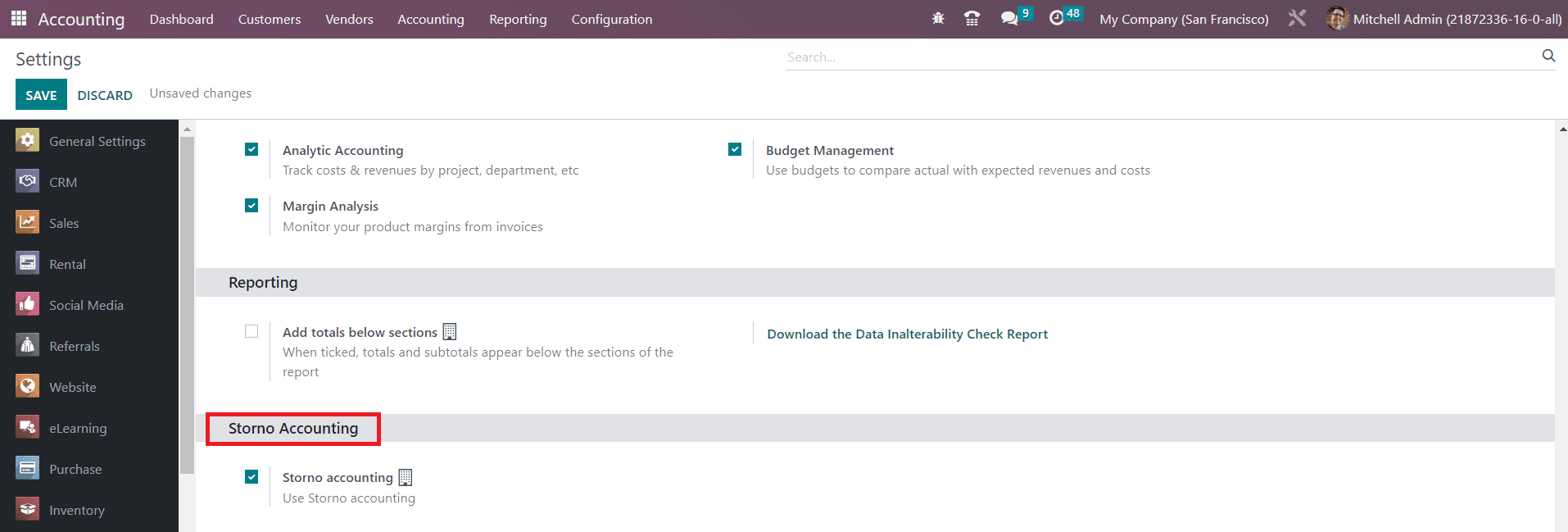

Storno Accounting

Storno Accounting is a newly introduced accounting feature in Odoo. In this method of accounting, it will use negative credit or debit amounts recorded in your account to reverse the original journal entries. With the assistance of this practice, it is possible to cancel a file having incorrect accounting information related to the recorded amount.

After canceling the wrong accounting document, you are responsible for entering the actual amount details to ensure accuracy.

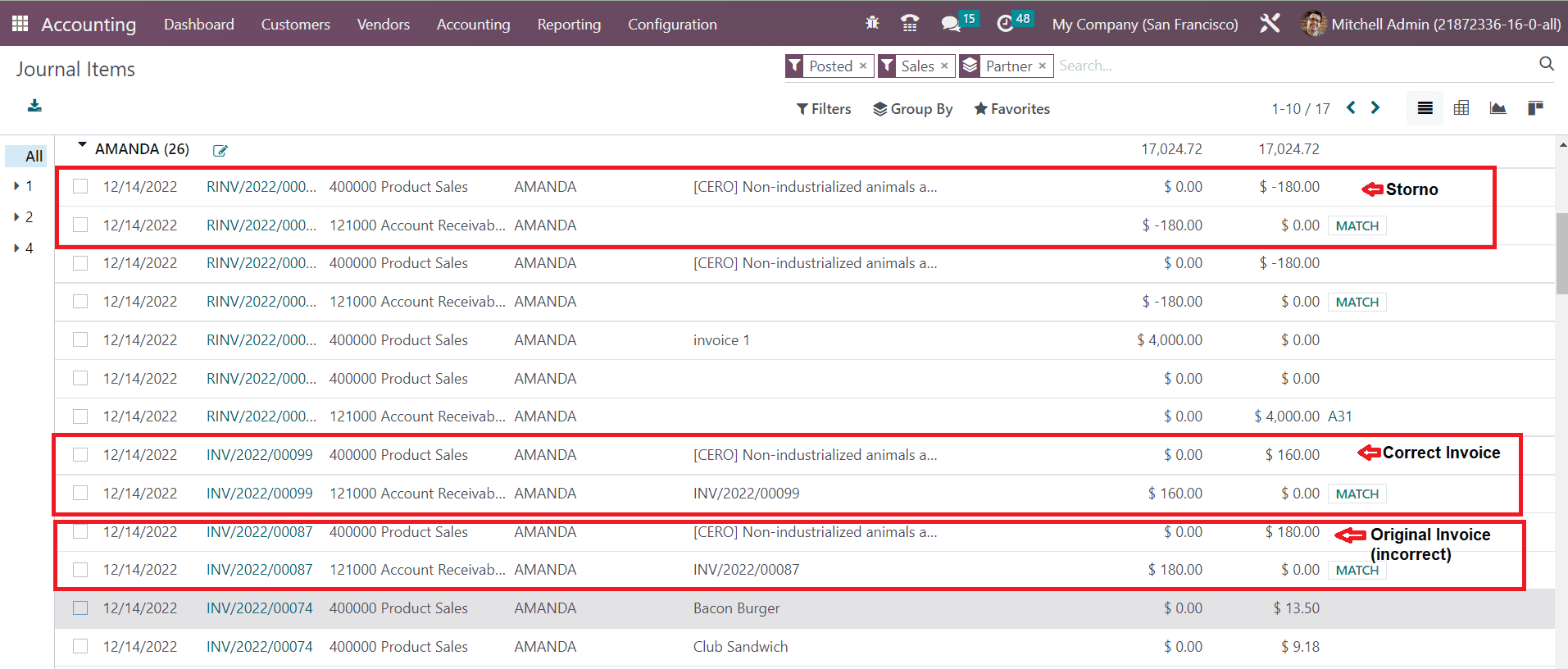

If you are using Storno accounting, Odoo will create a copy of the original entry, and you can see that the amount mentioned in the reverse entry will be shown in a negative sign.

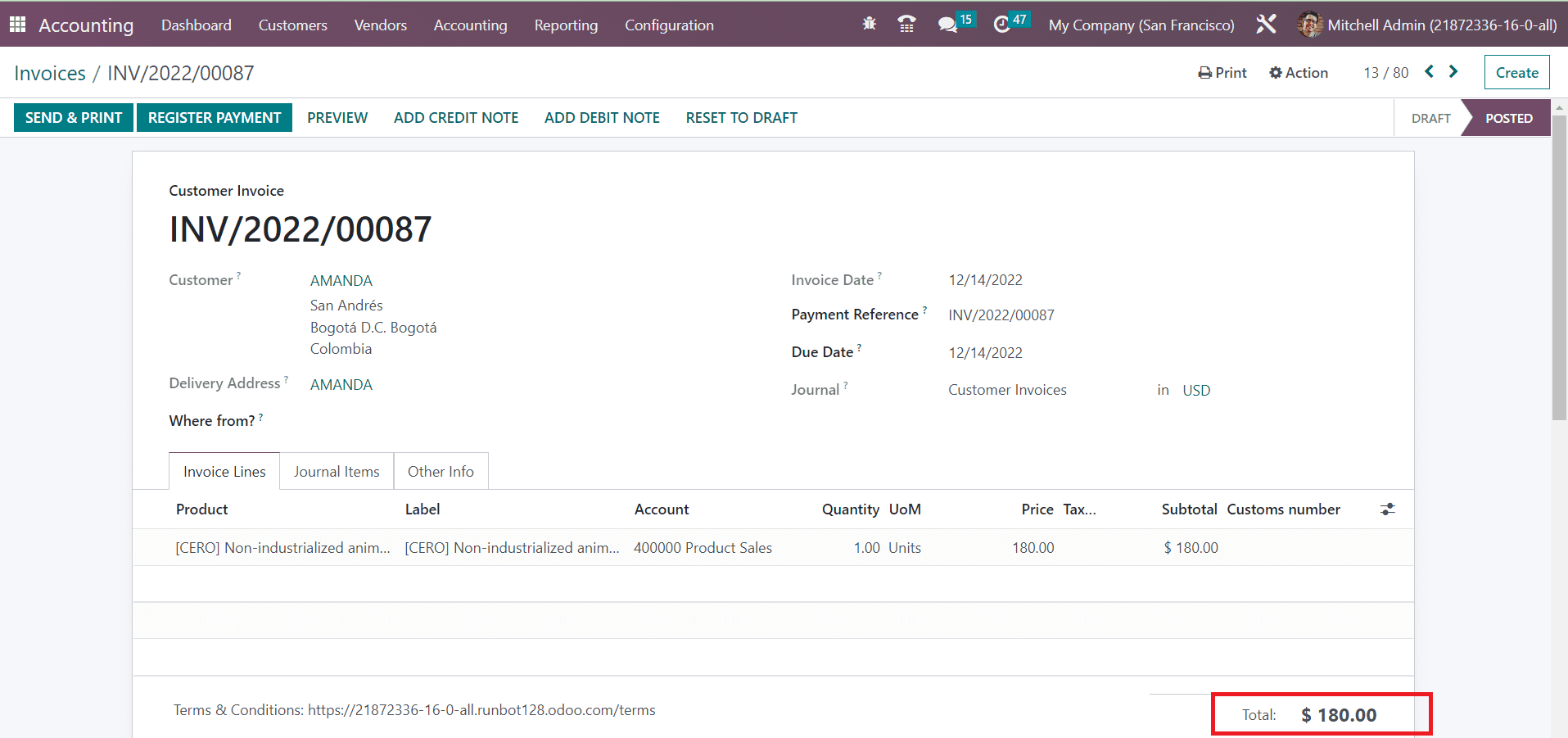

Let’s discuss this accounting feature through an example. Imagine that you already posted an invoice from a vendor in the amount of $180. While completing the payment, you discovered that the amount was mistakenly entered as $180 instead of $160. In this situation, you need to create Storno for the original entry. After reversing the entry, you can create a correct invoice for the amount of $160.

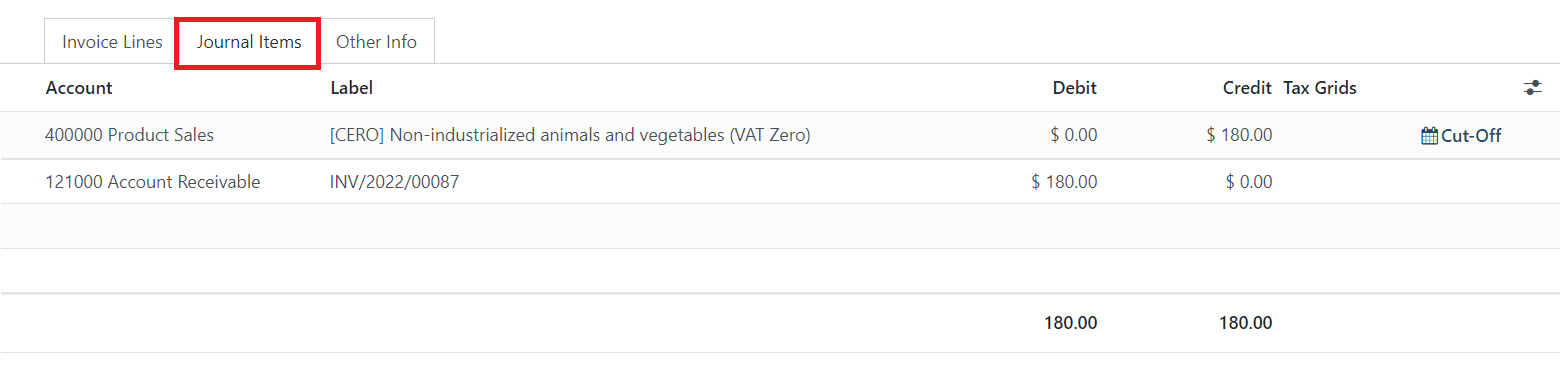

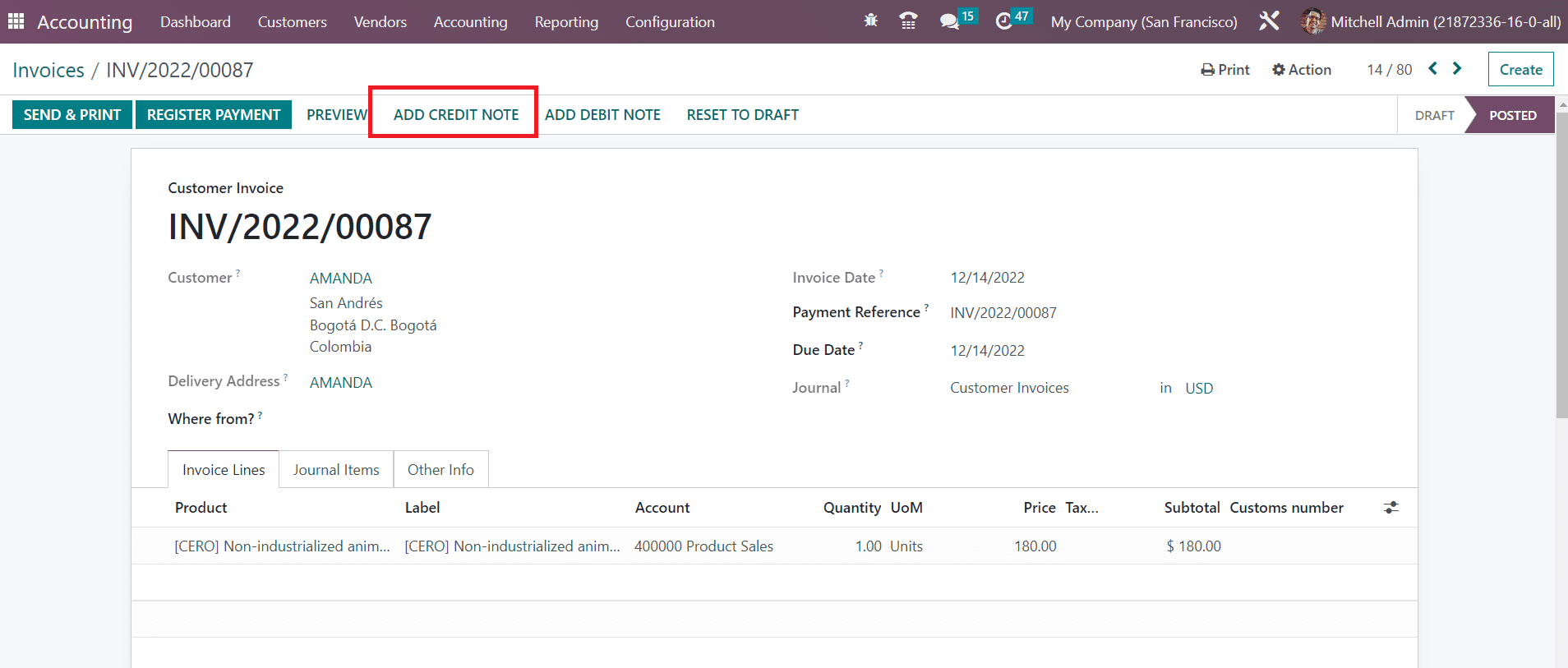

The screenshot shows the invoice for the amount of $180. The journal items for this invoice can be seen under the respective tab, as shown below.

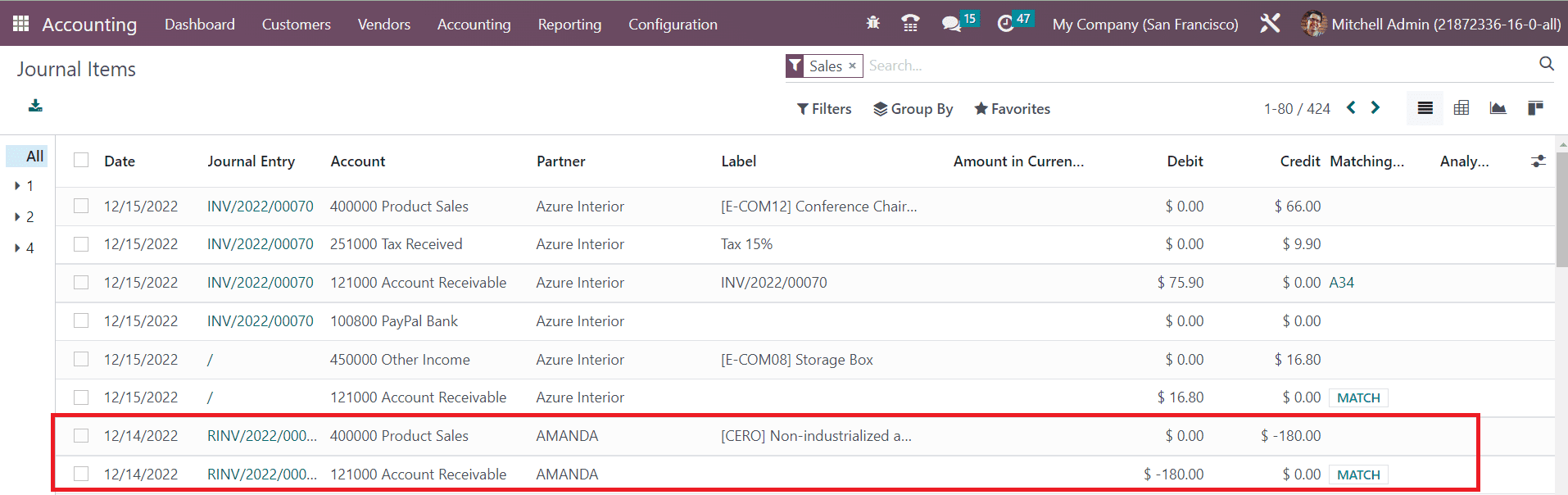

While checking the Journal Items in your Accounting module, you can find the posted journal items for the amount as shown below.

Now, we are going to reverse the entry because the invoiced amount is not the actual amount.

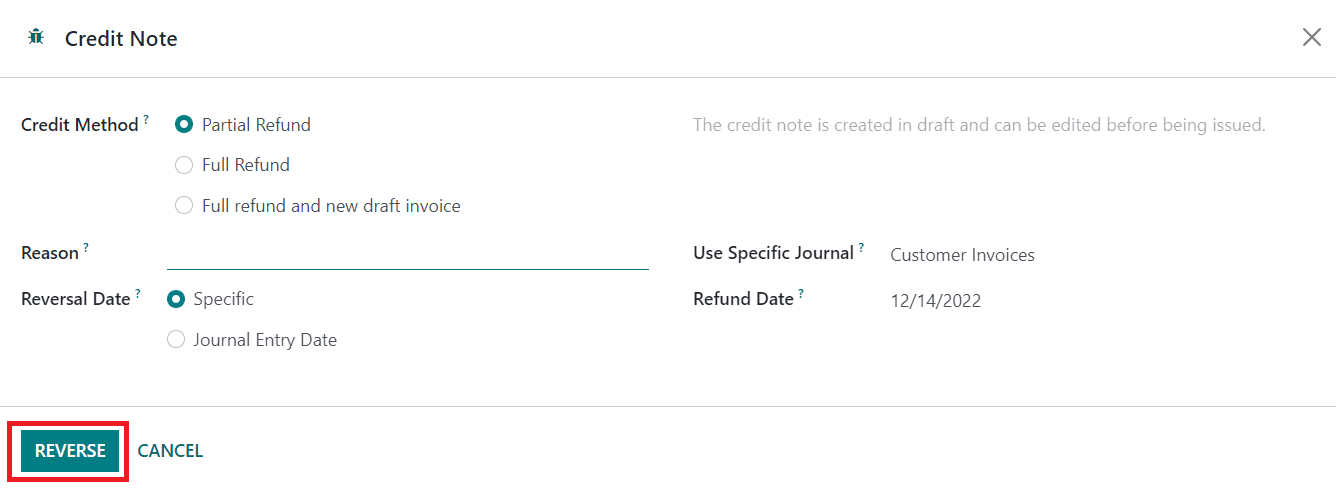

Click the Add Credit Note, and a pop-up will appear to mention the details of the credit note.

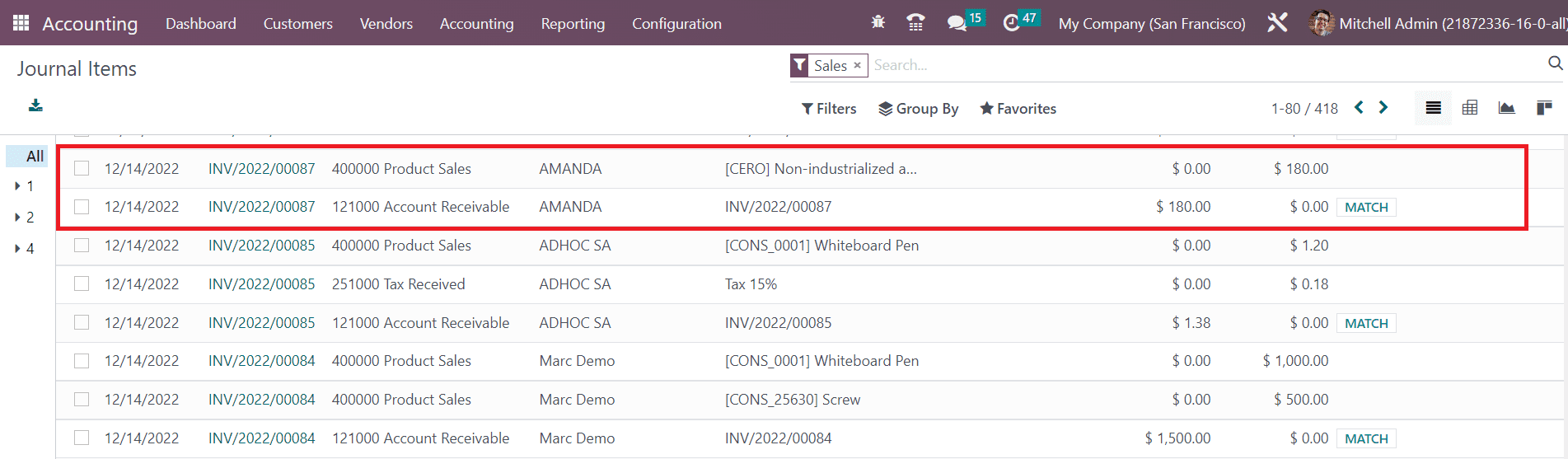

After mentioning the necessary details, you can click on the Reverse button. The posted journal entry will be reversed, and the amount will be recorded in the journal items with a negative sign, as shown below.

After reversing the journal entry, you can invoice the actual amount.

The journal items of the incorrect invoice, Storno, and correct invoice can be seen in the Journal Items menu of the Accounting module, as shown in the image above.