Configuring Journals

All financial transactions are recorded in the accounting system using journal entries, which

are the first phase of the accounting cycle. The term "journal entry" refers to a simple

accounting record of a business transaction that includes information about the transaction's

specifics, including the date, amount, account impacted, and a brief description. The

double-entry accounting system, which mandates that every financial transaction be documented

in at least two accounts, relies heavily on journal entries.

Journals are the records that are used to record accounting transactions in Odoo 17

Accounting. Sales, purchases, receipts, payments, and other transactions that have an impact

on the company's financial status are entered in journals. A summary of the company's

financial situation at any given time is also included in the journals. Accounts may be

reconciled, financial patterns can be examined, and reports can be generated. It will offer a

record of the occasion, sum, and goal of every transaction. For certain time frames, such as

monthly, quarterly, or yearly, journals can be produced.

Journals, as we all know, are crucial components of accounting operations in any business.

They assist in categorizing certain processes and serve as the foundation for financial

operations. Every form of business must keep and require journal entries. A strong feature of

the Odoo 17 Accounting module enables the construction and administration of custom journals.

This option allows you to specify each journal. Odoo17 provides a distinct menu for

controlling it, titled Journals, within the Accounting portion of the Configuration menu.

Below is a screenshot of the Journals window.

The Journals window gives a New option to start a new Journal as well as a clear preview of

the previously established Journals. As seen in the image above, the window shows important

information about the journals, including the default account, short code, and journal names,

types, and groups.

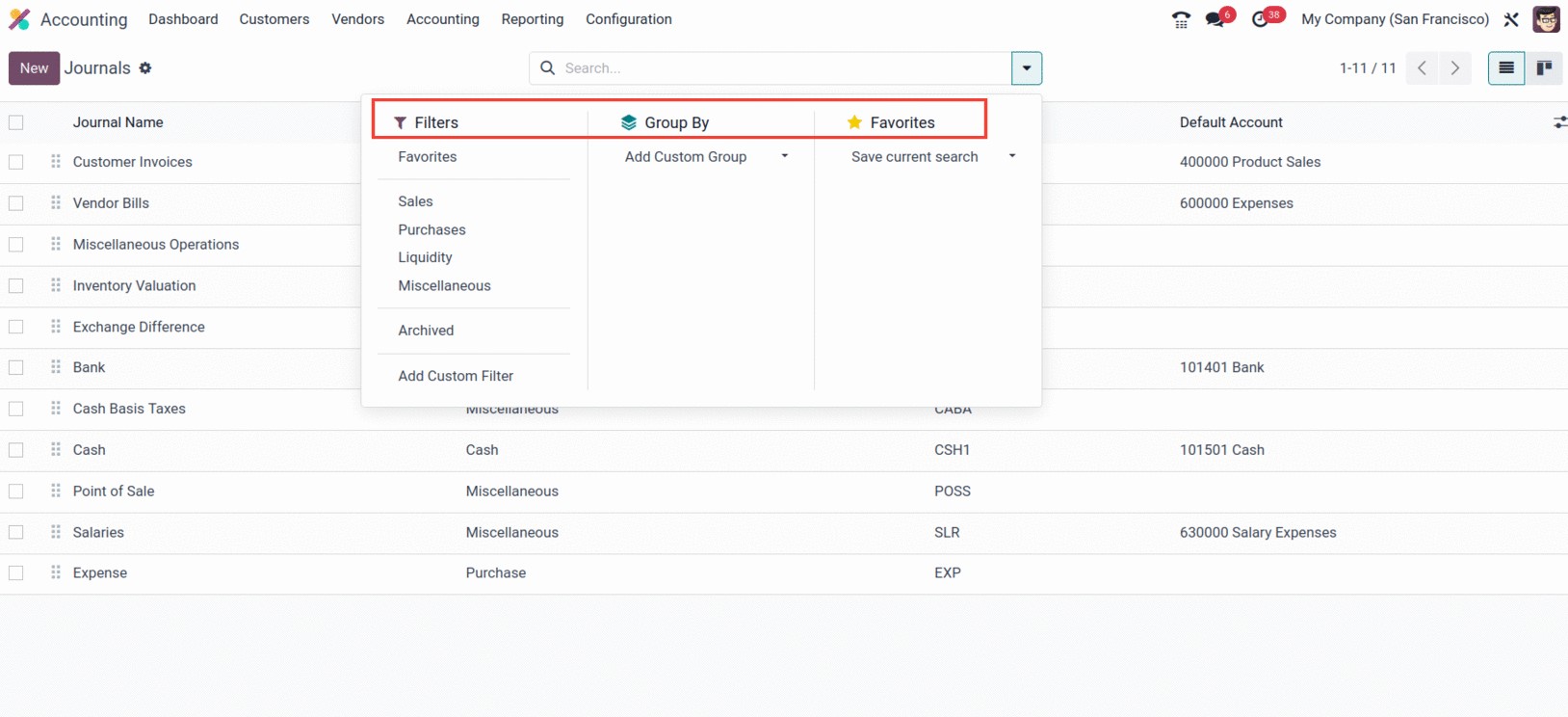

By selecting the appropriate menu icon located in the window's top right corner, you can

switch between the Kanban and List views of the window. Along with the search bar, the

Filters, and Group By choices can both be customized and defaulted under Favourites that

accomplish the necessary functions, including Save Current Search.

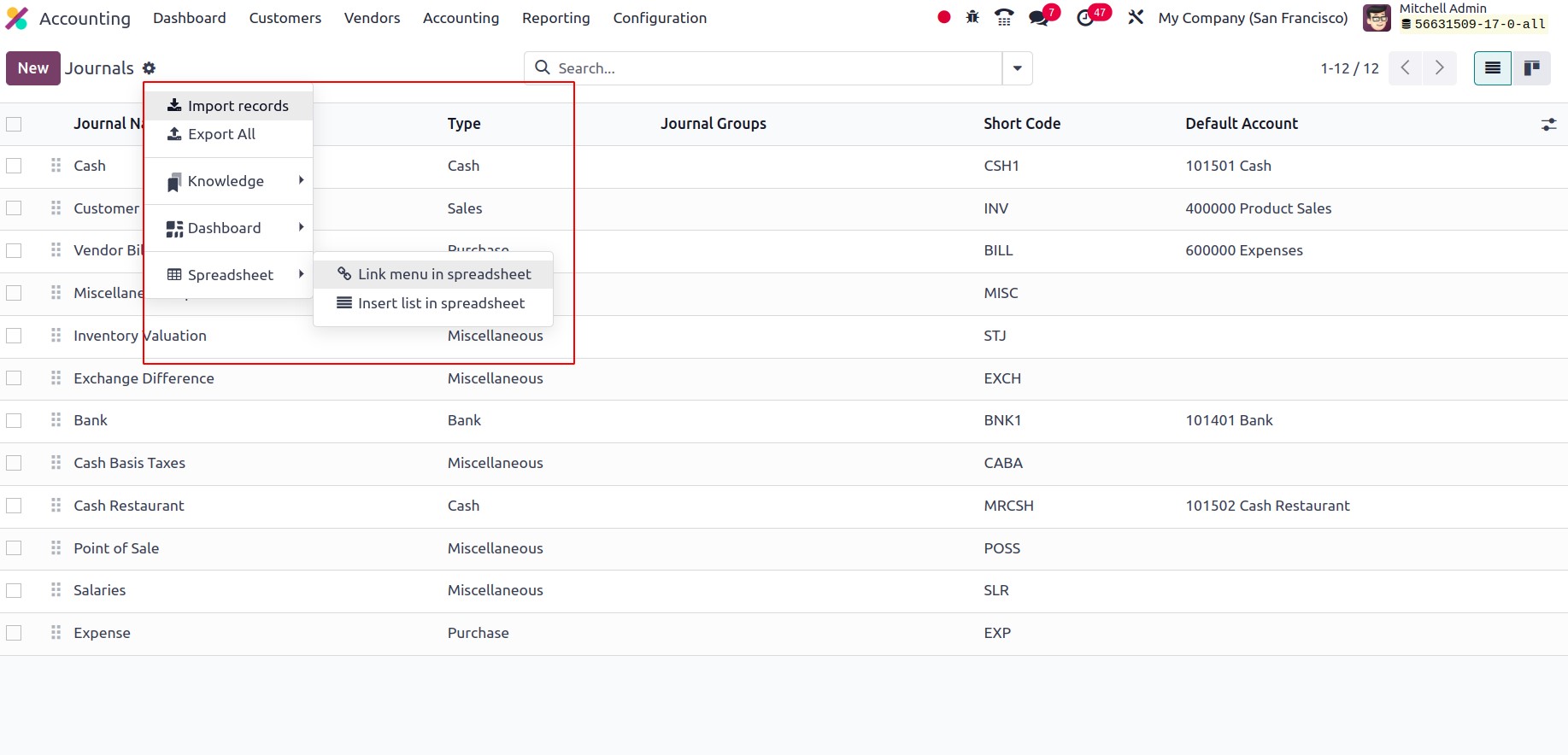

From the actions, one will be able to import and export records, with knowledge functionality

like ‘Insert view in article’ and ‘Insert in article.’ Also, we will be able to add the

journals to ‘My Dashboard,’ and with the spreadsheet feature, one can add details to the

spreadsheet using the ‘Link menu in spreadsheet’ and ‘Insert list in spreadsheet.’

These options are all very helpful for finding the required journal from the longer list of

designated journals rapidly. Additionally, the specific Odoo17 module makes it very easy to

specify journal Types based on those that are already established as defaults. Additionally,

for each journal that is defined, a journal type can be selected. The type of journal can be

Miscellaneous, Cash, Bank, Sales, or Purchases.

All sales transactions in a company are recorded in the sales journals in Odoo17 Accounting.

Sales orders, delivery, invoices, partner payments, as well as any other connected

transactions, may be included in these transactions. Sales journals make it simple to keep

track of all sales-related data and can be used to produce many reports, including sales

reports and analyses of sales trends, among others.

You can use purchase journals to keep track of every business-related purchase transaction.

These journals are employed to keep tabs on the price of the products and services acquired as

well as to produce financial statements. The debit and credit sides of the purchase are

recorded in the journal entries, and the entries are then posted to the general ledger. The

cost of the goods and services, as well as any applicable taxes, are recorded in the purchase

journals. The acquisition of inventory, raw materials, and completed goods are all documented

in the buy diaries.

As we previously stated, the Purchase journal defines all of the company's purchase

operations, just as the Sales journal is used to define all of the sales operations entries.

Similar to how the Cash Journal will characterize each cash operations entry in relation to

how the business is run with cash payments. Additionally, it is the same as the Bank Journal,

where all bank-based transactions are entered.

Any transactions that do not fall under one of the predefined categories of transactions are

recorded in a miscellaneous journal entry in Odoo17 Accounting. Discounts, returns,

allowances, bank charges, and other erroneous things can all be entered into it. The account

balance of any accounts that need modifications outside of the typical accounting period can

likewise be changed in this manner. The Odoo17 Accounting's Miscellaneous Journals include:

- General Journal

-

Adjustment Journal

-

Inventory Adjustment Journal

-

Currency Exchange Journal

-

Stock Valuation

-

Expense Journal

- Miscellaneous Journal Entries

-

Tax Journal

You can organize all the entries that don't fit into any other journals in the Miscellaneous

journal.

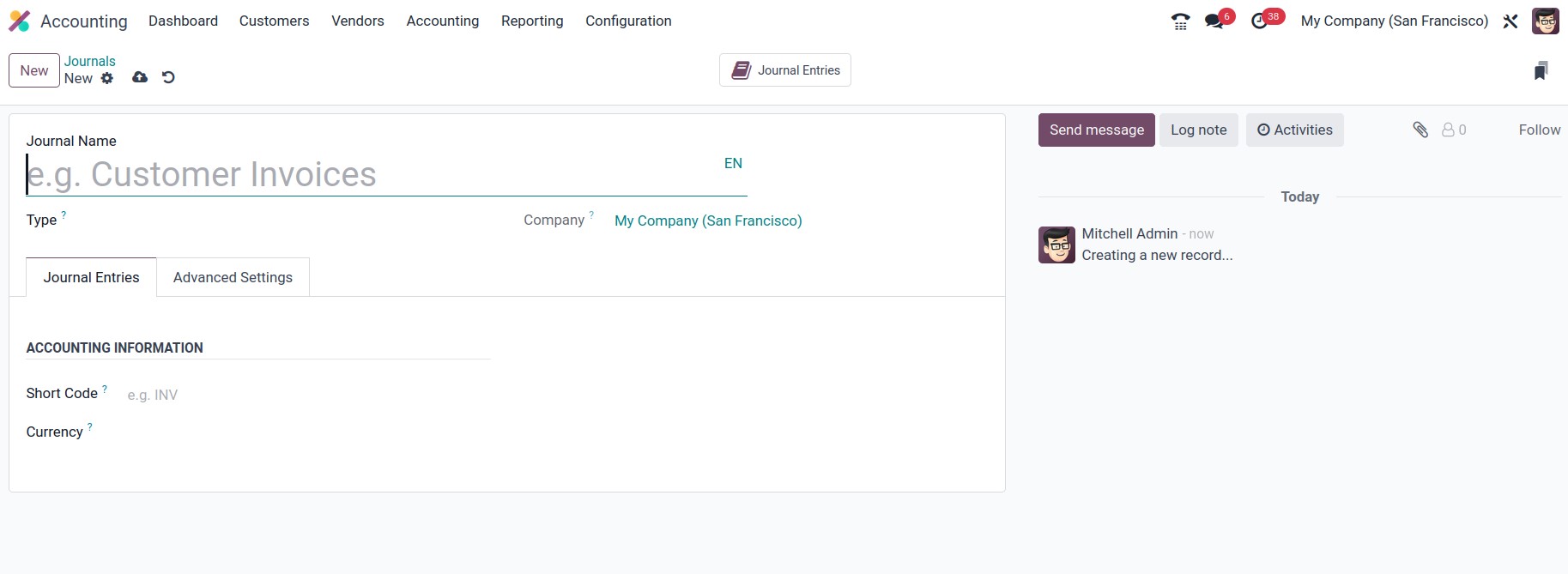

Now, select the New button in the top left corner of the Journals box to configure a new

Journal.

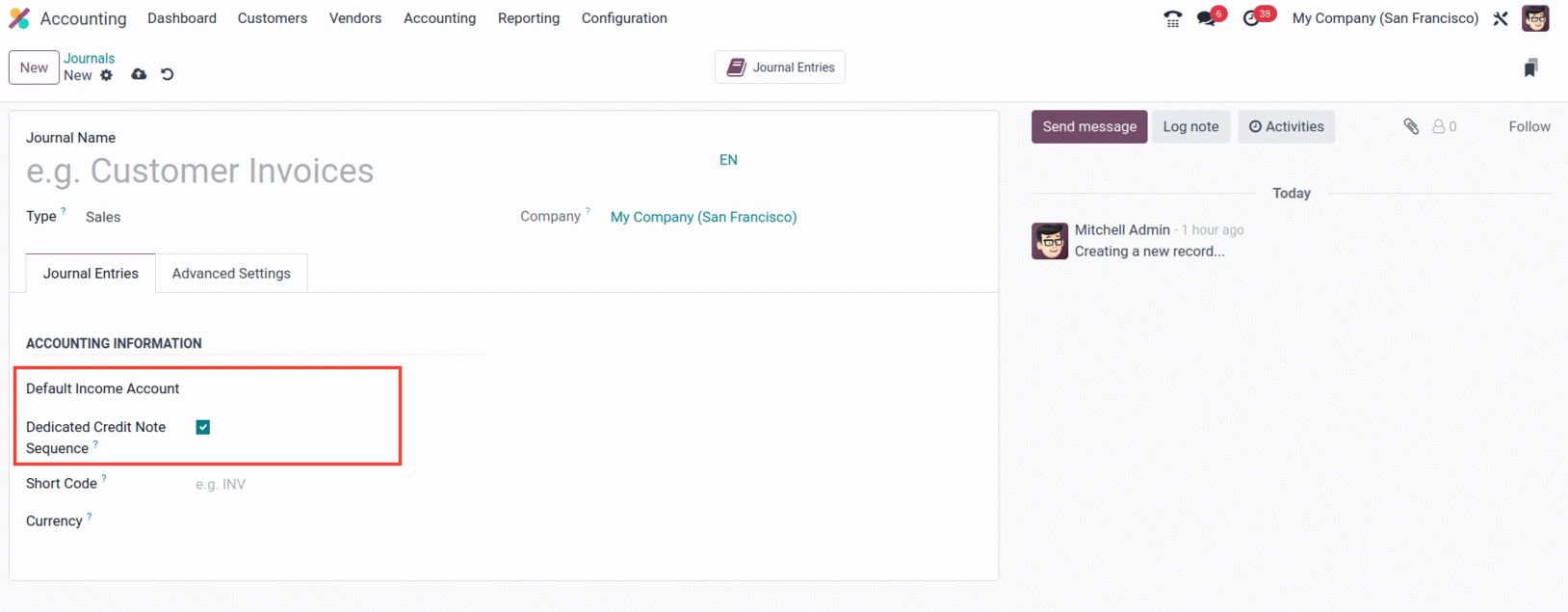

You can first mention the Journal Name in the creation form. Then, using the dropdown menu,

select the appropriate Journal Type. All of the journals,

including Sales, Purchase, Cash, Bank, and Miscellaneous, are represented in the dropdown

menu.

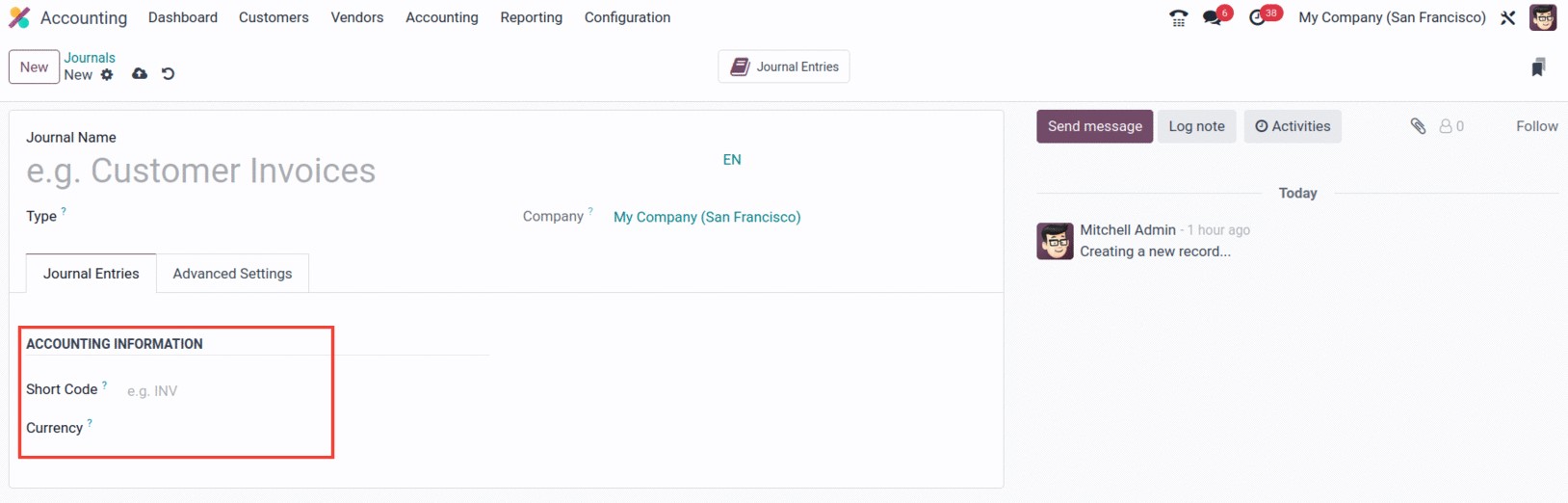

You can also define the accounting information, such as the short code and currency, using

the Journal Entries menu. You can enter the shorter name you want to display in the Short Code

field. This prefix will also be used by default to name the items in this journal. It is quite

helpful for ensuring that the credit note entries and invoices begin with the designated code.

For instance, if we define a short code as INV,

invoice generation will begin with that word before moving on to the sequence number.

The Currency section also specifies the currency that will be used to enter statements.

Additionally, the window will display additional fields according to the journal type you have

chosen. Default Income Account and Dedicated Credit Not Sequence are additional fields that

are available if you choose Sales as the category. You can choose the default one from the

dropdown menu or create a new one. If you don't want to share the same sequence for invoices

and credit notes created from this journal, you can activate the Dedicated Credit Note

Sequence option.

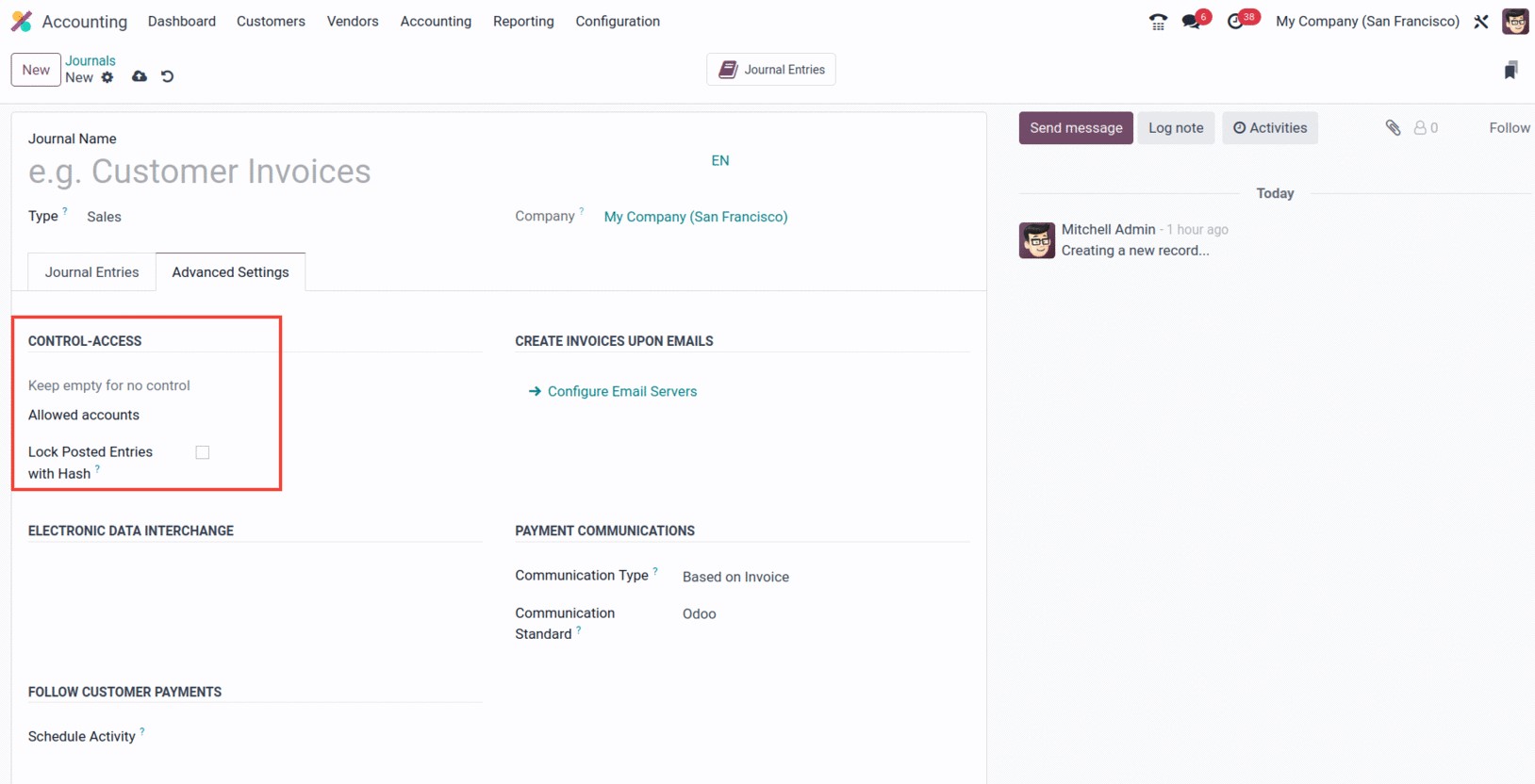

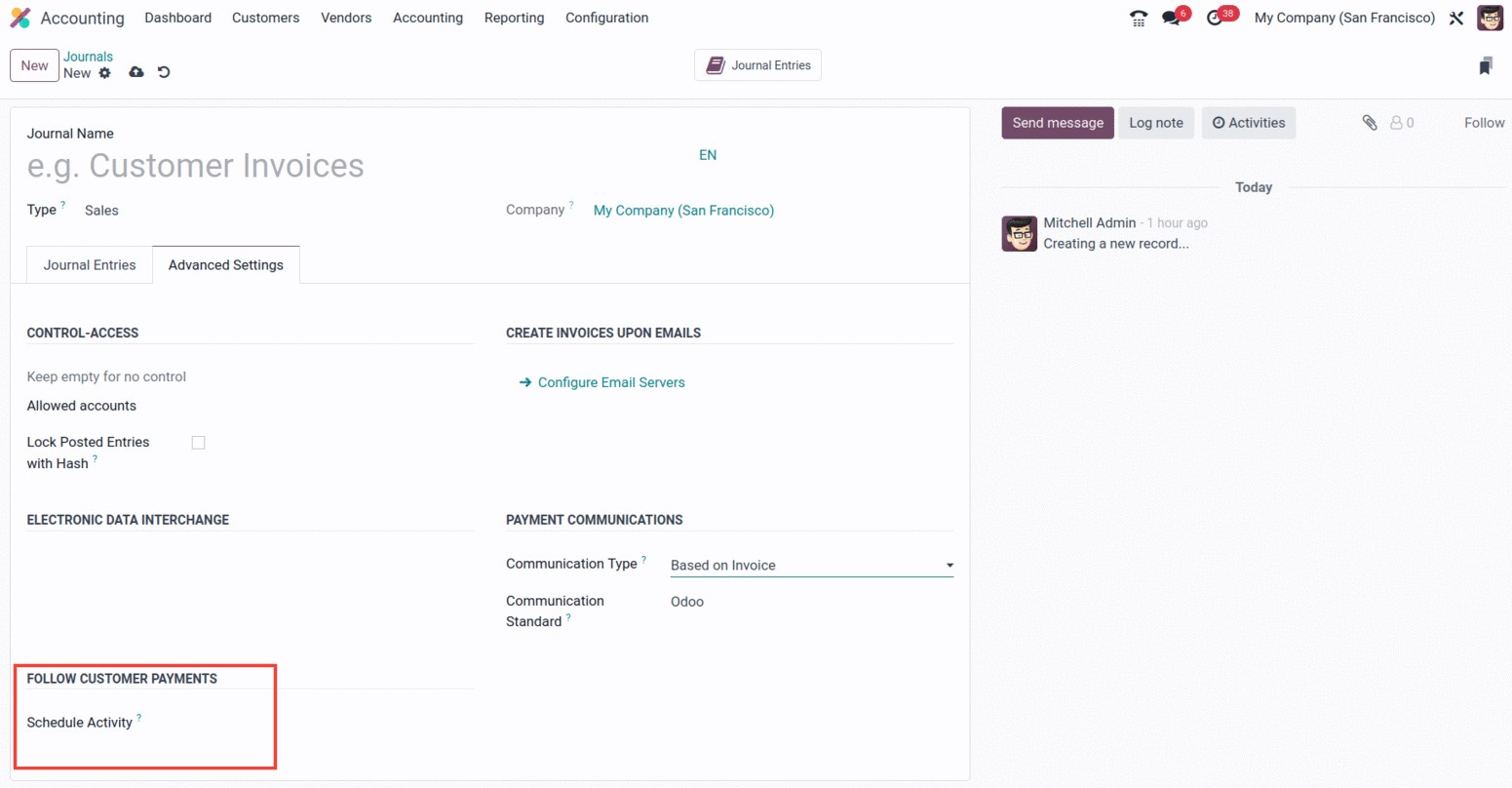

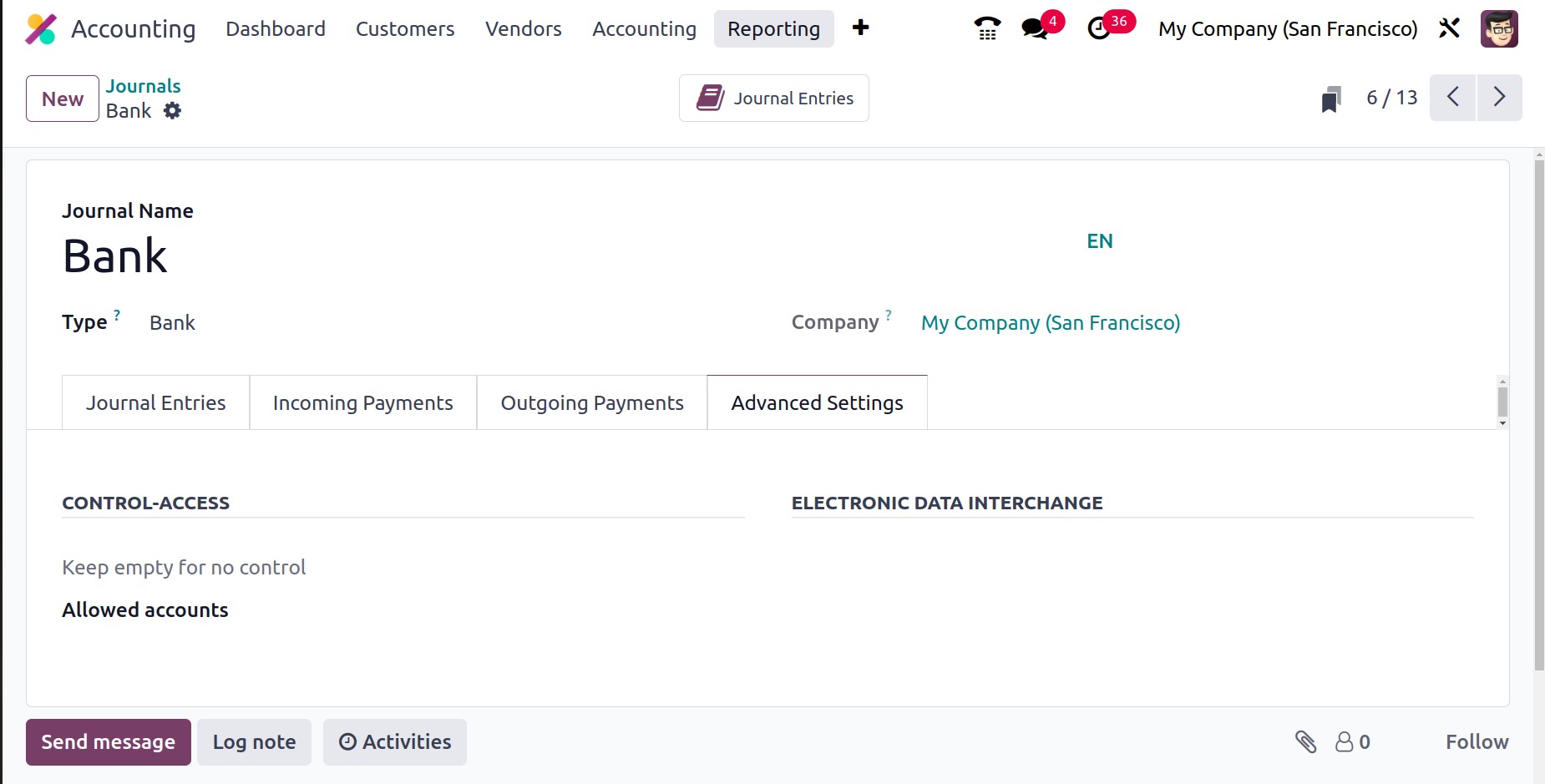

Additionally, the CONTROL ACCESS area of the Advanced Settings tab is where you may choose the

Allowed accounts in the corresponding field with the aid of the dropdown menu. You can leave

these fields blank if you don't wish to exercise any control. It is possible to enable or

disable the "Lock Posted Entries with Hash" box. If you enable this field, the accounting

record or invoice is hashed as soon as it is posted and cannot be changed again. This is a

great way to guarantee that no invoice created under a certain journal is altered. Once it is

posted, it cannot be changed to any other form or returned to draft status.

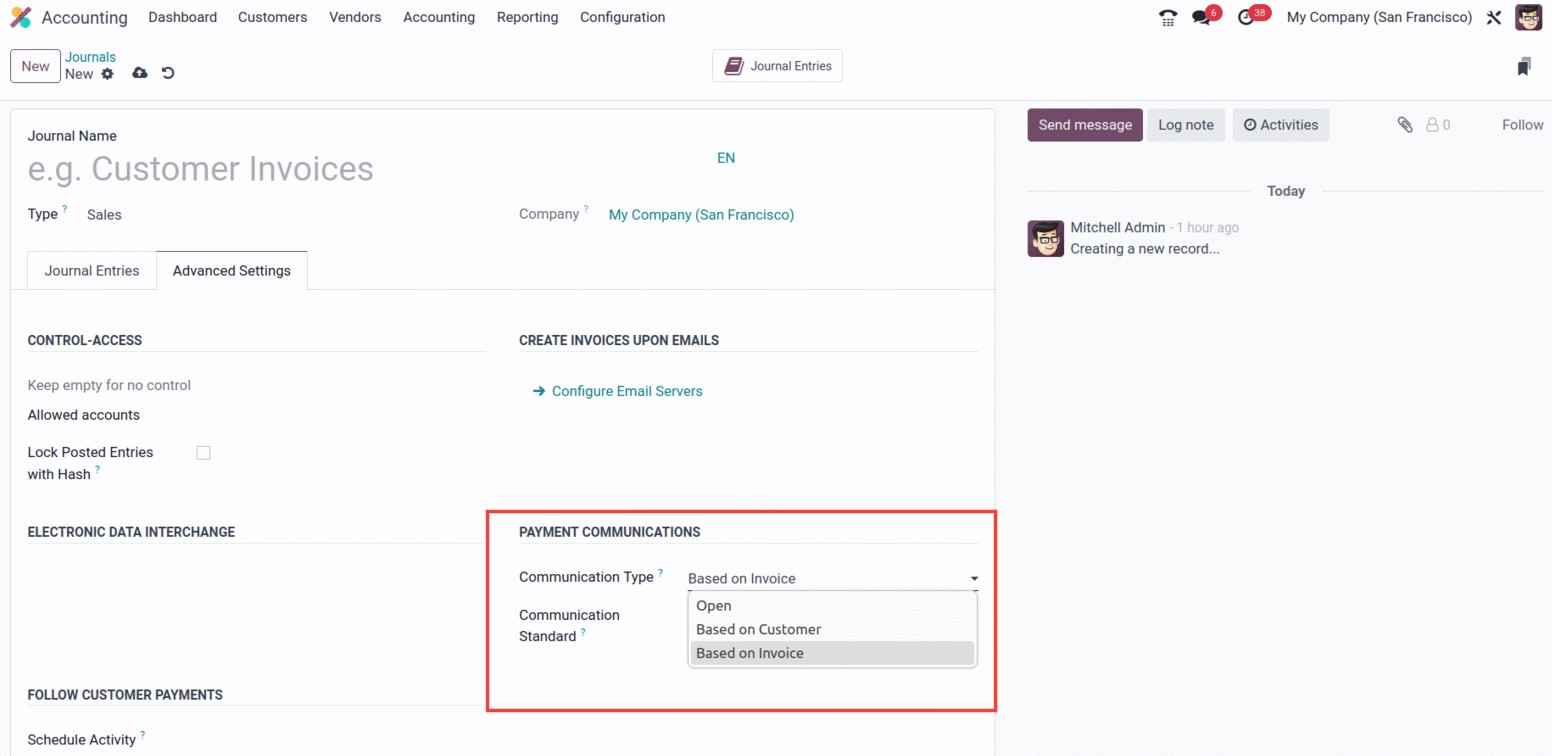

If the Type is Sales, you'll additionally show the extra fields under several headings, such

as PAYMENT COMMUNICATIONS, CREATE INVOICES UPON EMAILS, and FOLLOW CUSTOMER PAYMENTS.

Communication Type and Communication Standard fields are included in the PAYMENT COMMUNICATION

section. To make it easier for customers to remember to refer to a specific invoice when

making a payment, you can define the default communication that will appear on their invoices

once they have been validated in the Communication Type area. Open, Based on Customer, and

Based on Invoice are the three options available here. You may do the same for the

Communication Standard field. For each sort of reference, you can select a different model

using this field; the default option is the "Odoo reference."

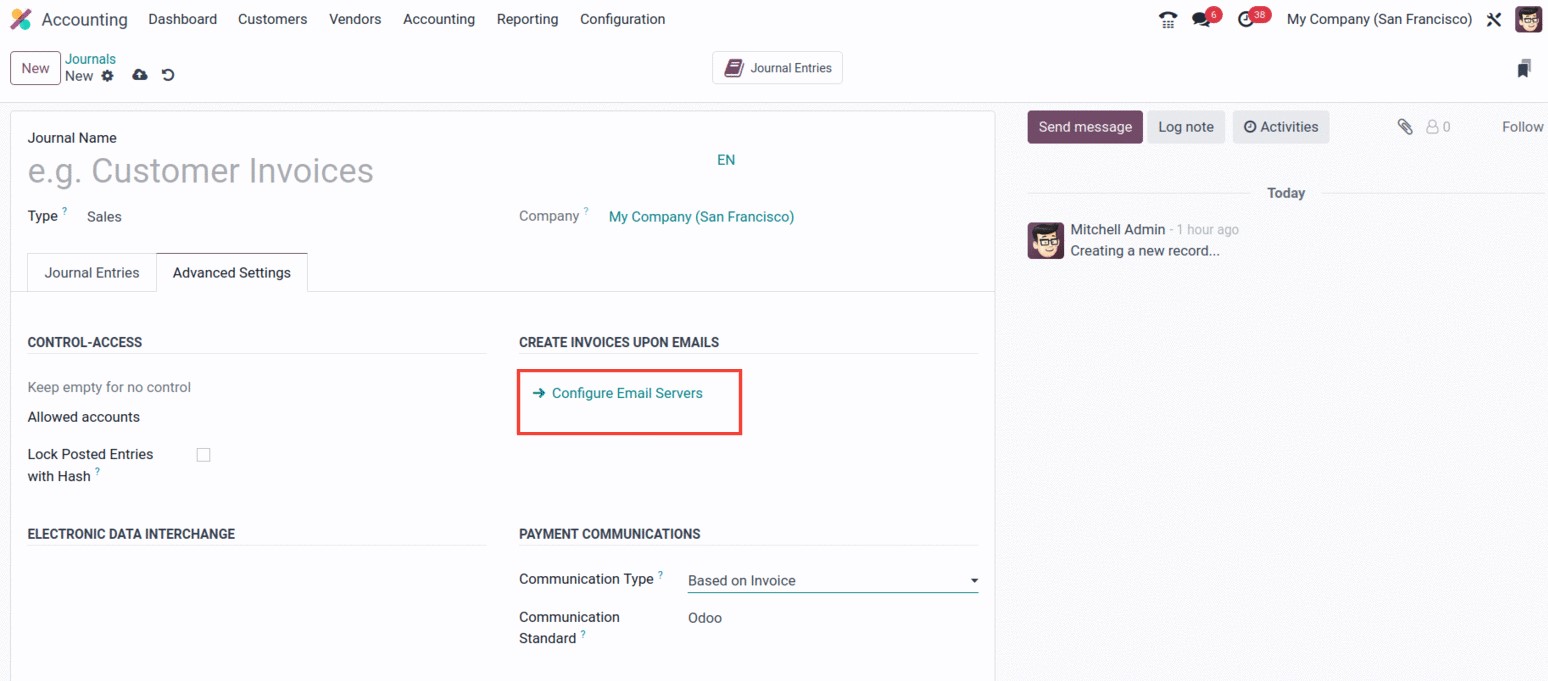

In the CREATE INVOICES UPON EMAILS section, you may also configure Email Servers. It will

work well to guarantee that an invoice will be generated if the email is received under the

appropriate server domain.

Additionally, you can submit XML or EDI invoices via electronic invoicing by using the

section on ELECTRONIC DATA INTERCHANGE. You can do that by turning on the E-Invoice option. If

the appropriate localization module for "e-invoicing" is installed, which will be possible

with accounting localization, then electronic invoicing will be available. An XML/EDI document

will be generated and attached once this capability is enabled, along with invoices and credit

notes.

You also have a space for scheduling an activity for the upcoming payments from customers.

Any activity you indicate will automatically be scheduled on the due date for payments, which

will improve the collection process. The drop-down menu can be used to select an activity.

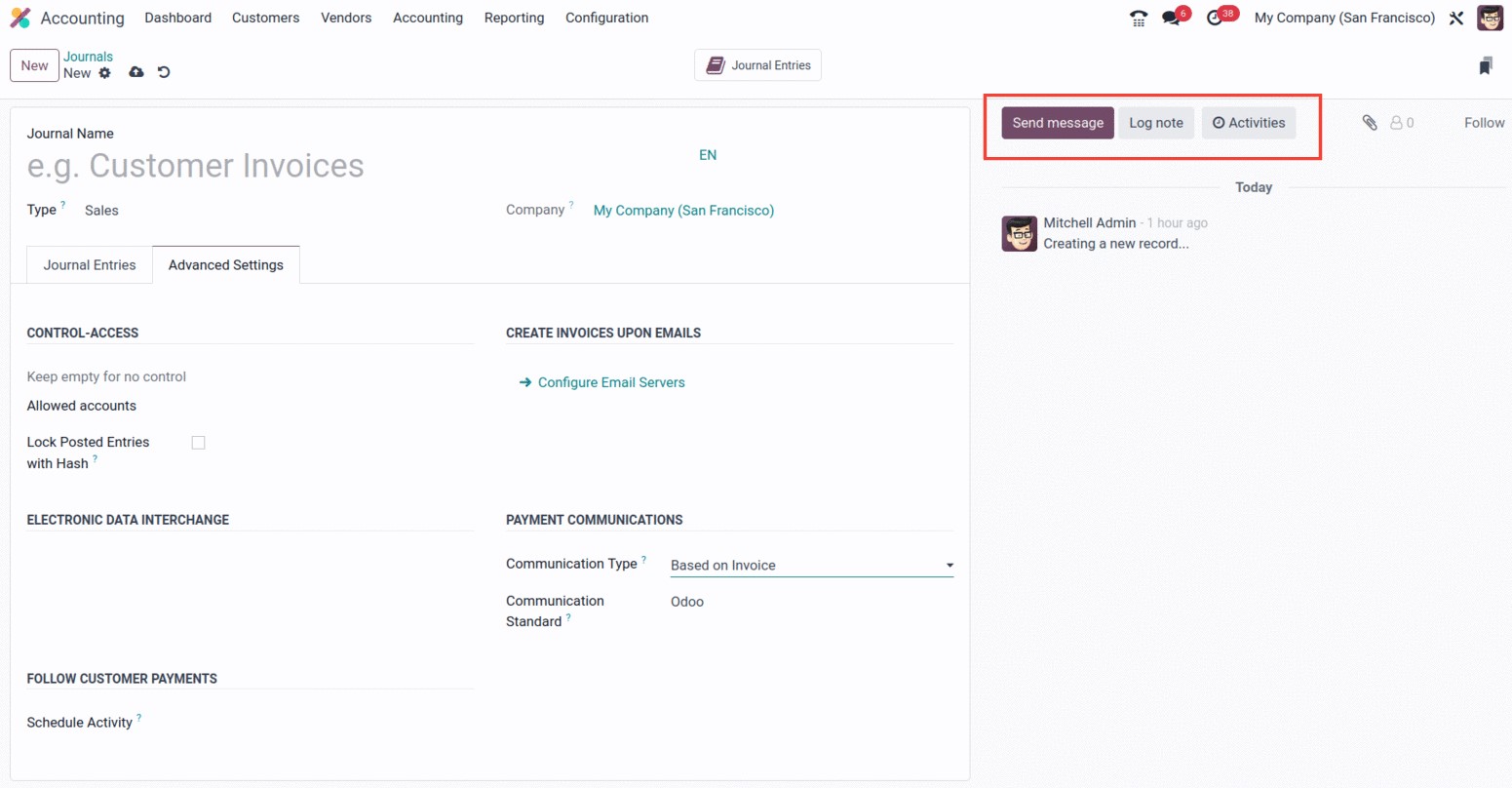

Finally, you have the choice to communicate with readers of the associated journal by sending

messages and describing log notes. Other users of your Odoo 17 platform, who may be members of

the staff of your business or affiliated members, could be followers. The Log Note option

helps you record the changes made by the employees and describes them together with the time

and date, while the Send Message option is quite helpful for notifying any pertinent

information.

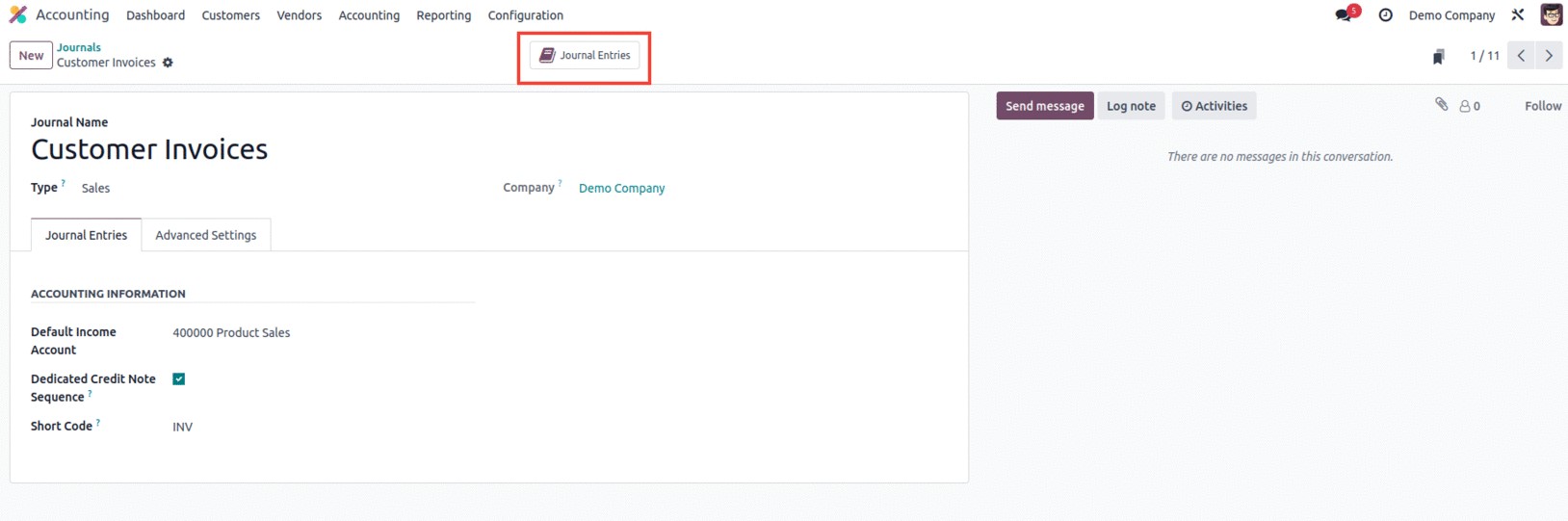

In addition to all of these choices, you can also see the smart tab in the window's upper

right corner, as seen in the illustration below. The 'Journal entries' smart tab will display

every entry made in that specific journal.

We now understand how to configure the Sales journal type. In Odoo17, the steps for creating

the Sales, Purchase, and Miscellaneous journals are all the same. Let's now talk about the

Bank journal's configuration processes, which differ from those for Sales, Purchase, and

Miscellaneous journal kinds.

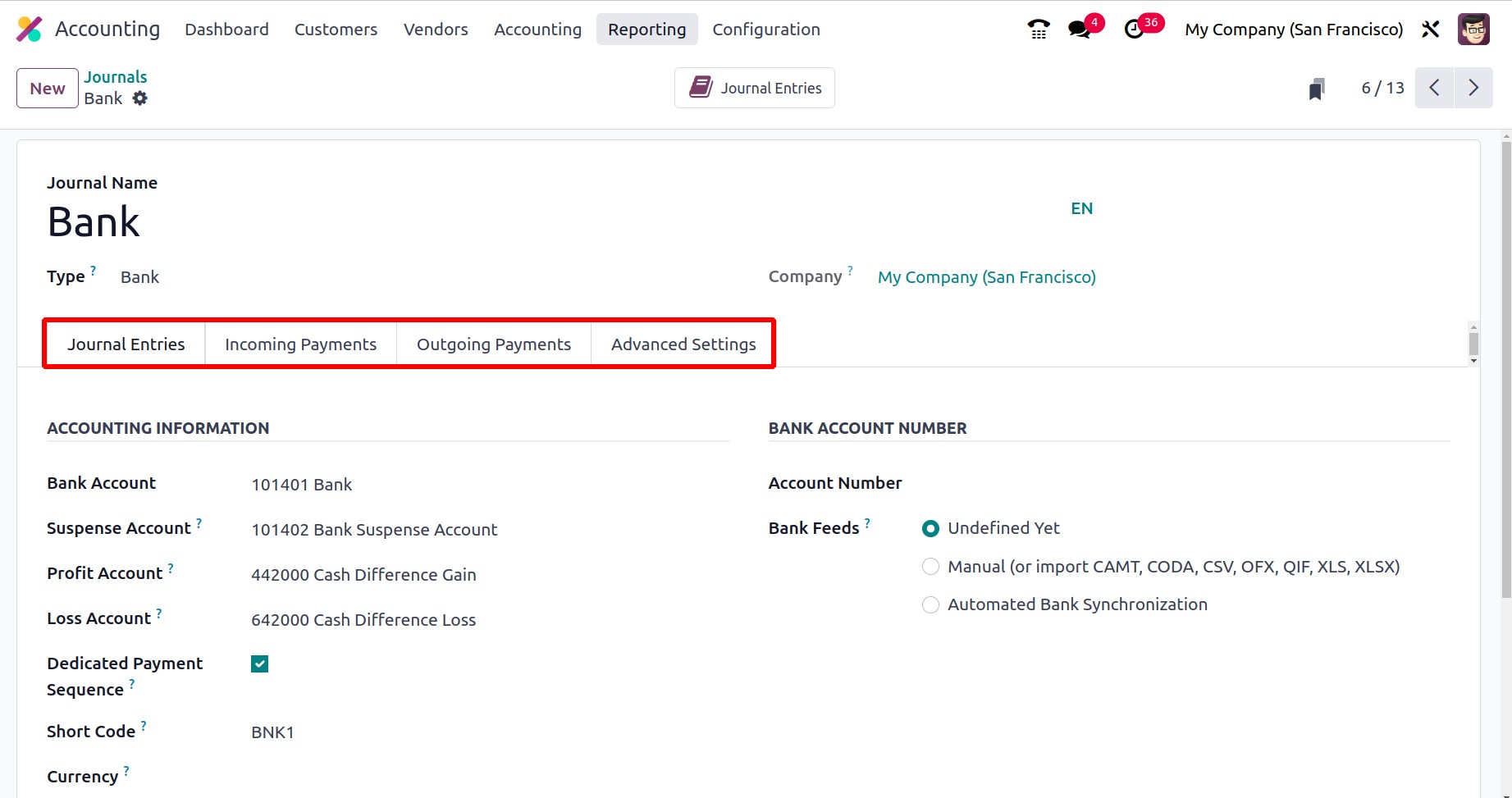

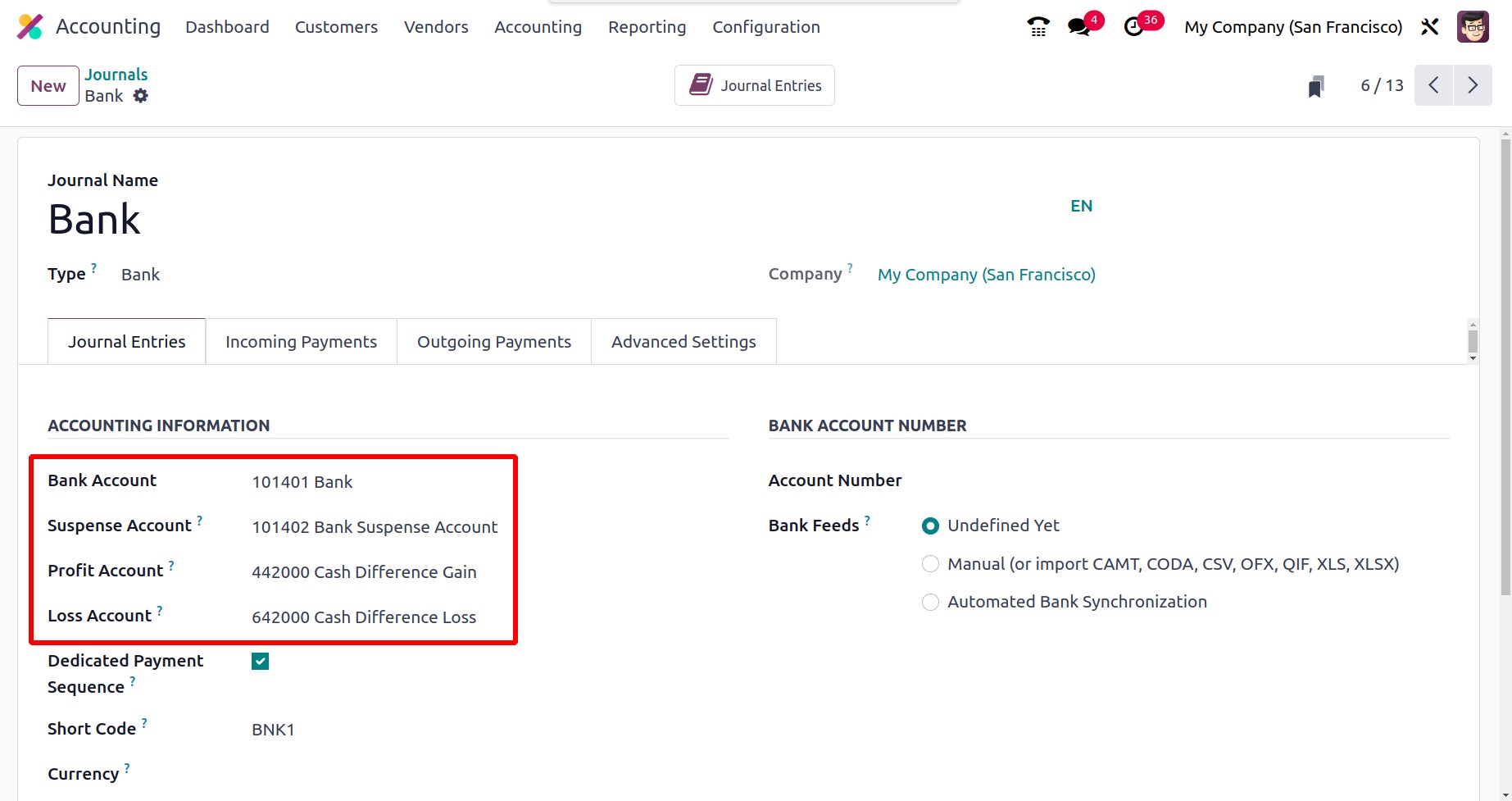

The creation window will show the various sections, including Journal Entries, Incoming

Payments, Outgoing Payments, and Advanced Settings when you choose Bank as the Journal Type.

You must provide details about journal entries under the "Journal Entries" tab. As a result,

you can provide the ACCOUNTING INFORMATION, including the Bank Account, Suspense Account,

Profit Account, Loss Account, Short Code, and Currency information. The Suspense Account

serves as a temporary account until the bank statement transactions for each journal activity

are reconciled, and is used to post bank statement transactions until the bank account is

balanced with the payments.

The Profit Account is also used to record a profit when a cash register's ending balance

deviates from the calculation made by the system. When the cash register's closing balance

differs from what the computer calculates, it is advantageous to record a loss in the loss

account. The Dedicated Payment Sequence option for activating is also shown in this section.

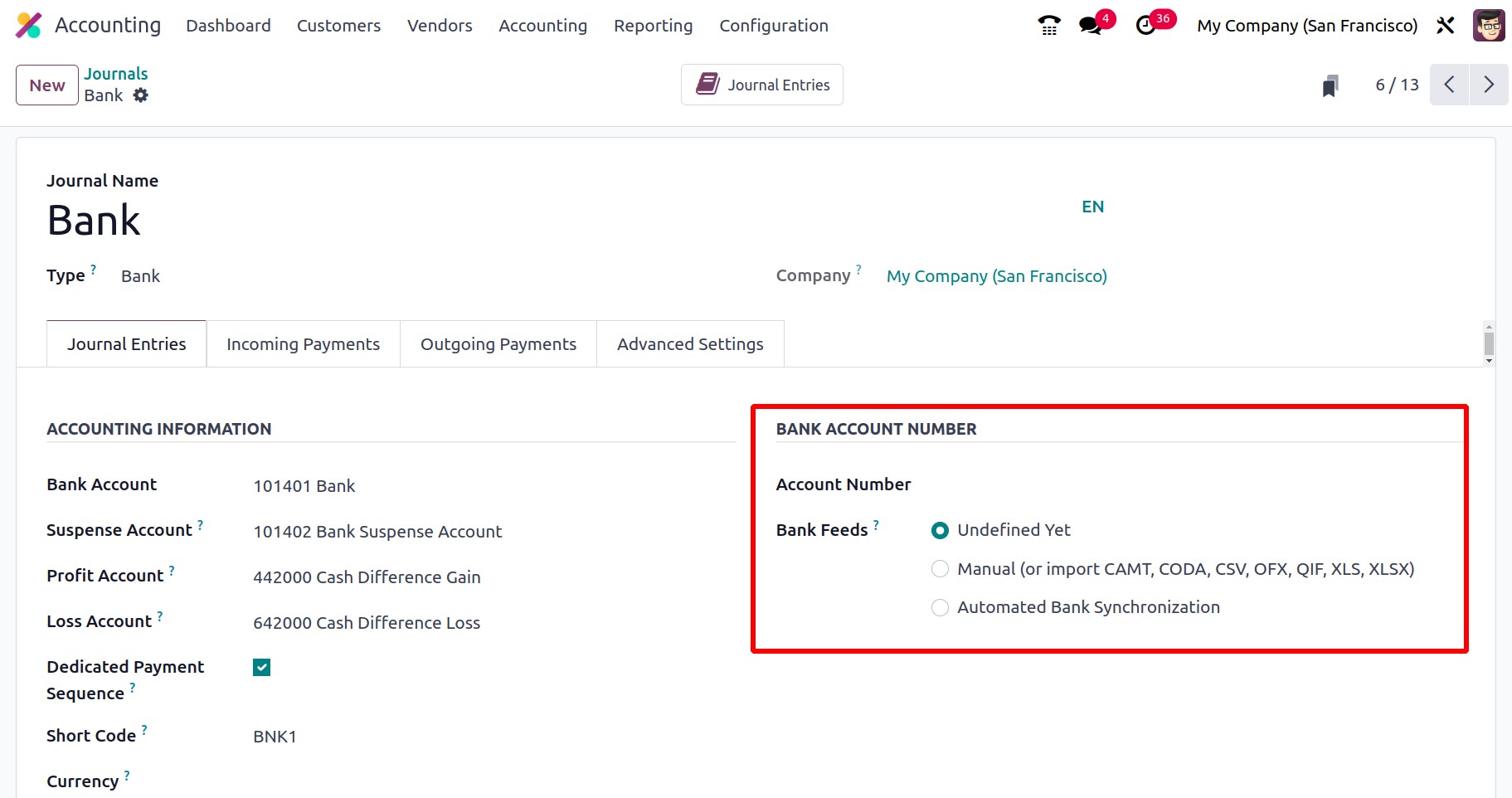

In the 'BANK ACCOUNT NUMBER' section, the Account Number can also be specified in the

appropriate field. Additionally, you have the choice to designate Bank Feeds, and the

registration of bank statements will be carried out in accordance with your choice. Three

options are available here: Automated Bank Synchronisation, Import (CAMT, CODA, CSV, OFX,

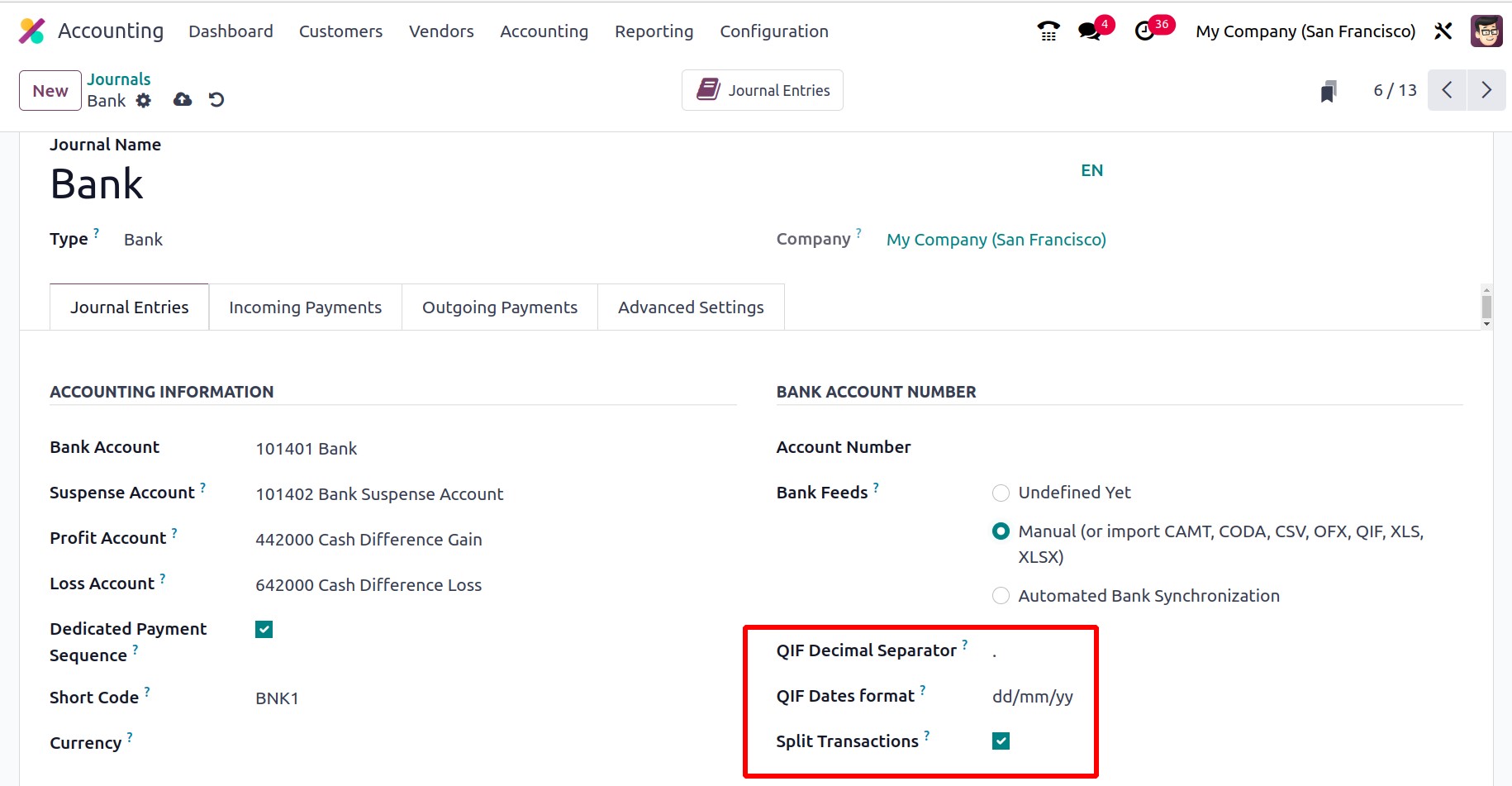

QIF), and Undefined Yet. When you select the Import option, more fields will be displayed,

including the QIF Decimal Separator, which is necessary to prevent conversion problems, and

the QIF Dates format, where you can select either dd/mm/yy or mm/dd/yy depending on the firm.

Split Transactions, the third field, can be turned on to split group payments for CODA files.

You can import information from the dashboard using the Import option.

The Odoo 17 platform can be made accessible for directly retrieving the invoice payment

information from the bank servers by selecting Automated Bank Synchronisation. Additionally,

you will have control over the review of the synchronized operations via the Dashboard.

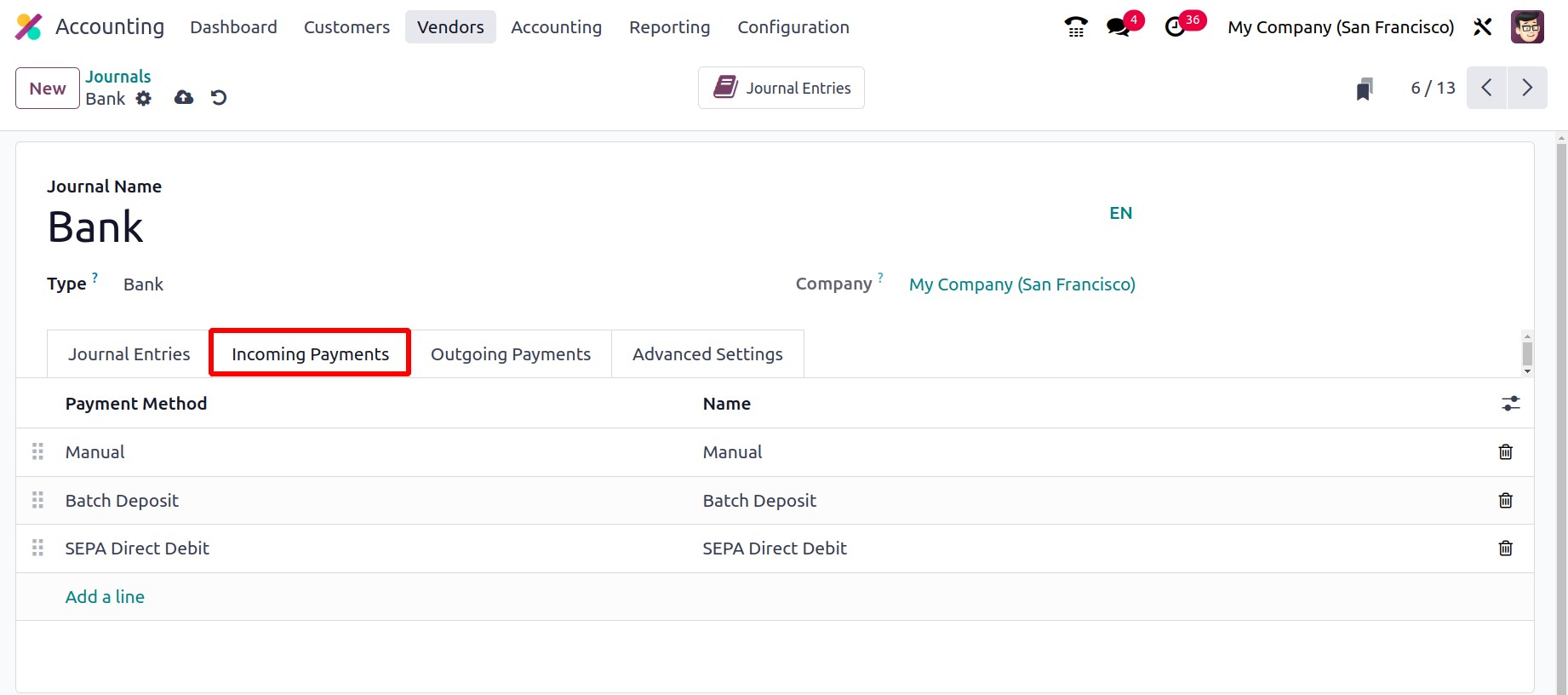

The incoming payment setup details can now be defined under the Incoming Payments tab.

Therefore, you can specify the Name and Payment Method using the Add a line option.

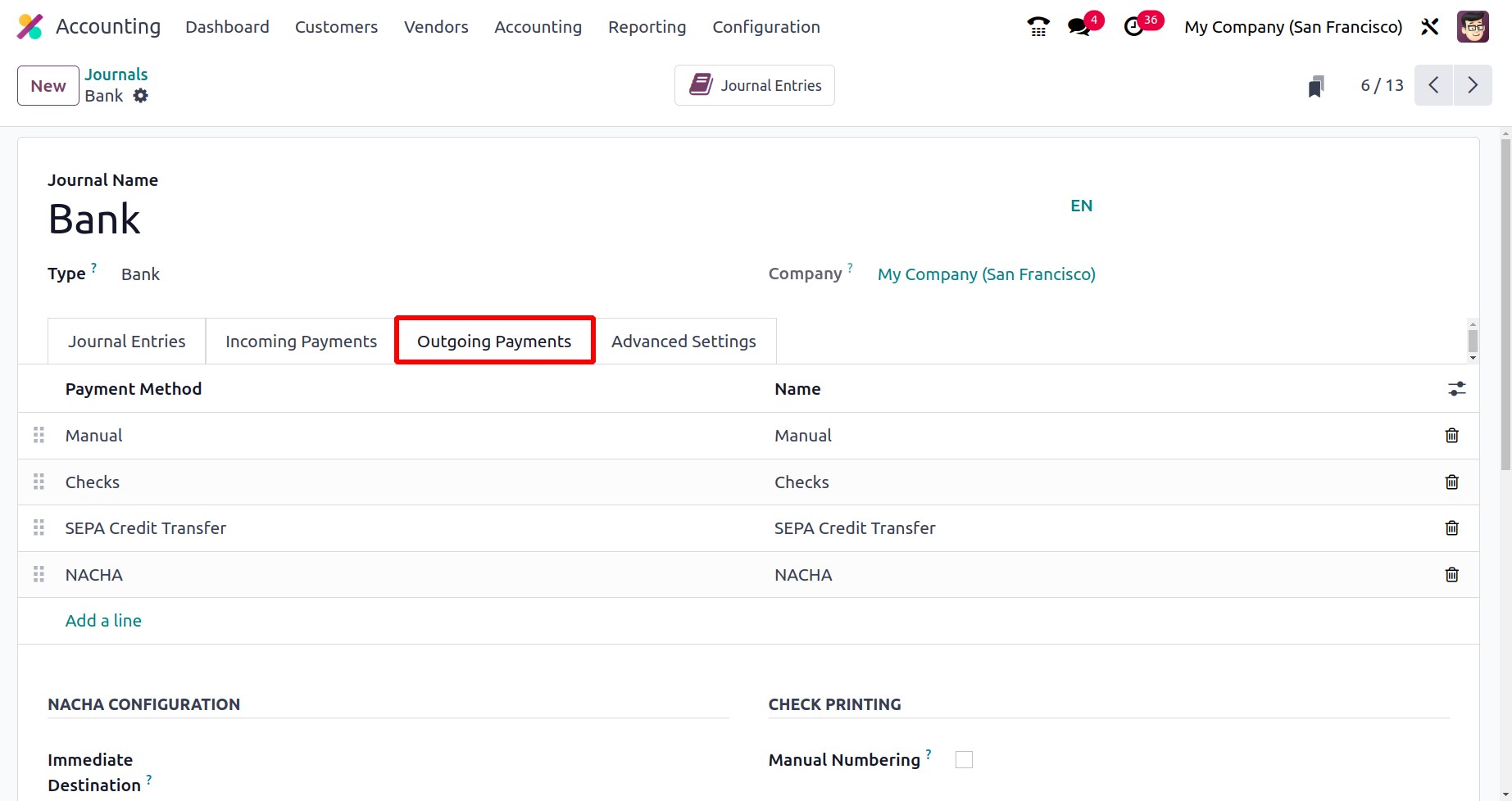

You must set up the outgoing payment methods under the Outgoing Payments tab. The 'Payment

Method' and 'Name' can be defined using the Add a Line option because it is almost the same as

the Incoming Payments. You can select a method from the drop-down menu and then apply it. If

the payment method is brand-new, configuring it won't take much work.

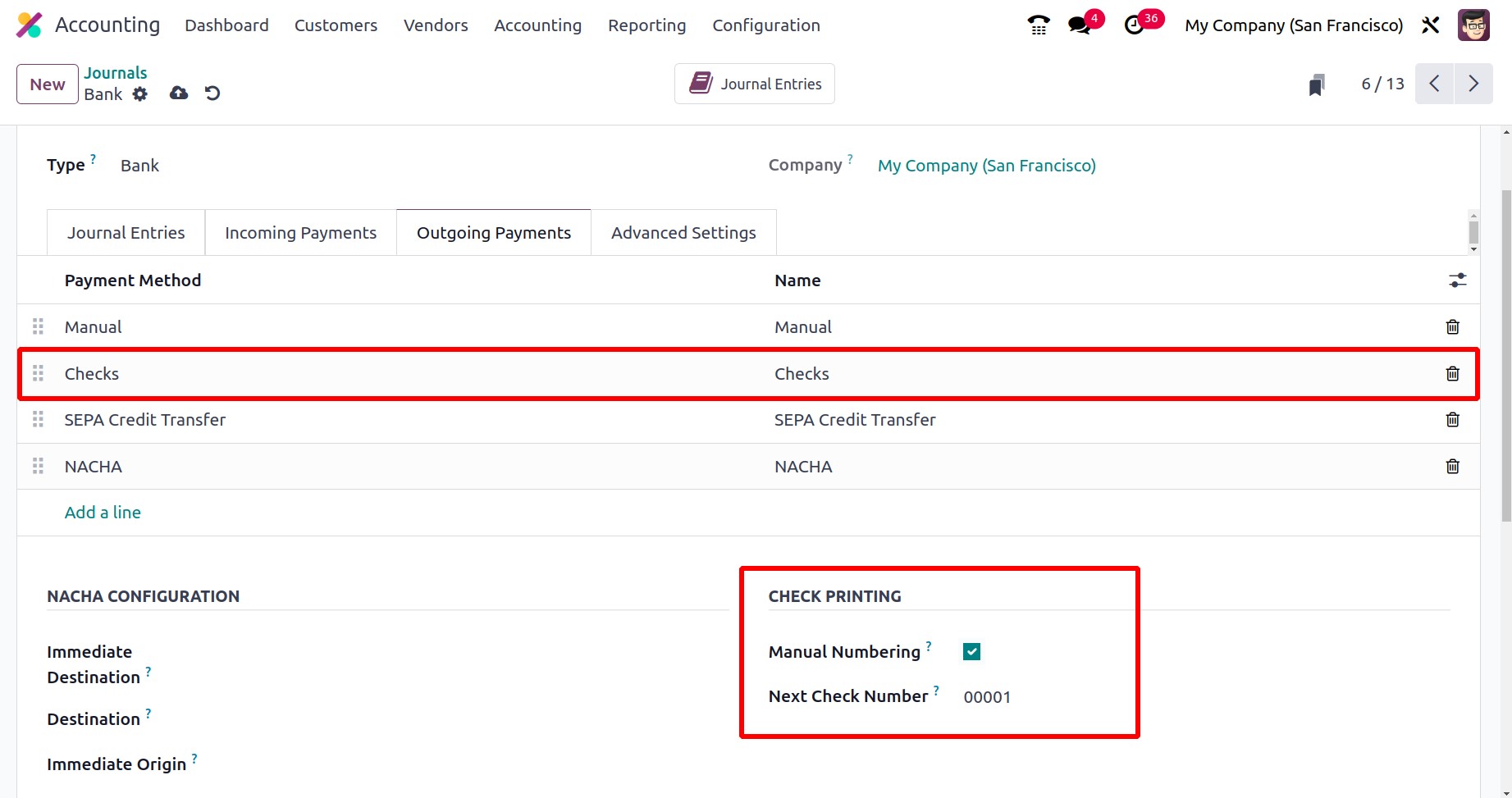

Furthermore, if your pre-printed checks aren't numbered, you can enable the Manual Numbering

field found in the CHECK PRINTING section.

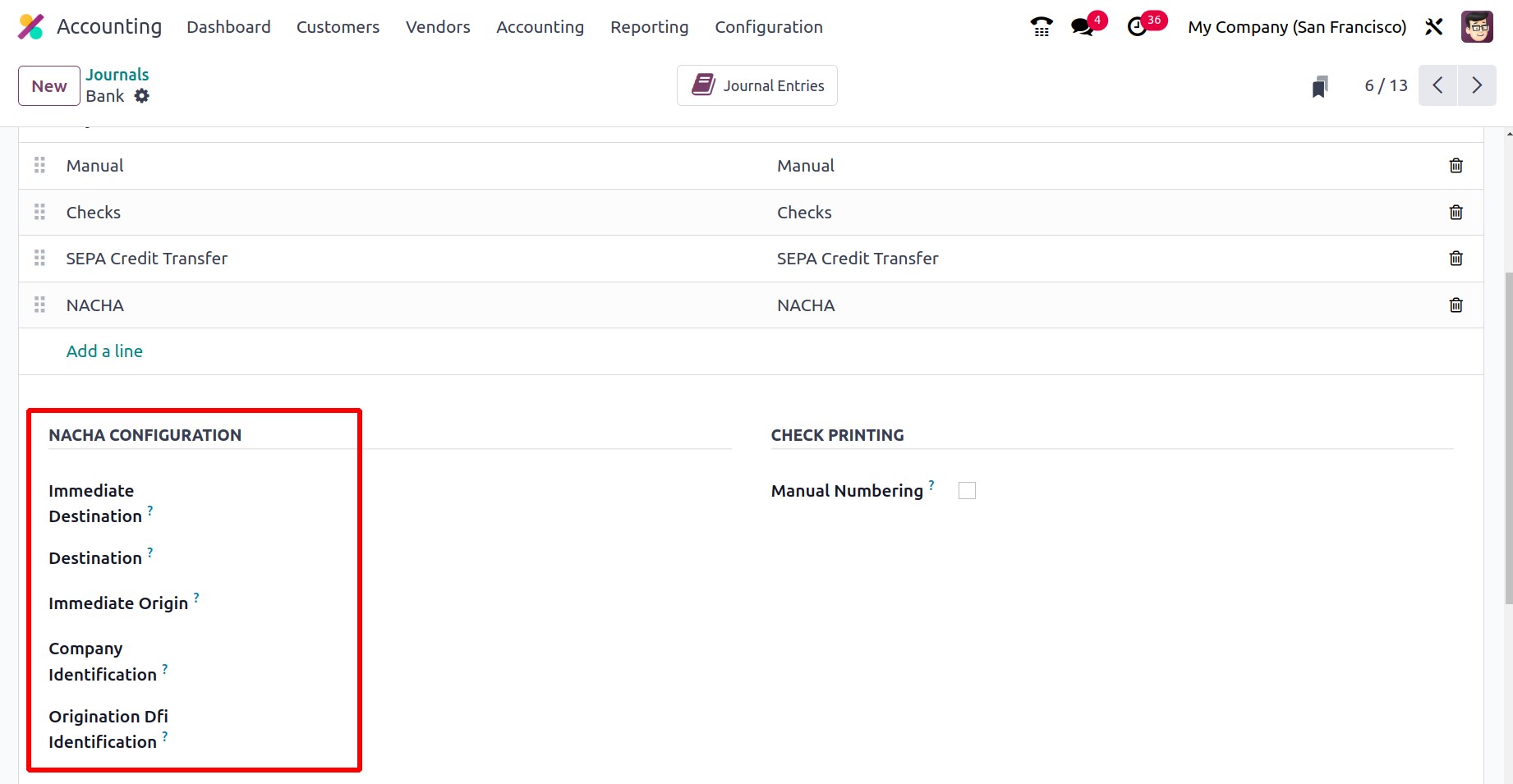

Additionally, there is the NACHA CONFIGURATION, where a number of fields are available,

including Immediate Destination, Destination, Immediate Origin, Company Identification, and

Originating DFI Identification. The bank will supply all of these facts.

NACHA CONFIGURATION: The term NACHA stands for National Automated Clearing House Association

compliant ACH file, which will be produced using US localization. At the appropriate location,

information such as the immediate destination, the immediate origin, the company

identification, and the origination DFI identifier can be provided. Your bank will frequently

inform you when you are authorized to send payments using ACH. With this payment method, you

can pay a vendor and create the NACHA file that goes with it.

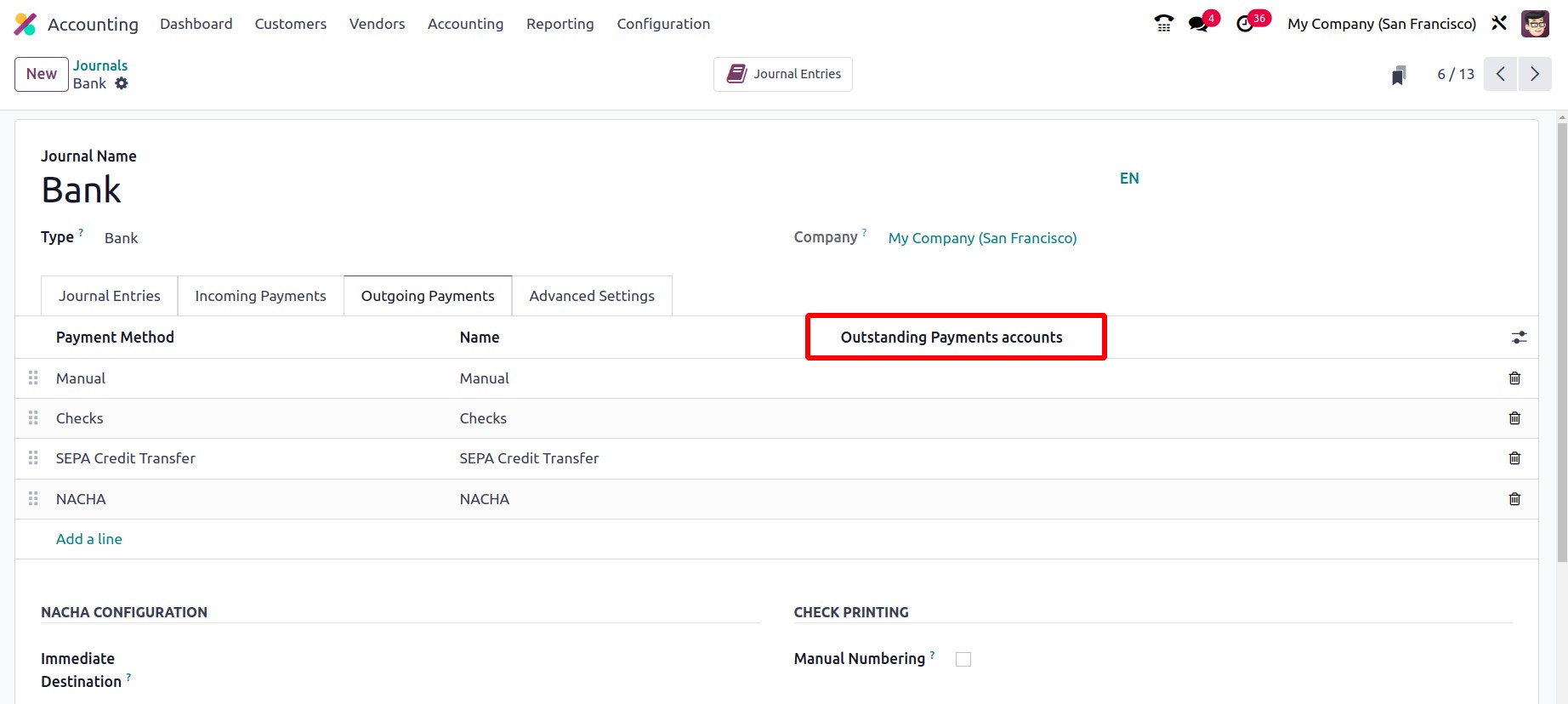

When a customer generates an invoice payment, the funds are not directly credited to the bank

account; instead, they are placed in the Outstanding Receipt Account, which is described here.

Only the payment will be deposited to the company's bank account following the automatic or

manual reconciliation of the bank statement and the payment is done. The amount for the vendor

bill will also be generated from Accounts Payable in the case of Purchase Payment, moved to

the Outstanding Payments Account, and then when the bank statement reconciliation process is

carried out in relation to the vendor bill, the bank will be reconciled with outstanding

payment entries rather than the payable account.

The final option, Advanced Settings, is identical to the Sales, Purchase, and Miscellaneous

accounts in the Journals configuration. Therefore, based on the operational requirements, the

account operation details for the Cash and Bank journals can be modified.

These are the proper methods for creating and editing journals, and these journals can be

used to create journal entries for the financial administration of an organization. Now that

we have covered every component of journal design, we can examine journal groups, which are

important for categorizing journals.

Journal Groups

You will have the opportunity to categorize numerous business operations elements through

categorization, which is a crucial aspect of business operations. It will enable you to divide

the process into delicate discs. For a company's accounting procedures to run smoothly, you

can define several journals using the Odoo17 platform. There is a good probability that

entries will be confused when defined in various journals. Thus, a special ability to group

the journals was provided by the Odoo17 platform. This cutting-edge function will provide a

lot of assistance in categorizing all the configured journals.

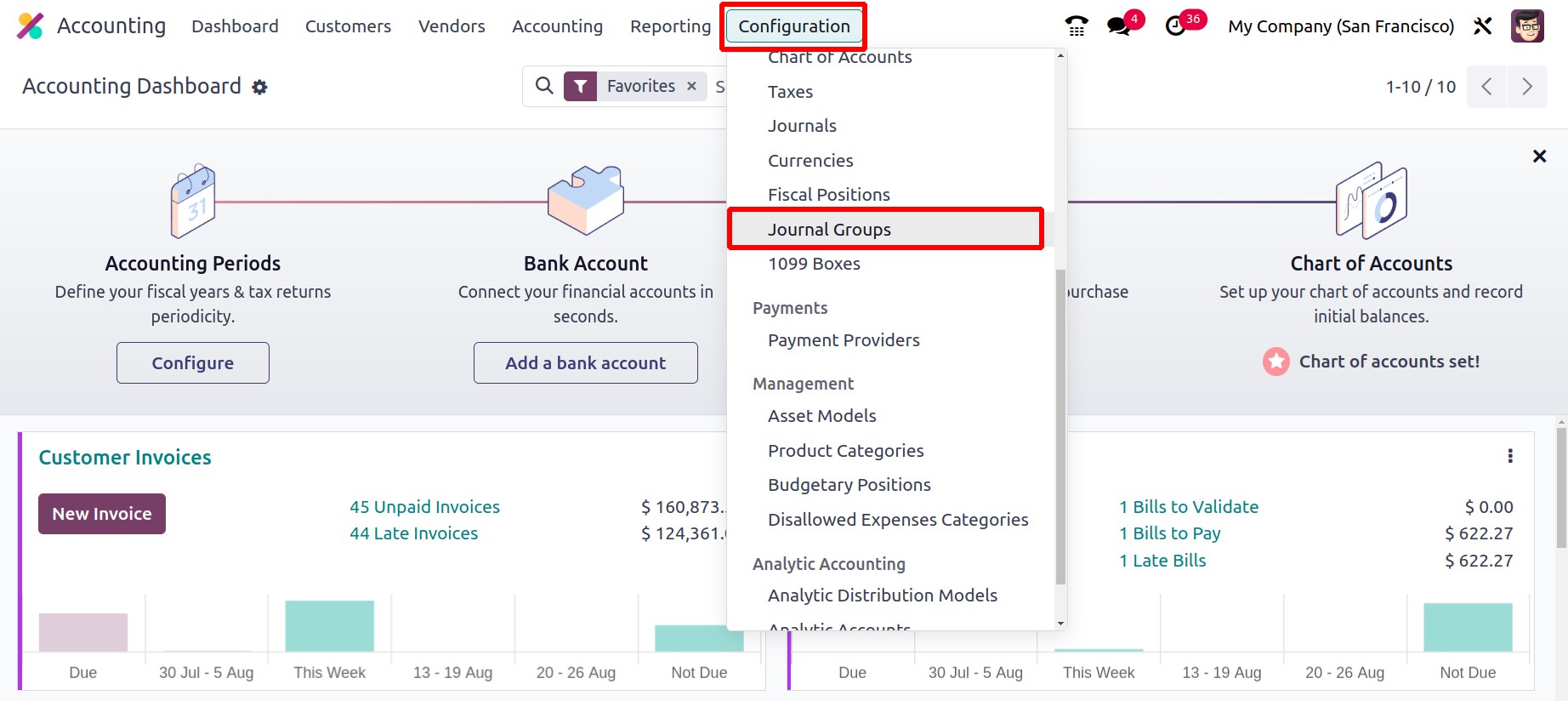

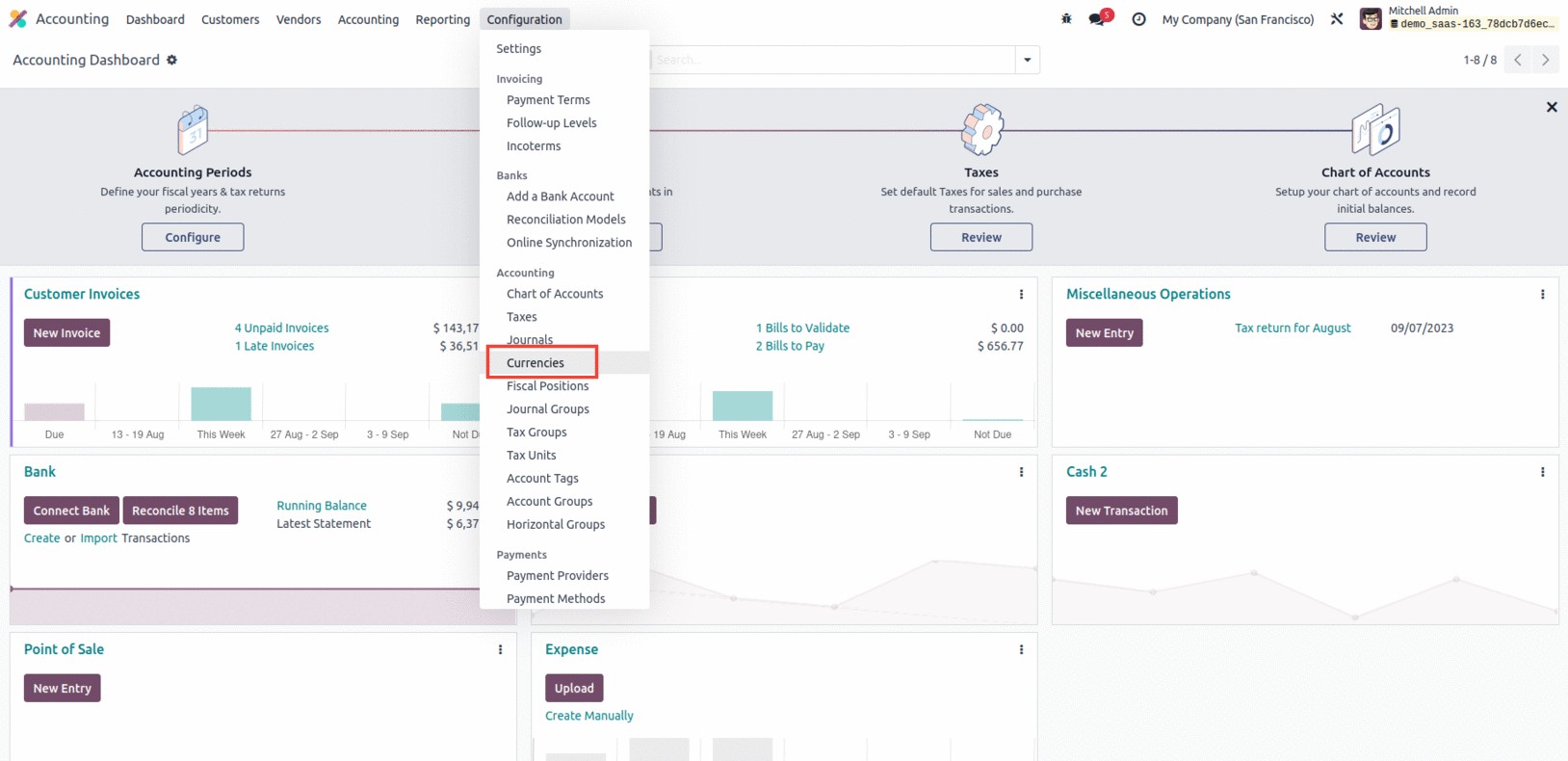

Go to the Configuration menu of the Accounting module to access the Journal Groups menu,

where you can view all the journal groups that were previously described in the Journal Groups

window, as shown below.

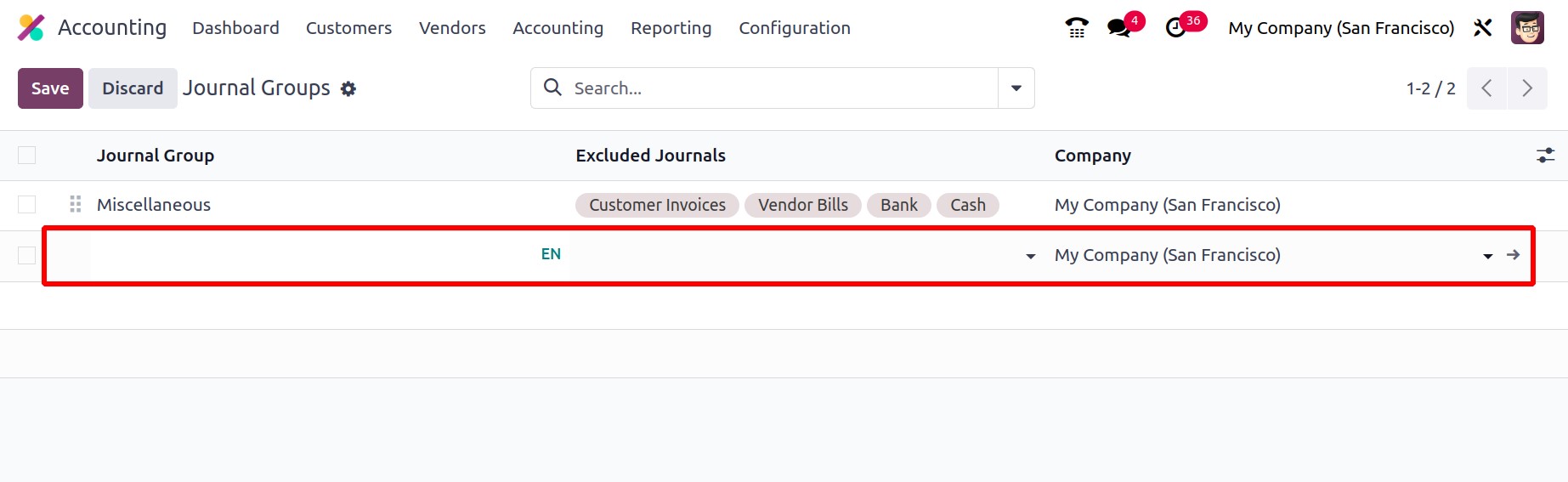

You will enter the window when you select the Journal Groups menu. You can make brand-new

Journal Groups by pressing the New button. The instant your cursor passes over the New button,

a new line for configuring journal groups will appear in the same window.

There, you can list the Excluded Journals and enter the names of the Journal Groups. The

Company field can be customized and will be automatically assigned.

This window also has access to the many sorting features offered by Odoo17. You can rapidly

sort out the necessary groups using the pre-set and configurable filters, as well as the Group

By choices.

One of the standout features of the Odoo17 Accounting module that enables you to classify

your accounting journals into categories is Journal Grouping. The groups can be used to

streamline reporting and more effectively manage accounting data. Users will find it simpler

to track and view all of your transactions with the help of this feature. By giving a

centralized mechanism to compare the various sorts of transactions, journal grouping also

contributes to the accuracy of the financial records. Then, financial data may be more

effectively organized and analyzed using these categories.

Journals can be grouped using this functionality based on the company, transaction type, or

other factors. Users can now easily look up and access particular journals as needed, thanks

to this. Users can arrange journals based on the type of transaction, which aids in keeping

their finances organized. Users may quickly discover which journals require reconciliation,

which aids in accounting reconciliation.

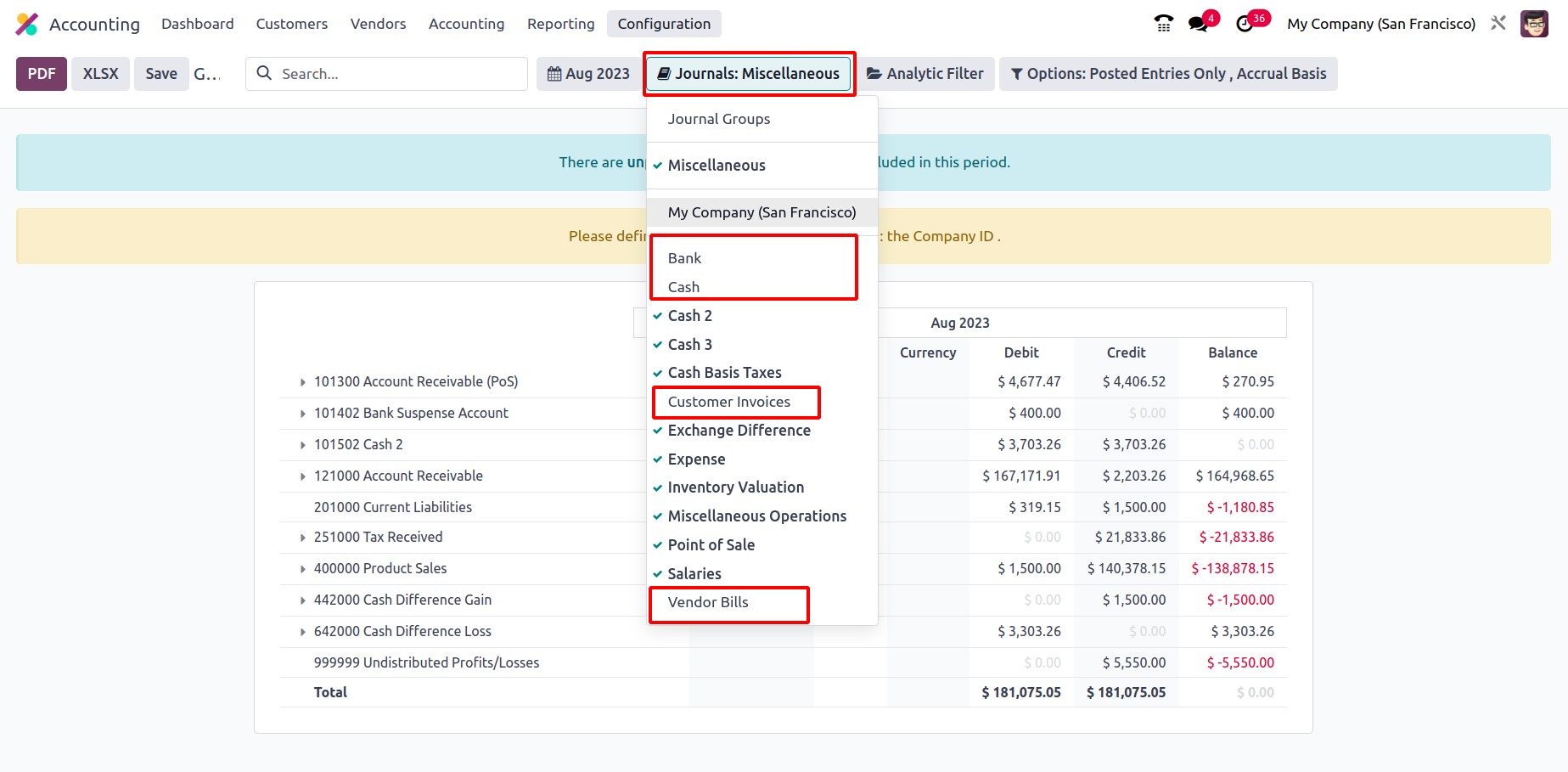

In reporting, these Journal groupings are used to bundle pertinent data together for display.

You can complete the Filtering and Group By requirements for various accounting and journal

activities. The Odoo17 platform places a high priority on report generation, and with the use

of filtering features, a variety of reports connected to accounts may be acquired in a matter

of seconds. To simplify the procedure, you only need to select Journal Types as the filtering

criteria.

While defining it, it is also possible to choose the appropriate Chart of Account Types

because doing so makes it easier to sort out the requirements for the accounting information

in relation to the Chart of Account Types that are being established.

While defining it, the Chart of Account Types can also be chosen for the relevant one; this

is advantageous for the filter of the accounting data with regard to the Chart of Account

Types that are being defined.

The accounts Customer Invoices, Vendor Bills, Bank, and Cash mentioned in the journal will

not be included in the filter of reports since the journal group "Miscellaneous" has been

selected in the report. Therefore, for the efficient operation of journal management

operations, the Journal Group feature has a considerable impact on the accounting department

of any organization.

After thoroughly understanding the capabilities of Journal Groups, let's have a look at the

Currency Management tool that is included in the Odoo17 Accounting module in the part that

follows.