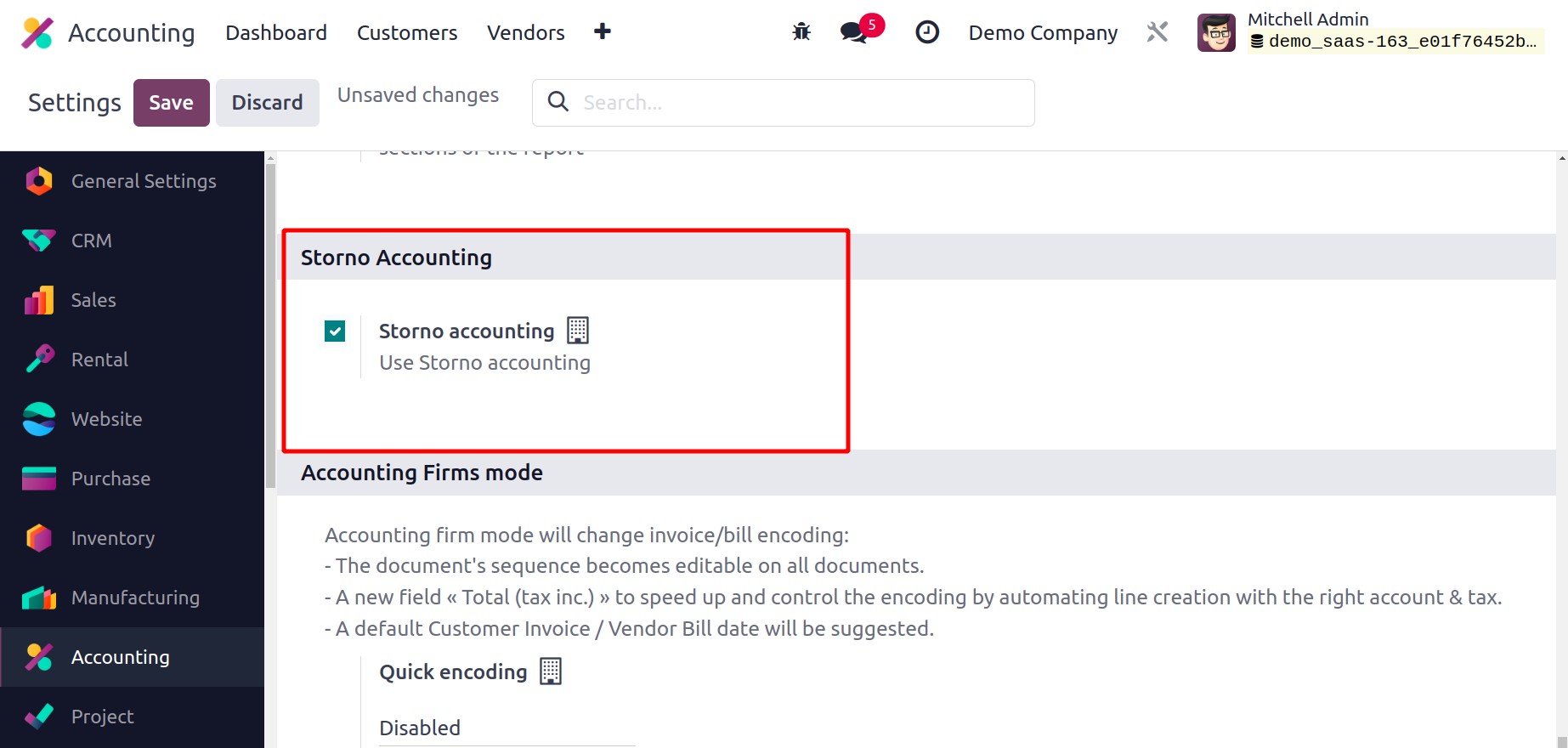

Storno Accounting

Odoo17's newest accounting function is called Storno Accounting. With this technique of

accounting, the initial journal entries will be reversed using negative credit or debit

amounts that are recorded in your account. This procedure makes it easy to remove a file

that contains inaccurate accounting information about the reported amount.

You are in charge of entering the actual amount of information to assure accuracy after

canceling the incorrect accounting record.

If Storno accounting is being used, Odoo17 will make a copy of the original entry, and

you can see that the amount mentioned in the reverse entry will be shown with a negative

sign.

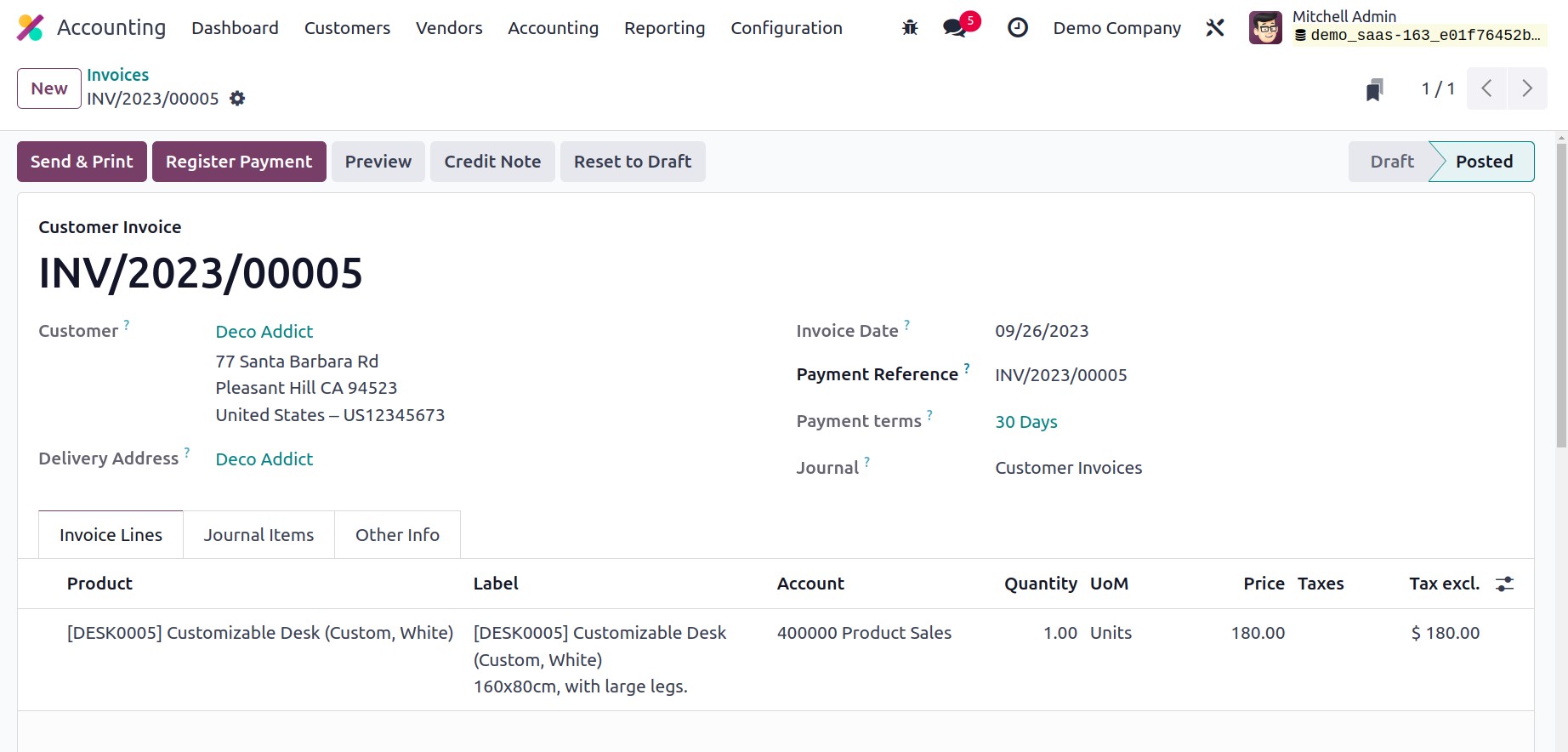

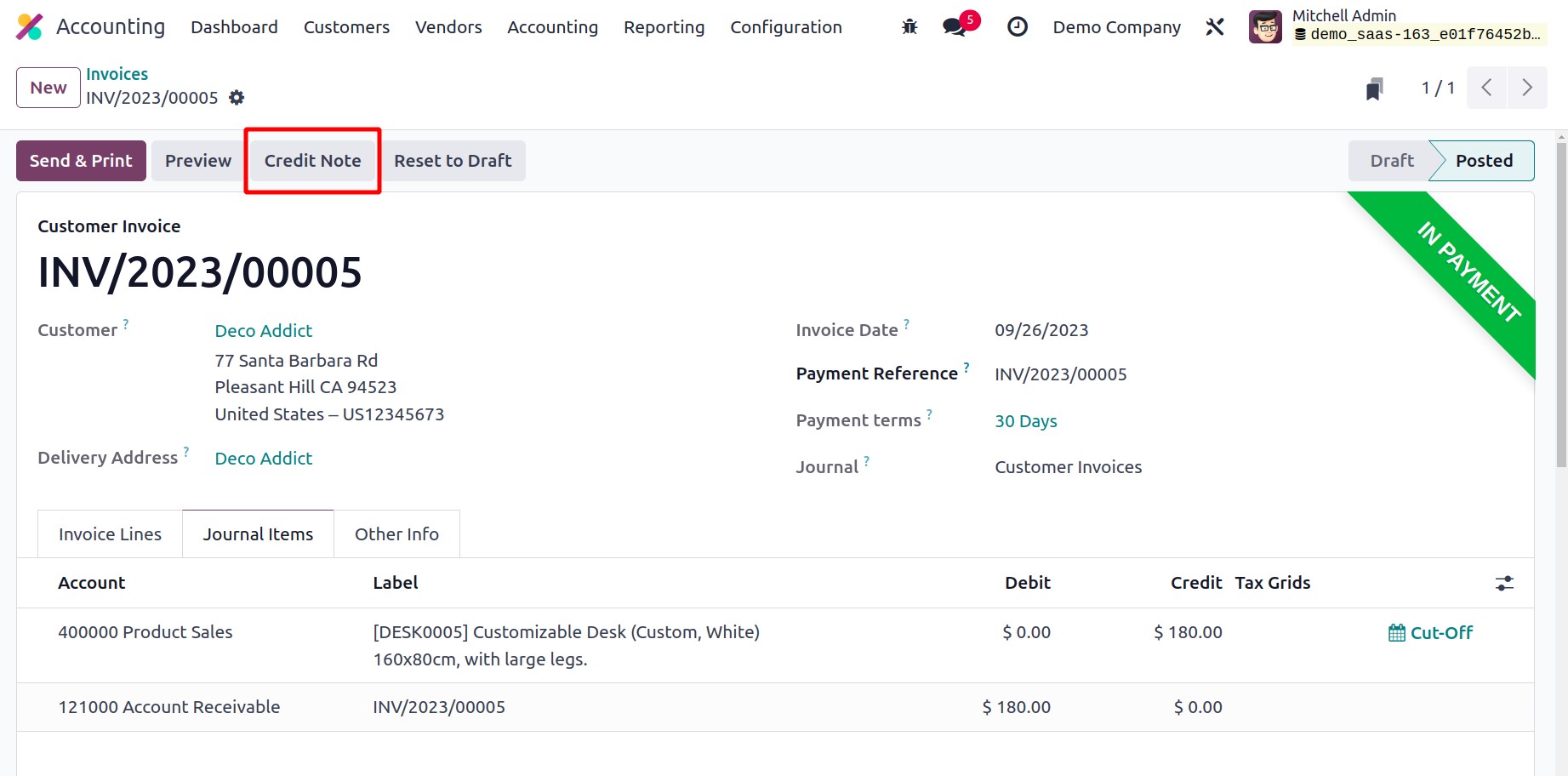

Let's use an illustration to talk about this accounting feature. Consider that you have

a $180 invoice that has already been posted. You noticed that the payment was intended

to be $160, but was accidentally recorded as $180. In this case, you must create the

original entry in Storno. You can construct a valid invoice for the sum of $160 after

reversing the entry.

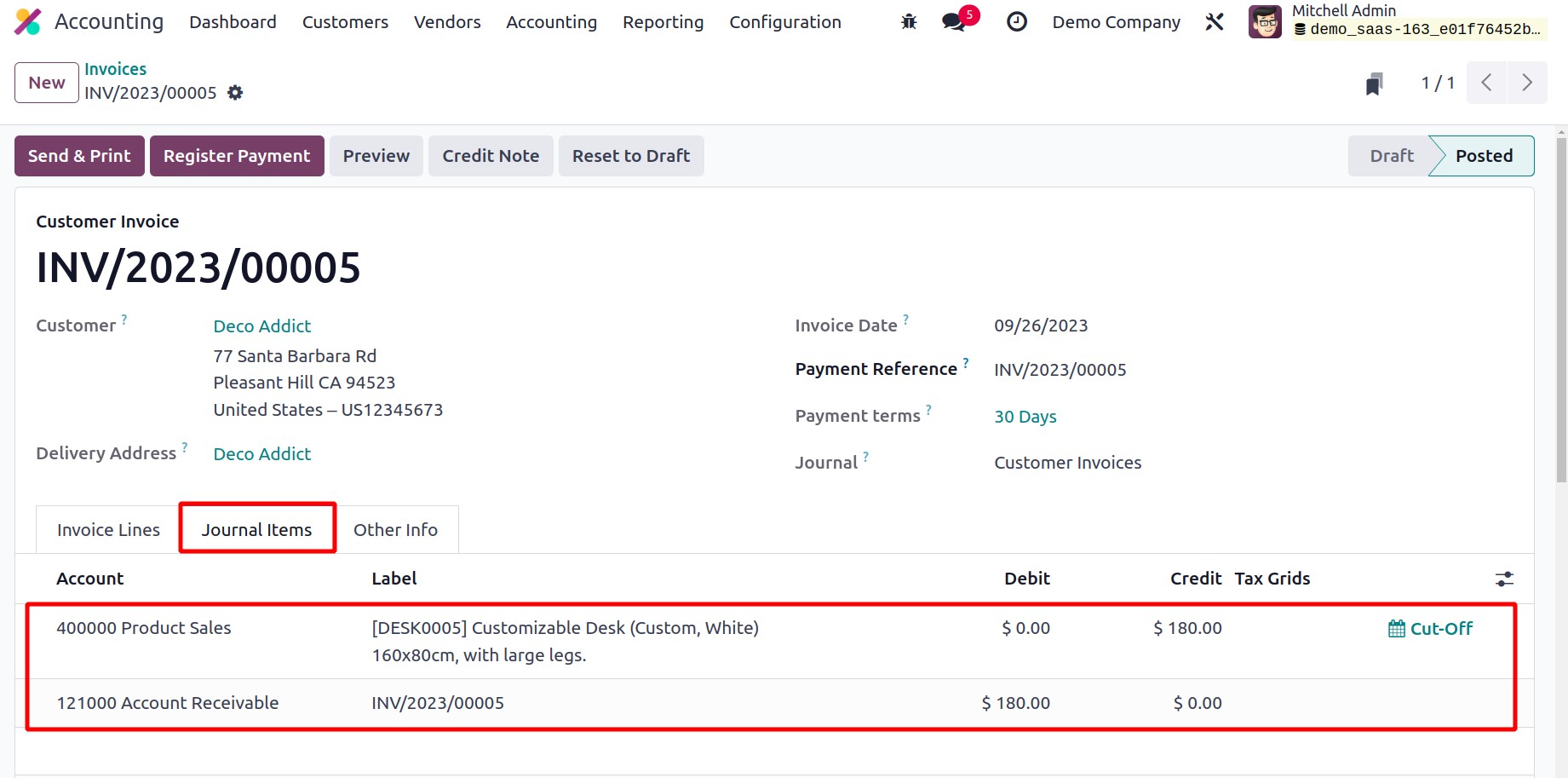

The $180 invoice may be seen in the screenshot. The relevant tab, as illustrated below,

contains the journal entries for this invoice.

You can find the posted journal items for the amount as stated below by looking through

the journal entries in your accounting module.

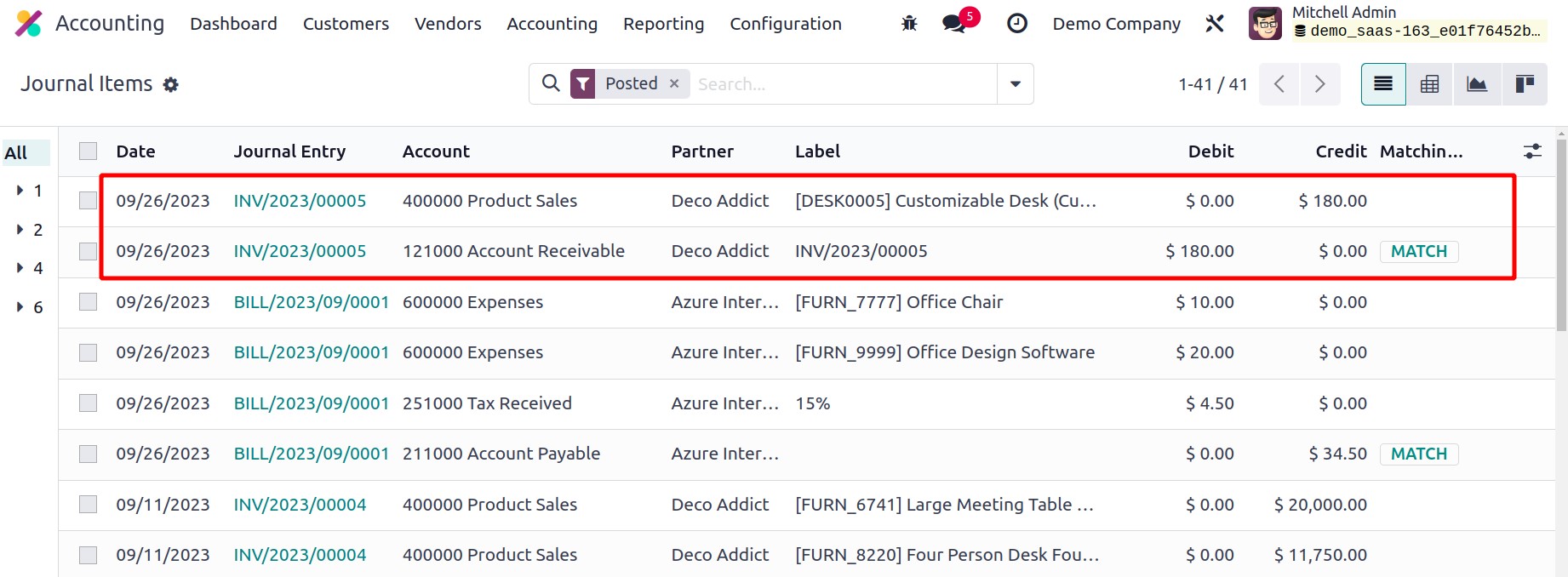

Since the invoiced amount differs from the actual amount, we will now reverse the entry.

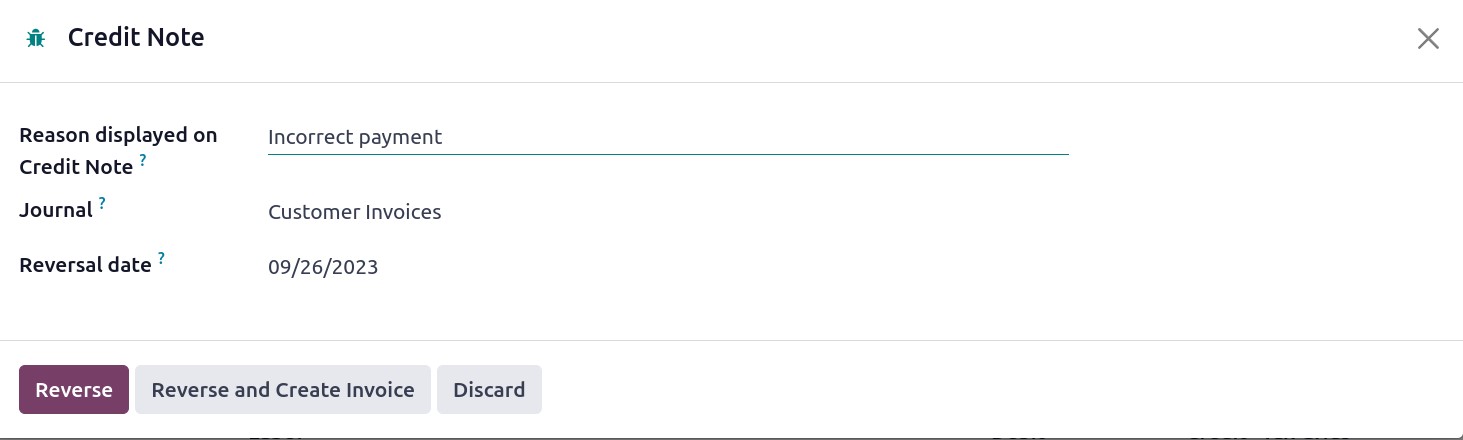

A pop-up containing the credit note's specifics will appear after clicking Add Credit

Note.

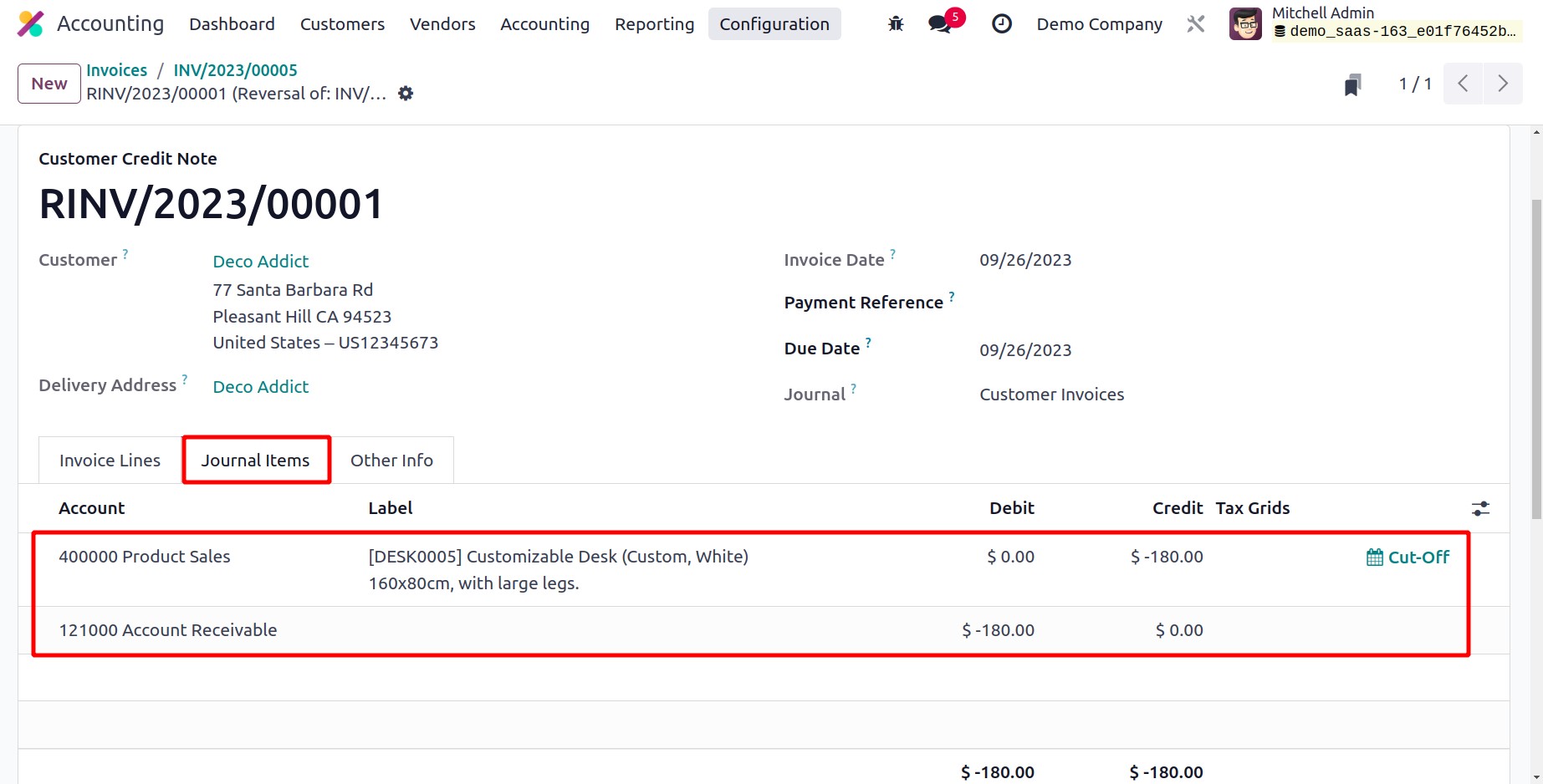

You can select the Reverse button after providing the essential information. As seen in

the example below, the uploaded journal entry will be reversed, and the amount will be

noted in the journal items with a negative sign.

You can charge the correct amount after reversing the journal entry.

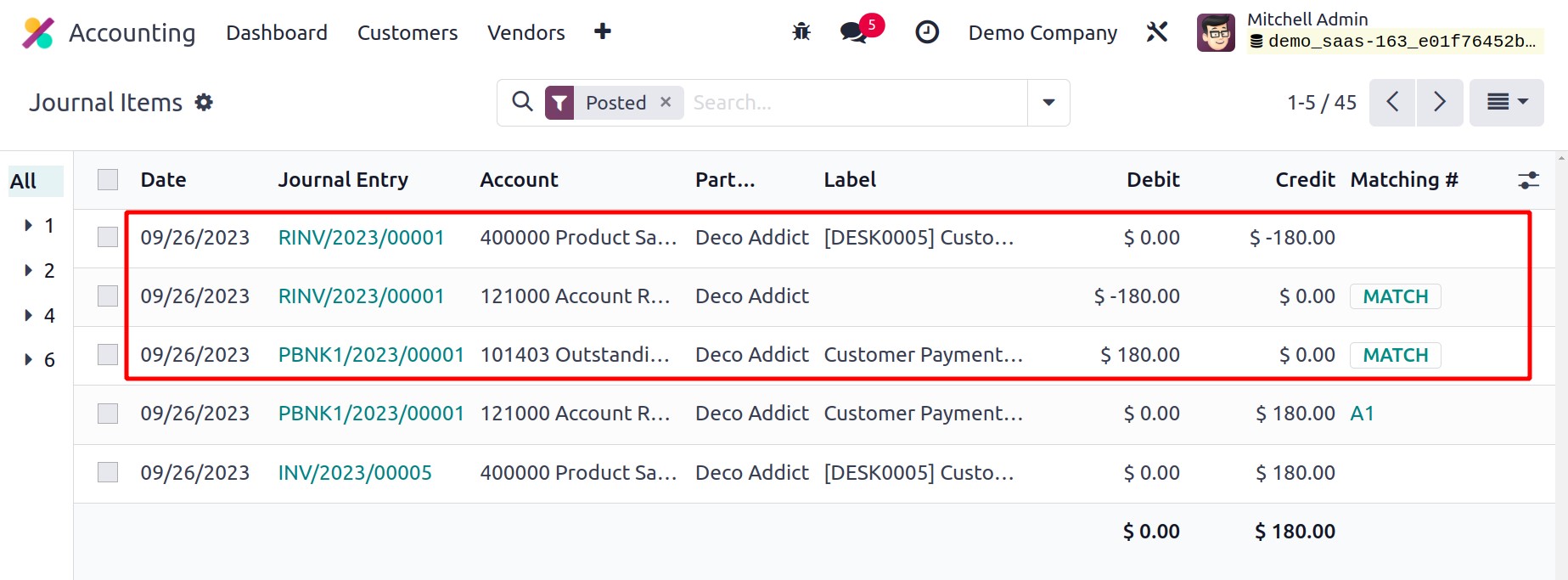

As seen in the figure above, the Accounting Module’s Journal Items menu provides the

journal entries for the wrong invoice, Storno, and proper invoice.