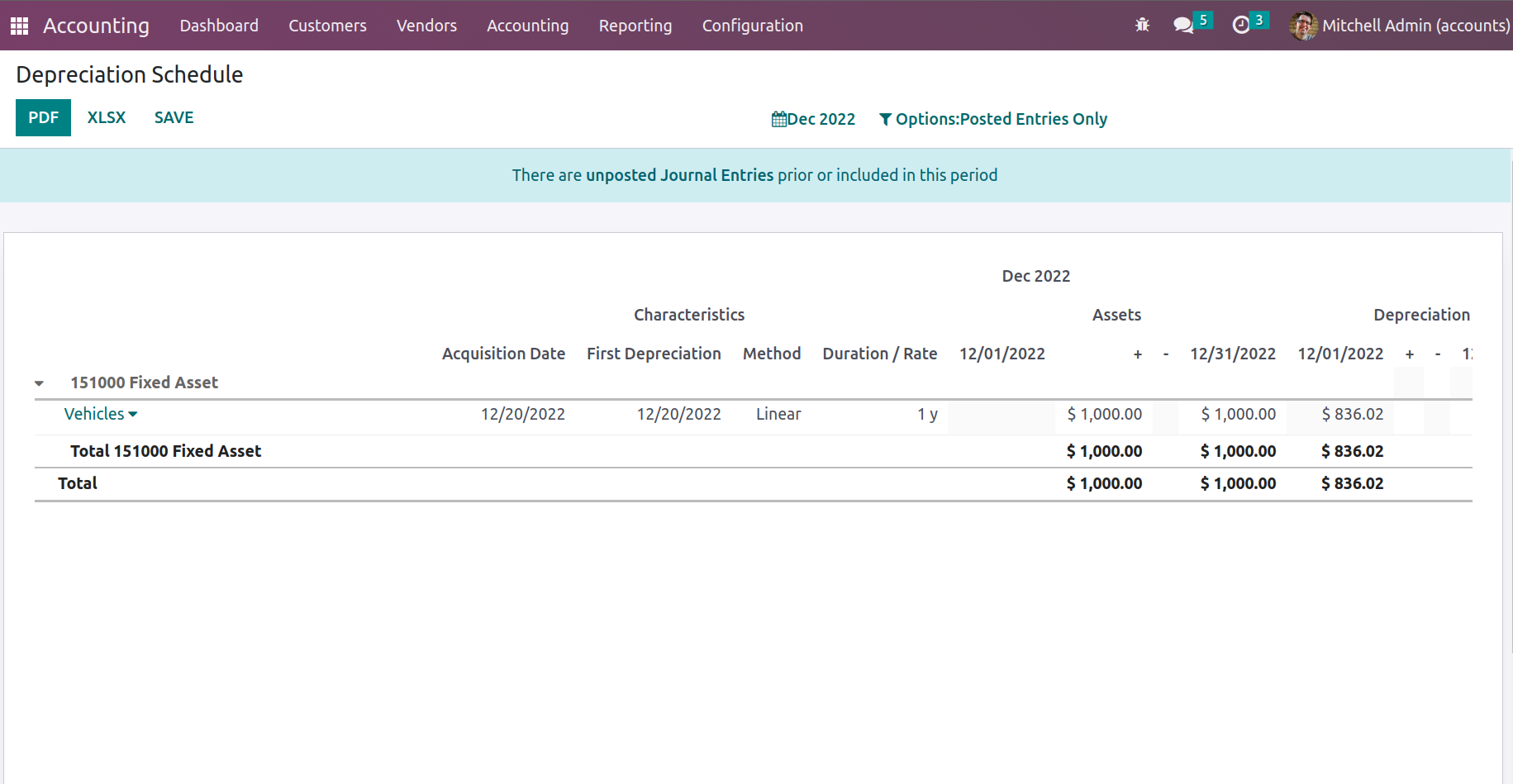

The Depreciation Schedule-based reporting will give you information on how quickly an asset that has been identified for use in your firm is depreciating. Your business may define the assets that you've already identified. The Accounting module's reporting tab provides access to the Depreciation Schedule reporting option. The reports on the Depreciation Schedule will be displayed once you choose the option, as seen in the following screenshot. Operations will define the Asset-based Chart of Accounts along with any Journals that are defined on it.

In addition, the definitions of Characteristics elements like Acquisition Date, First Depreciation, Method, and Depreciation Rate will be provided. The specifics of the asset will be defined in terms of the months and length of operation. Additionally, a representation of the asset's depreciation during the specified time period will be shown. The book value information pertaining to the Depreciation Schedule for each asset will also be defined.

Additionally, you will have Filtering and Group by tools that are available just as in all other menus on the Odoo platform, depending on the Fiscal period or the entries. These options for filtering and grouping are those that come standard, and the custom ones can be created using the noble tools. These specifically defined ones can be kept as Favorites for further use in the Depreciation Schedule reporting features filters.

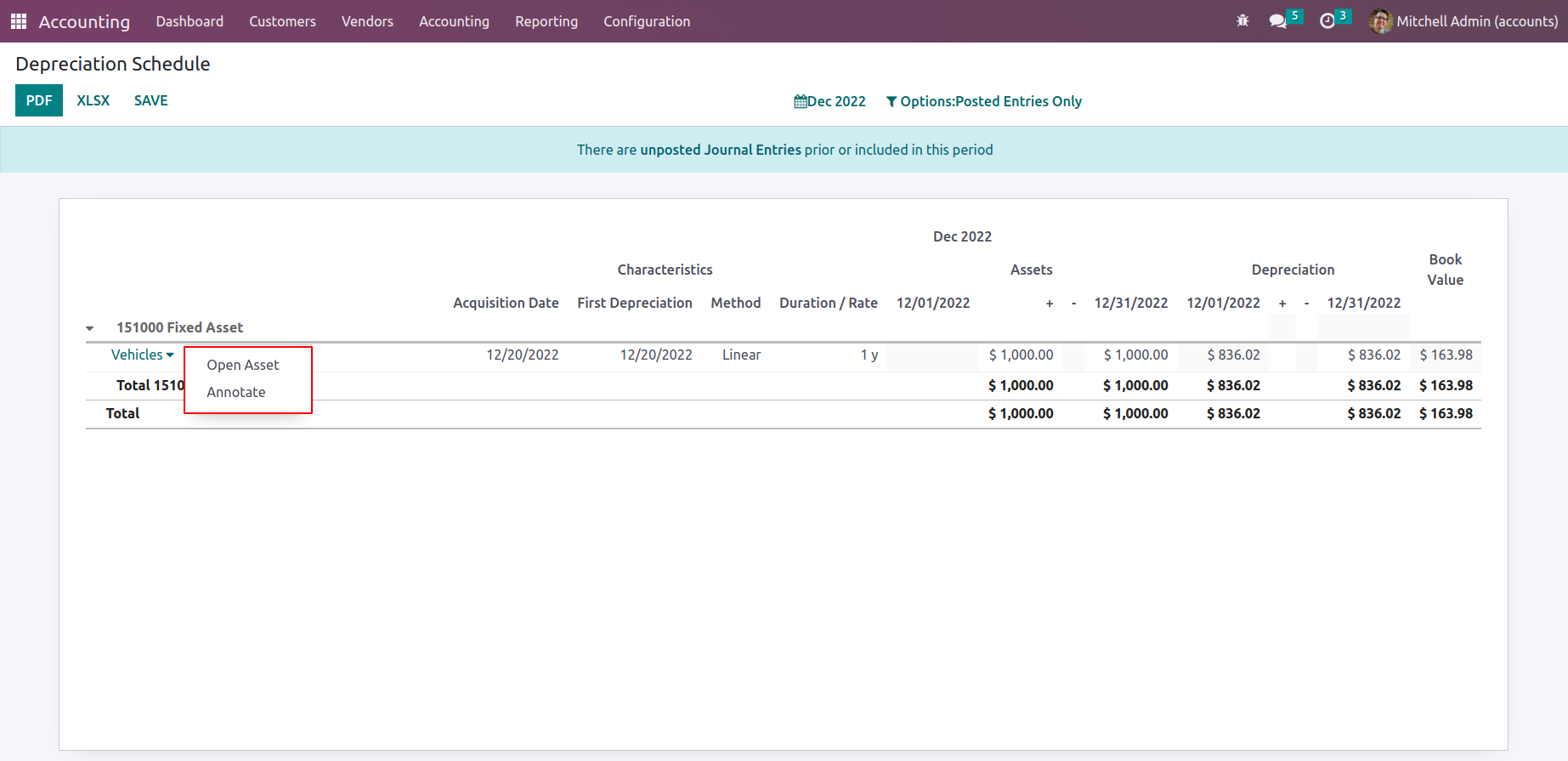

To get more information about the Journal and the entries defined in it, you can pick each of the entries under the relevant Chart of Accounts.

To get more information about the Journal and the entries defined in it, you can pick each of the entries under the relevant Chart of Accounts.

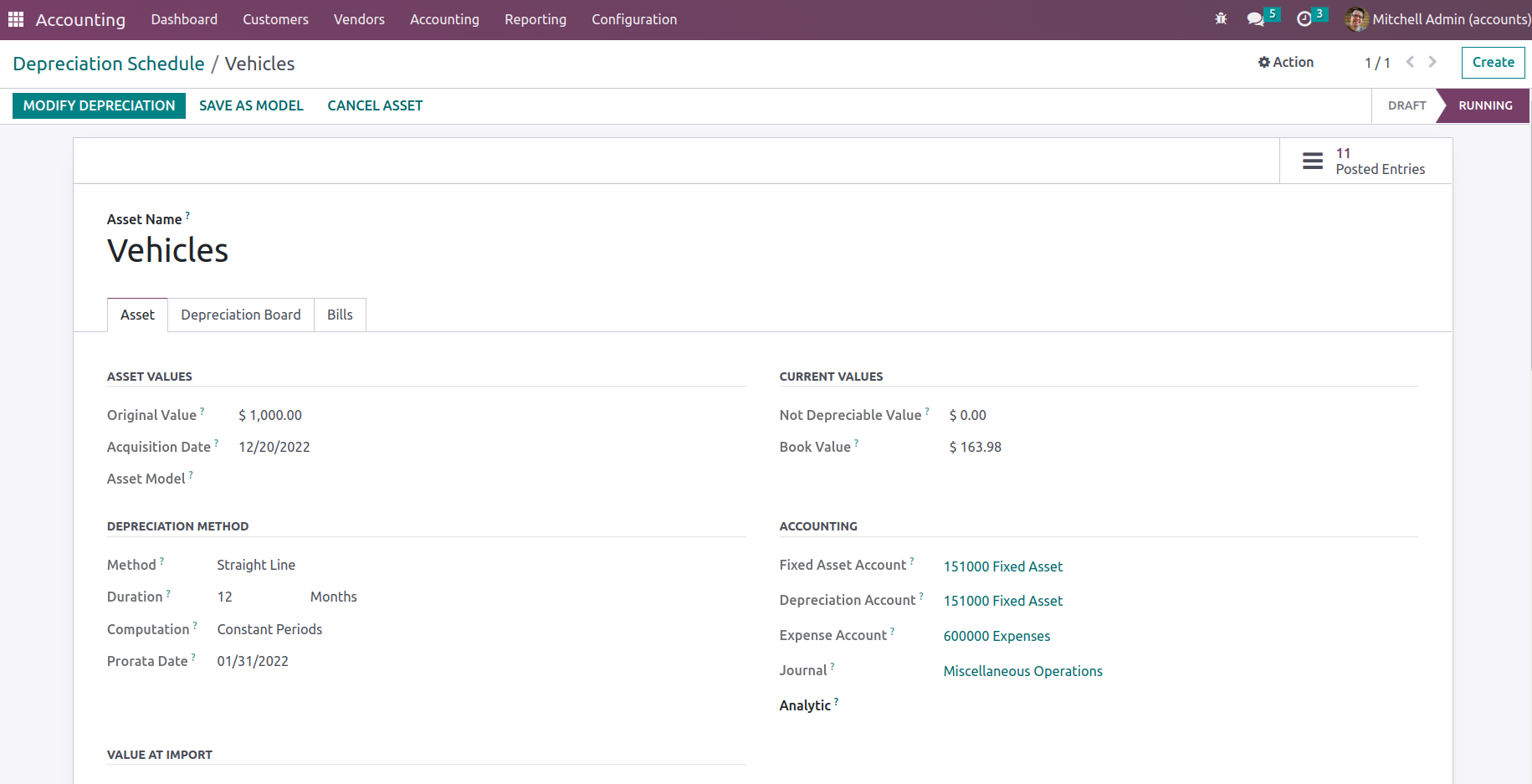

To access the asset details, click Open Asset.

By using the available Edit option, you may also choose to edit the journal's specifics. The option to sell, dispose of, re-evaluate, and suspend the asset depreciation is provided by the MODIFY DEPRECIATION. The choices to sell or dispose of the asset are listed under "Sell or Dispose." By choosing the available Re-evaluate option, you can change the depreciation in relation to the asset. entries that have been posted in relation to an asset that has been defined in smart tabs.

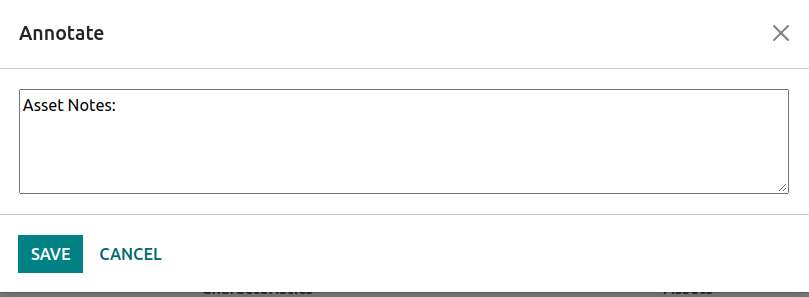

The Annotate window, which is displayed in the accompanying screenshot, will appear once you choose the appropriate Annotate option for the Journal that is defined in the Depreciation Schedule. You can define a description for the Annotate operations and save the activities using the Save option.

The Odoo platform's Depreciation Schedule reporting tool, which is available, will give you complete insight into all aspects of your company's asset depreciation as described there. Let's move on to the following section, where the Budget Analysis reporting of the Odoo Accounting module will be defined, now that we are clear on the Depreciation Schedule procedures.

Invoice Analysis