1099 Reports

It is crucial to produce 1099 income statements for contract workers who receive payments of $600 or more and work in the US in order to submit tax information for the services provided throughout a fiscal year. The Odoo Accounting module now makes it simple for users to submit 1099 reports electronically. Additionally, you can export related CSV files that contain all the data you require for the 1099 report.

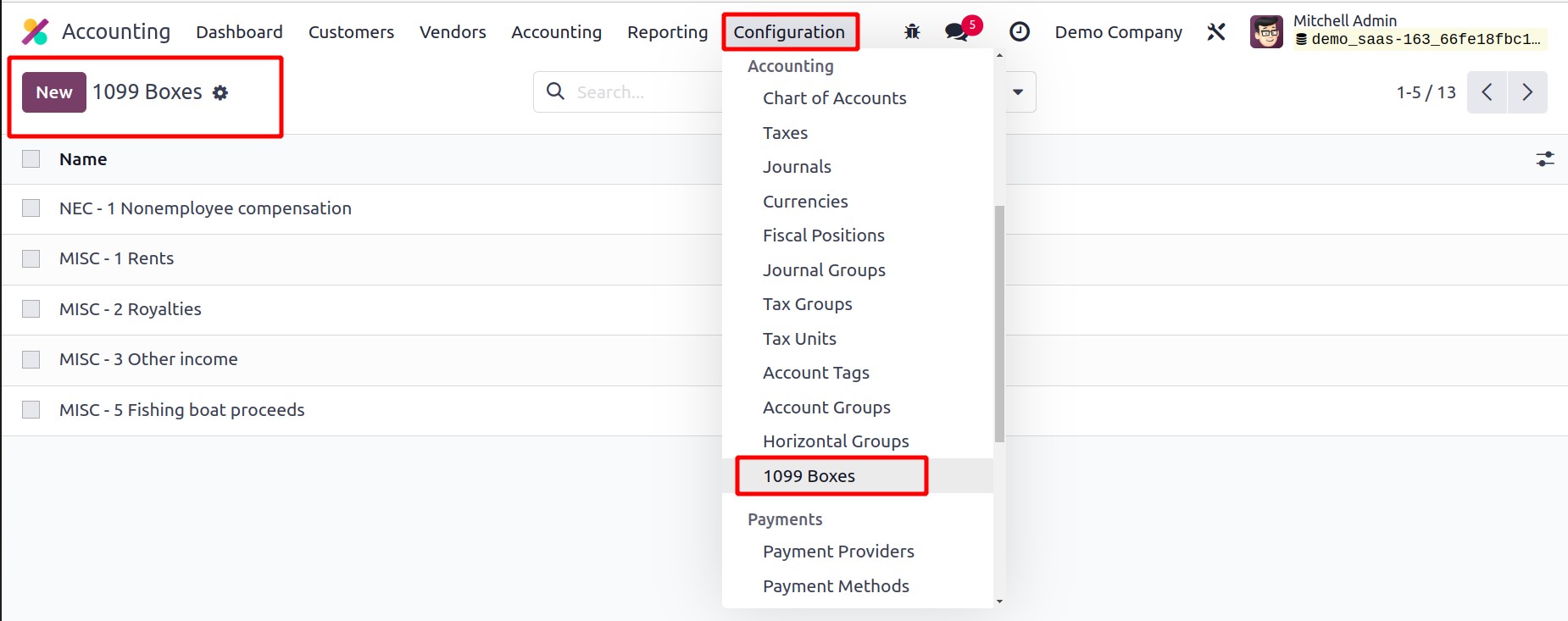

You can select the 1099 Boxes option from the Configuration menu in the Accounting module to generate 1099 reports using 1099 boxes.

You can create new 1099 boxes by pressing the New button. You can create the 1099 reports' CSV files by selecting the 1099 Reports option from the Accounting menu's Reporting menu.

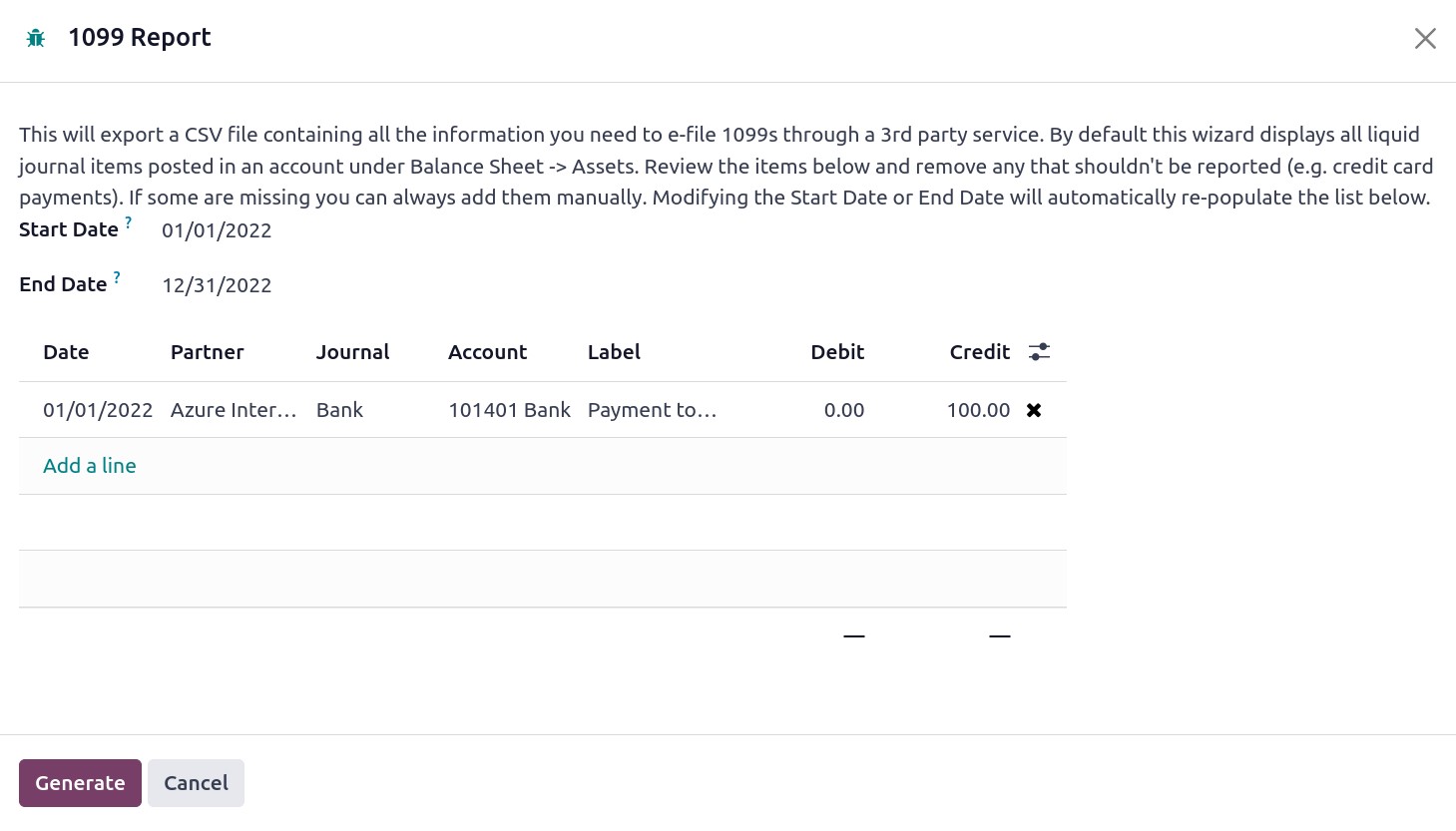

You will find all the information you require in the CSV file to e-file using a third-party provider. By default, the pop-up pane shows each liquid journal entry made to an asset account on the balance sheet. You can review the information in the pop-up window and edit any irrelevant information. The missing information can be manually added to the window. You can enter the Start Date and End Date in the appropriate areas to receive an automatically generated list of journal entries. The date, partner, journal, account, label, debit, and credit details are all included in the list. You can obtain the 1099 report's CSV file by selecting the Generate button.