When it comes to business accounting, auditing is a critical component of finance

management tasks. This unavoidable component is recognized as a priority throughout

the fiscal periods that are now being formed. Furthermore, in compliance with requirements,

the entire fiscal year's financial operations are checked, recorded, filed, and

audited. This is normally done once every fiscal year. The Accounting module in

Odoo provides you with specialized Audit Reporting features to help you manage your

company's finances and oversee its accounting operations.

There is a distinct category of Audit Reporting tools available, including General

Ledger, Trial Balance, Consolidated Journals, Tax Report, Intrastat Report, EC Sales

List, and Journal Audits, all of which are accessible via the Odoo Accounting module's

reporting page. Let us now go over each of the Audit reports separately in the next

section.

General Ledger

All accounting data related to business operations will be defined in the company's

general ledger. Furthermore, filters may be applied to Dynamic reports, and the

General ledger displays all business transactions from all Account Ledgers used

in the firm. All financial transactions connected to the company's sales, purchases,

and other activities will be defined in a unique way here to help the viewer understand

those transactions immediately. Furthermore, the well-organized menu may be utilized

to study and identify specific information relevant to the company's financial management

methods.

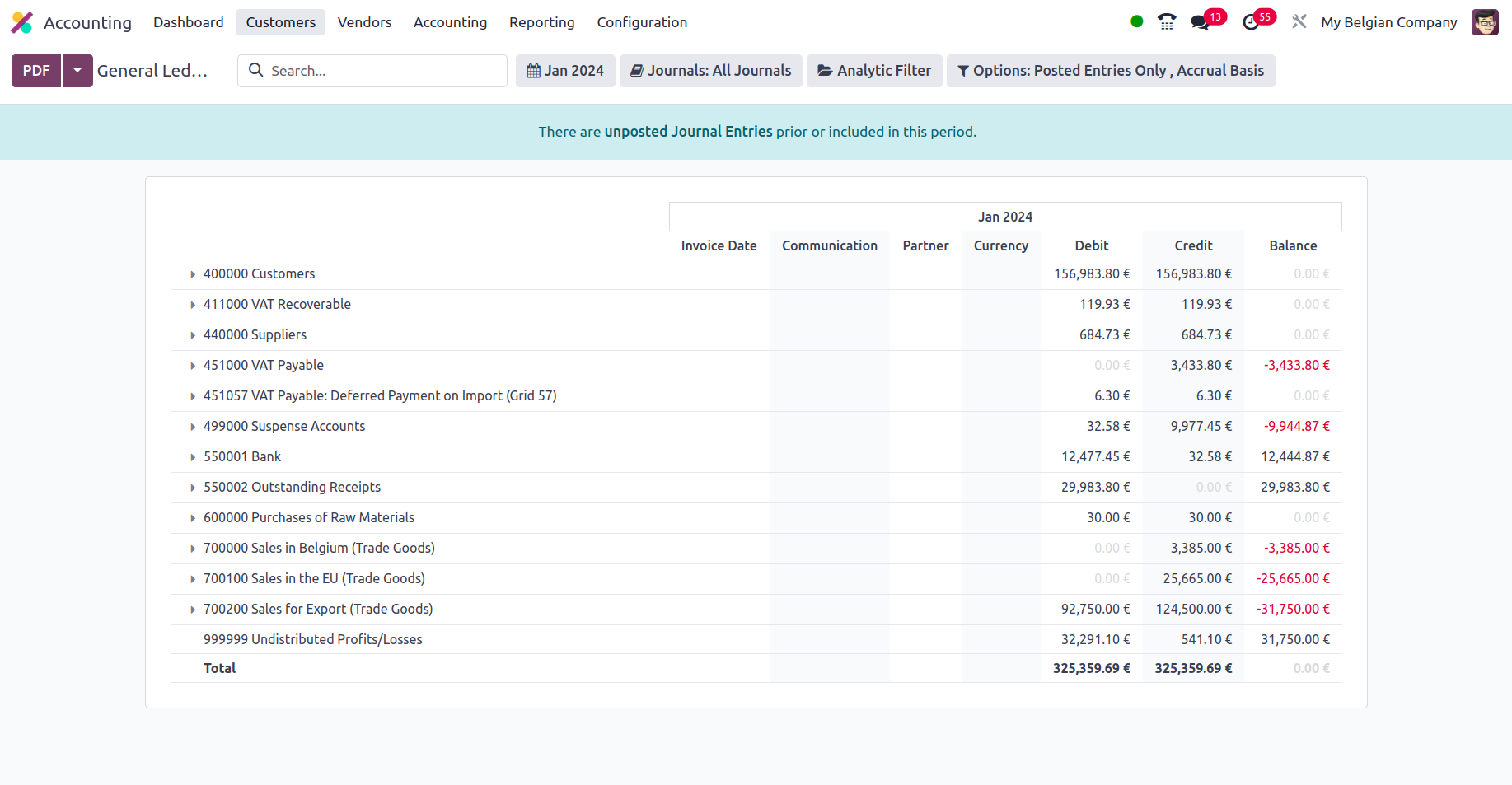

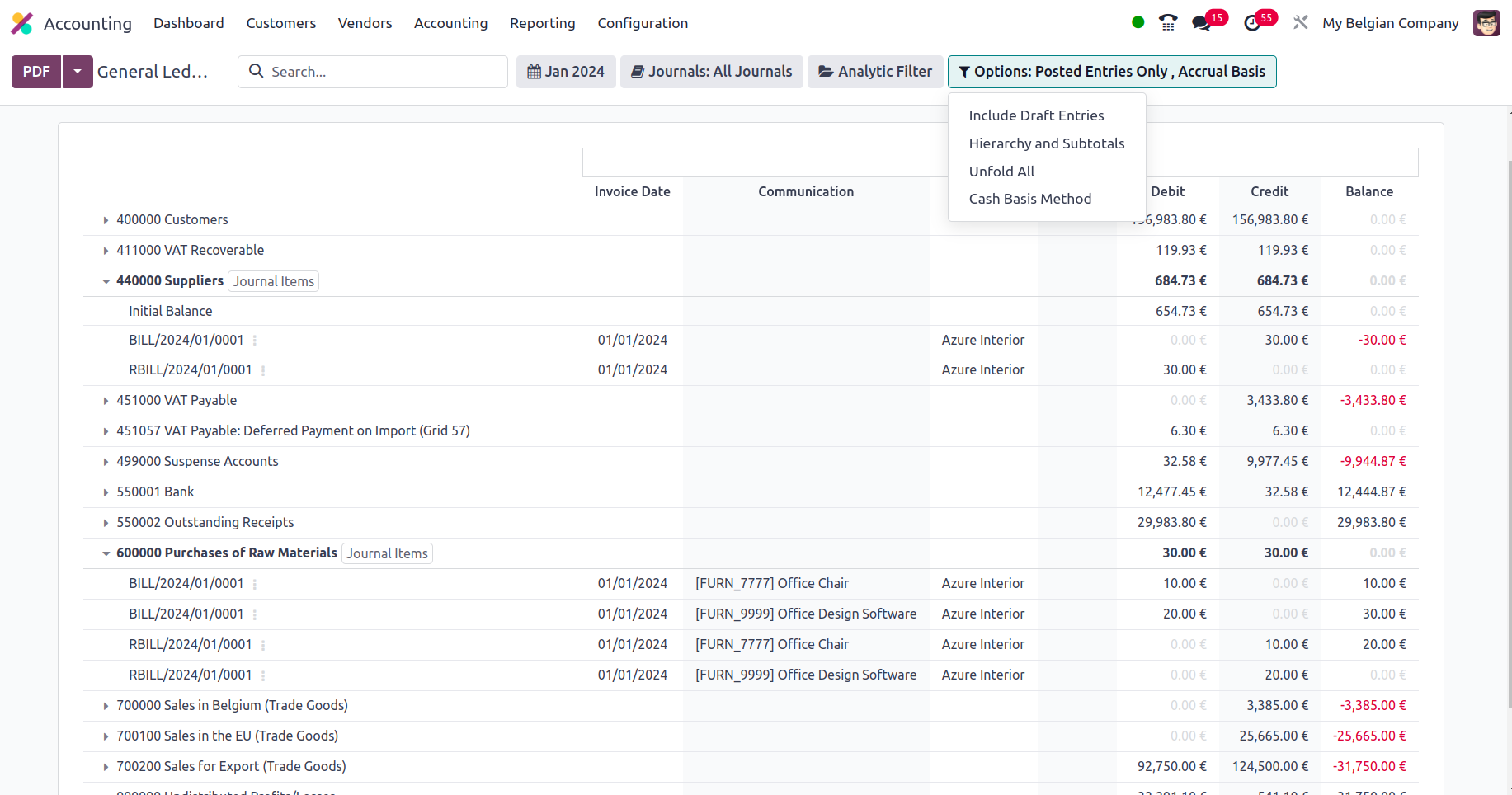

You may examine the company's general ledger by selecting the Reporting option in

the Accounting module, as illustrated in the following screenshot. All of the financial

operations items that have been filtered to appear for the given time will be displayed

here. Every journal that has been posted will be explained, along with the invoice

and bill details for that journal.

Additionally, you have the option to Print Preview, which will provide a General

Ledger Report preview before printing. In addition to exporting General Ledger data,

you may export the report in XLSX format for use in other corporate activities by

selecting the Export (XLSX) option. The Save option ensures that the set details

and filtering parameters are saved in the reporting menu. You may opt to enlarge

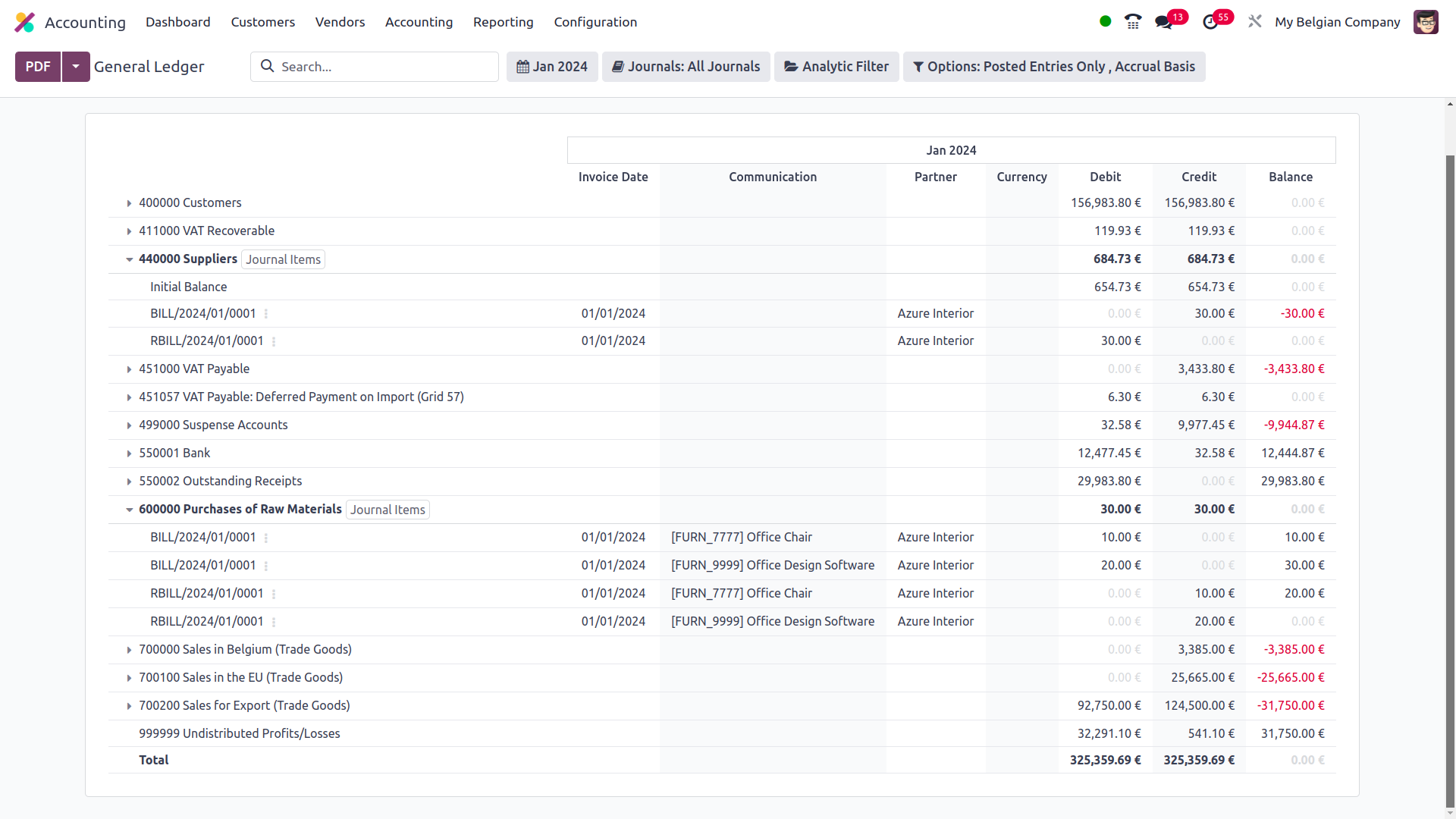

a Journal, which will display all linked bills and invoices. The Ledger entries

in the image below have been filtered to the month of January in the year 2024,

and Sample has also been selected as the Journal filter. Furthermore, only the entries

that have been uploaded are screened.

When an account is opened, the impacted journal entries are displayed together with

the date, partner information, currency, debit/credit amount, and balance. Additionally,

a right-click allows you to see and comment on the Journal Entries (add notes on

each entry). The remarks made to the journal entries can be viewed and updated at

the bottom of the General Ledger. You may filter the date or month of operations

as This Month, This Quarter, This Financial Year, Last Month, Last Quarter, or Last

Financial Year if you need to define a custom filter date of operations. The Filtration

menu in the General Ledger menu is shown in the screenshot below.

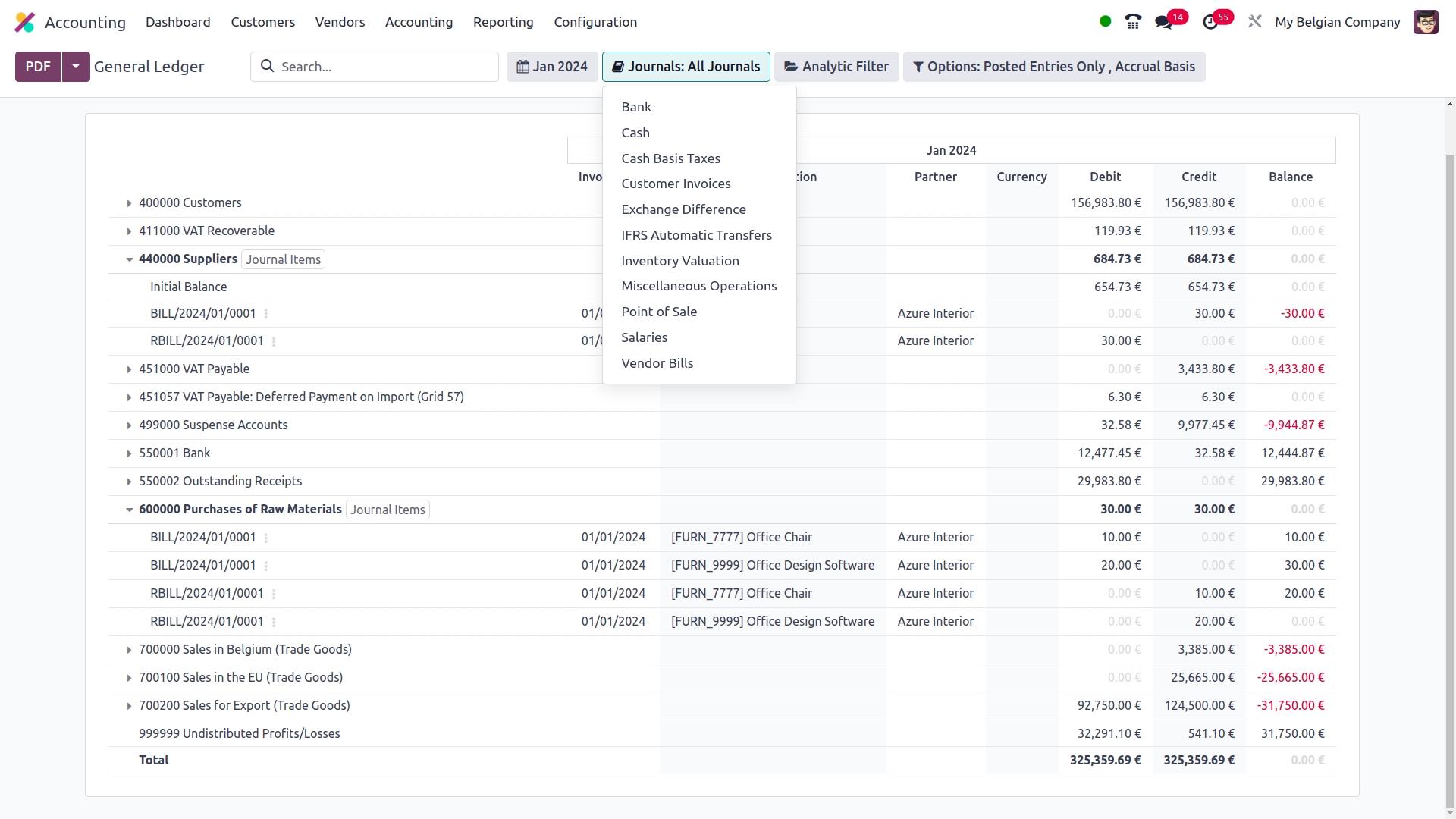

You have a different option to filter the journals where you can pick the particular

journals to be filtered as well as the defined journal groupings that may also be

selected as the filter.

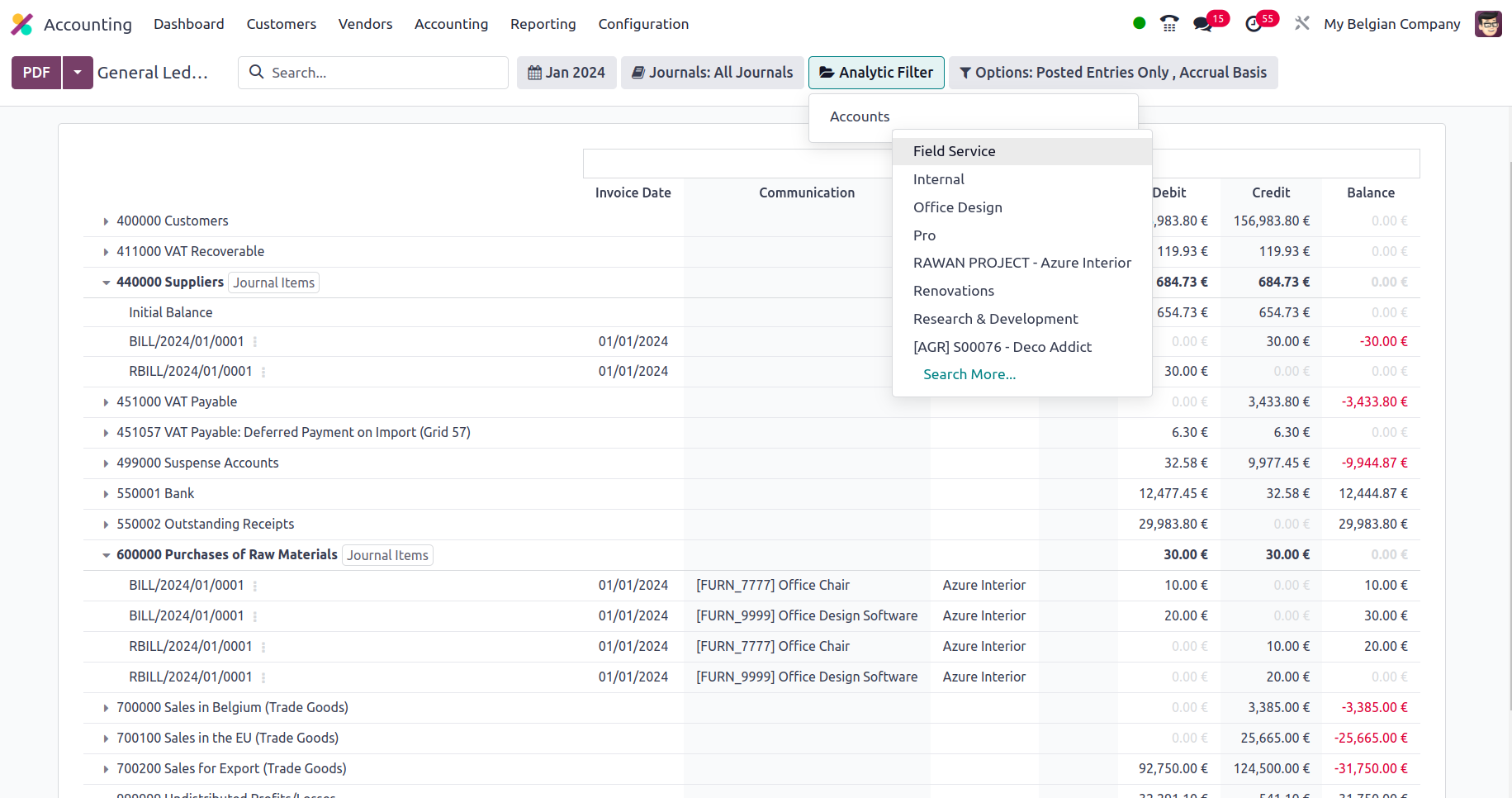

Additionally, using the available Analytic option, the filtration may be done in

relation to the Analytical Accounting sections of the firm's financial management.

Define the Analytical Accounts and Tags here to filter out General Ledger entries.

In addition, there is a particular filtering tool provided. This filter contains

just Posted Entries by default, but it also offers the choices to Include Unposted

Entries, Use Accrual Basis, Unfold All, and Use Cash Basis Method. Using this option,

the required General Ledger entries can be defined in operation. There are also

buttons that allow you to print reports in PDF and XLSX formats. The Store button

saves reports to the proper place in the Documents modules, allowing you to keep

financial information.

The general ledger is a report that initiates all posted and unposted accounting

operations connected to the operation of the firm. In the early days of business,

a specialized book known as General Ledger was kept, but with the Odoo Accounting

module, all entries will be automatically displayed with regard to the corporate

activities of the different Journals. Now that we've covered the Odoo Accounting

module's General Ledger reporting menu, let's move on to the next section, which

defines the Odoo Accounting module's Trial Balance Report.

Trial Balance

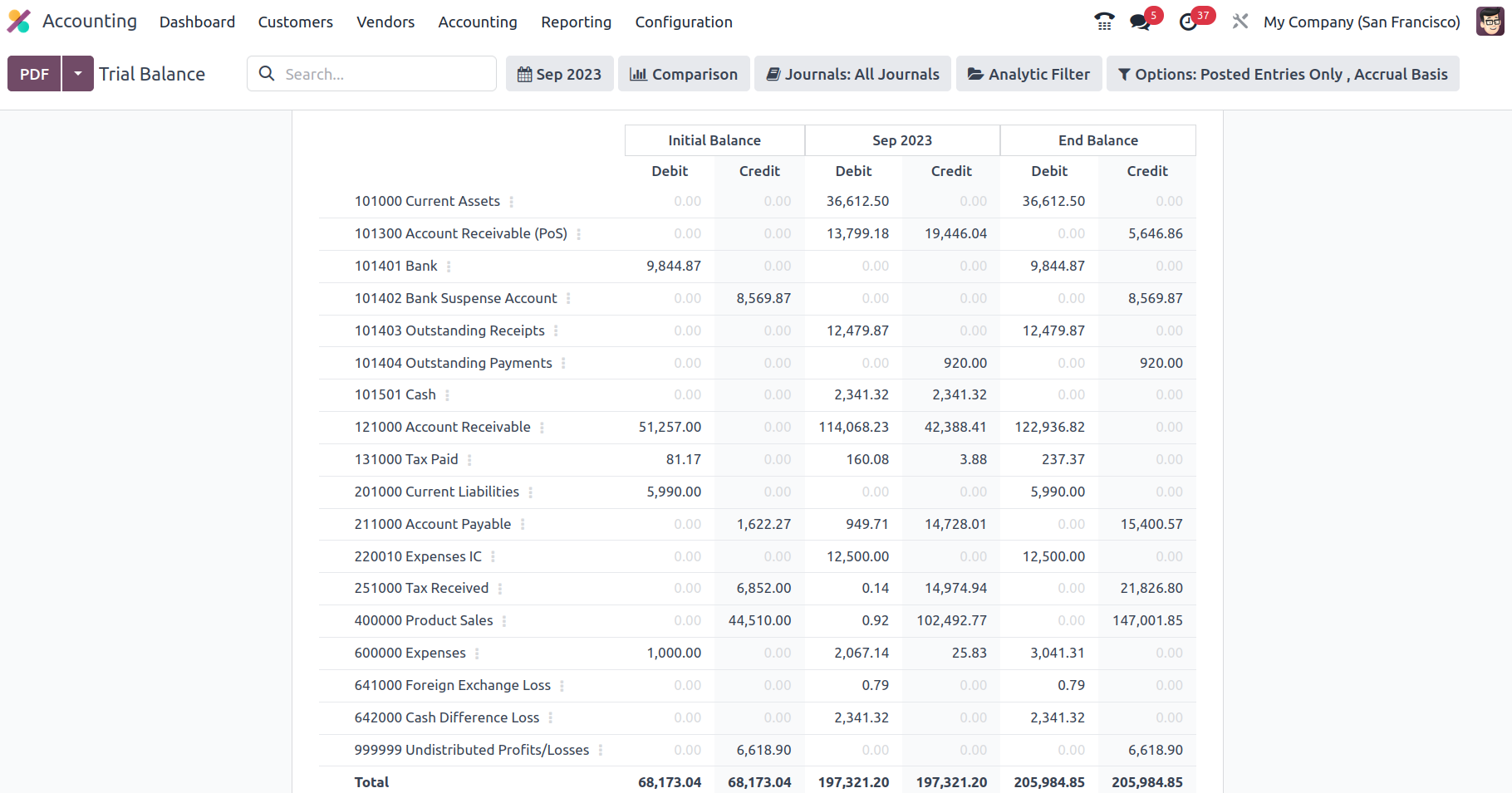

A trial balance is a sort of bookkeeping instrument that describes the balance of

each account in credits and debits in terms of the organization's accounting activities.

The Odoo Accounting module's specific Trial Balance reporting tool is specified

in the module and available via the module's Reporting page. All filtered journals

will be displayed in the Trial Balance report option, together with the operations'

beginning balance information in the form of a debit and a credit. The Debits for

the appropriate time will then be displayed, together with the Credit amounts of

the entries, with the Total Debit and Credit Amount stated. You will also be able

to search for a certain Account in the Trial Balance report.

There is also a Print Preview option, which displays a preview of the Trial Balance

Report before it is printed. In addition to exporting the Trial Balance details,

you may export the report in XLSX format for use in other business operations by

selecting the Export (XLSX) option. The Save option saves the set details and filtering

options in the reporting panel.

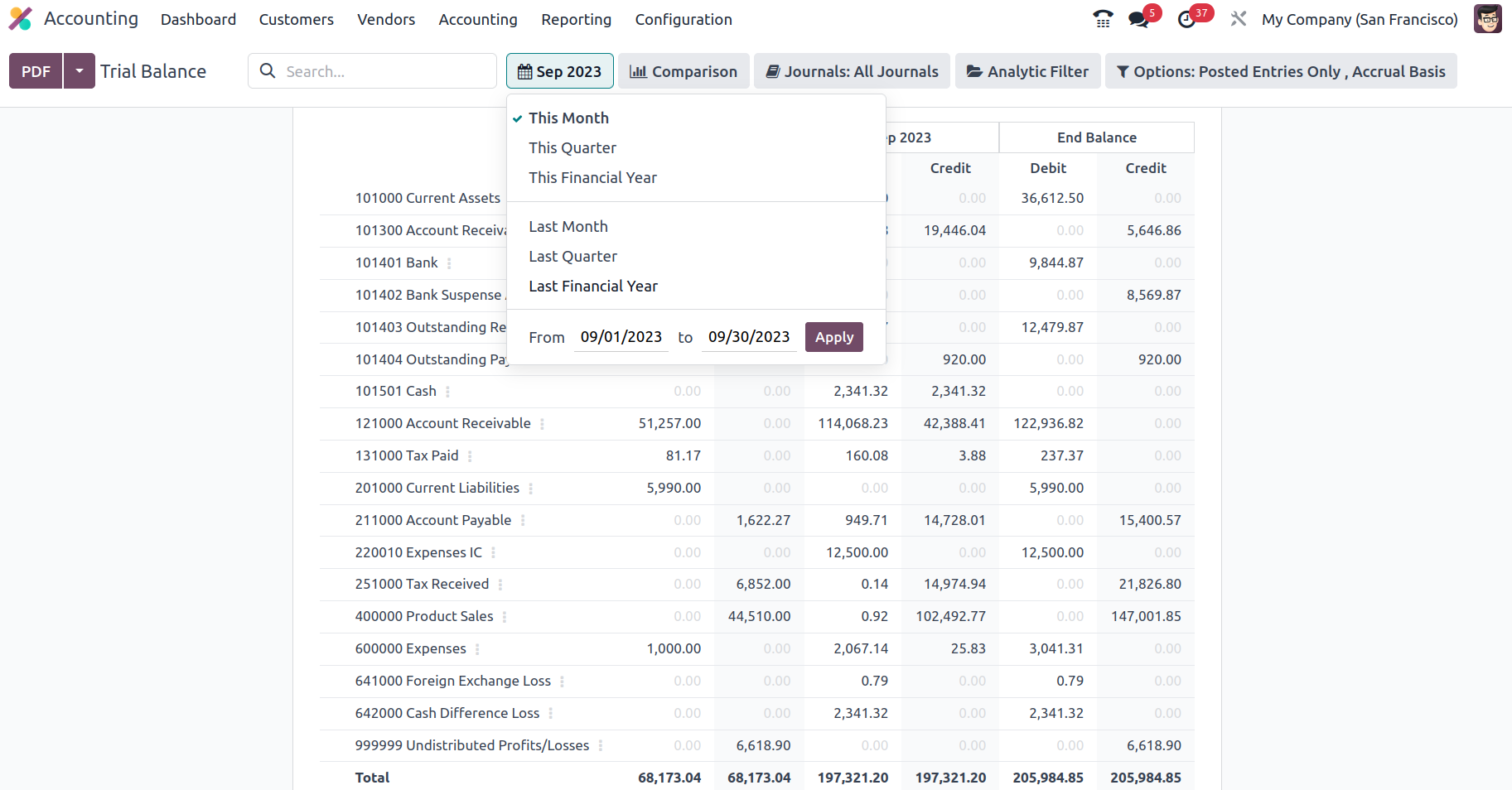

In terms of the Group by feature, you may define the Trial Balance for This Month,

This Quarter, This Financial Year, Last Month, Last Quarter, and Last Financial

Year, or add Custom filters as needed. The Group by choice is displayed in the accompanying

snapshot, and they may be used to filter the Accounts depending on how long the

firm has been in existence.

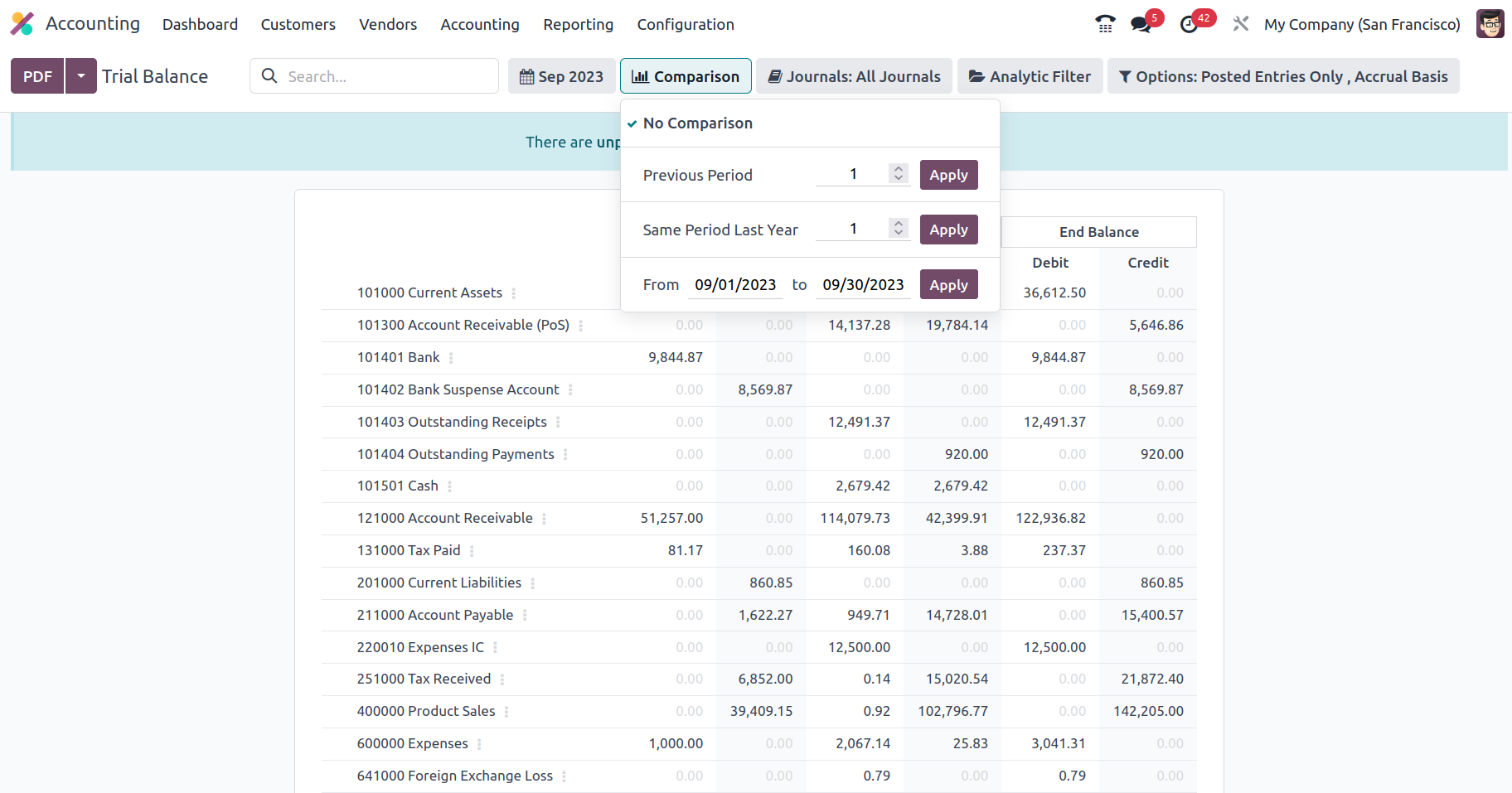

There is also an extra Comparison option that you may use to establish the comparison

between the company's Journal entries. The comparison might be with the preceding

period, the same period from the previous year, or a bespoke comparison set by the

needs. Once the Comparison is created, the Trial Balance Report will specify the

two Periods, the current one and the one you need to compare, as seen in the accompanying

picture.

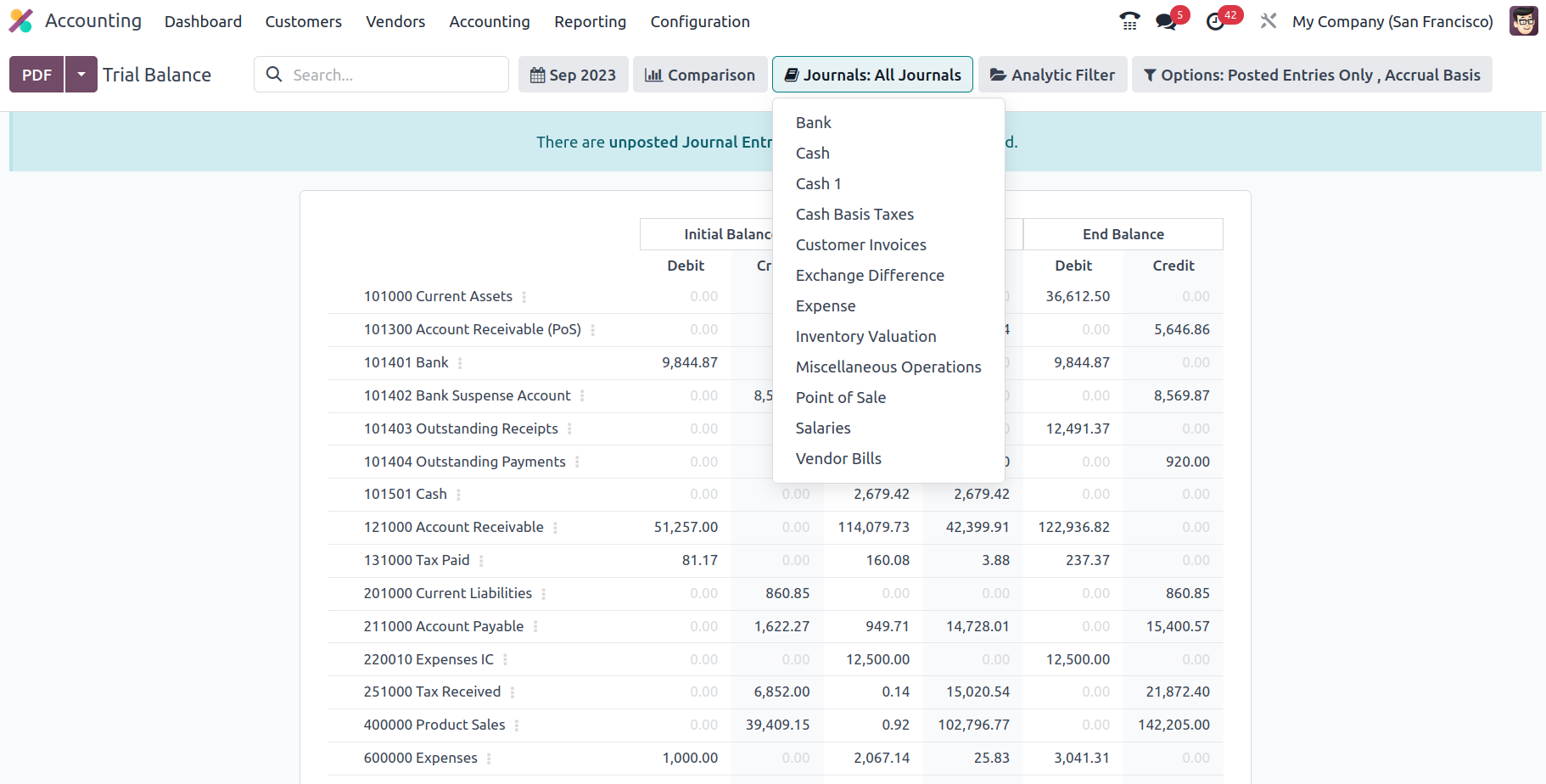

The Journal Groups and particular Journals given can also be used to group the Journals.

If you employ this grouping approach, you will have a better understanding of the

Trial Balance elements in relation to each of the operational Journals.

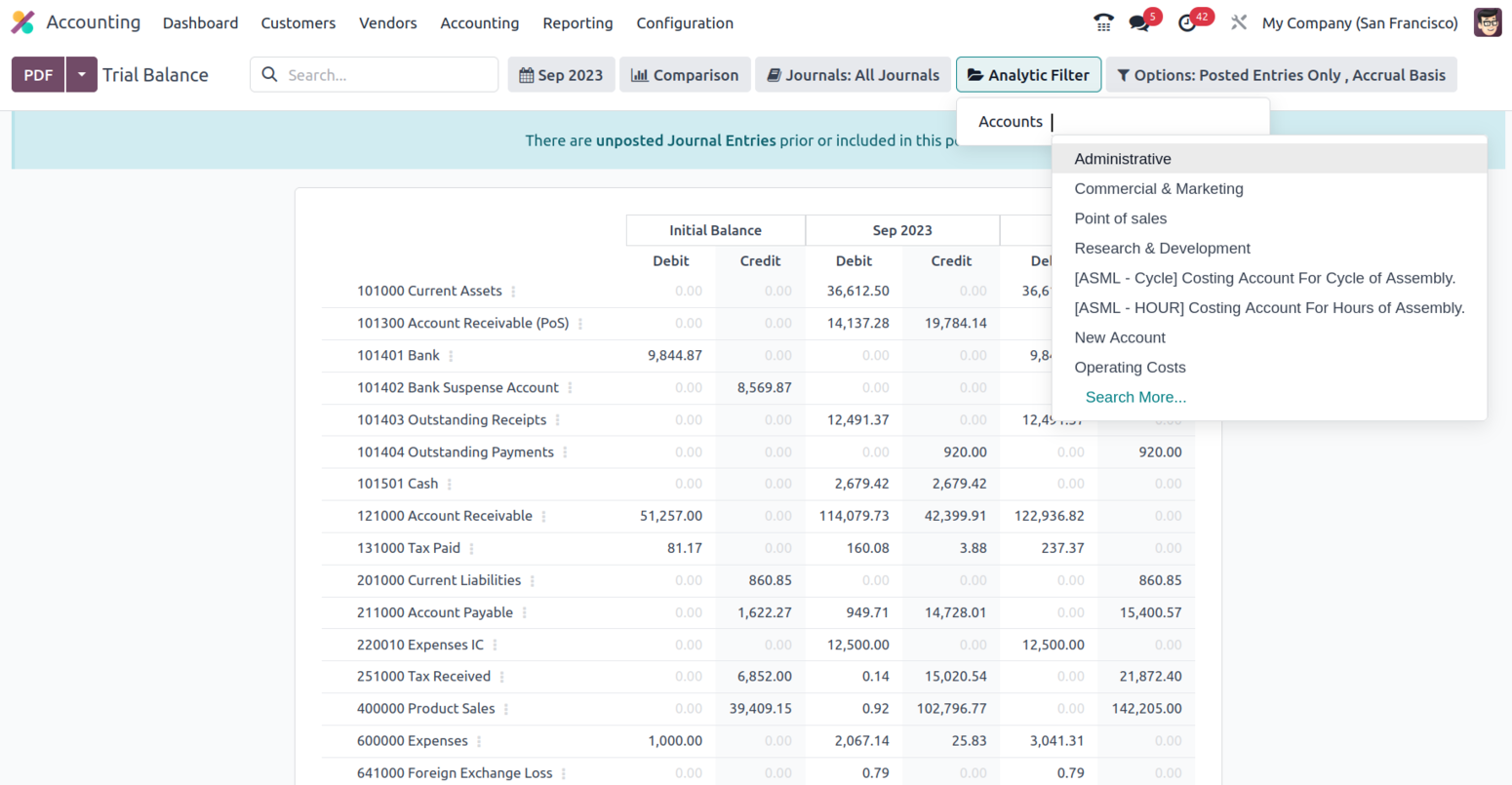

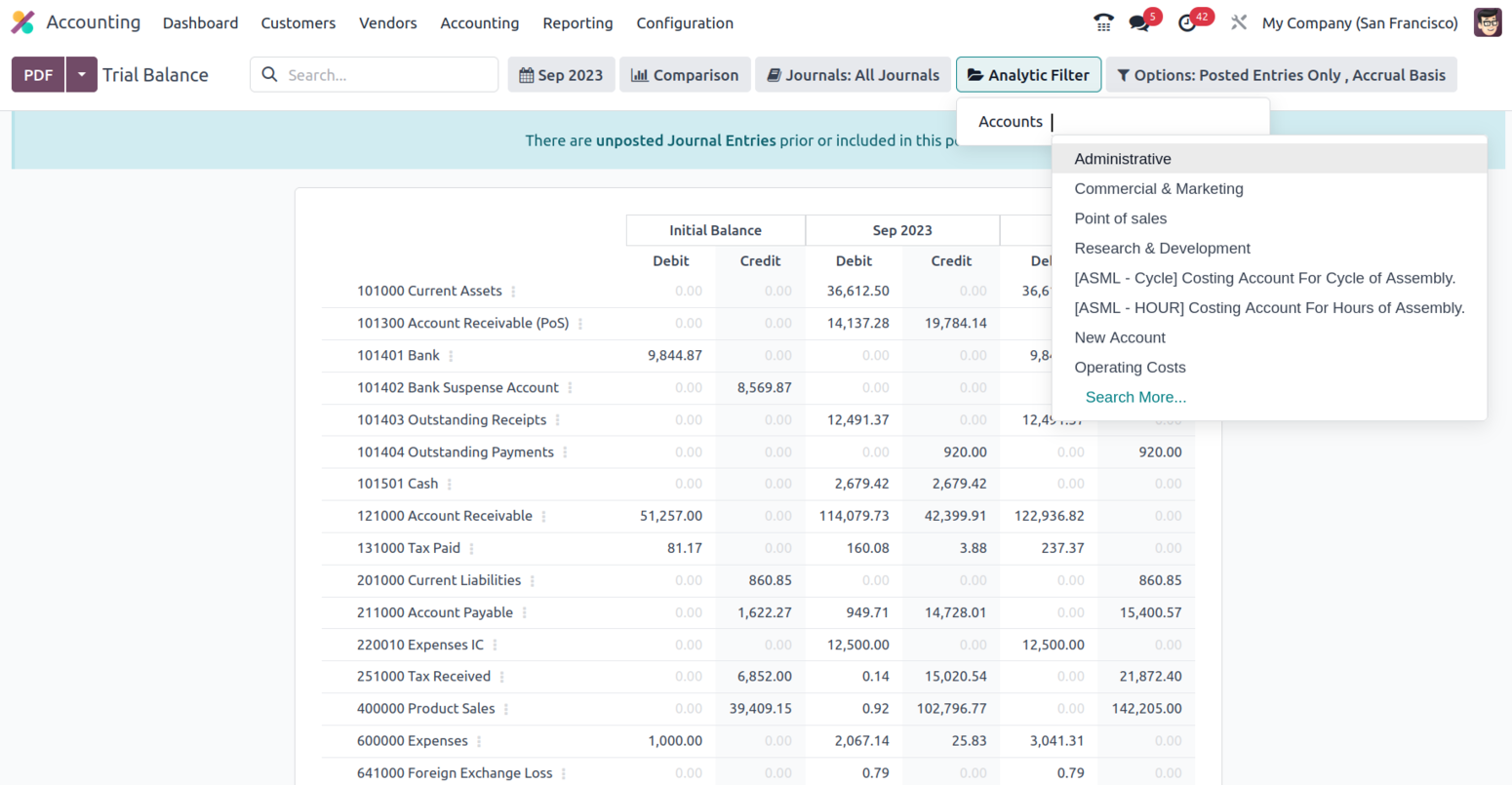

Additionally, the filtration may be done in reference to the Analytical Accounting

sections of the company's financial management utilizing the available Analytic

option. Define the Analytical Accounts and Tags below to filter the items in the

Trial Balance report.

In addition, there is a particular filtering tool provided. This filter contains

just Posted Entries by default, but it also offers the choices to Include Unposted

Entries, Use Accrual Basis, Unfold All, and Use Cash Basis Method. Using this option,

the necessary Trial Balance entries can be defined in operation. There are also

buttons that allow you to print reports in PDF and XLSX formats. The Store button

saves reports to the proper place in the Documents modules, allowing you to keep

financial information.

The Trial Balance report of the company's financial activities will provide detailed

information on the Credit and Debit amounts relevant to the organization's operations.

The Trial Balance report will also be useful in grasping and gaining an overview

of the company's financial activity. Let's move on to the part that defines Journal

Reports in Odoo as they relate to the accounting process of the organization.

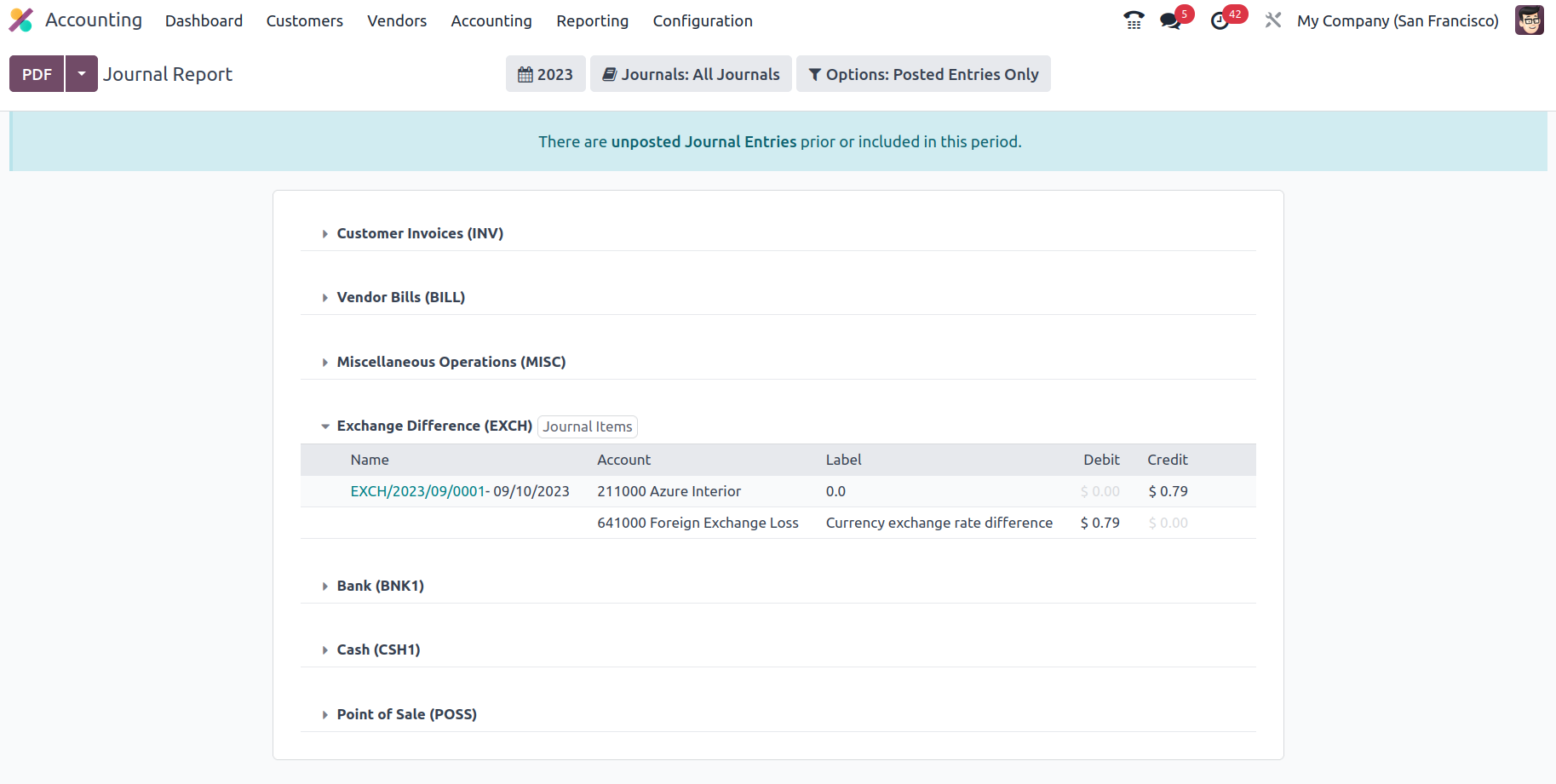

Journal Report

The journals of your accounting operations that are marked as Consolidated for the

operations are defined in the Odoo Accounting module's Journal report menu. All

operational Journals and their respective operating months will be presented in

the menu. The Consolidated Journals report may also be produced as a preview by

selecting Print Preview. Additionally, by selecting the Export (XSLX) option, the

Consolidated Journals in the XLSX report may be exported. After filtering and aggregating

the Consolidated Journals according to another setting element, you may store them

to report using the Store option.

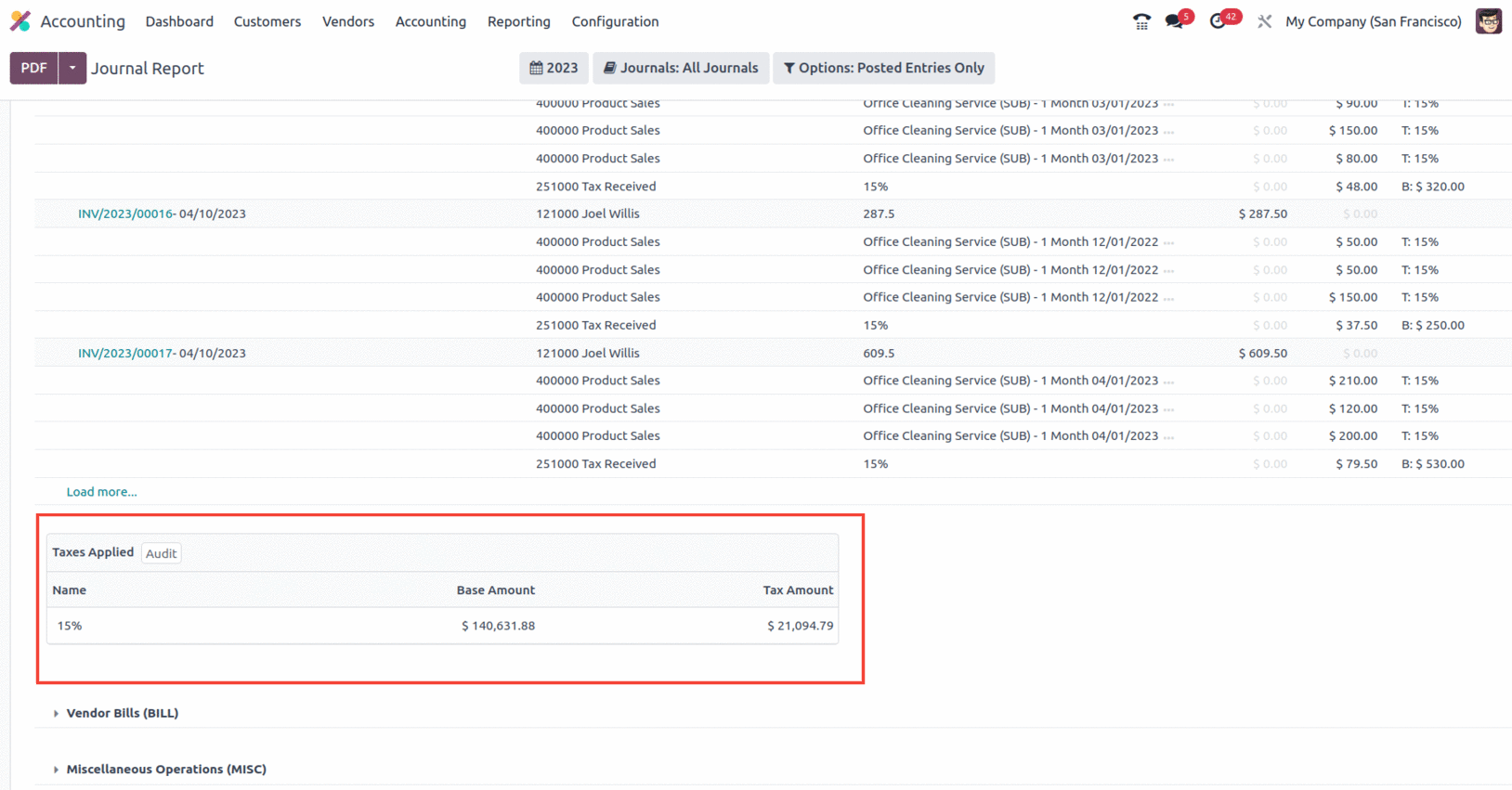

A tax declaration will also be added at the conclusion of the entries for sales

and buy journals, as seen in the screenshot.

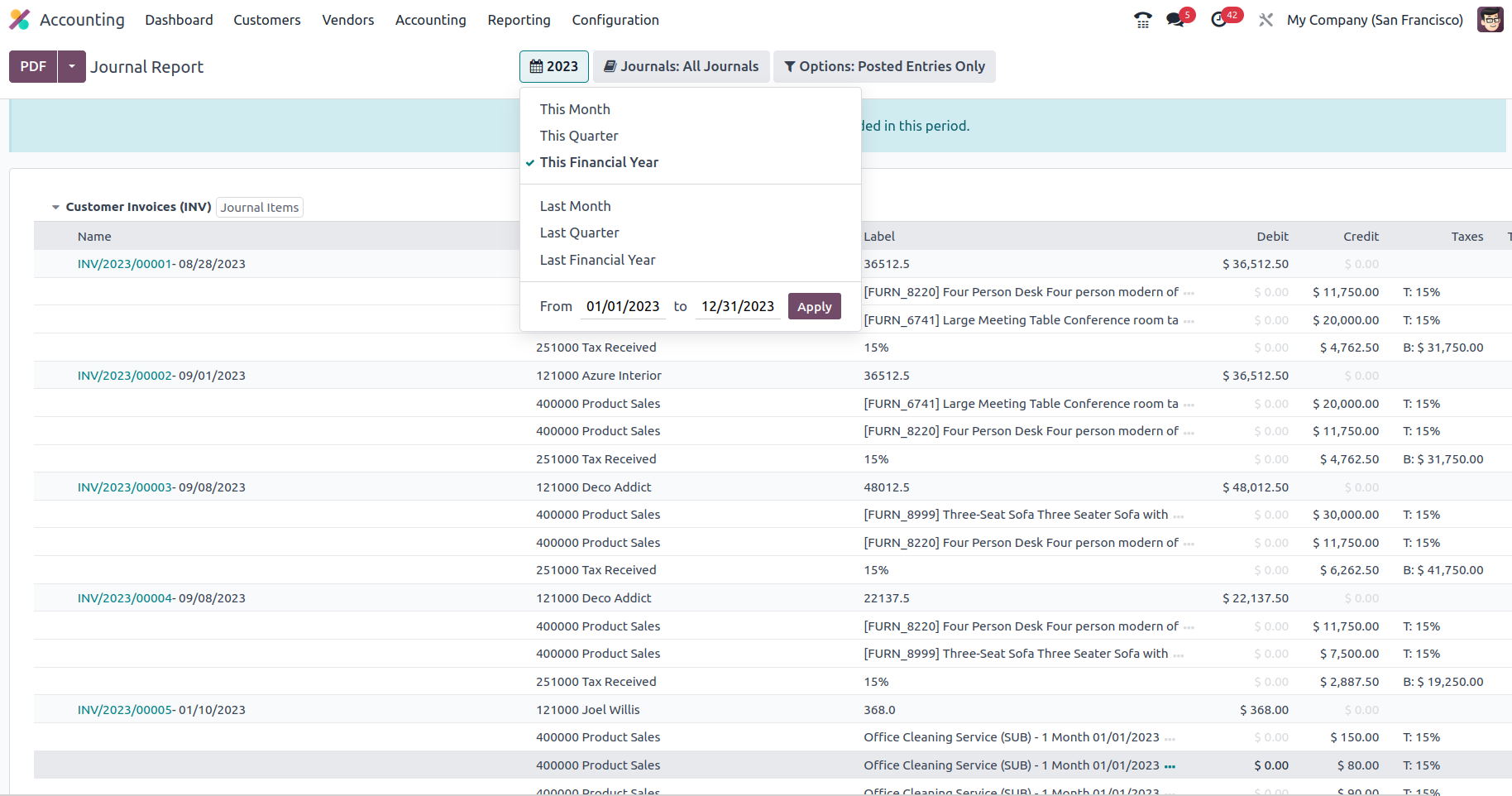

When it comes to sorting the entire depicted in the Consolidated Journals, you have

the option to Group by options based on the period of the operation, as well as

filtration options like This Month, This Quarter, This Financial Year, Last Month,

Last Quarter, Last Financial Year, or add Custom filters of operations as needed.

The Group by options available to you to filter the Accounts based on how long the

business has been in operation are given in the screenshot below.

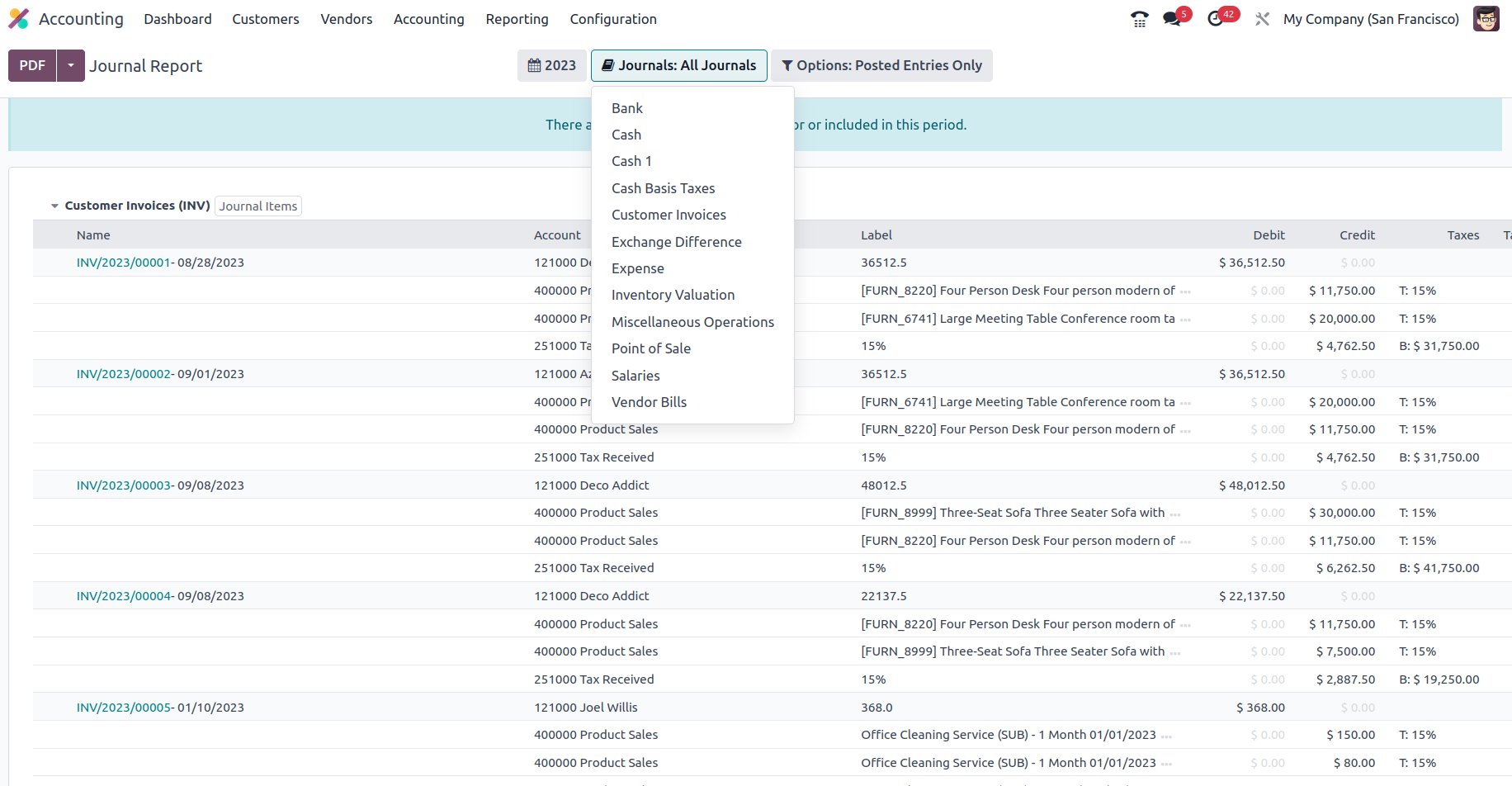

The Journal Groups and particular Journals given can also be used to group the Journals.

Using this process of grouping by Journals, you may better understand the Consolidated

Journals aspects in connection to each of the operational Journals being built.

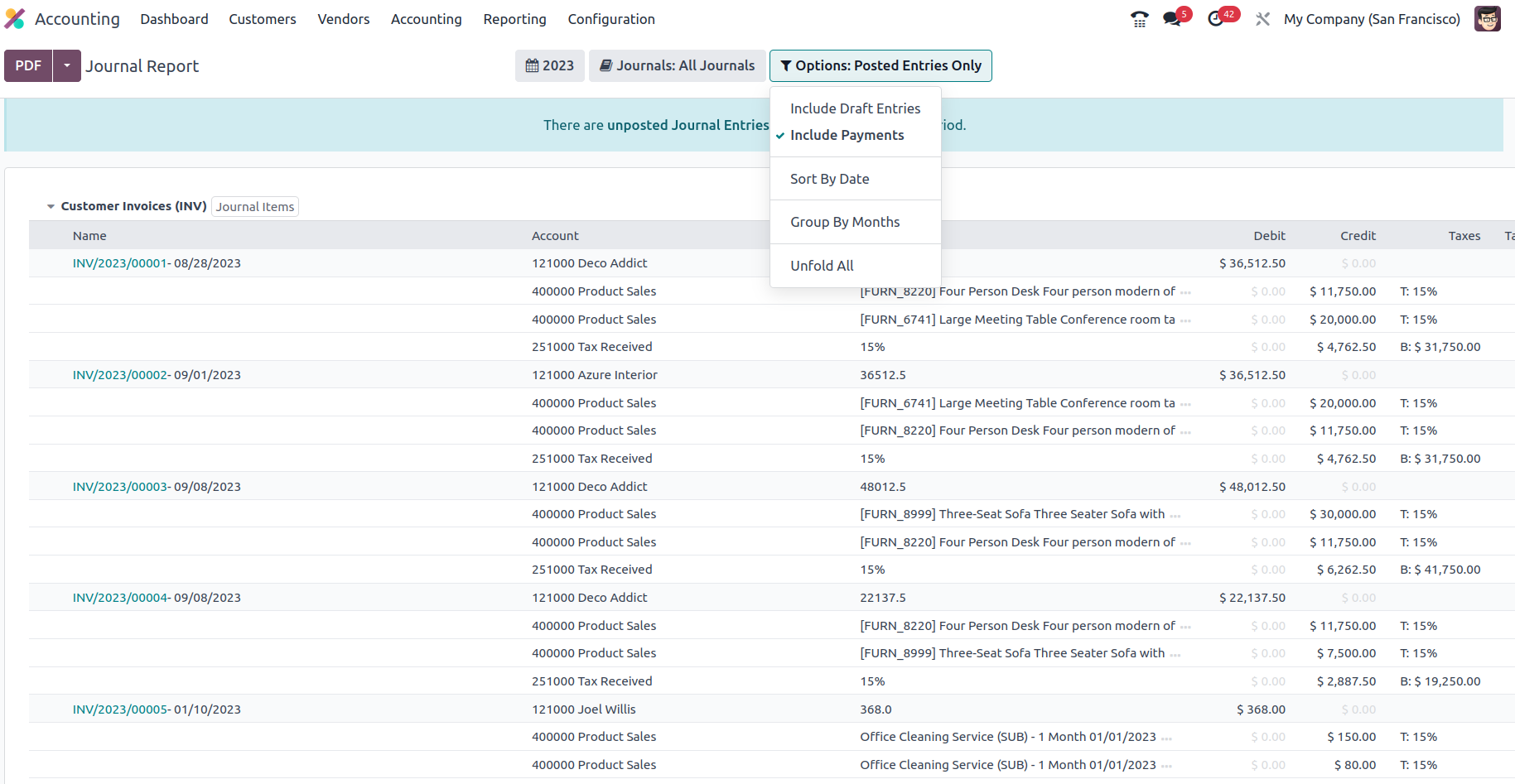

Additionally, the settings tool allows you to filter entries by utilising the Posted

Entries Only, Include Unposted Entries, and Unfold All choices. Thanks to these

filtering tools and selections, you will have clearly defined options for excluding

and sorting the Consolidated Journals items.

The Consolidated Journals reporting window ensures that the viewer understands all

of the financial entries and their allocated components of the company's accounting

activities. The Intrastat report, the next reporting tool in the Odoo Accounting

module, will be discussed in the following portion of this chapter.

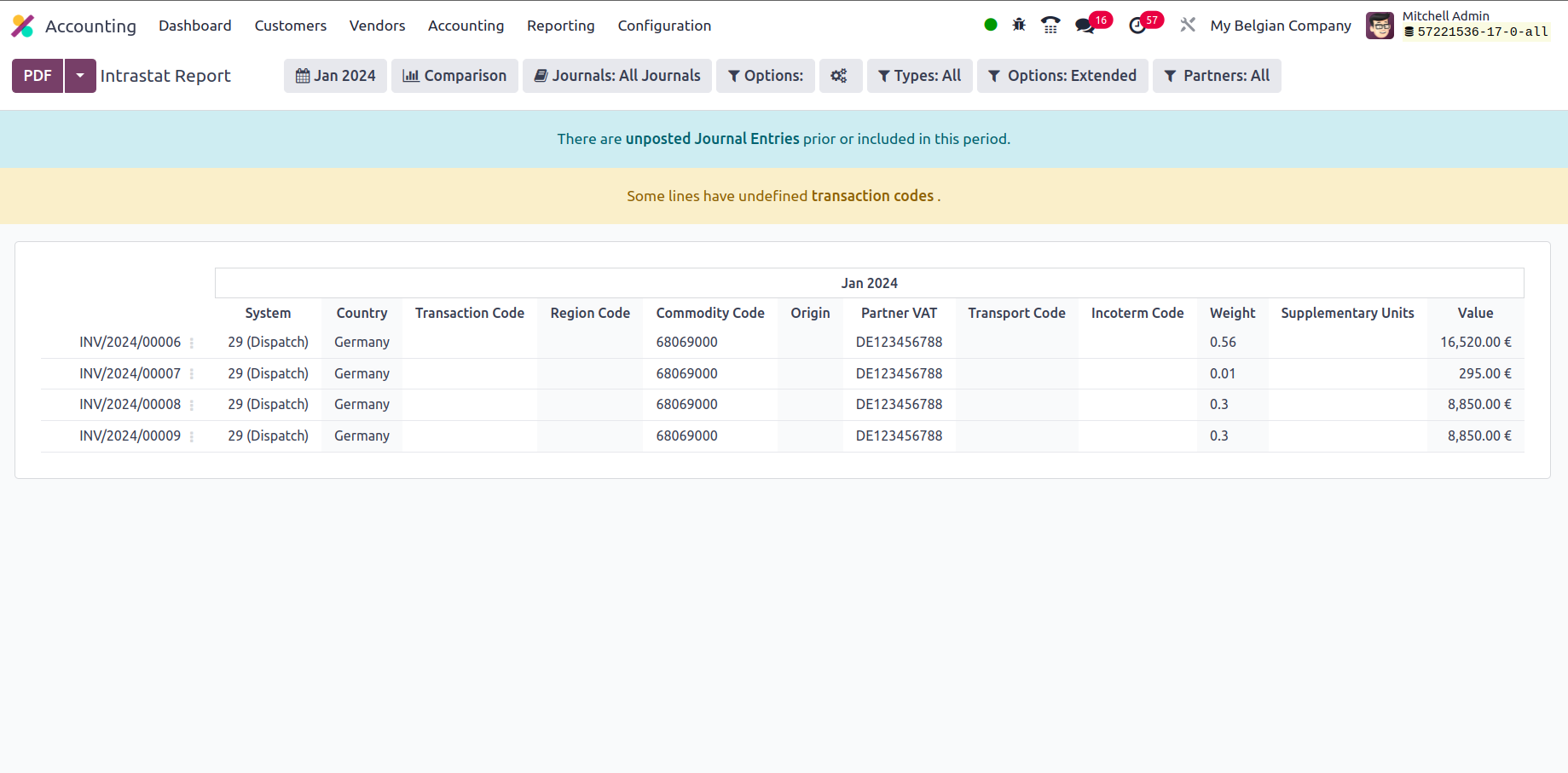

Intrastat Report

The Intrastat Report is one of the more comprehensive reporting options provided

by Odoo's Accounting module. The European Union and its member states may track

trade and business in a statistical manner owing to the Intrastat reporting mechanism.

The Odoo Accounting module's Reporting tab leads to the Intrastat Report menu. This

page will display all of the Intrastat Reporting components relating to business

operations. There are further options in the menu for Group by and specialized Filtering

that can aid in the sorting process.

Filtering tools will aid the Filtering component of the Intrastat Reports in the

Odoo platform in relation to the Fiscal Periods of Operations, Journals that have

been defined, Types of Journal Entries, and Filtrations depending on the Option

as well as the Company in which Business is performed either as Partners, Vendors,

or Customers.

If you want to learn more about the filtration features of the entries mentioned

in the report, you may refer to the reporting aspects provided in the preceding

sections. There are also buttons that allow you to print reports in PDF and XLSX

formats. The Store button saves reports to the proper place in the Documents modules,

allowing you to keep financial information. Let us go to the next phase, where we

will define the Odoo platform's EC Sales List reporting option.

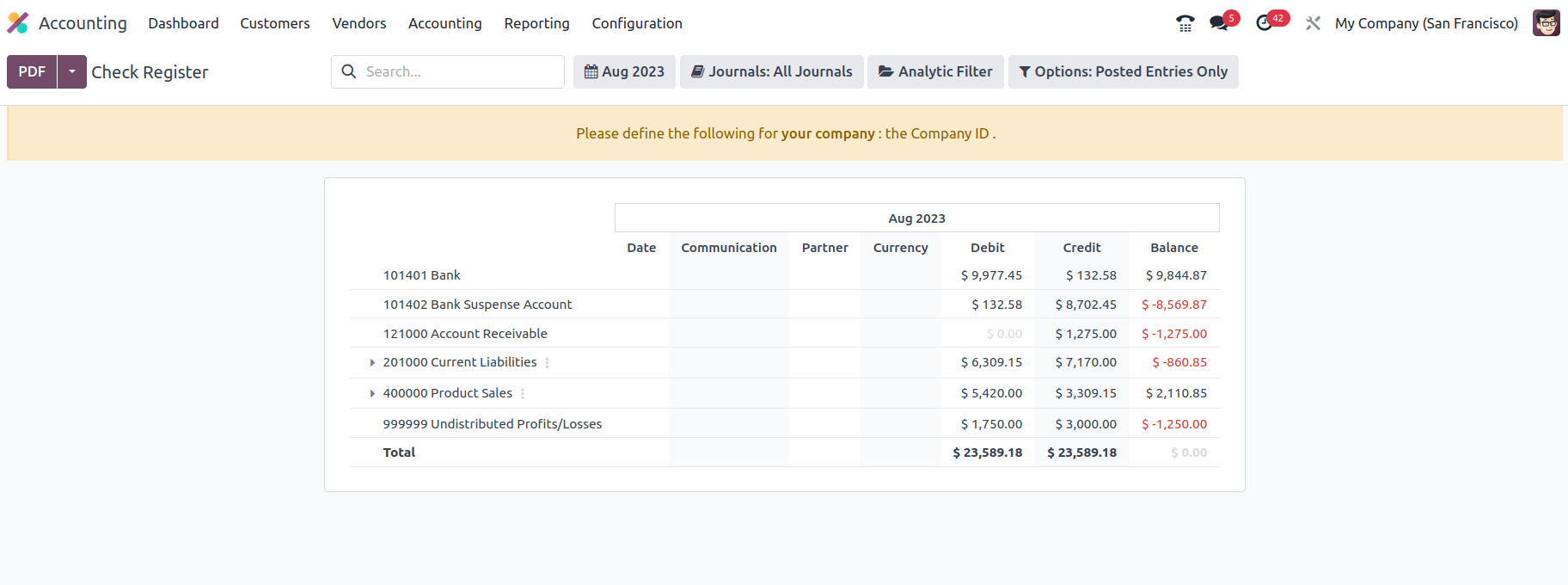

Check Register

The Check Register option is the last one under the Audit Reporting tools in the

Odoo Accounting module, and it will provide you with information about your company's

Check Register. A check register will describe every financial transaction linked

to the firm's functioning, and the check register report will do so analytically,

providing you with a full insight into how everything works.

The Accounts Register report will be illustrated using the numerous working Charts

of Accounts that have been established in the platform. Each operational Chart of

Accounts, as well as the date of operation, communication information, partner,

and currency utilized, will be noted here. Furthermore, the Debit and Credit amounts,

as well as the Balance of each of the Charts of Accounts, will be described as shown

in the following screenshot.

Filtering and grouping possibilities are accessible, much like any other reporting

choices in the Odoo Accounting module. You may use the criteria below to narrow

down the information in the cheque register based on fiscal periods, journals, analytical

accounting features, and posted and unposted entries. There is also a serving tool

that you may use to search the Bill Register entries depending on the data you have.

There are also buttons for printing reports in PDF and XLSX formats. The Store button

saves reports to the proper location in the Documents modules, allowing you to keep

your financial information.

The Check Register reporting menu in Odoo will play an important part in carrying

out each operation's elements in terms of the company's financial management and

will be a valuable accounting tool. The Bill Register completes the reporting functions

of the Odoo Accounting module.