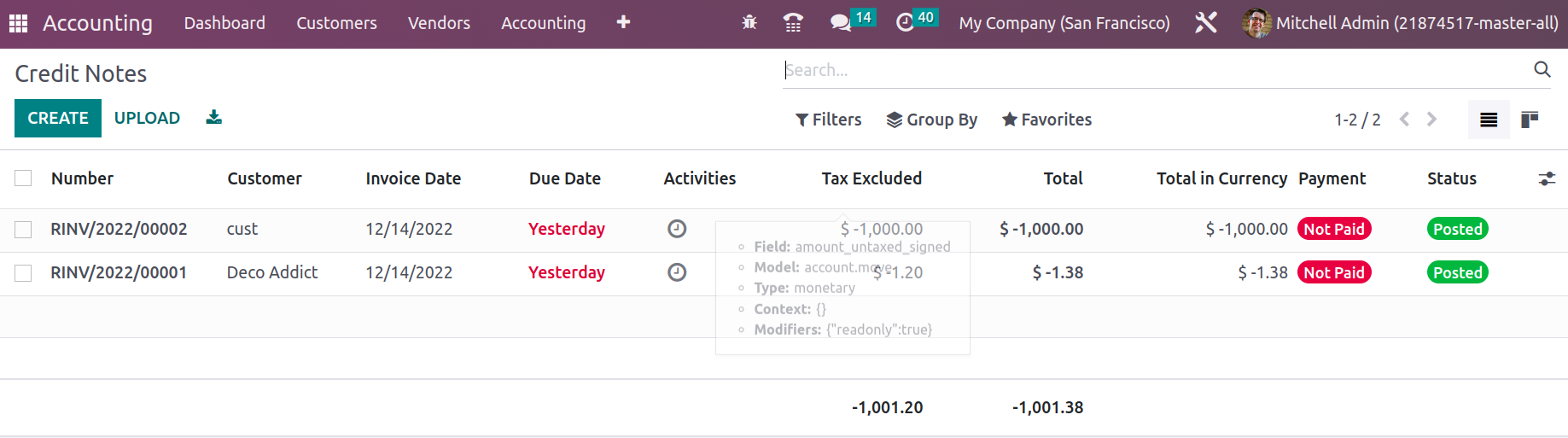

The characteristics of credit note operations that will enable you to reimburse the invoice amounts in the previous section may be clear to you. In a real-time business environment, it is likely that credit note operations will need to be defined; hence Odoo provides a special menu that facilitates the management of all credit note activities. All Credit Notes will be defined with the Number, Customer information, Invoice Date, Due Date, Next Scheduled activity, Tax Excluded, Total, Status, and Payment Status in the Credit Notes menu, which is accessible through the Customer page. You can specify custom and default Filter and Group by options to retrieve the necessary Credit Notes.

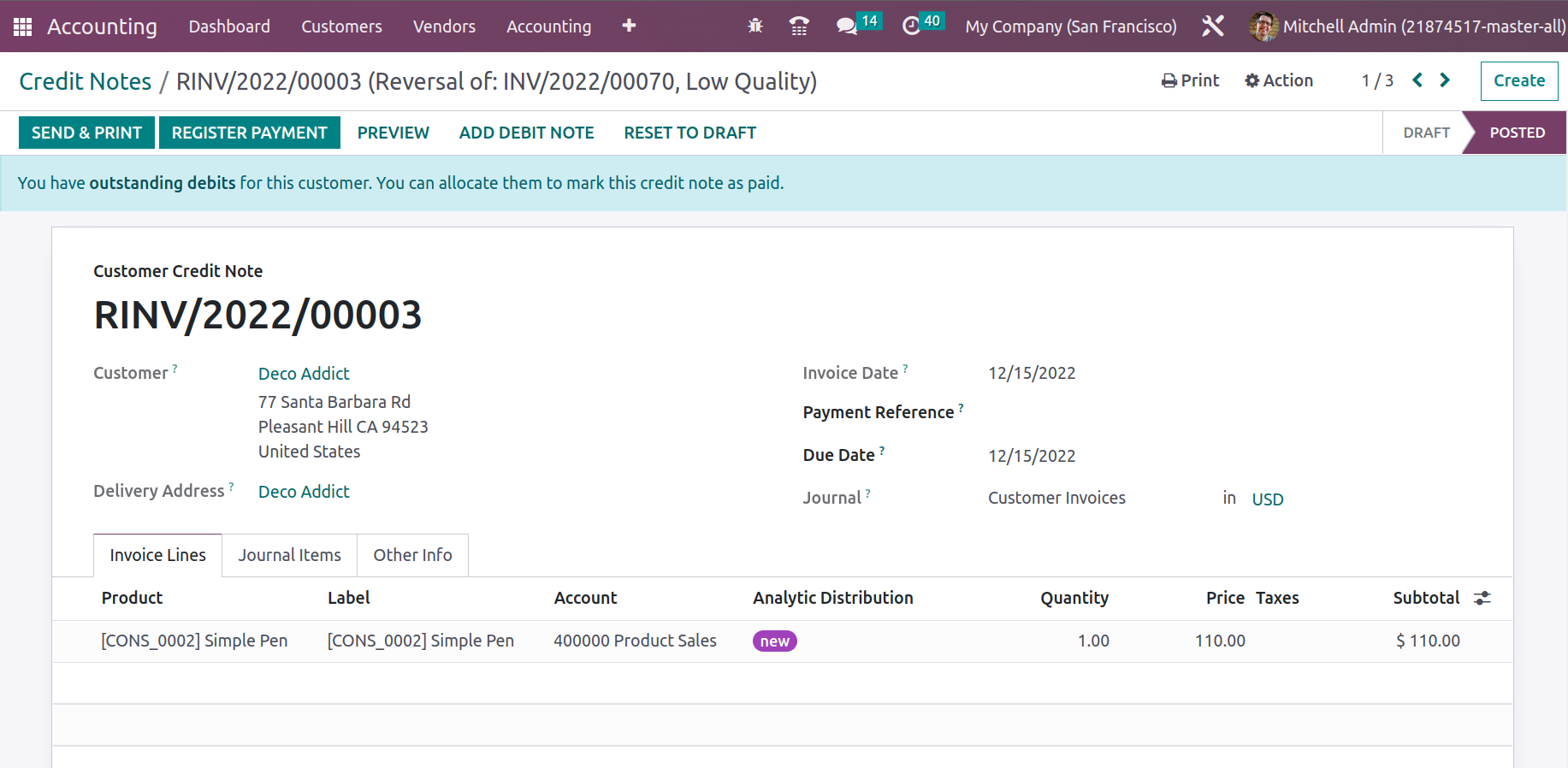

By choosing the Create option, you will also have the option to edit existing Credit Notes and create new ones. The Credit Note number will be defined in the Creation menu, and you can see that it begins with the RINV label, which denotes the reverse invoice action. As opposed to this, the invoice number will start with the letters INV. It is possible to define the Customer Details and the Payment Reference Details. Additionally, information about the Credit Note's Invoice Date, Due Date, Journal, and Electronic Invoicing will be shown.

The Add a line option can also be used to define the invoice lines. Additionally, you have the ability to add a section to the invoice by choosing the Add a section option, and you may add a remark by choosing the Add an available note option.

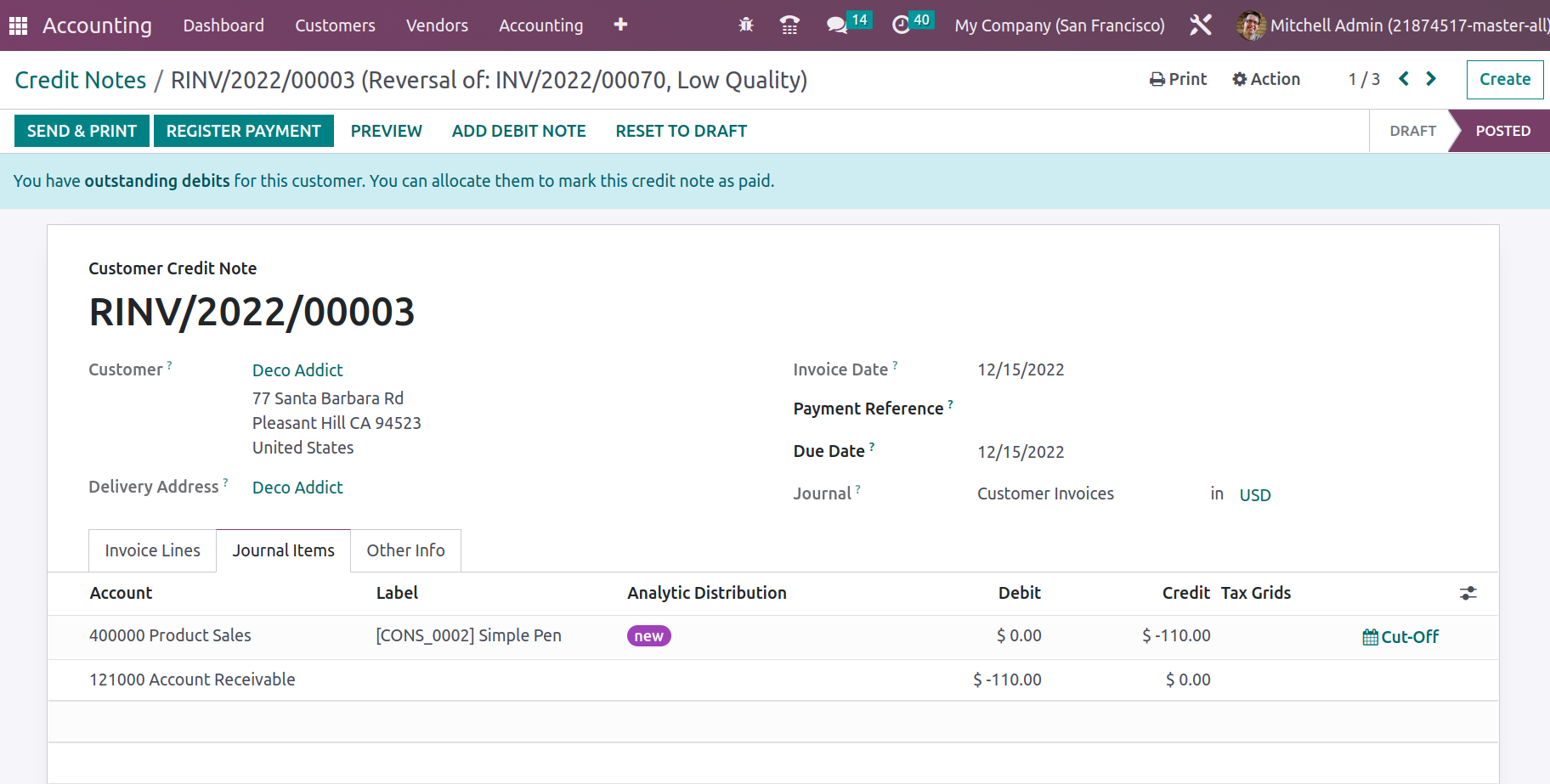

The Account information, Label, Analytic Tags, Debit, Credit, and Tax Grid details will all be defined in the Journal Items. The affected accounts will appear in the Journals items page once the product has been added to the reverse invoice itself. During this procedure, the Account Receivable is credited while the Income Account and Tax Account are debited. This indicates that as the invoice is reversed, the income drops and is debited, but the account receivable, which is an asset by nature, lowers and is credited.

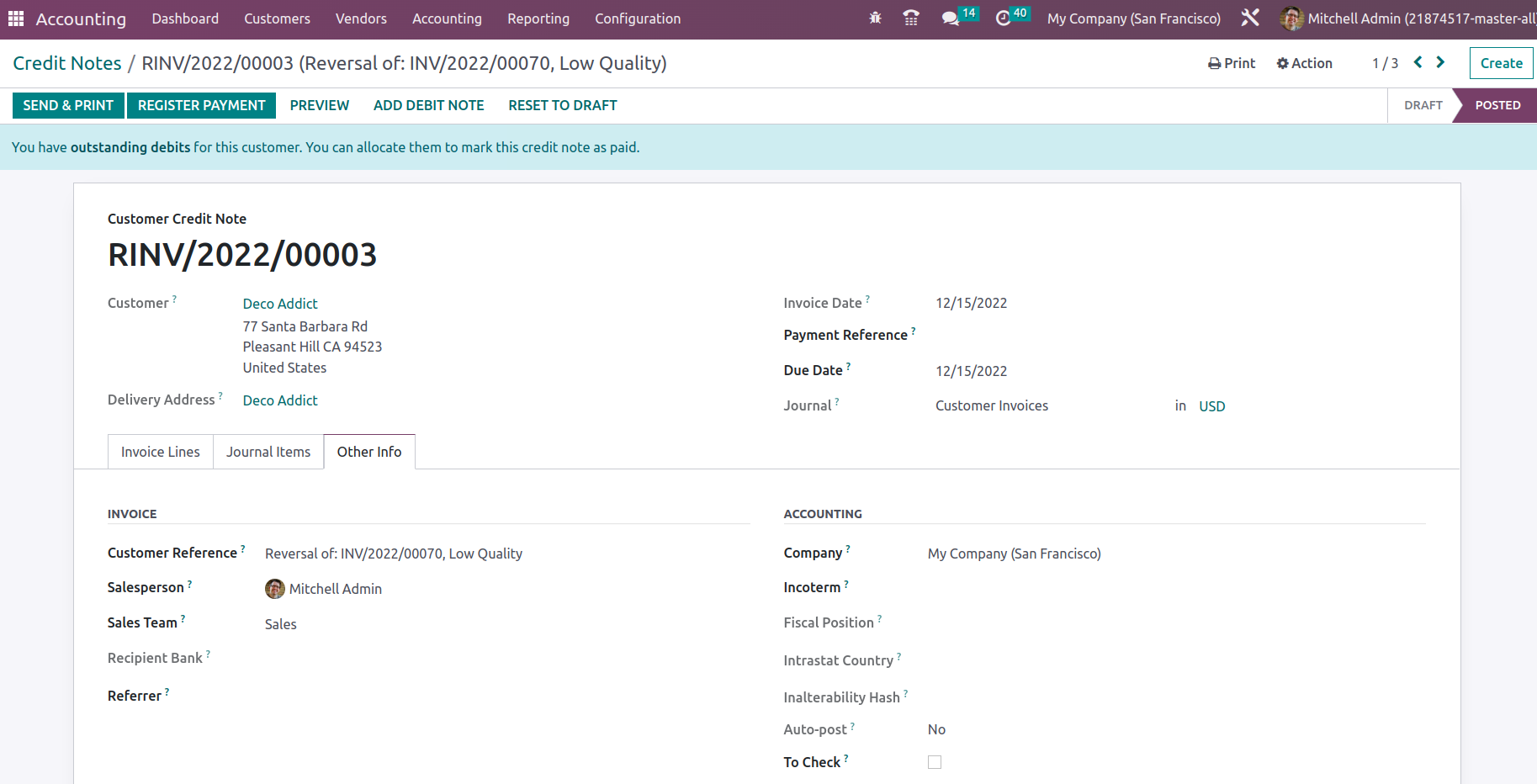

The Invoice and Accounting details can both be defined in the Other Info tab. It is possible to define invoice details such as the customer reference, salesperson information, recipient bank, and payment QR code. The need will determine the definition of accounting data such as Incoterms, Fiscal Position, Intrastat Country, Cash rounding Method, Post Automatically, and To Check.

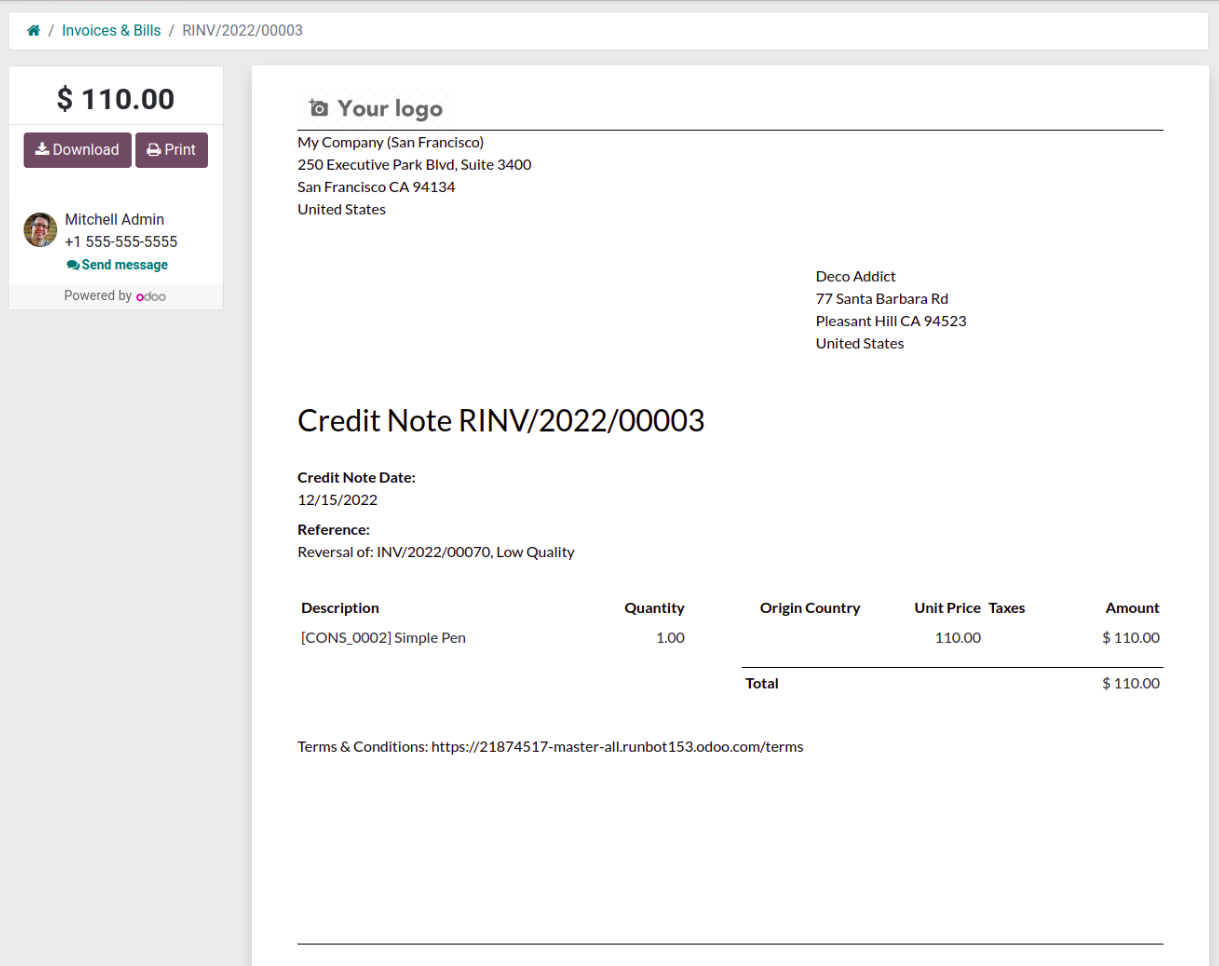

A reverse invoice needs to be sent back to the customer; you may view a preview of the reverse invoice for a Credit Note by choosing the Preview option from the relevant Credit Note menu. The reverse invoice that will be delivered to the customer is shown in the screenshots that follow. All of the information will be explained here in the exact same terms as they were in the credit note you sent us.

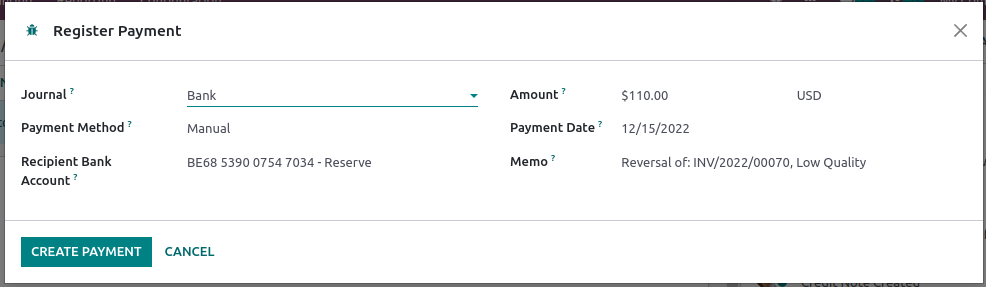

If the Credit Notes' descriptions are accurate, they can be mailed or emailed to the customer. Both Credit Notes and reverse payments can be made to the customer. Once the payment has been made, you should record it in the appropriate client payment journals of the financial operations on the relevant platform. When you choose the Register Payment option, a pop-up box will appear where you may enter the information for the payment register. Journals, payment methods that can be manual or by check, and other elements. You can also include information about the recipient's bank account.

Additionally, it is possible to define the Amount, the currency in which the payment must be made, the Payment Date, and the Memo. You can choose the Create Payment option once the details have been specified.

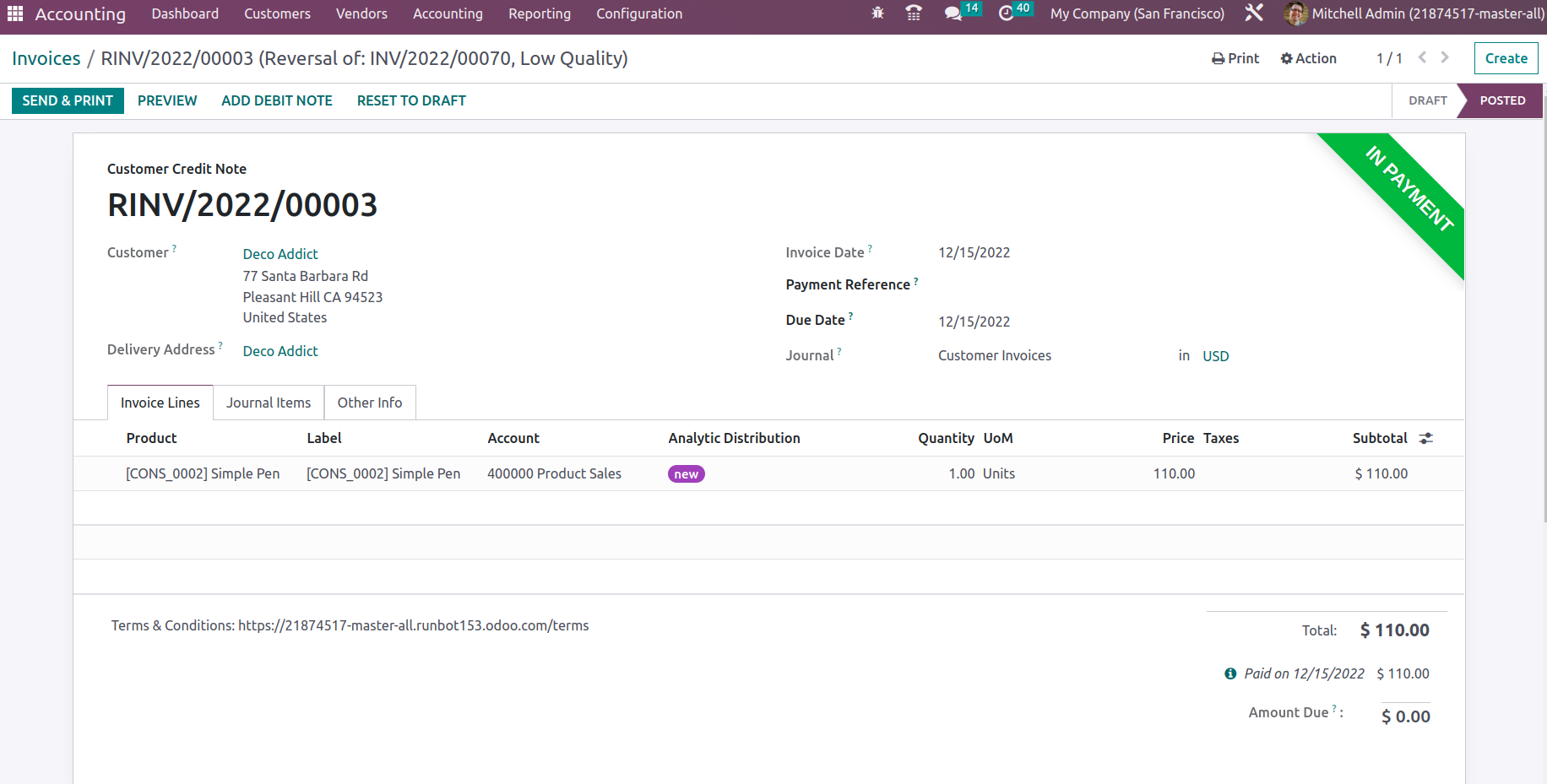

When a payment is made, the credit note for that payment will show that it has been received by designating it as In Payment if the payment has not yet been approved or is being done. If the payment is successful, the label will say "Paid."

As of right now, you will be experiencing the Credit Notes operations, how they work, and the management aspects of them. The administration of customer receipts in the Odoo Accounting module will be covered in more detail in the following section.