Salary Structures

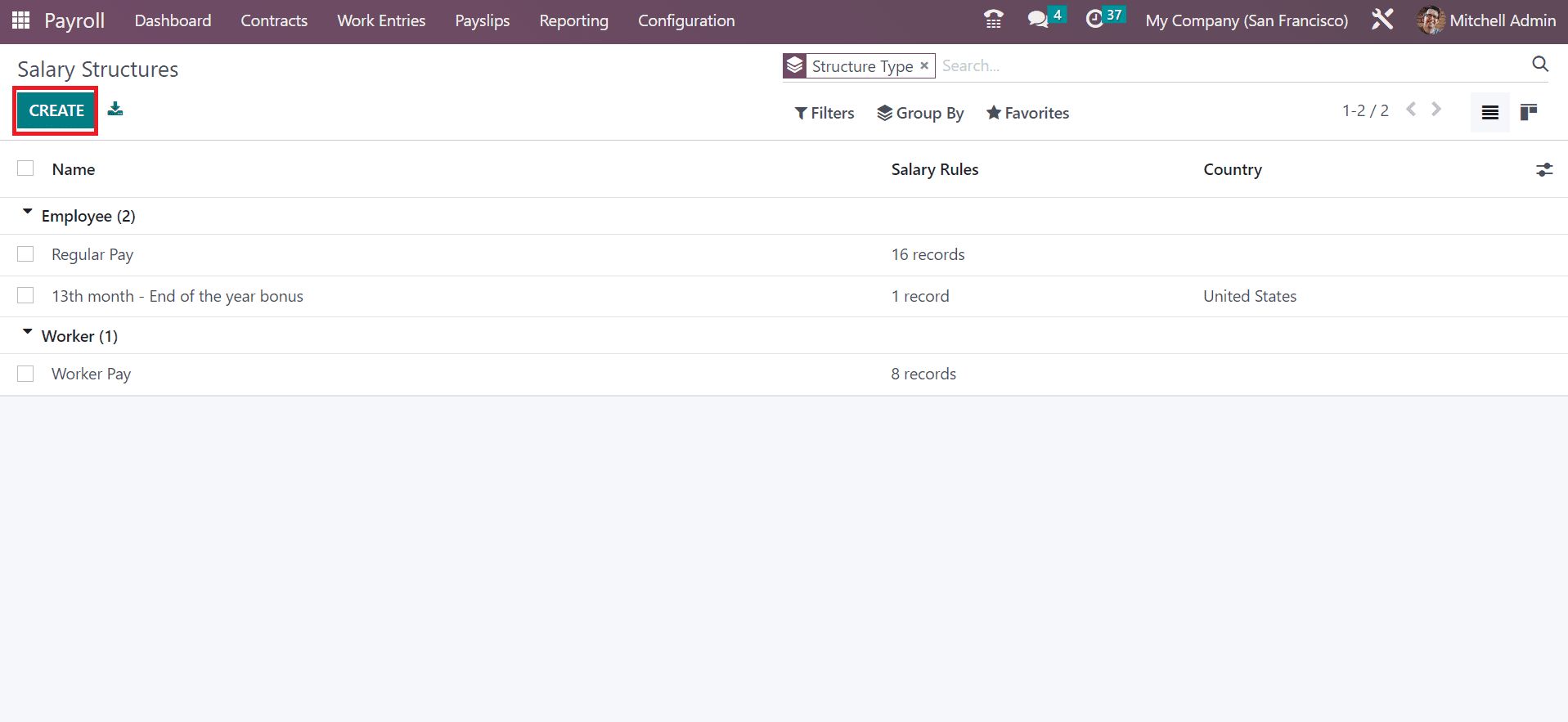

We can compute employee salaries as per the job post and formulate a payslip for payroll within the salary structures. You can define various rules set inside a salary structure that is beneficial for computing the payslips. The whole department or group uses a single salary structure. Users can describe a new salary structure once choosing the Structures menu in Configuration. On the open page, you can acquire the salary structures of Worker and Employee separately. We can view the Salary Rules, Name, and Country of each worker and employee salary structure distinctly. To describe a new salary structure, choose the CREATE icon in the Salary Structures window.

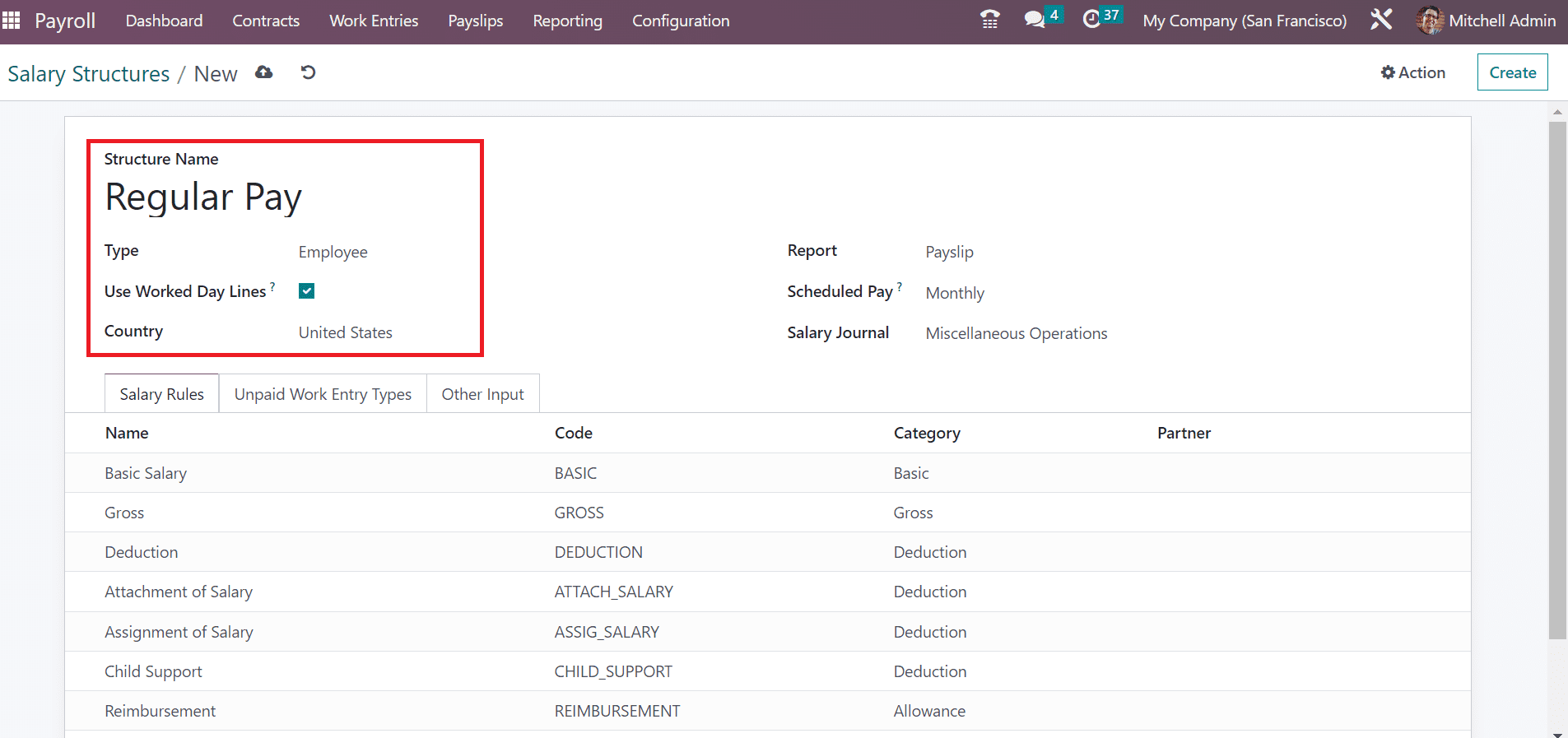

In the new screen, you must enter the Structure Name and category of structure type as employee/worker in the Type field. To view worked days in employee payslip, enable the Use Worked Day Lines option. Also, mention the Country regarding the salary structure of employees.

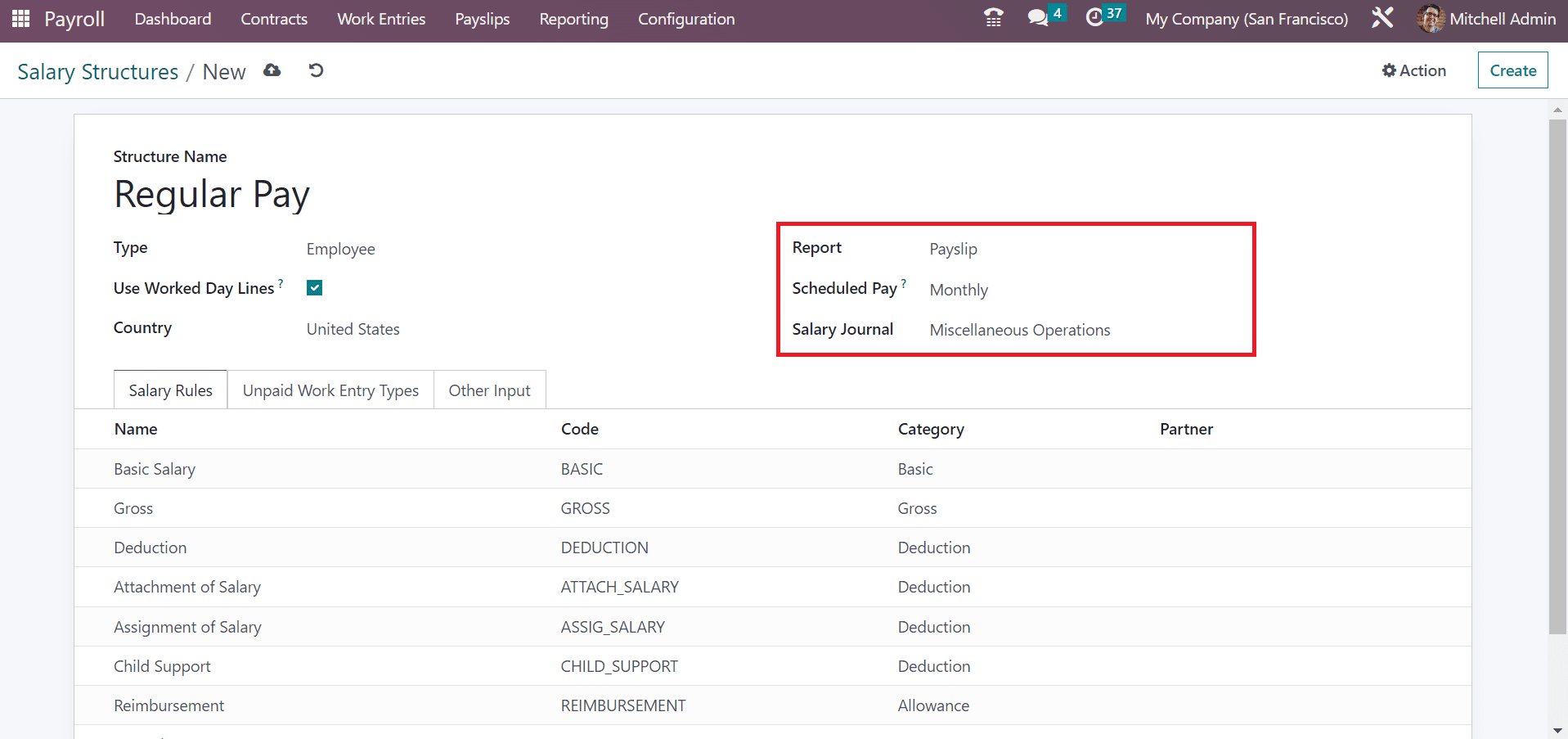

Users can pick a Report of employee salary structure as Payslip, Termination, and more. Additionally, enter the wage payment as Weekly, Annually, Monthly, and more within the Scheduled Pay field. We can also choose a respective salary journal concerning the salary structure.

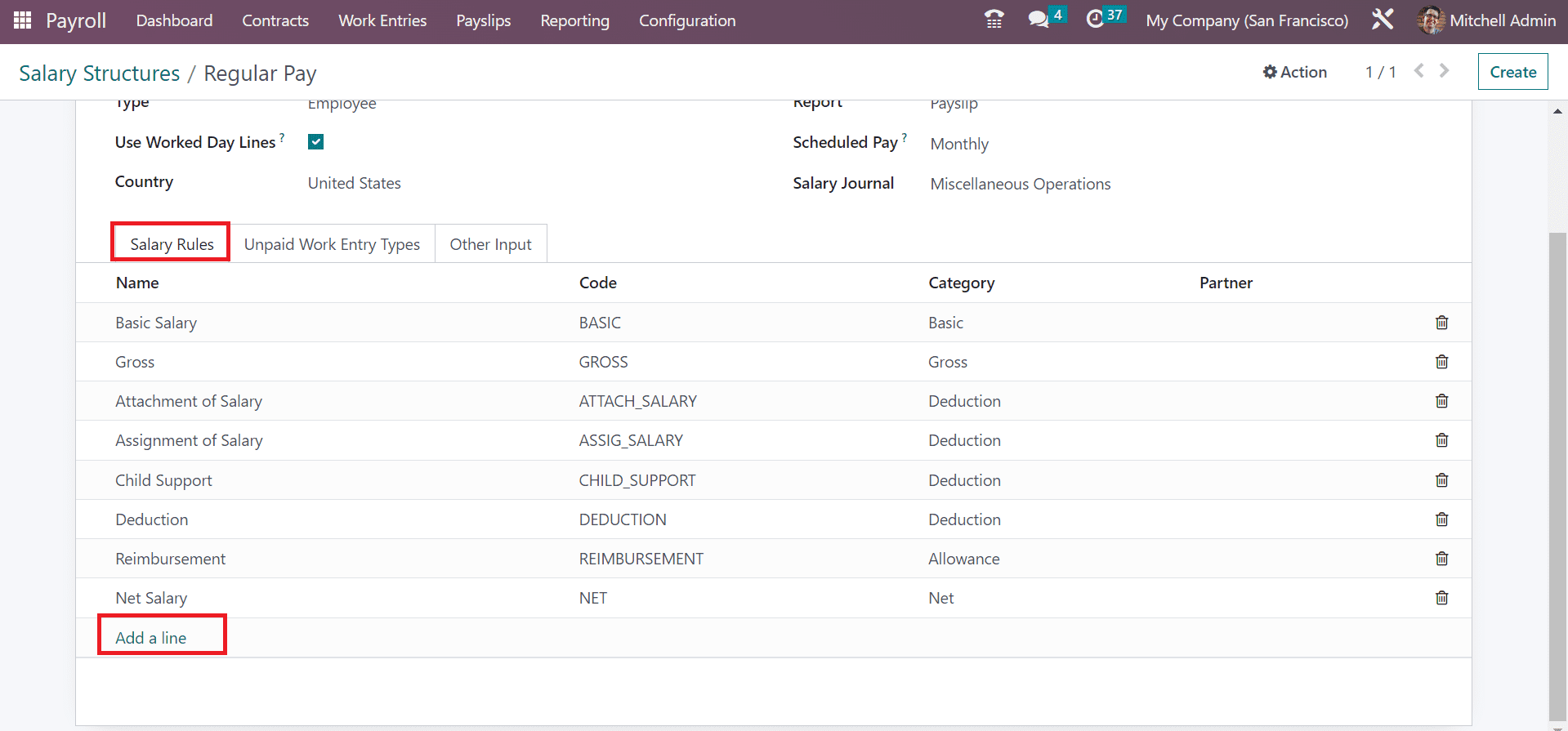

It is possible to apply specific rules related to employee salary structure. For that purpose, click the Add a line option under Salary Rules tab and mention the necessary rules for your employee salary structure. You can mention the Category, Name, Partner, and Code of each salary rule.

Salary Rules

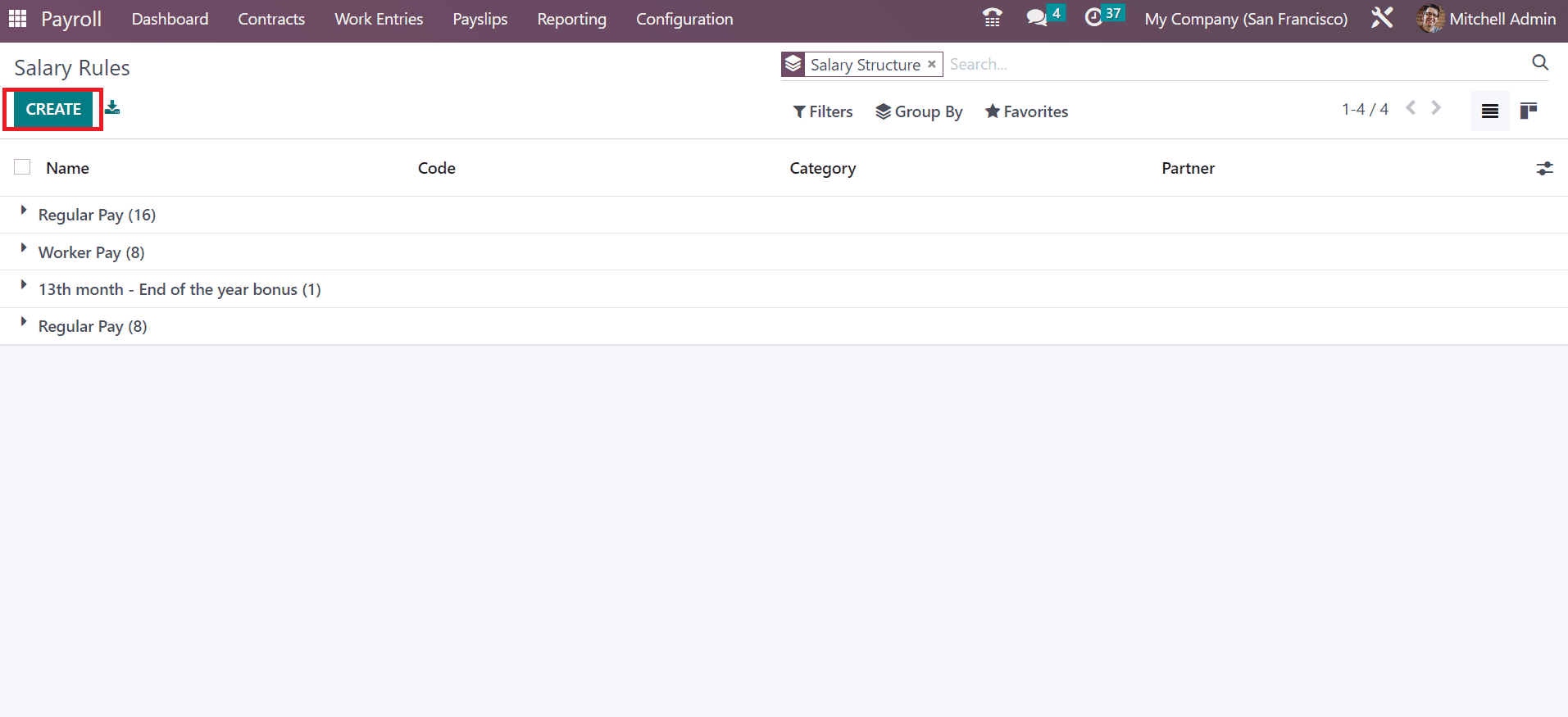

A crucial part of an organisation is developing and maintaining a robust salary structure in the company. A few factors that help for effective management in a company include setting rules, fixing reliable salaries, and planning ahead. All these rules ensure you can decide salary amounts calculation for various categories. By choosing the Rules menu in Configuration, you can get the access to Salary Rules window. Each salary rule defined in Odoo 16 is accessible to a user. The salary structures regarding each salary rule are viewable to the user include data such as Name, Category, Code, and Partner. After clicking on the CREATE button, we can produce a salary rule in Odoo 16.

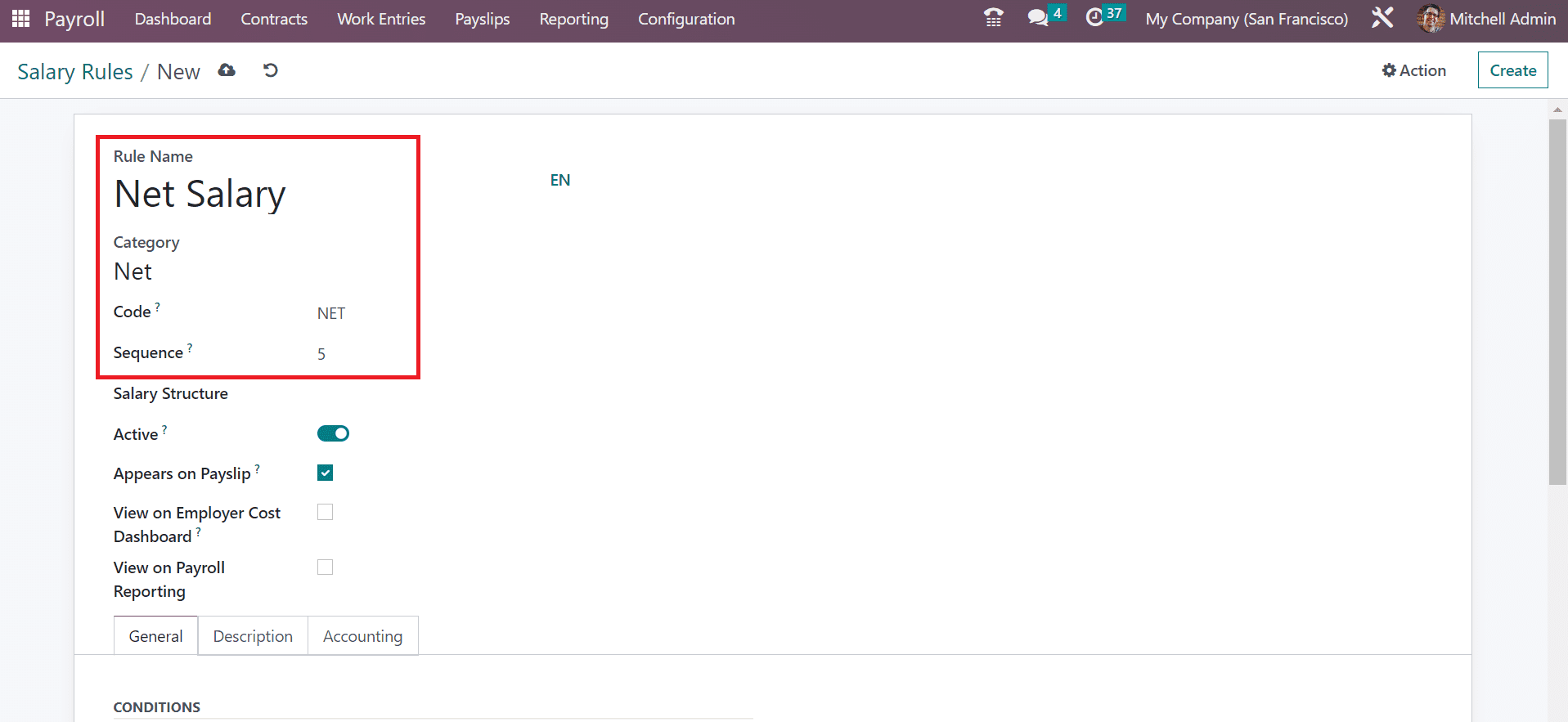

In the appeared page, add Rule Name, and set Category based on your added rule name. Users can specify a code to identify the rule easily. Also, make sure to mention a serial number to arrange sequence calculation.

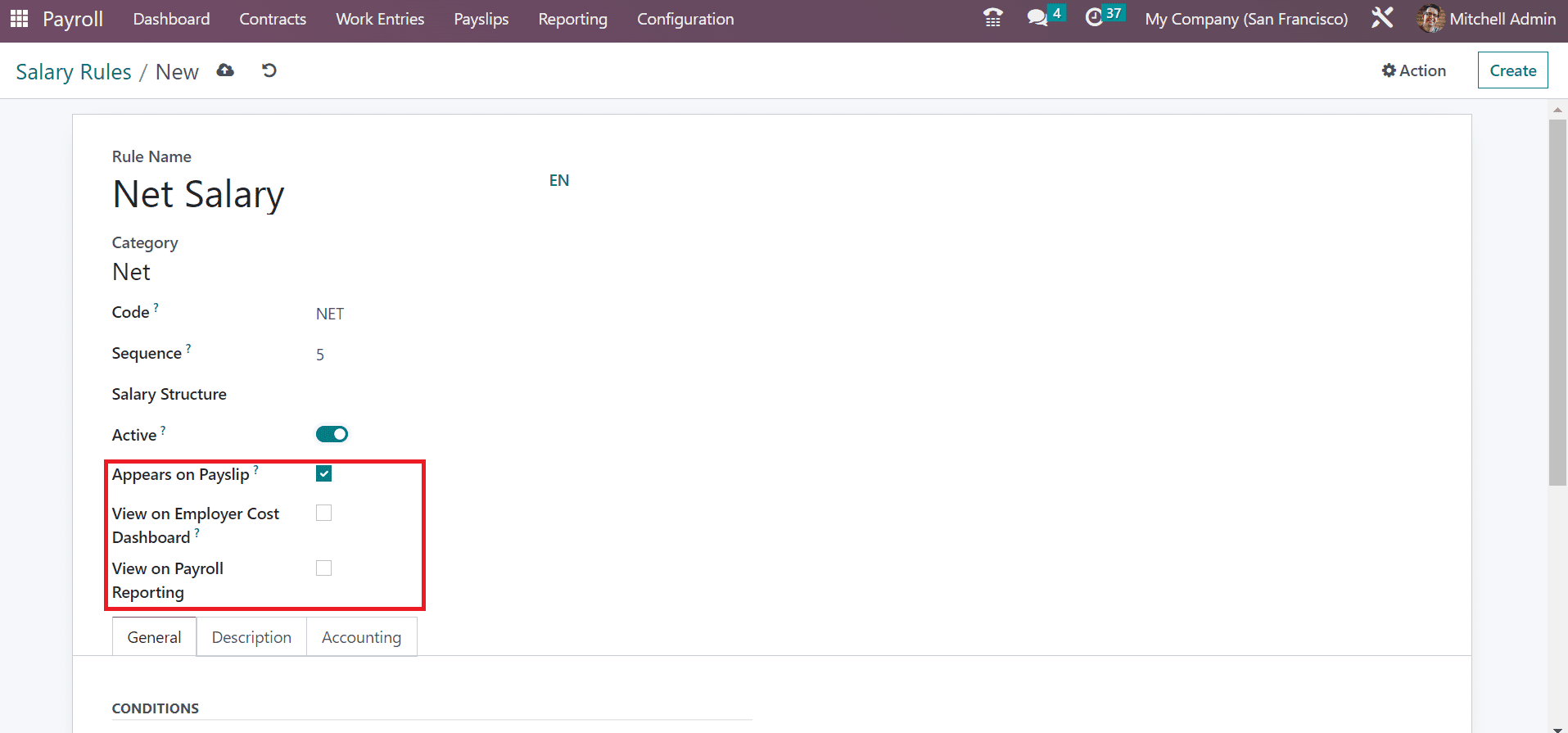

By enabling the Appears on Payslip option, we can view the salary rule within a payslip. After activating the View on Employer Cost Dashboard, we can display employer cost value in the dashboard. To set the salary rule on payroll reporting, activate the View on Payroll Reporting field in the Salary Rules window.

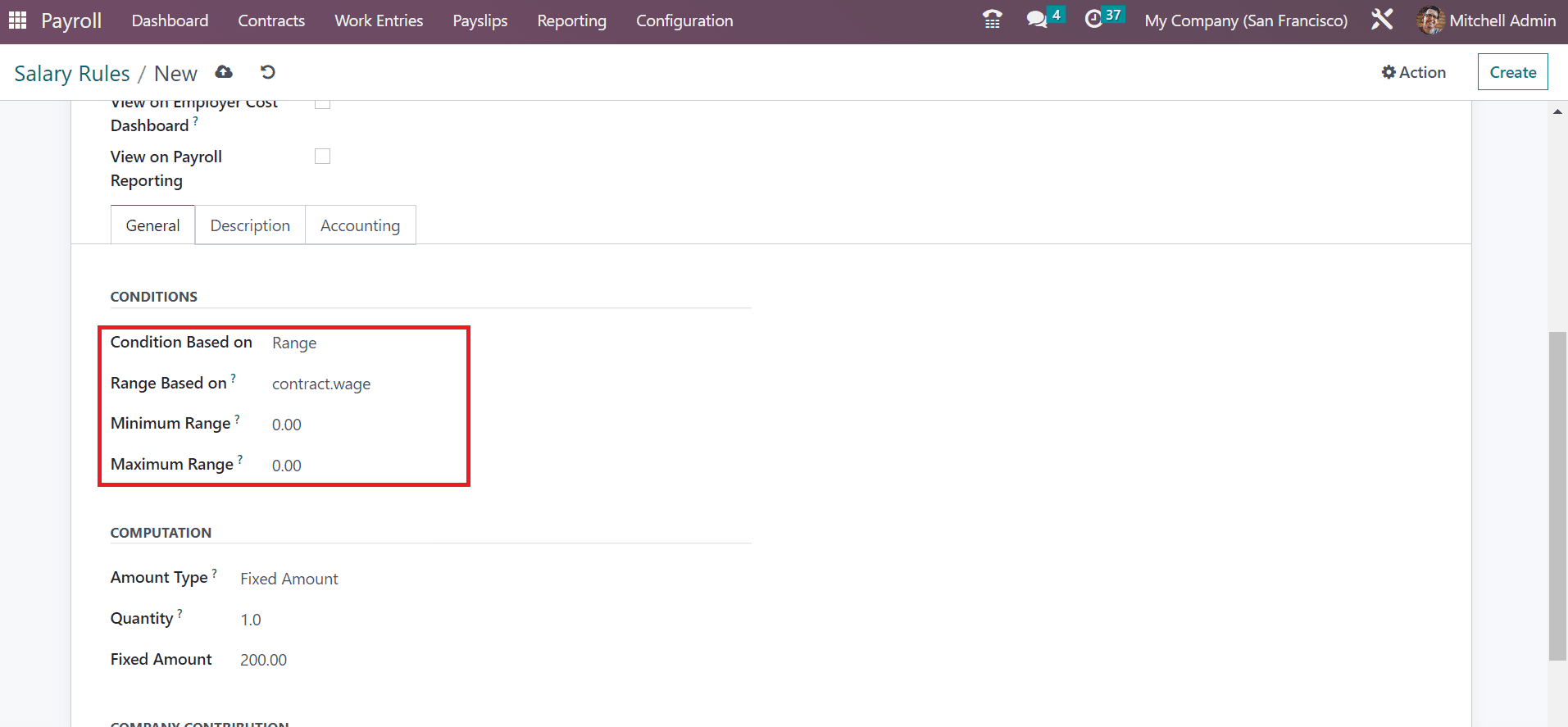

Below the General tab, we can manage the computation, conditions, and company contribution. Add the condition for the salary rule as Range, Always True, and Python Condition in Condition based on field. The relevant wage rule for salary computation is set easily by choosing the Always True option. After picking the Range option, you need to apply details including Maximum Range, Range based on, and Minimum Range. Range Based option is used to compute field values allocated automatically.

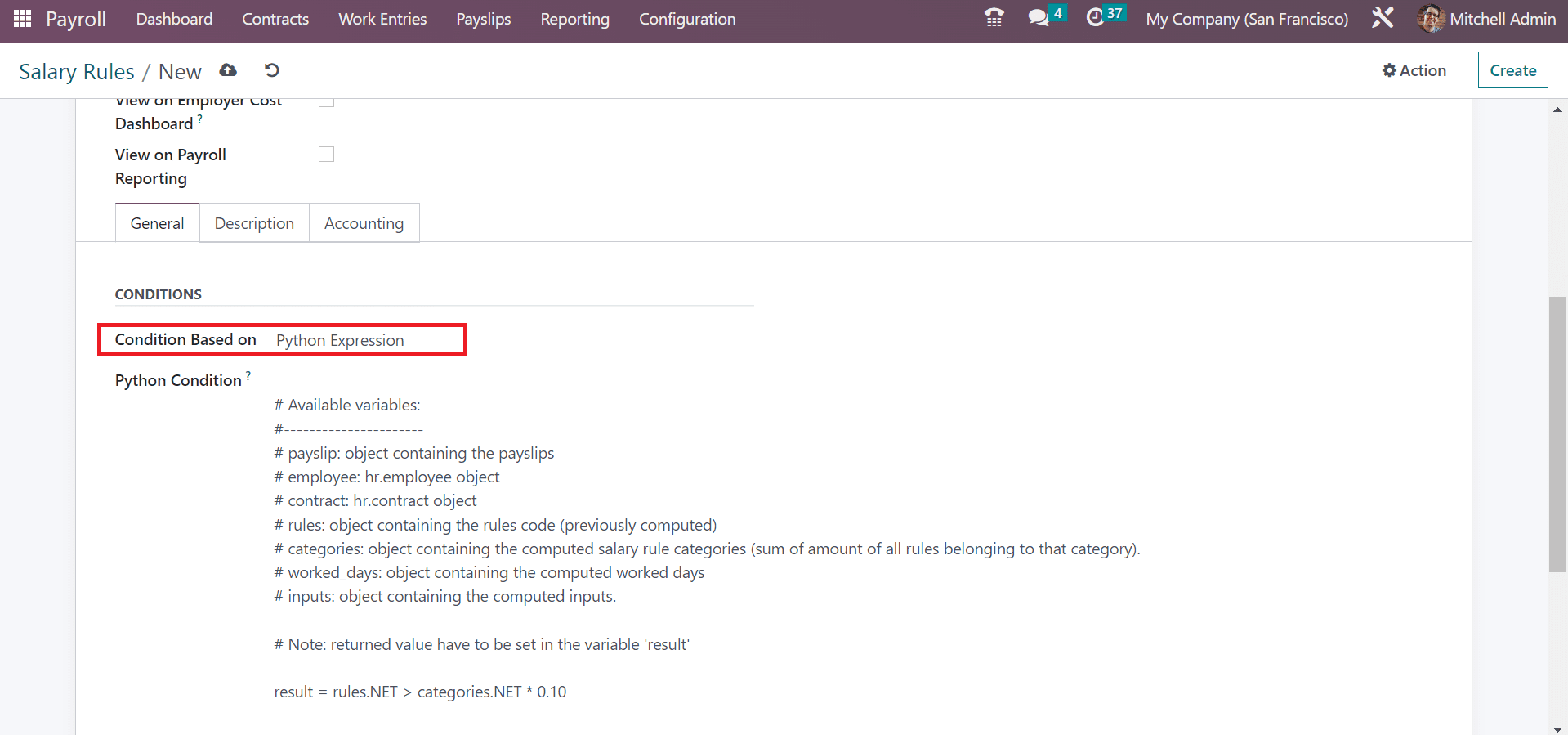

Odoo formulates equations in the default way once we choose Python Expression in Condition Based on field.

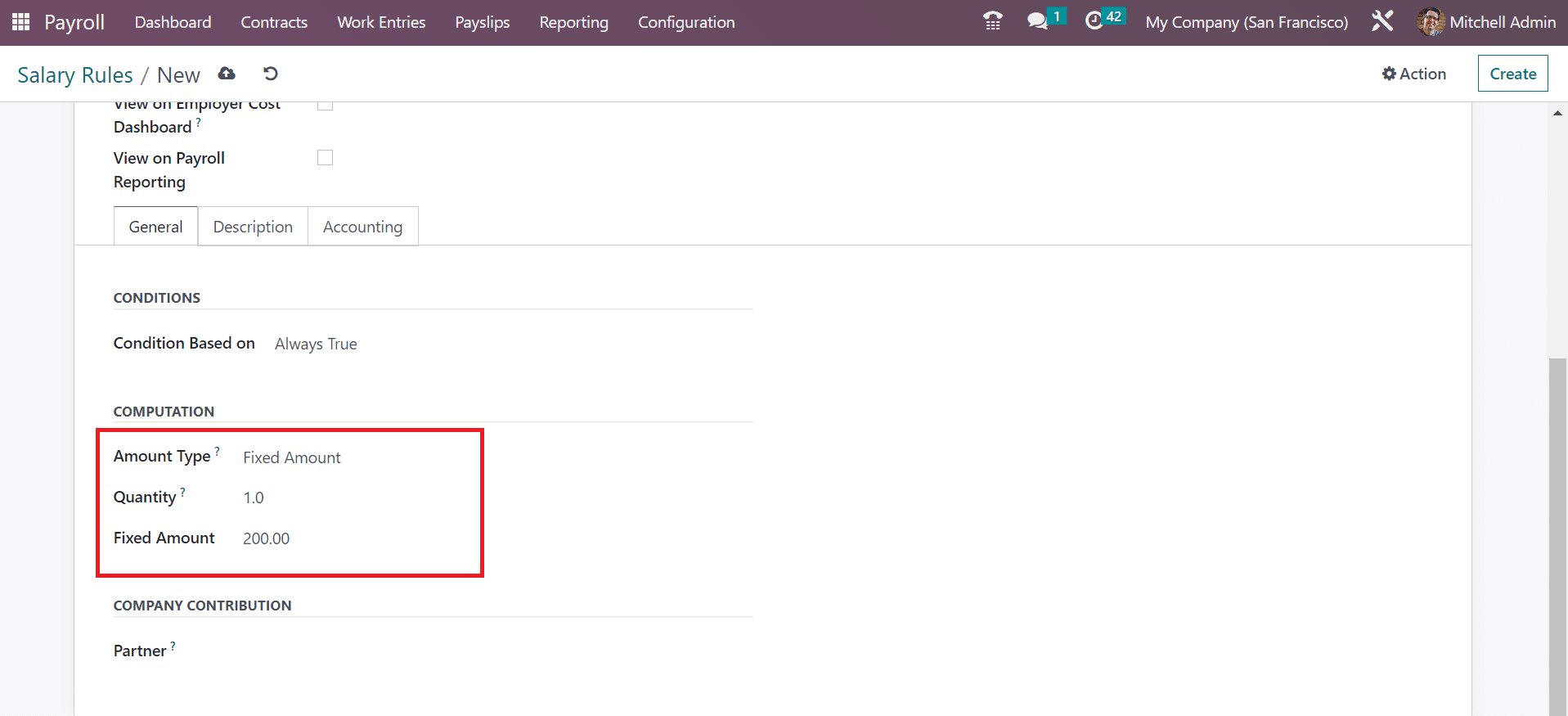

We can calculate the salary rules below the COMPUTATION section. For that, the user can specify a computation method in the Amount Type field as Percentage(%), Python Code, and Fixed Amount. According to the percentage, we can calculate the amount once selecting the Percentage as Amount Type. By choosing the Fixed Amount in the Amount Type field, we can set up a fixed amount. After selecting the Fixed Amount, you can mention the quantity and fixed amount of the salary rule.

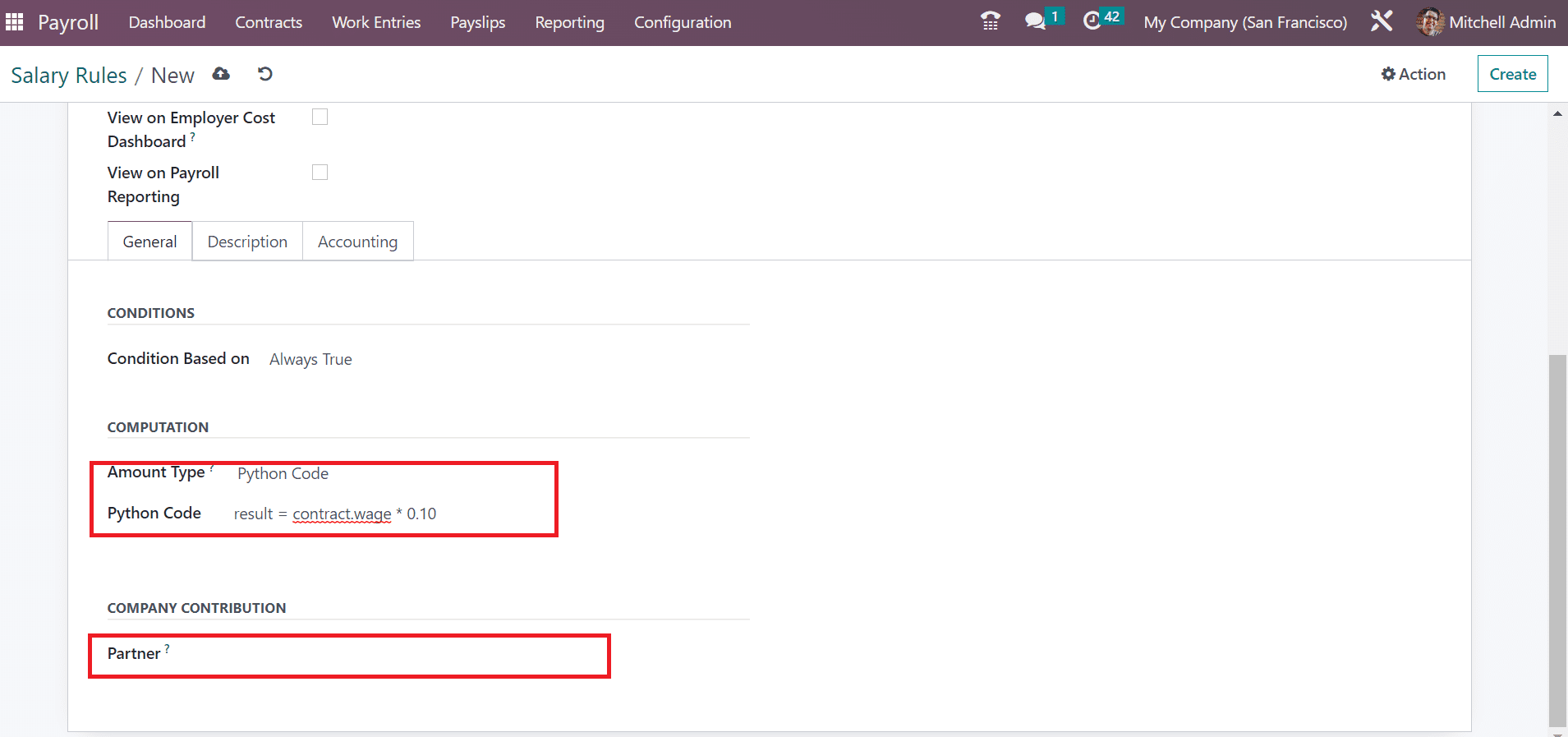

Users can also compute the salary rule as per python code. For that, add Python Code inside the Amount Type field. Later, you can define the python code as per the python attributes. Inside the COMPANY CONTRIBUTION section, we can define the third party involved in employees salary payments.

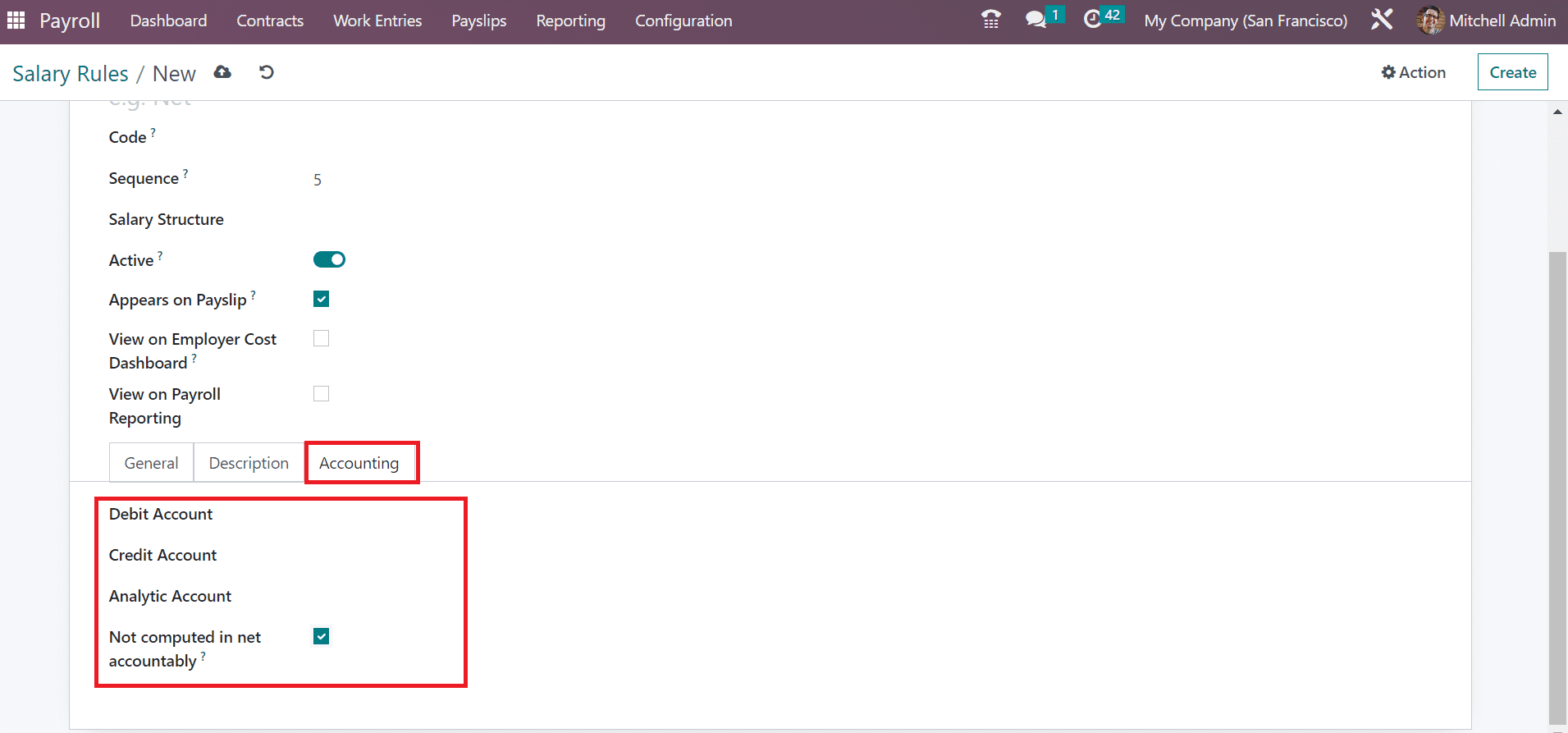

Below the Description tab, you can mention the note concerning the salary rule. Inside the Accounting tab, you can specify Analytic Account, Debit Account, and Credit Account details. You can remove the net salary rule value after enabling the Not Computed in net accountability option within the Accounting section.

Each of the details is saved manually in the Odoo 16 Payroll.

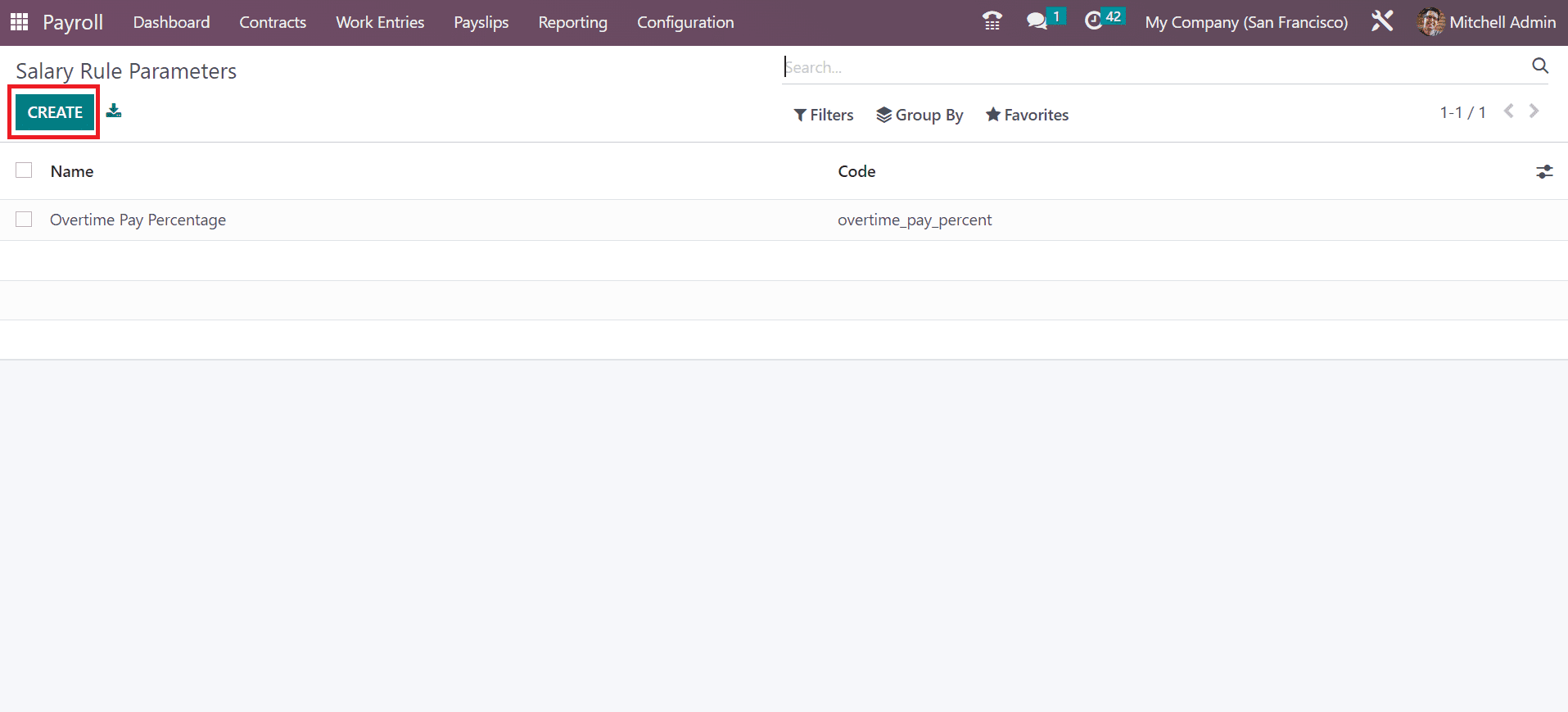

Salary Rule Parameters

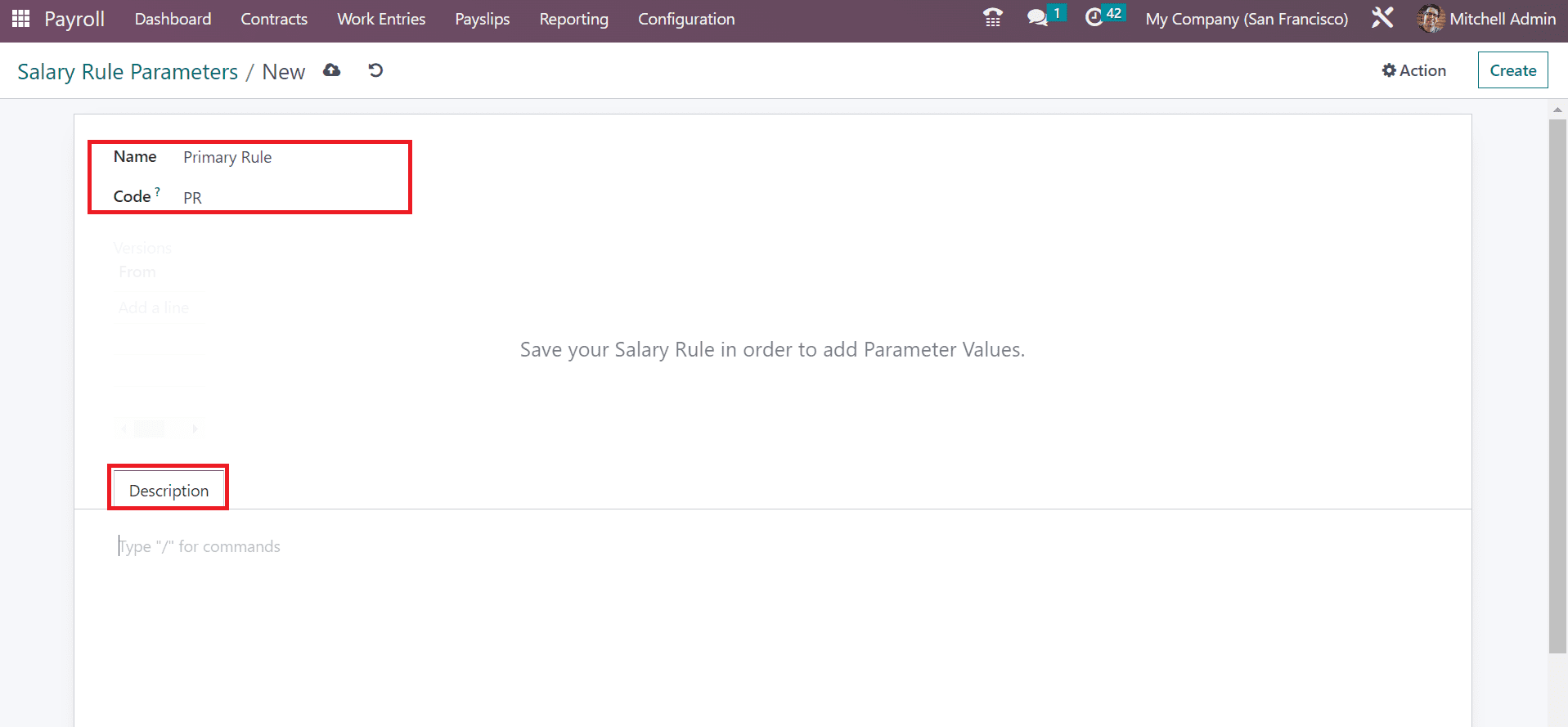

The Rule Parameters menu is accessible under the Configuration tab to manage different rule parameters. In the Salary Rule Parameters window, you can obtain the Code and Name of each salary rule parameter. To define a new rule parameter, click the CREATE icon on the Salary Rule Parameters page.

In the open screen, apply the rule parameter title in the Name option. Add code used in the salary rule to mention the salary parameter. After defining these details, you can explain further information about the salary rule parameter inside the Description tab.

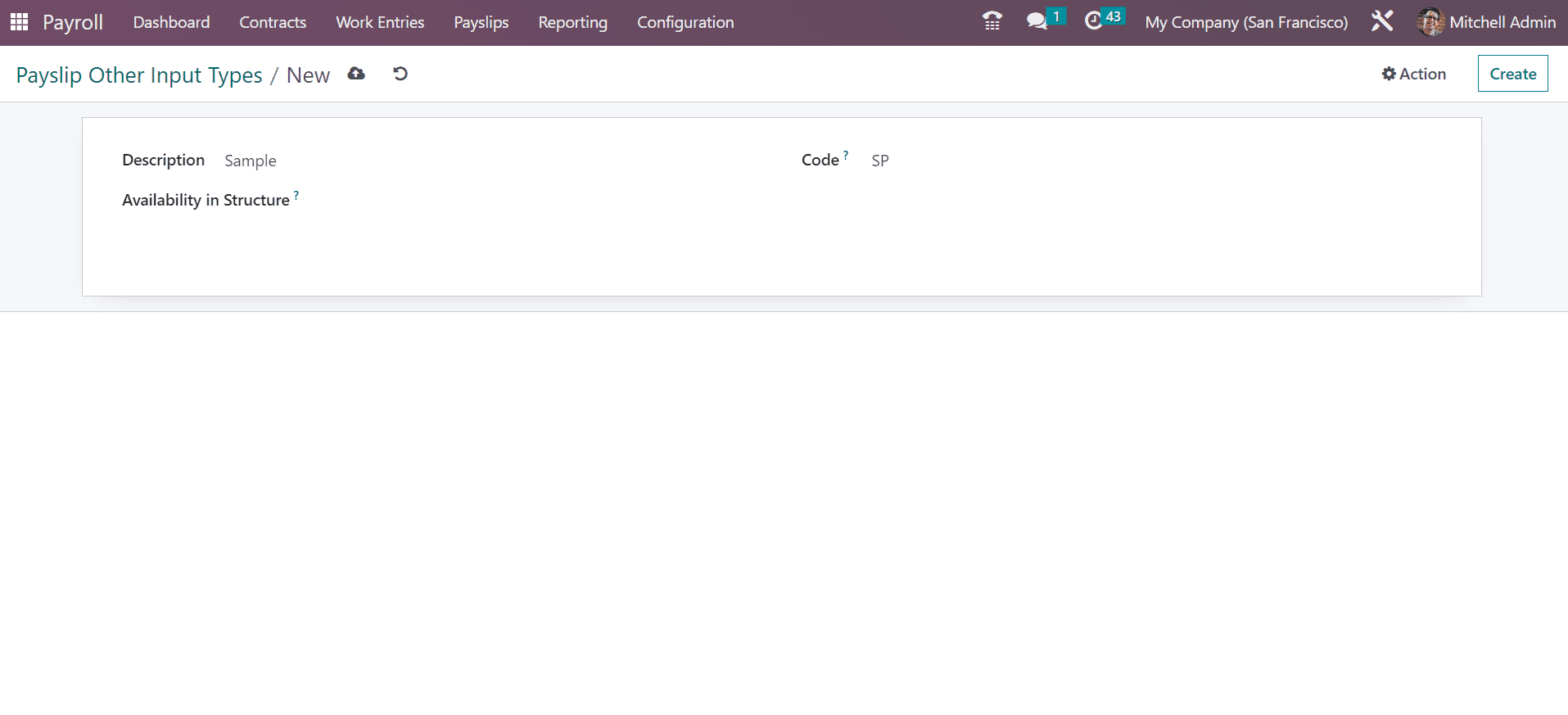

Other Input Types

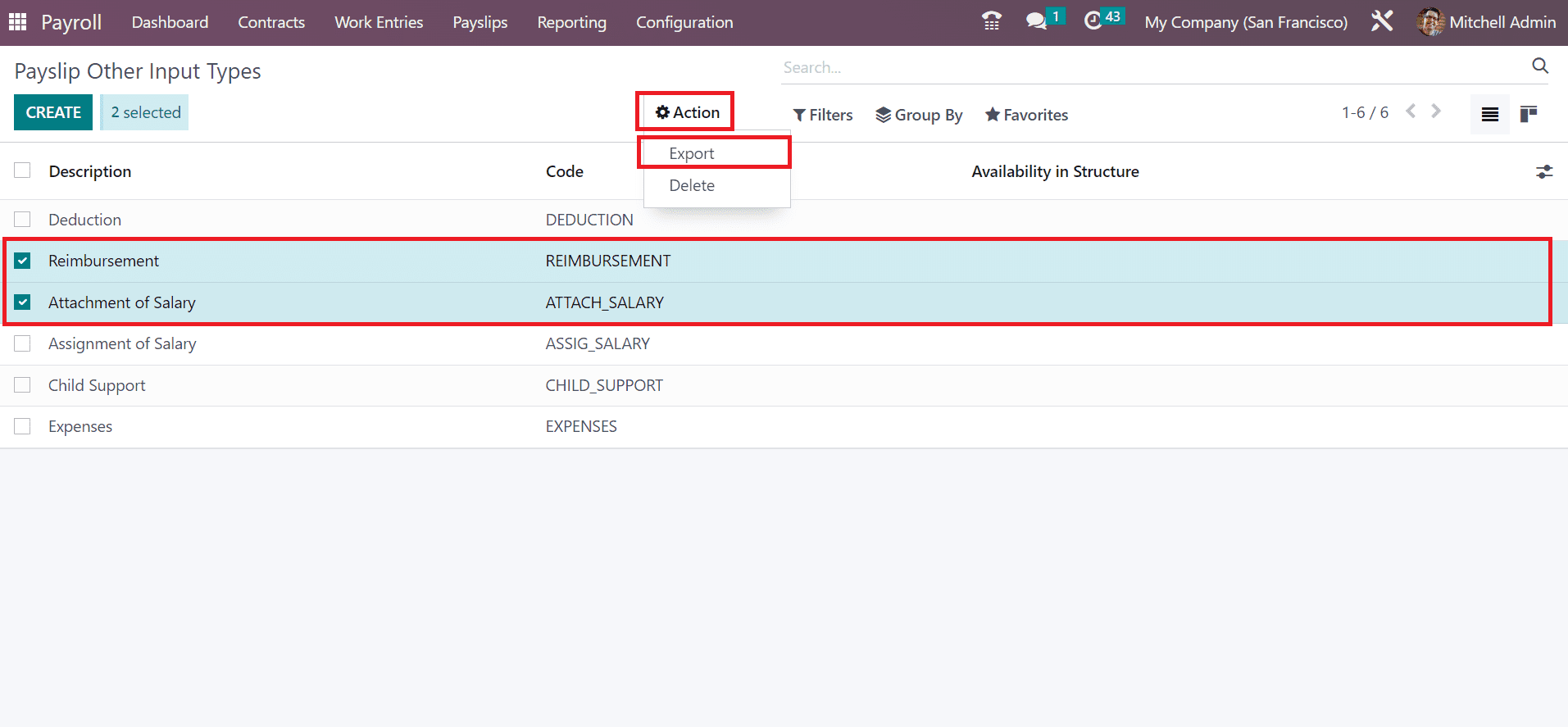

Users can obtain the Other Input Types menu below the Configuration to define a payslip input type. In the List view, you can see the Code, Description, and Availability in Structure separately in the Payslip Other Input Types window. If you need to export the payslip input type, select your specific input types and choose the Action icon. You can pick the Export menu inside Action once choosing the necessary input types.

By selecting the CREATE button, we can formulate a new payslip other input types. Mention the Description and Code used for the salary rule. The input is accessible in all structures if you set up the Availability in Structure. It will be visible in all payslips if you keep the field empty.