Assets

Assets play an important role in business as it allows the company to increase and gain profits, value as well as keeps the business running smoothly. It is important to maintain a record of assets as it will help in managing the company’s assets. Through the record of the assets, the stakeholders can have details of the assets that are available with the company and can be used to attain the anticipated profit or returns. With proper asset management the identification and management of risks that come from the usage of the assets can be done. Awareness of lost and damaged assets can be easily made with the records.

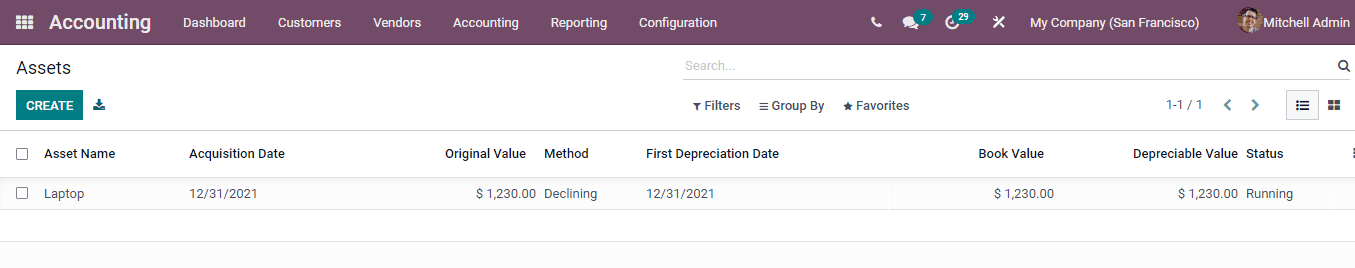

In the Odoo 15 Accounting module you can manage the assets of the company by selecting the Assets. Assets are listed with the details such as

Asset Name - which indicates the name of the belonging asset.

Acquisition Date - the date on which the asset was acquired by the company.

Original Value - the original cost of the asset when it was bought.

Method - the method used for calculating the depreciation of the asset.

First Depreciation Date - the date on which the first depreciation was calculated on the asset.

Book Value - the value of the asset after reducing the depreciation.

Depreciable Value - this represents the asset’s used value.

Status- status of the asset is denoted here.

Using the Filters you can display the assets which are Current, Closed and Archived. You can group the assets on the basis of Date and Asset Model. The assets of the company can be viewed in both List and in Kanban view.

Creating new asset

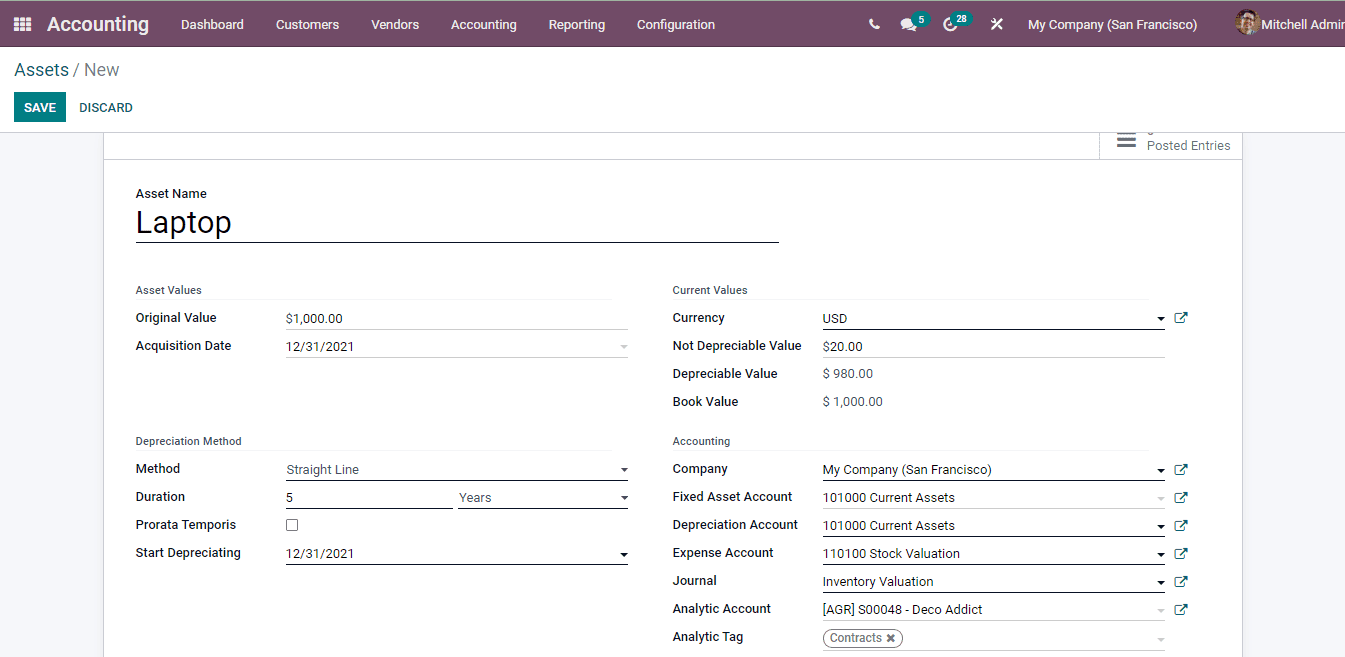

When new assets are acquired by the company it should be recorded. In Odoo you save the data corresponding to the asset by selecting the CREATE option from the Assets window. The details to be entered in the New Asset form page are :

Asset Name : Enter the name of the asset purchased at this given field.

Original Value : In Odoo you can either set the original value manually or select the value from related purchases.

Acquisition Date : Enter the date on which the asset was purchased or acquired in this field.

Method: Here you will have to select the method for calculating depreciation of the asset. There are three methods available to estimate the depreciation, they are Straight Line, Declining and Declining then Straight Line method. In a straight line depreciation method the value of the asset decreases uniformly over each period. This will continue until the value reaches its salvage value. The declining method of depreciation is also known as the reducing balance method, in this method the assets are depreciated by applying a constant percentage of depreciation to the net value of the asset. Choose the method according to the asset.

Duration : Enter the number of depreciation needed to depreciate the asset in terms of years or months.

Prorata Temporis : By enabling the Prorata Temporis you will need to specify the start date for the first period depreciation’s computation. By default the date is set to the day’s date rather than the start date of the fiscal year.

Start Depreciating : The date on which the depreciation must be started has to be inserted here. This date does not alter the computation of the first journal entry in case of prorata temporis assets. It only changes its accounting date.

Currency : Here enter the currency used to determine the values of the asset.

Not Depreciable Value : At this given field insert the amount you plan to have that you cannot depreciate.

Depreciable Value : The depreciable value will be automatically filled according to the Not Depreciable Value entered.

Book Value : At this given field enter the sum of depreciable value, the salvage value and book value of all value increase items.

Company : Name of the company which acquired the asset.

Fixed Asset Account : Enter the account used to record the purchase of the asset at its original price.

Depreciation Account : Add the account used in the depreciation entries, to decrease the asset value.

Expense Account : The account used in the periodical entries, to record a part of the asset as expense must be added here.

Journal : Add the journal related to the asset.

Analytic Account : This will help you in analysing and reviewing a single account.

Analytic Tag : Enter related tags which will help in making report generation and related operations simpler.

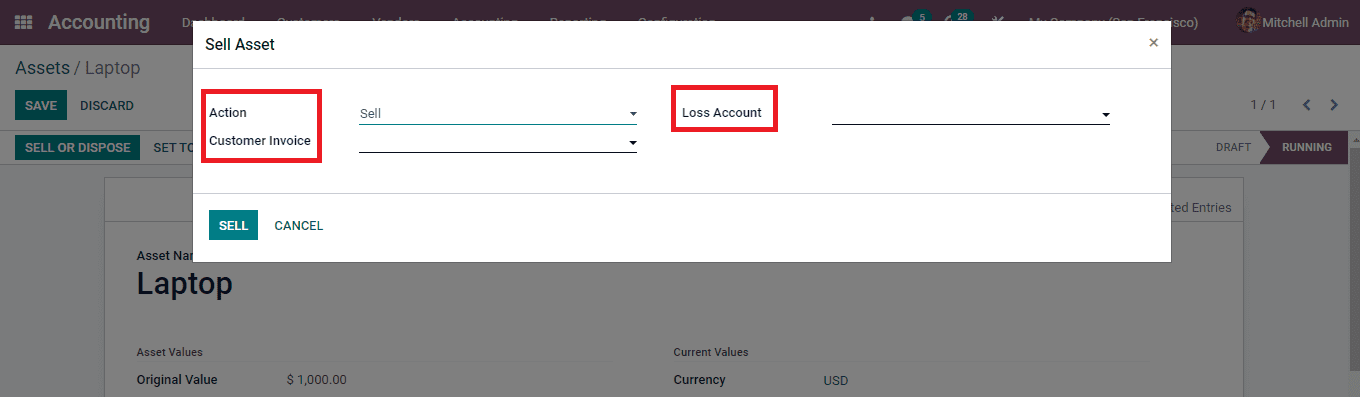

The depreciation can be calculated by selecting the COMPUTE DEPRECIATION button. By confirming the created asset you can either make moves to sell or dispose of the asset after using them. A Sell Asset window will appear on the screen after selecting the SELL OR DISPOSE button. At the window select an Action, either Sell or Dispose, Customer Invoice and Loss Account. By selecting the SELL/ DISPOSE button the entry will be recorded.

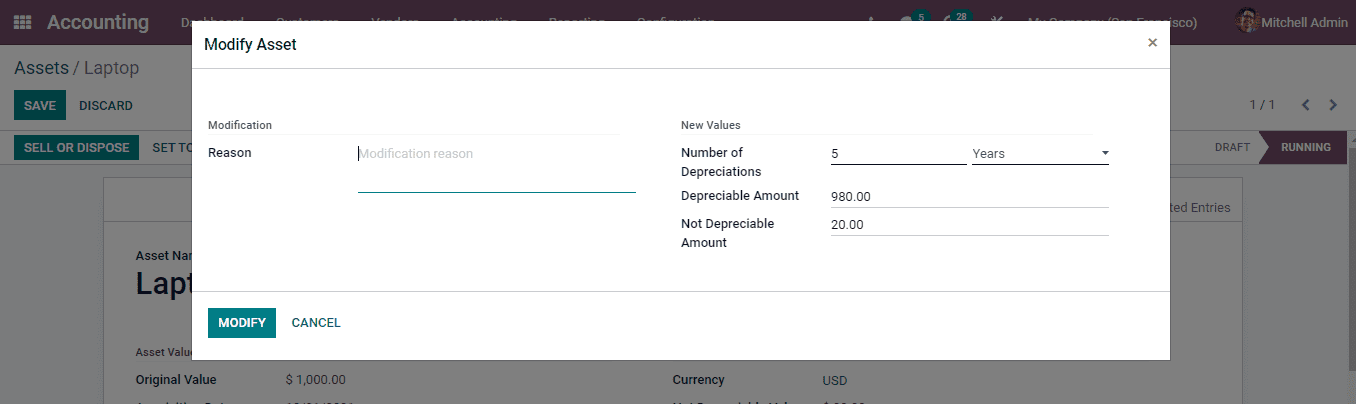

Changes can be made on the depreciation that was once created while recording the asset. You can pause the depreciation for certain dates by selecting the PAUSE DEPRECIATION button. Similarly alterations on the data related to depreciation can be made by selecting the MODIFY DEPRECIATION button. At the Modify Asset window enter the new details such as Reason for modifying the depreciation values, Number of Depreciation in terms of years or months, Depreciable Amount and Not Depreciable Amount. By selecting the MODIFY option new changes will be saved.

Creating Asset Models

Asset models help in managing the asset entries by setting up certain notions each asset may have. You can apply these asset models to the new entering assets so that the predetermined notion will get applied to the new asset. With a single asset model multiple assets can be created.

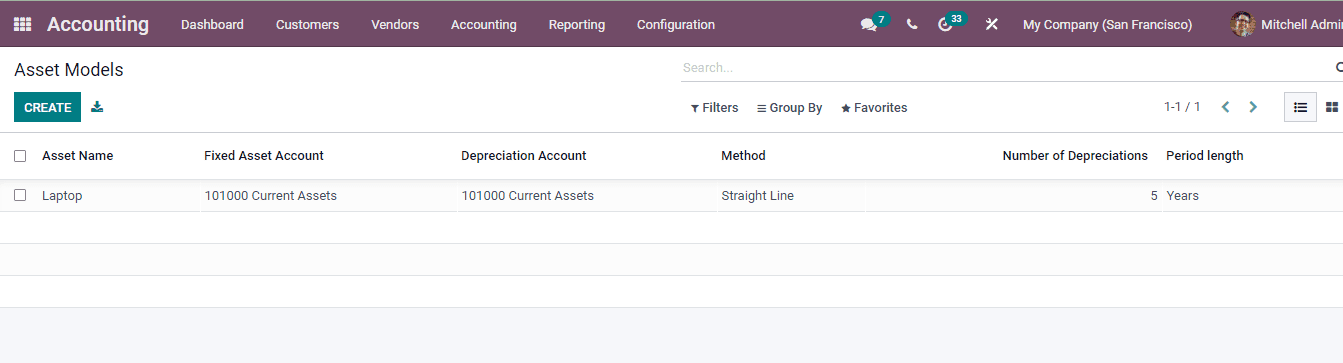

You can view the asset model by selecting the Asset Model option from the Configuration tab. The list of the models along with their Asset Name, name of the Fixed Asset Account, Depreciation Account, depreciation Method, Number of Depreciation and Period Length. The models can be grouped on the basis of Fixed Account, Depreciation Account, Expense Account and Journal.

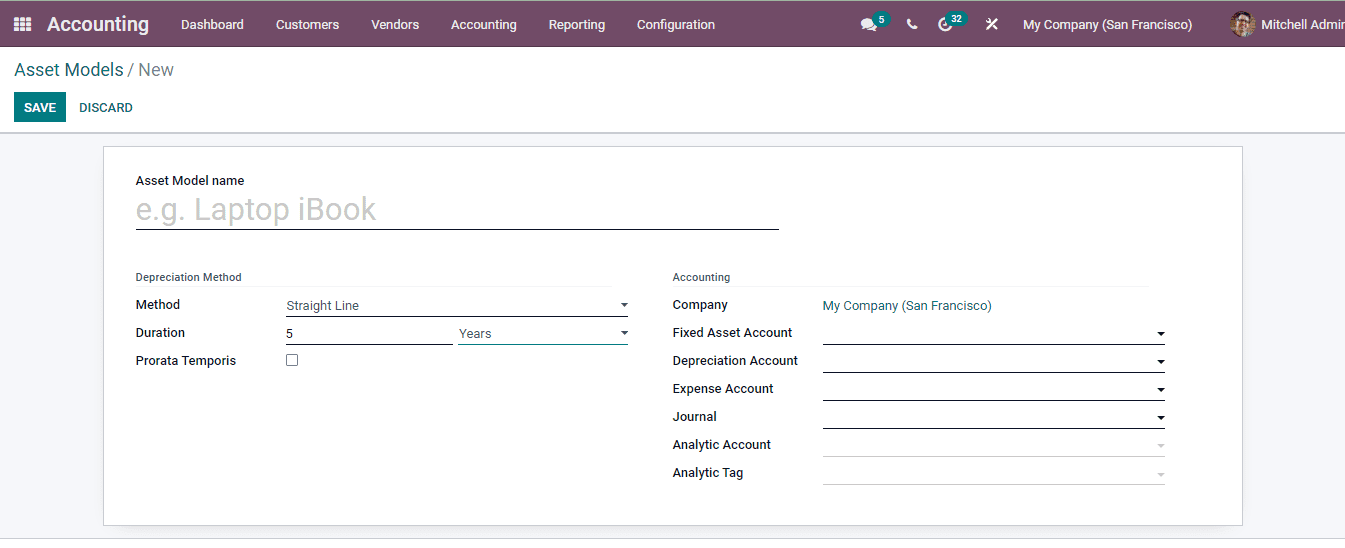

Select the CREATE button to add a new asset model. The details that should be added to the new asset model form are:

Asset Model Name: Enter the name of the model that will be used while creating or adding new assets to the system.

Method: Choose a method that will be used to compute the depreciation amount. Odoo gives you three methods for calculating depreciation. Straight Line method, Declining and Declining then Straight Line method.

Duration: The number of depreciation needed to depreciate your asset. Also mention whether years or months are taken into consideration while calculating depreciation.

Prorata Temporis: Enable the option to specify the start date for the first period’s computation.

Fixed Asset account: Enter the account used to record the purchase of the asset at its original price.

Depreciation Account: Add the account that is used to enter depreciations, to decrease the asset value.

Expense Account: Enter the account used to record a part of the assets as expense.

Journal: Add the corresponding journal that will be used to record the entries.

Select SAVE to validate the new asset model.