With Odoo16, introduced a new accounting feature Storno Accounting. Storno accounting

can be defined as the process of reversing original journal account entries by adopting

negative figures. This business practice of Storno Accounting is commonly used in

Eastern European countries. Some countries where Storno Accounting is mandatory

includes:

- Bosnia and Herzegovina

- China

- Czech Republic

- Croatia

- Poland

- Romania

- Russia

- Serbia

- Slovakia

- Slovenia

- Ukraine

They consider Storno Accounting is the best practice to reverse journal entries

with negative debits and credit which will not create redundant figures in the accounting

system. The reversal can be for various reasons such as when any mistakes happen

in the original transaction or in case the return of items refund has to be added

etc. This accounting technique is also known as Red Storno since bookkeepers frequently

write Storno entries in red ink. All such entries will be available in the accounting

reports as red color.

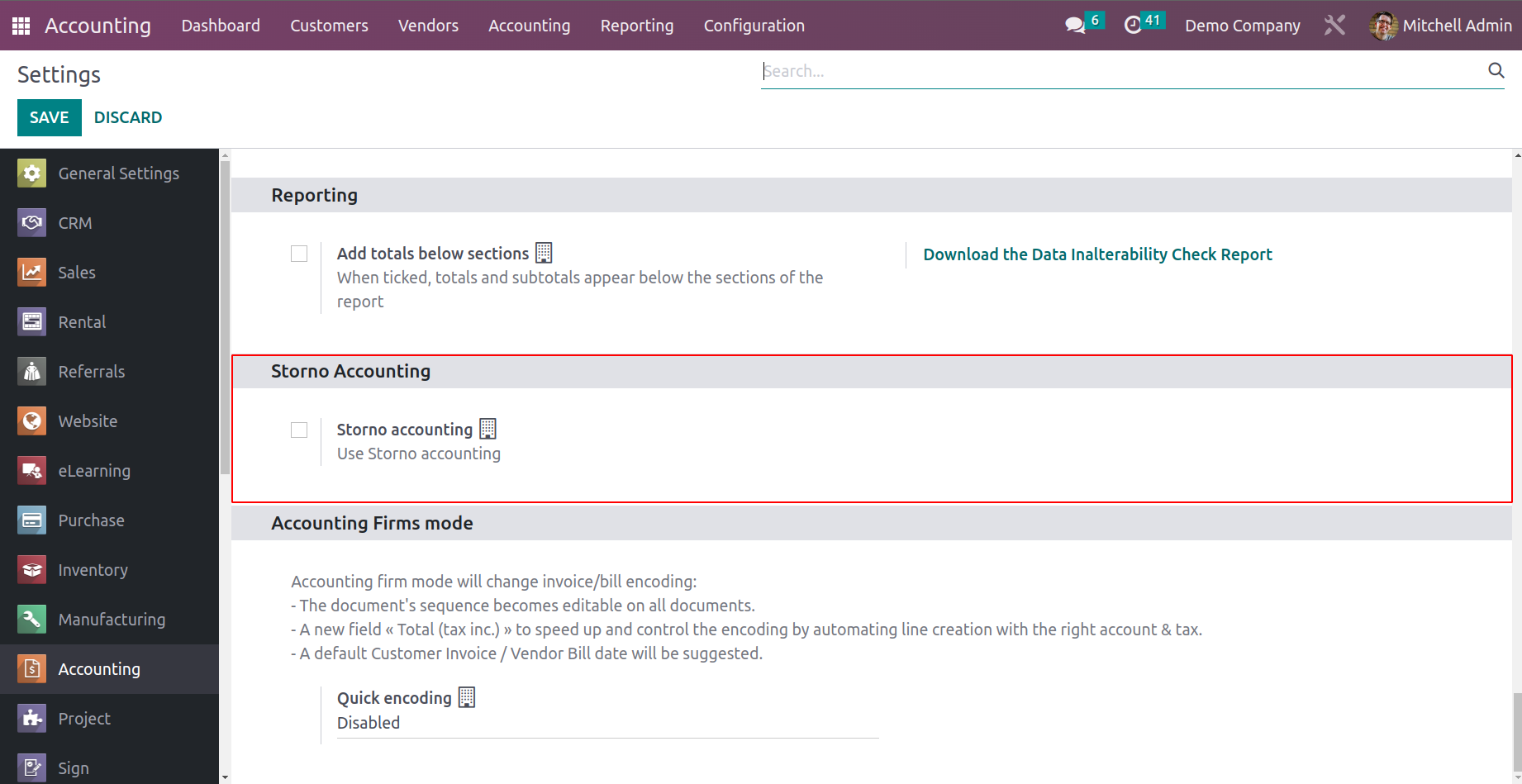

To avail of these features enable ‘Storno Accounting’ from the Configuration Settings

of the Odoo 16 Accounting Module.

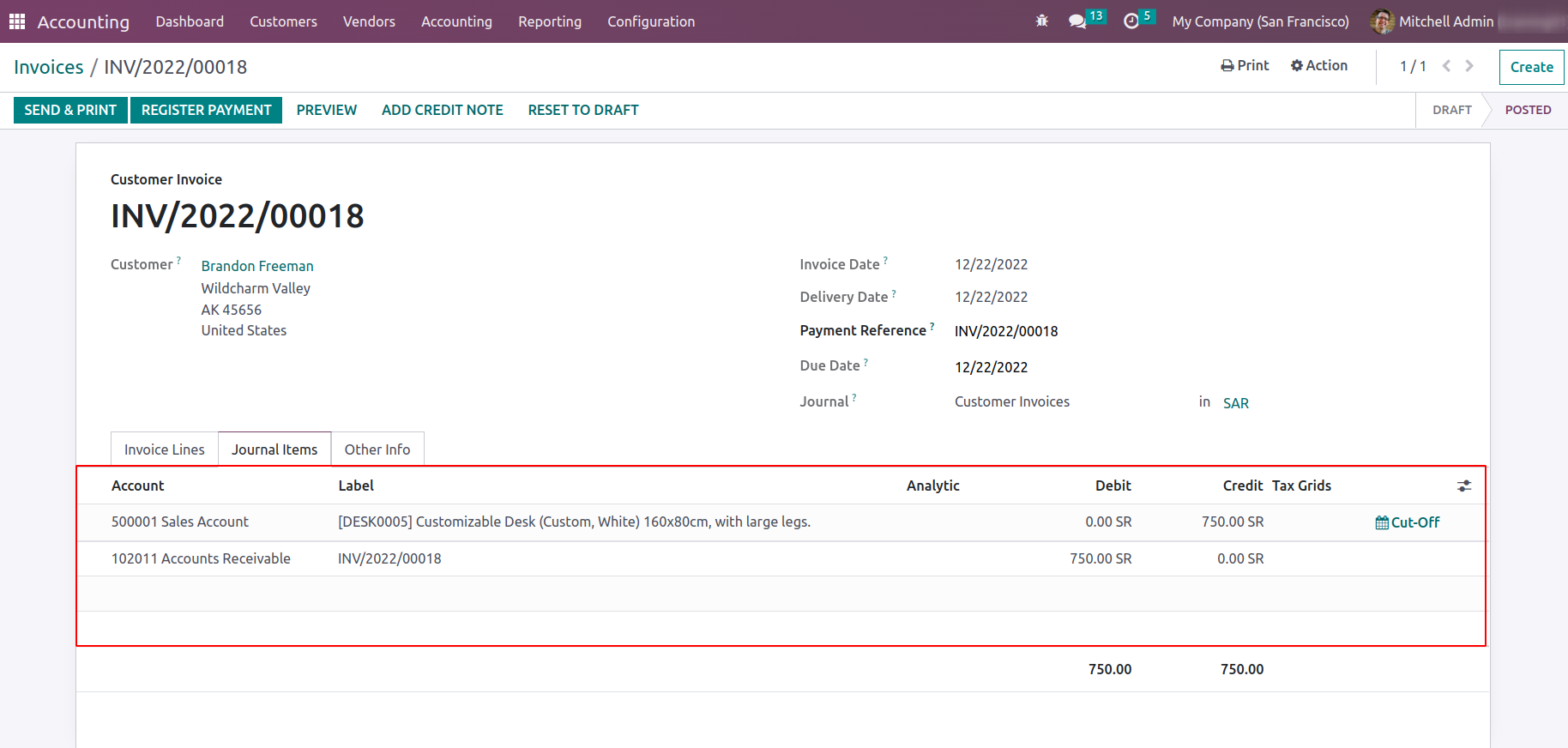

In general, when a transaction occurs, let's say an invoice is created which will

affect some ledger accounts. Usually, for an invoice, the Income Accounts get credited

and Account Receivable gets debited. If this transaction is reversed, what will

happen is that the Income Account will get debited, and Account Receivable will

be debited. But for Storno accounting for the reverse entry, Income Account will

be ‘-ve‘ Credit, and Account Receivable will be ‘-ve’ Debit.

Consider an Invoice that has been added as shown below screenshot.

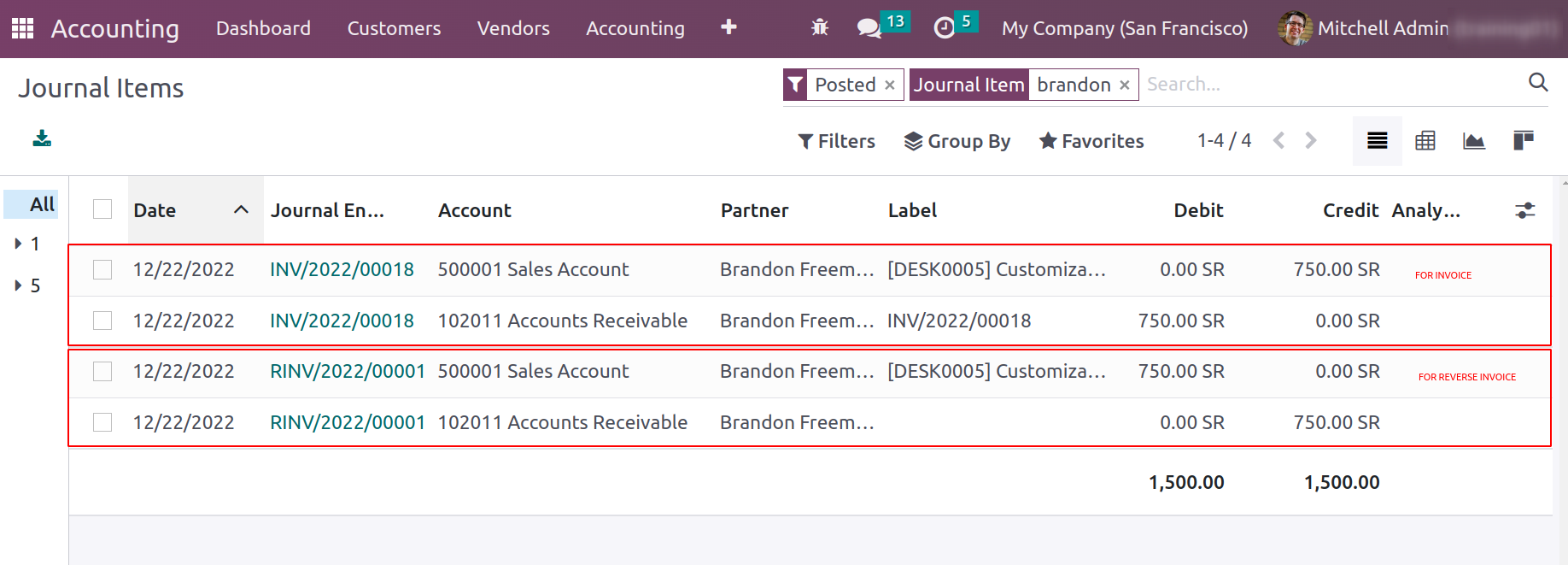

And for some reason, if this invoice is reversed and a credit note is created and

posted. Now let’s see the journal item and how each ledger is affected.

For invoice, Income Account is Credited and Account Receivable is Debited, and on

the reverse invoice or credit note, the opposite entry created with Income Account

is Debited and Account Receivable is Credited.

On enabling Storno accounting, for reversed journal entries, the Debits and Credits

are in negative figures. Create an invoice and credit note respectively for the

invoice. Let’s see the ledger posting in Storno Accounting.

For invoices, initially, Income Account is credited, Tax Account is credited, and

Account Receivable is debited. On reversing journal entry for Income Account and

Tax Account is credited with a negative figure, and Account Receivable is debited

with a negative figure. In short, the below table shows the general ledger posting

and Storno ledger posting.

| | General | Storno |

| Debit | Credit | Debit | Credit |

| Invoice | Income Account | | 320 | | 320 |

| Tax Account | | 48 | | 48 |

| Account Receivable | 368 | | 368 | |

| Reverse Invoice | Income Account | 320 | | | -320 |

| Tax Account | 48 | | | -48 |

| Account Receivable | | 368 | -368 | |