The United States Securities and Exchange Commission created the Universally Accepted

Accounting Principles (GAAP), often known as. In the event of an overseas transfer,

the GAAP standardized the accounting components such as currency rates, interest

rates, and tax included in the company's business operations. In addition to import

and export taxes, each country has its own national tax. Furthermore, GAAP is a

widely accepted standard or procedure for documenting and disseminating accounting-related

information inside an organization. A policy board established these guidelines.

This standard strategy will ensure that all components of the company's accounting

are documented, as well as that paperwork is analyzed and generated. Three fundamental

ones are required for the operation of any business.

The GAAP-based report-generating features are provided by default in the Odoo Accounting

module since they are needed for any firm operating anywhere in the world. Additionally,

under the Odoo Accounting module's unique Reporting page, you will have a new menu

that will aid you in preparing and saving all US GAAP reports. In the Odoo Accounting

module, you may automatically generate US GAAP reports like profit and loss statements,

balance sheets, executive summaries, cash flow statements, and cheque registers.

In the sections that follow, we'll go through each of the US GAAP reporting options

available in the Odoo Accounting module in greater depth.

Balance Sheet

The balance sheet, which provides an in-depth overview of the company's assets,

liabilities, and shareholders' equity, is the second most important document in

regard to the business's accounting activities. It may also be defined as a balance

summary of an individual's, a corporation's, or an organization's financial activity

that provides comprehensive information on the total reached as well as transactions

and depreciations during a fiscal year of business operations. The balance sheet

of an organization is described for each fiscal period as well as whenever necessary.

Furthermore, these reports will provide up-to-date information on the company's

financial activities and will be critical in directing financial management decisions.

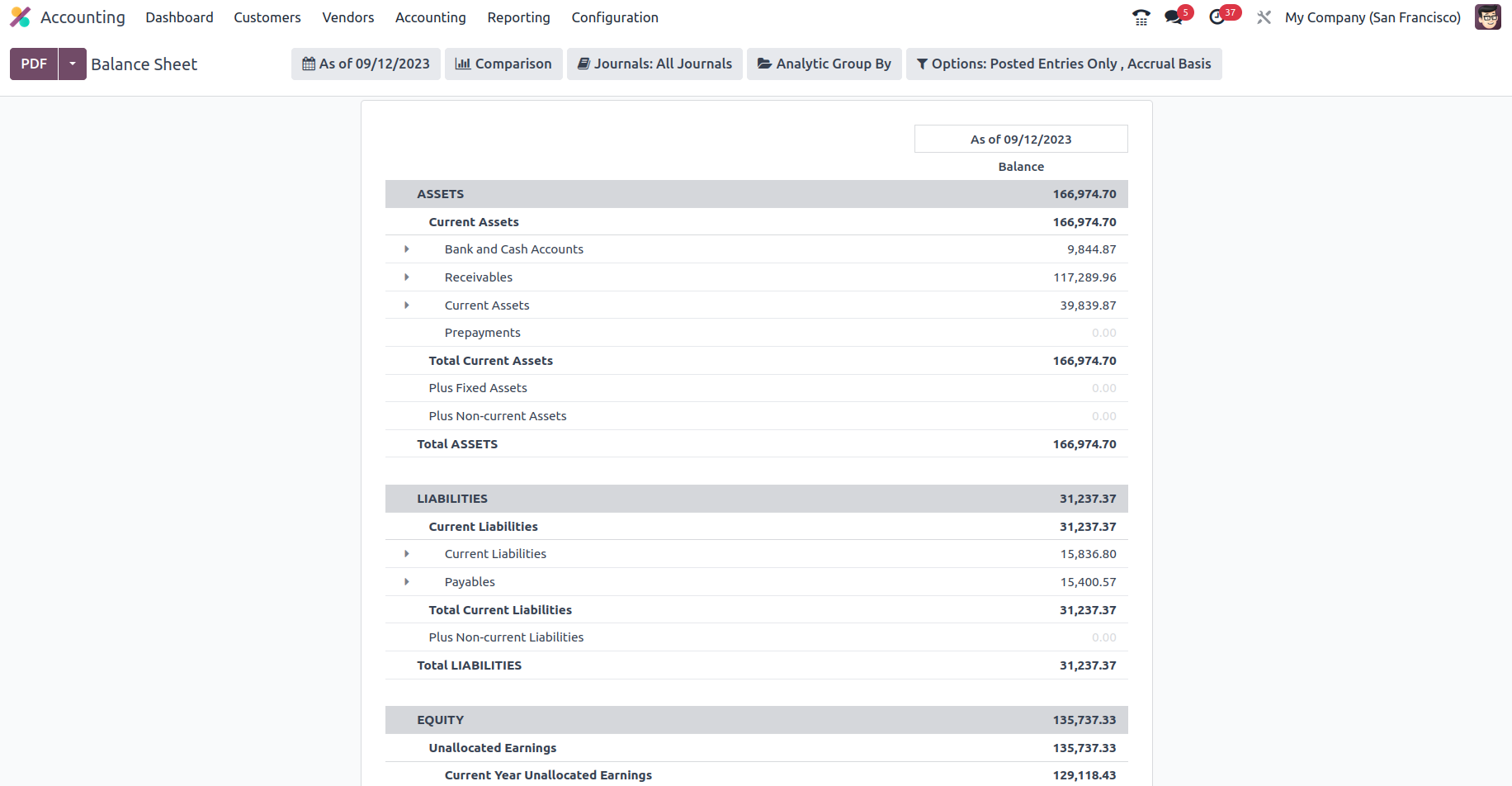

The Odoo platform has a delicate menu that will enable you to prepare financial

reports for the organization, including a balance sheet. You may examine the Balance

Sheet menu, which is available via the Odoo Accounting module's Reporting menu,

as shown in the picture below. The balance sheet's assets, equity, liabilities,

and other components are all presented in separate sections here, along with their

corresponding quantities and components, such as bank and cash accounts, receivables,

and current assets or liabilities. You will have access to filtering, grouping,

and comparison capabilities, as with all other report-generating menus in the Odoo

Accounting module. Filtering can be done here based on the fiscal year or duration

of operation.

Additionally, based on the needs, Journals, Analytical accounting components, Posted

and Unposted articles, and others may be selected and aggregated. Furthermore, the

Comparison tool allows you to compare the Balance Sheets of one fiscal year with

those of another fiscal year, providing you with detailed information on the company's

depreciation progress. You won't have any issue comprehending it because they have

the same options and procedures. The preceding report described in this chapter

contains information on the setup aspects of these Filtering, Grouping, and Comparison

tools.

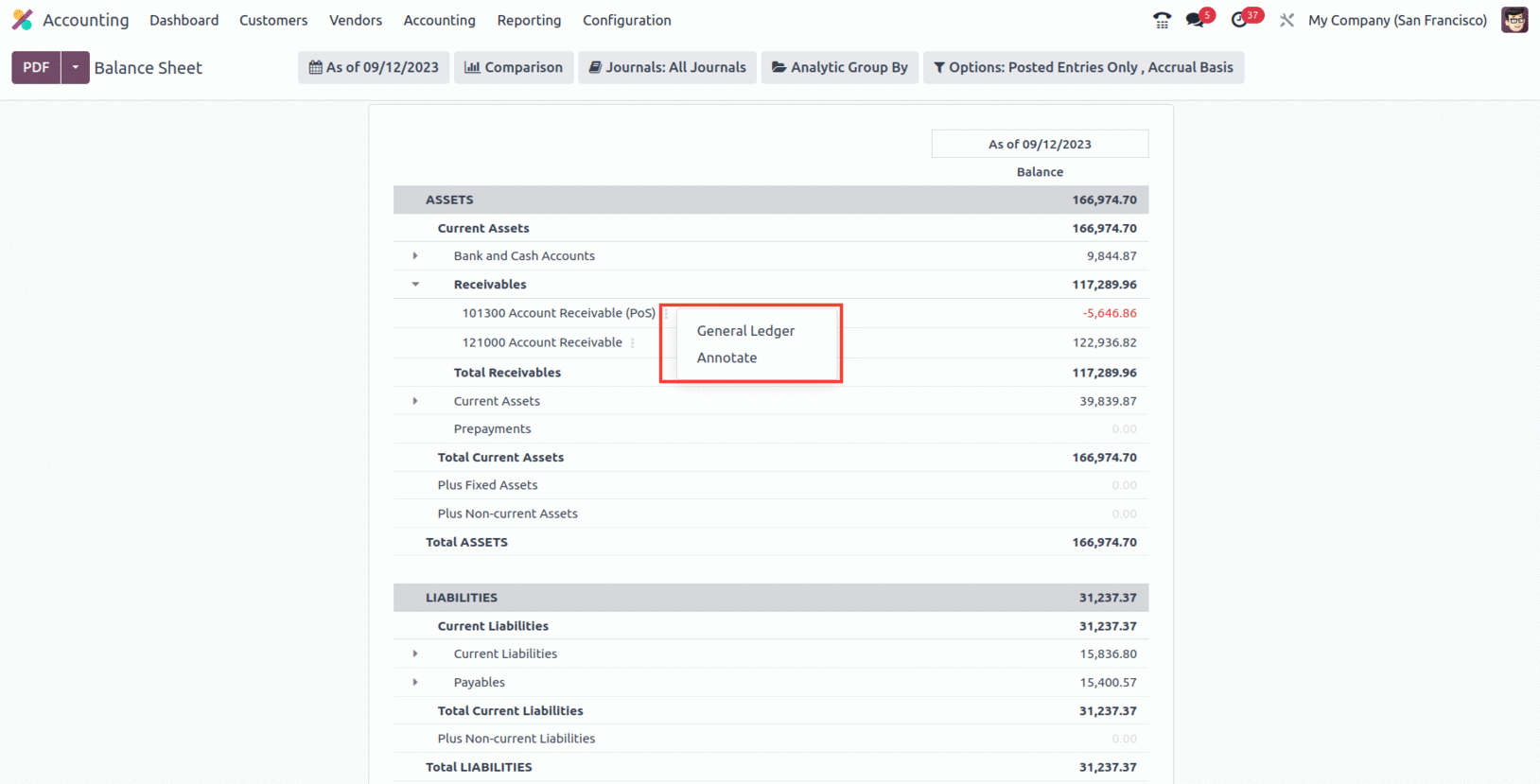

After selecting the drop-down option featured in the detailed entries, you will

notice two menu options: General Ledger and Annotate.

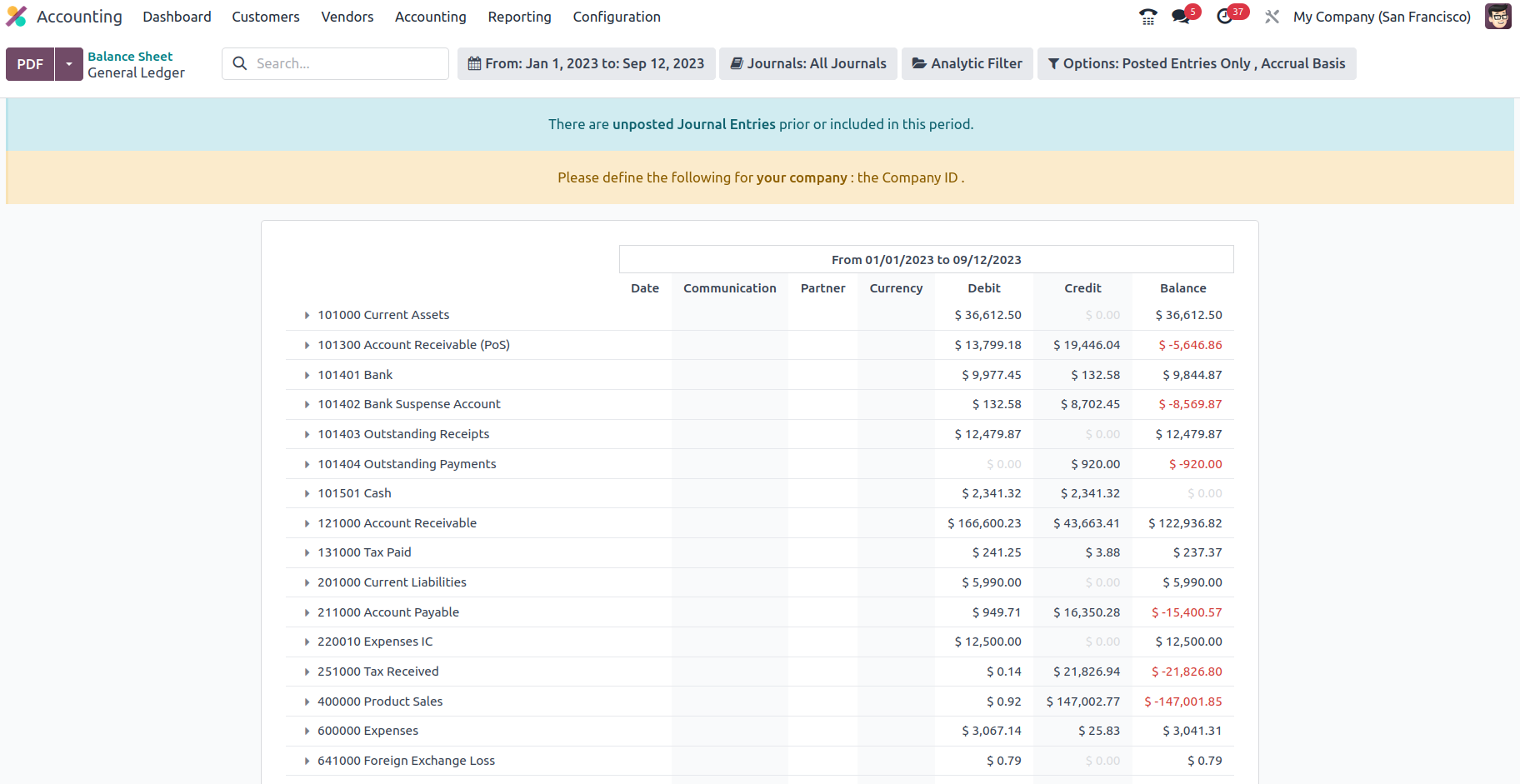

Let's start with the General Ledger option, which will display the ledger details

of the necessary entry immediately from the Balance sheet, as shown in the image

below. Filtering and the Group by option are both accessible here, as they are with

all other reporting options on the Odoo platform. You will also have access to a

save option, which enables you to save the General Ledger depending on the configuration

aspects that are being done, as well as a search option, the ability to examine

Print Preview and export the entries, and other features.

After unfolding, the Journal Items are available from the drop-down menu for each

ledger. As seen in the picture above, you will view the journal entries for the

appropriate entry. You may also sort the defined components using the Filters and

Group by options, which are available by default. Custom entry-based filters and

grouping options may also be implemented and saved as favorites for future usage

of the same filtration and grouping.

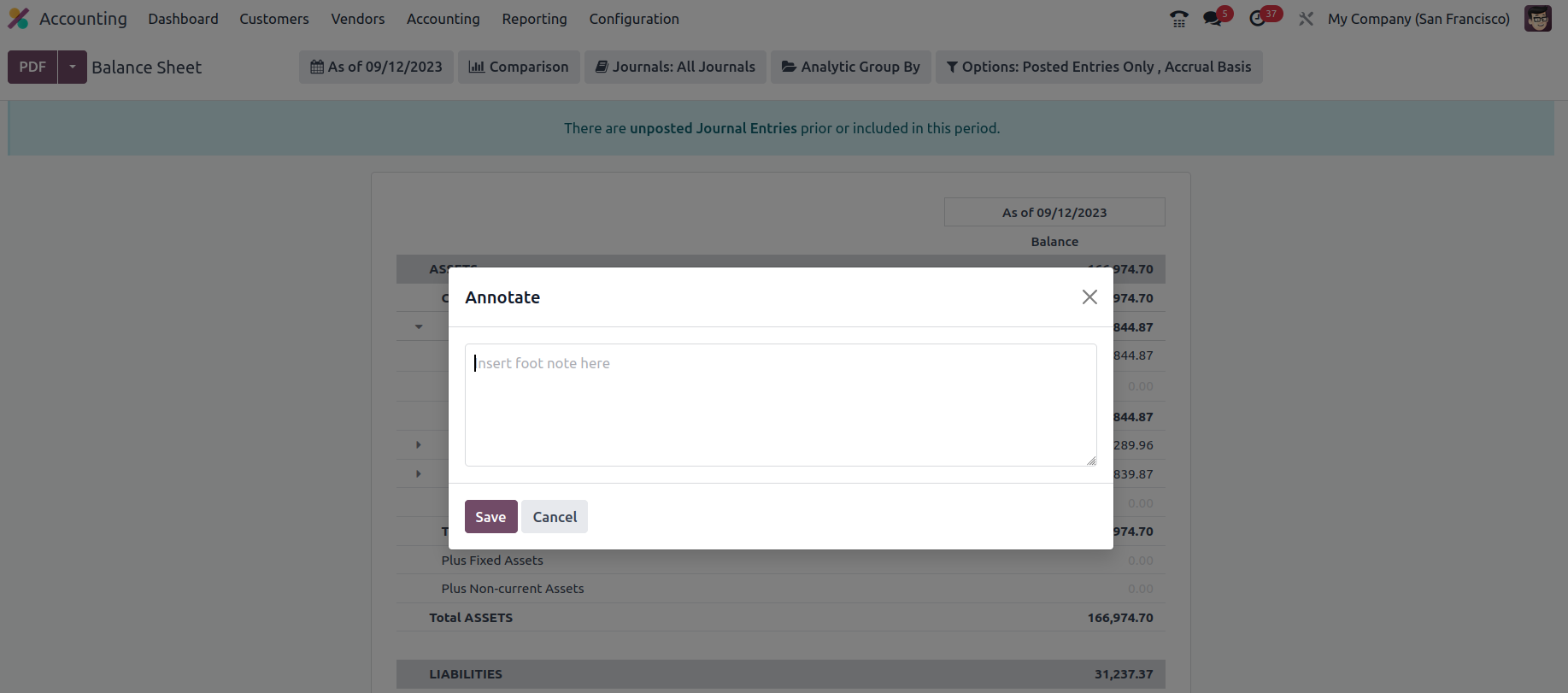

After selecting the Annotate option from the Balance Sheet, you will get a pop-up

window similar to the one seen in the picture below. You can provide descriptions

for the annotating that has to be done before storing it in this area. Furthermore,

the Annotation can be deleted using the given delete option.

The balance sheet of a company accounting is critical to the financial management

positions of the business, and you can quickly produce and see the balance sheets

of any fiscal users of the company operations using a specialized tool like the

Odoo Balance Sheet reporting. Now that we've covered the Odoo Balance Sheet reporting

menu's components let's move on to the part where we'll go over the Odoo Profit

and Loss reporting menu under the US GAAP Reporting tools.

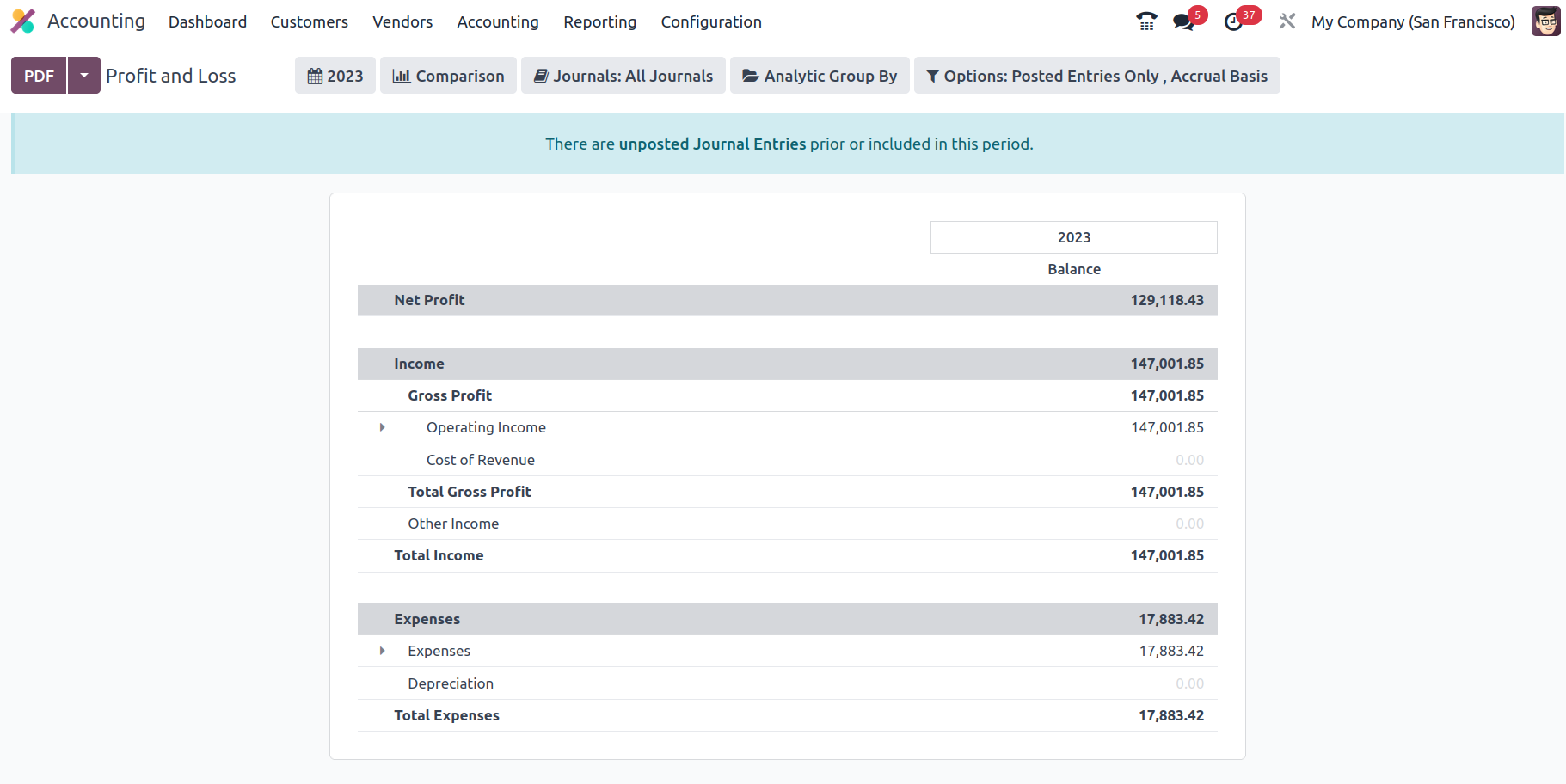

Profit and Loss Reports

Profit and loss statements are the fundamental US GAAP-based reports that each firm

will generate. Profit and loss statements will detail the company's financial activity,

as well as whether the firm is profitable or losing money. Profit and loss statements

are essential components of every business's accounting activity, and the Odoo platform

recognizes this. As a result, the Odoo Accounting module includes a separate menu

for creating Profit and Loss Reports. Profit and Loss Reports are accessible from

the Odoo Accounting module's reporting menu; choosing them will display the report

seen in the following picture.

The report will display all revenue, costs, and the net value of profit or loss,

as seen in the screenshot below. Under the Profit aspect, the Gross Profit information,

such as Operating Income and cost revenue, will be reviewed. A second section will

be included to address the chosen Other Income. Additionally, Expense data such

as the company's Expenses and the Depreciation expense-based value will be given.

Each Chart of Accounts related to the defined feature will be shown, providing you

with further information.

Filtering, grouping, and comparison features will be available in all other Odoo

platform reporting menus. Filtering can be done here based on the fiscal year or

duration of operation. Furthermore, the Journals, Analytical accounting aspects,

and Posted and Unposted items may be selected and categorized based on the requirements.

Furthermore, the Comparison tool allows you to compare the Profit and Loss Reports

of one fiscal period with those of another, providing you with detailed information

on the company's depreciation progress. Research is essential to comprehend the

organization's future plan.

The Profit and Loss Reports of a company play an important role in the financial

management operations of the company, providing a clear picture of the company's

track record in the past and an insight into the future, allowing you to plan your

budget and other financial operations in regards to the company functioning properly.

Now that we've covered the Odoo Accounting module's Profit and Loss Reports menu,

let's move on to the next part, which covers the Cash Flow Statement reporting features

of Odoo Accounting.

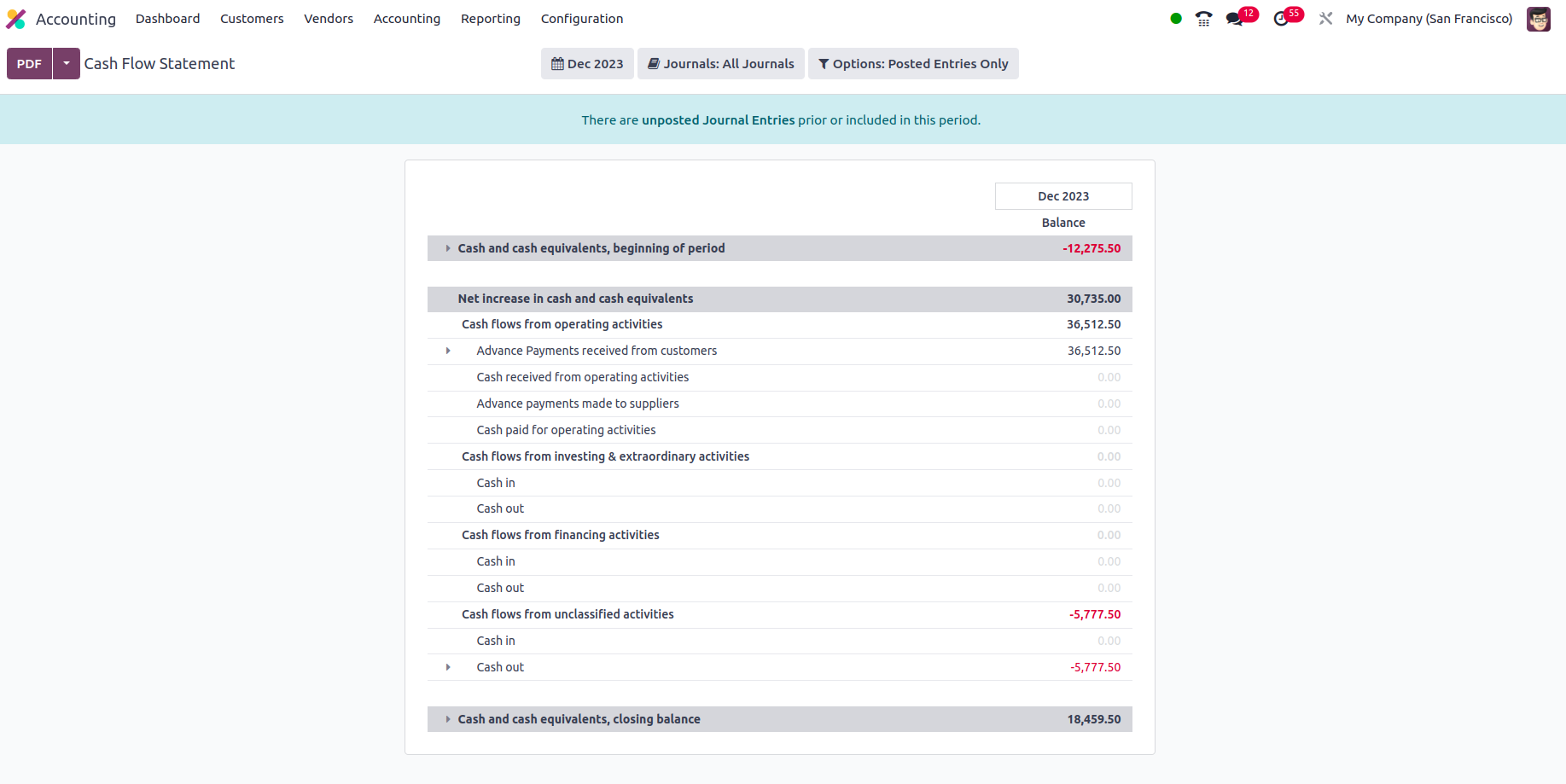

Cash Flow Statement

In company operations, you must understand where your money goes and how it is spent.

The same is true in your case. The Odoo platform includes a specialized management

solution in the Accounting module for managing the business's cash flow. You will

be able to grasp the numerous features of cash flow and the channels of your business

operations where it has been utilized in this section. There is a specific Cash

Flow Statement accessible in Odoo reporting parts of financial operations that will

define your company's cash flow activities. The Cash Flow Statement, which is accessible

via the Reporting tab of the Odoo Accounting module, will display the features of

cash flow (both cash in and cash out of the company) in the form of a report, as

depicted in the following screenshot.

The various aspects of the cash flow will be depicted here, such as Cash and cash

equivalents, the beginning of the period, Net increase in cash and cash equivalents,

and Cash and cash equivalents, closing balance, providing a clearer picture of how

the profits, as well as the money involved, is used for the business. These reports

will benefit investors since they will be able to grasp all areas of the cash flow

firm as needed. Filtering and Grouping capabilities are accessible in the Cash Flow

Statement window, as they are in all other Odoo Accounting Reporting menus. Here

you may select the Fiscal Periods and Journals that must be presented in the Cash

Flow Statement. Furthermore, the Entries may be specified based on both posted and

unposted ones using the unique filtering options that are accessible.

Furthermore, the cash Balance associated with each transaction will be defined on

the right side of the menu. You will be able to drop down the description of the

Cash Flow Statement and view the three menu options available, which are General

Ledger, Journal Items, and the Annotate option, which will help you to view the

respective menus as available in many of the reporting menus previously discussed

in this chapter. Furthermore, if we add a Customer Payment through Accounting Module

> Customers > Payments, it will be added to the line Advance Payments received from

Customers, and once some amount is matched with invoices, it will be shown under

Cash received from operating activities. Similarly, Vendor Payment and bill fall

under Advance payments made to suppliers and Cash paid for operating activities,

respectively.

The Odoo Accounting module's Cash Flow Statement Reporting menu is an excellent

tool for understanding the cash flow components of your organization as well as

the balance amount involved. Now that we understand how the Cash Flow Statement

report works, let's move on to the next part, which will discuss the Executive Summary

reporting option.

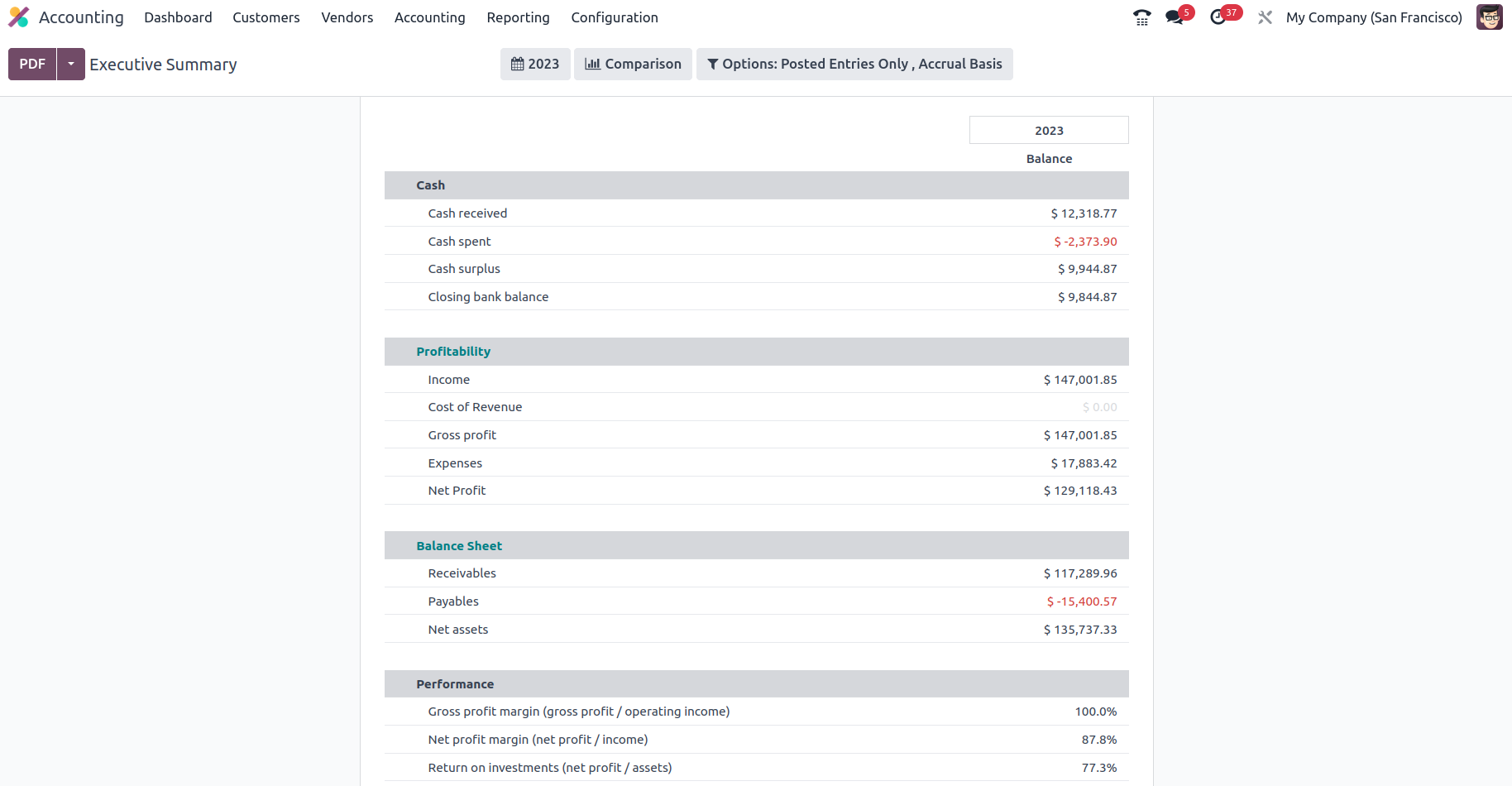

Executive Summary

The Executive Summary of a company's accounting will offer a thorough summary of

the company's financial activities for the whole fiscal period. Furthermore, it

explains the comprehensive estimate of the minute details of the company's financial

activities for executives and investors. The Executive Summary will be utilized

to provide a thorough overview of the company's financial management and operational

strategy.

The Executive Summary reporting option in the Odoo platform may be accessible from

the Reporting tab of the Odoo Accounting module, which will display a report of

how the firm runs, as seen in the picture below. The different parts of the company's

operations will be explained here, including cash operations, profitability, balance

sheet, profitability data, and many more. Furthermore, the structure and subject

employed in the Executive Summary may be divided into two categories: performance

and position. In the case of performance-based elements, we will have the Gross

Profit Margin, which is the total of all direct costs incurred while making a direct

sale. The Net Profit Margin is the total of the Gross Profit Margin plus the company's

fixed overheads, which include rent, energy, other utilities costs, taxes, and many

more in relation to a single transaction. Furthermore, the Return on Investment

is the comparable ratio of the Net Profit to the amount as well as the assets used

to produce the profit.

Furthermore, the position-based phrases in the Executive summary will offer information

on the financial holdings and the status of the sale or the entire firm. The average

debtor days is the number of days it takes your customers to make a payment. The

Average creditor days will provide the average number of days utilized to credit

the amount due for vendor invoices. Furthermore, the Short-term cash prediction

is a forecasting tool that provides insight into the monies that will travel in

and out of the accounts. Furthermore, the Current assets to liabilities ratio is

a ratio of current assets to obligations that may be converted to cash within a

year. Additionally, the elements of financial operations related to each of these

divisions will be outlined together with the money invested in them.

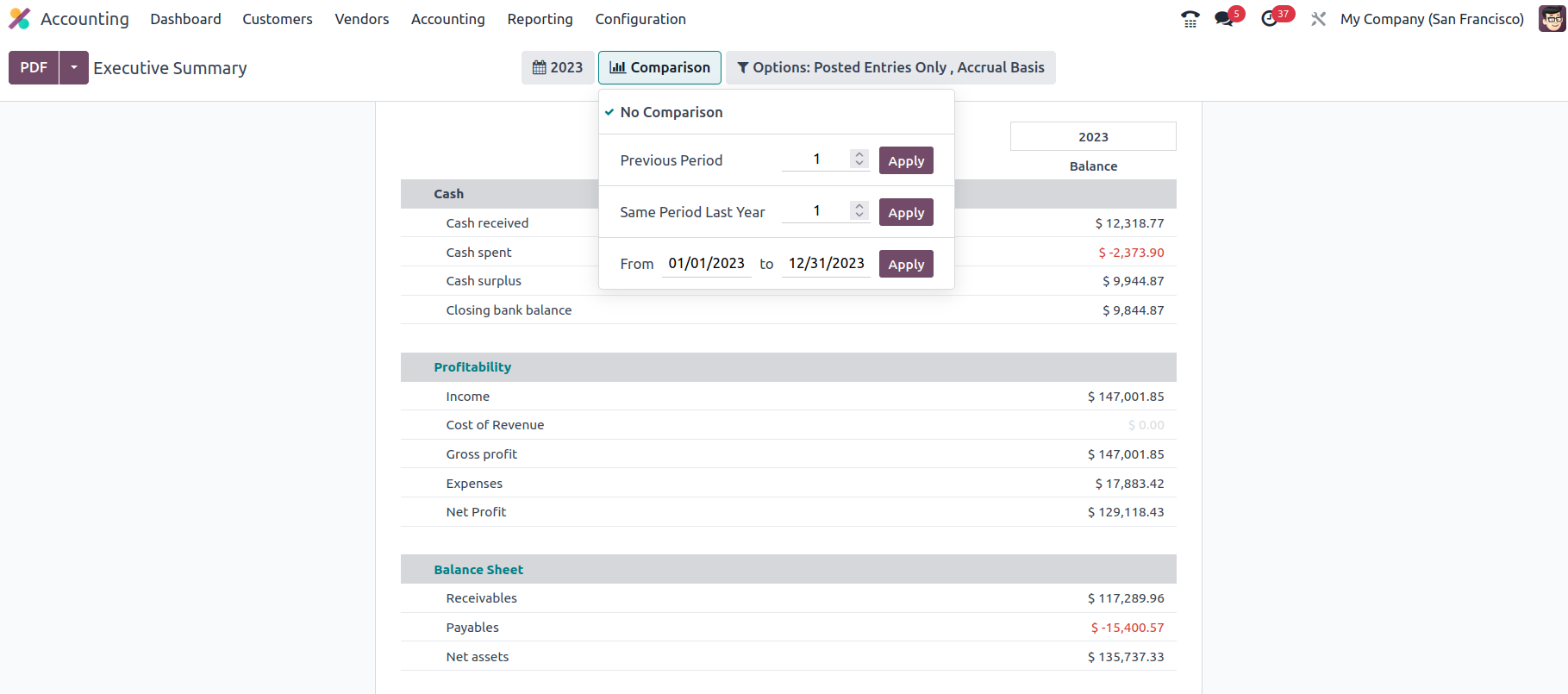

There are filtering and grouping options available to assist with the sorting out

operations of the Executive Summary entries that have been defined. You will be

able to group by fiscal periods of operation and posted entries. Furthermore, the

available Comparison choices will allow you to compare the Executive Summary information

of the company's financial operations from one fiscal period to another, as seen

in the image below. There will be several default comparison choices, including

the Previous Period and the Same Period Last Year. Furthermore, the Custom Comparison

options may be established depending on the situation.

The Executive Summary of a company's financial operations will provide a complete

understanding of the company's financial operations and can be used as study material

to understand the previous history and current track of operations, which will help

management make and take decisions accordingly. Now that we've covered the Executive

Summary reporting option on the Odoo platform let's move on to the next section,

which will cover the Tax reports.

Tax Report

Taxes and how they are applied in business, which is carried out all over the world,

are inescapable factors. As a result, companies like to keep a close eye on how

these taxes are applied to their financial operations since governments all around

the world falsify records to guarantee that taxes are paid on time and accurately.

Section 3.1.2 Configuring Taxes in Chapter 3 of this book gives a thorough description

of the Odoo Accounting module's dedicated Tax Management window. You can read the

appropriate sections of the book's past to discover how tax management operations

for a business in Odoo are carried out.

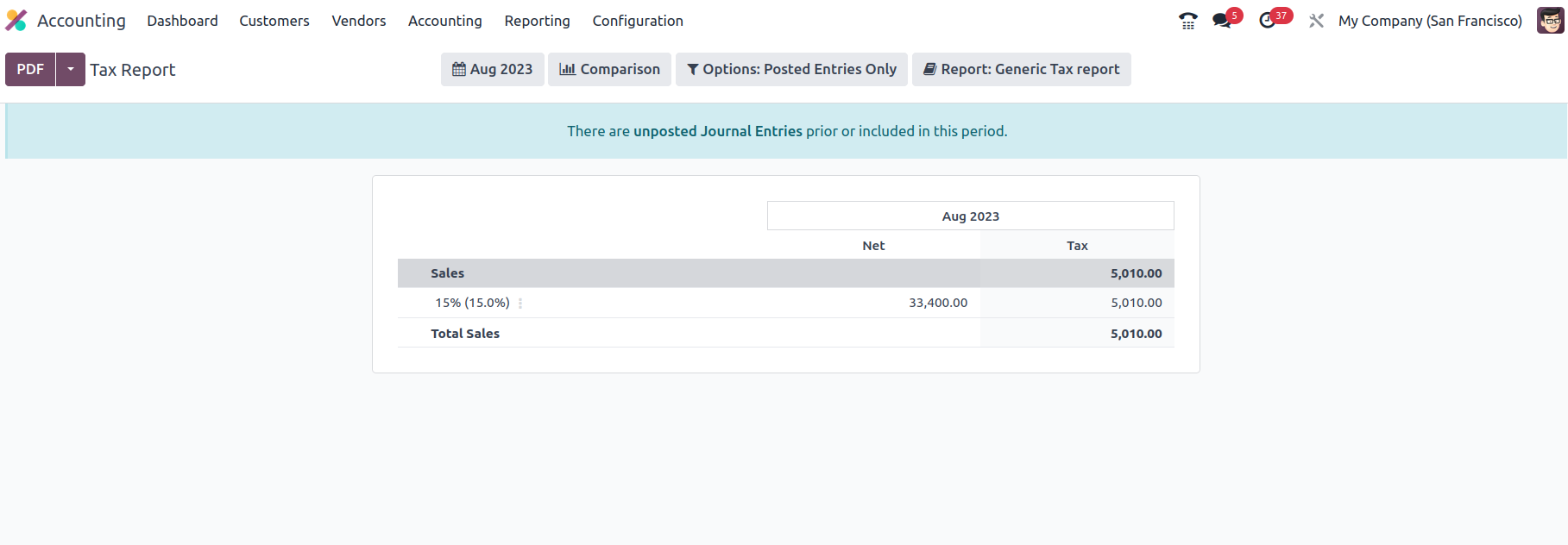

There is a Tax Report option accessible from the Reporting tab of the Odoo Accounting

module for reporting purposes on taxes connected to the financial activities of

organizations using Odoo. The screenshot below demonstrates how all financial features

in regard to the defined taxes will be shown, along with the operation, the Net

worth of money, and the tax amount. There are also buttons for printing reports

in PDF and XLSX formats. Another configuration option allows you to store the Consolidated

Journals report after the Filtration Group.

In addition, there is a closing journal entry option that can be used to shut and

submit the journal entries linked to tax operations. Additionally, as seen in the

following picture, you will have access to filtering and grouping options in the

Tax Report menu. Read the sections before this one to understand more about the

typical tools available in the reporting menus, such as the Period based Filtering,

Comparison filter, and Options filter. There are other options for grouping tax

reports that allow you to arrange them as a global summary, a tax group by account,

or a tax group by account and tax.

A summary of the tax operations in connection to the company's financial and accounting

activities may be found in the Odoo platform's Tax Reporting menu. Let us now go

to the part that specifies the EC Sales List Reporting tool.

EC Sales List

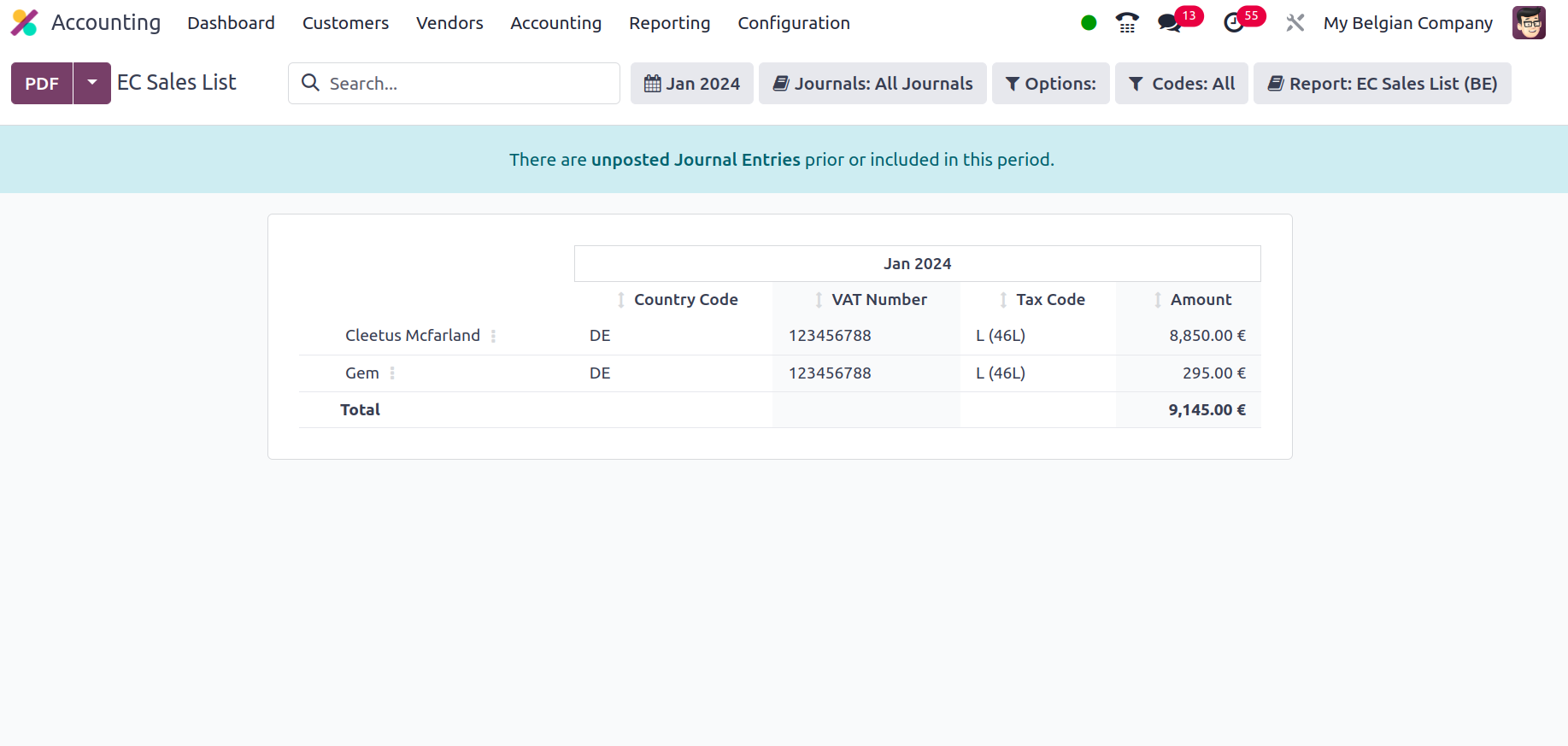

The Odoo EC Sales List reporting function is another form of reporting tool that

will provide you with a complete insight into the company's financial activity.

The EC Sales List reporting, which is based on the sales of goods and services made

by VAT-registered firms within the UK to other businesses in the European Union,

is one of the instruments that must be submitted to Her Majesty's Revenue and Customs

of the UK government. The Odoo Accounting module's Reporting tab leads to the EC

Sales List Reporting. Each entry on the EC Sales List will be specified here.

Filtering and grouping tools will be available to help you organize the data according

to fiscal years and defined journals. You can refer to the reporting options discussed

in the sections preceding this one. There are also buttons for printing reports

in PDF and XLSX formats. The SAVE option allows you to save reports to the appropriate

workspace in the Documents modules in order to maintain the financial records that

are available from the EC Sales List menu and will be important for the financial

management operations of the business.

Now that you understand the EC Sales List reporting management menu of the Odoo

platform, let's move on to the next step, where the Journal Audits will be set.