Deferred Revenues and Expenses

Deferred Revenue

Deferred Revenue or the unearned revenue occurs when the company receives a payment for the goods or services which isn't delivered or completed. The prepaid amount is recorded as a liability of the company. It is a liability as it turns out to be a non earned income and owes the customer goods or services. Also a factor of risk exists as it is not sure that whether the product or service can be delivered.

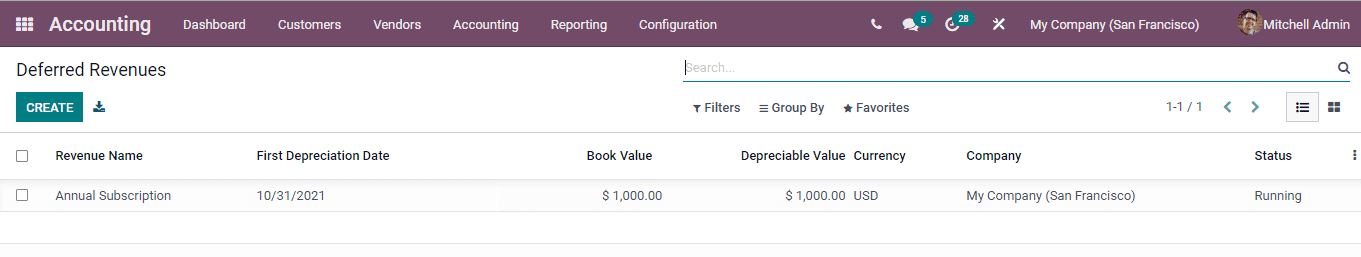

In the Odoo 15 Accounting module you can view and create new deferred revenues by selecting the Deferred Revenue option from the Accounting tab. The list of deferred revenue along with the details such as the Name of the Revenue, First Depreciation Date, Book Value, Depreciable Value, Currency, Company and Status of the revenue is displayed.

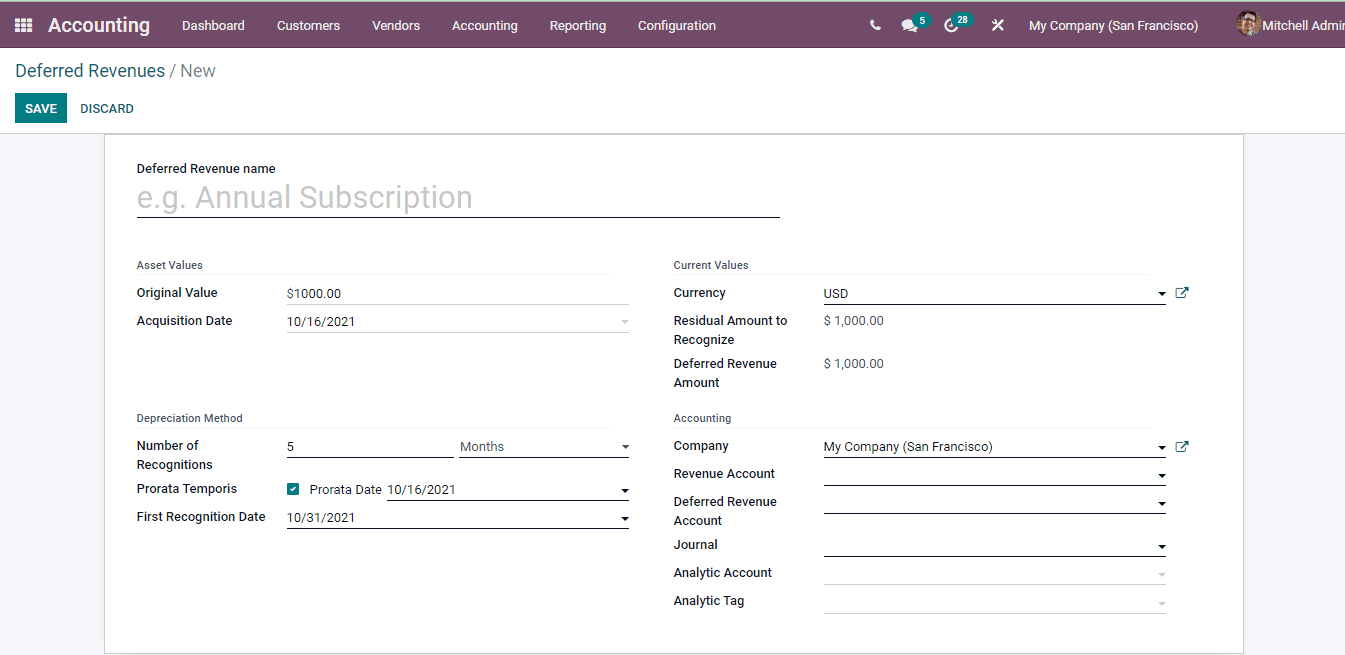

New deferred revenues can be recorded by selecting the CREATE button. At the Deferred Revenue Name field provide the name of the revenue. Insert the Original Value of the product either manually or select the amount from the related purchases. At the Acquisition Date, the date when the revenue was acquired should be noted. Insert the Number of depreciation, enable the Prorata Temporis and First Recognition Date under the Depreciation Method. Further, select the Currency used, Residual Amount to Recognize and Deferred Revenue Amount at the Current Values. The Deferred Revenue Amount is the sum of the depreciable value, the salvage value and the book value of all value increase items. Under the Accounting, enter the name of the Company, Revenue Account, Deferred Revenue Account, Journal, Analytic Account and Analytic Tags.

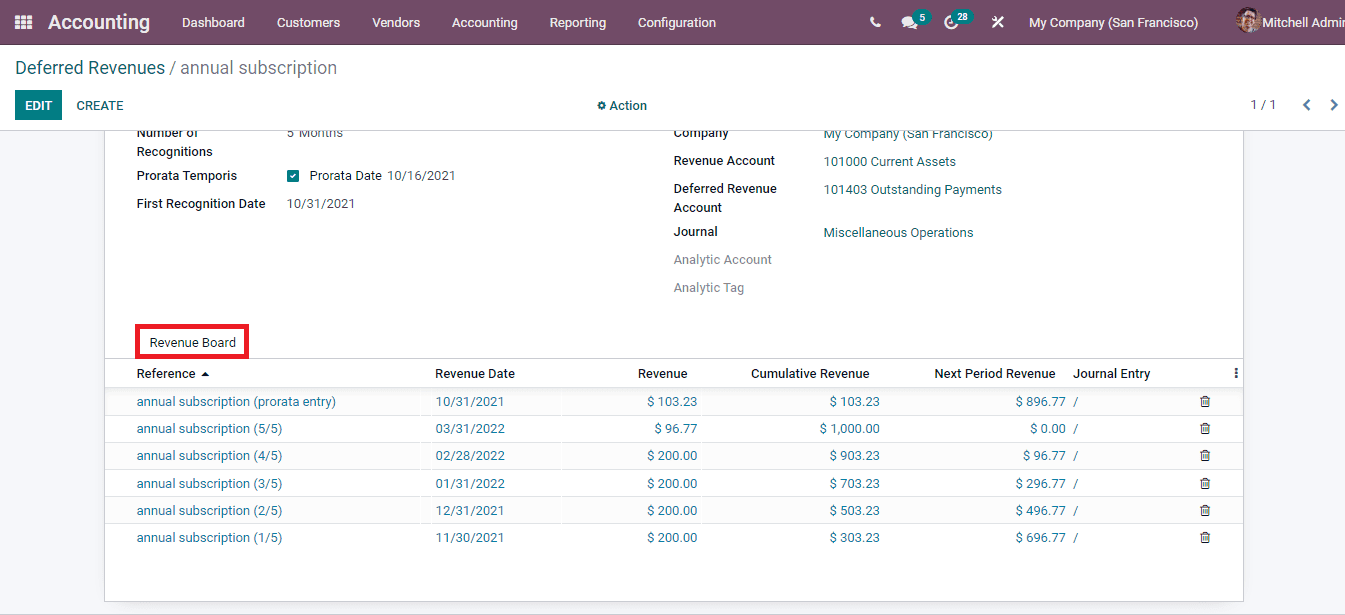

Revenue can be calculated using the COMPUTE REVENUE button. The journal entries related to the deferred revenue can be seen by selecting the Posted Entries option. By confirming the created deferred revenue you can view the revenue board of the revenue at the bottom.

The selected revenue can be modified after confirming the deferred revenue. By selecting the MODIFY REVENUE option the modify window will be displayed. At the window enter details such as the Reason for modification, Number of Depreciation, Depreciable Amount and Not Depreciable Amount. By selecting the MODIFY button the changes will be saved.

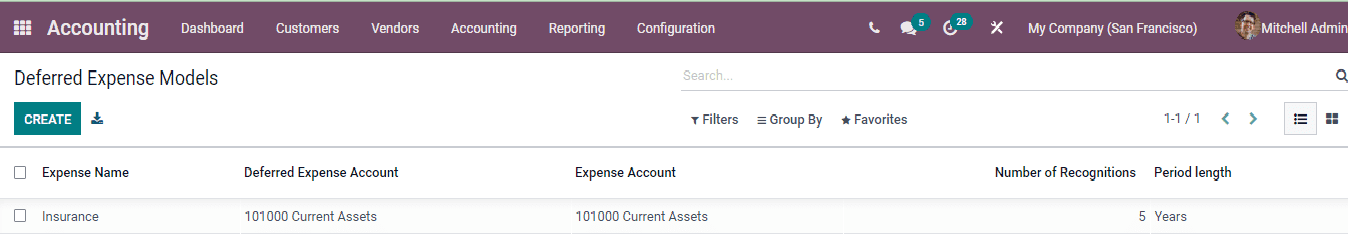

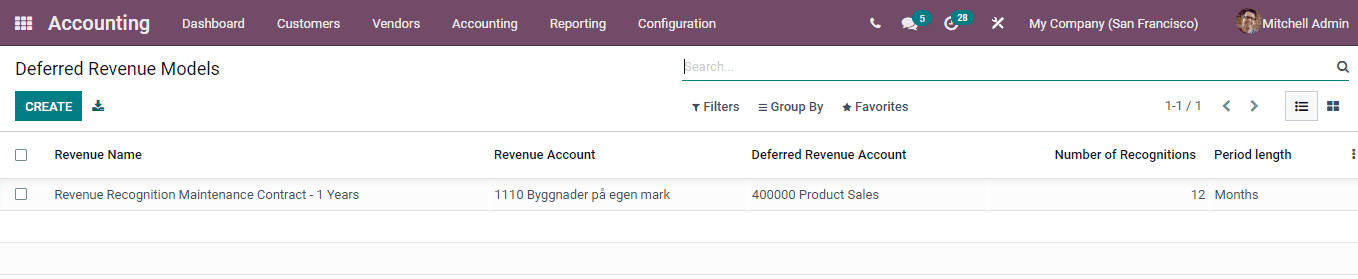

Deferred revenue models can be created so that making new deferred revenue can be easier. Select the Deferred Revenue Models option from the Configuration tab to examine and create new revenue models. The list of existing models are displayed with details such as the Revenue Name, Revenue Account, Deferred Revenue Account, Number of Recognition and Period Length. More details can be viewed by selecting them.

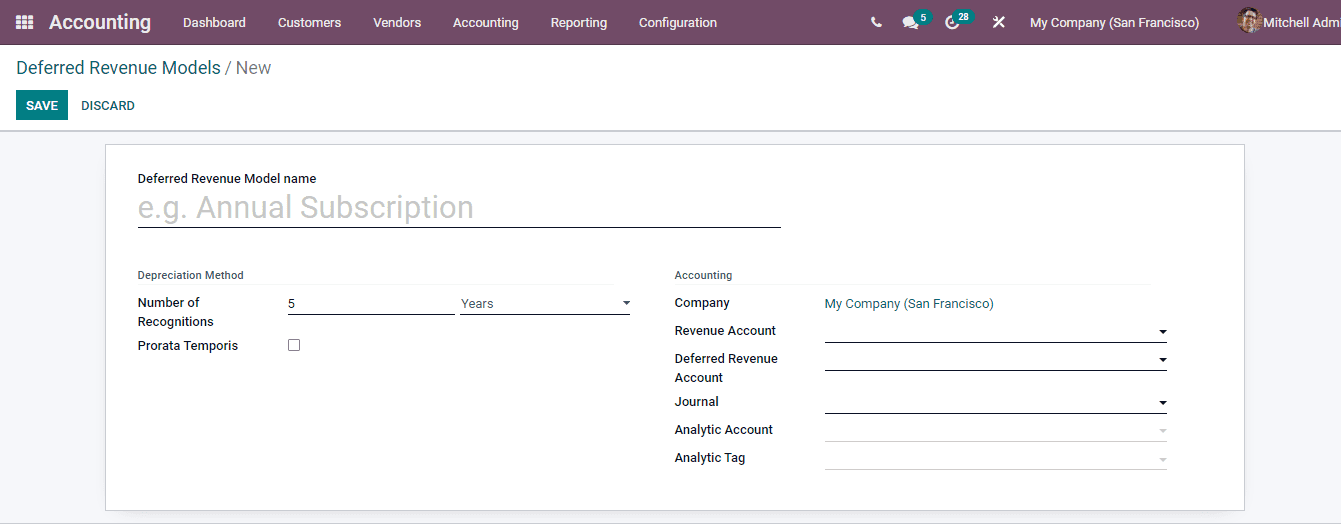

To create new revenue models select the CREATE button and enter the information regarding the new model at the displayed window. This information includes the name of the Deferred Revenue Model, the Depreciation Method used and the Accounting details.

Deferred revenue models are used so that the deferred revenues can be grouped according to their models and the information attached to the models can be executed in the added deferred revenue automatically. The same is with the deferred expense models. You can add multiple deferred revenue and expenses to their models.

Deferred Expenses

Deferred expenses or deferred charges are those charges when the company makes payment for product or services of whose consumption will not take place immediately or not in the next 12 months. They come under the long term asset category. For example when the company decides to install a new manufacturing unit, the money occured for the legal and consultation as fees will be charged to as a new project cost to expenses each year rather than adding the whole amount as expense.

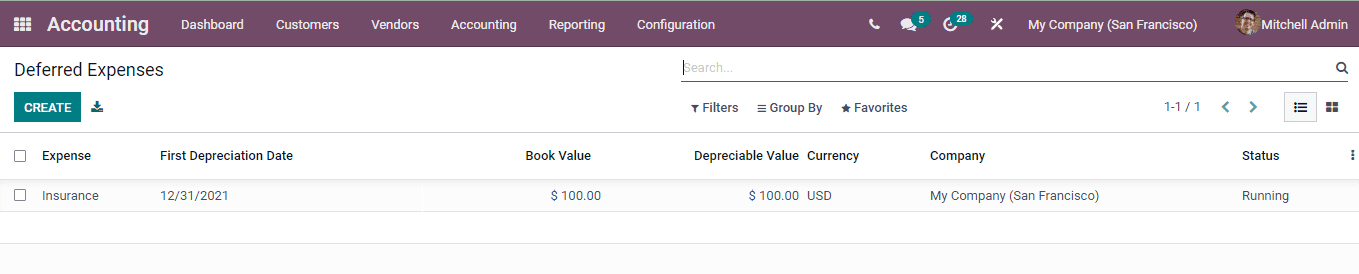

Similar to the deferred revenue, you can view the details of the expenses such as the name of the Expense, First Depreciation Date, Book Value, Depreciable Value, Company and Status of the expense by selecting the Deferred Expense option from the Accounting tab.

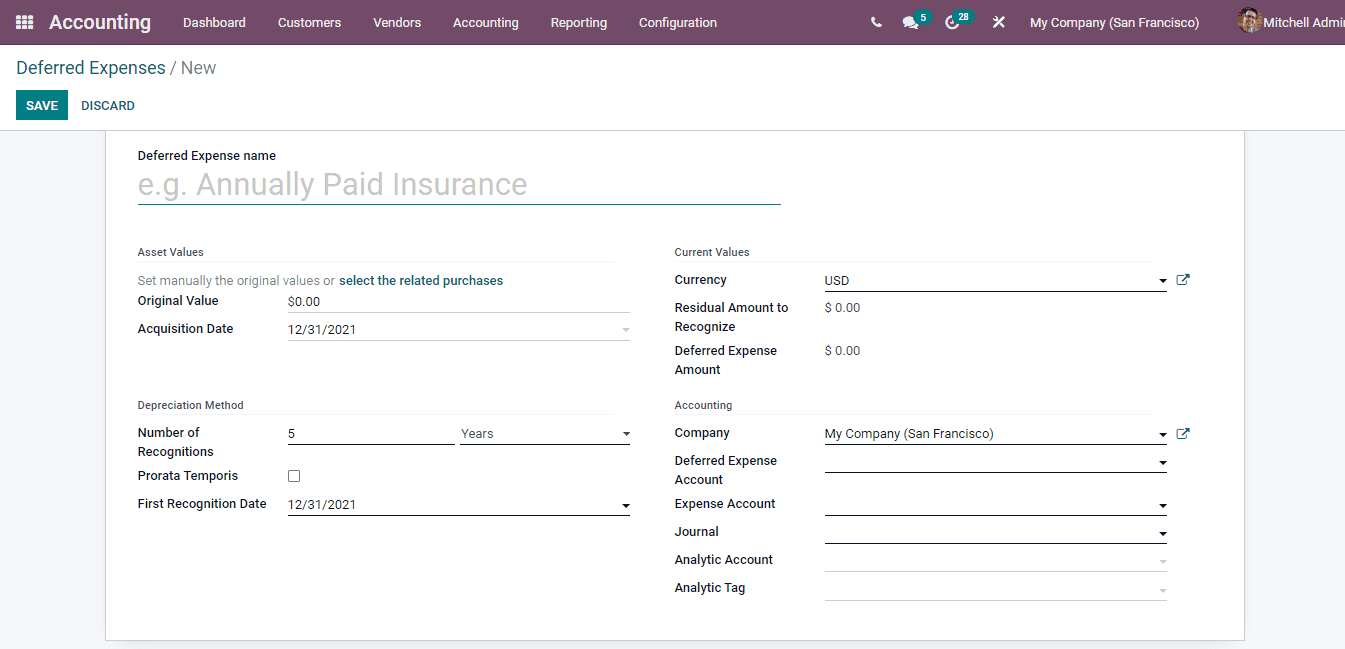

New deferred expenses can be recorded by selecting the CREATE button and at the displayed window necessary details along with details such as Deferred Expense Account and Expense Account.

Deferred expense models can also be configured as deferred revenue models. By selecting the Deferred Expense Model option from the Configuration tab you can view the list of existing deferred expenses models and also create new ones. The models can be grouped on the basis of Expense Account, Deferred Expense Account and Journal. With the CREATE button you can add new deferred expense models to the system.