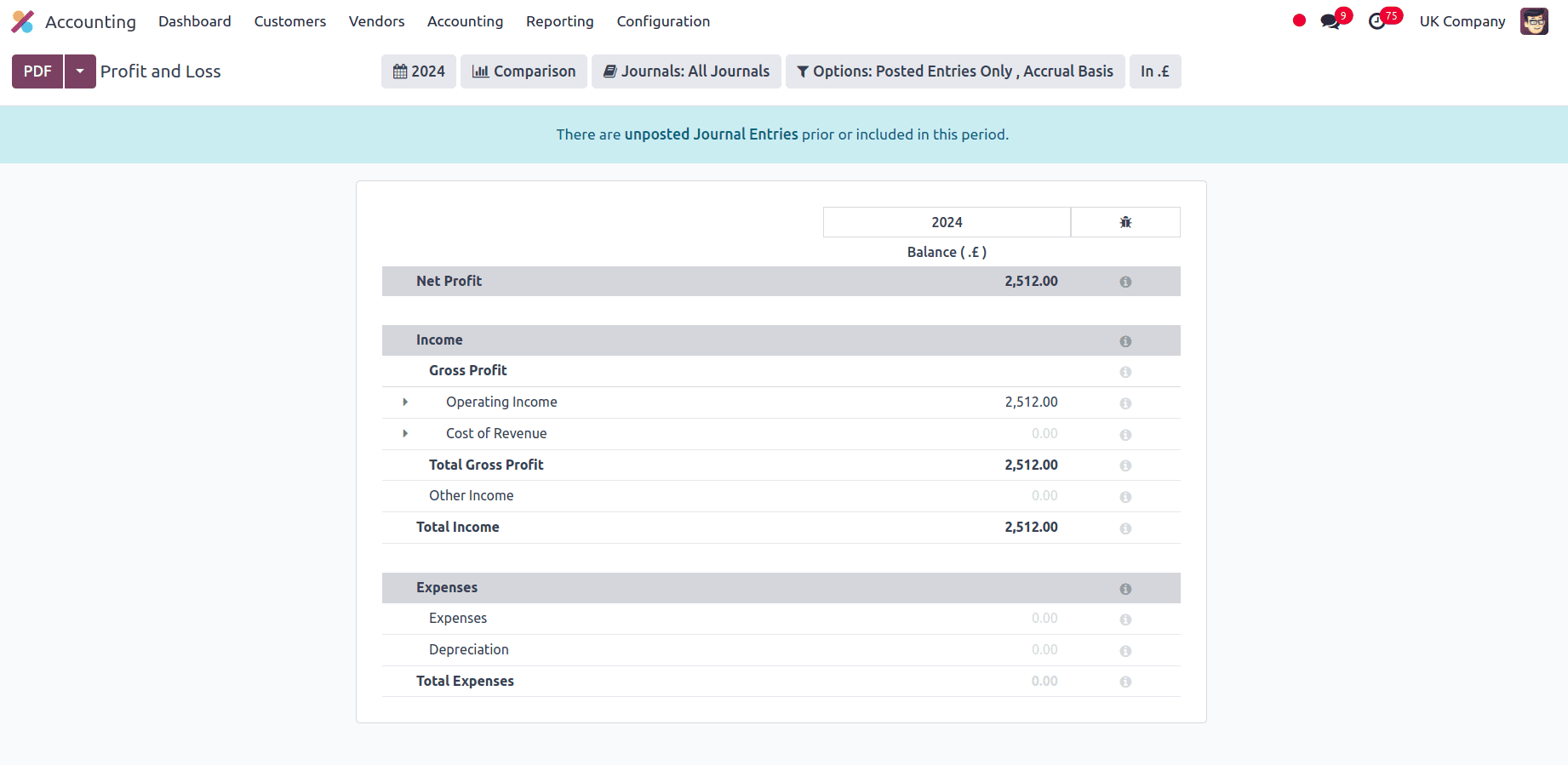

The profit and Loss Report is a basic financial statement that shows the financial success of a business over a given time frame. Businesses can see a comprehensive picture of their profitability and operational efficiency with Odoo's Profit and Loss Report, which is customized for the UK and compliant with UK accounting rules and procedures. The Profit and Loss Report fits with Financial Reporting Standard (FRS) 102 and other pertinent UK laws. As part of this regulation, revenues and costs must be properly classified in accordance with UK GAAP or generally accepted accounting principles. This covers all outside costs related to manufacturing products or providing services. Revenue is subtracted from COGS to determine the gross profit.

Tax Report

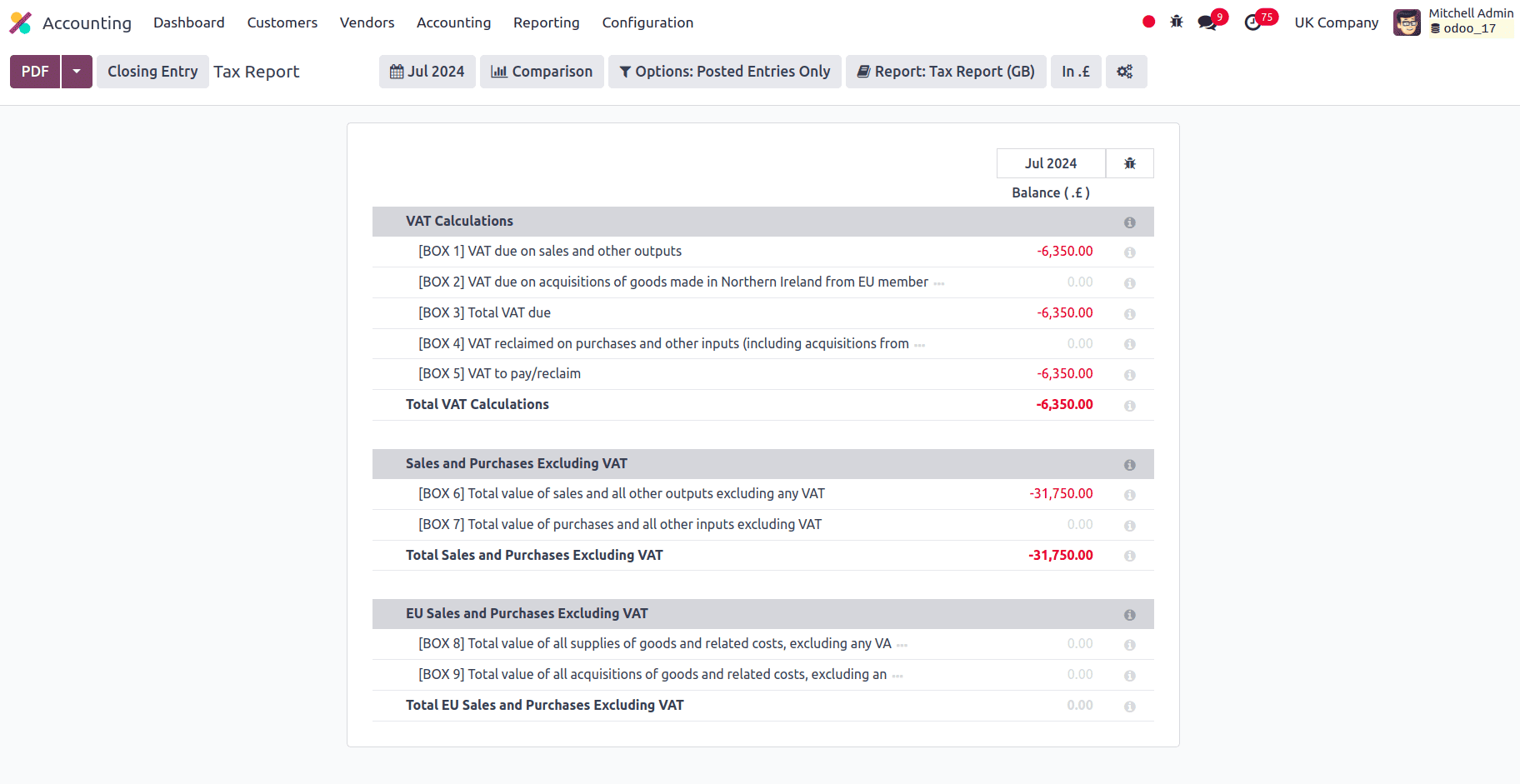

All pertinent tax information from a variety of transactions, such as purchases, sales, and other financial activity, is combined into the Tax Report. It guarantees that businesses have a comprehensive awareness of their tax liabilities by offering a thorough perspective of taxes received and paid. The Tax Report in Odoo 17 is set up to handle sales tax and VAT (Value Added Tax) for companies that are subject to local laws. It assists in accurately ensuring compliance with tax rules by calculating sales tax or VAT on transactions.

To summarise, organizations looking to align their financial operations with UK accounting standards and regulatory regulations will benefit from Odoo 17 accounting localization for the UK, which provides a comprehensive and customized solution. The localization facilitates important features, including automatic financial computations, customizable reporting formats, and reporting on sales and VAT. This improves financial management accuracy while also making compliance with UK accounting standards easier. Along with user-friendly interfaces and strong reporting features, the seamless interaction with other Odoo modules gives organizations a great tool to preserve transparency.

To read more about An Overview of Accounting Localization for Slovakia in Odoo 17, refer to our blog An Overview of Accounting Localization for Slovakia in Odoo 17.