Reconciliation

Bank reconciliation is crucial for analyzing and determining whether there are any

differences between the accounts utilized for commercial operations. If any deviations

are found, you can take corrective action right away to make things right. Manually

matching bank records with account statements will be challenging. Cash transactions in

the business are tracked in cash accounts, thus it's crucial to keep them in sync with

the bank accounts. Checking that the bank account matches the cash account is necessary

to ensure this. Manually carrying out all of these tasks will be challenging and take a

lot of time and effort. The Odoo17 Accounting module can be used to streamline the

reconciliation procedure.

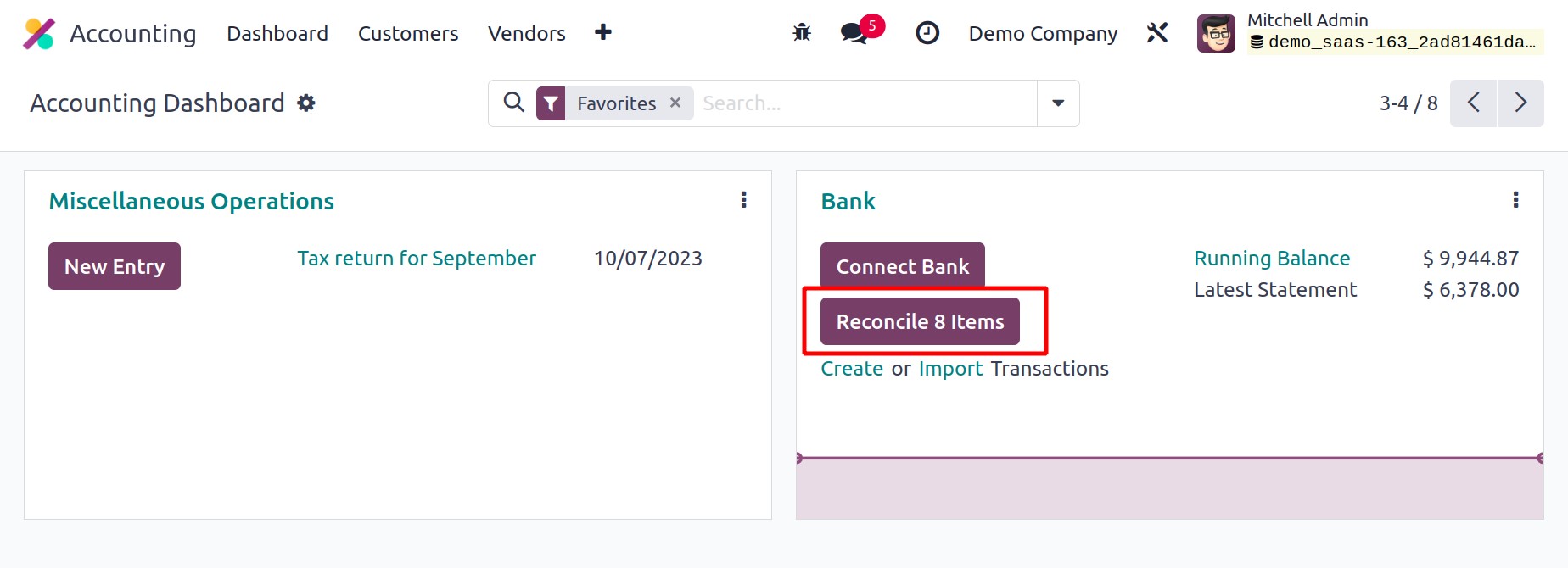

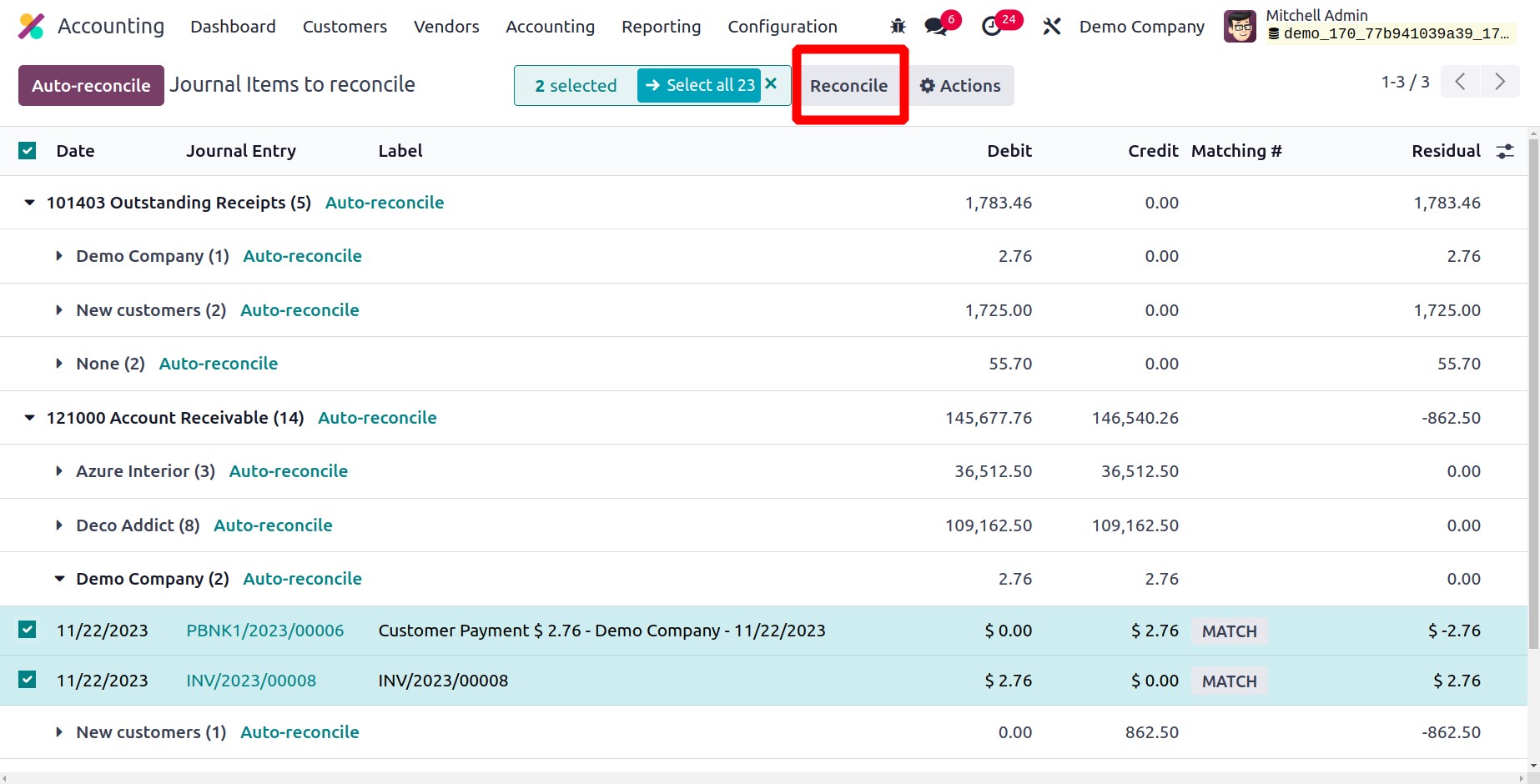

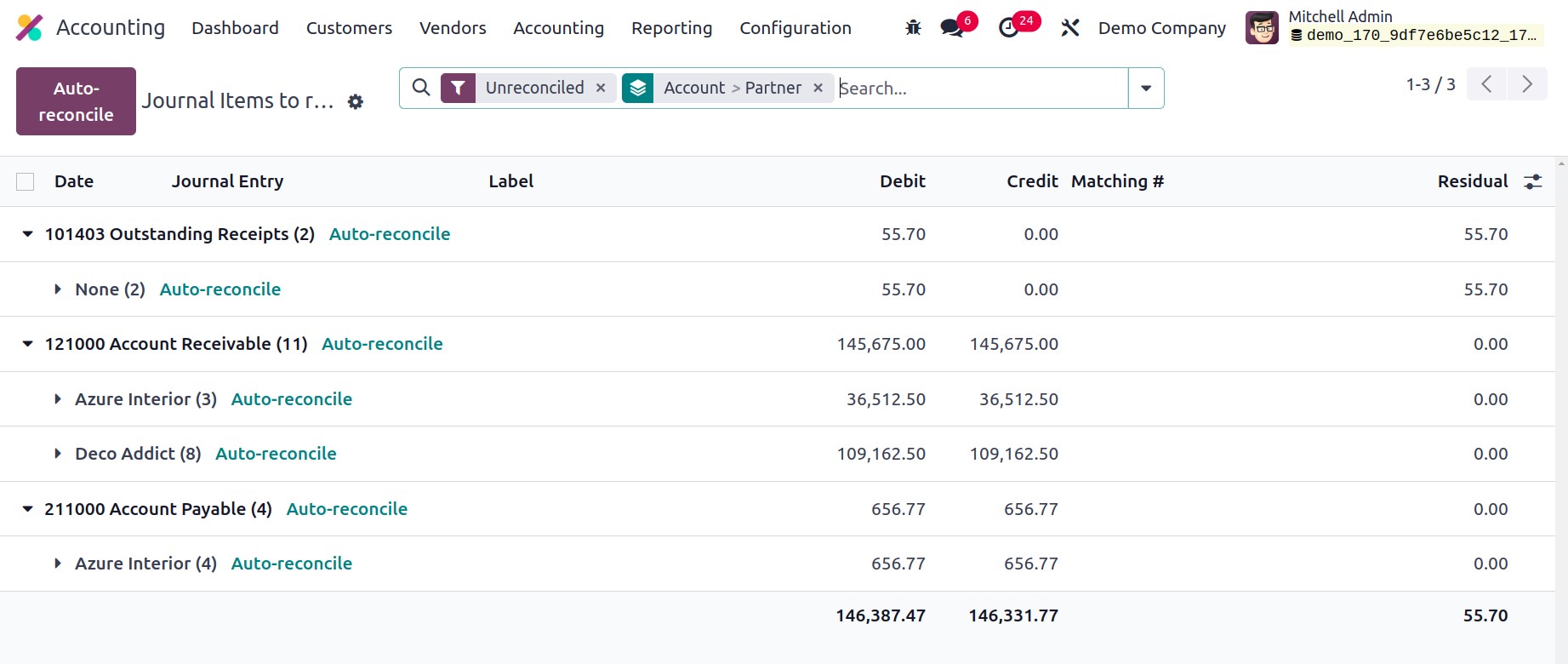

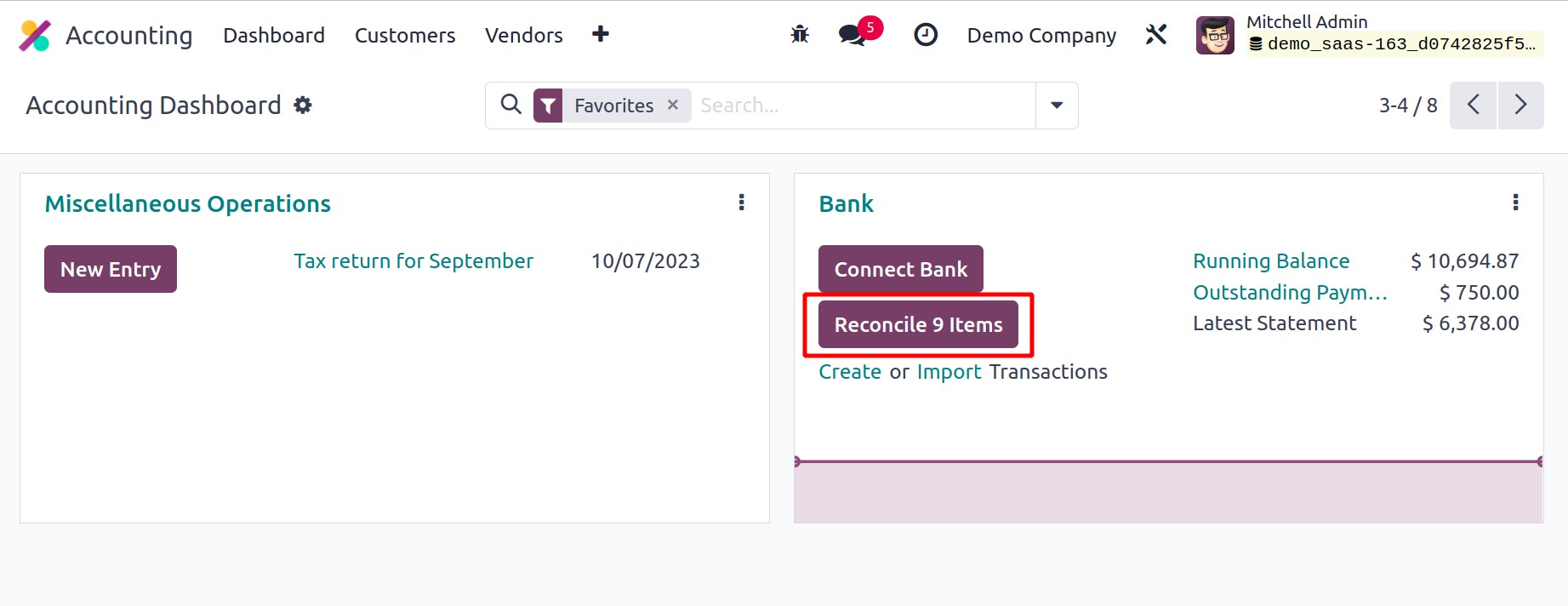

Reconciliation tasks are simple to carry out directly from the Accounting Dashboard.

The list of statements that need to be reconciled can be found here by clicking the

Reconcile button as shown above.

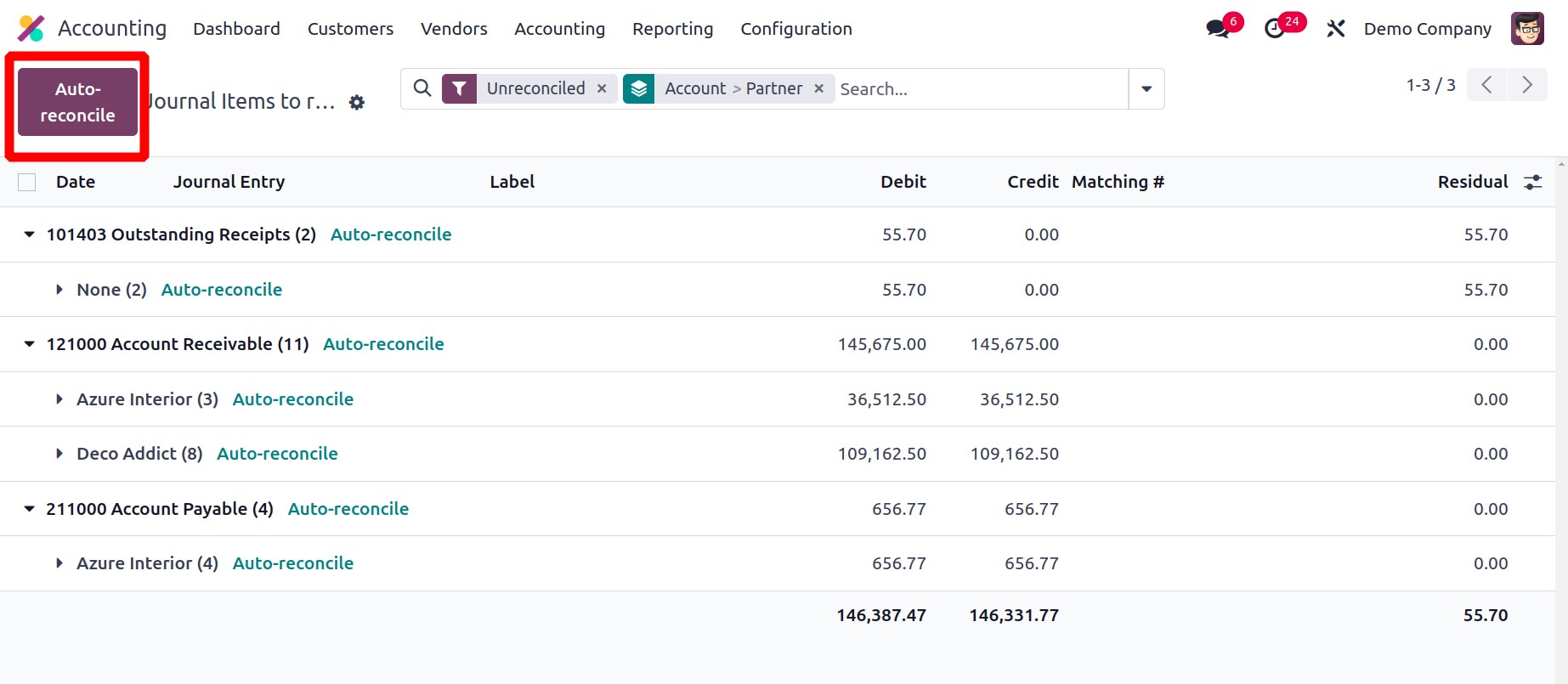

The Reconcile option is available under the Accounting menu.

The Auto reconcile button helps for the automatic reconciliation of the statements,

which is as similar as the Payment matching.

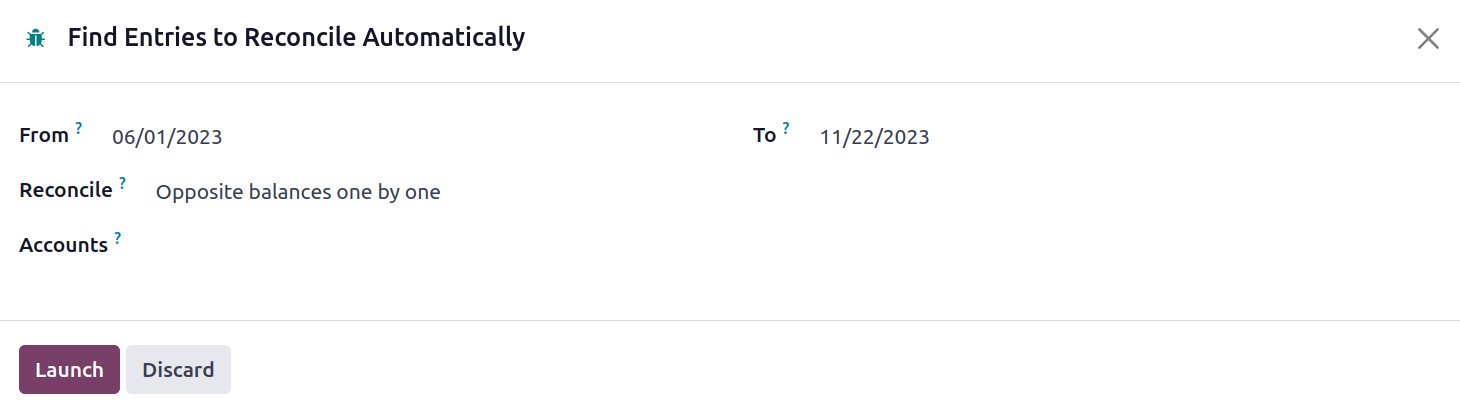

The pop up allows users to add from and to dates and accounts. Click on the Launch

button to launch the reconciliation. Then all the entries will reconciled.

The Reconcile button allows the user for manual reconciliation of the entries.

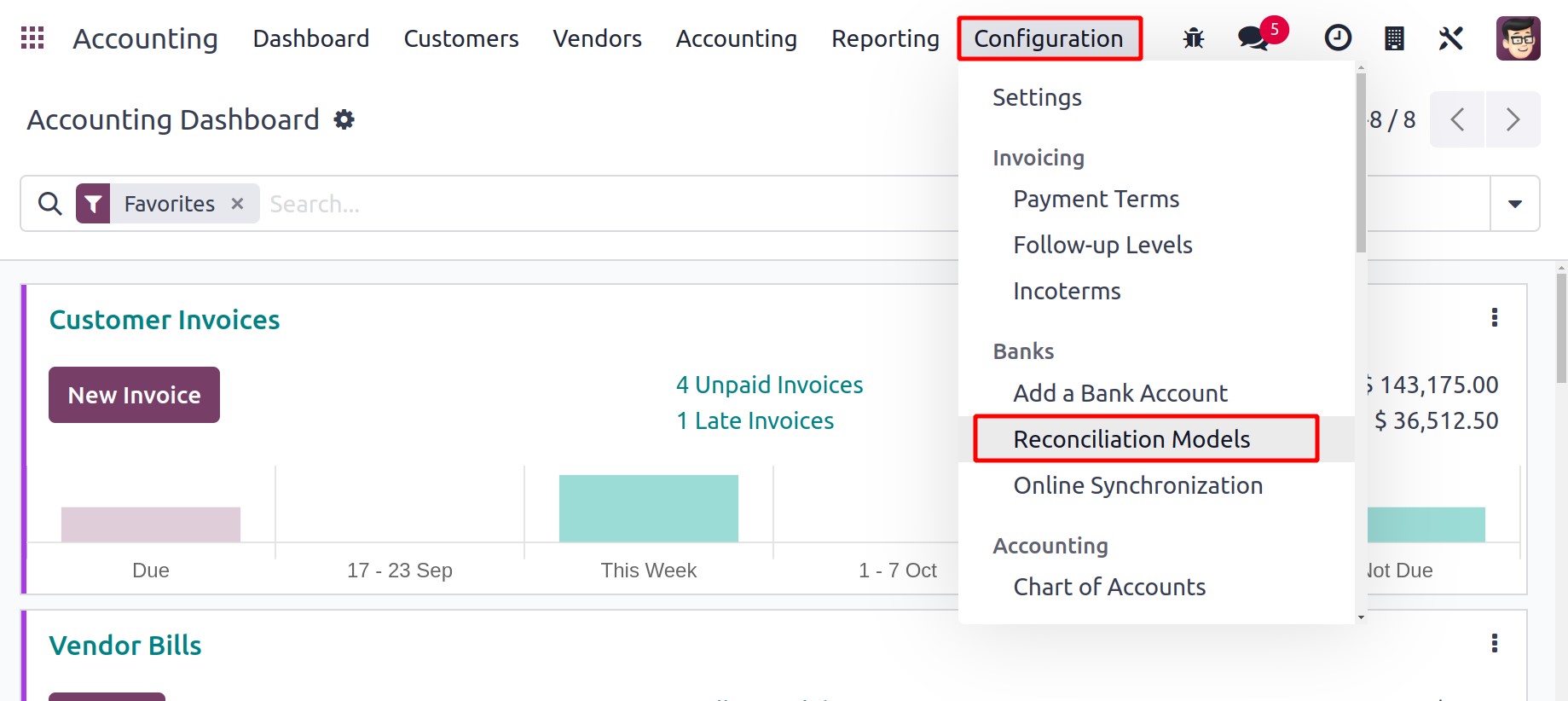

You can configure a suitable reconciliation model initially to simplify the

reconciliation procedure. Reconciliation Models, an option found under the

Configuration menu, can be used to do this.

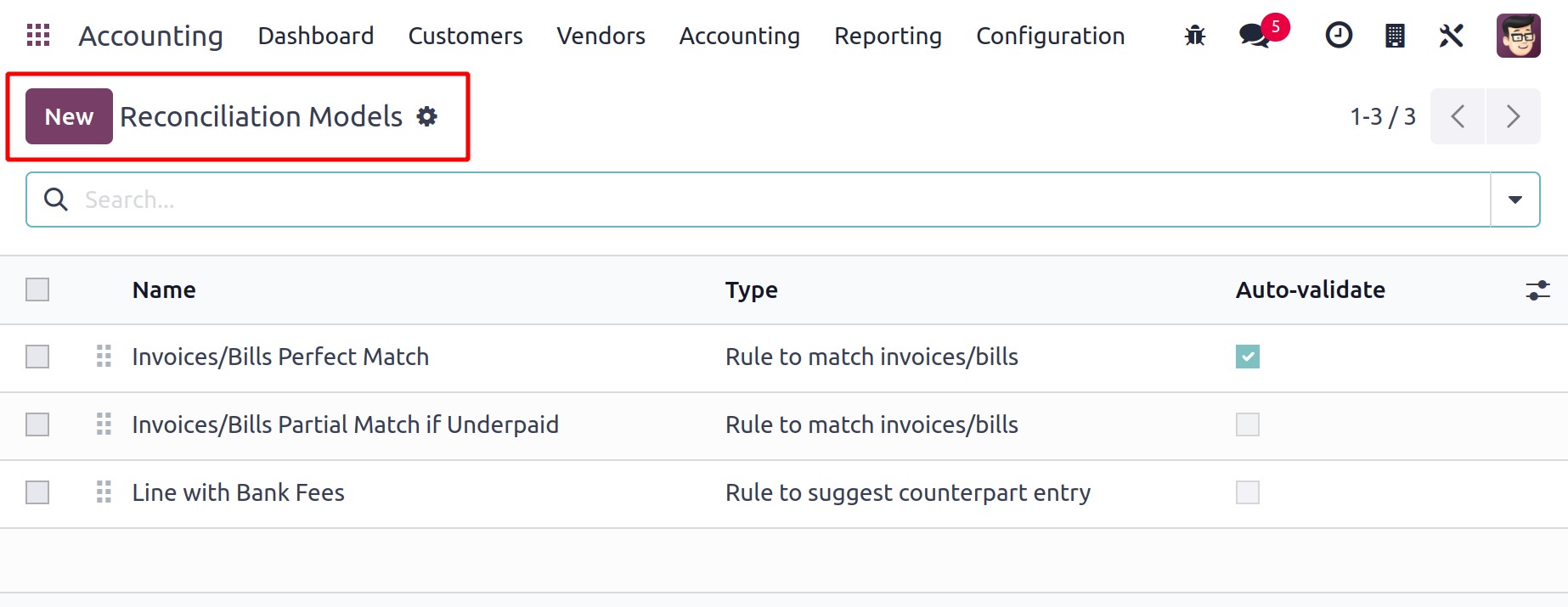

This pane displays existing reconciliation models along with information on their Name,

Type, and Auto-validate status. Get a new configuration window by selecting the

New button.

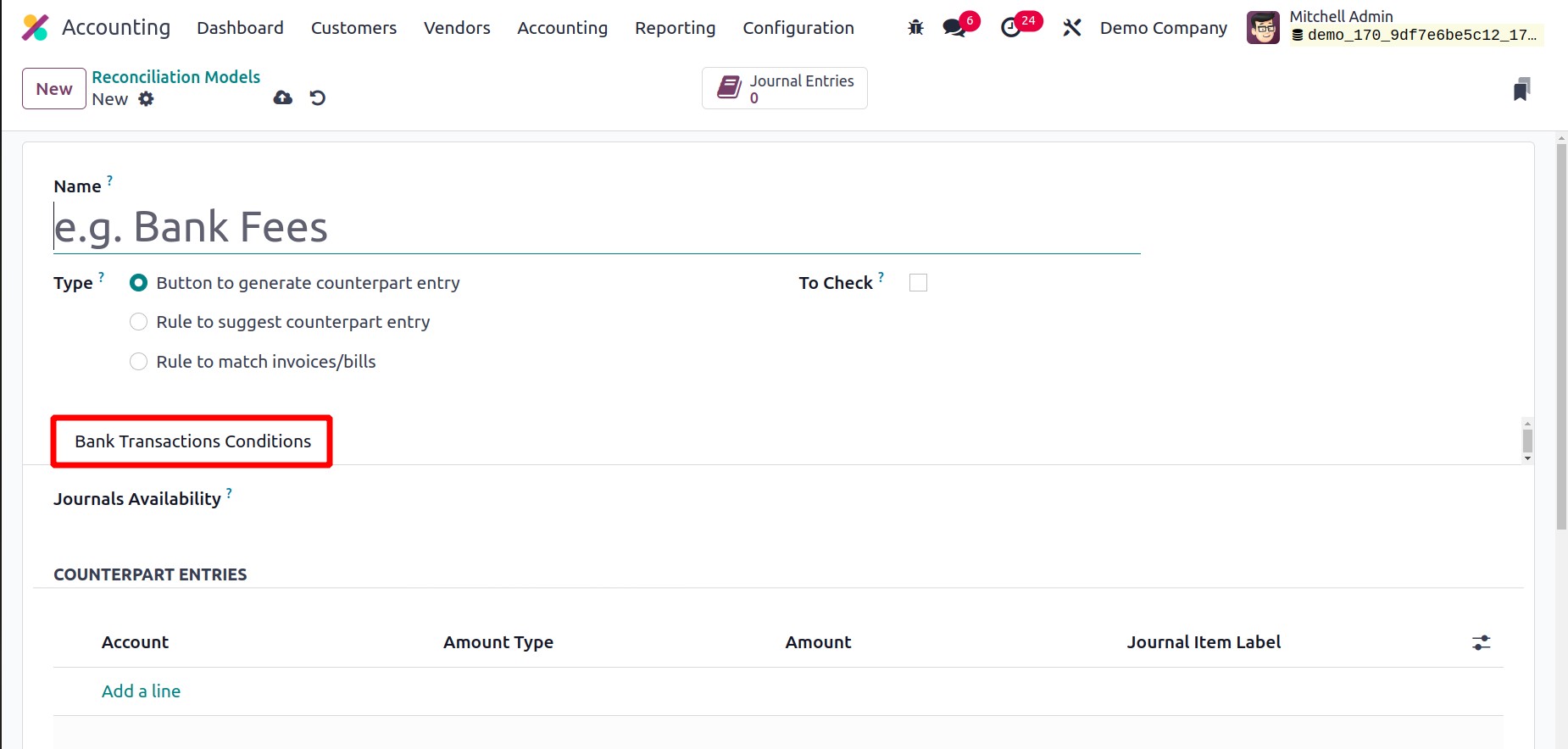

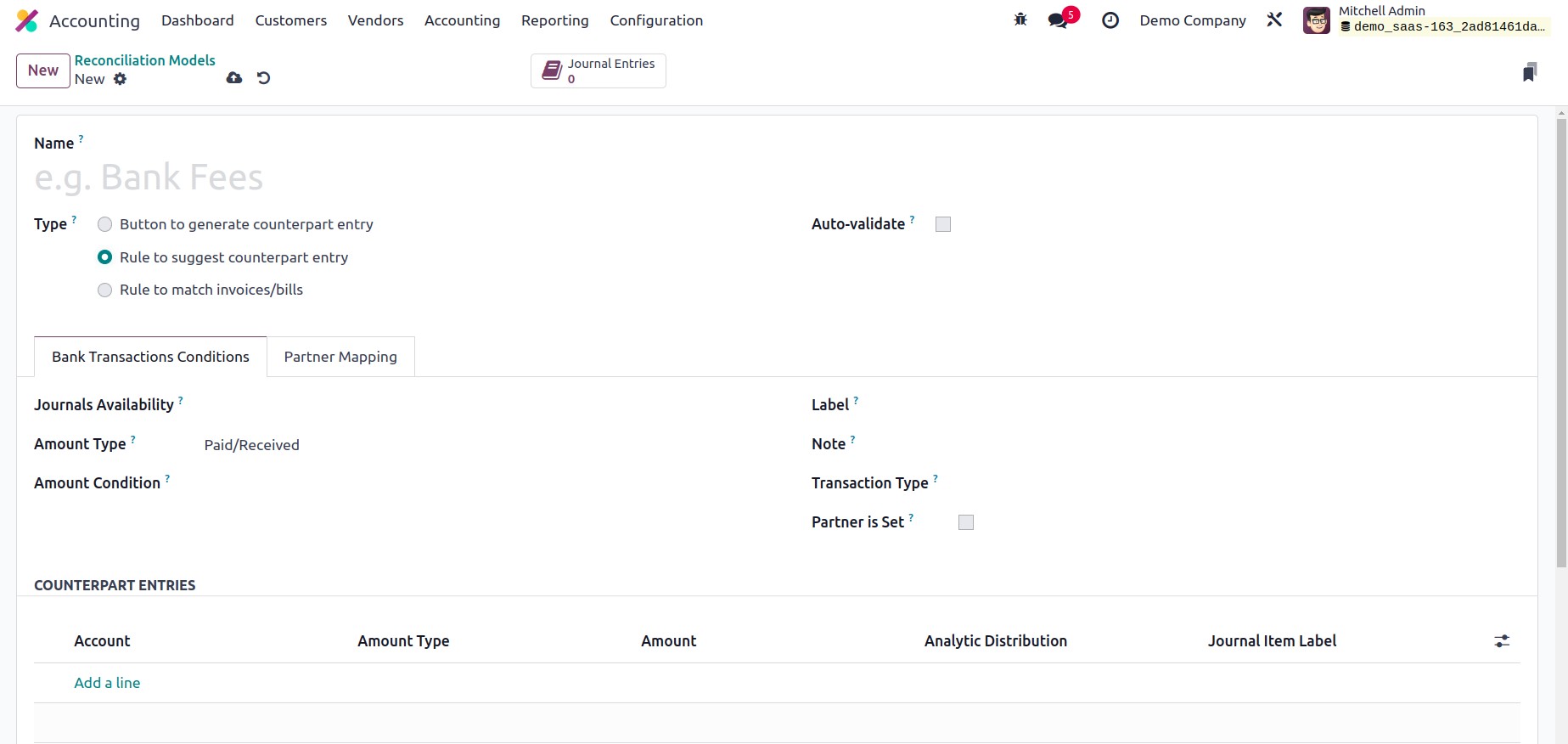

You can choose the type from the available alternatives after giving the name of the

reconciliation model. Depending on the setup type you choose, the remaining options may

change.

Button to generate counterpart entry

You will see the Journal Availability field when choosing the Button to produce the

counterpart entry option as the model type. Here, you can add a journal like Cash or

Bank. Only the chosen journals will have access to the reconciliation model.

You can choose the Account, Amount Type, Amount, Analytic, and Journal Item Label under

the Counterpart Entries tab. Fixed, percentage of balance, percentage of statement line,

or from labels are the possible account types. The button to produce a counterpart entry

model for reconciliation is available once the configuration is complete.

Rule to suggest counterpart entry

The screenshot below illustrates the setting choices for the Rule to suggest equivalent

entry.

You can use the Auto-Validate option to automatically validate the statement line

from this point. You can choose a suitable Amount Type from the alternatives provided

after mentioning the Journal Availability. These options are Received (applied

only when receiving an amount), Paid (applied only when paying an amount), and

Paid/Received (applied in both circumstances). By doing this, the specified

transaction type will be the only one to which the reconciliation model is applied. You

can specify a precise amount in the Amount Condition, and the reconciliation

model will be used when the amount is less than, more than, or equal to the amount you

indicated. Label, Note, and Transaction Type rules can be configured as

Contains, Not Contains, or Match Regex. When the Partner's established field is turned

on, the reconciliation model will only be used when a customer or vendor is already

established. You can receive more fields to mention the Matching Partners and Matching

Categories by turning on this option. Using the Add a Line button, enter Counterpart

Entries in the available area.

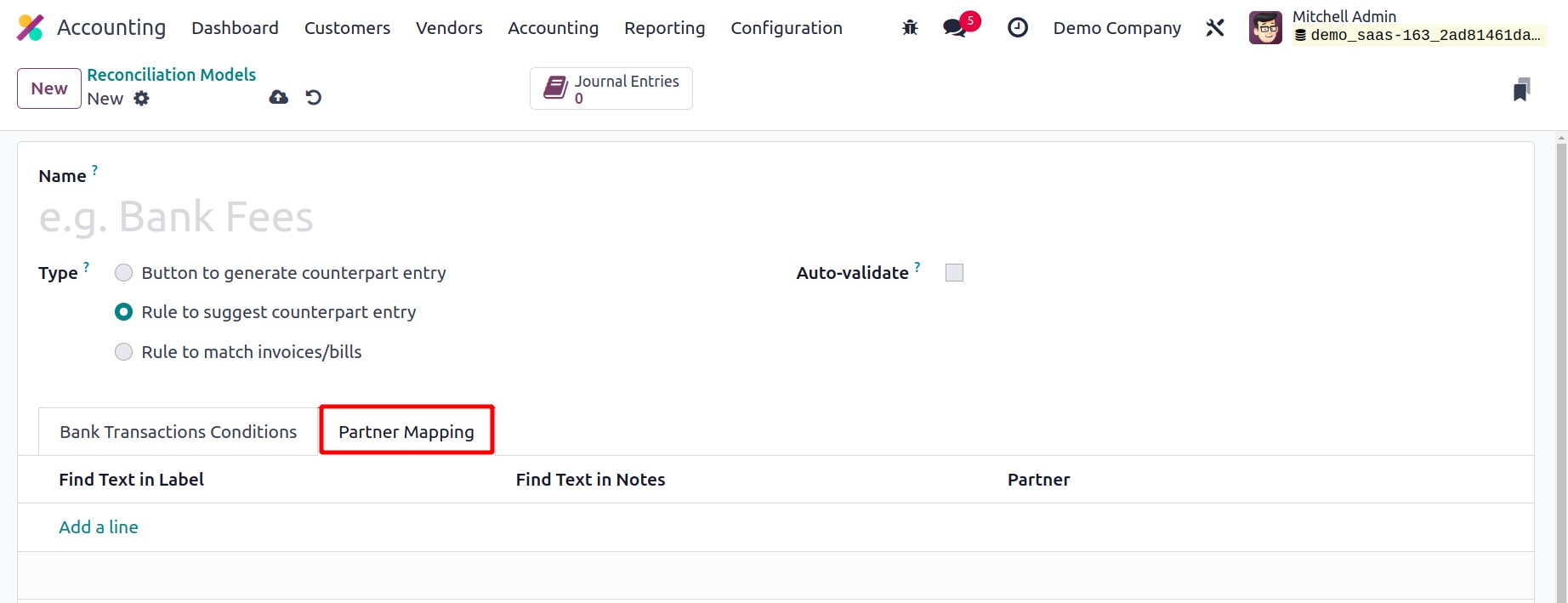

You can use the Add a Line button on the Partner Mapping tab to add Find Text in

Label, Find Text in Notes, and Partner.

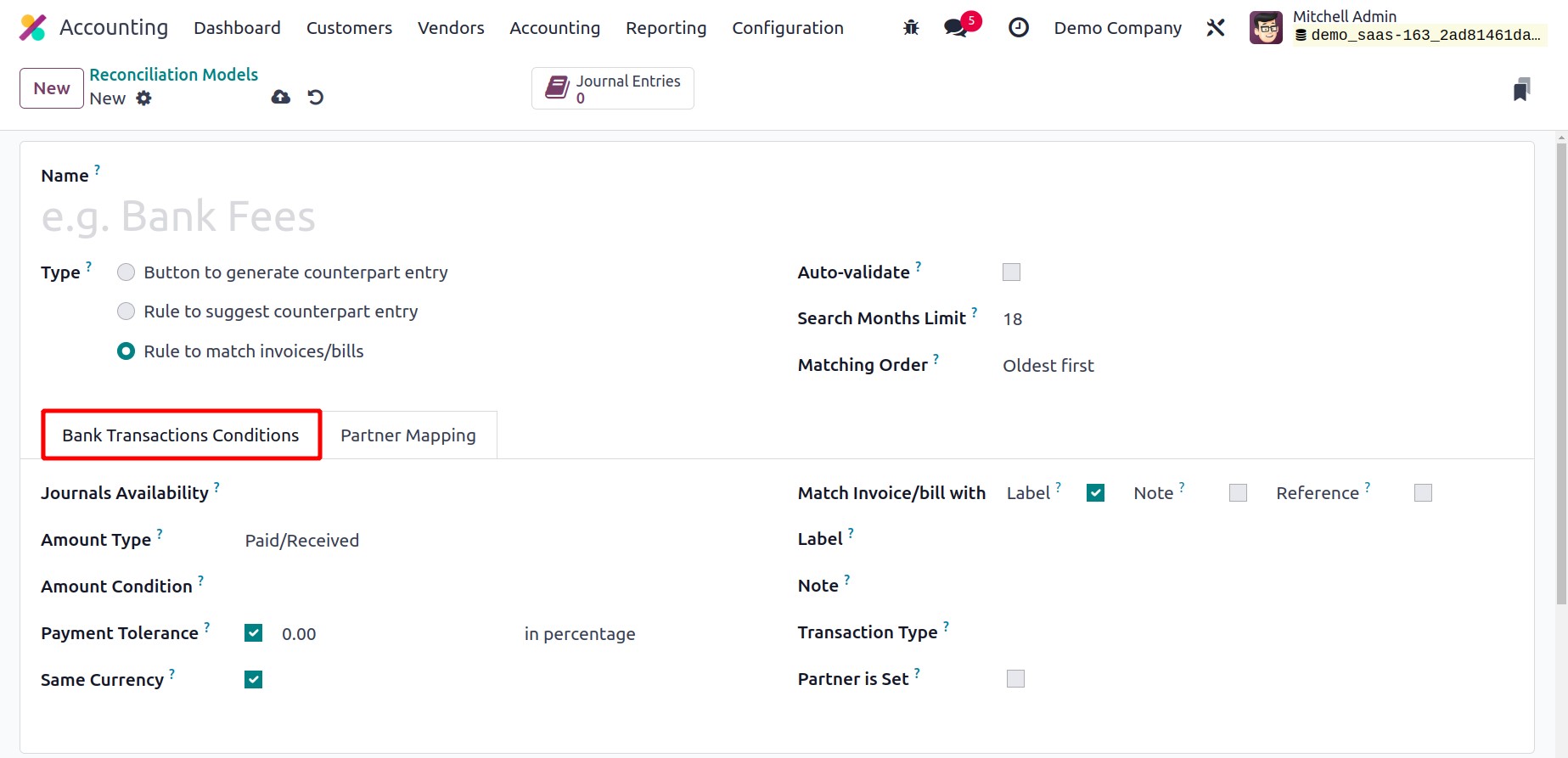

Rule to match invoice/bills

The setting window for the Rule to match invoices and bills reconciliation model type is

displayed below. You can turn on the Auto-Validate box to automatically validate the

statement line. You can specify how many past months to use when using this model in the

Search Months Limit field.

Either Oldest First or Newest First can be used for the Matching

Order. The settings we described before can be found under the Bank Transactions

Conditions tab. Furthermore, the Payment Tolerance will be activated for you so that you

can tolerate variations in case of underpayment. To limit propositions using the same

currency as the statement line, the Same Currency field can be turned on. You can

activate the Label, Note, or Reference to match the invoice or bill in the

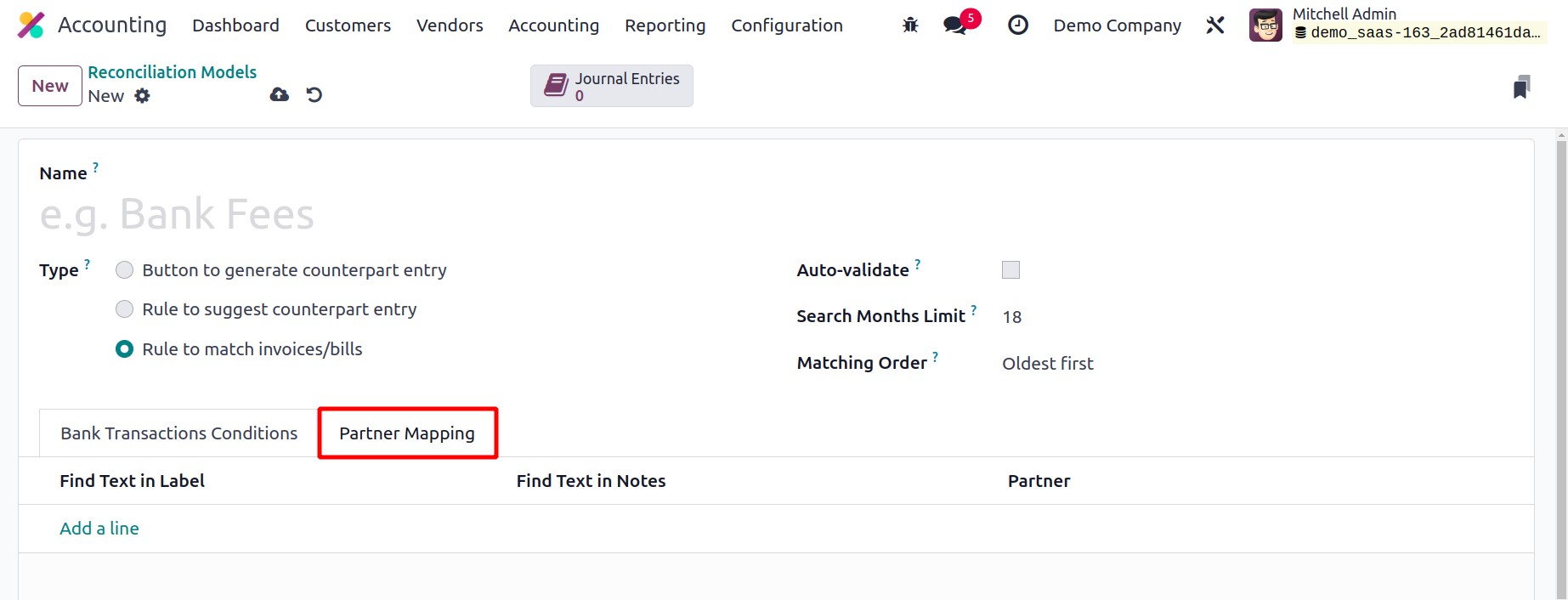

Match Invoice/Bill with field. By configuring the Partner Mapping on the

appropriate tab, the configuration can be finished.

You can go to the Reconciliation option under the Accounting menu to

acquire a list of all the statements that need to be reconciled.

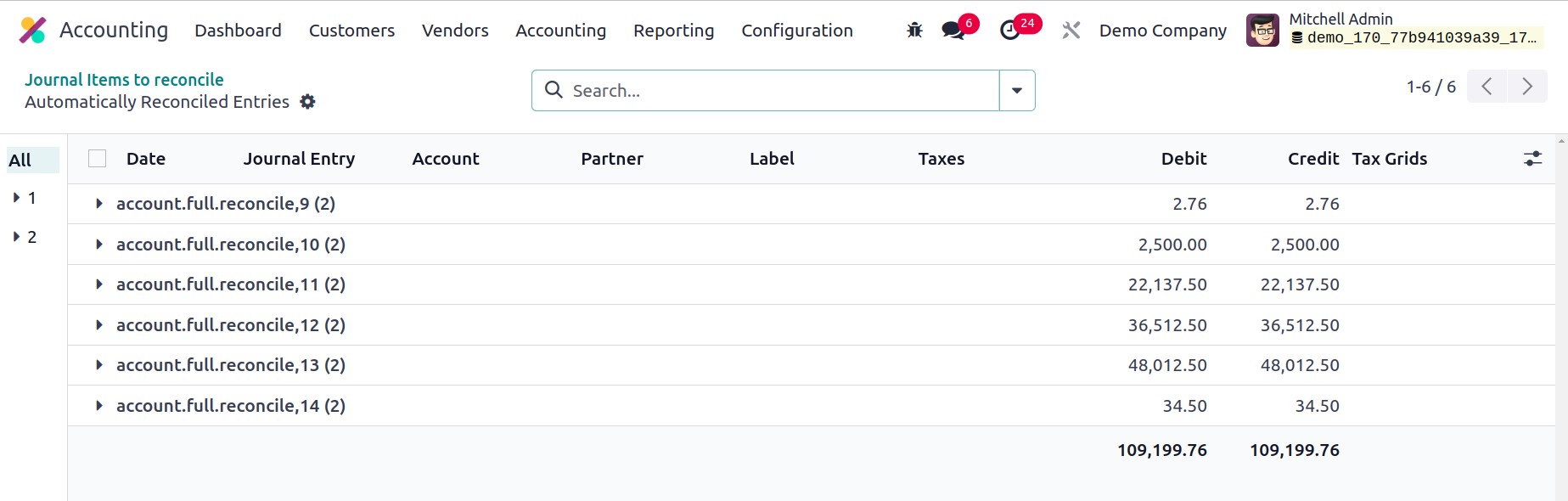

Here, automatic reconciliation of the statements with the bank accounts by clicking the

Auto Reconcile button.

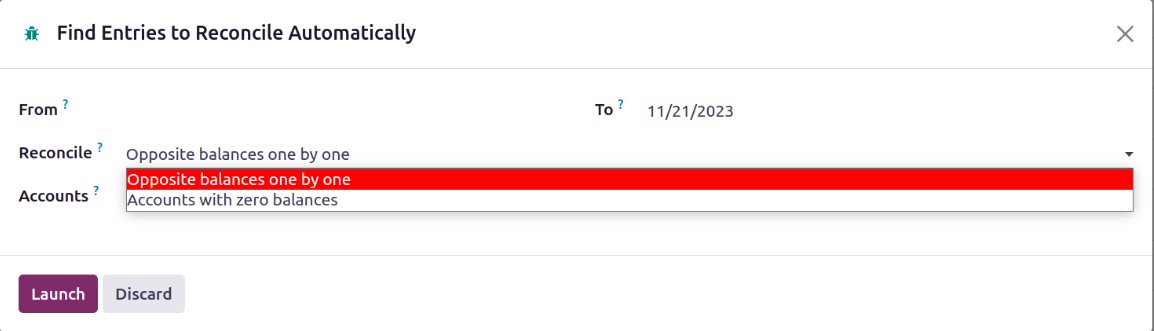

Users can locate the records for automatic reconciliation by clicking the Auto reconcile

button. Add the accounts, from, and to dates in the popup box. Select the

Reconciliation option for either Accounts with zero balances or Opposite balances

individually.

You may quickly import bank statements into your system through the Accounting Dashboard

of the module, which can then be used for the subsequent reconciliation process.

Depending on the option you select from the Settings menu of the Accounting module, you

can import your bank statements in the following formats: CSV, OFX, QIF, and CAMT.

As seen in the above image, the equivalent options are located on the Bank & Cash tab.

You will be able to use a button to import bank statements from the Accounting Dashboard

as soon as you activate this functionality.