Reporting

Reports are essential for any kind of business to understand the progress of operations and analyze the workflow. A well-defined reporting platform will simplify the process of analysis and help you to make decisions in crucial situations. In the case of the financial operations inside a company, reports play an important role in providing an insight into the management of finance in real time. In this section, we will detail the reporting features offered by the Odoo Accounting module.

Balance Sheet

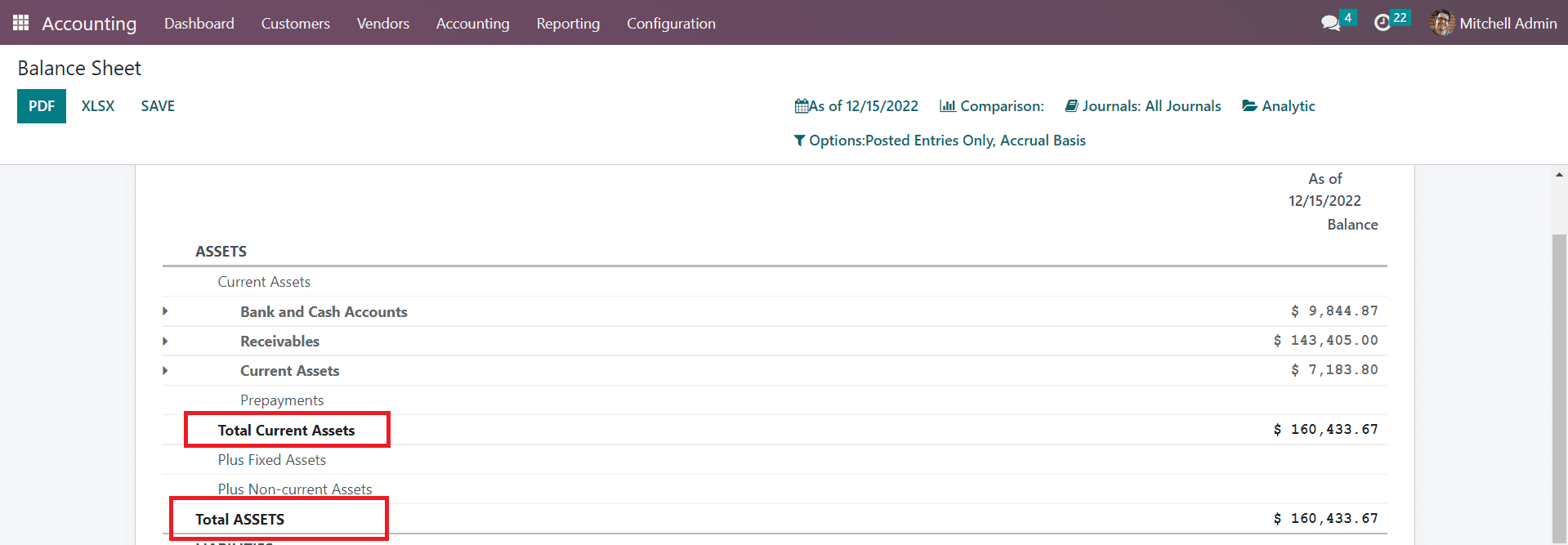

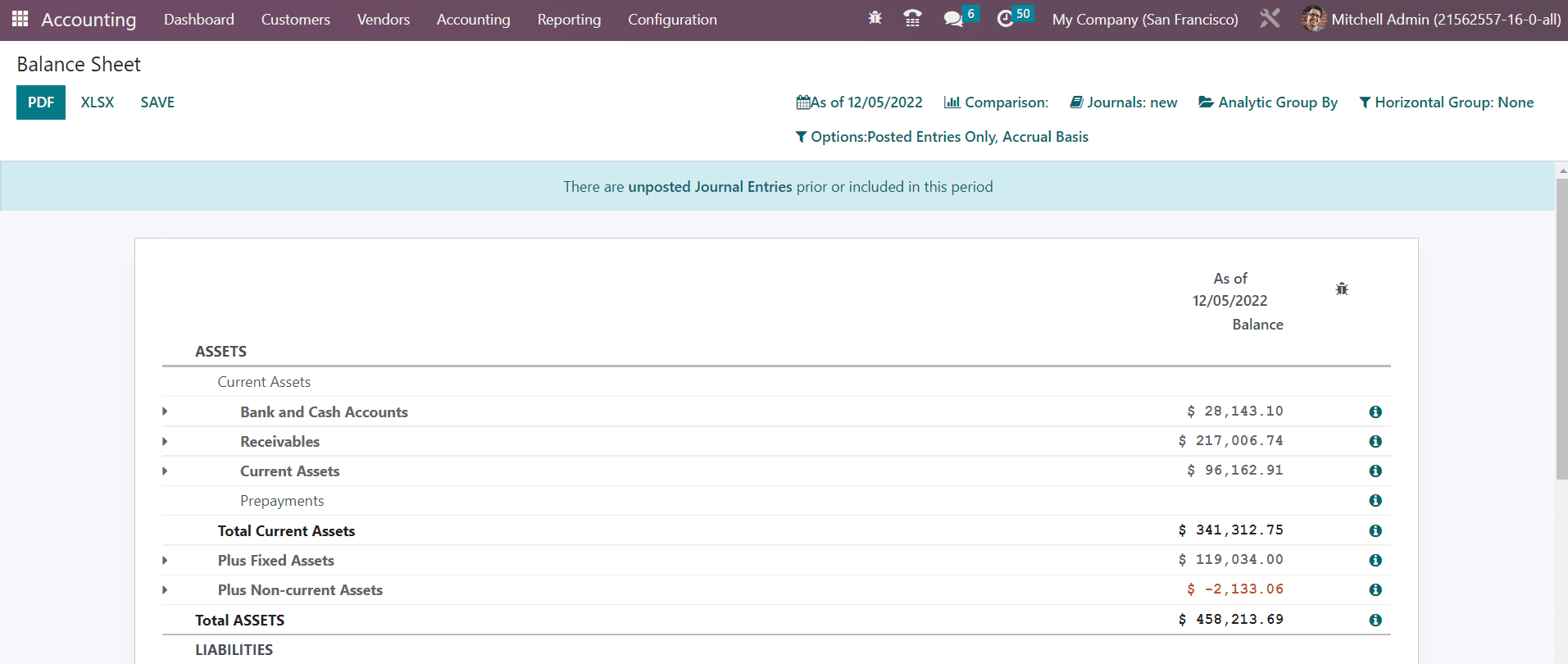

The user will be able to get details regarding the asset, liability, and equity of an organization from the Balance Sheet report at a single point of time. You can create customized reports by using the additional features offered by Odoo. It is possible to get the balance sheet of a particular date by selecting that date in the small calendar icon given in the screen.

The reports can be compared with the previous period using the Comparison tool. If you want to get the balance sheet report of a particular journal, you can select that journal from the Journals option. Additionally, you will get some advanced filters also in order to sort the available data according to the requirements.

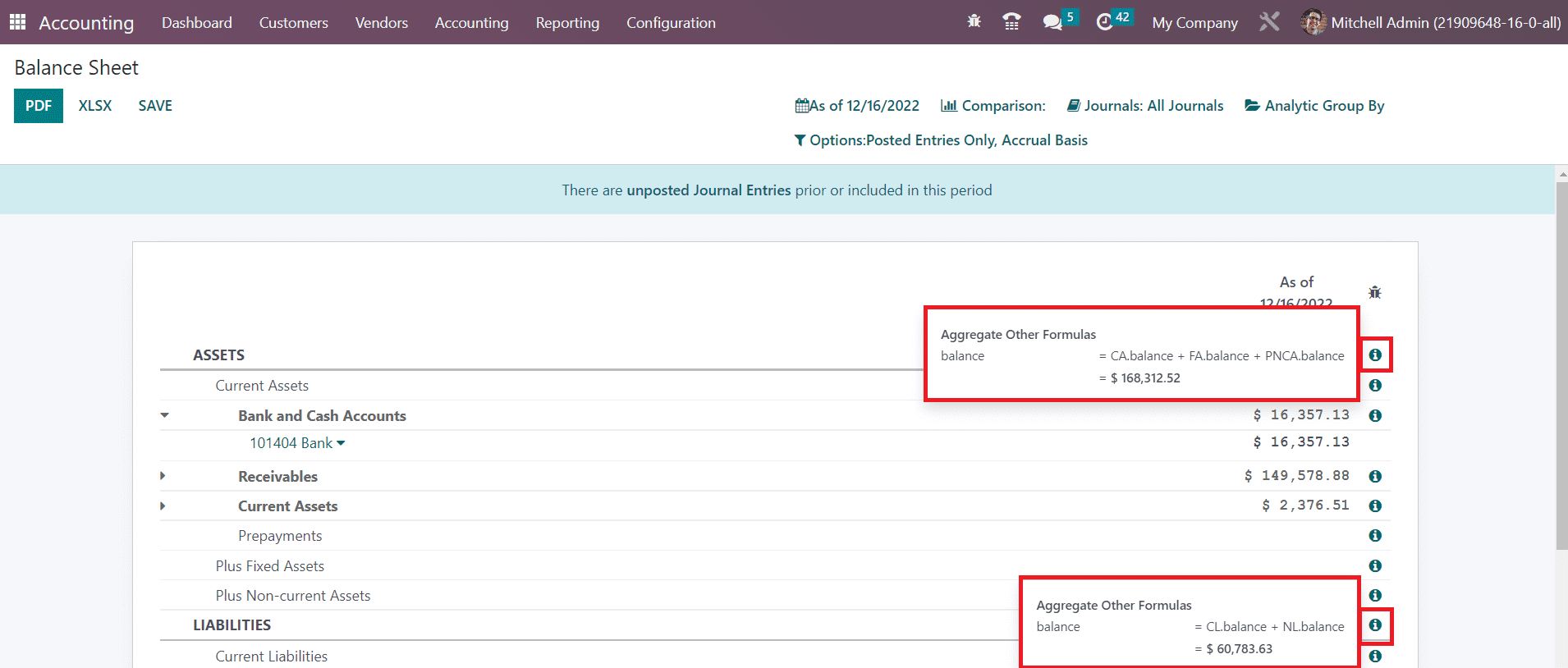

Once you activate the developer mode, you will be able to get a little ‘i’ at the end of each reporting line as highlighted in the image below.

This option will show the calculation formula of the respective reporting line.

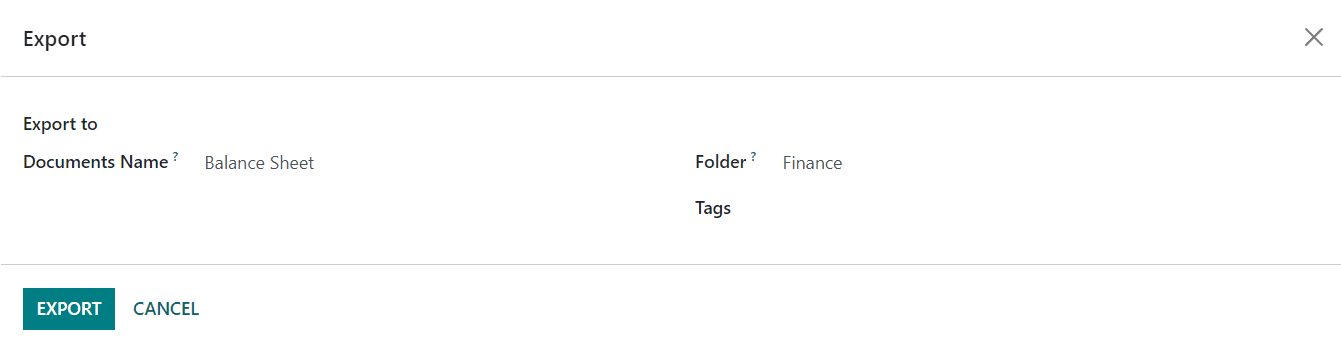

Using the PDF and XLSX options, you can convert the data into corresponding formats. In the Odoo Reporting platform, you will get a Save button to export the PDF or XLSX of the document to the Document module in Odoo. When you click on the Save button, a pop-up window will appear as shown below.

In the Export to field, you can mention the document format of the file. It can be either PDF or XLSX. The name of the generated document will be available in the window. Mention the Folder where to save this document file and click the Export button.

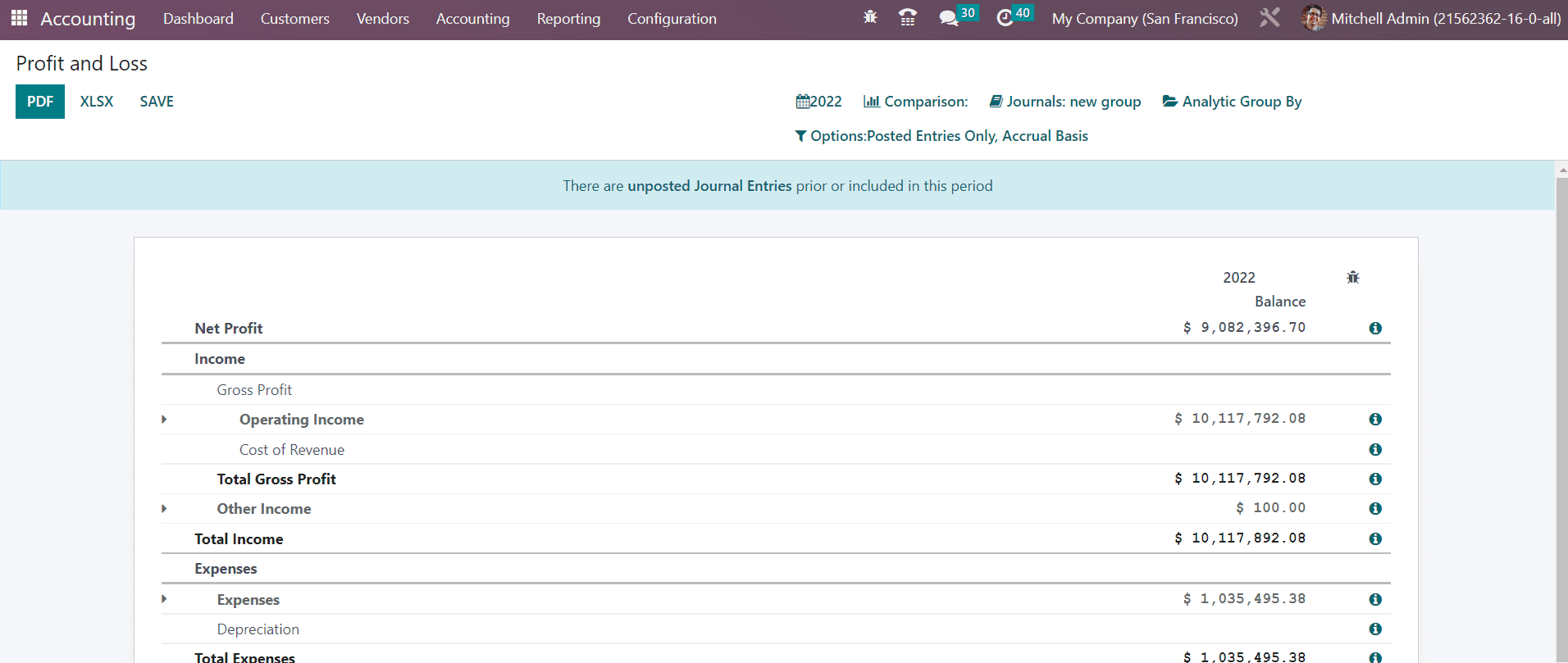

Profit & Loss

The reports of income statements are the most important part of the financial reporting. In the Profit & Loss reporting platform, you will get the revenue, expenses, profit, and loss of the organization during a particular period of time. The ending balance of the profit & loss report of the selected period of time will not be carried forward to the next accounting period unlike the balance sheet.

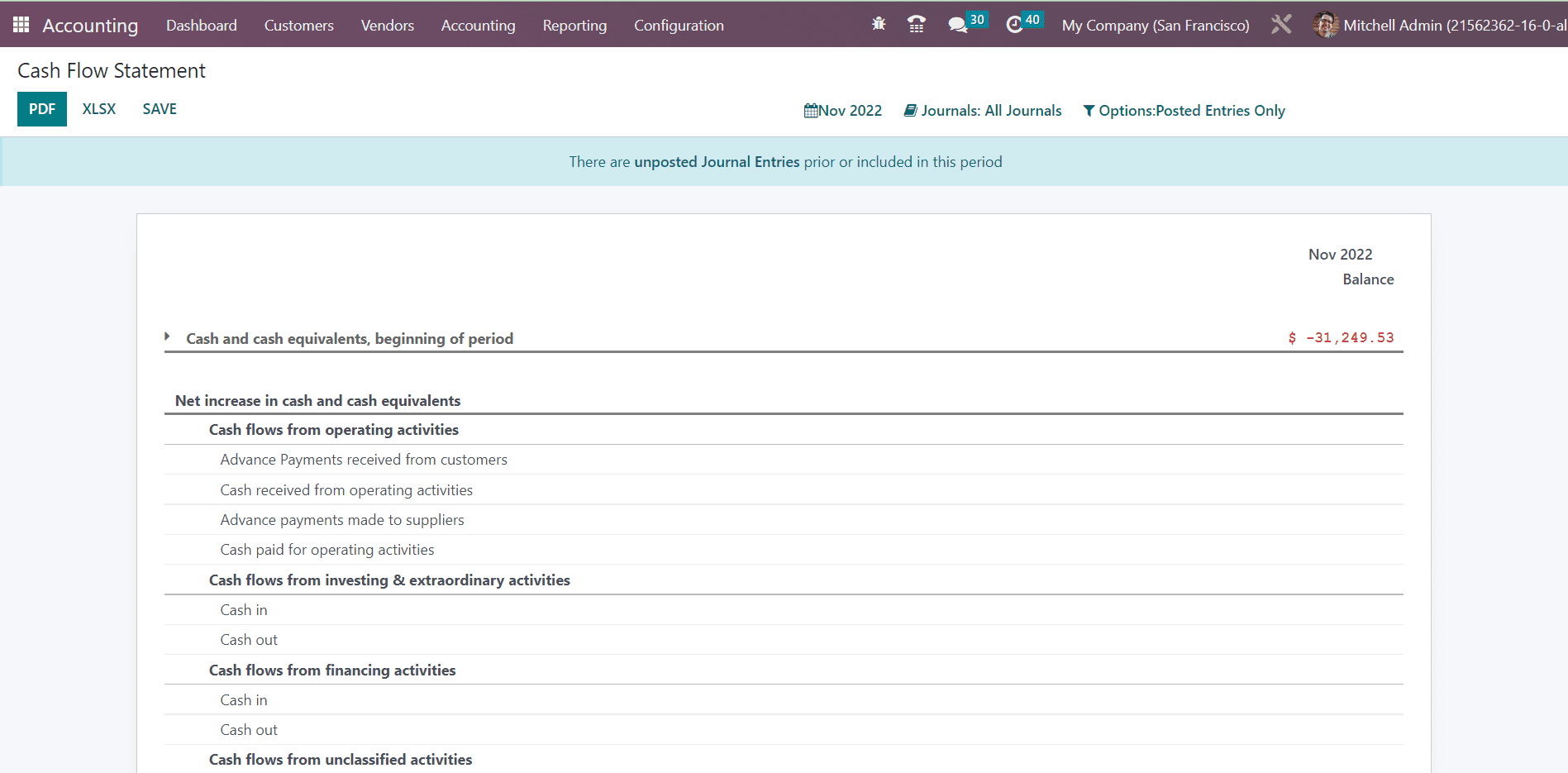

Cash Flow Statement

The cash flow statement reporting will provide the financial statement regarding all cash inflows and outflows. These reports will be based on the accounts you configured for the cash flow statement invoice. You will get the cash flow statement reports based on the operating activities, investment activities, and financial activities.

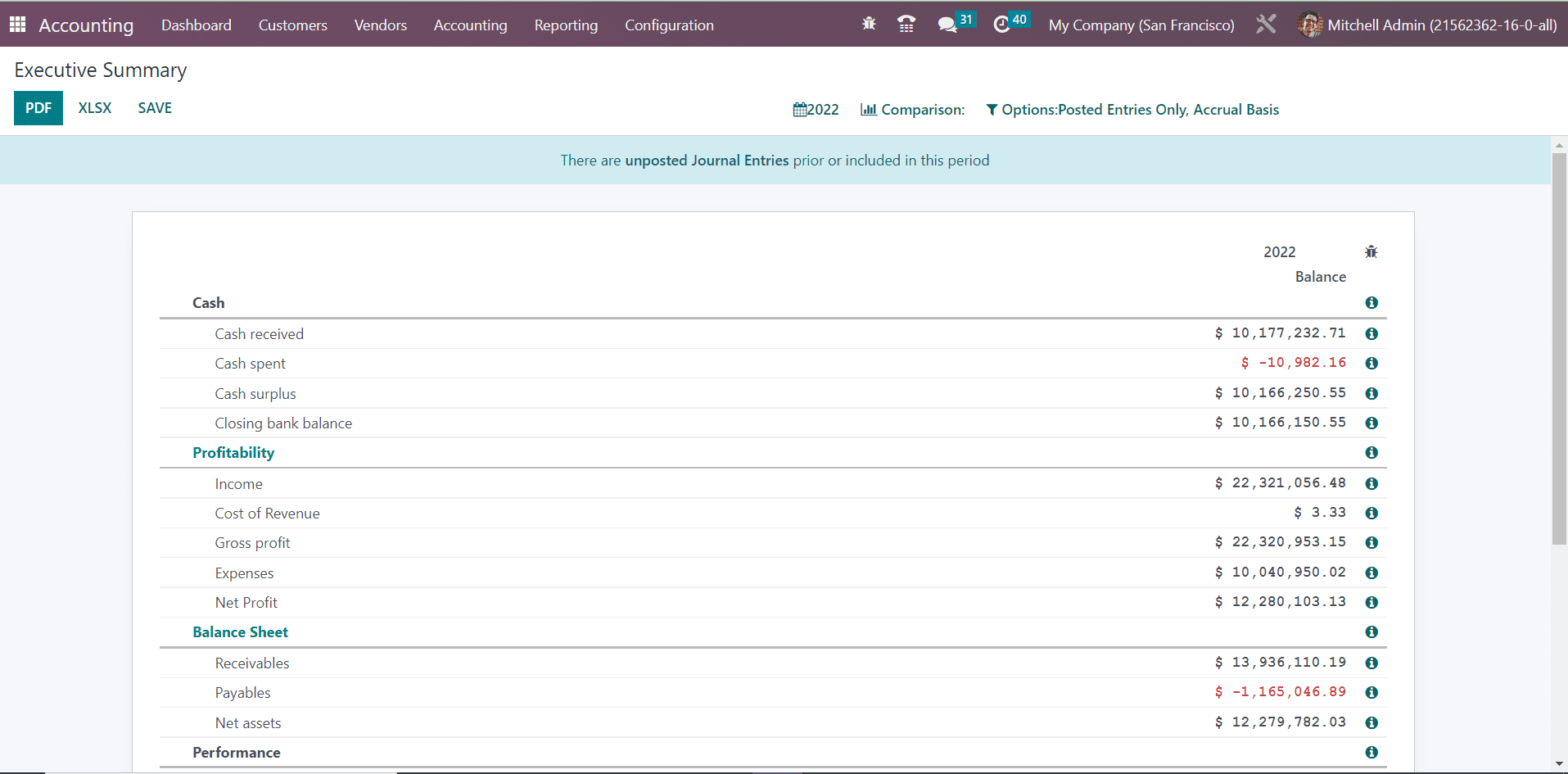

Executive Summary

The Executive Summary platform available in the Reporting menu summarizes the cash flow, profitability, and balance sheet reports of a particular period. Along with this, the Performance tab reports the Gross Profit Margin, Net Profit Margin, and Return on Investment. Under the Position tab, you can observe the Average Debtors Day, Average Creditors Days, Short Term Cash Forecast, and Current Assets to Liabilities.

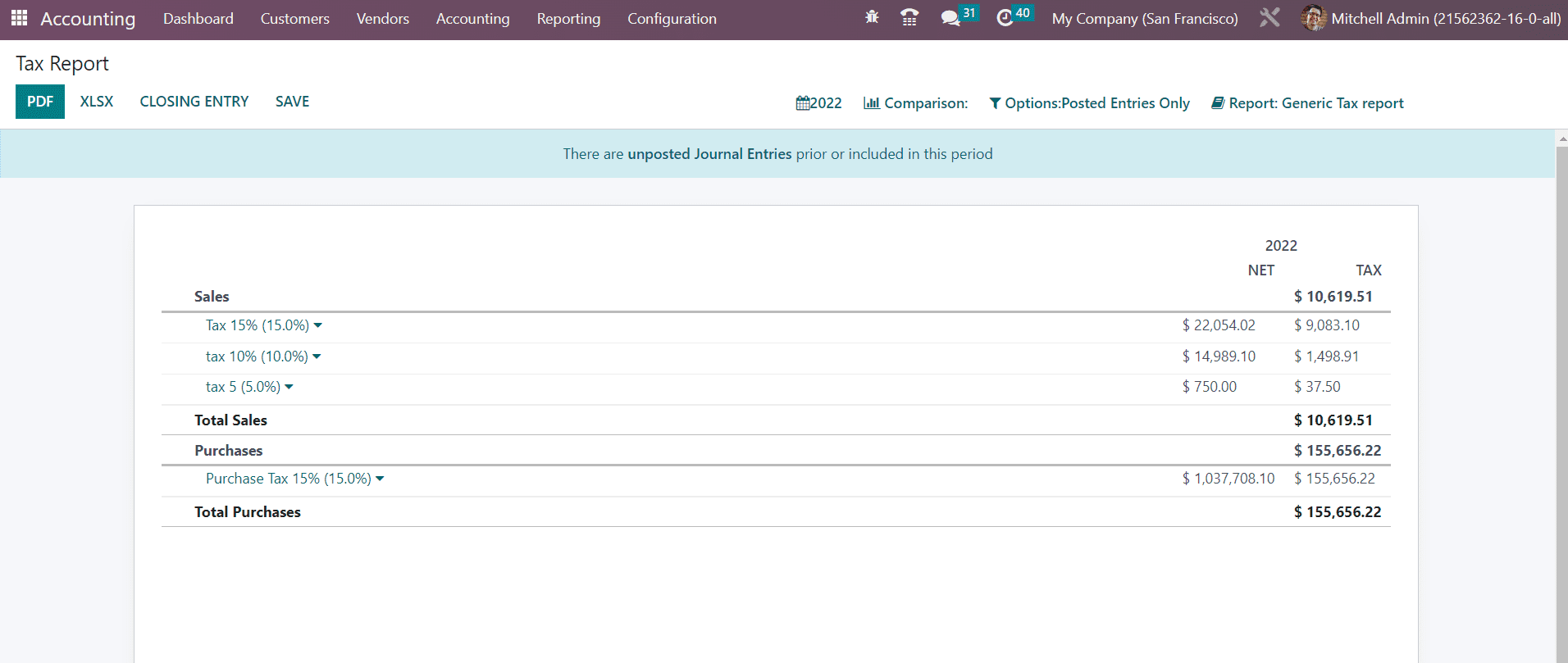

Tax Reports

The detailed reports of sales and purchase taxes can be generated from the Tax Reports platform available in the Reporting menu. Using the Closing Entry option, you can report the return tax of the selected period.

EC Sales List

This report will give the details of the sales of the goods and services you provided for the customers from the European Union who are registered for VAT. Filing the European Commission sales to HMRC is necessary for any sales transaction to the EU- VAT registered customers.

The report gives the total, country code, VAT number, and amount related to the EC Sales.

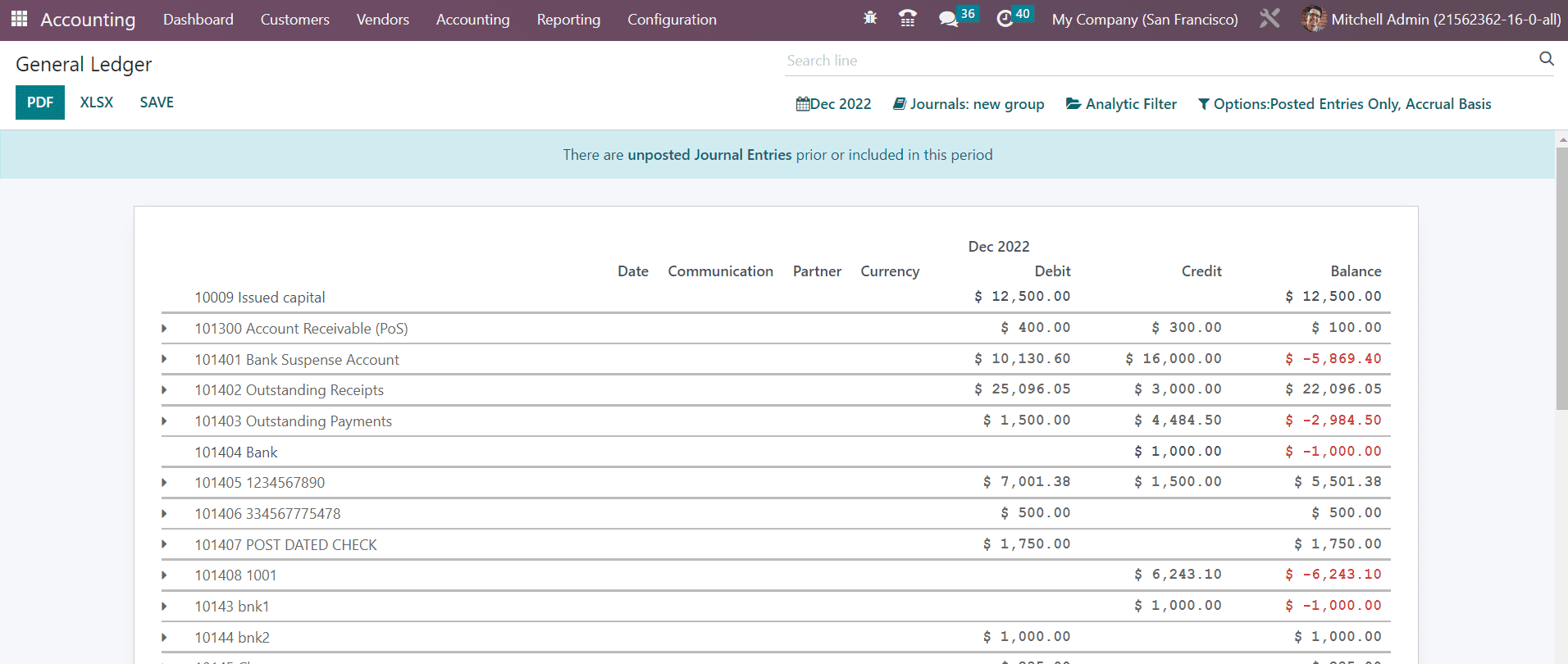

General Ledger

The General Ledger reports will show all transaction reports from all accounts configured in your system for a selected period of time. Along with the account name, you can observe the Date, Communication, Partner, Currency, Debit, Credit, and Balance of each account. It records every financial transaction of your organization during a financial year.

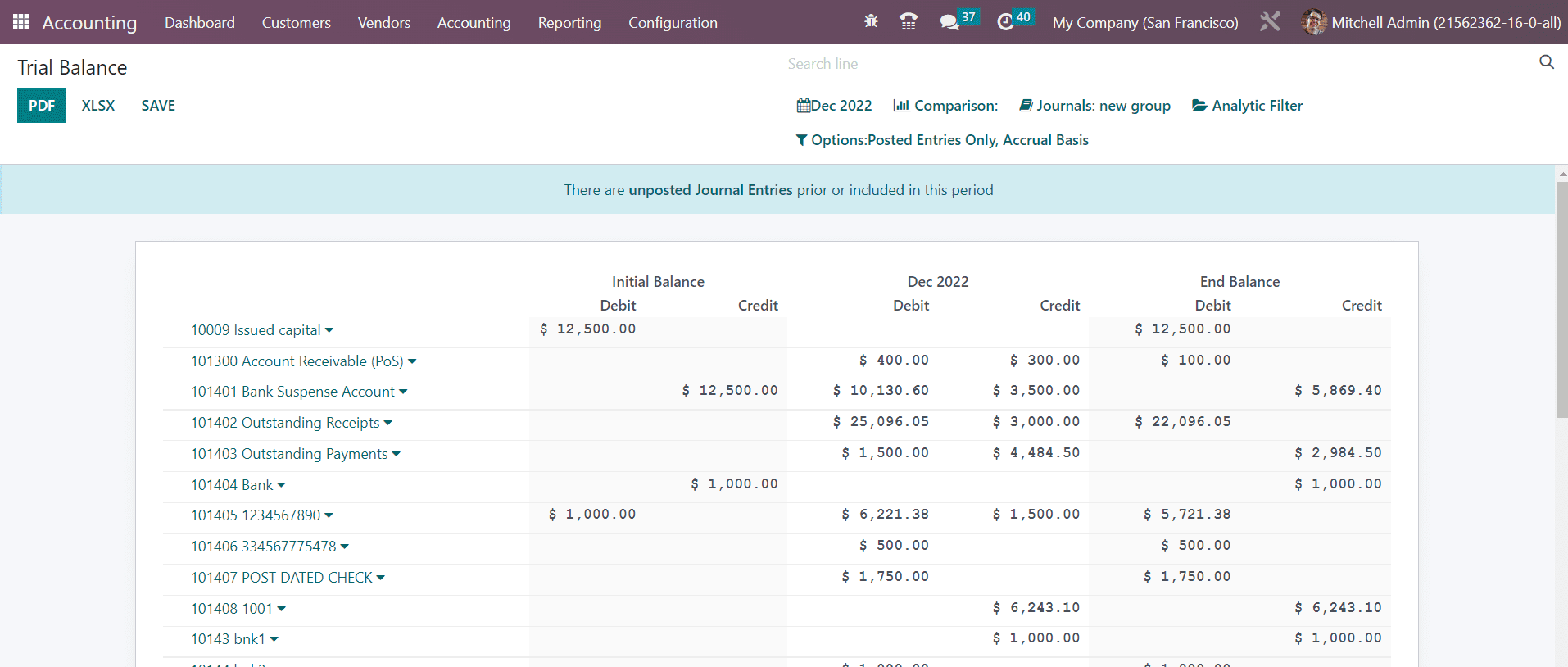

Trial Balance

Trial balance is an accounting report that shows the results of all accounting entries posted through different journals. The trial balance reports are mostly generated on the financial year end of the organization. These reports are used for the operations of auditing. As you can see in the image below, the report shows the credit and debit details from initial balance, selected month/year, and end balance of the journal entries.

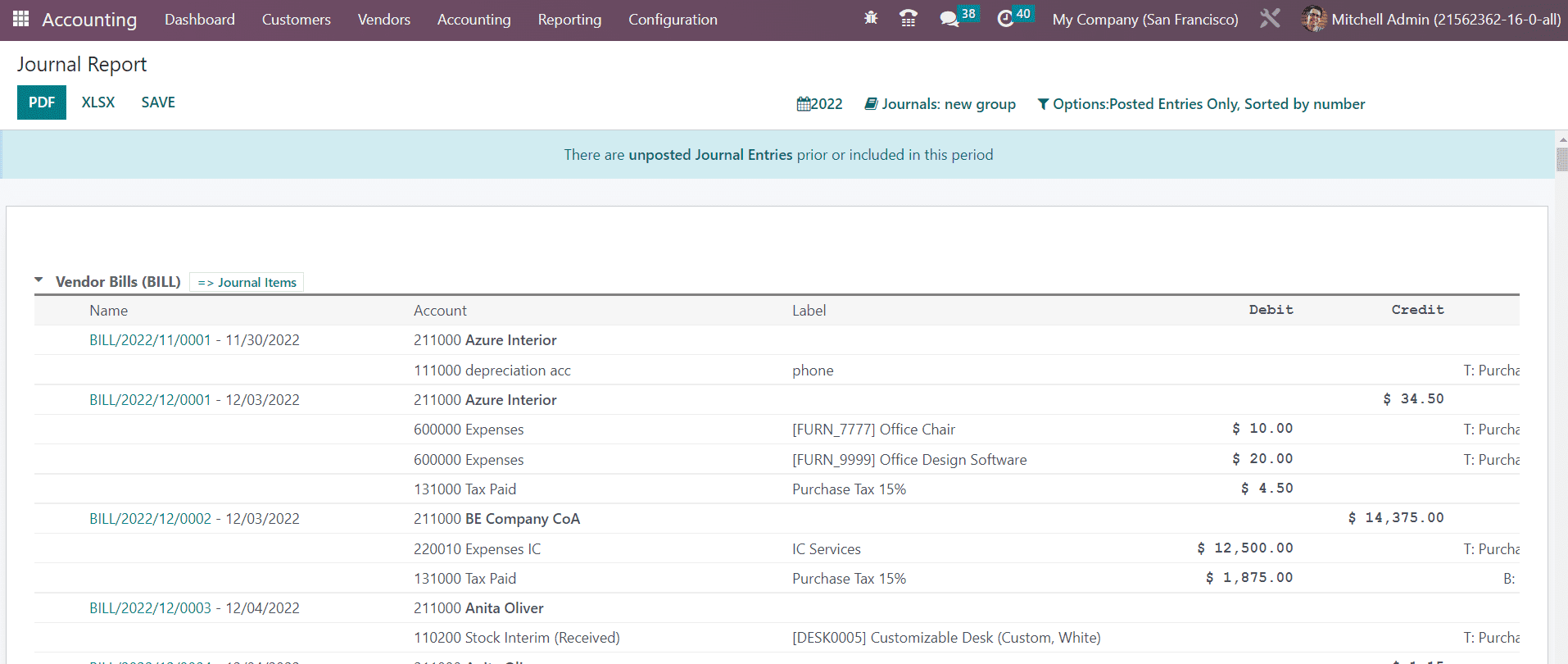

Journal Report

Accounting reports of various journals configured in your Accounting module can be generated from the Journal Reports platform. Under each Journal, you will get the report of corresponding journal items also with the details of the Name, Account, Label, Debit, and Credit.

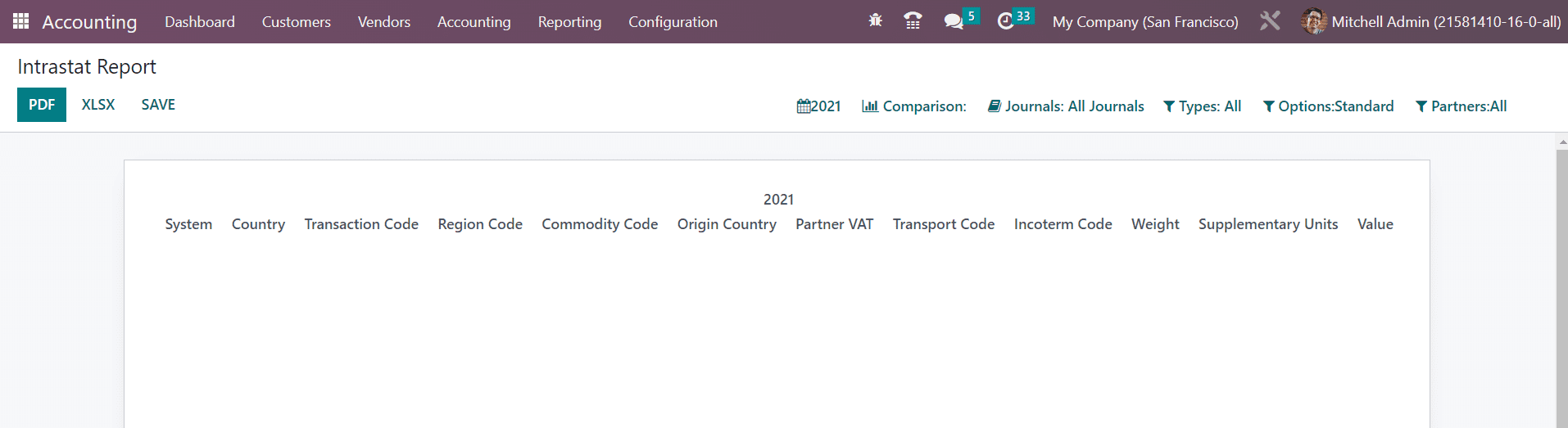

Intrastat Code

Intrastat is the system used to collect the statistics of transactions and trade of goods and services with EU member states. From the Settings menu of the Accounting module, you can activate this feature. The Intrastat Code option available in the Reporting menu will give reports of this, as shown below.

It includes the System, Country, Transaction Code, Region Code, Commodity Code, Origin Country, Partner VAT, Transport Code, Incoterm Code, Weight, Supplementary Units, and Value.

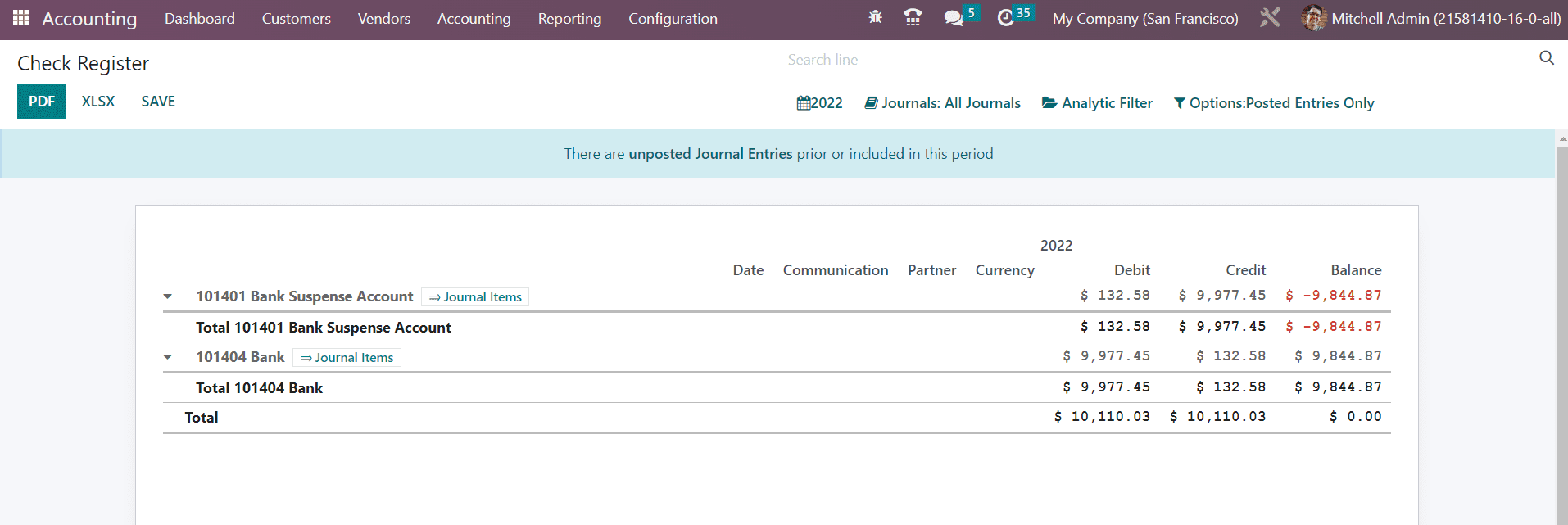

Check Register

All financial transactions using checks will be reported in the Check Register platform in the Reporting menu. You can generate check register reports on this platform by selecting a particular period of time. The bank accounts used for check transactions, along with respective journal items, can be seen in this report. It shows the Date, Communication, Partner, Currency, Debit, Credit, and Balance details.

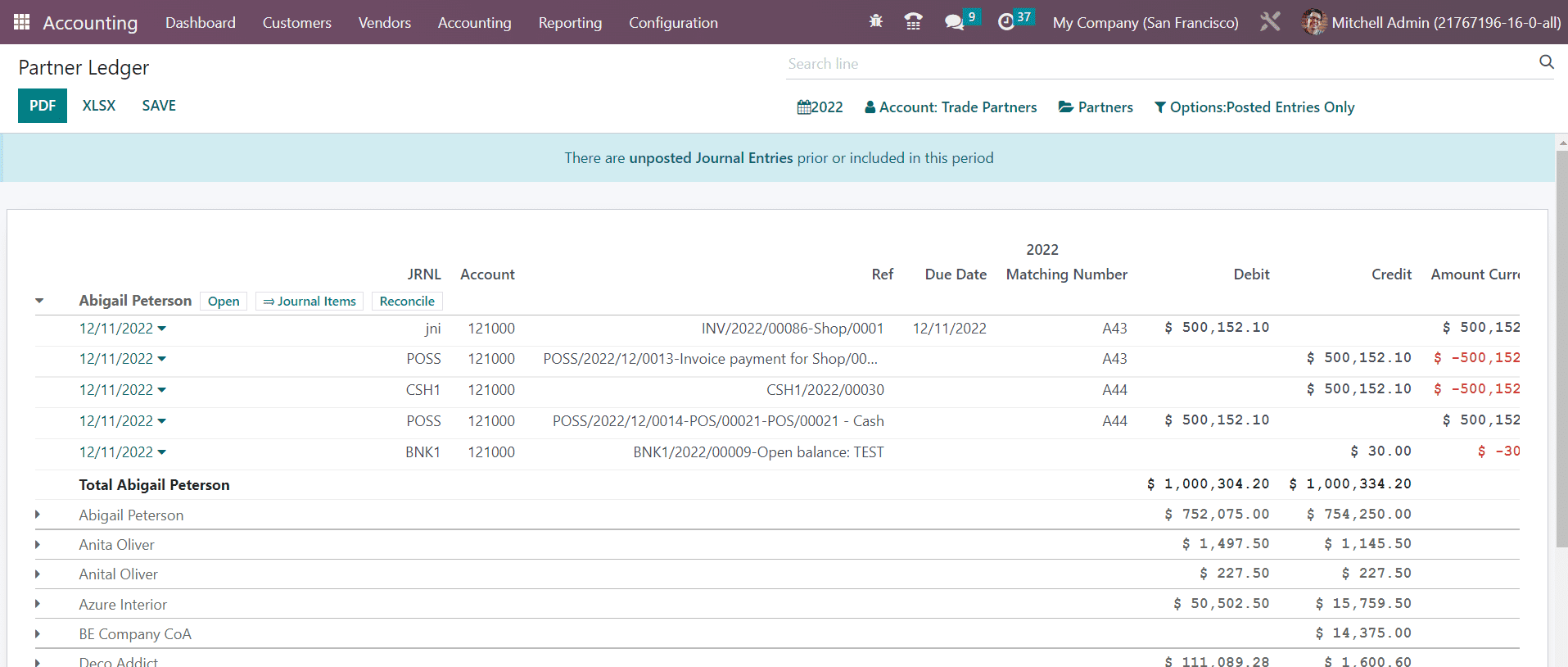

Partner Ledger

The report of receivable and payable journal entries of partners can be observed in the Partner Ledger reporting platform. It shows the Journal, Account, Reference, Due Date, Matching Number, Debit, Credit, Amount, Currency, Balance of the partners during the select period of time. In order to reconcile the accounts of the partners, you can use the Reconcile button given on the report.

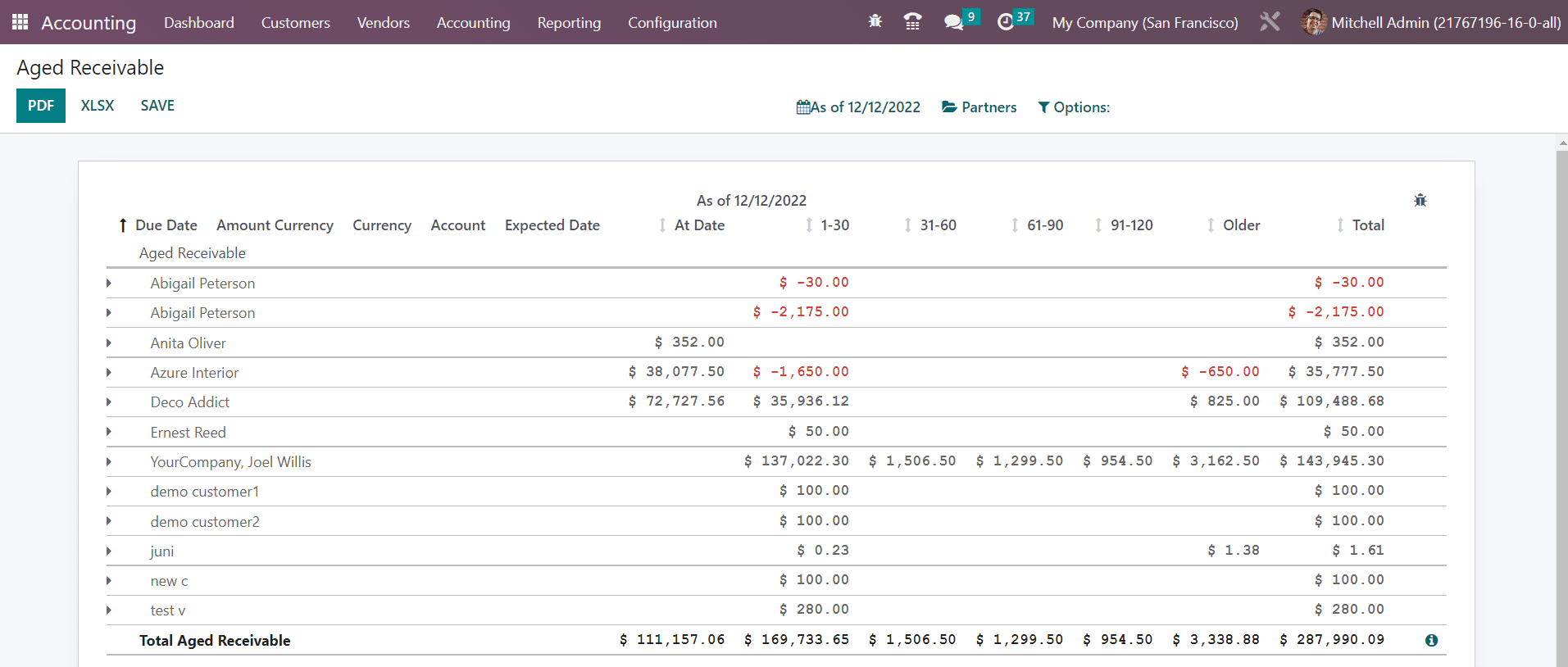

Aged Receivable

The Aged Receivable platform in the Reporting menu assists you to get reports of the aged partner receivable balances of the selected date. These are the reports of invoices that are awaiting payment. If the customer failed to pay the invoice even after the days mentioned in the payment terms, the payment will fall under the category of Aged Receivables. As shown in the screenshot below the report shows the Due Date, Amount, Currency, Account, Expected Date, receivable amount At Date, Older, and Total.

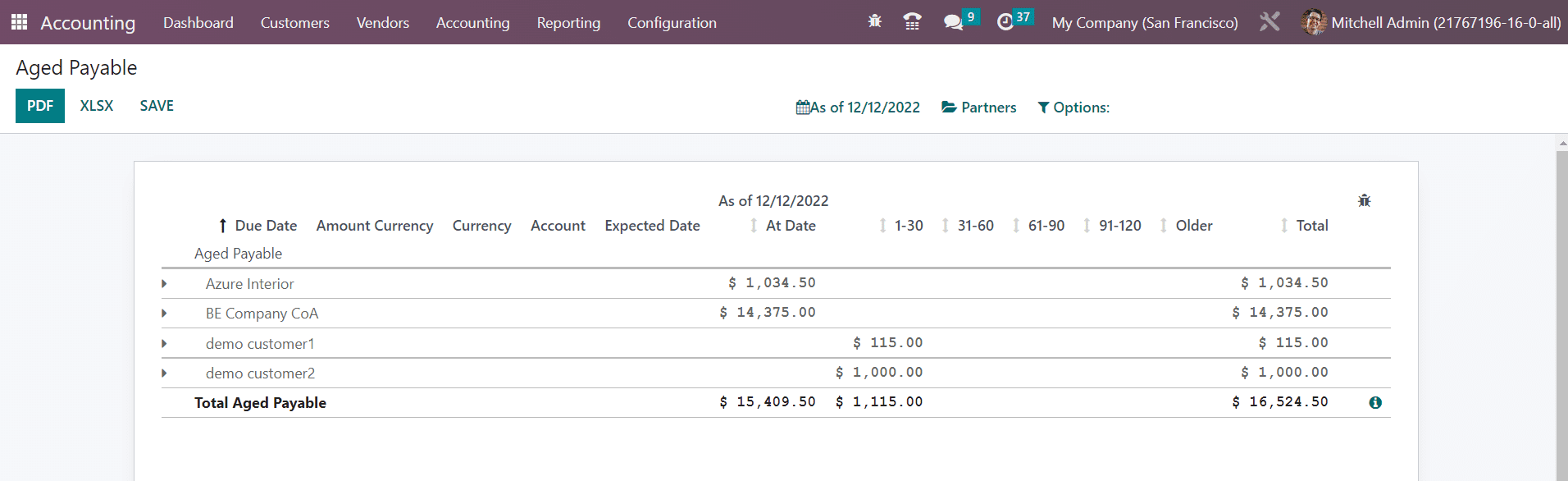

Aged Payable

Similar to the Aged Receivable platform the Aged Payable also shows delayed payment reports. These delayed payments are meant to be paid by your company to the respective partners before the due date. If your company failed to pay the invoices before the due date mentioned in the payment terms, it will be added to the Aged Payable report in the Odoo Accounting.

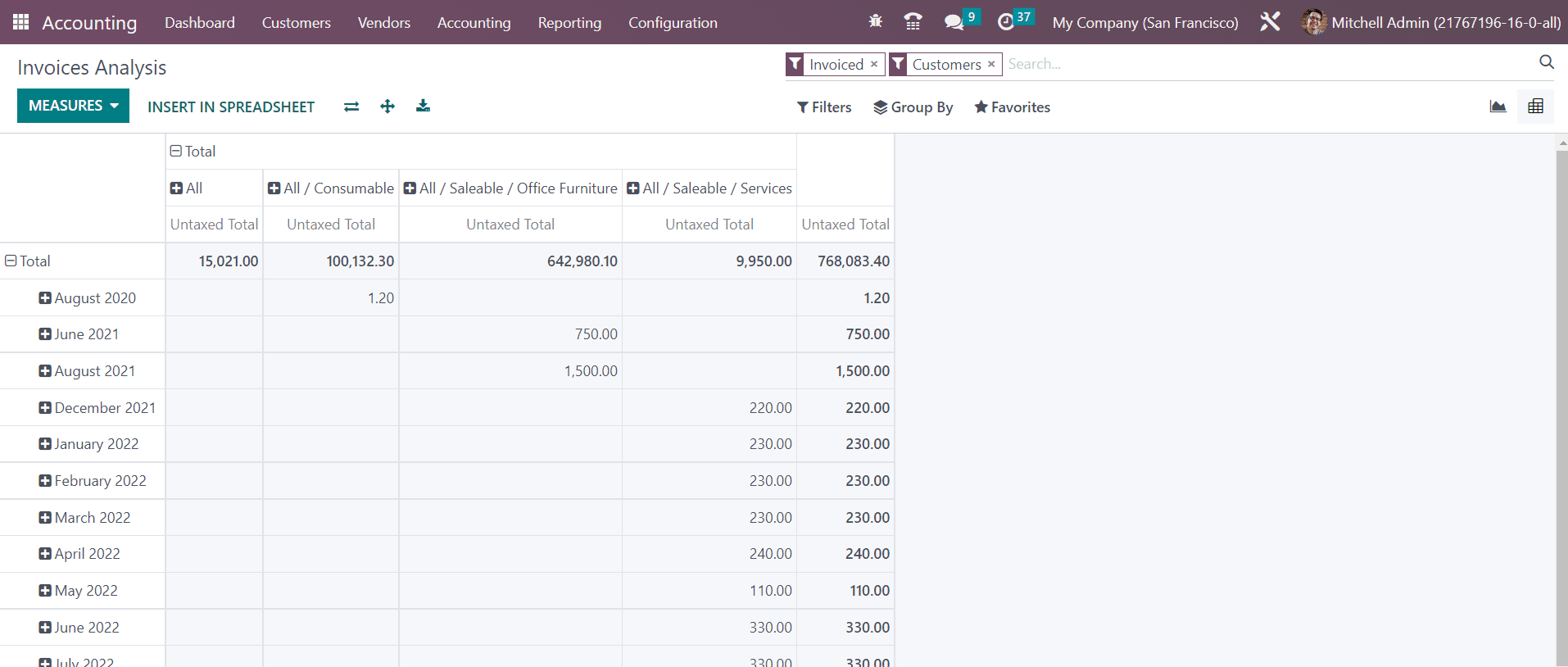

Invoice Analysis

Using the Invoice Analysis option from the Reporting menu, you can observe the invoice reports of the company during the selected accounting period. The report can be generated in the graphical and pivot table format at your convenience. You will get the Average Price, Product Quantity, Total, Untaxed Total, and Count as Measures on this window. The available default filters are My Invoice, To Invoice, Invoiced, Customer, Vendor, Invoices, Credit Notes, Invoice Date, and Due Date. The customization option will help you to create custom filters for invoice analysis.

You can group the invoices based on the Salesperson, Sales Team, Partner, Product Category, Status, Company, Date, and Due Date.

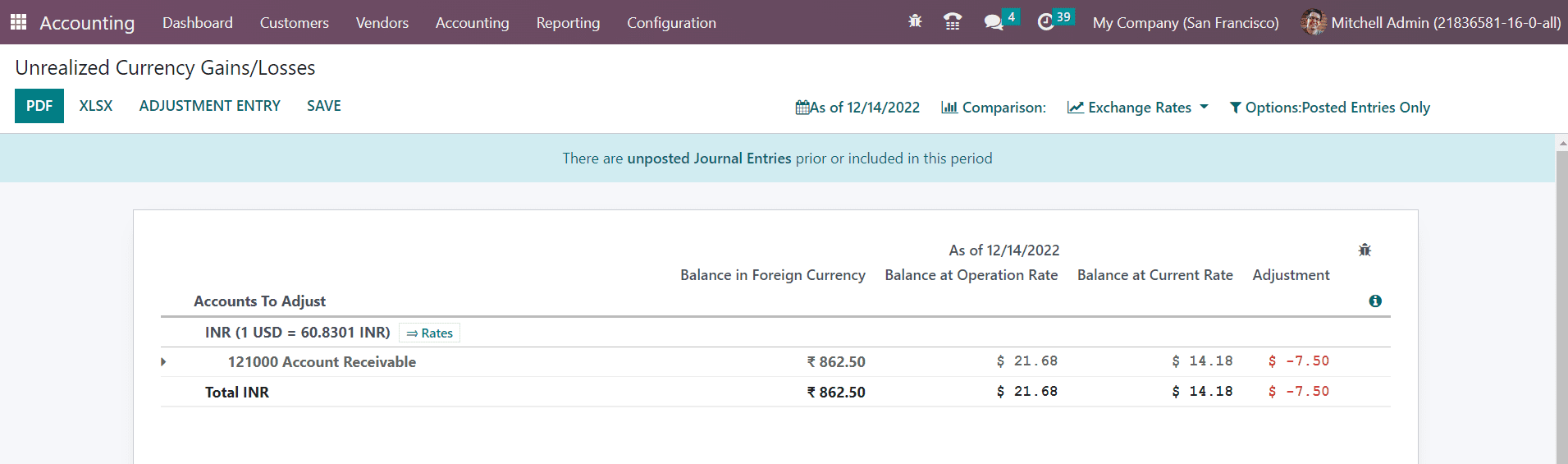

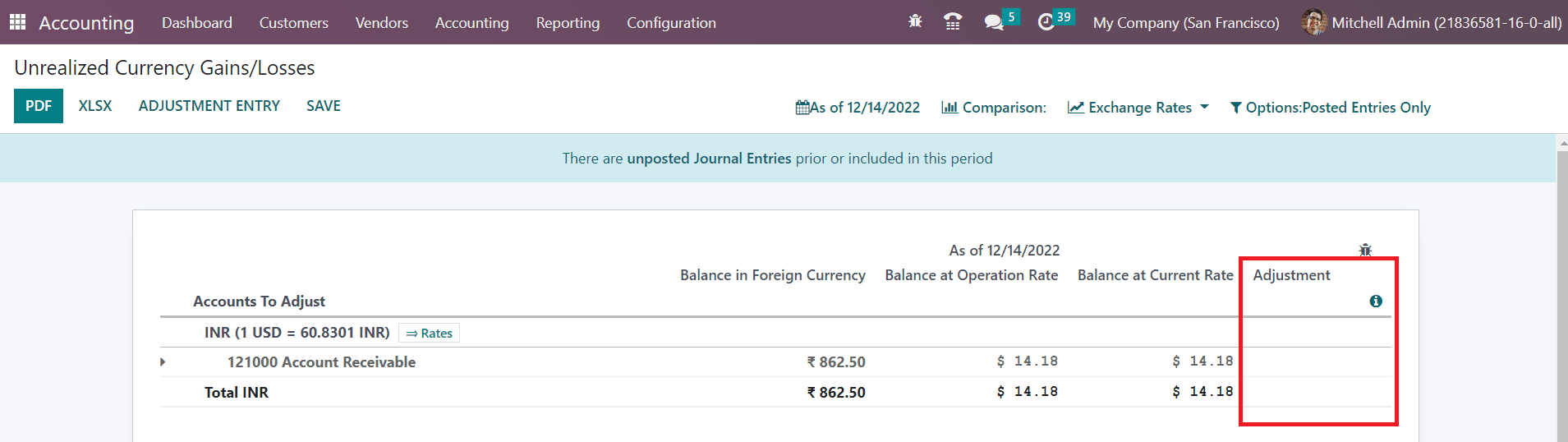

Unrealized Currency Gains/Losses

You will get the report of all open accounts on your balance sheet that need to be re-evaluated again in the Unrealized Currency Gains/Losses platform in the Reporting menu. The reports will be grouped based on the currency used in the respective account. It shows the details of the Balance in Foreign Currency, Balance at Operation Rate, Balance at Current Rate, and Adjustment. Required adjustments can be made to the entries using the Adjustment Entry button.

The amount that is taken from the bill or invoice can be seen in the Balance in Foreign Currency. In the Balance at Operation Rate, you will get the amount that is calculated at the time you received the bill. The current value of the amount at the time of the report generation can be seen in the Balance at Current Rate field. The value shown in the Adjustment column should be added to the accounting to update the financial reports according to the current information. Using the Exchange Rates feature, you can adjust the exchange rate accordingly.

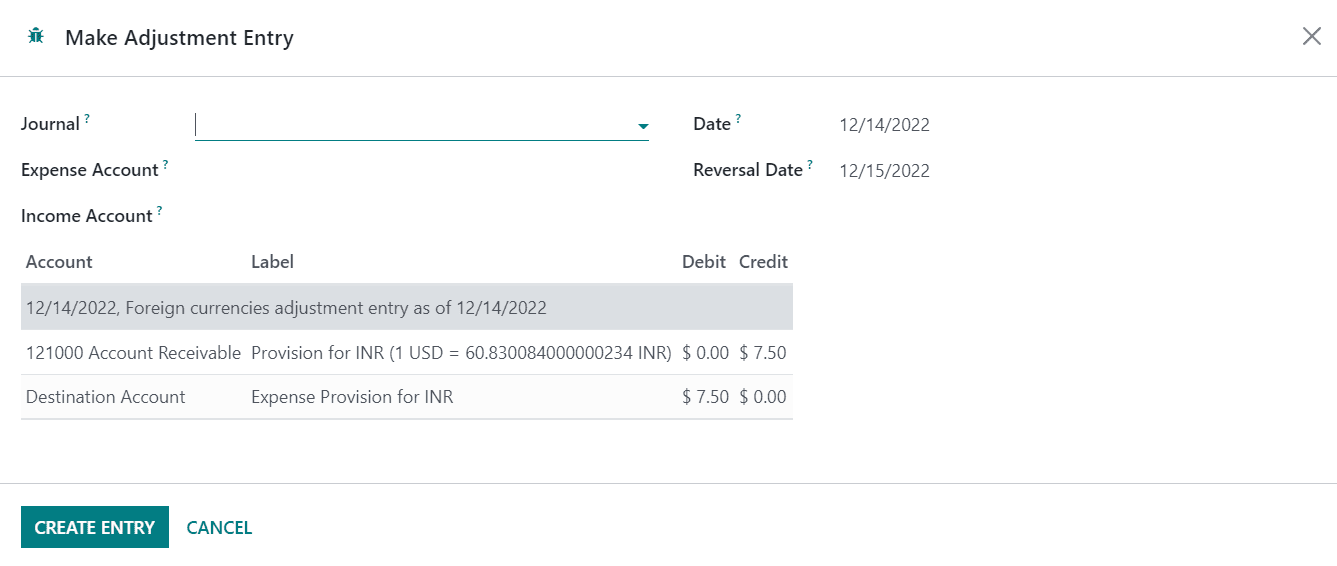

For making adjustments, you can click on the Adjustment Entry button.

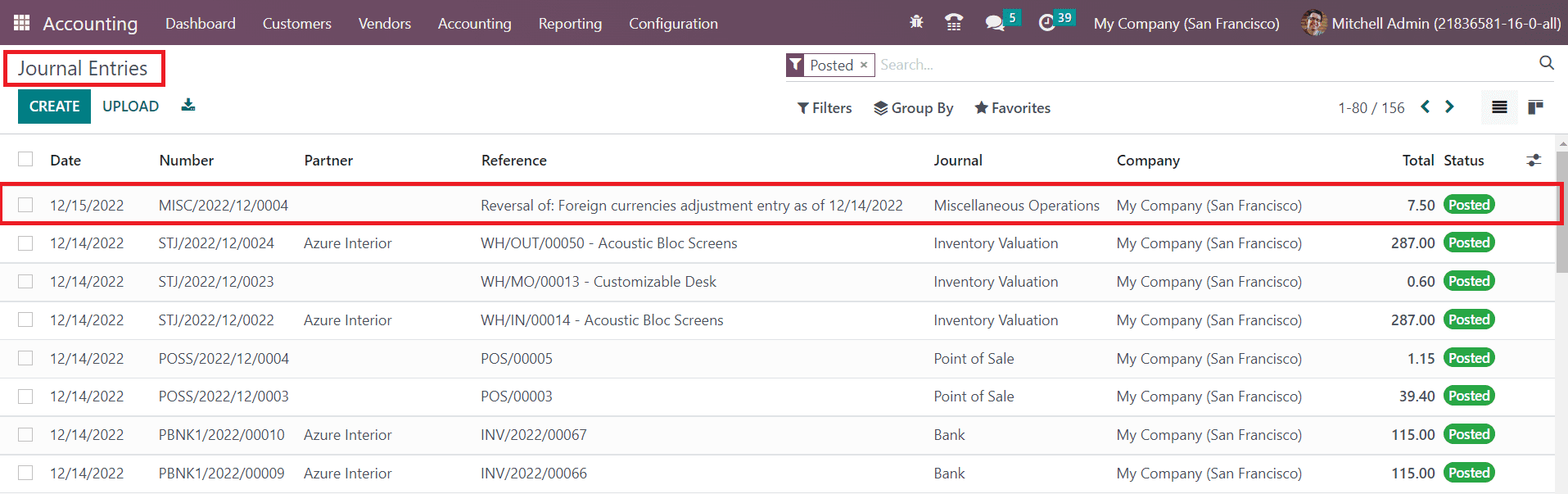

Here, you can select the suitable Journal to record this new accounting entry. Then, select Expense Account, Income Account, and set a Date on which you want this accounting entry to be reported in the respective fields. After adding the necessary details, you can confirm the adjustments by clicking on the Create Entry button. By doing so, the adjustment will be done automatically and corresponding accounting entries will be posted in the mentioned journal as shown below.

You can check the Unrealized Currency Gains/Losses report again to ensure if any adjustment is required or not.

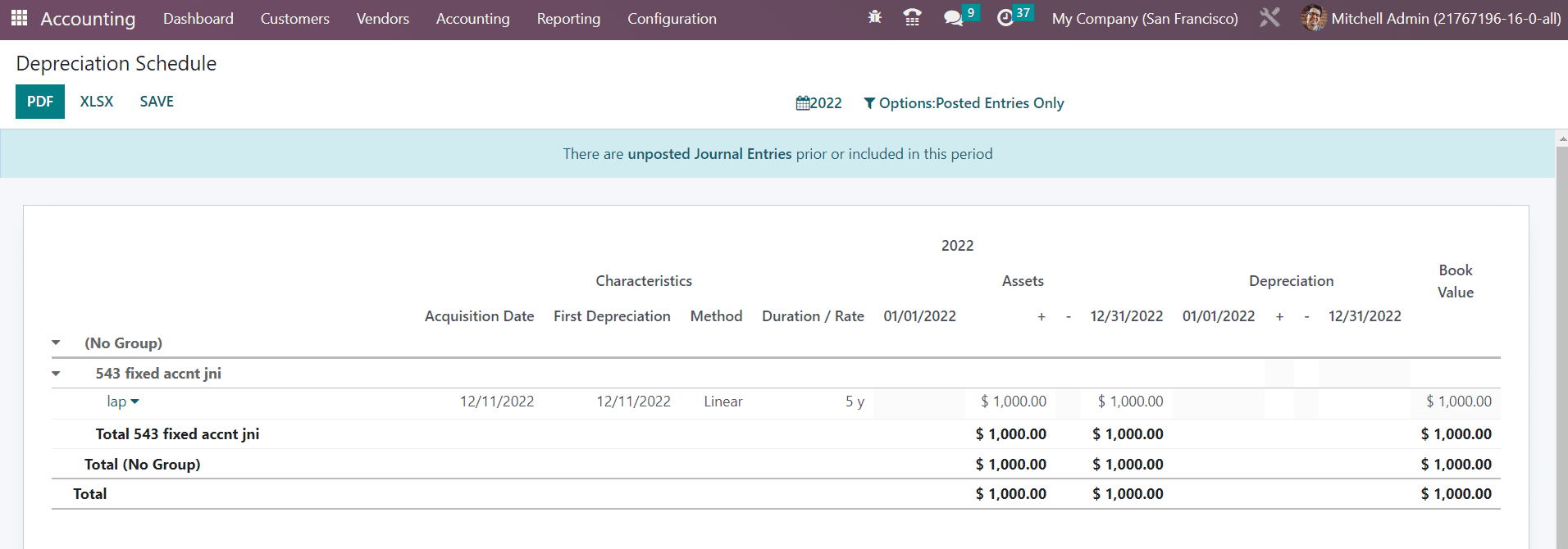

Depreciation Schedule

The schedule created for depreciating the cost of valuable assets over a particular number of accounting periods can be observed in the Depreciation Schedule platform. As shown in the image below, the report shows the Acquisition Date, First Depreciation, Method, Duration/Rate, depreciation dates, and Book Value.

Product Margins

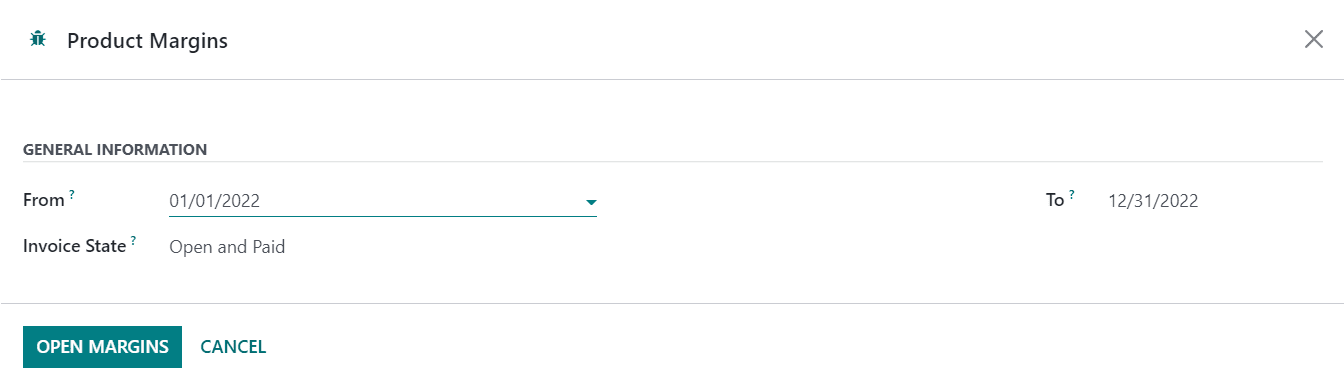

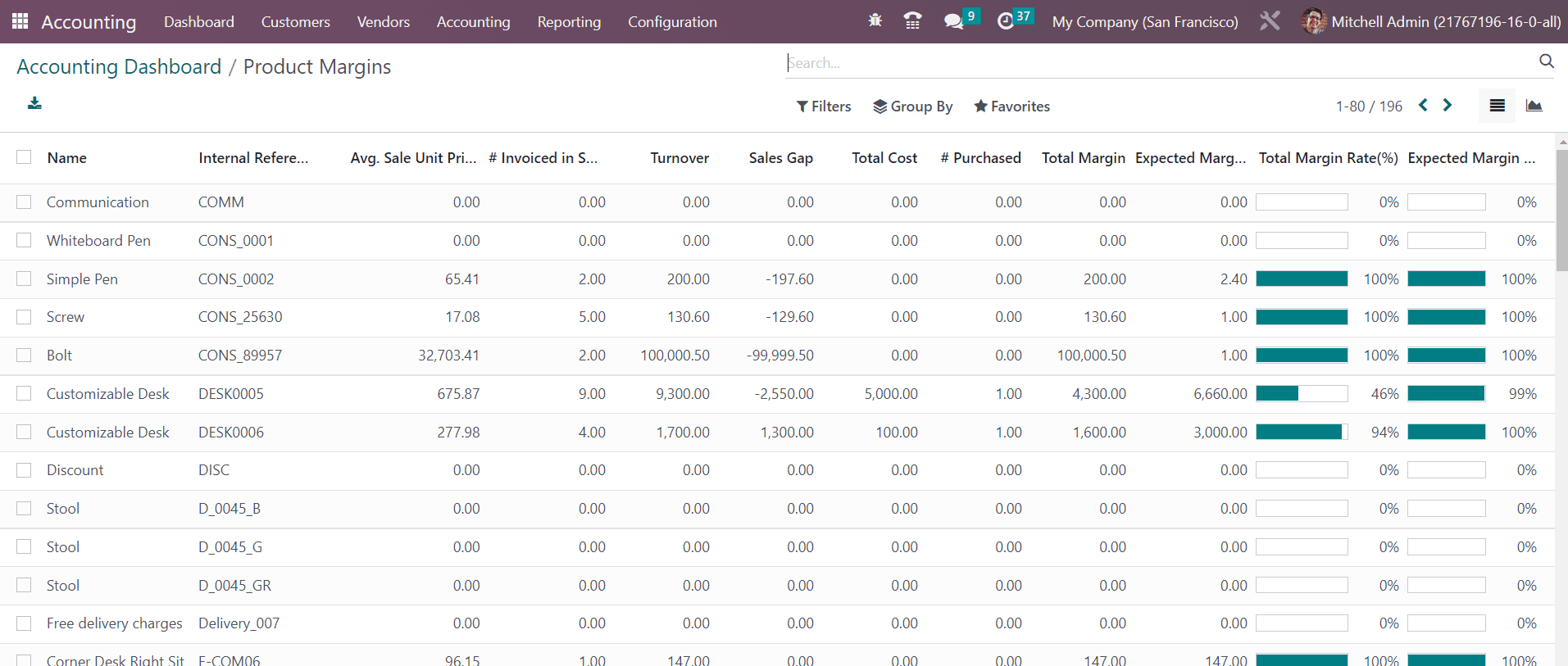

In order to calculate margins on products, you can click on the Product Margins option from the Reporting menu. A pop-up will appear as shown below to mention the From date and the Invoice State. The invoice state can be set as Paid, Open and Paid, or Draft, Open and Paid.

Now, click on the Open Margins button which will give the product margin report as shown below.

The report shows the Name of the product, Internal Reference, Average Sale Unit Price (Average price in customer invoices), Invoiced in Sale (Sum of quantity in customer invoices), Turnover (Sum of multiplication of invoice price and quantity of customer invoices), Sale Gap (Expected sale- turnover), Total Cost (Sum of multiplication of invoice price and quantity of vendor bills), Purchased (Sum of quantity in vendor bills), Total Margin (Turnover- standard price), Expected Margin, Total Margin Rate, and Expected Margin Rate.

The product margins report is beneficial to understand the product sales progress. It helps to improve the financial analysis of your company by tracking the performance reports over a period of time.

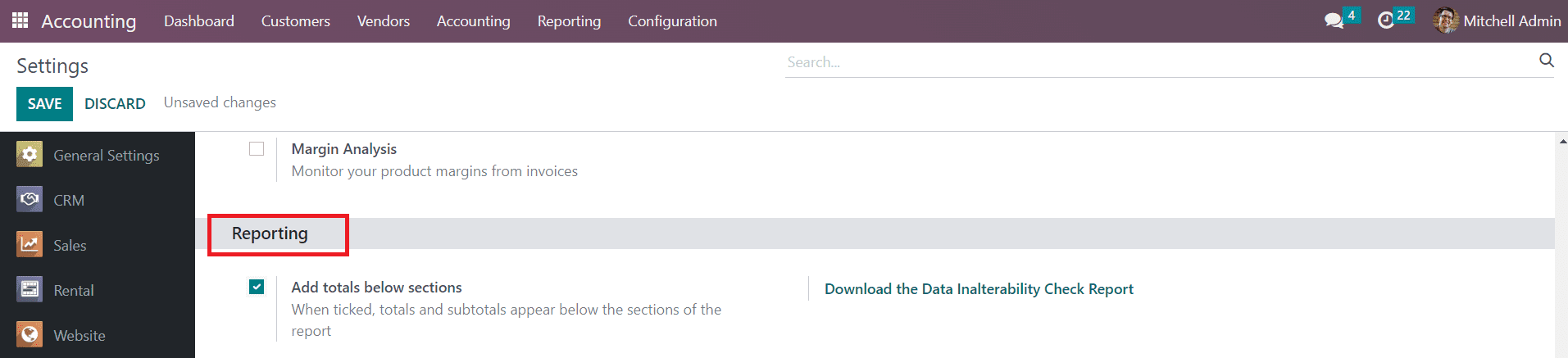

In the Settings menu of the Accounting module, you can find the Reporting tab from where you can activate the feature called Add Totals Below Sections.

By activating this feature, you will get the details of the total and subtotals in your financial reports as shown in the example below.