Reporting

Any type of business needs reports to understand how operations are progressing and to

analyze workflow. A clearly defined reporting platform will streamline the analysis

process and assist you in making decisions under pressure-filled circumstances. Reports

are crucial for gaining insight into the real-time management of finances in the context

of internal financial activities within a corporation. We will go into detail about the

reporting options provided by the Odoo Accounting module in this section.

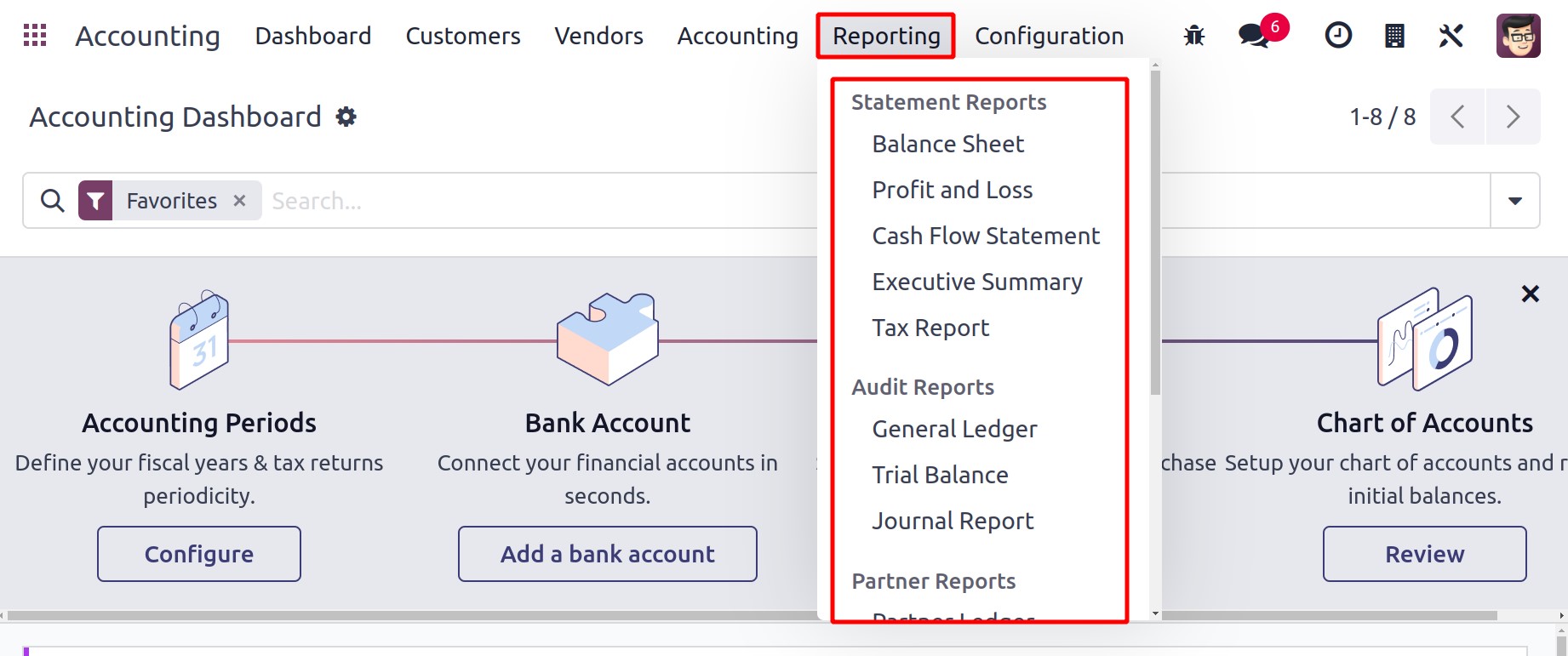

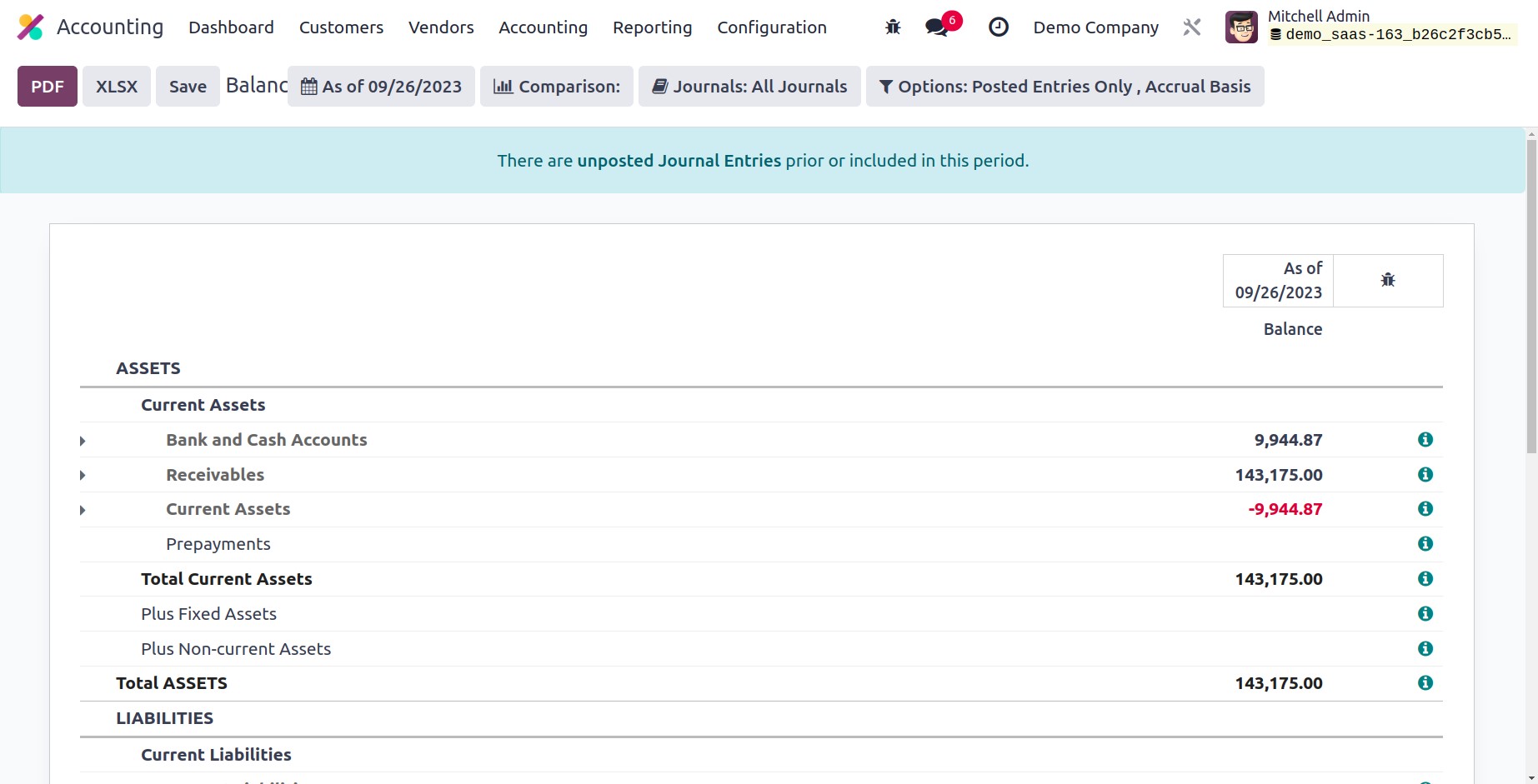

Balance Sheet

The Balance Sheet report gives the user access to information about an organization's

asset, liability, and equity at one time. By utilizing the additional functionalities

provided by Odoo, you may produce customized reports. By choosing that date on the small

calendar icon shown on the screen, it is able to obtain the balance sheet for that

specific date.

The Comparison tool can be used to compare the reports to the prior timeframe. You can

choose a specific journal from the Journals option if you want the balance sheet report

for that specific journal. You will also have access to some sophisticated filters that

will allow you to order the accessible data in accordance with your needs.

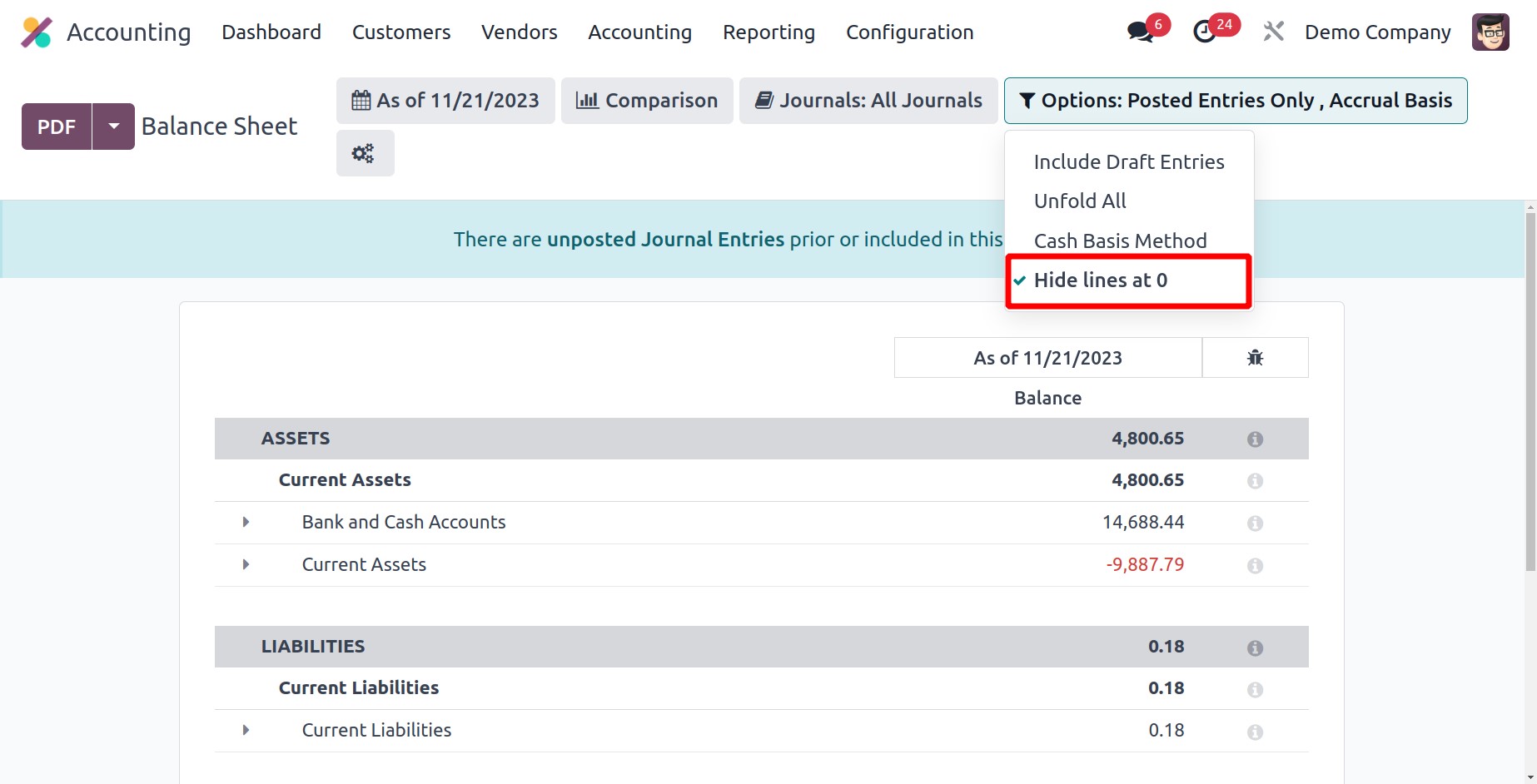

Hidelines at '0' is a new filter that Odoo 17 introduced. This specific filter can be

used to hide a line in a report that has a value of zero.

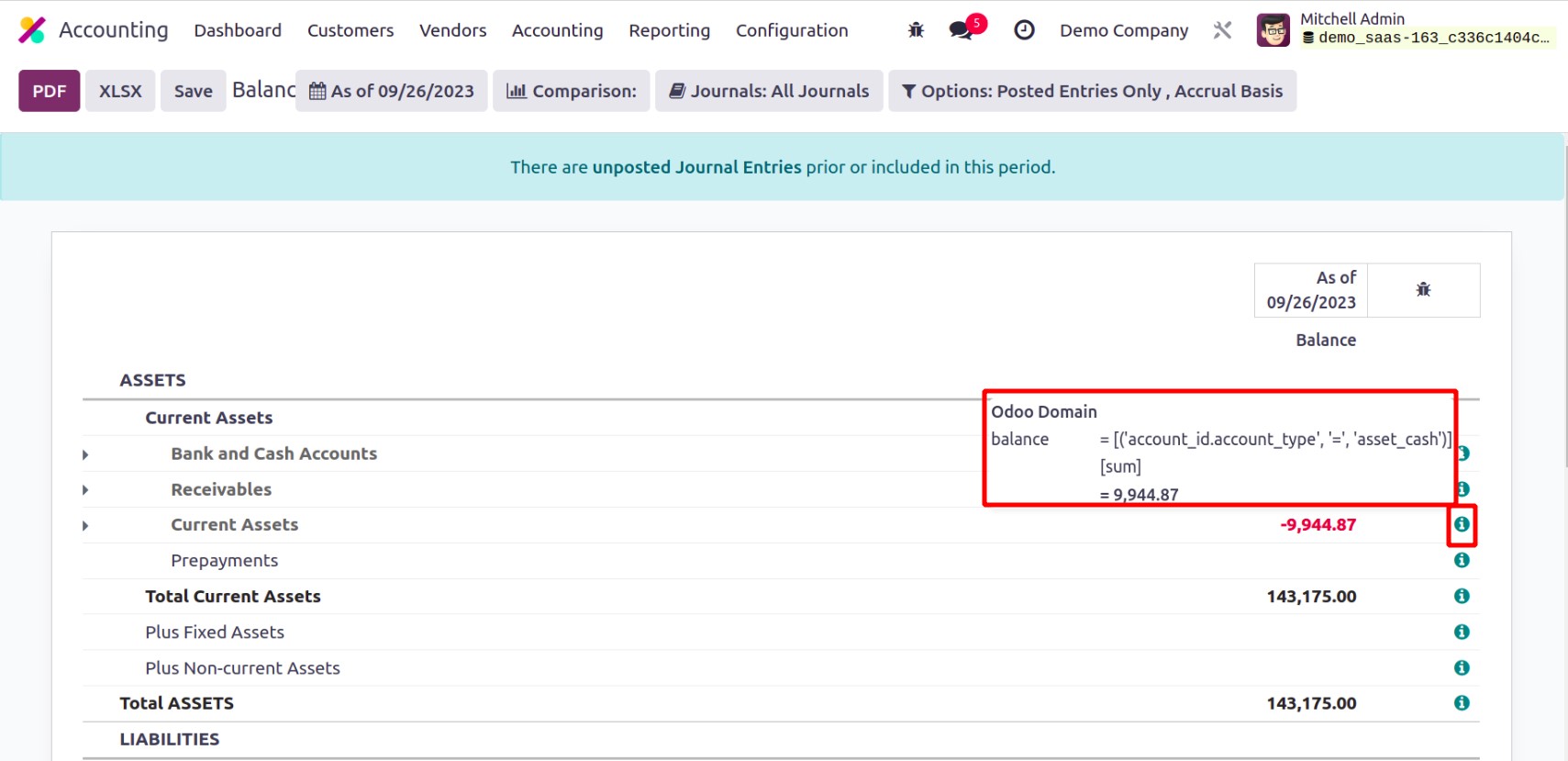

An 'i' will appear at the end of each reporting line as shown in the figure below after

the developer mode is activated.

This option will display the reporting line's corresponding calculation formula.

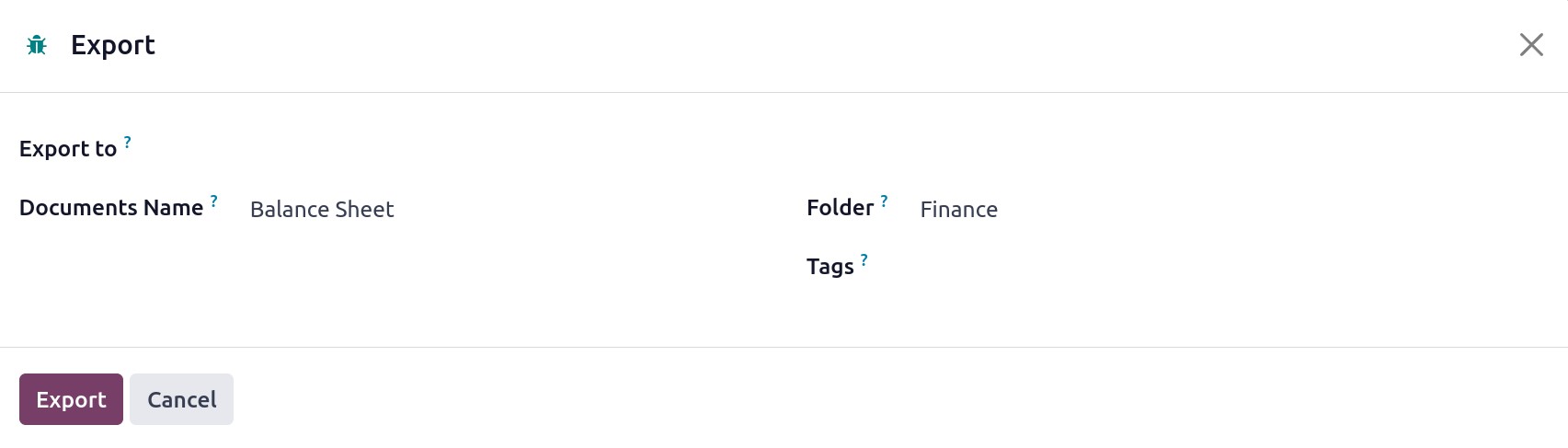

You can change the data's format by choosing the PDF and XLSX choices. You

will find a Save button in the Odoo17 Reporting platform to export the document

as a PDF or XLSX to the Document module in Odoo17. A pop-up window similar to the one

below will appear when you click the Save button.

You can specify the file's document format in the Export to area. Either PDF or XLSX are

acceptable. The produced document's name will be displayed in the window. Select the

destination folder for this document file, then click the Export button.

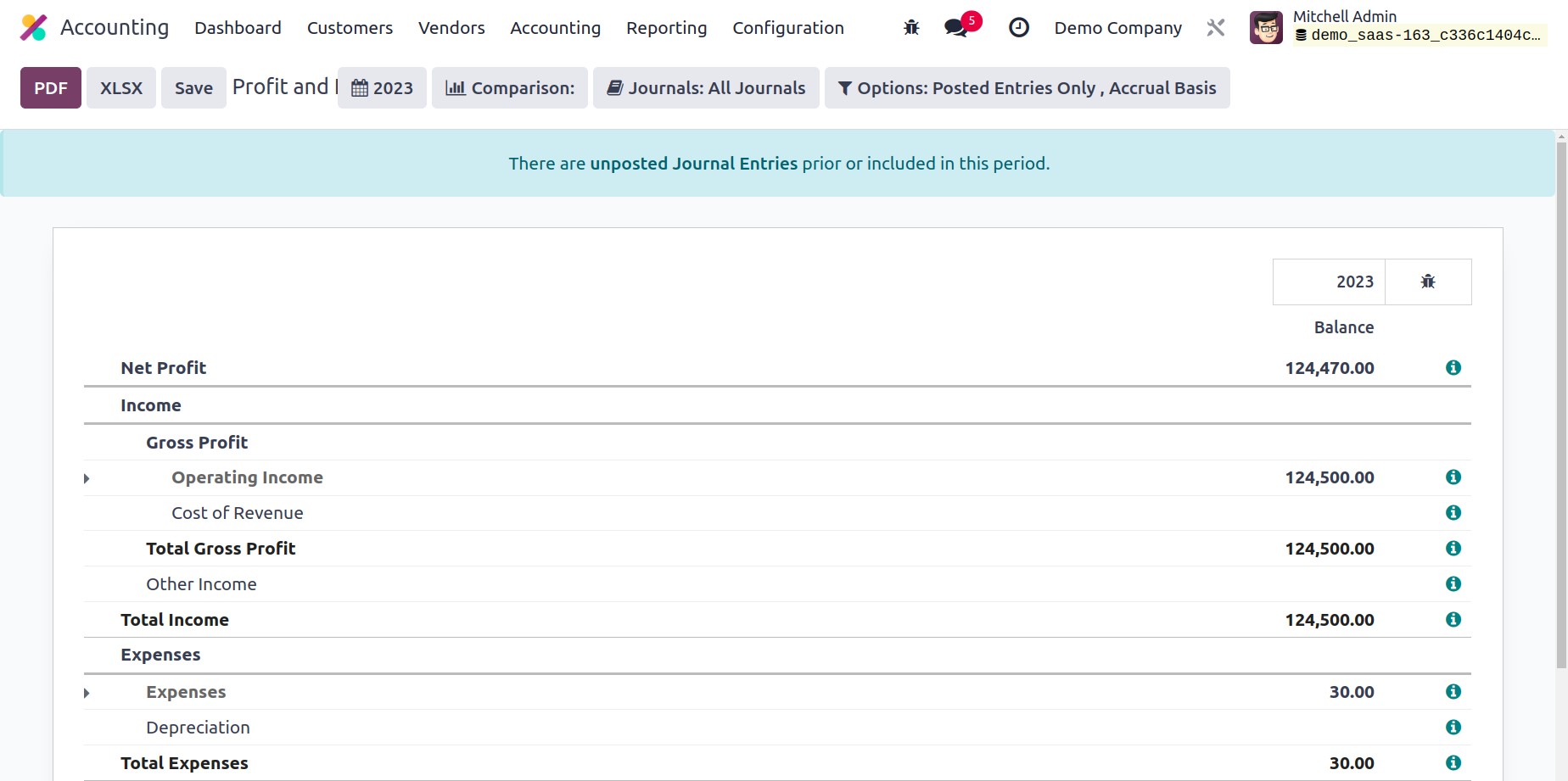

Profit & Loss

The most crucial aspect of financial reporting is the reports of income statements. You

may find the organization's revenue, costs, profit, and loss for a specific time period

in the Profit & Loss reporting platform. Unlike the balance sheet, the ending balance of

the profit and loss report for the chosen time period will not be carried over to the

following accounting period.

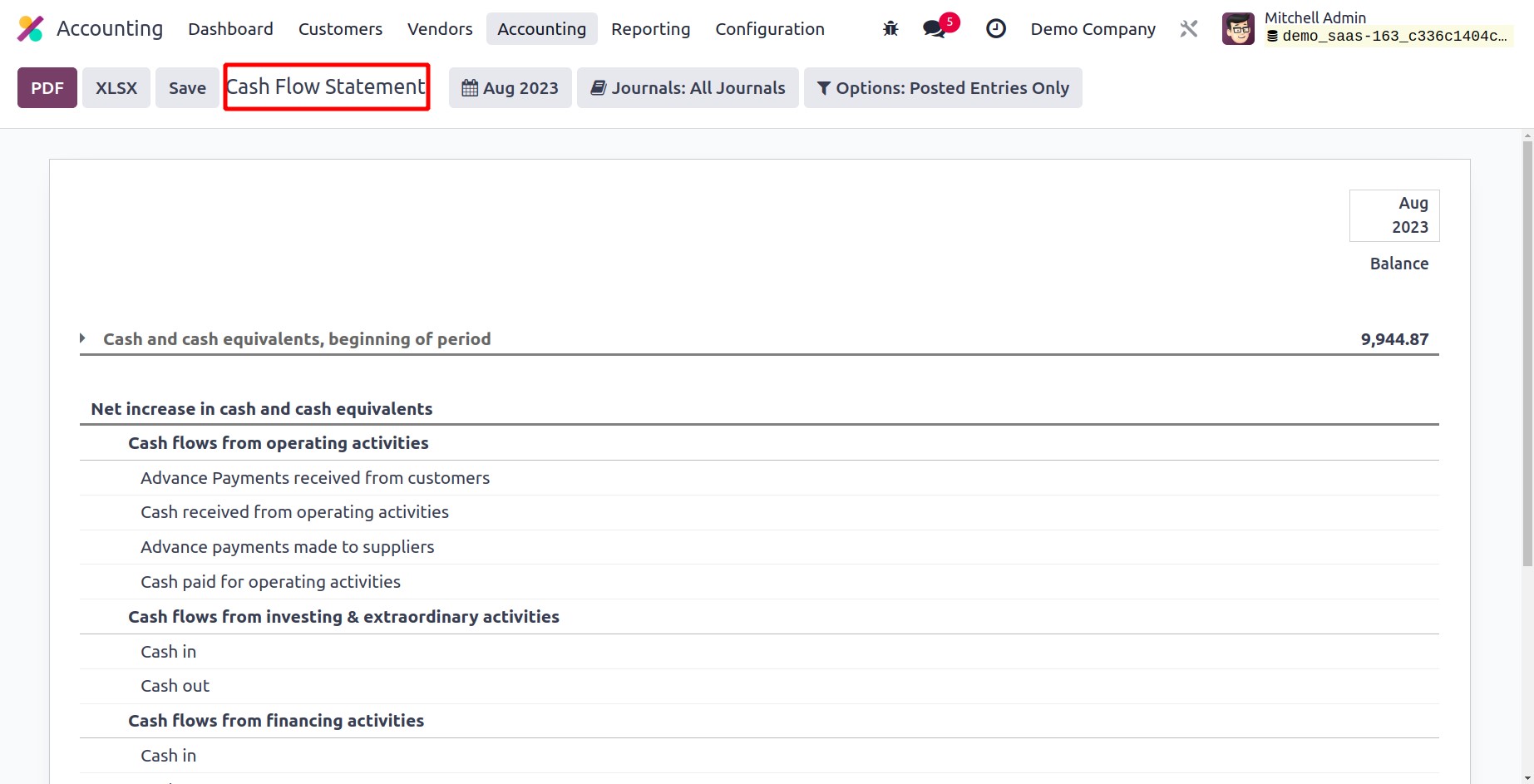

Cash Flow Statement

The financial statement for all cash inflows and outflows will be provided by the cash

flow statement reporting. The accounts you set up for the cash flow statement invoice

will be the basis for these reports. You will receive reports on the cash flow statement

based on operating, investment, and financial operations.

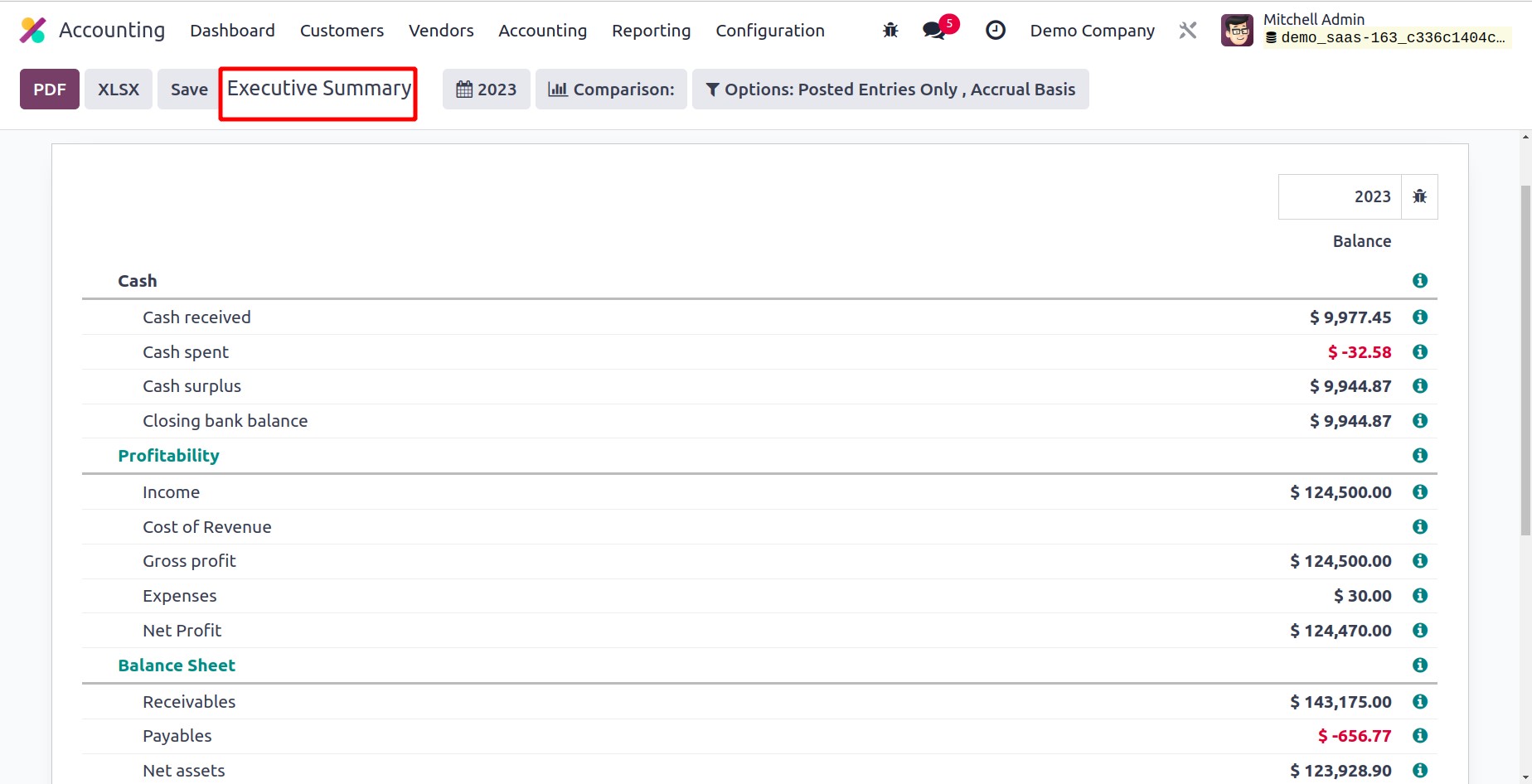

Executive Summary

The cash flow, profitability, and balance sheet reports for a specific period are

summarized on the Executive Summary platform, which is accessible from the Reporting

menu. The Performance tab also provides information on Return on Investment, Gross

Profit Margin, and Net Profit Margin. You may view the Average Debtors Day, Average

Creditors Days, Short Term Cash Forecast, and Current Assets to Liabilities under the

Position tab.

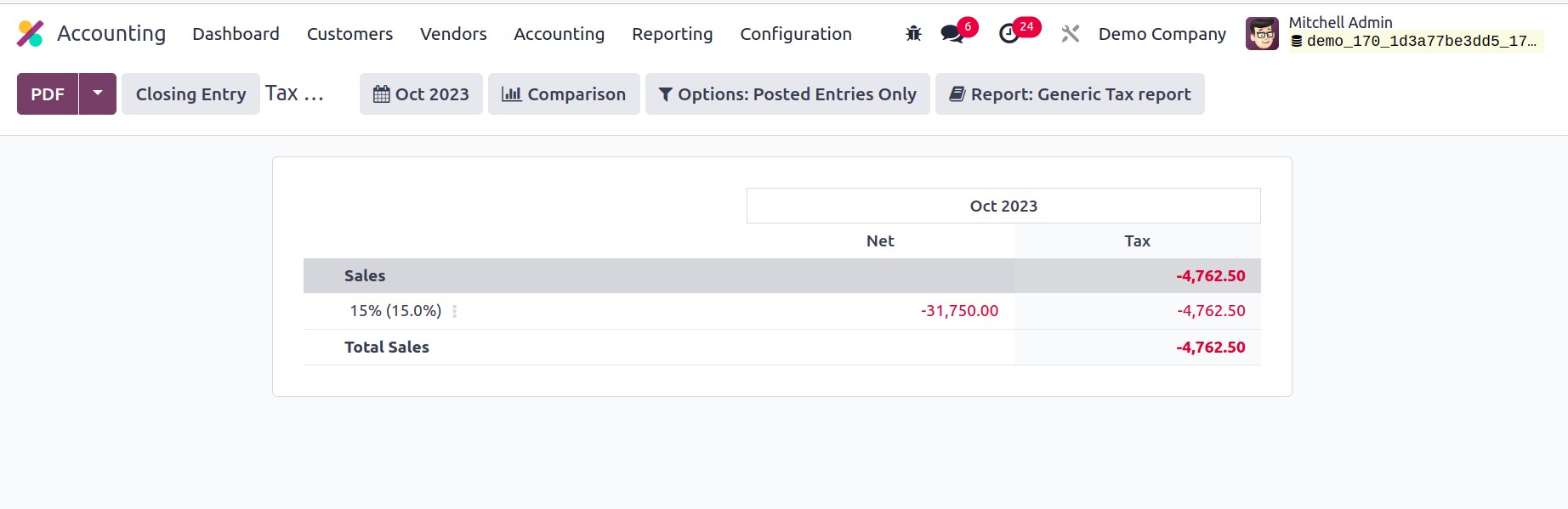

Tax Reports

The Tax Reports platform, which is accessible via the Reporting menu, may produce

thorough reports on sales and purchase taxes. You can submit the return tax for the

chosen period using the Closing Entry option.

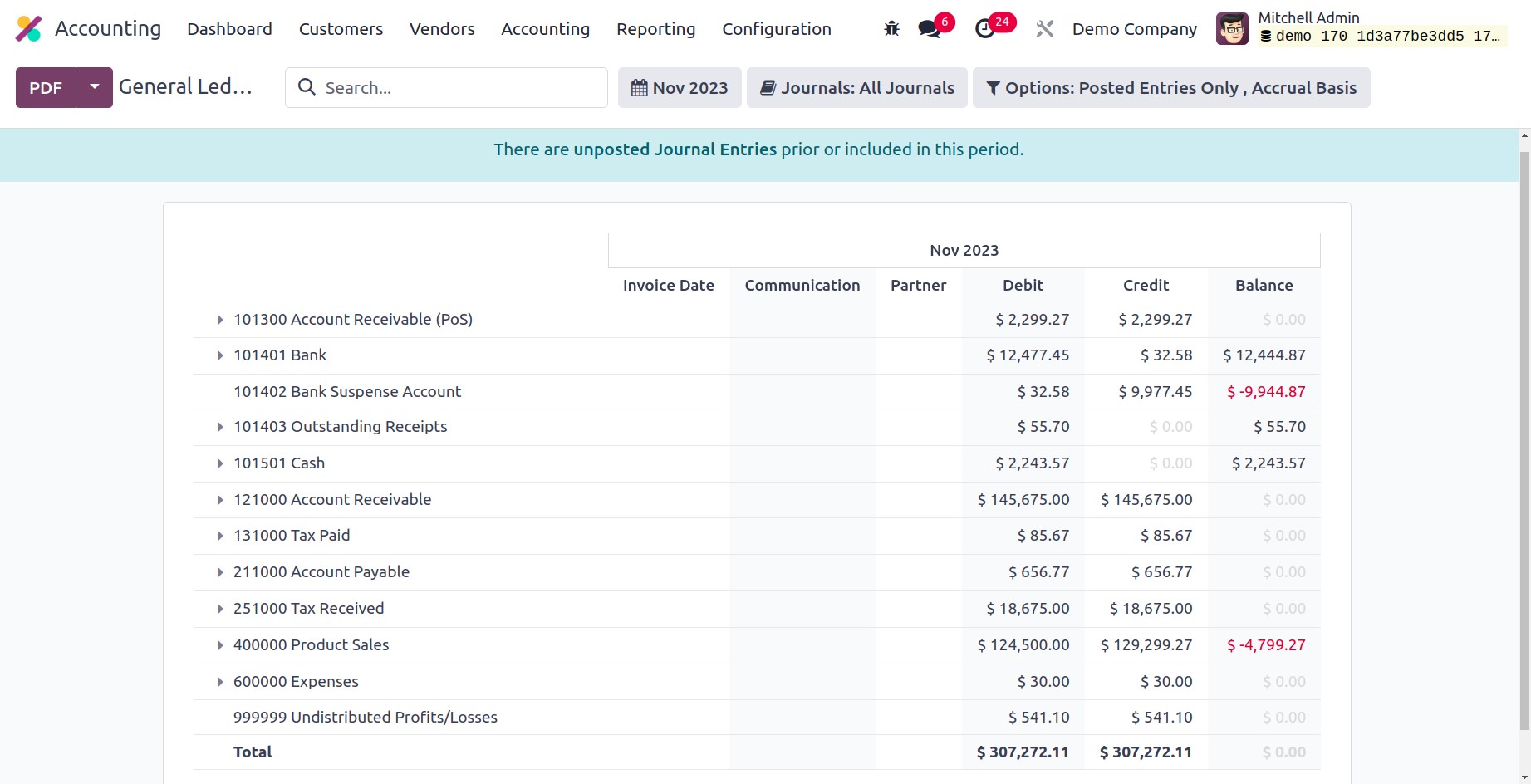

General Ledger

For a chosen time period, the General Ledger reports will provide all transaction

reports from all accounts set up in your system. You may see each account's Date,

Communication, Partner, Currency, Debit, Credit, and Balance in addition to the account

name. It keeps track of all of your organization's financial transactions over the

course of a fiscal year.

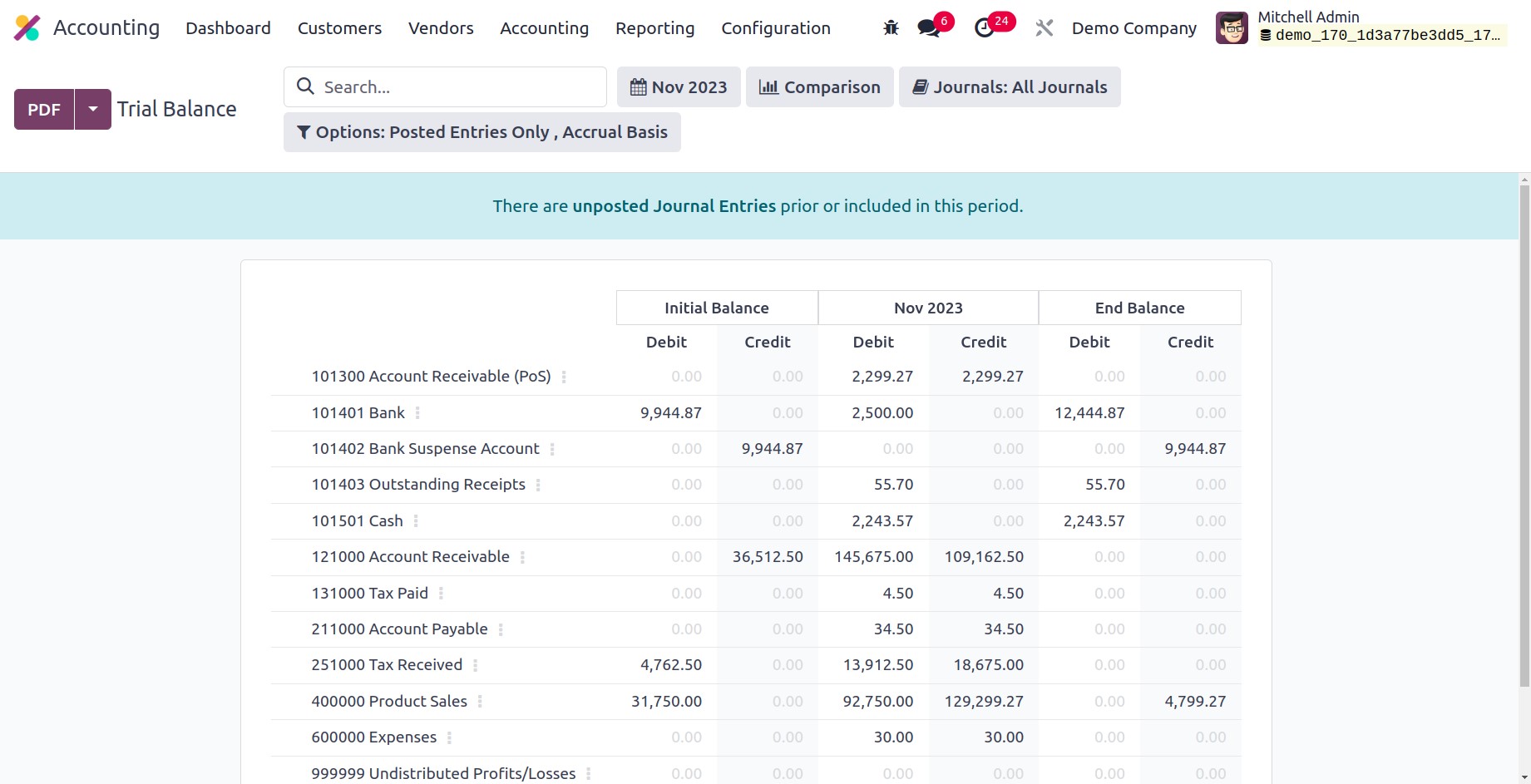

Trial Balance

The outcomes of all accounting entries filed through various journals are displayed in a

trial balance, an accounting report. The organization's financial year ends are mostly

when the trial balance reports are produced. These reports are employed in the auditing

process. The report displays the credit and debit information from the initial balance,

chosen month/year, and final balance of the journal entries, as seen in the image below.

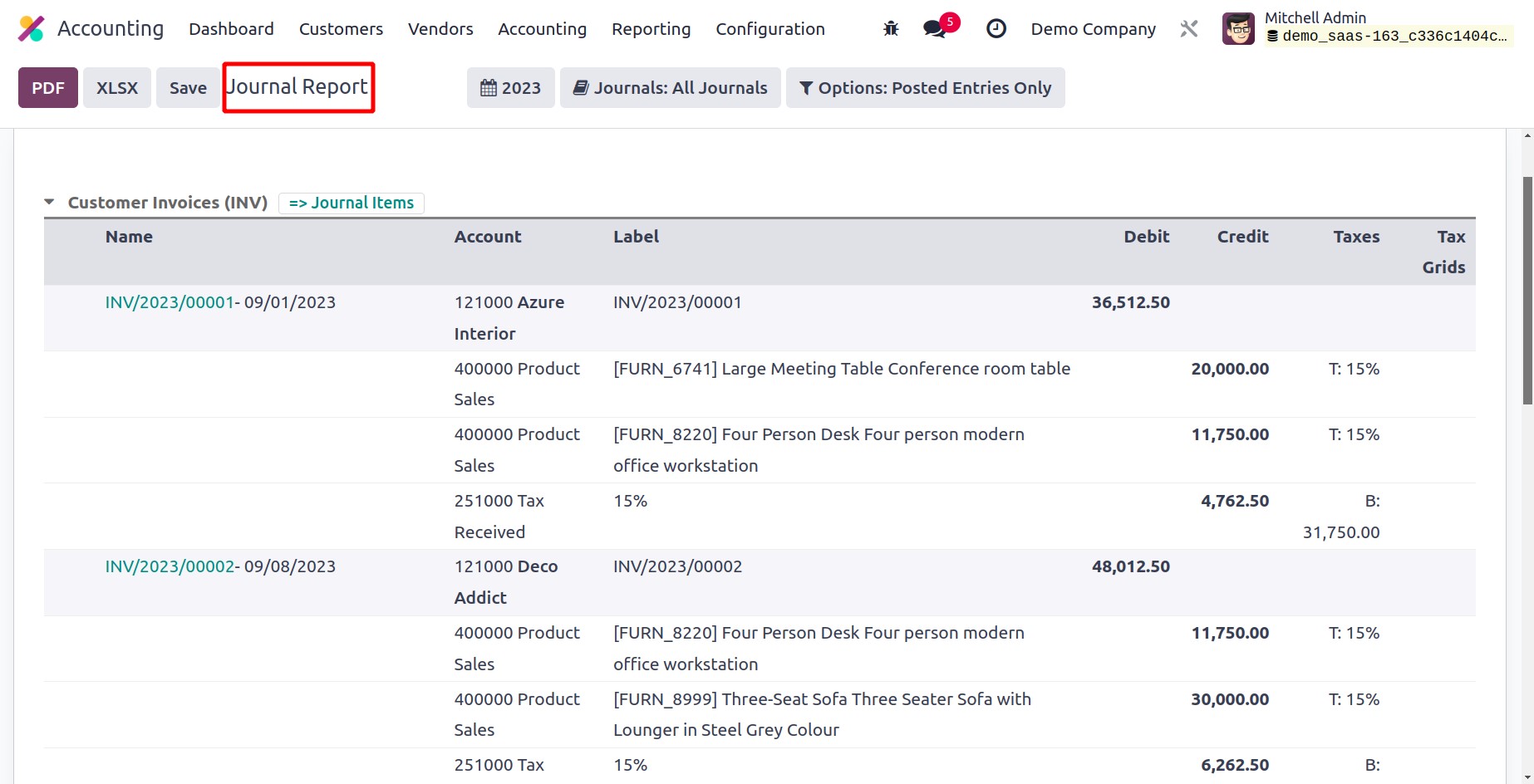

Journal Report

The Journal Reports platform can be used to generate accounting reports for the numerous

journals that have been configured in your Accounting module. You will receive a report

of the matching journal entries under each journal, along with information on the Name,

Account, Label, Debit, and Credit.

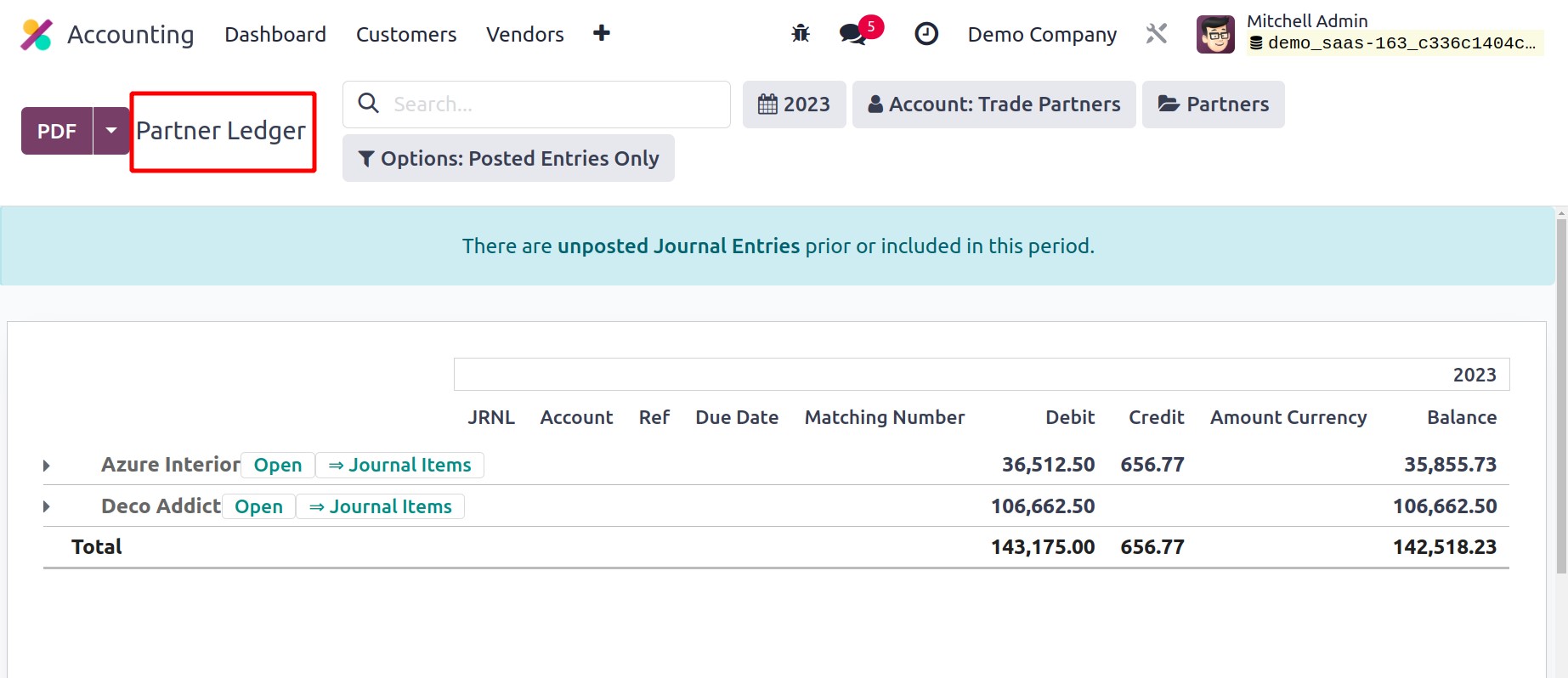

Partner Ledger

The Partner Ledger reporting platform allows users to view a report of the partners'

receivable and payable journal entries. During the chosen time period, it displays the

partners' Journal, Account, Reference, Due Date, Matching Number, Debit, Credit, Amount,

Currency, and Balance. You can utilize the Reconcile button on the report to match up

the accounts of the partners.

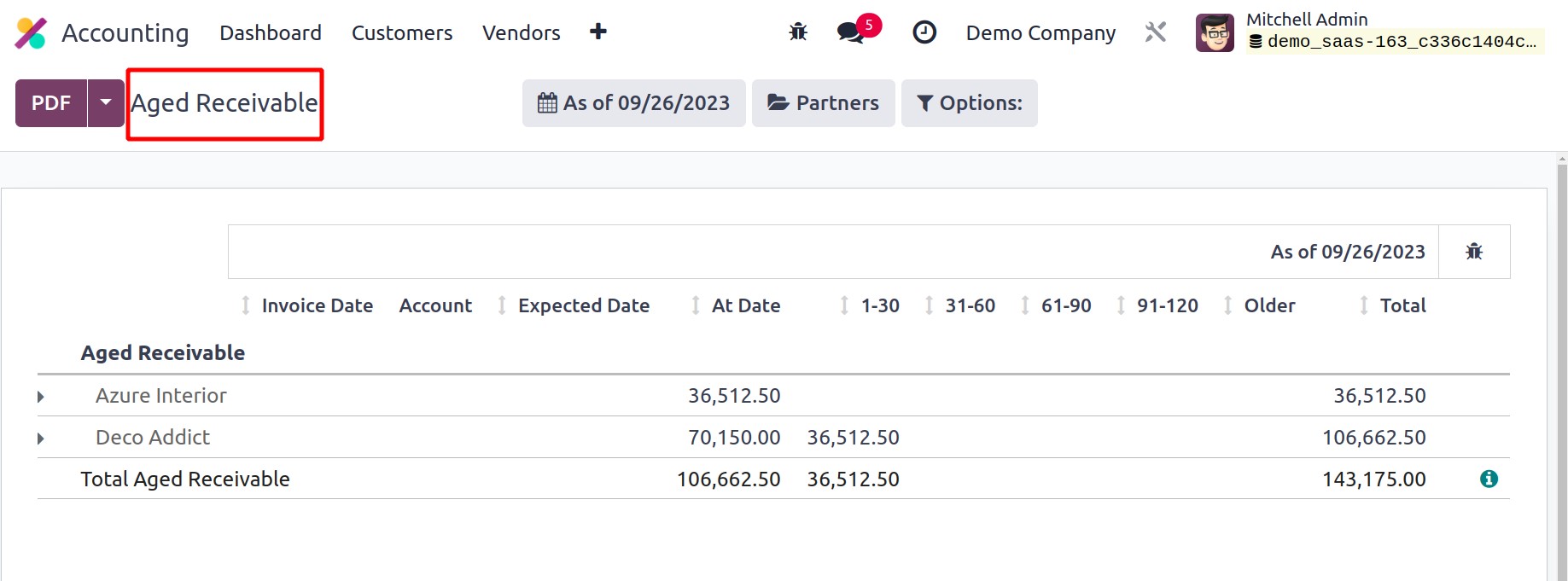

Aged Receivable

You can obtain reports of the aged partner receivable balances as of the chosen date

using the Aged Receivable platform in the Reporting menu. These are the reports on the

outstanding invoices. The payment will fall under the category of Aged Receivables if

the customer does not pay the invoice even after the days specified in the payment

terms. The report displays the Due Date, Amount, Currency, Account, Expected Date,

Receivable Amount At Date, Older, and Total as seen in the screenshot below.

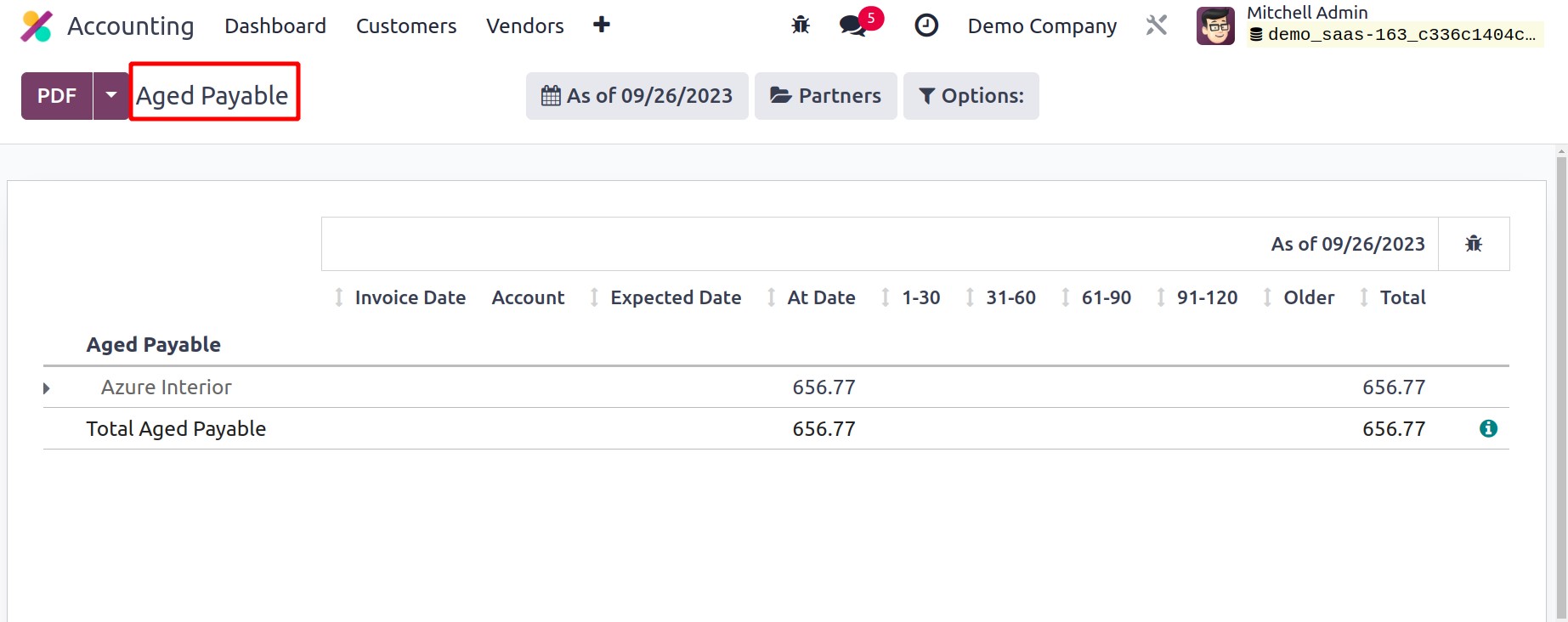

Aged Payable

The Aged Payable platform displays delayed payment reports similarly to the Aged

Receivable platform. These postponed payments are supposed to be sent by your business

to the appropriate partners prior to the due date. The Aged Payable report in Odoo17

Accounting will include any invoices that your business failed to pay by the due date

specified in the payment terms.

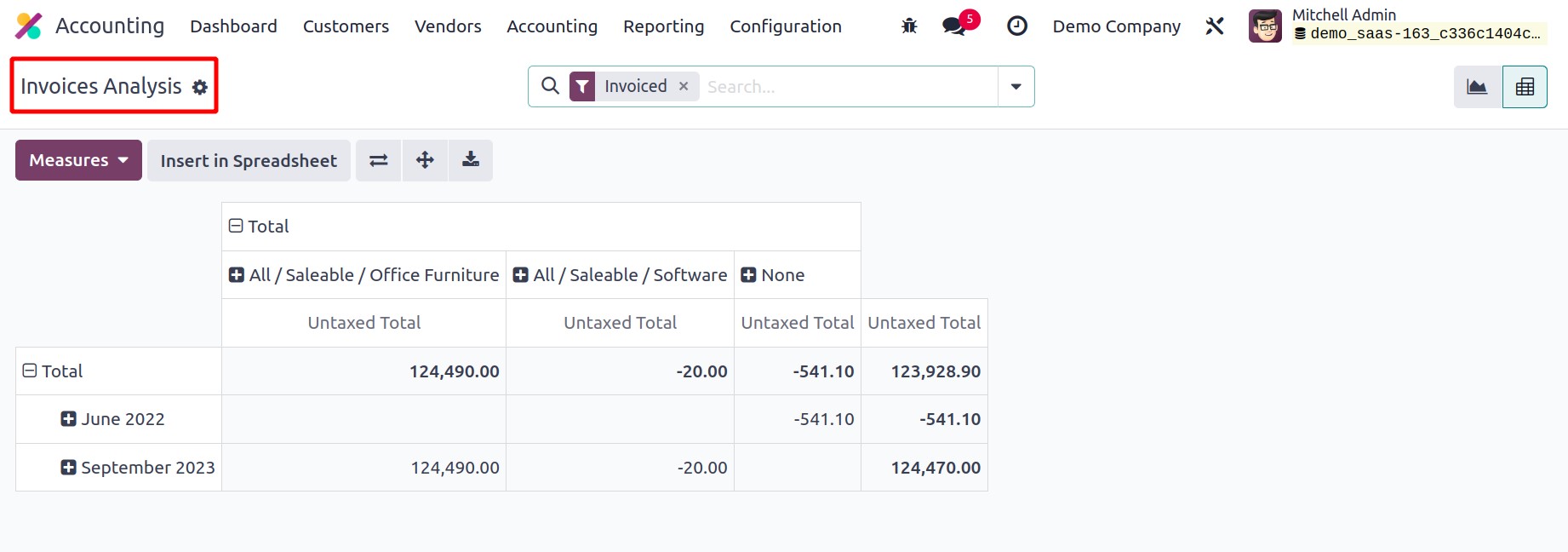

Invoice Analysis

You can view the company's invoice reports for the chosen accounting period by choosing

the Invoice Analysis option from the Reporting menu. You have the option of creating the

report in graphical or pivot table format. The measures that are displayed on this

window are the Average Price, Product Quantity, Total, Untaxed Total, and Count. My

Invoice, To Invoice, and Customer, Vendor, Invoice, Credit Notes, Invoice Date, and Due

Date are the basic filters that are available. The customization feature will enable you

to design unique filters for analyzing invoices.

Based on the salesperson, sales team, partner, product category, status, company, date,

and due date, you can organize the bills into different groups.

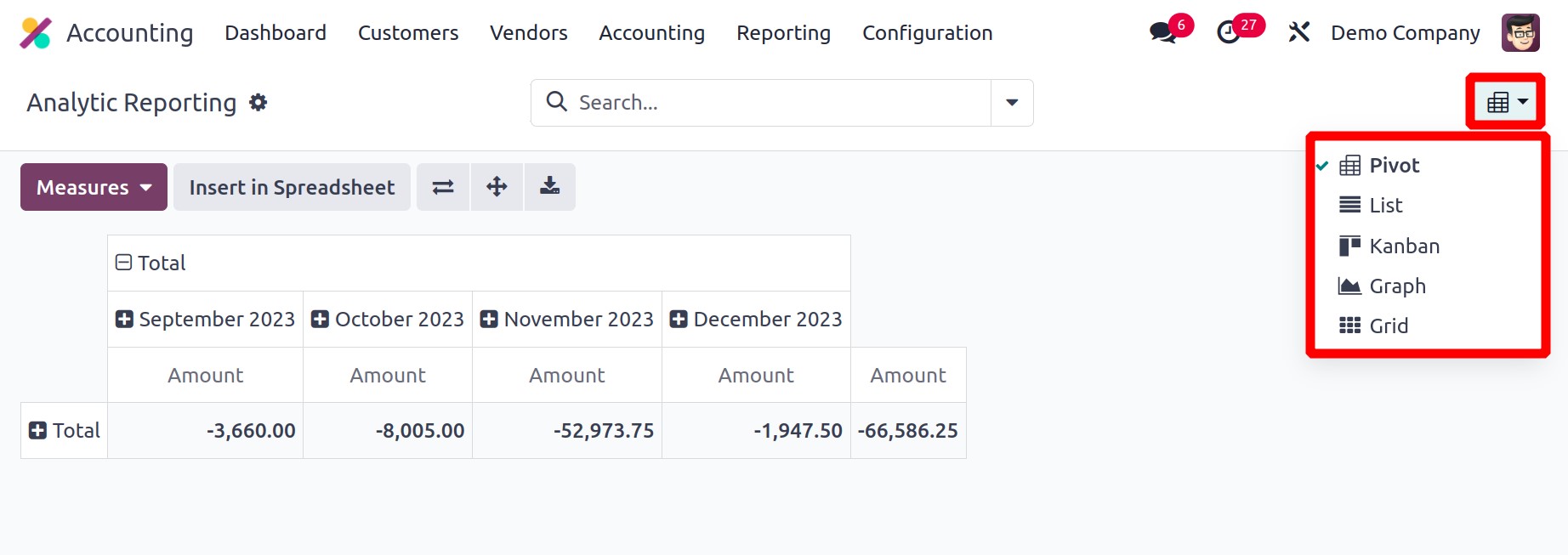

Analytic Accounting

An analytical accounting report aids in the analysis, interpretation, and generation of

reports for the company's accounting documents. Reinvoicing will be supported, and cost

management assistance will be provided for all analysis and report production tasks

based on the chart of accounts.

The reports contain different views like Pivot view, list view, kanban view, graph view,

grid view.

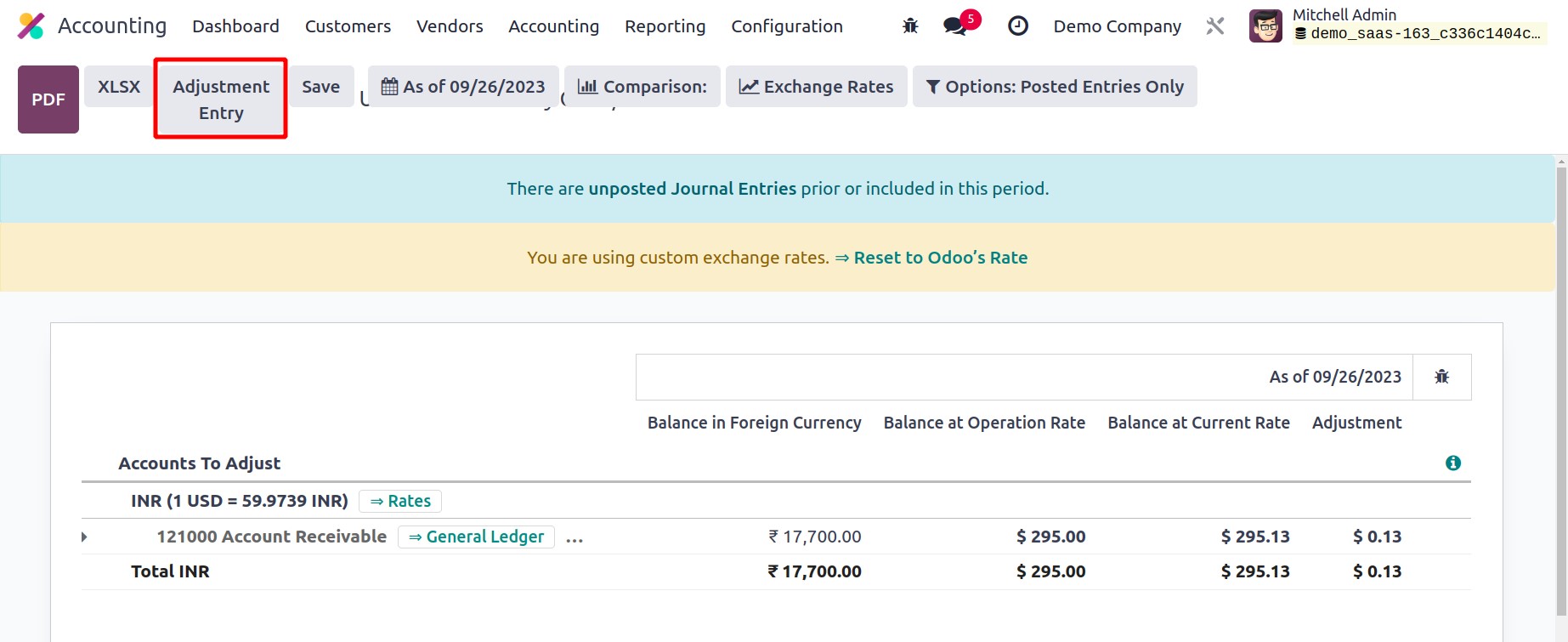

Unrealized Currency Gains/Losses

The Unrealized Currency Gains/Losses platform under the Reporting menu will provide you

a report of all open accounts on your balance sheet that require another evaluation.

Depending on the currency used in each account, the reports will be grouped. The Balance

in Foreign Currency, Balance at Operation Rate, Balance at Current Rate, and Adjustment

information are displayed. The Adjustment Entry button can be used to make any necessary

revisions to the entries.

The Balance in Foreign Currency displays the amount deducted from the bill or invoice.

You will find the amount that was calculated at the moment you got the bill in the

Balance at Operation Rate. The Balance at Current Rate field displays the amount's

current value at the moment the report was generated. To update the financial reports

with the most recent data, the amount mentioned in the Adjustment column should be added

to the accounting. You can change the exchange rate appropriately by using the Exchange

Rates function.

You can use the Adjustment Entry button to make adjustments.

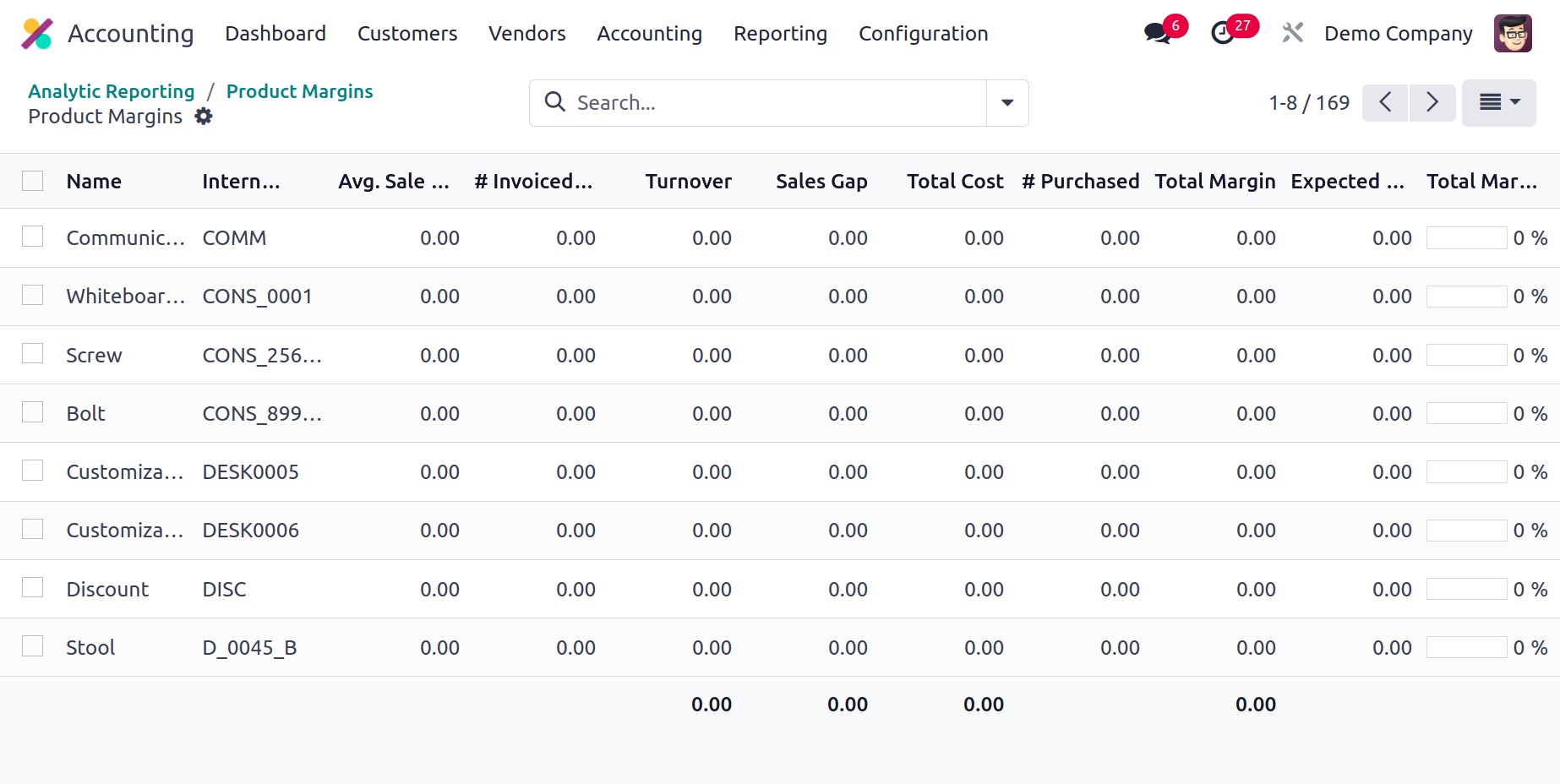

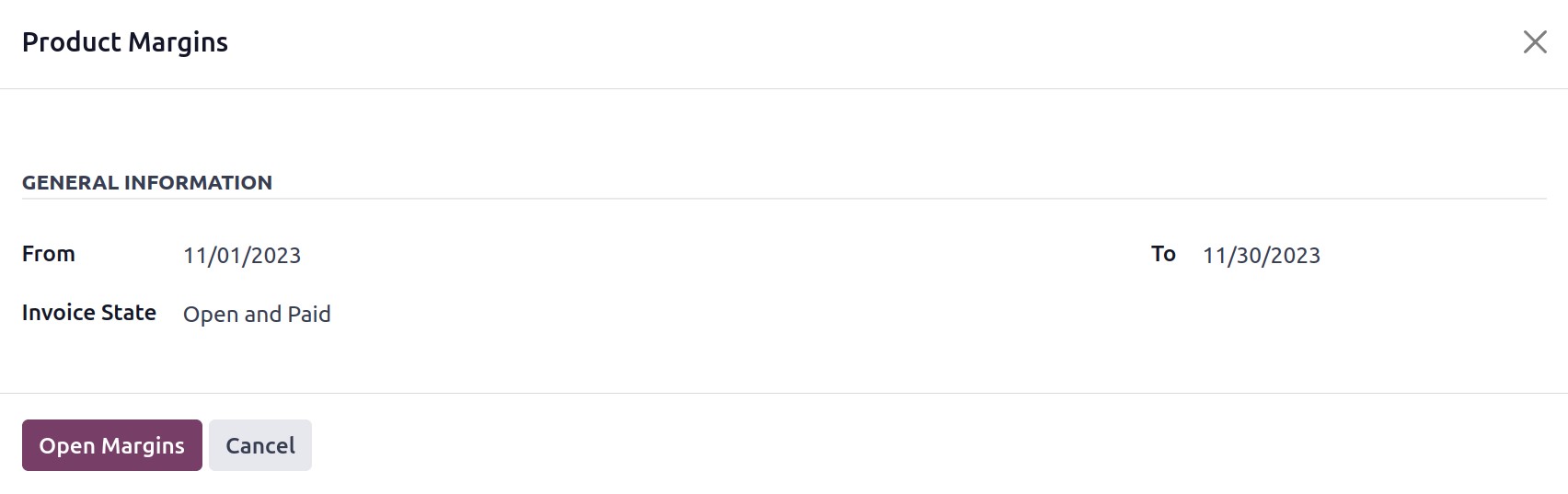

Product Margin

The user can analyze the sales product specifics with the aid of the product margin

report. A popup window will come up as indicated below when selecting the Product

Margin report from Reports. In order to generate reports, add the from

and to dates. The user can then choose his invoices' invoice state. Next, select the

Open Margin option.

The required report will then start to be produced. The name of the product, internal

reference, average sales, amount invoiced, turnover, sales gap, total cost, amount

purchased, total margin, anticipated margin, total margin rate, and the percentage of

the expected margin.