Accounting audit trails are an essential instrument for preserving accountability and openness in financial operations. They give auditors a thorough, chronological record of all financial transactions, making it possible for them to follow and confirm the accuracy of entries. This supports financial integrity and regulatory compliance by identifying mistakes, fraud, or disparities. Furthermore, by offering a thorough record of all operations that can be examined and adjusted as needed, audit trails improve the accuracy of financial statements. In the end, accounting's use of audit trails guarantees a solid framework that inspires confidence in stakeholders and promotes efficient financial management.

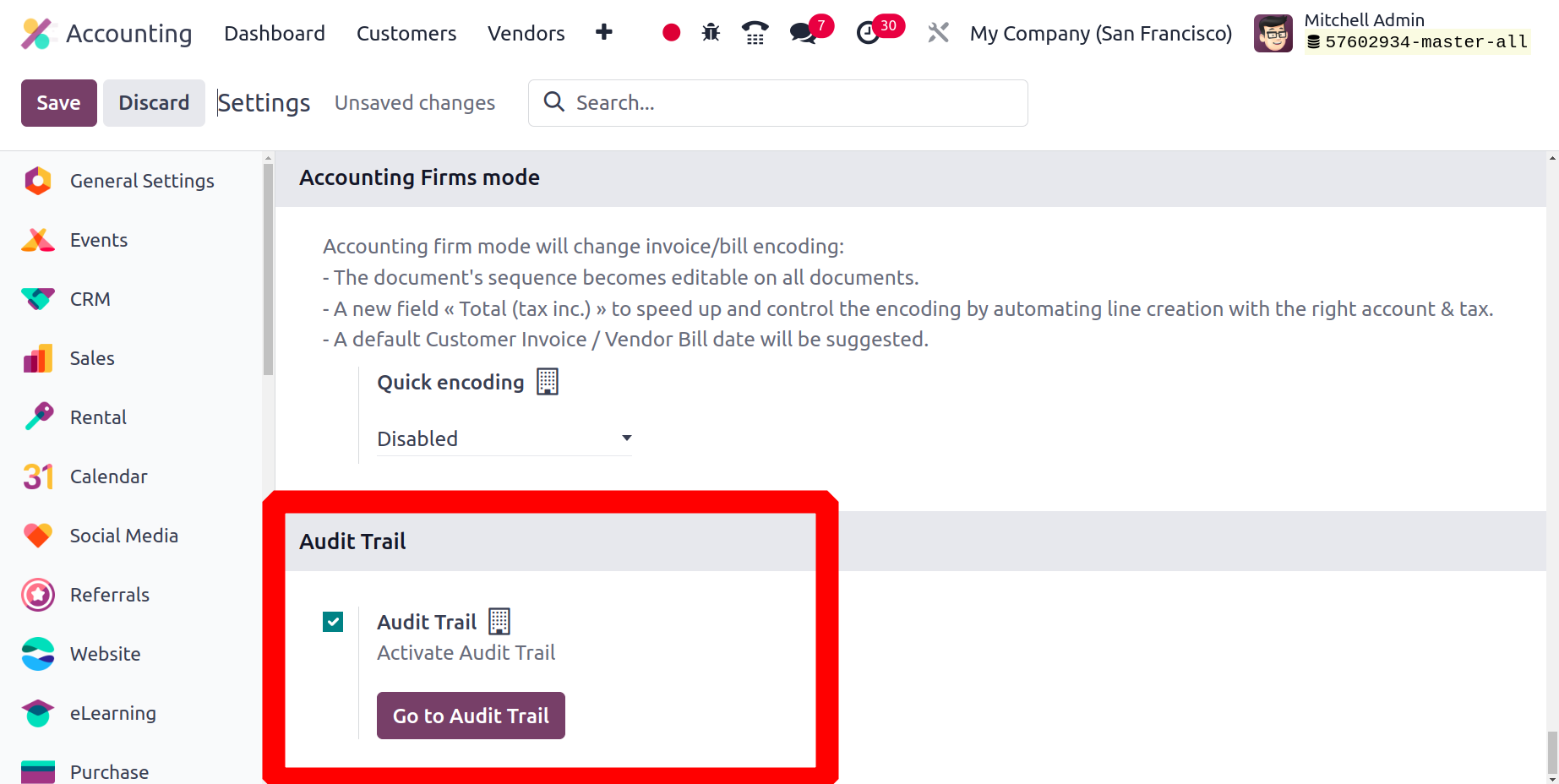

Thus, the accounting module in Odoo 17's Settings displays an option named Audit Trail. Give the audit trail activation option a go.

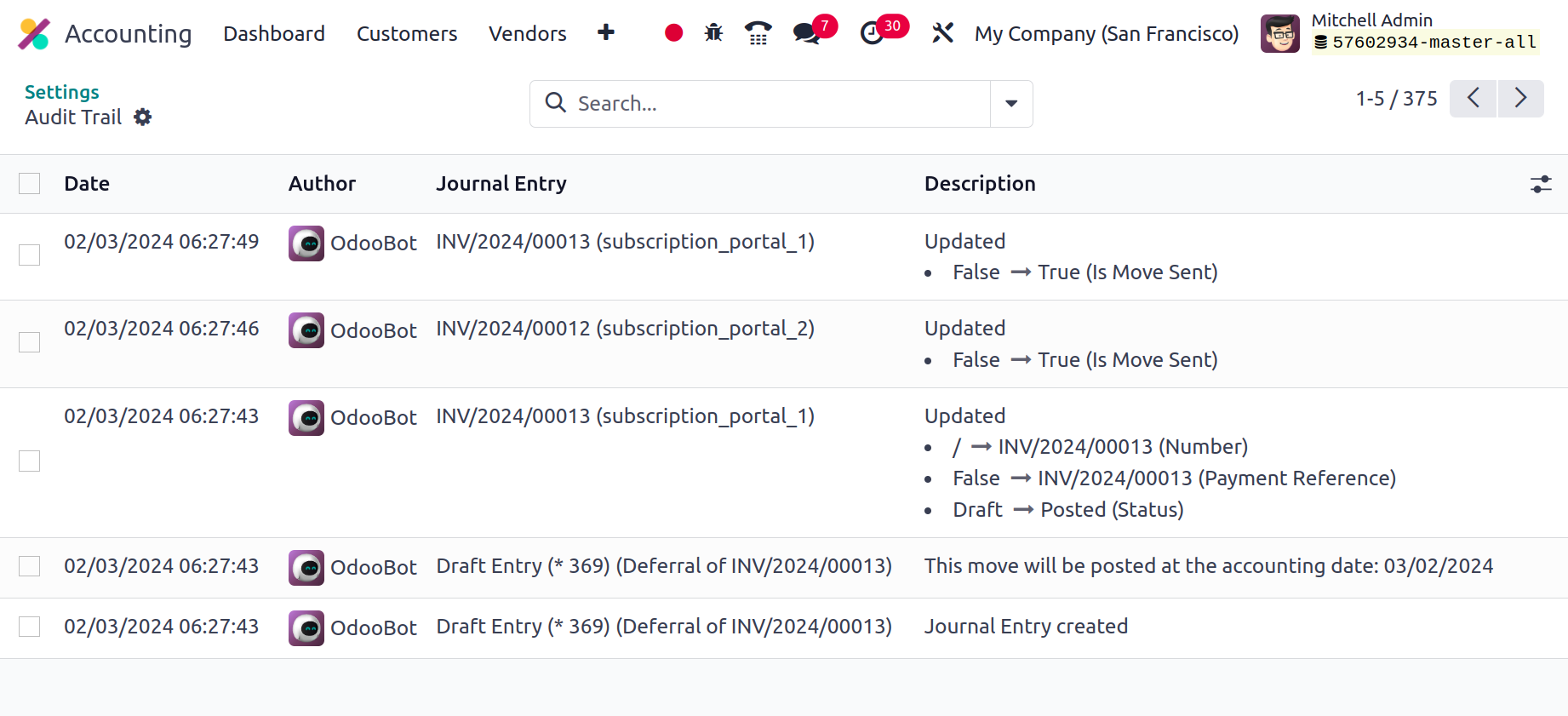

User modifications to an invoice will all be recorded in this audit trail. In order for the auditor to easily comprehend the modifications and revisions made to each invoice. This can be accessed by selecting the Go to Audit Trail option.

As seen in the image above, the date, author, journal entry, and description are accessible here.

The Odoo Accounting module will operate as the solution provider for the business operations management activities of an Organization, starting with specialized tools and solution providers that will pave the way for the company's efficiency in finance management. The Odoo Accounting book gives you a thorough understanding of the accounting management processes used by your company. In the book, we first covered an overview of Odoo. Then, we moved on to the Configuration choices and tools available in the Odoo Accounting module, which will serve as the foundation for operations and management.

In the following chapter, we focused on the Configuration tools in the Accounting module, where all of the configuration options, such as Accounting configurations, Payment Options, Management Options, Analytical Accounting, Configuring Invoicing, and Configuring Bank Payments, provide insight into how the Configuration tools in Odoo can be configured to meet the best of needs. We concentrated on the financial management elements of suppliers and customers with Odoo Accounting in the fourth chapter. The Accounting Module Dashboard, Customer Finance management with the Odoo Accounting module, and Odoo Accounting module Vendor management procedures were all discussed.

The fifth chapter of the book focuses on the accounting management tools in the Odoo Accounting module and includes detailed descriptions of the accounting management tools, accounting management actions, accounting ledgers, journal management, and administration of other miscellaneous entities. Additionally, in the sixth chapter, we discussed reporting, which is the best aspect of Odoo Accounting. In this chapter, we went into detail about topics like audit reports, management-based reporting, partner reports, and US GAAP reports, and provided examples of the Odoo platform.

In the seventh chapter of the Odoo Accounting book, we concentrated on the Configurations of Admin settings of the Odoo platform. In this chapter, the functions of the Odoo platform's User settings, Company settings, and Translation settings were thoroughly explained. Finally, the new accounting practice Strono Accounting and Accounting firms mode introduced in Odoo 17 is defined in this chapter.

In general, the Odoo Accounting module addressed a gap in the Odoo resource in terms of the demand for Functional reference materials for the Odoo Accounting module.