Reporting in Accounting

Profit and Loss

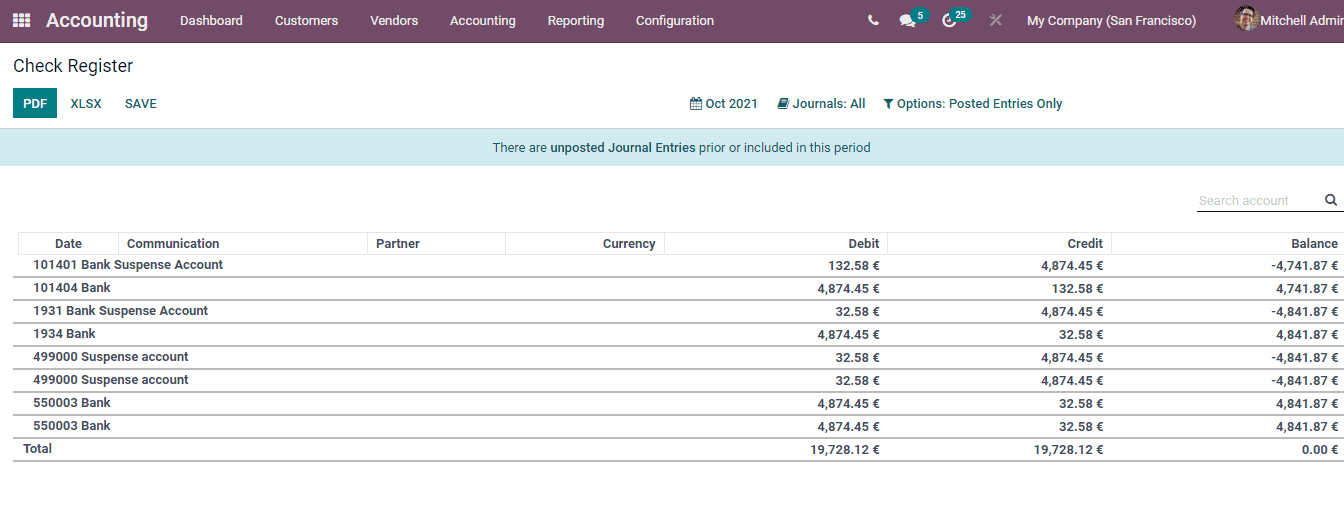

A company's most important financial document in every business is the Profit and Loss report. By looking at the profit and loss record of the company the investors and credit sources will receive information about the financial position of the company as well as the income and management of costs. The company can have a clear picture of where to improve the revenue streams and where to reduce the costs. Future expenses can be forecasted by evaluating the profit and loss report. Based on the prevailing economic conditions the company can adjust their strategic paths.

In the Odoo 15 Accounting module you can view your company’s profit and loss report by selecting the Profit and Loss option from the Reporting tab. The Income, Expenses and the Net Profit is displayed. You can view the profit and loss statement of This Month, This Quarter, This Financial Year, Last Month, Last Quarter and Last Financial Year. Also the profit and loss statement of the current period can be compared with the previous period or with the same period last year. You can select the profit and loss statements of specific journals by selecting the Journals option. The displayed report can be downloaded as PDF, copied into a spreadsheet and saved.

Balance Sheet

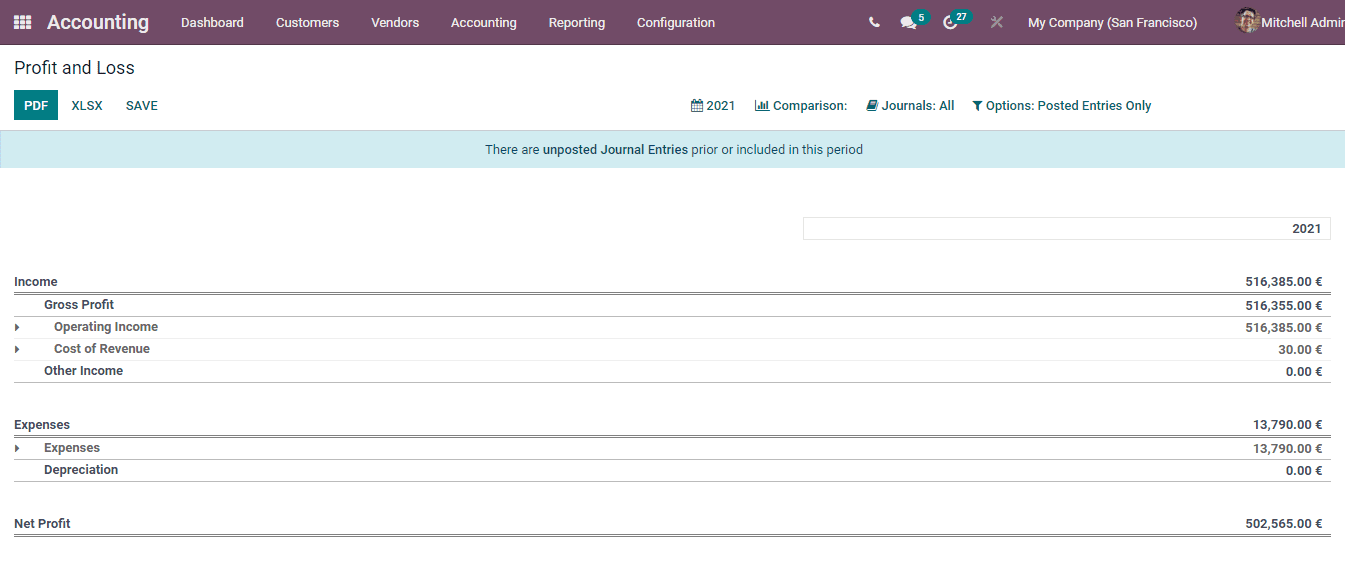

The statement of the company’s assets, liabilities and capital on a particular date is known as the balance sheet. How much and to what the company owes and owns is clearly stated in it. It helps to calculate the organization’s efficiency, profitability, leverage and liquidity. The financial health of the business can be examined with the balance sheet. At the same time the stakeholders can understand the performance of the company as well as the liquidity position. The sources of company’s funding can be identified through the balance sheet.

In Odoo you can view the balance sheet of the period by selecting the Balance Sheet option from the Reporting tab. You can view the Assets, Liability, Equity and Liabilities + Equities amount displayed. The journals and ledgers that come under each title can be viewed separately with details. The balance sheet of the present date, End of Last Month, End of Last Quarter and End of Last Financial Year can be displayed. The balance sheets of previous periods can be compared with the displayed balance sheet. The results can be saved into PDFs and can be copied into spreadsheets.

Executive Summary

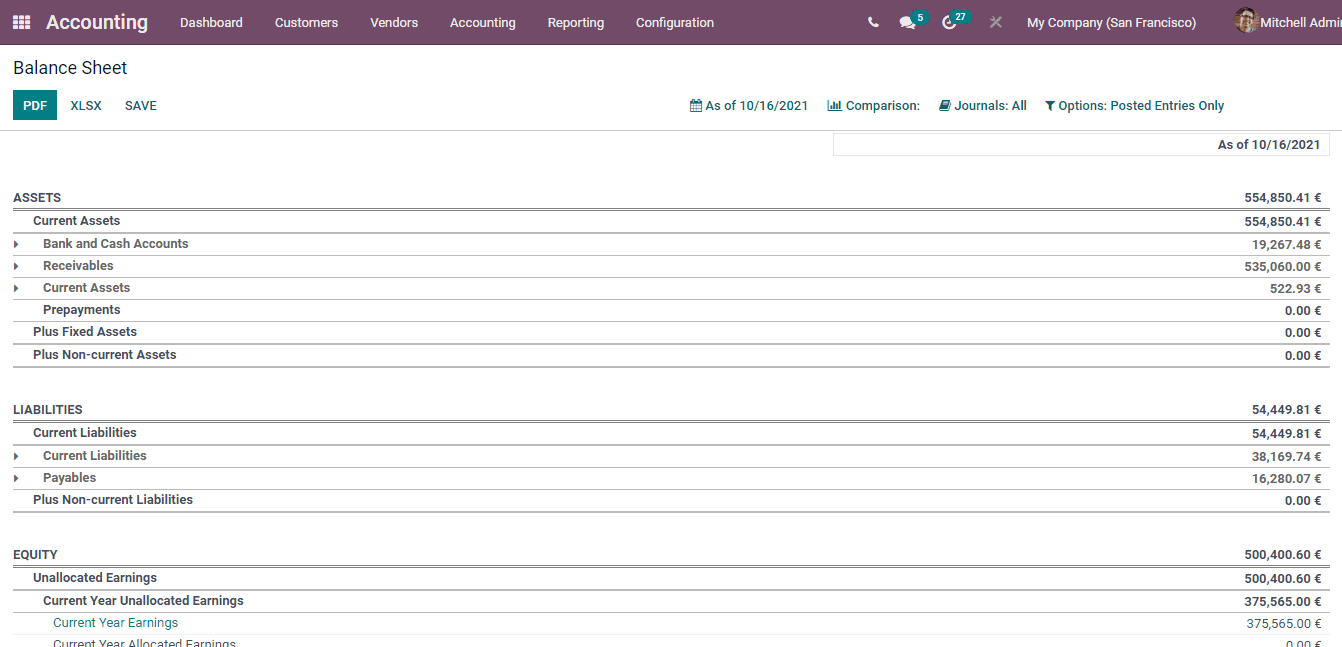

The summarized documents of the longer reports produced for the business purposes are known as executive summary. It provides a brief overview of a specific report and conveys the main points from the report. As it is much time consuming to read the entire reports, executive summary helps in saving time and at the same time provides a clear picture of the report.

Odoo 15 Accounting module provides you with executive summaries of Cash, Profitability, Balance Sheet, Performance and Position. You can view these reports by selecting the Executive Summary option from the Reporting tab. The result displayed can be saved as PDF or copied into spreadsheets by selecting the PDF and XLSX buttons respectively. You can also display the summaries of This Month, This Quarter, This Financial Year, Last Month, Last Quarter and of Last Financial Year. The summary can be compared with previous period reports as well as with the reports of last year.

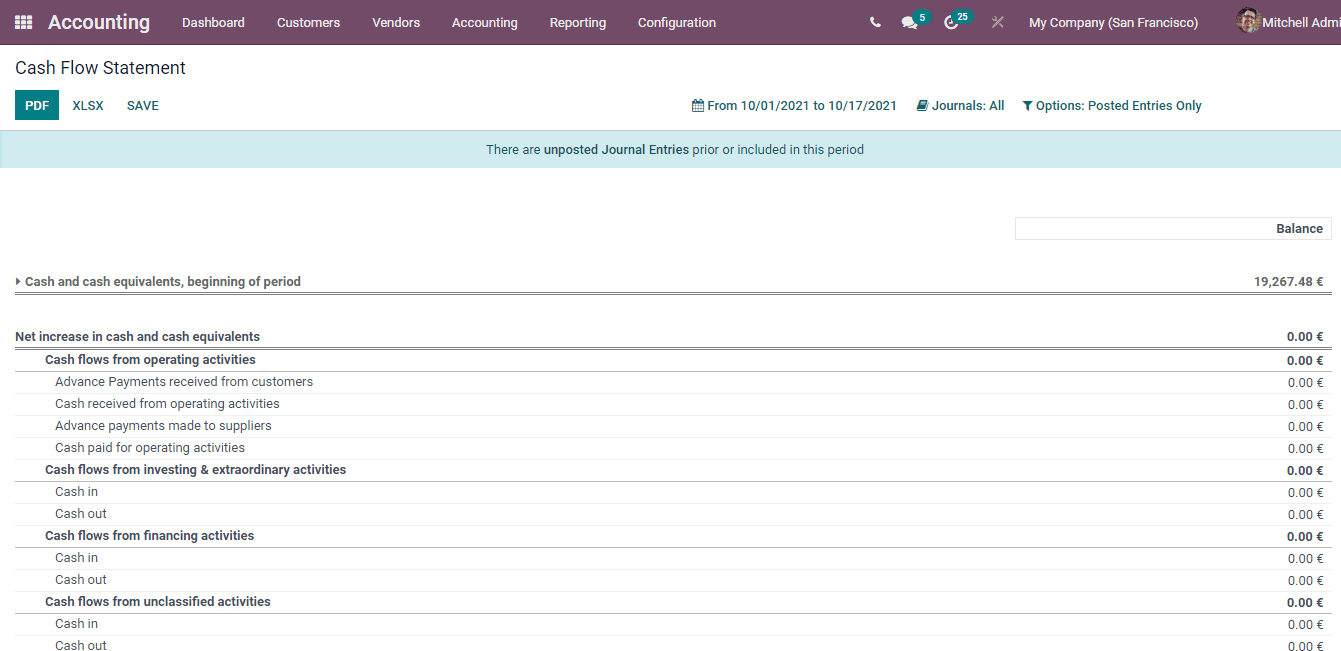

Cash Flow Statement

The statement which gives you the information about how much cash is entering and leaving the organization during a particular period of time is known as cash flow statement. It reveals the cash position of the business. With keeping control over the cash, the cash flow statement helps in making short term as well as long term planning. The details of money spent by the business which is not marked in the profit and loss statement are clearly visible in the cash flow statement. The optimum level of the cash balance can be acquired by evaluating the cash flow statement of the business. Financial decisions can be made accordingly with the help of it.

By selecting Cash Flow Statement from the Reporting tab, you can view the company’s statement. Cash and Cash Equivalents, beginning of the period and closing balance along with the Net Increase in cash and cash equivalents are displayed. You can view the statements of specific journals and save them.

Check Register

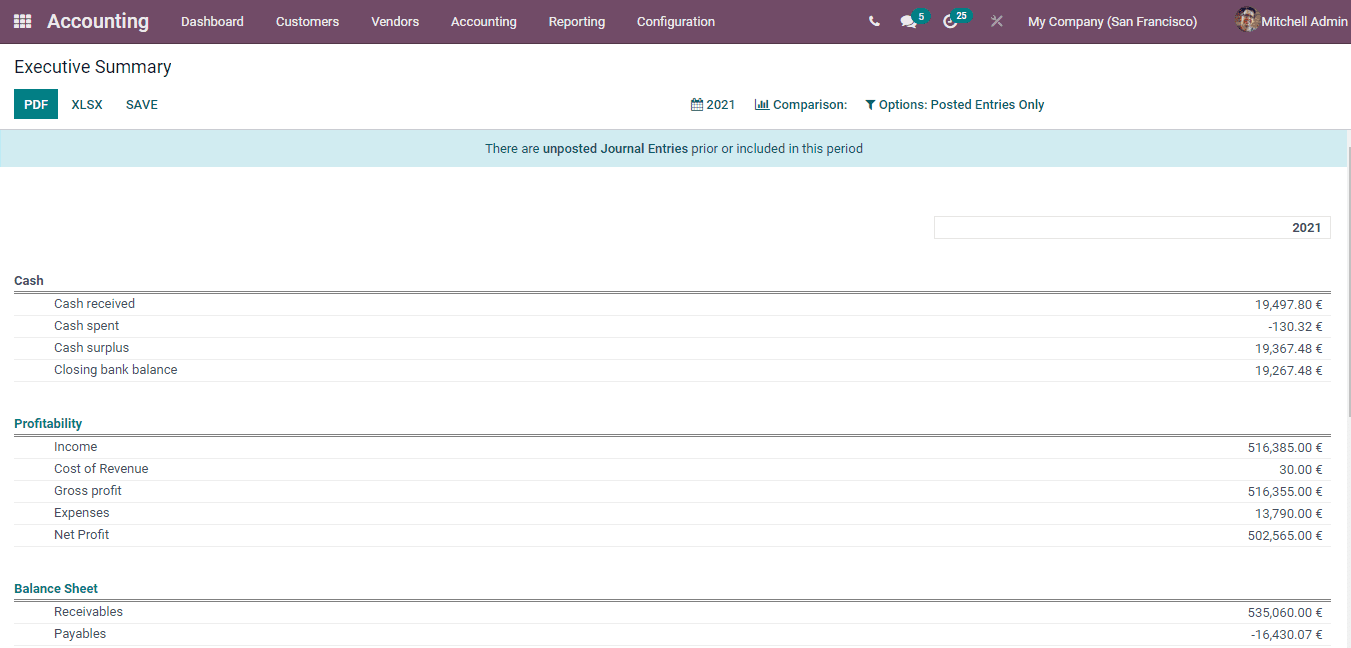

The record of all your transactions both check and cash, during a particular period of time is called a check register. Keeping a check register will help you to organize and break down the transaction information. The real time record of the bank account can be received at cash registers. The cash flows can be monitored and tracked along with keeping the transactions organised with the cash register.

To view the company’s cash register report, select the Cash Register option from the Reporting tab. You can view the report including information such as Date, Communication, name of the Partner involved, Currency used, Debit amount, Credit amount, Balance and Total amount. You can view all journals at once or can select specific journals and view their cash register reports.