Odoo 17 Expense Management

The expense management module facilitates the organized management and control of

company expenses. This module makes it simple to record daily spending, which aids

in maintaining employee records in an organized manner. Additionally, it aids in

strengthening the company's financial foundation. The scale of the company is irrelevant

in this case. The improvement of the organization's profit margin is largely dependent

on effective expense control. In certain instances, the worker will be required

to pay the full cost of the components or equipment without receiving any advance

payment. In these situations, the employees can quickly create reports detailing

their spending under Odoo expenses and send them to the boss for approval.

Let's examine how you use Odoo software to control and monitor employee spending.

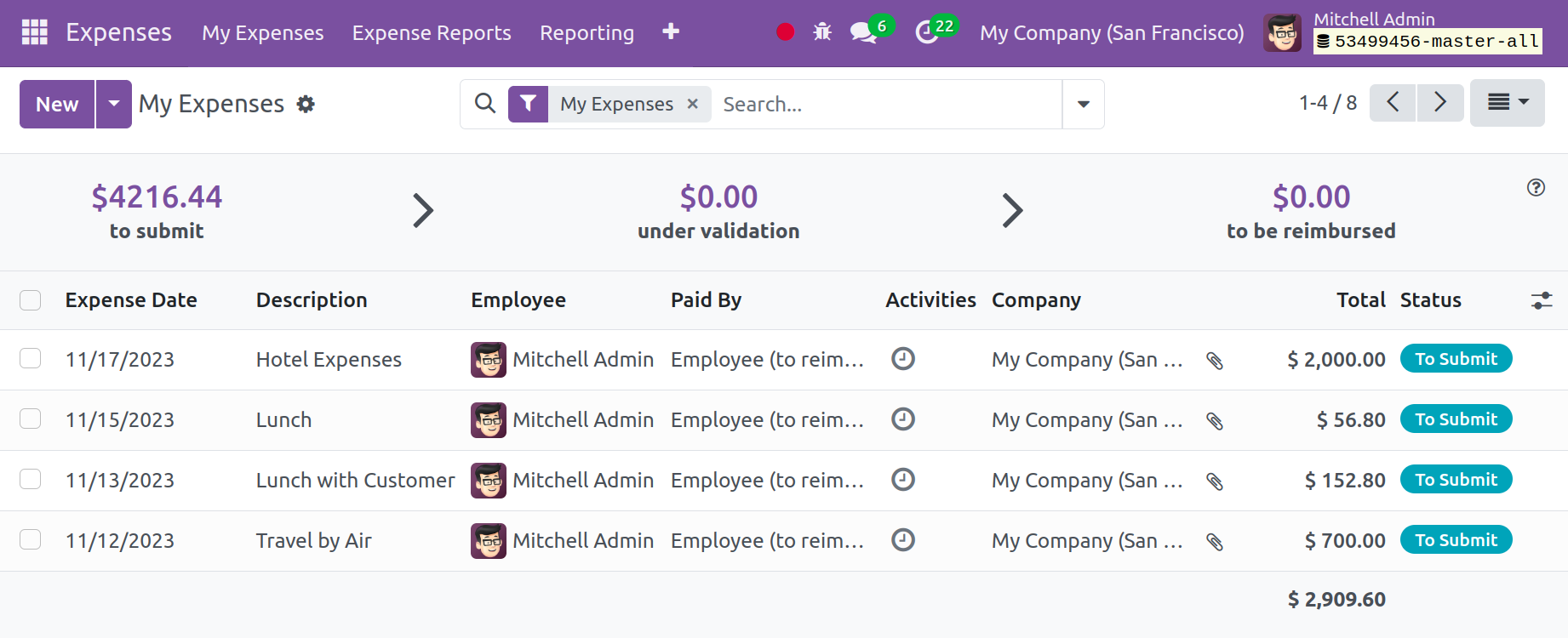

The module's primary dashboard will look like the screenshot below.

The provided page displays the costs associated with the reports that are sent to

the management of that specific business for approval. Accordingly, you can utilize

the group by, favorite, and filters. You will find the following sub-options under

the filters option: my expenses, my team, to report, refused, expense date, past

employees, and create custom filter options. You may now see options like employee,

category, status, company, expense date, and add custom groups in the group by option.

Right now, I can save a current search and add it to my dashboard using the favorites

option. Here, you can find the information on the given list, including the date,

type, and description of the expenses; employee data; paid by; firm; activity; amount

paid; total; and status of the expenses. Other than the Kanban view, the page is

also visible in list, pivot, and graphical views.

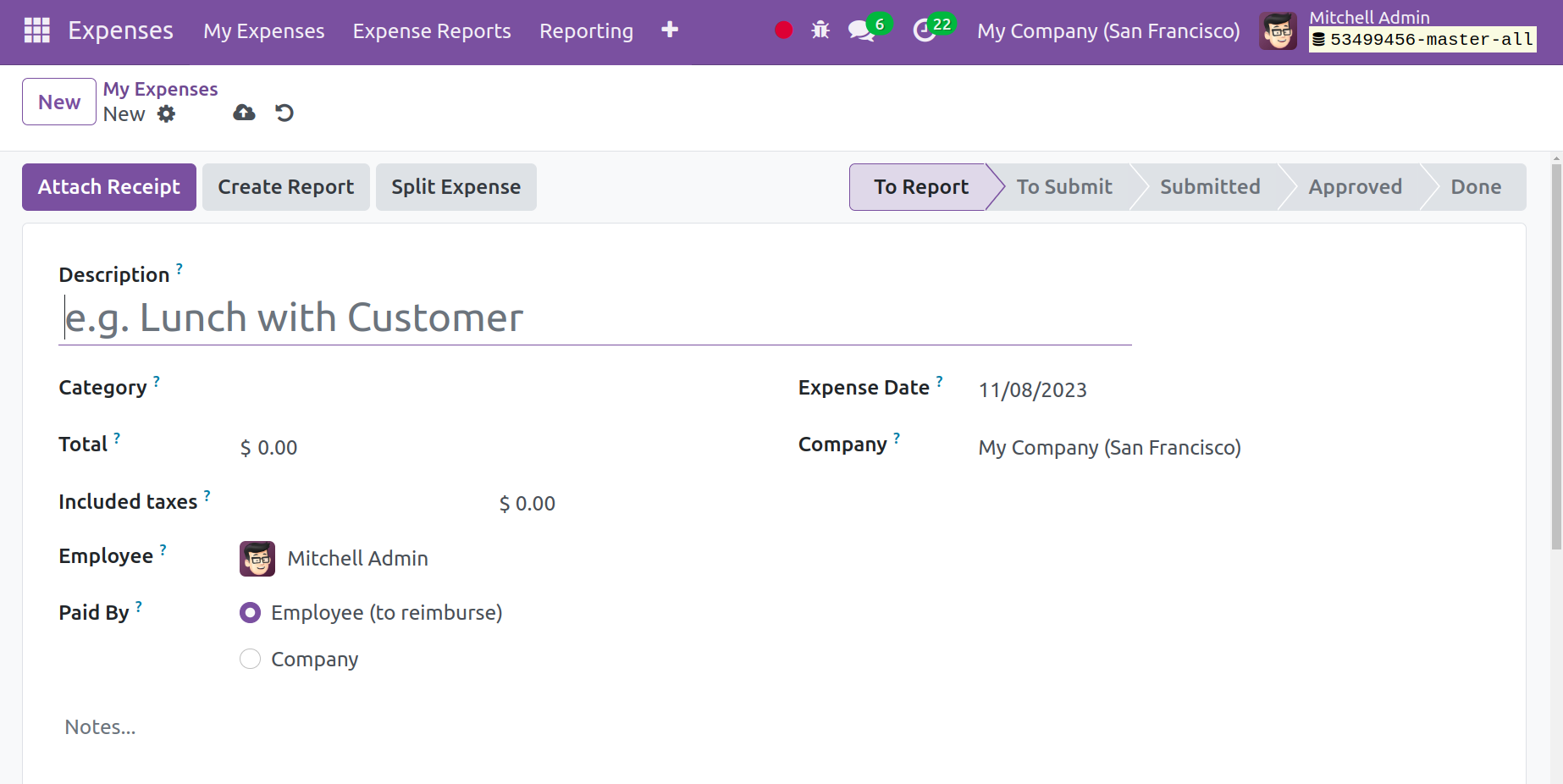

You can now click the New icon on the left side of the screen to generate an expense

report of a similar type.

The expense title can be entered in the description field. The category can now

be chosen using the drop-down menu that is situated beneath the description option.

You can add the employee's name in the designated space. You can choose the paid-by

option as an employee or company below that. You can enter the bill reference in

the following field. You can also add the name of the firm, analytics, account details,

and the date of the expense to the designated section. You can add more remarks

in the designated space if necessary. After entering all the necessary information,

you can select the Save icon.

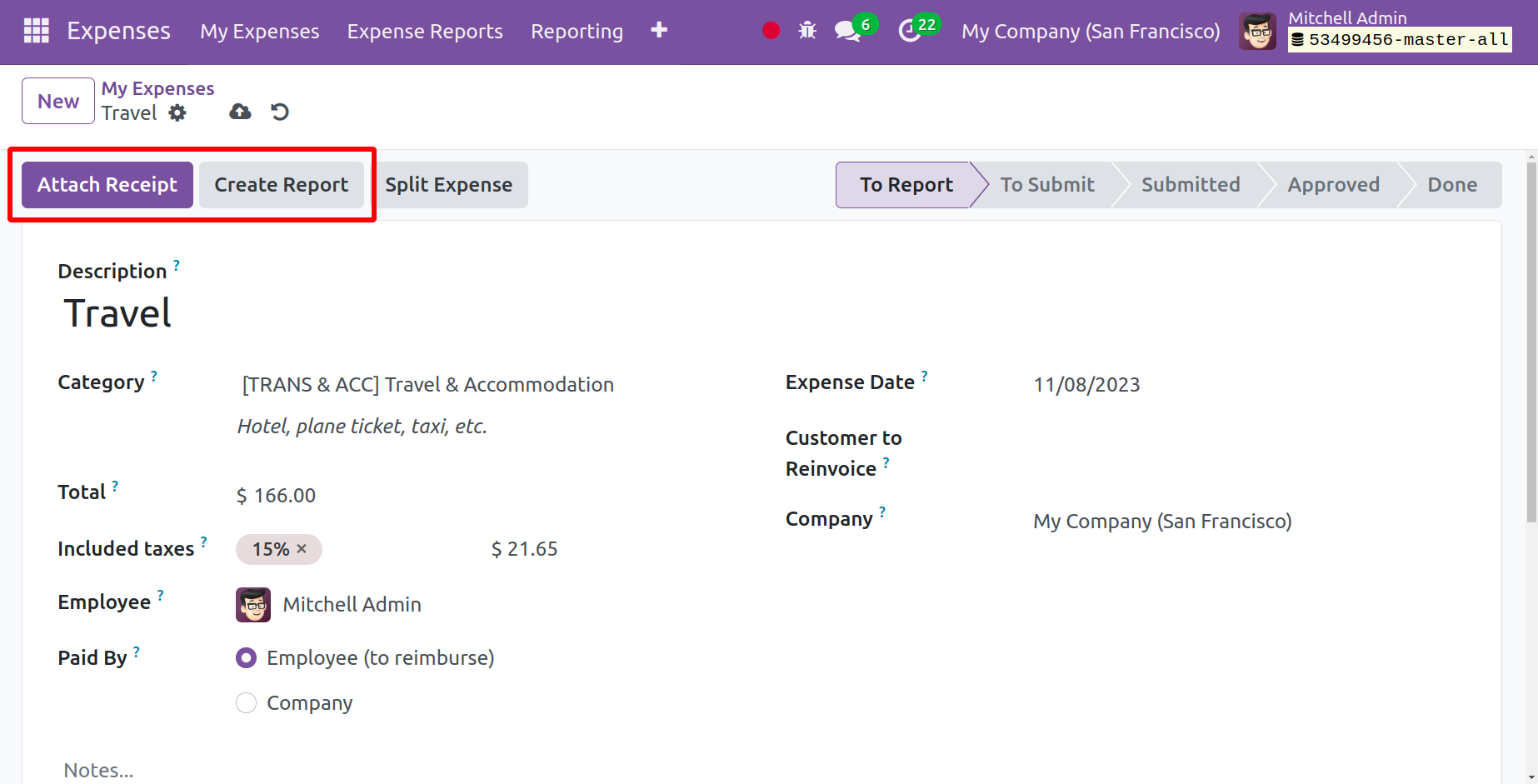

You can attach a receipt to the newly created expense by selecting the Attach Receipt

option when you save it, as shown in the screenshot above. As seen in the screenshot

below, you may now generate a report by using the Create report option that is available

on the expense page.

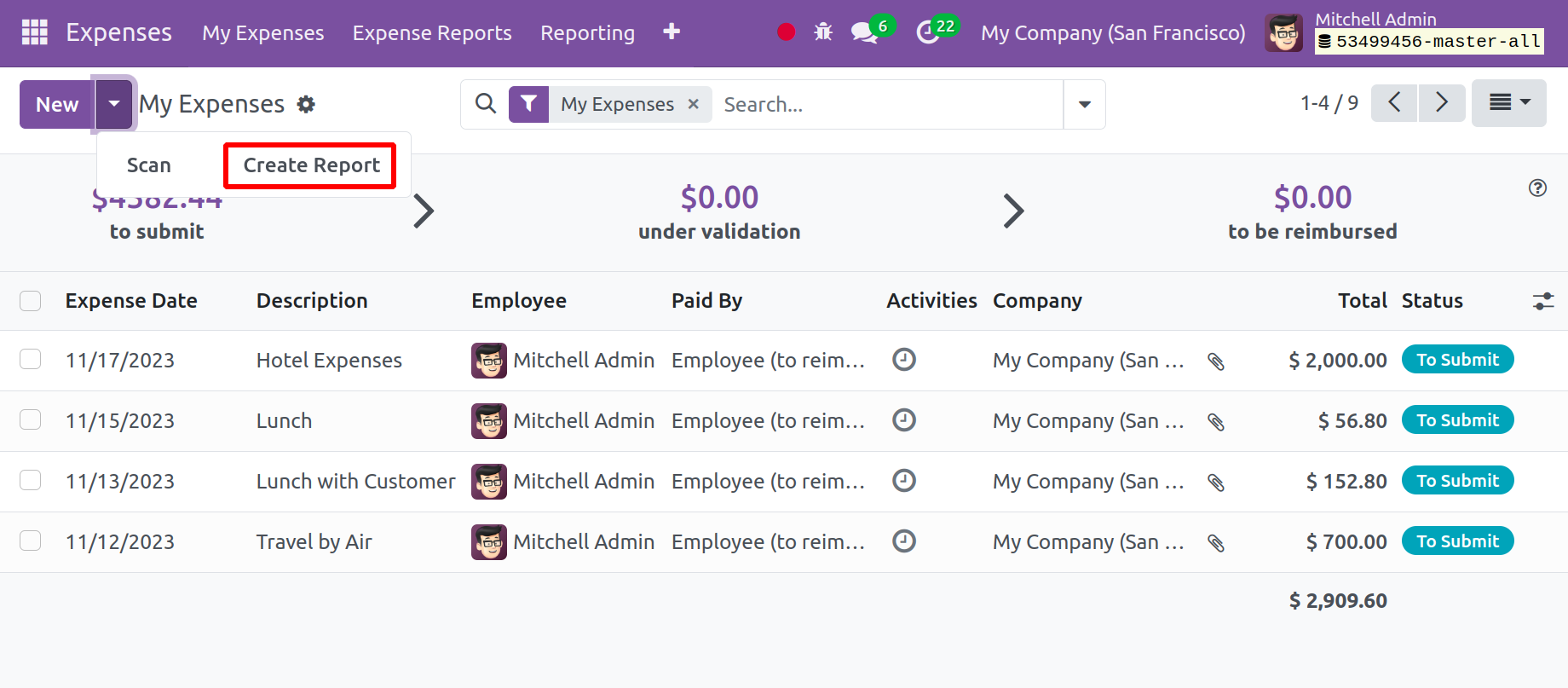

The expense report summary will appear when you click the "Create Report" option,

as seen in the image below.

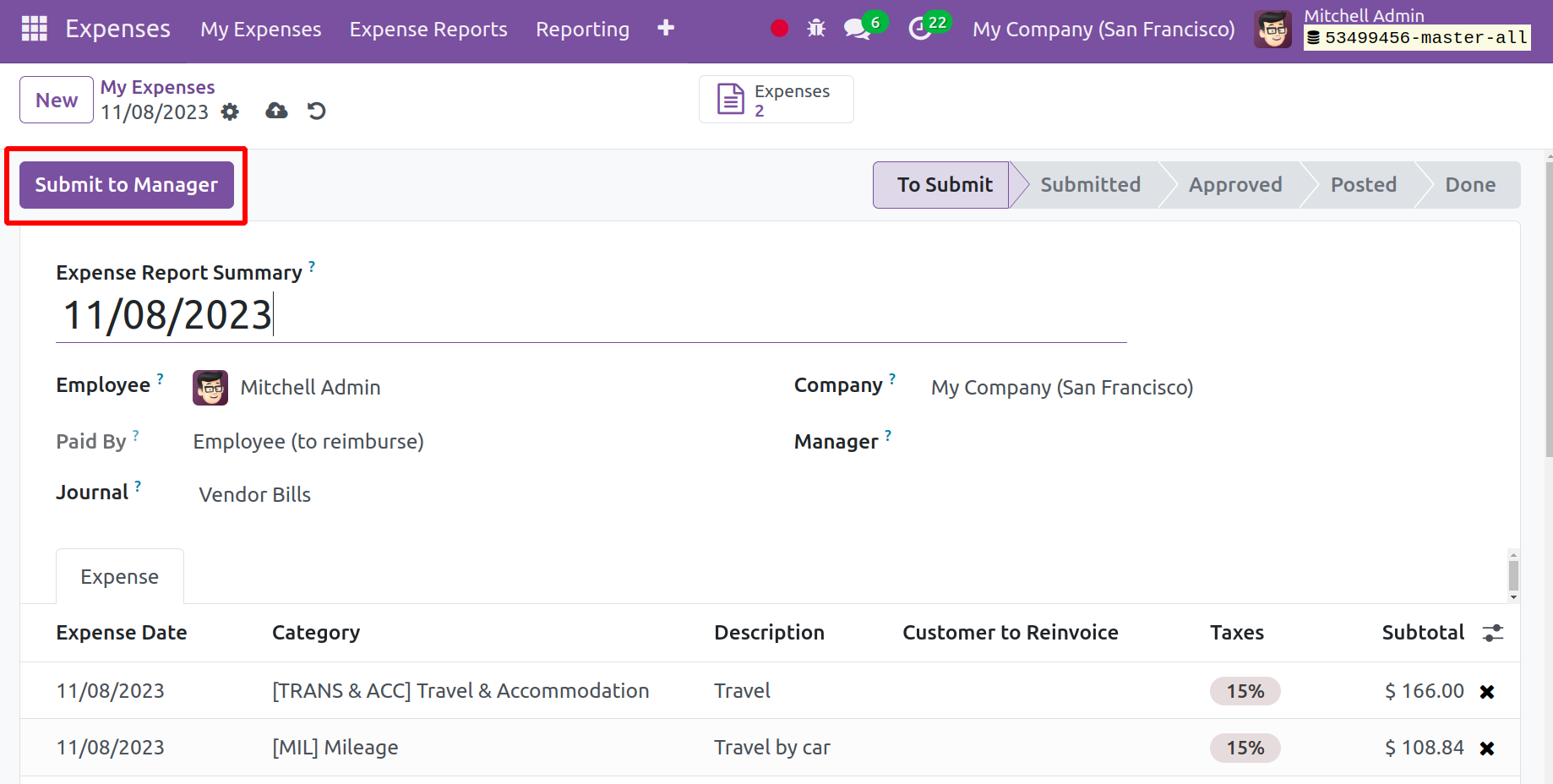

Here, you can send the generated expense report to the necessary person for approval

by selecting the Submit to Manager option.

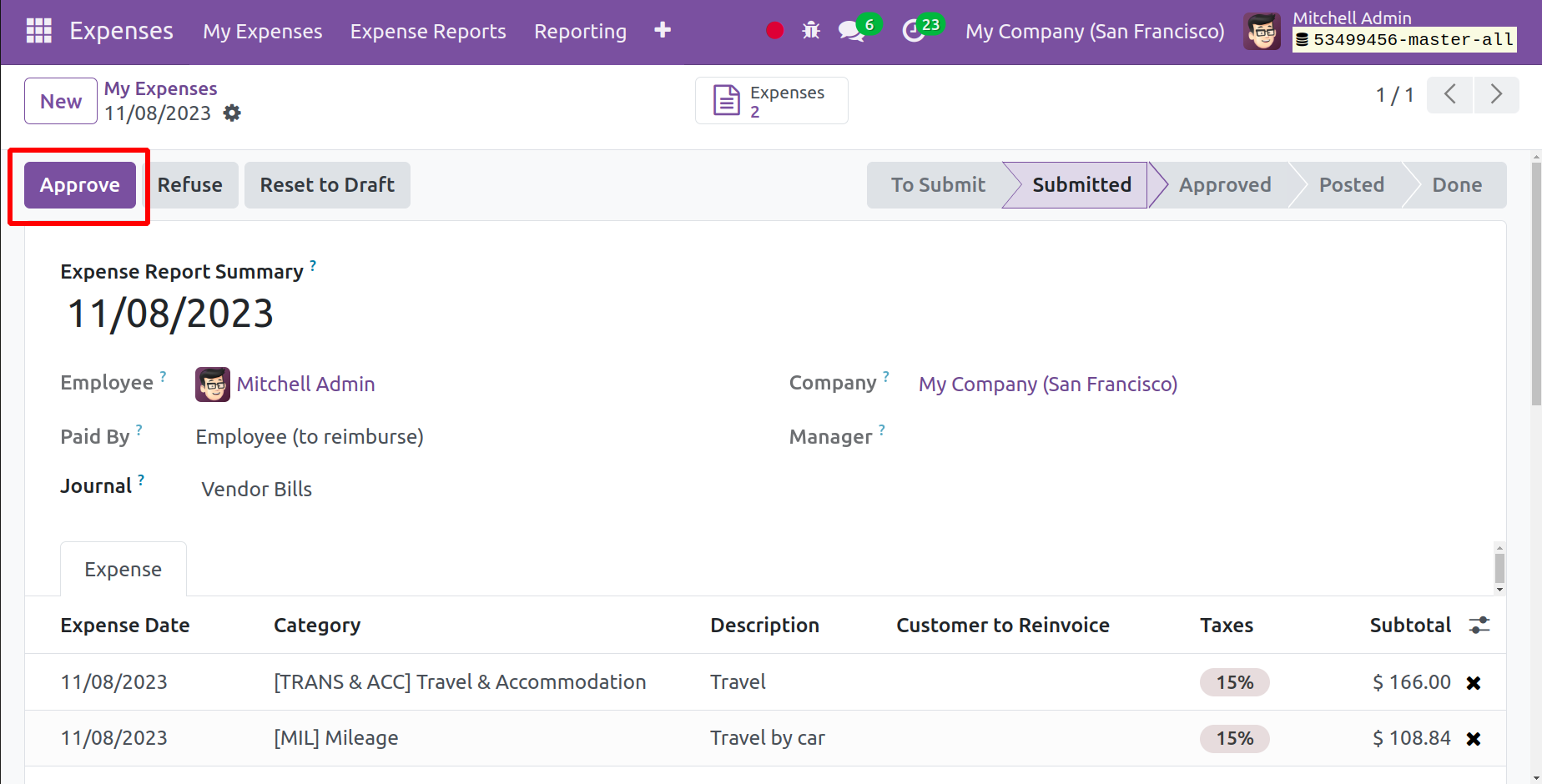

As you can see on the right side of the page, the management has the ability to

Approve or Refuse the report to the draft in accordance with that decision. The

manager can select the option that has been authorized and go on to the payment

procedure if the report is ready for approval.

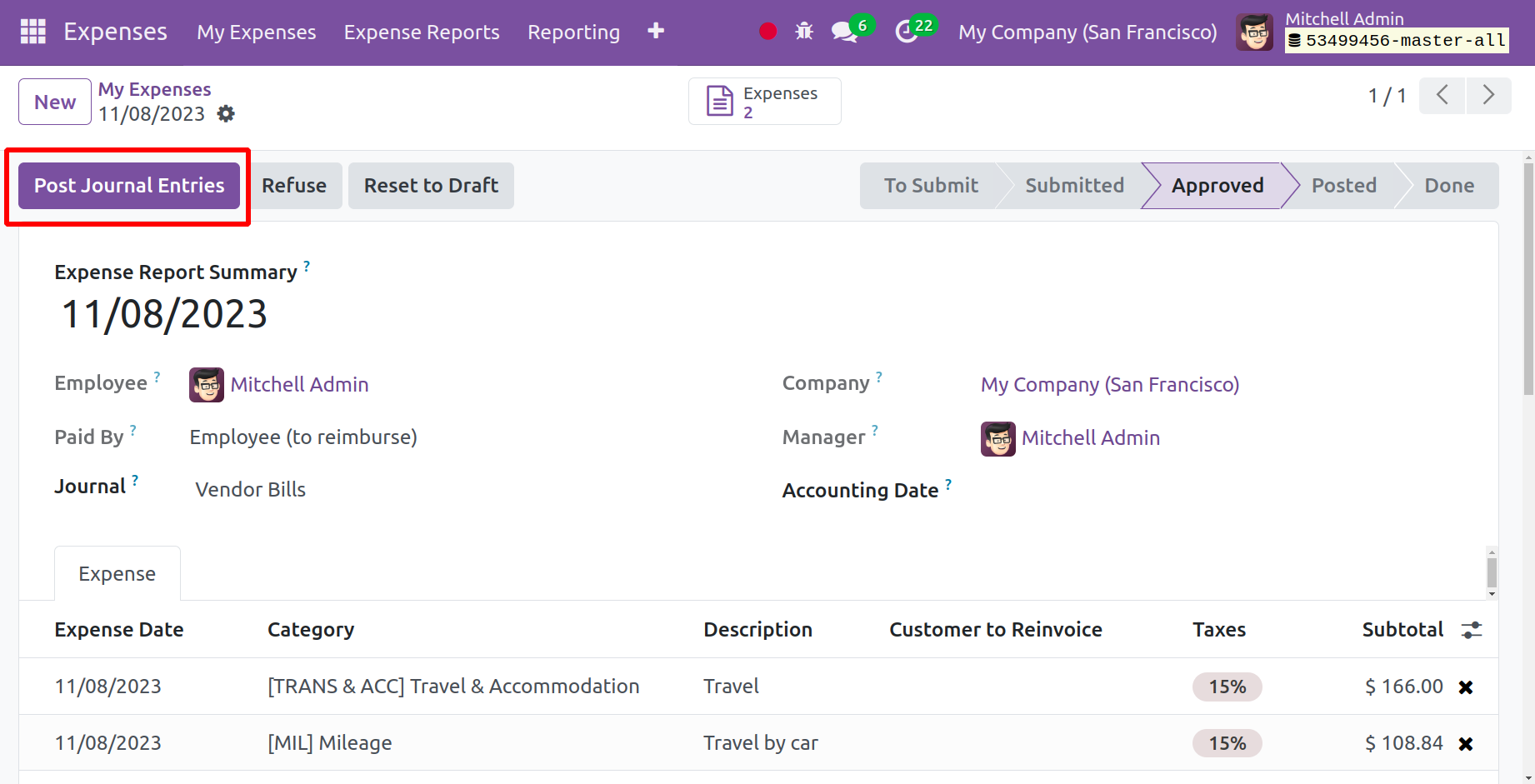

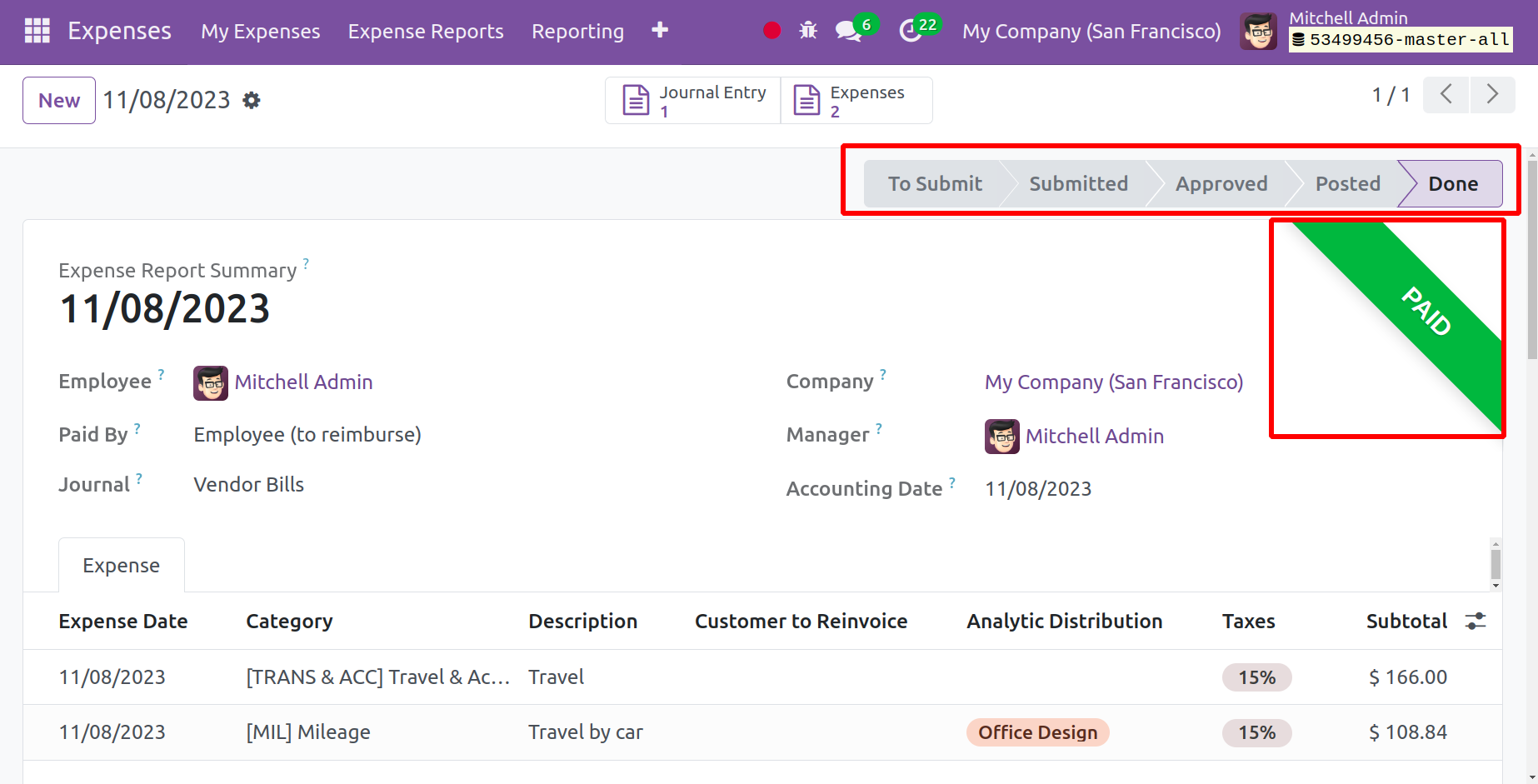

Posting journal entries to the expense report right away is made easier with the

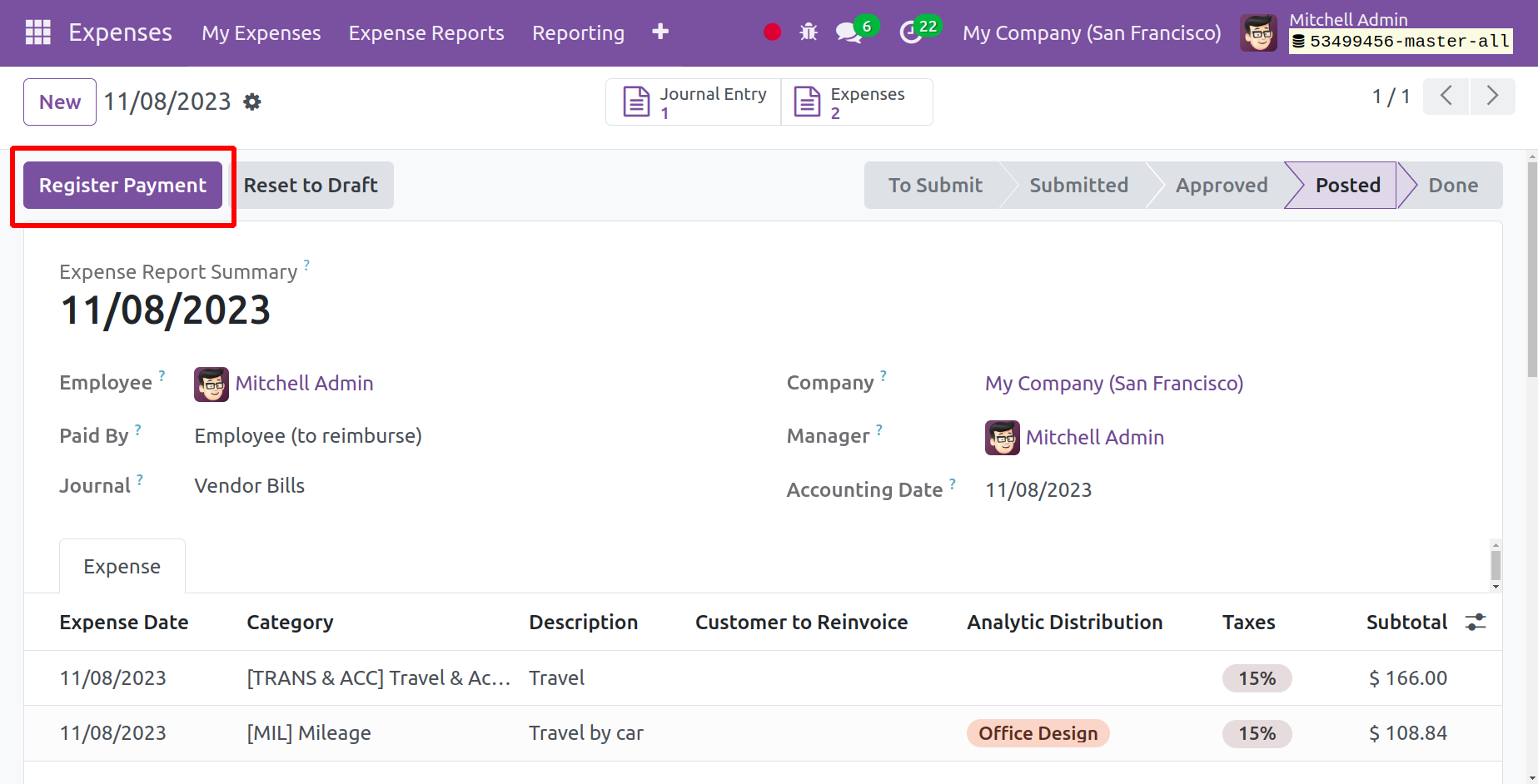

Post Journal Entries option. The manager can register the payment by selecting the

Register Payment option, as seen in the screenshot below.

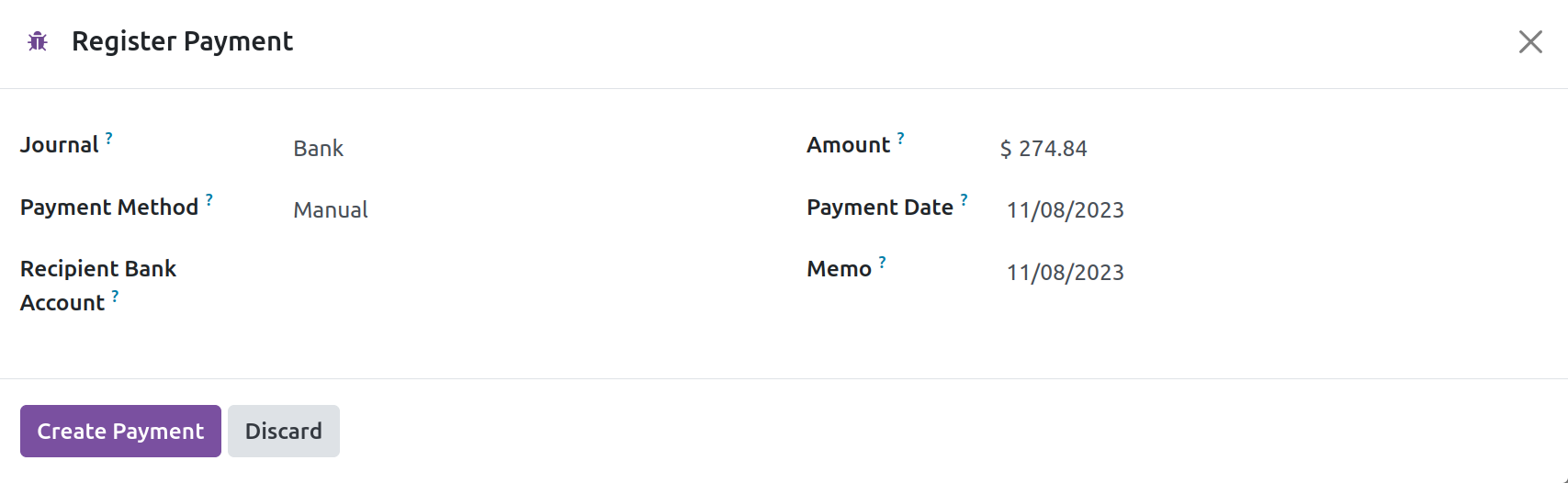

As seen in the image below, a pop-up window may appear when you choose the Register

Payment option.

Here, you can enter the journal name, payment method, recipient's bank account information,

payment amount, payment date, and memo, in that order. Upon choosing the Create

Payment option, the recipient's account will be credited with the amount supplied,

and the status will display as Paid, as illustrated in the figure below.

These are the procedures for using the Odoo software to create a new expense under

the expense module.

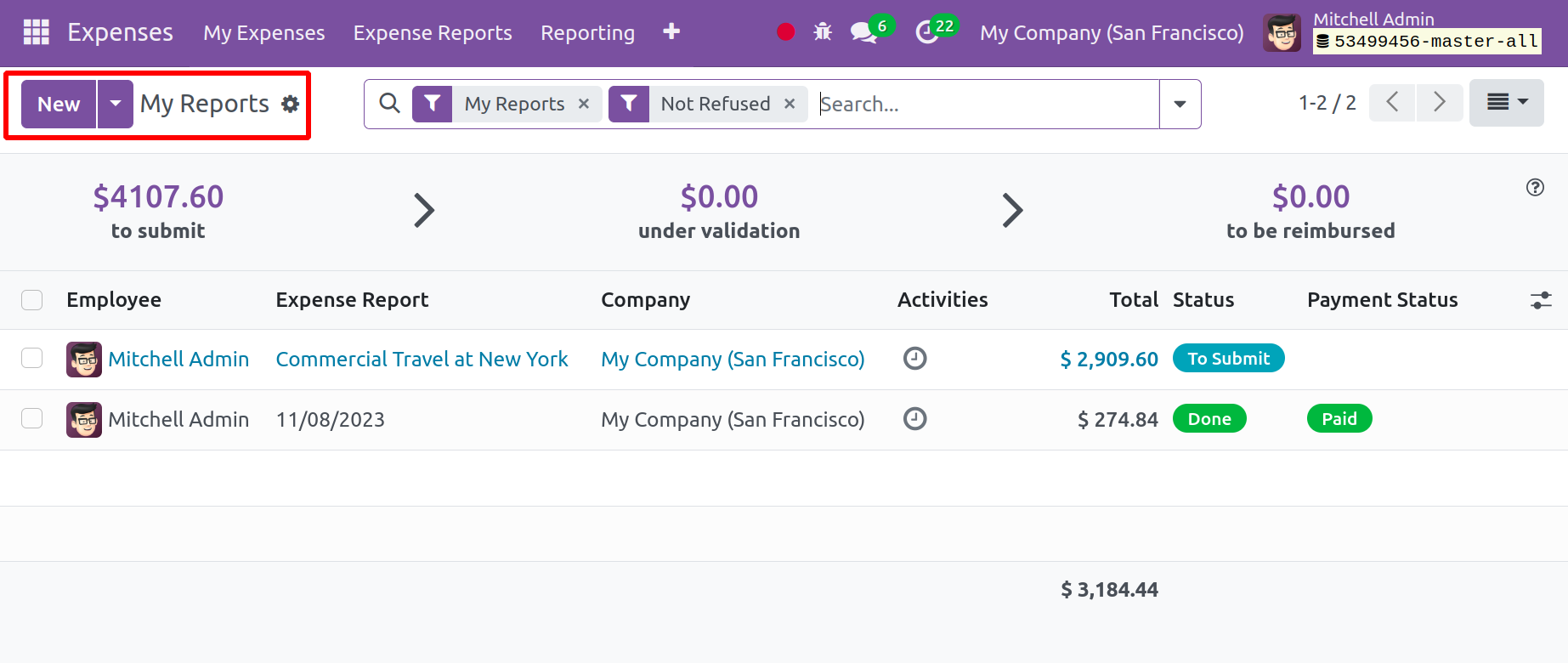

My Reports

You will find my report option under my spending menu; it is displayed in the screenshot

below.

Options like the employee's name, the expenditure report, the firm name, the activities,

the status of the total amount, and the payment status are all visible there. You

can use the corresponding filters, group by, and favorites options. To add a new

report, use the NEW option.

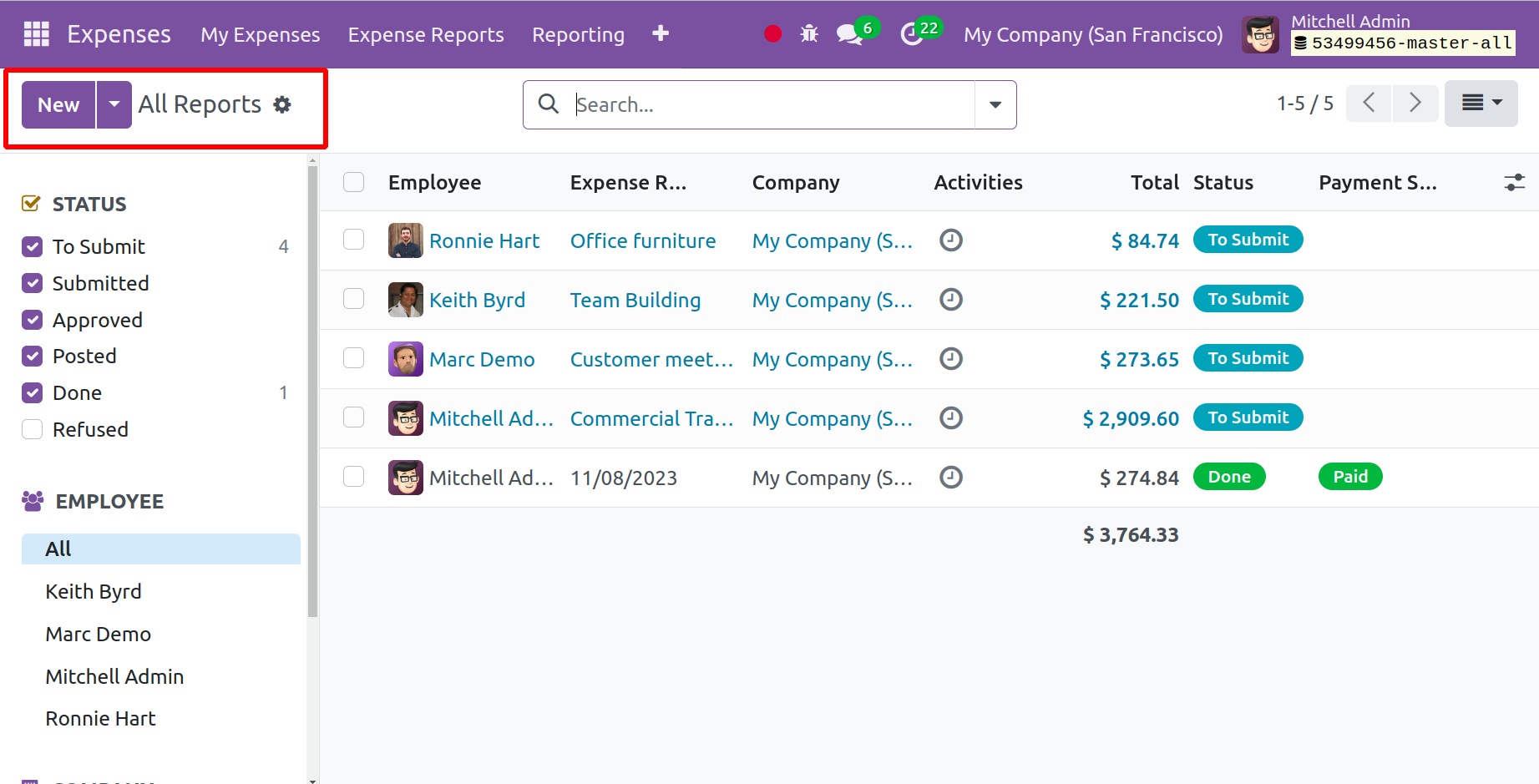

Expense Report

You can obtain reports on approved, posted, completed, submitted, posted, and many

other types of expenses by using the expense report menu included within the expense

management module. As seen in the screenshot below, the options will be on the left

side of the page.

Let's now examine the Configuration menu, which contains information on expense

categories and settings.

Expense Categories

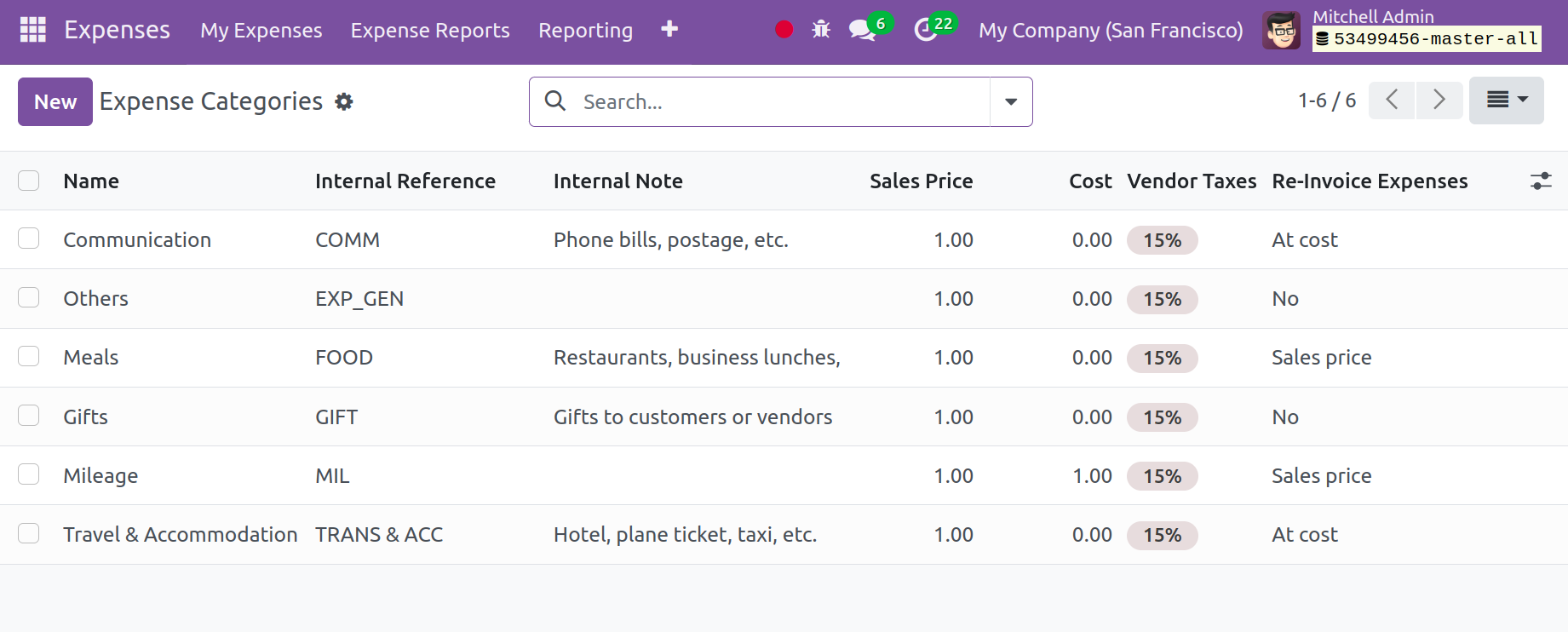

You will find options like spending categories and settings options under the configuration

option. The following graphic illustrates how the expenditure categories page will

look.

You may find the list of expense categories on the page dedicated to them. Accordingly,

you can utilize the group by, favorites, and filter features. Name, internal reference,

internal notes, sales price, cost, vendor taxes, and re-invoice fees are among the

details under each expense category. You may now use the New symbol that is available

on the left side of the page to establish a cost category that is comparable to

this one.

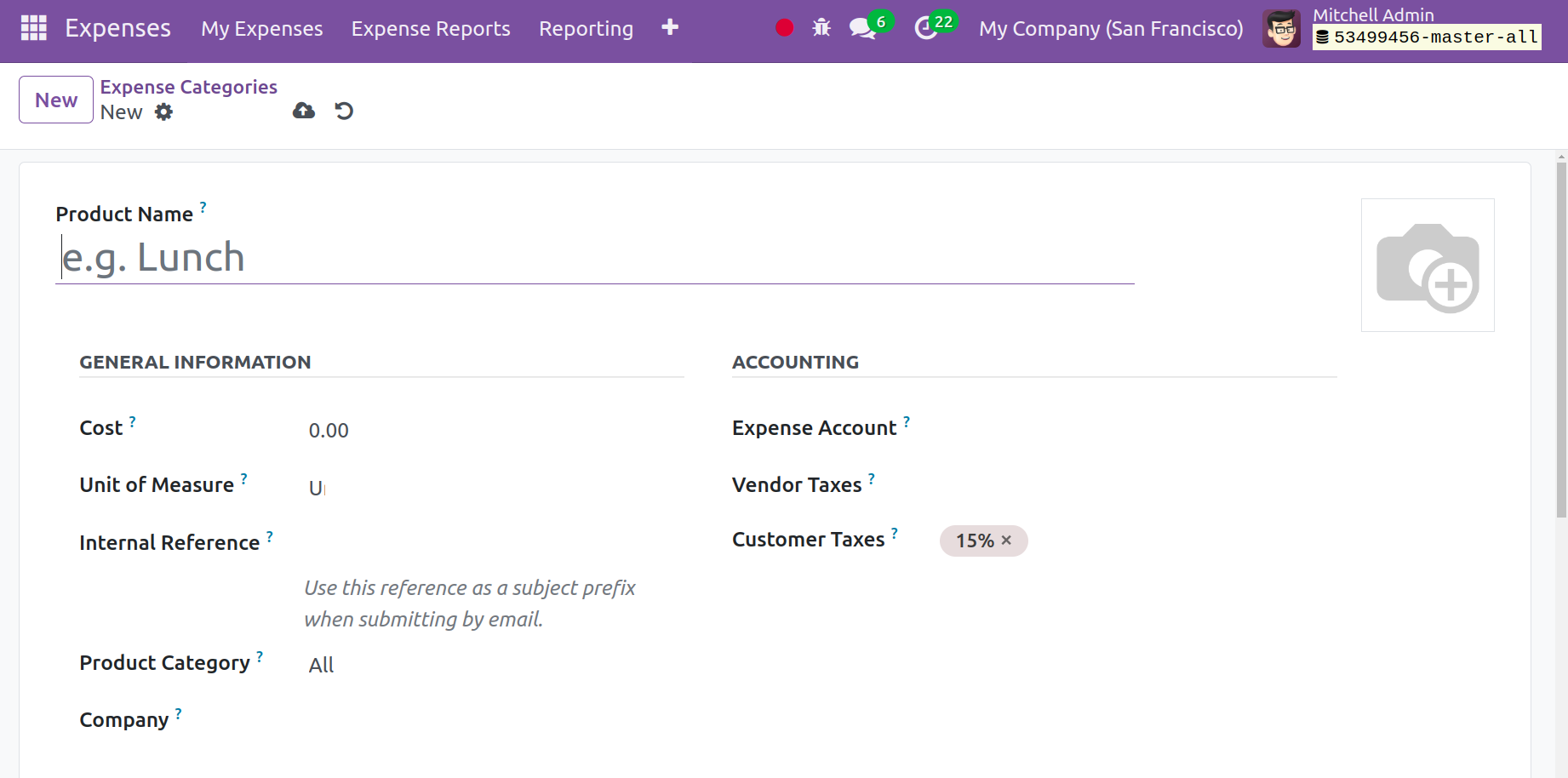

You can fill in the designated spaces on the expense categories creation page with

the product name and, if necessary, an image. You can now put the cost, unit of

measurement, internal reference, and company name, respectively, under that, in

the General Information tab. You may now include vendor and customer taxes, as well

as the specifics of the spending accounts, under the accounting tab. You can adjust

the re-invoice expenses to either no, at cost, or sales price in the invoicing tab.

Not only that, but there's also room for you to include internal remarks. Once you

have completed entering all of the information, you can proceed with the saving

procedure.

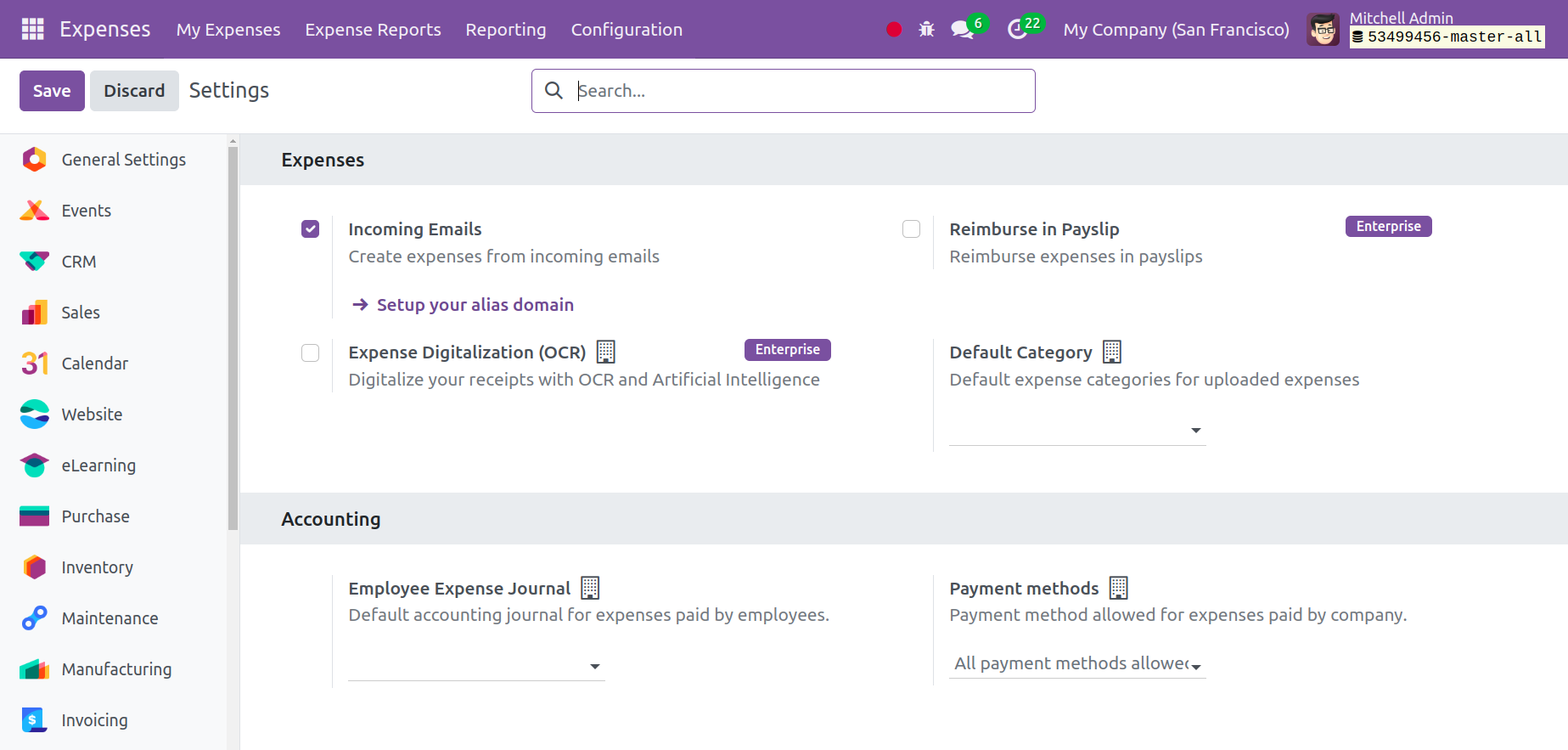

Settings

You now have several options under the Settings option. For example, you have sub-options

for incoming email, payslip reimbursement, and digitizing expenses under the expenses

option.

The default accounting journal for employee-paid expenses and the acceptable payment

method for company-paid expenses are also shown below. These will assist you with

default accounting journaling and payment options, respectively. The option for

incoming emails is one of those that assists you in deducting costs from incoming

emails. When a category's internal reference appears in the first word of the email

subject, the associated category is immediately set. The default category is the

default expense category for uploaded expenses and odoo 17 allows the use of specific

payment methods to pay employee expenses by the company as defined by ‘payment methods’.

One can remain it blank helps to support all payment methods.

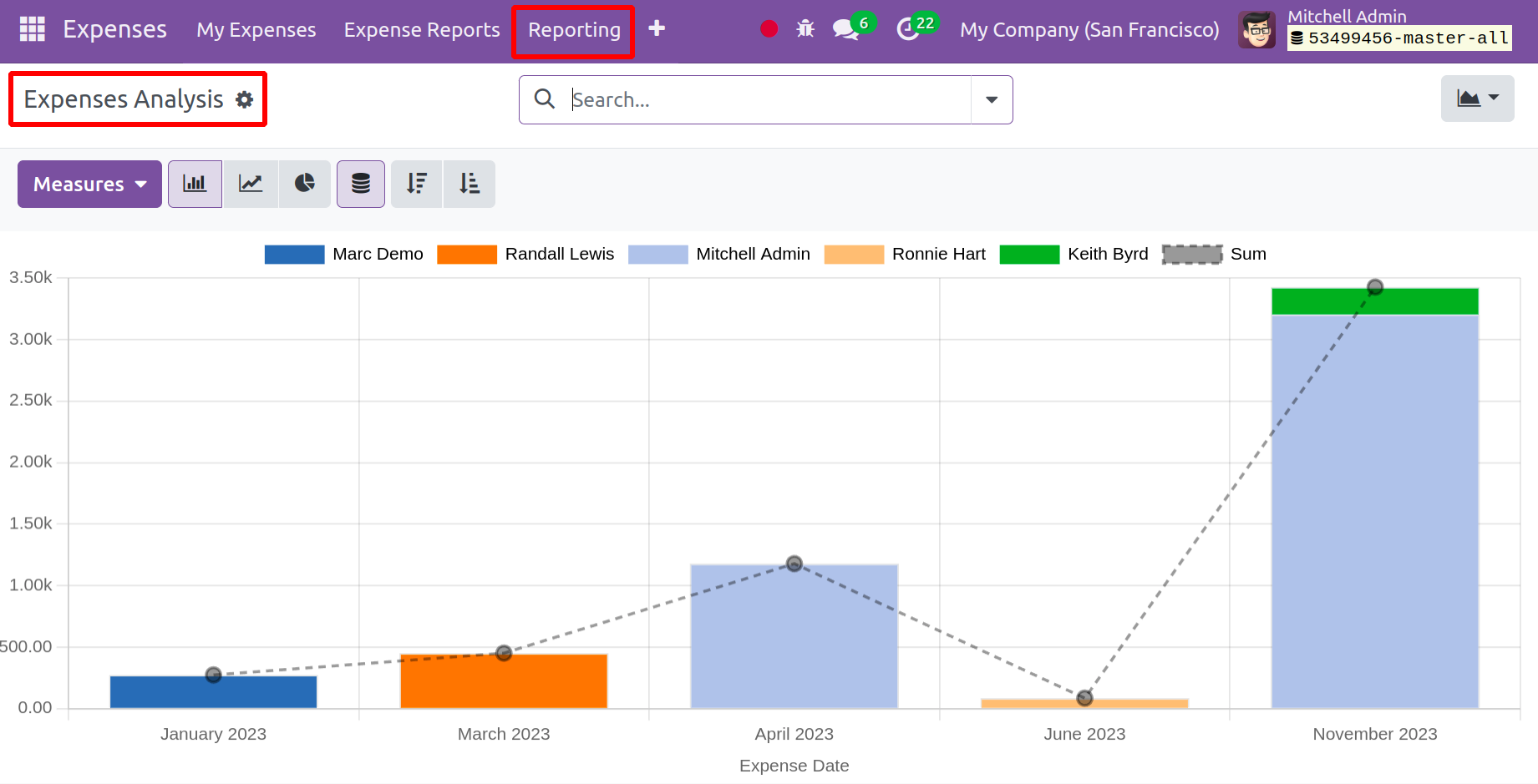

Reporting

The expense analysis option is located in the reporting option, and it will look

like the screenshot below.

Measures with sub-options, including tax amount, tax amount in currency, total,

total in currency, and total untaxed amount in the currency, are available for usage

here. You can obtain useful reports on the company's operations expense management

here. The page is also available in graphical, list, Kanban, and pivot views. It

is also shown as a bar, line, and pie chart in the graphical mode. You can use the

many colors that are offered to you to represent the various personnel in the organization.

All things considered, the module aids in controlling and overseeing business spending.