1099 Reports

For the purpose of reporting tax details for the services during a financial year, it is important to generate 1099 income statements for the contract employees with a payment of $600 or more who work in The United States. With the assistance of the Odoo Accounting module, now a user can effortlessly submit 1099 reports electronically. Along with this, you can also export corresponding CSV files which include all information you need in the 1099 report.

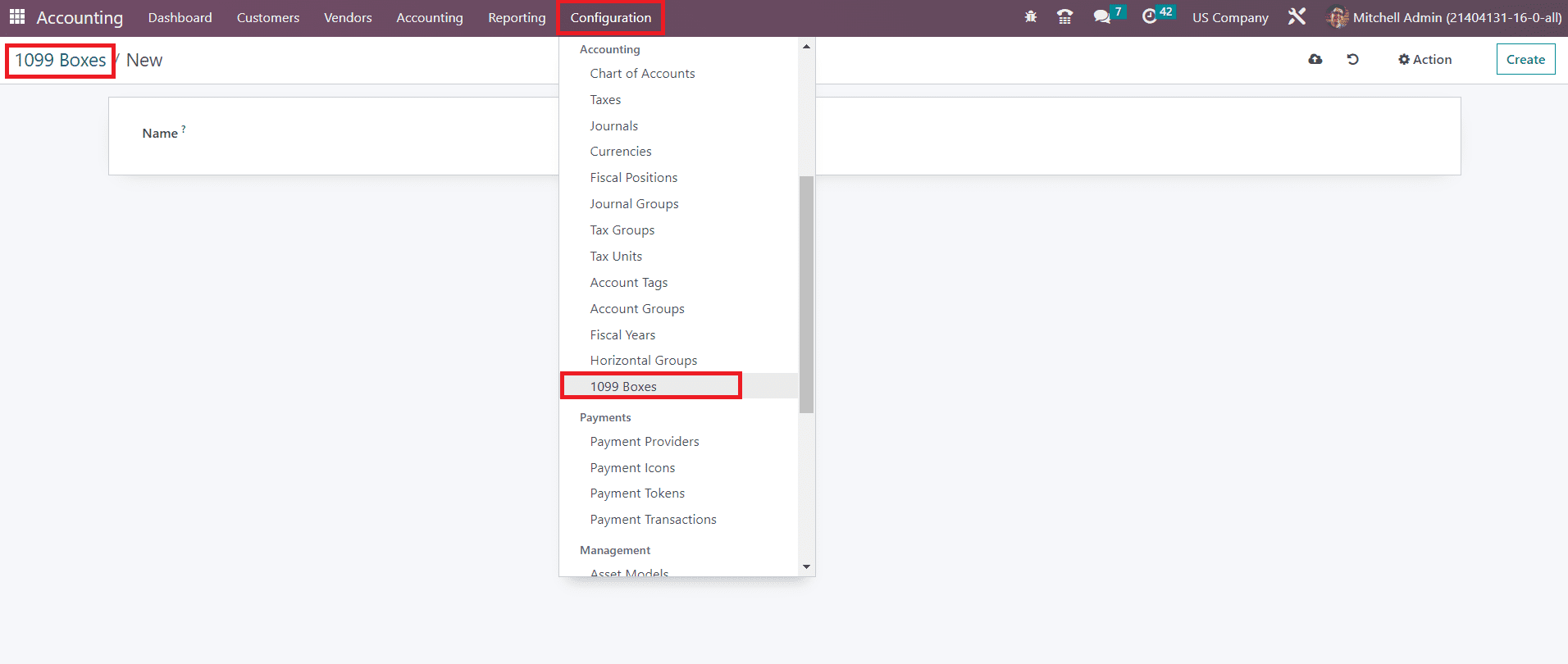

In order to create 1099 reports using 1099 boxes, you can go to the Configuration menu of the Accounting module and click on the 1099 Boxes.

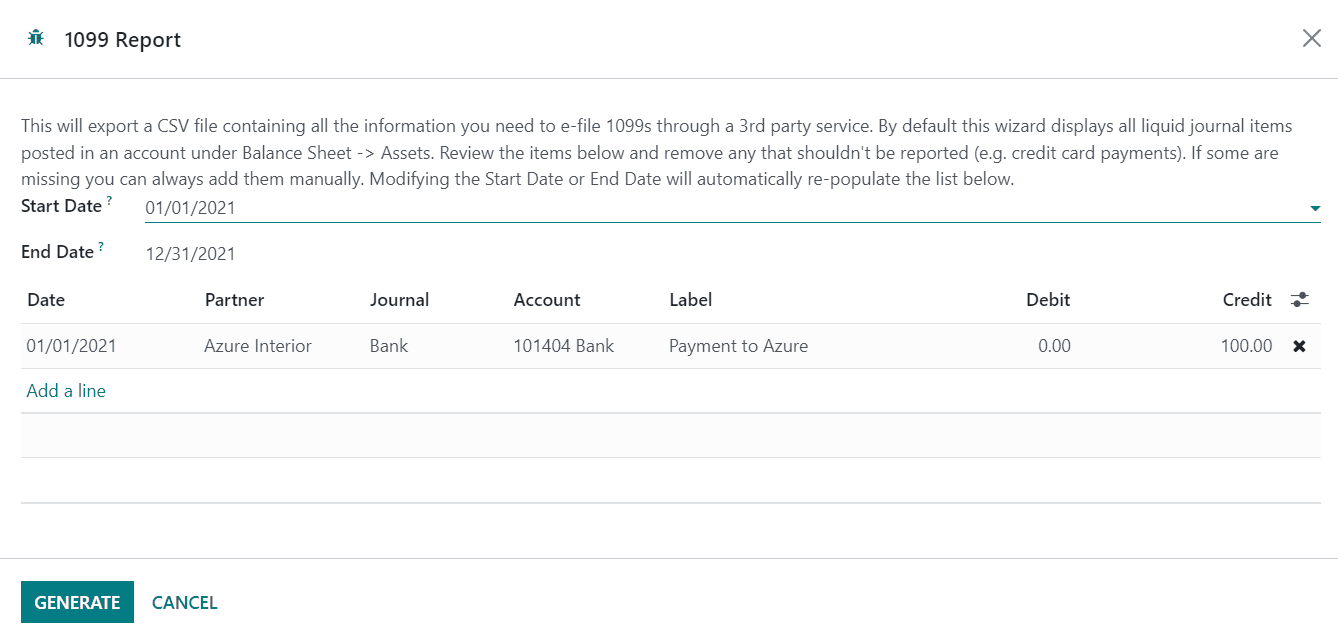

Using the Create button, you can create new 1099 boxes. Using the 1099 Reports button available in the Reporting menu of the Accounting menu, you can generate the CSV files of the 1099 reports.

The CSV file will encompass all the necessary information you need to e-file through a third-party service. The pop-up window by default displays all liquid journal items posted in an account under the balance sheet, Asset. You can check the details in the pop-up window and remove unwanted details. The missing details can be added to the window manually. In order to get an auto-populated list of journal items, you can specify the Start Date and End Date in the respective fields. The list includes the details of the Date, Partner, Journal, Account, Label, Debit, and Credit. By clicking on the Generate button, you will get the CSV file of the 1099 report.