The accounting module of the Odoo platform offers comprehensive operational management of the financial side of any company's activities. Many elements of financial management and accounting can be customized because Odoo is a customizable program. In addition, the Accounting module of the Odoo platform has a configuration menu with several configurable default values. All Odoo modules have a configuration menu that allows users to fully configure the functional management and performance of each module.

You can enable and disable this using the checkbox as part of the configurable options provided. You also have options to define an action from which you can select an entity from a drop-down menu. Each of these alternative types is defined based on a specific functional need. By building the platform, you have the opportunity to add unique features, which you can do with the help of experienced Odoo developers. Installation of various third-party Odoo applications from the Odoo application store provides customizable options for the specified modules to define functions. Additionally, you can change the default modules available through the Studio module. You can also create custom modules using the Odoo studio module with customizable options, just like any other default module.

In the Settings tab, you can choose from a long list of configuration options for the compute module. These options allow you to precisely define the functions of financial management and accounting. Additionally, these are the default options that come with both the Community and Enterprise versions of Odoo. However, the functional features of the community version are limited, while the commercial versions are significantly more advanced. We will continue to learn more about how each option works in the following sections as we navigate to the Accounting module settings page.

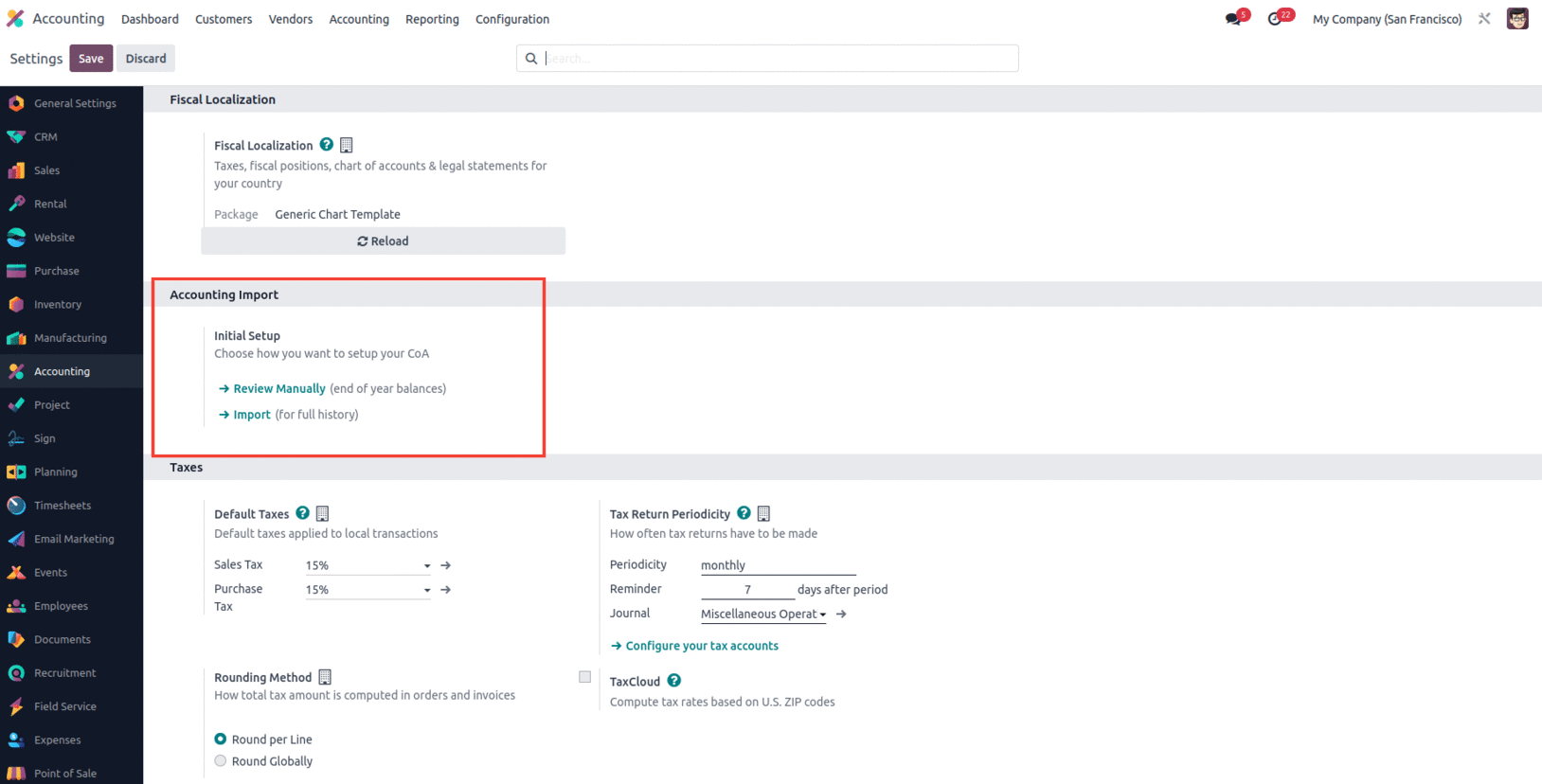

Accounting Import

The accounting import section allows you to handle the initial configuration, such as setting up the Chart of Account, and you can also import the Chart of account, open balances, contact addresses and journal information. It is basically implemented to bring the necessary data into Odoo quickly and easily from an external resource instead of entering it manually.

The manual view option directs you to the chart of accounts, where we can also set initial debits and credits, or even import the initial balance from the favorite import record option. We can check the opening balance here even if the opening balance has been posted.

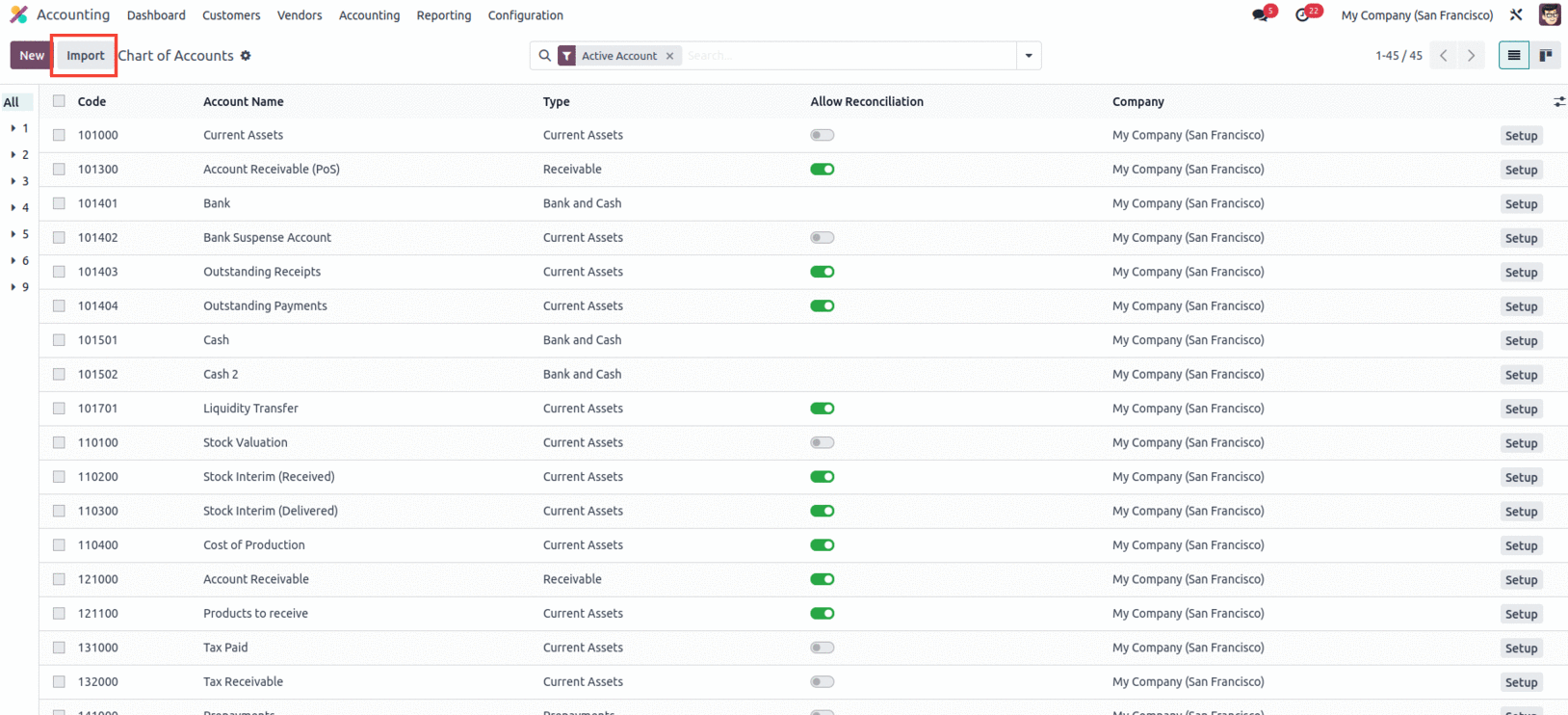

The next Import option takes you to the accounting import guide, where you can import contact details, charts of accounts, and journals.

Using a predefined template will help you import data faster. CSV or Excel templates can be used to import accounting data. Import contact information can be used to import partner information (both customer and supplier). You can import the chart of accounts and opening balances. Import journals allow you to import journals into Odoo. This is optional but useful for importing open receivables and payments using a template. Odoo recommends that you import your opening balance using Chart of Accounts Import and only use Journal Import for unreconciled entries in your Payable and Receivable Accounts.

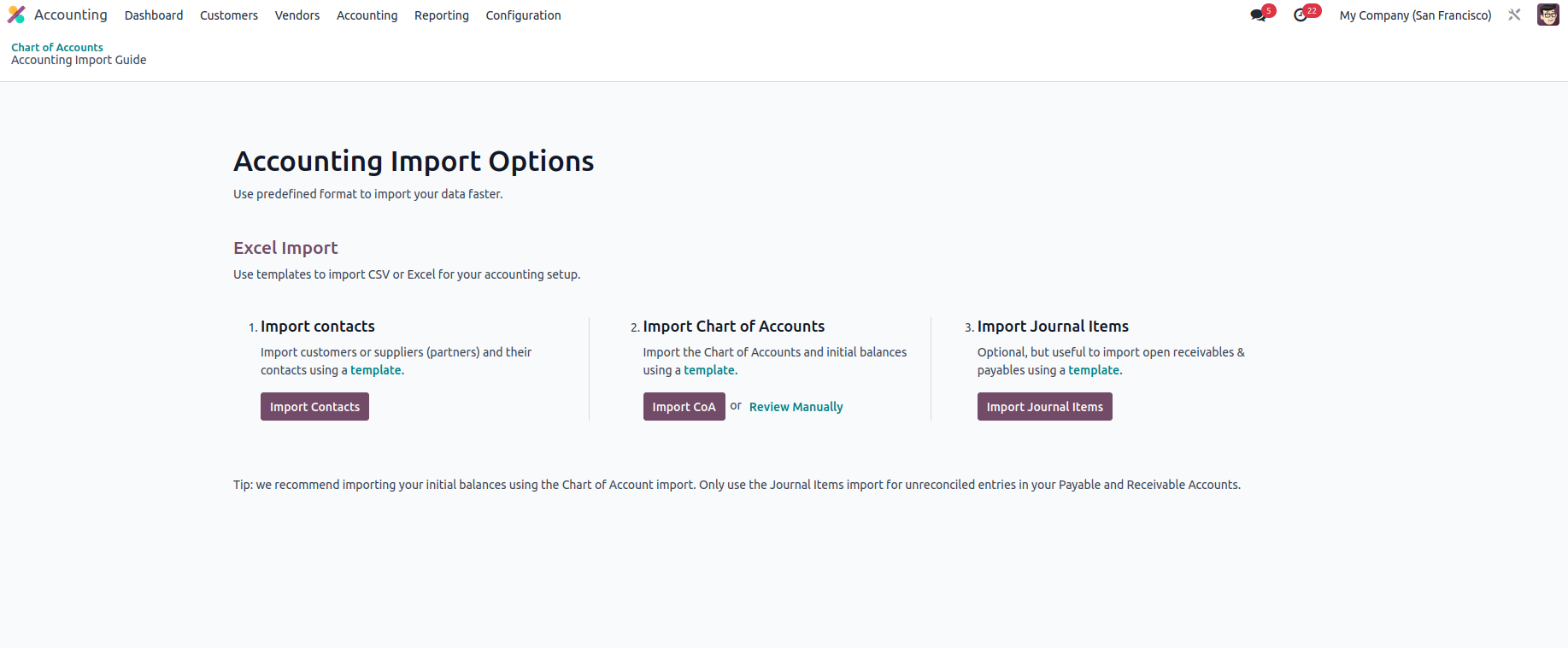

Define the taxes based on the region

In the Taxes tab of the Settings module, set operational taxes for the operational aspects of your business. If no special tax is charged on the product, the taxes mentioned below apply to both buying and selling activities and are considered in the activity. Now let's see what options are available in the Tax Setup section of the Accounting module settings menu.

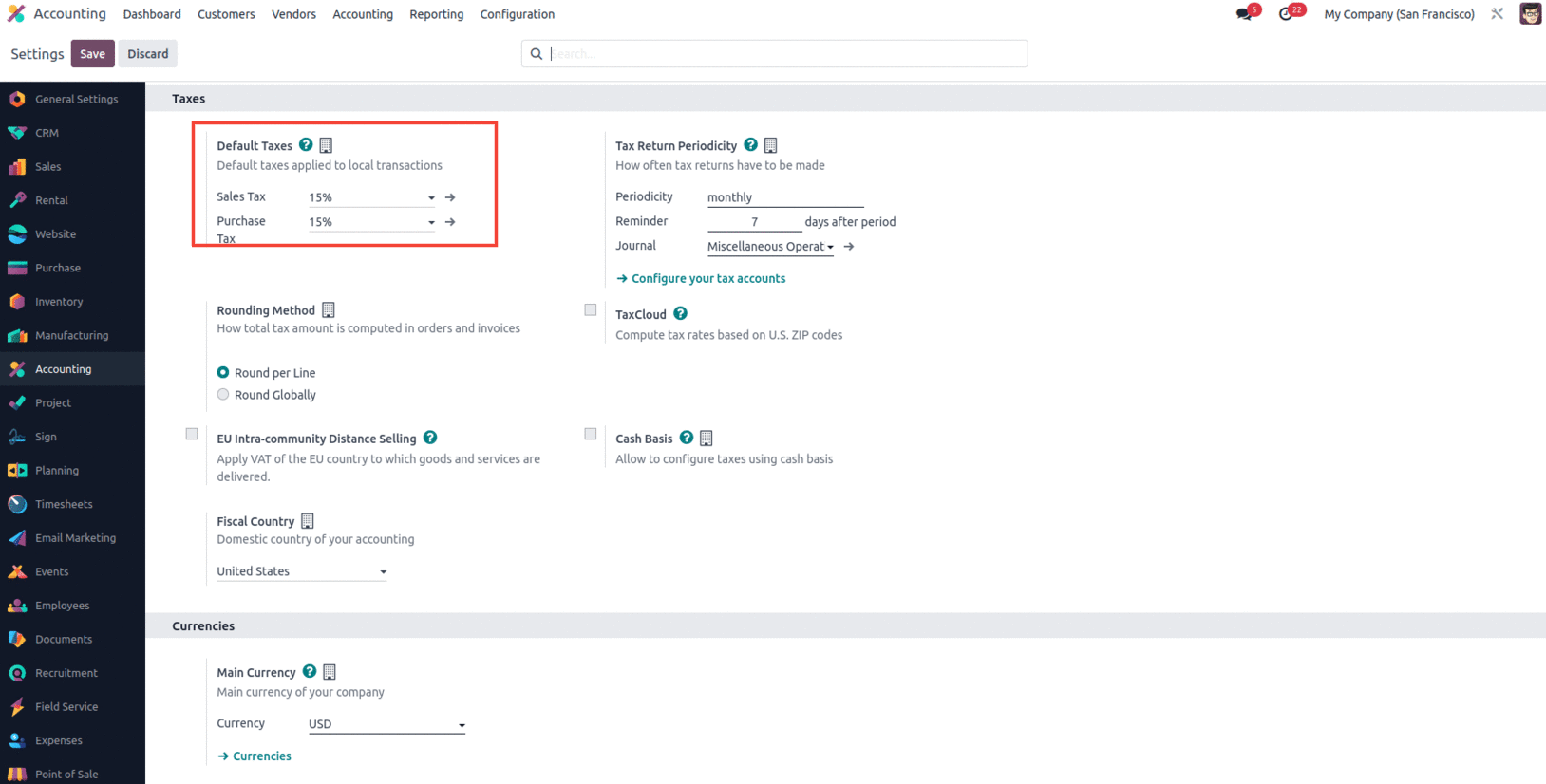

Default Taxes

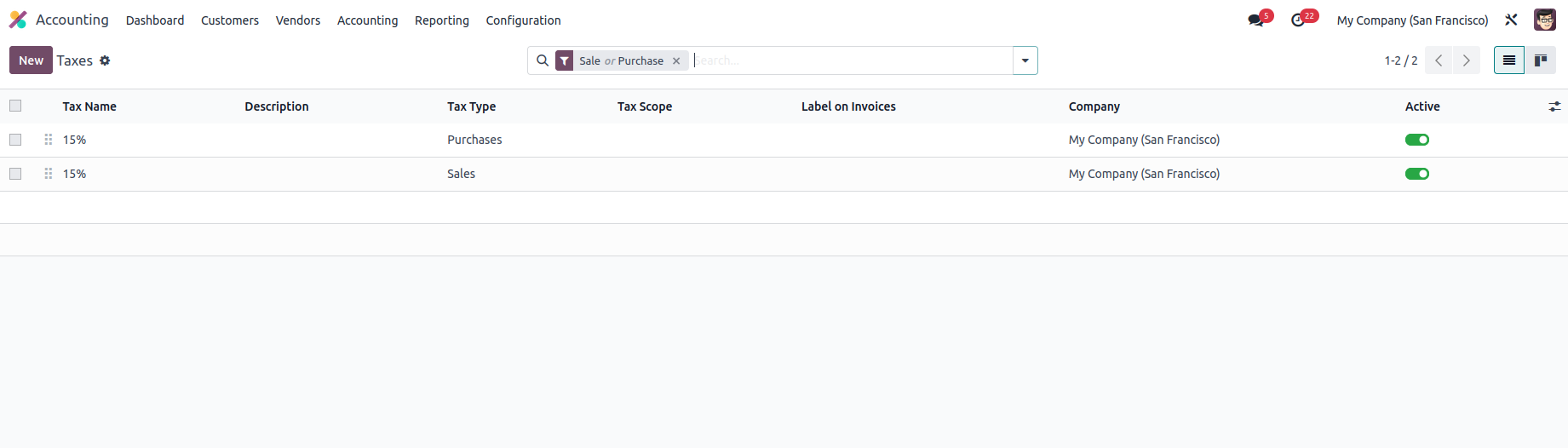

Initially, in the Taxes section, you can set default taxes to use the platform to manage your business. All local transactions defined on the platform are subject to these taxes. Here, you can select the VAT and Purchase tax options from the drop-down menu. You can set taxes in the Taxes menu item in the Settings menu of the accounting module; here, you simply set the corresponding rates according to your needs. The Settings tab of the Default Tax Settings menu of the Accounting module can be seen in the following screenshots.

Tax Return Periodicity

The tax collected must be returned to the authority at specified intervals; the time may depend on the procedures of authorities and/or companies. The frequency of return depends on the competent authorities and can be once a month, once a quarter, once a year or once a year. In the Tax return periodicity menu, you can change the settings related to the return, which indicate how often the returns must be sent. The cycle can be set under the menu to occur once a year, semi-annually, every four months, once every three months, every two months or once a month. In addition, you can set a reminder that can be set for days after the period.

In addition, the work platform has already created journals defined in the menu, which are used to record collected taxes.

You can also set up tax accounts by selecting Set Up Tax Accounts, which will take you to the Tax Groups box, where you can set up tax account information. Defined taxes are displayed here and you can select one of them to create a tax account. As you can see in the image below, you can define the Tax Prepayment Account, Tax Utilization Account (payable), and Tax Utilization Account (receivable) from the Tax Groups menu.

Rounding Method

The Rounding elements of the taxes received, which can be based on the two settings available by default in Odoo, is another feature that can be configured from the Taxes menu. Round per line or Round Globally are both acceptable. In general, you can choose between these two solutions depending on your work needs.

The "Round per Line" option in Odoo accounting allows for more exact and targeted rounding for particular goods or services inside a document by ensuring that rounding is applied independently to each line item. When distinct items in the same document require different rounding, this method can be helpful.

When "Round Globally" is selected in Odoo accounting, rounding is done consistently to the total amount of a document, guaranteeing uniformity across all line items. By treating the document as a whole rather than rounding each line item separately, this strategy streamlines the rounding process.

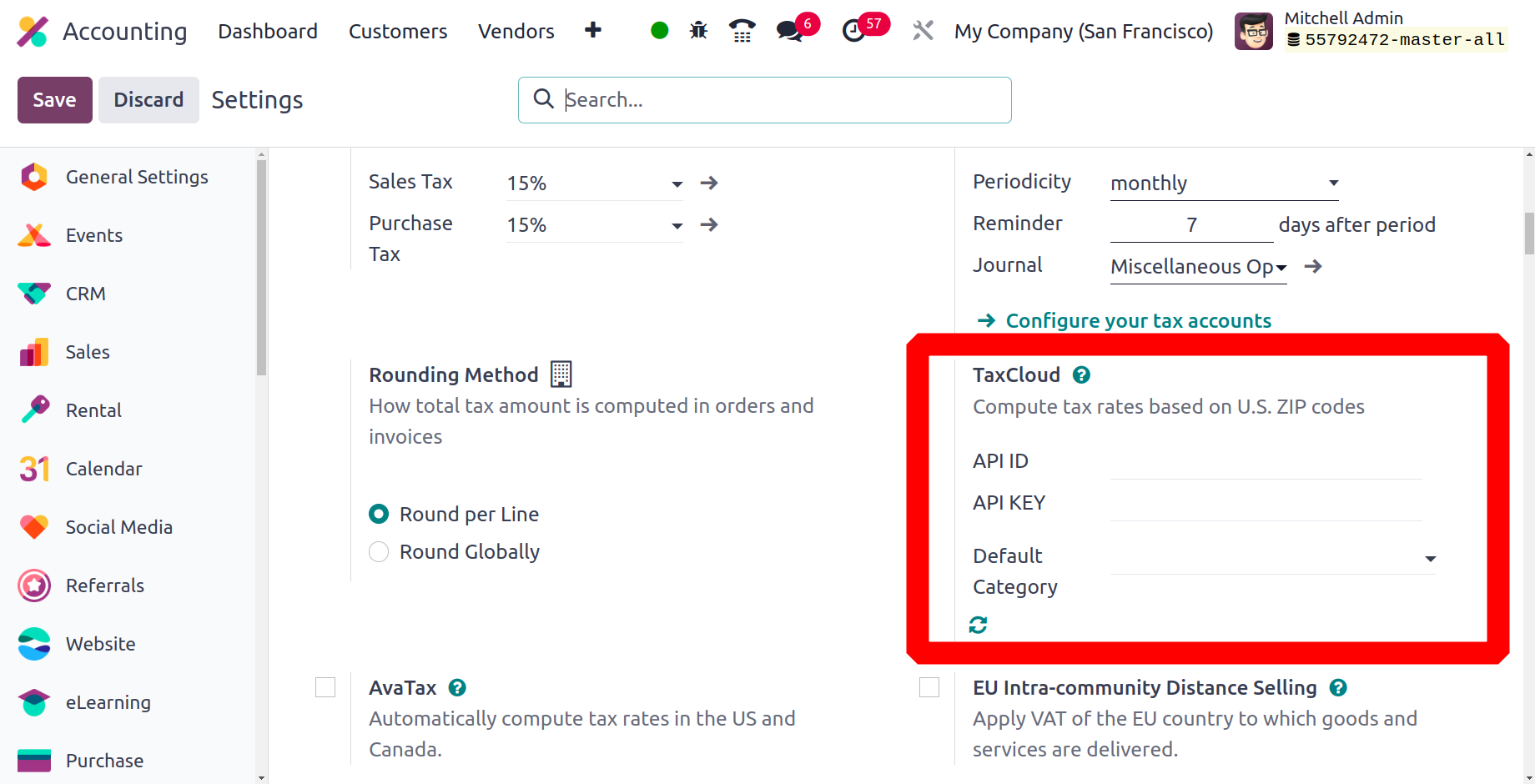

TaxCloud

The TaxCloud computation will compute the taxes on sales, purchases, and any other commercial operations for a company operating in the United States based on the ZIP codes. The TaxCloud setup, one of the Odoo platform's localization components, will be based on US ZIP codes. The TaxCloud option, as seen in the image above, may be enabled or removed in the Taxes settings menu. You may also define the API ID, API Key, and Default Category, all of which are customizable. You may discover more about the credential components by selecting the "how to get credentials" option, which will take you to the TaxCloud settings page.

AvaTax

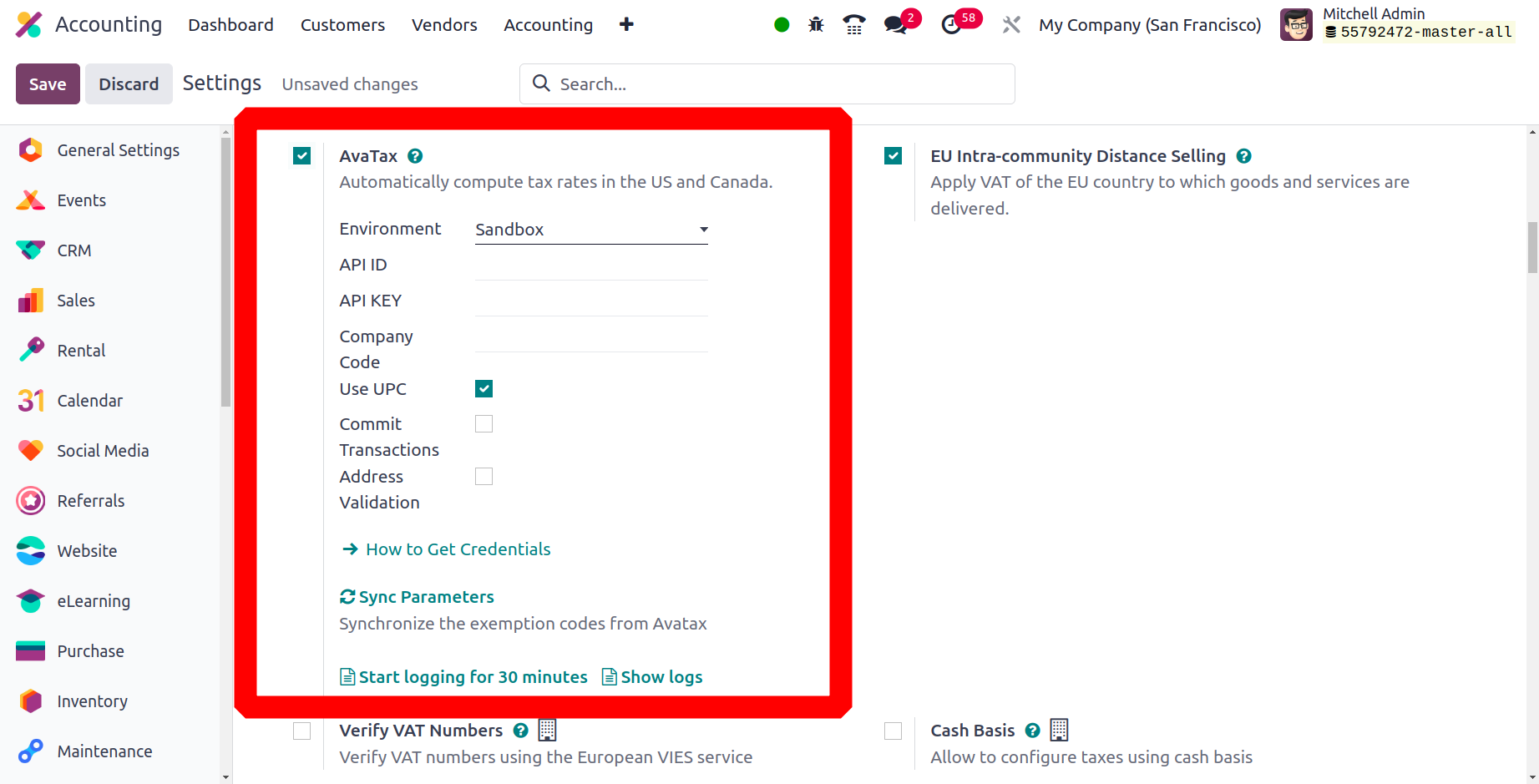

Odoo 17 supports AvaTax integration, allowing users to map taxes based on tax registrations and regions. AvaTax is a tax engine that assists with tax compliance.

Businesses can use Avalara AvaTax, an integrated third-party application, to determine sales tax amounts on their invoices according to a customer's location. To make tax compliance simple for clients, Avalara provides pre-built connections and custom integrations with popular accounting, ERP, e-commerce, and other business applications.

EU Intra-community Distance Selling

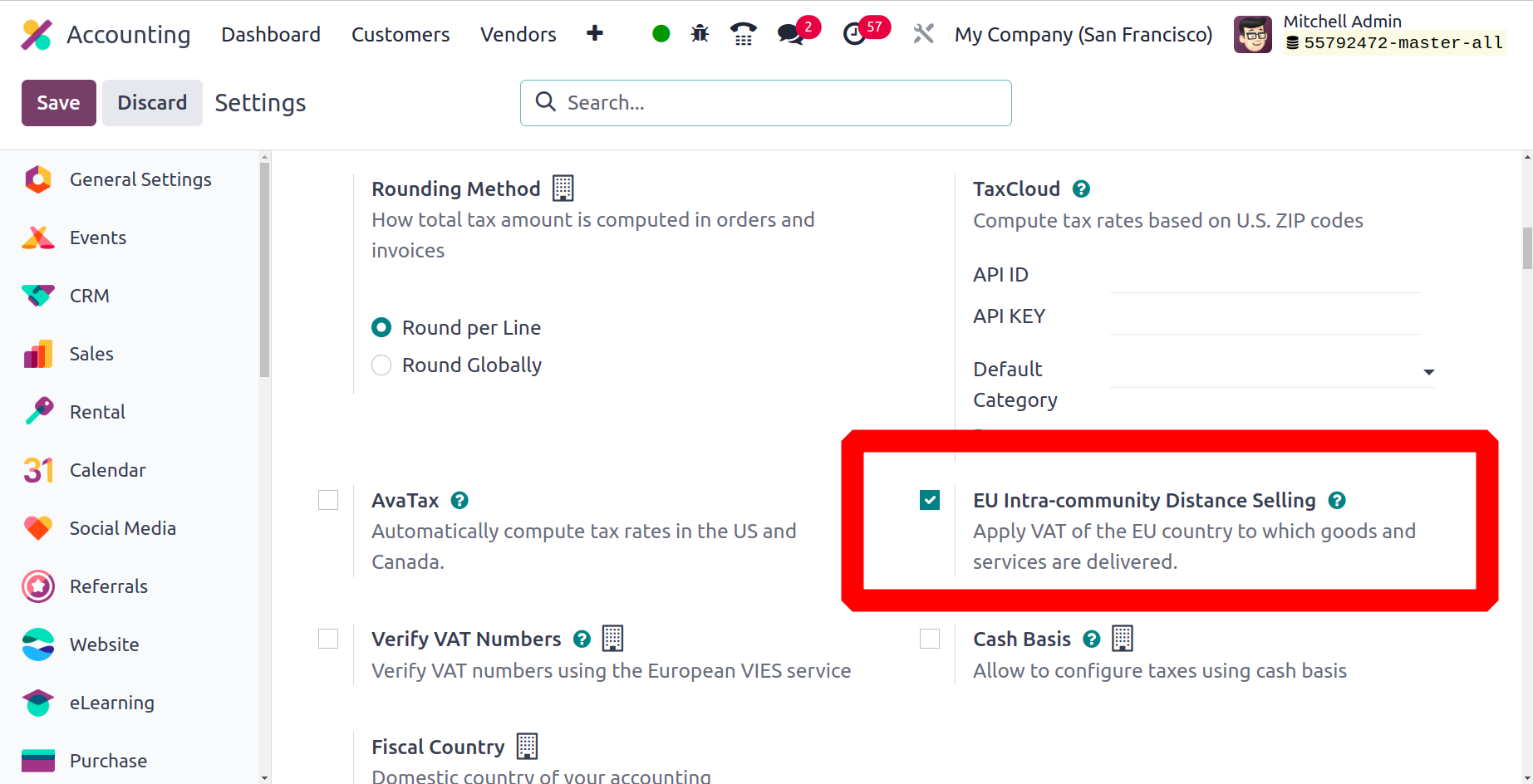

EU intra-community distance selling is the sale of products and services across borders to consumers (B2C) in member states of the European Union by vendors who are registered for VAT implications. The transaction is carried out remotely, usually by phone, mail order, internet platforms, or other modes of communication.

Distance selling within the EU is governed by particular VAT laws and regulations. VAT must be charged by the vendor at the rate that applies in the buyer's nation. This still stands valid, even if the vendor is based outside of the European Union.

By establishing and configuring new fiscal positions and taxes depending on the nation in which your business is located, the EU Intra-community Distance Selling feature assists you in adhering to this legislation. Select EU Intra-community Distance Selling under Accounting ‣ Configuration ‣ Settings ‣ Taxes, then click Save to activate it.

If you sell products based on digital technology in the country where your business operates, you must meet the EU VAT requirements for digital products. You can enable or disable EU VAT for digital products using EU-based Odoo, which treats it as a localization component. In addition, you can select the country of fiscal activity from the drop-down menu to tax your Odoo-related activities in the selected country.

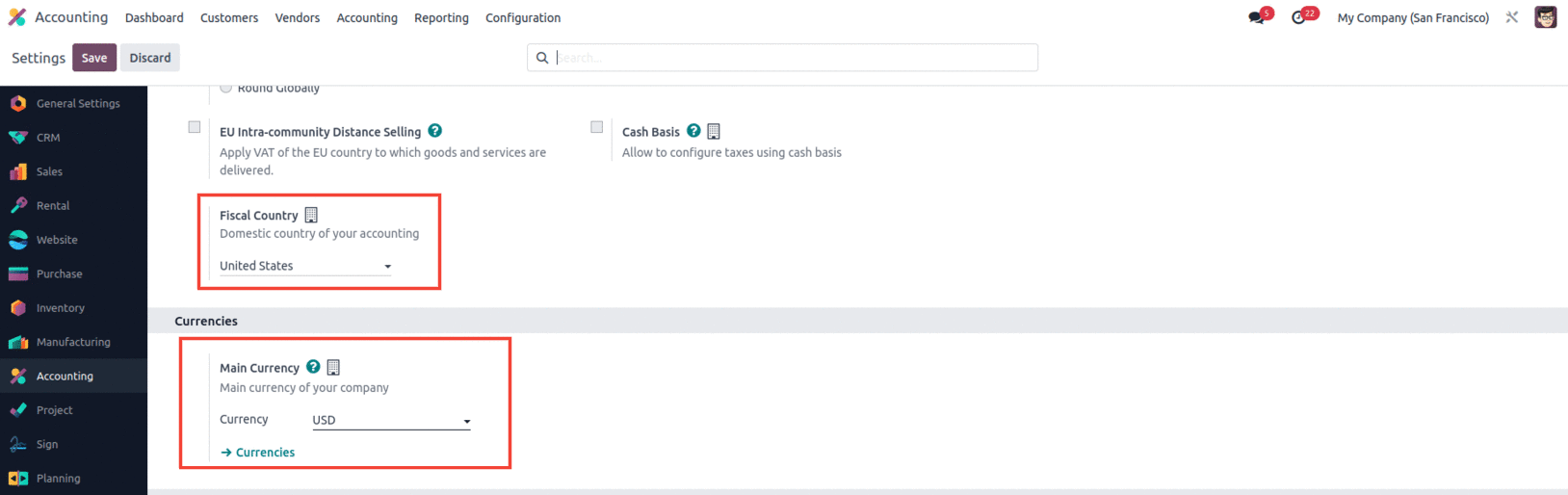

Fiscal Country

Fiscal country determines your company's home country, and that determines what the tax laws mean for your business. This is critical information for determining the tax rates and rules applicable to a company's financial transactions.

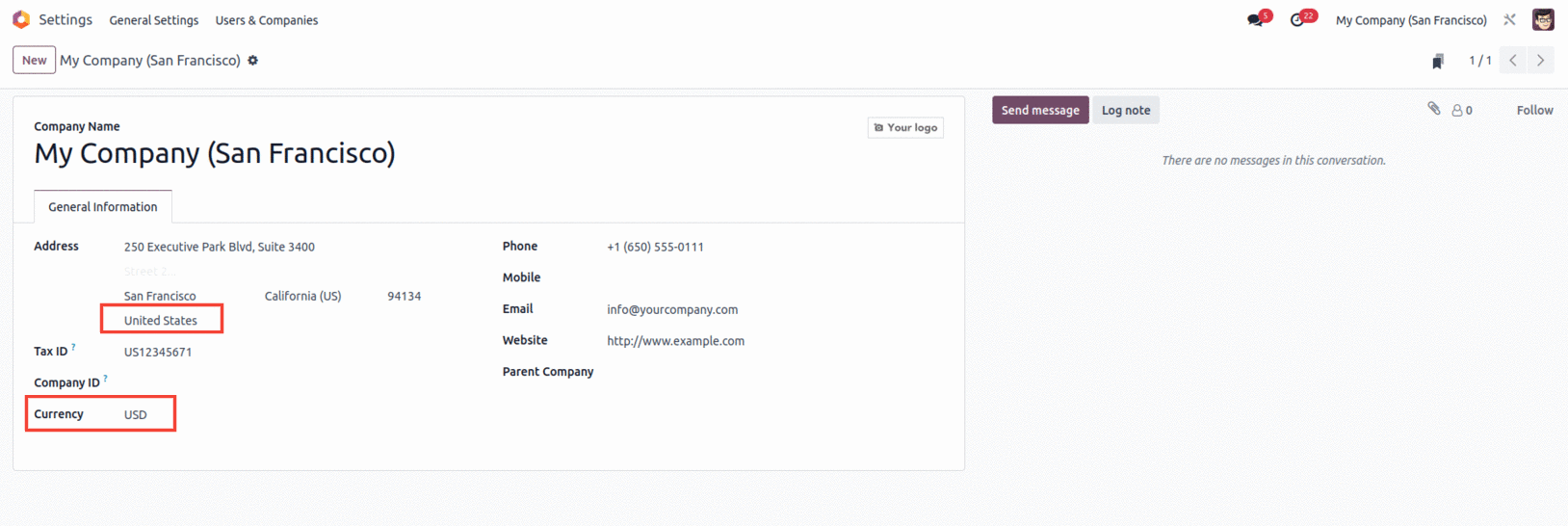

Each country has its own accounting practices regarding taxes, chart of accounts, journals, requesting tax points, etc. At first, when setting up a company in Odoo, we must mention the country of our company accordingly. We decide which accounting localization we should use.

As you mention your company country in the company details currency, it will be automatically updated according to the company country. The tax country in settings will then be updated to your company's home country, such as the United States.

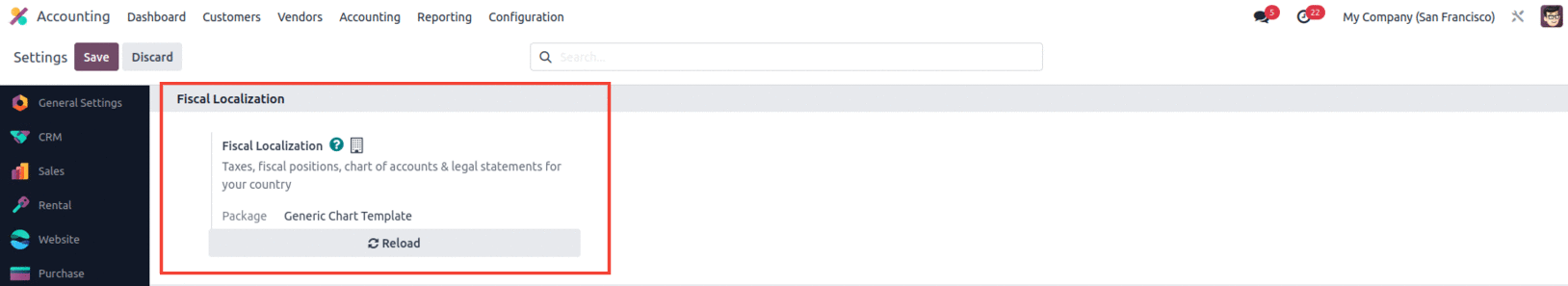

The company's base currency is automatically updated accordingly. When creating a new company, a fiscal localization must be defined in the accounting configuration to install the accounting package defined in the Fiscal Localization section for each country.

Once this package is added and saved, all default charts of accounts, taxes, journals, tax rates, etc., are automatically installed in the database and do not need to be configured separately. In addition, if you want to add or change the installed information, it is also possible to edit them, but only before making any accounting entries.

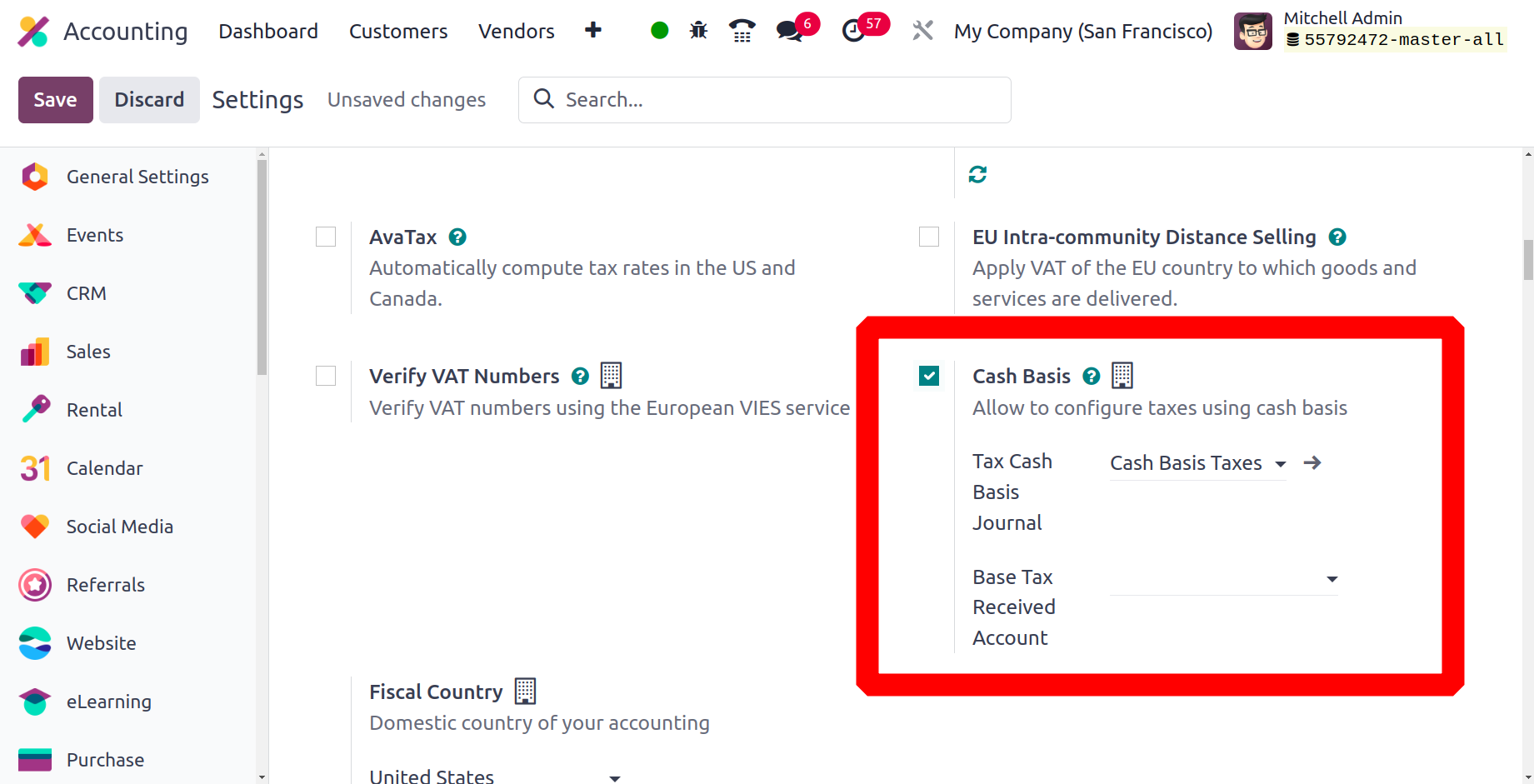

Cash Basis

Using the Cash Basis option under the Taxes menu, you may handle the tax procedures on cash payments received. This feature may be enabled or disabled depending on corporate policy. Let's move on to the following section of the settings, which is focused on currency management, to understand the next operational menu.

Having an excellent currency management system will do wonders.

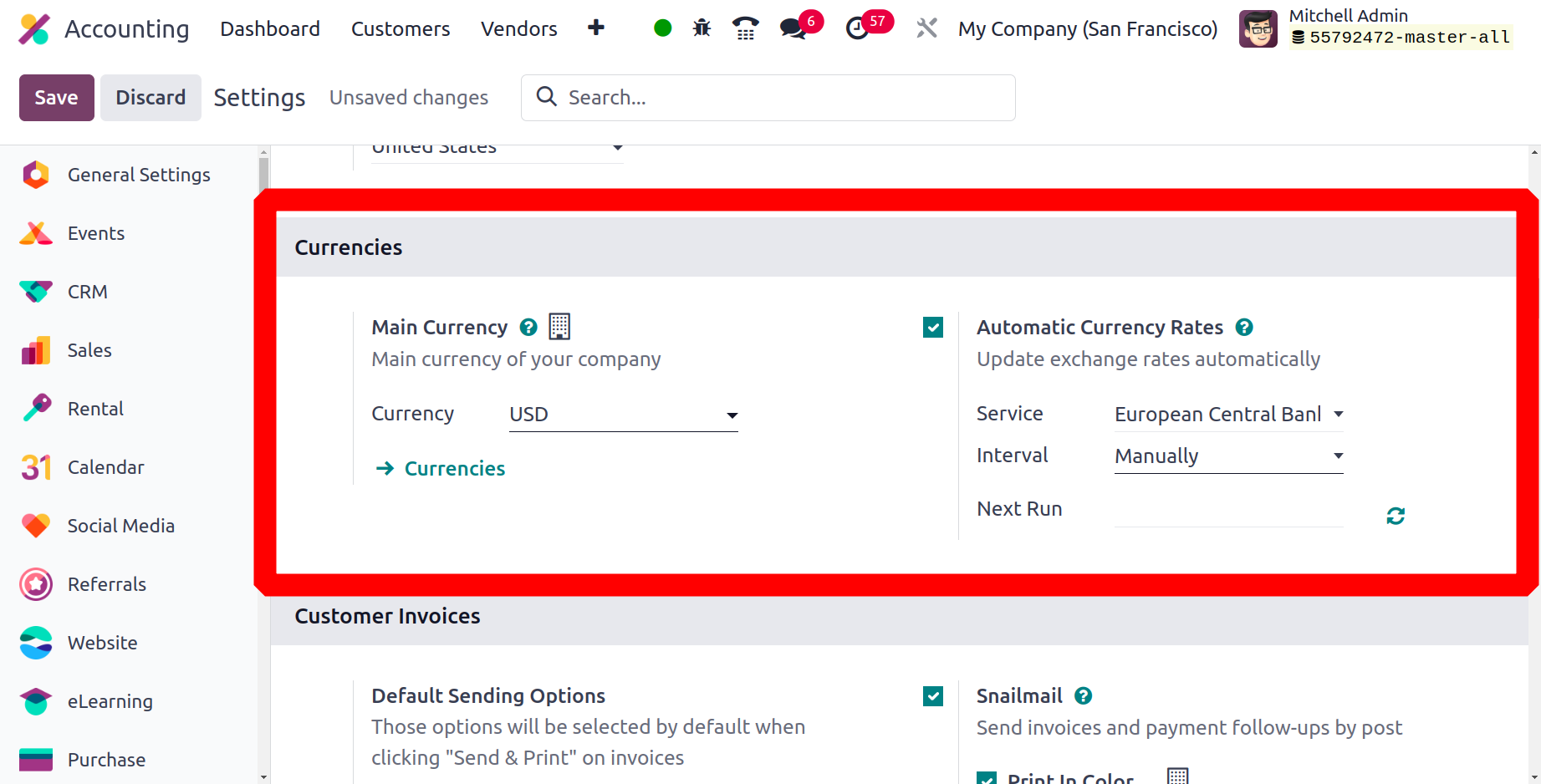

You can configure your company's currency operations with Odoo using the Currencies option in the Settings tab of the accounting module. In this menu, you can set the main currency of the company's operations. The option drop-down menu allows you to select a currency. All available currencies are defined on this page. The currency in which the business is defined also acts as the primary unit of account, and you can use other currencies to operate your business.

Also, if your country acts as an international tag, you need to manage each location's currency correctly. Thanks to this, you can configure the Multi-Currency option of the Odoo platform, which allows you to save bets in any currency in the world and automatically adjust exchange rates.

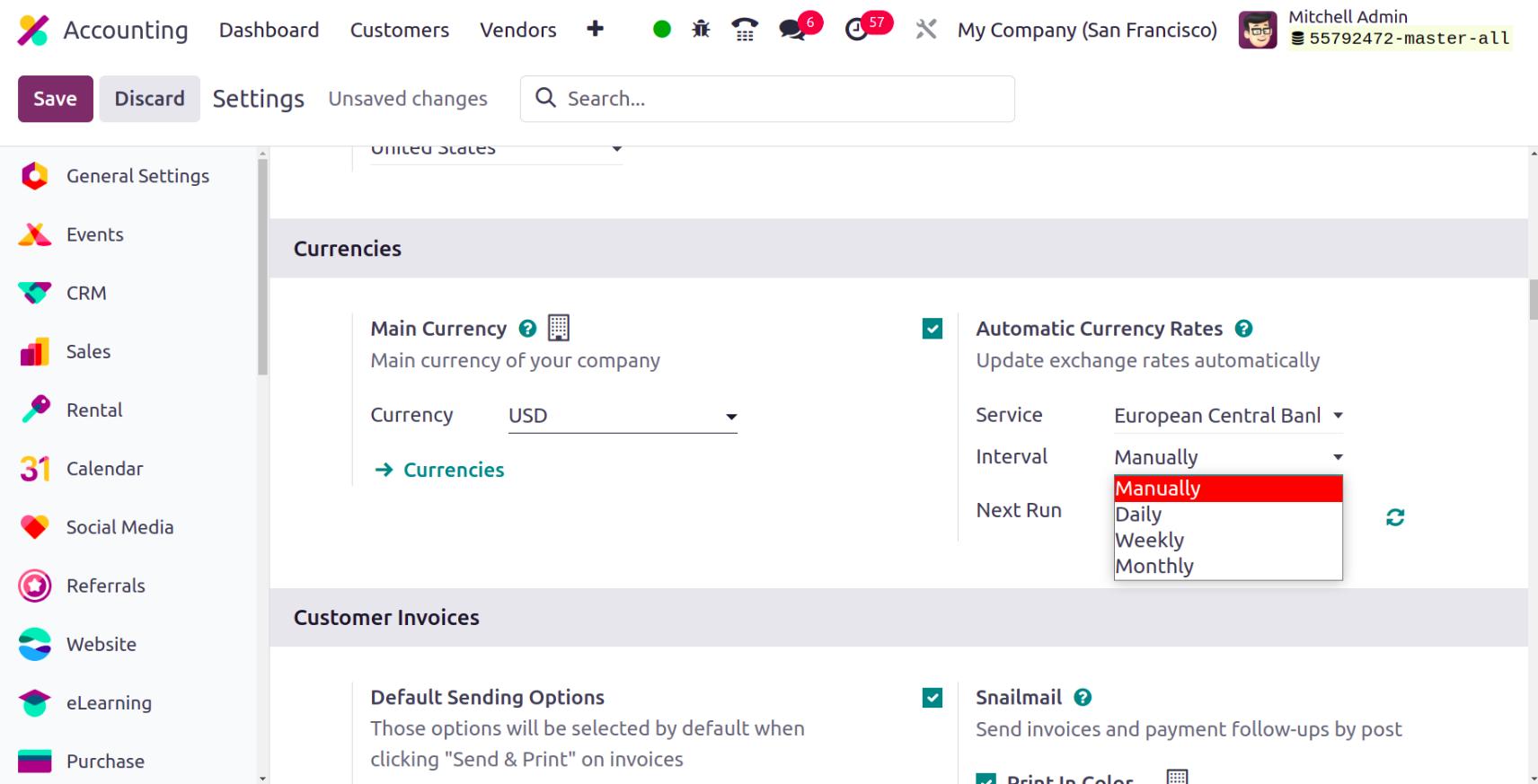

To help with automated currency rate updates, select Automatic Currency Rates. This can be completed manually, every day, every month, or every year during specific times.

Let's move on to the next section of the menu, Invoice Management, accessible from the Settings tab of the accounting module.

Complete and effective invoice management

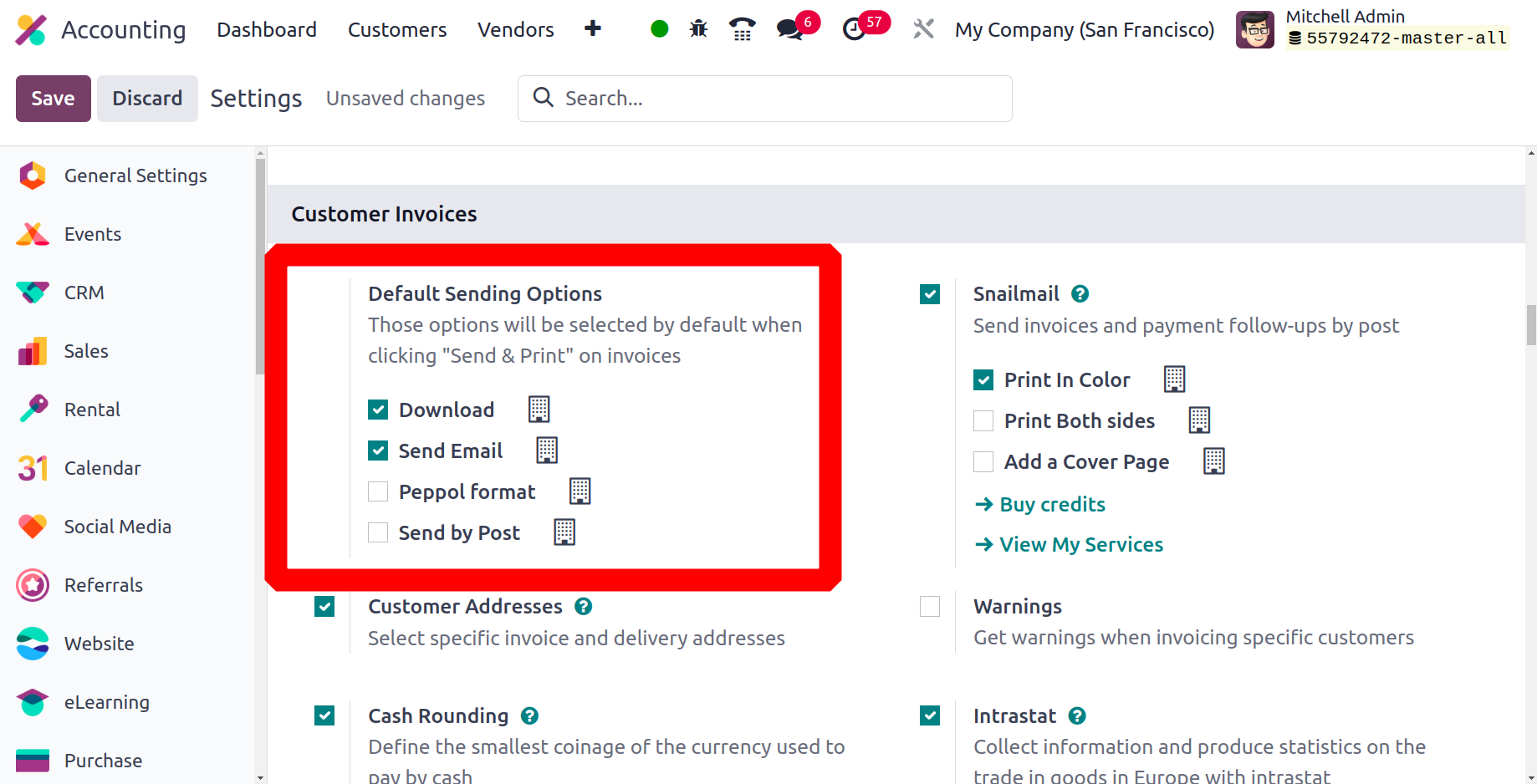

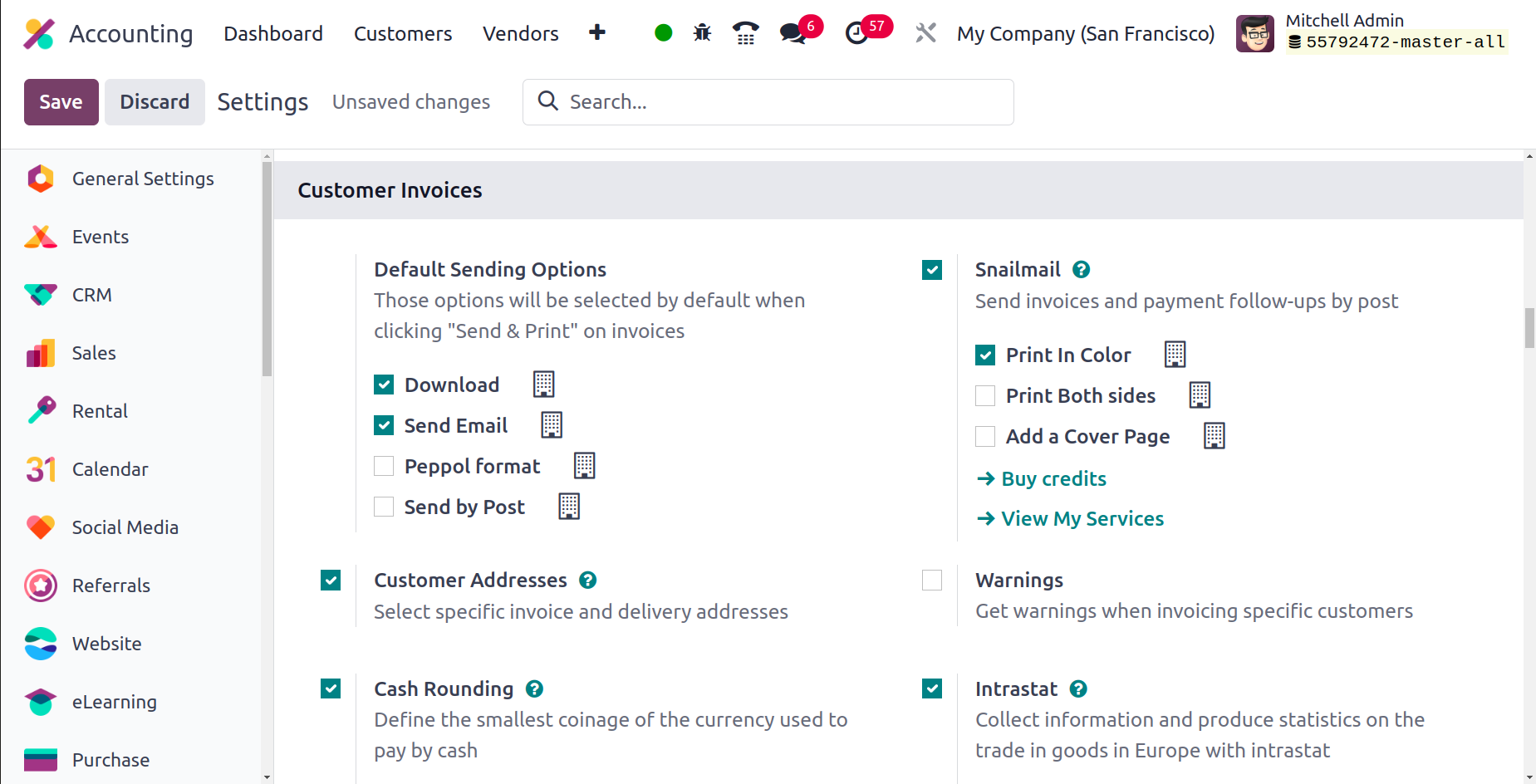

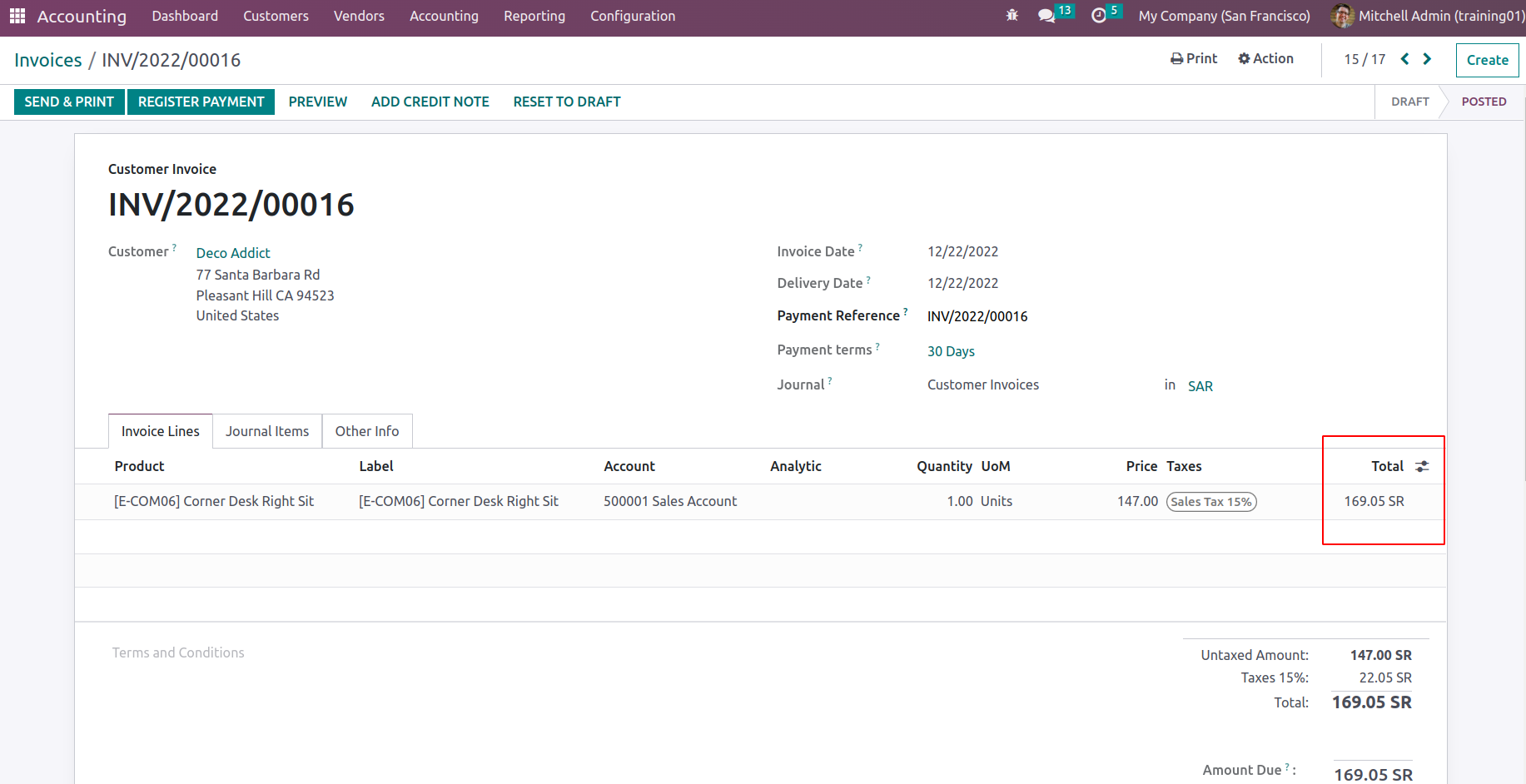

Sending customer invoices with control elements helps your ability to fully and successfully manage the invoicing process. The default configuration option found in the Customer Invoices section must first be configured. The setting is possible in the default billing settings and in the Send and Print settings. Print, Email Sent, and Send by Mail are the three invoice-sending options that can be configured. If there are, they will appear in the Send Invoice field for you to select.

In addition, the subtotal tax display of the generated invoice line can be set to either Tax Excluded or Tax Included, depending on the operational needs of the company or the rules issued by the authorities.

Another localization option that allows you to send invoices directly by mail is snail mail. You can set up direct customer invoices by enabling Snailmail under Customer invoices. Snail Mail's default settings include the option to print in color, print on both sides and add a cover page. The platform also has a Buy Credits option in the Settings menu, which will take you to a website where you can buy Odoo Credits for Snail Mail since the functionality of the service is integrated according to the cost of credits.

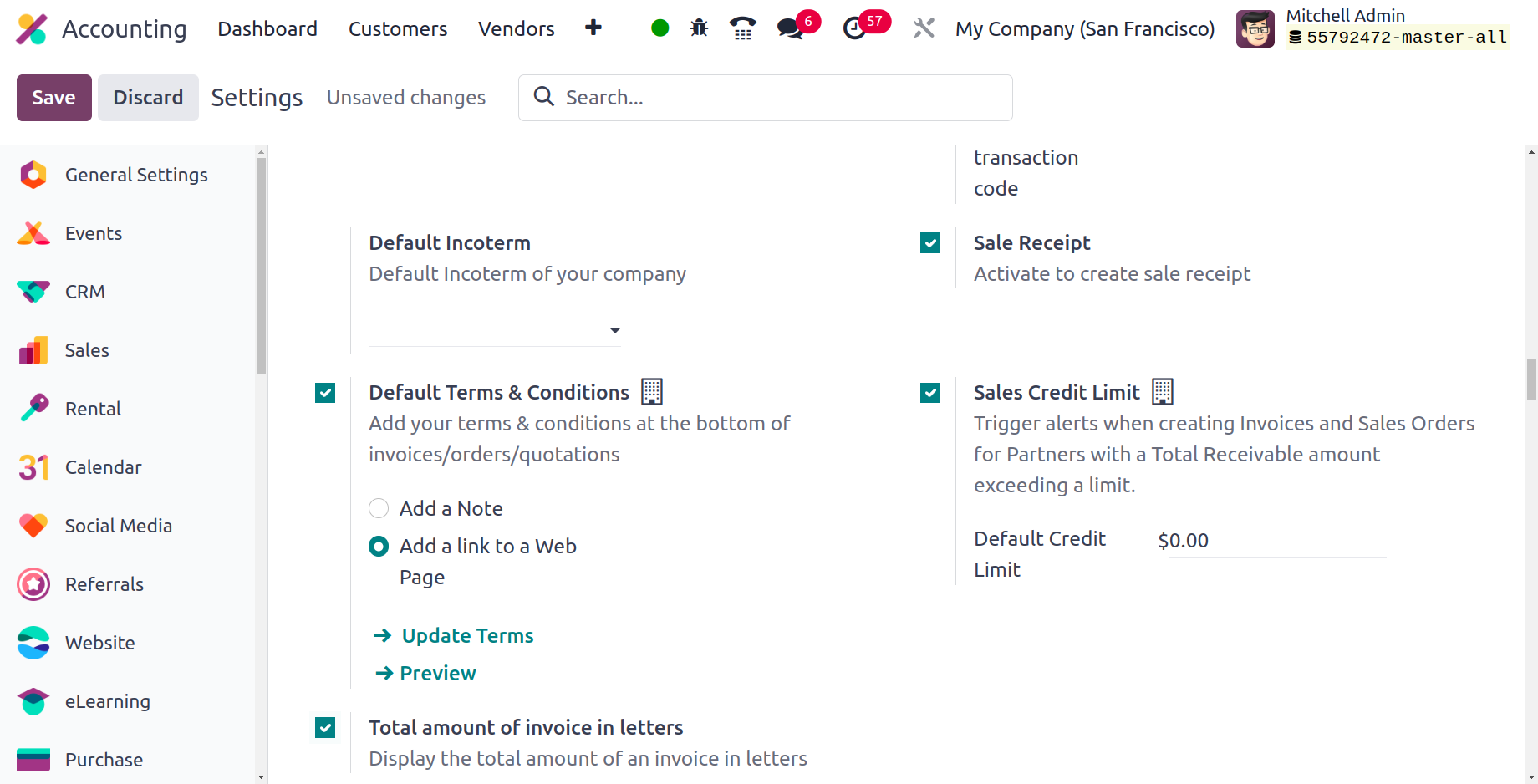

You can also enable or disable several other settings in the Customer invoices section, including default terms displayed on the invoice, warnings, cash rounding, Intrastat, default incoterm, and sales receipt. Let's take a closer look at these options.

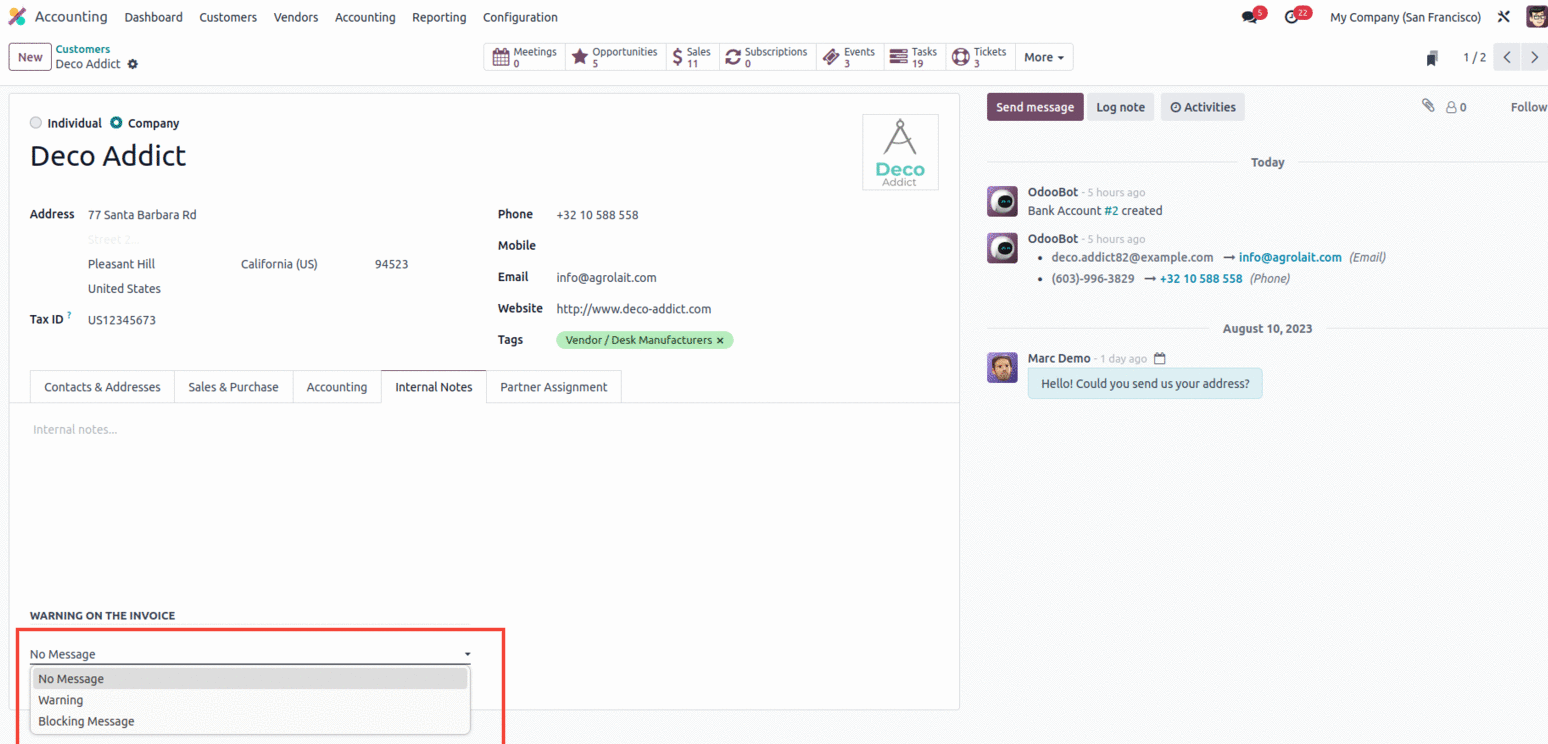

Warnings

By enabling the warning option, you may set warnings for certain customers identified in the Odoo platform. These warning messages will appear once the invoices have been created. Furthermore, these alerts may be tailored to your needs in order to inform operators based on the consumer. As a consequence, you will be able to cancel the transaction and create an invoice for that client.

Cash rounding

The invoice pricing will be adjusted to the nearest whole figure since it is unlikely that a customer would get precise change or that the counter will have enough coins to finish their transaction during retail time operations. With Odoo, you can customize the Cash Rounding procedure to meet your individual requirements and the currency in use. If you enable the cash rounding option, a cash roundings menu icon will appear, allowing you to specify cash roundings.

Customer Addresses

With Odoo Sales, you can specify multiple shipping and billing addresses. For some customers, it is very useful to specify specific billing and shipping addresses. Not all have the same delivery location as the billing location. In Odoo 17, this feature allows customers to add a separate shipping address.

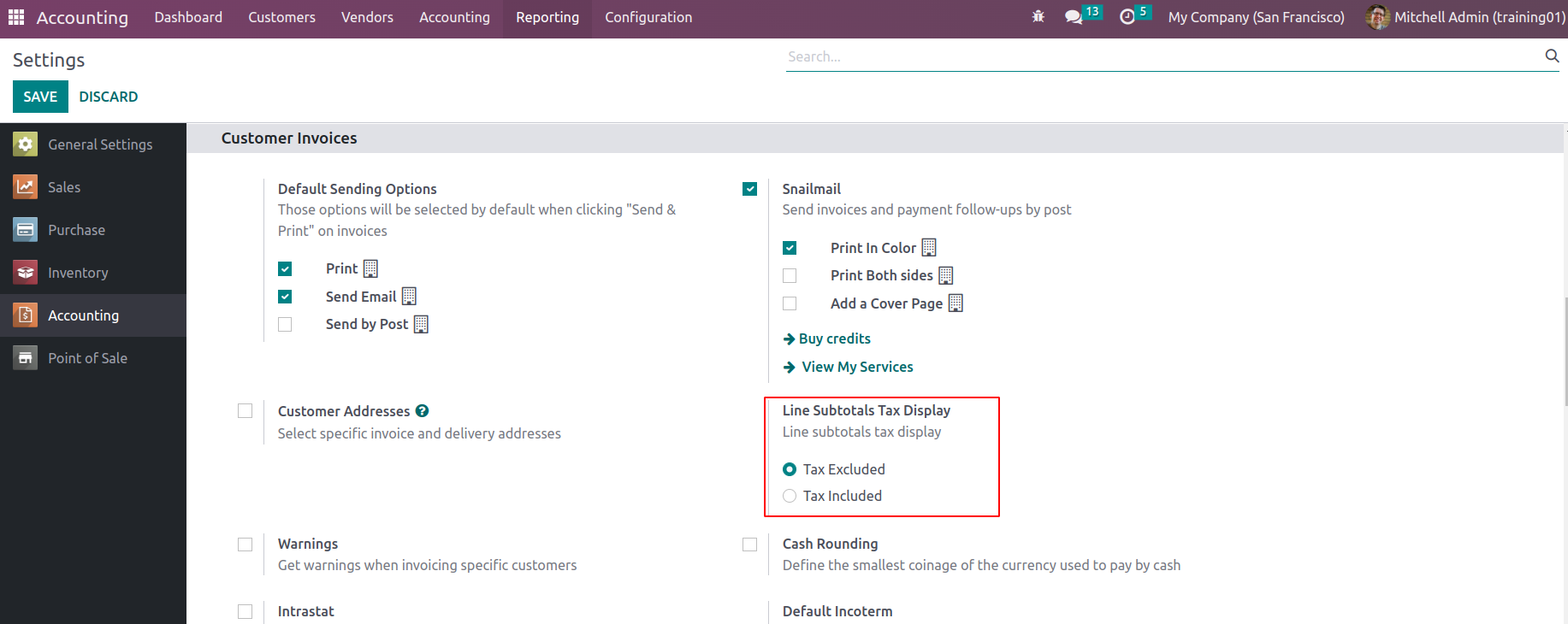

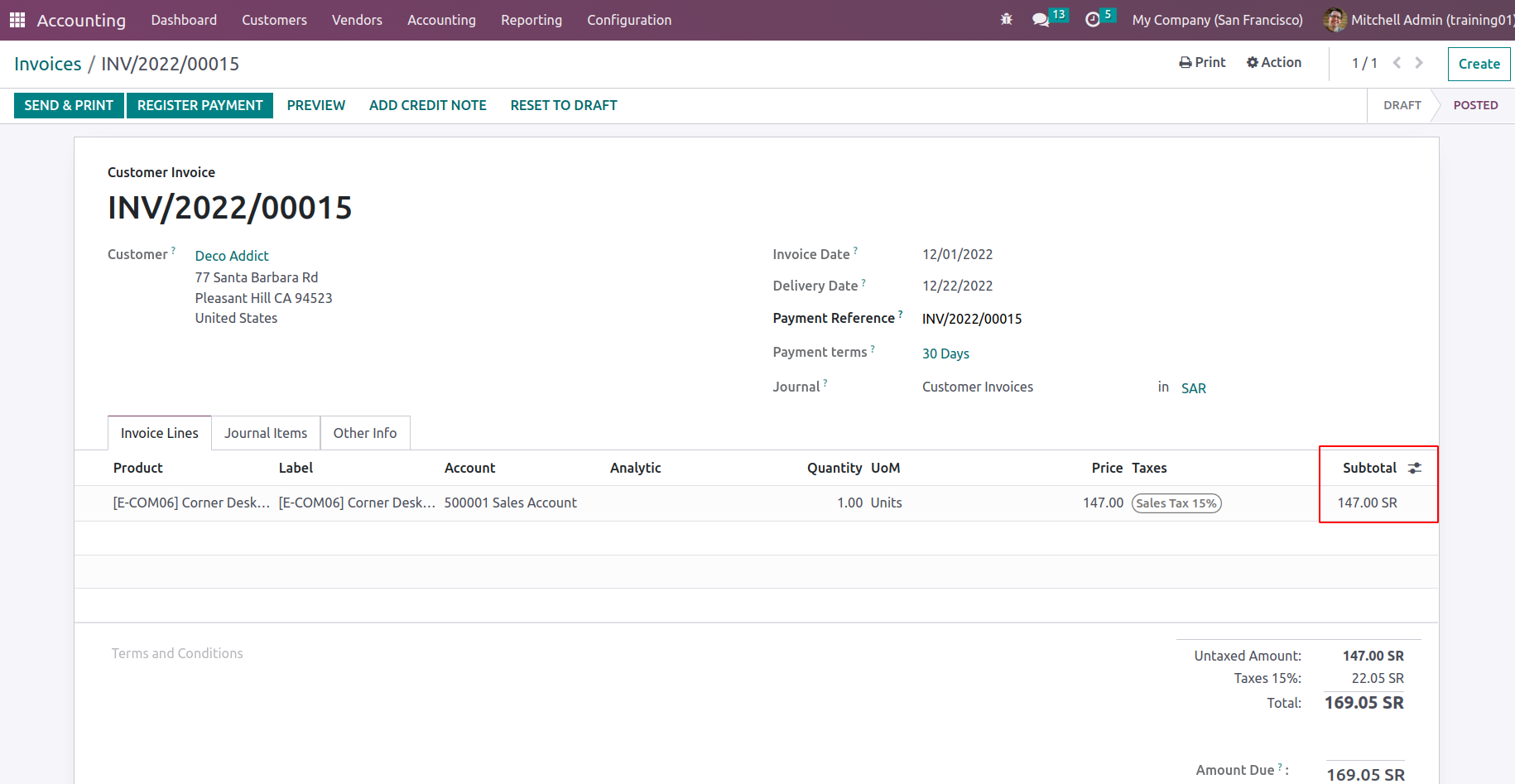

Line Subtotals Tax Display

The subtotal row of the invoice is the total sum of the quantity of the purchased quantity of product. The average amount shown on the invoice can be either Tax-Included or Tax-Excluded.

If tax excluded is selected to show subtotal tax on the line, the subtotal on the invoice line is tax excluded.

If Taxes are selected as the tax display for the Subtotal line, the subtotal is displayed as an amount with taxes in the calculation line.

Intrastat

The setup of Intrastat, which may be done here by enabling the option, is another part of localization in terms of Odoo's business operations in Europe. When you enable the option, you will get a drop-down menu where you may select the default incoterm to be used.

Default Incoterm

In addition to the ability to define it, the default incoterm may be adjusted in the Odoo Accounting module settings. There is also a drop-down box where you may pick the default Incoterm.

Sales Receipt

If the Sales Receipt option is turned on, a receipt can be created for the sale of the product after the sale. As a result, the same number of products are sold, invoiced, and shipped.

All configuration options are available in the customer invoice management section of the accounting module. Let's move on to the next section, which includes configuration options for managing customer payments.

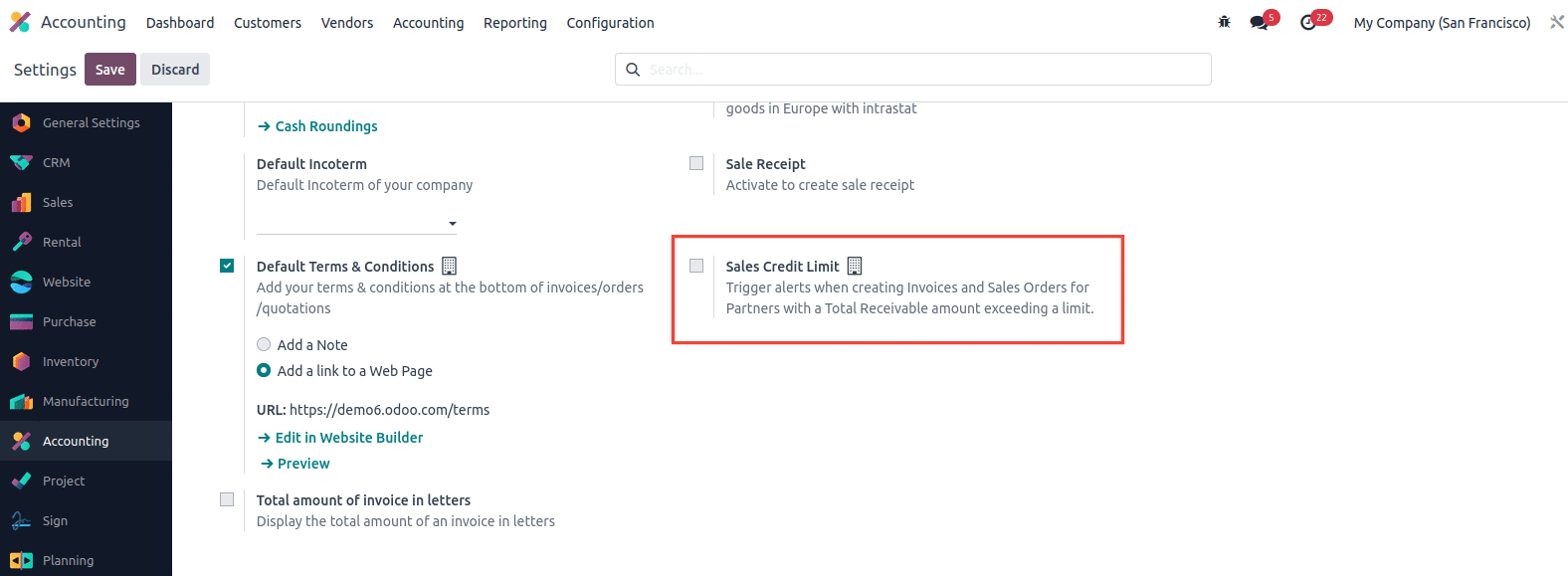

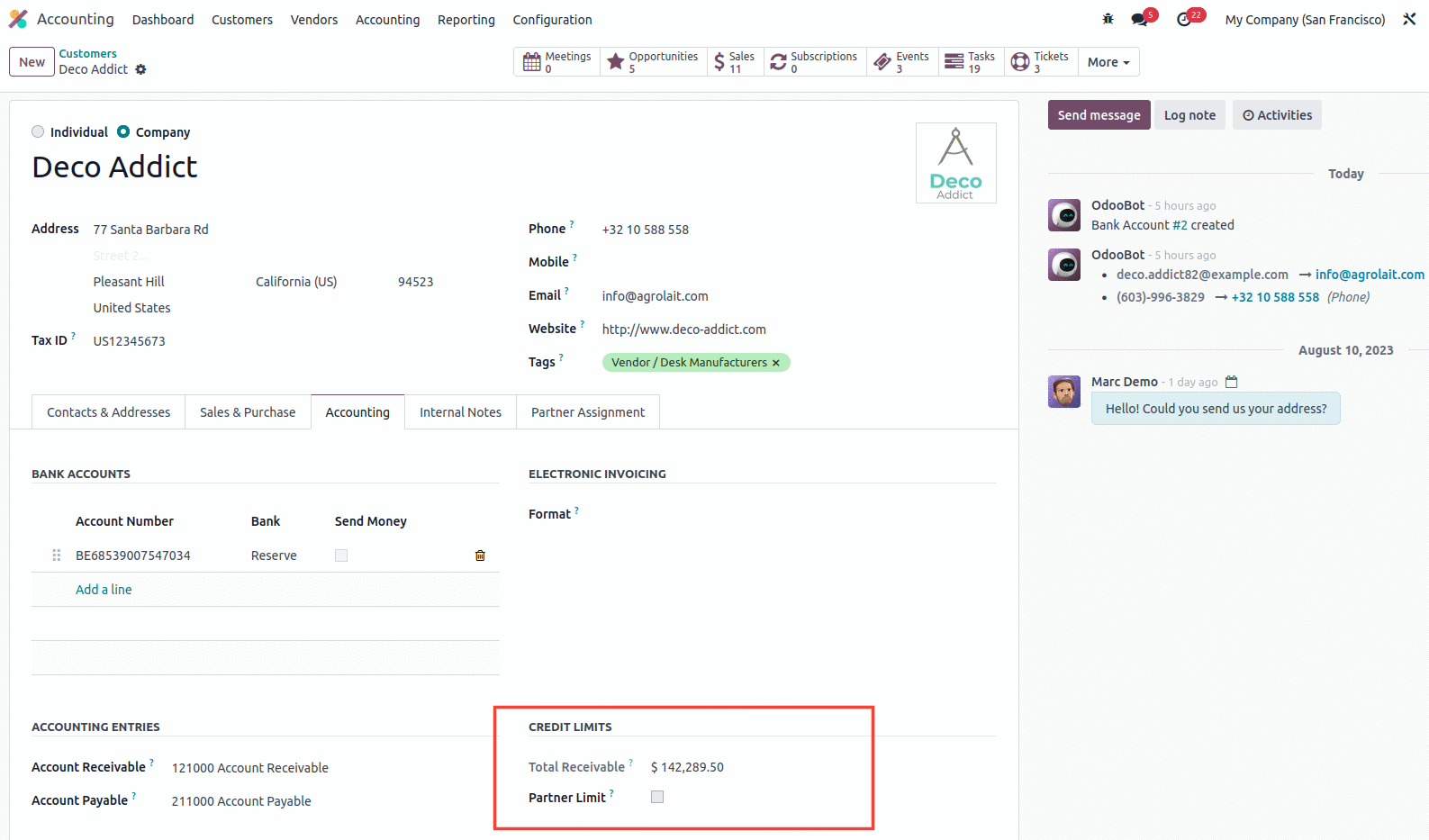

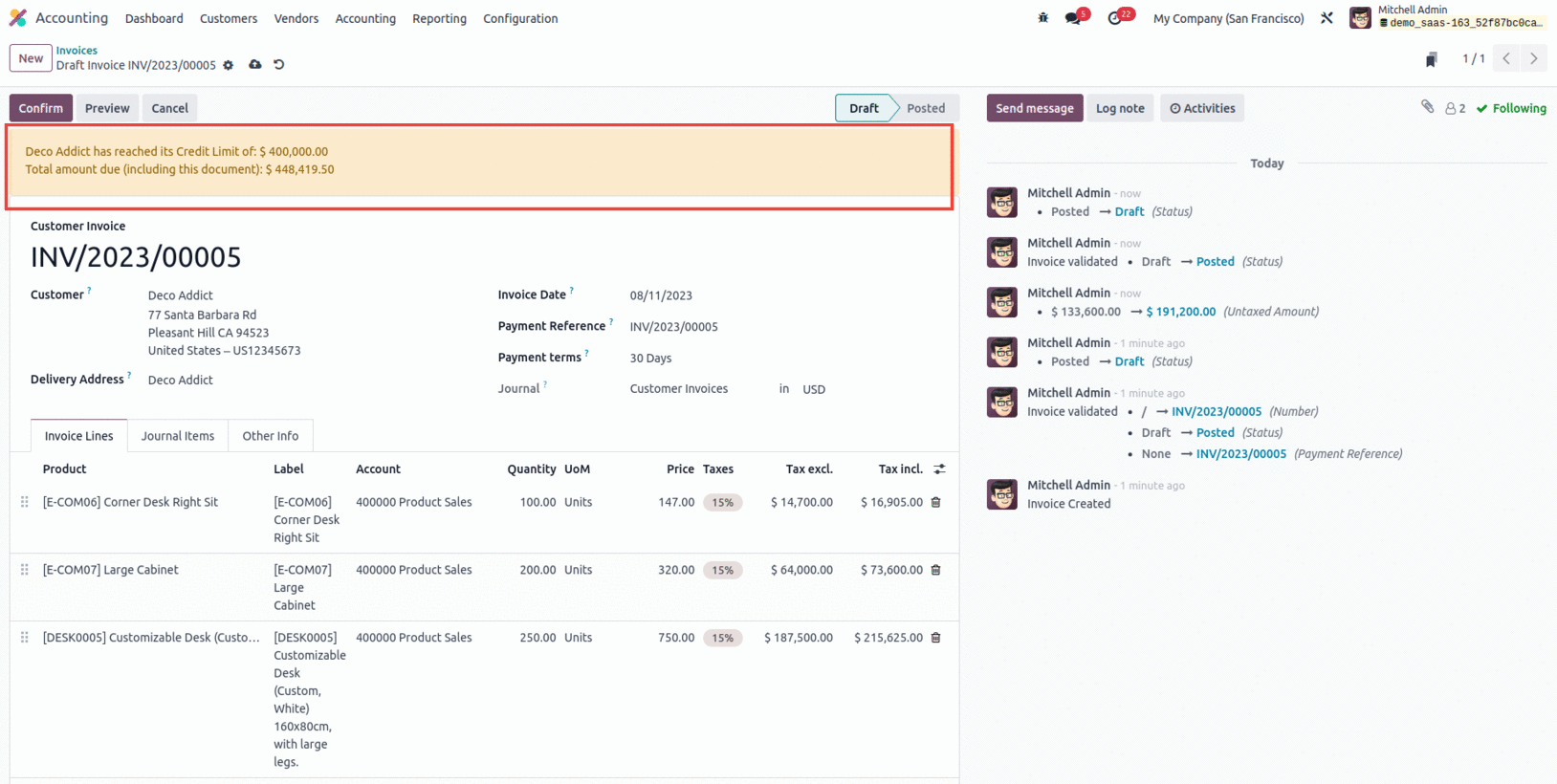

Sales Credit Limit

The maximum amount of credit available to the customer is called a credit limit. It is used to reduce the loss that the company incurs if the customer refuses to pay. The size of the credit limit is decided by the finance department. In the accounting settings, we can set a sales credit limit that can be applied to each partner as a company policy.

In Odoo 17, you can also set a maximum credit limit for certain partners. So, if this function is turned on, we can set a credit limit for the partner using the partner form, and it is also possible to see the requirements of the partner.

If a partner's receivable amount exceeds the partner's limit, future bills will show a warning that the partner has reached their credit limit.

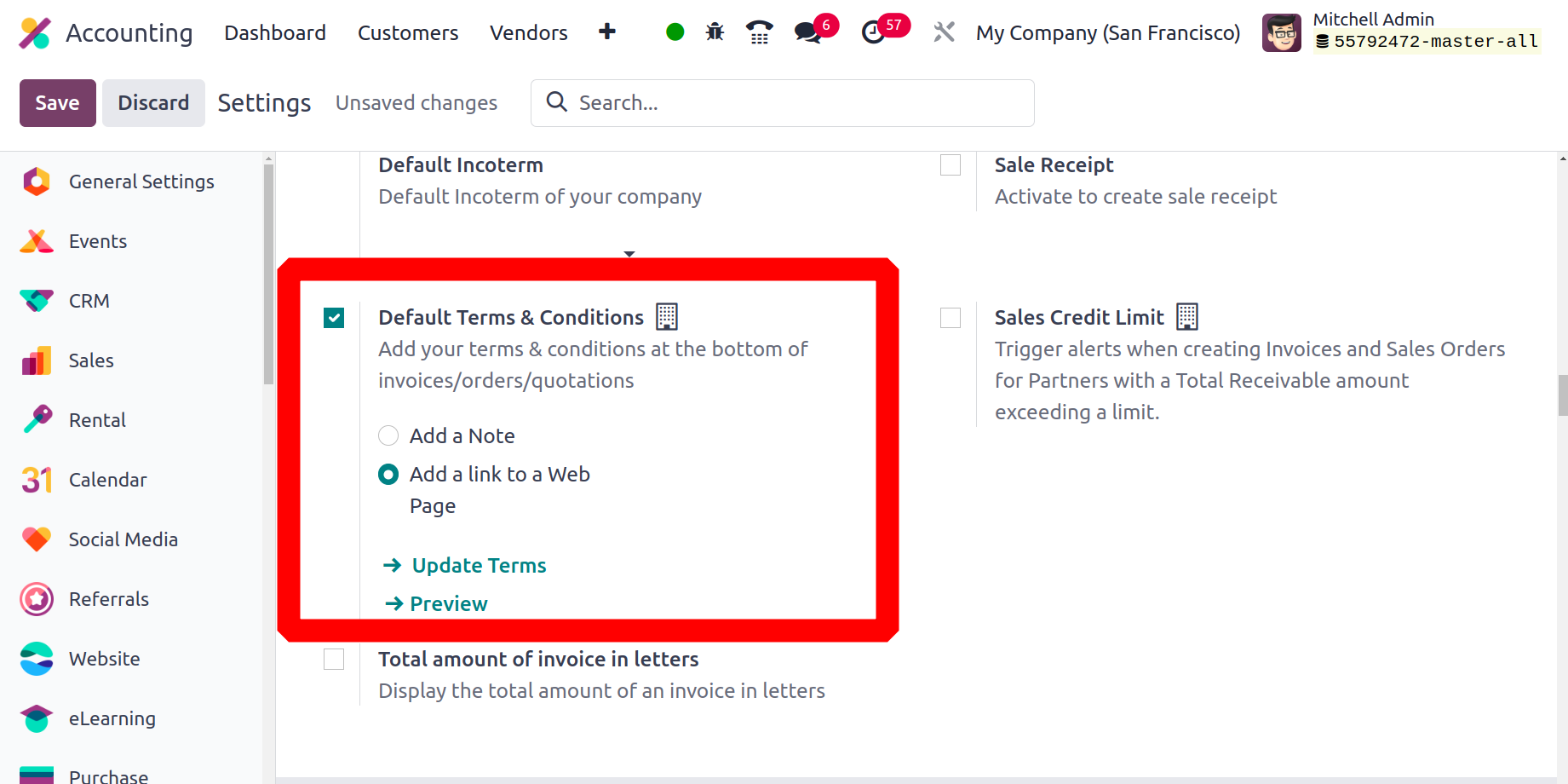

Default Terms & Conditions

Writing thorough and correct terms and conditions on sales invoices entails a plethora of minute but critical data, such as detailing the company's details, the description of the goods or services being offered, and any applicable taxes or discounts. So, under terms & conditions, the default terms and conditions may be added, which will display as notes or as a link in the Invoices/Sales Orders/Quotations.

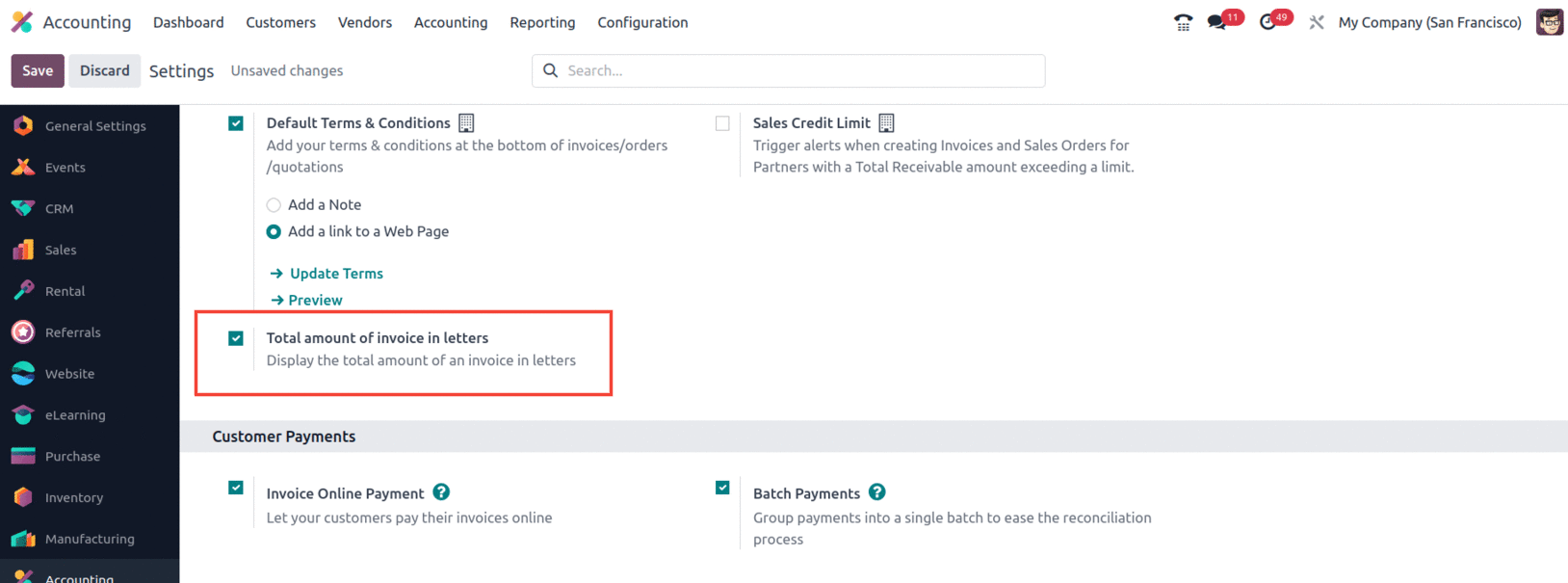

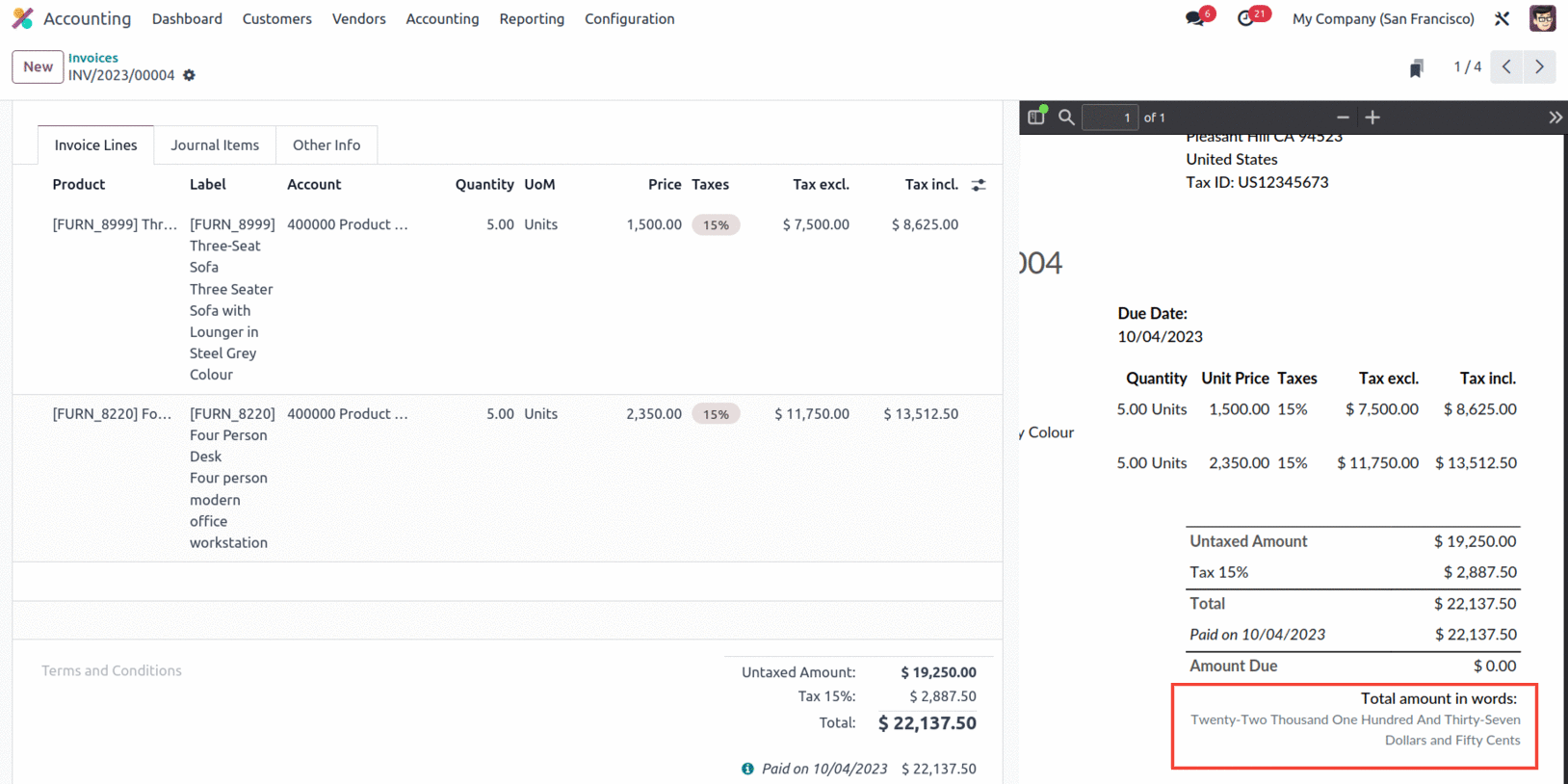

Total amount of invoice in letters

The accounting module for Odoo 17 now has a new function that allows you to print the total amount of invoices in the letter. Enable this from the settings of the Accounting module under the Customer Invoice section as shown below.

After enabling this feature, let's create an Invoice for a customer and confirm it. Once the invoice is confirmed, take the print of the invoice, which will show the Total amount of the invoice in letters as shown below.

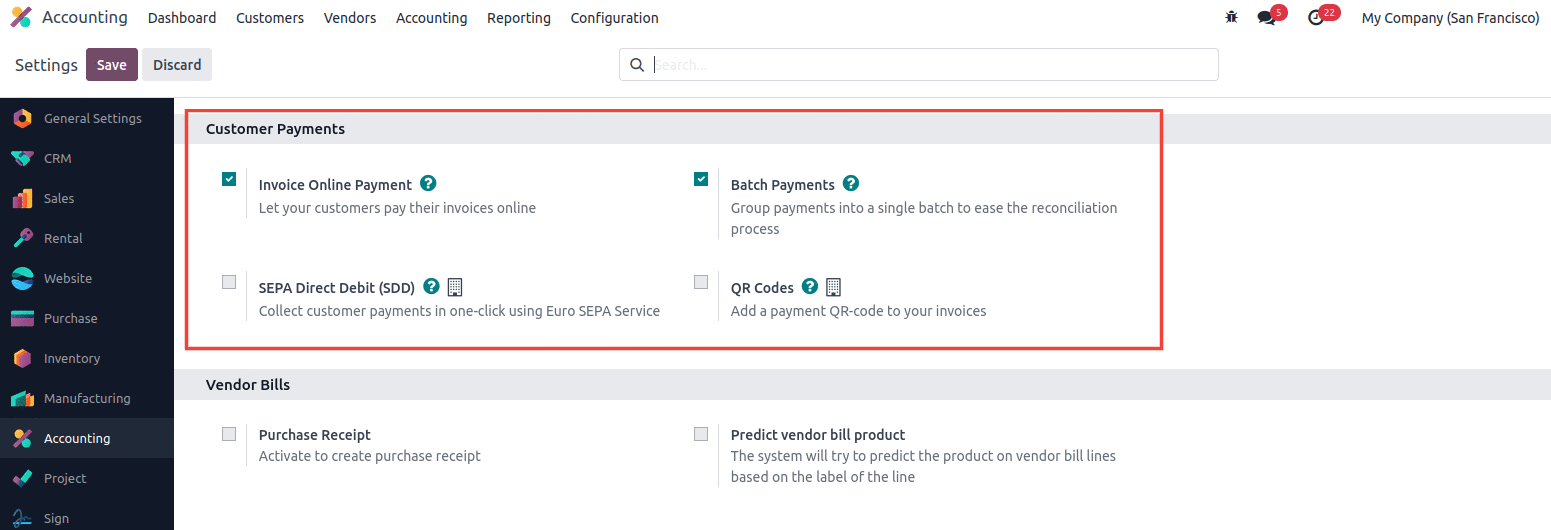

Streamline the customer payments

The management of customer payments is of primary importance in the financial operations of any company, and the configuration menu of the Odoo accounting module offers various configuration options for this purpose. You can enable online payment of customer invoices by enabling features such as online bill payments. In addition, the installment payment option can be activated, which allows the consumer to pay several bills at the same time. A useful localization option for European countries is SEPA Direct Debit (SDD), which enables fast collection of payments from customers using Euro-SEPA services. The options for managing customer payments found in the Settings menu of the accounting module are shown in the image below.

With Odoo, you can process several payments at once with efficiency and less manual labor by using the Batch Payment option. It makes it simple for companies to organize and carry out payments for several bills or invoices in a streamlined and integrated way.

If you enable QR codes, you can add a QR code to your invoices that consumers can scan to pay. With all these options, you can correctly define and process customer payments. So far, we've talked about creating customer invoices and managing payments. Let's move on to the next part, where we will discuss Vendor bills management.

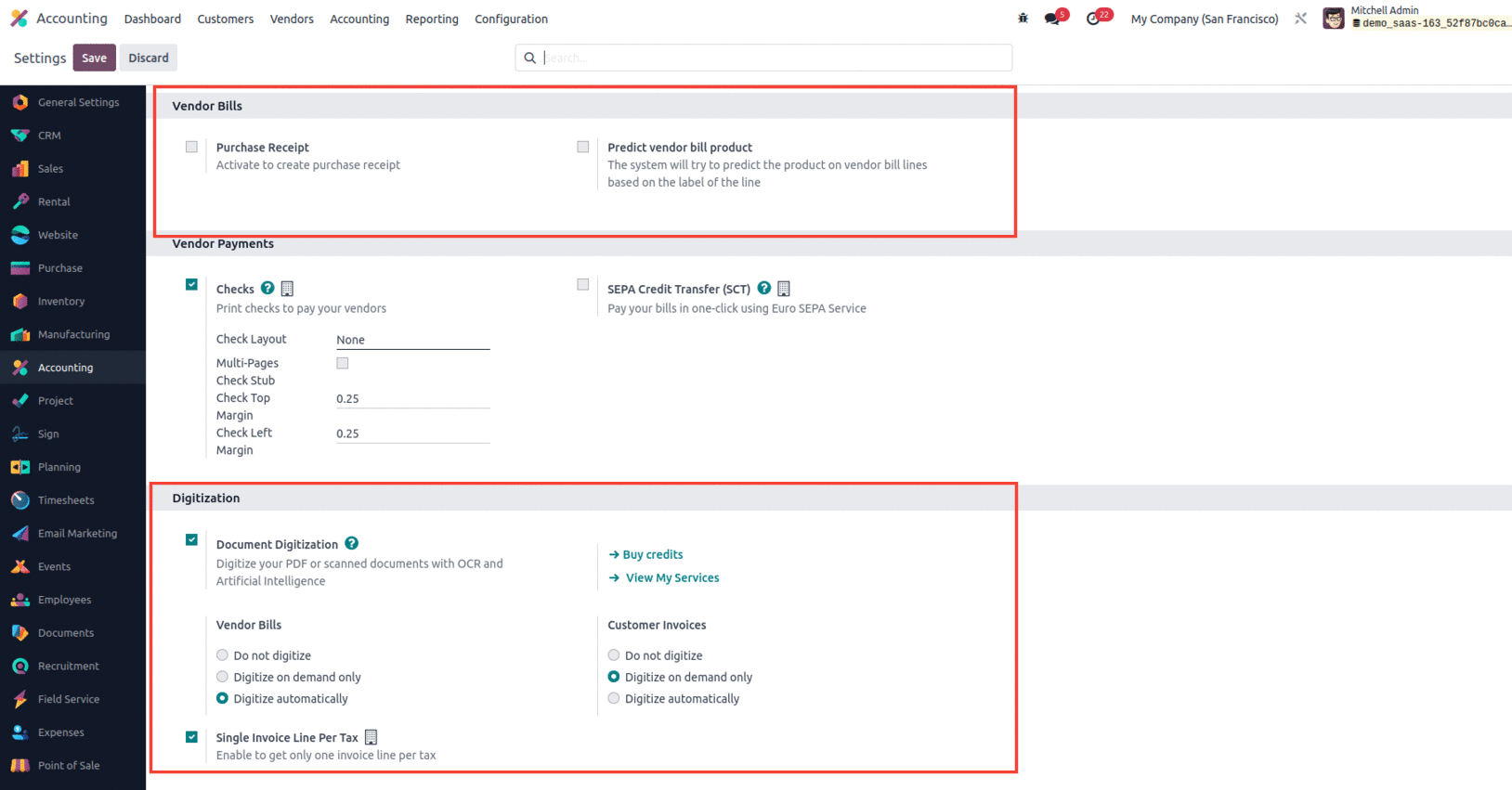

Well-defined vendor bills configuration tools

Odoo's accounting module makes it easy to manage vendor invoices for purchased goods. To effectively manage vendor bills, you need to set the right options in the accounting module's configuration menu. The advanced option of the Odoo Platform accounting module helps you proactively understand vendor bills based on previous supplier invoices.

The menu has options for digitizing invoices, such as Do not digitize invoices, Digitize invoices only on request and Digitize all invoices automatically. If you need to digitize an invoice, you will need to purchase some credits, which you can do by selecting one of the Purchase Credits options. You can also get just one invoice line per tax with the OCR Single Invoice Line Per Tax option. In addition, the possibility of creating purchase receipts for product procurement procedures can be implemented.

These are the several configuration options that are offered under the Vendor Bills. Let's move on to the administration options for Vendor Payments found in the settings menu.

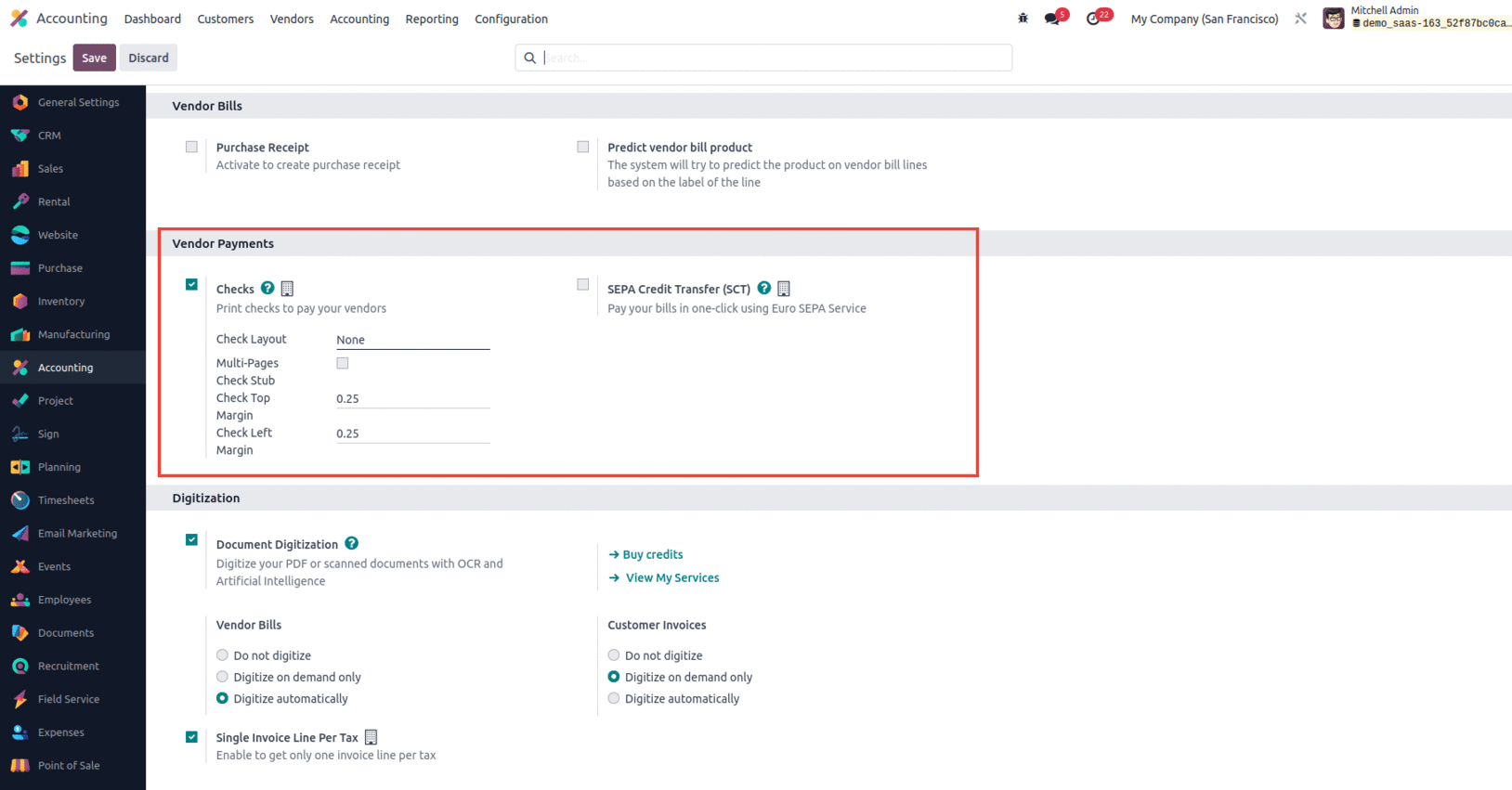

Full control of vendor bill payment

The advanced vendor payment management capabilities offered by Odoo's accounting module are useful for the company's accounting management capabilities. You can edit this by enabling checks and selecting Check Layout from the drop-down menu. Additionally, you can configure the Control Top Margin and Control Left Margin settings and enable Multi-Page Control Loop.

In addition, companies in European countries have the option of SEPA Bank Transfer (SCT), which allows them to pay their invoices with one click using Euro-SEPA services. Let's move on to the next section to learn more about the options related to banking and cash management in the configuration menu of the Odoo accounting module.

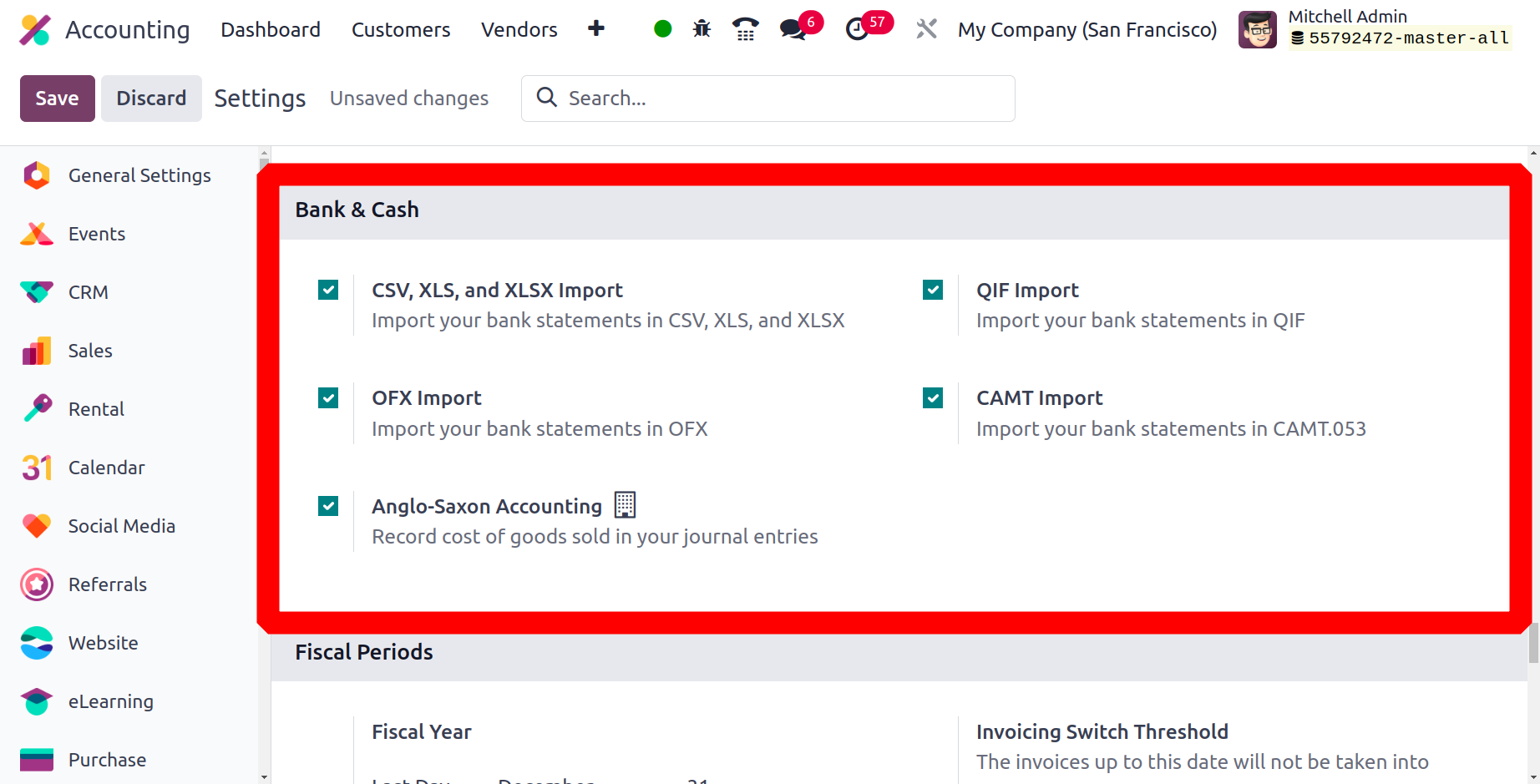

Managing the finances with bank and cash management

The bank and cash management options found in the configuration menu of the accounting module provide comprehensive insight into the efficiency of operations. By describing the transfer account and using it, you can set up transfers between banks under the menu. In addition, you can enable automatic import, which automatically imports bank statements. If you want to import bank statements into a CSV file, you can also enable the CVS import option. By enabling the QIF import function, you can import bank statements in QIF format

Additionally, you have the option to enable QFX Import and CAMT Import to import bank statements in these formats. The default accounts used for different operations can be defined in the Default Accounts section. When you set up and use an internal transfer account, you can set up Interbank transfers from the menu.

The Default Accounts section defines the default accounts used for various accounting operations, including Profit Accounts, Loss Accounts, Bank Suspense Accounts, Outstanding Receipts Accounts, Outstanding payments Accounts, Internal Transfer Accounts, Cash Discount Accounts, Cash Discount Loss Accounts, Deferred Expenses Account, Deferred Revenue Account, Income Account, Expenses Account etc. Each account is used for specific functions.

Profit and loss statements are used to reflect the exchange rate difference that occurred during the transaction. A change in the exchange rate results in either a loss or a profit for the company, and these losses or profits are reflected in the income statement depending on the scenario. The journal entry corresponding to the exchange rate difference is entered in the mixed journal specified in the Journal field.

A Bank Suspense Account is a temporary account used in Odoo to settle bank statement transactions where the exact account is uncertain. Basically, they are used to show the amounts on the bank statement up to the reconciliation date since the exact match is not known. Transactions in the escrow can then be periodically monitored and transferred to the correct accounts when they have been reconciled or paid.

The Outstanding Receipts Account and Outstanding Payments Account are temporary accounts that will keep unreconciled entries. These accounts are used to avoid situations where accounts receivable and accounts payable are directly related to reconciliation. Once the reconciliation is done, the amount is transferred to the bank. An internal transfer account is an intermediate account for interbank transfers.

Next comes the Cash Discount Gain Account and Cash Discount Loss Account, which are used to reflect the discounts or rebates given in the accounting transaction which are posted to the respective accounts. Let us now further understand the aspects of defining fiscal periods in the Odoo accounting module in the next section.

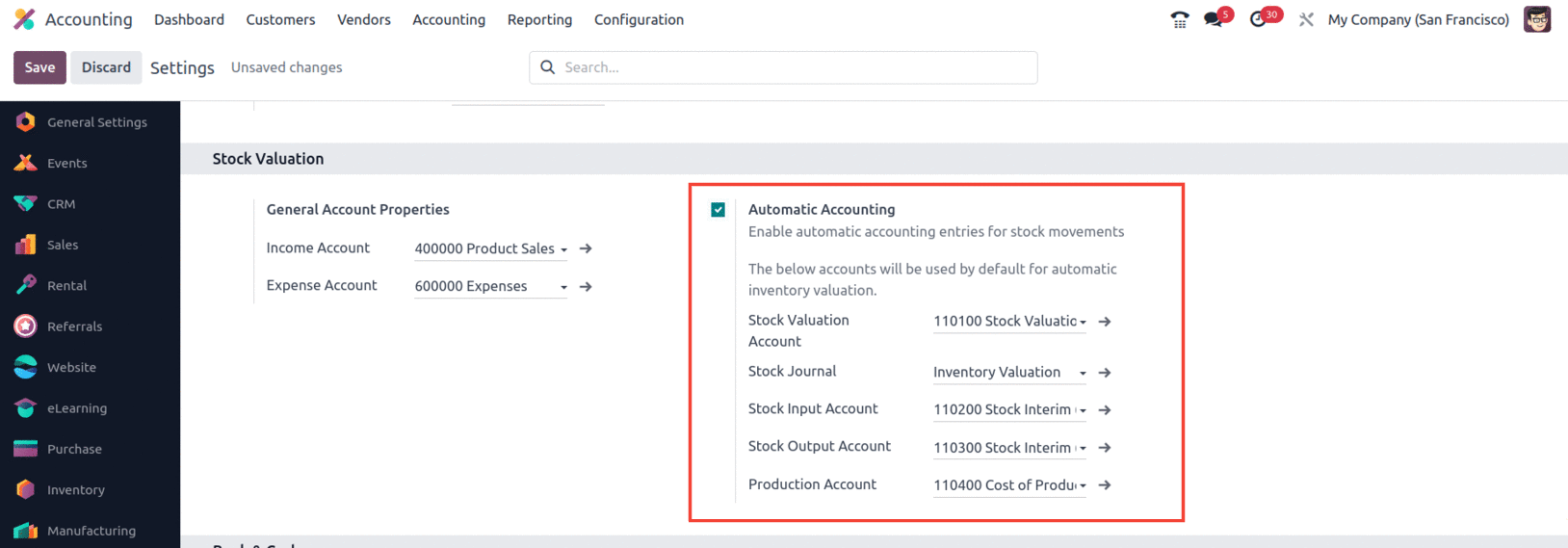

Odoo v17 includes a significant modification in the setting of automatic stock valuation, as well as the addition of a new configuration to incorporate the "Cost of Production" account. This will help to provide transparent stock movement and value as part of the Cost of Production account ledger, from raw material consumption through finished goods stock valuation. To add the account, enable the feature from the settings of the accounting module under the Stock Valuation section, as shown below.

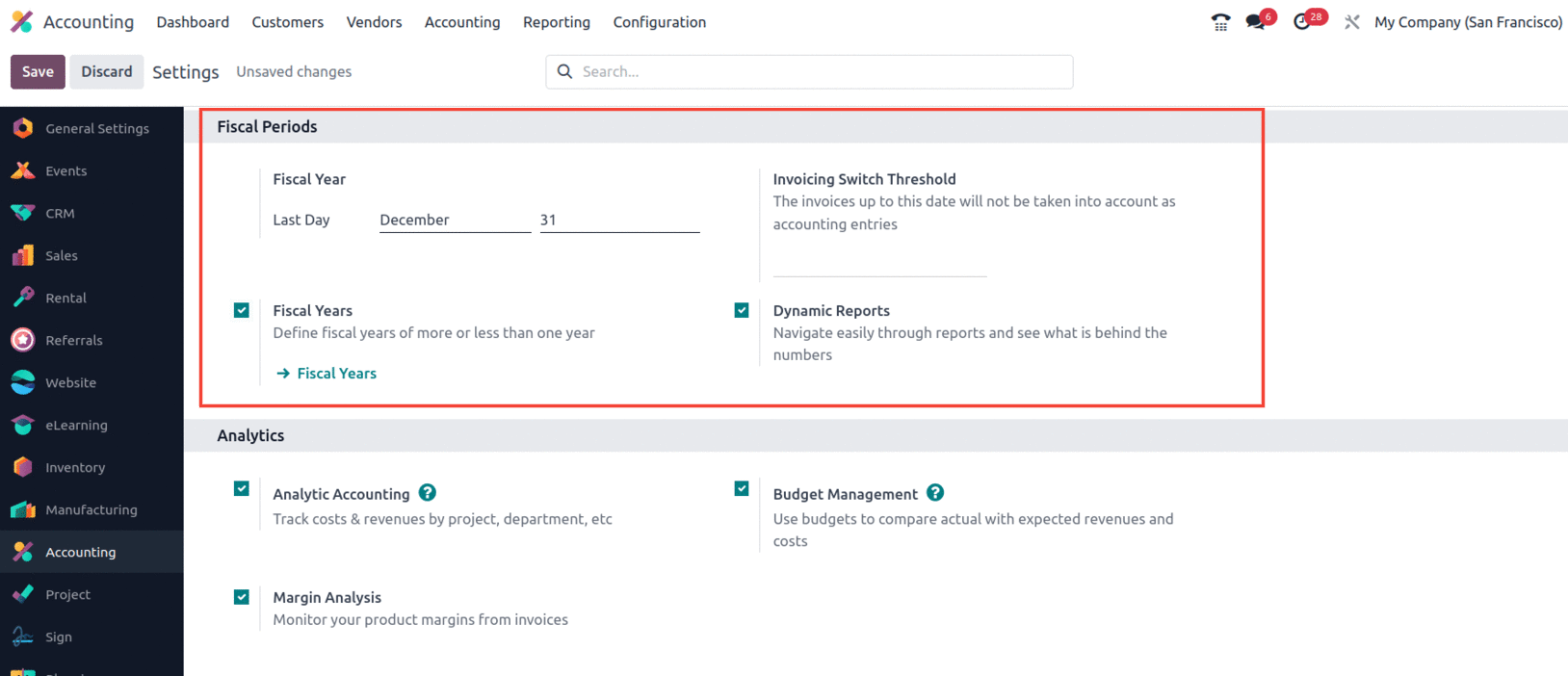

Configurable fiscal periods and positions

In Odoo's accounting module, you can set the accounting period during which your company operates. You can specify a fiscal period by specifying the last day and month in the Fiscal Period tab. You enable the option if the fiscal activities are carried out based on fiscal years. Additionally, you can set an invoicing threshold by selecting a date from the calendar when you set the invoicing switch threshold. Any date that is entered as the Invoicing Threshold made prior to that date is placed in canceled status. In addition, the income component and the reporting component are removed, and you start the operation.

A valuable feature of Odoo during development is the threshold setting to delete all test data from invoices, vendor bills, and related revenue associated with them. In other words, once the test actions are completed and the threshold is set, the platform returns to its new form, ensuring that all test actions remain undone. Let's move on to the next section, where we will discuss the analytical accounting and budget management of the accounting module.

The odoo 17 Accounting application now has a new feature called the Dynamic report. This tool allows you to effortlessly navigate through reports and uncover what is hidden behind the numbers.

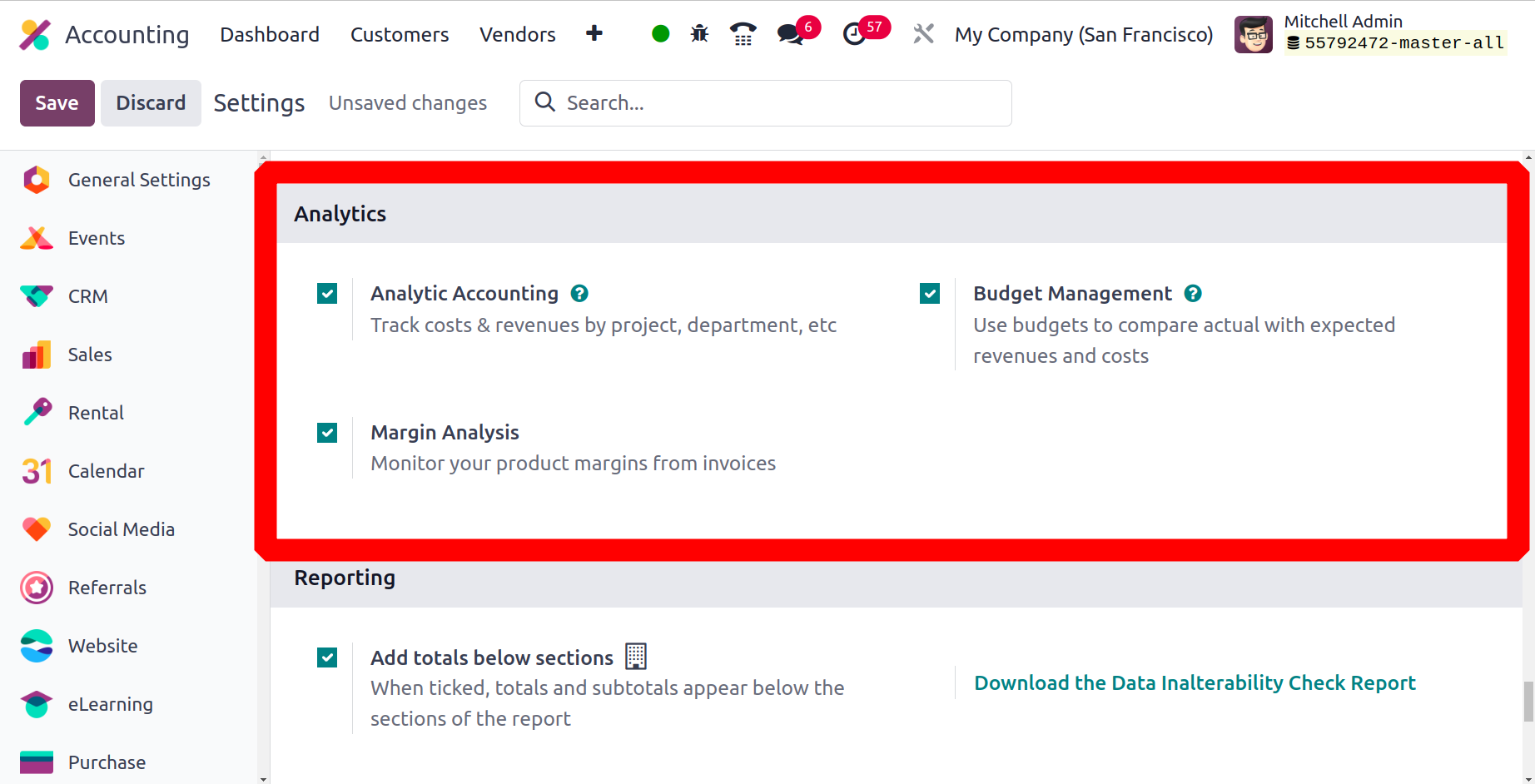

Analytical accounting and budget management

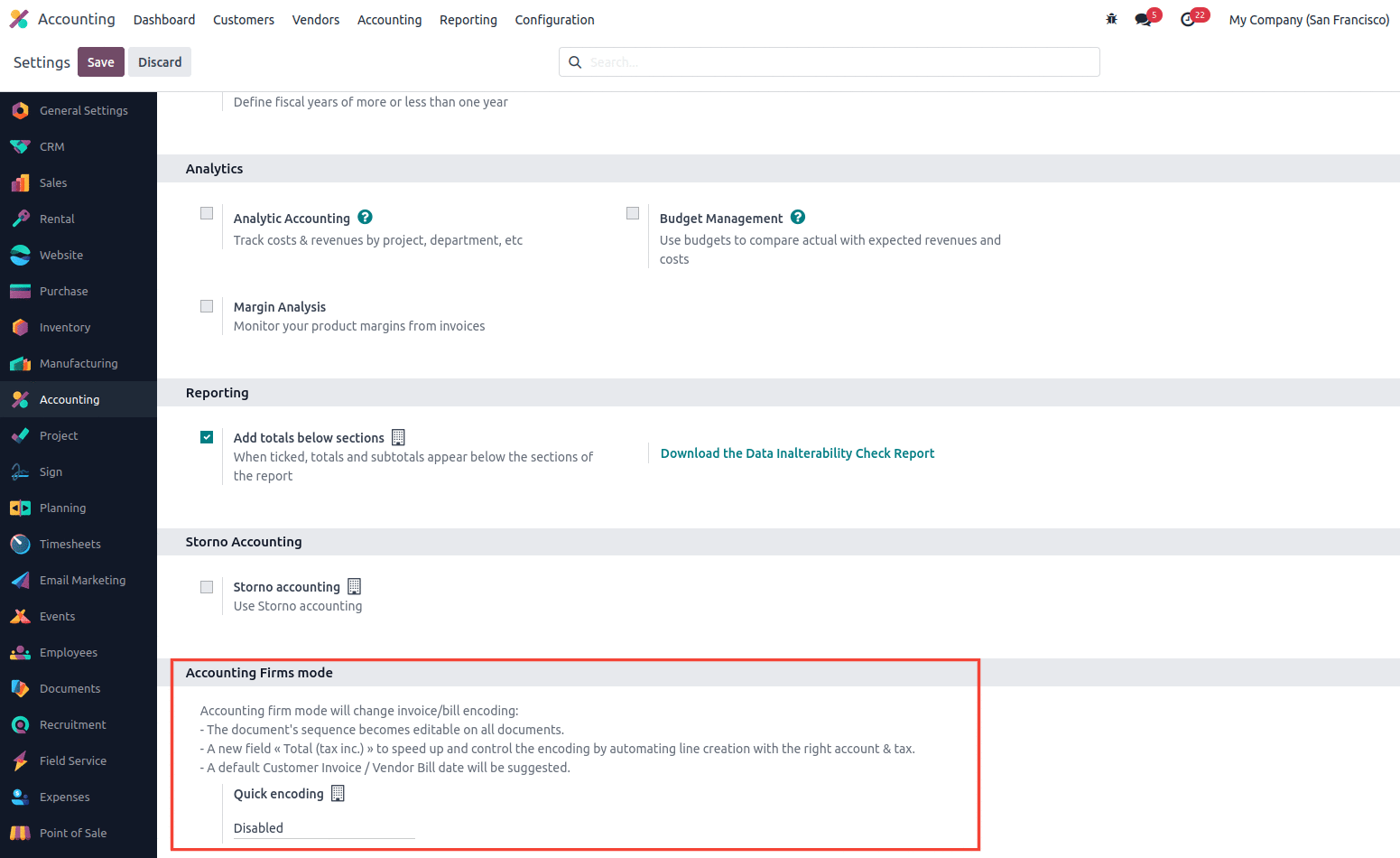

With Odoo's Analytic accounting tools, you can grow in the financial management tasks of your company. All analytical accounting setup options can be configured from the Analytics menu in the Analytics module's Settings tab. Using the menu option, you can enable and disable the analytical accounting component of your company's activities. Analysis identifiers can also be applied according to the needs of operations, which simplifies the classification of analysis accounts and related processes.

In addition, the budget management options ensure that you have adequate control over the activities related to the financial budget as well as the free funds of the company. By activating the Margin Analysis option, you can also track the product margins from invoices. The options available in the Analytical Accounting settings are displayed in the Settings menu of the Accounting module. As we move forward, we will learn more about the configuration options for generating analytics reports.

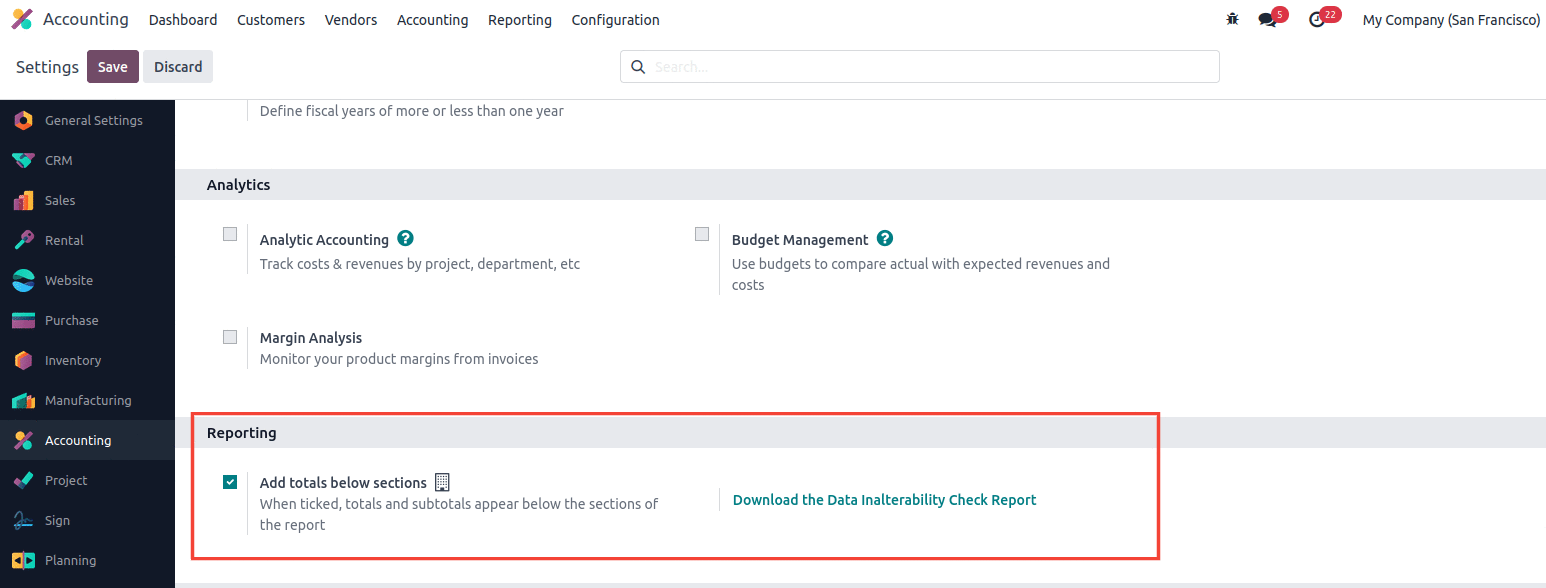

Create informative reports

In the Reporting and Analysis section, there are two options for generating reports. To get started, you can enable the Add Totals feature under the sections below that describe the sum of the parts of the report. In addition, you can select the Download Data Audit Report option from this menu, which will download the report to your computer.

Depending on the usage requirements, there are many customizable options available in the configuration menu of the accounting module of the Odoo platform. You can quickly change them to get the operational control you need over your company's finances.

At the beginning of this chapter, we covered the basics of Odoo and its installation and hosting features. The localization feature of the platform is then discussed, followed by the installation functions of the Odoo accounting module. This chapter has covered in detail every option in the configuration panel of the accounting module.

In the next chapter, we will focus in detail on the configuration tools available in the compute module.

Configurable Options in the Accounting Module

The Odoo platform's Accounting module will offer total operational management of the financial side of any company's operations. Odoo 17 is a customizable software that allows you to set up different parts of accounting and financial management. In addition, the Accounting module of the Odoo 17 platform has a configuration menu with several configurable default values. All Odoo 17 modules have a configuration menu that allows users to fully configure the functional management and performance of each module.

You can configure the settings by checking the corresponding boxes to enable and disable it. You also have options to define an action from which you can select an entity from a drop-down menu. Each of these alternative types is defined based on a specific functional need. While building the platform, you also have the opportunity to add unique features, which you can do with the help of experienced Odoo developers. Installing various third-party Odoo applications from the Odoo app store provides customizable options for specified modules that allow you to define functionality. Additionally, you can change the default modules available through the Studio module. You can also create custom modules using the Odoo studio module with customizable options, just like any other default module.

The Settings tab of the Accounting Module Settings page provides access to a number of configuration options. These options allow you to precisely define the functions of financial management and accounting. Additionally, these are the default options that come with both the Community and Enterprise versions of Odoo. However, the functional capabilities of the community version are limited, while the commercial version is significantly more advanced. We will continue to learn more about how each option works in the following sections as we navigate to the Accounting module settings page.

Also, if your country acts as a global brand, you need to properly manage the currency of each location. To save bets in any currency in the world, the Odoo platform allows you to set up a multi-currency option.

Let's move on to the next menu, Manage Invoices, in the next section, accessible from the Settings tab in the accounting module.

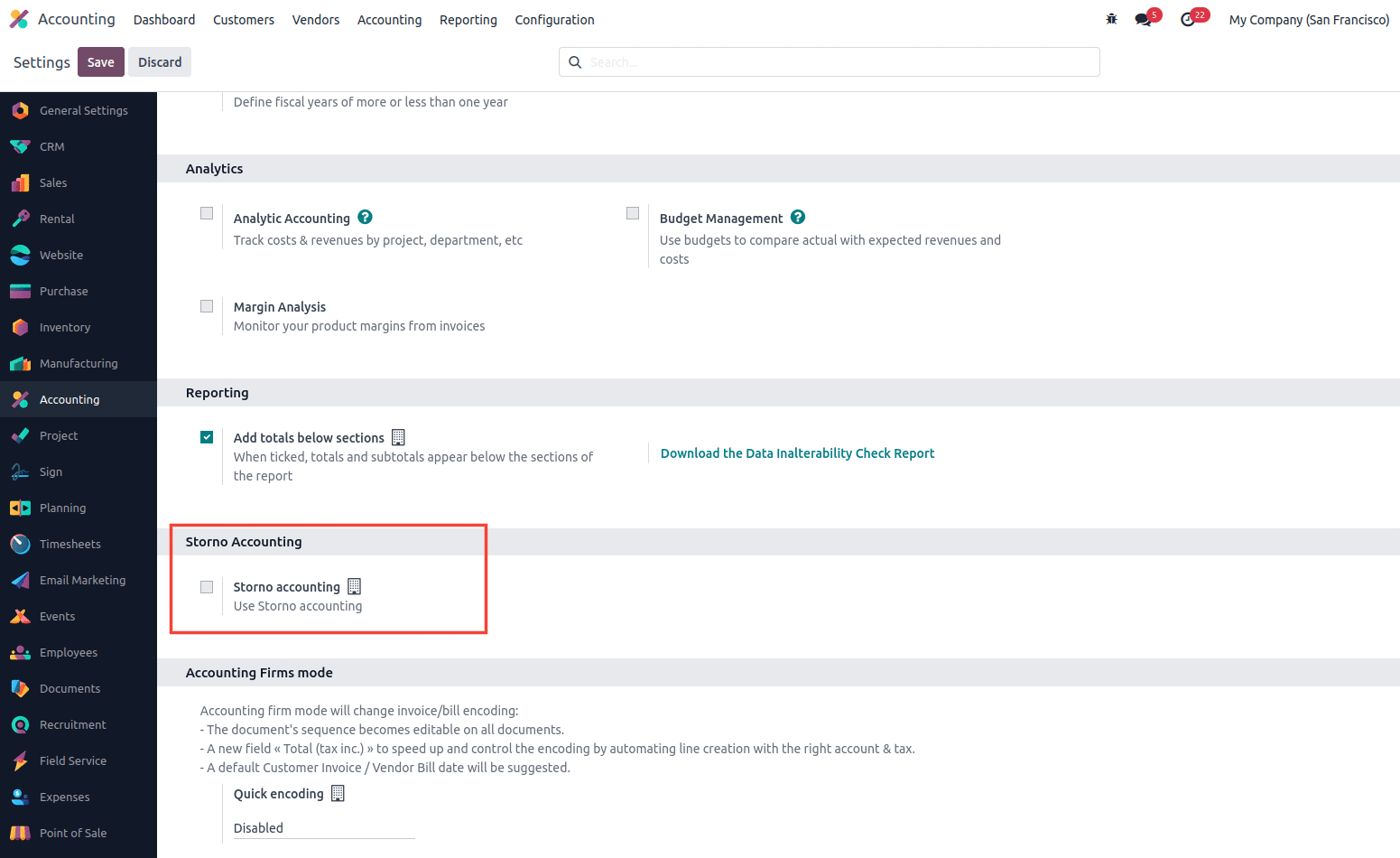

Storno Accounting

Storno Accounting in Odoo 17 is used to record reversed entries as negative. Both negative credits/debits are shown in red in the financial statements. The original transaction is "zeroed out" for each reversal transaction because they all appear in the same debit or credit column.

Accounting Firm Mode

Another feature in Odoo 17 is the Accounting Firm Mode, which helps to change the sequence of the bill/invoice. A Quick Coding field can be defined and a set of documents defined based on the coding can decide whether it is exchangeable or not. The total (tax inc.) field enables you to add a tax-included value to your invoice document, which will automatically split the service amount and tax in the invoice line. Also, the billing date will be auto-suggested.

The accounting module of the Odoo platform contains several configurable options that can be expressed as user requirements in the configuration menu. You may quickly customize them to get the necessary operational functional management over your business's finances.

At the beginning of this chapter, we covered the basics of Odoo and its installation and hosting features. The localization feature of the platform is then discussed, followed by the installation functions of the Odoo accounting module. This chapter has covered in detail every option in the configuration panel of the accounting module. In the next chapter, we will focus in detail on the configuration tools available in the accounting module in detail.