Product Categorization

The Product categorization feature available in the Odoo Inventory module will permit you to categorize your list of products. This advanced feature is very helpful for managing your product operations. Using this option, you can easily list out the products based 0upon the sales and purchase categories. In addition, the Product Category option will be very useful for department wise categorization at different levels of a company.

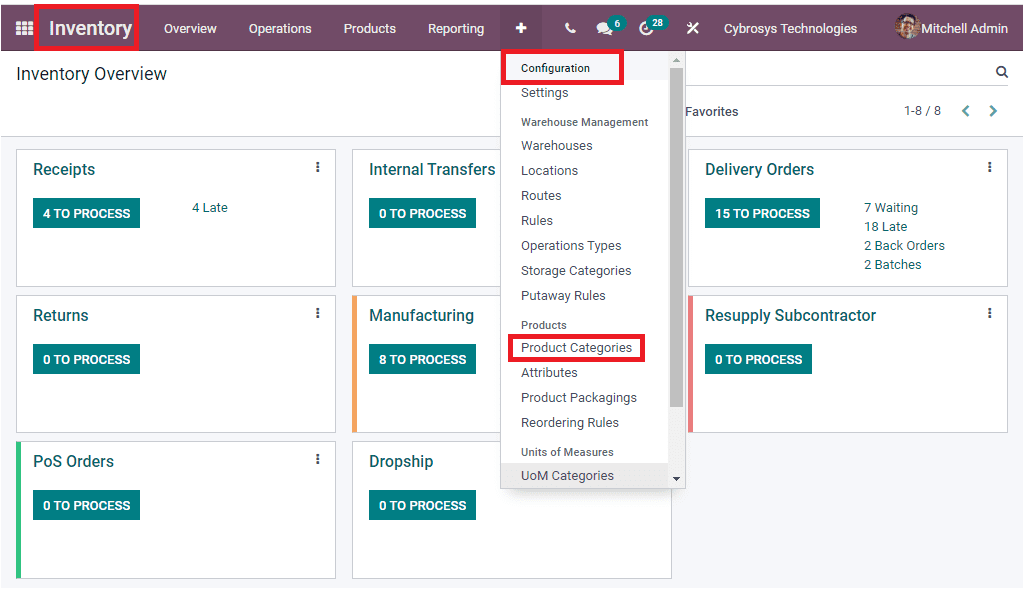

You can easily access the Product Category menu from the Configuration tab of the Odoo Inventory module.

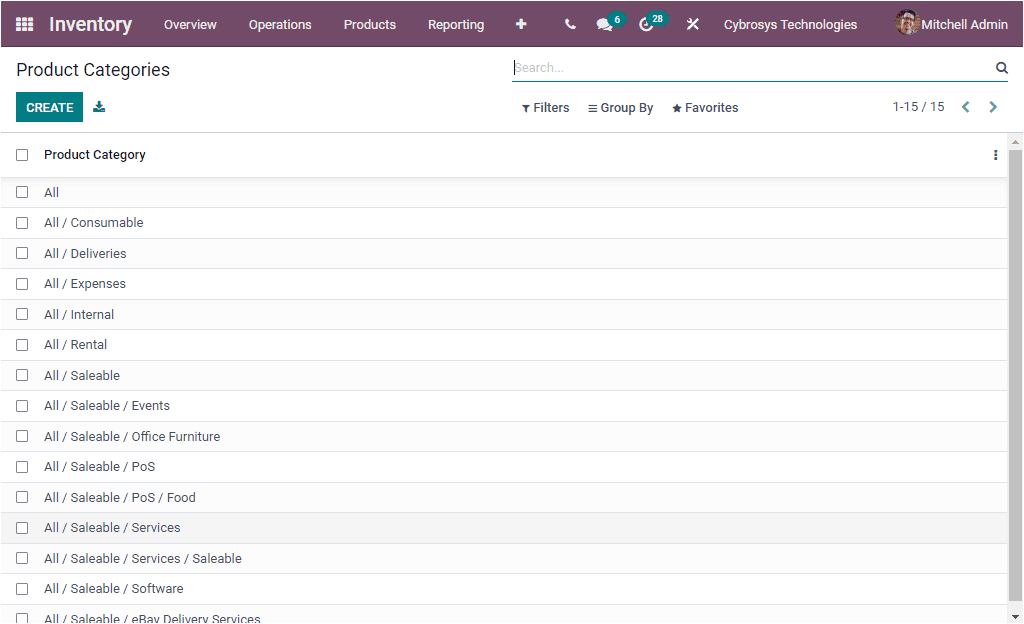

The image of the Product Categories window is depicted below.

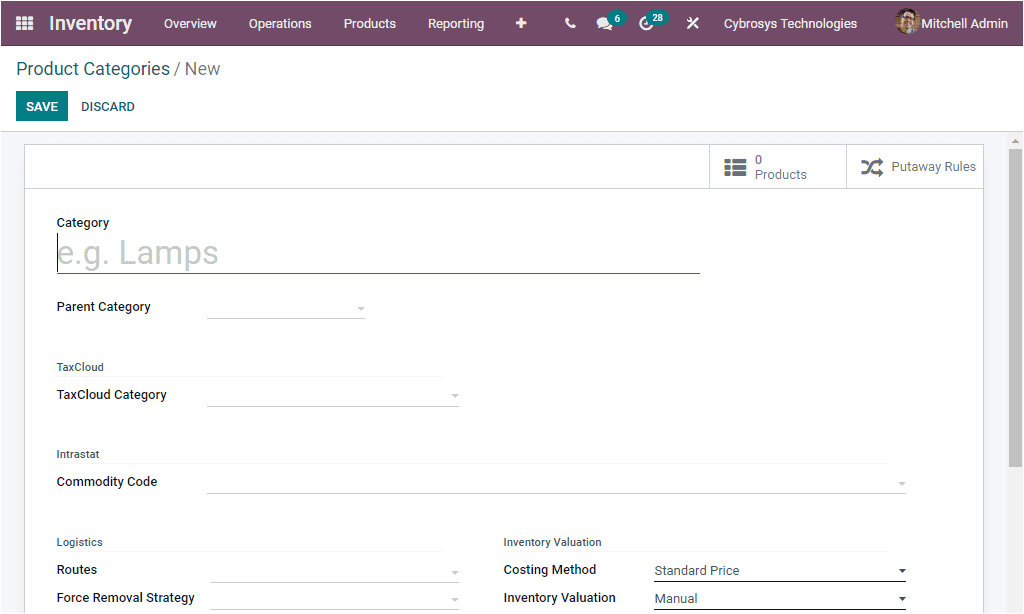

Product Categories window will comprise all of the categories described in the Odoo system. You have the provision to view each of the categories in detail by clicking on the respective one. You are also able to edit the details if required. For creating new Categories, you can select the CREATE icon which can be accessed from the top left corner of the Product Categories window. The image of the Product Categories creation window is depicted below.

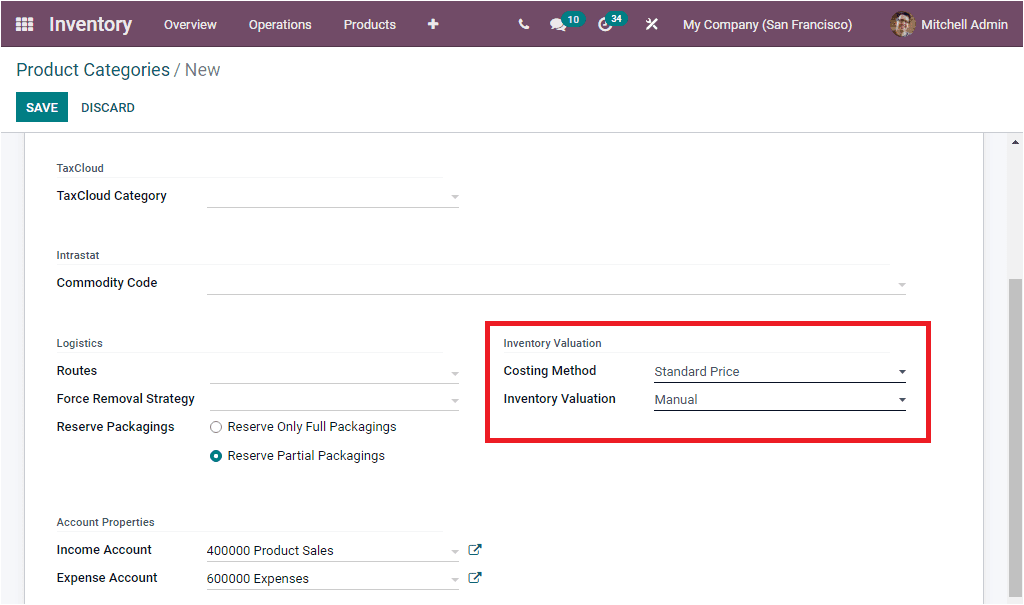

In the Product Category creation form you can give the Category Name along with the Parent Category. Then you can allocate the TaxCloud Category. This TaxCloud Category refers to the Taxability Information Codes (TIC). These are used by TaxCloud to compute specific tax rates for each product type. This value is used when no TIC is set on the product. After allocating this field you can specify the Commodity Code. Moreover, you can describe the Logistic aspects of the product category such as Routes, Force Removal Strategy, and Reserve Packagings. Furthermore the Inventory Valuation terminologies and Costing Method can be specified based upon your organization principles. The costing method is the reliable tool available in Odoo which will allow you to get a report on how much you are spending on products. With this effective tool, you can easily manage the price description on the product based upon the various aspects of purchase and extra charges connected with the logistics. Odoo enables you three types of product costing methodologies and they are the

- Standard Price

- Average Cost (AVCO)

- First In First Out(FIFO)

In the case of Standard Cost, the products are assessed based on their standard cost defined in the product where the product pricing is described standard as defined by the user. If there is any product in Odoo which has not been defined any costing method will be assigned to this category. When we come to the Average Cost, it will allow you to define the cost of the product based on the average cost of the entire product quantity. The First In First Out method is mainly for costing aspects and product removal aspects. In this case the products are operated based on the policy that the first entered product in the company will also leave first.

Now we have to fill out the Inventory Valuation aspect of the Product Category.

Inventory valuation is one of the important features in Odoo as it denotes how you value your stock and the method used to identify the accurate value of the inventories at the end of a financial period. Having an accurate inventory valuation is very important for a company. It is the reported stock or inventory calculation that determines the expense of sold products, whole profit, total gain in the income statement. An accurate inventory valuation will help you to calculate the actual income and true financial position of the company.

Odoo helps you to have two types of Inventory Valuation. That is Manual and Automated. In the case of Manual, the accounting entries to value the inventory are not posted automatically. In the Automated option, an accounting entry is automatically created to value the inventory when a product enters or leaves the company.

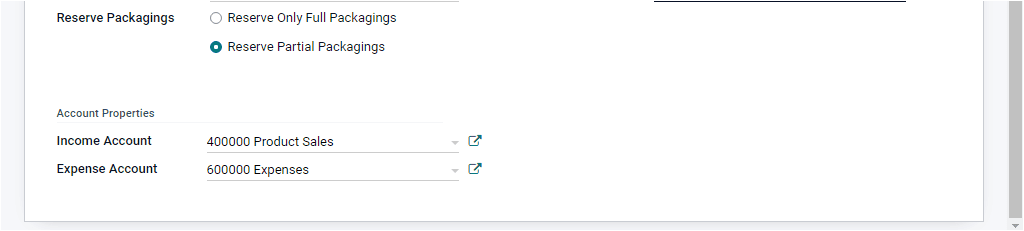

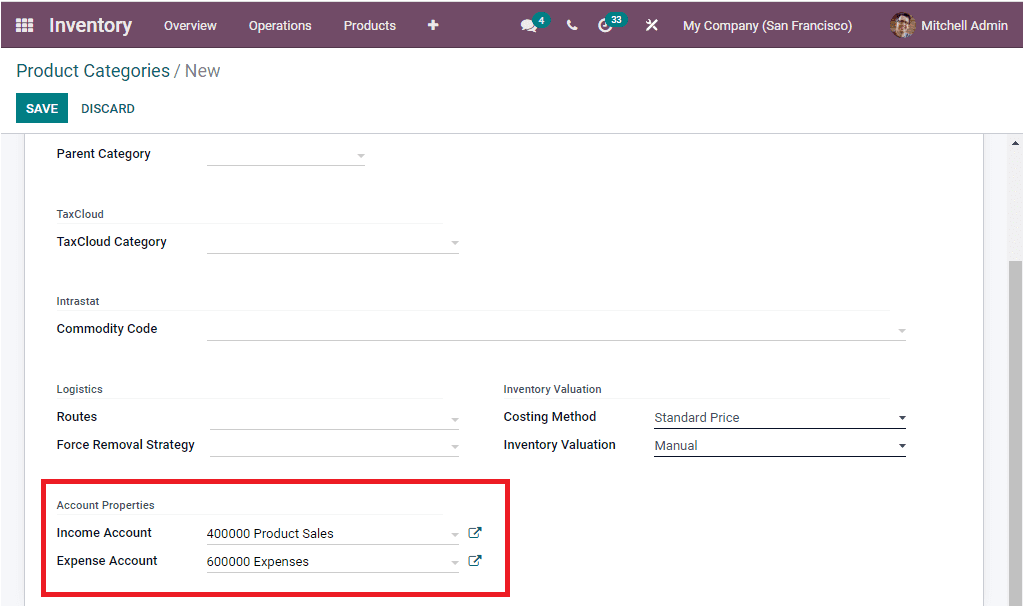

After defining the Inventory Valuation you have to mention the Account Properties in the Product Categories creation window.

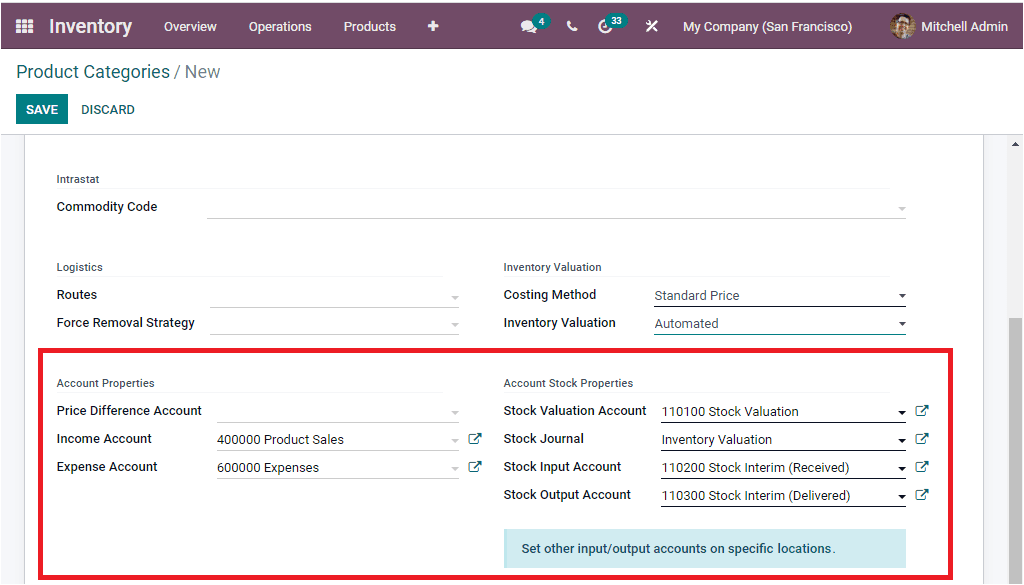

If the Inventory Valuation is set as Manual, the Income Account and Expense Account in the Accounting properties section can be managed. If you set up Inventory Valuation as Automated, we will have to fill the Accounting properties in detail.

Now we have two sections as Accounting Properties and Account Stock Properties. In the Accounting Properties section, you have to fill up the

Price Difference Account: The Price Difference Account can be used to value the price difference between the purchase price and accounting cost.

Income Account: The Income Account is used to validate the invoice of the customer.

Expense Account: The Expense Account is mainly used when a vendor bill is validated.

In the Account Stock Properties section you have so many fields and these are the following

Stock Valuation Account: This field will represent the current value of the product when automated inventory valuation is activated on a product

Stock Journal: When doing automated Inventory valuation, this is the accounting journal in which entries will be automatically posted when stock moves are processed.

Stock Input Account: Here in this account, you can enter all the incoming stock details.

Stock Output Account: The Stock Output Account is used to record outgoing stock movements. So we can manage accounting information using product categories. We are also able to set income accounts and expense accounts for product and product categories. However, while managing the operations, the account set in the product will be considered. If there is no account set for the product the Odoo system will automatically select the income and expense account that we set for the product category.

So far we were discussing the Product Categories window available in the platform and now let us have a look into how Odoo will help you to manage deliveries.