Fiscal Position

For various nations, there will be variations in the exchange rates and tax calculation

procedures. Odoo17 will assist you in developing the necessary rules to automatically

change the taxes and accounts of a nation utilized for business purposes using the

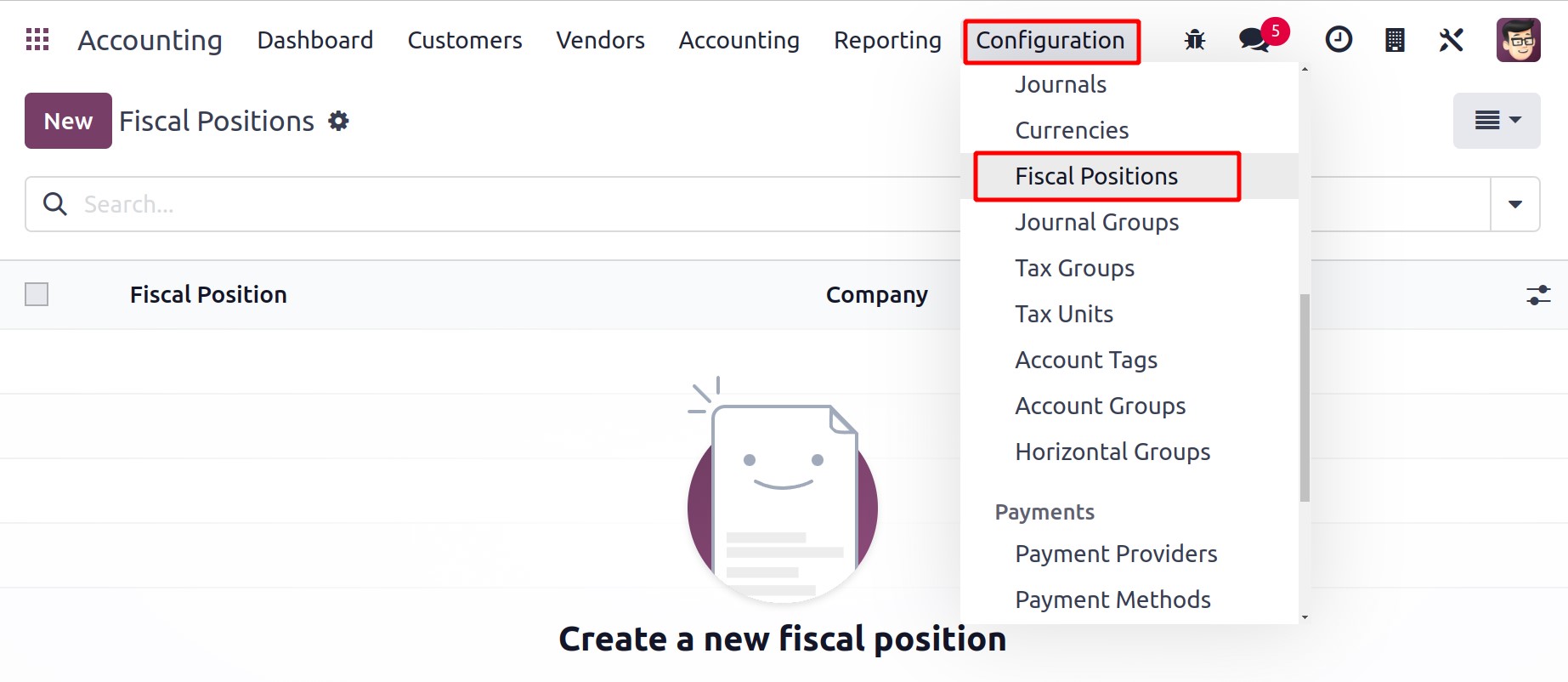

fiscal positions. Go to the Accounting module's Configuration menu and select the

Fiscal Position button to configure the Fiscal Position. You may find the already

configured fiscal positions with the data of their names and companies here, as shown in

the image below.

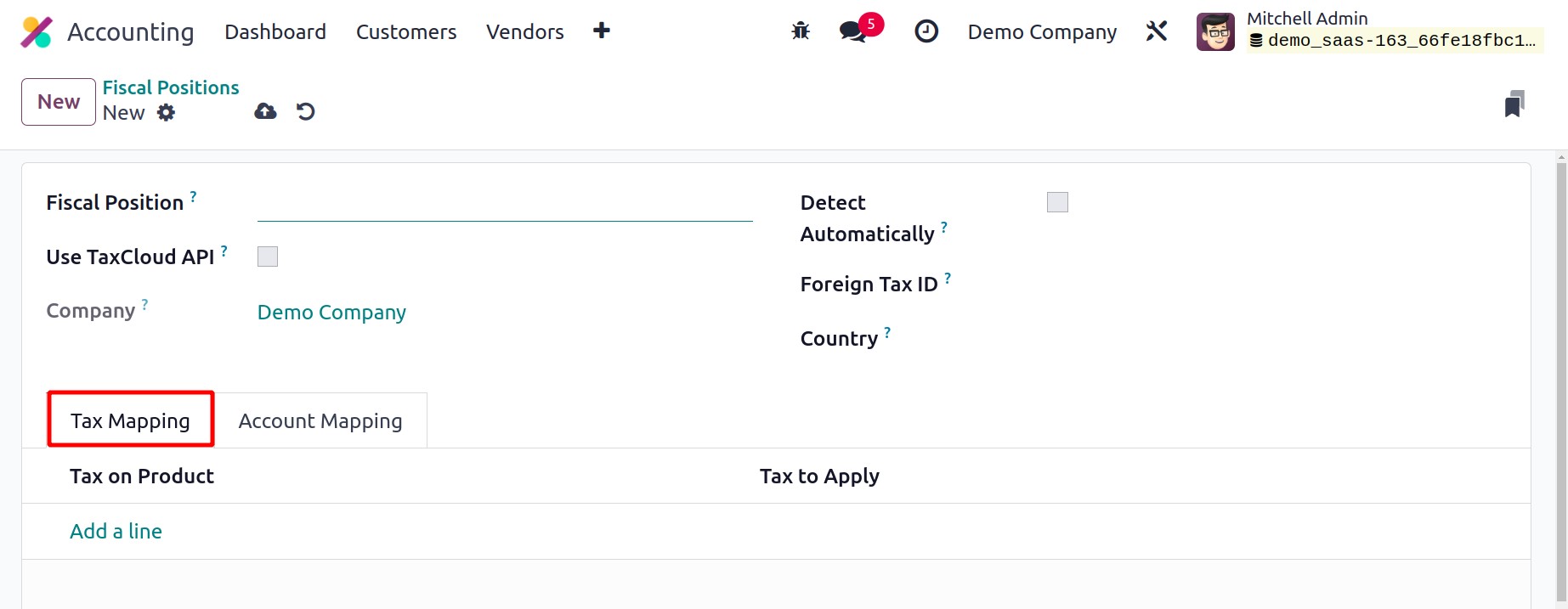

Click on the New button to start a new one. In the provided area, you may enter a name

for the Fiscal Position.

To automatically determine the customer's tax rate by location, turn on the Use

TaxCloud API. You may see the name of your company in the Company field.

Odoo17 will automatically apply this fiscal position based on the place you choose if

the Detect Automatically option is turned on. Once you turn on this option,

you'll have access to two more choices, namely VAT Required and Country Group. By

turning on the VAT Required option, Odoo only considers the partner for this fiscal

position if they have a VAT number.

Only if the delivery country corresponds to the group or groups of nations indicated in

the Country Group and Country fields will the fiscal stance be applied. The Foreign

Tax ID box can be used to specify your company's tax identification number in

the region covered by this fiscal situation.

The Tax Mapping tab allows you to add the tax that will be mapped to this

financial situation. You can specify the tax you want to substitute in the Tax on

Product box by clicking the Add a Line button. The Tax to Apply section

allows you to specify the tax that you want to apply to this financial situation.

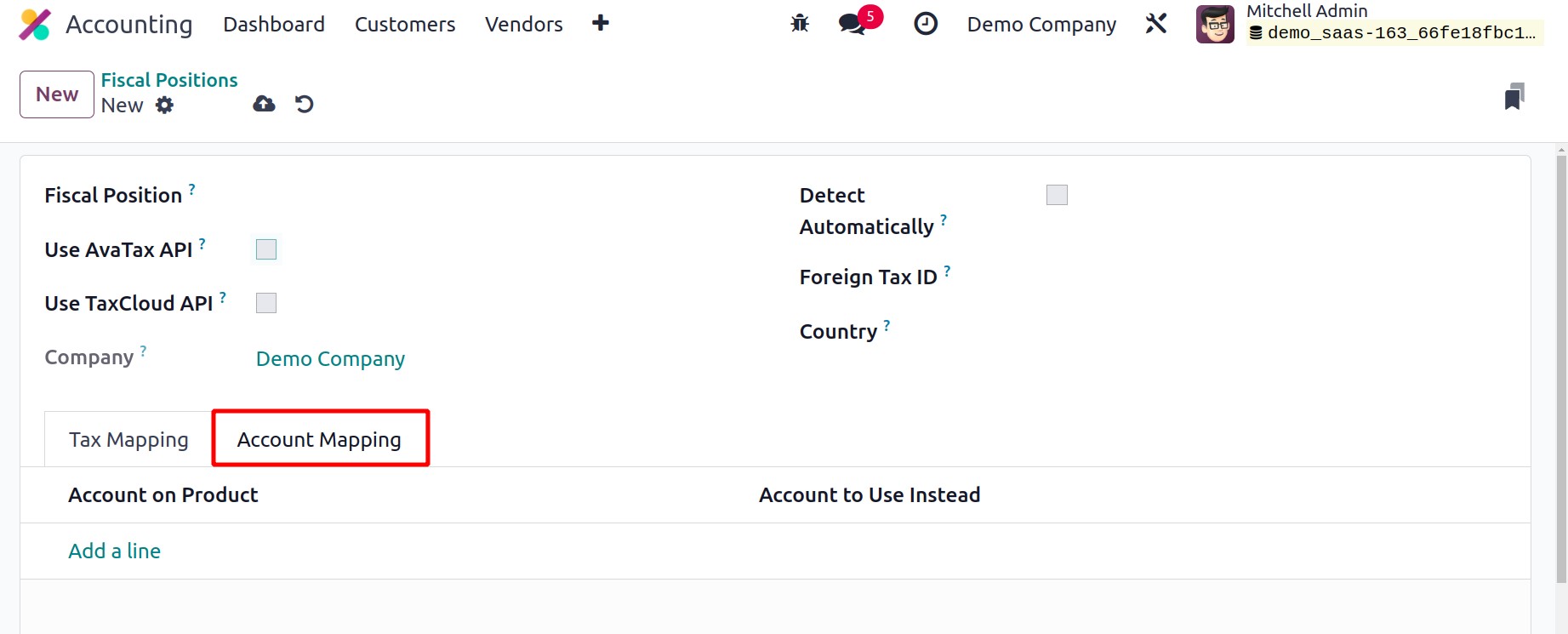

You can specify the account you wish to use for this fiscal position in the Account

on Product and Account to Use Instead sections, respectively, under the

Account Mapping tab.

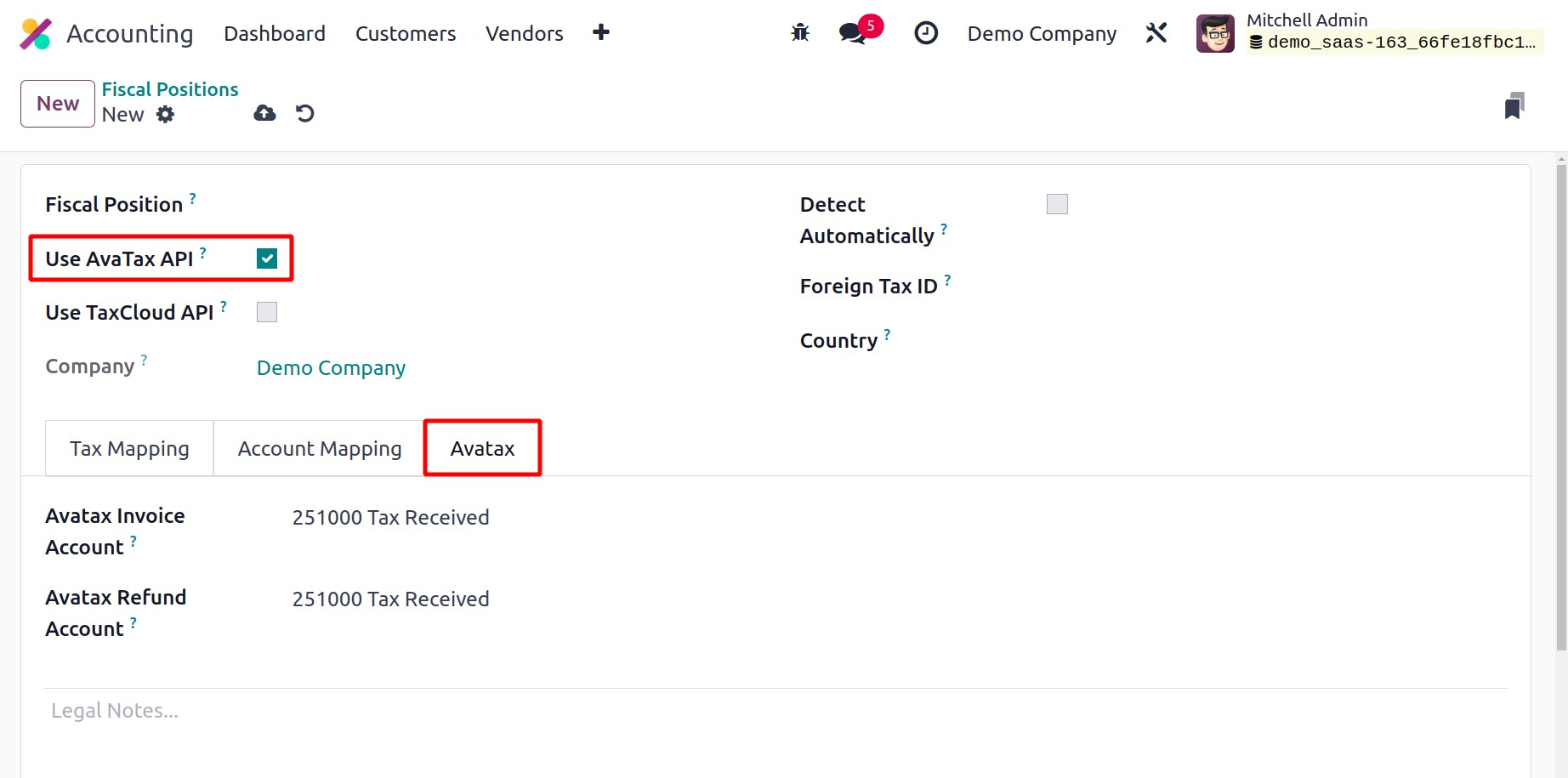

By turning on the Use AvaTax API option, the tax rates can be calculated

automatically. You may access the AvaTax tab by turning on this option, as shown

in the screenshot below.

You can enter the Avatax Invoice Account (the account that AvaTax taxes will use

for invoices) and the Avatax Refund Account (the account that AvaTax taxes will

use for refunds) here. The Legal Notes area can be used to specify the legal notations

that must be printed on the invoices.

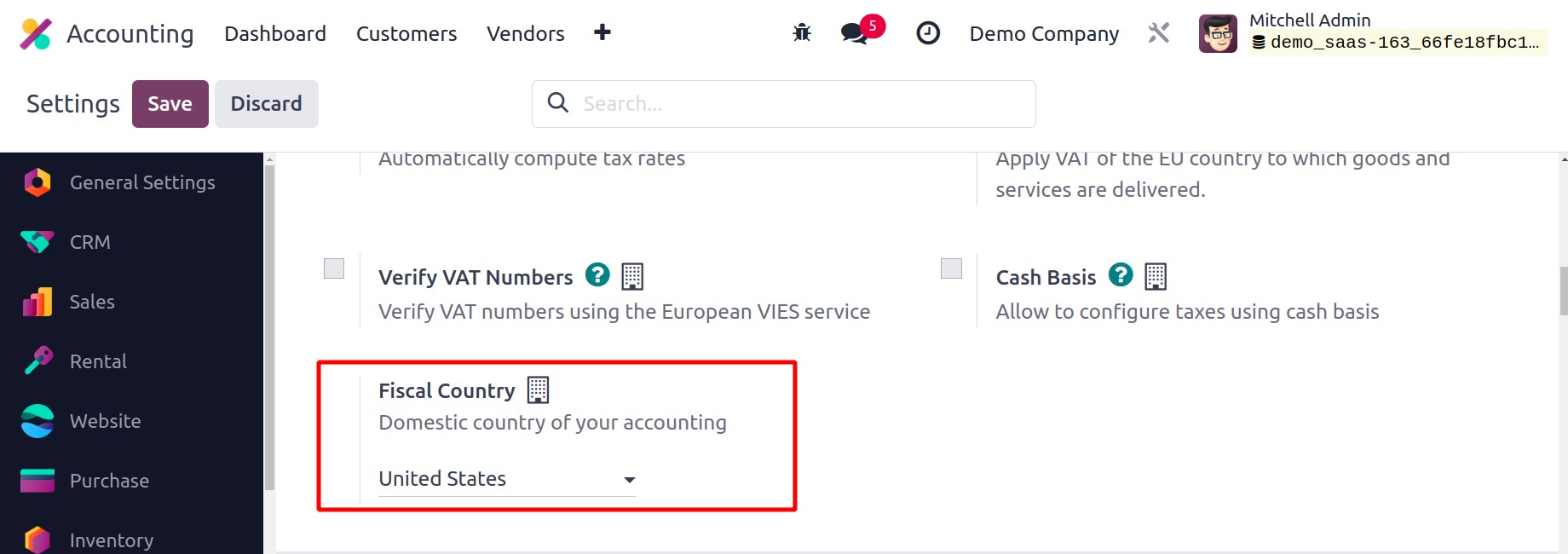

In the Settings menu, you can select your home country for accounting purposes.

You can choose your Fiscal Country under the Taxes tab, as seen in the

image below.

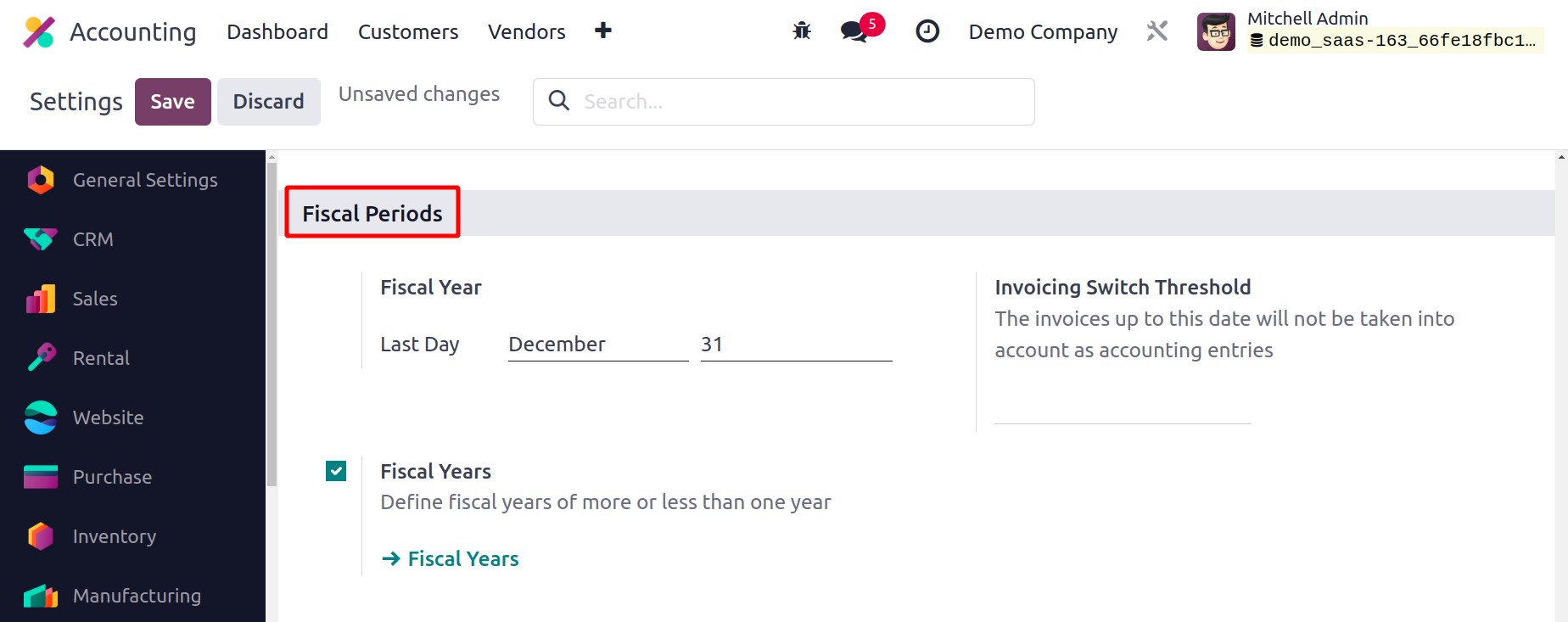

It is crucial to specify the end of your fiscal year so that Odoo17 can open new entries

on that day every year. The Fiscal Period option, which is found in the

Settings tab, allows you to specify the end of your fiscal year.

You can enable the Fiscal Years option to configure your company's fiscal year

whether it is longer than or shorter than 12 months. Using the external link provided in

this section, you can configure new fiscal years.

You can enter a date in the Invoicing Switch Threshold field to specify the date

after which invoices will no longer be counted as accounting entries.