The Odoo platform supports the financial management and accounting aspects with specific tools that are covered in this chapter. The Odoo Accounting module has a number of noteworthy Action management features in addition to its unique tools and features that will help with the efficiency of the company's financial management. You can establish the reconciliation operation and lock the dates for the financial processes with the aid of certain actions. Let's now examine the two Accounting Action tools that Odoo offers.

Reconciliation

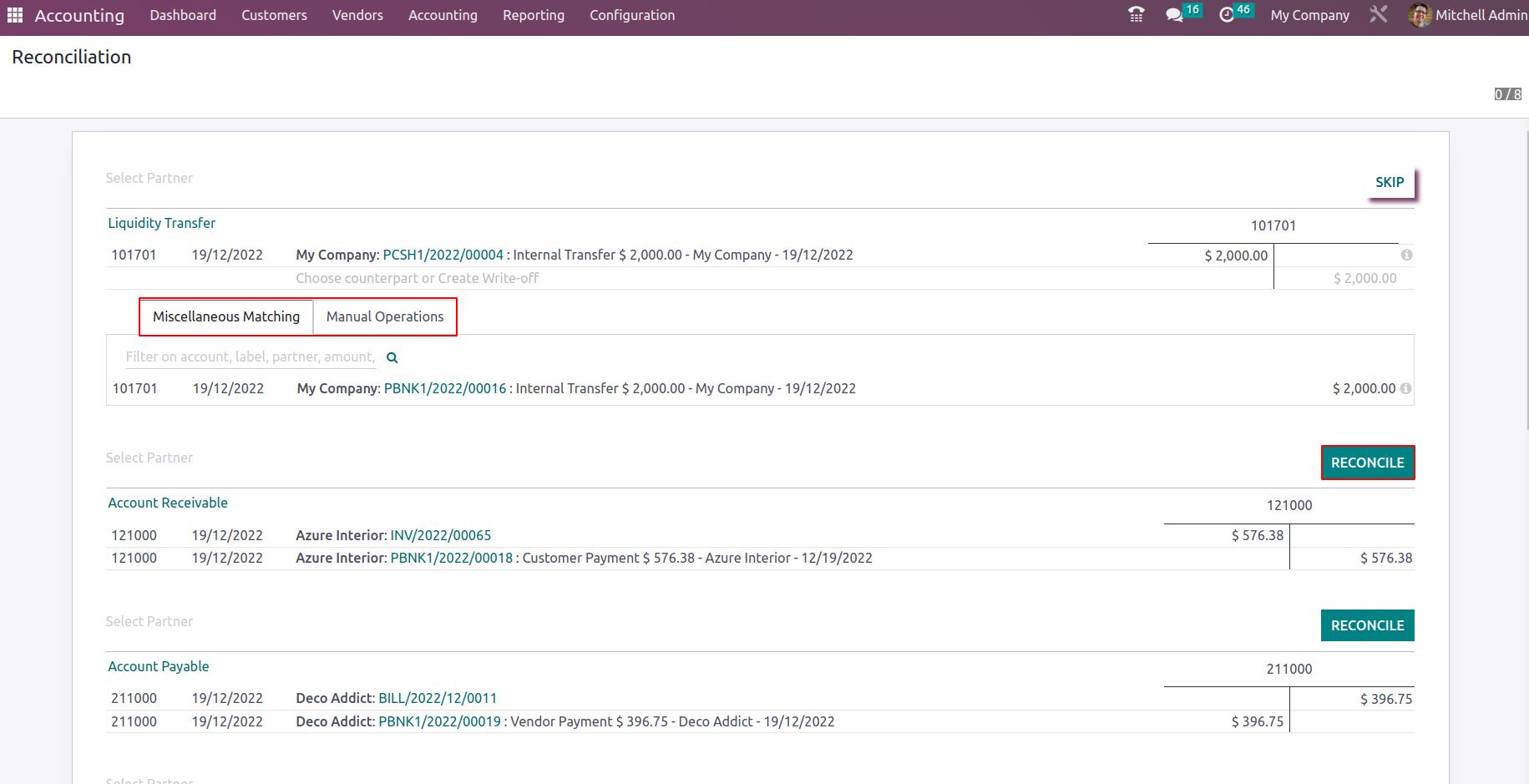

Reconciliation is a function that enables you to synchronize your company's accounting and financial management processes with those of a bank account operation, as well as with regards to the ledgers and the stated chart of accounts. The Reconciliation option will assist you in all Finance Management activities related to sales, purchases, and other corporate operations in a clear-cut manner. You may access the Reconciliation option from the Accounting tab of the Accounting module's Actions tab, and after choosing it, the Reconciliation window, as seen in the screenshot below, will appear.

Here, the company's entire payment-related features as well as its operational Chart of Accounts will be described. Each Chart of Accounts invoice information, together with the amount involved, will be listed for selection. You can also choose to skip a specific Chart of Account that has been defined by using the Skip option. Additionally, there is a Miscellaneous Matching tab beneath each defined Chart of Accounts that will define the invoices and bills along with the number, date, and amount.

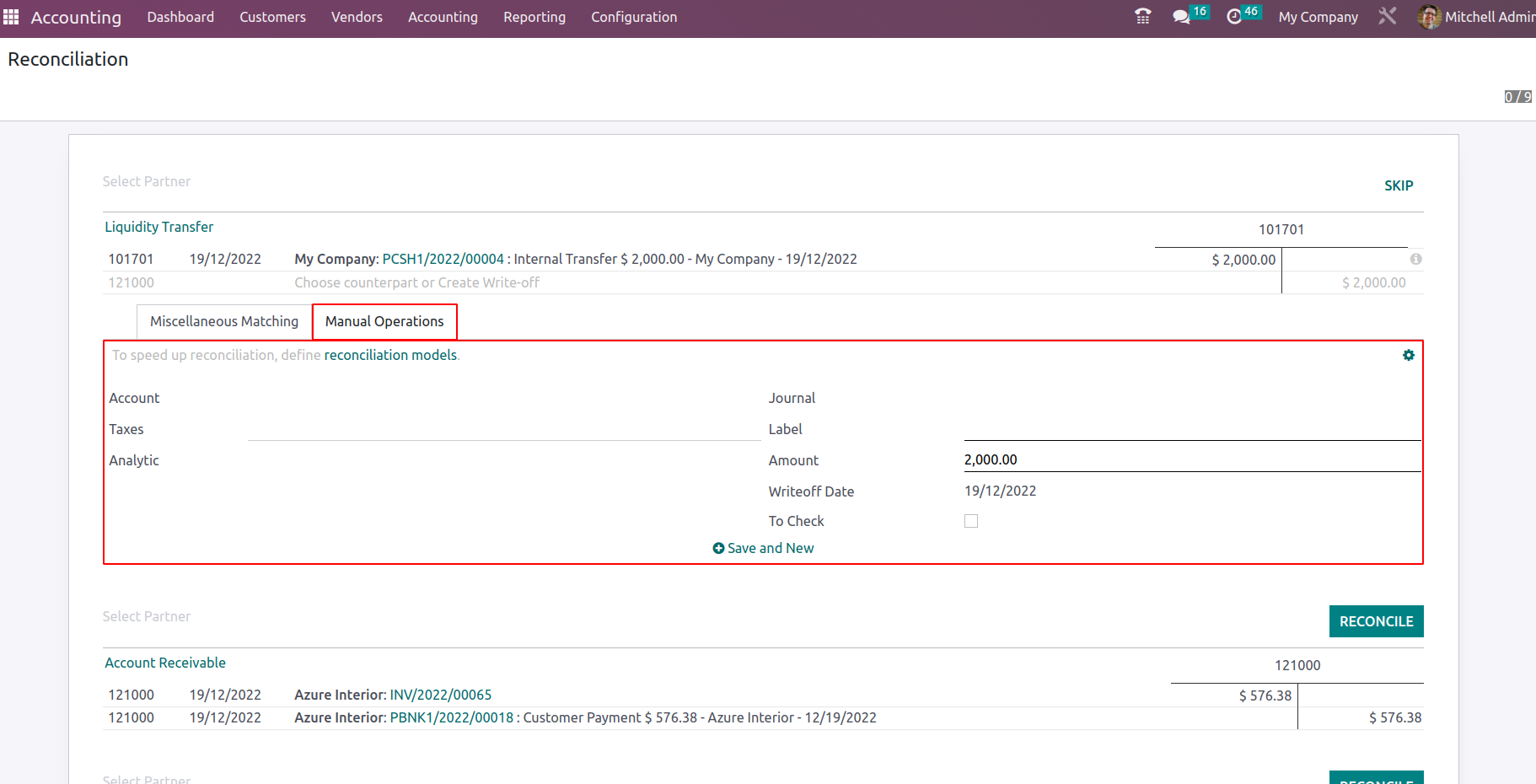

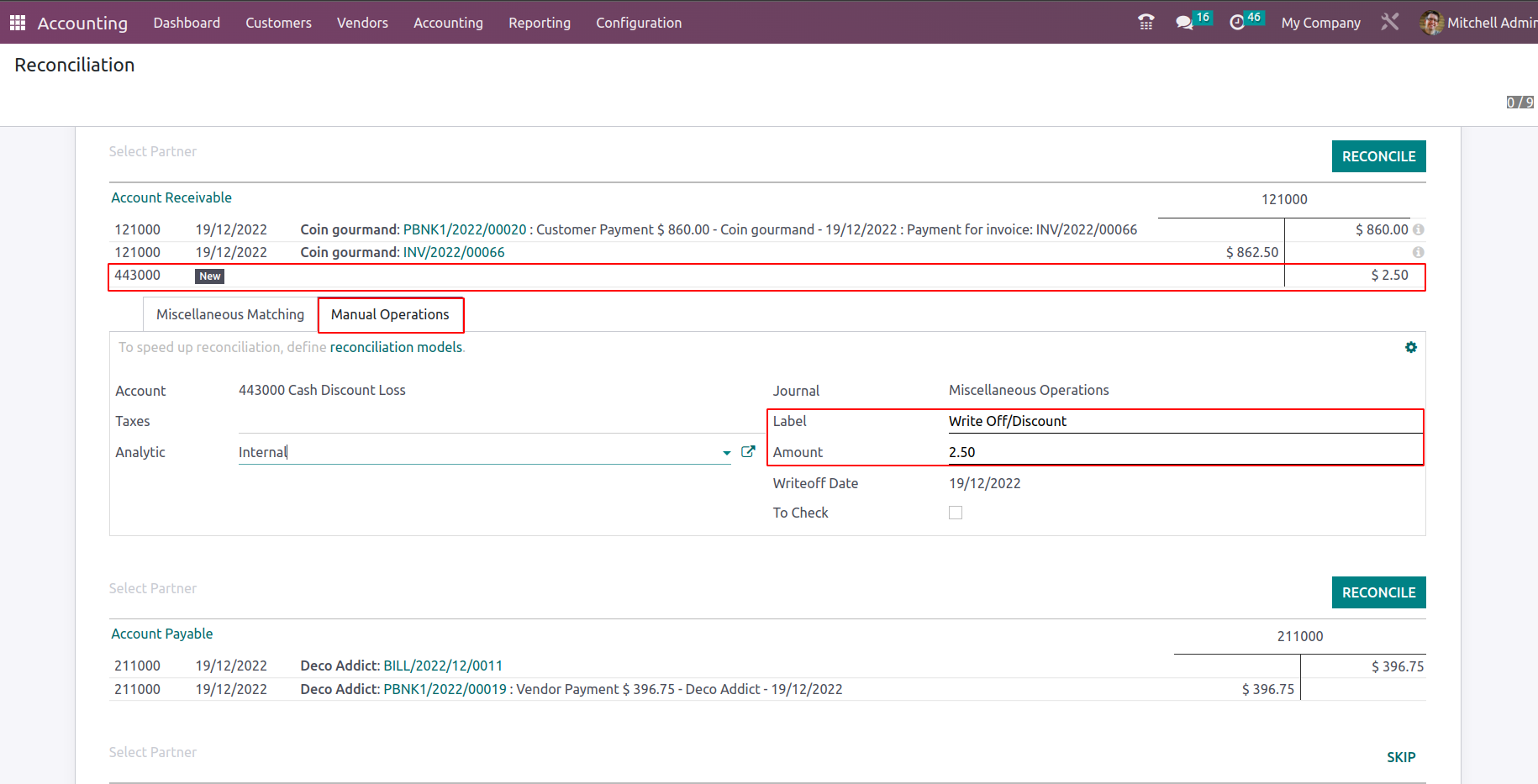

In order to create a counterpart, you may also choose the Manual Operations option, where you can define the Account, Taxes, and Analytical Account data like the Account and the Analytical Tags. Label, Amount, and Write Off Date can also be defined, as well as the Journal of the relevant Chart of Account. Additionally, if you want the corresponding functionality to be defined, you can enable the To Check options. By choosing the Save and New option, which is being defined, you can save and create a new manual operation.For each and every defined Chart of Accounts, the Manual Operations and Miscellaneous Matching can be described.

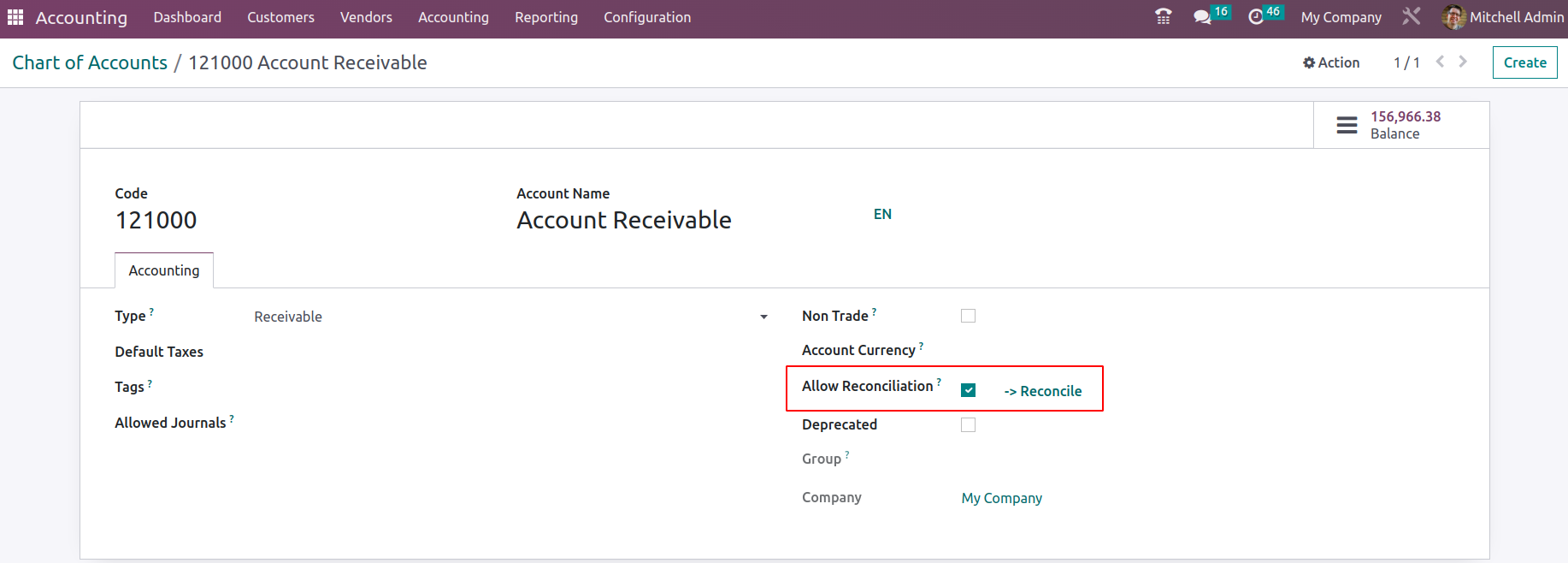

Finally, you can choose the Reconcile option, which is present at the top of the menu as seen in the screenshot above. This will take you to the appropriate Reconciliation menu of the defined Chart of Account. The Reconciliation menu of a Chart of Accounts is seen in the screenshot below. This is where the Code of Account, Account Name, Type, Group, and Account Currency are defined. Additionally, there are choices for reconciling that can be chosen to do the reconciliation of the corresponding Chart of Account defined.

In Odoo Accounting, the Reconciliation menu will be a helpful Action tool for you to specify the Financial operations pertaining to each of the Chart of Accounts that a company has defined to be operating in an orderly manner. Let's go on to understanding the next menu, the Lock Dates, in the following part now that we are clear on the Reconciliation menu accessible in the Odoo Accounting Action tools.

Lock Dates

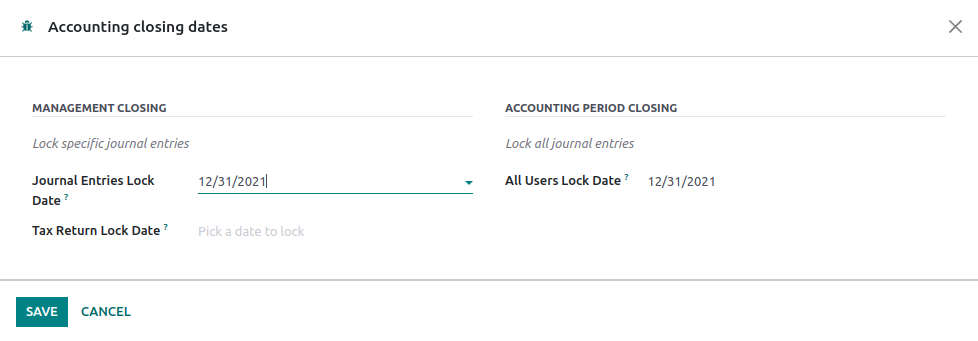

You can set up the operations of the Fiscal Periods of operation for the business operations using the Lock Dates functionality in Odoo Accounting. The corporate management will benefit from this functionality because they may need to adjust the Fiscal Periods based on their needs. The Accounting module's Actions tab is where you can find the Lock Dates menu. When you choose the menu, a pop-up window will appear, exactly as shown in the screenshot below. According to your needs, you can Lock your Fiscal Period here.

You must first choose a date for the calendar that will be displayed after selecting a drop-down option in order to establish the Journal Entries Lock Date, All Users Lock Date, and Tax Return Lock Date. Users in the following categories have varied access rights within the Odoo Accounting module: Billing, Read-Only, Bookkeeper, Accountant, and Consolidation User. Each of them can function in the Accounting module according to their respective privileges. Similar to this, unless the Lock Date for all users is set, no user can update the papers. Lock Dates are typically set so that no user can modify during the company's financial operations auditing period and similarly after the fiscal year's end. Finally, you must choose the Save choices if the dates are being defined. With the appropriate authorization, you also have the option to Discard the Lock Dates whenever you wish.

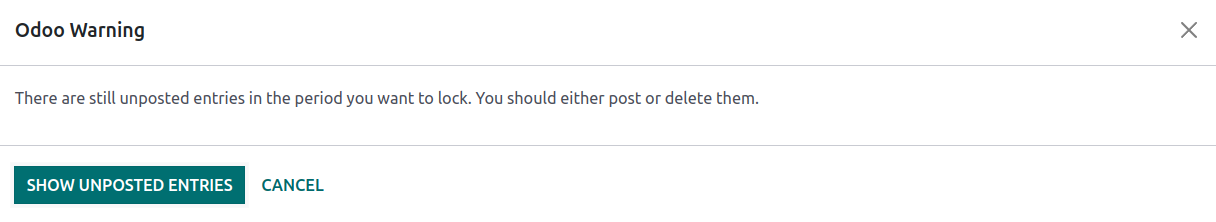

Additionally, the Odoo Warning box will appear as a pop-up in your direction if there are certain Unposted entries in the relevant Fiscal Period, as seen in the screenshot below. The Odoo platform is set up to support the company's financial management processes, so warnings are automatically created. However, unposted entries should be defined originally before completing a fiscal period. You can use the Show Unposted Entries option or the Cancel option to prevent the Lock Dates posting from going live.

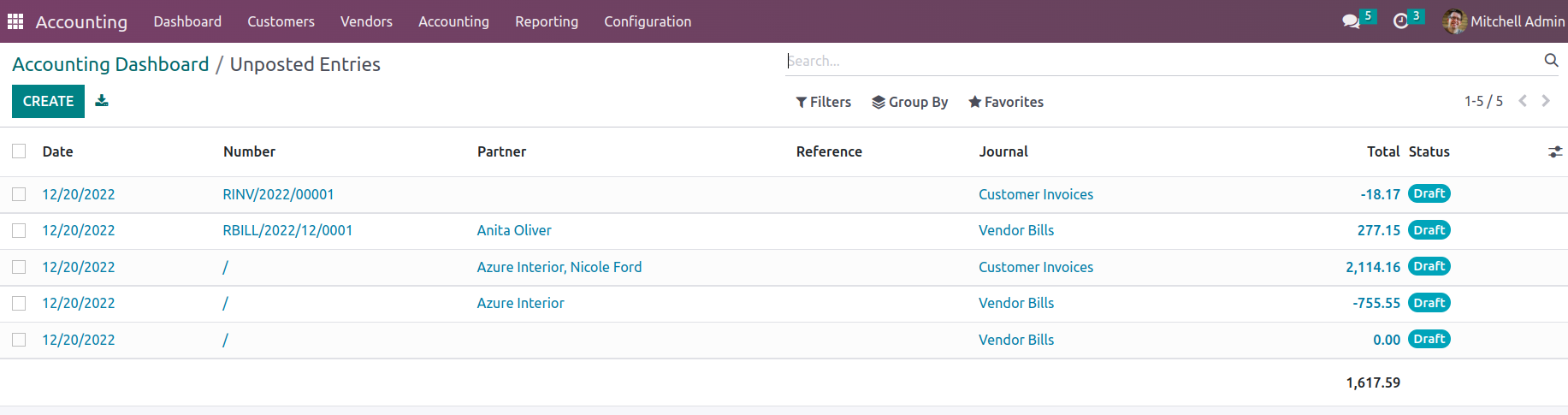

When you choose the option to "Show Unposted Entries," a menu containing all the unposted entries pertaining to the financial activities of the relevant fiscal period will appear.

As with all other Odoo platform menus, Filtering and Group by options will be provided, enabling us to identify the relevant Unposted Entries from the menu being described. Let's move on to the following section, where the Accounting Ledgers are discussed, now that we are clear on the features of the Accounting Action tools accessible in the Odoo Accounting module.

In conclusion, you can easily do the various Finance management operations with regard to any parts of the organization by using the Accounting management tools in the Odoo Accounting module. Additionally, the Accounting management solutions have sophisticated regulating tools. The reporting features of the Odoo Accounting module will be the subject of the following chapter.