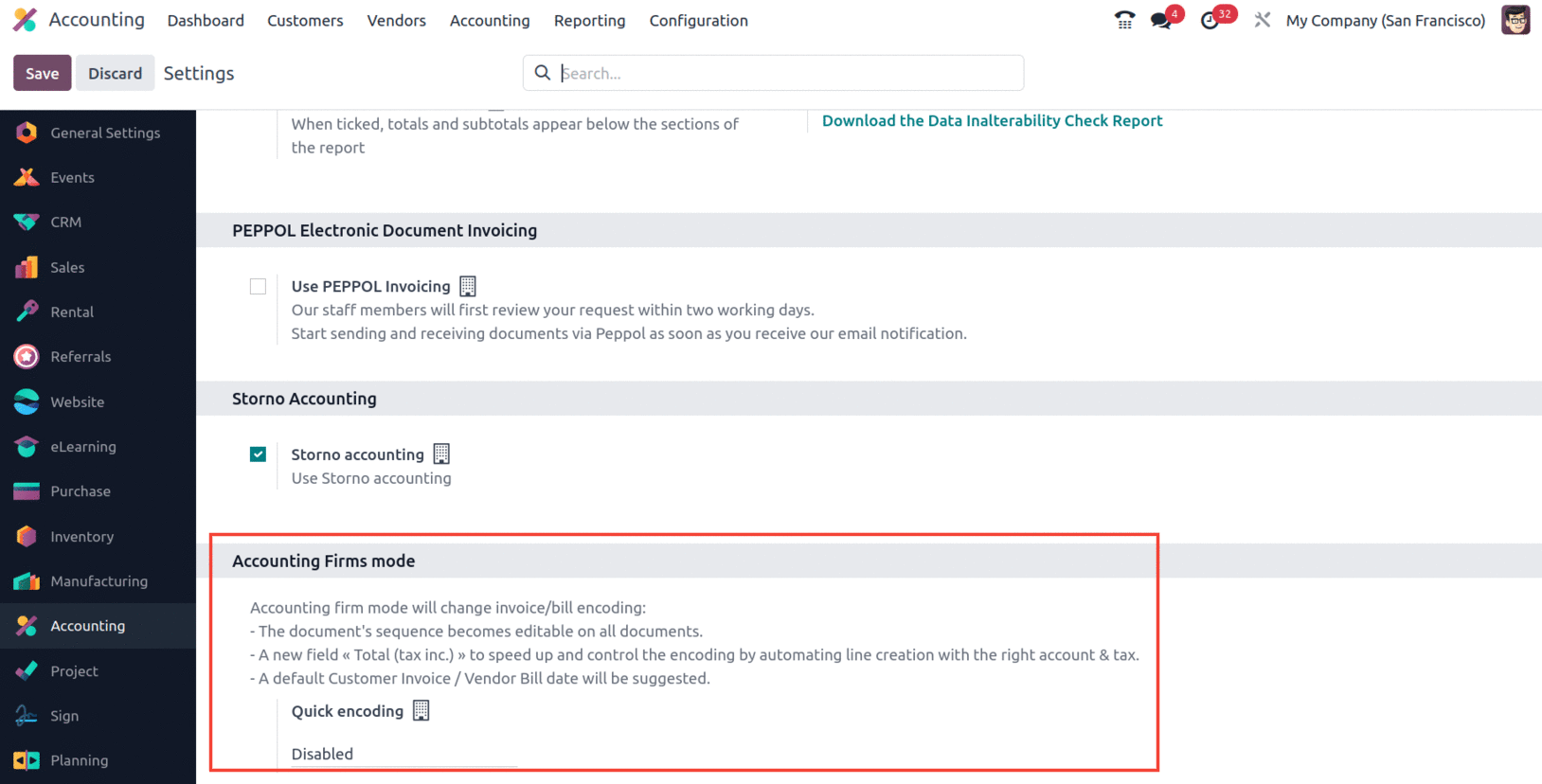

Accounting Firm Mode, another feature of Odoo 17, alters the invoice/bill encoding. Depending on the encoding, a defined sequence of documents is decided whether or not it is editable. The accounting module's configuration settings allow you to set the accounting firm mode.

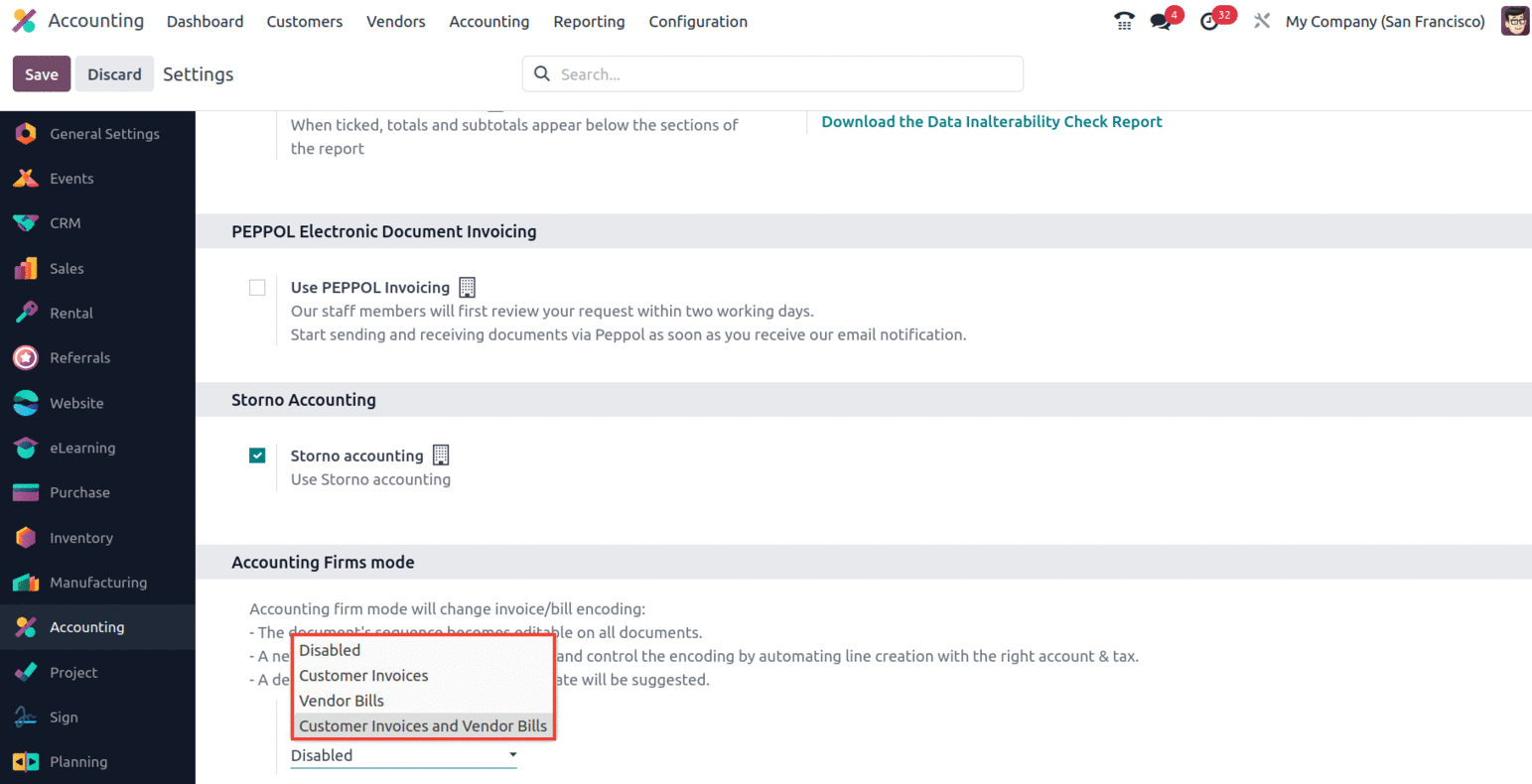

The document can be encoded under the Accounting Firm Mode section. 'Customer Invoices,' 'Vendor Bills', or 'Customer Invoices plus Vendor Bills' are all acceptable options.

Once the encoding document has been selected, save the modifications.

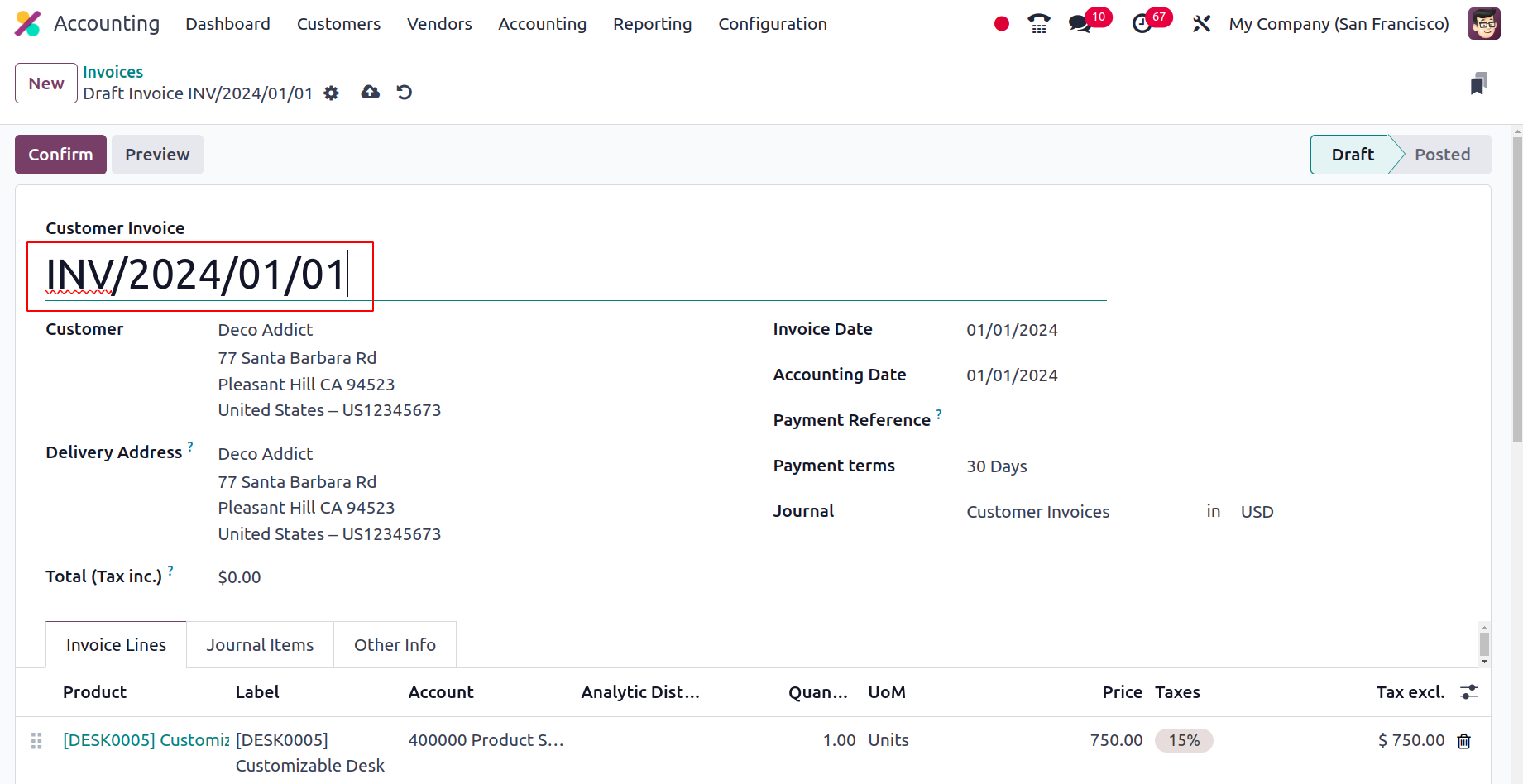

Accounting firm mode will change the encoding of bills and invoices. The sequence of the document is now customizable on all invoices and bills.

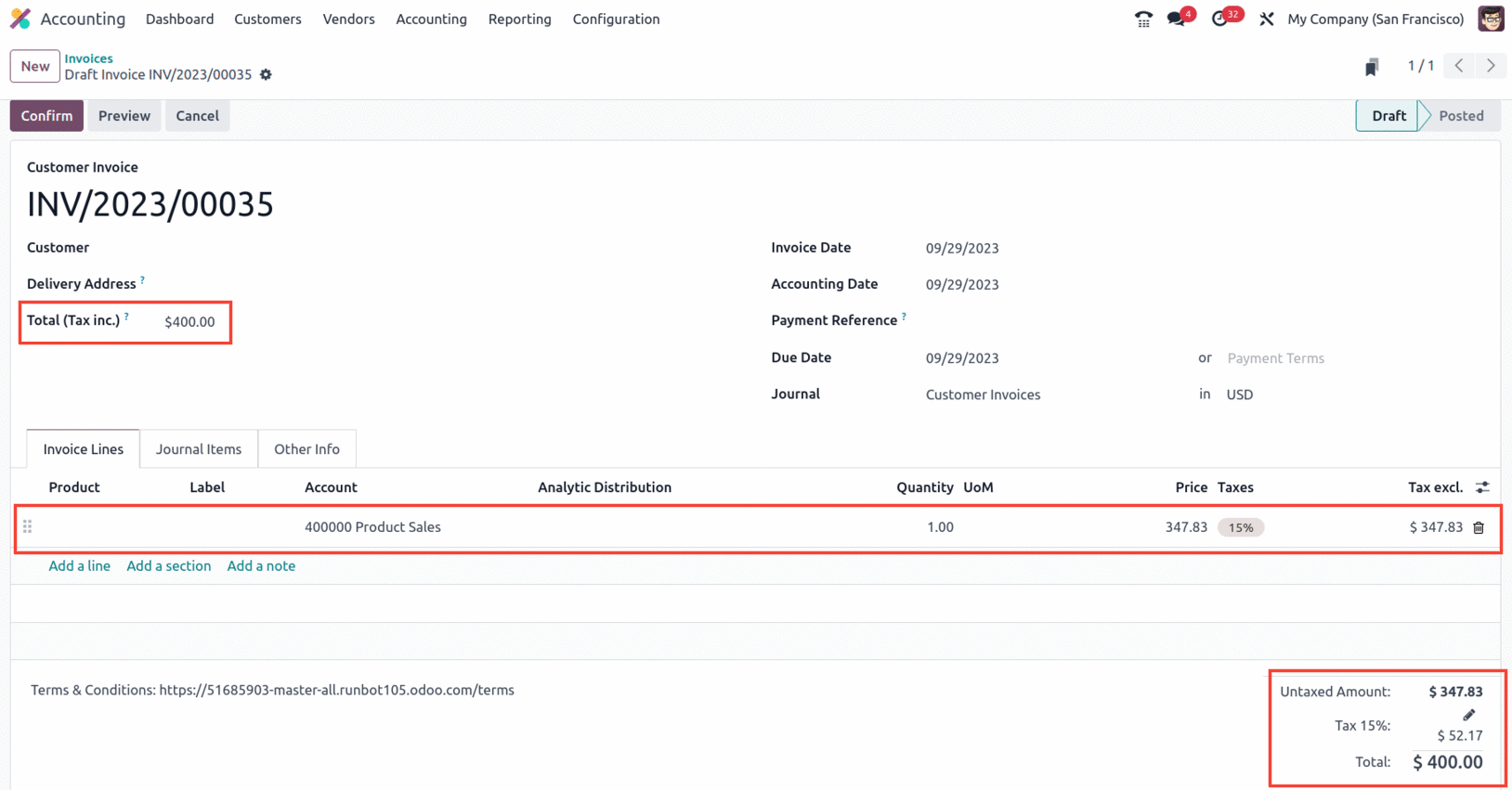

The new field "Total (tax inc.)" on the invoices and bills will appear in the document with the appropriate account and tax, speeding, and managing the encoding.

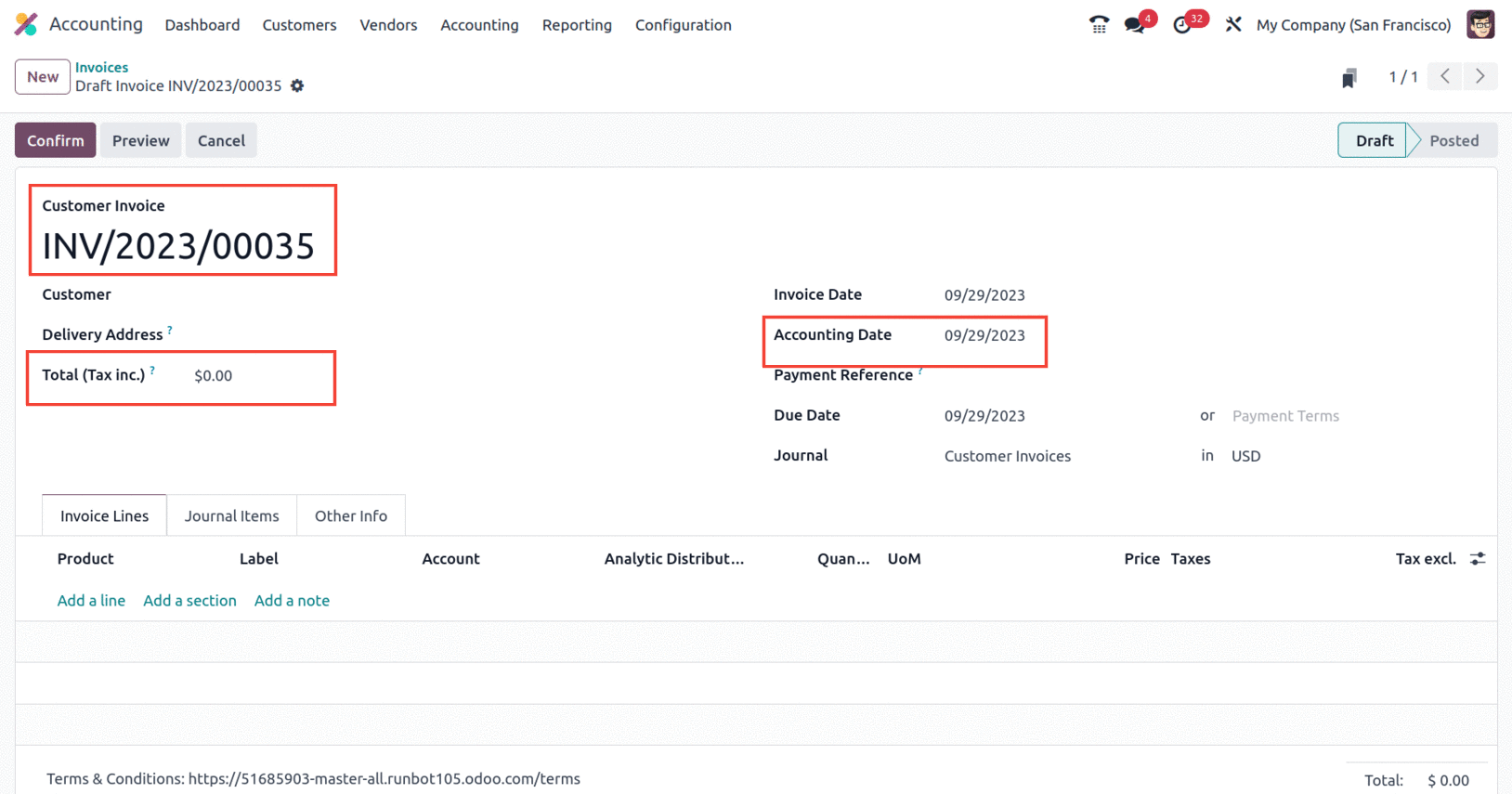

If 'Customer Invoices and Bills' is selected as the quick encoding, the sequence of these documents is customizable. It is also possible to determine the gap between the invoices/bills. So, while creating an invoice, the sequence number can be changed, and a new field, Total (tax inc), needs to be added.

The field 'Total (tax inc)' is used to encode the invoice's total amount. Odoo will automatically generate a single invoice line with matching default values. Also, the invoice date is predicted automatically.

Consider changing the invoice number in the screenshot below to INV/2023/00035 and the 'Total (tax inc)' field to $400, even if the customer hasn't been specified. The price, including taxes, is $400. As a result, a line is automatically inserted under the bills line even though there is no product present; instead, the untaxed value is 347.83, and a 15% tax is applied for a total of $400.

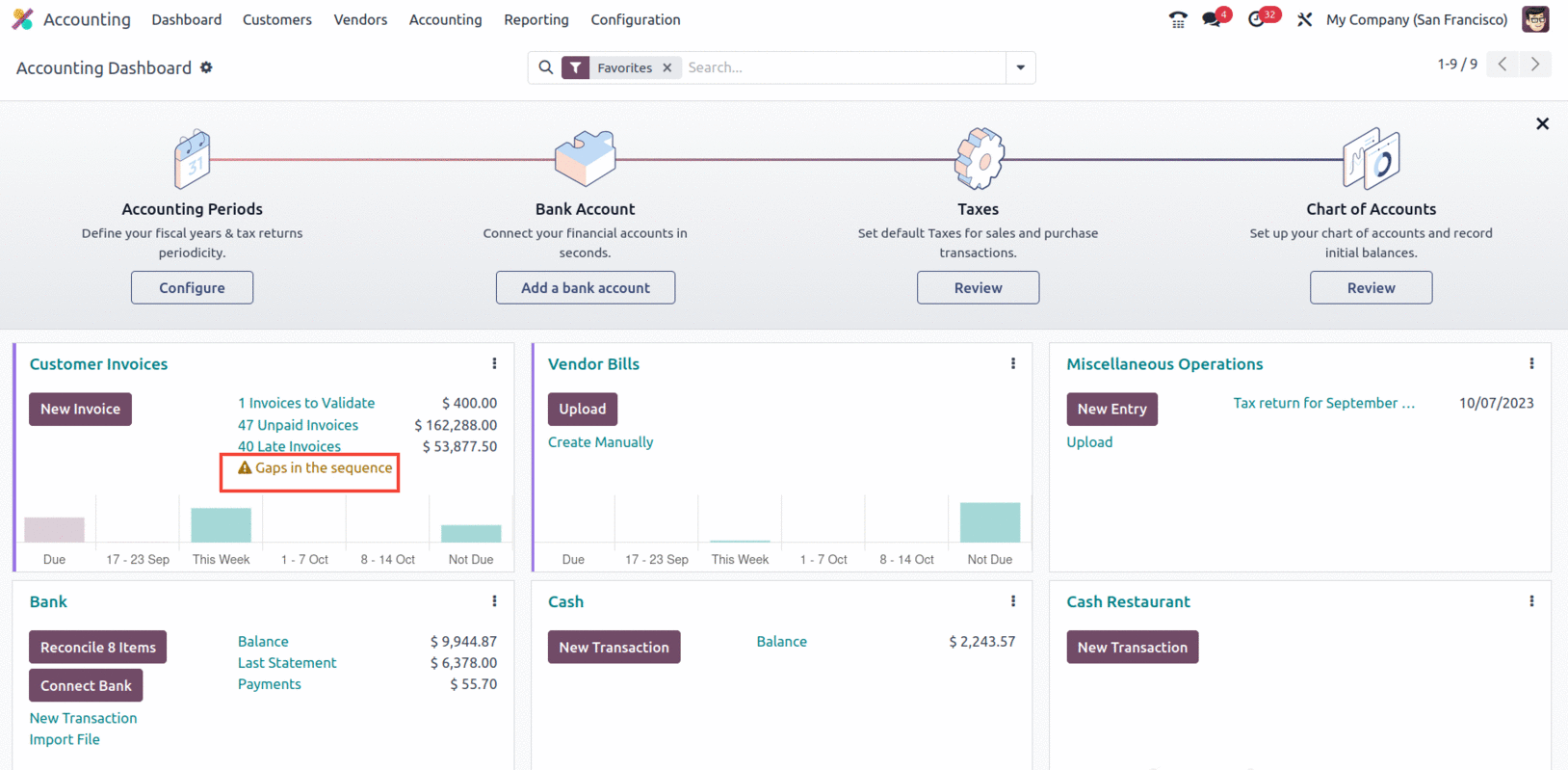

Since quick encoding documents have been selected as 'Customer Invoices and Vendor Bills' in the accounting setup settings, this will also be accessible for vendor bills. The accounting dashboard for the relevant journal will indicate any gaps in the invoice or bill sequence.

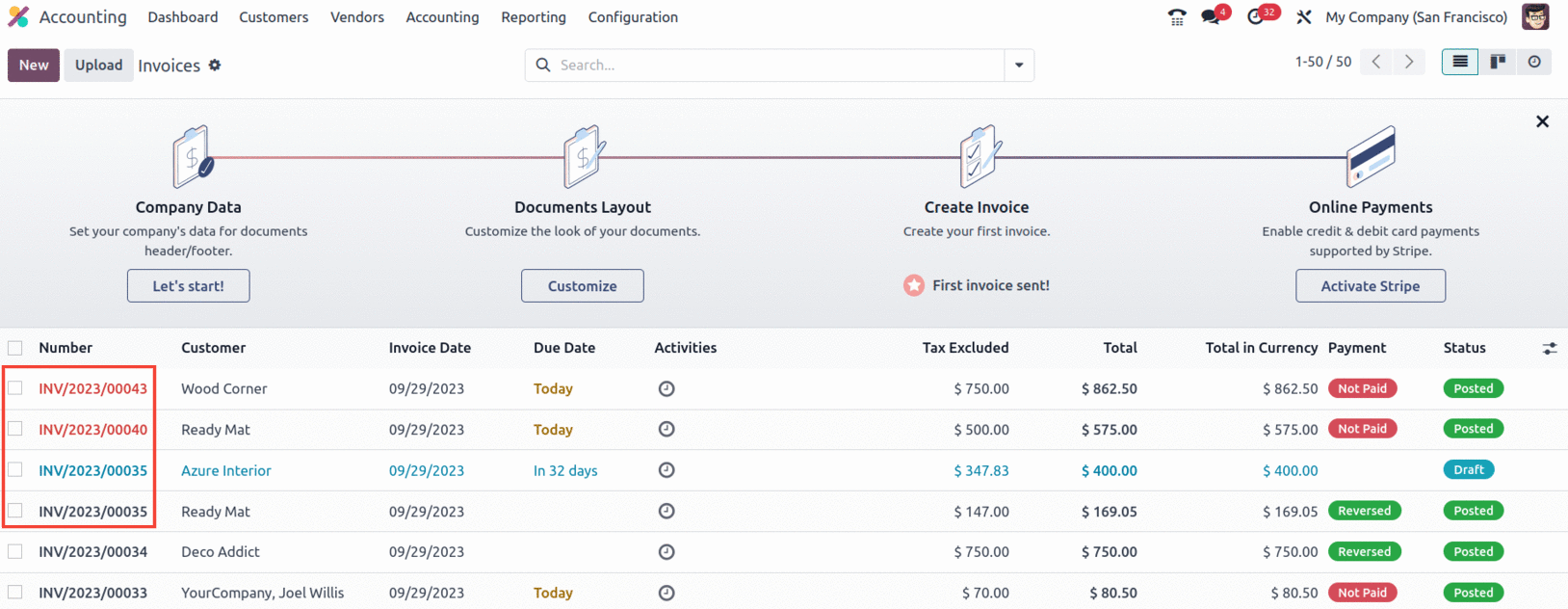

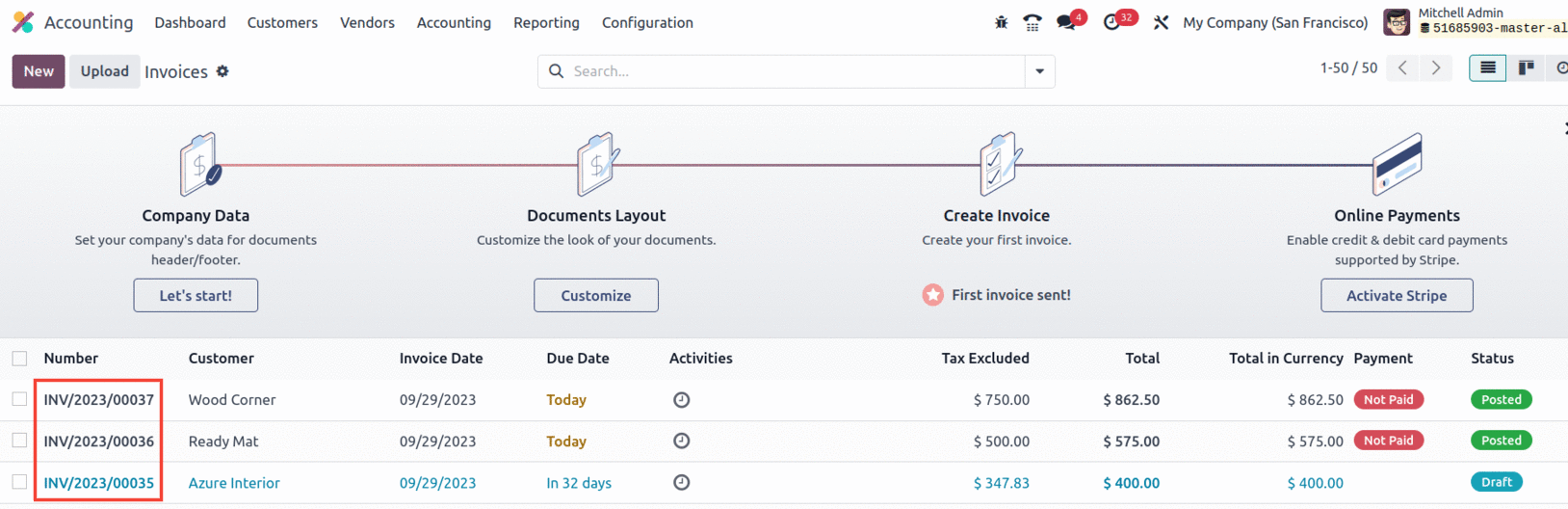

The invoices with sequence gaps will be shown in red color in the list view.

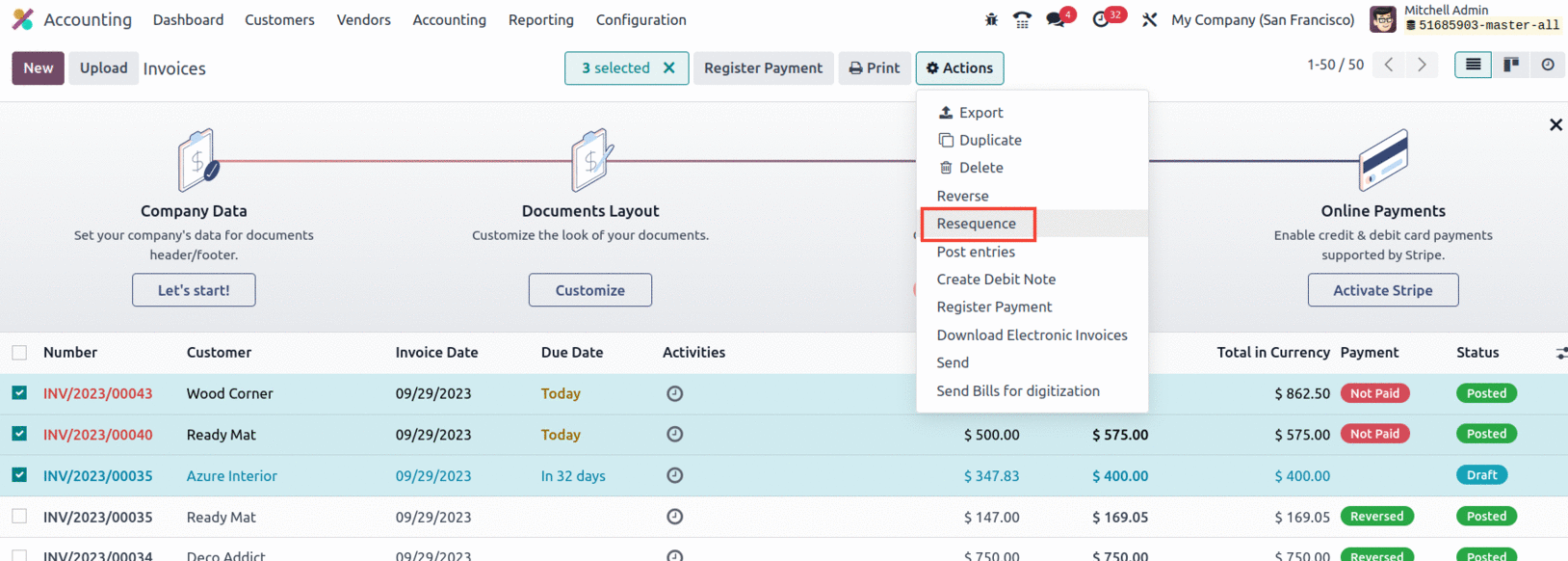

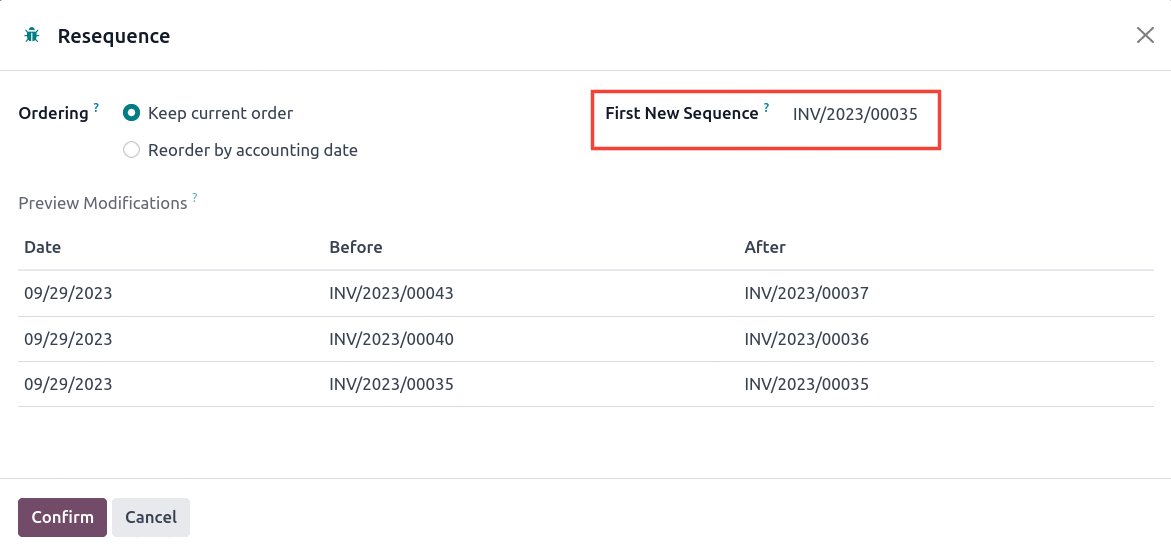

If needed, the invoice/bill number can be resequenced. Select the records whose sequence has to be changed, and the 'Resequence' option will appear in the actions menu.

When you click 'Resequence,' a pop-up window displays where you may provide information for requesting the data. In the screenshot above, the invoice number 'INV/2023/00035' is followed by 'INV/2023/00040' and then 'INV/2023/00043'. Therefore, we can resequence to fill in this gap.

We will be able to include the next sequence number in the pop-up, and so the records following the INV/2023/00035 will be modified from INV/2023/00036 onwards. Additionally, you have the option to reorder documents using the "Keep Current Order" or "Reorder By Accounting Date" criteria.

When the sequence is confirmed to be in sequential order, the accounting dashboard's sequence gap alert is also eliminated.