Accounting localization in Odoo 17

Accounting localization is the process of adjusting accounting software to abide by a certain nation's particular accounting rules and regulations. Simply put, you customize the product to your nation's specific financial needs. Localization enables the automation of numerous accounting processes in accordance with regional norms. This covers characteristics such as:

* Automated tax computations.

* The generation of compliant reports and invoices.

* Integration with local e-invoicing systems, if applicable.

Accounting localization saves your accounting staff time and money by automating procedures and keeping to regional standards. Instead of focusing on laborious data entry and compliance assurance, they can focus on more strategic responsibilities. In this blog, we'll discuss the localization features of Japanese businesses.

Localization for Japan in Odoo 17

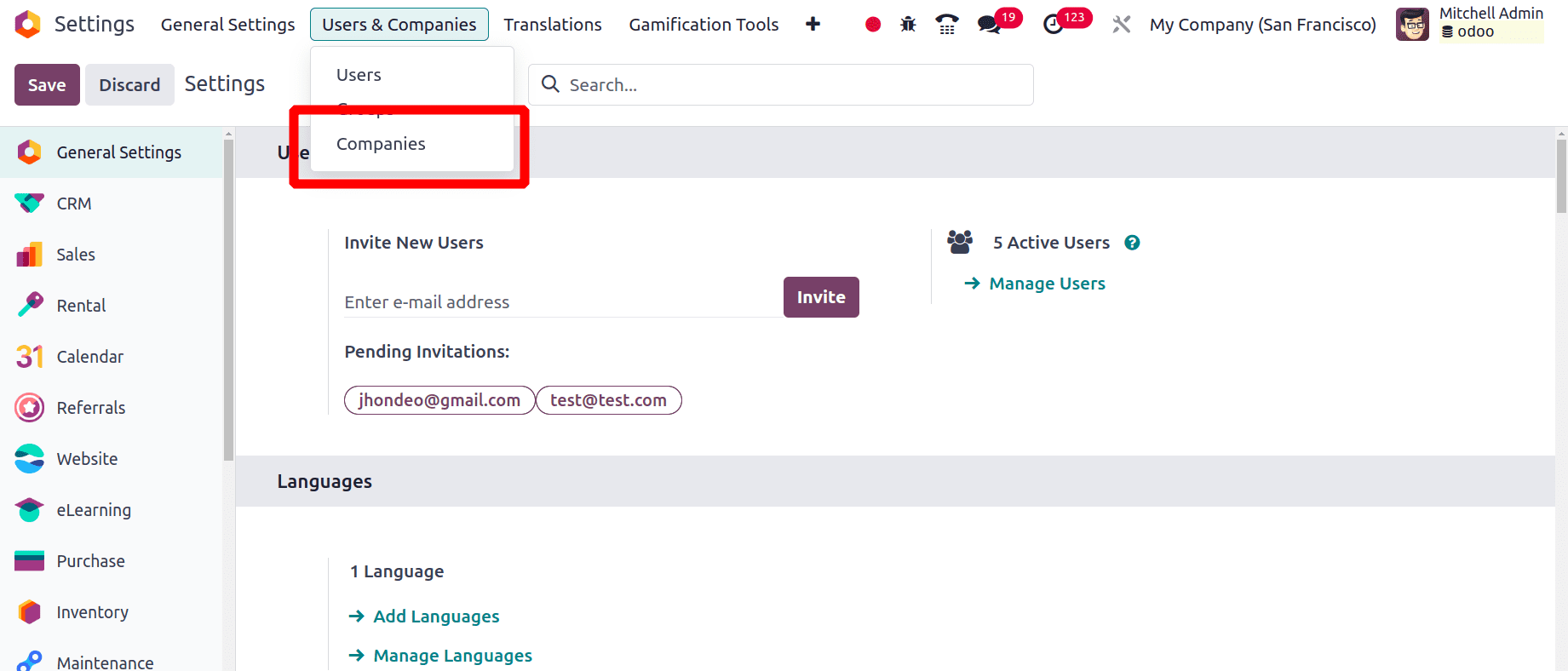

We must first create a Japanese organization or business to set up the localization for Japanese in Odoo. To achieve this, navigate to Odoo's General settings, then choose the Users & Companies menu, then the Companies sub-menu.

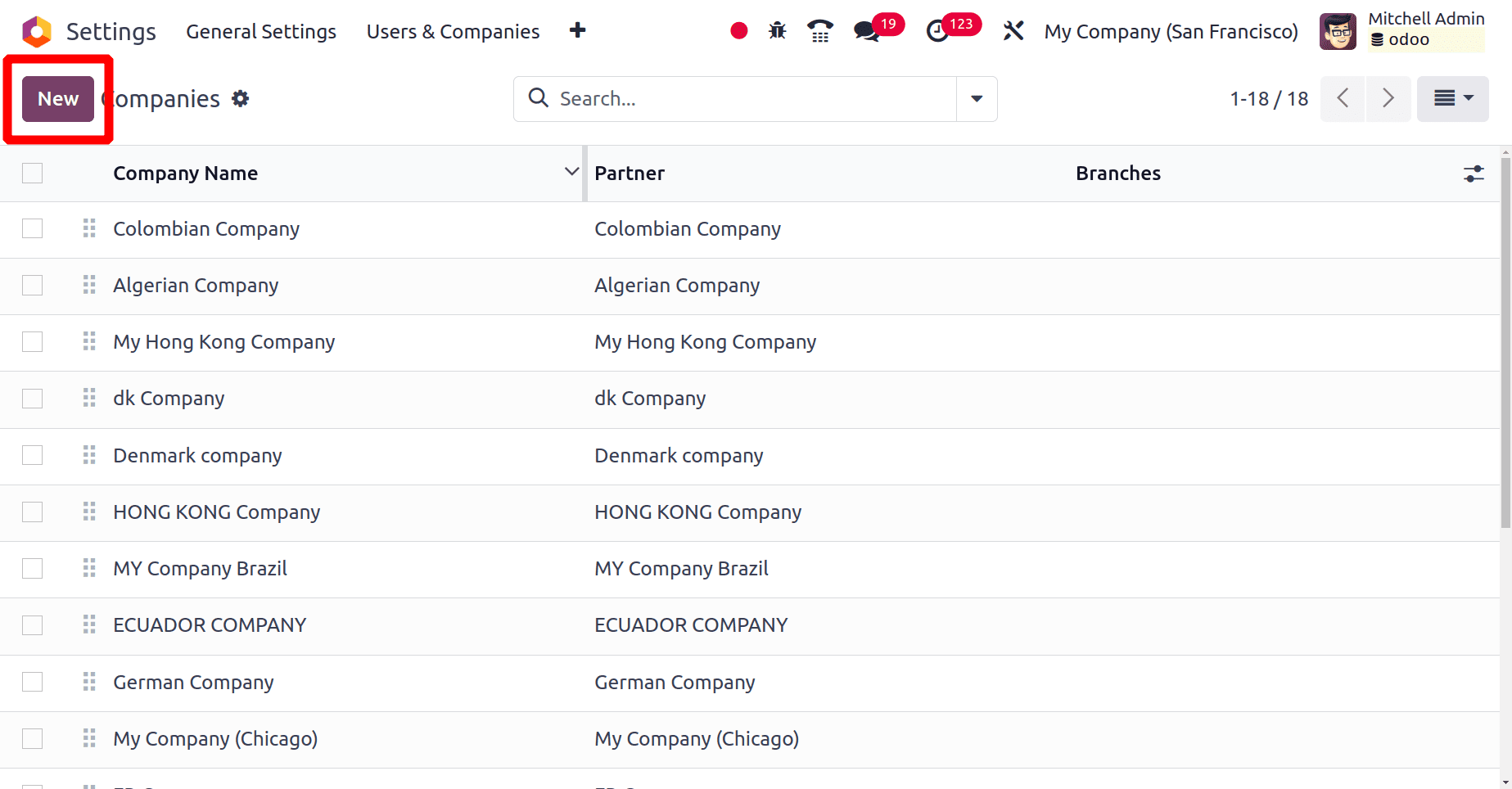

All of the organizations that have already been created can be seen by clicking the "Companies" sub-menu; to add a new company, click the "New" button.

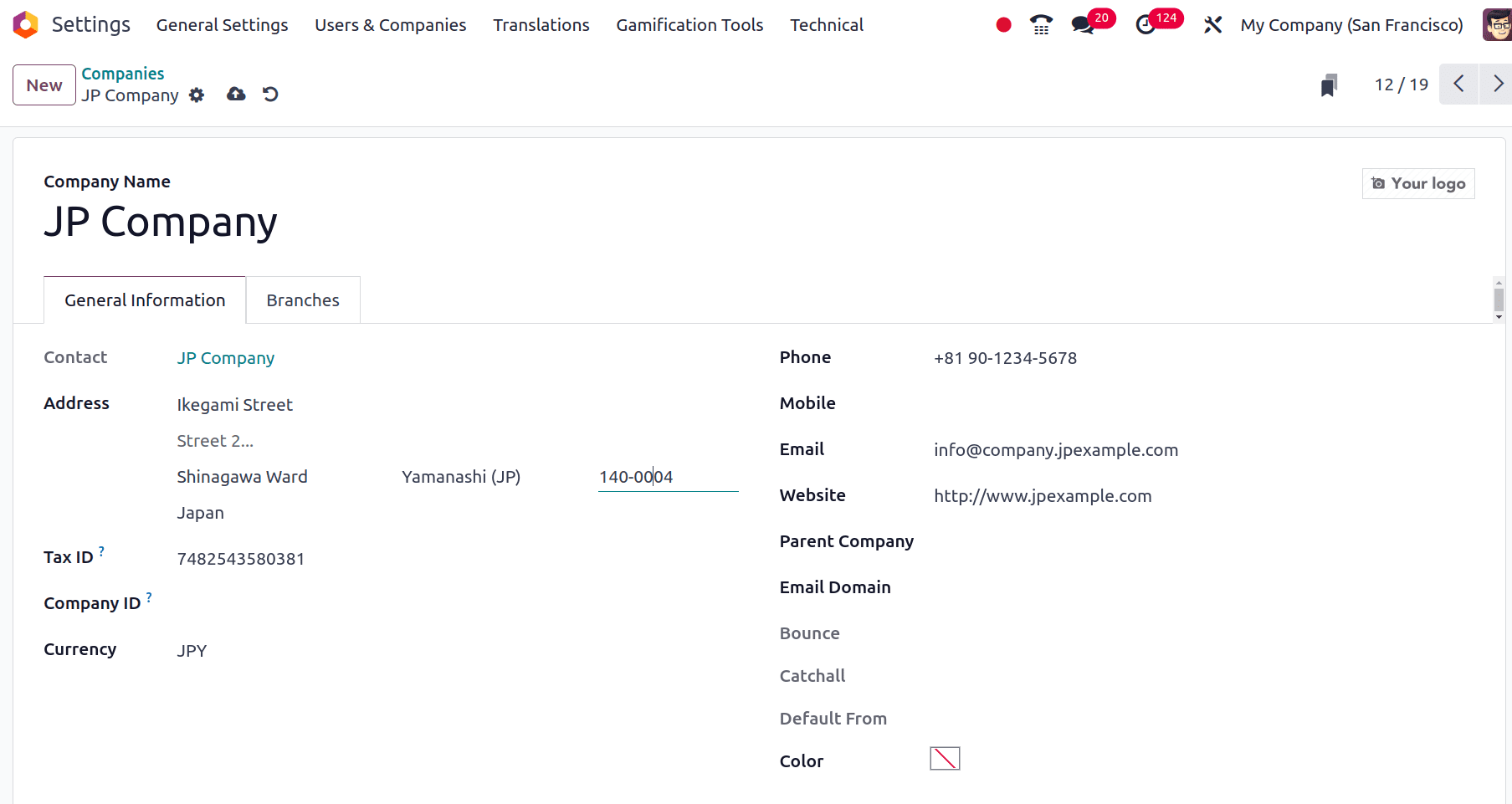

When we click the "New" button, a form with the details of the new company will show up for us to fill out.

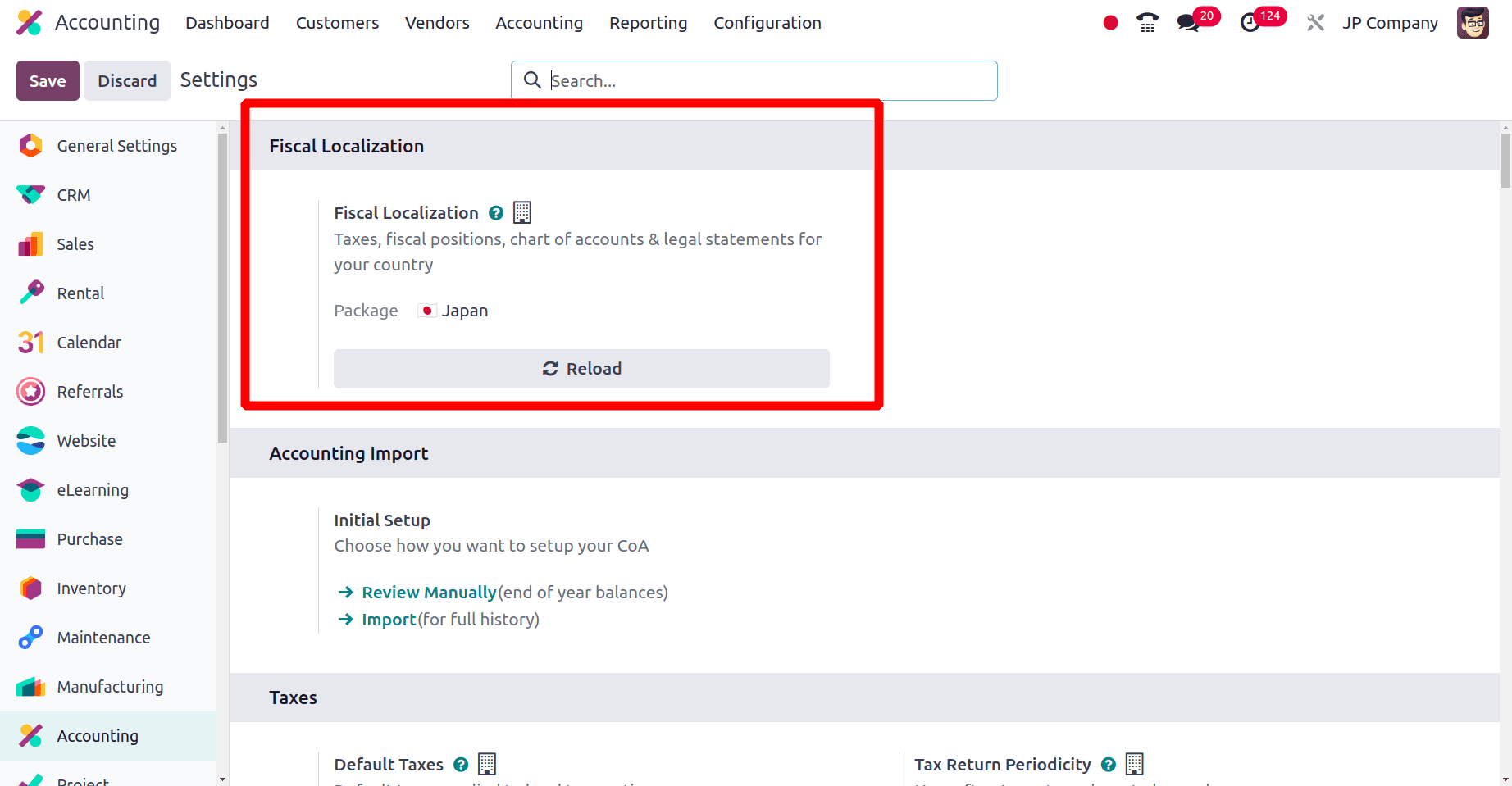

Once all of the options have been made correctly, click the save icon to save the company details. We know that the official currency used in Japan is Japanese Yen (JPY) and once we provide the country name in the address of the company, Odoo directly sets the currency for the company as Japanese Yen (JPY). The next step is to set up the localization package for this company. Open the accounting application in Odoo 17 and choose Configuration > Settings. In the Fiscal Localization section, we may configure the localization package. After choosing Japan as the package, press the "Save" button.

Changes formed when Japanese localization is configured

When the company localization was set to Japanese, a lot of changes were visible. In Odoo, some of the major configurations are Fiscal position, Chart of Accounts, Taxes, Journal, etc. Whenever a localization package is assigned the mentioned properties like CoA, Taxes for operating the business in that country, journals, and fiscal positions are all pre-installed.

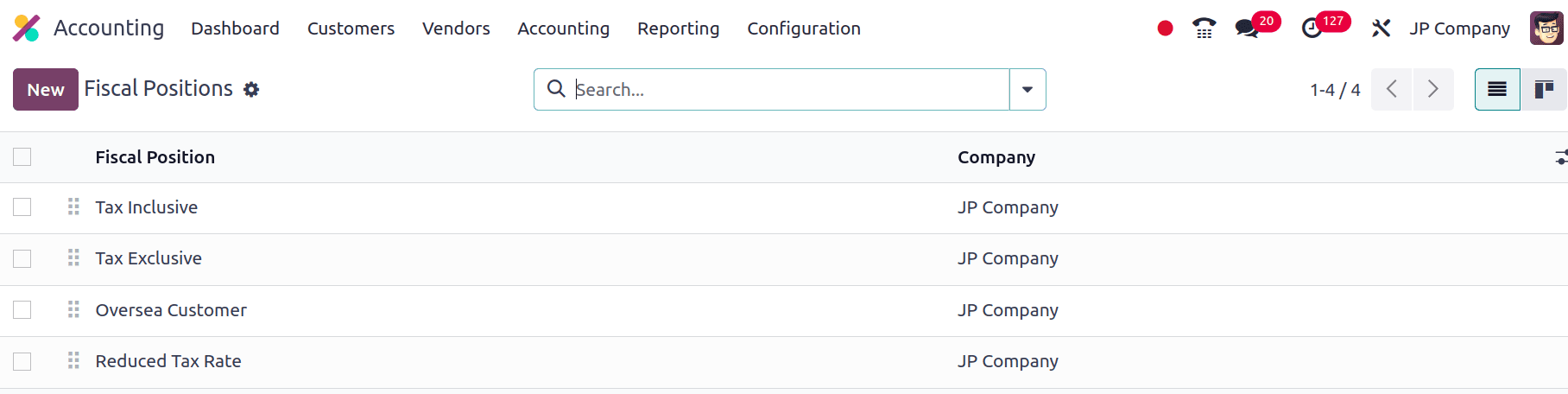

Fiscal position: In Odoo, a fiscal position is a set of rules that define how accounts and taxes are applied to transactions based on several aspects such as the customer's location, the nature of the business, the type of product, etc. To put it simply, it helps manage the tax and accounting challenges caused by many different countries.

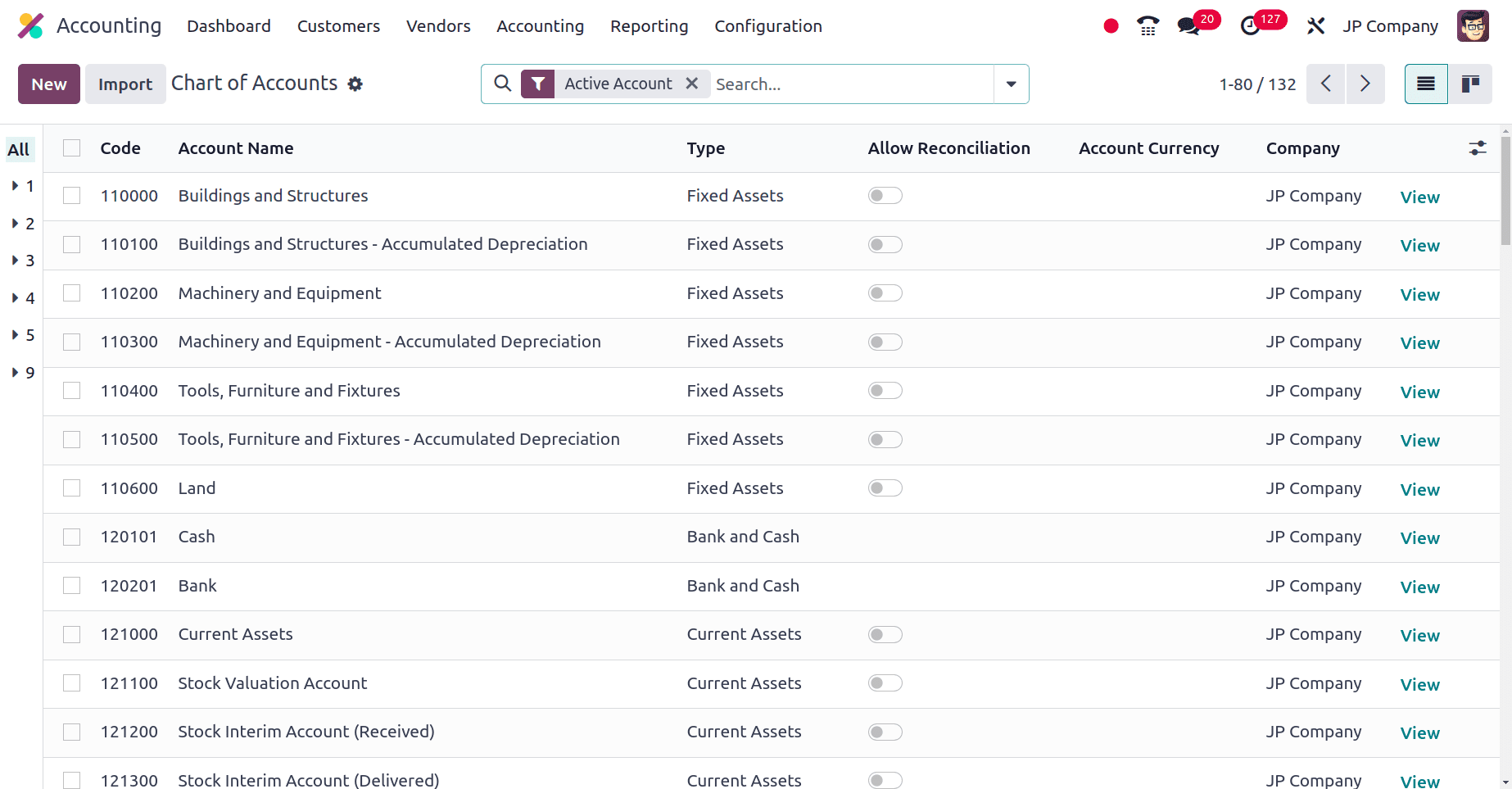

Chart of Accounts: The chart of accounts is an essential component of Odoo's accounting module. It acts as a list of all the accounts you use to monitor your company's financial transactions. Companies from various nations may use different charts of accounts.

The Chart of Accounts used by the companies from Japan is shown in the above screenshot. To create a new Chart of Accounts for this company, click the New button and fill out the details.

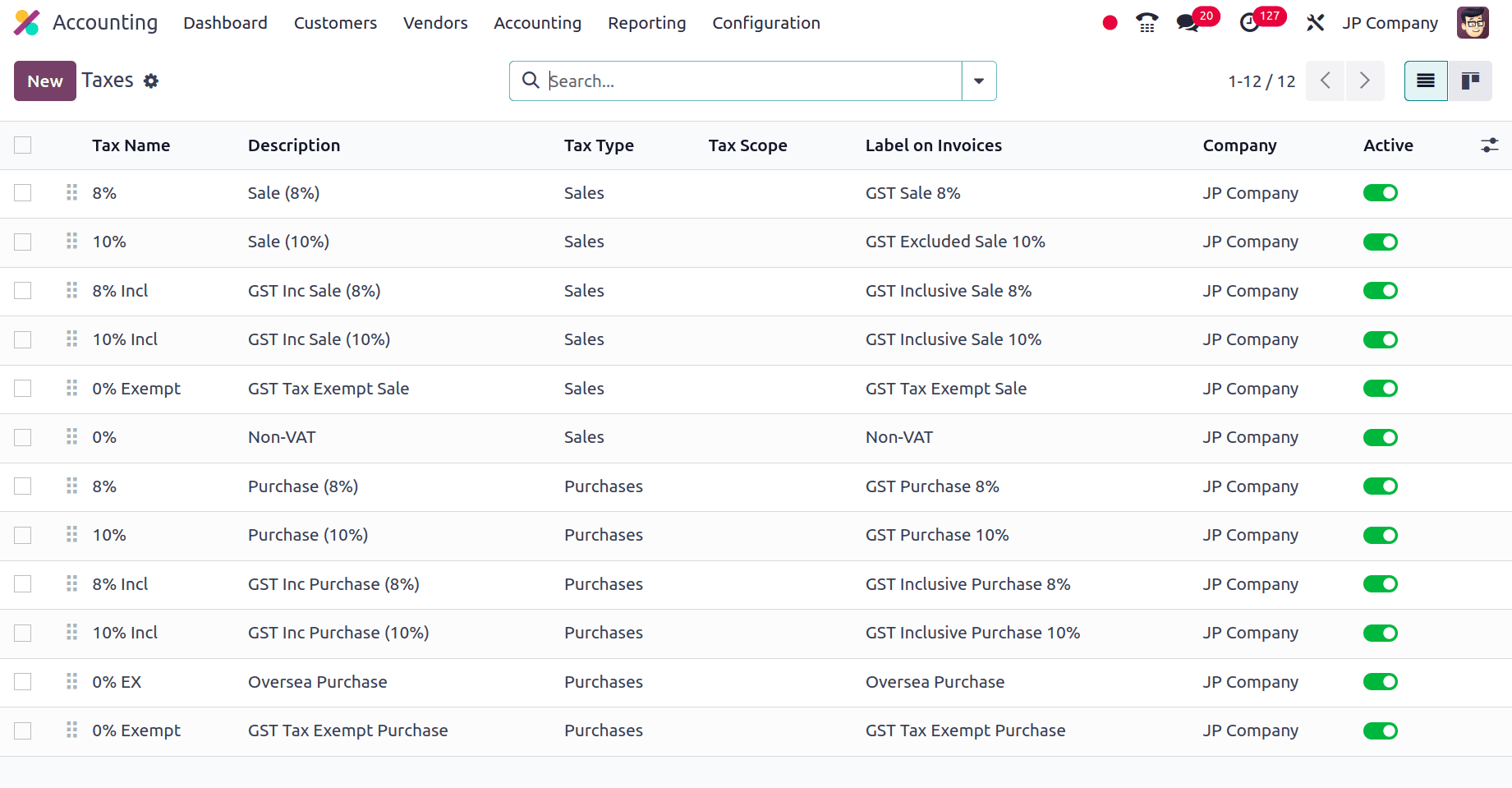

Taxes: Charges imposed on various aspects of a business transaction are known as taxes. With Odoo's tax tools, you can automate tax computations, manage tax compliance, and make sure financial reporting is accurate. In Odoo, you may create multiple tax types, including purchase and sales taxes, along with the rates and conditions that go along with them. Based on the vendor's location and the goods or services being bought or sold, Odoo automatically calculates the applicable taxes when creating purchase orders or invoices. Under the configuration menu of the Accounting application, we have the Taxes sub-menu.

When we click the Taxes sub-menu, we can see all the pre-configured Taxes for this Japanese company, and we can use any of these taxes in our transactions. We can also create new taxes by clicking the New button. Here we can see that there are mainly two different types of Taxes, sales taxes and Purchase taxes. Sales taxes are the tax imposed on products or services while selling them to customers, and Purchase taxes are the taxes imposed on products or services while purchasing them from a vendor.

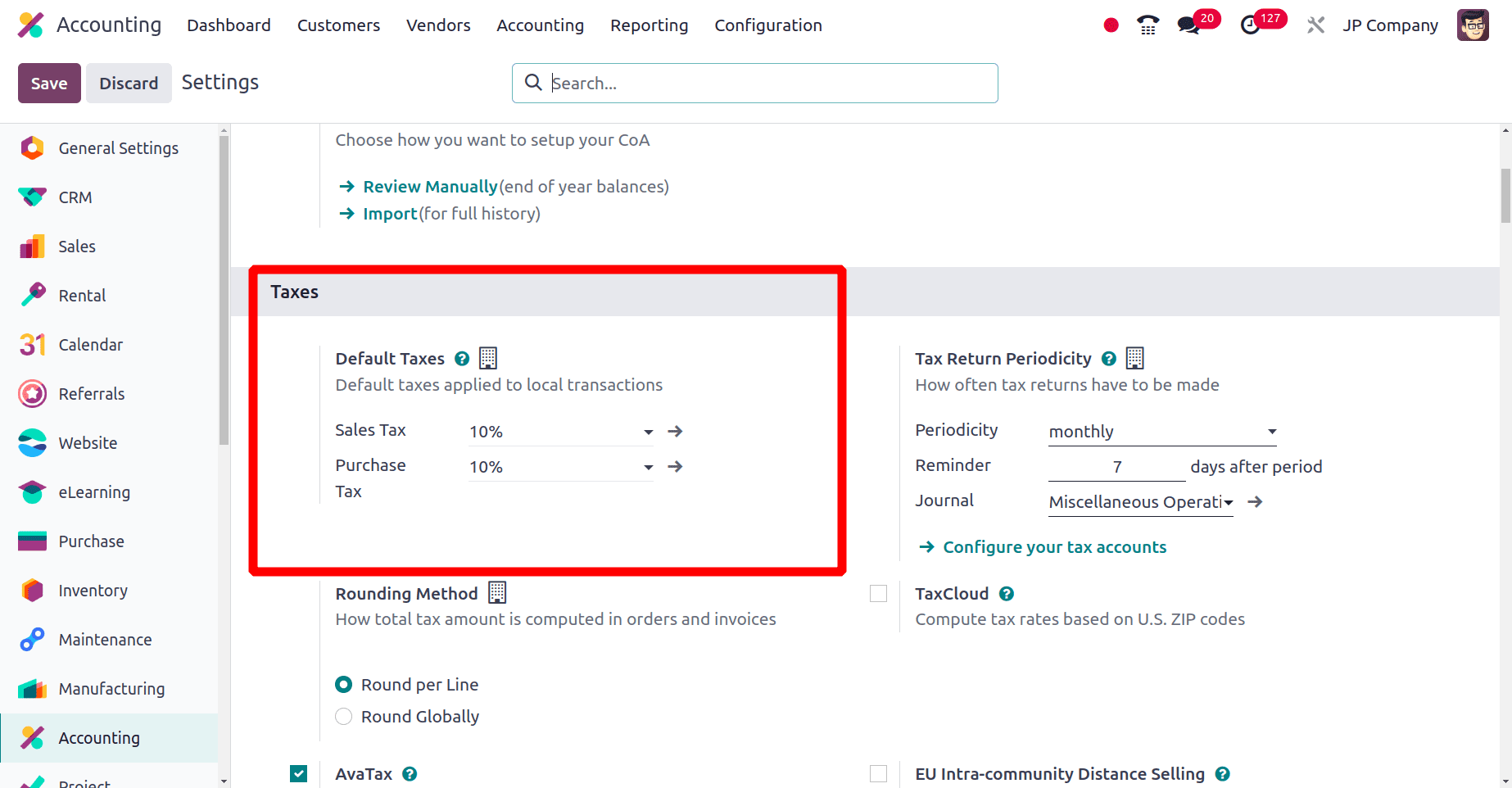

When we move to Configuration > Settings, under the Taxes section, we have the option to set the Default taxes for the company. There we have the option to set this manually or Odoo will set this automatically. Here, Odoo will set the Default Taxes for the company automatically when we set the Localization Package for the company as Japan.

From the above screenshot, we can say that the Default sales tax and the default purchase tax used by the companies in Japan are 10% sales tax and 10% purchase tax. That is all the companies from Japan want to use these taxes as their default tax in their transactions.

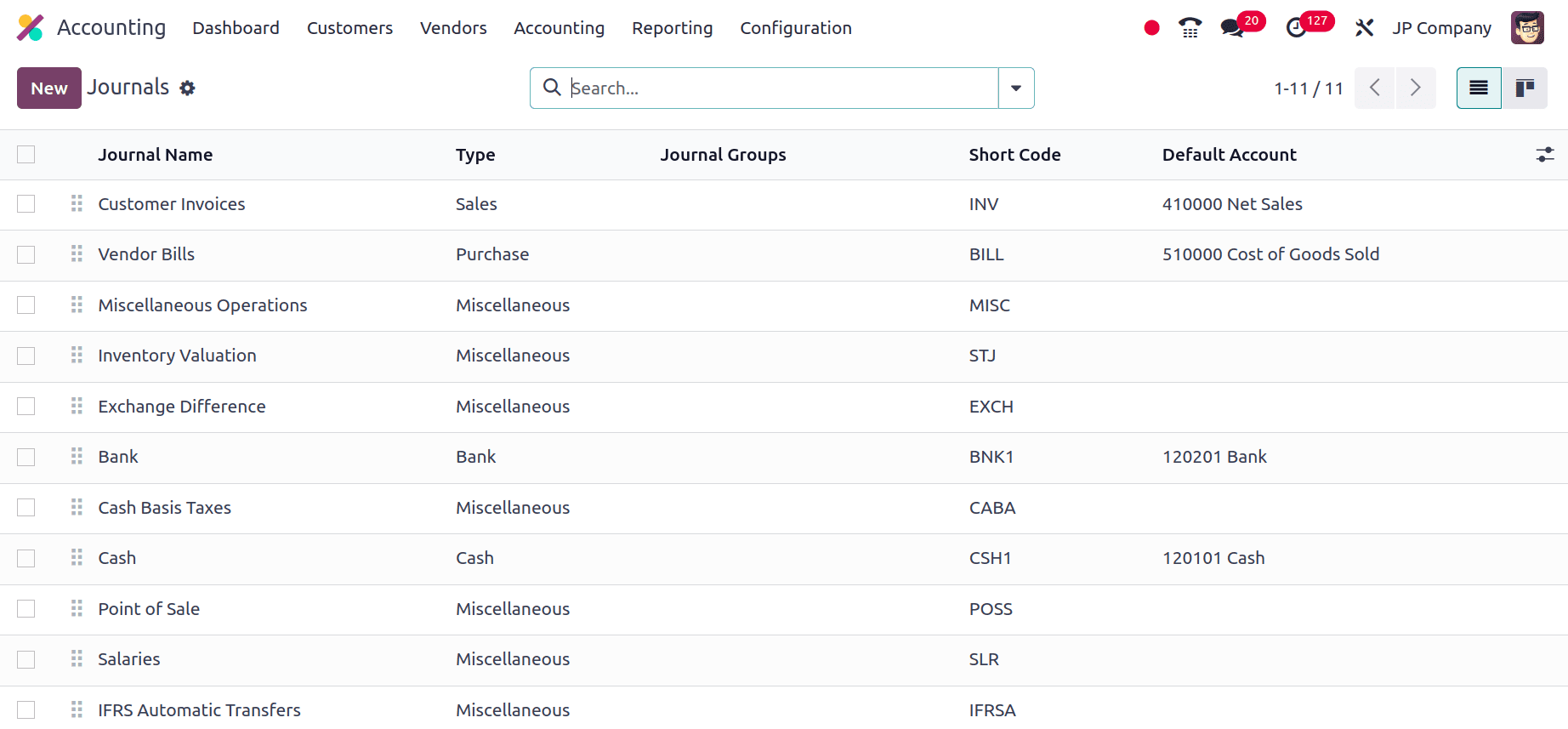

Journals: Accounts of a company use journals for recording financial activities. You can build multiple types of journals in Odoo to manage and organize various aspects of your accounting system. Specific configurations and settings, including default accounts, journal type (such as sales, purchase, bank, etc.), sequence settings, and access rights, can be applied to each journal in Odoo. Within your Odoo instance, these options help in accurately recording and classifying financial activities.

The screenshot above displays the several journals that Japanese companies use. Each of the journals will have an account to keep track of the transactions.

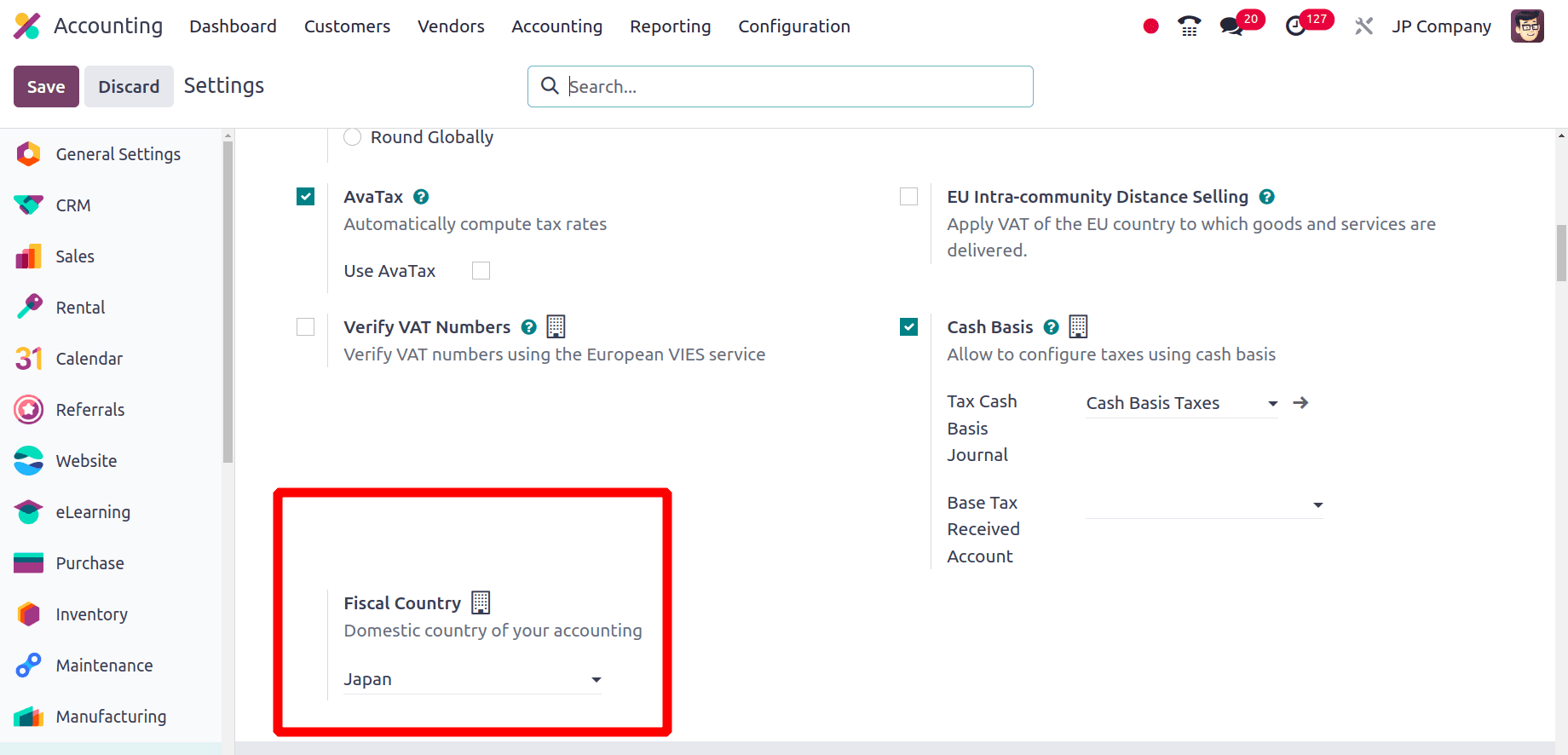

Under the Configuration > Settings of the Accounting application, there is a field to add the Fiscal country for the company under the Taxes section which is the domestic country of the company.

Here, Odoo set the Fiscal country for the company as Japan automatically, because here we have set the Localization Package as Japan.

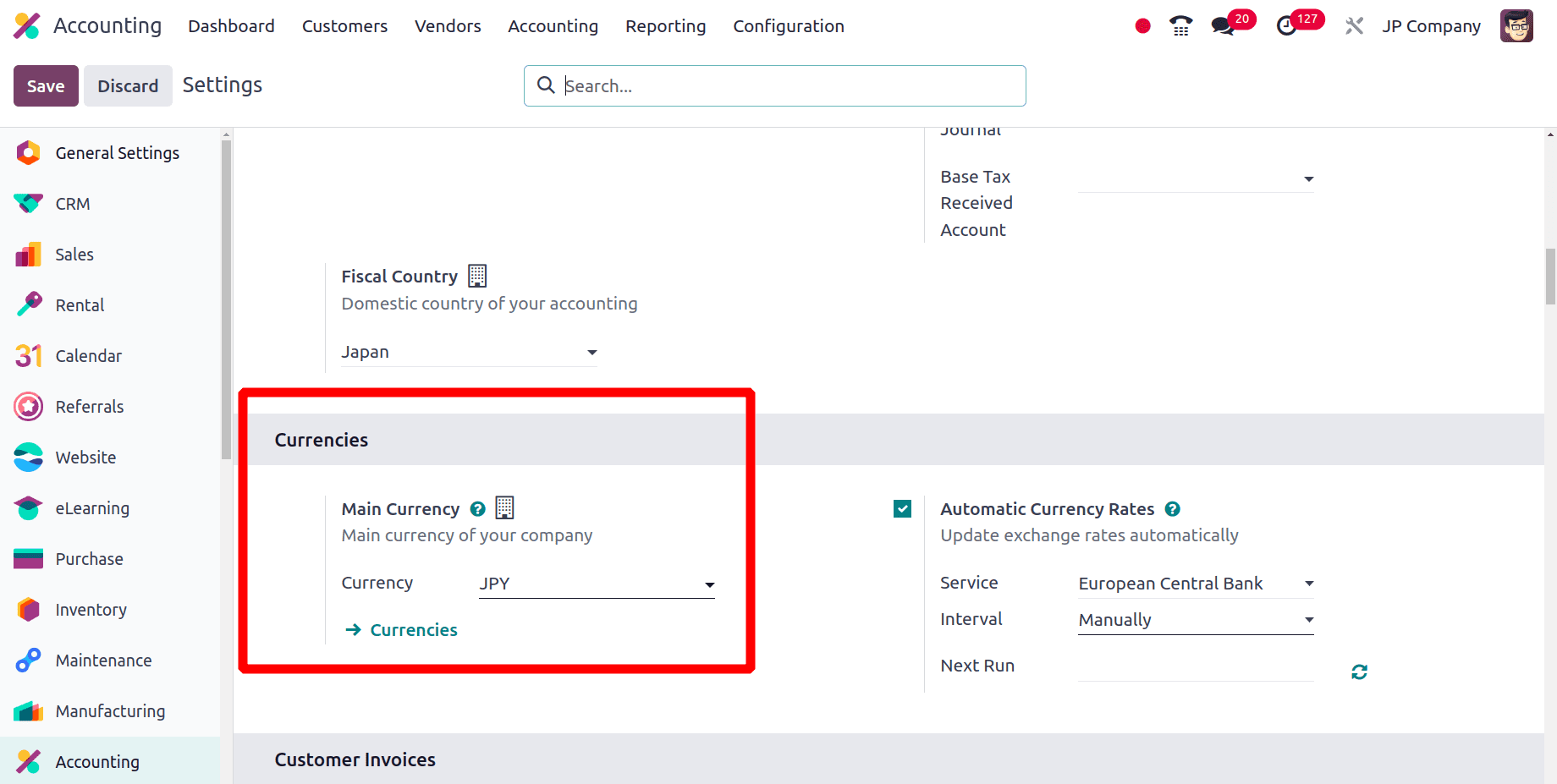

We know that the official currency in Japan is the Japanese yen (JPY) and here in Odoo, we can set the main currency for a company by selecting the main currency under the Currencies section in the Configuration settings of the Accounting application.

Here Odoo automatically sets the main currency for the company as the Japanese yen (JPY) when the Localization Package is set as Japan.

When we move to the Reporting menu of the Accounting application, we can find different reports regarding the company data like Balance sheet, Profit and Loss, Tax Report, etc.

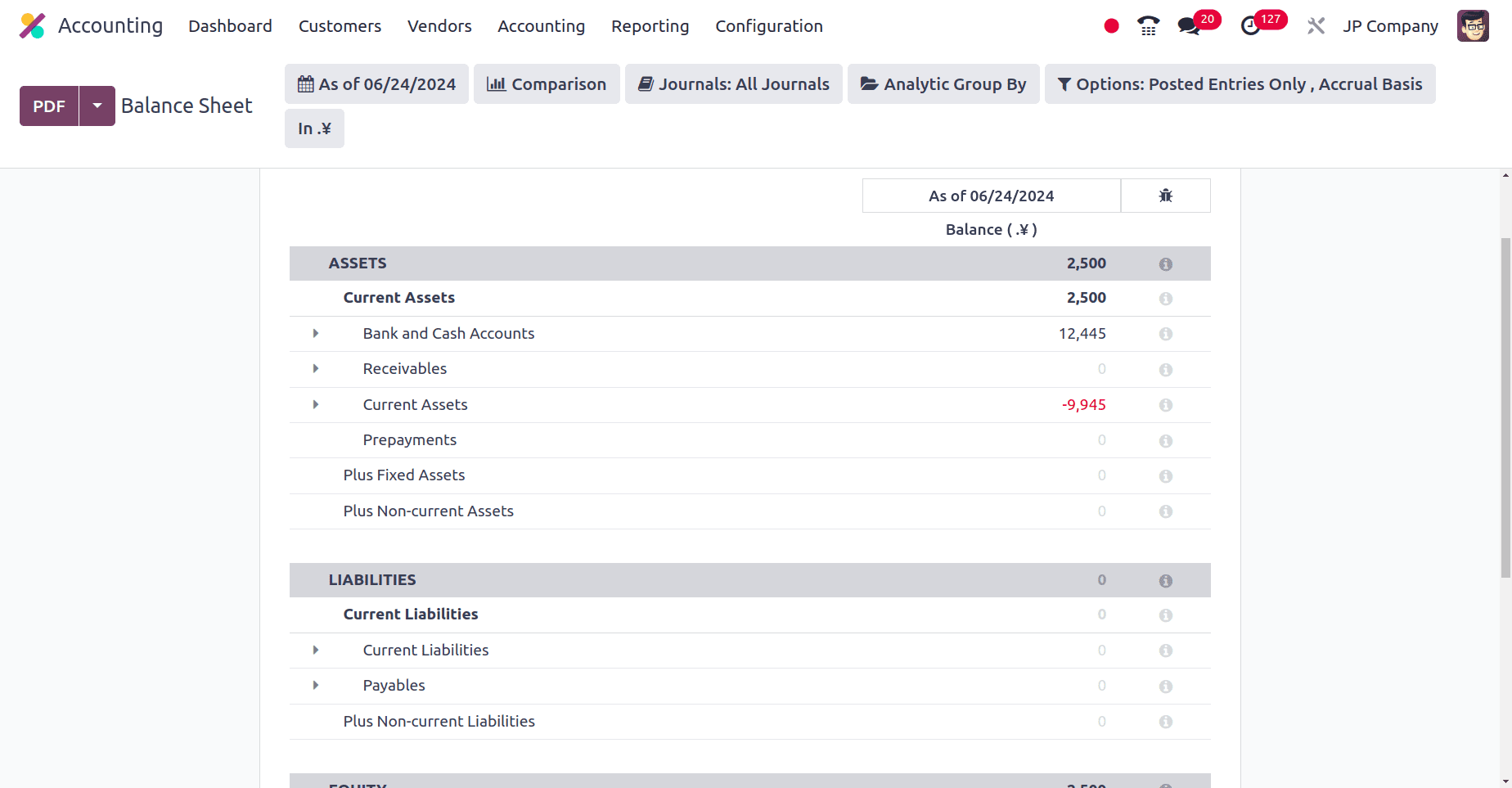

Balance sheet: a balance sheet of a company summarizes the company's financial position by showing the Assets, Liabilities, and Equity of that company.

* Assets: Assets refer to resources that a business or an individual has that are valuable economically and will likely provide future advantages. Assets are an essential concept in financial accounting, and they are usually categorized according to their kind and role in the operations of the company.

* Liabilities: Liabilities relate to financial commitments or debts that a business owes to other parties. The amounts owed by the business to lenders, suppliers, creditors, and other organizations are represented by liabilities, which are listed on the balance sheet.

* Equity: Equity is a company's remaining share in its assets after its liabilities have been subtracted. It is a crucial part of the balance sheet that shows the ownership stake of the shareholders and offers information about the entity's performance and financial situation.

Bank and Cash Accounts, Receivables, Current Assets, Prepayments, Plus Fixed Assets, Plus Non-Current Assets, etc are included in the assets section of the Balance sheet. Current Liabilities, payables, Plus Non-Current Liabilities, etc are included in the Liabilities section of the Balance Sheet. Current year Unallocated Earnings, Current Year Earnings, Current Year Allocated Earnings, Previous Year Unallocated Earnings, and Retained Earnings are included in the Equity section of the Balance Sheet.

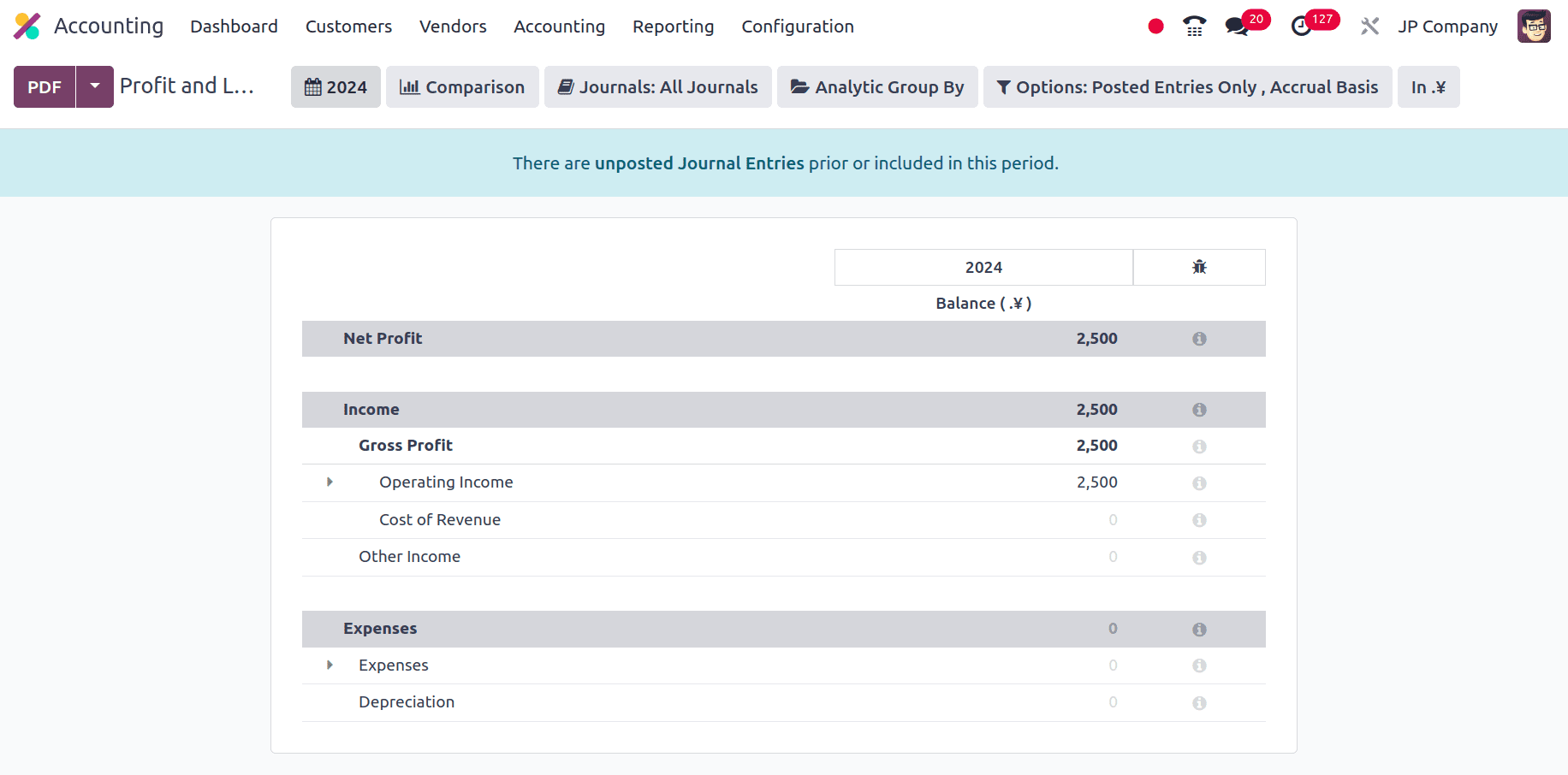

Profit and Loss: Under the Reporting Menu, we have the Profit and Loss report of the company. A Profit and Loss report of a company is a type of financial statement that lists a company's payments, expenses, and net profits or losses for a given time period. It gives an overview of the business's financial performance over that time and is crucial for determining how profitable the business is.

he profit and Loss report of the company from Japan mainly includes Gross Profit, Operating Income, Cost of Revenue, Other Income, Expenses, Depreciation, etc.

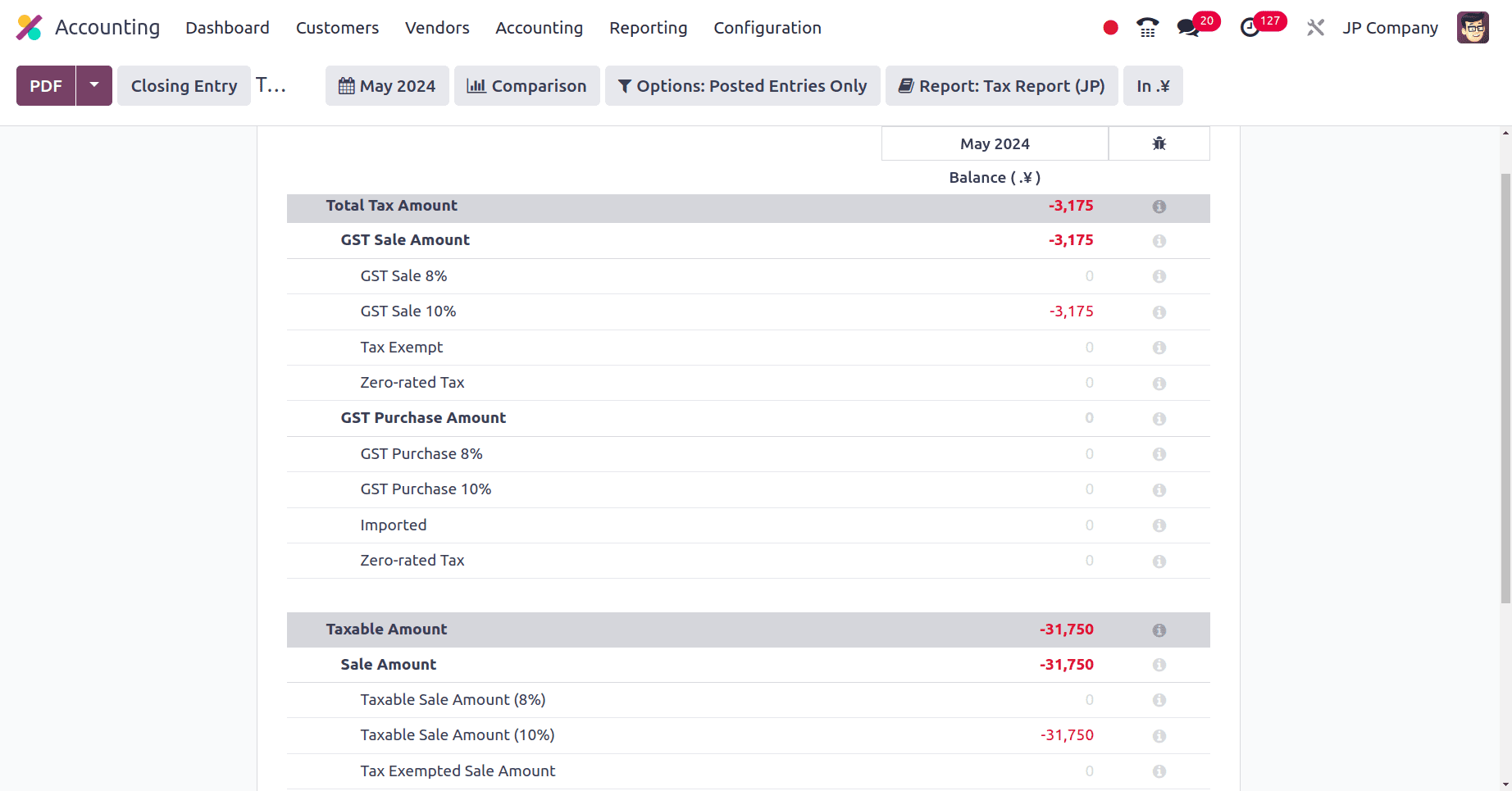

Next, we can move to the Tax Report of the company from Japan. Under the Reporting menu, we have a Tax Report sub-menu. On clicking the Tax Report sub-menu we will get the Tax Report of the company.

Here the above screenshot shows the tax report provided by odoo for this company from Japan in a specific period. GST Sales Amount, GST Purchase Amount, Sales Amount, Purchase Amount, etc are included in the odoo 17 Tax Report.

So here we have completely discussed the features when Japanese Accounting localization is configured in Odoo 17. It is now clear that Odoo 17's Japanese transformation makes sure that intricate Japanese tax laws are followed. This enables us to generate financial reports that adhere to national guidelines and are easily understood by stakeholders and financial institutions in Japan. All things considered, the accounting localization of Odoo 17 for Japan provides companies doing business in the area with a complete solution. It guarantees adherence, streamlines procedures, enhances precision and facilitates better-informed financial decision-making.

To read more about An Overview of Accounting Localization for Greece in Odoo 17, refer to our blog An Overview of Accounting Localization for Greece in Odoo 17.