Miscellaneous Accounting

Journal Entries

Keeping and maintaining the financial transactions of the company is known as a journal entry. The accounting journal of the company shows the company's credit and debit balances. When following the double entry bookkeeping system for the accounting purposes, the journal entry acts as the foundation.

Recording every transaction in the journal book can be overwhelming, consumes a lot of time and the possibility of errors can be high. But with an automated accounting tool the process of journal entry can be of no efforts.

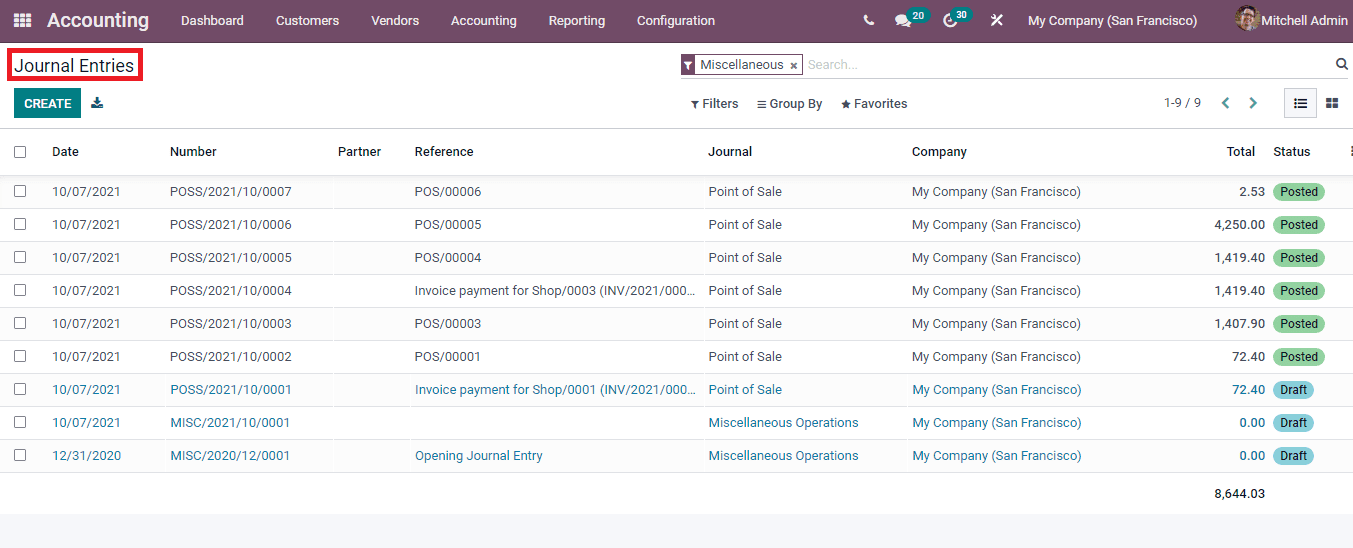

In the Odoo 15 Accounting module you can evaluate and manage the journal entries of the company by selecting the Journal Entries option from the Accounting tab. The entries are recorded in chronological order along with other details such as Number, Partner, Reference, Journal, name of the Company, Total amount and Status of the journal. The entries can be viewed in List and Kanban view. The journal entries can be grouped according to their Partner, Journal, Status, Date and Company.

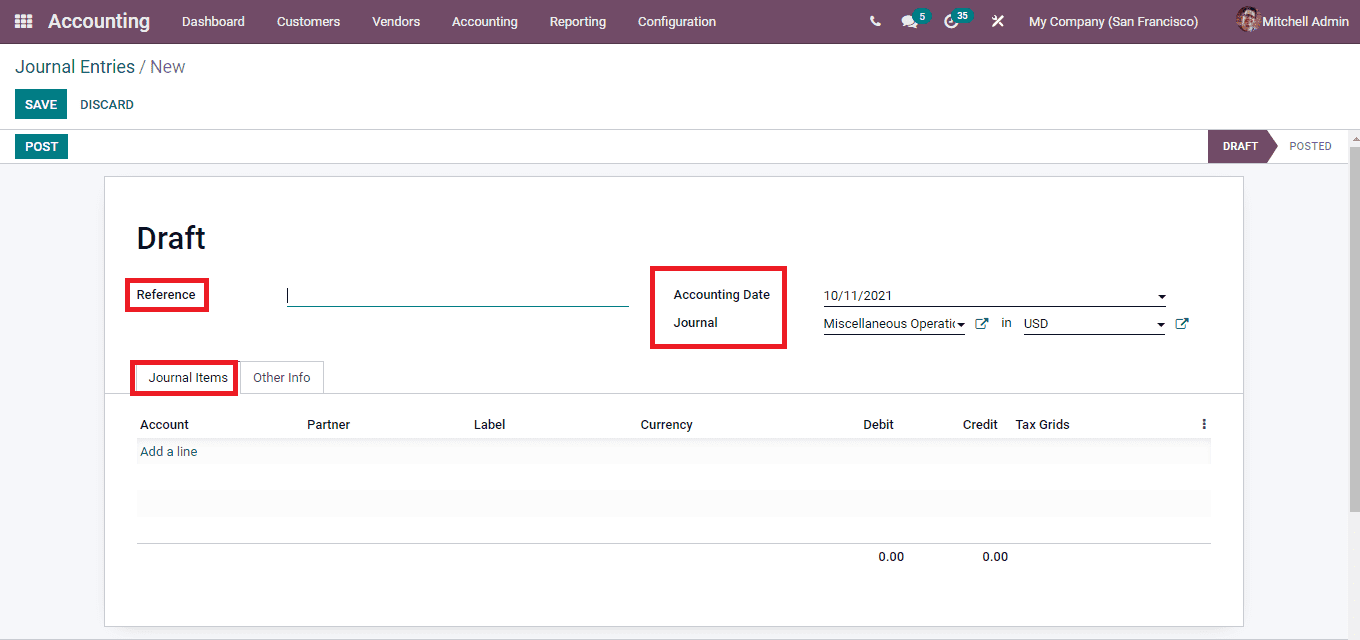

New entries can be added to the journal account by selecting the CREATE button. At the new journal entry page enter the information such as the Reference, Accounting Date, Journal and Currency used in transaction. Under the Journal Item menu, add the details of the Account, name of the Partner, Label, Analytic Tags, Currency, Debit amount, Credit amount and Tax Grids.

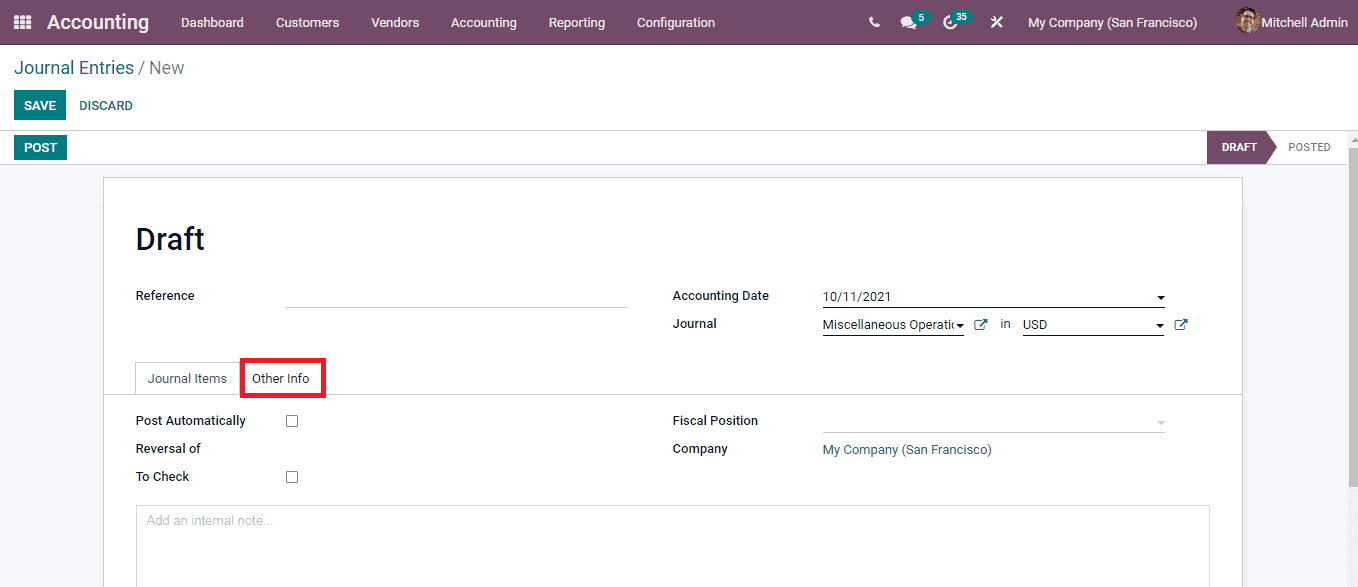

At the Other Info tab you can enable Post Automatically if the entry needs to be posted on the given date, To Check which will enable you to recheck the added information, enter the Fiscal Position to adapt taxes and accounts for particular customers or sales orders / invoices and lastly enter the name of the Company. The default value of the Fiscal Position comes from the customer. You can also add any internal notes regarding the journal entry at the space provided.

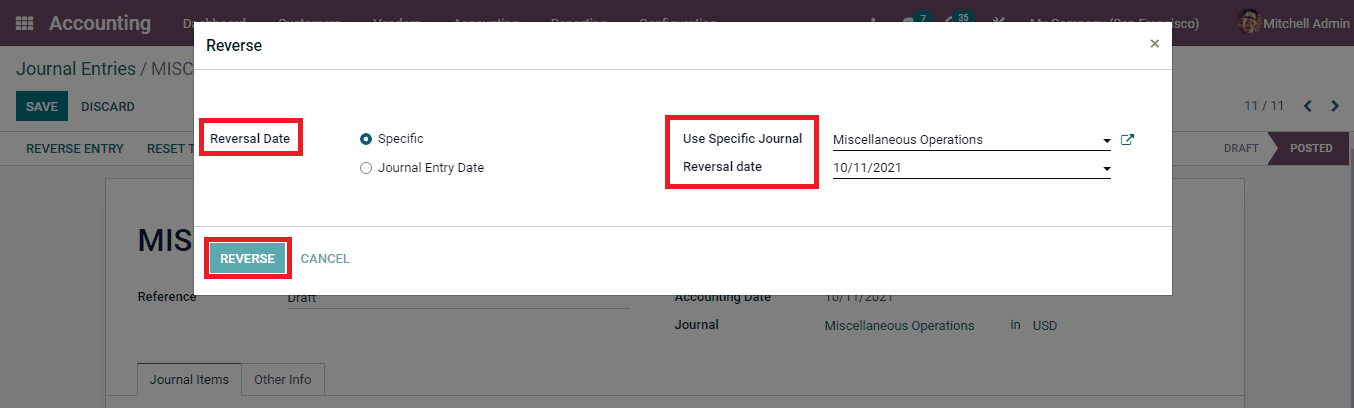

The created journal entry can be posted by clicking on the POST button. The created entry can be reversed for a new accounting period in the Odoo 15 Accounting module by selecting the REVERSE ENTRY button. At the Reverse window enable the Reversal Date as either Specific or Journal Entry Date, enter the journal at Use Specific Journal field and Reversal Date. After entering all the details you can reverse the journal entry by selecting the REVERSE button.