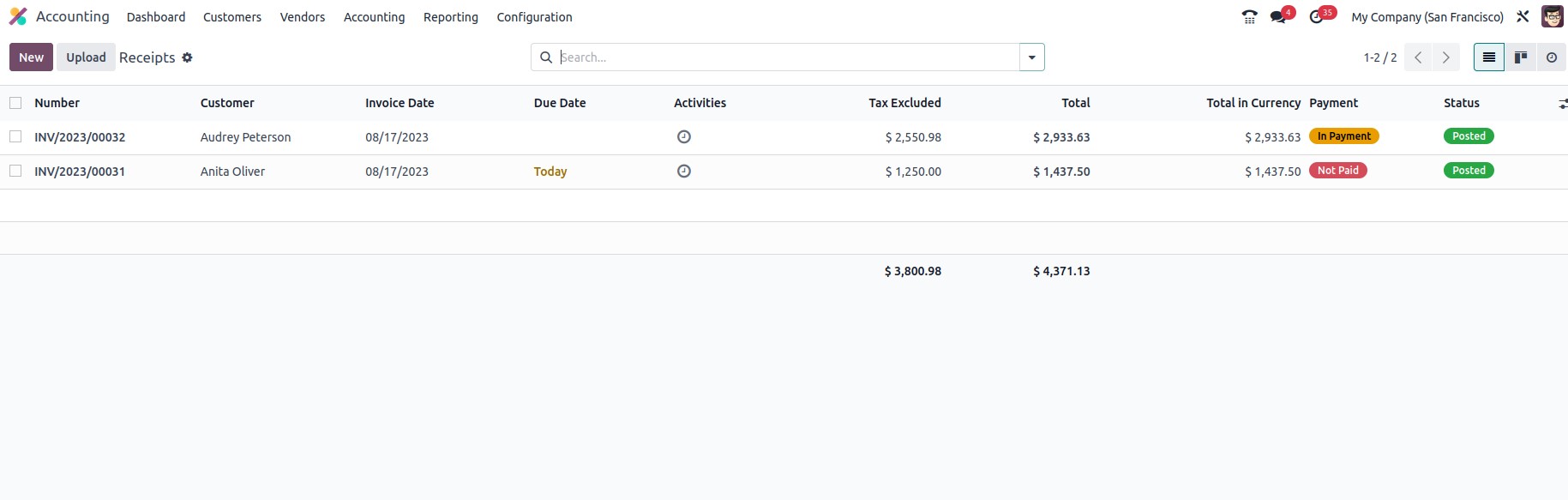

Receipts are an important aspect of ensuring that payments to the invoices record are made. In many businesses' real-world situations, the operations for producing receipts are carried out both before and after payments are received. Only corporate activities are responsible for this. The company's operations for client sales receipts will be supported by a particular tool for handling receipts that is offered by the Odoo platform. The Receipts menu may be accessed from the Customers tabs of the Odoo Accounting module. The menu will define all operation receipts. Number, Customer, Invoice Date, Due Date, Next Activity, Tax Excluded, Total, Status, and Payment Status will all be shown. The activities will have a foundation, and the understanding of it will be obvious thanks to the color-coordinated representation of the Status section of the menu.

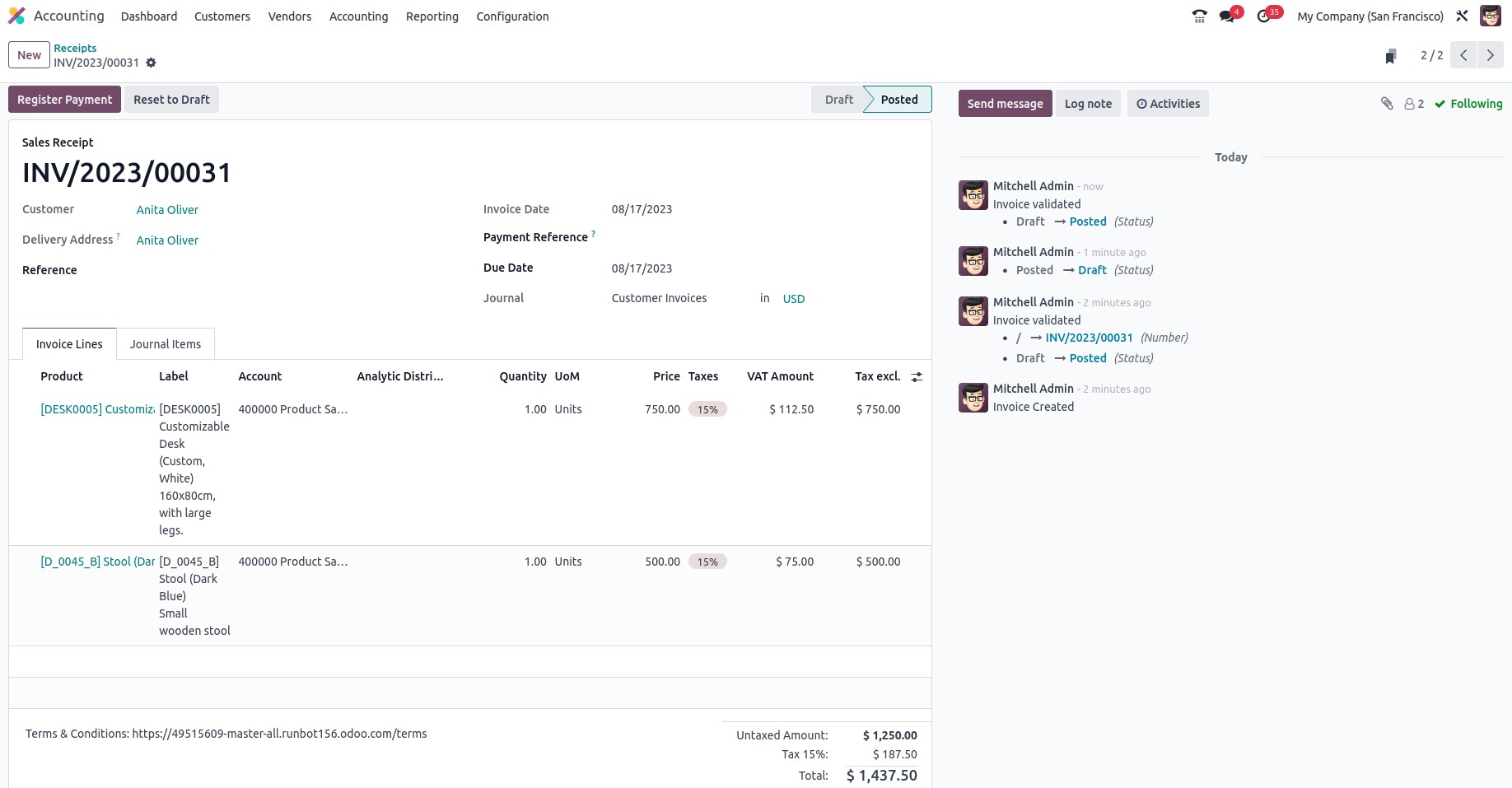

Receipts defined in the menu may be changed, and there is also the opportunity to produce new ones using the accessible Create option. The choice for producing receipts will provide the Customer name, Reference, Payment Reference, Invoice Date, Due Date, and the Journals description, along with the Currency used. Under the invoice, lines are also listed Product data, Label, Account details, Analytical Accounting details, Analytics Tags, Intrastat, Quantity, Price, Taxes, and Subtotal.

By choosing to include a line, it may be defined. You may also add a new section to the invoice by selecting the Add a section option. You may add remarks to the customers by choosing the Add a note option. It is possible to delete or alter the sections, product lines, and remarks that are being provided.

The amount of the invoice, as well as the tax information, will be shown in the relevant invoice window at the bottom of the page.

Once the reverse invoices are configured, you may proceed to register the payment by selecting the relevant option. At that time, a pop-up window similar to the one in the picture below will display. Here, you must select whether to use manual, batch, or SEPA direct debit as your payment option. Next, you must provide the recipient's bank account, payment sum, payment date, and payment note.

Finally, you must select the Create Payment option.