Storno Accounting

Storno accounting in Odoo17 is described as the process of undoing initial journal account entries by using negative values. Storno Accounting is a prevalent business practice in Eastern European nations. Storno Accounting is required in several nations, such as:

● Bosnia and Herzegovina

● China

● Czech Republic

● Croatia

● Poland

● Romania

● Russia

● Serbia

● Slovakia

● Slovenia

● Ukraine

They view storno accounting as the ideal method for reversing journal entries with negative debits and credits so that the accounting system won't have duplicate figures. The reversal can occur for a variety of reasons, such as when errors occur in the initial transaction or, when a refund must be made for the return of merchandise, etc. This accounting approach is also known as Red Storno since bookkeepers commonly write Storno entries in red ink. The accounting reports will display all such items in red.

To use these functionalities, turn on "Storno Accounting" in the Odoo 17 Accounting Module's Configuration Settings.

In general, when a transaction takes place, let's say an invoice is generated, certain ledger accounts will be impacted. Generally, when an invoice is paid, the Income Accounts are credited, and the Account Receivable is debited. If this transaction is reversed, normally, what will happen is the Income Account will be debited, and the Account Receivable will be credited. However, for Storno accounting, the Account Receivable will be a "-ve" Debit and the Income Account a "-ve" Credit for the reverse entry.

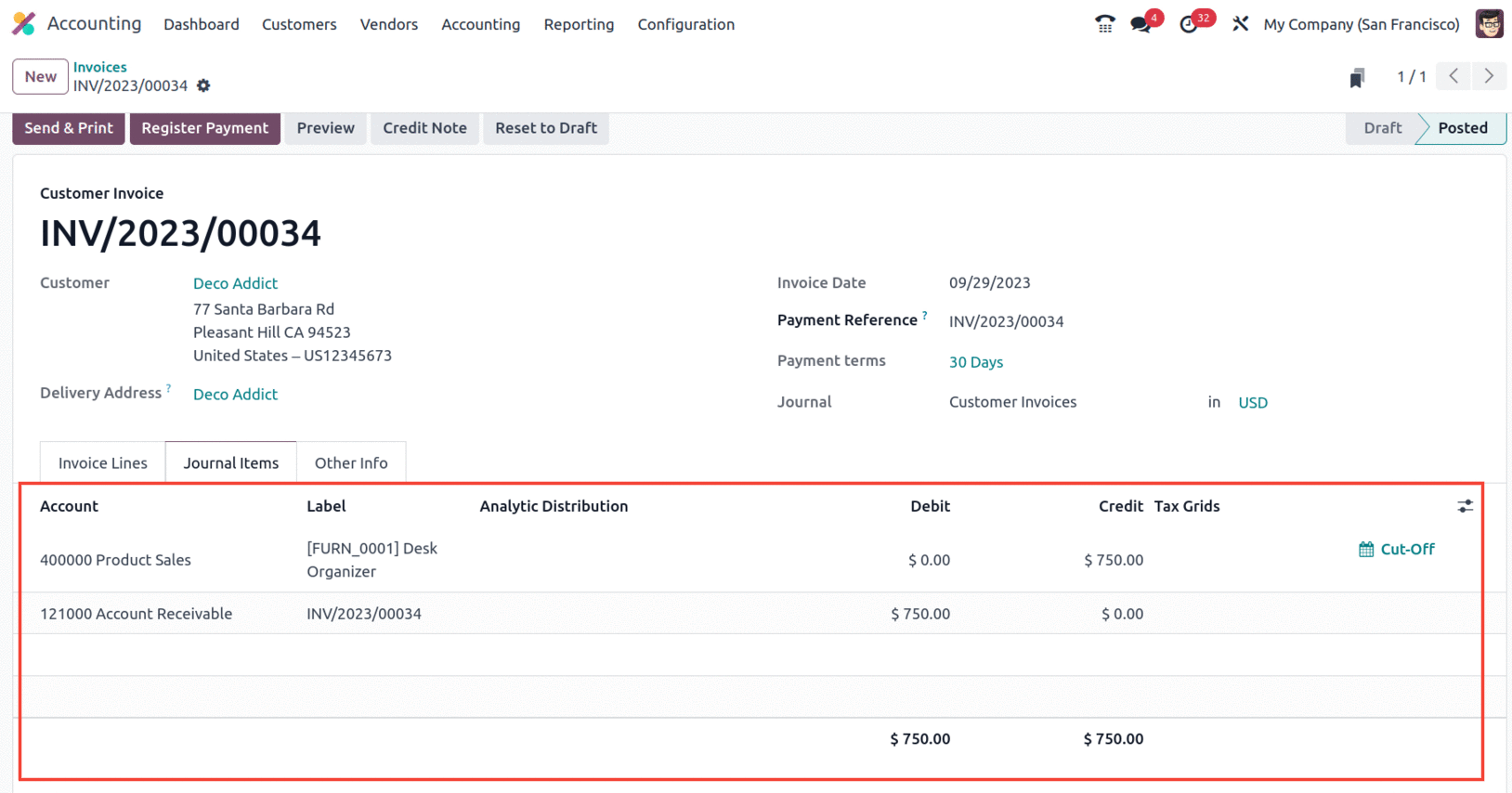

Consider the Invoice that has been added in the screenshot below.

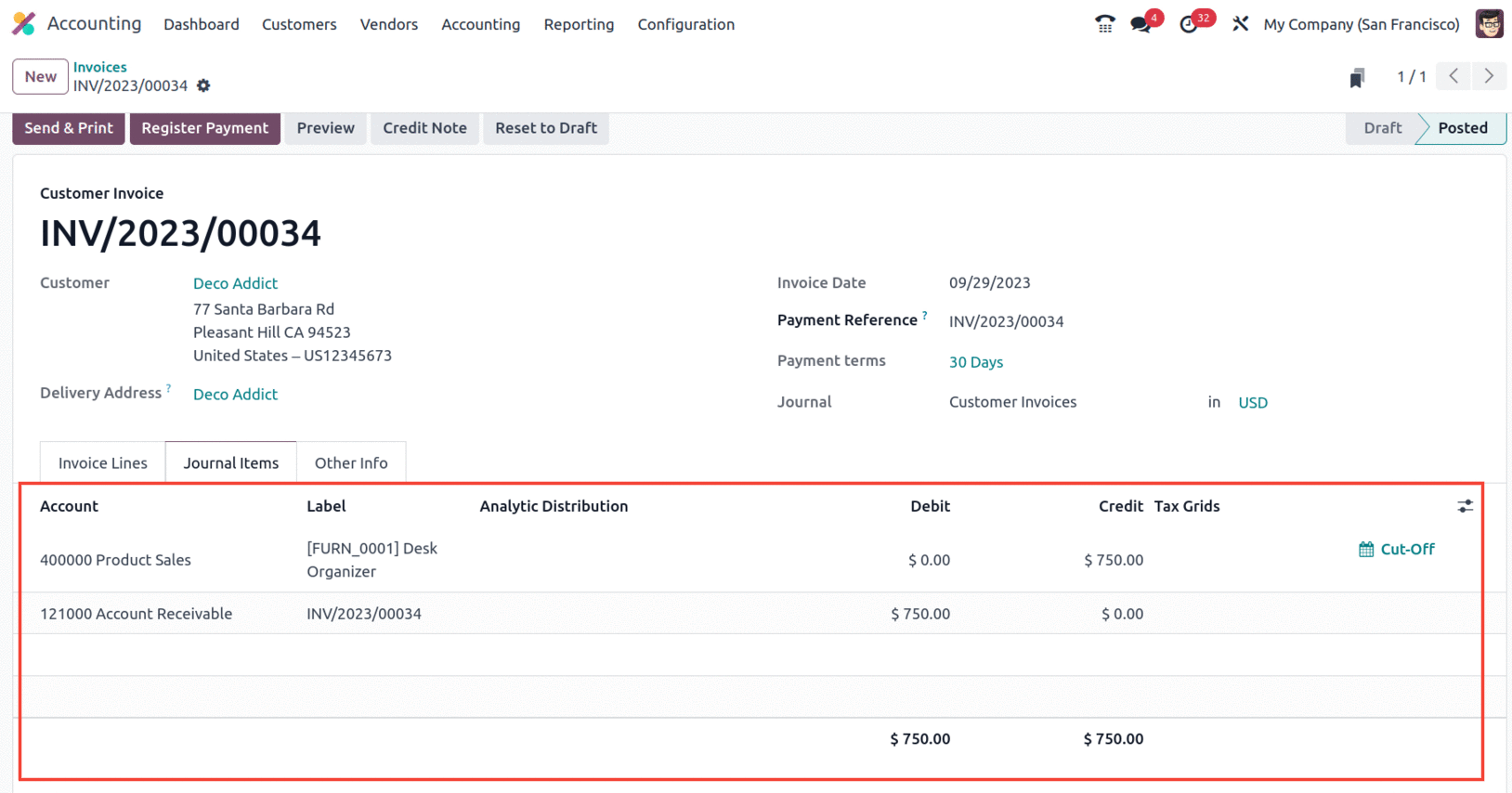

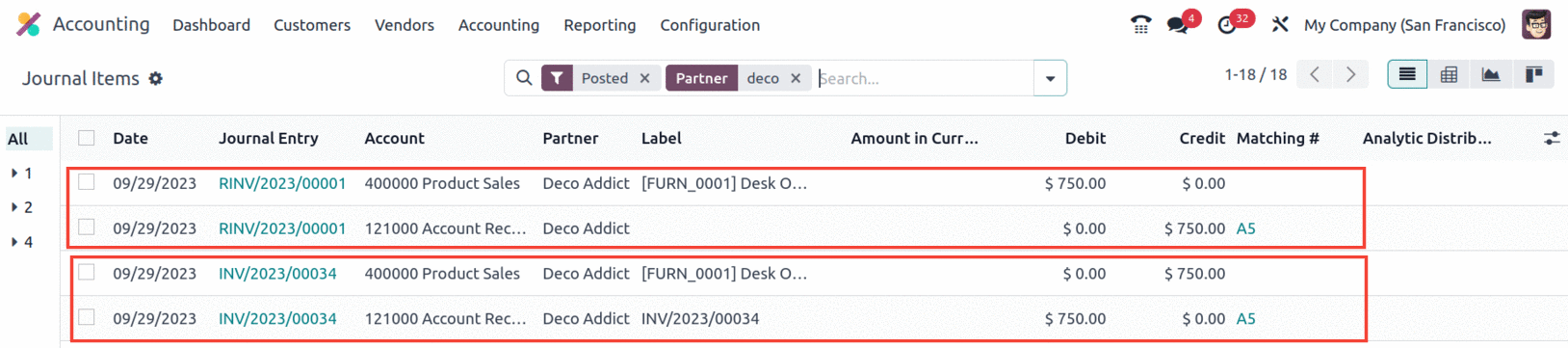

And for some reason, if this invoice is reversed, a credit note is made, posted, and recorded. Let's examine the journal entry now and how it affects each ledger.

When creating an invoice, the Income Account is Credited and the Account Receivable is Debited; however, when creating a reverse invoice or credit note, the Income Account is established as the opposite entry and is Debited and the Account Receivable is Credited.

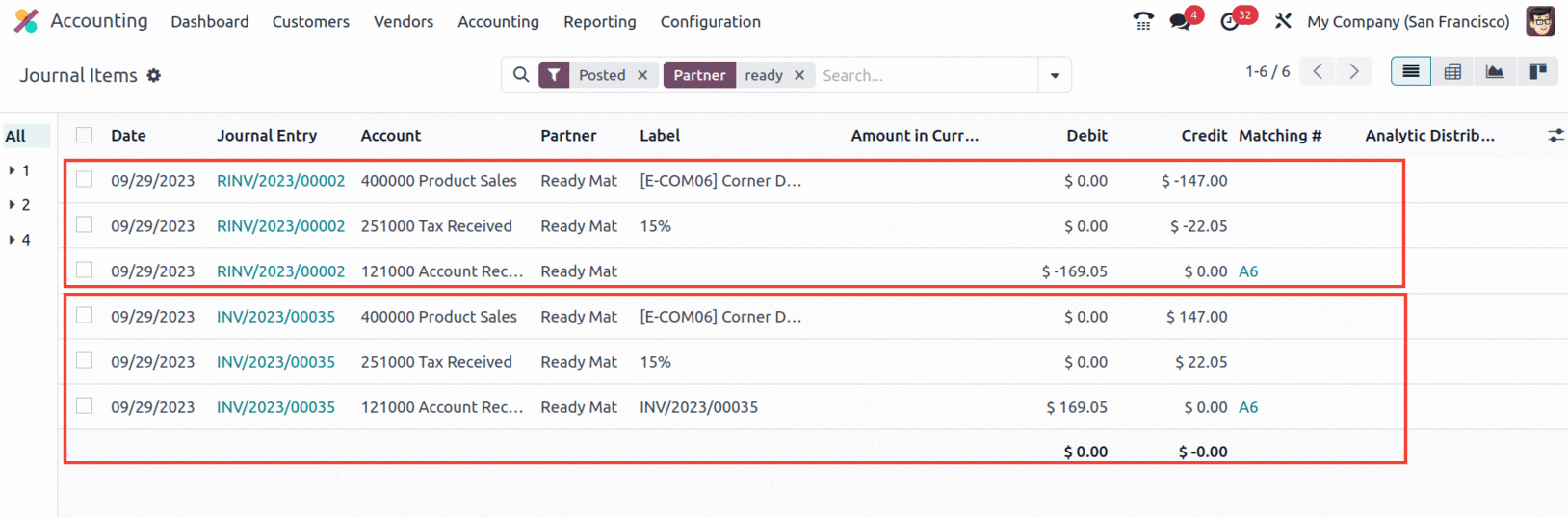

When Storno accounting is enabled, the Debits and Credits for reversed journal entries are negative. For the invoice, make an invoice and a credit note accordingly. Viewing the ledger posting in Storno Accounting is next.

In the case of invoicing, the Income Account is first credited, the Tax Account is credited, and the Account Receivable is debited. When a journal entry is reversed, the Income Account and Tax Account are credited with a negative value, while the Account Receivable is debited with a negative figure. In a nutshell, the table below displays the posting to both the regular ledger and the Storno ledger.

| | General | Storno |

|---|

| Debit | Credit | Debit | Credit |

|---|

| Invoice | Income Account | | 147 | | 147 |

| Tax Account | | 22.05 | | 22.05 |

| Account Receivable | 169.05 | | 169.05 | |

| Reverse Invoice | Income Account | | 147 | | -147 |

| Tax Account | 22.05 | | | -22.05 |

| Account Receivable | | 169.05 | -169.05 | |