Taxes

When you choose the tax option from the Configuration, a popup with numerous other tax-related options will open. The setting menu also has the ability to access the Tax choices.

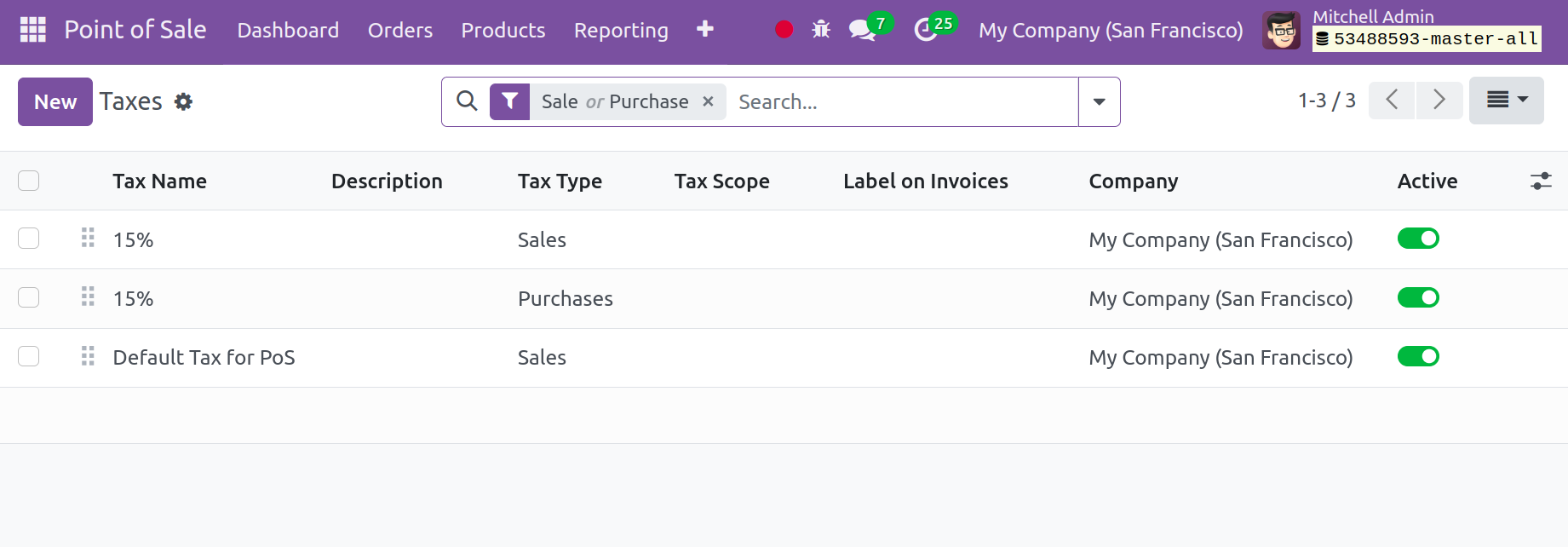

You may find a list of all the configured taxes on this page by visiting the tax page. The page includes the following information: Tax name, Tax type, Tax scope, Invoice label, Company, and Activation option. Click the New icon to create a tax that is comparable to this one.

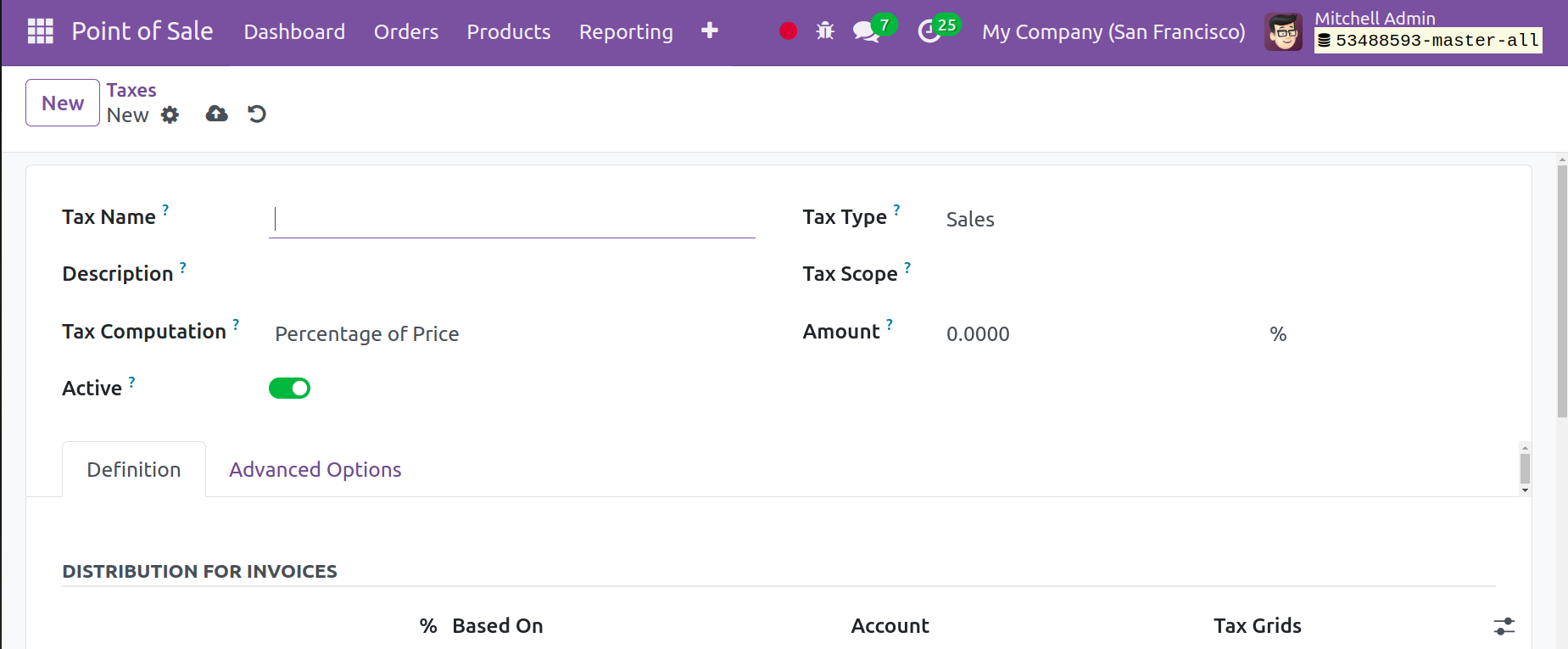

Here, you must specify the tax's name and choose a Tax Type, which determines whether or not the tax is selected. There are three different tax types: sale, purchase, and none. Any Tax Computation method, including Group Tax and Tax with a Group of Sub-Taxes, is available to you. Fixed, meaning that the tax remains the same regardless of price changes. As a percentage of the price, the tax price represents a percentage of the cost. The tax cost is a category of the price, as indicated by the percentage of the price that is tax included, and the tax is computed using the Python code. A Tax Scope on specific items and services can be chosen. This option will regulate the application of taxes just to a specific category of goods. You can enter the tax amount in the Amount area. The new tax can be activated by pressing the Active icon.

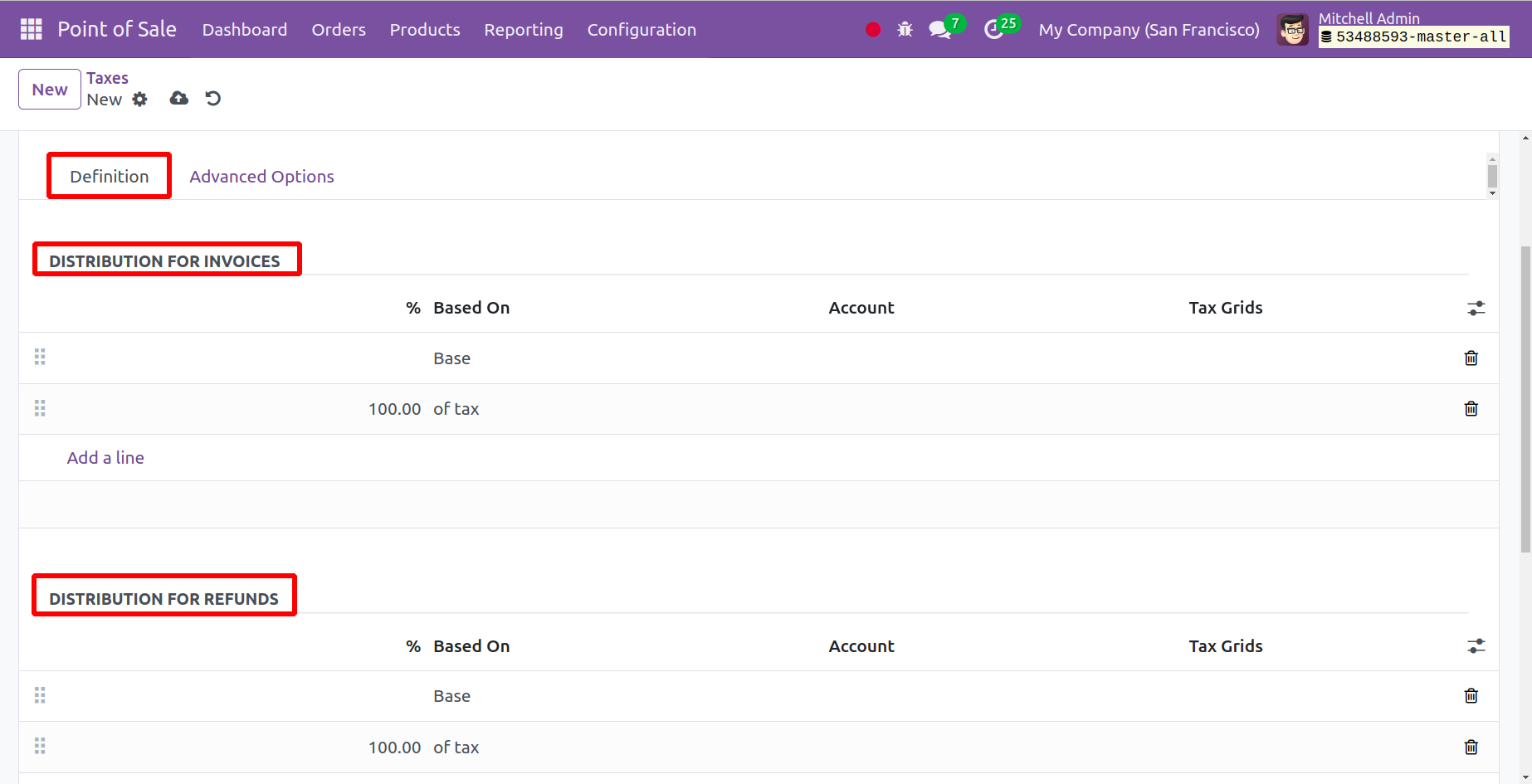

The Distribution for Invoicing options is located beneath the Definition tab. Using the Add a Line option, you may add the distribution of the just-formed tax in this option. The distribution may be used for a specific invoice within the tax period. Additionally, you can supply the credit note distribution under the Distribution for Refunds section by using the Add a Line option, just as you previously did. When the tax is being refunded, the option may be used.

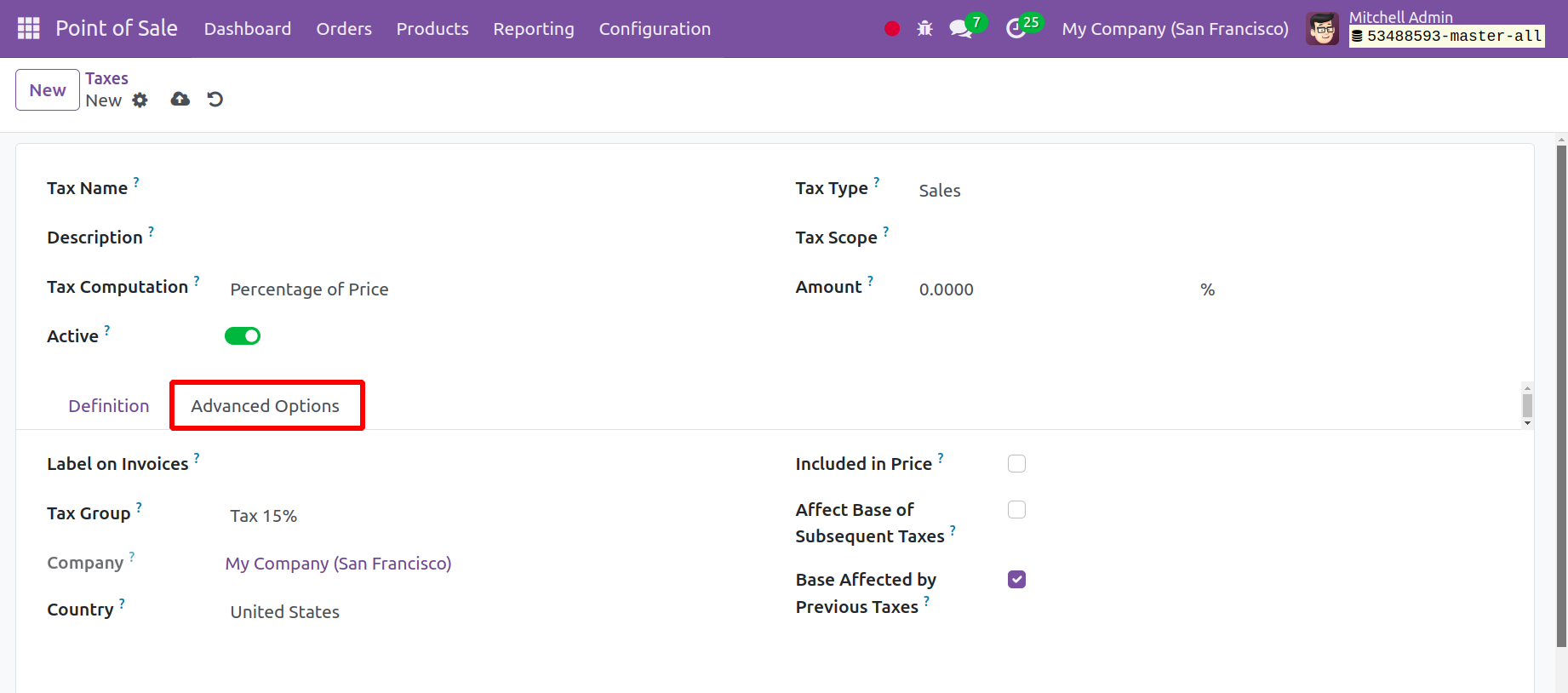

You can now fill up the Label in Invoice and Tax groups options found beneath the Advance options.

The Country and Company can be listed below that. If the product and invoice price are included in this specific tax, it will activate the Included in Price option. The specific tax with a higher sequence number than this one will be impacted upon activating the Effect Base of Subsequent Taxes. The tax with the lower sequence will be impacted when the Base Affected by Previous Taxes is triggered. In order to make this freshly formed tax, finally click the Save icon