Partner Reports

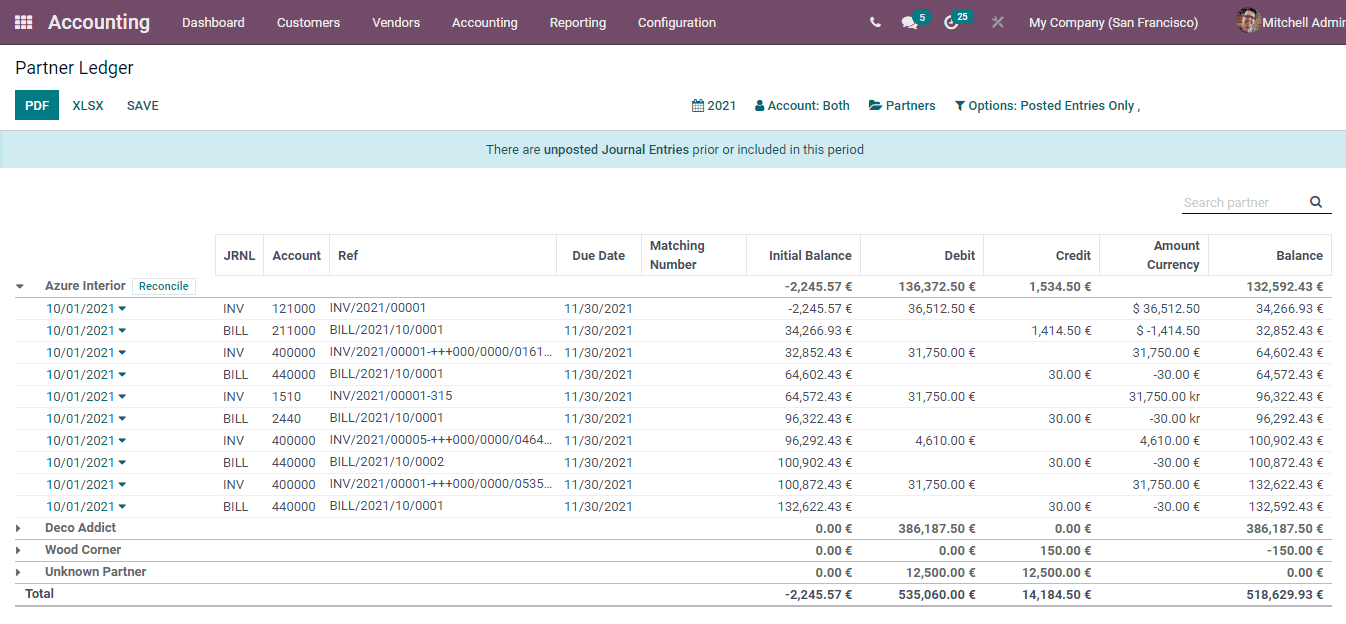

Partner Ledger

The partner ledger shows receivable and payable journal entries of the partners. The debits and credits of individual partners can be evaluated and viewed with the help of partner ledgers. In Odoo you can view the partner ledger by selecting the Partner Ledger option from the Reporting tab. The chart of the ledger along with details such as Journal, Account, Reference, Due Date of the receivables and payables, Matching Number, Initial Balance, Debit, Credit, Amount Currency and Balance of each partner can be seen. You can also reconcile the accounts of individual partners by selecting the Reconcile button positioned next to the partner. Receivable and payable accounts can be viewed separately. You can select the name of the partners and view their associated ledger.

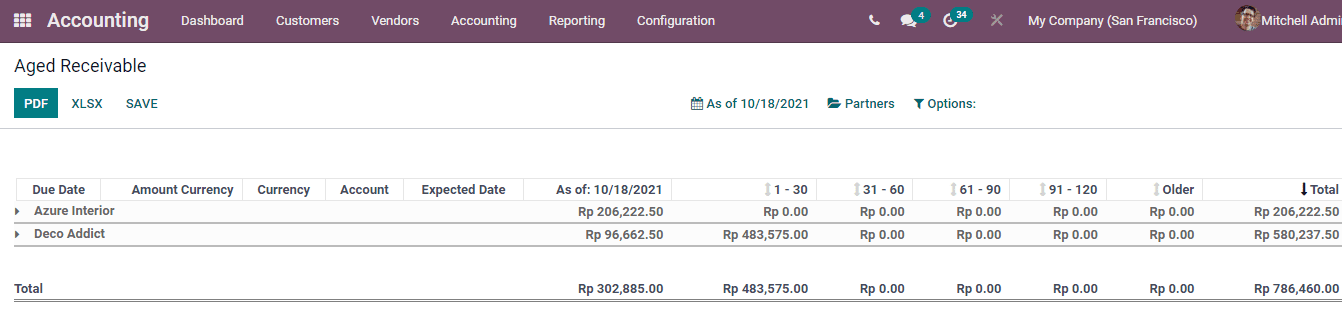

Aged Receivable

The report which displays the company’s receivable accounts based on the length of time the invoice has been outstanding is called as aged receivables. This report is also used as an instrument to measure the financial health of the customers. It is helpful in determining the allowance provided for the doubtful accounts. It reveals the accounts of the customers who are credit risks and helps in determining whether the company should continue business with them.

You can view your company’s aged receivables report in Odoo by selecting the Aged Receivables option from the Reporting tab. The chart of aged receivables along with the details of the Due Date, Amount Currency, Currency, Account, Expected Date, amount As Of date, amount due on the basis of the due days and the Total amount receivable is displayed. The due days are categorized into 4 groups each containing 30 days. After 120 days the amount will be categorized into the older receivable amount category. You can view the aged receivables of current date, End of Last month, End of Last Quarter and End of Last Financial Year.

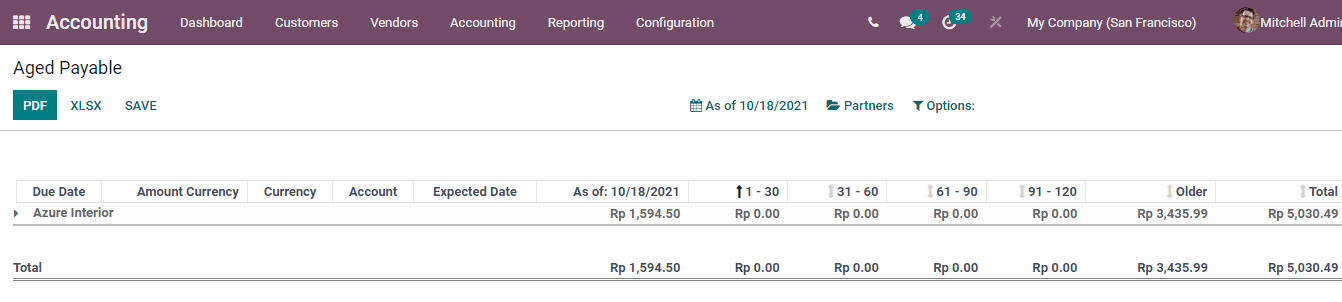

Aged Payable

The amount owed by the company to the suppliers according to the due dates are known as aged payables. The aged payables report monitor the outstanding expenses of the company. A quick visibility of the debts of the company can be viewed with the help of aged payables report. A friendly relationship with the customer can be maintained by supervising the payables report and paying off the debts.

By selecting the Aged Payables option from the Reporting tab, you can view your company’s payables report. All the information displayed in aged receivables can also be viewed in aged payables with only difference that the aged payables depicts the debts owed by the company to its suppliers.

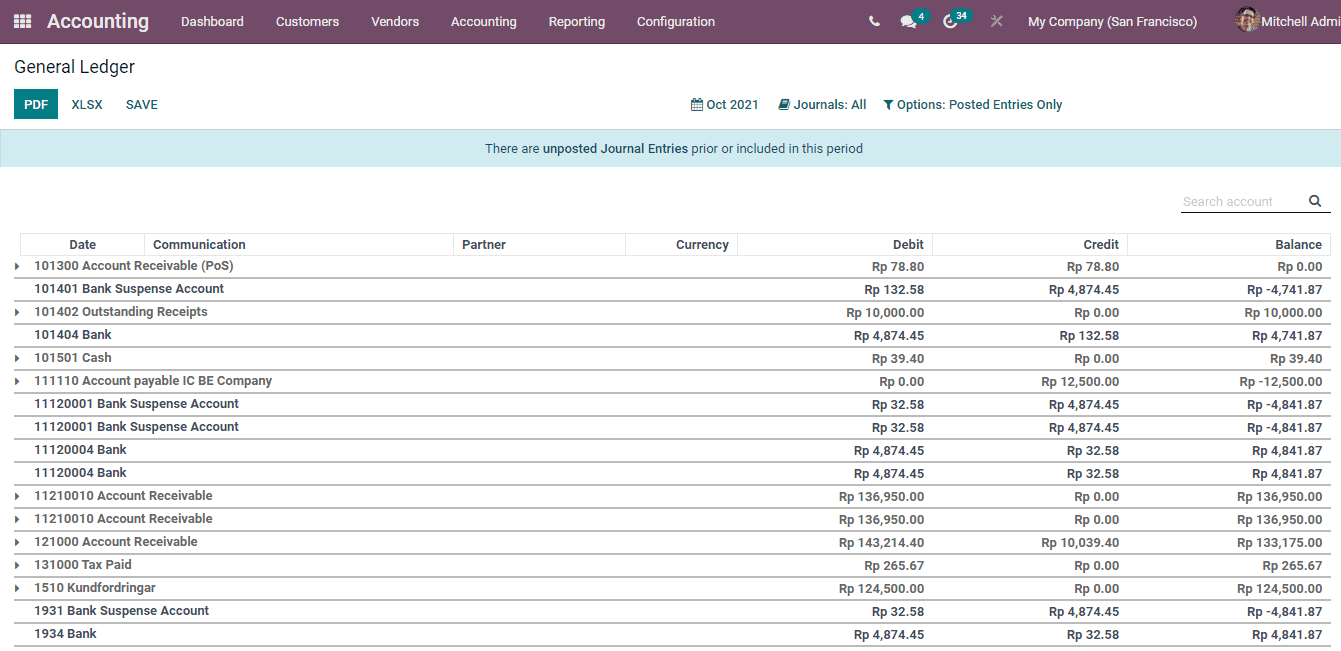

General Ledger

The master accounting document which provides a complete record of every financial transaction of the company is known as general ledger. General Ledgers are considered as the foundation of the double entry accounting system. All the financial transactions required to produce the company’s balance sheet, income statement and any other financial statement can be found in the general ledger.

To view your company’s general ledger in Odoo select the General Ledger option from the Reporting tab. The general ledger with information such as Date, journal, name of the Partner, Currency used, Debit amount, Credit amount and Balance is displayed. The Total debit, credit and balance is displayed at the bottom. You can view specific journal entries by selecting them from the Journals option. The general ledger can be copied to the spreadsheet and also saved as PDF by selecting the XLSX and PDF buttons respectively.

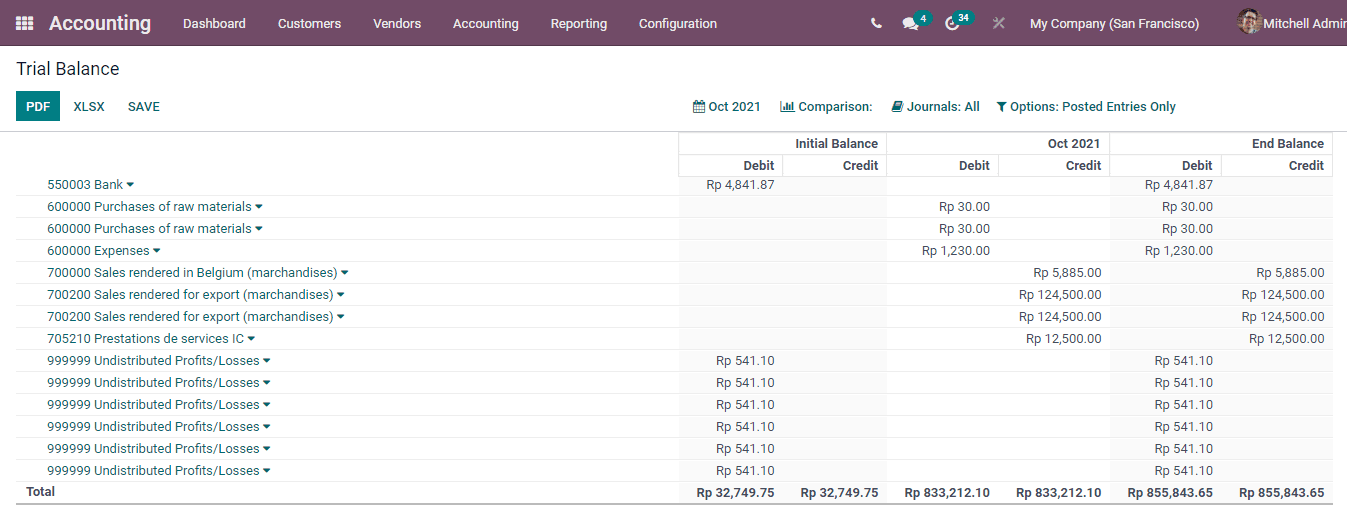

Trial Balance

Trial balance provides a summary of all the business activities. All the ledgers of the company are taken and they are put into a single document with a particular date. This is known as the trial balance of the company. Trial balances are made at a particular date which is mostly on the financial year end or on the calendar year. For the purpose of auditing, trial balances are analysed. Trial balances are regarded as the first step taken towards the closure of accounts.

To view your company’s trial balance in Odoo 15 select the Trial Balance option from the Reporting tab. The journal entries along with the Initial Balance, Debit and Credit amount of the selected month, and End Balance amount is displayed. You can generate the PDF of the trial balance and also copy them to the spreadsheet. The financial position of the company can be determined by comparing the result with previous periods. The journal entries of specific accounts can be viewed separately. At the end of the trial balance you can view the total amount of the initial balance, current month and end balance.

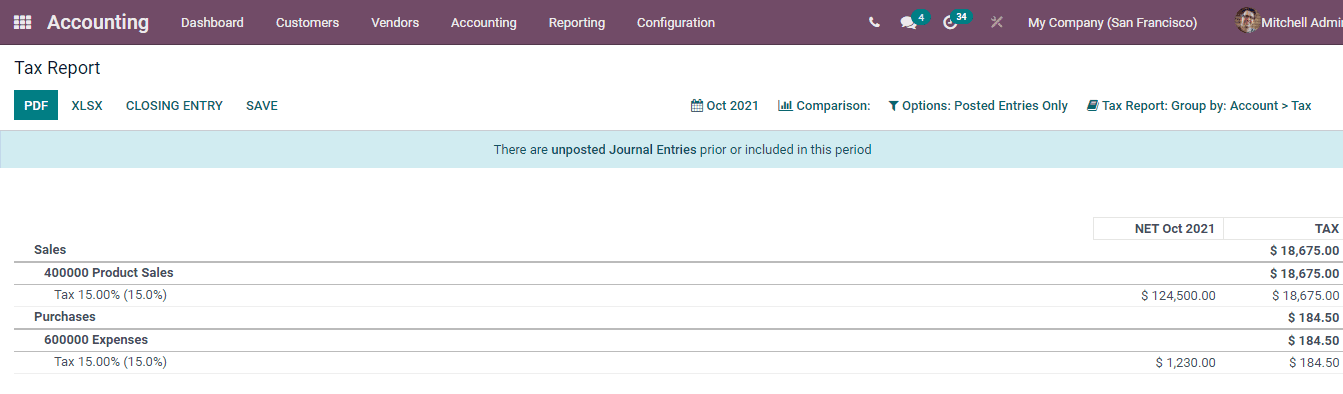

Tax Report

The document which calculates the company’s earned income with the tax paid amount is called the tax report. In Odoo 15 you can view the tax report by selecting them from the Reporting tab. The generated report can be converted to both PDF and Excel format. The tax reports are generated based on the start date and end date. The sales and purchase taxes are displayed in separate categories for easier visibility.

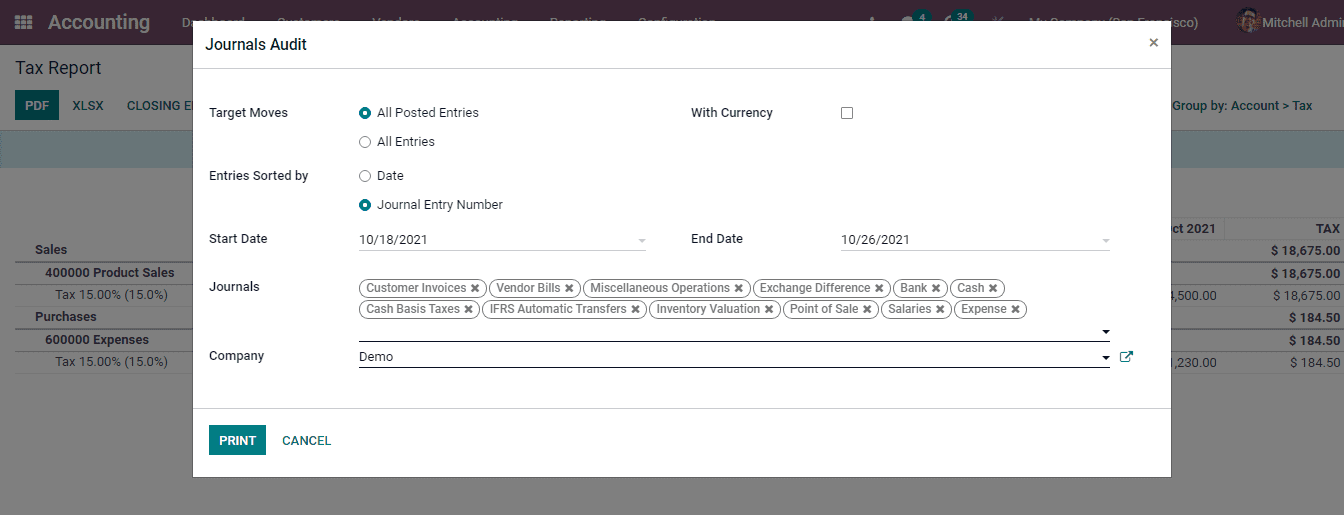

Journals Audit

Journals audit report provides the opportunity to view and pass the final entries which are used to finalise the accounts book. In Odoo 15 you can generate the journal audit by selecting the Journals Audit option from the Reporting tab. At the displayed window select the Target Moves. It can be either All Posted Entries or All Entries. The result can be saved with or without Currency. Then select how the Entries must be Sorted, it can be either by Date or Journal Entry Number. Enter the Start Date and End Date. insert the Journals that have to be added and at the given field enter the name of the Company. After inserting all the information select the PRINT button to print the generated result.

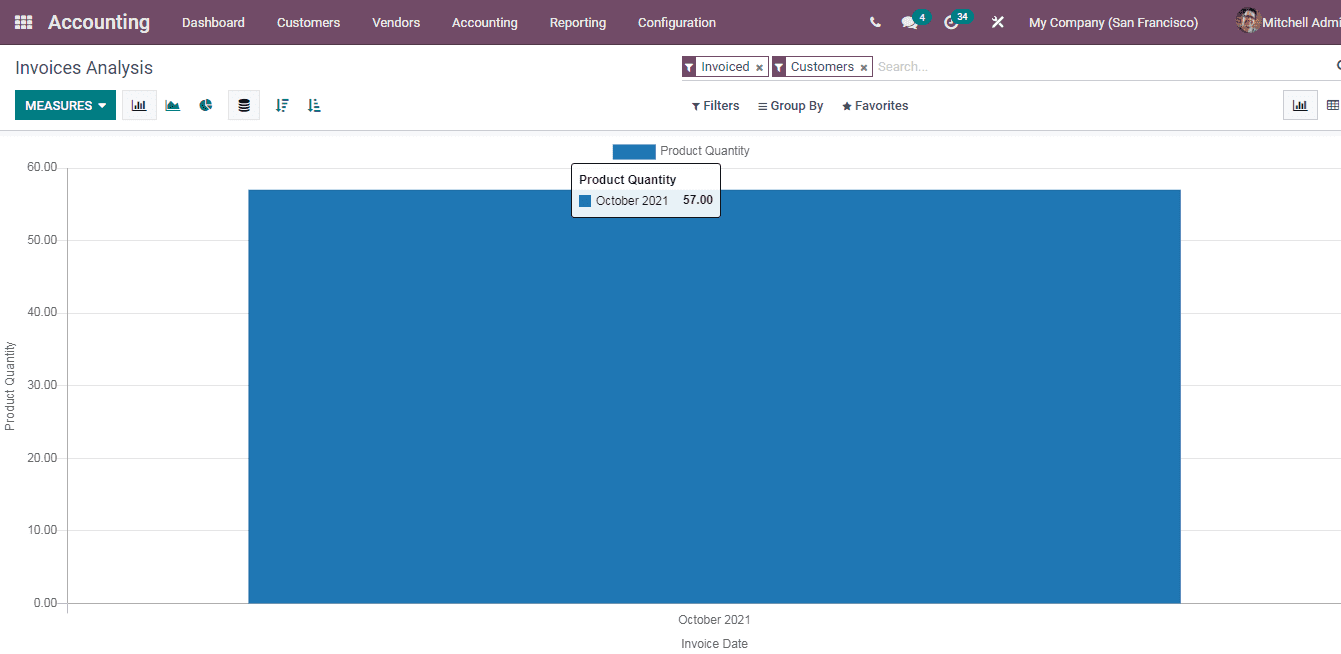

Invoice Analysis

Evaluating the invoice analysis of your company can save you from duplicate payment on invoices, over payments and fraudulent payments. You can view them by selecting the Invoice Analysis option from the Reporting tab. You can add measures such as Average Price, Product Quantity and Untaxed Total to display the graphical analysis. The result can be grouped by on the basis of Salesperson, Sales Team, Partner, Product Category, Status, Analytic Account, Company, Date and Due Date. The result can be viewed in Bar Chart, Line Chart and Pie Chart. The analysis can be viewed in Pivot and Graph view.