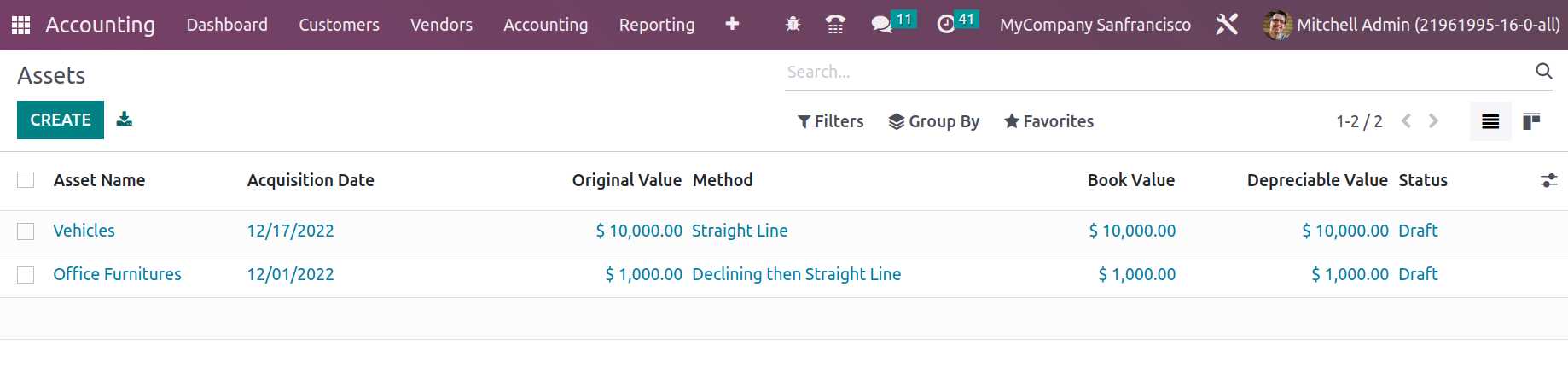

An important component of financial management operations is the management of the company's assets. The management parts of the organizations may get out of hand when their financial and non-financial assets develop along with them. As a result, it is imperative to have a specific Assets management system or tools. All of the company's assets can be defined in the Accounting module of the Odoo platform, which has a dedicated Assets management menu. You can choose the Assets option from the Accounting menu in the module to access the option, which will display the window as seen in the screenshot below. All defined assets are shown here along with their names, first depreciation dates, book values, depreciation value currencies, and asset statuses. In order to obtain the appropriate Assets from the menu, you may also use the filtering and grouping options that are offered.

You will have the opportunity to edit the defined Assets by choosing them from the menu, and you can use the Create option to create new Assets. You will see the form shown in the following window after choosing to create new assets. You must first enter the Assets Name here before specifying the Assets Values, such as the Original Value and the Acquisition Date. Additionally, you may either choose the Asset from any connected transaction or directly input Asset Value to construct the Asset. Its acquisition price will be added to the asset value as a result. The following step is to define the current values, which can include the currency, non-depreciative value, depreciative value, and book value. In current values, only the currency and non-depreciable values are updated. The amount you will receive when you sell the item and it won't lose any more worth is known as the Non-depreciable value. As an illustration, if an asset has a value of 1000 and a Non-depreciable value of 200, the depreciable value will be 800, and it is this residual value that is used to determine how much depreciation will be applied.

Aspects of the depreciation method can also be described as straight line, declining, or straight line then declining. When an asset is depreciated using a straight line method, its value will not change over the course of the asset's use by the business or for the stipulated Duration. Declining depreciation is a form of asset depreciation where the value of the asset will decline in accordance with the supplied depreciation factor. A declining then straight line depreciation is one in which the asset value initially depreciates based on the established depreciation factor and then converts to a straight line model after a predetermined amount of time.

Additionally, the period of the Decline in years or months can be defined together with the Declining Factor. If asset depreciation is calculated using "No Prorata," "Constant Periods," or "Based on days per Period," it is specified in the Computation column. The specifics of each asset's current value can be defined in terms of elements like currency, not depreciable value, depreciable value, and book value.

Additionally, by specifying the Depreciation Amount, an Asset may be allocated to be operational with a Value at Import. The value at import configuration will make sure that the assets value is preserved when importing them from new software.

By choosing them from the drop-down menu of the appropriate choice that is accessible, the accounting components of the fixed asset, where we will be setting the Fixed Asset Account, Depreciation Account, Expense Account, Journal, Analytical Account, and the Analytical Tags, may be defined.

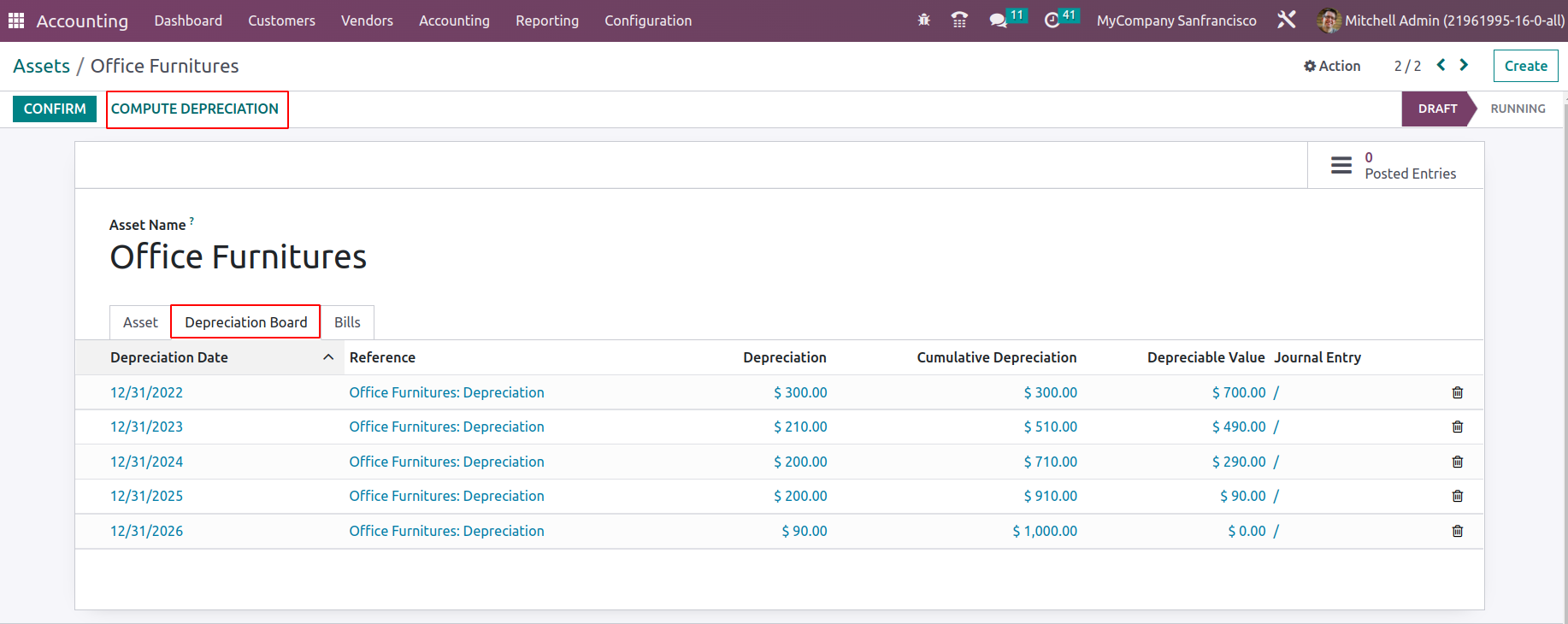

Once the asset's settings and details have been established, you can save the asset in the window and see options to compute depreciation. The depreciation of the asset will be calculated and presented in the depreciation board as seen in the following image after choosing the Compute Depreciation option. The computation and depreciation aspects will be defined here. The Depreciation Reference, Depreciation Date, Depreciation Amount, Cumulative Depreciation, Depreciation Value, and specifics of the Depreciation Journal Entry will be discussed.

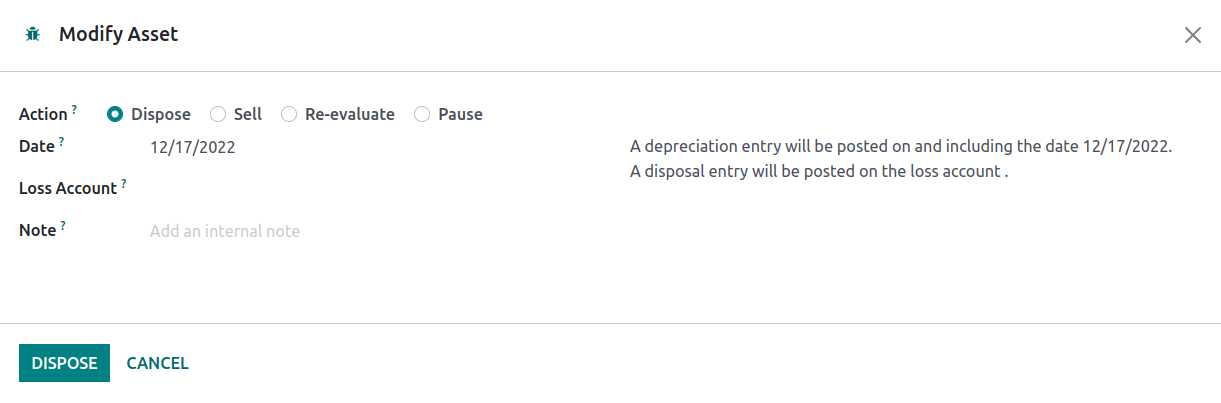

Once the Asset has been defined you can save the menu and Confirm the operations which will depict you the window with ‘Modify Depreciation’. This will enable various other Actions such as Dispose, Sell, Re-evaluate and Pause.

On disposing of assets one should add a Loss account at the specified field and depreciation entry will be posted on and including the specified date . A disposal entry will be posted on the loss account.

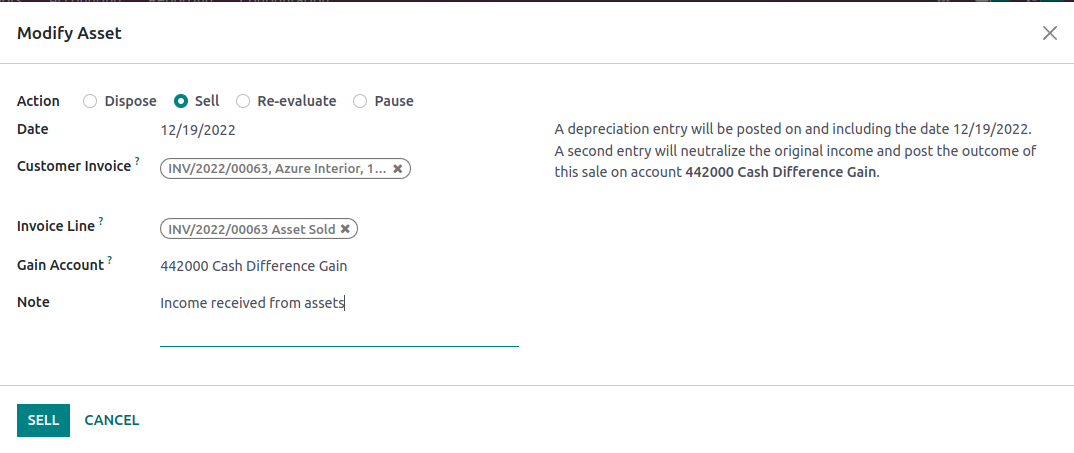

Sell option enables you to sell the assets. On choosing Sell , some details to be provided such as Customer invoice to which the asset has been sold. Thus the invoice line of the invoice will be autofilled. The gain account to which income received on selling the asset will be recorded and Note can be provided.

So a depreciation entry will be posted on and including the date 12/19/2022 and a second entry will neutralize the original income and post the outcome of this sale on account 442000 Cash Difference Gain. On selling the stage of the Asset will be moved to Closed.

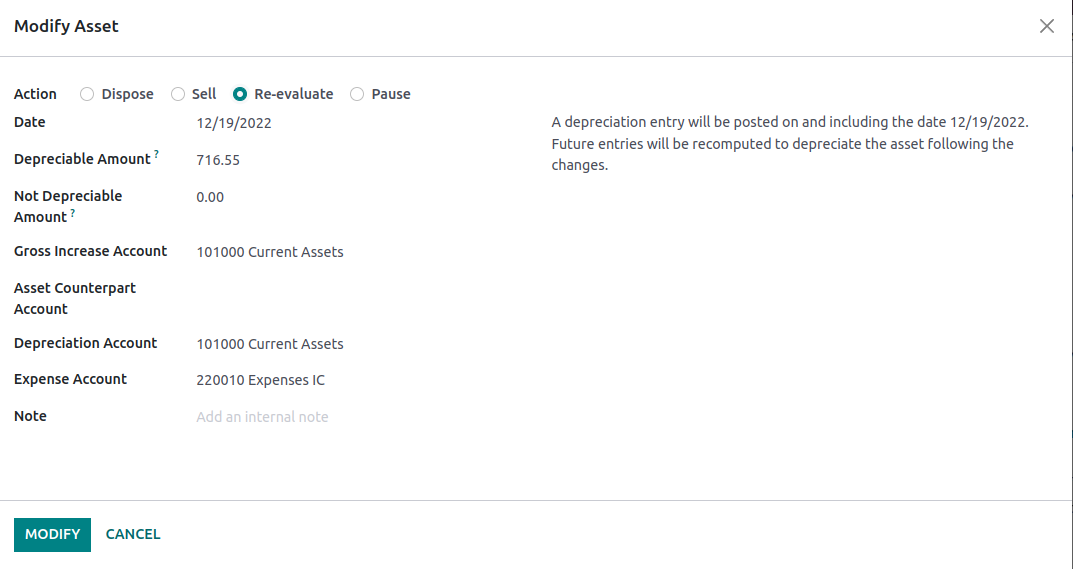

Re-Evaluate enables you to re-evaluate/modify your assets depreciation values.

On re-evaluating assets, the new depreciation amount will be updated at the Depreciable Amount field on which new depreciation will be calculated. Other details including Cross Increase Account, Asset counterpart Account, Depreciation Account, Expense Account and notes. Once details are added, modify the asset and the asset will be created for the value increase of the asset. Thus the future entries will be recomputed to depreciate the asset following the changes.

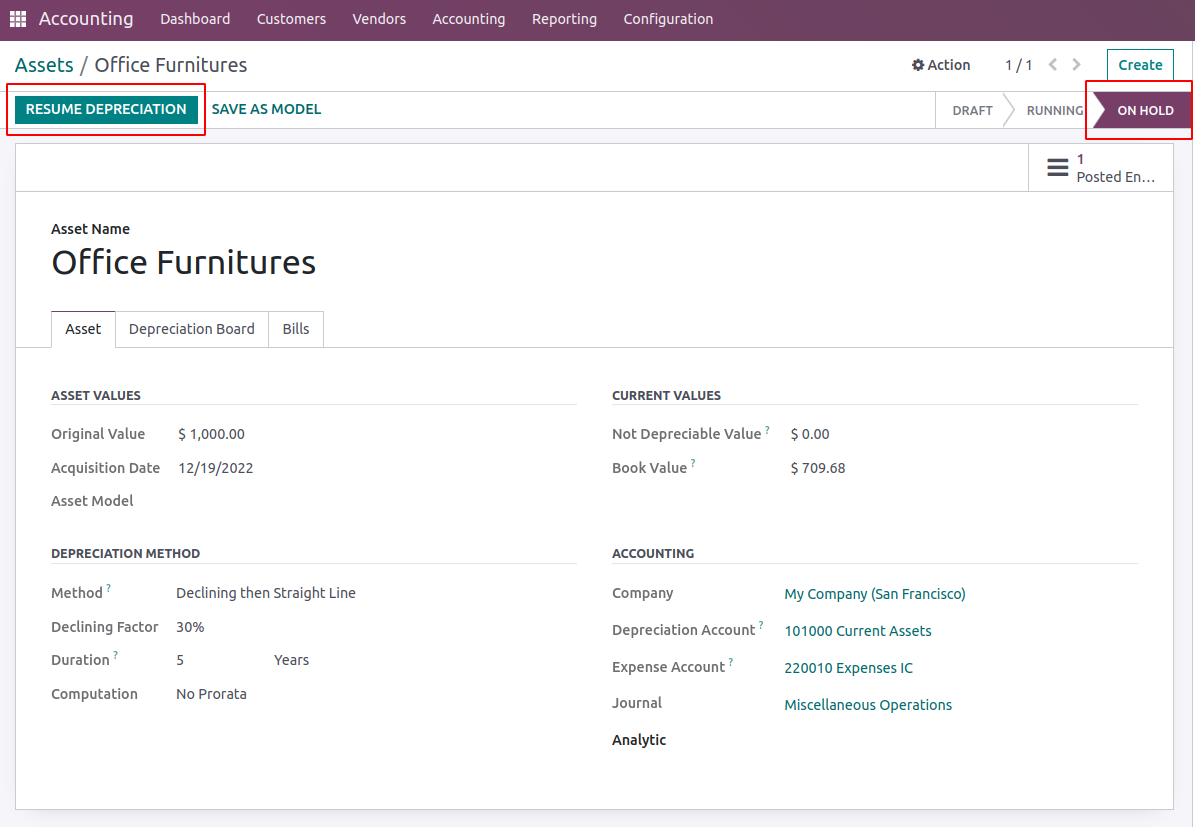

You can choose the Pause options and date which will pause the process of the Asset Depreciation and the status of asset moves to On-Hold.

Also we will be able to resume asset depreciation on clicking Resume Depreciation. So you need to provide the date, Duration, Depreciable Amount, Not depreciable Amount and Note to re-compute the future entries to depreciate the asset following the changes.

You may specify the various assets of the company in a clear and well-structured manner with the help of the Asset management menu, which is accessible under the Accounting module. It will also enable the Depreciation operations on these assets. To gain a better grasp of the operations features of the Assets, you can refer to section 3.3 of the book where the Asset Models, their configuration, and those aspects' definitions are given. Let's move on to the next portion of this chapter, where we will examine the components of the Deferred Revenues management menu included in the Odoo Accounting module.