In order to run a business, you will need to deal with many customers and vendors with whom you will sell goods and services and source raw materials. All of these actions are carried out independently, using remote technologies that assist the operational facets. This is a different group of commercial establishments with which your company has collaborated to work, having a shared goal and working to be the best at what you do. These businesses will operate under an agreement whether they are owned by the same person or a different person. Depending on the requirement, products and services will be transferred among each other.

In some instances, an organization will collaborate with a different company dealing in a different area to carry out operations there under the name of the partner. Both firms will benefit from this because it will reduce the amount of money they spend on import and export taxes and widen their customer base. Odoo ERP features specific Partner and Partnership management tools in it to support the operations of the Partner function in a business. The aspect of partnership operating can be clearly defined in operations with Odoo thanks to a separate Ledger and functionality of internal transfer between partners and collective holding.

If the Partner operations are to be successful, the financial aspects of such operations are crucial for the business as well as for the development of focused management strategies.

The financial management of the Partner operations will be supported by the Odoo Accounting module. Additionally, the Odoo platform supports the reporting parts of the partner functionality via the Partner-specific reports in the Accounting module's Reporting menu. You can be confident that you have a precise grasp and analysis of the financial elements of the Partner operations in your business thanks to the report production tools like the Partner Ledger reporting, Aged Receivable reports, and Aged Payable reporting features. In the sections that follow, we'll go through each of these partner report kinds in more detail.

Partner Ledger

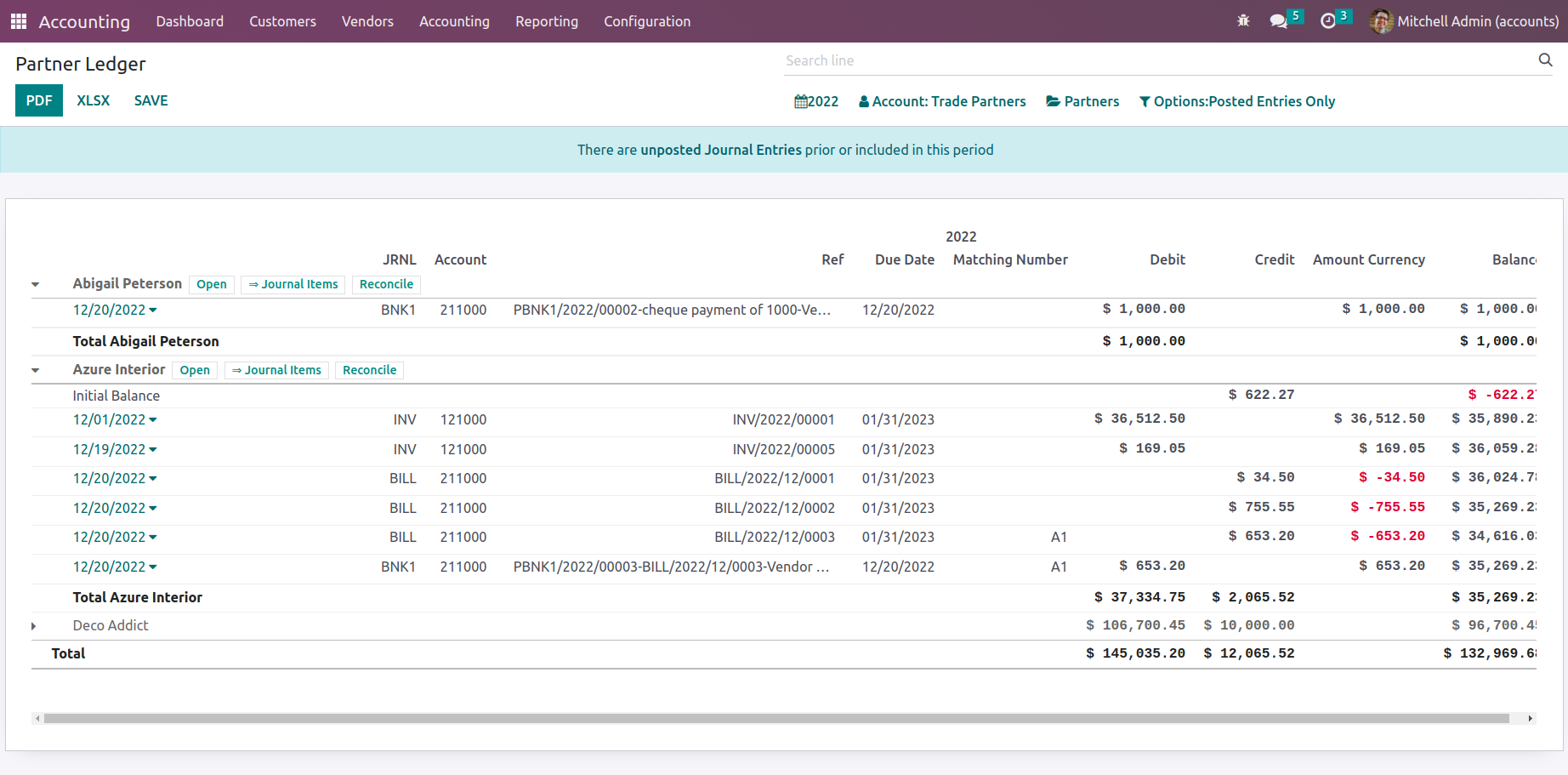

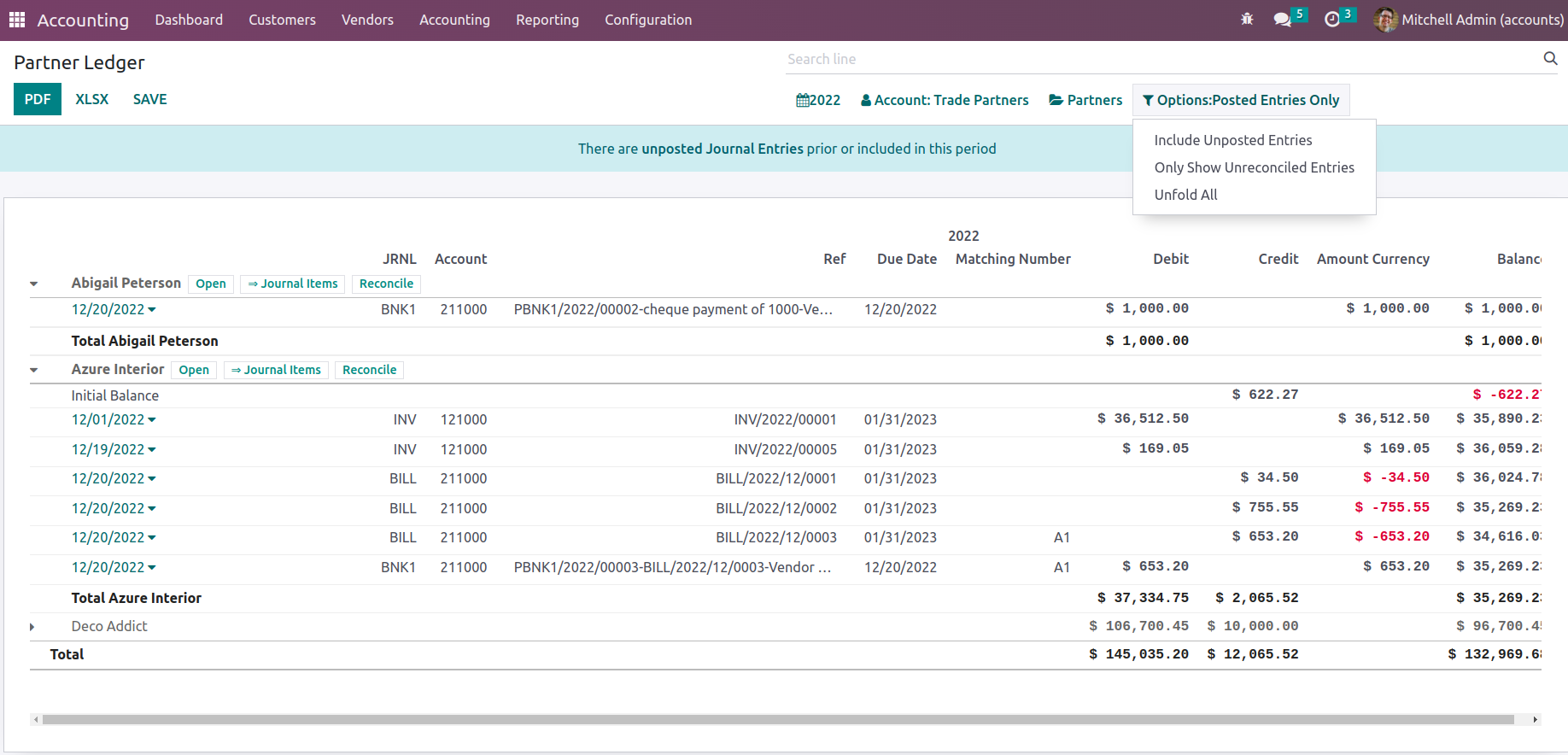

The Odoo Accounting module's Partner Ledger reporting menu offers details on the partners' Ledge details as well as completed entries. Additionally, each Partner Ledger's financial characteristics will be described. The Reporting tab of the Odoo platform's Accounting module may be to cause for the menu. All of the Others working for your company will be defined in the menu. Using the drop-down arrow option, you can enlarge the summary and entries under each Partner. All Partners, the Transaction Date, Journal Involved, Transaction Account, Transaction Reference Details, and the Transaction Date will be defined here. In addition, the Due Date, Matching Number, Opening Balance, and the Amounts of Debit and Credit amounts involved will be described.

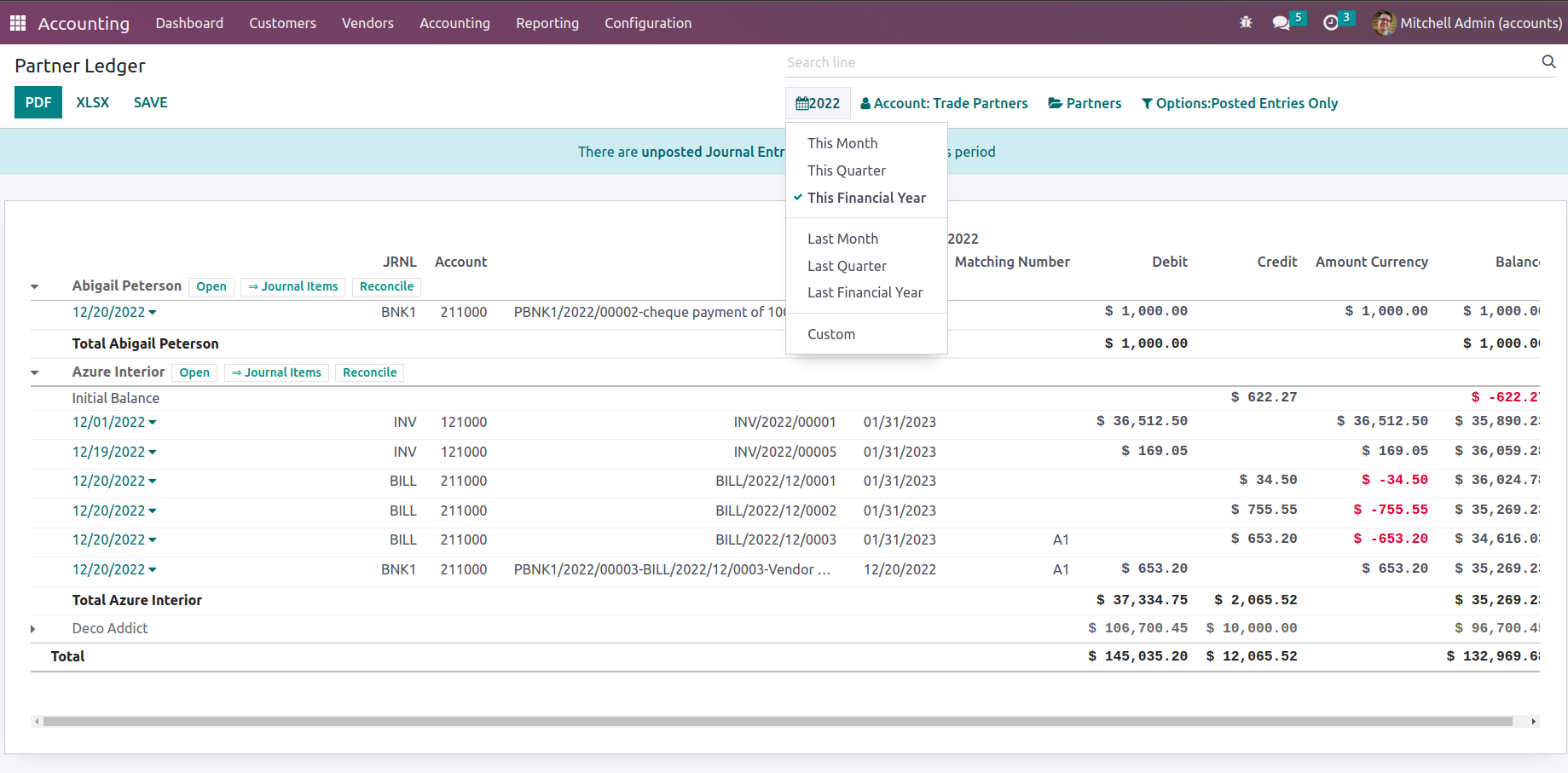

Where the entries have been described, there is a Search option provided. You can use this search box to look up defined Partner entries. Additionally, the tools for Distinctive filtering and Group by, which allow you to sort the data according to both the customised and predefined ones that have been created by default, will be useful. The Partner Ledger items can be sorted according to the fiscal period using the Fiscal Period filtering tool, which is shown in the following screenshots.

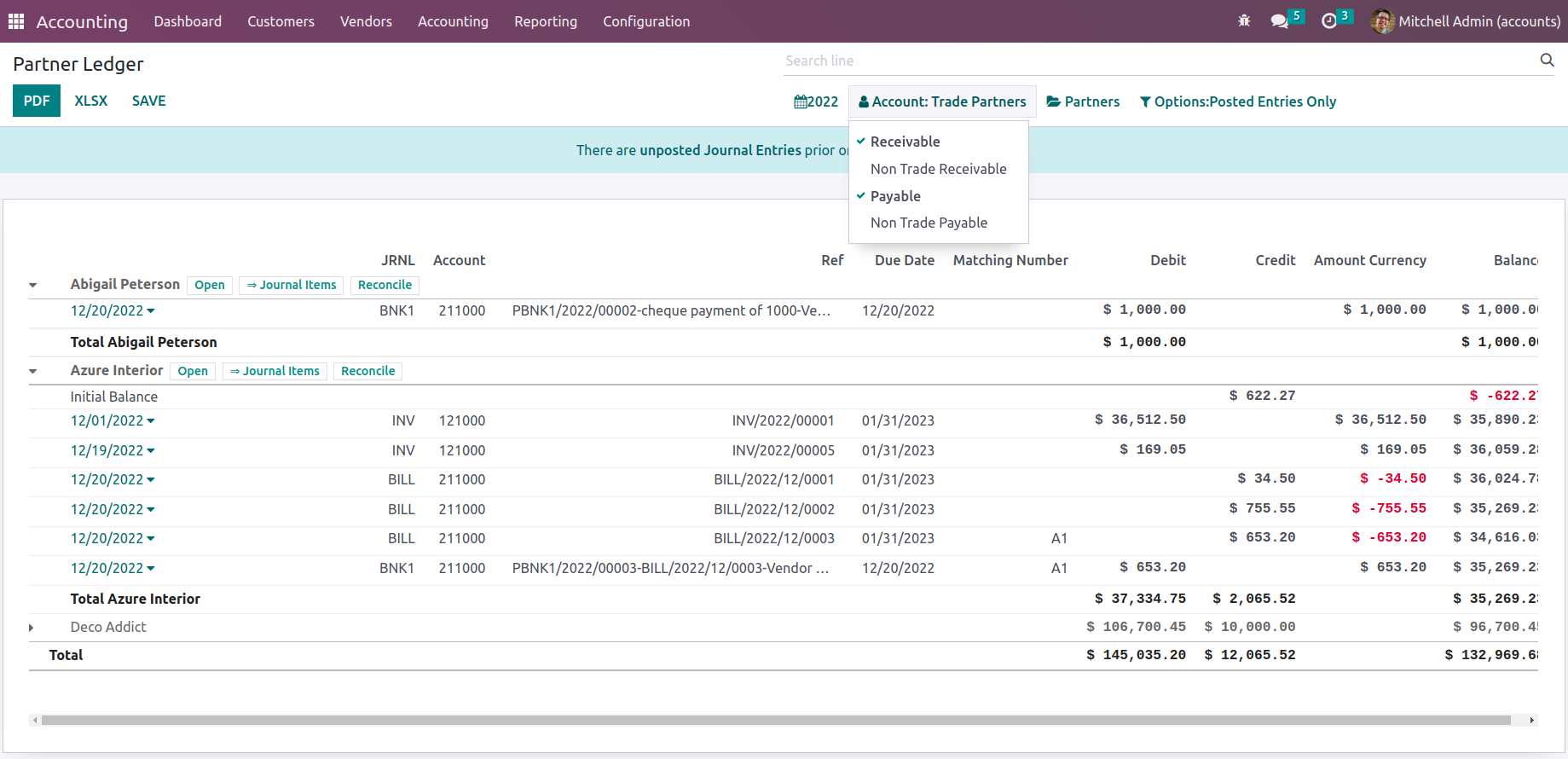

The Partner Ledger entries can also be sorted and grouped according to the account in which they are defined, whether it is the Receivables account or the Payables account. The sorting tool based on the Accounts on which the Partner Ledger entries are defined is shown in the following screenshot.

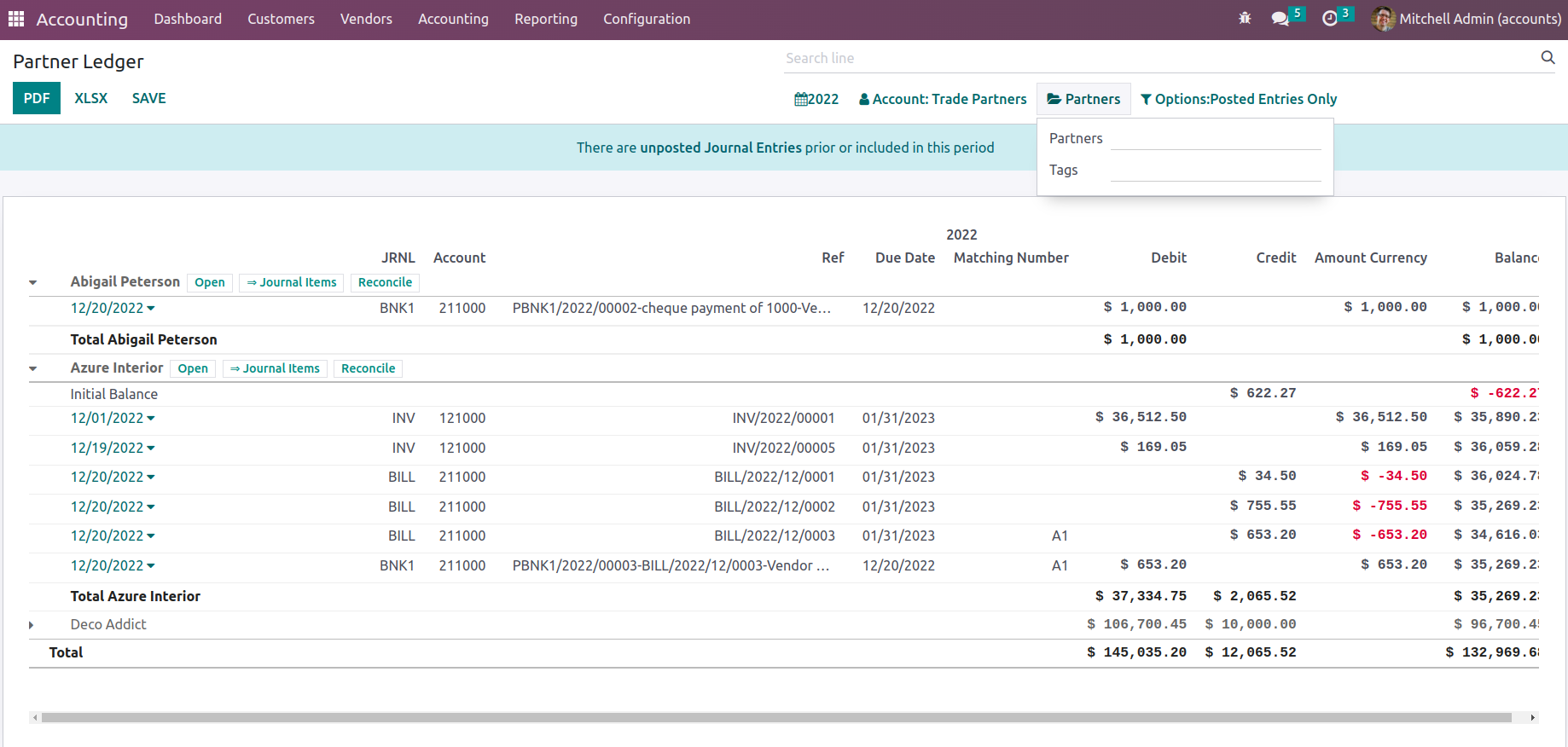

Additionally, you may use the Partners filter options to define the Partners and Tags by choosing them from the drop-down menu, which will enable you to list out the distinct Partner Ledger entries. The Partner screening tool is described in the following screenshot.

Additionally, there is a filtering tool that you can use to categorize the Partner Ledger based on the Posted Data, Include Unposted Entries, Only See Unreconciled Entries, or you may select the Unfold All option to show all the defined Partner Ledger entries. Additionally, buttons for printing reports in the PDF and XLSX formats are there. Additionally, after editing the entries, the Partner Ledger report can be saved using the available SAVE option.

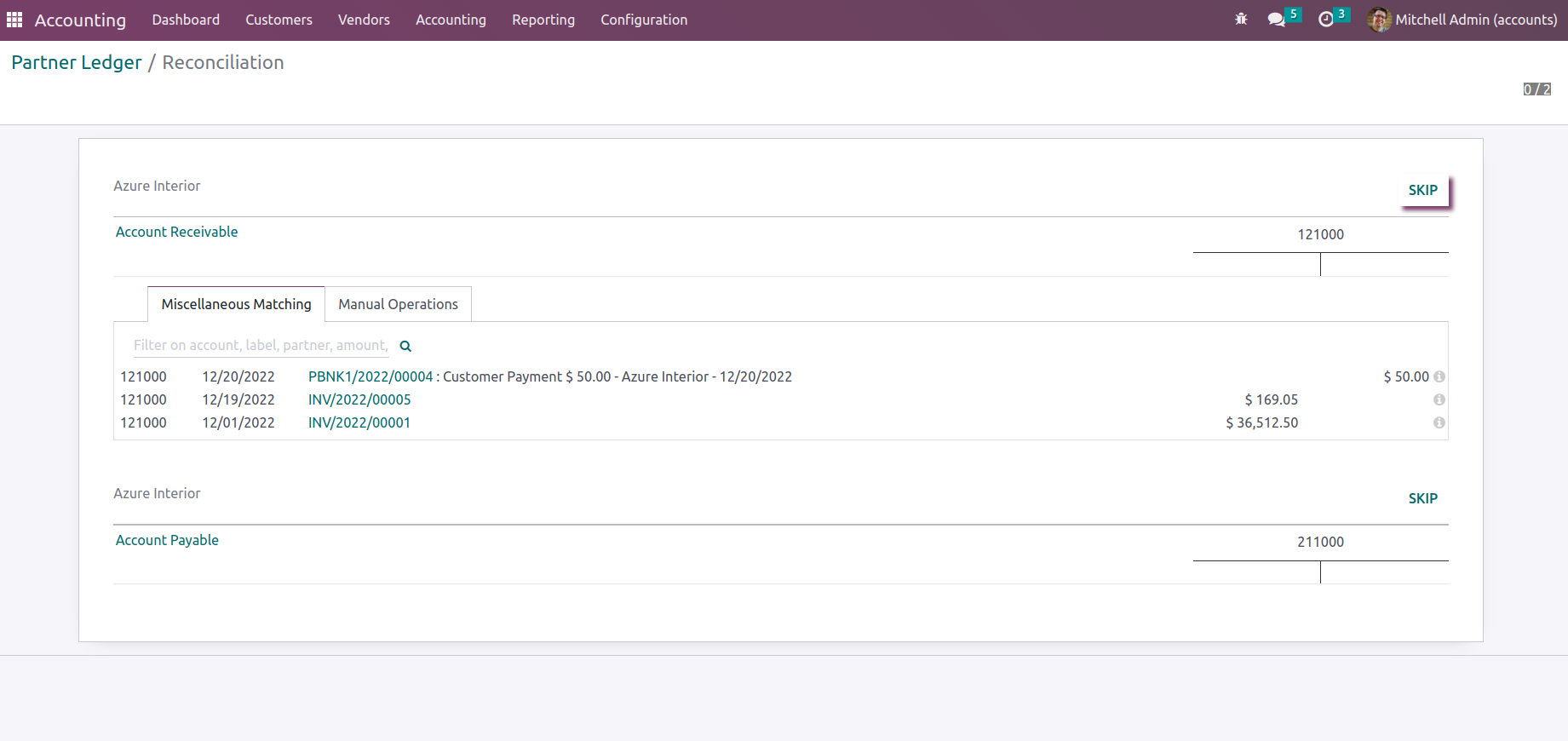

To reconcile the financial entries that have been defined in relation to the partner operations, select one of the Reconcile choices under each of the Partners that have been defined in the Partner Ledger. After clicking Reconcile, you will be taken to the Partner's specific Reconcile window where you can choose whether to reconcile or not.

The Partner Ledger reporting feature of the Odoo Accounting module will give you information on how the financial operations of the Partners compare to those of the business. Additionally, you will be able to sort out the necessary information using unique filtering and grouping tools, making it a crucial tool for the organization. Let's move on to the next partner-based report type in the Odoo Accounting module, the Aged Receivable reporting menu, now that we are clear on how the Partner Ledger reports function.

Aged Receivable

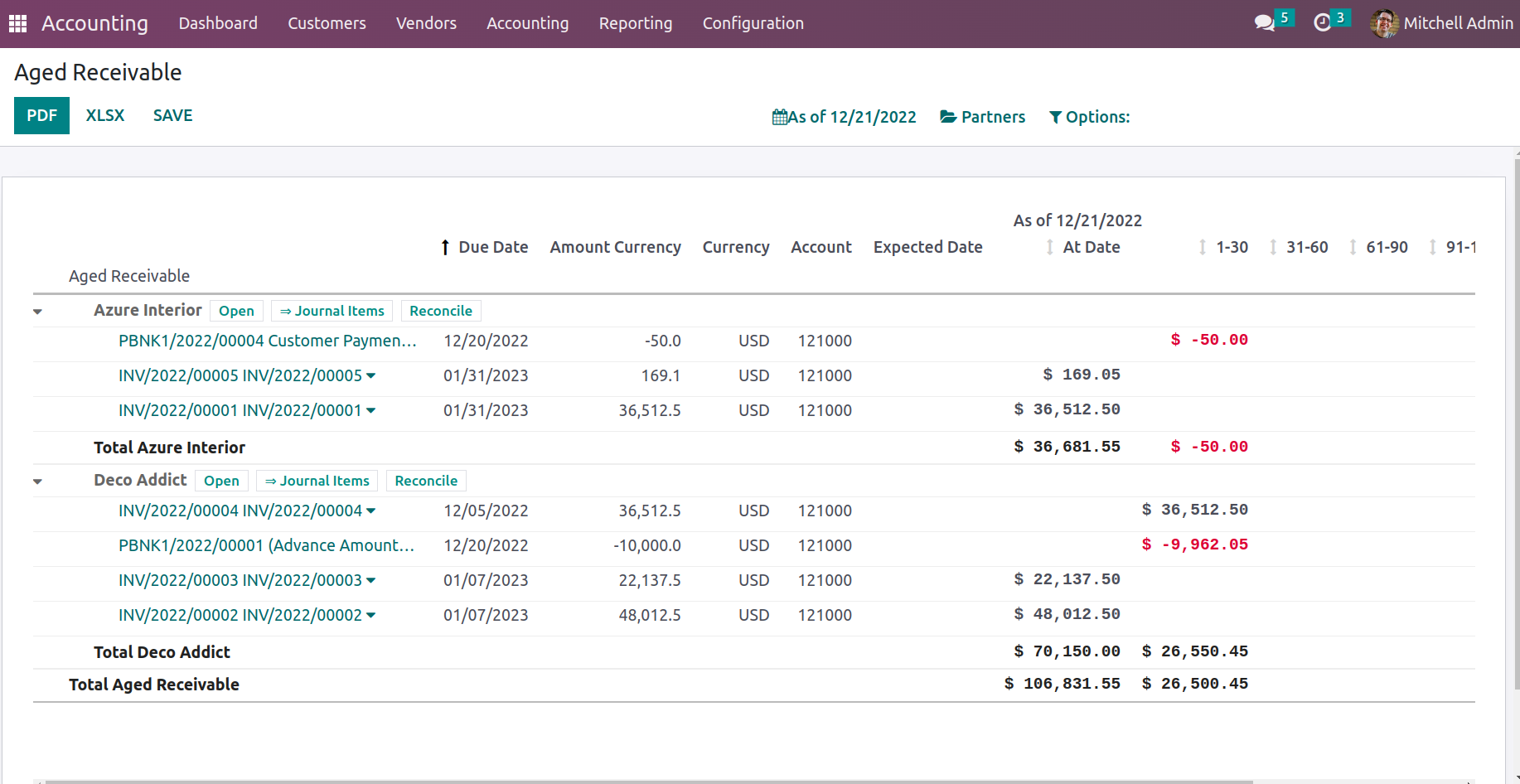

When a partner or customer's payment for the purchase of goods and services is delayed, they fall under the company's category of aged receivable payments. Even after the specified payment term has passed, the Delayed Amount will really be classified as an Aged Receivable. Assume the payment term is 10 days and the invoice date is December 1st, 2022. Therefore, the payment is regarded as Aged Receivable if the customer hasn't made it even after the applicable payment term, which is by 10 December 2022.

As a result, when December 22nd rolls around, this amount is Aged Receivable in 1-30 days. This classification will make it easier for the company to thoroughly follow up on the payment, ensuring that you get paid before it's too late. Aged Receivable reporting will be essential to the business in Odoo, where managing the company's operations is of the utmost significance. The Aged Receivable reports, which fall under the Partner-based reports of the company using the Odoo Accounting module, will provide you a better knowledge of how the delayed payments that have not yet been received by the company operate.

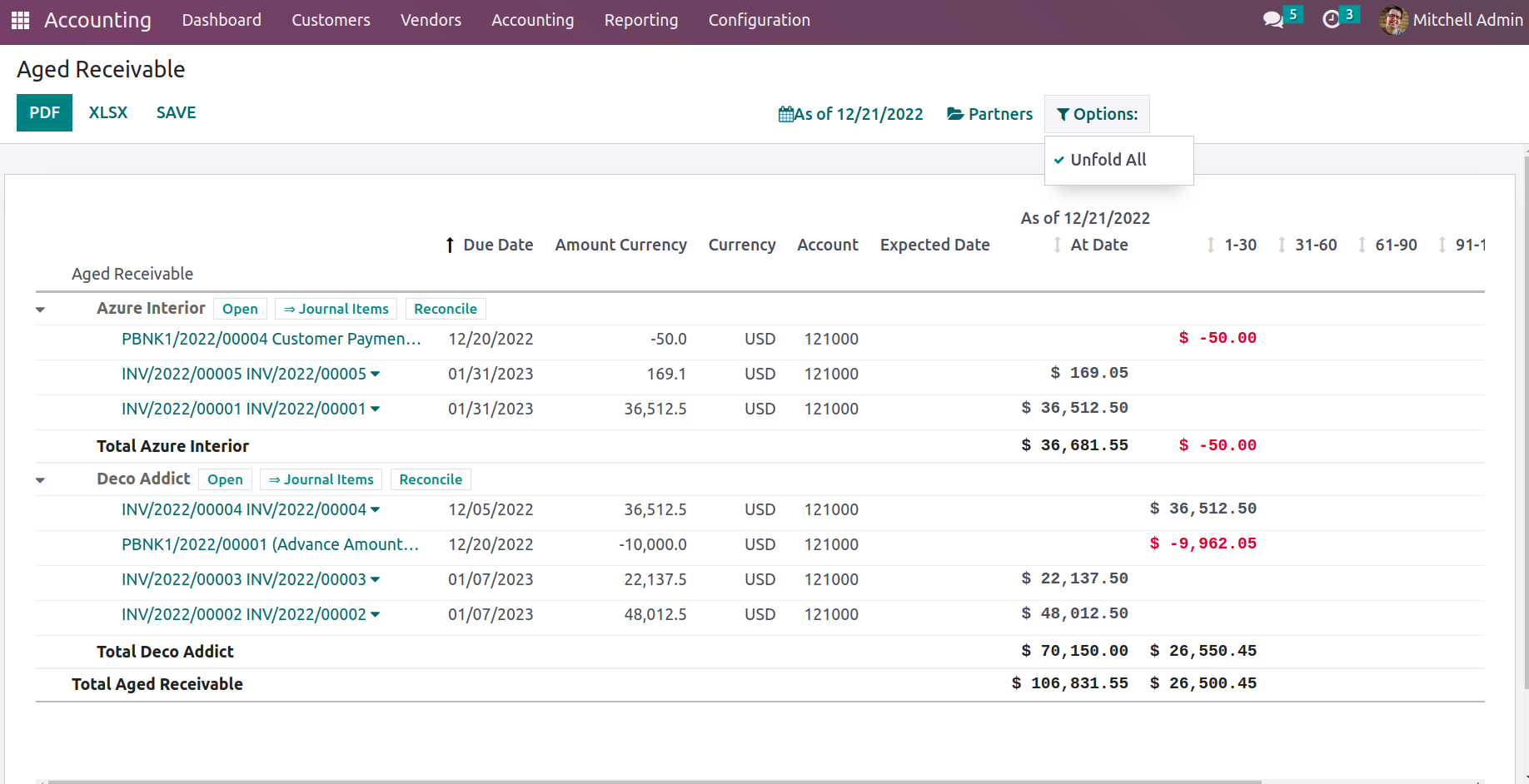

The Reporting tab of the Odoo Accounting module provides access to the Aged Receivable reports. According to the partners and customers who are currently in business, the Aged Receivable entries will be shown here. With the available drop-down arrow options, all entries pertaining to the partner will be shown and accessible. Here, the partner or client information will be shown, and when the arrow is dragged down, the invoice information that is included in each of their aged receivables will be shown in a separate way. Additionally, the Report Date, Journal Details, Amount Involved, and Expiration Date are all shown as 1- 30, 31-60, 61-90, 91-120 and older ones, respectively, to indicate the amount to be paid if the payment is prolonged based on the length. The total sum due will also be shown in the end. The Aged Receivable reporting menu, which defines all Aged Receivable items, is shown to you in the screenshot below.

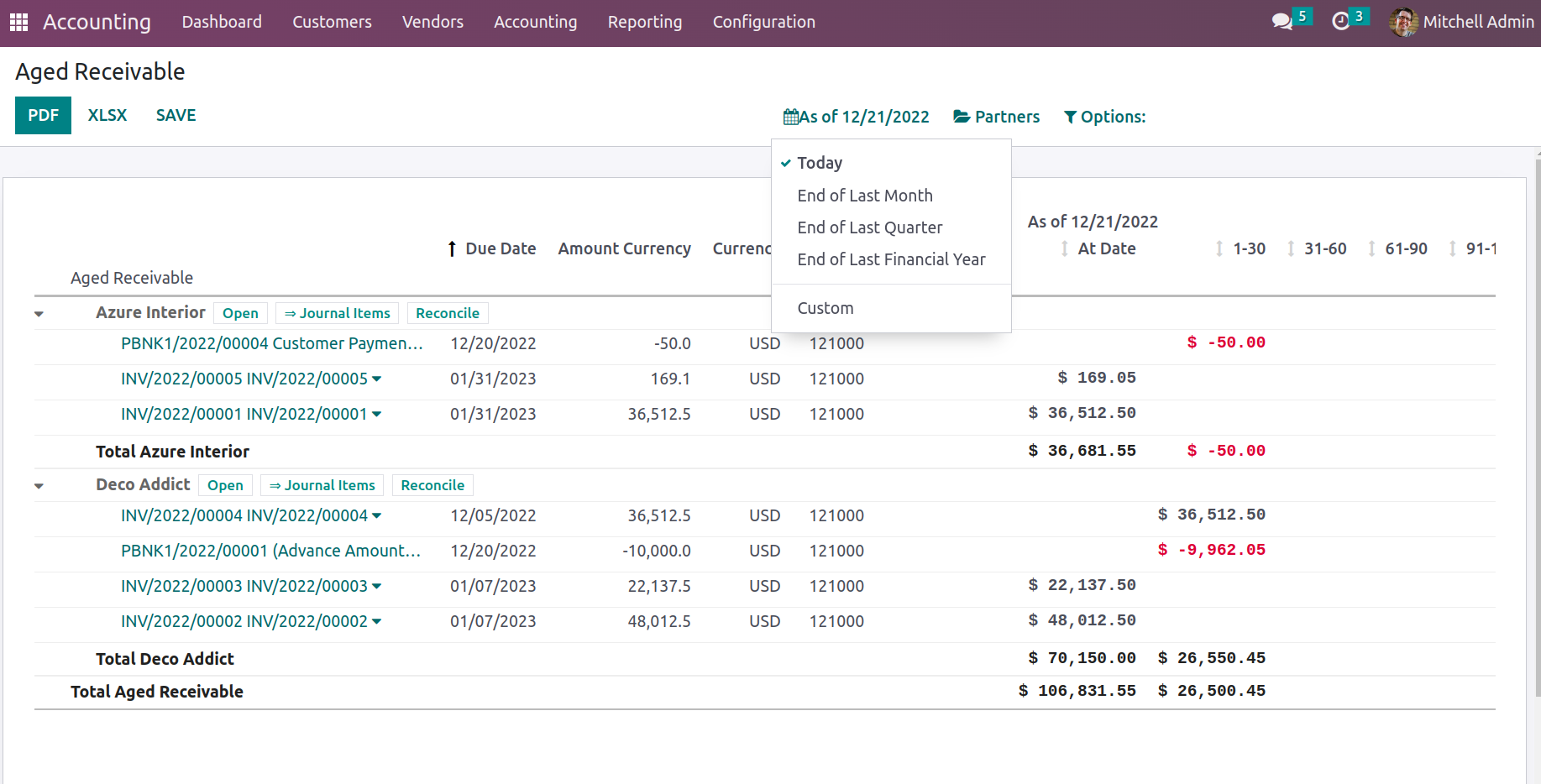

Additionally, the distinct filtering and Group by features will assist you in organizing the information according to your needs. You can use both the standard tools and the available custom ones to aid in sorting processes here. As seen in the following screenshot, the fiscal period can be used as the basis for the first filtering.

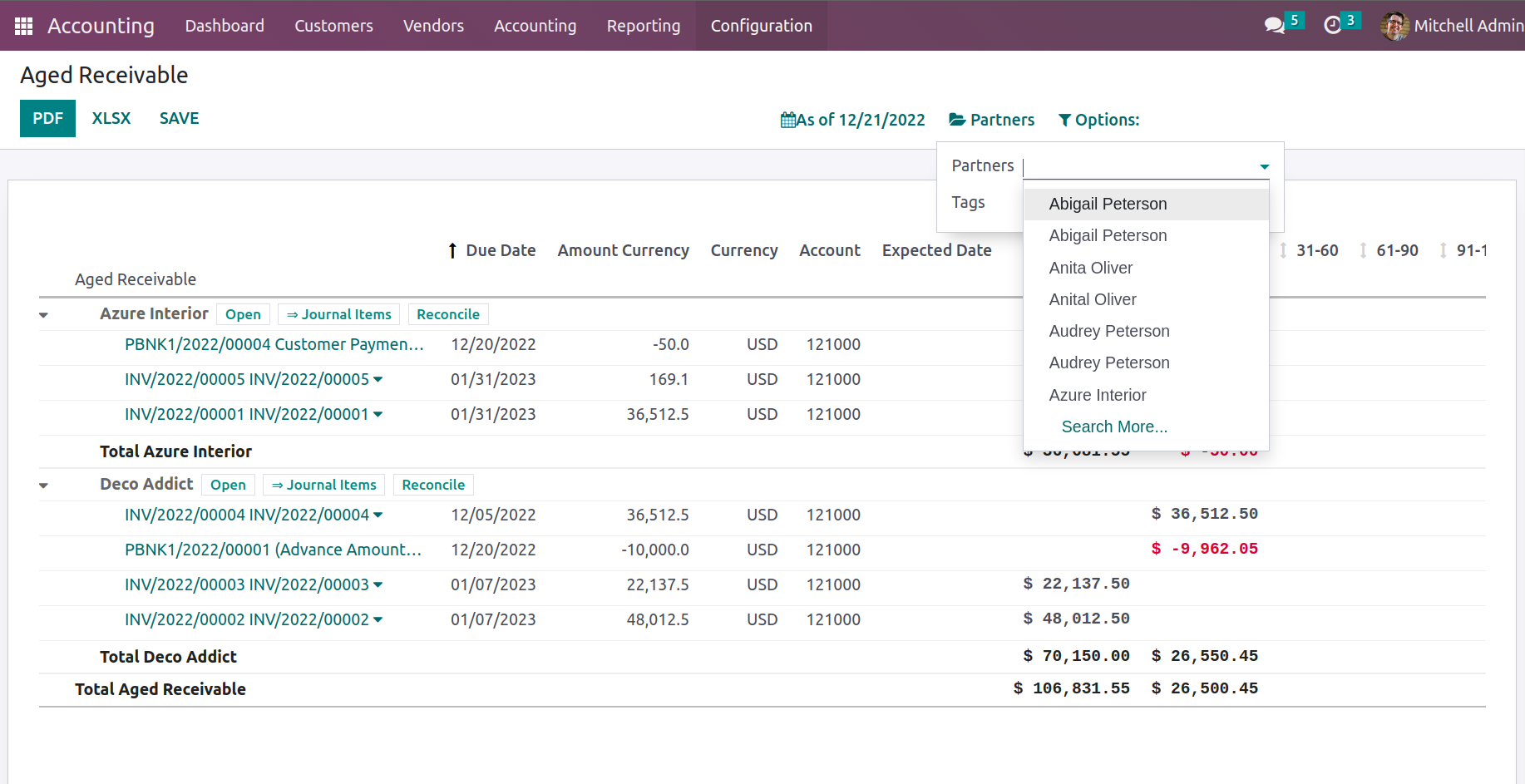

The Partner-based filtering tool will then be presented, where the Partners and any associated tags will be established and available for selection from a drop-down menu. You will be given a list of all the operational Partners and the Tags assigned, from which you can select.

You can select Unfold All Filtering under the Options tab, in which case all entries for Aged Receivable will be shown to you. Additionally, there are buttons that allow you to print reports in the PDF and XLSX formats. The Store button allows you to save reports to the appropriate area in the Documents modules so you can save your financial records.

Let's move on to the following phase, where the next partner basis to report the Aged Payable reports is being defined, now that we are clear on the Aged Receivable report function, which is provided in the Accounting module of the Odoo platform.

Aged Payable

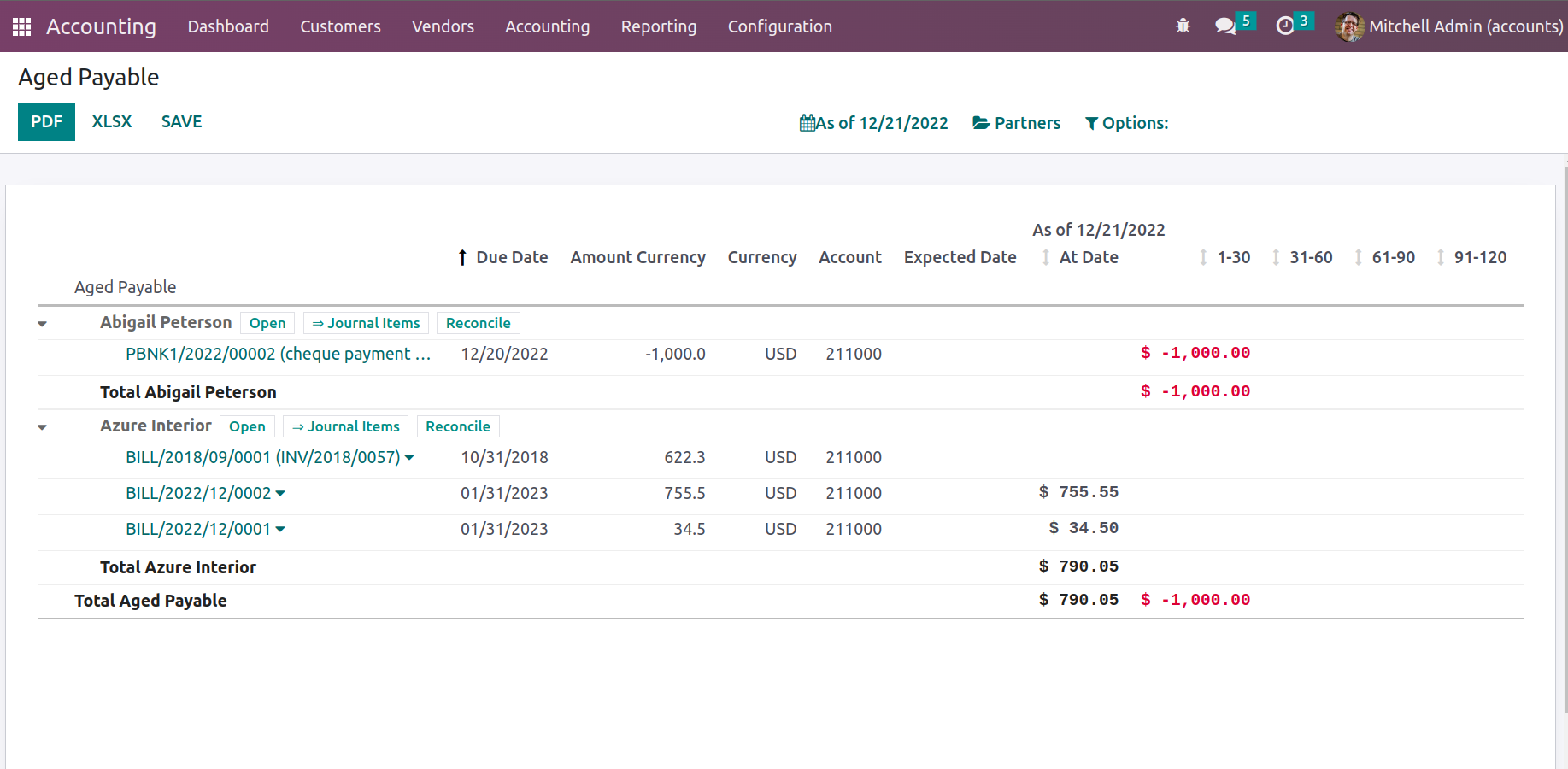

The Aged Receivable reports that are valid in the Odoo Accounting module are identical to the Aged Payable reporting feature in Odoo. The report, however, will be based on the late payment that your business must make to the partner.

You will be able to comprehend the aspect of the delayed payments that you should have done with the help of this reporting functionality. The Partners or Vendors of Business Operations will be defined, and the Aged Payable entries about each of them will be defined in the Aged Payable reports, just like the Aged Receivable reports.

Likewise, the entries of the Aged Payable reports will show the Report Date, Journal details, Amount involved, the Expiration date is any depreciation increase the amount as the duration passed will be depicted as 1- 30, 31-60, 61-90, 91-120 and older ones indicating the amount to be paid if the payment is extended based on the duration. The total amount due will also be shown in the end. The Aged Payable reporting menu, which defines all Aged Receivable items, is shown to you in the screenshot below. The Aged Payable report has filtering options that are comparable to those in the Aged Receivable reports, as shown in the screenshot below.

Now that we are clear on all the partner-based reporting tools, let's move on to the next portion of the chapter. These are all the partner-based reporting tools that are available in the accounting module of the Odoo platform. The definition of management reports will be provided in the chapter's next section.