Deferred Revenues refers to components of revenues that are received by the company in advance, even before the goods or services are provided to a client. The company's advanced use of revenue management in its accounting processes will help make subscription-based goods and services more effective. This is due to the fact that a subscription-based good or service, such as a newspaper, milk delivery, or magazine, is paid for in advance for a month or a set amount of time.

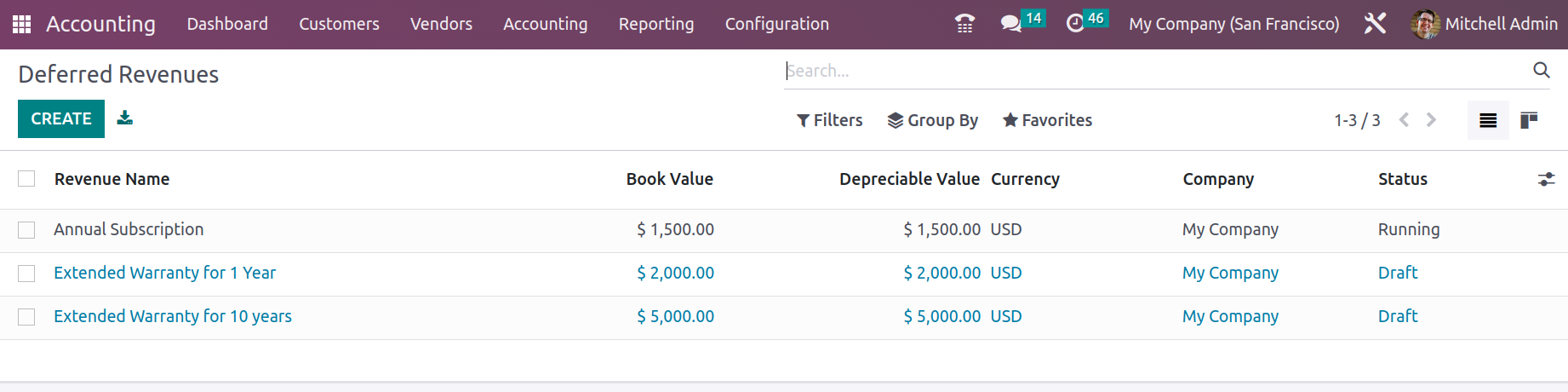

The management of the company's deferred revenues can be facilitated by a special menu found in Odoo Accounting management elements. Instead of maintaining the financial aspects of subscription-based items on outdated journals and ledgers, this function will assist you in managing them in an upgraded system. The Accounting tab of the Odoo Accounting module leads to the Deferred Revenues menu. The menu will show all of the defined deferred revenues along with their names, first depreciation dates, book values, depreciable values, companies, and statuses. As with all other menus on the Odoo platform, filtering and grouping options are available to assist us find the appropriate Deferred Revenue based on our needs. In addition to the Dashboard view, the menu may also be viewed in List view.

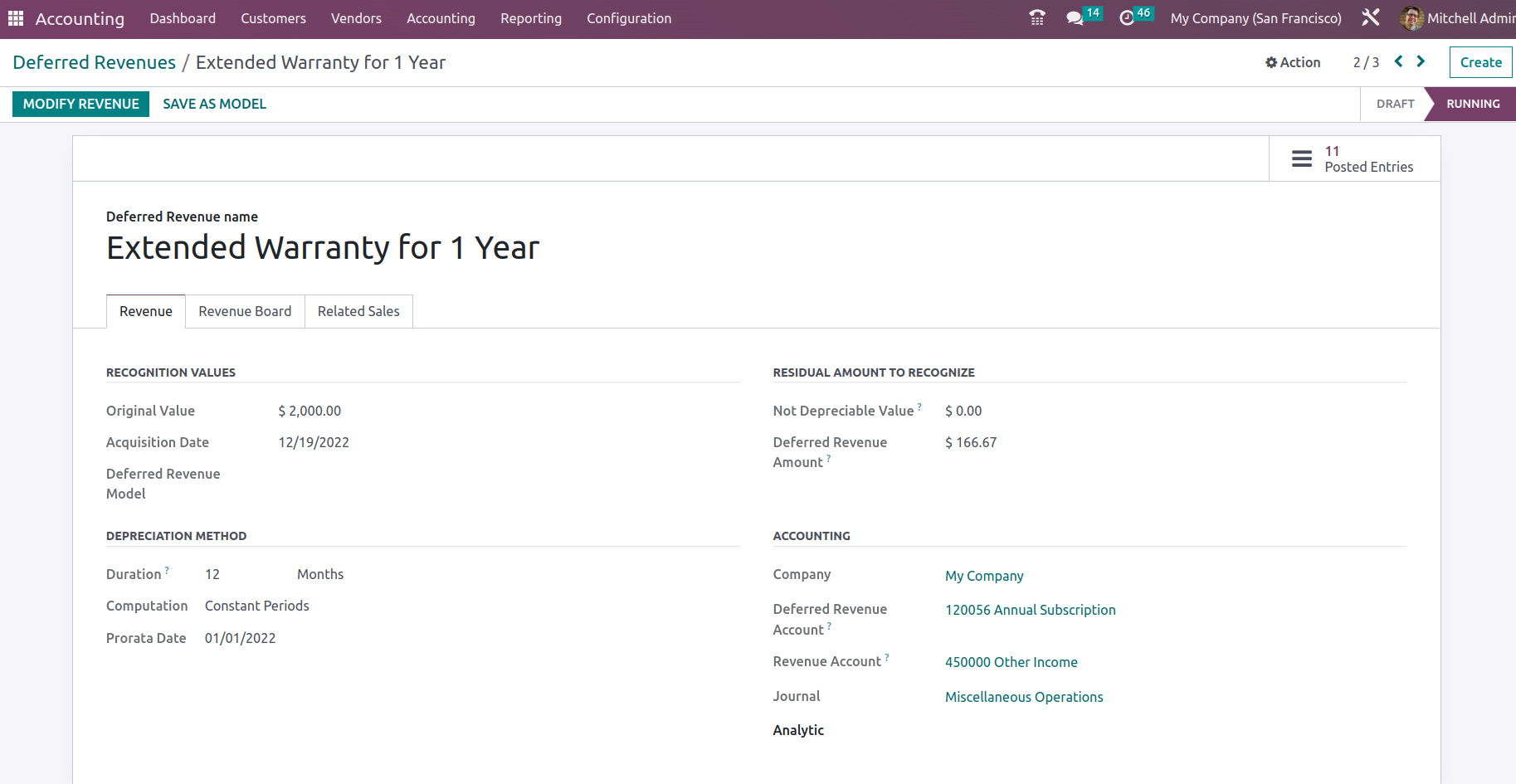

You can choose the Create option to bring up the creative menu and create new Deferred Revenues. This is displayed in the screenshot below. Here, it is possible to define the Deferred Revenue Name. Details such as the Original Value and the Acquisition Date can be defined in addition to the Asset Values. It is possible to define the current values components, including the currency, the residual amount to be recognised, and the quantities of deferred revenue.

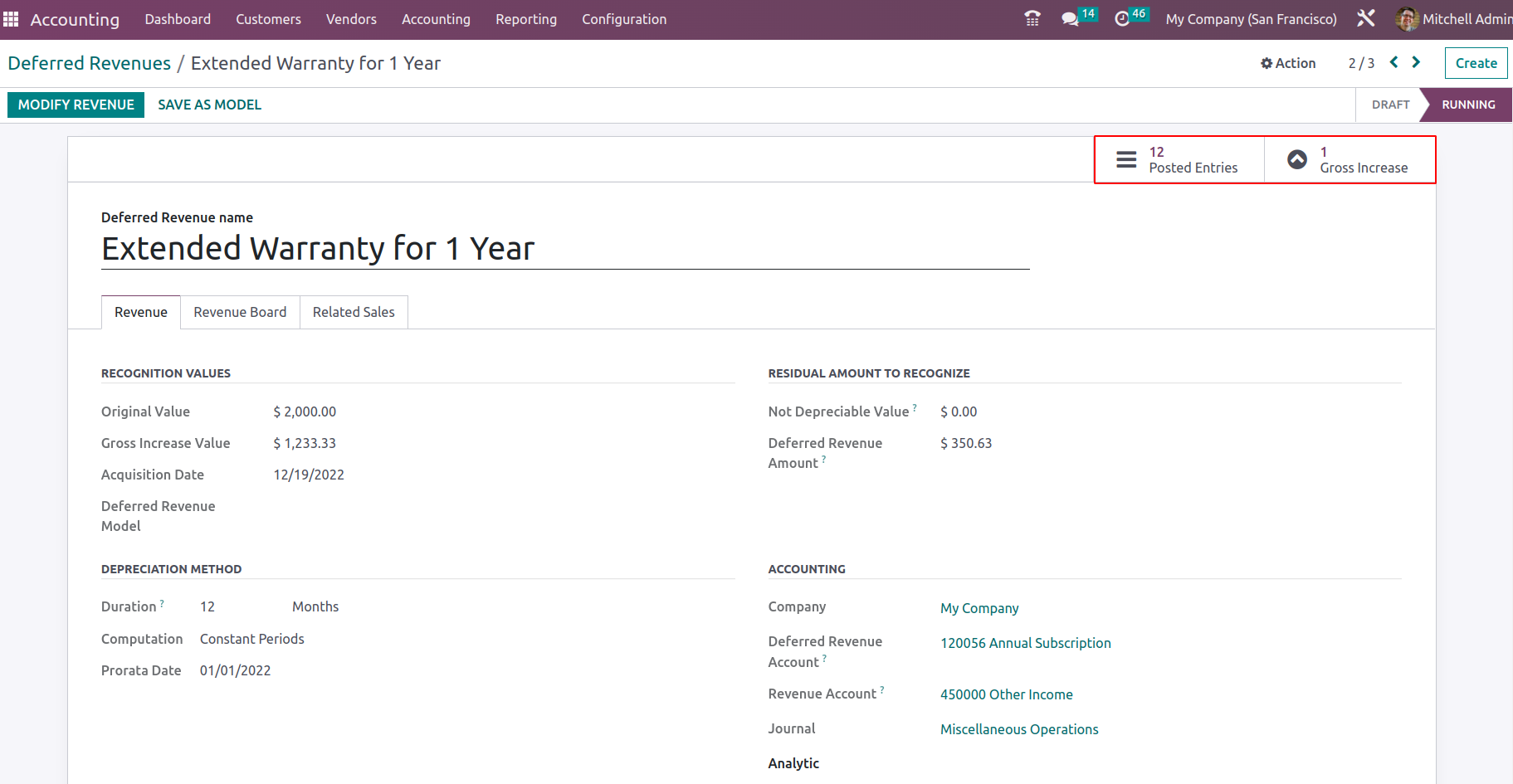

Additionally, there is a standout tab where the depreciation method, the number of recognitions, and whether the applicable deferred revenue's depreciation criteria are based on months or years can all be specified. Additionally, the accounting components can be configured by choosing them from the drop-down menu, including the Revenue Account, which is used to record revenue, the Deferred Revenue Account, Journal information, Analytical Account, and the Analytic Tag. Additionally, the account to record deferred income whose account type is Current Liabilities is the Deferred Revenue Account. Since the consumer has not received the entire service when money is made from it, the corporation will actually become liable for this.

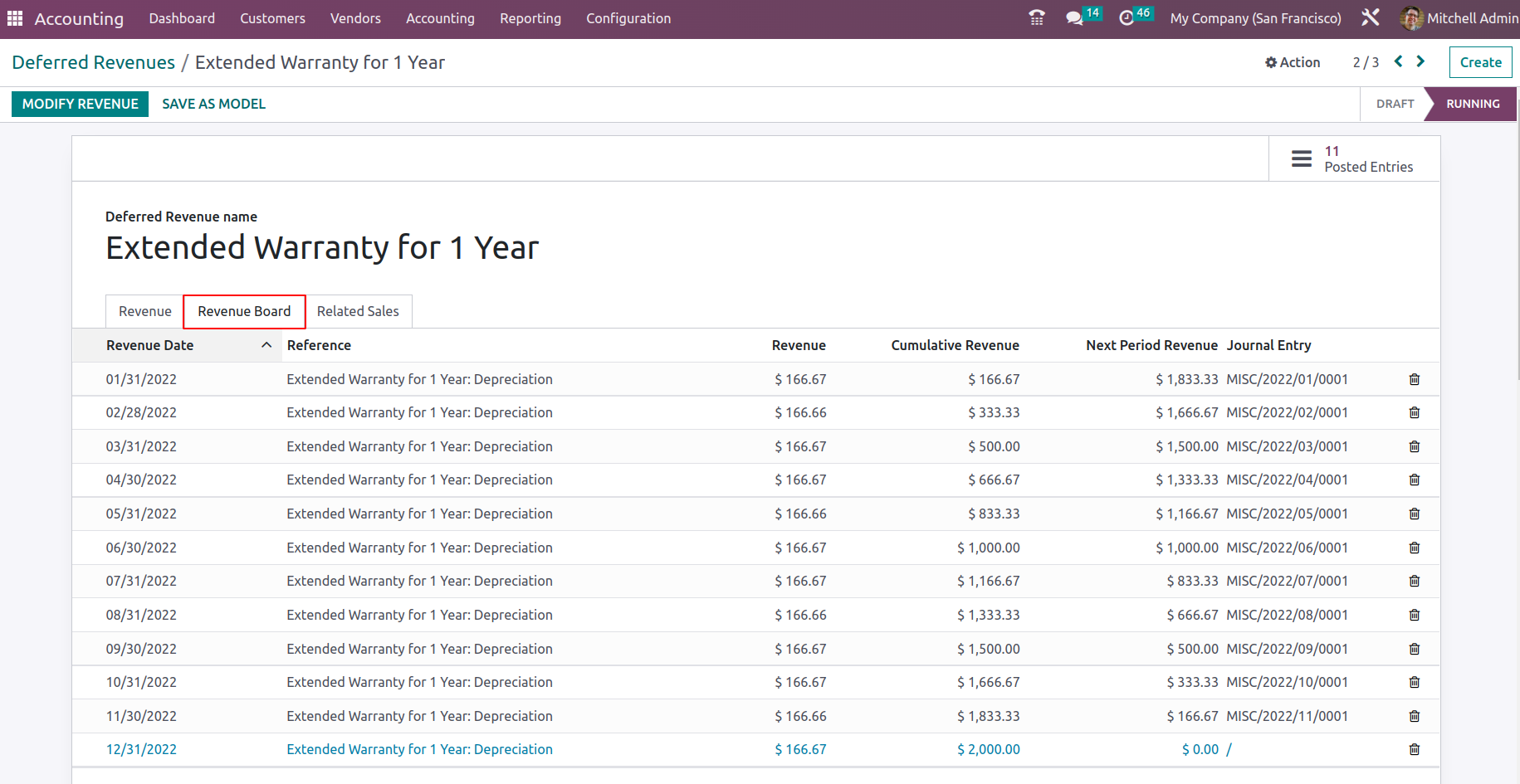

Once all of the deferred revenue's components have been established, save the menu and confirm the deferred revenue by choosing the Confirm option, which will make the deferred revenue operational. The Revenue Board, which will be auto-calculated and defined based on the contrarians of the Deferred Revenue being defined, will be depicted as the Deferred Revenues are operational. Here, the Reference, Revenue Date, Revenue, Cumulative Revenue, Next Period Revenue, and the Journal details will be described.

The calculated value for each year based on the original value and the number of recognitions will be available to the Depreciation Board. The computation can be ‘No Prorata’, ’At Constant’, ‘Based on days per period’

Once it has been verified, you can locate the drafted journal entries in the smart tab Posted Entries, where you can either manually post them to the appropriate accounts or have them post automatically on the accounting date if the Auto-Post option is chosen as the At Date. As a result, the income and deferred revenue are added to the balance sheet and profit and loss report, respectively, at the beginning of each period. Additionally, you will have the option to remove any Revenue Board information or Deferred Revenue lines.

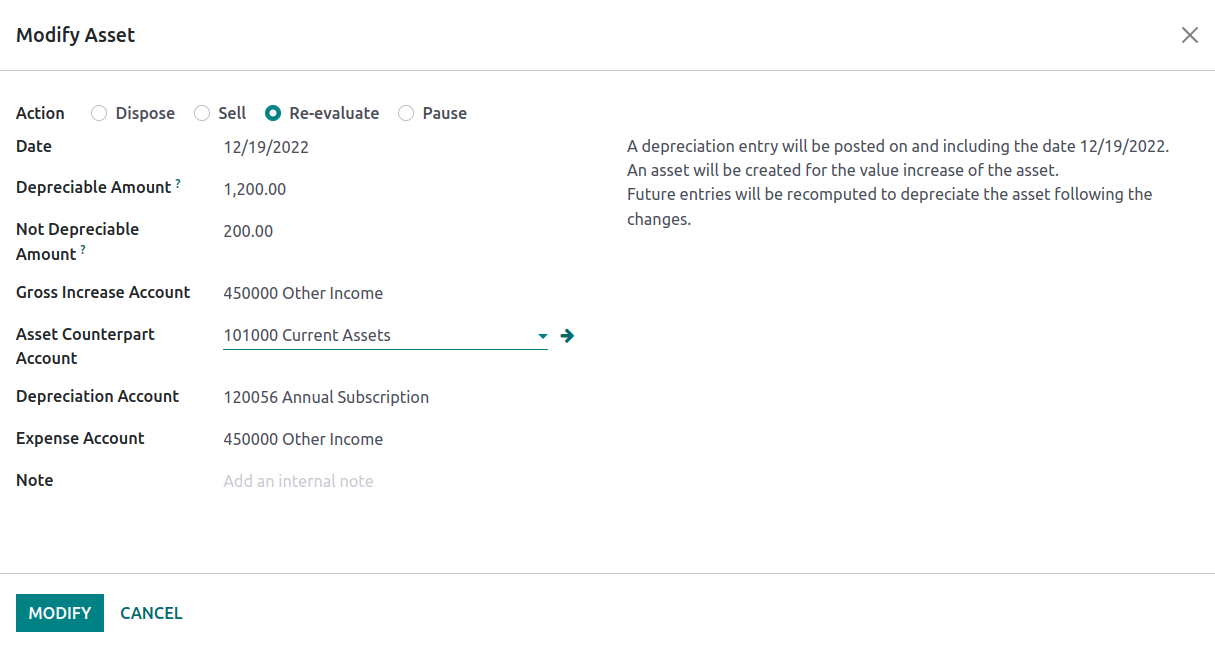

There will also be a Modify Revenue option in the menu outlined above if you need to change any parts of the deferred revenues. When you choose the Modify Revenue option, a pop-up window similar to the one in the accompanying screenshot will appear, allowing you to specify the various characteristics of the Modified Deferred Revenue. First, it is possible to specify the Reason for the Modification and the Date on which it will occur. Furthermore, the number of depreciations and their duration, which can be specified in months or years, can be used to establish the New Values for the Deferred Revenue. Additionally, the specifications of the Non-Depreciable Amount can be stated alongside the Depreciable Amount.

Additionally, the increased Accounts details, such as the Asset Gross Increase Account, Account Asset Counterpart, Account Depreciation, and the Account Depreciation Expense, can be established by choosing the appropriate account from the drop-down menu that has been defined. The next step will be to choose the Modify option, which will modify the Deferred Revenues in accordance with the set parameters, once all of these aspects have been configured.

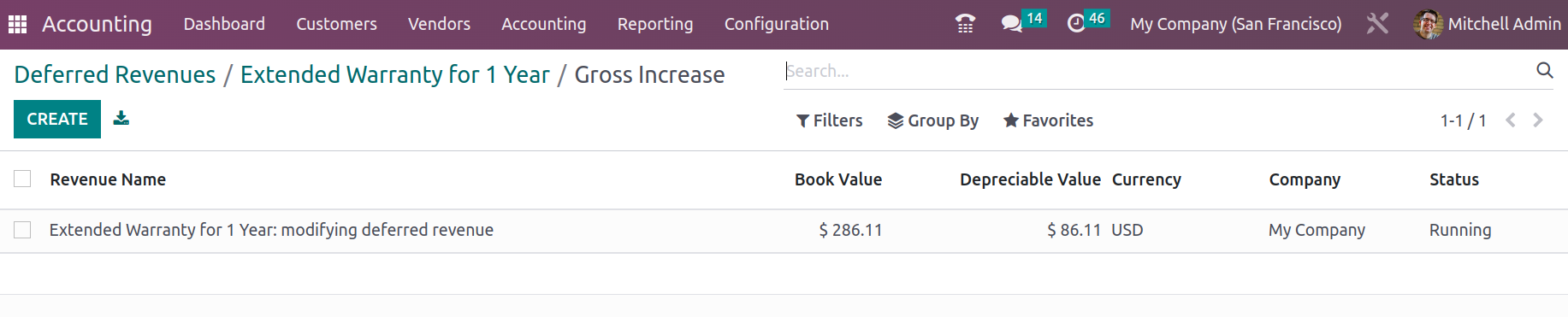

When you return to the relevant Deferred Revenue, you will note that the Revenue Modifications have been explained and that a new smart choice to check the Gross Increase is now accessible on the dashboard.

When you choose to view the Gross Increase, a window similar to the one in the accompanying screenshot will open. The Revenue Name, First Depreciation Date, Book Value, Depreciation Value, Currency Details, and Status will all be defined in this section under the description of the Gross Increase Details. As with all other menus on the Odoo platform, there are choices for Filtering and Grouping by, which assist us find the appropriate Gross Increase if several have been established based on the situation.

The other factors that should be taken into account with regards to the Deferred Revenue operation may be found in section 3.3.2. To have a thorough grasp of them, refer to the Automating Deferred Revenue and Deferred Revenue Models sections. You may effectively define the financial management of the subscription product using the management option for Deferred Revenue. Now that we are clear on the components of the deferred revenue, let's move on to the definition of the deferred expenses in the following section.