Salary Rules

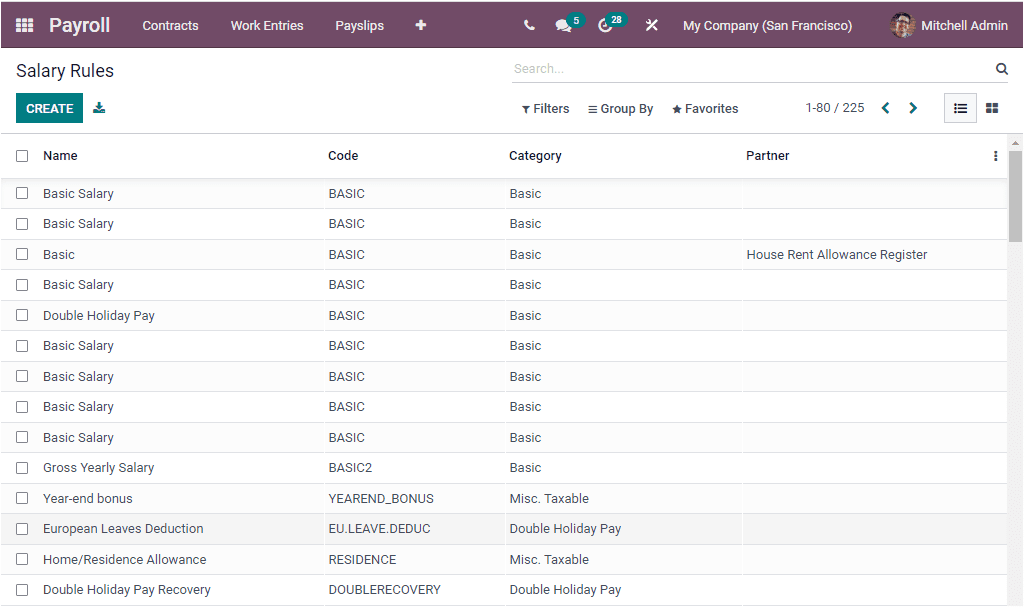

Creating and maintaining a robust salary structure is crucial for any organization. Planning ahead, setting rules and conditions, and fixing a reliable salary for employees are essential for the effective management of an organization. Odoo Payroll management system helps you to define Salary rules in an efficient manner. This set of rules will help you to determine the calculation of salary amounts for different categories. This feature allows you to define the sequence of the rule for displaying on the payslip and will enable you to specify a unique code that will be helpful for further calculations. The Salary Rules menu can be accessed from the Configuration tab of the Odoo Payroll module. The image of the window is depicted below.

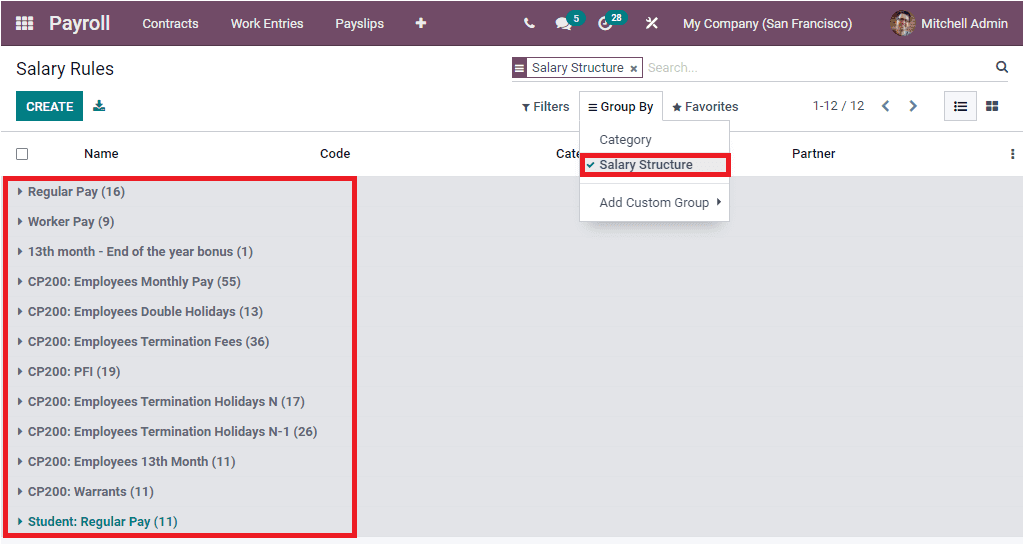

The advanced Salary Rules window in the Payroll module will provide better assistance to create new Salary Rules. The Salary Rules window will depict all the Salary Rules defined in the Odoo system. Odoo will describe the details in both the List view and Kanban view. You are also able to apply various default and custom filters based on your company requirements. Likewise, the Group By option allows you to view the Salary rules based on the Salary structure and Category defined. You can also add new Custom groups by clicking on the Add Custom Group menu available under the Group By tab. If you want to group the defined Salary Rules based on the Structures, click on the Salary Structure menu. Now your window will look like the image below.

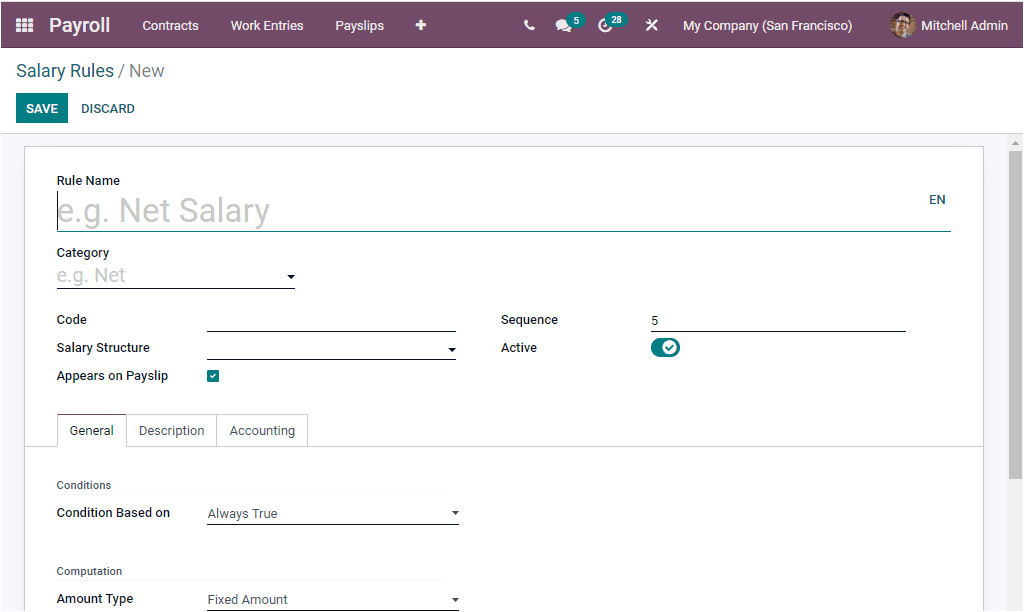

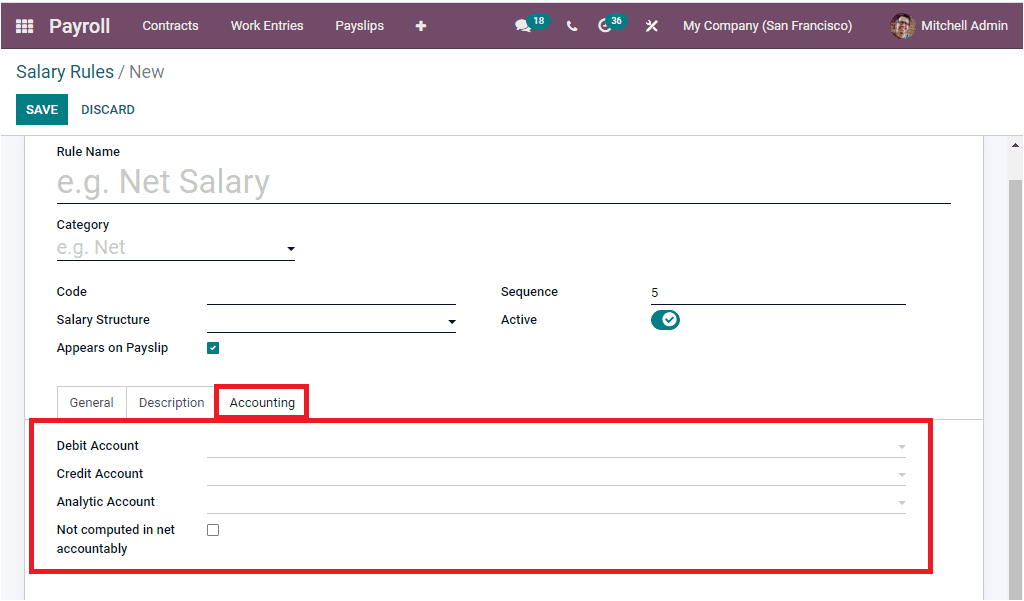

You can click on the CREATE button to create a new salary rule. The image of the Salary Rule creation window is shown below.

In the creation window, you can provide the Salary Rule Name, and then you can allocate the Category such as Basic, Allowance, Gross, Deduction, Net, Company Part, and many more. Also, you can specify the Code of the Salary Rule. It can be used as a reference in the computation of other rules. Additionally, the Salary Structure can be mentioned. It is also a mandatory field that is required to calculate the salary of your employee and create a payslip for the employee. You can use the predefined Salary Structures or create and edit a new one using the dropdown menu available. The next option available in the Salary rule creation window is the Appears on Payslip. You can activate this field to display the salary rule on payslips. Moreover, you can set a Sequence number to arrange a calculation sequence. Finally, you have the Active field. If you set the active field to false, you can hide the salary rule without removing it.

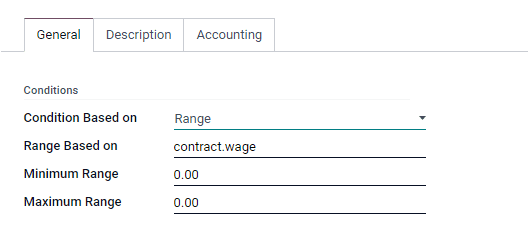

Under the General tab of the Salary Rules creation window, you can include general information on the Salary Rule. You can choose the Condition Based on the field from the dropdown menu. This field will allow you to set up conditions for the salary computation in different ways. The drop-down menu includes the options such as Always True, Range, Python Expression. The Always True can be set to make available the relevant wage rule for all salary calculations. In the case of Range, you have to fill in additional options such as Range Based On, Minimum Range, and Maximum Range. The Range Based on the field will be automatically allocated by the contract wage based on the employee wage described in the employment contract.

When we come into the Python Expression, it will depict the Odoo developed equation by default.

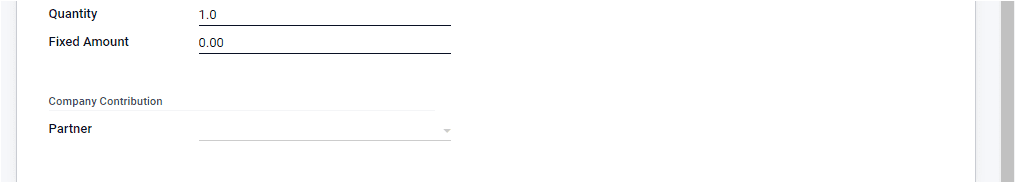

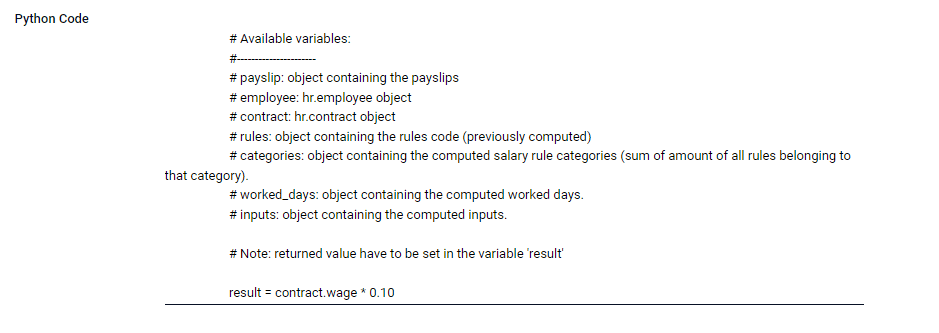

Under the Computation section, you can define the Amount Type, which can also be chosen from the dropdown menu given. This dropdown menu includes Percentage,% , Fixed Amount, and Python Code. When we choose the percentage amount type, the amount will be calculated based on the percentage. You can also use a fixed amount by setting up the fixed amount as the Amount Type. Then you can specify the Quantity and Fixed Amount. In addition, you can add the Python Code to this field based on the python attributes, which will ascertain the net compensation amount.. In the Company Contribution, select the Partner. It is the eventual third party involved in the salary payment of the employees.

The salary calculation will be made based on a few factors, including Percentage, Fixed amount, Python code

Fixed Amount: Using this option the salary can be provided in a fixed amount.

Percentage(%): The variable required to compute the percentage is provided here.

Python code: Can mention code to calculate the amount, and there are few predefined variables such as

# payslip: An object containing the payslips

# employee: hr. employee object

# contract: hr. contract object

# rules: an object containing the rules code (previously computed)

# categories: an object containing the added salary rule categories (sum of the amount of all rules belonging to that category).

# worked days: an object containing the computed worked days

# inputs: an object containing the calculated inputs.

# Note: returned value have to be set in the variable “result”.

Using variables, the user can write its code as per the company process the payroll of the employees.

Under the Description tab, you can include a note, if any. Moreover, the Accounting tab allows you to have the details of the Debit Account, Credit Account, and Analytic Account required for the new salary rules. Finally, you can enable or disable the option “ Not computed in net accountability”. This field allows you to delete the value of this rule in the “Net Salary” rule at the accounting level to explicitly display the value of this rule in the accounting. For example, if you want to display the value of your representation fees, you can check this field. After defining the Salary rule, you can save it by clicking on the SAVE button. The newly created Salary Rule is held in the Salary Rules window and applied when configuring the suitable salary structure.

As we are clear on the configuration steps of Salary Rules in the Odoo Payroll module, let us look into the Salary Rule Parameters.