To guarantee that the company complies with local rules, taxes are a crucial component of the

business process that must be managed correctly. Taxes can be set up in the Accounting

application of Odoo 17 Accounting. This section will walk you through the process of

configuring taxes in Odoo 17. Due to the fact that taxes are an expense that must be disclosed

on financial statements, they play a crucial part in accounting. Understanding the various tax

rules and regulations is necessary for accounting for taxes. You also need to be able to

accurately record, submit, and pay taxes to the appropriate tax authorities. Both accounting

and tax knowledge are combined in tax accounting.

Tax returns must be prepared, the correct tax liability must be determined, and returns must

be filed with the correct tax authorities. In addition, it entails the recording of

tax-related transactions, including payments, credits, and deductions. Additionally, the

creation of financial statements to reveal a person's or a company's tax liability.

The amount that needs to be deducted from employee wages for taxes is also determined using

tax accounting. Tax accounting is also used to figure out how much money should be deducted

from employee paychecks for benefits and other deductions. It also entails creating tax

budgets and projections that can be utilized by a business or individual to plan their tax

obligations and cash flow. To ensure that a business or individual complies with the relevant

tax rules and regulations, tax planning is crucial. It is, however, a complicated topic that

necessitates a full knowledge of the numerous tax laws and rules. Tax preparation, filing, and

payment help can be obtained from qualified accountants and tax preparers. The process of

preparing, filing, and computing taxes can also be automated using software tools like Odoo17

Accounting.

Taxes are regarded as a debt owed by the client to the service provider in exchange for a

favor. When submitting taxes, the organizations must pay the same amount to the government or

other authorities. All nations operate their taxes in a variety of ways, with varying

percentages, and it solely depends on the local governing bodies in each nation. Because of

this, the accounting management tool you use in your company needs to have the ability to

configure specific taxes for various operations, and the Odoo17 Accounting software excels at

this.

For defining all tax kinds for their sales, purchases, and services offered, the Odoo 17

Accounting platform is very convenient, and it can be defined based on the nation in which the

firm works. One of the localization tools that the Odoo17 platform provides may provide this

capability.

You can use the following procedures to arrange taxes for your business activity.

Navigate to the Accounting module and select the "Configuration" menu from the left-hand menu

list. As illustrated in the image below, select the 'Taxes' menu under the Accounting part of

the Configuration menu.

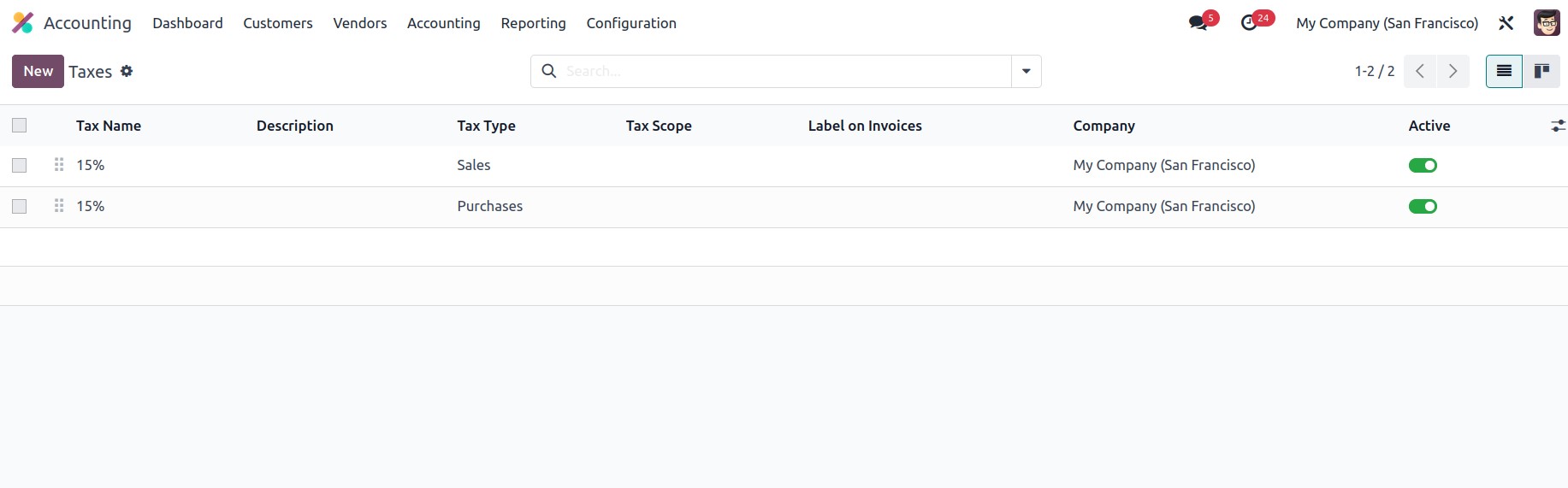

To add a new tax, use the NEW button in the Taxes window. Additionally, as seen in the

picture below, the Taxes window will show all of the previously configured taxes' specifics.

The present taxes can also be changed. The crucial information about the configured taxes,

including Tax Name, Tax Type, Tax Scope, Label on Invoices, and Company, will be shown in the

window. In addition to these choices, you may view a boolean field called Active to enable or

disable the particular tax.

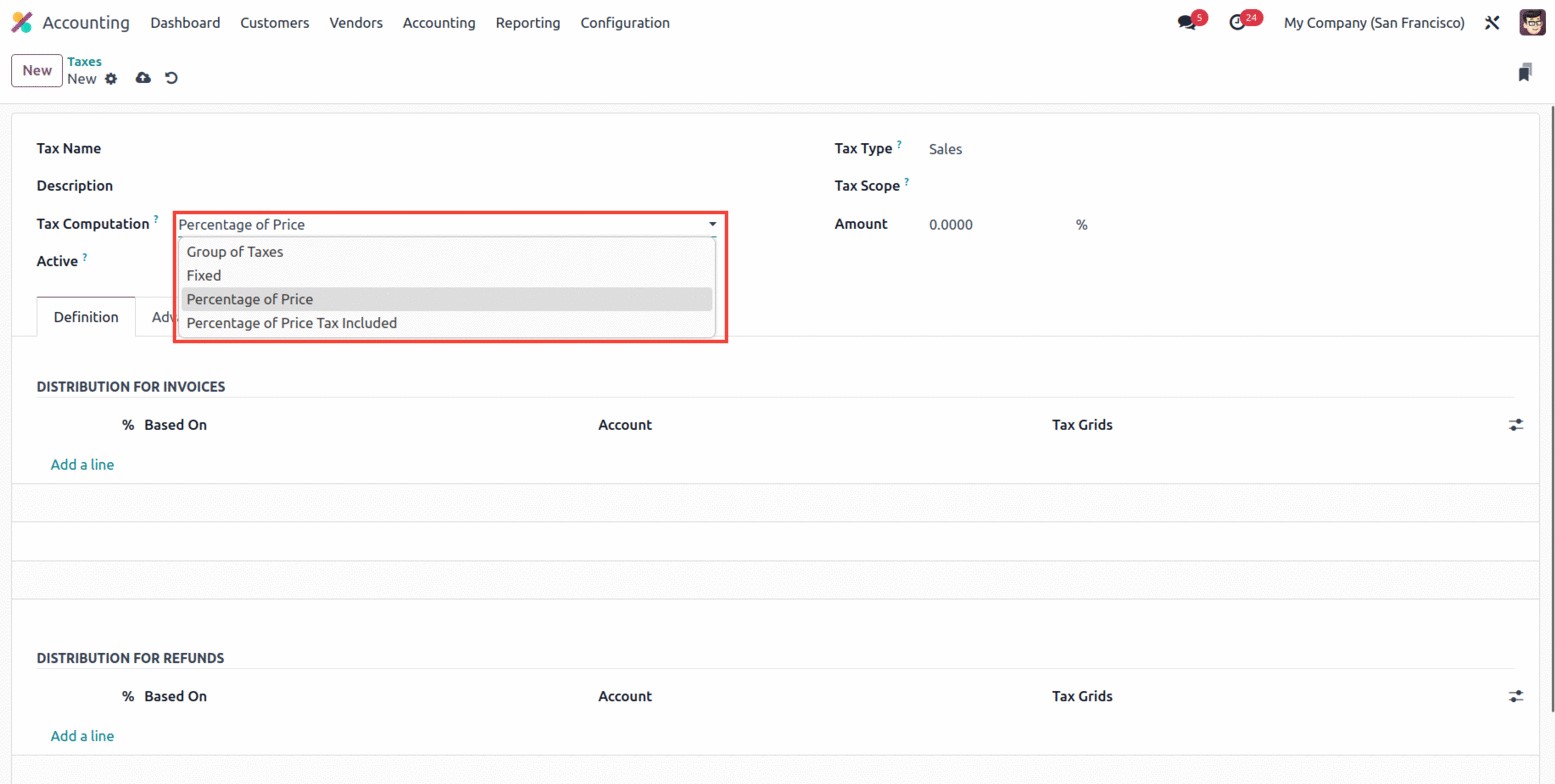

Therefore, it is extremely easy to build tax computation for the applicable taxes that are

already defined utilizing the Odoo17 platform. Additionally, the platform provides a number of

default tax computations, including Fixed, Percentage of Price, Percentage of Price Tax

Included, Group of Taxes, and Percentage of Price.

Fixed Tax Computation: The automated tax calculation method known as Fixed Tax Computation in

Odoo17 Accounting enables the calculation of taxes based on a preset set of guidelines and tax

rates. Taxes, sales, and purchase calculations, as well as payroll and other financial

operations, can all be done using this system. Businesses that need to swiftly and precisely

calculate taxes and have a lot of transactions can benefit from this solution. Businesses that

need to keep accurate records for tax compliance might benefit from fixed tax computation in

Odoo17.

Group of Taxes: You may set up and manage various tax rates using the Group of Taxes

Computation tool in Odoo17 Accounting. You can also group taxes and apply them to

transactions. Users can make various tax groups, allocate taxes to them, and then apply those

taxes to their transactions. This makes it easier to guarantee that all taxes are calculated

accurately and consistently.

Percentage of Price: It depends on the kind of taxes being used in the Percentage of Price

Tax Computation. For illustration, a conventional VAT rate might be 20%, but a custom duty

rate might be 10%. Different sorts of transactions may be subject to a certain tax at a

specific rate. It will be based on the predetermined fixed percentage of the total amount.

Percentage of Price Tax Included: Finally, the setup of the tax regulations affects how the

Percentage of Price Tax Included computation is calculated. The percentage of tax that is

included in the price will be determined automatically when the tax rules are configured,

depending on the applicable tax rate. The tax configuration options in Odoo17 Accounting

contain the proportion of the price tax included in the computation. The award sum will

include the tax amount.

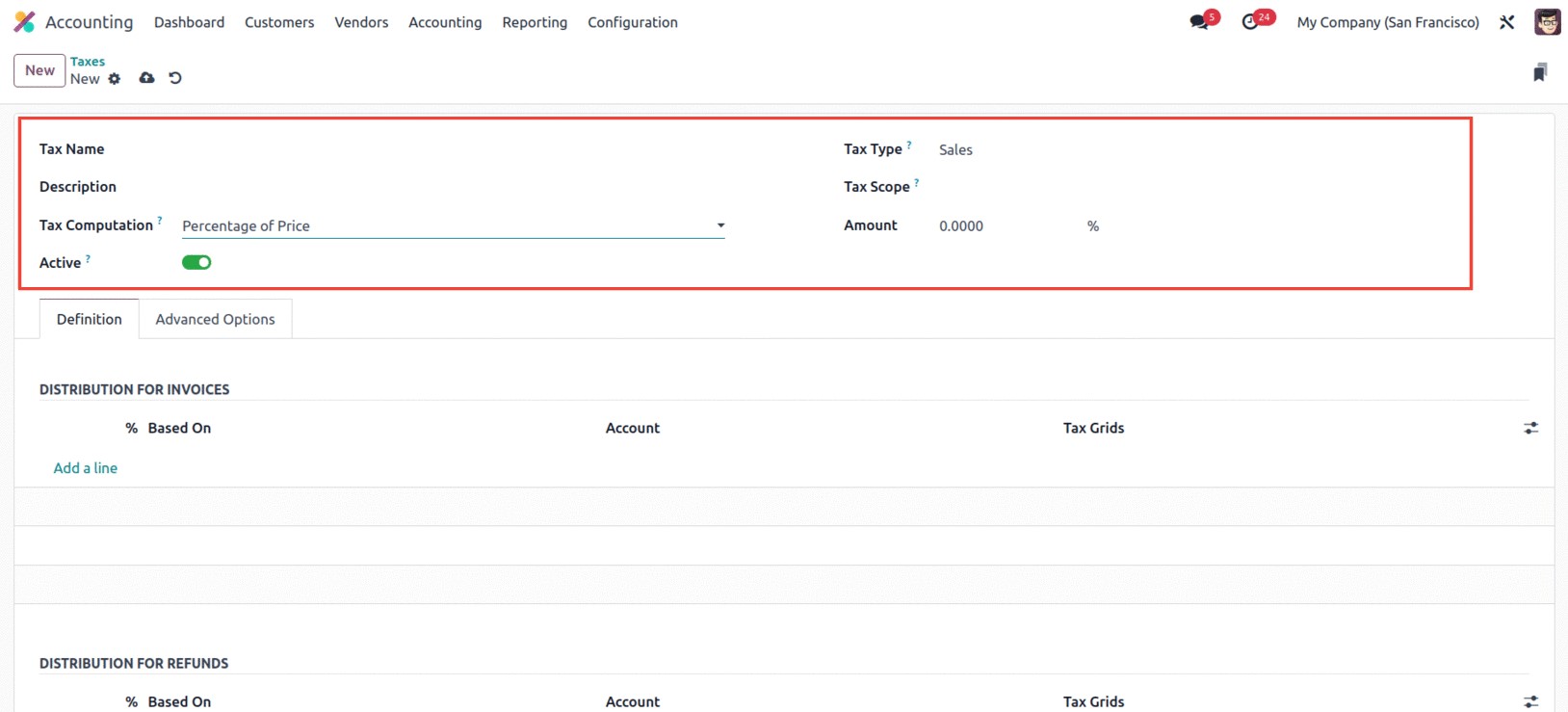

Returning to the Taxes window, you can view the different fields that must be filled out to

establish a tax in the Taxes Creation window. Below is a screenshot of the creation form.

First, you can enter the tax name in the Tax Name area here in the window. The Tax Type can

then be mentioned. Using the dropdown menu, you can choose between Sales, Purchase, or None.

Where the tax is selectable is determined by this Tax Type. The 'None' selection indicates

that the tax is ineffective on its own. However, a group can still use it.

You can fill up the Tax Scope form after selecting the appropriate option in this field.

Either services or goods may be chosen. You can limit the application of taxes to a certain

product category, such as services or goods, by using this parameter. Then, in the Amount

area, you can include the tax amount in percentage.

Additionally, you can use the dropdown to select the Tax Computation. Options like Group of

Taxes, Fixed, Percentage of Price, Percentage of Price Tax Included, and Python Code are

available in the drop-down menu. You can specify the Definition tab based on the chosen

option. The option to set the Tax active's boolean field to false will, therefore, allow you

to conceal the tax without actually eliminating it.

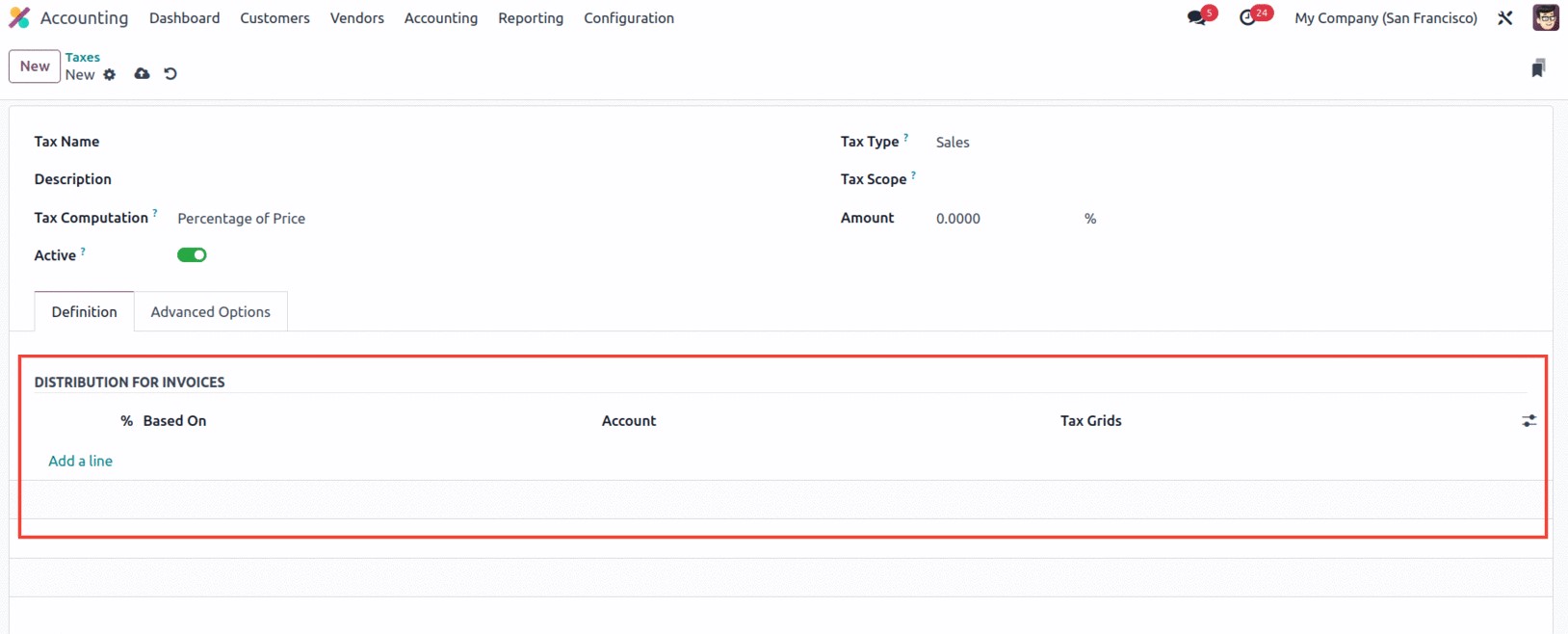

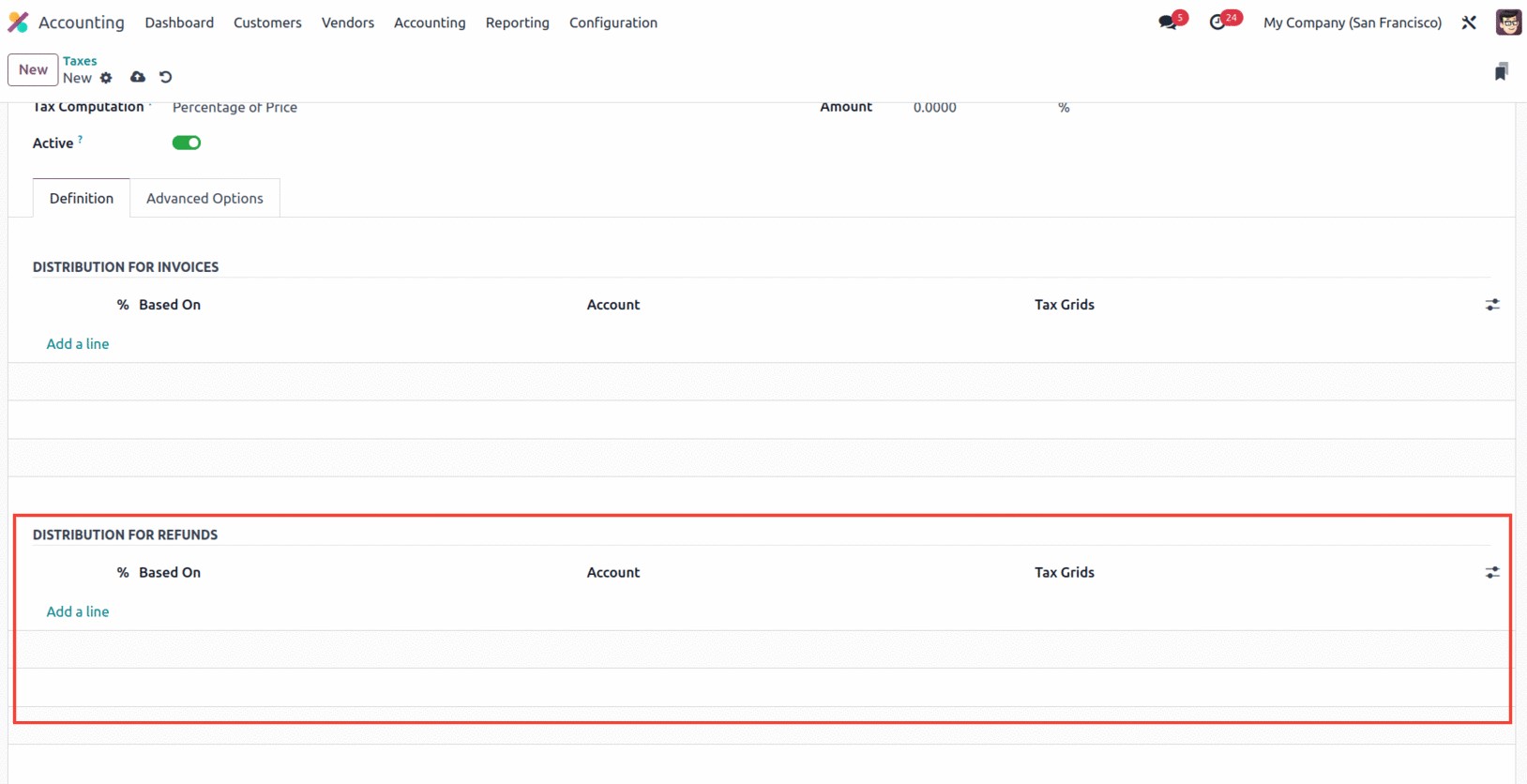

Additionally, under the Definition tab, you may define the definition of the tax on the many

aspects of business operations. The Distribution of Invoices should be described in the

DISTRIBUTION FOR INVOICES part of any tax computations other than the Group of Taxes. Where

you can use the ‘Add a Line’ option to describe the Tax definition, the ‘% based on’, the

Account on which to post the Tax Amount, and the Tax Grids.

With the aid of creating a line, it is also possible to delete the current definition and

create a new one. The DISTRIBUTION FOR REFUNDS can likewise be defined using the same

approach.

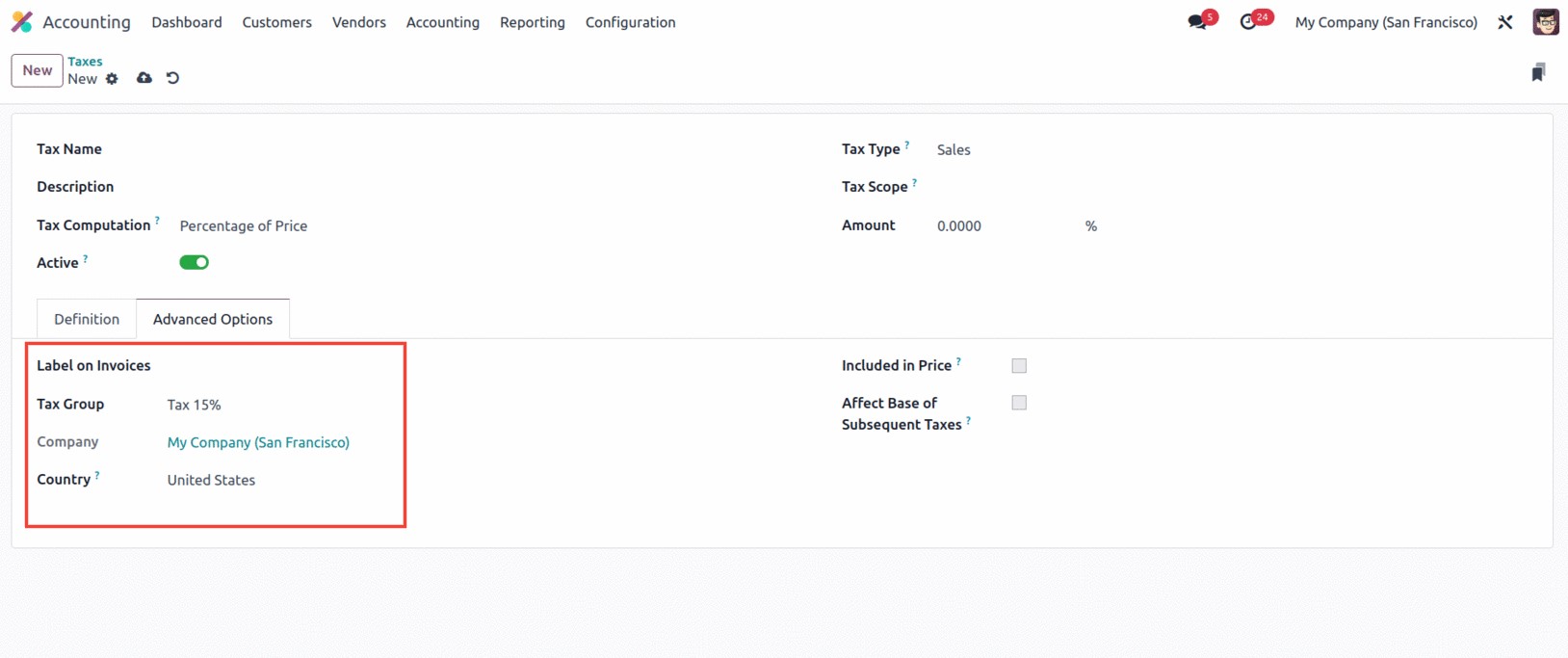

Furthermore, additional fields like Label on Invoices, Tax Group of the defined tax, and many

more were available under the Advanced Options tab in the Taxes creation window. You can

enable or uncheck the 'Include in Analytic Cost' option. The amount calculated by this tax

will be assigned to the same analytic account as the invoice line if you enable this option.

The 'Include in Analytic Cost' option is only accessible if Analytic Accounting is turned on.

The Company and the Country for whom this tax is applicable can then be specified in the

corresponding fields.

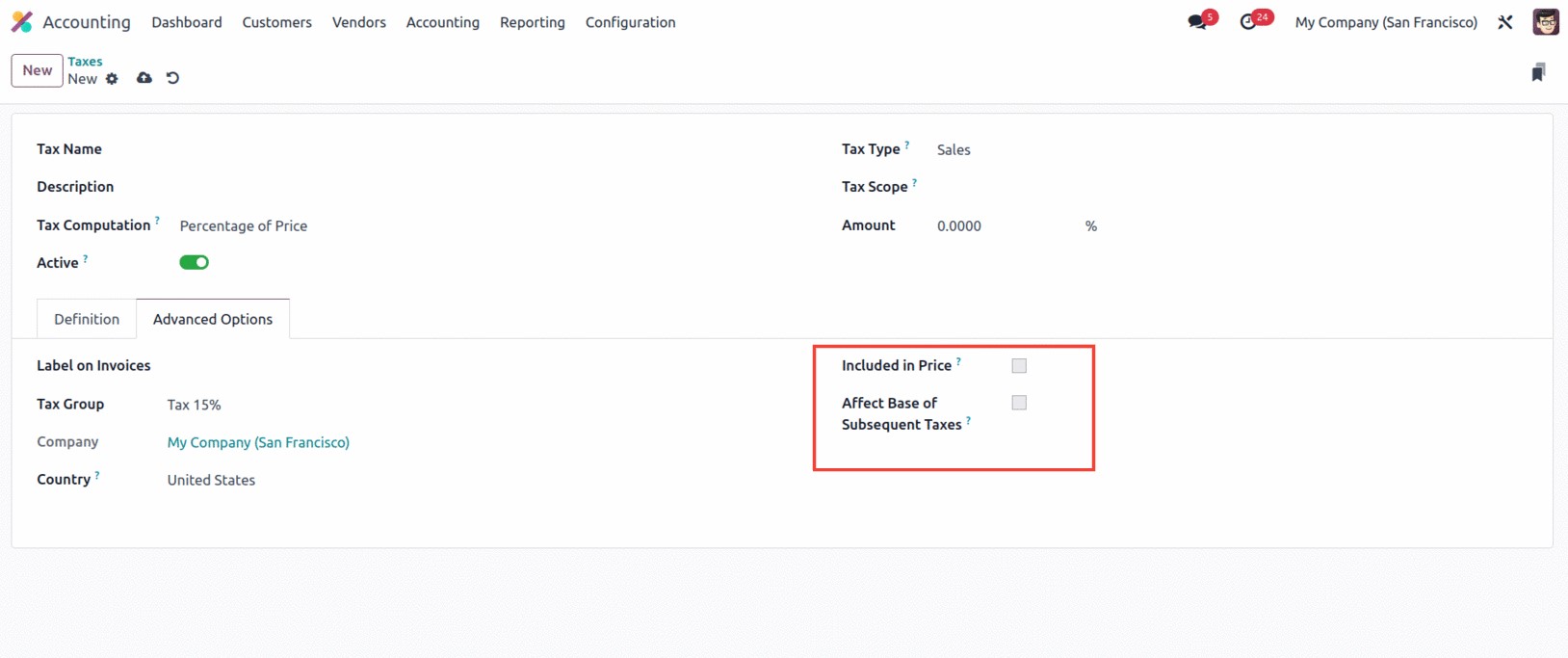

If the price you use on the goods and invoices includes the tax amount, you may also check

the box next to the option "Included in Price." You also have a field called "Effect Base of

Subsequent Taxes" that, if enabled, will cause taxes higher in the series than this one to be

affected. The 'Base Affected By Previous Taxes' field is another option that you have, and it

can be turned on or off. If you make this field active, taxes at lower positions in the

sequence might attempt to affect this one.

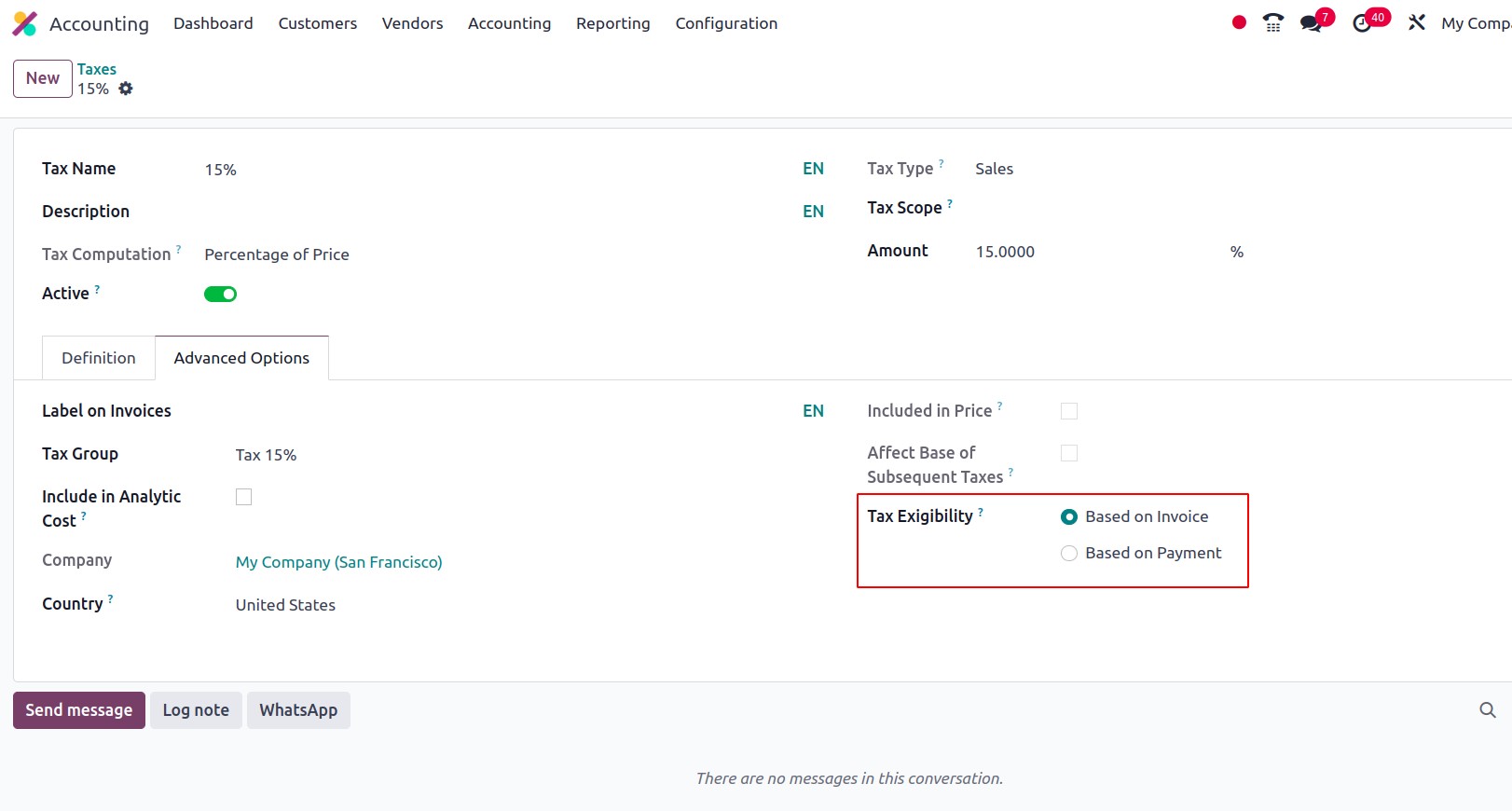

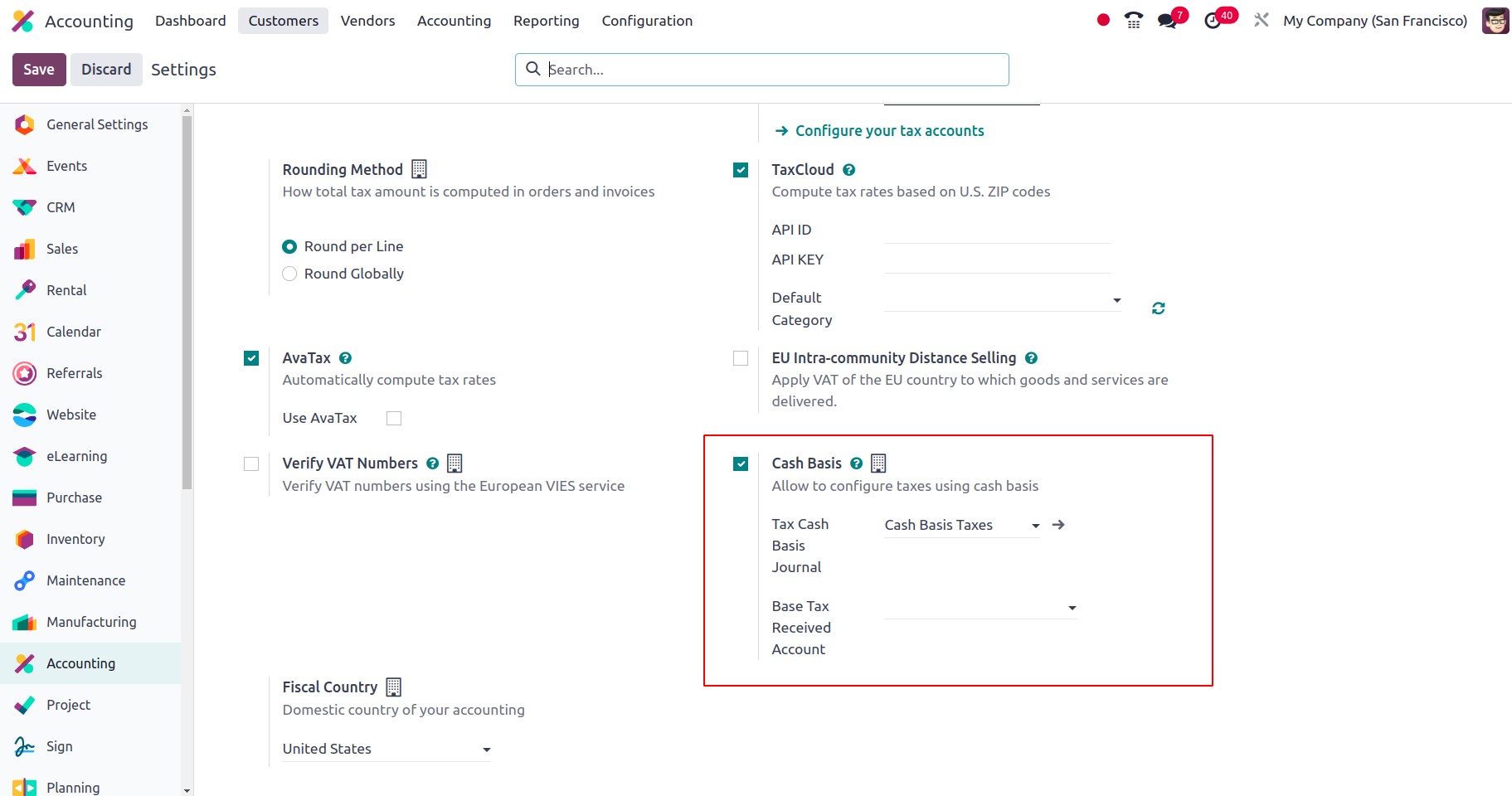

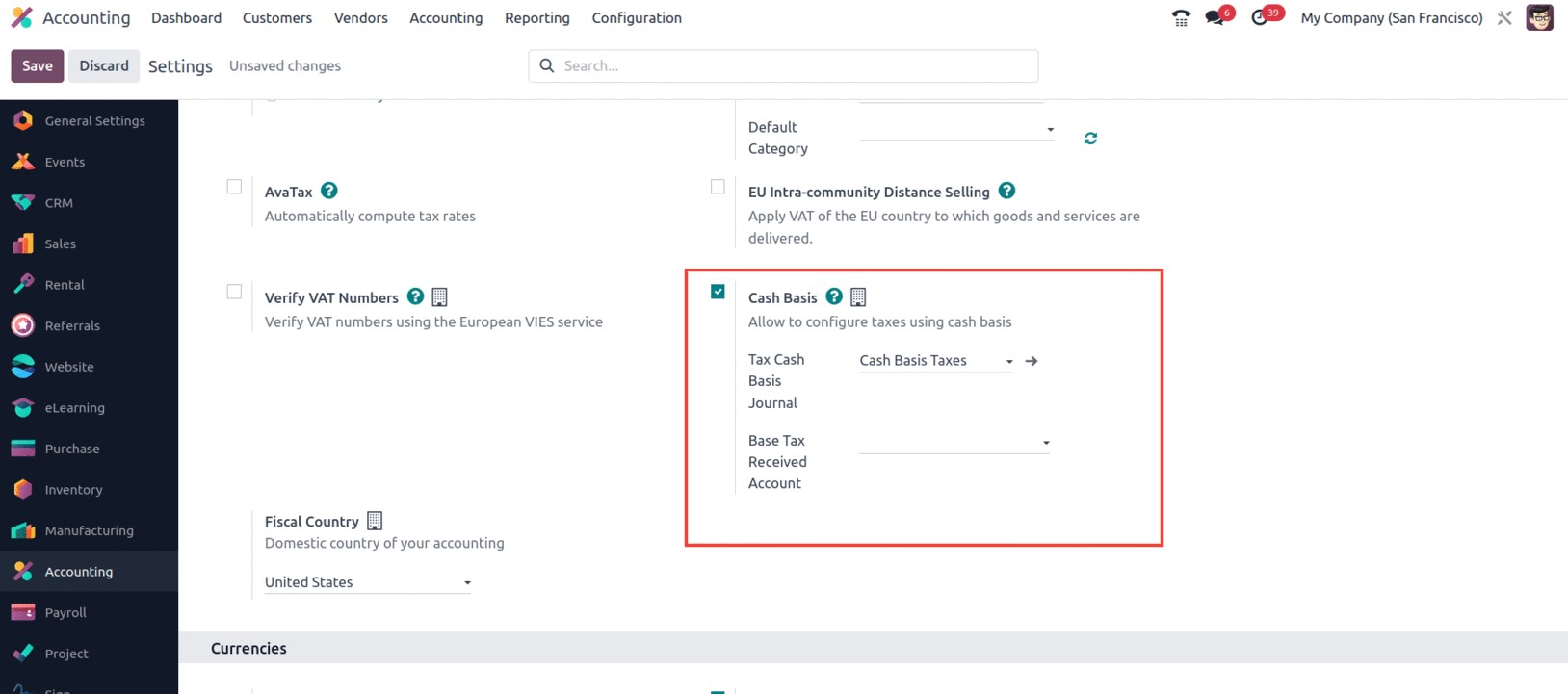

The Tax Exigibility field, which has the options ‘Based on Invoice’ and ‘Based on Payment’,

is the last one. The tax is due as soon as the invoice is validated if you choose Based on

Invoice. If the tax exigibility is based on payment, it must be paid as soon as the invoice

payment is received.

The screenshot above highlights the creation widow of the taxes for the advanced options.

Only after enabling cash basis in the configuration settings will the Tax Exigibility field

appear there.

Everything pertaining to the Tax Configuration is included here. If a tax configuration is

successful, you can use it in business activities. With the help of this function, you may

specify all sales taxes, purchase taxes, and service taxes, which can then be applied to every

good and service in accordance with the specifications.