Journals

Accounting journals will contain a record of every accounting entry made by a corporation. Journals of accounting are thought of as transaction records organized chronologically. A company's Purchase Journal is used for vendor bills, Sales Journal is used for client invoices, Bank Journal is used for bank transactions, and Miscellaneous Journal is used for other sporadic activities. The invoice module can help you efficiently handle these types of journals. These journals contain journal entries that contain the transaction records. All of the financial records you have pertaining to various business operations and transactions can be kept up to date as journal entries in journals.

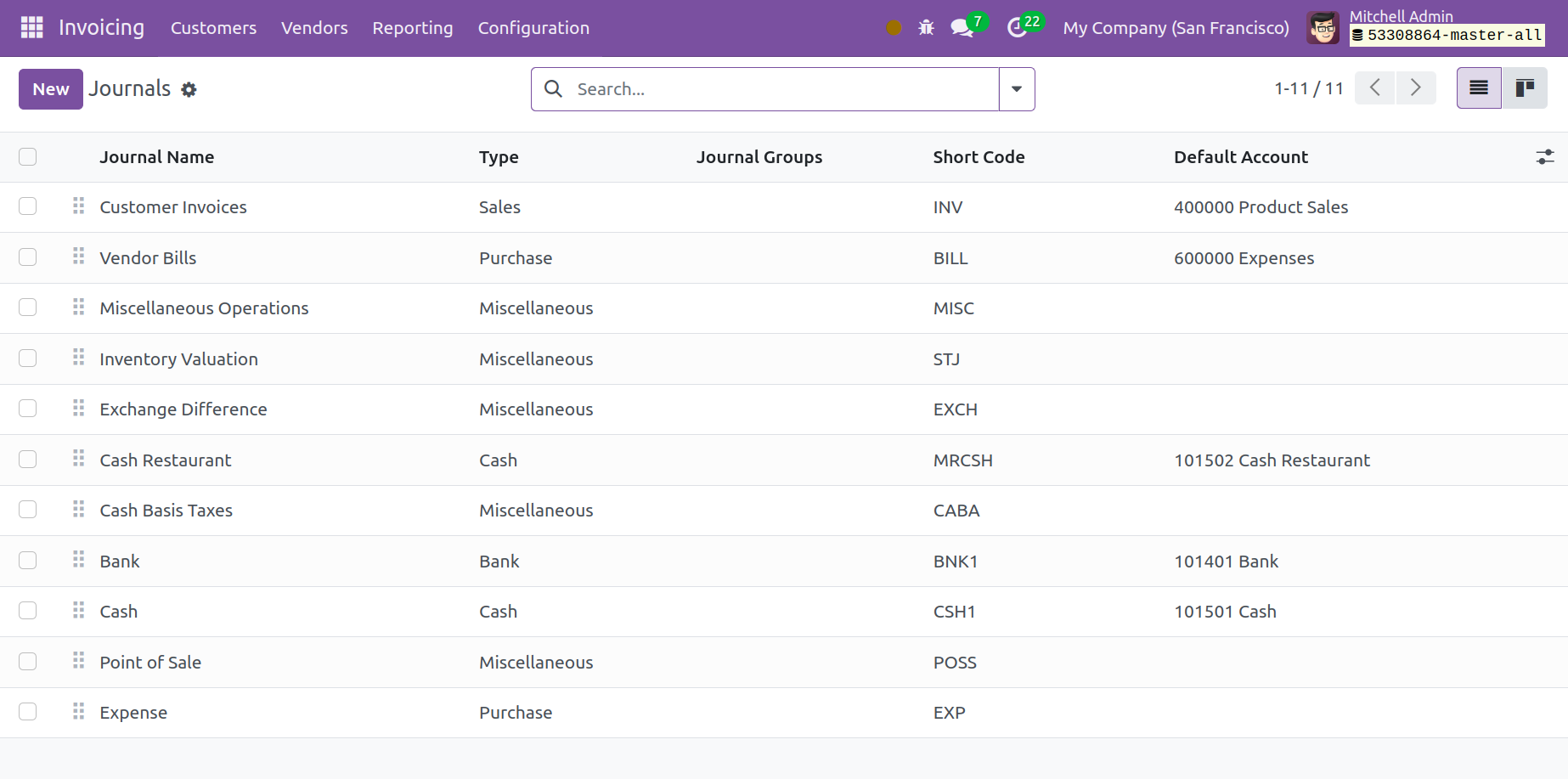

You can navigate to the Configuration menu of the Odoo 17 Invoicing module to gain access to the Journals platform. Below is the Journals window in list view.

Additionally, the window is shown in Kanban view. From the list view, you can see the Journal Name, Type, Journal Groups, Short Code, and Default Account. When you select a specific journal, a thorough view of the data listed in that journal appears, and you can edit the data as needed. Default and configurable options are available to make the sorting procedures easier. Favorites, Sales, Purchase, Liquidity, Miscellaneous, and Archived are the default filters that you will see.

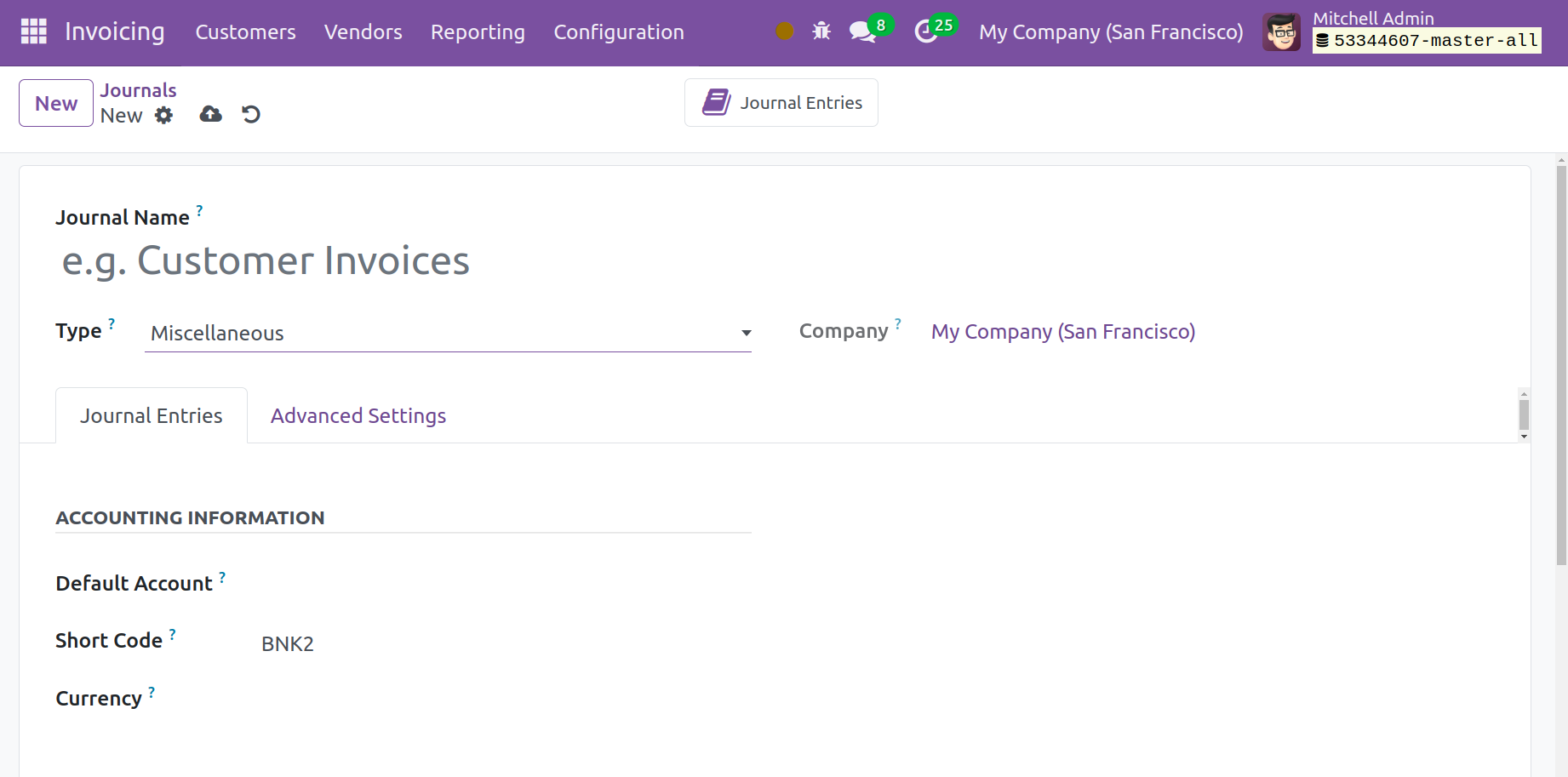

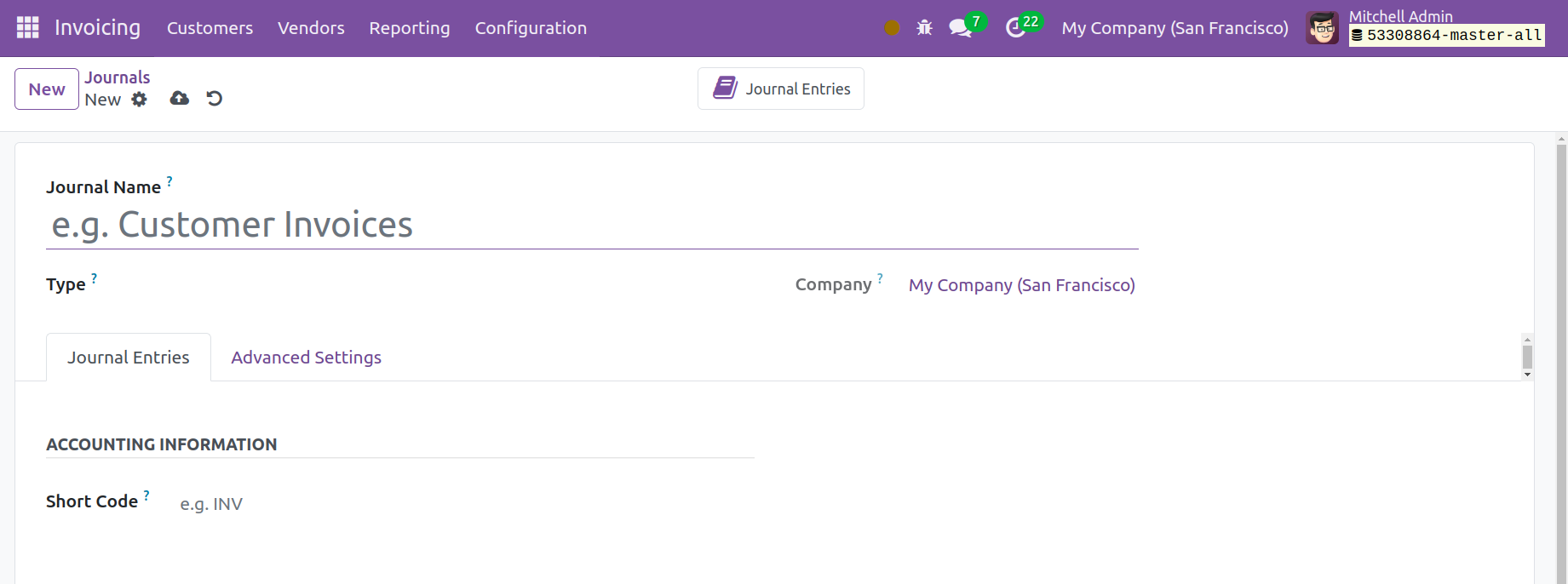

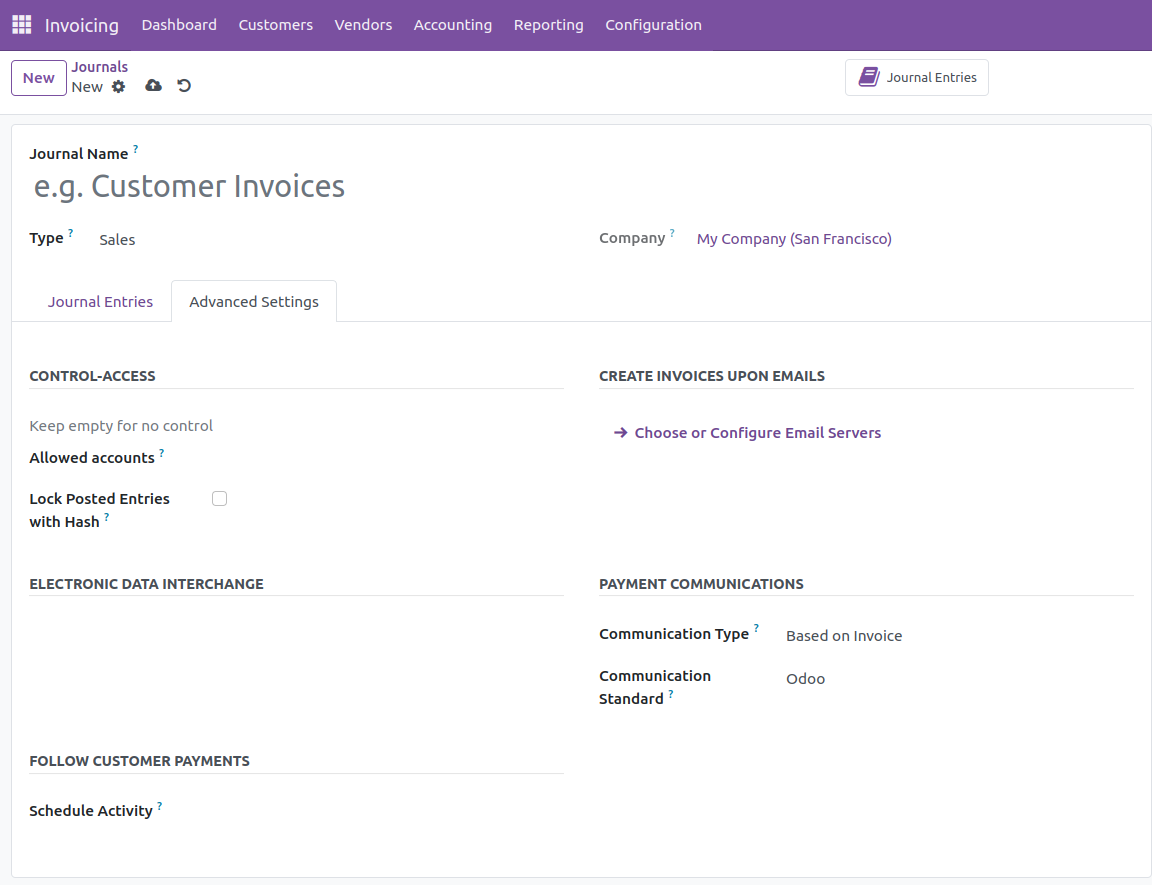

To start a new journal for your accounting operations, click the New button. You can create a new journal by clicking on the New button, which will take you to the form view shown below.

Here, you can fill up the appropriate fields with the Journal and Company names. In Odoo, you may create journals in five different categories: sales, purchase, cash, bank, and miscellaneous. The remaining tabs in the form view will change based on the kind that you choose. Let's examine each kind of journal in turn.

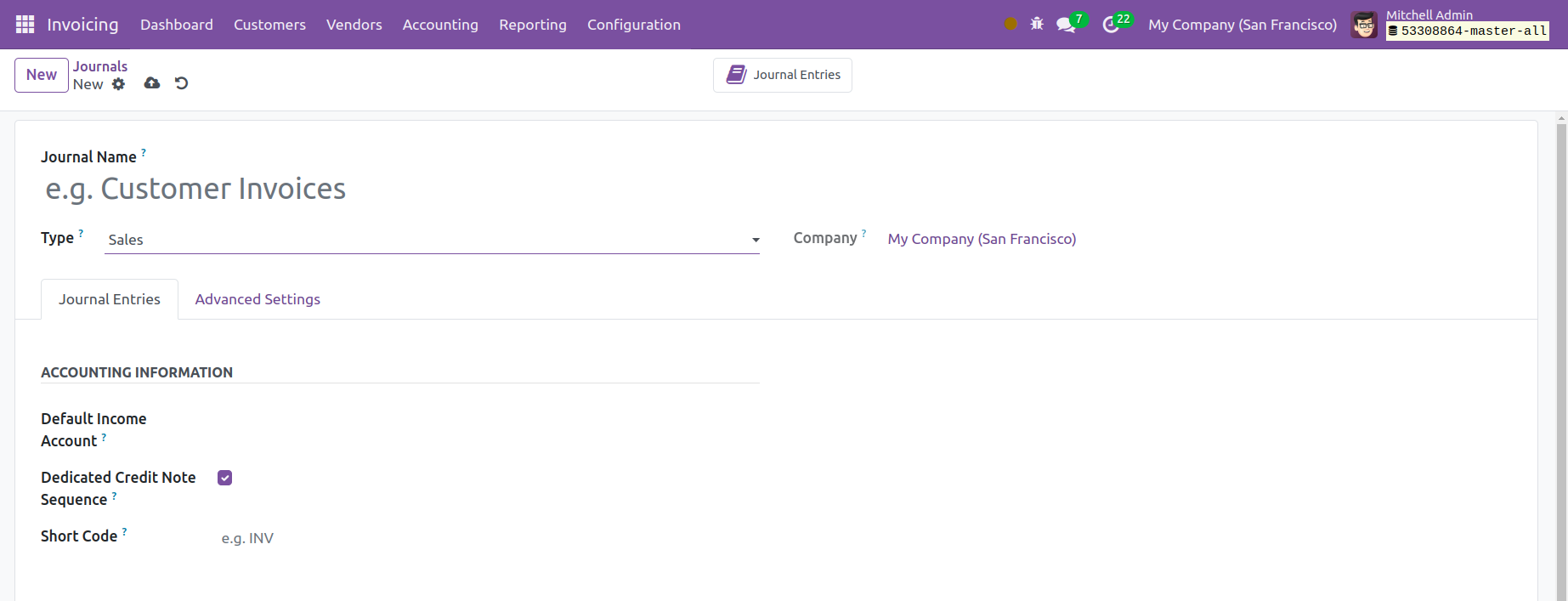

Sales

All the sale transactions record under the sales journal. You can choose the Sales option in the Journal Type section to create journals for customer invoicing. Under the Journal Entries tab, you can specify a Default Income Account for this journal after choosing the Type. If you would prefer not to share the same sequence for invoices and refunds made from this journal, you can turn on the Dedicated Credit Note Sequence field. Bring up the Shirt Code, which will serve as a display name. You can enter the currency that was used to enter a statement in the designated space.

You have Control-Access settings under the Advanced Settings tab. If you want no control, you can leave the fields empty. Indicate which accounts are allowed in the corresponding field.

When the Lock submitted Entries with Hash feature is enabled, an invoice or accounting entry is hashed as soon as it is submitted and becomes unmodifiable. You can designate a Communication Type in the Payment Communications section that, once validated, will show up on customer invoices to make it easier for the customer to refer to that specific invoice when making a payment. Establish appropriate communication standards in the allocated area. In Odoo 17, you will see a box where you may set up email servers to generate invoices based on emails. In order to enhance the collection process, the activity you specify in the Schedule Activity section will be automatically booked on the day of payment due.

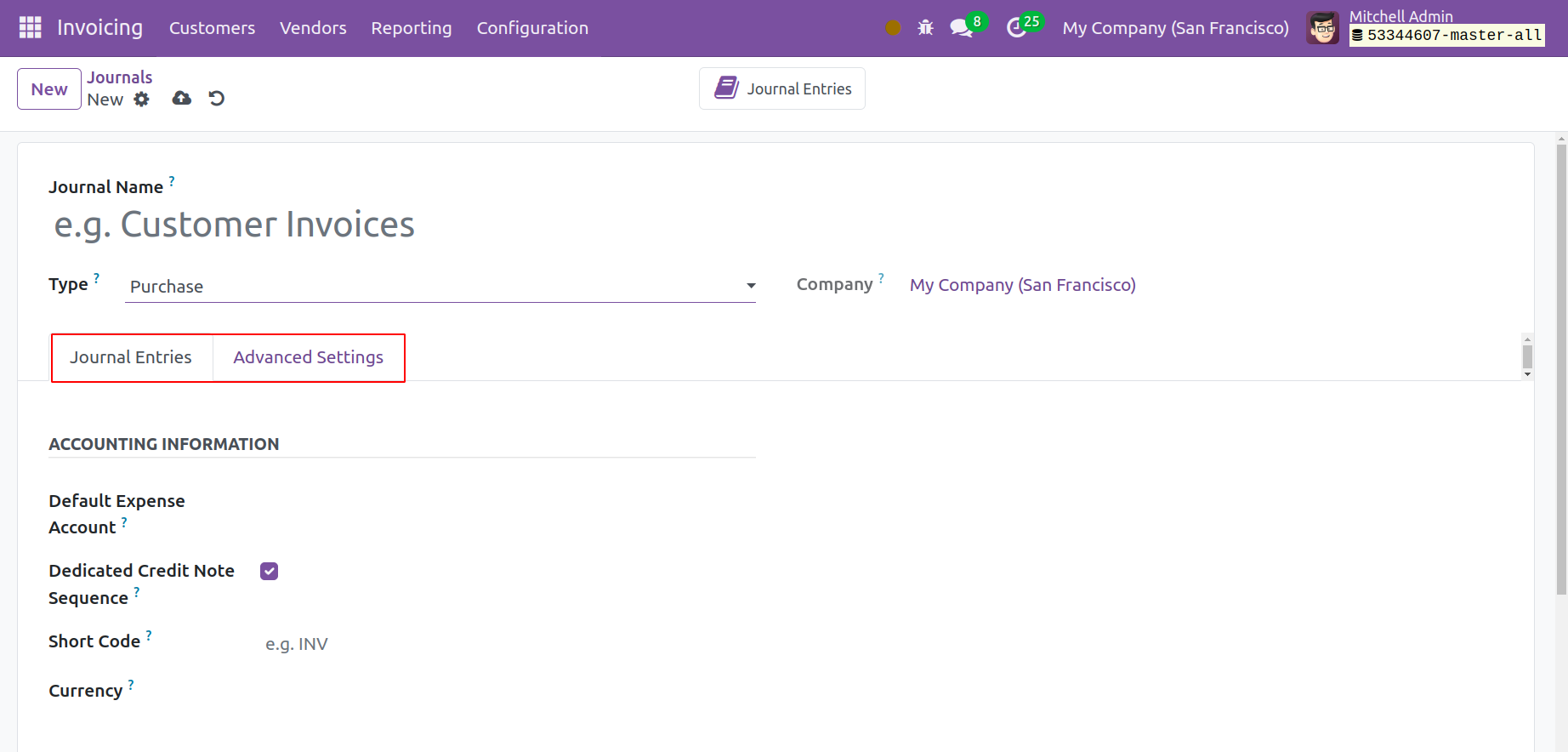

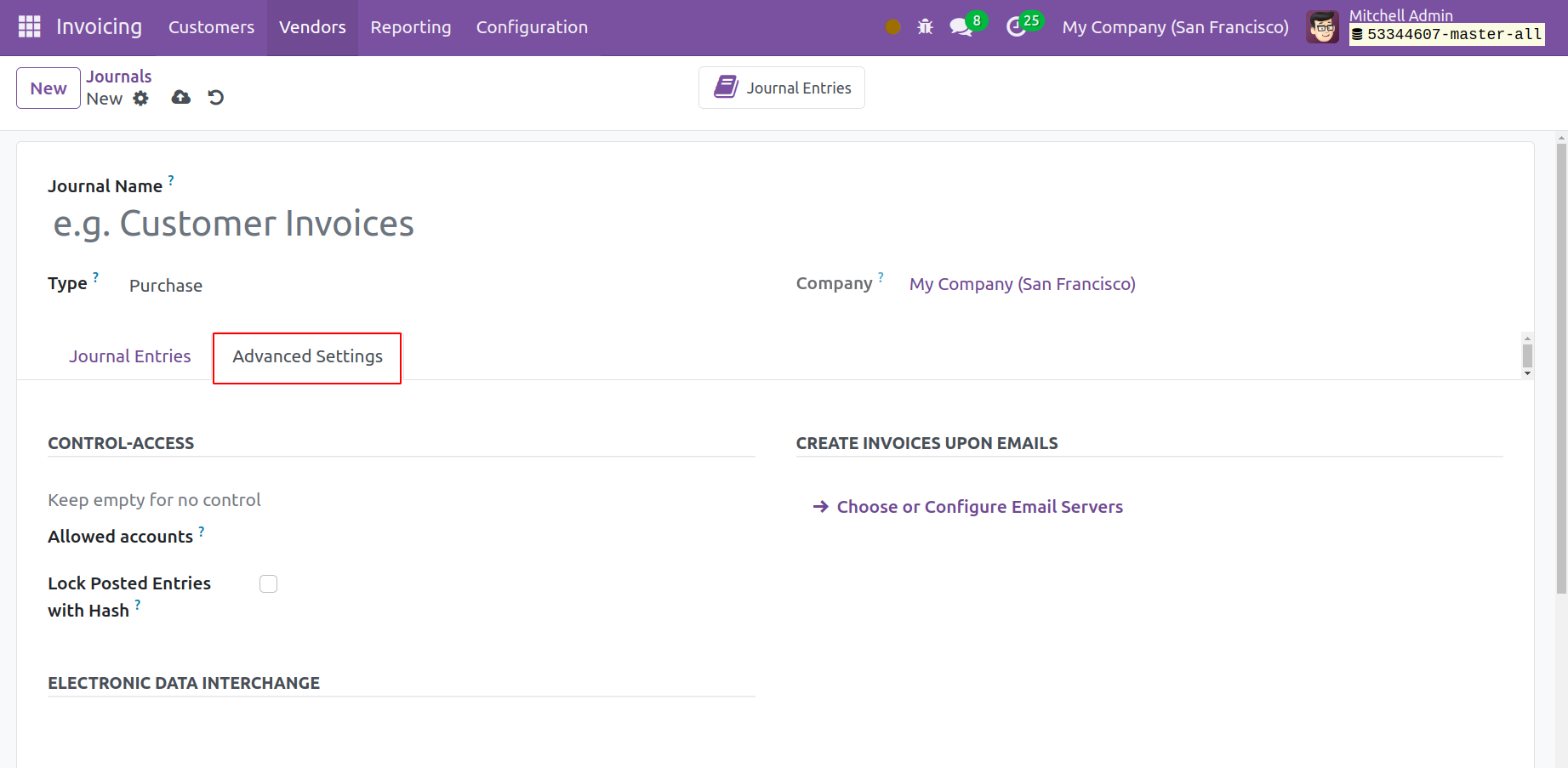

Purchase

Should you wish to create journals for vendor bills, you can check the Purchase option in the journal Type field.

You can enter the Default Expense Account, Short Code, and in the corresponding fields on the Journal Entries tab. If necessary, turn on the Dedicated Credit Note Sequence.

You can enter the Allowed Account in the Control-Access box under the Advanced Settings page. Set up email servers to generate invoices in response to emails. You can use the Hash option to activate the Lock Posted Entries based on the requirements.

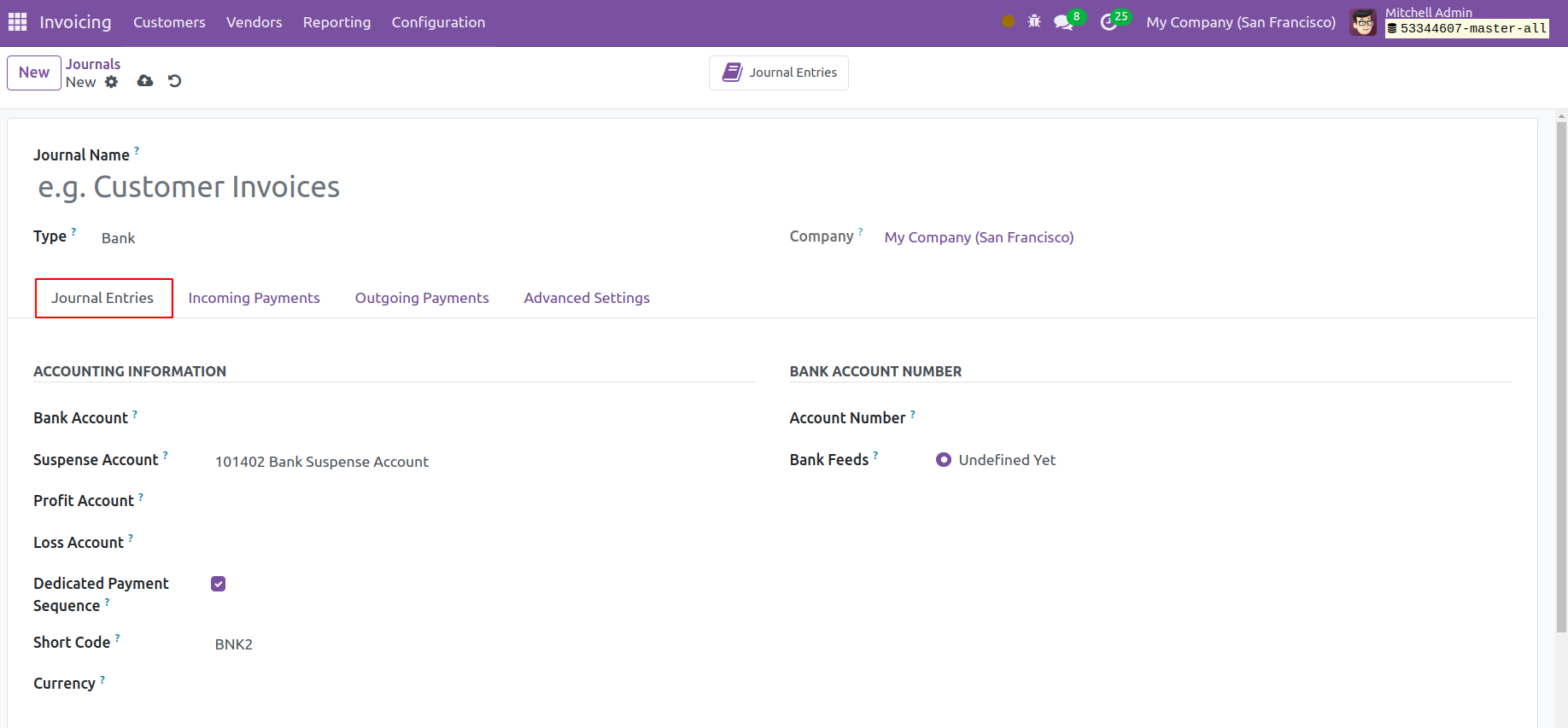

Cash and Bank

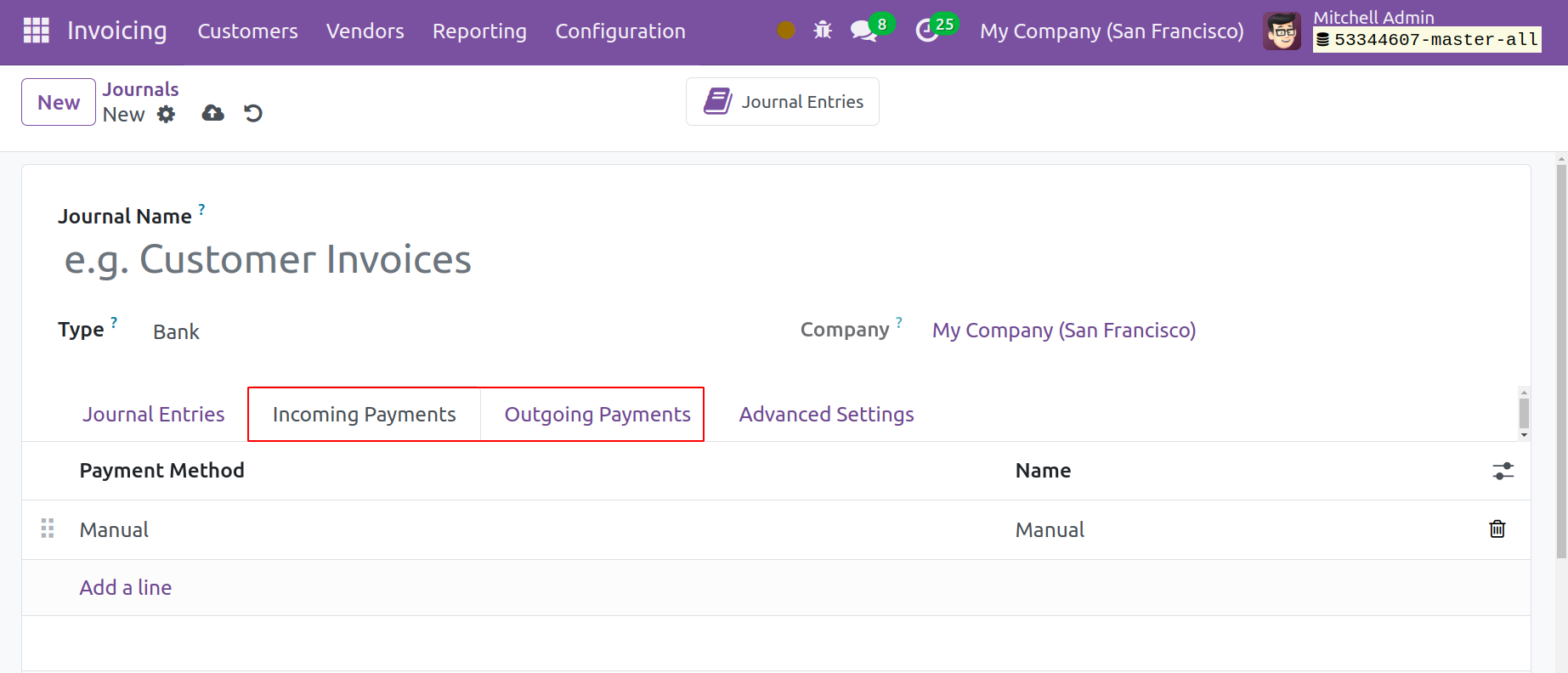

You have two more tabs to fill out: Incoming Payment and Outgoing Payment, whether you choose Cash or Bank as the Type of Journal. To keep track of your bank statements and cash transactions, use Cash and Bank Journals.

You must refer to the Accounting Information found on the Journal Entries tab when selecting the Cash option. The Cash/Bank Account, Suspense Account, Profit Account, and Loss Account can all be mentioned here. The remaining fields correspond to the ones we already discussed. Until the final reconciliation makes it possible to identify the correct account, the bank statement transactions will be placed on the suspense account. When the closing balance of a cash register deviates from what the system computes, a profit or loss will be recorded in the profit account or loss account, accordingly. You must provide the Bank Account and Account Number in the appropriate areas when selecting the Bank option. For both Bank and Cash choices, the Incoming Payments, Outgoing Payments, and Advanced Settings sections are identical.

Under the Incoming Payments and Outgoing Payments tabs, you can add Payment Method and Name by using the Add a Line button.

Miscellaneous

The Miscellaneous Journals can be used to document any additional business interactions. From this window, you can build a journal that is appropriate for your accounting processes.