What is Accounting localization in Odoo?

There will be lots of unique tax laws, accounting standards, legal reporting obligations, etc., for different countries, and these may vary. Accounting localization in Odoo is the process of modifying the accounting modules to conform to the unique features of each country. The major feature of Odoo 17 is the presence of country-specific modules for accounting localization named ‘Fiscal Localization Packages.’ The fiscal localization packages offered by Odoo are made to comply with the unique tax laws, accounting systems, and legal reporting obligations of different nations. This lowers the possibility of mistakes and fines by ensuring that your accounting procedures are compliant. Tax computations and reporting are automated by prepared components such as fiscal events, charts of accounts, and tax groups. As opposed to manually configuring your accounting system from the beginning, this saves you time and work. The possibility of human error in applying the proper tax rates and codes to transactions is reduced when tax computations are done automatically. More accurate financial statistics result from this. Localization can save you money on accounting fees and resources by optimizing accounting operations and reducing errors. Odoo's localization features let you handle your finances uniformly across different regions if your firm runs in multiple nations. The accounting module of Odoo allows for multi-currency transactions. By guaranteeing the correct handling of foreign exchange rates and taxes for international transactions, localization can further improve this.

Here in this blog, we can discuss all the features of Odoo accounting localization for Kazakhstan in Odoo 17.

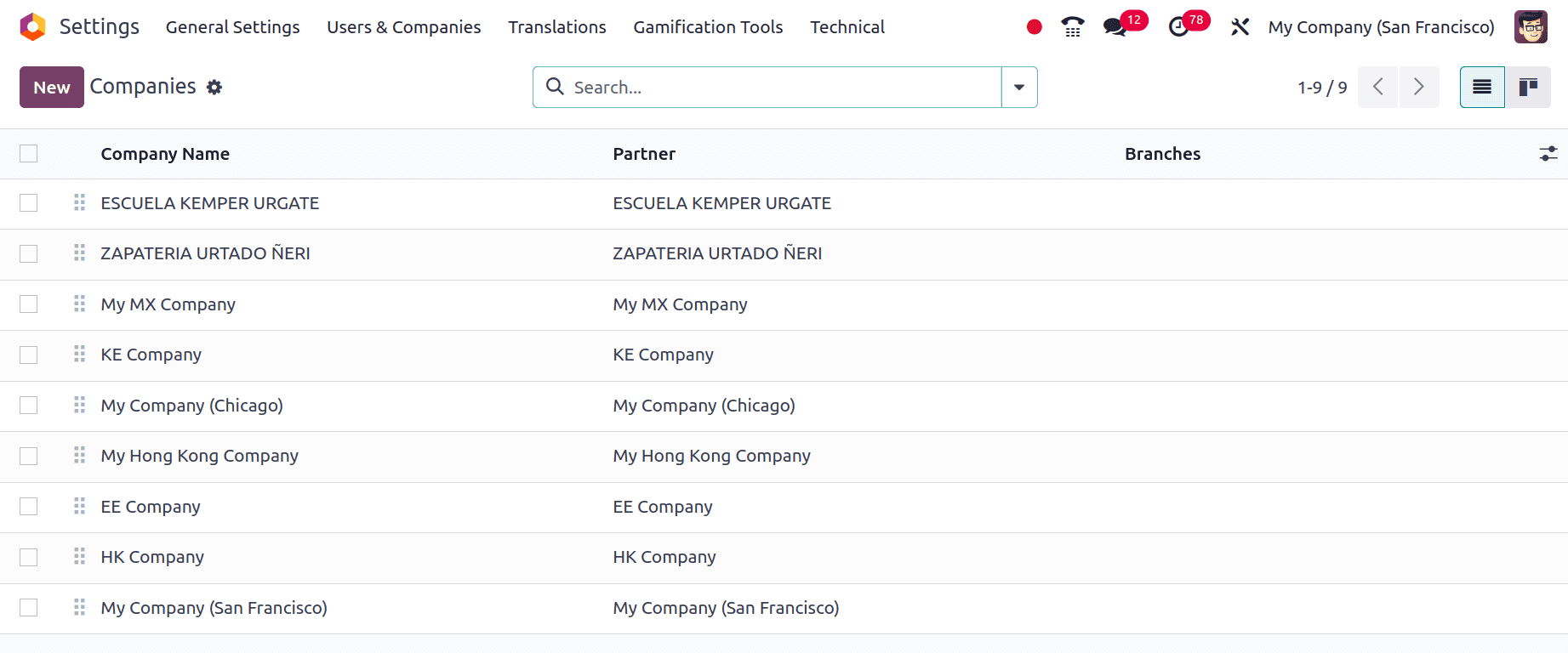

To set up the localization for Kazakhstan, we need to configure a new company. In Odoo 17, we can create a new company from Odoo's general settings. Move to the General Settings of the Odoo application and select the Companies sub-menu under the Users & Companies menu.

Then you will get the list of companies that are already created under Odoo. By clicking the New button, Odoo provides a form to fill out all the details of the company that you are going to configure.

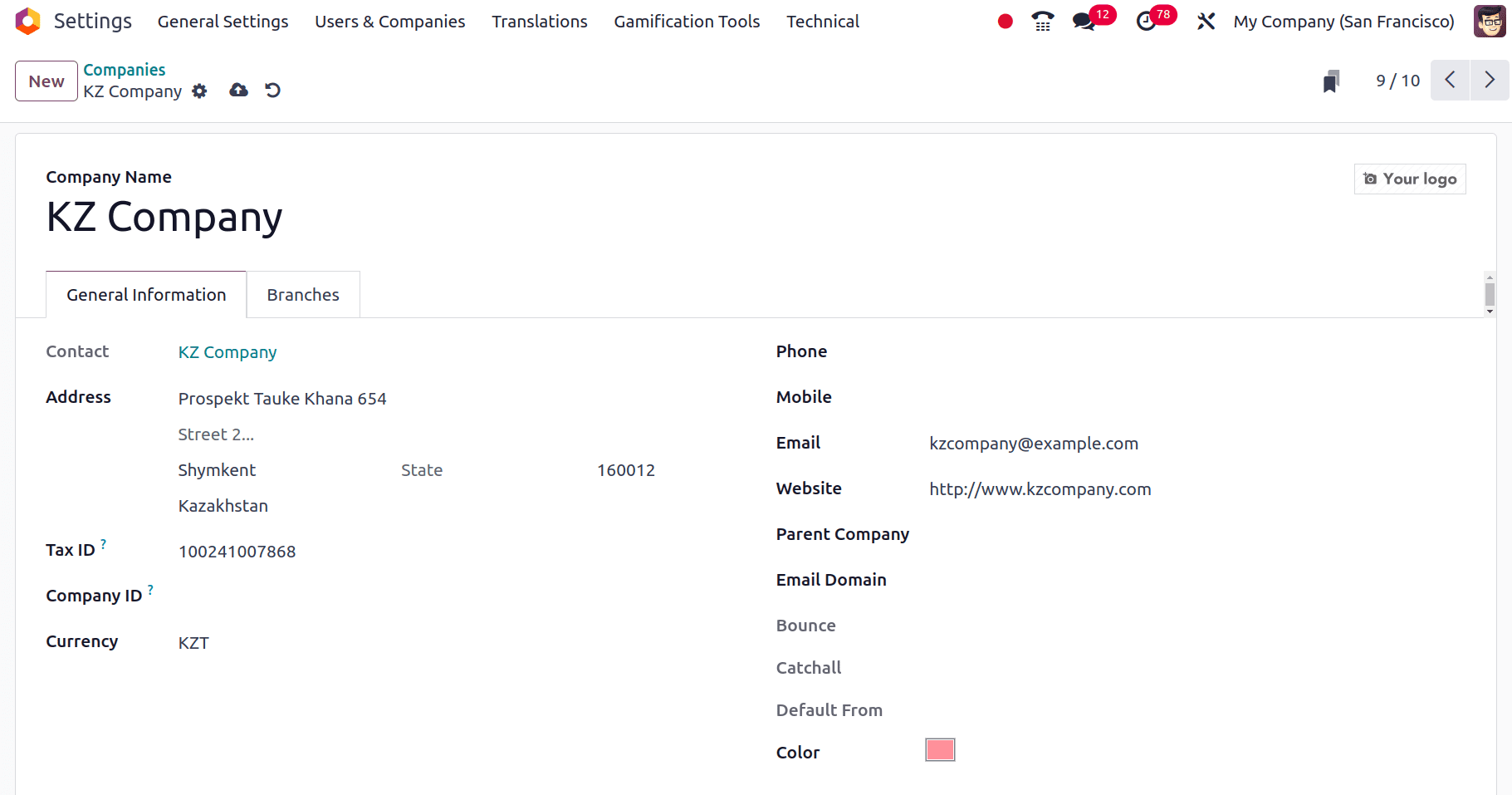

Provide the name of the company, address, country to which the company belongs, and Tax ID of the company. Here you can see that the currency in the company registration form is configured by Odoo automatically as the official currency, ‘Kazakhstani tenge’ whenever the country is set as Kazakhstan. After the new company configurations are completed properly let's discuss the variations in the accounts of this company.

Variations formed when localization for Kazakhstan is configured

The major configurations of Odoo 17 accounts are the Fiscal Position of accounts, Chart of Accounts, Taxes, Journals, etc. so we can begin with these features of Odoo.

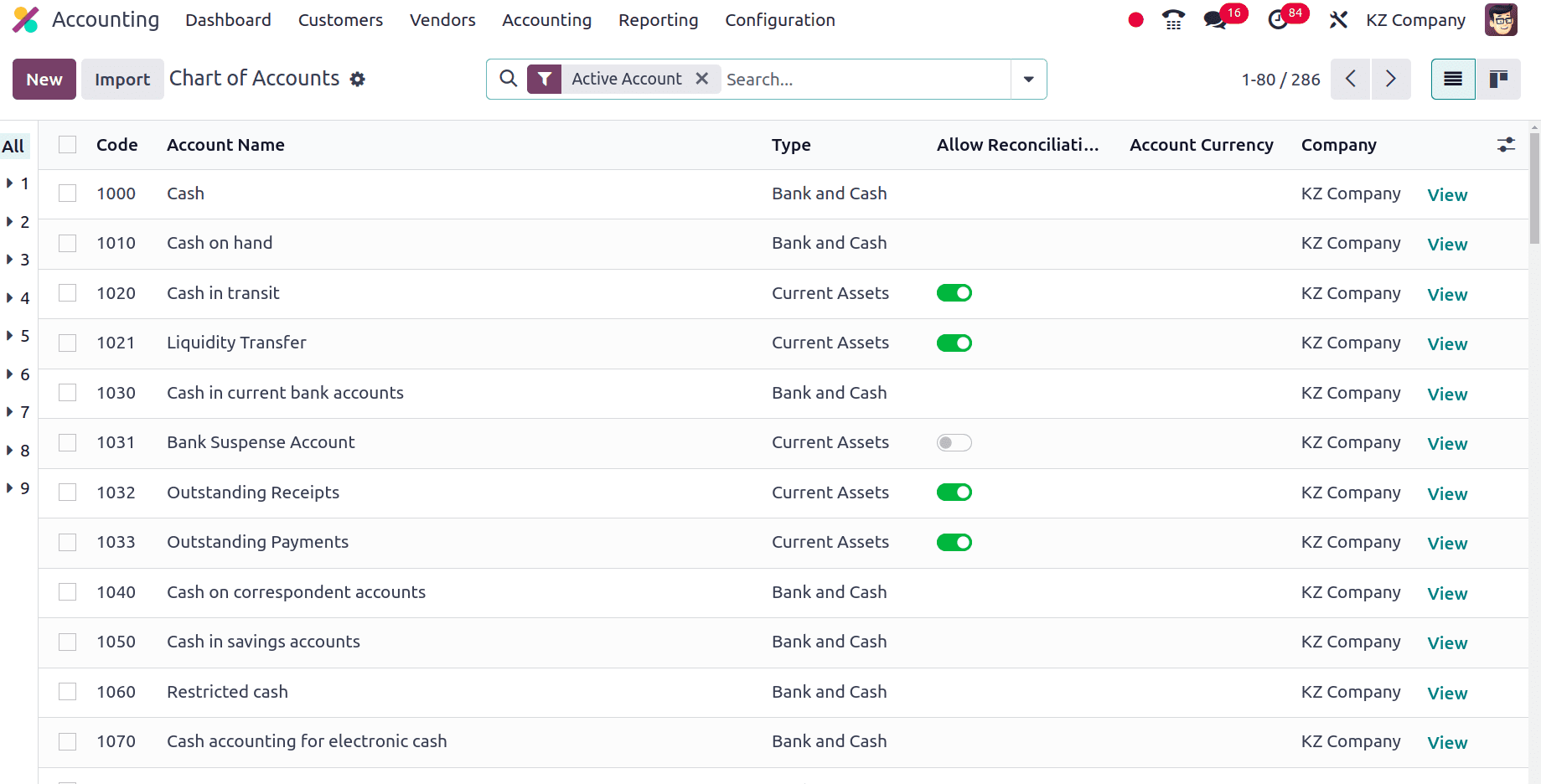

Chart of Accounts

Any accounting system, including Odoo, is built on a chart of accounts (COA). It is a complete listing of all the bank accounts that are used to classify your business transactions. Consider it your financial data's filing cabinet, where each account serves as a labeled folder.

The Chart of Accounts used by the companies from Kazakhstan is shown in the above screenshot. The code of the account, Account Name, Type of the Account, Currency used by this company, etc are shown here. The name and code of the accounts may vary from company to company. By clicking the New button, we can create a new Chart of Accounts for this company. All of your financial accounts are organized into categories such as income, expenses, assets, liabilities, and equity by the Chart of Accounts. You can more effectively monitor the money flow within your company with this classification.

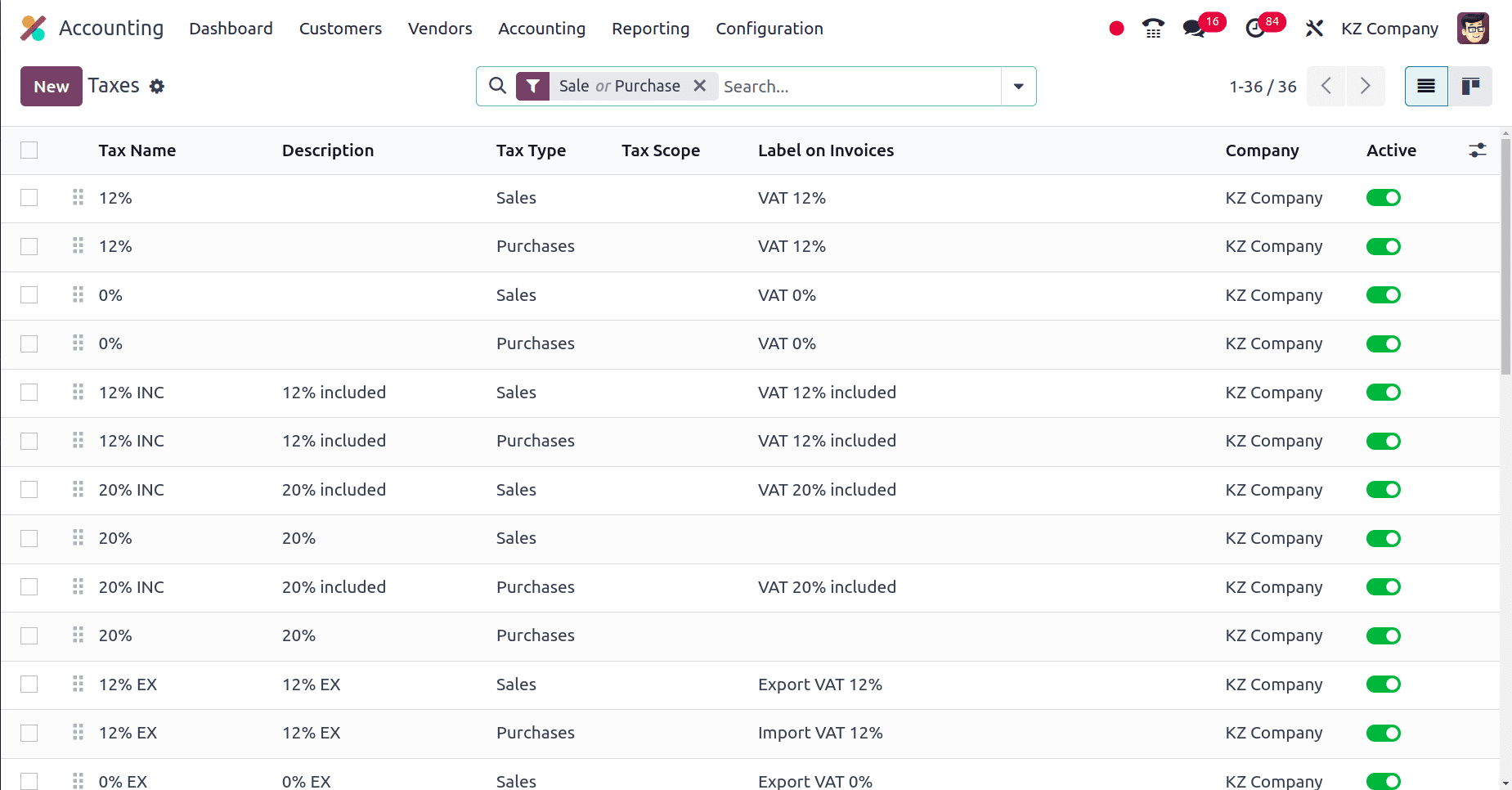

Taxes

In essence, taxes are required charges that are gathered by governments. They are usually a percentage of your earnings, the cost of the items and services you purchase, or the value of your property. Government programs and services, such as road construction, park maintenance, and social security funding, are supported by tax revenue.

In Odoo, you can establish several taxes, including their name, rate (fixed amount or percentage), and method of calculation (price, price including tax, etc.). We have the list of all the taxes for this company in the taxes sub-menu under the configuration menu of the Accounting application.

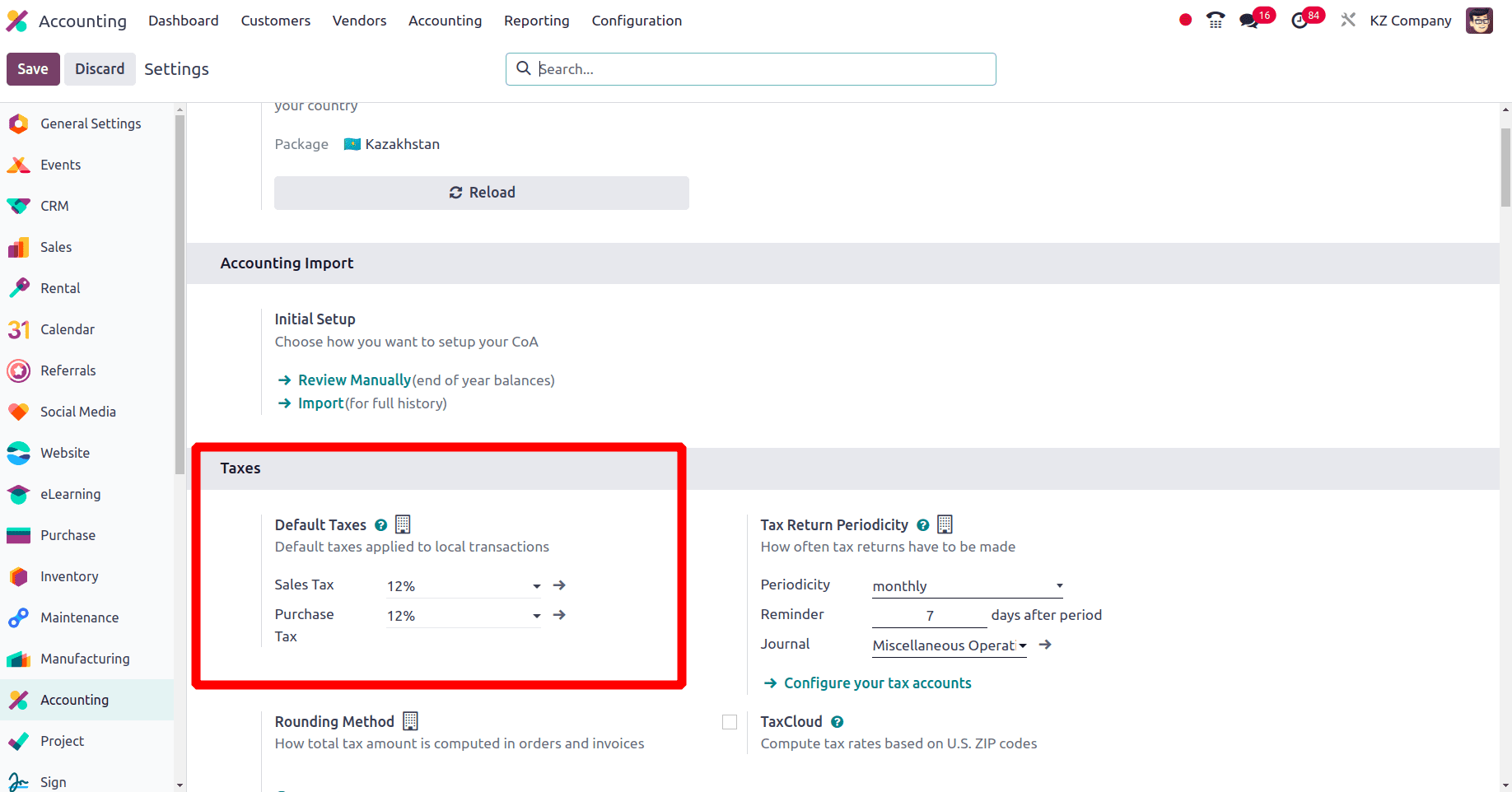

Taxes are mainly of two types, Sales tax, and purchase tax, so the sales taxes are used for the sale orders, and the purchase taxes are applied on the purchase orders. Here on the taxes page, we can see the different taxes, their descriptions, the tax types, etc are provided. We are also able to create new taxes for this company by clicking the New button. Each country has its own Default tax for all the products and services from that country. Odoo may know the default tax used in Kazakhstan, so Odoo automatically sets the default tax for the company. When you move to the Configuration settings of the Accounting application, there is a taxes section. In that taxes section, you have the option to set the default sales tax and default purchase tax for this company. But when we set the localization package for the company as Kazakhstan, Odoo automatically set the default taxes for the company.

From this screenshot, we can see that the Default Sales Taxes and the Default Purchase Taxes for this company are set as 12 % by Odoo automatically.

Journals

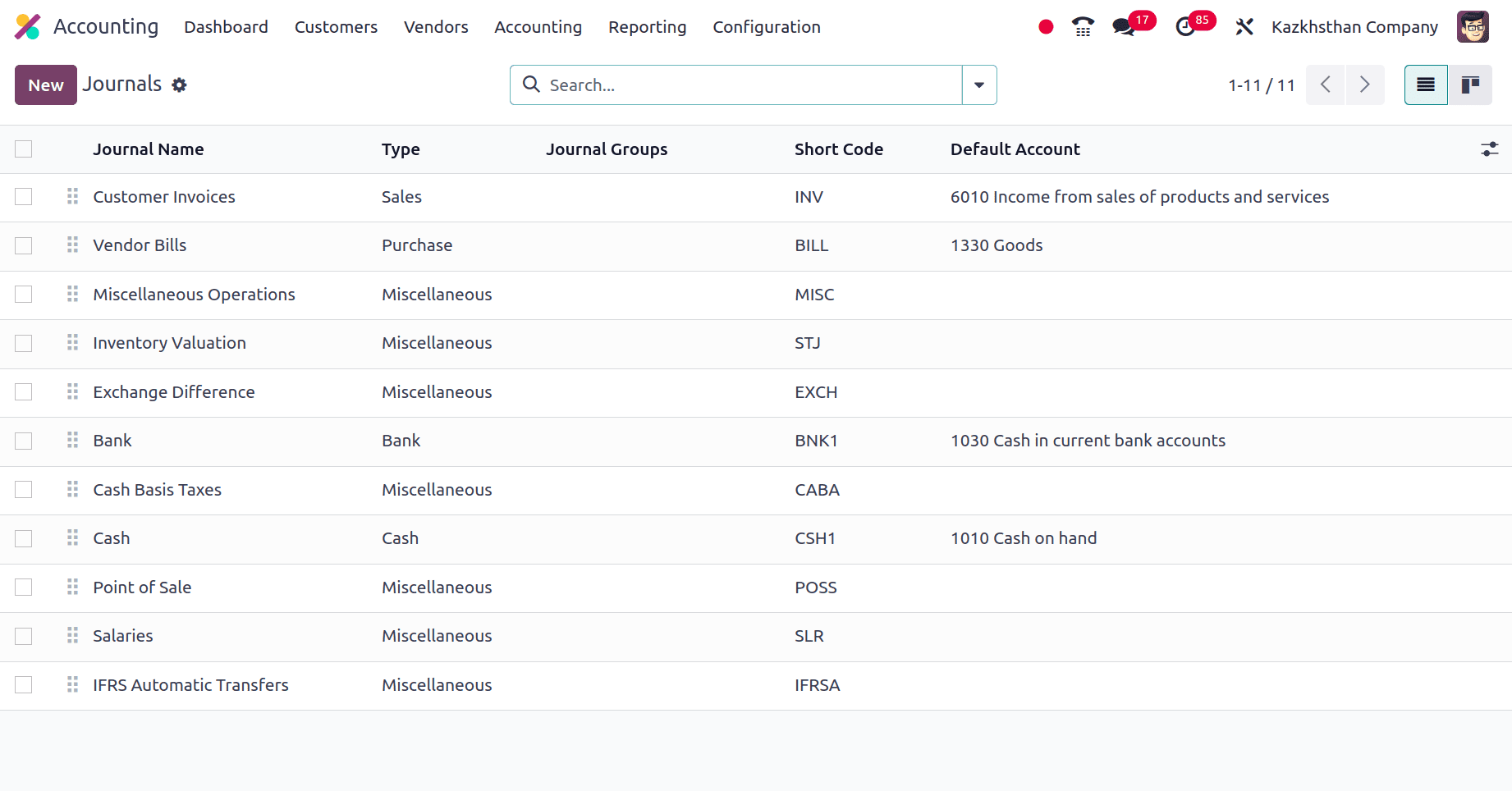

The basic components of accounting journals are used to record financial transactions. They serve as a kind of chronological record keeping, where all financial transactions are recorded. The who, what, when, and how much of every transaction are recorded in journals. They ensure a clear timeline of financial occurrences by classifying items based on dates. Transactions are categorized by several journals according to their nature, which are, Sales Journal, Purchase Journal, Cash Journal, Bank Journal, General Journal, etc.

* Sales Journal: Records sales of products or Services.

* Purchase Journals: Track purchases from vendors.

* Cash journals: Manages cash receipts and disbursements.

* Bank journals: Specifically for bank transactions.

* Miscellaneous Journal: Used for miscellaneous entries not fitting other categories.

The journals used by the companies from Kazakhstan are shown in the above screenshot. Journal name, type of journal, shortcode, etc are shown in the list.

Fiscal Position

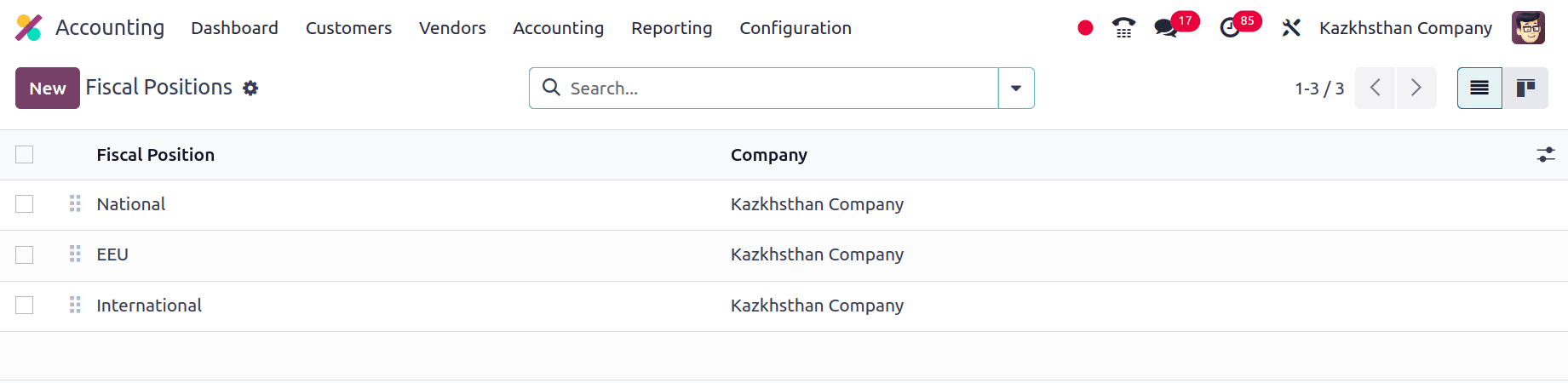

A fiscal position is a collection of guidelines that transactions follow to automatically apply the appropriate taxes and accounts. Companies that manage complicated tax procedures or operate in many locations will find this very useful.

The major Fiscal positions used by the companies from Kazakhstan are shown in the above list. Based on predetermined principles, fiscal positions guarantee the automatic application of the appropriate taxes and accounts to transactions. This lowers the possibility of human error and promotes adherence to tax laws. Fiscal positions reduce time and effort by automating tax computations and account mapping rather than requiring manual configuration for every transaction. This makes your accounting procedures more efficient.

Noticeable changes while configuring the Kazakhstan localization package

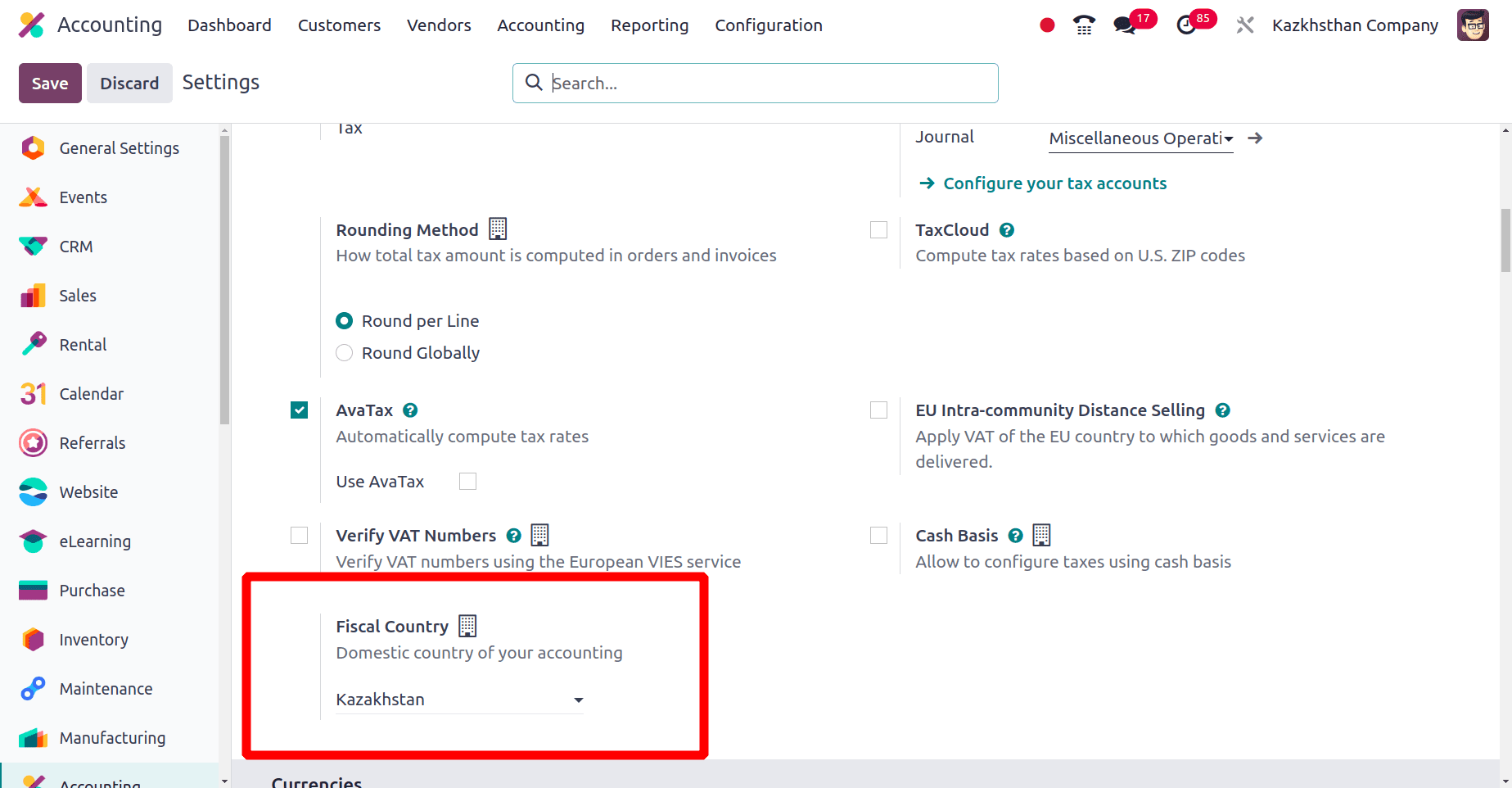

Then, we can move to the Configuration Settings of the Accounting application. There we can see that under the Taxes section, we have the option to set the Fiscal Country for this company.

When we set the localization package for the company as Kazakhstan, Odoo automatically sets the Fiscal country as Kazakhstan.

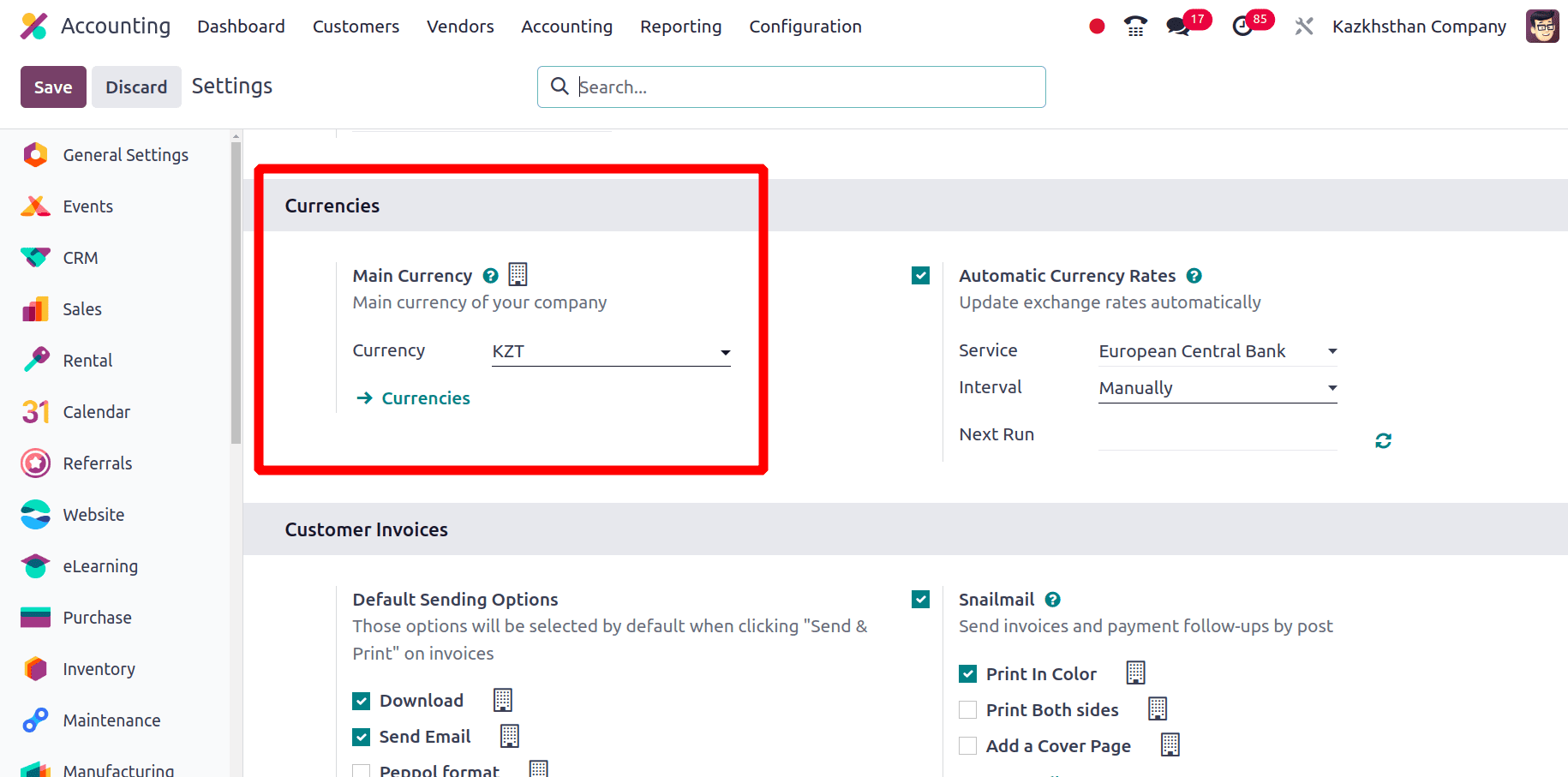

The next is the official currency of the country. In Odoo, the official currency is represented as the main currency. We know that the official currency of Kazakhstan is Kazakhstani tenge (KZT).

Here, when the localization package is set to Kazakhstan, Odoo automatically sets the Main currency for the company as Kazakhstani tenge (KZT).

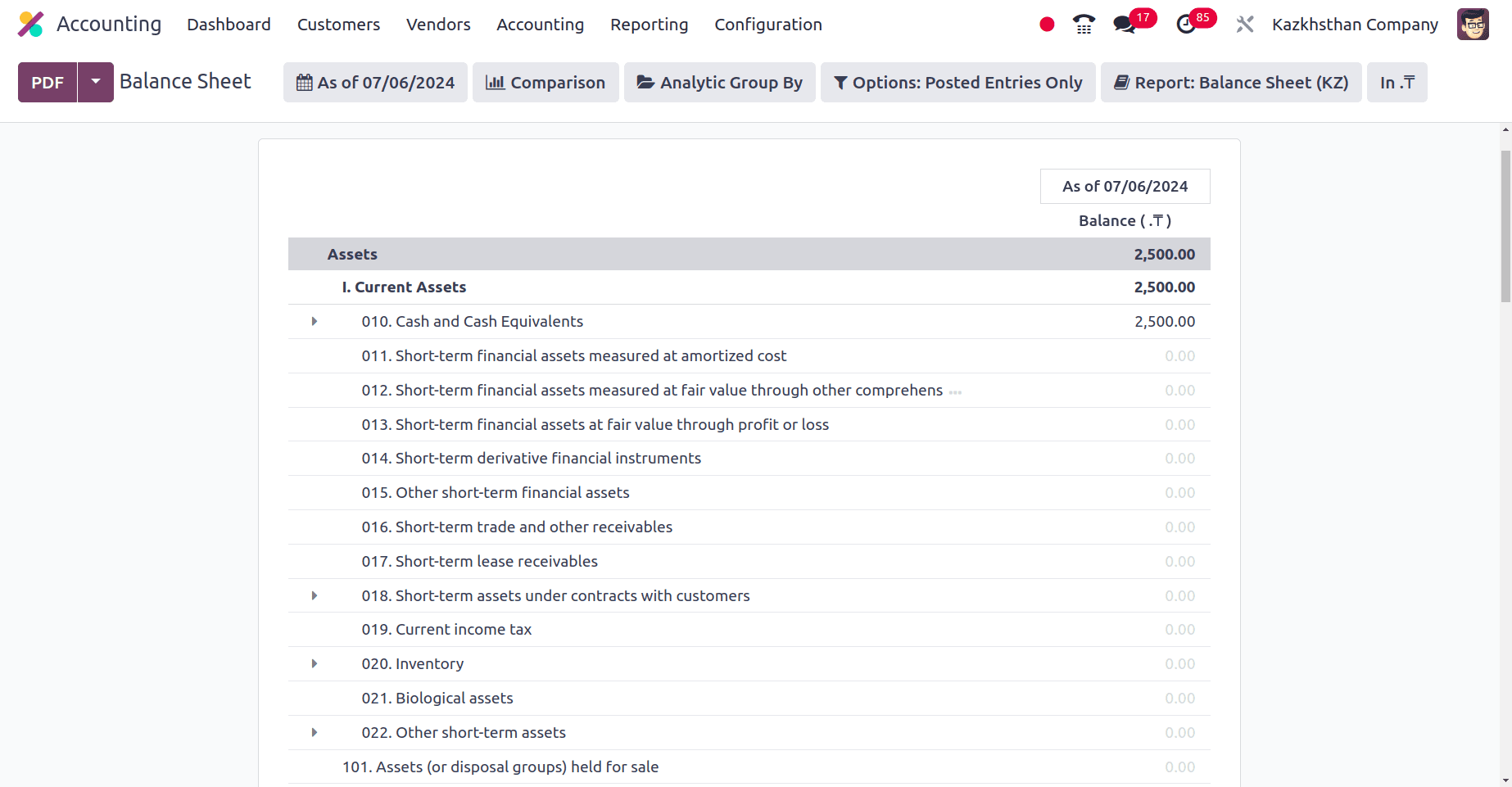

Next, we can move to the Reporting menu of the accounting application. Under the reporting menu, we have the balance Sheet of the company.

A balance sheet of a company provides an overview of a company's finances as of a particular date, while an income statement analyzes performance over time. It functions as a company's net worth declaration, basically. It offers a quick glance at the financial standing of a business on a certain day. It functions similarly to a financial picture, showing the assets, liabilities, and the difference, which represents the owners' claim (equity). You may assess the company's overall financial stability, health, and ability to fulfill its responsibilities by looking at these components.

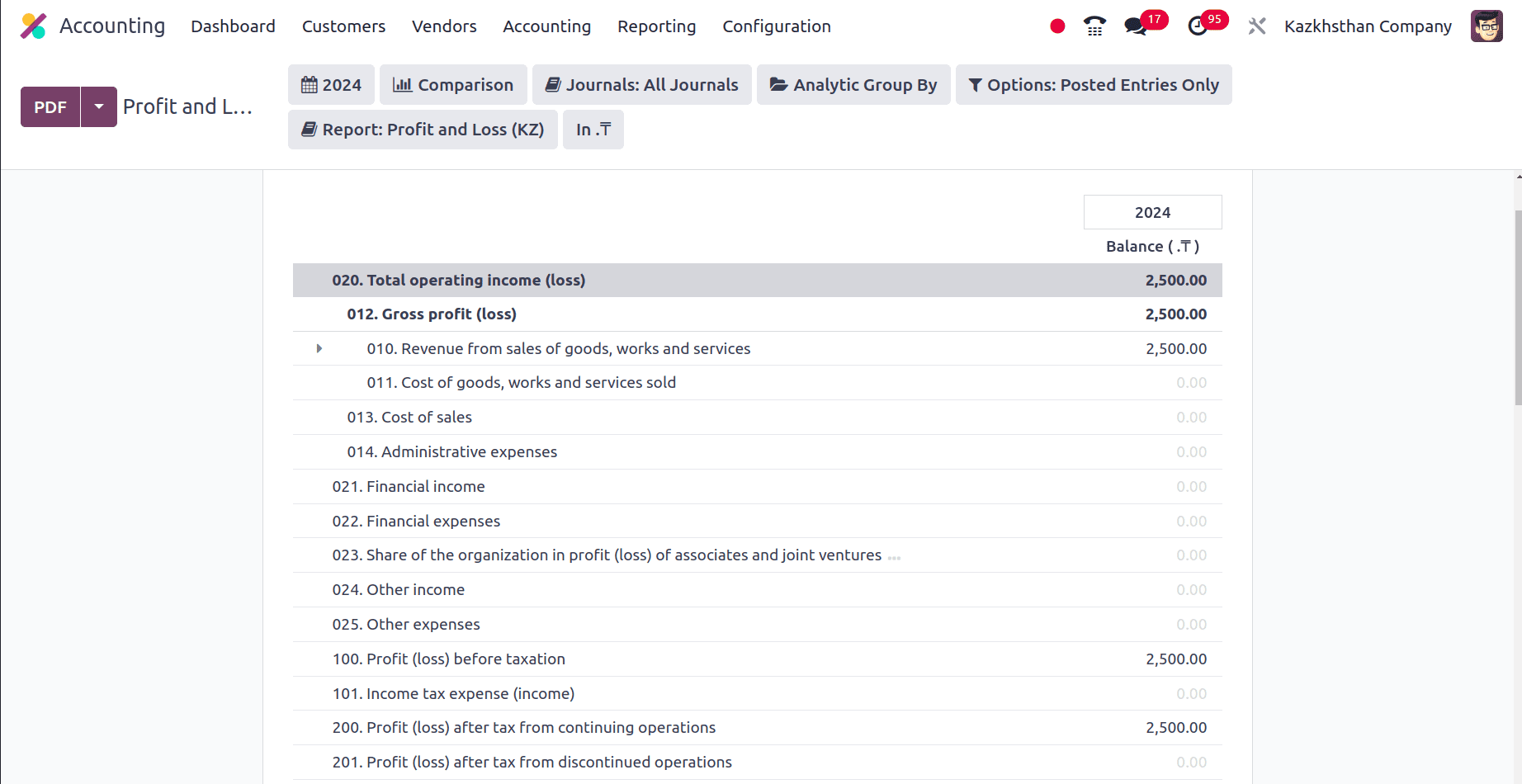

Next is the Profit and loss report for this company. When we choose the Profit and Loss report sub-menu whole profit and loss report of this company will be listed.

Odoo integrates with other modules like sales and inventory, automatically feeding relevant data into the P&L report, reducing manual data entry, and minimizing errors. You may create P&L reports for different periods with a few clicks, and you can customize them by department, date range, or product line. When compared to creating reports by hand, this saves time and effort. The Profit and Loss report of the companies from Kazakhstan includes revenue from sales of goods, work and services, Cost of sales, Administrative expenses, Financial Income, Financial expenses, Other Income, Other Expenses, Profit (loss) before taxation, Income tax expense, etc.

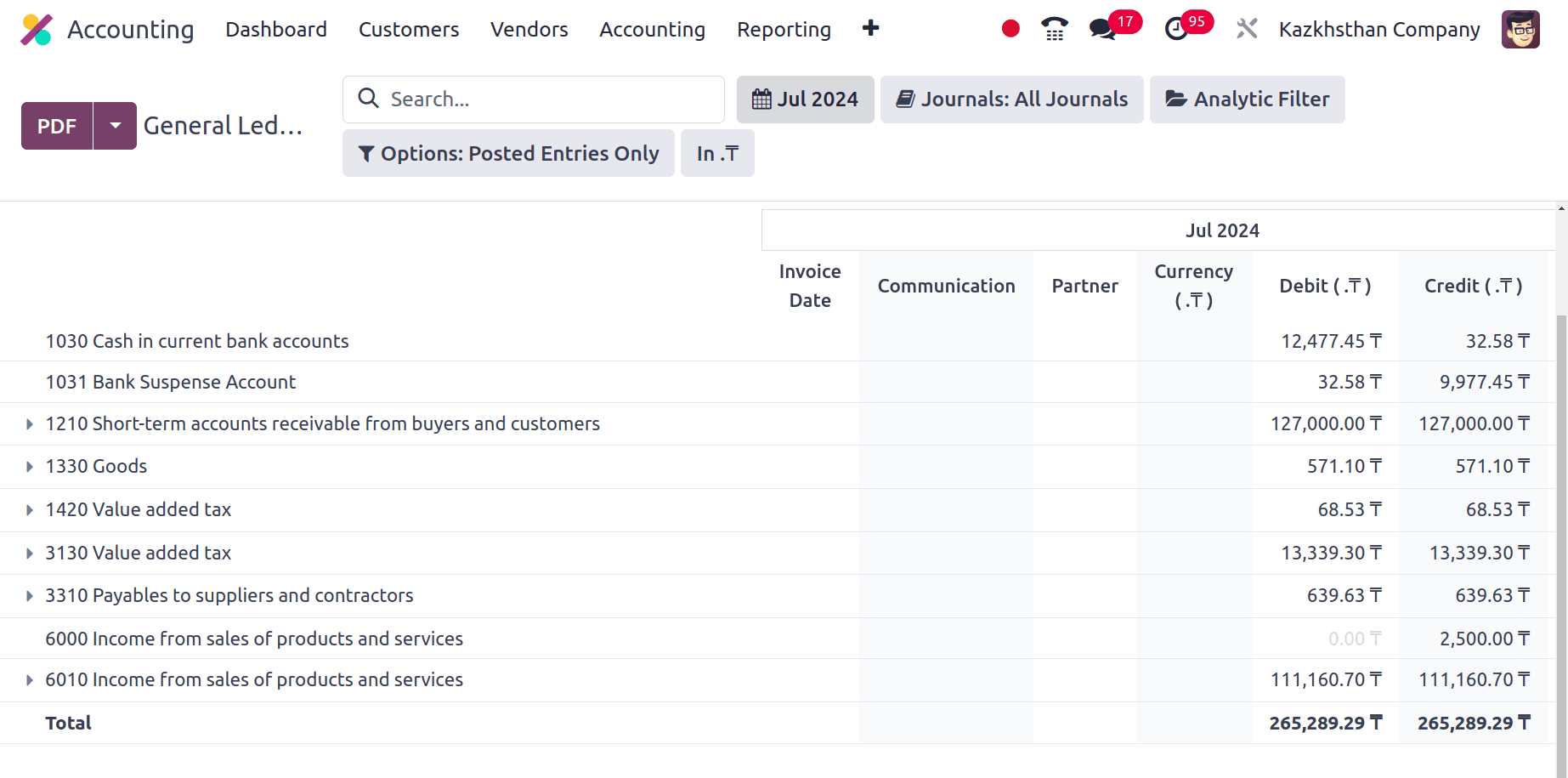

A General ledger is the master set of accounts that contains a summary of all a business's financial transactions. It functions as a centralized system of record-keeping for the financial transactions of your business. Individual accounts that classify various financial variables make up the General Ledger. Usually, these accounts stand for revenue, expenses, equity, liabilities, and assets.

The general ledger of this company has the Cash in current bank accounts, bank Suspense Accounts, Goods, Value added tax, Payable to Suppliers and Contractors.

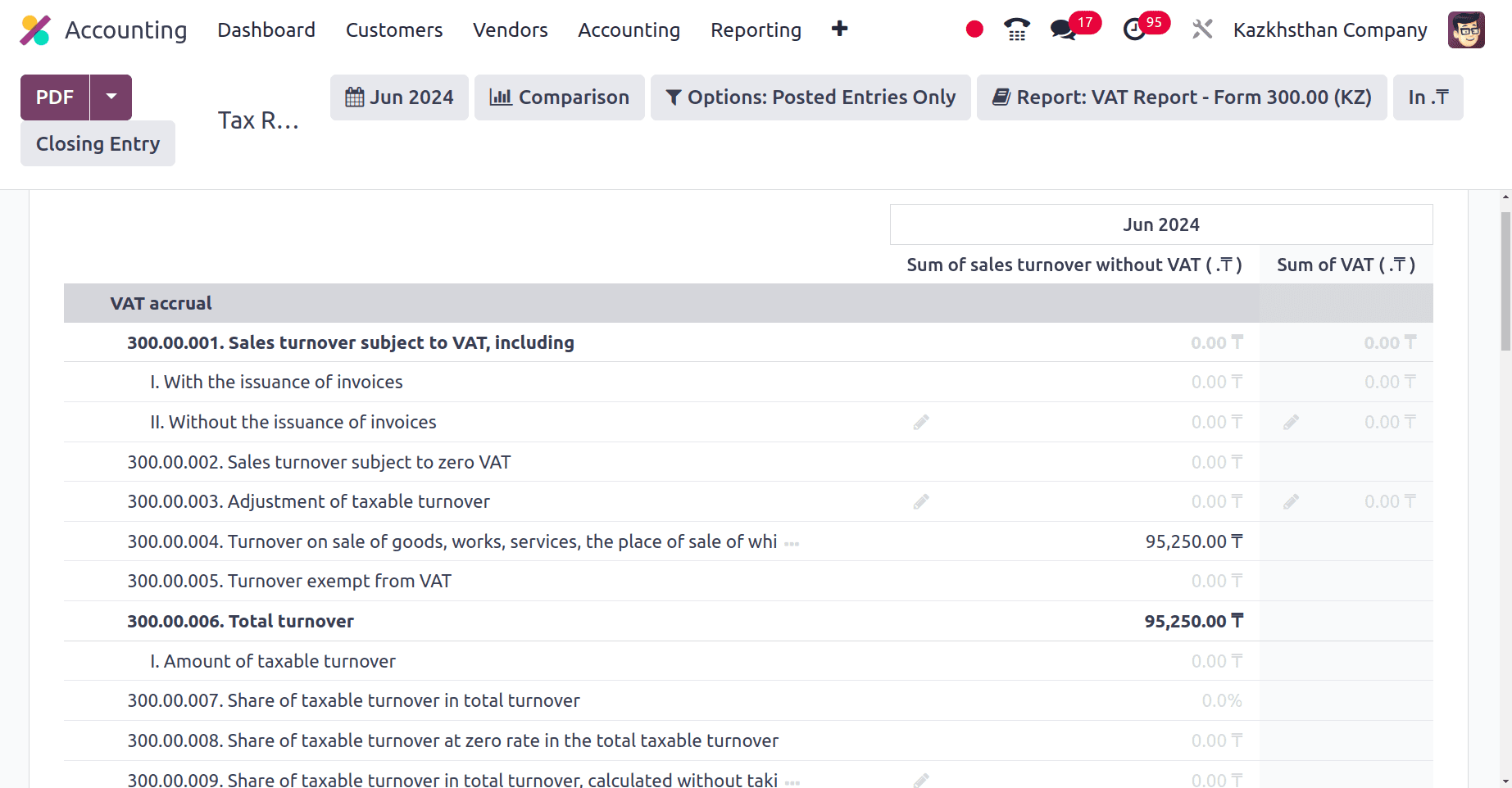

The major contribution of Odoo is the Odoo Tax Report. Under the Reporting menu, we have a Tax Report sub-menu. On clicking the Tax Report sub-menu the complete Tax Report of the company will be listed here.

VAT accrual, Sale turnover subject to VAT, including, Total turnover, The amount of VAT to be credited, VAT calculations for the VAT period, etc are included in the Tax report of the company. Odoo automatically fills tax reports with relevant data by integrating with other modules, such as sales and purchases. This minimizes errors and saves on human data entering. Numerous pre-configured tax reports that adhere to regional laws are available from Odoo. By doing this, you ensure that the reports you're producing are accurate for your area and save time. Errors in tax reporting and computations are reduced by automation and pre-configured reports.

In this blog, we have discussed the Accounting localization features of a Kazakhstan company in Odoo 17. Odoo 17 offers a dependable accounting solution with a user-friendly interface, abundant features, and integrated Kazakhstan localization for businesses in Kazakhstan. Utilizing automated computations and pre-configured tax reports, manage Kazakhstani taxes with ease. Make sure local laws are followed to prevent fines. Save time by automating difficult operations like data entry and report production for your accounting team. Simplify accounting procedures to increase productivity.

To read more about An Overview of Accounting Localization for Colombia in Odoo 17, refer to our blog An Overview of Accounting Localization for Colombia in Odoo 17.