The right-time integration of the bank operations with company accounting is a salutary attempt for successful and smooth finance management operations. The Odoo 16 Accounting explores a great way for it, and the platform offers wonderful support and assistance to it. Odoo encourages you to establish the bank accounts and the company’s payment associated with the corresponding accounts. There are several benefits of configuring bank payments in company accounting software, including,

- Increasing Efficiency: Automating bank payments can help to increase the efficiency of your accounting and finance team by reducing the need for manual data entry and processing.

- Improved Accuracy; Automating bank payments can help to improve the accuracy of your accounting records by eliminating errors that can occur when manually processing payments.

- Increased visibility: Configuring bank payments in your accounting software can help to provide you with greater visibility into your company's financial transactions. This can be helpful in detecting and preventing fraud.

- Reduced costs: Automating bank payments can help to reduce the costs associated with processing payments, such as postage and stationery.

- In addition, the reconciliation feature in the platform will confirm that the bank account operations and the organization's operational ledgers are in high correlation.

In the coming section, we can discuss the two options obtained under the Configuration tab of the Odoo 16 Accounting module.

Add a bank Account

The ‘Add a Bank Account’ feature is available in the Odoo 16 Accounting module. This feature allows the user to add a new bank account to the Odoo database. The user can specify the bank name, account number, and account type. The user can also denote the account currency, account holder name, and account holder address. It is useful for companies that have multiple bank accounts and need to track their balance and transactions. This is the best way to quickly and easily add bank accounts. This can be considered as a fine way to keep track of your finances and can also help you save time and money by allowing you to automatically reconcile your bank statements.

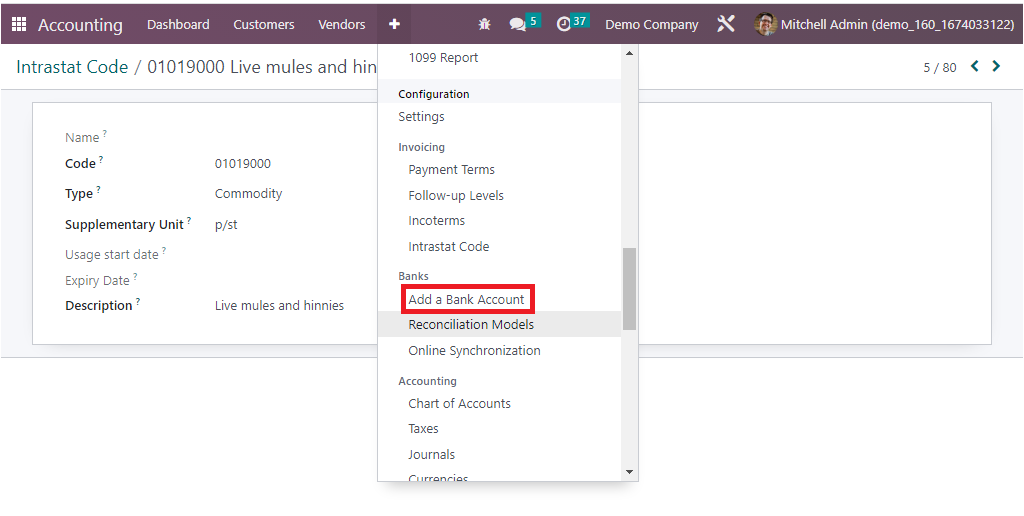

You can find the Add a Bank Account menu as the first menu under the Banks section of the Configuration tab as showcased below.

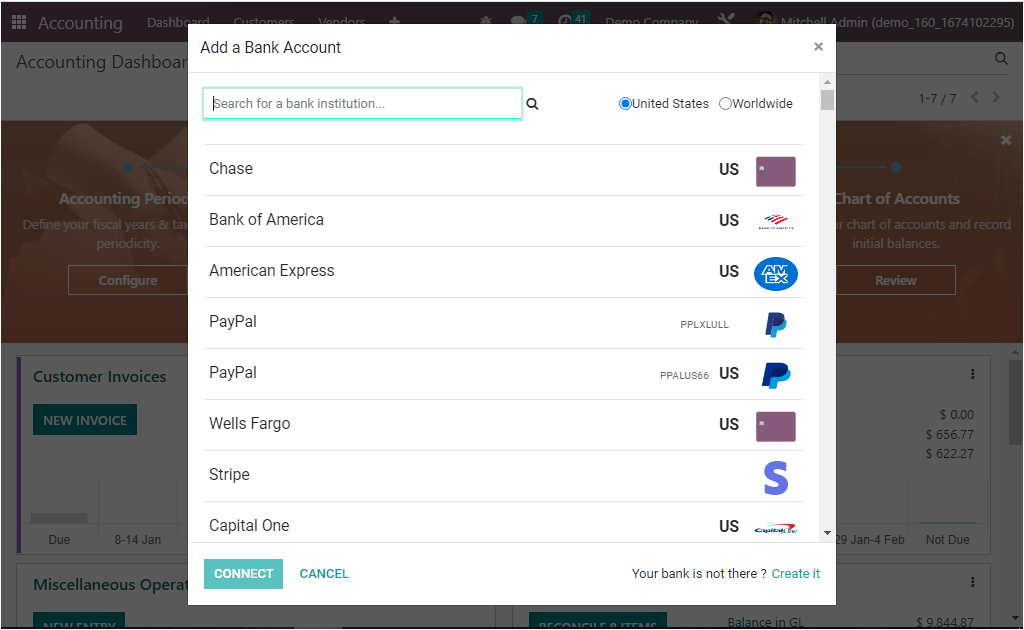

With the aid of this Add a Bank Account menu, you can configure various bank accounts based on business requirements. The very instant you go over the menu, you will be optimized with a Add a Bank Account pop-up window where you can view the default bank information. From this pop-up, you can choose your bank and can confirm to configure it with Odoo platform operations.

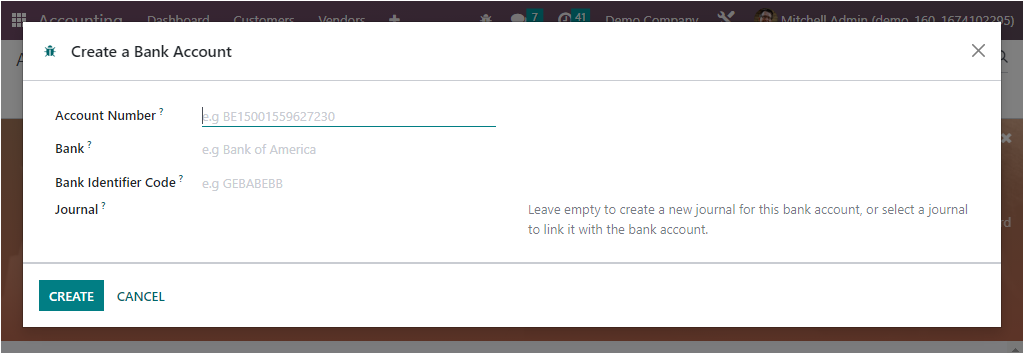

Almost all the bank details from worldwide will be listed here in the window by default. If, in case, your bank is not mentioned in the window, you can choose the ‘Create it’ option, which is depicted in the bottom right corner. Consequently, a new pop-up for configuring a bank account will pop up as given in the image below.

Here you can set aside the Account Number, Bank, Bank Identifier Code, and Journals in the allotted space. The Journal field can be left empty to create a new journal for this bank account, or you have the provision to select a journal to link it with the bank account. Once you give all the details, click on the CREATE button located on the bottom left in the pop-up to activate your bank account in the Odoo system.

Now it is evident how to Add a Bank Account to the Odoo platform, and now we can move on to the Reconciliation tool existing in the Configuration tab of the Odo Accounting module.