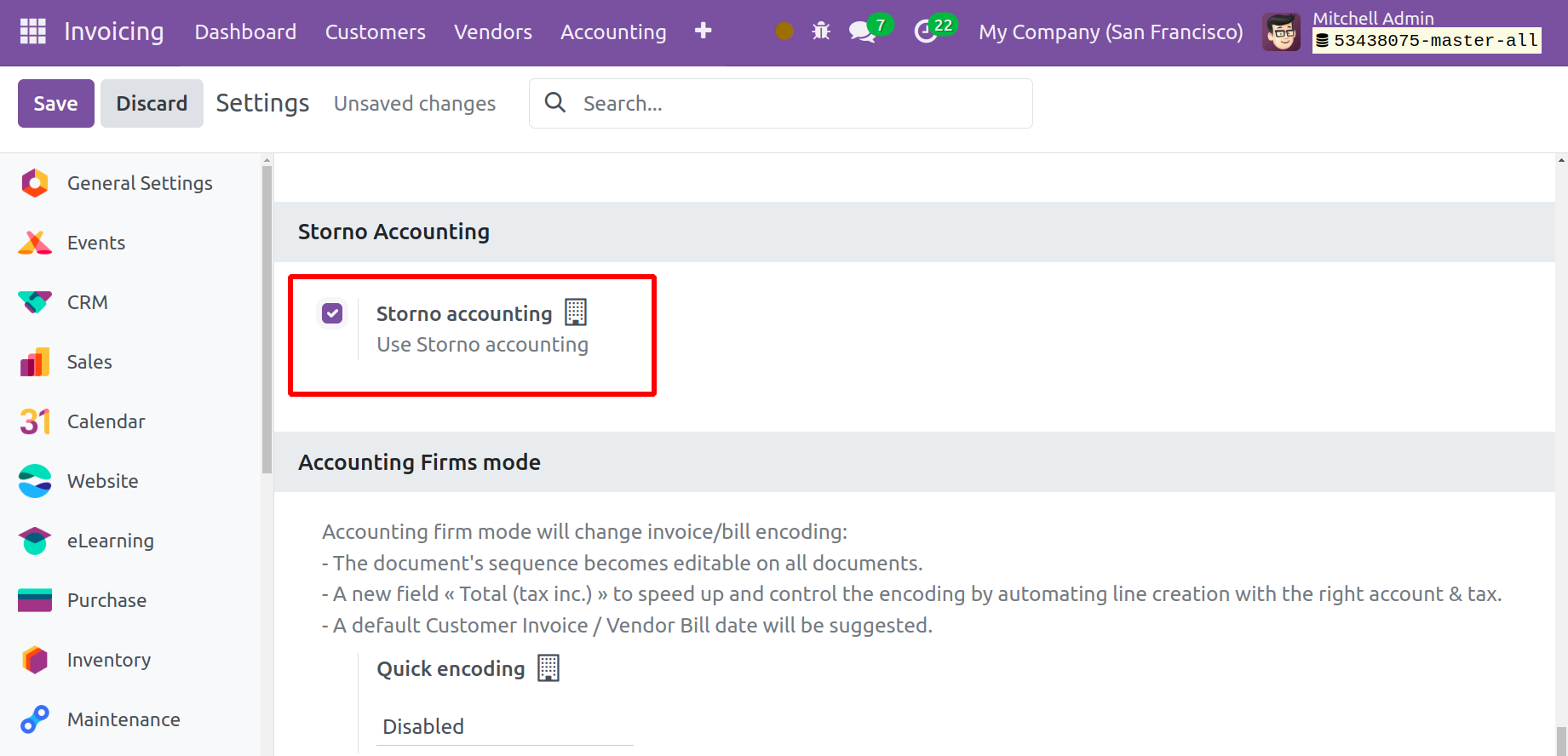

Storno Accounting

One of the recently added accounting capabilities to the Odoo Invoicing module is Storno Accounting. This accounting technique will reverse the initial journal entries using the negative credit or debit amounts that are tracked in your account. You can delete files that contain inaccurate accounting data related to the recorded amount with the aid of this new feature. After the inaccurate accounting data has been canceled, you must confirm that the proper data has been entered.

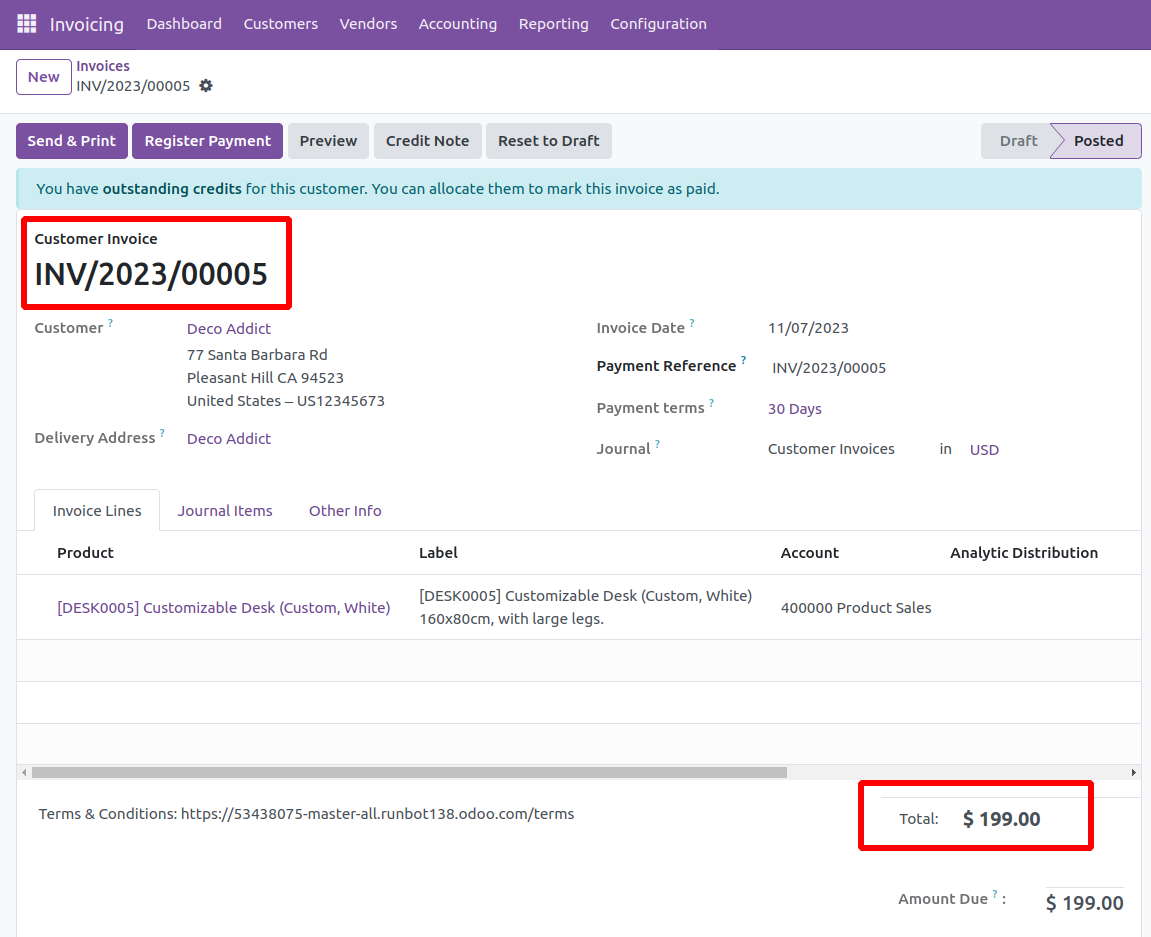

The amount specified in the reverse item is visible in this mode as a negative sign. We'll use an example to demonstrate this capability. You discovered that the amount on a customer invoice was entered incorrectly—instead of $150—while handling the invoice. For the original entry, you can make Storno here. After you've finished reversing the original entry, Odoo will assist you in creating an accurate invoice for $150.

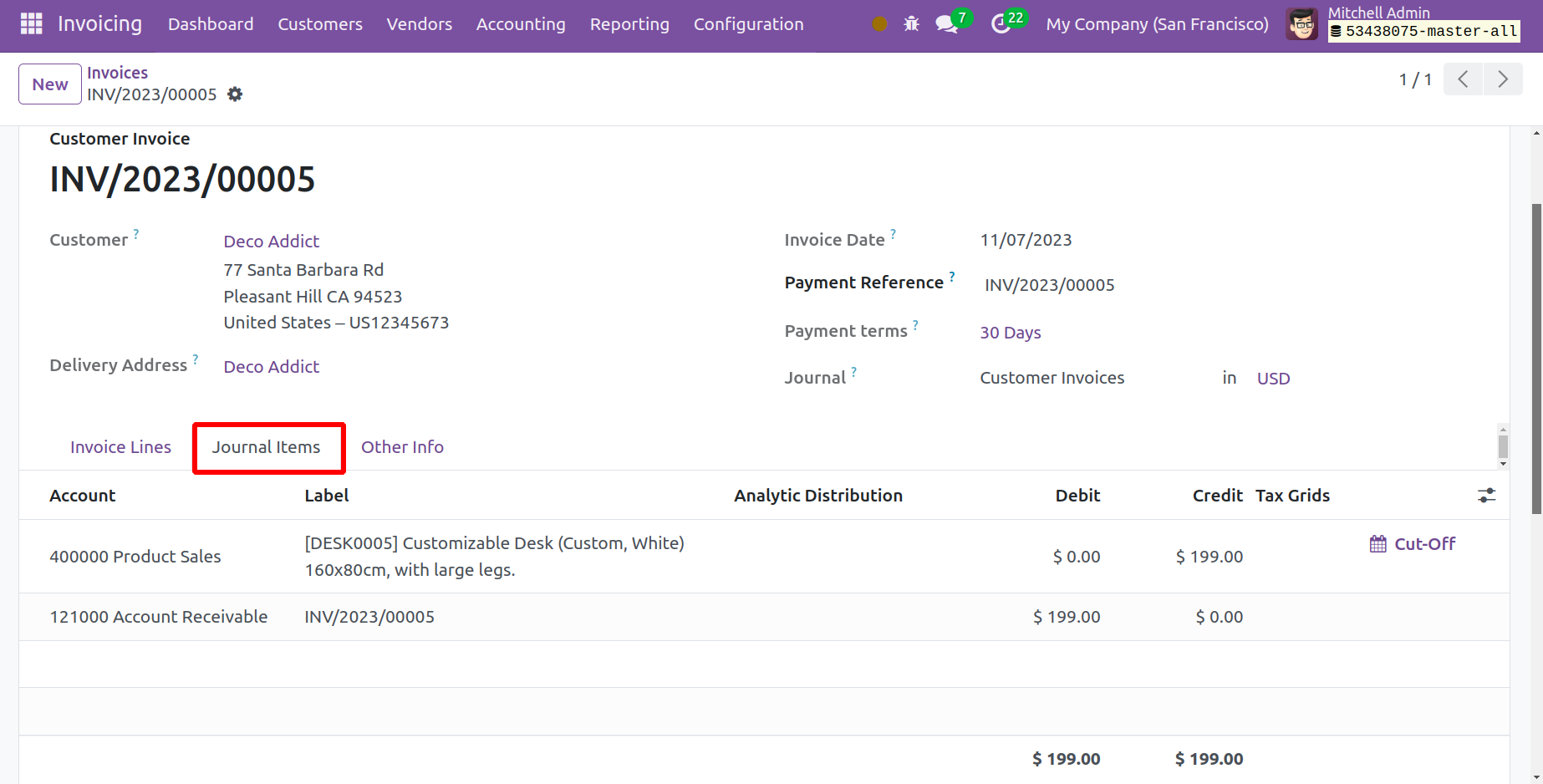

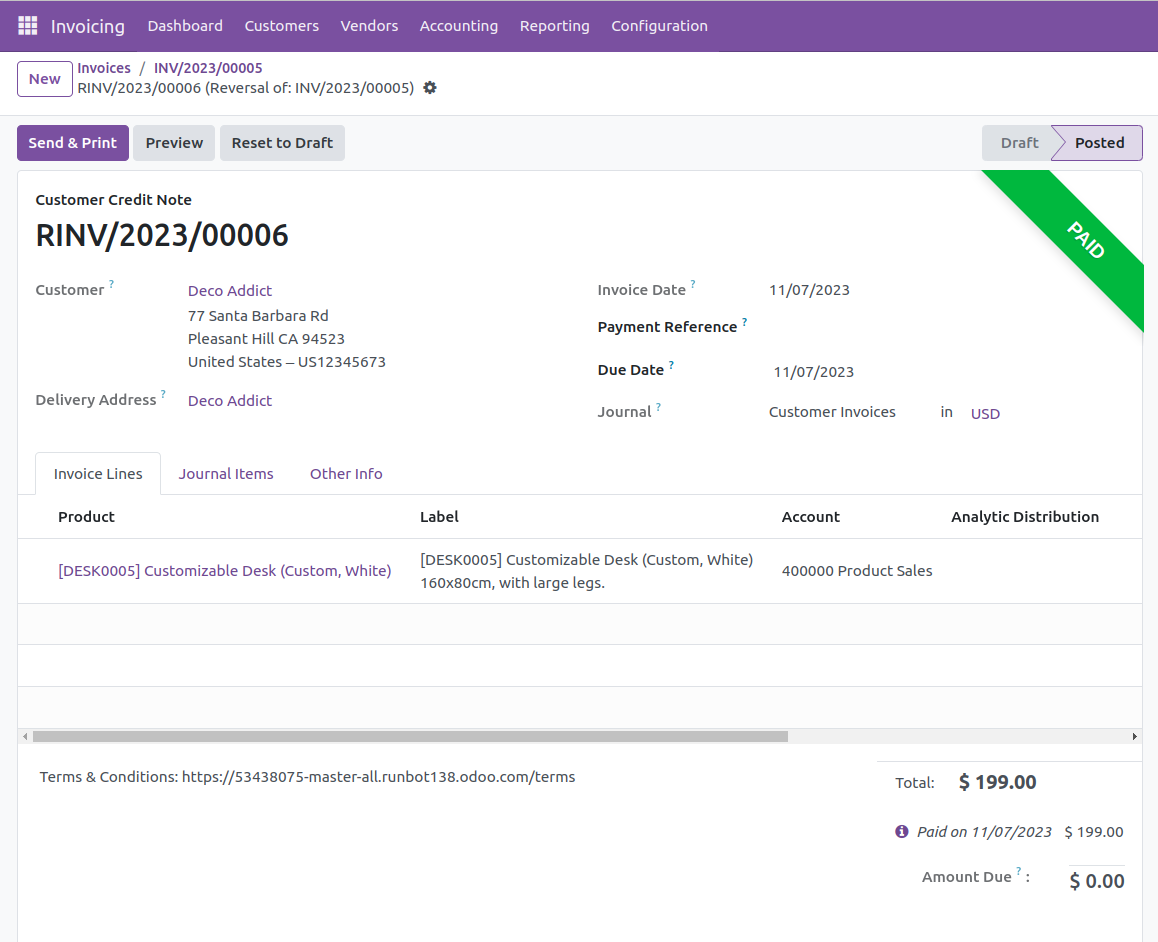

The client invoice for $199 is shown here. The items generated for this invoice are visible under the Journal Items tab.

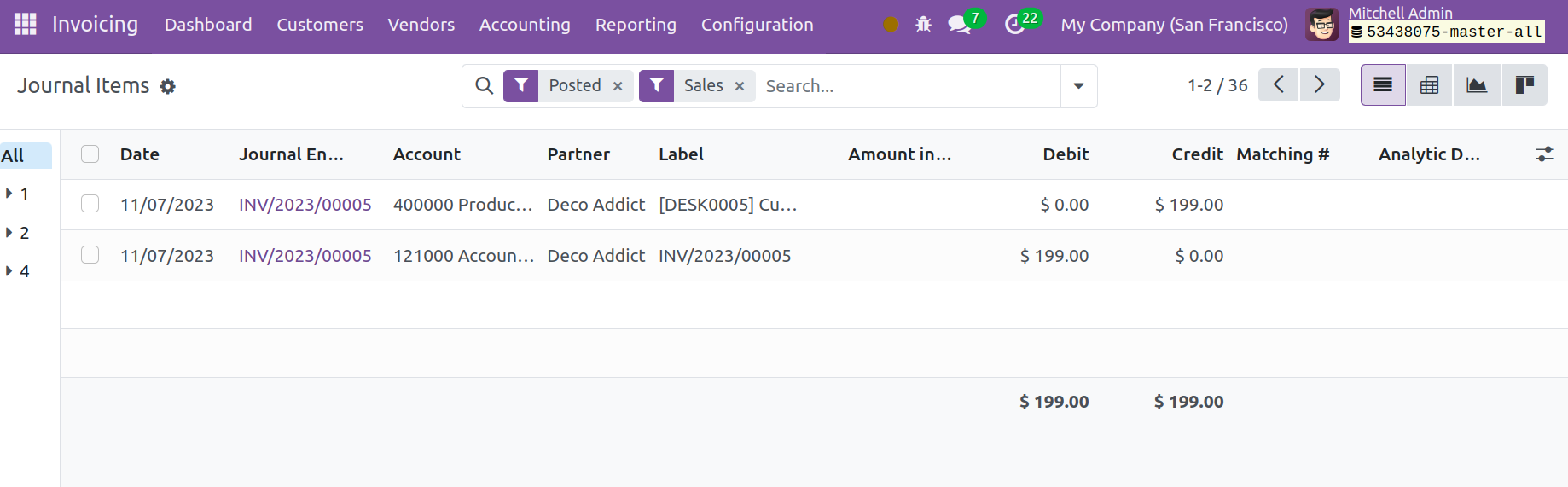

Navigate to the Journal Items menu item under Accounting. This is where the $170 journal item that was posted can be found, as seen in the picture below.

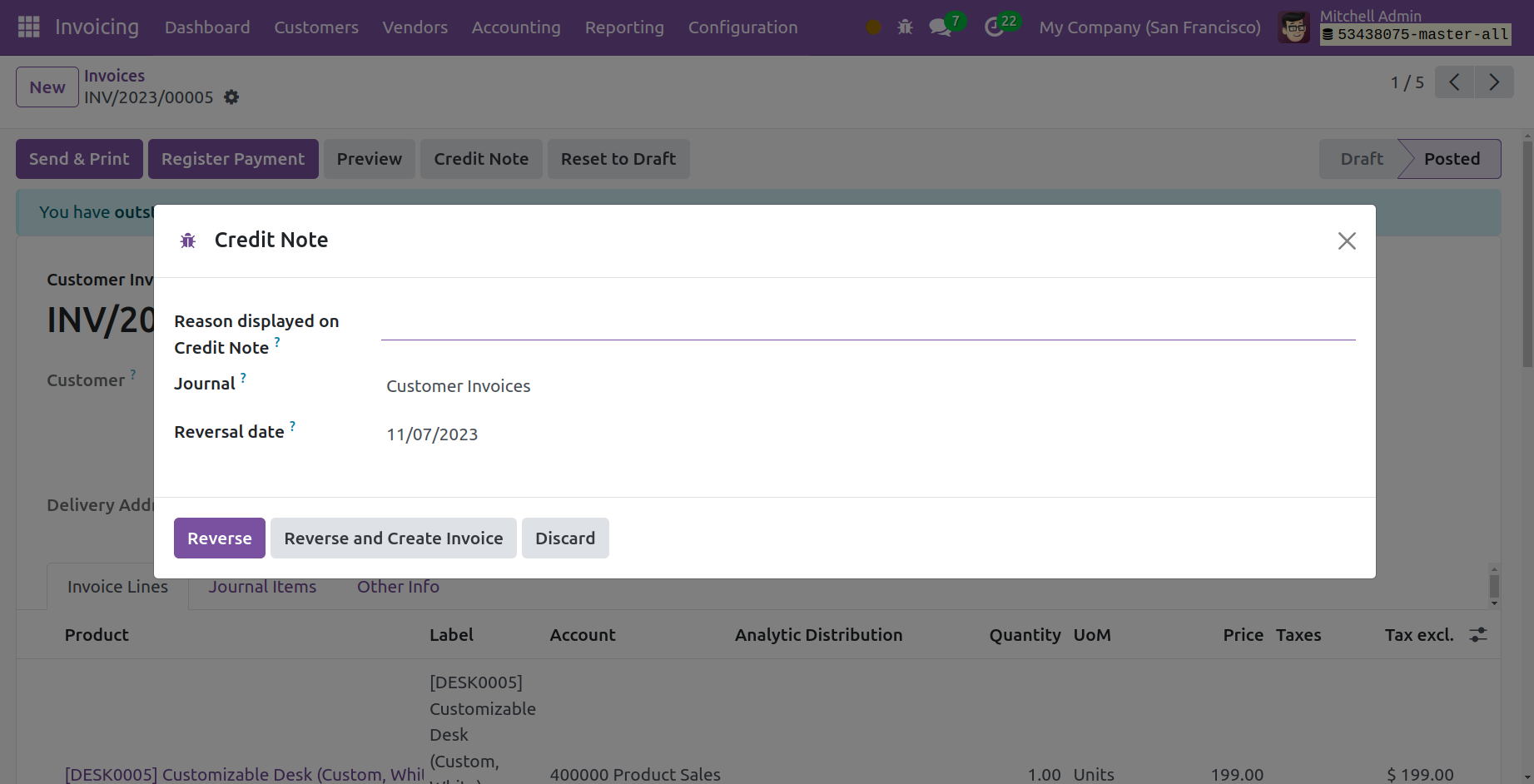

You can undo the journal entry because that isn't the real amount. For the specified amount, you can make a reversal entry by using the add Credit Note option.

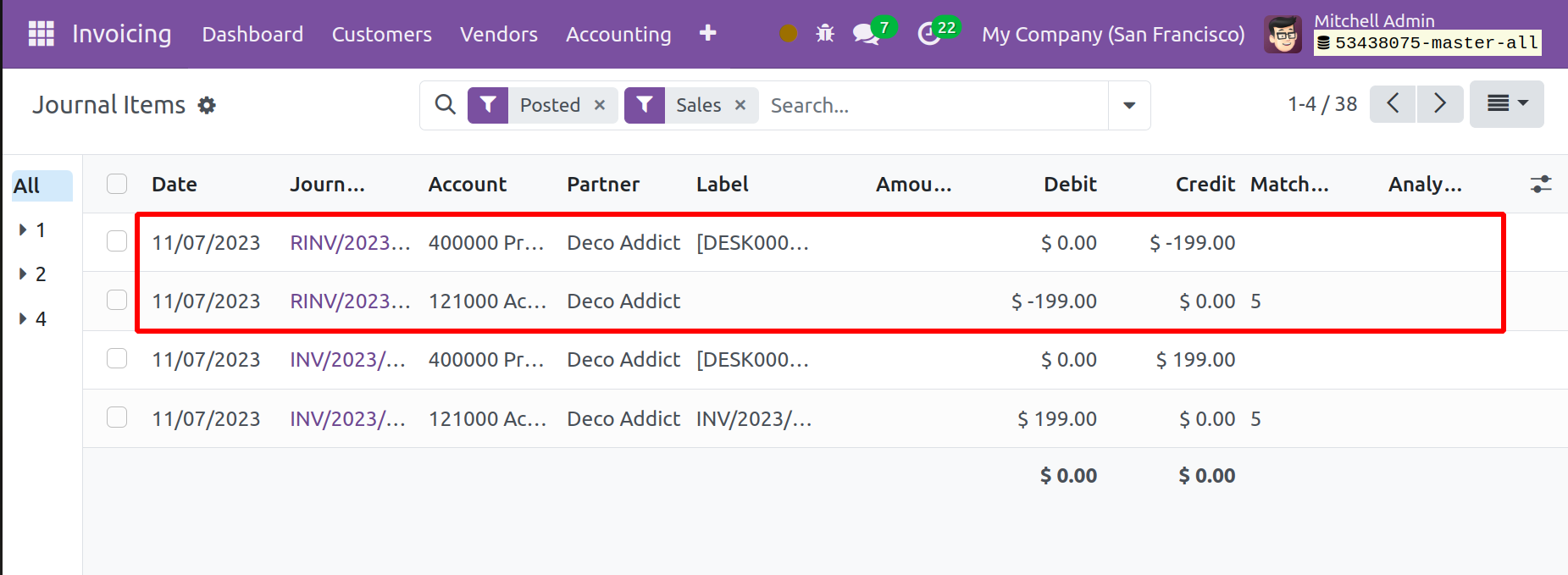

As soon as you confirm the customer credit note and click the Reverse button, the posted entry will be reversed. The amount appears as a negative sign when you check it in the journal item window.

You can now make a new journal entry with the proper amount because we have reversed the wrong one.

As seen in the screenshot above, the Journal Items option of the Accounting menu displays the journal items of the wrong invoice, Storno, and proper invoice.