The essential factor of the company is the management of the financial parts of

the operation, and managers are constantly looking for tools and solutions to make

the process easier and more efficient. The reporting and report generation features

will be utilized as a management tool to evaluate the status of your company's accounting

operations. Furthermore, because the reports are real-time, you may rapidly understand

how the company's financial operations are developing by taking a fast glance at

the accounting-based data.

Odoo, being a sophisticated management tool, provides a number of reporting possibilities

as well as report production capabilities for business management and operations.

There is a finance management module that provides extensive reporting tools and

operating capabilities. In Odoo's Accounting management module, there are various

reporting tools for financial operations, as well as reporting tools for Accounting

management features such as Invoice Analysis, Analytic Report, Unrealized Currency

Gains/Losses, Depreciation Schedule, Budget Analysis, and Product Margins. We will

go through each of these components of report production in detail in the sections

that follow.

Invoice Analysis

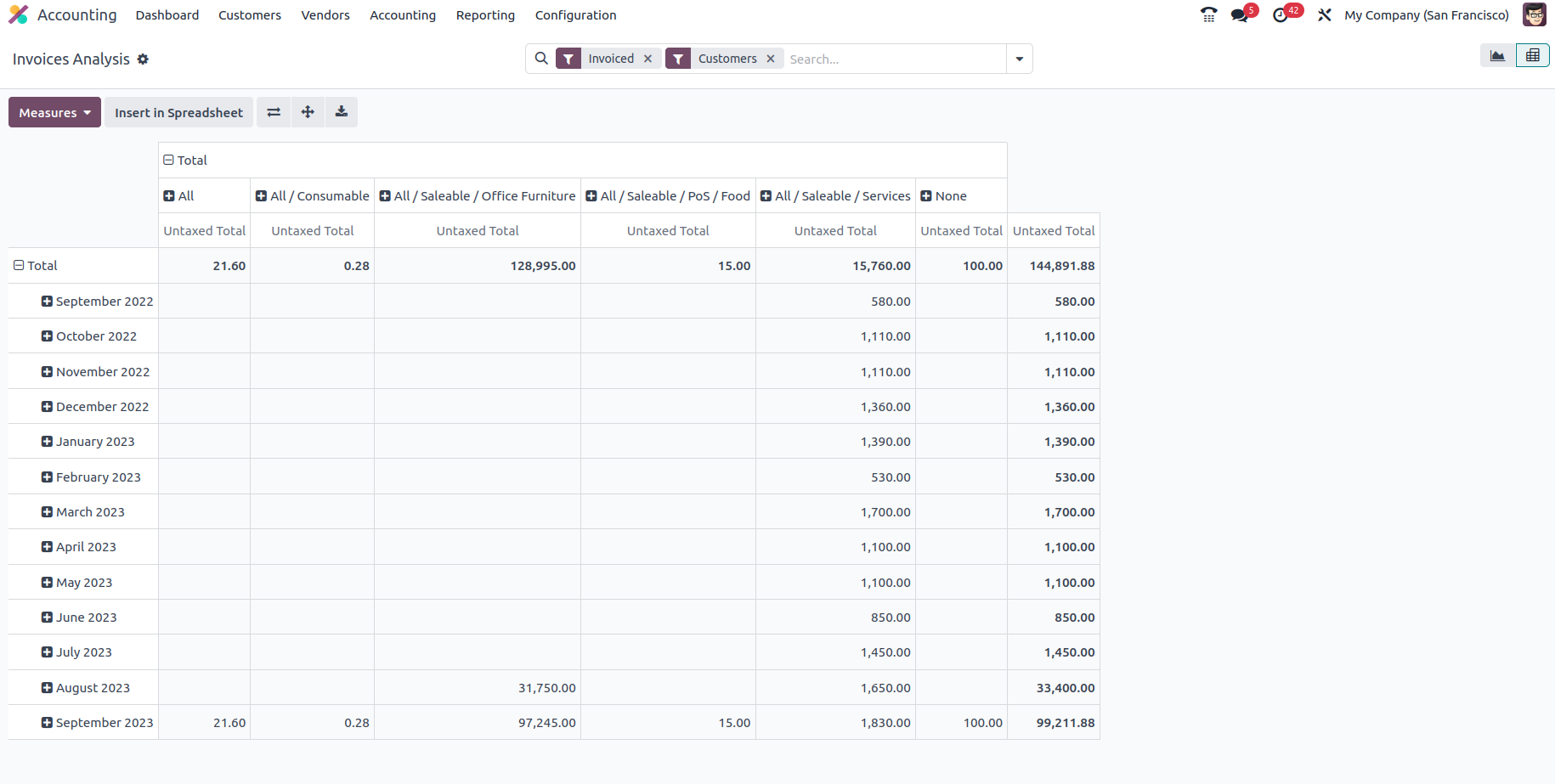

The Invoice Analysis report is the most common sort of accounting management report

provided by the Odoo Accounting module. This report will analyze both comprehensive

invoices and those that are still in the creation stage of operation. Invoice Analysis

reports will include all invoices associated with customer-based activities in the

sale of both services and products. View invoice analysis reports using pie, bar,

line, and other types of charts. You may see the invoice analysis report based on

your requirements by utilizing the filtering and grouping tools featured in the

invoice analysis report.

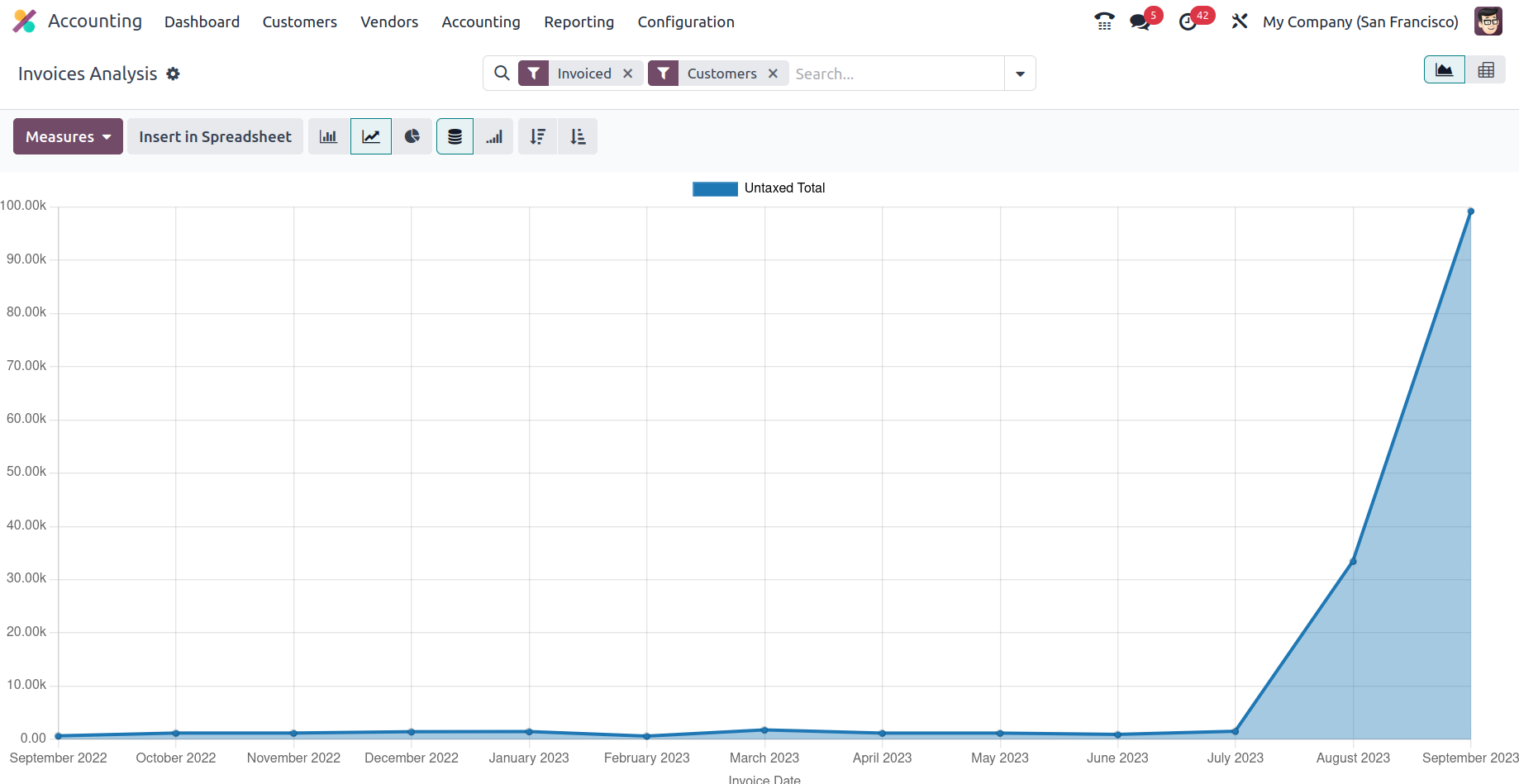

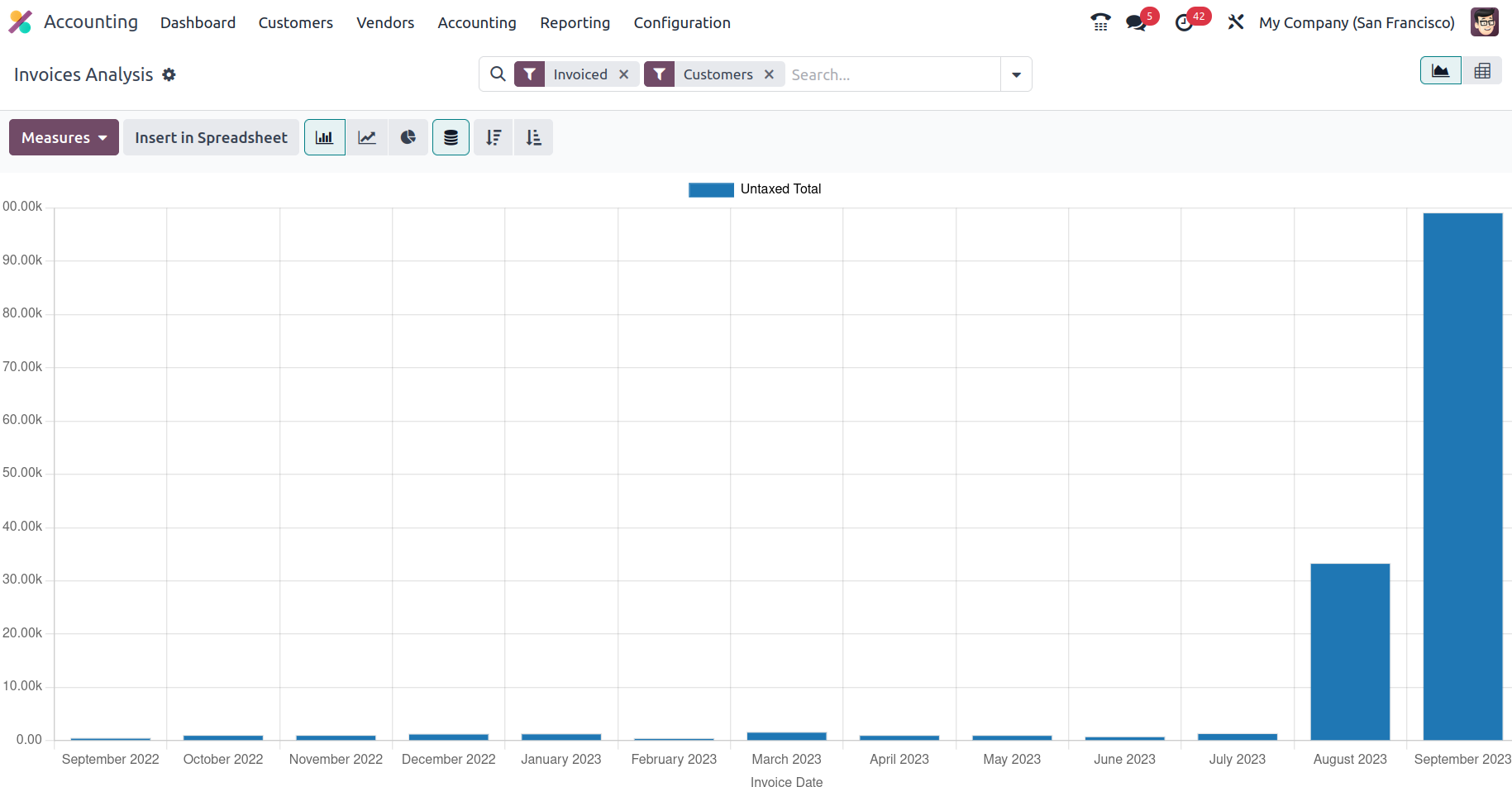

The invoice analysis report bar graphs, which are color-coordinated as appropriate,

can be seen in the following screenshot. Filtering and grouping by options helps

to organize the necessary information about the generated invoices.

In addition, the Kanban view, which is an alternative to the graph view, allows

you to produce reports in a different way. Filtering may be done inside the report

in the Kanban style, allowing you to display only the essential + and - aspects,

as well as expand and depreciate the reporting aspects in respect to the defined

entries. You can also use the Filtering and Group by options to generate the report

with the available default settings as well as personalized ones. Furthermore, you

may establish the measures on which the measurements are based by utilizing the

Measures configuration choices, which will assist you in defining the measures on

which the Invoice Analysis reporting elements have been defined.

The Invoice Analysis reporting is an exception tool that has been defined for the

purposes of the Accounting management alternatives for the business's operations

with regard to the invoices that have been created as well as those that are presently

in use. Now that we understand the invoice analysis reporting menu in Odoo Accounting,

let's move on to the next section, which defines menu for constructing analytical

reports.

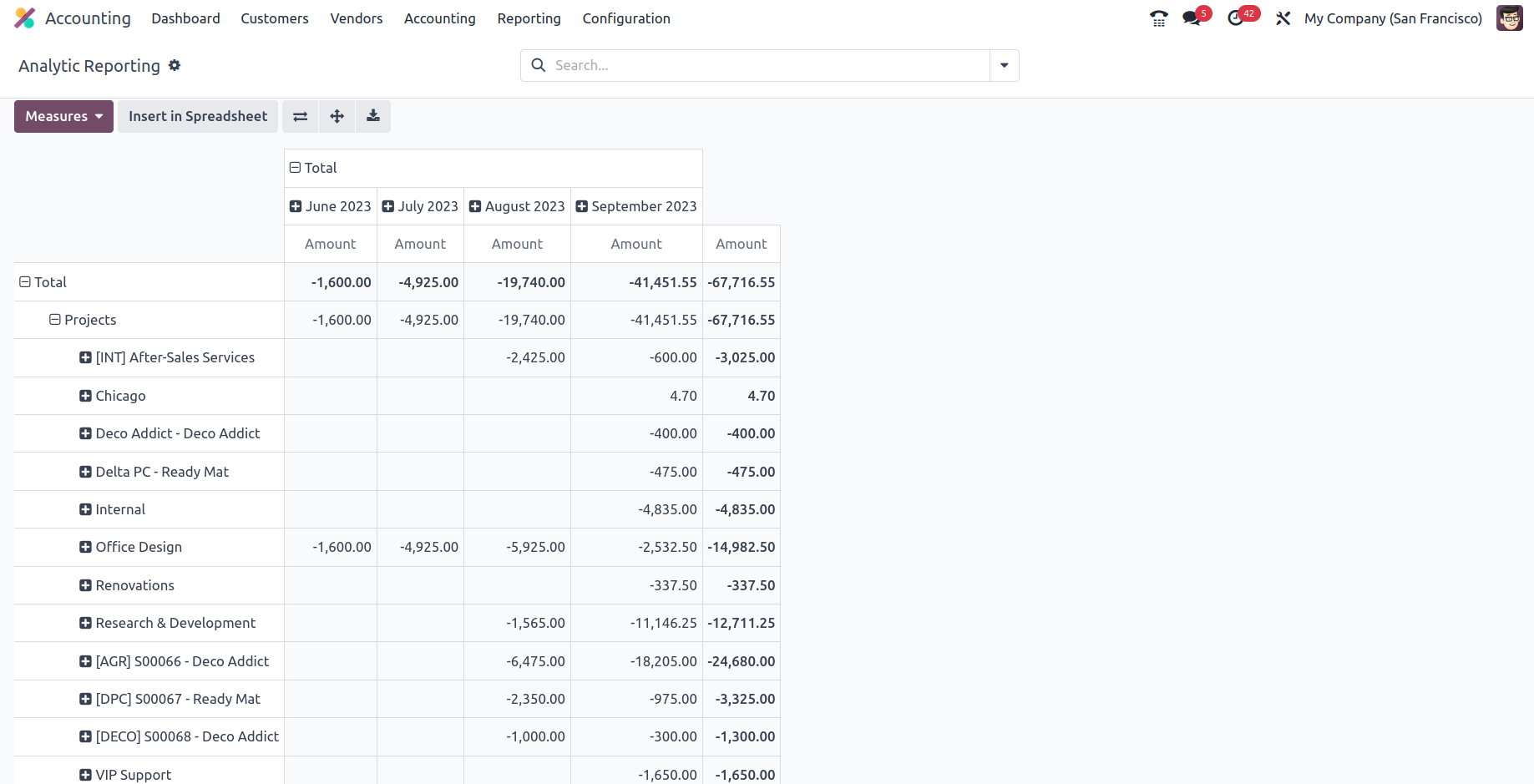

Analytic Report

With the analytical reporting tool of the Odoo platform, you can define analytical

functions related to the accounting components of the organization. In addition,

the report provides a quantitative overview of all defined components of the organization's

accounting. The available Odoo Analysis Report window is shown in the screenshot.

As you can see in the following screenshot, all the components of Odoo's accounting

functions are listed here, as well as reference information for the financial functions,

the partners involved, and the balance amount.

Additionally, there is a Group by the tool that can help you organize the entries

into groups according to the operational, fiscal period, and there is a filter for

analytical accounting that can help you filter each of the defined analytical accounts.

The different settings may be changed with respect to the Analytical entries to

be filtered, which is also possible utilizing a sophisticated filtration tool.

After you choose each entry in the analytical report, you will see all financial

operations in connection to the financial elements, as shown in the picture below.

We've gone with the Costs & Revenues menu choice here. The menu will define the

operations' Date, Description, Analytical Account, and Amount. There are further

methods for filtering and grouping available to assist in identifying the relevant

entry. By selecting the available Create option, you will also be able to add new

entries. Additionally, you may change an entry by choosing the one that has been

defined.

By selecting one of the entries, you may read the specifics of that entry, including

its description, analytical account, tags assigned, reference information, partner

name, and entry date. The level of information, including the amount and quantity

allotted to each product, as well as the unit of measurement, will be specified.

We will define accounting terms such as Financial Account and Journal Item. You

can alter the details that have been defined here as needed by clicking the edit

option. The analytical report tool will help you regulate the aspect of the analytical

accounting entries by providing you more insight into each activity, making it a

vital tool for the company's financial management. Now that we know how the analytical

report works, let's move on to the section that covers the reporting requirements

for unrealized currency gains and losses in Odoo Accounting.

Unrealized Currency gains/losses

The Unrealized Currency Gains/Losses option in the Odoo accounting reporting tools

will provide you with information about the company's filtering gains or losses

for the selected fiscal quarter. These Gains or Losses are the effect of foreign

exchange rates in connection to how the firm is operated. Furthermore, unrealized

currency gains and losses are typically connected with multinational enterprises

that operate on a worldwide scale or with activities that include many currencies.

Because the Odoo platform allows the firm's activities to be conducted in many currencies,

this option is accessible in Odoo accounting reporting.

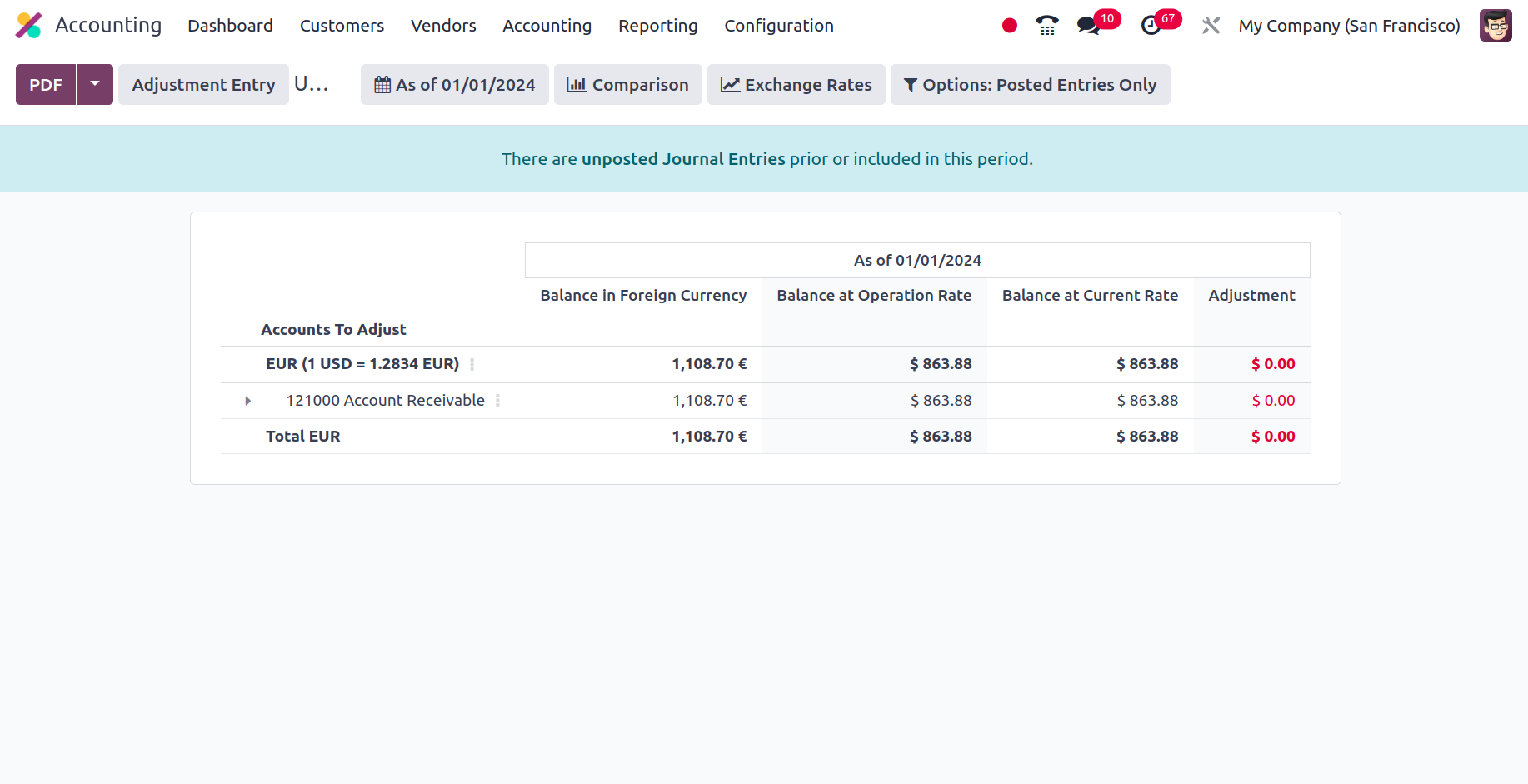

The entries in the Unrealized Currency Gains/Losses reports will be dependent on

the filters done for the fiscal periods provided for the report. Furthermore, there

are numerous filtering tools that may be utilized to assist with the filtration

elements, as well as Custom ones that can be developed based on the requirement.

Filtration may be performed using the set conversion rates for the currencies used

by your organization and the Odoo platform. With the help of the choices filters,

you may sort the data depending on the entries with the Draft entries and the Unposted

entries that have been defined.

The entries will comprise Balance in Foreign Currency (the amount taken from the

bill in the relevant currency), Balance in Operational Rate (the amount computed

at the operation date, or when you received the bill in company currency), and Balance

in Current Rate. It is the value in effect at the time the report is submitted or

when the corporation is paid. To update your accounting reports with this new information

to be specified for the entries to be defined in operation, the Adjustment amount

value should also be changed.

Now that we've covered the Unrealized Currency Gains and Losses reporting tool featured

in the Odoo Accounting module, let's move on to the section on Depreciation Schedule-based

reporting.

Deferred Expenses

Expenses that have been incurred but are not yet payable are known as deferred expenses.

In other words, these are costs that have already been incurred but won't be reimbursed

until later. Deferred expenses are crucial because they give firms a mechanism to

account for costs associated with assets that will be used over an extended period

of time.

Deferred expenses are used in Odoo17 Accounting to manage such expenses. These are

intended to specify the framework for the system's handling of postponed expenses.

This can be used, for instance, to specify account posting guidelines and the timing

of when a cost should be recognised. It can also be applied to create a deferred

expense account. Deferred expenses are tracked in this account, which is updated

as costs are reimbursed or recognised. This makes it simple for businesses to manage

their delayed expenses, maintain tabs on their finances, and control the expense

operations of subscription-based products to perfection. The Deferred Expenses take

into account costs like;

- Prepayment: In this arrangement, an expense is paid by the business

before the product or service is delivered. It is typically used to pay for substantial

items like rent, insurance, or subscriptions.

- Accrued Expense: A corporation uses the accrued expense model when

an item is incurred but not paid for right away. This might apply to things like

unpaid loan interest or staff bonuses.

- Depreciation: When a business buys an asset, it uses this model

to expense it throughout the asset's useful life. This might apply to things like

structures, machinery, or cars.

- Amortization: When a business pays an expense over time, such loan

payments or software license fees, it might use the amortization approach.

The Deferred Expenses are directly related to the subscription-based goods and services

that are bought from numerous vendors.

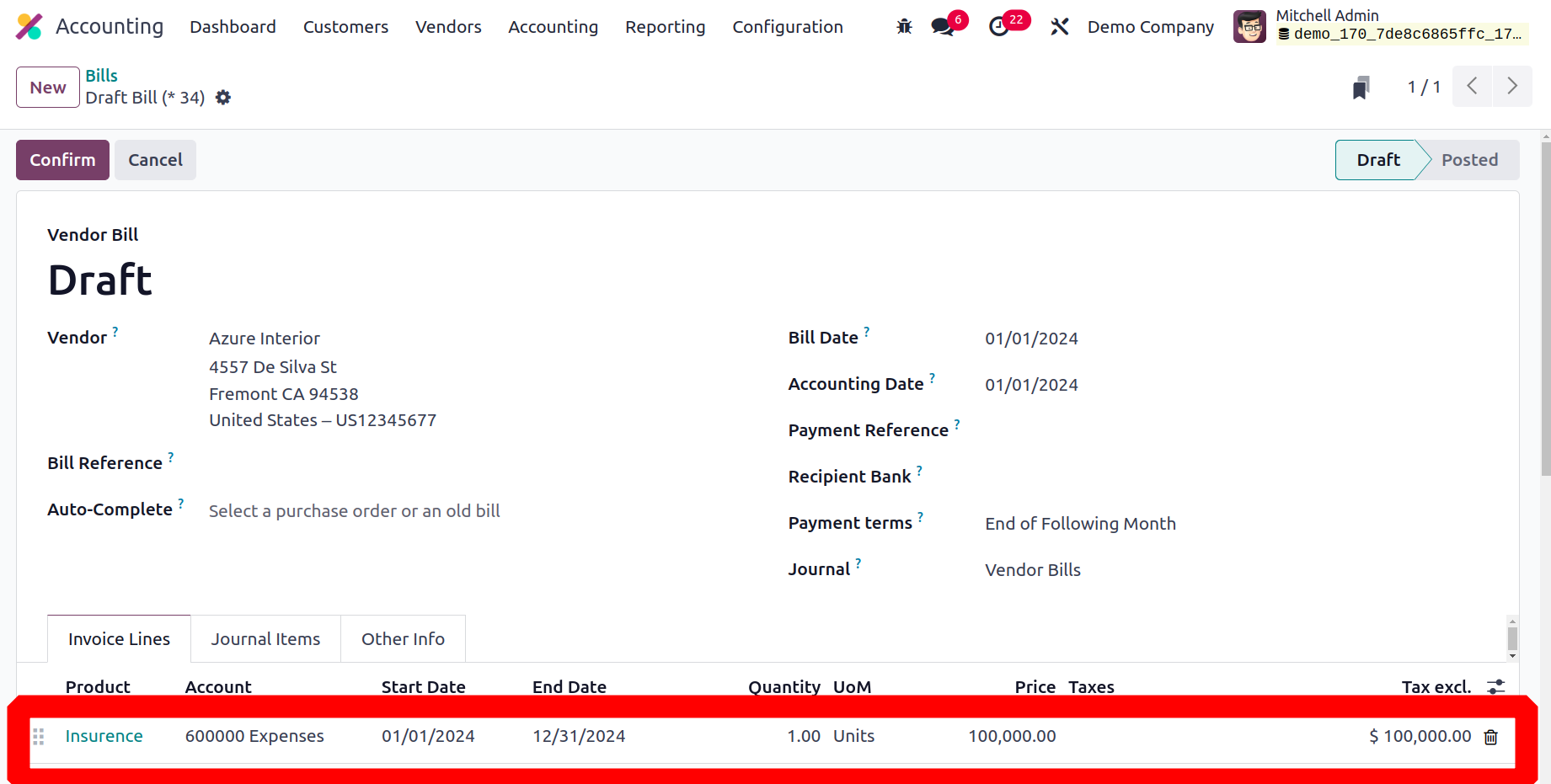

You can navigate to the Accounting module to access the Deferred Expenses pane.

You may view the Vendor Bills window here in the Vendor menu, as displayed in the

image below.

The Deferred Expenses created in odoo 17 from the bill like given below;

Include the vendor and the product in the vendor bill. The beginning and ending

dates of the postponed entries are determined by the start and end dates. Thus,

the date the delayed expense begins is the Start Date. The deferred expense's expiration

date is known as the End Date.

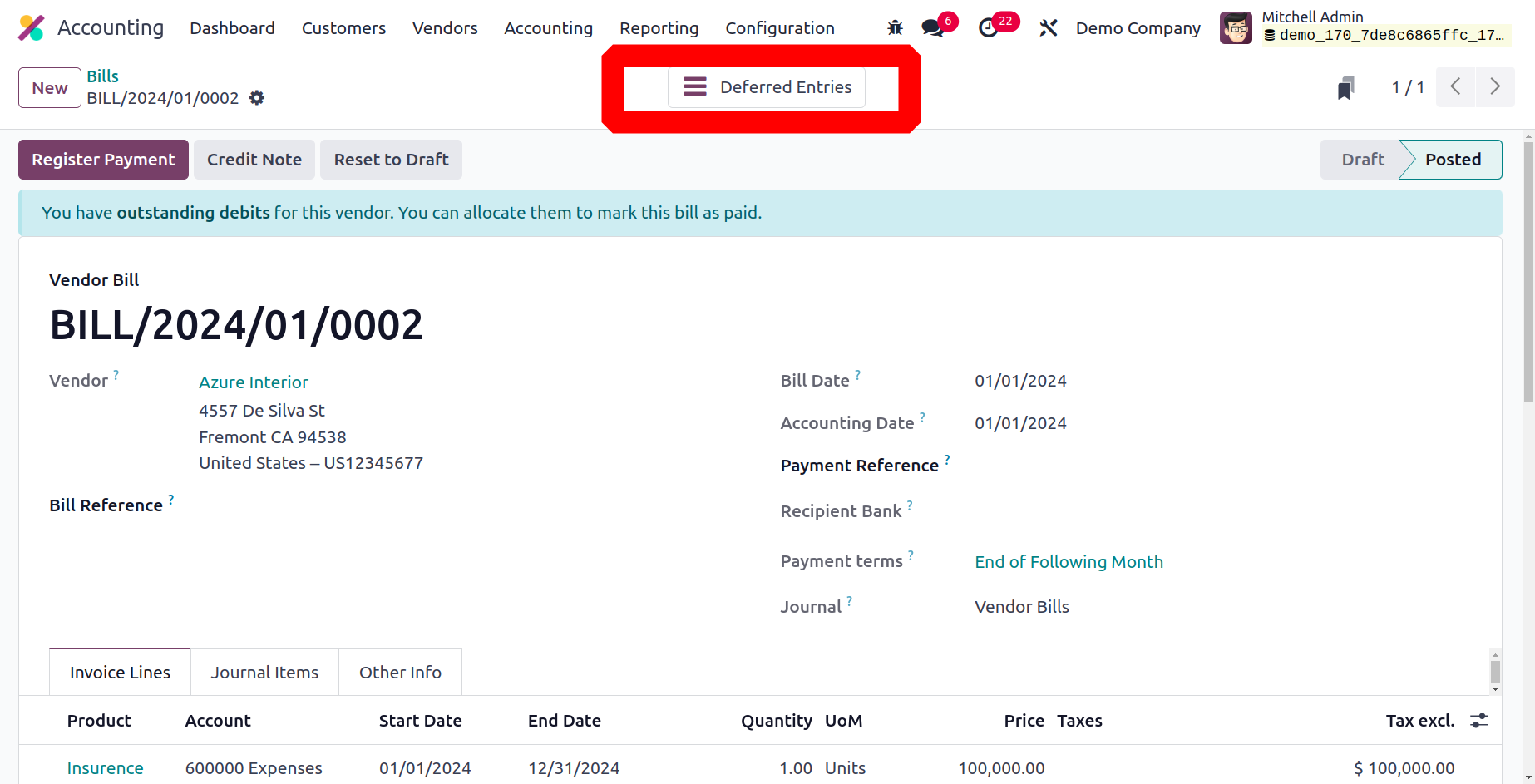

To confirm the bill, click the "Confirm" button as previously mentioned. Next, a

smart tab called "Deferred Entries" appears. Users can access the Deferred Expense

Entries by activating the Smart Tab.

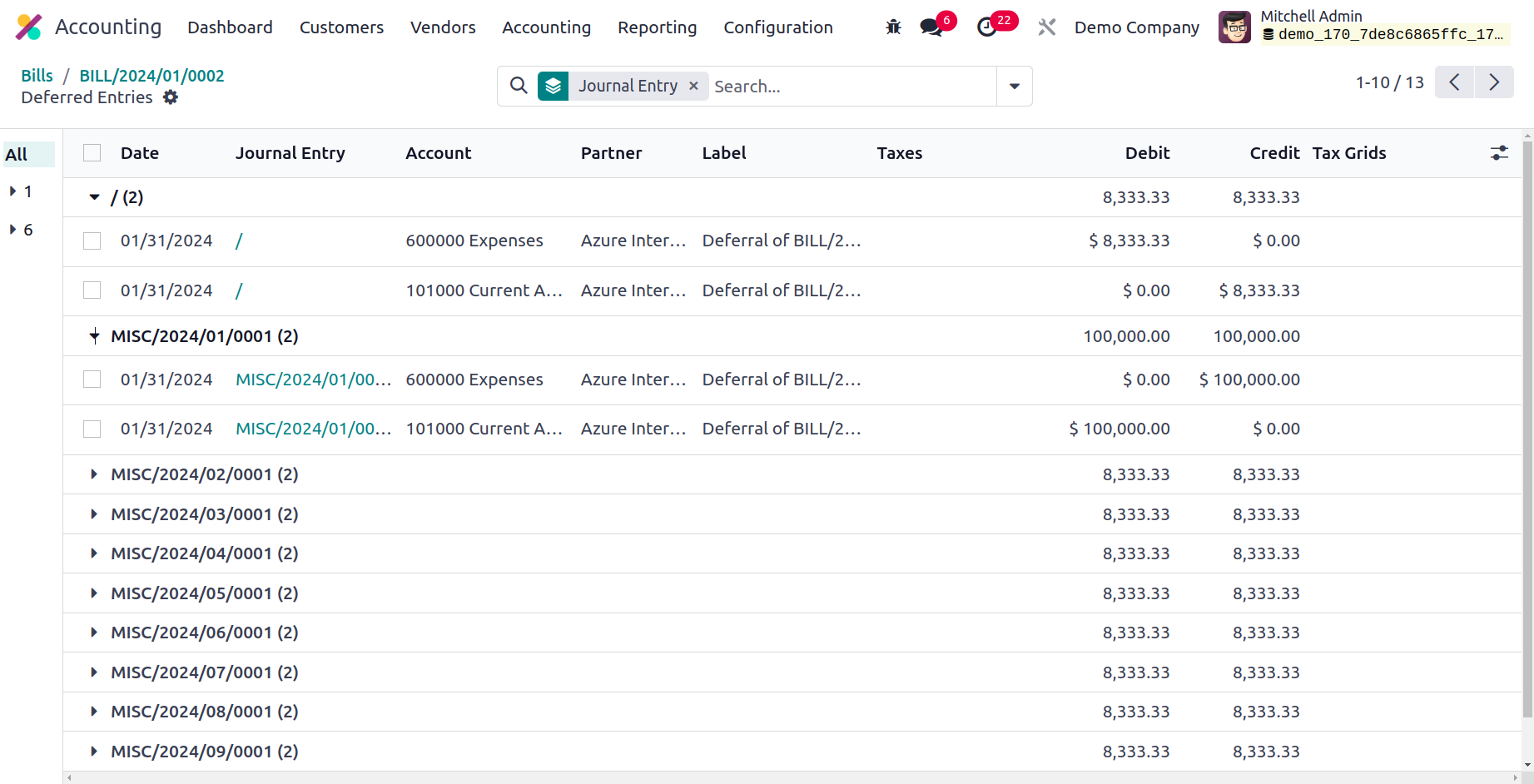

The date, journal entry, account, label, taxes, debit, and credit are all displayed

on the entries page.

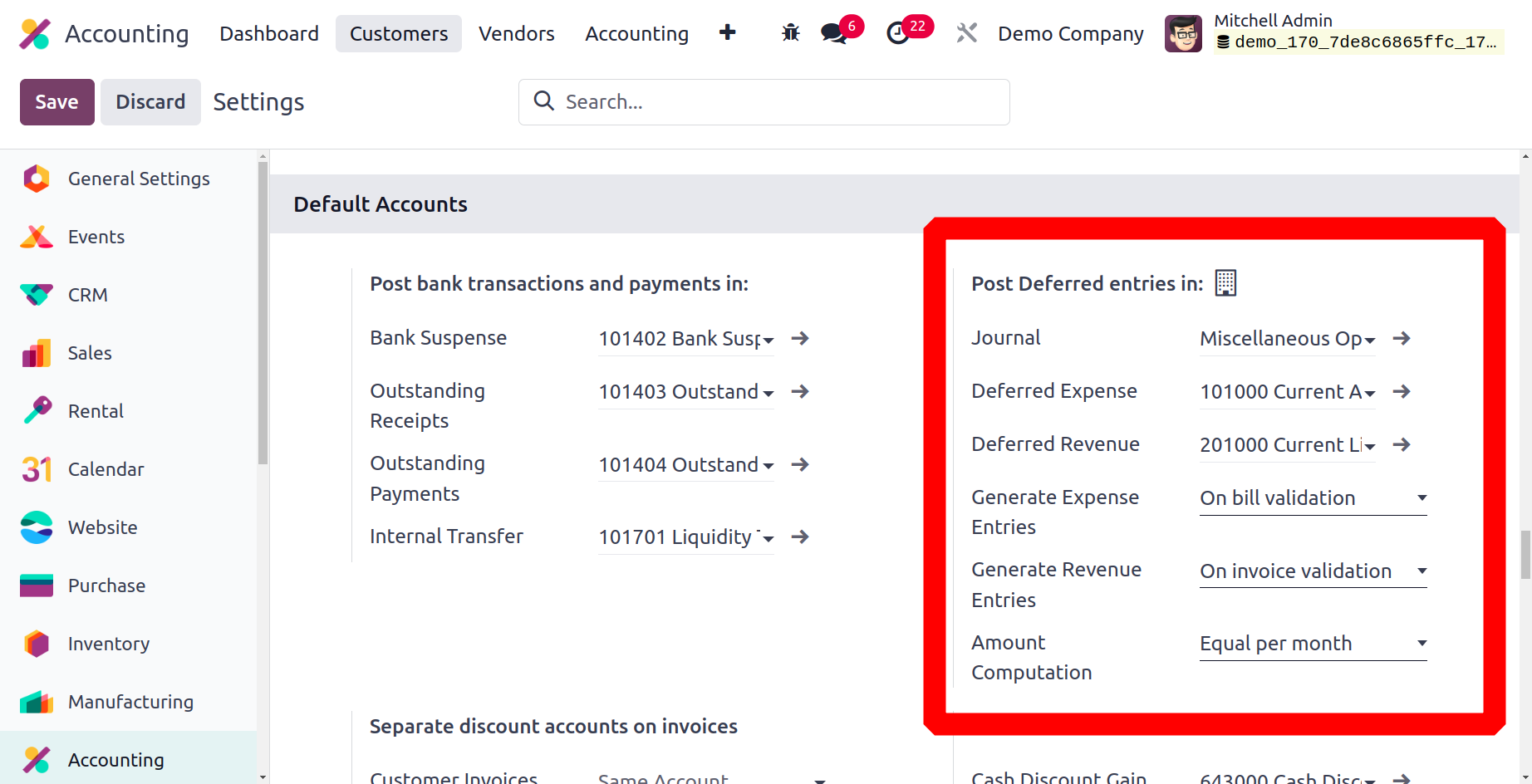

The user has the option to select the accounts for deferred entry posting. There

is a mention of these accounts in the settings. The section "Default Accounts" is

present. Thus, there is a mention of the default accounts for those entries. There

are two ways to generate the deferred expense entries: manually and grouped, or

based on the validation of vendor bills. After that, the sum can be calculated using

either the equal of all months or the days.

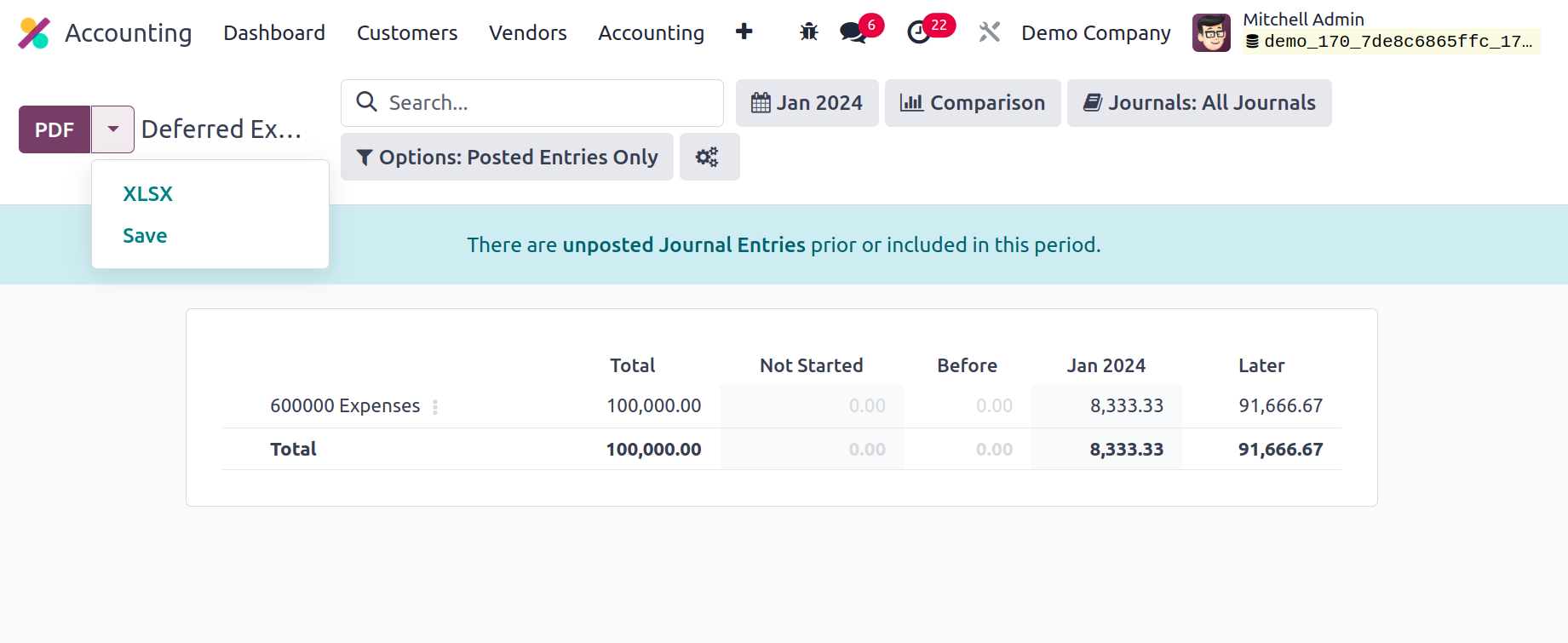

The Deferred Expense Report, located in the Management area, displays each and every

deferred expense entry that has been made. The report displays the account, total

amount, and depreciation amount.

It can be stored on the system as an XLSX or PDF file. Click the Save button to

save the report to the Documents module.

Deferred Revenue

The Deferred Revenue feature is especially helpful for businesses that provide subscription

services or have a recurring revenue model because it makes it possible for companies

to monitor client payments made in advance for goods or services that have not yet

been received. The sum is recorded as deferred revenue when a consumer makes an

advance payment. When the service or product is supplied, this sum is subsequently

recorded as revenue. With the help of this tool, businesses may more easily track

their revenue and have more control over their financial statements.

The Odoo 17 Accounting module's Deferred Revenue is simple to set up and utilize.

The terms of the deferred revenue agreement, such as the due date, the payment amount,

and the delivery date, are readily defined. The money is then recorded as deferred

revenue when a customer makes an advance payment, and the revenue is then recognised

when the service or product is provided.

It is regarded as a great tool for any companies with recurring revenue models or

subscription services. Businesses benefit from safety precautions over the financial

records and reliable income tracking. In order to accurately track the organization's

present and future liabilities, which will help to ensure that the business can

meet its financial responsibilities and continue to be compliant with accounting

standards. As a result of knowing when and how much money it expects to get in the

future, the company can manage its cash flow more effectively thanks to the deferred

revenue model. It is appropriate for services or goods that require upfront payment,

such subscriptions or memberships.

For instance, a business might provide a subscription-based service and charge the

client before providing the service or commodity. The payment will be represented

on the balance sheet as "deferred revenue," indicating that the revenue has not

yet been generated. When the service is rendered, this deferred money will subsequently

be recognised as actual revenue.

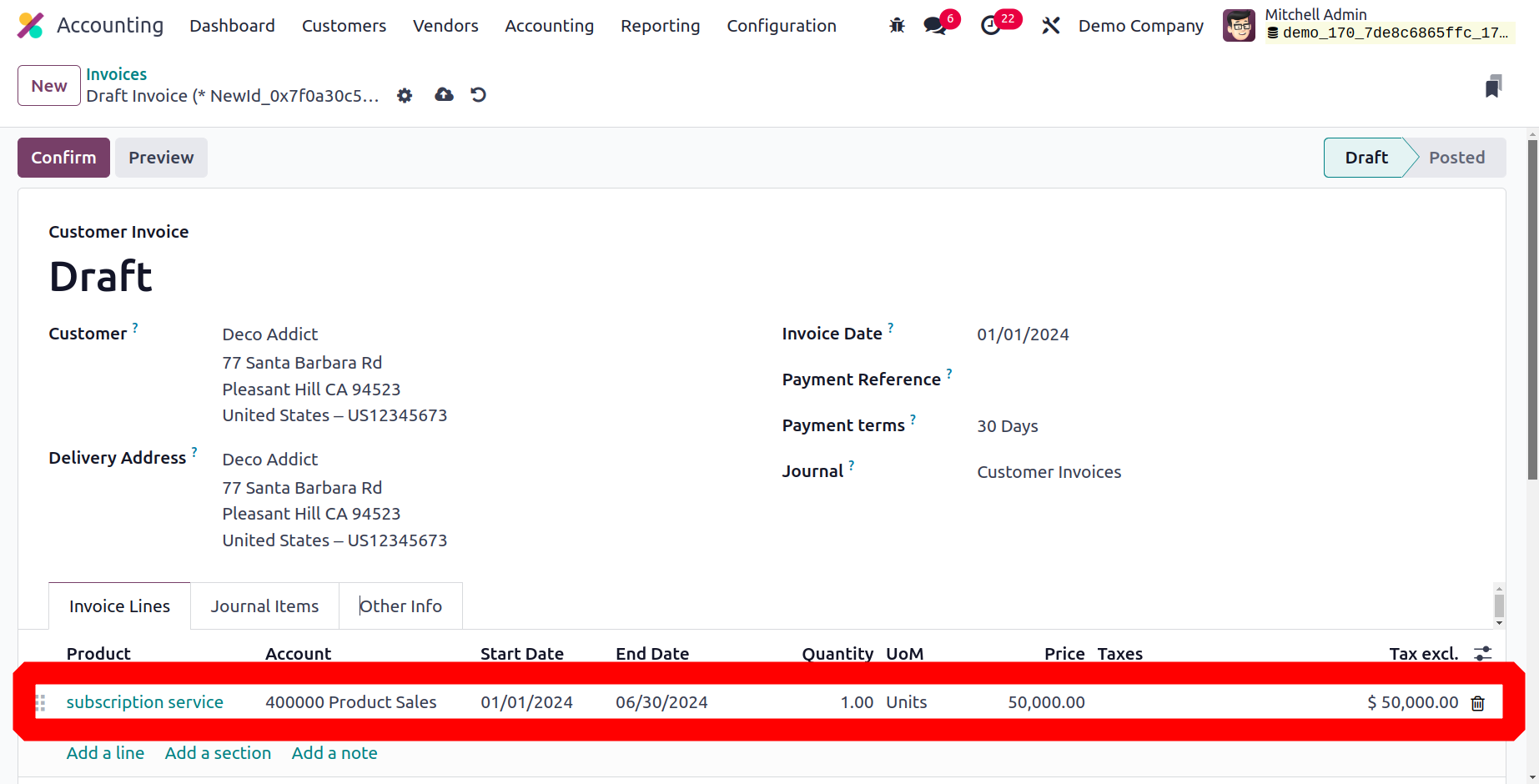

Let's imagine a business charges $50000 for a year of subscription services. The

business adds $50000 in deferred revenue to the balance sheet when the client pays

the fee. The business provides the service and generates revenue throughout the

year. The corporation will record the deferred revenue as actual revenue at the

conclusion of the fiscal year and make the necessary adjustments to the balance

sheet.

The organization's Deferred Revenues can be managed through a single invoice in

the Odoo17 Accounting module. The invoice, which is located on the Customers menu.

Select the client and the subscription item from within the invoice lines. The invoice

line includes additional information such as the account, quantity, and unit price.

It also includes the start and finish dates of the service.

The beginning and ending dates of the postponed entries are determined by the start

and end dates. Thus, the date the deferred revenue begins is the Start Date. The

deferred revenue's end date is known as the End Date.

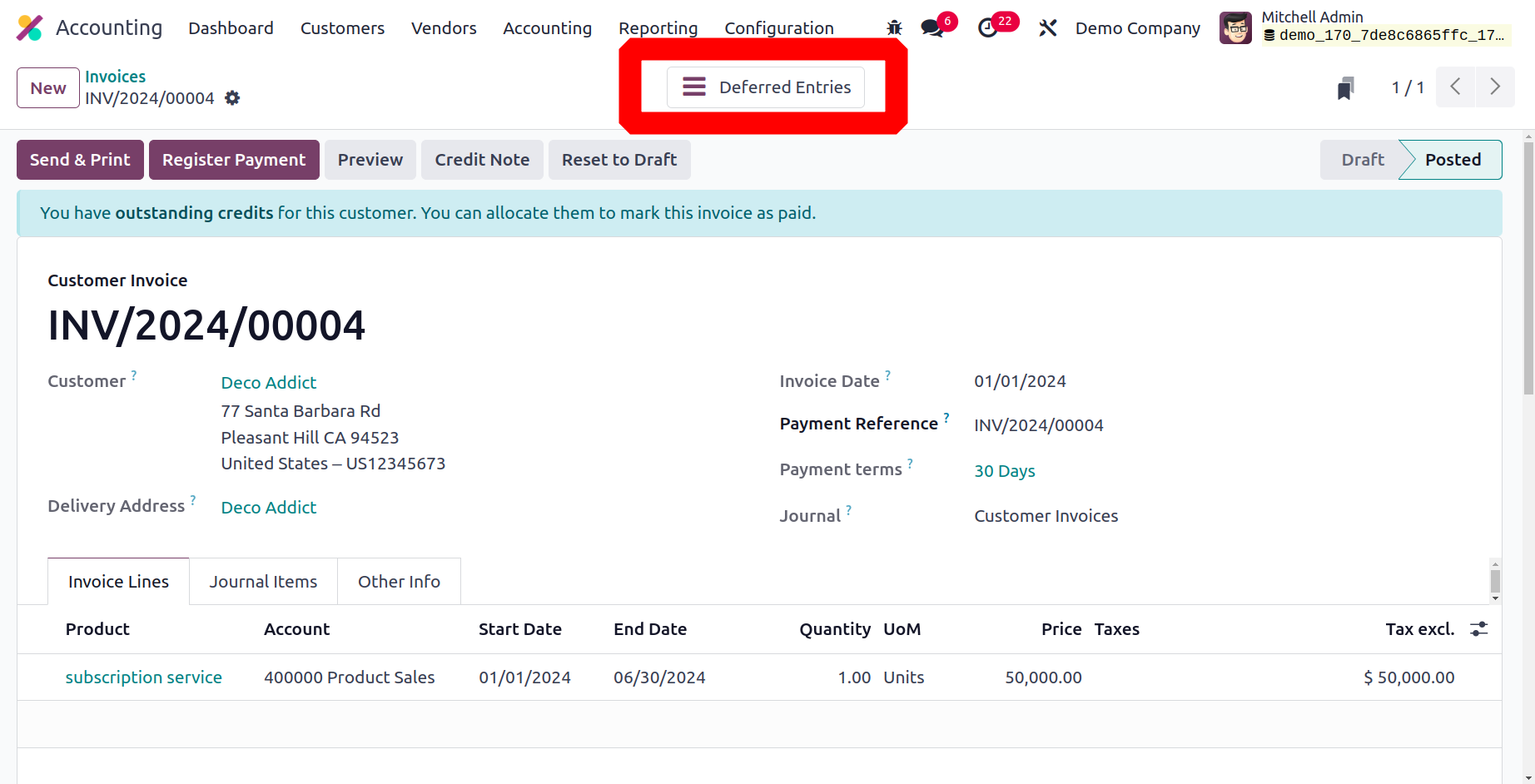

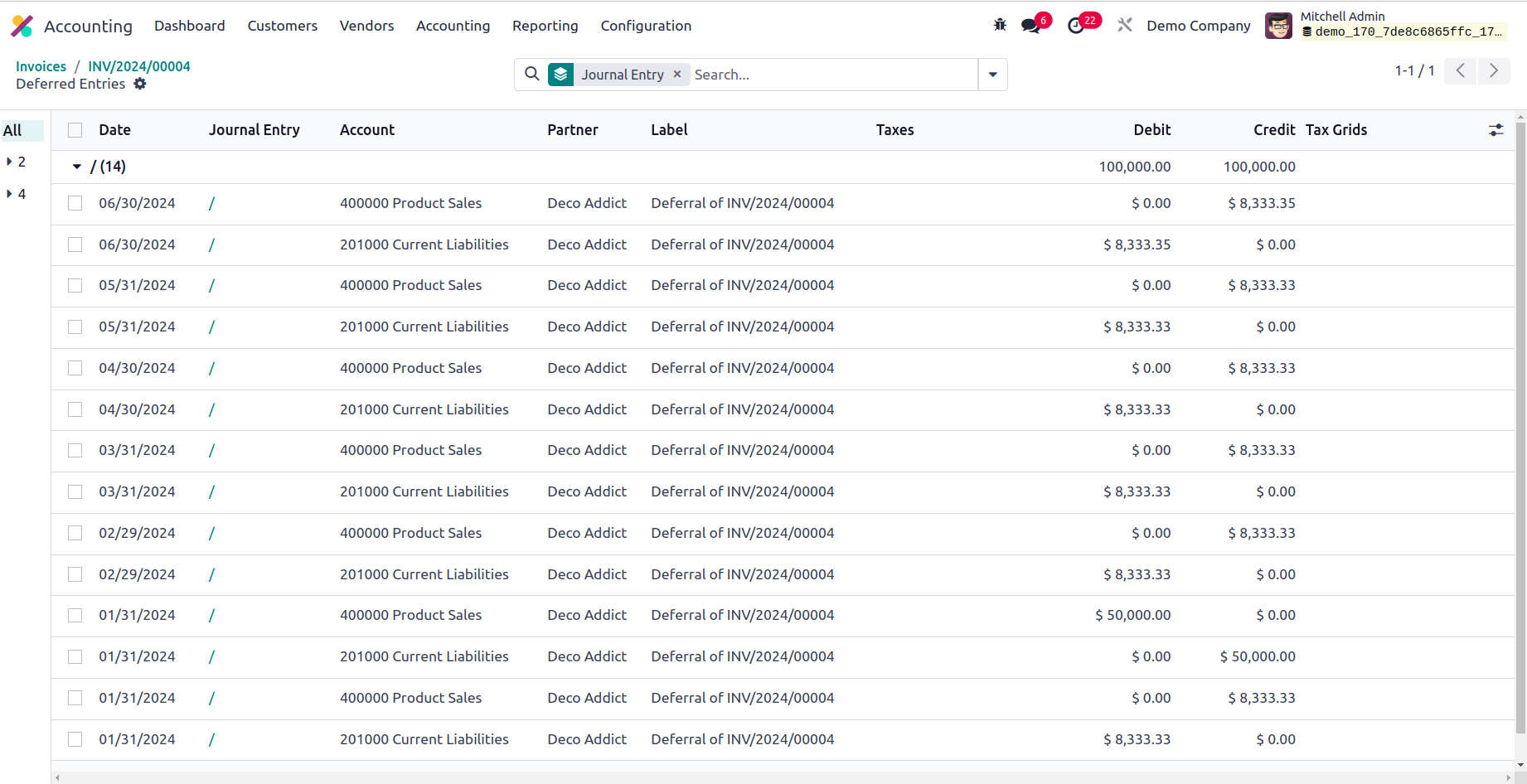

The user can verify the invoice after inputting the necessary information. A new

smart tab called Deferred Entries will appear after the invoice has been verified.

All of the produced entries will be accessible when you open the Deferred Entries

smart button. There are several details available, such as the date, journal, account,

partner, label, debit, and credit amount.

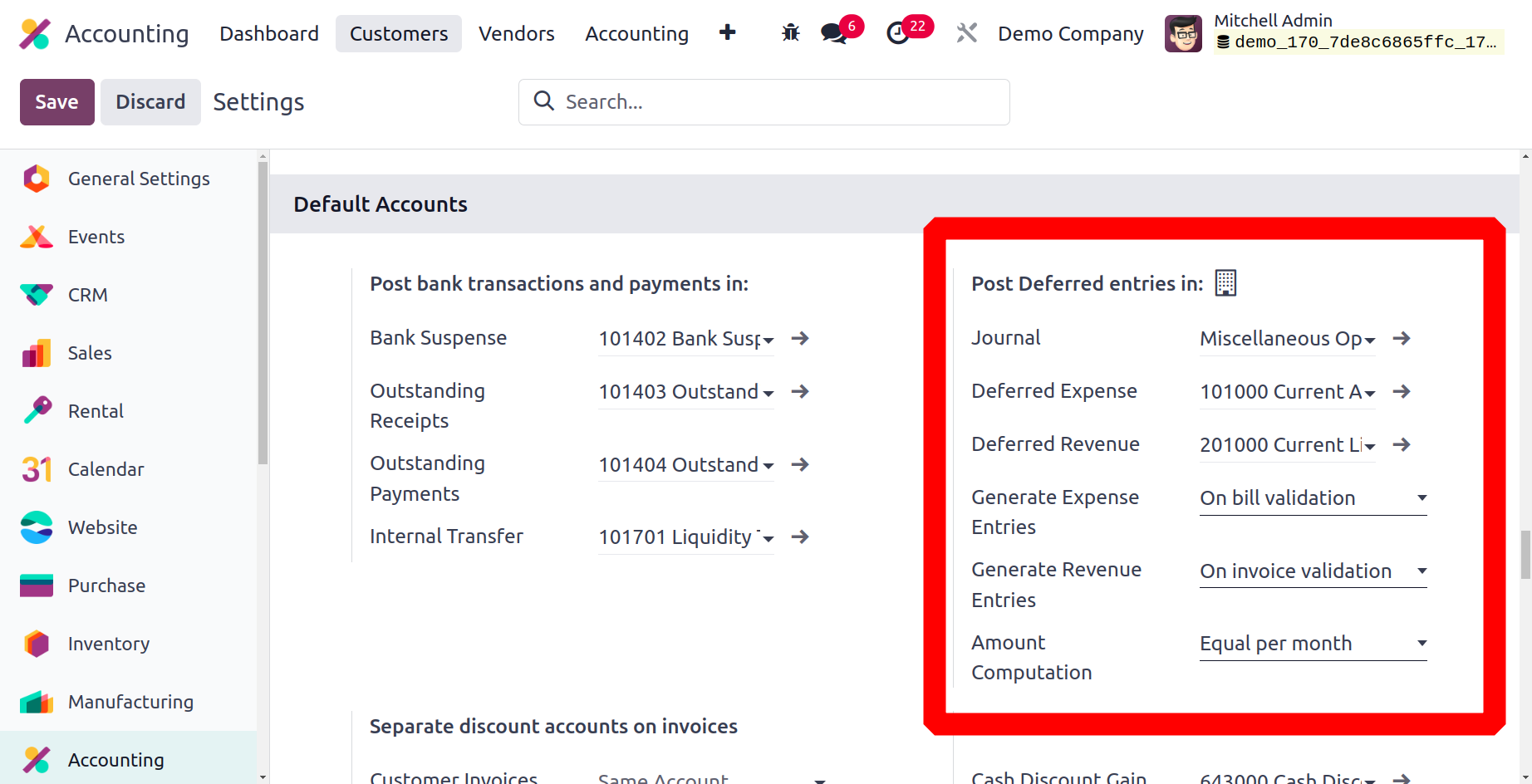

When you click on Settings, you can examine the Default Accounts area where the

accounts that are taken are specified.

One can set the default Deferred Revenue there. Next, the deferred entries' generation

method is determined by the Generate Revenue Entries parameter. Users can select

Manually & Grouped or On invoice validation there. To specify how the total money

is allocated across the period, there is a money Computation field. It can be divided

equally into months or computed using the number of days.

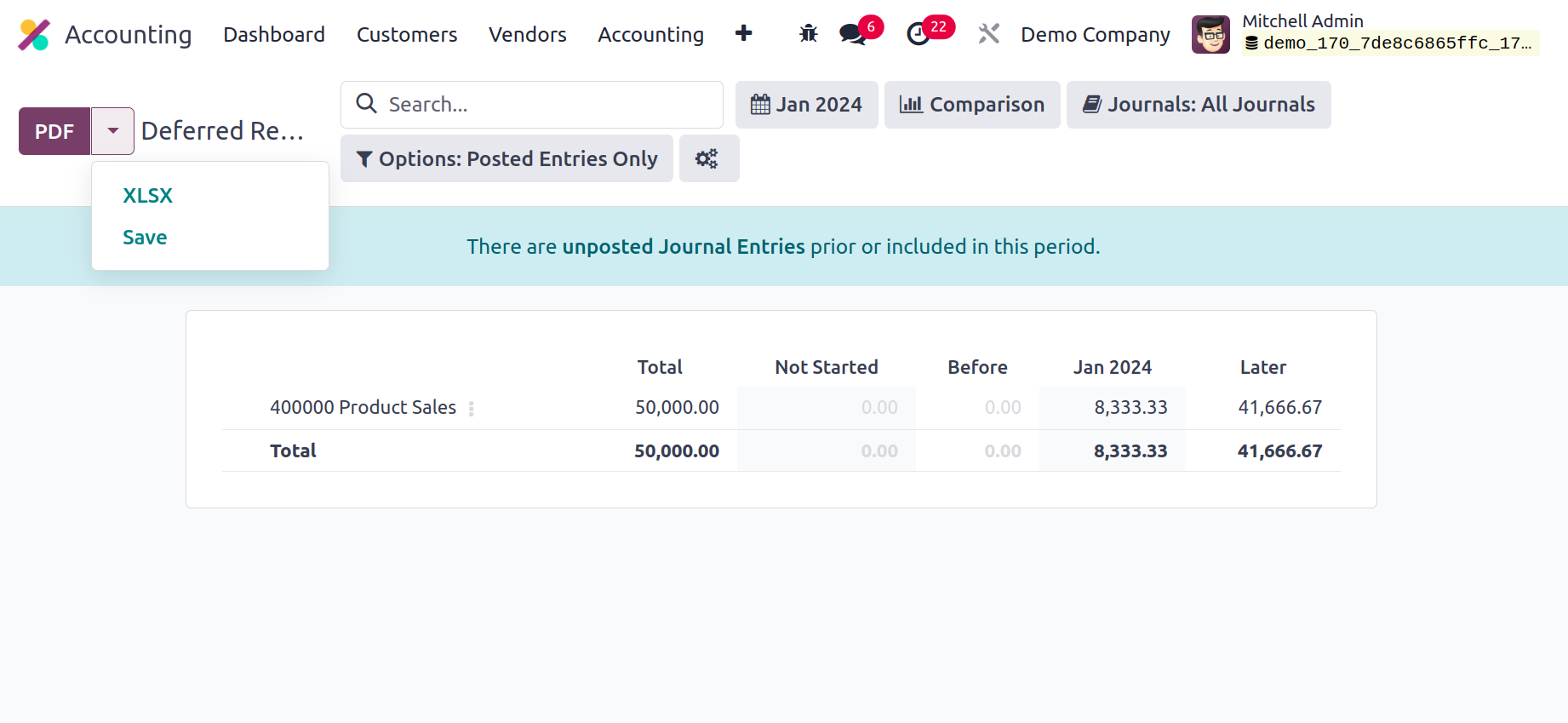

The Deferred Revenue Report, located in the Management section, has the ability

to display the entry in the event that one is made. There, you may see the account,

total, and monthly depreciation amount.

The report is available for download in XLSX and PDF formats to the system. By selecting

the Save button, the report can be saved to documents.

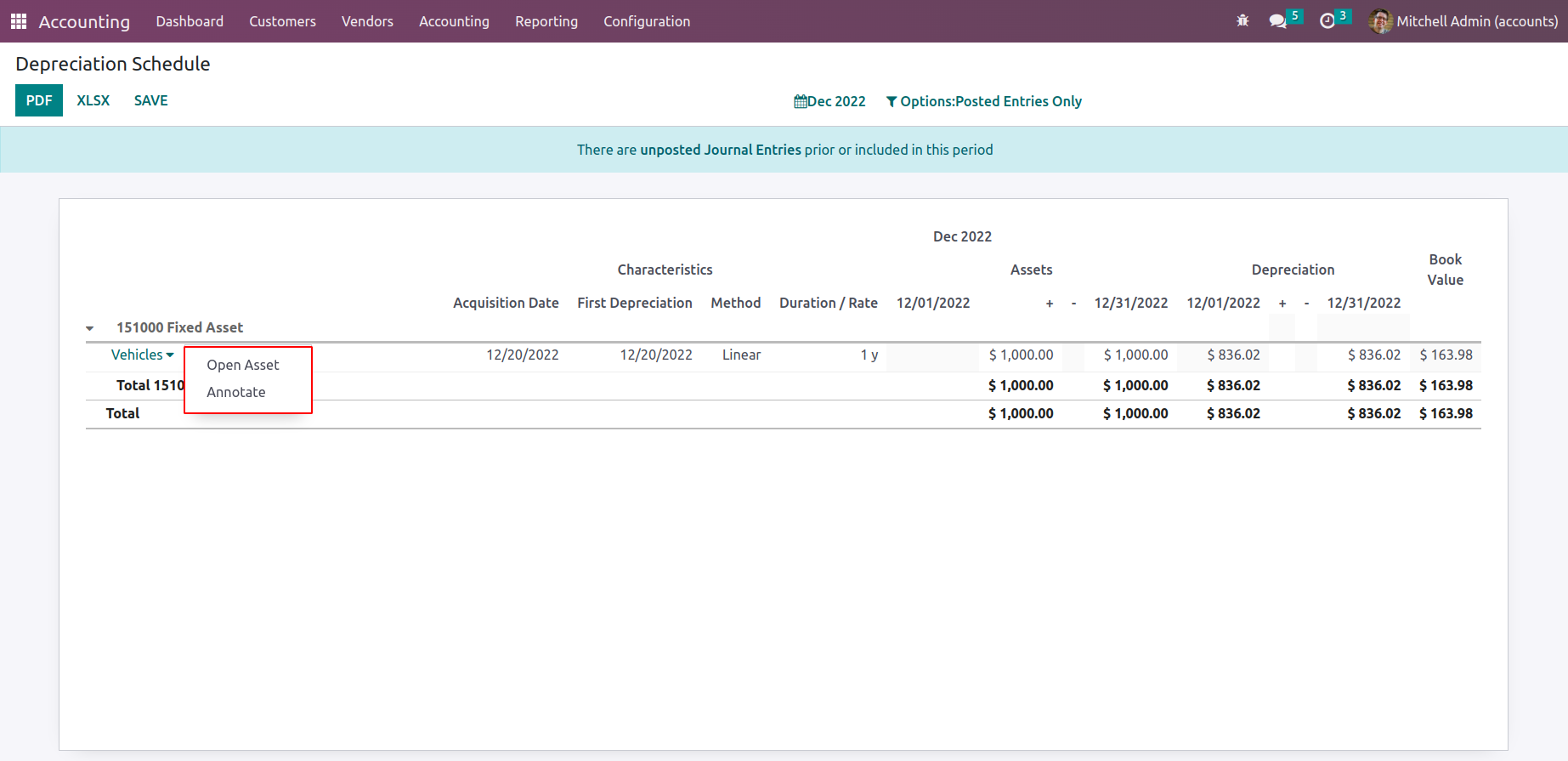

Depreciation Schedule

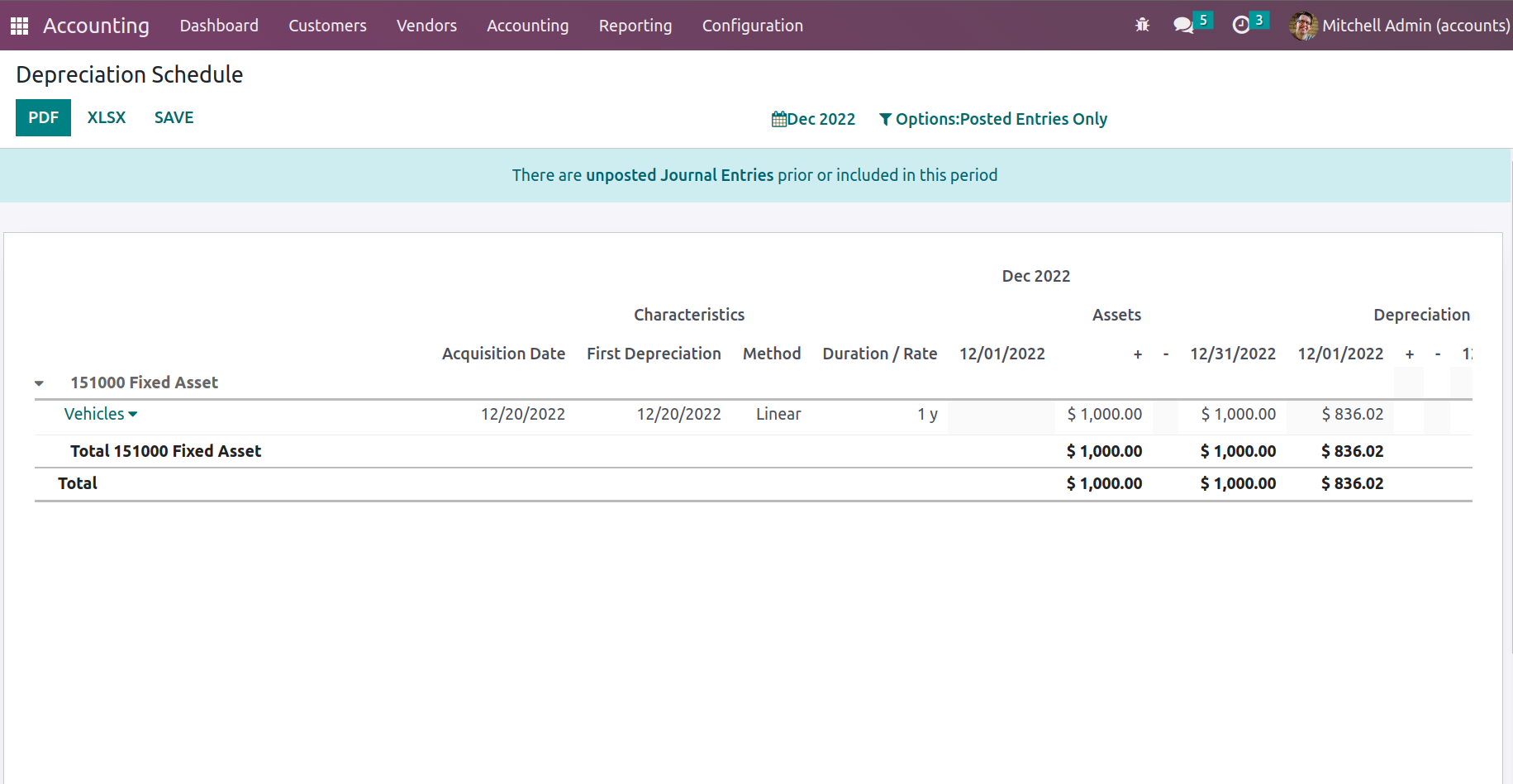

The Depreciation Schedule-based reporting will provide you with information on how

rapidly an item selected for usage in your company depreciates. Your company's assets

may define the assets you've previously recognised. The Depreciation Schedule reporting

option is accessible via the Accounting module's reporting tab. Once you select

the choice, the reports on the Depreciation Schedule will be shown, as seen in the

image below. The Asset-based Chart of Accounts, as well as any Journals created

on it, will be specified by Operations.

In addition, definitions of Characteristics aspects such as Acquisition Date, First

Depreciation, Method, and Depreciation Rate will be supplied. The asset's specifications

will be stated in terms of months and length of operation. A depiction of the asset's

depreciation during the given time period will also be displayed. The book value

information for each asset's Depreciation Schedule will also be defined.

Additionally, based on the Fiscal period or the entries, you will have Filtering

and Group by tools accessible, exactly like in all other menus on the Odoo platform.

These are the usual filtering and grouping choices, and additional ones may be built

using the noble tools. These specially specified ones can be saved as Favourites

and used in the Depreciation Schedule reporting features filters in the future.

To learn more about the Journal and the entries described in it, choose each entry

under the corresponding Chart of Accounts.

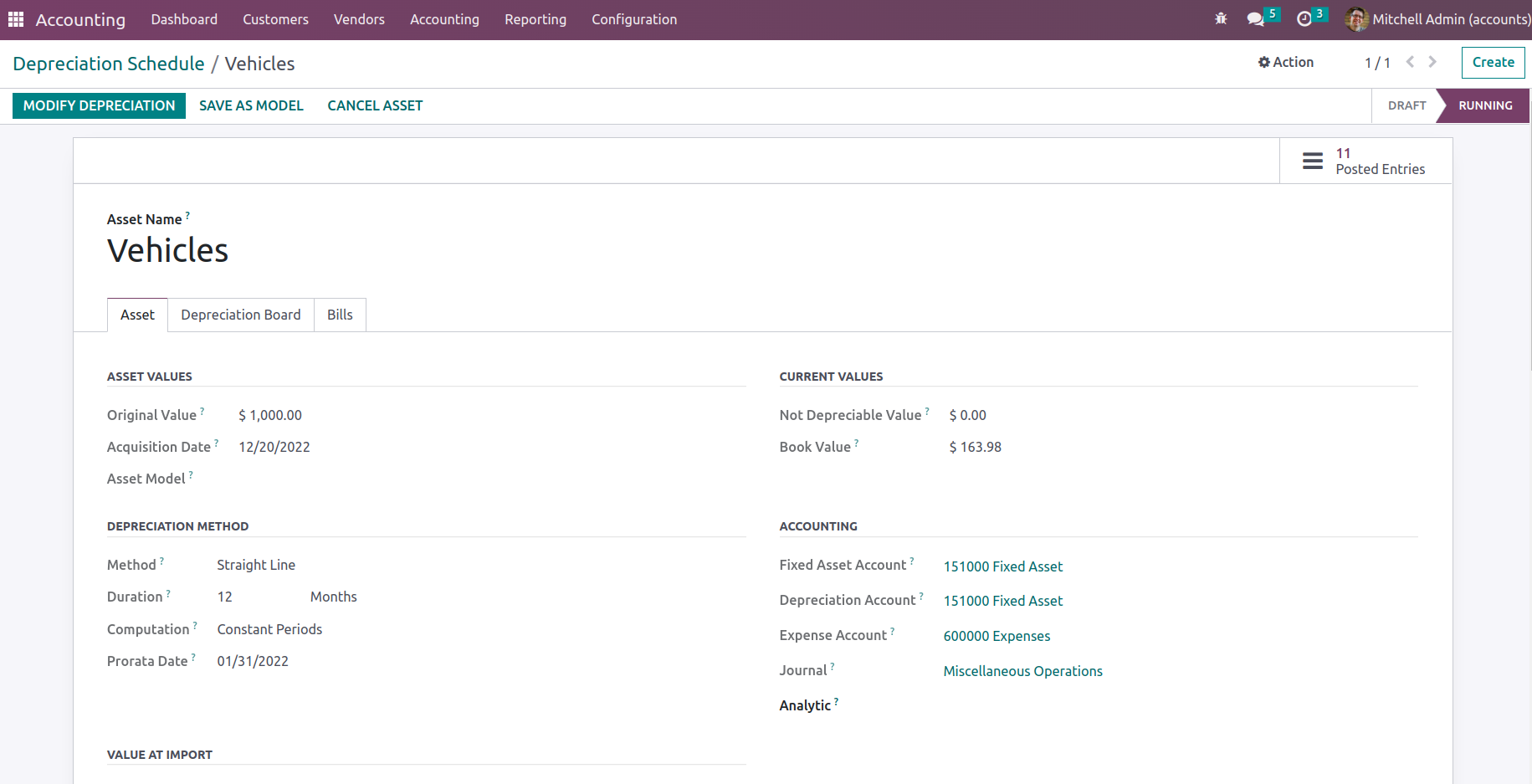

To access the asset details, click Open Asset. You can also choose to edit the journal's

specifics by using the available Edit option. The MODIFY DEPRECIATION option provides

the option to sell, dispose of, re-evaluate, and suspend the asset depreciation.

The choices to sell or dispose of the asset are listed under "Sell or Dispose."

You can change the depreciation in relation to the asset by choosing the available

Re-evaluate option.

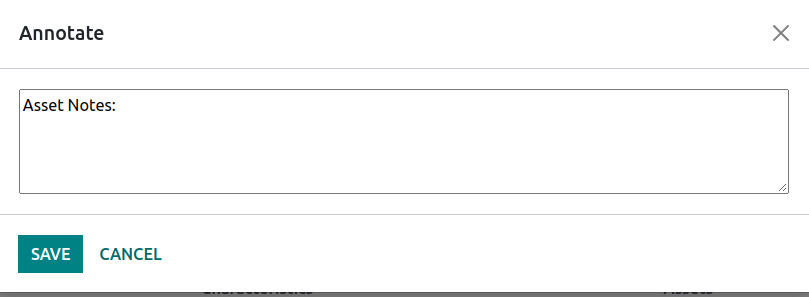

When you select the appropriate Annotate option for the Journal indicated in the

Depreciation Schedule, the Annotate window, as shown in the following screenshot,

will open. You may add a description to the Annotate actions and save them with

the Save option.

The Depreciation Schedule reporting tool, which is accessible on the Odoo platform,

will provide you with comprehensive insight into all areas of your company's asset

depreciation, as detailed there. Now that we've covered the Depreciation Schedule

methods, let's move on to the next part, which will create the Odoo Accounting module's

Budget Analysis reports.

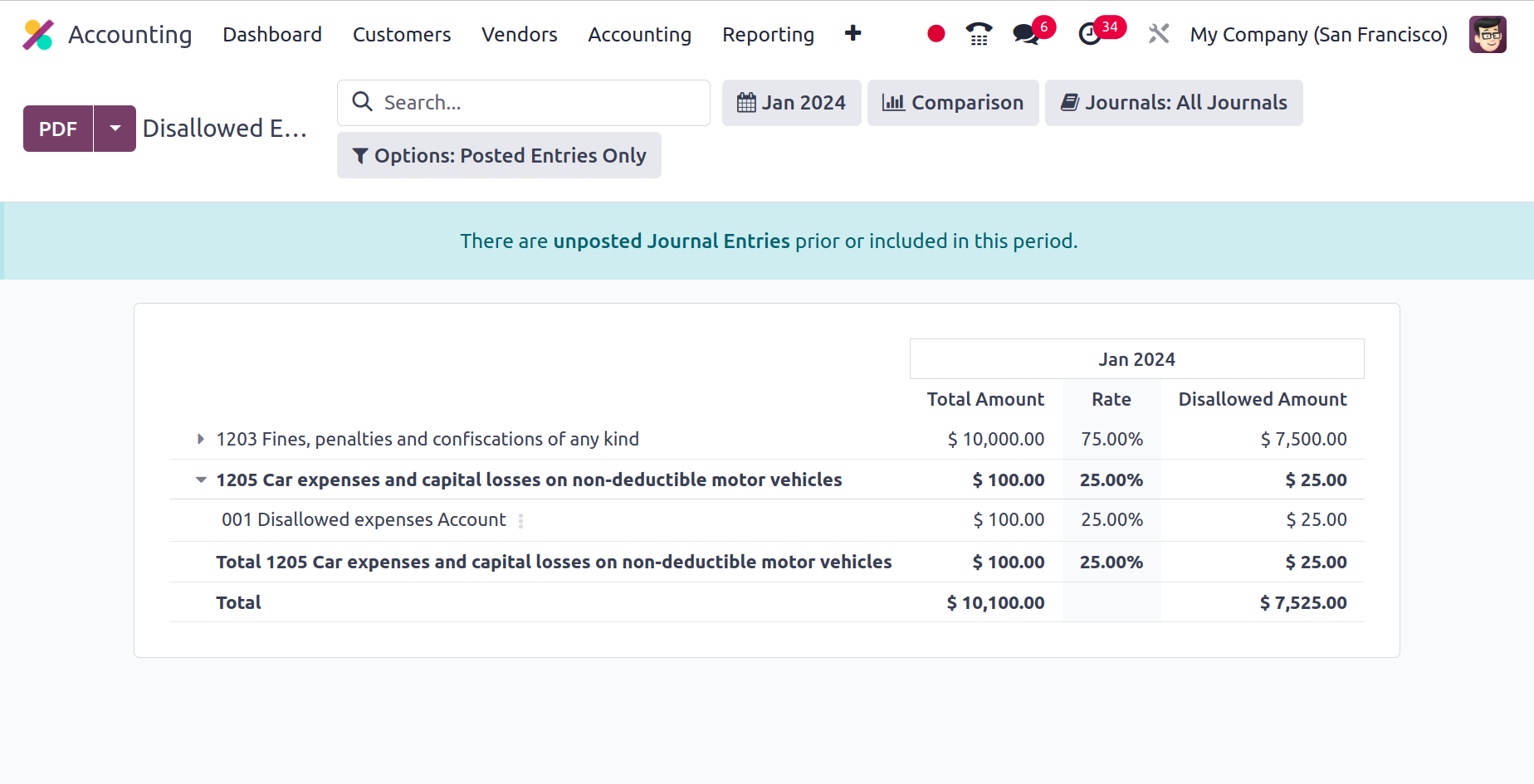

Disallowed Expense Report

Disallowed expenses in Odoo 17 Accounting are costs that, in the context of business

accounting, are not allowed for reimbursement or deduction, frequently because of

internal or regulatory guidelines. The computation of taxable income or reimbursable

amounts does not include these expenses.

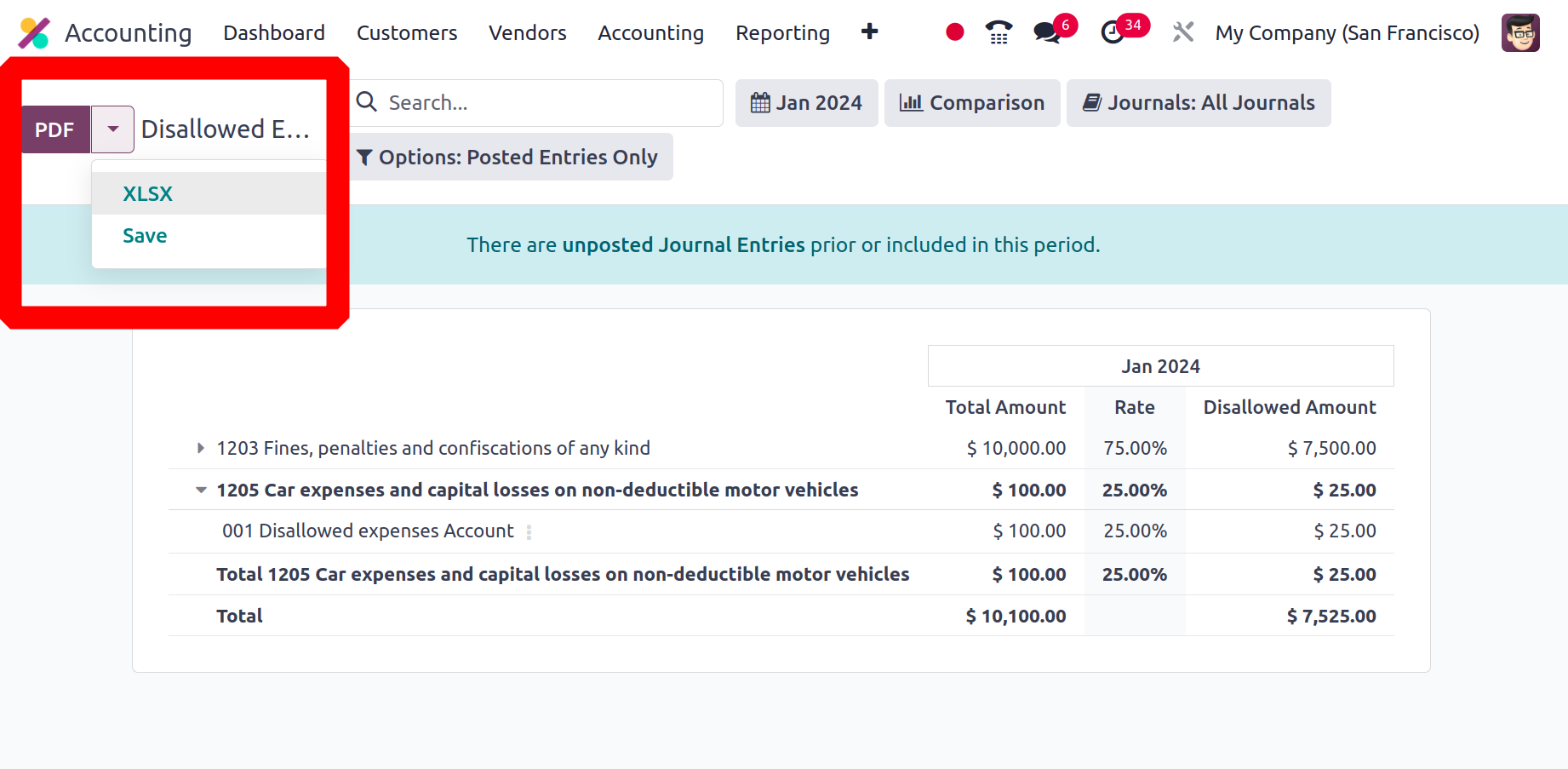

As a result, these fabricated charges are shown in the Disallowed Expense Report

report under Management, as may be seen below. Every detail of every Disallowed

Expense entry is included in the report. The report displays the total amount, the

disallowed rate, and the disallowed amount.

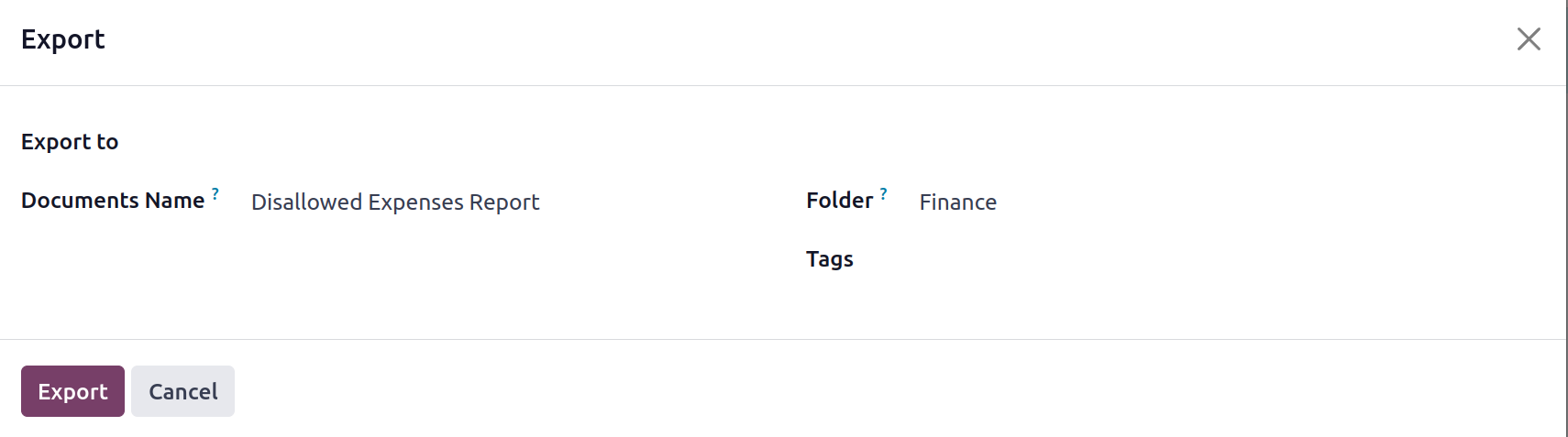

The report is readily available for download to the system in XLSX or PDF format.

Additionally, by selecting the Save button, the report can be saved to the Documents.

A popup window will appear if the Save button is selected; select the Document Name,

Folder, and Tags from there. In order to export this to Documents, click the Export

option.

Budget Analysis

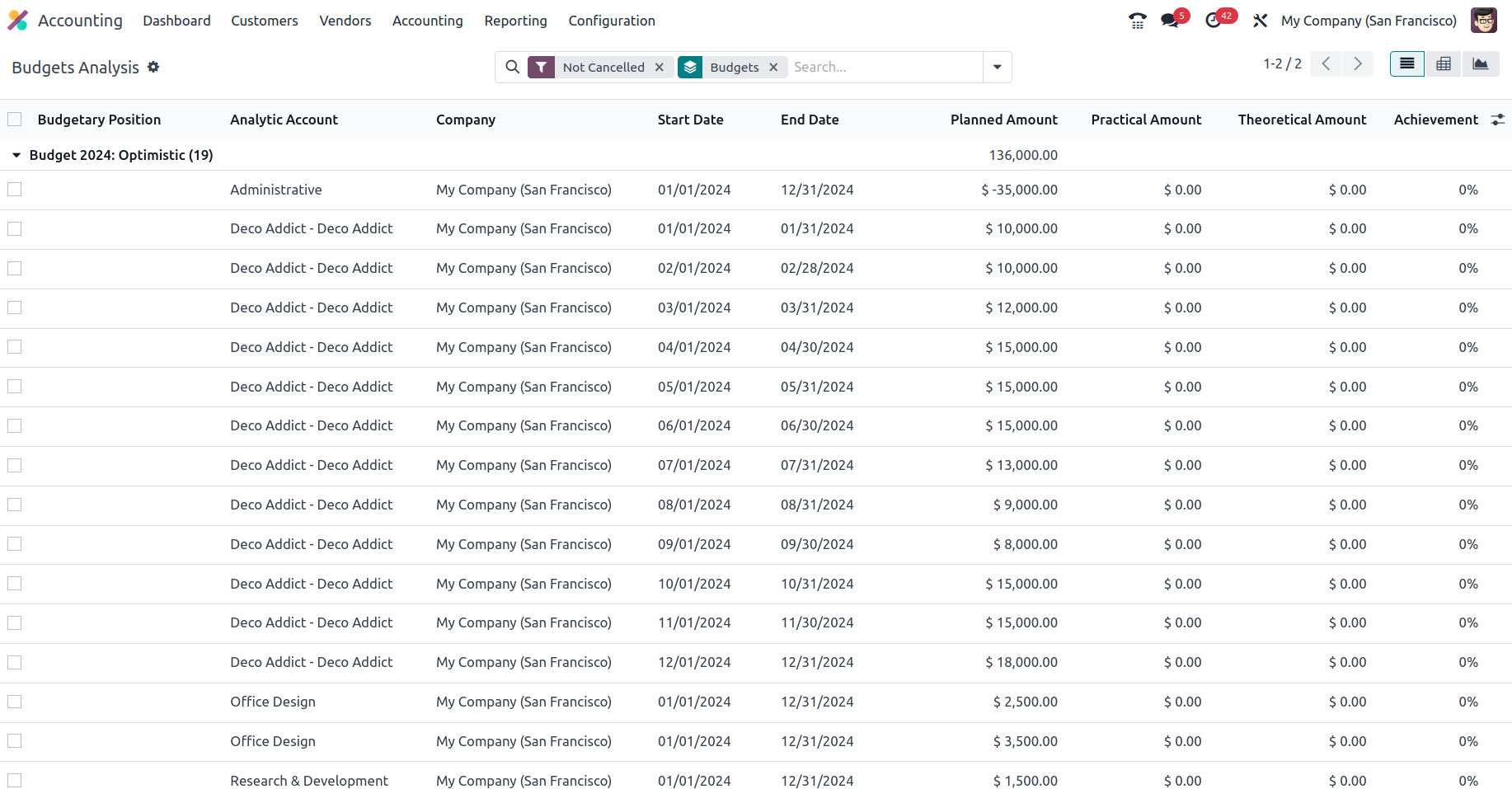

The financial planning of a company's business activities for a certain fiscal term

or period is primarily reliant on the company's budget. The fiscal department of

a corporation will create a single budget as well as several more based on the company's

operational and functional requirements. The Odoo platform's Accounting module has

a complete Budget Analysis reporting menu where the reporting component of the various

budgets can be adjusted. The Budget Analysis Report, which can be accessed via the

Accounting module's reporting page, will provide a detailed picture of the business's

budgetary activities.

Filtering and grouping by options are available in all Odoo platform menus and may

be used to arrange the entries of the Budget Analysis reports in accordance with

the needs.

These filtering and grouping options are common, and additional ones may be built

using the noble tools. These specially specified ones can be saved as Favourites

and used in the Depreciation Schedule reporting features filters in the future.

The report will define all budgeted operations from prior fiscal quarters as well

as those that are presently ongoing. These sections can easily be expanded to encompass

the budget's various financial components.

The budgetary position, analytical account, as well as the Start Date, End Date,

Planned Amount, Practical Amount, Theoretical Amount, and Achievement Percentage,

will be determined.

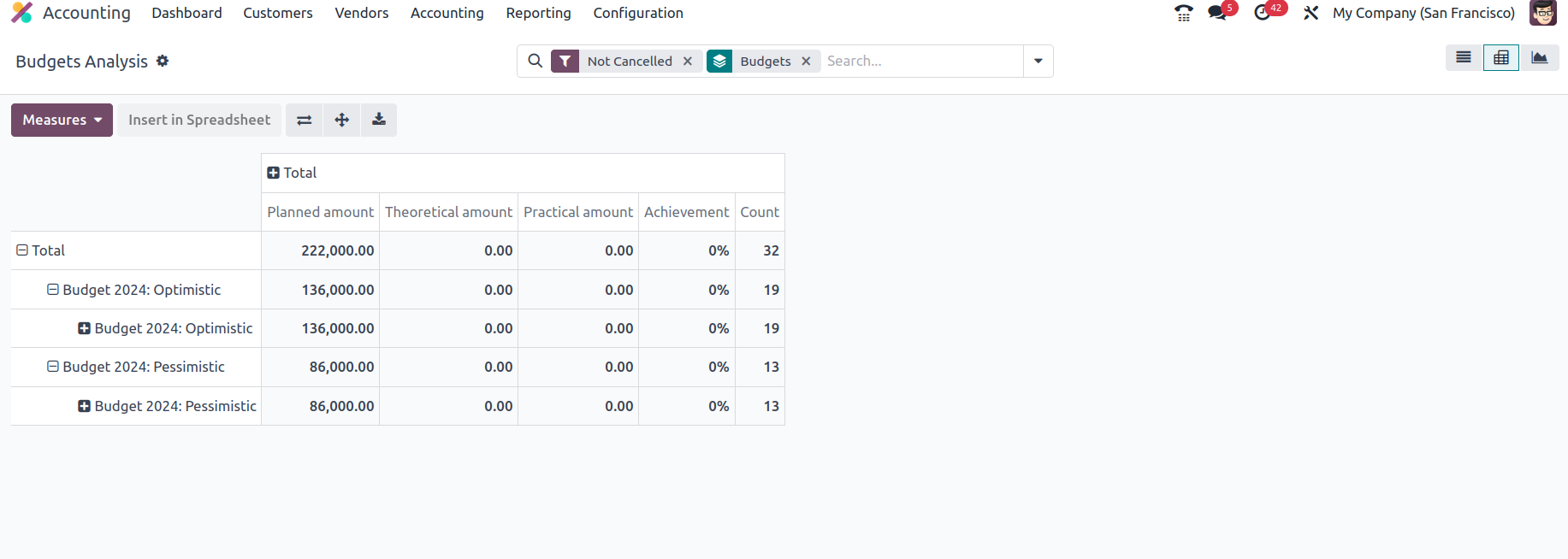

The budget analysis report may be seen in the List view, Pivot view, or Chart view

by selecting it from the right-hand menu. The prior pictures showed the list view

of the Budget Analysis report. The following screenshot shows the Budget Analysis

report's Pivot View. In the pivot view, you may specify the Measures for the aspects

that have been created for the different attributes of the entries to be sorted

out. By utilizing the + and - signals, you may add the default Measures that have

been defined in both axes of the report. You may build and publish reports based

on the operational components of the budget using this capability.

Along with the graph view, the budget analysis reports will offer you with a full

insight of how your business's budget is running. Furthermore, you will be able

to sort out the required entries of each of the reports that have been defined depending

on your requirements by using the distinct as well as precise filtering and group

by choices that are provided. With Odoo's unique Budget Analysis reporting management

solution, you can now grasp the many components of budget management reporting.

Let's move on to the part that defines Odoo Accounting's Project Margins reporting.

Product Margins

The product margin is the profit you make from the sale of a thing you manufactured

or bought. Product margins and their analysis will provide accurate facts on the

products that firms will generate based on product sales. In terms of mathematical

operations, the Product Margin is defined as:

Product margin= (selling price – cost of product) / selling price

The product is profitable for the company and the margin percentage is positive

if the selling price is higher than the cost price. However, if the selling price

is lower than the cost price, the company loses money, and all sales activity results

in a negative margin. The Odoo platform is aware of the importance of the production

margin in business operations and has created a special reporting function for this

purpose in the Odoo accounting module. Product margin reporting, accessible through

the Reporting menu in Odoo's accounting module, provides a clear summary of a company's

product margin performance.

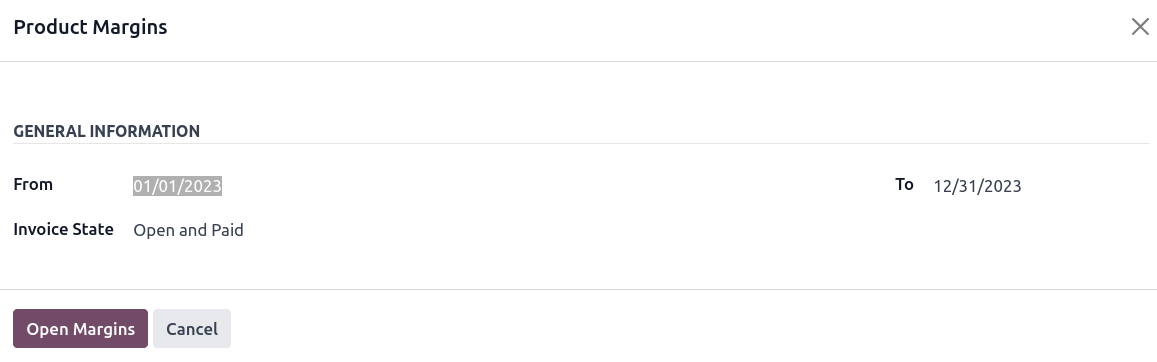

After selecting the Product Margins option, you will get the pop-up box displayed

in the picture below. The General Information data must be configured here, including

the From and To choices, which must be further described. You may select Invoice

State from the available drop-down menu.

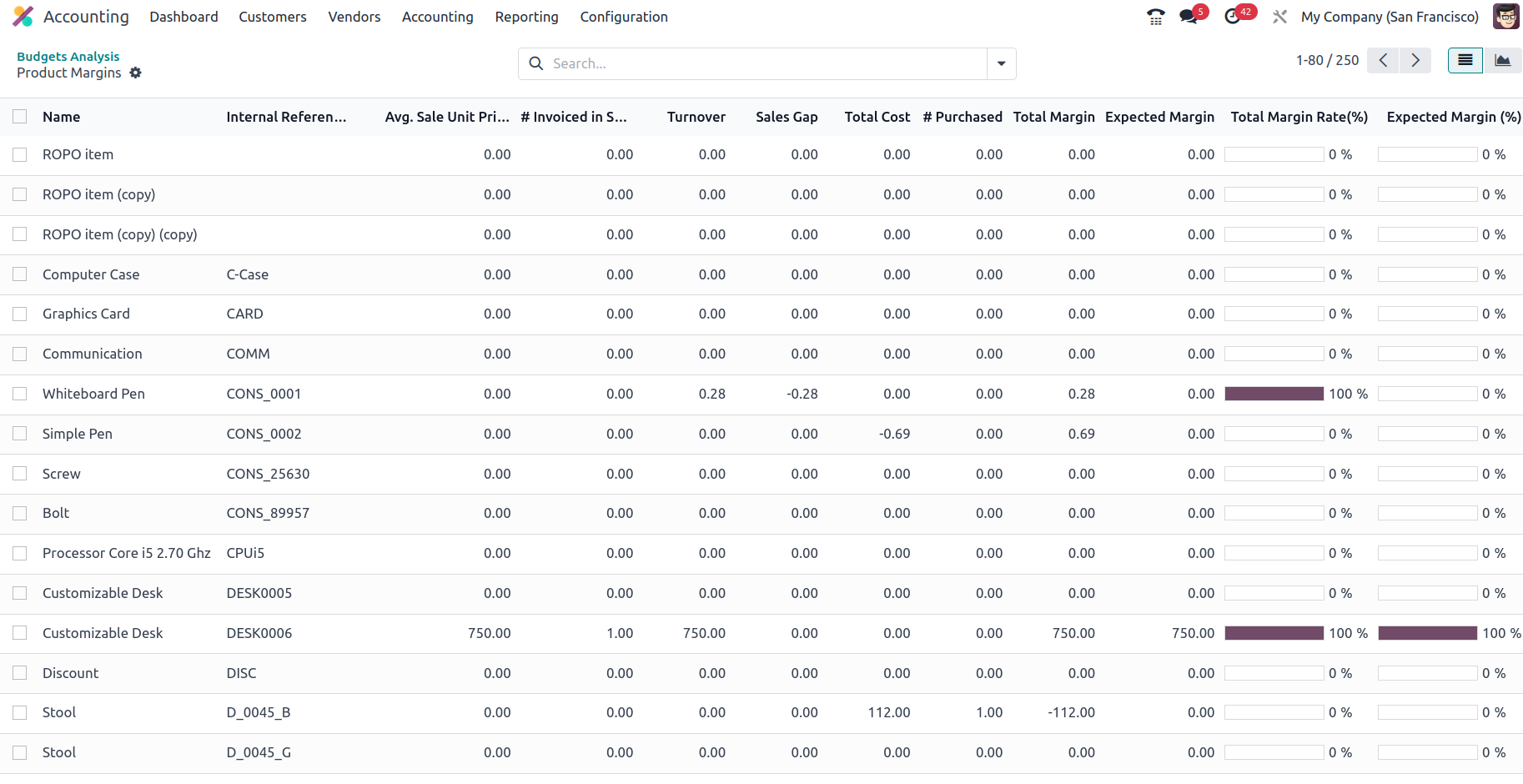

After configuring the operations aspects, select the Open Margins option to show

the Product Margins report aspect and the configurations aspect. The product margin

reporting will be displayed based on the given settings and the budget analysis.

Product names, internal reference information, average sales unit price, invoiced

sales amount, turnover, sales gap, total cost, bought amount, total margin, projected

margin, total margin rate percentage, and predicted margin percentage are all displayed

here.

Furthermore, the Filtering and Group by tools, which are available in all other

menus of the Odoo platform, will assist in organizing the Product Margins report

inputs according to requirements. These are the usual filtering and grouping choices,

and additional ones may be built using the noble tools. Those that are specially

tailored to your requirements can be saved as favorites for future use when filtering

the Product Margins reporting features.

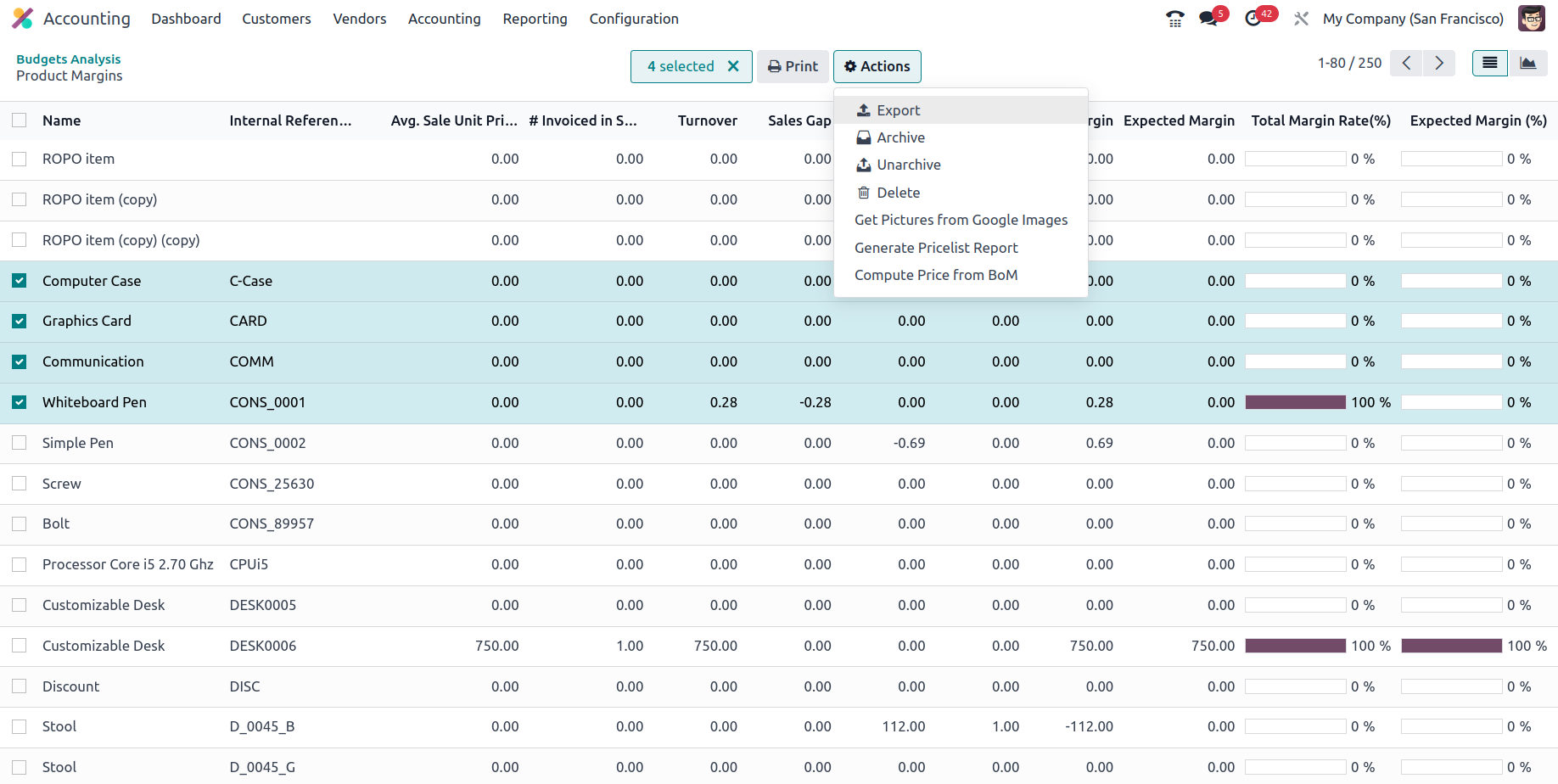

Additionally, you may select from a number of specified Products by using the available

Tick box option, which will display the Action option, which will show you the options

for Export, Archive, Unarchive, Delete, and the Generate Price List option, as seen

in the image below.

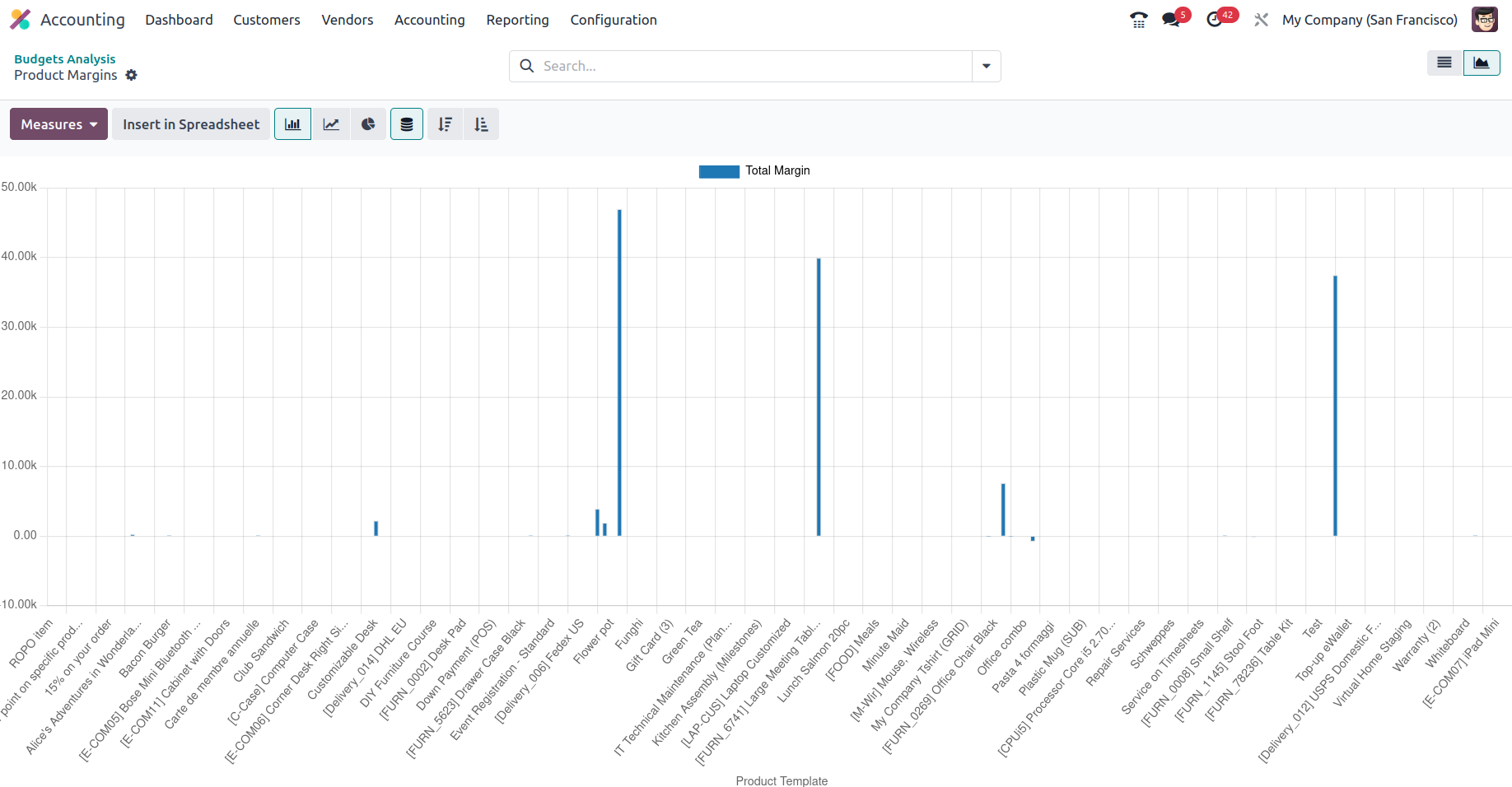

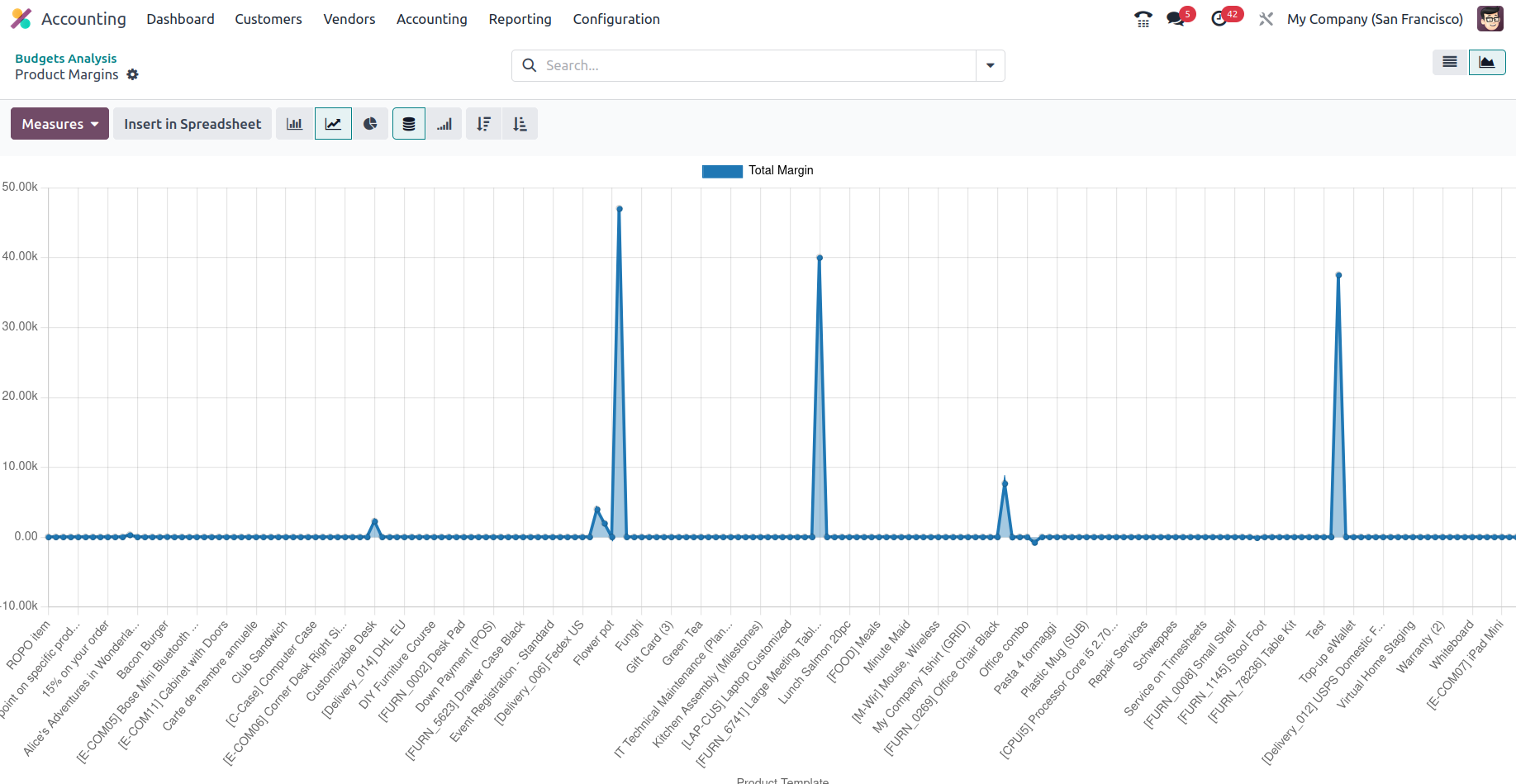

Additionally, the Product Margins reporting menu may be seen in Graph View, which

provides a more statistical perspective on the Product Margins. The screenshot below

shows the Bar Chart View of the Product Margins reporting. You can also choose whether

it should be displayed as a Line or Pie chart based on your needs. There are established

grouping options, as well as default and custom filtering tools. The measurements

can be defined as needed by selecting from the specified default measures.

The screenshot below displays the Product Margins reporting's Line chart, in which

the different attributes of the defined entries are represented by lines.

We've been discussing the management-based reporting features of the Odoo Accounting

module up to this point.

This chapter focuses entirely on the reporting functions of the Odoo Accounting

module and provides a comprehensive description of how they work. We discussed the

reporting instruments classified as statement reports, partner reports, audit reports,

and management-based reports. The following chapter will focus on configuring Odoo's

general settings, which are critical for accounting procedures.