US GAAP Reports

GAAP stands for the Universally Accepted Accounting Principles which have been adopted

by the US Securities and Exchanges Commission. The GAAP brings standardization of

the accounting aspects such as exchange rates, interest rates, and the tax included

in the business operations of the companies in the case of an international transfer.

There are also country-bound house taxes as well as import and export ones. Moreover,

the GAAP falls under a set of authoritarian standards which has been decided by

a policy board which is a commonly accepted way or principle of recording and reporting

the accounting-related information in an organization. This universal method will

ensure that all aspects of the company accounting should be drafted and documents

analyzed and reported to be generated. Three are various basic ones that are necessary

for the operations of any business.

The Accounting module of Odoo supports the aspects of the GAAP-based report generation

by default as its mandatory aspects in regards to the company operating in any region

of the world. Moreover, in the Odoo Accounting module with the distinctive Reporting

tab that is available, you will be having a separate menu that will help you to

generate and record all the US GAAP reports. By default, in the Odoo Accounting

module, you will be able to generate the US GAAP reports such as Profit and Loss

Reports, Balance Sheet, Executive Summary, Cash Flow Statement, and Check Register.

Let's now move on to understand each of these US GAAP reporting menus available

in the Odoo Accounting module in detail in the upcoming sections.

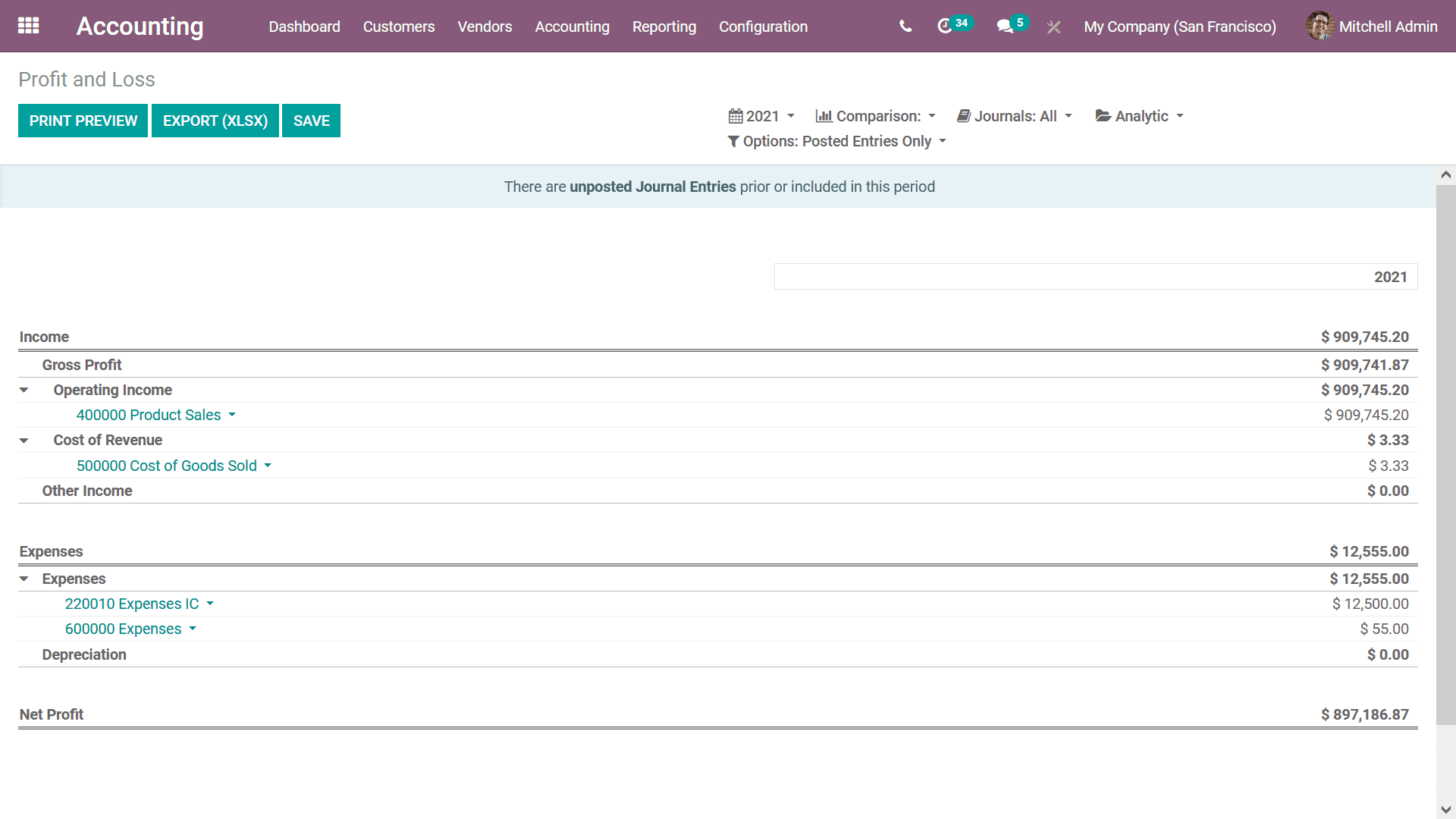

Profit and Loss Reports

The Profit and Loss Reports are the basic ones in regards to the US GAAP-based report

that every company will generate. The Profit and Loss Reports will provide an insight

into the financial operations of the company and whether the company is generating

a profit or is functioning with a loss. Profit and Loss Reports are the basic elements

of every accounting operation of any company and the Odoo platform understands this,

therefore a dedicated menu where the Profit and Loss Reports can be generated is

available in the Odoo Accounting module. Accessible from the reporting menu of the

Odoo Accounting module, Profit and Loss Reports can be selected and you will be

presented with the report as depicted in the following image.

In the Report, all the Incomes, as well as the expenses and the net value of Profit

or Loss, will be depicted just as shown in the following screenshot. Under the Profit

aspect, the Gross Profit details such as the Operating Income and the cost revenue

will be described. In addition, there will be a separate section to describe the

Other Income which is being defined. Furthermore, the Expense details such as the

Expenses of the company as well as the Depreciation rate-based value of the Assets

will be depicted. Each of the Chart of Accounts in respect to the aspect which has

been defined will be depicted which can provide you with further details.

You will have Filtering, Grouping, and Comparison tools just as available in all

other reporting menus of the Odoo platform. Here, you can do the filtration based

on the Fiscal year or period of operation. Further, the Journals along with the

Analytical accounting aspects along with the Posted as well as the Unposted entries

can be filtered and grouped based on the need. Additionally, the Comparison tool

helps you to compare between the Profit and Loss Reports of a fiscal period as well

as the one of another fiscal period which will provide you with complete details

on the progress of the depreciation of the company. A study is needed to understand

the plan for the future of the organization.

The Profit and Loss Reports of a company plays a crucial role in the financial management

operations of the company and provide a clear picture of the track of the company

for the past and will provide an insight of the future allowing you to plan your

budget and other financial operations in regards to the company functioning accordingly.

As we are clear on the Profit and Loss Reports menu of the Odoo Accounting module,

let's now move on to the next section where the Balance Sheet reporting aspects

of Odoo Accounting are being discussed.

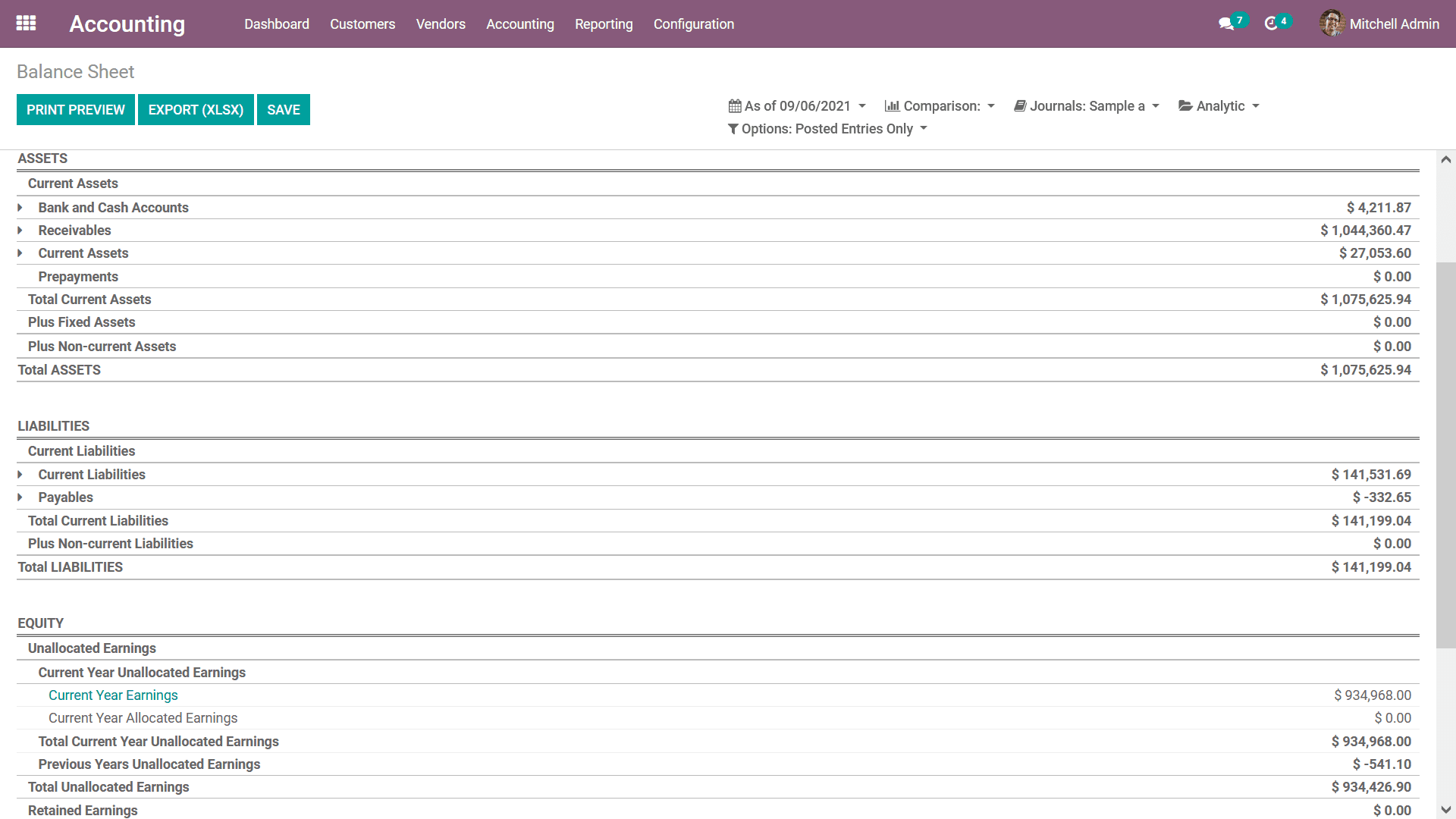

Balance Sheet

The Balance sheet is the second important document in regards to the company's accounting

operations as it provides you with complete insight into the company's assets, liabilities,

and shareholders' equity. Furthermore, it can be defined as the balance summary

of the financial operations of an individual or a company or an organization providing

complete information of the amount achieved as well as transactions and losses during

a financial year of operations of the company. The Balance Sheet of an organization

is described for all the fiscal periods as well as whenever needed. Moreover, these

reports will provide real-time information on the financial operations of the company

and play a crucial role in the decision-making process regarding the financial management

of the company. The Auditors of an organization are well attached to the Balance

Sheet and use it in their day-to-day operations in sorting out the finances of the

company.

The Odoo platform has a delicate menu that will help you to generate the Balance

Sheet reports of the company's financial operations. Accessible from the Reporting

menu of the Odoo Accounting module, you will be able to view the Balance Sheet menu

just as described in the following screenshot. Here, the Asset, Equity, Liabilities,

and all other aspects in regards to the company's Balance Sheet will be depicted

in separate sections along with the amount and the aspects involved in them such

as the Bank and Cash Accounts, Receivables, and the Current Assets or Liabilities.

You will also have Filtering, Grouping as well as Comparison tools available just

as in all other report generation menus of the Odoo Accounting module. Here, you

can do the filtration based on the Fiscal year or period of operation.

Further, the Journals along with the Analytical accounting aspects along with the

Posted as well as the Unposted entries can be filtered and grouped based on the

need. Additionally, the Comparison tool helps you to compare the Balance Sheet of

a fiscal period as well as the ones of another fiscal period which will provide

you with complete details on the progress of the depreciation of the company. You

can read about the configuration aspects of these Filtering, Grouping as well as

Comparison tools in the previous report which has been described in this chapter

as they are of the same options and similar nature of operations you will not have

any trouble understanding it.

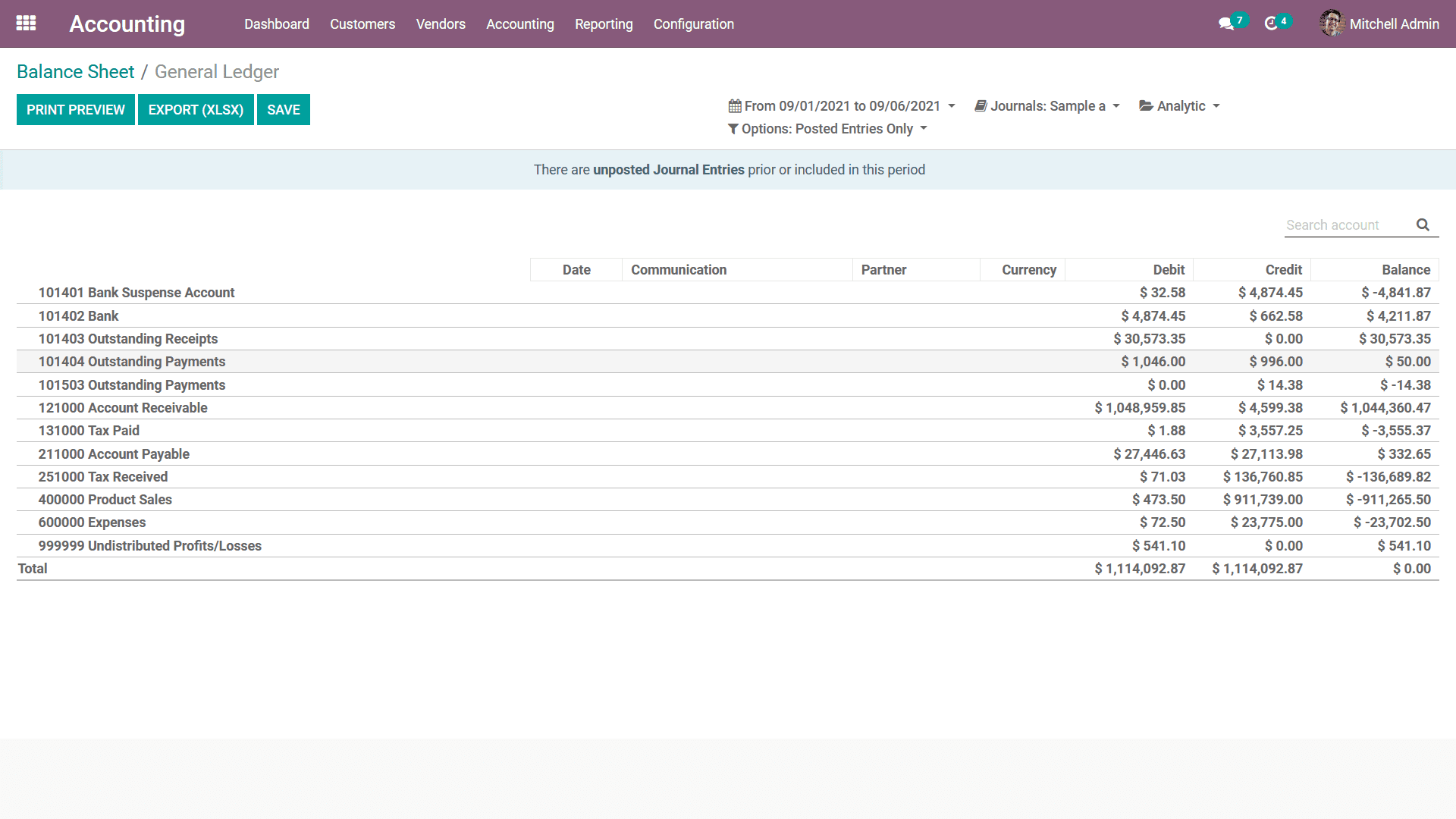

Upon selecting the drop-down option available in the entries which have been described,

you will be depicted with three menu options: General Ledger, Journal Items, and

the Annotate option. Let's initially choose the General Ledger option which will

depict the ledger details of the respective entry directly from the Balance sheet

as depicted in the following screenshot. Here, you will also have filtering as well

as Group by option available just as in all other reporting menus of the Odoo platform.

Furthermore, with a search option as well as the option to view Print Preview and

export the entries you will have a save option available which lets you save he

General Ledger based on the configuration aspects which are being done.

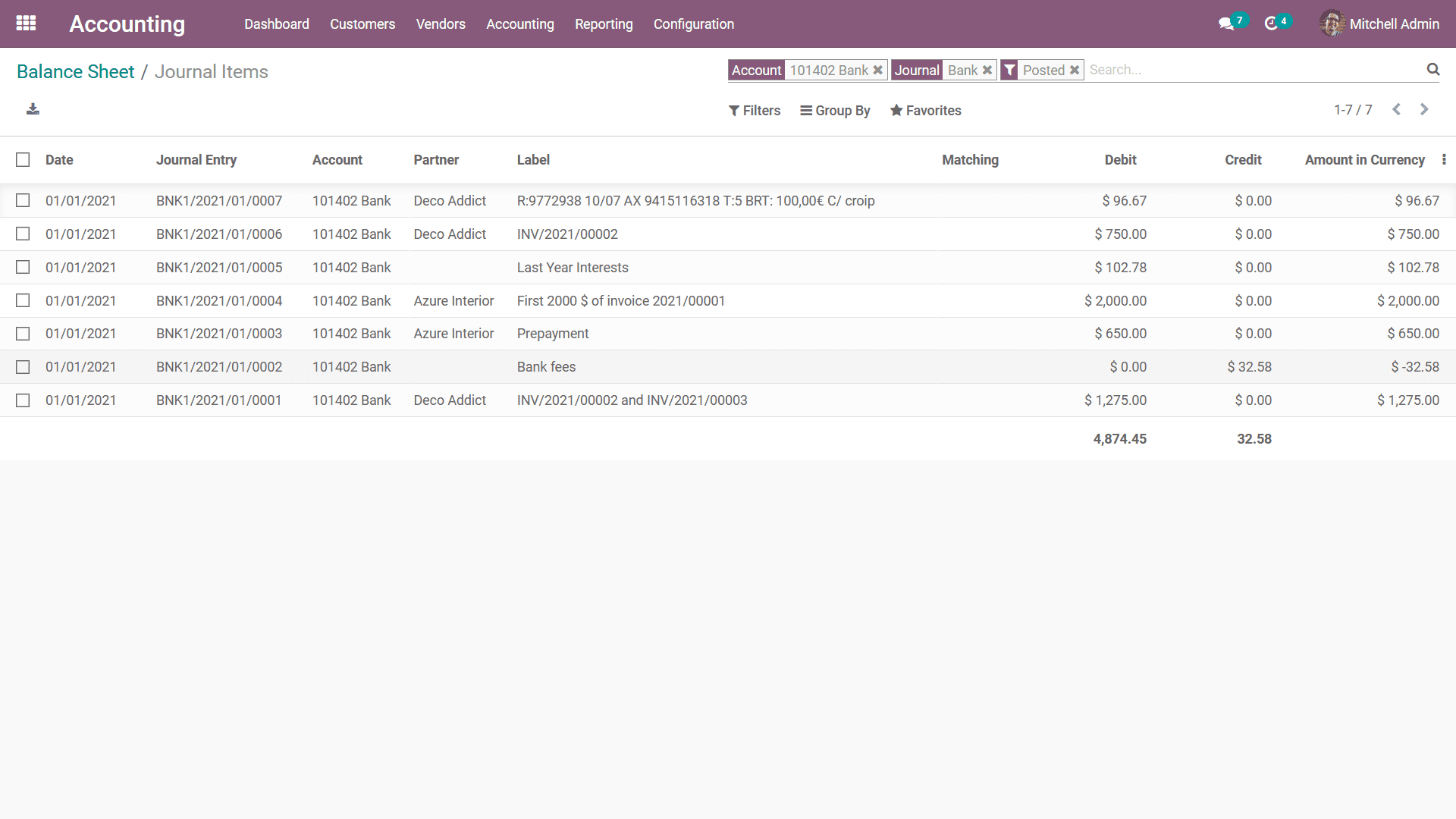

Upon selecting the Journal Items option available under the drop-down menu of the

Balance sheet menu, you will be presented with Journal Entries of the respective

entry as depicted in the following screenshot. This will provide an insight into

the Journal Entries of the Balance sheet. Furthermore, there are Filters as well

as Group by options available by default, helping you to sort out the entries which

have been defined. You can also add in custom entries based Filters as well as Group

by options which can be added as favorites for further uses of the same filtration

and grouping.

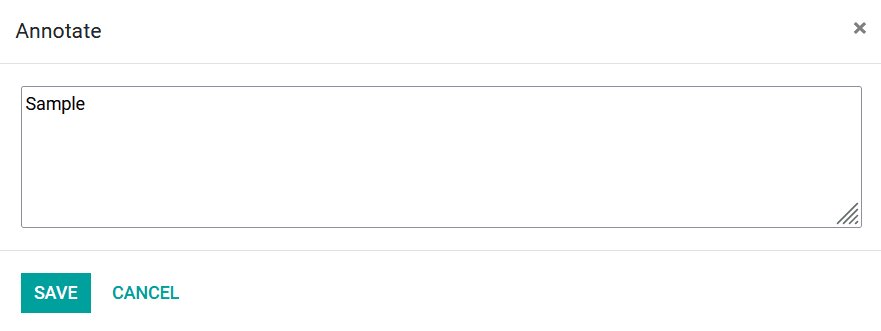

Upon selecting the Annotate option from the Balance Sheet you will be depicted with

a pop-up window as depicted in the following screenshot. Here, you can provide descriptions

for the Annotation which is to be done and then Save it. There is also a provision

to cancel the Annotation with the available Cancel option.

The Balance Sheet of a company accounting plays a vital role in the financial management

positions of the company and with a dedicated tool such as the Odoo Balance Sheet

reporting, you will be able to generate and view the Balance Sheet of any fiscal

users of the company operations with ease. As we are clear on the aspects of the

Balance Sheet reporting menu of Odoo, let's now move on to the next section where

the Executive Summary reporting menu under the US GAAP Reporting tools of Odoo will

be discussed.

Executive Summary

The Executive Summary of a company's accounting will provide a complete summary

of the financial operations concerning the functioning of the company for the entire

fiscal period. Moreover, it describes the complete estimate to the minute details

in regards to the financial operations of the company for the executives as well

as investors. The Executive Summary will be used to give clever understanding in

respect to the financial management and the path of the company operations.

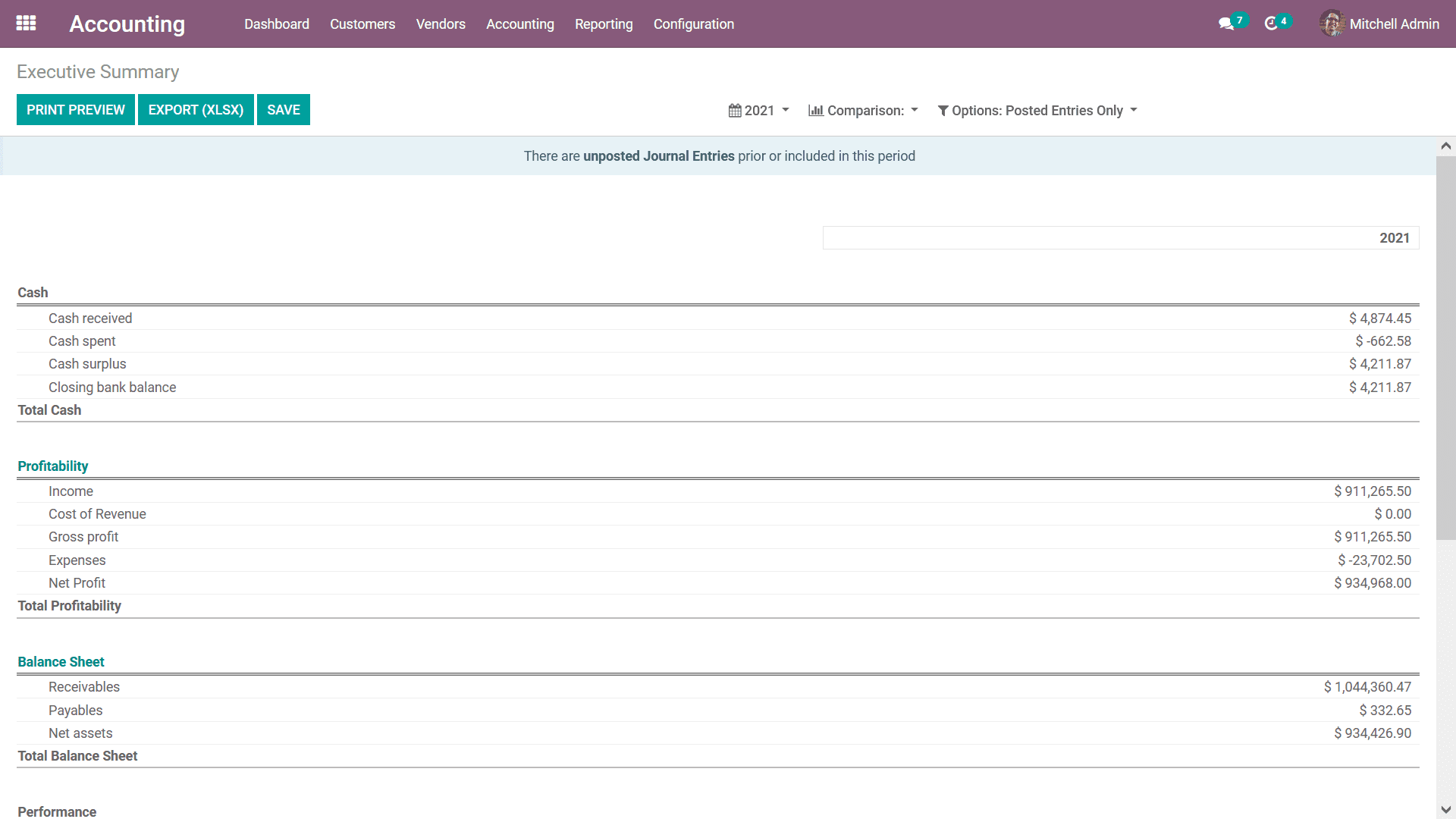

The Executive Summary reporting menu in the Odoo platform can be accessed from the

Reporting tab of the Odoo Accounting module which will depict you with the report

of how the company operates as depicted in the following screenshot. Here, the various

aspects of the company operations such as Cash operations, Profitability, Balance

Sheet, Profitability details, and many more will be described. Moreover, the structure

and the theme used in the Executive Summary can be defined as two firstly as Performance

and Position. In the case of Performance-based aspects, we will have the Gross Profit

Margin which is the collective sum of any direct cost made for a direct sale. The

Net Profit Margin is the sum of the Gross Profit Margin as well as the fixed overheads

which the company has such as rent, electricity, other amenities charges, taxes,

and many more with respect to an individual sale. Furthermore, the Return on Investment

is the equivalent ratio of the Net Profit which has been made to the amount as well

as the assets spent or utilized to make the profit.

Furthermore, the Position based terms in the Executive summary will provide insight

on the financial possession and the state of the sale or the entire company. The

Average debtor days is the average number of days which your customers take up to

make the payment. The Average creditor days will depict the average number of days

used to credit the amount which should be paid for the vendor bills. In addition,

the Short term cash forecast is a forecast function that will provide an insight

into the funds which will move in and out of the accounts. Furthermore, the Current

assets to liabilities is a ratio of the current asset to liabilities which can be

turned into cash within a year. Moreover, the aspects of financial operations in

respect to each of these sections will also be described with the amount inculcated

in them.

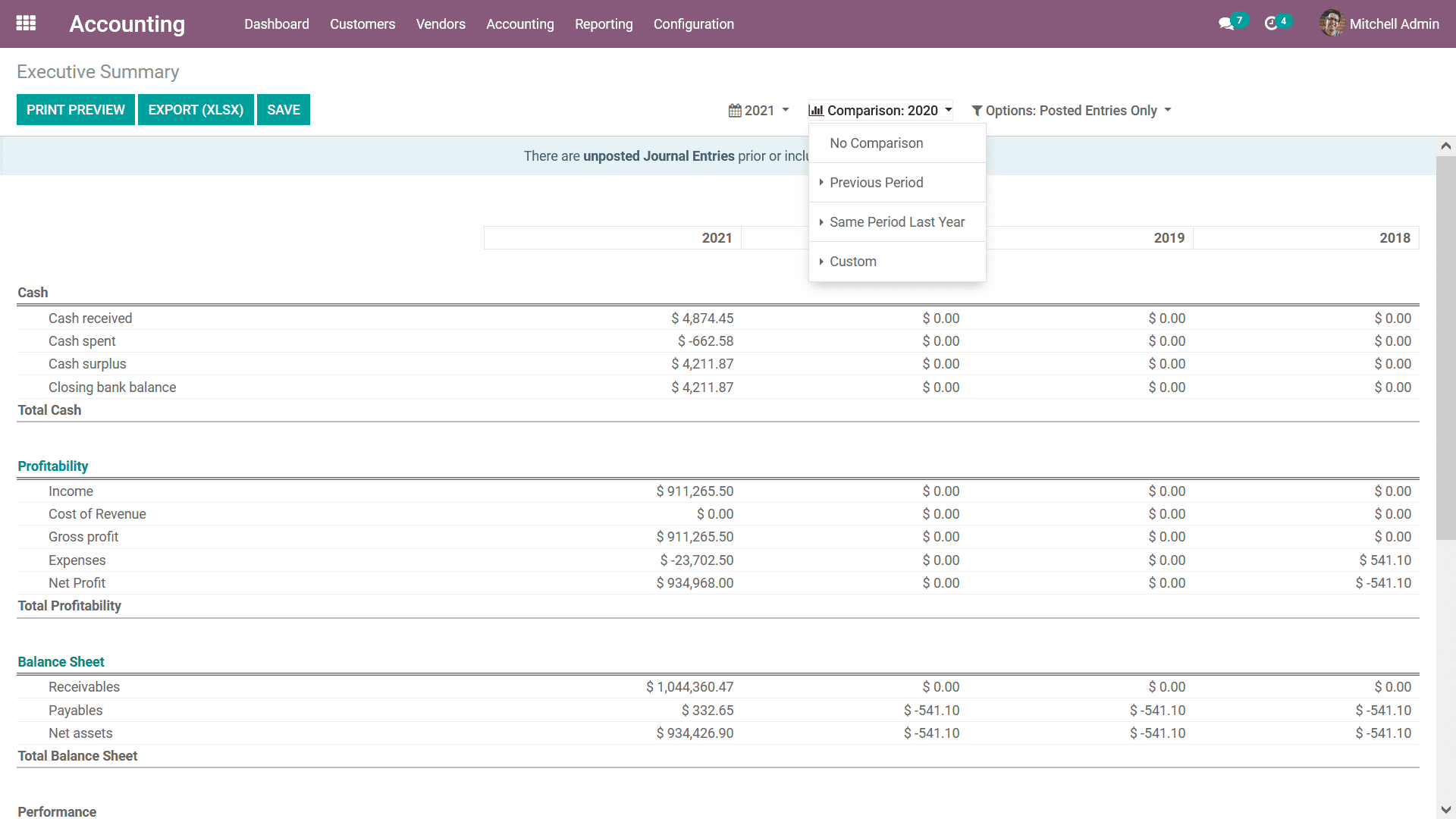

There are filtering as well as Group by tools that are available which will help

with the sorting out operations of the entries of the Executive Summary which have

been defined. You will be able to Group by the Fiscal periods of operation and based

on the posted entries. In addition, the Comparison options that are available will

help you to compare the Executive Summary details of the company’s financial operations

of a respective fiscal period to another one as depicted in the following screenshot.

There will be default Comparison options such as Previous Period and Same Period

Last Year. Moreover, the Custom Comparison options can be defined based on the need.

The Executive Summary of the financial operations of a company will provide a complete

understanding of the financial operations of the company and can be used as a study

material to understand the previous history and the current track of operations

helpful for the management to make and take decisions accordingly. As we are clear

on the Executive Summary reporting menu of the Odoo platform, let's now move on

to the next section where the Cash Flow Statement reports will be described.

Cash Flow Statement

In the operations of a business, you need to understand where your money goes and

how it's been spent. The same is in your aspects too. In regards to the Cash Flow

management of the business, the Odoo platform has a dedicated management solution

in the Accounting module. Here you will be able to understand the various aspects

of the flow of the cash and the channels of your business operations where it's

been used. In Odoo reporting aspects of the financial operation, there is a dedicated

Cash Flow Statement available that will describe the cash flow operations of your

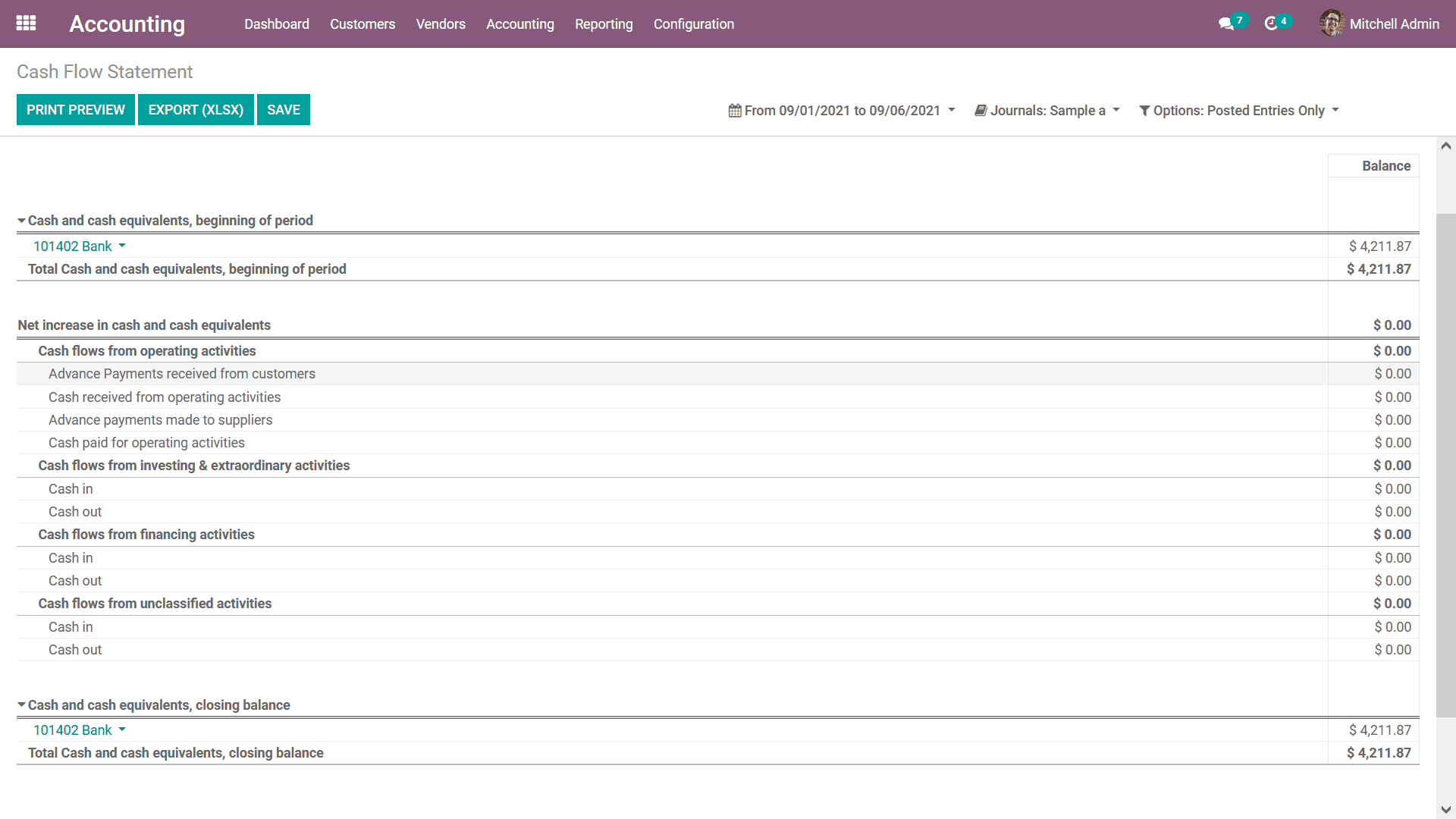

company. Accessible for the Reporting tab of the Odoo Accounting module, the Cash

Flow Statement will depict the aspects of cash flow (Both cash in and cash out of

the company) in the form of a report as depicted in the following screenshot.

The various aspects of the cash flow will be depicted over here such as the Cash

and cash equivalents, beginning of the period, Net increase in cash and cash equivalents,

and the Cash and cash equivalents, closing balance providing a clearer picture of

how the profits, as well as the money involved, is been utilized for the business.

These reports will be an advantage to the investors as they can understand the complete

aspects of the cash flow business as per the need. In the Cash Flow Statement window,

there are Filtering as well as Grouping tools available just as in all other Reporting

menus of Odoo Accounting. Here you can filter out the Fiscal Periods as well as

the Journals which are required to be displayed in the Cash Flow Statement. In addition,

the Entries can be defined based on the posted as well as unposted ones with the

distinctive filtering tools that are available.

In addition, the cash Balance involved in each of the transactions will be defined

on the right side of the menu. You will have the capability to drop down the description

of the Cash Flow Statement and will be able to view the three menu options on being

General Ledger, Journal Items, and the Annotate option available which will help

you to view the respective menus as available in many of the reporting menus which

have been previously discussed in this chapter. Additionally, if we add a Customer

Payment, through Accounting Module > Customers > Payments, in the cash flow statement

that will be added to the line Advance Payments received from Customers and once

some amount is matched with invoices, that will be shown under Cash received from

operating activities similarly, for Vendor Payment and bill they fall under Advance

payments made to suppliers and Cash paid for operating activities respectively.

The Cash Flow Statement Reporting menu of the Odoo Accounting module is an exceptional

tool in understanding the cash flow aspects of your business as well as the Balance

amount involved in it. As we are clear on the operations of the Cash Flow Statement

report, let's now move on to the next section where the Check Register reporting

menu will be described.

Check Register

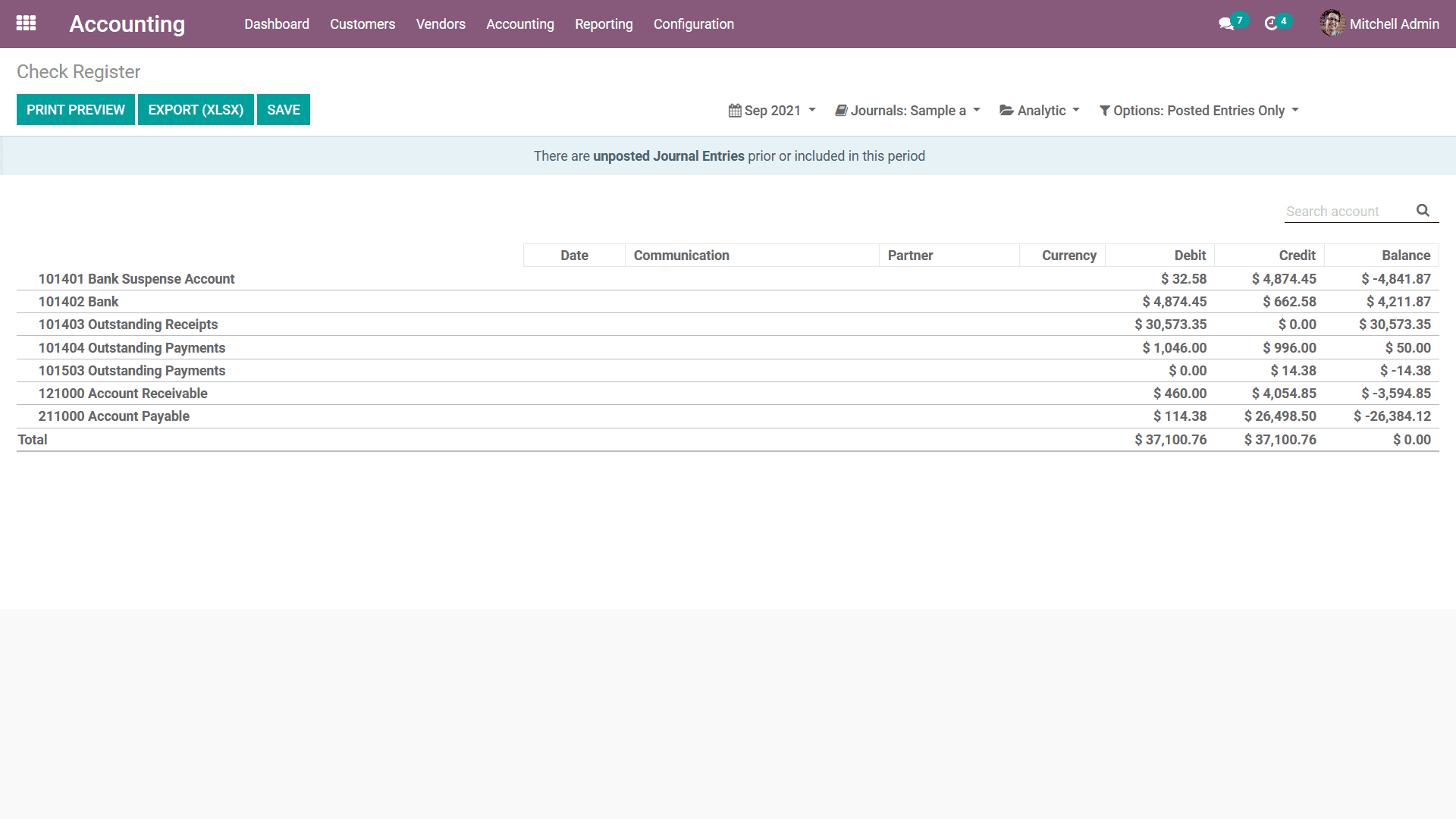

The Check Register is the final menu under the US GAAP Reporting tools available

in the Odoo Accounting module which will provide you information on the Check Register

operations of your business. All the money involved with the functioning of the

business will be described in a Check Register and the Check Register report will

describe it in an analytical format providing a complete insight into its operations.

The Check Register report will be depicted with the help of the different Chart

of Accounts of operation which have been defined in the platform. Here each of the

Chart of Accounts of operation along with the Date of functioning, Communication

details, Partner as well as the Currency involved will be described. Furthermore,

the Debit, as well as the Credit amount along with the Balance of each of the Charts

of Accounts, will be described as shown in the following screenshot.

here are also filtering and Grouping tools available just as in any other reporting

menus of the Odoo Accounting module. Here you can Filter the Check Register details

based on Fiscal Periods, Journals, Analytical Accounting aspects, and based on the

Posted and Unposted entries. Furthermore, there is also a serving tool available

that will help you search the entries of the Check Register based on the information

you have.

The Check Register reporting menu in Odoo will have a calendar role in undertaking

the aspects of each operation in respect to the financial management of the company

and will be a viable tool in the company Accounting aspect. With the Check Register,

the reporting tools of the Odoo Accounting module come to an end.

In this chapter, we are entirely focused on the Reporting aspects of the Odoo Accounting

module and provide a complete insight into its operations. We discussed the reporting

tools falling under the classification of Audit Reports, Management based Reports,

Partner Reports, and US GAAP reports. In the next chapter, we will be focusing on

the configuration of the General Settings of Odoo which will be helpful in the Accounting

operations.