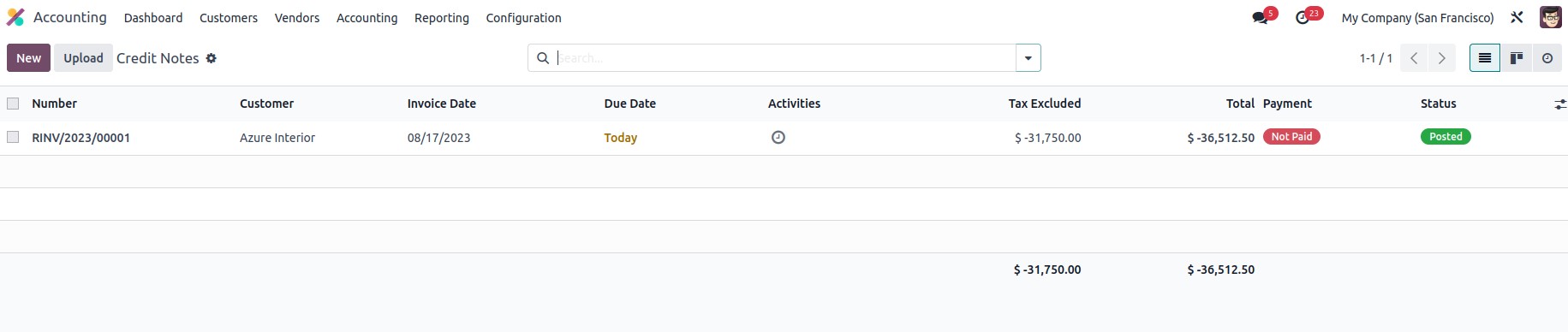

The characteristics of credit note activities that will allow you to refund the invoice amounts in the section prior may be clear to you. Credit note operations will probably need to be specified in a real-time business context; hence, Odoo offers a particular menu to make managing all credit note activities easier. In the Credit Notes menu, which is available from the Customer page, all Credit Notes will be described with the Number, Customer information, Invoice Date, Due Date, Next Scheduled activity, Tax Excluded, Total, Status, and Payment Status. To get the required Credit Notes, you can provide custom and default Filter and Group by settings.

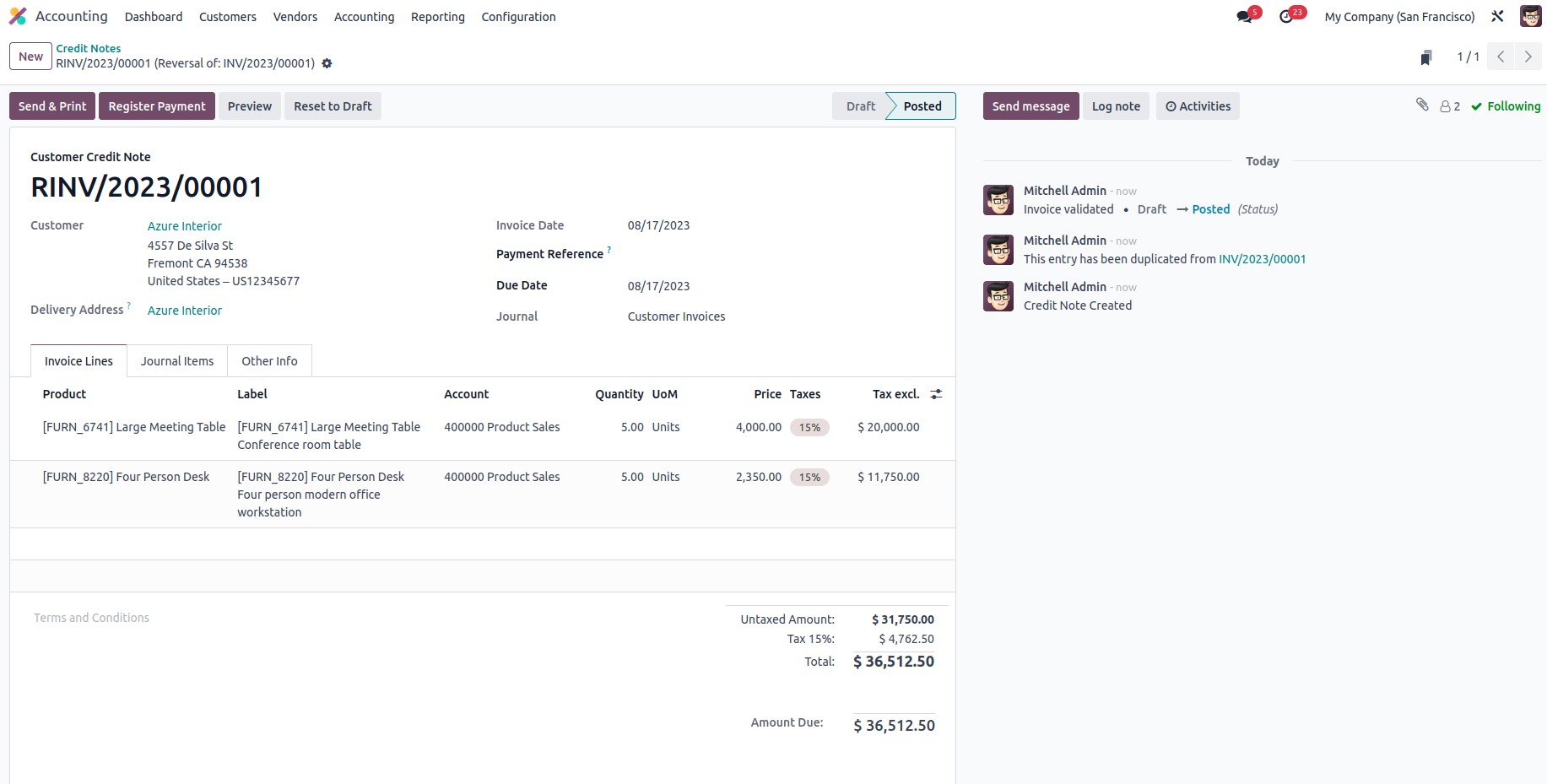

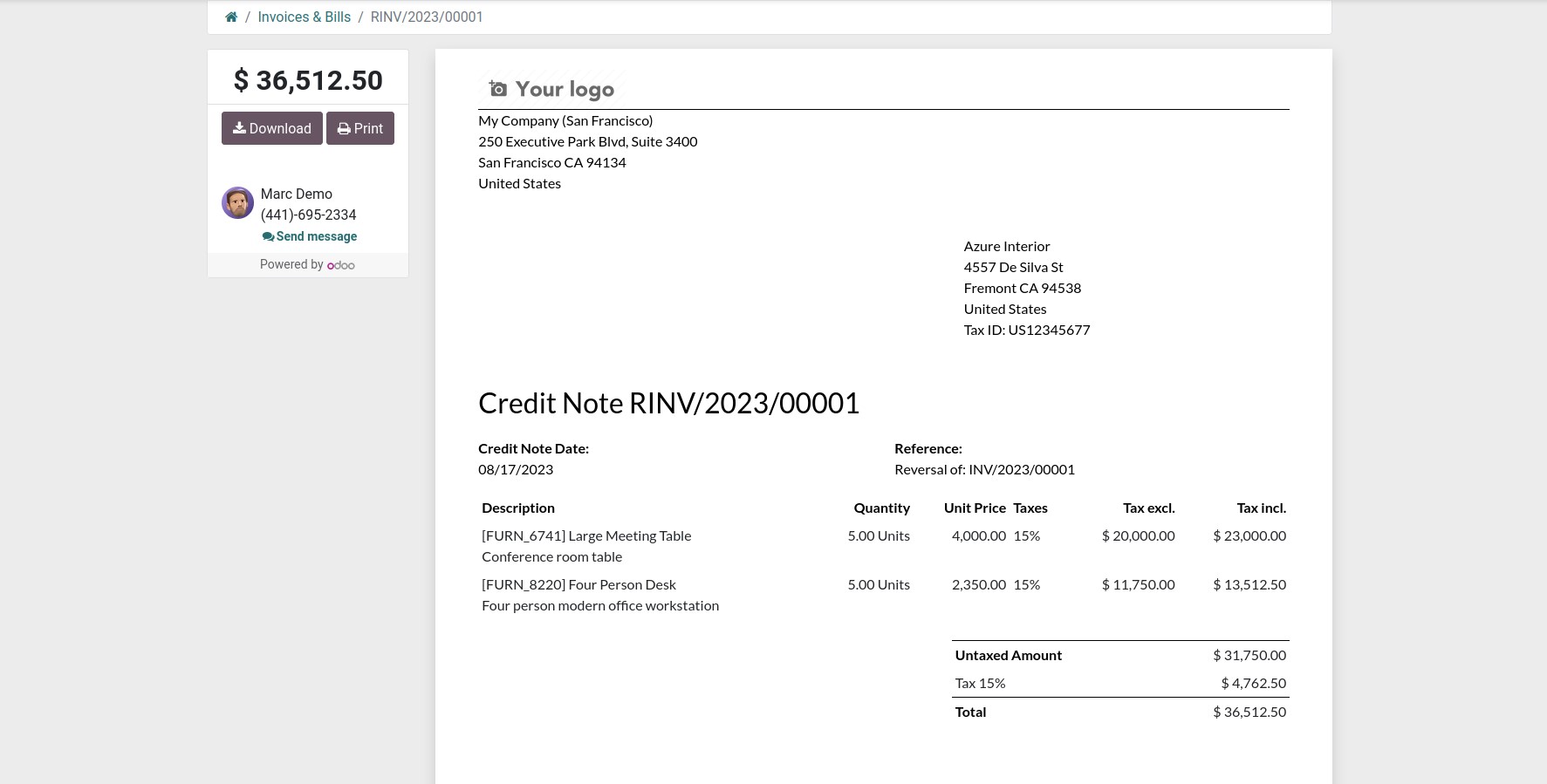

By hitting Create, you will also have the opportunity to create Credit Notes and create new ones. You can see that the Credit Note number starts with the RINV label, which stands for the reverse invoice when it is defined in the Creation menu. The invoice number, however, will begin with the letter RINV. The Customer Details and the Payment Reference Details may be defined. The Invoice Date, Due Date, Journal, and Electronic invoice for the Credit Note will also be displayed.

The invoice lines can also be set using the Add a line option. Additionally, by selecting the Add a section option, you may add a section to the invoice, and you may add a remark by choosing the Add an available note option.

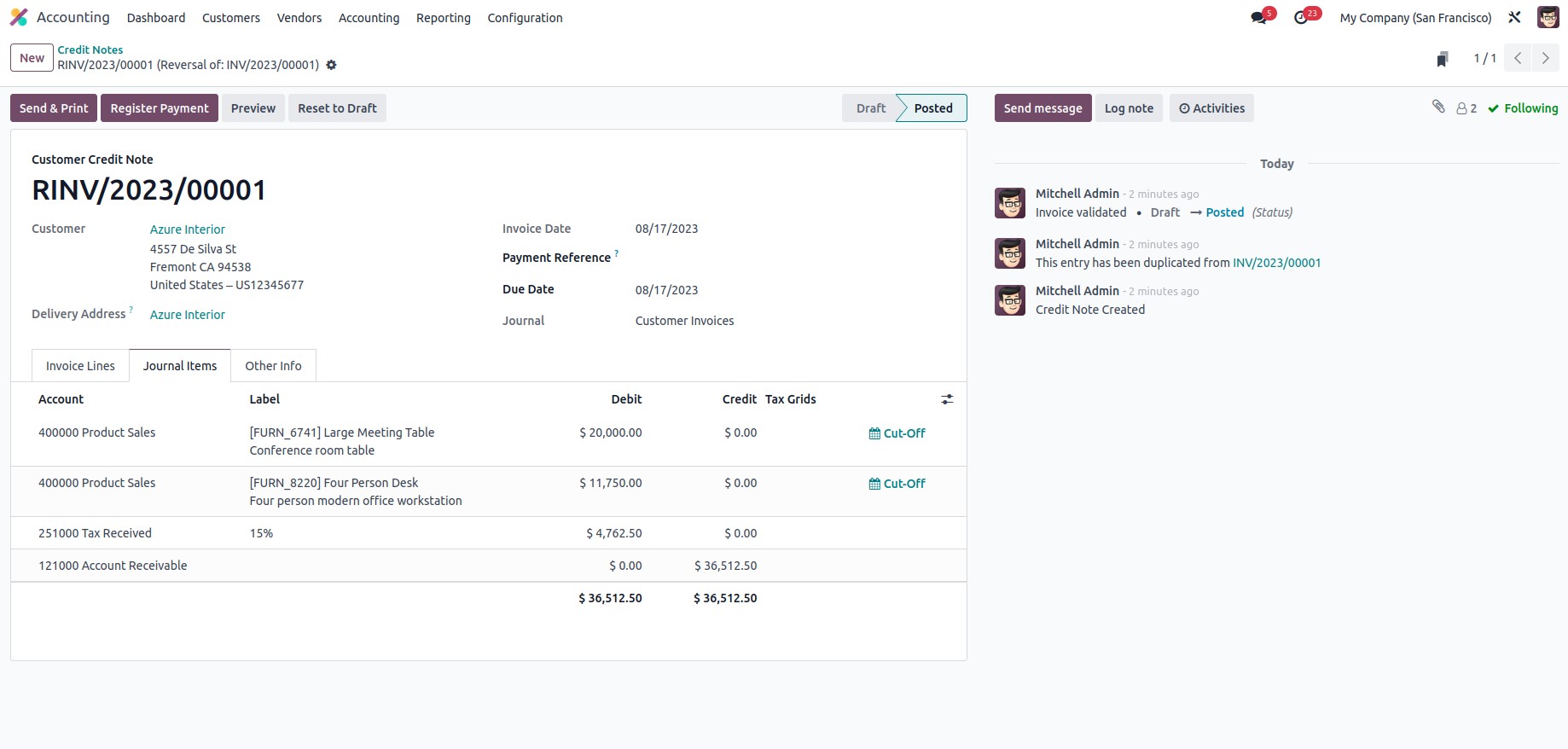

The Journal Items will populate the Account data, Label, Analytic, Debit, Credit, and Tax Grid information. Once the product has been included on the reverse invoice itself, the impacted accounts will show up on the Journals items page. The Account Receivable is credited during this process, while the Income Account and Tax Account are debited. This shows that when an invoice is reversed, income decreases and is debited, but account receivable, an asset by nature, decreases and is credited.

Both the Invoice and Accounting data may be specified under the Other Info tab. Invoice data such as the customer reference, salesperson information, recipient bank, and payment QR code can be defined. The Incoterms, Fiscal Position, Intrastat Country, Cash rounding Method, Post Automatically, and To Check can be added depending on the business requirement.

If the Credit Notes' descriptions are correct, they can be delivered or emailed to the customer. Reverse payments, as well as Credit Notes, may be made to the consumer. After making the payment, you must record it in the necessary client payment journals of the financial operations on the platform. When you select the Register Payment option, a pop-up window where you may enter the payment register's details will display. Journals, manual or check-based payment mechanisms, and other components. You can also mention the recipient's bank account details.

It is also possible to specify the Amount, the currency in which the payment must be made, the Payment Date, and the Memo. Once the information has been entered, you may select the Create Payment option.